The Borg: A Financial Allegory

Posted by Gail the Actuary on October 6, 2008 - 10:38am

This is an allegory explaining some of the monetary issues associated with the current financial crisis. It was written by Jason Bradford. Jason was an academic biologist who "retired" at a young age to become a community organizer and learn how to farm with peak oil in mind. He also hosts a biweekly radio show on public radio called The Reality Report.

I have never been a huge follower of Star Trek, but when thinking about the financial beast thrashing about the Borg comes to mind.

"Strength is irrelevant. Resistance is futile...Your culture will adapt to service ours." -- The Borg.

The Borg is a hive-like hybrid swarm of humanoid species, turned partially robotic. They are distinctly goal oriented towards “assimilation” of all other humanoids and press themselves relentlessly with the creepy mantra “Resistance is futile.”

The money system is eerily Borg-like. Because it structurally requires growth, it works relentlessly to assimilate all forms of capital. The natural consequence is that everything must be for sale. Values of freedom, independence, self-reliance, and even conservation are subservient to the goal of growth—which is really just growth of the financial Borg, not human welfare or the security of a habitable planet.

How the Money System Depends on Growth

Modern money is not based on any physical assets or intrinsic value. Instead it is called a “fiat currency,” which in Latin means, “let it be done.” The government, or law, decrees that the face value of money is what it is. Money is created through forms of credit and debt, i.e., when banks make loans and debtors accept them, the money instantly exists. Only a fiat system can allow this form of money creation.

Money is used as a claim on real things, like labor and material goods. The money system is supposed to be regulated, usually via central bank interest rate policies, to make sure that what money can purchase, or what value it holds, doesn’t change too rapidly. When money changes in value quickly it is difficult to plan, and a panic may even occur that could collapse the system.

A collapse can happen, for example, when too many people try to collect their bank deposits at once. Banks don’t keep all the money given to them by depositors, only some portion of it. This is called “fractional reserve banking.” Banks have to constantly manage their reserves, which means juggling how much money they lend out, how much is coming in from new deposits, and how many of their loans are being repaid. If a bank is having trouble with cash flow and can’t keep up its reserves internally, it can borrow money from other banks that have more than they need at the moment. If too many banks are having trouble, the Federal Reserve (in the U.S.) can step in and lend.

The money system needs to grow because money is lent into existence with interest. All borrowers need to come up with principal plus interest. The interest portion of the money supply needs to be created in the future or too many borrowers will default. How is more money created in the future? Through more debt!

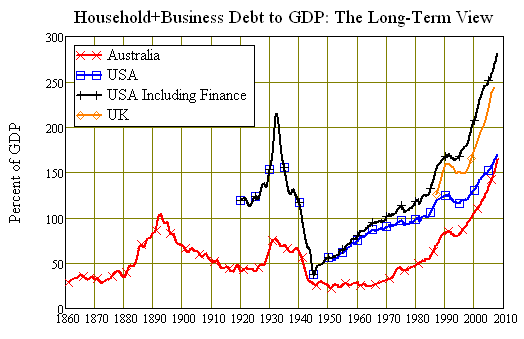

Debt and money supply will necessarily rise exponentially until they collapse. And collapse is inevitable because money is still a claim on real, tangible things, like labor and resources, which in the real world are finite.1

Real World Growth Can’t Keep Up with Money

A human being eats and grows, and produces wastes in the process. The energy and mineral resources of an animal are called food. If someone doesn’t get enough food and they are a child, they fail to grow. As an adult they may lose weight or starve. It is also important that a person doesn’t grow too fast, and at some point stops altogether or health will decline—possibly leading to death.

The economy does something similar by consuming resources and causing pollution. The energy inputs of our economy are called gasoline, natural gas, hydroelectricity, etc. Other resources our economy claims include mineral ores, forests, and, as I explain further below…people! And just as a human should stop growth due to physical constraints, an economy can become too large relative to the support structure of the ecosystems around it. Many old civilizations ended up in the archeological trash heap because they over taxed agricultural soils and deforested too extensively.

What is happening in the financial world is that the claims the money system is making on debt holders are greater than their ability to pay. Most of the blame right now is being placed on a bubble in lending to purchase homes. But is the sub prime mortgage fiasco the only explanation for money troubles?

I don’t think so. What we are seeing reflects a general insolvency of the global financial system. Part of the problem is that investors, business people and governments didn’t foresee that crude oil production would flatten in 2005 and prices would go from $10 per barrel in 1998 to $100 per barrel in 2008. Or that China and India would consume so much so fast that nearly all forms of commodities would rise in parallel with oil prices.

When credit is extended over a long time horizon, as in a home mortgage, the underlying assumption is that the future will be akin to the past. Inflation will be relatively modest and incomes will keep up so that a steady flow of cash can go back to banks and keep up their reserve balances. Obviously this hasn’t occurred: prices rose faster than incomes and the ability to repay debts faltered.

As an example, I learned at the 2008 ASPO-USA conference that the airline industry was given credit to buy planes and enlarge airports with the expectation that crude oil wouldn’t be higher than $30 per barrel. When banks see that many of the loans they previously extended can’t be repaid in full, they become less able to loan out more funds in order to preserve cash reserves. Bankers are currently asking the governments (in the U.S. and elsewhere) to remove many of the bad loans from their books so they can become less stingy extending credit. In the short term this could help banks and borrowers create more money. But this move would do nothing to change the underlying dynamics of the situation, only move the debt plus interest obligations elsewhere, such as to taxpayers.

What Changes Hath the Borg Wrought?

The financial Borg isn’t as creepy looking as in Star Trek, and that’s why we have trouble seeing it. Instead, money works through slow, steady pressure that manifests itself in Borg-like assimilation over time.

Think of America circa 1950, where mom stayed home and cooked and cleaned and everyone watched each other's kids. Now we have fast food and cleaning services and professional child care and all adults join the labor pool to pay money for what they once did themselves. Mom and Dad are now Borgs.

Imagine small, mostly self-sufficient farmers. They live on inherited land and have little need to buy anything, including food. Now put in place trade policies and land reforms that lead to consolidated land holdings and encourage migration to cities where factories reside. These once largely self-sufficient people now need to rent their shelter and buy their food. The world’s poor workers are now Borgs.2

The financial Borg does two things to grow. It promotes increasing consumption by those it has already assimilated, which results in further ecological debt, and it assimilates those on the margin and gives them prosthetic appendages to yield ever more of the species Homo colossus W. Catton.3

What Next?

The United States (and likely other nations with negative trade balances and large foreign held debts) is in a Catch 22 situation. Flows of credit are so crucial for the daily functioning of our economy that it looks as though these will be preserved at all cost. Practically, this means Federal Reserve regulated interest rates will be kept low in the short term to encourage banks to make loans. It also looks as though "a higher power" is going to try to lift the bad loans off some bank balance sheets. This may lower bank-to-bank lending rates which are currently very high. The medium term risk (within a year) of low interest rates is a rapid collapse of the value of the dollar.

Remember that when something is in greater supply, its value declines. Because low interest rates and huge government bailout schemes place more dollars into circulation, the owners of dollars could panic over concerns about the value of their holdings. But the U.S. is desperately dependent upon foreign creditors. In order to attract foreign creditors into the U.S. market with a weaker dollar, U.S. Treasury bill rates would need to be raised, which would then lead to an increase in interest rates. Because imports of foreign resources are also crucial to the U.S. economy, a weaker dollar will make these more expensive. The overall impact is therefore even higher inflation, perhaps hyperinflation, while the economy actually contracts.5

It is difficult in a panicky time to step back and ask questions about the greater purpose of what we are doing. One of the problems I have is balancing my current anxiety over the unraveling of systems that I depend on, with the knowledge that these systems are highly misguided and need radical change. As a people, we have become very poor at distinguishing between productive and unproductive debts. Not all debts are bad. We probably need to have lines of credit in order to install renewable energy systems, build low energy transportation systems, and develop local food systems. But too much of our debt does not generate future revenues and is simply wasteful, such as the military and much of the travel industry. And much of our debt is incurred building "assets" that will be seen as liabilities once oil declines and the oceans rise, such as NAFTA superhighways or sea-level ports for trade with Asia. My bigger worry is that current leadership will do anything to prop up what exists, such as feeble U.S. car manufacturers, rather than demand a shift in priorities.

Fig. 4. Ever larger quantities of debt are now being required to produce the same amount of GDP.6

Our Borg-like monetary system is showing us how poorly it serves our needs. What it needs is growth—growth as measured in the "formal economy" in the form of monetary units, which is recorded in the ledger books of banks, businesses and governments. Because this formal economy is structurally dependent upon growth, it has worked to incorporate more and more of the "informal economy," meaning the work done without monetary reward. Growth in the formal economy does not necessarily lead to our prosperity, and as the formal economy declines we will be back to more of the informal economy. There will likely be much fear and real pain in the short run, but in the long run a stronger informal economy and reprioritization of investments is what we need. And in typical human fashion, it looks like it takes a catastrophe for us to pay close enough attention to see something other than what we want to see.

Notes

1Good on-line material that covers these points in greater detail can be found in Chris Martenson’s Crash Course and associated materials. See: http://www.chrismartenson.com/

2Thanks to Sharon Astyk for describing this: http://sharonastyk.com/2008/09/25/peeling-the-onion-whats-behind-the-fin...

3 I am using the scientific notation for naming species, i.e., Genus species Author, and the colorful terms of William Catton. See: http://dieoff.org/page81.htm

4Find image here: http://whatsinmyipod.blogspot.com/2008/01/african-jazz-n-jive-authentic-...

5I am only discussing one possible dynamic to illustrate the systemic risk and feedbacks. If the money supply can’t be expanded fast enough, prices fall and cash is hoarded, which is deflation. Financial system catastrophe can go either way.

6 Source of chart: http://yellowroad.wallstreetexaminer.com/blogs/files/2008/06/img0009_209.... For a very nice U.S. only chart see: http://www.buchananfs.com/files/23843/Total%20Cdt%20Mkt%20Dt%20thru%2020...

There have been a number of previous articles that have featured either Jason's writings or his radio interviews. This is a link to some of them.

Take away thought: Does the current monetary system serve us, or are we slaves to it?

Yet another insightful article, Gail.

I don't deserve credit on this article. The work was Jason's, and several other of TOD staff reviewed it and provided input, including Nate and Ace. I did the HTML and a bit of final editing.

Does the current monetary system serve us, or are we slaves to it?

Do you believe in the illuminati, New World Order? The creature from Jekyll Island?

Or...

"Never ascribe to malice, that which can be explained by incompetence." - Robert J. Hanlon (though perhaps Heinlein or even Goethe)

Nevertheless, we are all born into it, and have been for at least 300 years, which gives an idea of the probability of changing it for the better.

I've always heard that notion attributed to Napoleon. But in honor of Heinlein, I offer the corollary:

"Any sufficiently advanced stupidity is indistinguishable from malice."

oh, I like that and with permission. will spread it.

I think the point of "not ascribing to malice" is that it is much better for one's own mental health, and thus leading to a more positive state of mind w.r.t. adressing a problem.

If one ascribes something to malice then one is creating an additional problem to deal with. Namely, one has the tendency to take things personally when one perceives them to be the consequence of bad intent. One then has additional personal issues to deal with, rather than deal with the actual problem at hand in a detached, objective and constructive way.

The statement to me, therefore, is about how we personally *chose* to perceive/interpret a situation.

So your corrololary essentially turns the statement upside down.

Let me put it this way. The following two statement seem logical equivalent:

However, there is a world of difference in the direction of the implied choice of one subjective point of view over another.

Clarke

Nice call -- the corollary above does seem to pattern after Arthur C. Clarke's third law better: "Any sufficiently advanced technology is indistinguishable from magic."

I've always been partial to Salvor Hardin's saying: "Violence is the last refuge of the incompetent." In context here, what would that be, perhaps: "Bailouts are the last refuge of the incompetent."

Do you believe in the illuminati, New World Order? The creature from Jekyll Island?

Is something a conspiracy if it is done out in the open?

Perhaps the cancer is that sociopaths are running things.

http://www.energybulletin.net/node/3066

http://www.energybulletin.net/node/37751

(and if the nutters are running things, how does one determine who is or is not worthy of your support? Where is the social rating network for who's a sociopath?)

Although this isn't the best place to discuss things like the Illuminati, Freemasonry, conspiracies, or similar things... there is a lot of evidence proving the existence of these things.

No less than David Rockefeller blatantly admits that his goal in life is to promote a one world government. I'm not saying that a one world government is a bad thing in and of itself. Instead the evidence is that the people promoting these agendas at a high level have malicious intentions and will push forward their ideas at nearly any cost to the general public (aka "cattle").

When you look at the various secret societies and think tank organizations (CFR, Bilderberg, PNAC, etc.), there is a great deal of reliable information about their membership and agendas. It's rather eerie to find out the big names in business, government, and media who are part of these organizations. However, TOD tends to be more scientifically oriented and from what I've seen there are only a small percentage of members who have taken the time to delve deeply into these subjects. Perhaps people are afraid of being labeled kooks.

I agree fully with your observation. I think the "enemy within" angle is one that is frequently forgotten in discussions on how messed up our societies have become. Myself, I was quite naïve about this until I had a stint in the corporate environment (the natural habitat of the sociopath).

One suggestion to the Oil Drum editors: try to get a psychologist to write a guest article on sociopaths. Hopefully it will be an eye-opener for many people.

Energy flow is the key to all activity on earth. Economics is a book keeping system, a way of using an abstraction such as money to allocate available energy and resources. If the public can be kept ignorant of means of the bookkeeping the bookkeepers will be king of a mass of ignorant slaves. Money is the means and the end is control.

"[T]he powers of financial capitalism had another far-reaching aim, nothing less than to create a world system of financial control in private hands able to dominate the political system of each country, and the economy of the world as a whole. This system was to be controlled in a feudalist fashion, by the central banks of the world acting in concert, by secret agreements, arrived at in frequent private meetings and conferences.

The apex of the system was the Bank for International Settlements in Basle, Switzerland, a private bank owned and controlled by the world's central banks, which were themselves, private corporations. The growth of financial capitalism made possible a centralization of world economic control, and use of this power for the direct benefit of financiers and the indirect injury of all other economic groups."

~Carroll Quigley, Tragedy and Hope: A History of the World in Our Time (New York: Macmillan, 1966) p.324

If you wish to believe it was just happenstance that it turned out this way that is your choice. The modern global finacial system and "globalization" in general represents exactly what Rome stood for but on a global scale. It offers the least "happiness" to the greatest number of people.

“America is today the leader of a world-wide anti-revolutionary movement in the defense of vested interests. She now stands for what Rome stood for. Rome consistently supported the rich against the poor in all foreign communities that fell under her sway; and, since the poor, so far, have always and everywhere been far more numerous than the rich, Rome's policy made for inequality, for injustice, and for the least happiness of the greatest number.”

~Arnold Toynbee, 1961

Since most of us who have access to computers and an education are amongst the lower tiers of the “rich” it is hard to gaze out into the world with unfettered eyes. The fact remains that the “wealth” we now posses has been stolen; our civilization has been built with military power and conquest and there are no signs of changing that course.

“What we call progress is a mysterious marriage of creativity and plunder. Civilization has flowered when human beings have devised ingenious new ways to organize production and social life, but such organization has usually been accomplished with stolen goods…. Under girding [its] extraordinary achievements in art philosophy, literature, and statecraft [are] military power and conquest.”

~Richard J Barnet

As we collectively head down the road of diminishing returns any and all arguments will be conceived to maintain the current state of wide spread inequality. All the arguments will be thinly veiled lies carefully crafted to work in the favor of the global capital Empire.

"Wherever men hold unequal power in society, they will strive to maintain it. They will use whatever means are convenient to that end and will seek to justify them by the most plausible arguments they are able to devise."

~Reinhold Neibuhr

==Angry Chimp

Great Post, AngryChimp! Keep it coming.

Energy flow is the key to all activity on earth. Economics is a book keeping system, a way of using an abstraction such as money to allocate available energy and resources.

And so is eMergy.

True but Odum’s eMergy is based on real values, i.e. solar energy, unlike “money” which is just printed with no relationship to a natural energy value.

I would not be surprised to see a play at an integrated, global governing body come out of all this. Fear can do a lot to making people bend to the "only" option available.

From what you state above, you could currently argue there is already one integrated entity running the global financial machine.

"From what you state above, you could currently argue there is already one integrated entity running the global financial machine."

I would argue that there is an affiliation of different groups/families running the financial machine. The question is how tight is this affiliation? Nietzsche wrote long ago:

“…every specific body strives to become master over all space and to extend its force and to thrust back all that resists its extension. But it continually encounters similar efforts on the part of other bodies and ends by coming to an arrangement with those of them that are sufficiently related to it: thus they then conspire together for power.”

In the journey of increasing net energy even former powerful enemies would unite as they conspire together to increase their power. The rub lies in a world of decreasing net energy will this formation of different groups brought together by the desire of power fragment once again and begin to fight amongst each other for their piece of the ever shrinking energy pie?

==AC

thats the paradox of materialism. . what else are we slaves to?

"what else are we slaves to?"

We are slaves to our own ignorance…

“Each person “has” an idea of the absolutely real, the highest good, the greatest power: he may not have this idea consciously, in fact he rarely does. The idea grows out of the automatic conditioning of his early learning; he “lives” his version of the real without knowing it, by giving his whole uncritical allegiance to some kind of model of power. So long as he does this he is truly a slave; not only is he unconsciously living a slavish life but he is deluding himself too: he thinks he is living on a model of the true absolute, the really real, when actually he is living a second-rate real, a fetish of truth, an idol of power.”

~Becker, “The Birth and Death of Meaning”

I made the comment in a different forum that the financial system was in effect a sort of Ponzi scheme. I suppose it isn't a 100% accurate metaphor either, but this need for constant growth has concerned me as well. In my view, globalization was done largely because Western consumers were saturated with debt, and the only way that further growth could take place would be to develop consumers in other parts of the world. Even assuming that this could actually work, eventually you would reach a point where the entire world is saturated in consumer debt, and there would be no way to expand further.

The other question I have has to do with the question of the degree to which economic growth is aided by population growth. And if you assume that population will plateau and then decline, will traditional types of economic growth ever be possible in the future?

Nobody really reacted to my comments in that other forum. I suppose most people wrote it off as crazy talk..

I hadn't thought about the idea of globalization fitting with the need for more growth, but of course you are right.

I don't think it is just consumer debt that it is growing. It is business debt, and government debt, and undeclared government debt (like social security). Population growth enters into this as well.

I have said many times before that in a finite world, we reach limits. There is no way this growth can continue. It is not possible for the majority of borrowers to pay back principle plus interest in dollars that buy as much as originally, if the world is not growing. Lenders will eventually figure this out, and stop trying to lend. Then (now ?) the whole scheme starts to unwind.

"Lenders will eventually figure this out, and stop trying to lend. Then (now ?) the whole scheme starts to unwind."

um... They've had several millennia to work it out. Perhaps they consider the acquisition of assets for little effort a feature rather than a bug in the system.

There is a rather lengthy (almost 4 hours) video conspiracy theory about the nature of the Federal Reserve, and the use of such to deliberately alternately inflate and deflate the monetary system in order to maximise the acquisition of real assets.

http://video.google.com/videoplay?docid=-515319560256183936

With limited resources, the acquisition of assets for very little effort is going away. One has to pay more and more, for quite a wide variety of minerals and energy products. This adds a whole new recent twist to the process.

Gail

I think yours is a very important point of recognition.

Globally, 'we' are only part of the way through a roll-out of industrialization. Roll-out of BAU (and commanding the resources to underpin industrial 'growth') to encompass all the globe is, as you say, clearly not possible. Creation of new 'markets' and technologies which have allowed and still allow investments in one part of the world to be realized as profits in another, run up against critical limiting factors.

Technological changes in transport, storage and production have always been accompanied by a competitive race for resources. Money chases industrial and market 'growth' in a feed-back loop?

Globalization is a way of importing resources. I'd see it not as a way to increase debt, but more like debt is one of the tools used to enforce and define globalization and technology (as in form of treaties and trade agreements).

Population growth is one of the multipliers in the growth equation. That's a trivial answer. Going beyond that takes a whole library. That's probably why you didn't get a response.

cfm in Gray, ME

I understand that 97% of our money supply is debt based (in the UK anyway), I wonder if anyone has a historical graph of this over the last say 100 years?

Prior to the Great Depression was it very high, and did it fall afterwards, and if so, by how much?

I sometimes wonder if debt been growing worldwide since the inception of the Bank of England? Wasn't that their agenda?

Also, I see the the main benefit of credit cards etc, is that they reduce the public demand for cash, and therefore allow more of the base cash to be used as the reserve requirement component for lending, and the growth of debt.

Globalisation was done simply because of modern cheap transportation technology. It gave companies access to cheap labor and lower costs than even western robotic factories.

In addition to that you had construction companies going to the developed world, and offering to modernise countries infrastructure. And that of course was paid for with debt. But the ultimate push behind it all was cheap labor, it let developing countries see a chance for growth and become willing to lay down debt.

Basically it's that maximising the remaining human labor was more efficient than going to automation. But there's still quite a way to go before we reach peak productivity with just existing technology. But standing in the way of increasing productivity is demand which has been maxed out with every means possible including of course debt. And also supply of raw materials.

Globalisation will reverse when oil peaks, at least in manufacturing, companies will build factories closer to where their consumers are, with tiny work forces and robotic labor, powered potentially from solar energy or other means. Once you've built the solar panels you now have free electricity essentially, instead of being reliant on electric bills.

Expensive energy will even encourage even factories to go off the grid. ;)

The need for growth will lead to efficiency once scarcity is reached. Assuming the system doesn't implode first.

Which it unfortunately very likely will, due to the debt bubble imploding.

The debt bubble is as much a risk to the global economy as peak oil. And it will add difficulties to efforts to deal with peak oil. The government should not be throwing away tax payer money on propping up the finance industry which is only allowing them to get further into debt, that just serves to make a larger implosion, this $700 billion should go to peak oil mitigation efforts. At this point a depression is inevitable, and what credit we still have really needs to go towards alternative energy.

The relative value of modern currency is determined in the currency marketplaces. ALL hard currencies are 'fiat' in that the primary exchange rate (Dollar- Pound- Ruble- whatever- Gold) are fixed by decree ... and can therefore be ignored. The only true fiat regimes today are the Chinese Renmimbi and some currencies that have dollar pegs or countries like Ecuador and Panama which use US dollars as currency. The petrodollar regimes are more market derived than fiat since the underlying crude is traded and price control is difficult to achieve. What has been happening to crude prices at the moment is a good example. Most dollar pegs in oil producing countries have been strong even under pressure of high crude prices. High crude prices tend to be inflationary for the producer countries.

Most of the debt creation of the past ten years has remained in the asset markets; debt is used to inflate the values of things that hedge fund managers can make fortunes upon; stocks, real estate paper (ABS) and 'companies' taken over. It remained in this sphere and does so today ... somewhat unBorglike. The debt trickling down to the masses has been expensive and where it wasn't - home equity lending, for instance - the price of the cheap credit is being paid now.

A good overview of the situation can be found here:

http://www.prudentbear.com/index.php/commentary/creditbubblebulletin?art...

Fiat comes from the statement that "you must accept this as payment of debts". Rather than the value itself.

Hmm then its made from lead.

I've said several times the the US has perfected turning lead into gold.

Hot metal jacketed lead but still lead.

.

Think of cash & money as food, and picture 2 male twins, pigging out on the food. EVERYDAY. The only difference is one sits on the couch and keeps eating and eating while watching TV. While the other goes to the gym, and and sticks to a strict workout routine. The result, the food in the first twin will go too all the unwanted places, and be stored as excess fat (bonuses, political scrimmage) and the outcome will be viewed as undesirable, and unappealing (by the vast majority). While the other twin who utilizes his food correctly, begins to develop muscles in places he never new existed, and turn out chizzled, and well defined. Overall he is not only more appealing, but his health is stronger, he is more disciplined, and he has learned to become more focus.

This is our monetary system. It all depends on how money is used, and the impact of its effectiveness. Lets not squander the few dollars we have left, but use it wisely, learn from our mistakes, and become more disciplined, and improve the overall health of our economy.

What you have described, Gail, is a cancer. Unrestrained, all-consuming growth without purpose, until the host is dead.

The key concept seems to be "without purpose."

Borg, in Star Trek had some kind of central direction and purpose, though it wasn't necessarily understood by the Good Guys of the Starship Enterprise.

So my question now, as always, is there something purposeful behind this worldwide economic meltdown?. Are the "crazies" who have been warning us of a takeover of the world by a relatively few shadowy bankers ("The Bilderbergs", etc.) to impose a World Wide Dictatorship through the U.N., etc., really that crazy?

Are we being set up? Or are we merely victims of our own good fortune gone terribly wrong?

This is Jason's post, not mine.

I doubt conspiracy has anything to do with the situation. It is really the way the monetary system works. It can function as long as there is growth, but once you run out of growth capabilities, it falls down. We don't know whether this happens in stages, or in very big chucks. It looks like we may be witnessing a step-down of some sort now.

OK. Then I would keep the Borg out of it. Their "purpose" was to rule the Universe.

Apparently no one, and no group is interested in such a thing, here on Earth.

What remains is that Western Finance is a cancer. Our Islamic brothers (half-brothers if you buy the Ishmael story) have been telling us that for a long time. Now perhaps we will have a chance to see if they can do any better.

Organisms with a mind are said to be goal oriented. The Borg would qualify.

The money system doesn't have a mind, so it can't qualify as being purpose driven, but the results are the same--growth and assimilation.

Allegories often personify processes.

Something like a cancer would probably be a better analogy. Each individual cancer cell is only programmed to grow and divide, but there isn't a greater purpose or intelligence that ultimately motivates the thing.

Or perhaps a parasitic infection is a better analogy. A parasite can kill the host if it grows too rapidly, but the parasite also depends on the general well-being of the host for the survival of the parasite.

Very true.

Part of why the Borg allegory is helpful, though, is that it puts a "face" on it. And because humans brains are wired to respond to faces, perhaps more people will pay attention when presented this way.

The reason the Borg analogy falls down for me is the apparent absence of "purpose" in the financial meltdown.

If there is a purpose behind it (as there was for Borg), then there is an intelligence and a will which guides it.

That is precisely what we are all at pains to do here on TOD-- a "purpose" would imply that someone was trying to initiate, then control the situation for their own purposes. That would amount to "conspiracy theory", and I guess that is bad.

If there is no intelligence behind the collapse -- just the result of overbuilding of a house of cards-- then it really is more like a cancer.

The important thing is that the remedies are different -- you can't treat a cancer as though it were a criminal, and you can't pretend that a criminal doesn't know what he is doing.

The purpose of financial markets is to make rich people richer as fast as possible. The this particular get rich scheme had a short time horizon for sucess, indicating that the perpetrators were not thinking very far ahead. However, this lack of foresight is only an extreme case of a general characteristic of our economic system. Even more 'solid' growth base on manufacturing infrastructure building and adequate intermediate term energy flows refuses to look at the long term future. The whole background of our economic system is the assumption that the vigorous economic growth of the last two centuries is going to continue on into the indefinite future.

I once audited a Macro Econ 101 class at a major public university and sat dumbfounded as the very nice and capable professor explained in clear as can be terms and equations that it makes no sense for the people alive today to conserve out of concern for the future because high growth today permits the problems caused by that growth to be solved by our descendants.

I tried introducing him to Ecological Economics and still wonder if I had any influence.

I'm still a little surprised my Macro Economics professor not only passed me with an A+, but also refrained from ejecting me from class. At one point I made a major mistake by openly referring to basically the same thing as bull!#@$. Undoubtedly I could have used more tact, but when I took the class I already had rather strong views about the demise of our economic system.

I'm more of a Ron Paul leaning, Austrian school of economics sort of person.

Here is a potential purpose. The top 1% are harvesting the real wealth of the planet. Outlandish, but a purpose.

Processes probably don't like being personified.

What remains is that Western Finance is a cancer. Our Islamic brothers (half-brothers if you buy the Ishmael story) have been telling us that for a long time.

Meditate on if the reason to vilify Islam is because following Islam breaks the banking/money system as the west practices it.

Just a note on why Islam doesn't allow charging interest.....

Apparently charging interest was frowned upon by Christianity many many centuries ago too. However, I would expect that Islam stuck with this, because it largely came out of the desert environment of North Africa+Arabia and growth in such a fragile environment was probably always extremely slow, so it would be not surprising that this is embedded in the psychic or culture of Islam since it would have been plain that charging interest required growth and that was never going to last. Indeed it has probably been long recognised that in that part of the world that a burst of rains can bring a spurt of growth but that things soon return to 'normal'

I don't know if anyone is still looking at this thread-- but my knowledge of Islamic finance is minuscule in the worst way. All I know I learned from Wisdomfrompakistan on his posts here.

He seems to be very certain that charging interest to one's brothers is immoral, and fundamentally will result in the collapse of the system for purely structural reasons, let alone its immorality.

That seems to make sense -- one can't have unlimited growth through debt and interest-- it becomes unsustainable. Instead, there has to be some way of pruning the debtors (send them to war, kill them, send them to Australia, etc.), or forgiving debt (Jubilee, etc.) Western finance has its own form of jubilee--bankruptcy-- but it seems like the rules seem to favor the giant players over the weaker ones. (That's just life, right?)

Now the government steps it to decide who will live and who will fail -- I suppose wisdomfrompakistan would consider that to be a desperate act that is beginning to show the cracks.

I'm not much of a conspiracy theorist but, to put on the tinfoil hat for a moment...

I have been wondering whether it might be possible that the PTB finally came to a consensus that peak oil, or resource depletion, was an imminent show-stopping reality and that, if the system fell apart on it's own, they could lose a lot. But, if they knocked the system over discretely they could manipulate the fall and take advantage, while also hiding the resource problem from the masses, enabling a continuation of BAU through a long portion of the beginning of The Great Decline.

(I've personally named the time before "about now" as the Age Of Abundance, and the time after "about now" as The Great Decline, not depression, because it will likely not end for a hundred years or more.)

while aesthetically appealing in theme, the reality is the origins of this crisis were when SEC approved wall st banks ability to lever 30-40 times and pushed FNM/FRE to lend to sub-standard credit risks. While the swing for the economic finances was an attempt to replace a declining energy surplus (at least partially), I can't imagine this has all been orchestrated, other than maybe in our genes. A)there would be enormous unintended consequences based on chaos theory (of course - we ARE seeing those) and b)those SEC changes occured when EROI was still increasing and oil was $10 a barrel. I guess it's possible that they had foresight back then but I doubt it.

Quite true. And while I don't doubt the fraudulent practice of the bankers and predatory loans, on the other hand it did to a certain extent require all those taking out the loans to believe that the economy really would grow and somehow it would be all paid back. And this belief is very much part of the general belief, growth will somehow continue. The almost religious like faith in technology is part of this too, since I find that the vast majority of people that I try to discuss any of these resource issues with are convinced that technology will solve any problems. And why do they believe this? -because as far as they are concerned it has delivered and will do so again.

In a strange way a lot of this is tied up with both the denial of Peak Oil and Climate Change. Lots of people are vaguely aware, we must doing something about the later and of the former say we have biofuel and shale oil, but are unable to accept that deep change is needed. They still think technology will allow Business As Usual and not only that but life will somehow get better. They just simply ignore the elephant in the room of PO and CC. It is this set of still widespread beliefs that formed the other half of the debit-loan fiasco. Indeed a good many of my colleagues are certain that an upturn will appear in a year or two. Nobody wants to accepts the Limits to Growth have well and truly arrived.

You're likely correct, it's probably far too complicated to have all been constructed. But I was thinking only of the recent part, the collapse, as having been "forced" for gainful purposes (after a majority of TPTB, only recently, finally realized where things were inevitably headed). The build up of this house of cards over the last few decades was not within my tin foil delusions.

It was quite coincidental that it all started falling apart right when prices were zooming sky high and PO was starting to enter the public discourse...remember that hopeful moment not too many months ago?

Yes, I do!

Just a couple months before that I had the PO thing 'properly' sink in, after knowing about it for a couple of years. But was still in the bargaining phase ("Wait! We can still do something if people wake up!").

That has kind of faded. I'm really infuriated now, that we justed wasted that money / chance. :/

Guess I hadn't really done the anger stage yet.

I'll try to keep my old foil hat in the attic for a while...

(Hey! Everybody write CNBC and ask them to do a follow up on "The Hunt For Black Gold" that could talk about how depletion will make recovery difficult/impossible.)

It was quite coincidental that it all started falling apart right when prices were zooming sky high and PO was starting to enter the public discourse...remember that hopeful moment not too many months ago?

Great story... There are limits, there must be limits. Nothing is infinite, including growth, credit and oil.

I'd propose that the real problem is that money has become divorced from physical assets- Money is not something that is tied to gold (or any other asset) but the idea that things have value, and will continue to have the same value in the future. It's the idea that stock has a value over time, that the pretty green pieces of paper in your wallet has value to someone else and will continue to have value.

A fix (as I see it) would be to tie it back to physical assets... It does not necessarily need to be gold- it could be a basket of items (Gold, Platinum, Silver, Oil, etc.) that are TANGIBLE. "Fiat" is just another 4 letter word...

Another fix is sustainable living- we are consuming too many resources and causing large and possibly unsolvable problems. There may need to be an adjustmnet to our population growth (and it'll happen either voluntarily or involuntarily).

A book I'd recommend to Jason (or anyone else) is When Corporations Rule The World by David Korten . The idea of what has happened with globalization is explored here... A partial synopsis is below:

Thanks, I haven't read Korten's book, but he did speak in our town and I saw him speak at a BALLE conference too. That quote is a great summary of a main point of this article too.

Instead of using metals to constrain money supply, FEASTA suggests an energy/pollution backed currency system for international trade. See: http://www.feasta.org/money.htm.

Gail/Jason/all, I really enjoy your posts. It frustrates me that you don't talk about what I feel is a glaring problem with our modern economy. The fact that some of the participants are provided a free giveaway of limited liability insurance regardless of risk.

The idea that the voting owners of a business have no personal liability for the debts of that business is simply a break in the market logic at it core. Because the "cost" of this liability is not factored into the price of owning a business (share price), there is no way the market is pricing these businesses correctly. The idea that an investment bank with 30 to 1 leverage should pay the same liability insurance as a farm or a software developer (currently they all pay ZERO), is not a workable long term solution.

Note, I am not talking about getting rid of limited liability, liability insurance in the case of bankruptcy simply needs to be *paid for* by the individual business based on the risk (like all insurance), only then will the market price the risk and determine which business is worth investing in... or not!

That "flaw" is really a design of the system. By definition, the owners of a corporation have no personal liability for the misdeeds of the organization. The price of the stock can fall to $0, but beyond that, there is no liability.

I think some have been arguing here that with all of the bailouts (historically and now), there is also a "heads I win, tails you lose" aspect of big businesses. Businesses that are considered too important to fail are frequently bailed out, if things go too badly. The taxpayers get to pay for the mess, even though they never owned stock in the company and may not have gotten much benefit from the company.

Liability insurance is somewhat different. It pays for specific kinds of risks--that people will be injured by a product a company makes, or will be injured in the parking lot of the company, for example. There is also insurance for Directors and Officers of the company, to the extent that this can be insured. Rates for liability insurance will vary with the type of business, based on historical claims experience for that type of company.

In some cases, industry groups put together insurance programs (typically in offshore locations) that insure risks of a particular kind. These pools will cover up to a selected per claim limit. Reinsurance or excess insurance may purchased above that limit. For example, actuarial consulting firms have a pool to cover their liability risks. I am sure that there are insurance pools in the banking industry, in the nuclear industry, and almost any industry you can think of. The rates, of course, will reflect the experience of the particular type of business.

"the owners of a corporation have no personal liability for the misdeeds of the organization"

I guess that's exactly my point. In a market context, that makes no sense. It hides a potentially huge cost of doing business from the owners of that business. Markets depend on pricing risk in order to work. If risk is not priced, then it is not a "real" market.

Let me put it this way: you gave a number of examples of liability insurance in your answer to me. All I'm saying is that the most fundamental insurance: that insurance that covers the owners from personal risk in the event of a bankruptcy is being given away FREE when it really doesn't have to be. How tough would it be to have businesses pay for liability insurance for it's owners?

I feel like you are just saying "hey that's just the way it's gotta be.." I think it's really worth examining if that's true. One thing is certain in my mind, if the owners of Bear Sterns had to pay for limited liability insurance, they NEVER would have leveraged 30 to 1 on the kind of BS that they did,because the liability insurance would have skyrocketed, cutting profits and making taking that risk much less attractive.

That's exactly how a market should work, the owners assessing a risk and investing or not. Hiding risk is just never going to work out...

One purpose of government is to act like a giant insurance agent. The economy tanks, the government makes sure the jobless get food stamps. Regulators are supposed to be there to make sure that business doesn't try to externalize all costs, e.g., don't add cheap toxins to the food supply. This would be similar to an external auditor from an insurance company making sure the price of the risk is appropriate.

Unfortunately, after a long trend towards corporate control of politics the foxes now guard the coop.

"This would be similar to an external auditor from an insurance company making sure the price of the risk is appropiate"

Similar but not the same. Regulation costs the taxpayer, the whole point is that taking high risk bets should cost the *owners* of the business taking those risks not the taxpayer. Having the business pay for insurance does this, and allows shareholders to get an independent guage on how risky a stock is.

One purpose of government is to act like a giant insurance agent.

That would be a Kensian model, no?

Von Mises and his Austrian school have a different opinion - correct?

(and what other models exist?)

I think if you go back to small enough businesses, the owner has his reputation to uphold. If things go badly, everyone knows who he is, and who is family is.

I think that part of the problem is that we have moved toward huge organization. No one really feels much responsibility. The person in charge is getting a huge salary, and a bonus based on quarterly or annual financial targets. Al he (and it usually is a he) cares about is meeting that target.

As we move toward relocalization, I would think that the problem should start to get better. I think the legal system will start playing a smaller role also, regardless of how the laws are changed.

the owner has his reputation to uphold.

How does one create a 'reputation system'?

How does one encourage small business - follow the 'abolish the IRS' for individuals camp - thus making a 1 person business tax-advantaged?

Small communities create their own reputation system. When one knows everyone else in a community it is difficult to do business if you screw someone over.

Often a small business owner will own their business premises and home in the area and will maintain both of these.

Gail, I agree with all your points individually. Let me point out that the very reason we have such huge organizations is, in part, free limited liability insurance. Many of these giant corporations could never have grown at the rate they did if they had to pay liability insurance. The cost would have eaten into earnings, the stock price would not rise as fast, so people would not invest as much in it, less available capitol = slower growth for many of the highest risk corporations.

Markets work when you pay for what you get. Right now owners of businesses are not paying for this insurance, and you are seeing the results ~ 1 trillion so far in my money and yours because the owners simply didn't have to worry about 30 to 1 leverage - they just walked away.

I want to stress that this isn't a matter of removing protections from investors, it's simply that those investors are getting something for free that they should be paying for - insurance in case the company they are part owner of owes a debt that it doesn't have the assets to cover.

It seems like companies will start getting smaller if we start losing services that make big companies "work"--such as large quantities of imports from overseas, easy airline transportation, universal electricity, jumbo sized banks to handle their accounts, and cheap transportation of goods over long distances. Credit is another essential service. Government will attempt to keep everything going, but at some point, it will not be possible to do so.

"That "flaw" is really a design of the system. By definition, the owners of a corporation have no personal liability for the misdeeds of the organization. The price of the stock can fall to $0, but beyond that, there is no liability."

So my blind 92 year old mother in an assisted living home should have personal liability for any misdeeds of employees of J.P. Morgan-Chase or insert your choice of evil Wall Street bank? (The dividends pay the cost of the home and then some.) You want to punish stockholders, beyond loosing everything for the misdeeds of the corporation, huh? And what do you think that would do to capital markets? The possibility the value of your stock falling to $0.00 seems to be a pretty good definition of a liability to me. (Try using stock in Fannie or Freddie as loan collateral about now.)

puhkawn, as I said in my initial post, I do *not* advocate getting rid of limited liability. This insurance is clearly needed to insure that people like your grandmother feel comfortable investing in businesses.

However, that creates a problem. Right now, according to you, your grandma happens to be a voting owner in one or more businesses (she's a shareholder). And right now if those businesses goes into debt and fails, the tiny fraction of that debt that is owed by your grandma (let's be clear, your grandma is part of that business - that's what ownership is) is not paid by your grandma. Why not? Because there's a special type of insurance given away to certain types of businesses for "free" by the government (that is, the cost is picked up by the taxpayer).

All I'm advocating is that the cost of covering the owners of a business in this way be born by the business as an expense. This would allow price signals to better inform the owners like your grandma.

"The possibility the value of your stock falling to $0.00 seems to be a pretty good definition of a liability to me."

To me that sounds like partial liability. That is, liability until the stock hits $0. What happens to all the money that is still owed? Why, you and me pick up that tab. Instead Goldman should have been paying for liability insurance that would cover it's owners in the event that they go belly up. If they had, the insurer would have taken one look at the 30 to 1 leverage on unbelievably risky mortgages and said "fine, but your limited liability insurance is going to cost xxxx hundred million dollars a year". This would have implications on the profitability of the company, and thus the stock price. Grandma would have seen her stock price going down and asked "WTF??!?!?! I'm selling or voting those idiots on the board out" - which is *exactly* how a market should work. But because there was no price signal on the risk of debt default, Grandma, and we, got the total shaft.

And what do you think that would do to capital markets?

It could cause them to act in a responsible manner. Pray tell how the value of Leaman's stock falling to zero be enough of an impact when the company was leveraged 30 to 1. Are the big wigs giving back those Christmas bonuses?

You will be assimilated.

I am Locutus of Borg. Lower your shields and surrender your ships. We will add your biological and technological distinctiveness to our own. Your culture will adapt to service us. Resistance is futile.

Thanks a lot guys for new nightmares to haunt my already shortening sleep....a Paulson Borg...ewwwww!!!

Looks like he's wearing a bluetooth headset - they just usually use a blue LED.

That photo was made, I estimate, in 1992. I don't think any blue LEDs were available then.

--- G.R.L. Cowan, author of How fire can be tamed

I changed the initial pic to this one because Jean-Luc looks a lot like Paulson. :) I almost was going to go over to the lab and get on Photoshop, but this one will do.

If you click on Locutus' picture, it takes you to the MemoryAlpha site, which provides a Star Trek geek's wet dream of information: http://memory-alpha.org/en/wiki/Locutus_of_Borg

Holy macaroni he does look like Paulson! Nice catch.

Of course I saw that one when putting this together, but found the other image more creepy.

"FREEDOM IS IRRELEVANT. SELF-DETERMINATION IS IRRELEVANT. YOU MUST COMPLY."

"We would rather die."

"DEATH IS IRRELEVANT."

Science fiction is often clever social commentary in disguise.

As in Bob Shaw suggesting we explore the relevance of Asimov's Foundation Trilogy.

Asimov's Foundation is rather simplistic, although well written, it has the old idea that complex systems can be predicted once we know the rules. Social engineering in the literal sense. Chaos theory has shown that is not true, but Asimov does have his own Black Swan in the form of the Mule.

As a message to mankind, I much prefer Brian Aldiss' Helliconia trilogy.

Your forgetting the Asimov's Foundations concept of predictive collapse and directed decline. See Naomi Kline's 'Shock Doctrine' and 'Confessions of an Economic Hitman' by John Perkins for more details.

Cascading blowbacks, assertion of Liebig Minimums, Strategic Element Control, the Rise of Earthmarines, the Porridge Principle of Metered Decline, and other concepts I have briefly sketched all play into Optimal Overshoot Decline.

That's a lot of jargon, I don't know what it means, and some conspiracy theories thrown in. It sounds like you are trying to engineer an ideal society like you would design a machine. Calculate inputs, outputs and design a sustainable process, which everyone follows. I just don't think it works like that.

Have you read the Helliconia trilogy? I highly recommend it. Some words about it from Brian Aldiss:

I had the idea once to start a blog about the BORG and economic assimilation on planet earth. But given the antics over the last few years I thought it appropriate that it be named after what we used to call "Banana Republics".

Hence I registered the domain name "BananaB.org" for the blog. Problem was I really didn't have enough to say and certainly nothing new. Never used it.

So I still own that name - if anyone wants to use the name for a site, I'm sure I can be convinced to part with the name for a very reasonable sum. And giving it added value: the BananaB part is whatchamacallit, you know when a word reads same forward and backwards... forget what that is called now.... um, palindrome.

Here is the solution, implement all of the following:

(1) Stop fiat currency altogether. Money should be gold and silver coins and only that.

(2) Eliminate all interests on all debts at once. The lender has right to only take back the loan given. The lender never had right to take any interest on the loan for so many obvious reasons.

(3) Stop all governments' manipulations of the market at once. All markets must be free markets and must be allowed to work freely. That would naturally kill the bad and save the good. If you not believe in free market then better be communist, don't expose yourself to the bad of both worlds.

These are the necessary steps to solve the financial problem world is facing today. Once the problem is solved implement the following (in addition of keep implementing the above) to avoid any future financial crisis:

(1) Minimize government taxes as much as you can so that governments not have that much wealth at first place to bail out the bad portions of society, to start unnecessary wars, to perform unneeded space research etc. Low taxes also means more disposable income for people which means better and more desirable economy.

Note: Any reduction in taxes must be accompanied with equal reduction in government expenses.

(2) Avoid taking any kinds of debts even non-interest debts for any purpose. Do business with your own money so you can keep functioning in less profit too because you would not have to pay interest. Buy houses, cars, fridge etc with your savings and don't buy them when you not have enough savings.

(3) Be more good to people around you, your neighbours, relatives, friends, colleagues etc and help them when they are in trouble to encourage them to help you when you are in trouble. That eliminate any need of insurance.

(4) Learn to produce more and consume less to be a net positive to society.

(5) Learn to take only as much from nature as it can renewably supply you in long run.

With respect to 'free markets' unfettered by government: I just read an enlightening article in the New Yorker about the illegal timber trade. A huge amount of timber gets cut in Russia and sold to China where it is turned into goods to sell at places like Wal*Mart. The trade is dominated by Mafia-like crime organizations, since government doesn't really exist on these frontiers, whose modus operandi is to wipe out competition--literally. The 'fiat' is cash and cash only.

This type of situation is what I see as happening if governments and government regulation is done away with. Free markets, indeed!

WFP,

While your suggestions sound simplistic, their simplicity gives them viability.

The question then becomes how do we do this globally and simultaneously?

Perhaps a global ctrl/alt/delete. Eliminate all fiat currencies, issue every global citizen 10,000 grams of gold and title to the dwelling they occupay and any business they may own. After that, its a clean start with a realtively leveled playing field.

Just a thought.

I like the analogy of a global crtl/alt/delete!

Hello Gail,

IMO, it's more precisely known as Jay Hanson's fast-crash, Thermo/Gene Collision prediction timeline, as opposed to the ArchDruid's long grind to Catabolic Collapse. For TOD Newbies [small PDF]:

http://warsocialism.com/thermogenecollision.pdf

--------------------

...If you were born after 1960, you will probably die of violence, starvation or contagious disease...

-------------------

My Peak Outreach efforts to the young is to hopefully induce them to move towards Optimal Overshoot Decline, which will shoot the gap between Jay's and Michael's great works. Time will tell...

Although the best approach would be to do it simultaneously but we can also do it country by country.

Stop giving vote to any political party that supports this system and tell people to do so. When the vote turnover would be less than 10% of adult population for a while existing political parties have to change their strategy and new more desirable political parties can emerge.

Avoid taking any further debts. Buy things from your savings only. Try to repay the debt by cutting expenses, sooner the original debt is paid lesser would be the total interest paid.

Follow the insurance avoidance method told above.

Take out all investments and deposits from all interest based banks to accelerate their shut down.

Teach others the same.

and within a year there will be poor and rich once again.

You do not begin by doing it globally. You do it locally first. Save your own community and establish useful relationships with other communities.

Debt and money supply will necessarily rise exponentially until they collapse. And collapse is inevitable because money is still a claim on real, tangible things, like labor and resources, which in the real world are finite.

I don't think that follows. I grant you that interest-paying deposits force the banks to reloan your money on fund the interest they pay you and thereby continue existing, but nothing sets an absolute minimum on that rate. (I have a checking account that pays 0.25%... I don't think that's inflating any asset bubbles!) And labor and resources are growing: population increases, and new capital goods (machinery, intellectual property) are being created, as well as more natural resources entering the economy. So, there should be a rate at which the money supply is growing at the same rate as the actual economy. Now, certainly irresponsible lending in the quest for higher yields was a driver for the credit collapse. But I think it's completely possible for "the system" to work in a healthy way, and that the fact that this crisis occurred is more of a failure of the people involved (Fed Chairmen setting rates too low, investment bankers getting greedy, morons watching Flip This House on TV and thinking "me too!" with interest-only mortgages, bankers blindly trusting Moody's instead of doing research) than our financial system.

Naturally, given where I'm posting, I want to make it clear that I do believe natural resources are limited in the grand scheme of things, and that at some point we'll have to transition from a growth-based economy to a sustainable one where populations remain stable and total wealth grows only when someone discovers a way to use the same sustainable resources more efficiently. BUT: it seems like the eventual resource constraints aren't what's being discussed here, just an assertion that the banking system causes crashes on its own merely by existing.

The interest you receive on a checking account is the bank letting you in on a share of interest-earned profits.

Another way to look at this would be the natural rate of increase in an asset, such as a forest, and compare that to interest rates. If a forest grows at 2% per year, and an old growth forest doesn't grow at all, then liquidating that forest in order to sell its wood and put that money into even something like CDs will yield a greater return on money. Stuart Staniford discussed this in his post The Net Present Value of Grandchildren.

So, I would argue that the interest placed on most credit instruments is much, much higher, than growth in real-world assets and so we simply are forced to liquidate Nature to get the return demanded by our debts.

No, do you have a link to that post on NPV?

Here:

http://www.theoildrum.com/story/2006/6/24/184325/864

This is a link to Stuart's Inflationary Collapses, or the NPV of Grandchildren.

Jason, I was looking for the right place for this comment until I saw your mentioning SS's post. Because the following comment is an upgrade of one I made at that thread.

For a clear understanding, it's necessary to decouple the monetary system and the banking system and look at the options for each. Below are the possible combinations in the form:

Monetary system; Banking system; stability; historicity

1. Gold standard; 100% reserve banking (or usually no banking); stable; historical (first)

2. Gold standard; fractional reserve banking; unstable (no bullion lender of last resort); historical (1694 in England - around 1930 everywhere)

3. Fiat money; fractional reserve banking; stable (as long as central bank is willing to print currency as needed); historical (since around 1930 everywhere)

4. Fiat money; 100% reserve banking; stable; theoretical (Simons 1934 and Fisher 1935).

Heretofore, I refer to system 1 as pure precious metals-based (actually, silver has a longer and richer monetary history than gold), and to systems 2, 3 and 4 as "soft" (should be "funny money" in gold bugs's jargon).

Of note, the biblical prohibition of interest:

Ex 22:24 - "If you lend money to one of your poor neighbors among my people, you shall not act like an extortioner toward him by demanding interest from him"

Lev 25:37 - "You are to lend him neither money at interest nor food at a profit."

Ez 18:8 -"if he does not lend at interest nor exact usury..."

was issued when the monetary system in effect was pure precious metals-based. And it applies only to that system, so that it is legitimate to earn interest from soft monetary systems. That's because the properties of the currency (the entity performing the functions of money) are fundamentally different between pure pm-based systems (where gold and silver have to be mined), and soft systems (where central banks can easily print bills and even more easily create their electronic equivalent).

Below I try to show that:

1. The existence of a widely available, RISK-FREE interest bearing investment requires a "soft" monetary system.

2. For that investment to also yield a REAL positive interest rate, real economic output must grow at that rate or higher.

To demonstrate the first point, let 's assume we have a pure gold system. How can some person or institution make a risk-free promise to anyone to pay them interest on the gold they initially lent (plus the principal at maturity)? By one of two ways:

a. The borrower has the power to exact ever increasing quantities of gold from subject/victim populations, i.e. to forever expand its share of the total bullion stock. Clearly that cannot last long.

b. If we assume the borrower's share of total bullion stocks to remain constant at most, which is plausible, then we need the total stock of monetary gold to grow exponentially at that rate or higher (which implies that the amount of gold mined each year must grow exponentially at the same rate too). Actually, the cumulative gold production did grow exponentially, only the rate was very low, as you can calculate from the data at page

http://www.gold-eagle.com/editorials_00/mbutler031900.html

Thus, the annual rate of growth of above-ground gold stocks was

0.11 % from 1200 BC to 600 BC and again from 300 BC to 500 AD (see the reason for the biblical prohibition of interest?),

0.05 % during the Middle Ages,

0.59 % during the XIX century, and

1.7 % on average during the XX century (actually it was 1.8 % 1900-1950, 1.6 % 1950-1975 and 1.5 % 1975-2000).

Adding silver to the picture changed the above percentages very little.

(As an aside, this shows that a pure pm-based monetary system would have been deflationary since the industrial revolution, most notably after WWII: during the period 1950-1975 world real GDP increased at a cumulative rate of 4.7%, while world total gold inventories rose at a cumulative rate of 1.6%, so that a pure gold-based monetary system would have caused an annual DEFLATION rate of 3%. In practice, that level of deflationary pressure would have directly prevented the occurrence of that economic growth rate. Which could have been actually good, but that's another story.)

As said, the above figures provide the ceiling for the interest that could be offered by a risk-free investment if a pure gold standard had been in place. BTW, 1.5 % leads to k = 1/67. Clearly, the correlation of higher rates of growth of above-ground gold stocks with higher energy use in the XIX and XX centuries is no coincidence, as modern mining is very energy intensive, which also means that, after Hubbert's Peak for oil, the annual growth rate is bound to get lower and lower.

In a fiat money system, on the other hand, the monetary stock can (and certainly does!) grow exponentially at any rate that suits the keepers of the printing press or its electronic equivalent, so the government can promise beyond any risk to anybody to return them any nominal interest rate below that.

Now comes the second point: how do you insure that the nominal interest earned (plus the returned principal) allows the lender to buy more REAL goods and services than the principal initially allowed them to, in a fashion of a certain annual real rate? By having the amount of available goods and services grow exponentially at a rate that fulfills:

(1 + yGR) = (1 + RIR) (1+MGR) / (1 + NIR)

where

yGR: real Net National Income Growth Rate (approx real GDP Growth Rate)

RIR: Real Interest Rate

MGR: Monetary stock Growth Rate

NIR: Nominal risk-free Interest Rate

Since MGR >= NIR as said above (to make the investment yielding NIR risk-free),

it follows that the real GDP growth rate must be >= the real interest rate.

(BTW, the last condition holds for any monetary system, hard or soft, and it comes from the Fisher Equation of the Quantity Theory of Money, M V = P y, assuming constant V. See below.)

The "good" news, then, is that after Hubbert's Peak, since real GDP Growth rates will become negative for a long time, so will real "risk-free" interest rates, and therefore there will be no financial incentive for clearcutting the forest.

Calculation of the real interest rate:

Again from the Fisher Equation of the Quantity Theory of Money:

M V = P y,

where we assume constant V.

P = M V / y

At t=0, let be:

y0 the real Net National Income (can be substituted by real GDP, since we will deal with its growth rate, which will not differ substantially)

M0 the monetary stock (M1 or M2 depending on country)

P0 the price level = M0 V / y0

Let's call Real Purchasing Power at t=0 what an initial amount A0 can buy:

RPP0 = A0 / P0 = A0 y0 / M0 V

Let that initial monetary amount A0 be invested in a risk-free vehicle that yields a nominal interest rate NIR.

At t=n, we have:

yn = y0 (1+yGR)exp(n)

Mn = M0 (1+MGR)exp(n)

Pn = Mn V / yn

An = A0 (1+NIR)exp(n)

where

yGR: real Net National Income Growth Rate (approx real GDP Growth Rate)

MGR: Monetary stock Growth Rate

How much can An buy at t=n?

RPPn = An / Pn = A0 (1+NIR)exp(n) y0 (1+yGR)exp(n) / [M0 (1+MGR)exp(n) V]

RPPn = RPP0 (1+NIR)exp(n) (1+yGR)exp(n) / (1+MGR)exp(n)

Now, you want RPP to grow at a certain annual Real Interest Rate, RIR, so:

RPPn = RPP0 (1+RIR)exp(n)

From the last two equations:

(1+RIR)exp(n) = (1+NIR)exp(n) (1+yGR)exp(n) / (1+MGR)exp(n)

Taking the nth root:

(1+RIR) = (1+yGR) (1+NIR) / (1+MGR)

As said above, for an investment vehicle that yields a nominal interest rate NIR to be risk-free, NIR has to be <= MGR (otherwise it needs to capture an ever greater share of the monetary stock).

That implies RIR <= yGR

You should do a full post on this and submit to TOD for those who love to study the equations!

I think that what happens is the debt part of the money supply collapses at some point. Because the world is finite, the amount of oil, food, and other resources entering the system slows down. The amount of resources in the system eventually reaches the point were it is no longer sufficient to generate enough output from the system to pay back the loans with interest (unless the dollars are worth much less then they were when the loans were taken out). Lenders eventually come to the realization that they cannot make loans without high interest rates to compensate now for the higher default risk and the risk that money will be worth less when the loans are paid back. At these higher interest rates, many fewer loans make sense. The volume of debt drops precipitously. If debt is what is used to drive investment, this collapses. Simple transactions like mortgages become difficult. Real GDP levels drop greatly.

You can argue as to exactly what collapsed, but the outcome is a very much reduced standard of living.

Is this basically that the debt:GDP ratio gets so large that the size of the required payments becomes debilitating/overwhelming?

The way I've thought of this whole idea before is that when you take on debt you either use it to grow your income so that you can pay the debt back without compromising your future standard of living or you don't and your future standard of living falls by the amount of the payments until the debt is paid off.

At the collective level, new loans must constantly be made to replace the currency that leaves circulation when loans are repaid; otherwise we get deflation because the currency:asset ratio declines as the loan's principle vanishes back into the void from where it came when it was initially loaned out. (And we really don't want deflation unless there is something like a demurrage rate in excess of the rate of deflation because otherwise people have the incentive to just hold onto their money while waiting for better prices, rather than invest or spend it, which just feeds back into even more deflation.) The consequence of this is that in order to get people to willingly (& rationally) continue to take on debt, much of it will have to be for investing in growth in their incomes, and this expectation will have to be routinely validated or else people will stop taking on more debt, with all of the previously stated problems.

I like the idea that you put forward, though, that the physical growth rates fail to keep up debt growth resulting in periodic financial implosions, although maybe in the short term it's demand that fails to keep up? I'm thinking this could tie into the behaviour of the capitalist business-cycle, with its over-build-up of productive capacity that results in oversupply of markets, followed by reduced investment (i.e. fewer loans issued), which threatens the aforementioned deflation unless the central bank drops interest rates to encourage even more debt. I suppose that's where your idea comes in: if continued long enough, the debt:GDP ratio gets so large there is never any hope of the debt being paid off (particularly if most of it was taken on not as investment but for "parties"), and at some point, enough debt has to be defaulted on to enable starting it all over again (assuming the physical resources are available)...

Just my thoughts; I'm curious what you think.

The rub is the transition. I doubt there is any historical precedent for this sort of transition being done in an orderly and peaceful way, if at all. The growth paradigm is firmly embedded in at least Western society and won't be easily overturned for something significantly different. You will see TPTB trying repeatedly to 'jump start' the economy using the same paradigm, in the process wasting valuable time and energy that could be used for a sensible transition.

Great post Jason - This an important topic to consider when thinking about and planning a future.

I have been looking at is from the perspective of job creation.

It seems that many big developments in our society were designed, or simply evolve out of the need to keep people off the streets.

"Idle Hands Are The Devil's Tools"

There simply is not enough productive work for the population so we needed to encourage make work. Thing is the make work can’t just be building sand castles on the beach. It has to make money.

Everyone is familiar with the cliché that goes something like “ An average man works for money, a smart man has his money work for him”.