IEA WEO 2008 - Fuzzy Focus on Saudi Arabia

Posted by JoulesBurn on November 18, 2008 - 1:43pm

Given the central role Saudi Arabia will play in the world's energy future, the continued fuzziness regarding its oil prospects is cause for concern. According to the IEA 2008 World Energy Outlook, Saudi Arabia will remain the world’s largest producer through at least 2030 as its output climbs from 10.2 mb/d (million barrels per day) in 2007 to 14.4 mb/d in 2015 and 15.6 mb/d in 2030. The future totals include Natural Gas Liquids (NGL) production as well as additions from enhanced oil recovery efforts (EOR).

Given the central role Saudi Arabia will play in the world's energy future, the continued fuzziness regarding its oil prospects is cause for concern. According to the IEA 2008 World Energy Outlook, Saudi Arabia will remain the world’s largest producer through at least 2030 as its output climbs from 10.2 mb/d (million barrels per day) in 2007 to 14.4 mb/d in 2015 and 15.6 mb/d in 2030. The future totals include Natural Gas Liquids (NGL) production as well as additions from enhanced oil recovery efforts (EOR).

The 2008 WEO represents a step forward in that projections are purportedly based on a bottoms-up querying of a database containing reserves and past-production information for 800 of the world's largest oilfields, rather than just being extrapolated to what future demand will require. However, the results obtained from such a data mining effort are limited not only by the quality of the data therein, but also by the assumptions made when querying the database. A close look at the data and projections for Saudi Arabia in the WEO reveals a rather spotty effort, providing neither a clear picture of what is happening in this important region nor much confidence that the overall report for the world is accurate.

They're Still the One

Throughout the 2008 WEO, Saudi Arabia is cast in a leading role -- both figuratively:

On present trends, just to replace the oil reserves that will be exhausted and to meet the growth in demand, between now and 2030 we will need 64 mb/d of new oil-production capacity, six times the size of Saudi Arabia’s capacity today.

(from the Forward and Executive Summary)

and literally:

Saudi Arabia remains the world’s largest producer throughout the projection period, its output climbing from 10.2 mb/d in 2007 to 15.6 mb/d in 2030.

(Executive Summary, page 40)

Currently, Saudi Arabia produces over 10 percent of the world's crude oil (with the Ghawar oilfield alone producing 7 percent) and is the largest exporter. If all imminent and pending Saudi Aramco development projects come online as planned, one half of the ten most productive oilfields will be in Saudi Arabia (Ghawar, Safaniyah, Khurais, Manifa, and Shaybah). Consequently, it would seem desirable to get the Saudi picture correct. This is of course hindered by the reluctance of Saudi Aramco to make their data available, but the sheer size of the production and the remaining reserves means that large uncertainties in either of these translate into similarly large uncertainties for the world outlook.

Averaging the Unaveragable

By analyzing all of the world's resources collectively, it is hoped that such uncertainties will tend to average out. Unfortunately, Saudi fields and Ghawar in particular are true outliers. They are unique geologically, with a large volume of oil trapped in relatively few yet accessible reservoirs; politically, in that production is and has been under monolithic control; and economically, as the size of the resource relative to internal consumption has up to now allowed for a more measured depletion than has occurred elsewhere. In some sense, what happens in Saudi Arabia stays in Saudi Arabia, and the value of conflating trends with the rest of the world is dubious. It is perhaps questionable doing this for the other different oil producing regions as well.

The Elephant in the Report

Every analysis of Saudi Arabian oil should begin and end with Ghawar. Matt Simmons covered Ghawar thoroughly in the book "Twilight in the Desert", questioning many of the reassurances of Saudi Aramco about the future of the field. The Oil Drum (Stuart Staniford, Euan Mearns) has probed further into the state of the field, showing that it is possible to assess the resource independently using published information. Subsequently, I have shown that it is possible to independently monitor depletion mitigation efforts in Ghawar using satellite images (see these stories on The Oil Drum and Satellite o'er the Desert). One particular result of such studies relevant to the question of remaining reserves is an improved estimate the area of the field, necessary for an estimation of oil initially in place (OIIP). For Ghawar, a value of approximately 193 billion barrels was determined. The assumptions and method for this determination are given in Appendix 1 at the end.

The 2008 WEO mentions Ghawar often, but there is little new information presented. The 2005 release of the WEO had a specific focus on Middle East oil, and both the 2005 and 2008 releases of the World Energy Outlook have close-up looks at the Ghawar oil field. In fact, much of the Ghawar content from the former was copied and pasted verbatim in the new IEA 2008 report (with notable differences which are rather interesting). Both versions stumble right out of the gate with the same geographical error:

The area of the field — more accurately described as a collection of oil-bearing formations — is partitioned into six geographical areas, from north to south: Ain Dar, Shedgum, Farzan, Hawiyah, Uthmaniyah and Haradh.

As shown in the map below, the above listing of geographical areas is somewhat random rather than strictly north to south:

This is perhaps a minor (repeated) mistake, somewhat irrelevant to the goal of predicting future oil flows, but it indicates a certain level of carelessness with regards to the information presented. And as will be seen, the numerical data follow this theme. From 2005:

Ghawar is a large anticline structure, 280 km long by 25 km wide, with about 50 metres of net oil pay. Initial oil in place is believed to amount to at least 300 billion barrels. Cumulative production is 61 billion barrels and, according to Saudi Aramco, remaining proven reserves are about 65 billion barrels. Saudi Aramco has not provided sufficient data for a proper assessment, but the recovery rate could be between 40% and 60%.

and the corresponding text from 2008:

Ghawar is a large anticline structure, 280 km long by 25 km wide, with about 50 metres of net oil pay. Initial oil in place is 250 billion barrels, of which initial recoverable reserves are estimated at 140 billion barrels (implying an expected ultimate recovery rate of 56%). Cumulative production reached 66 billion barrels in 2007, so remaining reserves are about 74 billion barrels.

According to these reports, in three years time, Ghawar has lost "at least" fifty billion barrels of oil originally in place (OIIP), yet it seemingly has accrued nine billion barrels more in reserves -- and add to that the 5-6 billion barrels produced over that time. Reserves is the amount of the OIIP which is estimated to be economically extractable, and this can increase over time as technology improves or the price of oil changes. In this case, however, we also have an unexplained decrease in the OIIP.

Where did the 2005 number come from? The WEO suggests that most of the data came from the IHS database, although published accounts suggest that the IHS figure for 2005 was 210 billion barrels (Laharrere, 2005). It is probable that the 2005 WEO number does not originate with IHS but elsewhere. An indication of a possible source for the OIIP is the APS Review Gas Market Trends from October 2005, which has the following snippets:

Ghawar is the largest axis of fields in the world and is the main producer of Arab Light crude oil in Saudi Arabia. It is 250 km long and 15 km wide. It contains several fields, of which eight are major oil producers, and huge fields of natural gas in a Khuff reservoir deep beneath the oil formations (Fms). Ghawar's recoverable crude oil reserves exceed 70 bn barrels. Oil in place in the Ghawar region is estimated to be over 300 bn barrels.

...

The Ghawar fields are now producing close to capacity, with the output being AL crude oil. The other Ghawar fields producing this grade are Khurais, Harmaliya and Abu Hadriya.

The scope of misinformation in the above is too vast to address here, but the "over 300 billion" figure is strangely familiar. It seems possible that, in the least, the above document and the 2005 WEO have a common source for this value. Along that line, Saudi Aramco quotes a reserves value for Khurais of 27 billion barrels, so perhaps the extra 50 billion is accounted for by the Khurais OIIP. But beyond this forensic trivia, the more important point is that the value of 250 billion for Ghawar is still much higher than what appears to be in the IHS database (unless their estimate for Ghawar has been abruptly increased) and is much larger than is obtained (193 Gb) using the best available public information (see Appendix 1).

A Wrong Turn

A final revealing clue in this autopsy is revealed in a sentence at the end of the Ghawar segment:

Reports suggest that enhanced oil recovery techniques are being used to boost capacity in the mature zones of the Shedgum and Uthmaniyah areas, where extensive drilling programmes have recently been undertaken (Source: Sanford Bernstein, 2007).

The "reports" are two documents released by Bernstein and Associates which described investigations of Ghawar using satellite imagery. Unfortunately, as detailed here and here, the work contained major flaws, including the misidentification of rock outcroppings and electrical transmission towers for oil wells and an erroneous placement of the Ghawar field in the images. There is no evidence - or statements from Saudi Aramco - that anything other than continued peripheral water injection (plus infill drilling and workovers) is being used to coax oil from Shedgum. That the IEA analyst relied on the Bernstein work is not a positive development.

Whither Ghawar Decline?

While the WEO quotes a figure of 5.1 mb/d for current (2007) Ghawar production, there is no estimate provided for future levels. Indeed, Ghawar is still in the "plateau" stage according to the WEO criteria. It is not clear what decline rate rate for Ghawar, if any, was use to predict future Saudi production levels. There is acknowledgement, however, that decline is occuring:

The most recent project, involving the Haradh area in the southern part of the field, was completed in 2006, tripling capacity there to about 900 kb/d. This has helped to offset natural declines in other parts of the field. The overall capacity of Ghawar is sustained by infill drilling and well work-overs to maintain flow pressure in various parts of the field.

Thus, with no areas of Ghawar left to re-develop, maintaining current production levels will become more challenging.

Saudi Oil Beyond Ghawar

The 2008 WEO has many non-Ghawar references to Saudi Arabia oil, but the data is usually combined with other countries as well:

There are 101 upstream oil projects currently under development and planned in OPEC countries as a whole, involving an estimated 48 billion barrels of proven and probable reserves. Of these projects, 56 are onshore, involving about 28 billion barrels of reserves. The largest element of new production is due to come from Saudi Arabia, which will bring four new onshore fields into production.

(p. 273)

First, there are the pending onshore projects:

Saudi Arabia will continue to play a vital role in balancing the global oil market. Its willingness to make timely investments in oil-production capacity will be a key determinant of future price trends. Five major onshore projects, Khurais, Khursaniyah, Hawiyah, Shaybah and Nuayyim, which collectively hold 13 billion barrels of reserves, are all in the final phases of development and are projected to provide a total gross capacity addition of close to 3 mb/d by 2015.

(p. 274)

There are a few problems with the above excerpt, the first being the total reserves. If Khurais has roughly 27 billion barrels of reserves (as per Saudi Aramco), than the other four in that list have negative 14 billion. Next, we have Hawiyah (part of Ghawar) listed as a separate development project, which is not the case; it is being re-developed similarly to the rest of Ghawar. The Hawiyah NGL plant was completed recently, but it's not clear how NGL reserves are computed in Saudi Arabia by IEA. As for oil, Hawiyah by itself probably has 13 billion barrels remaining.

For production rates, we consider the described addition of "close to 3 mb/d by 2015". The following capacities can be found from many sources including Saudi Aramco :

| Project | Type | mb/d |

|---|---|---|

| Khurais | oil | 1.2 |

| Khurais | NGL | 0.07 |

| Khursaniyah | oil | 0.5 |

| Khursaniyah | NGL | 0.3 |

| Shaybah Phase II | oil | 0.25 |

| Nuayyim | oil | 0.1 |

| Hawiyah | NGL | 0.3 |

This adds up to 2.72 mb/d, which perhaps could be rounded up to 3. But clearly distinguishing between crude and NGL would seem to be a good idea here.

There is one offshore project in the works: the re-development of the Manifa field, although its delay for economic reasons seems likely:

Over the next five to six years, 45 offshore projects are either under development or firmly planned in OPEC countries, totalling 20 billion barrels. The largest project by far is the Manifa field in Saudi Arabia, accounting for one-quarter of these reserves. This field is expected to come on line in 2012 and will produce close to 1 mb/d when the plateau is reached about three years later.

(p. 274)

The Manifa output probably includes NGL, but only about 65 kb/d is expected to arise from that contribution. There might be some redevelopment of other offshore fields, but it is not clear how much (if any) additional IEA assumes there will through 2030 -- although the ramblings of Saudi Oil Minister Al-Naimi have been referenced:

Expansions of the Zuluf, Safaniyah and Berri fields could give further momentum to Saudi Arabian production.

(a footnote references Saudi Oil Minister Al-Naimi's comments at the Jeddah Summit on June 22, 2008)

So up to 2015, there is an addition of 4 mb/d oil + NGL to existing Saudi production (after being rather generous in rounding) from current projects. There are also many discovered but undeveloped fields remaining, although these are much smaller than those currently producing. Such development would also likely occur after 2015:

There are more than 100 onshore fields awaiting development, each holding more than 100 million barrels and with combined reserves of more than 50 billion barrels. The bulk of them are in just three countries: Saudi Arabia, Iran and Iraq. Two-thirds of those reserves are concentrated in about 30 giant fields (each holding more than 500 million barrels), including Sharar, Niban, Jaladi, Dhib and Lugfah fields in Saudi Arabia...

(p. 273-274)

Elsewhere, the report seems to give a figure for total Saudi reserves in undeveloped fields:

There are 6.2 billion barrels of reserves in 11 other known fields in Saudi Arabia that have yet to be developed — the highest in the world. Each of them holds reserves of at least 150 million barrels and the average is 450 million barrels.

Wait...11 fields times 450 million is 4.95 billion. Either the total reserves or the average is wrong, but it is difficult to surmise which without at least knowing which fields are included. One of these is offshore:

The largest known undeveloped field, Hasbah 1, holds 1.8 billion barrels. Part of the increase in gross capacity will be offset by the decline in capacity at existing fields. Saudi Arabia aims to maintain spare capacity in the range of 1.5 mb/d to 2 mb/d in the long term.

Production in 2015 and 2030

So, what differences are expected for Saudi oil production by 2015? Table 11.4 in the WEO gives a total liquids (crude plus NGL) value of 14.4 mb/d, which is a net addition of 4.2 mb/d from 2007. From above, we have the IEA additions of 3 mb/d from onshore and 1 mb/d from Manifa, totaling 4 mb/d. This leaves 200 kb/d unaccounted for, but more importantly, leaves little room to account for decline from existing production. Any assumed decline must be offset by a corresponding amount of new production in order to match the production predicted in the WEO. Several possible development projects are identified, but none of these are likely before 2015. If IEA has assumed new development in its analysis, they should provide specifics. And as with Ghawar, it is difficult to parse out exactly how much production growth is expected vs. how much decline. Net production is obviously the bottom line, but IEA should demonstrate that such predictions are backed by reasonable estimates.

For 2030, the WEO provides a more specific breakdown for total Saudi production (utilizing Figure 11.4): From 2007 to 2030, total liquids increases from 10.2 mb/d to 15.6 mb/d. About 3.5 mb/d of this increase is due to NGL, and 1.9 is due to crude oil. Furthermore, 1.2 mb/d of the added crude flow is attributed to enhanced oil recovery (EOR) efforts beyond 2015. Similarly to the prior period, any substantial gains in crude production due to new development must be offset by declines elsewhere, and the fate of growth potential for Saudi Arabia production lies with natural gas liquids.

CONCLUSION

The 2008 IEA World Energy Report urgently (and appropriately) recognizes the need for an assessment of future energy supplies based on a detailed accounting of the world's inventory. This need is not reflected in the data presented for the specific yet critical example of Saudi Arabia. Building and querying a database of the world's oilfields is good, but this is only of value if the underlying data is sound. Given the importance of Saudi Arabia's oil production, both from a practical and a symbolic standpoint, it is unfortunate that surprisingly little incremental effort was expended from WEO 2005 to WEO 2008 on conducting a truly original analysis of the situation for Saudi Arabia, especially given recent events. Furthermore, the aggregate data presented contains several glaring errors, casting further doubt on the quality of the raw data (assumed to be provided by IHS). IEA has clearly been hamstrung in its own efforts of painting an accurate energy picture, both in its available resources and in its access to the necessary data. It would be useful if IEA made available the raw data used for their work, thus allowing for additional analysis from the larger energy community. The focus on the world's oil future, and Saudi Arabia's in particular, needs to be sharpened.

.....................................................................

Appendix I: Estimating Ghawar OIIP

An important part of determining the cumulative amount of oil expected from a newly discovered field is to calculate the total amount of petroleum trapped within the geologic structure. This requires the following determinations:

- the area encompassing the field

- the thickness of the oil-bearing reservoir

- the porosity of the reservoir rock

- the percentage of the pore space occupied by water

- the change in volume for the petroleum upon being brought to the surface

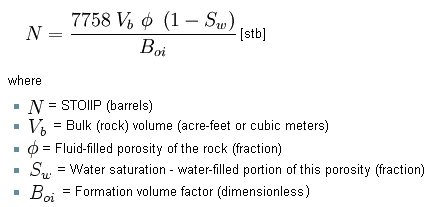

The overall calculation is then:

In a simple approximation, the bulk rock volume will be the area of the field times the average reservoir thickness.

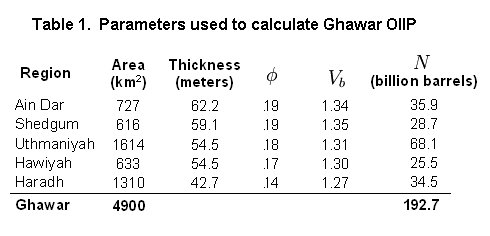

Saudi Aramco keeps most of its data regarding Ghawar under wraps, but quite a bit is known from reports prepared before Saudi oil was fully nationalized. Many of the parameters are available from the Greg Croft website as well as in "Twilight in the Desert".

It is also necessary to estimate the areas for each of the Ghawar regions. These were computed from the field original oil-water contact (OOWC) locations determined using Google Earth. As a first approximation, the OOWC location can be assumed to lie under the curve connecting all the peripheral water injector wells. With the use of several maps showing the OOWC location relative to oil wells in the center of the field, however, it is possible to locate the OOWC more precisely. From a Google Earth kml file containing the polygon descriptions for each of the Ghawar regions, areas are measured using an online tool which uses an algorithm described here. I have tested this approach by tracing the boundaries of several US states, and the deviation from published areas is less than 3%.

A Google Earth file containing the current field boundaries and areas measured for Ghawar can be found here.

The measured field areas and parameters obtained from Greg Croft, along with the OIIP results, are shown in the table below.

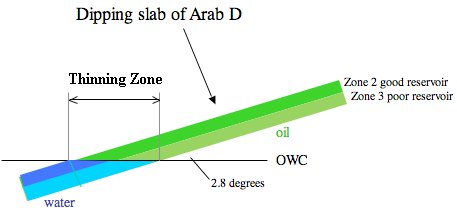

There is much uncertainty as to what the average oil layer thickness values in the above table refer to. Towards the edges of the field, the oil layer thins out, as shown below in a diagram (modified from Mearns).

Specifically, if the stated thickness represents an average over the entire field (or region) including the edges, then a simple multiplication of the area by this average will yield the total volume of oil-bearing rock. Note, however, that the physical parameters of interest here, especially porosity, will vary both across the field by also vertically through the various reservoir zones. An accurate determination of OIIP requires the integration of oil content over all three dimensions.

From interpolated well core samples and more recent 3-D seismic investigations, Saudi Aramco clearly has more accurate numbers than from what is computed here, and given that there is no other way to check, it is worth comparing if available. The summed OIIP for the Ghawar regions of 'Ain Dar and Shedgum was reported by Baqi and Saleri of Saudi Aramco as being 68.1 billion barrels. The corresponding value obtained here is 64.6 billion barrels, an underestimate of about 5%. Extrapolating to the entire field would raise the OIIP to just over 200 billion barrels.

I thought that perhaps the most interesting comment at ASPO-USA was the offhand comment by the IHS guy that North Ghawar would be effectively watered out in two years.

And since it appears that Saudi Arabia's 2008 annual production rate will be below their 2005 annual production rate, it remains to be seen if they will ever again exceed, on an annual basis, their 2005 rate.

In any case, as a continuing example of world energy agencies ignoring the net export situation, at Saudi Arabia's current rate of increase in consumption, in 2030 they would be consuming about 12 mbpd, versus 2 mbpd in 2005 (total liquids). I estimate that their 2008 net export rate will be about 700,000 bpd below their 2005 net export rate.

After thinking about it, your reference is probably to a statement at the ASPO-USA conference by Peter Wells. He is not from IHS himself, but analyzed IHS data and came up with a peak date of 2020. His presentation can be found here. I didn't take all that good notes, so don't remember that comment specifically.

When I first read your comment, I thought you were referring to the paper by Aage Figenschou, with Matt Simmons, that is up on the APSO-USA web site now. It says:

I didn't take notes either, and my apparently incorrect recollection was that Peter Wells was formerly with IHS, but it does appear that he predominantly used the IHS data base.

His comment about North Ghawar was during the Q&A, probably in response to a question that Alan Drake asked.

I seem to remember the guy sitting next to me saying "Did he really say that?", when he said that.

"at Saudi Arabia's current rate of increase in consumption, in 2030 they would be consuming about 12 mbpd, versus 2 mbpd in 2005 (total liquids)"

I appreciate very much the export land model. But I don't think that there will be a purely linear consumption trend:

1st: Even if the Saudis get (even more) extremely rich there will be an upper limit of oil consumption. As soon as each Saudi has his set of gold-plated luxury cars they will spend their remaining money elsewhere (e.g. state funds).

2nd: I am not sure if the petro dollars will trickle down to all of the KSA's population. In history this was not so, and many stayed rather poor.

3rd and most importantly: It would be illusory to think that KSA (and other OPEC countries) become increasingly rich whereas the rest of the world suffers a terrible crisis due to peak oil. As soon as oil prices rise and global economy goes down also the OPEC countries will have a restricted inflow of money - just like what is happening now.

So I expect that in the lower part of the export land curve the decline will decrease, as internal consumption goes down.

I agree that Saudi Arabia is unlikely to show a +7.2% rate of increase in consumption for 25 years, but my point is that the IEA and other agencies are basically just ignoring the net export issue.

Here is a "What if" scenario, assuming a +5.7%/year rate of increase in consumption, with a flat total liquids production rate of 11 mbpd for Saudi Arabia. A key point to keep in mind regarding Saudi consumption is that the average Saudi family has something like six kids.

http://graphoilogy.blogspot.com/2008/01/quantitative-assessment-of-futur...

If we go back to the original ELM, with a -5%/year rate of decline in production and a +2.5%/year rate of increase in consumption, net exports from Export Land go to zero in 9 years. With no increase in consumption, net exports go to zero in 14 years. In any case, I estimate that the cumulative shortfall between what Saudi Arabia would have (net) exported at their 2005 rate and what they actually exported will exceed a billion barrels of oil next year.

Regarding relative wealth, consider the increase in oil prices from 1972, through 1986. The big drop in oil prices did not occur until Saudi Arabia boosted production in 1986, even with the recession in the US in the early Eighties.

I just read an article in The Economist, which makes myself doubt about the 3rd point of my above statement. Among others it says:

If these projects come true and give them more self-sufficiency then their economy could grow more with less dependence from the world economy, somewhat similar to the situation in China.

A strategic alliance between China (or East Asia) and the OPEC countries would be a logical consequence.

and

It is really nice when two independent estimations come into close agreement.

Fantastic work JB!

Yes. A couple of days ago I suggested TOD couldn't be an IEA watchdog. I was too hasty, bedfellows. Kudos to JewelsLearned.

A question about WEO 2008.... Do they offer cases, in addition to their reference scenario, that capture other possible outcomes? i.e. on account of tepid investment etc.

The EIA's high price scenario (which assumes slow investment) is much more pessimistic than the IEA's reference scenario in that it shows conventional oil plus NGLs falling slightly by 2030. Is there anything of that nature in the IEA's report?

There are warnings and caveats in the overall report, but there are certainly no alternative scenarios for individual countries.

Although it increases the effort immensely, what is needed are several scenarios with probabilities assigned to them. For example, what if NGL doesn't live up to expectations? What if enough gas isn't found? Given their recent lack of success finding more in the Empty Quarter, I would say this probability is non-negligible.

Agreed. We have to convert to the Bayesian religion.

Not just with respect to what the rocks can ultimately yield but also with respect to how the decision makers behave.

As someone has suggested: What if King Abdullah is presented with a new great-grandchild that captures his heart and he begins to give serious attention to production targets for 2060 an beyond?

The EIA's high price case does get at that a bit. (It is a near-term peak oil scenario, painted mostly in numbers with precious little commentary).

Belief is not governed by the laws of probability, but by fast and frugal heuristics allowing fast evaluations (these can mimic Bayesian inferences) (Kahneman, Tversky and recently many in neuroscience)

We use analog not digital decisionmaking algorithms - multiple stimuli at one time do not get 'weighted' in our decisions - which ever shouts the loudest gets answered.

Humans are not Bayesian thinkers. That would be well above our paygrade.

In my opinion, many humans can be educated to be Bayesian thinkers. Indeed, that was one of the main goals of a course in informal logic (critical thinking) that I taught for more than twenty years.

One can view various scenarios sequentially and put subjective probabilities on each one. For example, I put the odds of inflation at sixty percent and the odds of deflation at forty percent; either scenario is plausible, but I think inflation is somewhat more likely than deflation.

I suspect that petroleum geologists, in making their recommendations to "Drill over there, not right here" are using Baysian thinking to come up with their recommendations.

Of course I agree that Bayesian thinking does not come "naturally," because we want and crave certainty. Nevertheless, I think the proper higher education can go a long way to create many Bayesian thinkers. For estimating future Saudi oil production I think Bayesian approaches are a sine qua non.

Don - I totally disagree that we are Bayesian thinkers. We can be taught to THINK in Bayesian terms, which is an advantage when nothing else is going on, and yes, for estimating future Saudi oil production, we SHOULD think in Bayesian terms. But once someone in the room or debate feels politically or otherwise threatened, etc. all Bayesian priors go out the window. I will discuss this in my belief systems post. Sorry to sidetrack discussion - lets focus on IEA KSA.

And to Datamunger, even though I disagree about Bayesian wiring, I do agree that if the Prince of Saud can access and act upon thoughts about his unborn grandchild (intergenerational equity), then that changes the game....

We don't disagree on the wiring. It is against the wiring (for most of us).

But, hey, education is all about domesticating and civilizing our sorry asses so that we can do things that don't come naturally. (And avoid things that do!!)

The technical know how of you guys is truly impressive. But conceptually the entire discussion is similar to a bus full of people heading for a cliff at accellerating speed and the excited chatter amoungst the passengers is about the distance to the cliff, what it will be like when the cliff is reached, would it be possible to move the cliff, is the path to the cliff an uphill slope or a down hill slope, should the guy who talked about putting on the brakes be thrown off the bus or just be sat upon, the price of the bus fare, etc.

There was figure that I read somewhere that suggested that an area the size of Minnesota (225,000 sq klms) would produce sufficient oil from algae to supply the entire world's oil needs daily. Now assuming that this is even vaguely true, and recognising that all of the oil that we are consuming now was produced by algae over millions of years, many millions of years ago, you would have to recognise how flukey it is that there has been enough oil captured geologically to keep our oil powered civilisation going for just 150 years. Where is the end of this road? where is the cliff? We know that it is not more than a hundred years away.

It would be nice to see a percentage of the phenomenal collective intellect of TOD directed positively towards what the next phase of our energy march will be. No responsible oil man would run his well dry before he started the search for a new field. So that is what should be happening here. Our collective oil well is in decline. There should be an increasingly determined search underway for our next energy field.

BilBb

2 quick questions:

1) Next phase of energy march for 'who'? All 6.8 billion plus their descendants? Or some fraction thereof?

2)If/when we find the next energy field, shouldn't we also consider the non-energy limiting inputs required for the energy? Land, water, soil, minerals etc? Energy is key. But it's not the only thing we are approaching limits on

Do you agree that the first thing to do would be to take your foot off the accelerator?

That's how I see politics right now. One party (we'll call them the "red" team) just wants to keep accelerating. The other (the "blue" team) wants to pick up passengers first, and then accelerate off the cliff.

Well, Minnesota is half covered in lakes, so you could test that now.

Using a solar insolation table for MN:

http://rredc.nrel.gov/solar/old_data/nsrdb/redbook/sum2/14922.txt

the total solar energy hitting the ground annually can be calculated. I come up with about 1.4 times the energy in the total annual oil usage. But then the discounting begins. It's too cold for anything to grow much of the year, photosynthesis isn't all that efficient (much less than PV) at creating stored energy, and the earth is really, really lousy at keeping the energy from degrading over the years. We're just lucky it was concentrated by gravity (oil being lighter than water).

Similarly, the Ogallala Aquifer was charged up over millions of years. How could we possibly deplete it in 100?

Perhaps not, but many a pragmatic oil man would just take his money and get out of oil.

Pickens?

Our collective oil well is in decline. There should be an increasingly determined search underway for our next energy field.

But what if there isn't a "next energy field", at least on the scale needed to replace hydrocarbons? Then "increasing determination" will only put us further in the ditch.

That's the next big debate IMO. Peak or near peak is baked. What's still in the oven: is there ANY source of energy that can replace on the necessary scale?

If not, we must retrench, starting yesterday.

Necessary scale:

- Amount of power produced after accommodating EROEI (assume some conservation)

- Resource availability for buildout (material and financial)

- Political / social will

Next to totoneila's wheelbarrow, I suggest some sandbags and a good shovel. Stops bullets, stops floods, grows potatoes, and it's great exercise.

Good comment, you got me thinking.

Where we know we need to retrench is in the size of our ecological footprint. We need to use less water, soil, pollute less, and in general put less stress on the natural systems which provide the ecological services that enable us to be here. I think the big questions are 1) how much do we need to reduce this footprint and 2) how much net energy will we have after this reduction, especially when you consider that as high quality fossil fuels deplete, use of lower quality fossil fuels will increase not decrease our collective footprint.

A better question to decide before "size of new ecological footprint" is "what will be the limiting mechanism used?" Access to money, government military force, etc. etc.

Decide that first, thn I might take a shot at your question.

My vote would be for mutual agreement enforced through overwhelming ostracism for violators. In much the same way that some here think SUVs will eventually go away because excessive consumption will become socially intolerable. As I think you are suggesting, nothing else would be fair.

In that case I'll guess that the future ecological footprint will be "as large as available finances will allow", in other words financial / market constraint. Worst case, actually.

But this doesn't answer the question of how much strain our natural world can withstand. In my mind that is what needs to be answered. Or at least answered with a Bayesian response since it is unlikely that there is a single knowable answer.

Folks, as mentioned upthread, the EIA's high price case is much more pessimistic than the IEA's reference case in WEO 2008. Peak 2010.

Here's a history of how their views have evolved. Conventional liquids in the graph below includes, in addition to oil, refinery gain and natural gas liquids.

Source: Table G5 at the following link (for 2008 data)

http://www.eia.doe.gov/oiaf/ieo/ieopol.html

I've posted it a couple of times here before. Both times, I was contacted by journalists and green energy lobbyists. But I don't think people refer to it in the media.

I'd love to see a detailed comparison between the EIA and the IEA's scenarios.

What are the assumptions underlying the EIA's high price scenario?

1) The resources base is a little smaller.

2) OPEC invests less in new production.

On February 24, 2004, the Center for Strategic and International Studies had a classic debate between Matt Simmons and Saudi Aramco about the state of the later's oil fields. The Power Point slides for that debate are at:

http://www.csis.org/component/option,com_csis_events/task,view/id,429/

In the Saudi slides, slide 23 and 24 show that if the Saudi's maintained a Maximum Sustainable Output rate of 10 MBPD they could sustain that rate until 2042. If they ramped up the rate to 12MBPD, they could sustain that rate until 2033.

How well do the resent numbers compare to the above rates?

The Saudis are very conservative folks and so far they seem to be telling us straight such as telling us the world is well supplied just before the bottom fell out from $140 oil and now we are in $55-60 oil range.

Is it **possible** for the Saudis to maintain their 2004 projections? If not, what would they have to do to obtain that goal?

If they are using 8mb/d internally by 2030, exports will be considerably down, there is still lots of potential for demand growth in OPEC. Due to taxes Europe pays roughly double the market price at the pump, OPEC consuming at a European per capita rate would destroy exports.

It would also be useful to know how much of 8mb/d (if that is best estimate) of internal oil consumption is used by the (wide boundaried) energy industry (also how much nat gas, etc.) as opposed to by non-energy general population. Asked a bit differently, what % of KSA 'economy' in 2030 would be devoted to energy production? Under comparative advantage, economists and analysts might assume KSA might be best served by devoting 100% to oil/gas and trading for guns/butter. In reality there may be an upper limit.

Datam. - I made much the same graph using the reference case data, which I think is all they provide before 2003...maybe. Going by memory. Anyway it's the one they shove on PPTs for the MSM, and even there the air's slowly going out of the tire.

Used the wrong paper for the title, btw. Got a little dizzy staring at those trendlines. Interesting conclusion you've found there.

Thank you, Joulesburn, another great TOD piece I'm adding to my bookmarks. I'm going to have to read through again to more completely absorb it. Kudos!

Hello TODers,

I wish to express my thxs to the authors of all these keyposts [plus the very astute TODer comments] on the IEA WEO-->well done! ..and keep 'em coming. It would be fascinating if the IEA thought it worthwhile to assign a spokesperson to address the obvious concerns that we TODers have found.

I agree with WT, Nate, and others that a valuable addition to this report would have been a net export projection for each oil exporter out to the 2030 report cutoff point. Obviously, this would have strengthened the political hand of those internally dissenting IEA analysts who must be getting tired of contributing to poorly designed investigative methods and too optimistic report generation, therefore the IEA topdogs probably quashed this effort in its infancy.

IMO, the earlier leaked report was just another sign of internal IEA conflict, thus the stomach antacids per IEA employee has probably ratcheted up again in the IEA workplace.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

"It would be fascinating if the IEA thought it worthwhile to assign a spokesperson to address the obvious concerns that we TODers have found."

It sure would, but there is no way they would subject themselves to such scrutiny if they didn't have to. TOD isn't a public enough figure for anyone to care what is said here, yet... Maybe if the GOV itself raised concerns about the report, the IEA would do something, but it probably wouldn't even make the news.

We struggle with this...i.e. don't know the answers. Many of us have interacted with IEA folks. I know they are reading these reviews. I have no datapoints to suggest they are other than good people, focused on their part of the problem with what they have. But what TOD (and other places like it, though few) has, is since we do this for free, we can't really lose our jobs for putting out the truth as we see it (or rather pointing out what is likely not the truth)...;-)

I also think we approach problems from the point of the global commons - there is currently really no 'agency' or institution with such a charge because there is no incentive to do so. Most are connected, either tightly or loosely with the existing paradigm. Who is going to take this to the next level? I don't know. The contributors here put a ton of their own time into these posts -with no resources other than their own time and ideas- I would hope there is some secret cadre of energy policymakers taking notes, but we have no idea of WHO reads here. We do know how many, but not the impact. But until something changes, we'll keep putting it out there...In short, I'm sure if you took a battery of morality, intelligence, and oil knowledge tests among IEA analysts and the team at TOD, you would find little difference. We just have more freedom, fewer economists (zero) and perhaps a broader lens..;-)

I have read many many times here that it's the economists' fault, and how people are so very proud of themselves not being in touch with any of those devil's advocates.

I'd like to offer a diferent view.

While I totally agree with you that neoclassical economics presents itself as established science when it is clearly not for reasons we all know by heart, neither me nor TOD will be able to change the world and make it a place 'sans economists'. I'm not even sure such a scenario would be desirable, but I'm pretty sure it's unrealistic, like wanting all weapons going away by Xmas.

Economics is very much like medical 'science': It is based on some real science and tries to act as if it was (and depicts itself as itself being) sound science as well... but neither of the two is true about neither of the two 'sciences'. (I have two degrees, one in medicine and one in economics... so I know. ;-D ) It is because the subject they want to use their respective (not so) scientific views upon (i.e.: a human organism or a multicultural global society) is much more complicated and is clearly above our collective paygrade.

A doctor more often than not only 'tries' to cure the patient. Sometimes there is success, but many a times there is none. What's more, doctors in the past have many times made matters worse, not better with their 'supposed medications'. Yet, (when sick) people seek a doctor and not an engineer or even a biologist. This has been the case for thousands of years, whether you call that doctor an MD or a shaman - or by any other name. Shamans and most doctors tend to think they are omnipotent when they are clearly not -- as illustrated by humans still dying all over the place despite (by definition: at all times) state-of-the art technology.

The same is true with economics.

It is not omnipotent, yet this 'non-science' still offers some reasonably good assumptions -- with boundaries (at present not very well known at higher places) of course. However, when trying to figure out whether the corn crop will or won't be sufficient, supply&demand and the price elasticity of both is still a useful concept. Planning on a societal level is hardly imaginable w/o economics, whatever you call the people engaging themselves in these fields. Economics has been around since the first agricultural revolution many thousands of years ago, and it will not go away. Its assumptions will definitely change, it may one day become biophysical economics w/o the growth model or maybe something else. But there will be economics and there will be people doing that economics -- the economists.

To me it makes little sense to fight against economists -- it is not a battle that can be won. What we should instead do is try to get economists involved in the discussion, the way Jeff Rubin contributes. Or a Matt Simmons type, or even Pickens. Having a broader lens means working together and not against each other I think -- especially when the fight cannot be won.

People will die but there will forever be doctors as long as there are humans. And society as we know it will also die but there will be economists until there are more people / acre than that piece of land is capable of directly feeding.

Just my 2 cents.

P.S.: Thanks for the great article, Joules.

B - thanks for your contributions here. I hear what you are saying, but the parallels are not the same. I speak of Walrasian Welfare economics which has dominated world institutions unlike medicine ever has. To speak against growth, or to assume that ones data might lead to a conclusion other than resources that meet demand is anathema in economic circles. In medicine there is such a thing as a terminal patient. Not so in economics - at least not on a global sense. Once again, I have friends who are economists - actually 2 of them are my thesis advisors. My point above is that being an economist trained in econometric methods that have seeming validity on a growing planet but conflate correlation and causation on a full one is a handicap to the problems we now face. To think and speak outside of that dogma gives one freedom, and that freedom gives insight and advantage.

-We are not rational actors (ergo we can be persuaded and influenced by powers outside of our control.

-Utility is just what our preferences are, which is just utility. Utility in the global sense does not distinguish between wants and needs but whatever is 'wanted' is good.

-Pareto optimality cannot happen on a full planet with lower energy gain and has not been happening for some time -only the illusion of such. There will soon be allocation and scale issues that economics cannot deal with.

I agree with the general tenor of your statement - and that after peak oil there will still be people with expertise on how to allocate scarce resources among fairly unlimited wants, but most of the principles of both economics (and psychology) are being subsumed by evolutionary neuroscience -we are getting very close to a unified framework of human behavior - much of this work is coming from within conventional economics itself (behavioral econ, neuroecon)- but it bears little resemblence to the Milton Friedman claims that we will one day not need resources at all - some people still believe that crap. Actually alot do - did you see the letter from editors of Barrons to Barrack Obama this weekend.

I have a finance background, which is not so dissimilar from economics. But about 90% of what I learned in grad school I now know was wrong. (comparative advantage and statistics were things that were valid). Efficient frontier - capital asset pricing model etc. were all based on flat world assumptions - they had the 'capital' input wrong, ignoring the 4 real capitals (natural, social, human and built) in lieu of a marker for them - financial. How long will the worlds business schools adhere to this fallacy?

I disagree with you there will be economists much longer in the future, or if there are they will be of a much different stripe - more of a cross between accountants, biologists and psychologists. I agree with you though that we are all on the same team, including well meaning economists trying to answer these questions. The people you mention don't discuss things in biophysical terms -only $ translations. That will have to change.

Sorry to sidetrack Joules excellent work on such a tangent. We will have opportunity to discuss this topic further in the comming 7-10 days.

Cheers,

Nate

Since I have no intentions of any additional sidetracking, I'll keep this post (relatively) short.

In general, I agree with what you say here. Without being lost in the details I also agree with you that some of the general assumptions like the concept of utility or the mathematically correct but otherwise questionable Nash-equilibrium will have to be replaced. On the other hand, I do not share your optimism as far as neuroscience is concerned, but it has a lot to do with the fact that I was trained to be a neurologist and have worked at the intensive care unit of Neurology -- with lots of terminal patients.

The thing I disagreed with (and I might have misunderstood you) is making 'the economists' the main scapegoats. We, the people, created this society -- and the economists along with it. We, the people, get what we deserve. It's a lot like my dislike towards religion-bashing comments. I'm not religious myself in the orthodox meaning of the word, but on one hand I do believe that something other than chance must exist, and on the other I have found e.g. taoism in very good agreement with quantum mechanics. What's more, either there is a God and thus religion only states the truth, or there is none -- and then we, the people, who are responsible for creating religion were collectively mistaken. (There are of course other possibilities, like there being a God but not the way we imagine, or there not being anything we call 'reality' -- t is just an illusion. I won't continue.) So dismissing religion or economics MAY make sense, but we are dismissing our very selves in the process.

One more thing I wanted to add. IRL I'm working on energy security in my country. Because I want some success, I have to work with others. Companies, Institution, the Government, etc. I cannot start a conversation with the words: economists (and in fact all people doing social 'sciences') are sorry, mistaken losers... because those people sitting at the same table are more often than not economists themselves. There is a thing called cognitive dissonance reduction... as I'm well aware you know.

Later.

(Sorry, Joules.)

Lot of agreement up to there. Its likely just me, but I think a willingness to accept religion indicates weak and/or uncritical thought processes. Ok now, everyone bash on me. Sorry Joules.

No bashing here, the idea that dismissing a specific cult's fairytales is "dismissing ourselves" may be lofty rhetoric but if you cannot dismiss nonsense then you are not allowing yourself to think critically.

And the idea of infinite growth on a finite planet is patently absurd, and should be dismissed along with all religion/supersition/myths, etc., sure the psychology of belief is an interesting subject for neuroscience, but otherwise this magical thinking is just people attaching meaning to memes/memeplexes without much regard to objective reality and the laws of physics.

You didn't understand too much of what I've been saying, did you?

I'm not getting into it in this thread, but perhaps re-reading my post would actually help. BTW, a blind, dogmatic faith in (ever changing) science is as religous as it gets.

I find this 'either this or that' type of westerner thinking superficial, easy and deceptive. Try using AND some of the time. Not OR.

Or a different thought process. As a matter of fact I doubt mine is any weaker or more uncritical than yours.

But it is not for us to decide.

Joules, thanks for an informative post!

In your conclusion, you said

There was a lot more effort by the IEA, in these two previous publications, to critically analyse and disclose information about Saudi Arabia.

IEA WEO 1998

http://www.iea.org/Textbase/publications/free_new_Desc.asp?PUBS_ID=1244

and the IEA 1996 Middle East Oil and Gas

http://www.iea.org/Textbase/publications/free_new_Desc.asp?PUBS_ID=1413

The IEA WEO 2008, p202, only has a token comment on reserves of Middle East, including Saudi Arabia:

In sharp contrast, the IEA WEO 1998 questioned the increase in reserves in mid 1980s starting on page 91 and ending on page 94.

Pages 91-94 of the IEA WEO 1998 also include two charts to support the IEA's questioning of official OPEC figures, including Saudi Arabia.

This chart shows the huge suspect increase in OPEC reserves in the mid 1980s.

This table shows Colin Campbell's estimate of OPEC reserves, including a possible overstatement of 63 billion barrels for Saudi Arabia.

The IEA 1996 Middle East Oil & Gas discusses Saudi Arabia and Middle East, but it doesn't question Saudi Arabia's reserves, instead it shows Fig 1 with Saudi Arabia having remaining proven oil reserves of about 260 billion barrels.

However, the IEA 1996 report does disclose much more information about Saudi Arabia than either the IEA WEO 2008 or WEO 1998 reports.

Just after Fig 1, an estimate Ghawar URR is provided.

There is a further detailed discussion about Saudi Arabia from page 186 to page 203. On page 188, there is further disclosure about Saudi Arabia's field URRs, presumably from the Arab Oil & Gas Directory 1992.

The total URR from those fields above add up to 153-168 Gb. Today, the IEA WEO 2008 report says that Saudi Arabia's remaining proven crude reserves is still 260 Gb. The cumulative crude production of Saudi Arabia to the end of 2008 is about 117 Gb. That means the IEA WEO 2008 implies that Saudi Arabia's total URR is 377 Gb, which is at least 200 Gb more than the total URR of 153-168 Gb of the largest fields. Saudi Arabia's last major discovery was Shaybah in 1968. Where have these extra 200 Gb come from? Improved recovery factors through better technology. I don't believe it.

Page 237 of the IEA WEO 2008 states that Ghawar's URR is 140 Gb, up from 85 Gb in 1996, due to an increased recovery factor. I don't believe it. Based on Joules' estimate of Ghawar OIIP of 200 Gb, from the end of Appendix I and using IEA 1996 URR 85 Gb, the recovery factor is 42.5% which appears believable.

In addition, the IEA 1996 report shows detailed data about producing oilfields in Saudi Arabia, on Table 36, including depth, API and Sulphur.

Table 37, spanning two pages, shows details of expansion projects, as of May 1990.

Table 38 shows the Saudi development programme, as of Feb 1993, including new project capacities from Khurais, 150 kbd; Khursaniyah, 150 kbd and Shaybah 500 kbd. Further on, the IEA 1996 report states that Shaybah could produce up to 700 kbd. It's amazing that these same fields of Khurais and Khursaniyah are now scheduled for new capacity of 1,200 kbd and 500 kbd, respectively. I have difficulty believing these huge increases.

The truth from Saudi Arabia about its true reserves and true production ability will come, but probably not in a pleasant way. The truth will arrive, just like the current credit crisis arrived, as a sudden shock. As the world is in a credit crisis and demand for oil will probably only show a slight increase in 2009 over 2008, the truth about Saudi Arabia's oil will most likely arrive as a sudden shock in late 2010.

Ace-

From 1998 WEO

From your own comments on the tod listserv:

Three (and a half) questions:

1)Has data not improved since 1998? At least in the fact that we have 10 years more of actual results?

2)Why do you think there was a good deal of work done in 1996 and 1998 there was a good deal of effort put into KSA by IEA, and since 2005 report (also publication of Twilight in Desert), there has been little?

2a)If IEA is limited by data and resources re KSA, shouldn't they have error bands or some language admitting there is serious shortfall risk to this part of analysis and therefore to the total?

3)Where do you think the extra 200 Gb has come from? EOR, or an extrapolation of recent EOR into the future?

I think your analogy to finance is apt. Who would have thought that AIG would need 100 billion bailout and Lehman would file for bankruptcy, and Iceland as a country would suffer same fate? The banks at all times said their balance sheets were strong. Was it pride or political fear that kept the right questions being asked by the 'financial' watchdogs? Or something else?

Actually it won't be too sudden as the EIA itself in their high price scenario projects Saudi output at only 9.4 million barrels per day in 2030.

That 9.4 includes both conventional oil and natural gas liquids.

Source: Table G5

http://www.eia.doe.gov/oiaf/ieo/ieopol.html

Anybody want to hazard a guess as to why TOD doesn't do a piece on the EIA's high price case which shows a peak in conventional liquids production in 2010? (It's been around since 2006)

Let me try a different tactic ... hee hee.

There..... no more excuses :-)

I traded on that and did very well first half. If I can read, so can others. (Sold before the top, though. DOH!)

Datamunger,

If I read your many postings correctly you seem to believe that the EIA internally believes their "high price" case to be their actual best guess and that they actually believe in Peak Oil.

On several occasions you have posted info which has not yet been released by the EIA which has subsequently proven correct. Do you have "inside" contacts?

If the EIA believes their "high price" case to be the most likely then is it not dishonest (actually outright lying) to fail to call it the "reference case"?

I fail to understand why you keep gloating over alternative scenarios portrayed as unlikely in the reports as if they were the reports actual projected outcomes.

This sounds to me like the very worst kind of institutional cowardice.

They publish a report with the results their political masters want, and which will justify their ignoring peak oil, and tuck away as an outside possibility where it will get ignored their true, central projection, disguised as an outlier.

In this way when TSHTF they have something to point to to say 'see, we warned you at the time'.

The politicians, although some of them will have been instrumental in putting on the pressure, will likely not realise that at the cost of millions of Euros they have in their hands a document which deceives, and intends to deceive, whilst covering up for the worthless individuals who are prostituting their profession.

Mind you - above 2 posts related to EIA, not IEA. (I point that out because you mentioned Euros.)

Yep, I've got it.

The EIA projected a slightly declining production for the end of the wild 30s.

Now I don't remember why they had the high price scenario for. Maybe this version fits best:

It was their fallback option so that 'later' they could say that they had always warned. Just the same as the IEA, who 'suddenly' had started their 'unique' survey of Earth's 800 largest oil fields and came up with 'surprising' findings. In fact they already had anticipated long ago the looming turmoil and realized they'd lose all credibility if they maintained their old story. In the beginnings all seemed to go well for both entities, but of course none of them survived the Great Rage of the late 10s.

So far the information from my old historypedia bookchip from 2067. Now I have to go back to my hydroxygen farmicle...

"... only 9.4 million barrels per day in 2030."

it is likely production in ghawar will be below* 2.5 million bpd, where's the other 7 million bpd coming from ?

* based upon 50 gb remaining.

From those who have the full WEO 2008 report can we please have the full production table similar to Table 3.2 in WEO 2006, page 93, so that we can compare it line by line?

Matt,

Three tables from IEA WEO 2008:

It's hard to imagine anything more important for a decent global oil forecast than a revision to Saudi Arabia's inflated reserves.

And what you have done with google earth continues to amaze me (and the basic flaws in the work others have tried to do is just as incredible).

Again from Laherrere, it seems that in 2006 recovery for Ghawar in IHS database was raised to 70% - that's one way to show reserves growth!

East Texas is at 77% - most prolific (if that's the word) giant field in the world. SPE115683 Engineering and Geologic Characterization of Giant East Texas Oil Field (SPE PDF). Also Maximizing Hydrocarbon Recovery from East Texas Field. Aramco certainly have the know-how and cash to work over Ghawar for all its worth. Bets on them drilling >31k wells in the thing?

Regardless of what residual reserves remain in Ghawar as well as other Saudi fields, we need some caution in the interpretation of recovery percentages. A 70% recover, or even higher, isn’t that difficult to anticipate at Ghawar Field. Fields with strong water drives, especially if supplemented with water injections, have a capability of very high recoveries. A field in Louisiana I worked on in the 90’s probably exceeded a 90% recovery. But this was a result of producing well beyond the economic limit (long story as to why Shell Oil did this). The tail production, as some have called it, can cumulatively add large volumes to URR. But it does it at a very slow rate. One field in S TX produced 150 million bo but the majority came during the tail phase at low rates (25 bopd/well) and very high water cuts (70% to 99%).

As long as the KSA can expand the surface water handling facilities they can increase the well count (thus increasing water and oil volumes). In theory 35,000 Ghawar wells producing 150 bopd each could deliver over 5 million bopd for many decades. Oil decline rates at this stage in the life of a field are low…usually around 2% or so. I work with wells today which produce a 1% oil cut but thanks to relatively low water disposal costs they are commercial even though they produce only a few bopd per well. But here’s the kicker: can the KSA justify the expense of drilling all those new Ghawar wells? It can be very economical to continue producing a stripper well which already exists but can you justify the expense of drilling a new well to gain this sort of production. Most low risk projects (drilling additional wells at Ghawar would certainly qualify) need to generate a 4 or 5 year payout and a rate of return in the order of 15% to entice investment. I can’t speculate on what economic parameters the KSA might favor. But if they accepted a low return on investment they might be able to maintain a higher delivery rate from their fields then we would anticipate. But if they did drill 35,000 new wells (at $3 million each…just a very rough guess) they would need to pony up over $100 billion. They could probably write that check but would they? Once again we are left with “possibilities” but no assurance they would ever come to fruition.

i get your point rockman, but i dont see any reason the saudi's wont figure out how to move large volumes of water. isn't ghawar still flowing for the most part ?

That was my point elwood. There is that potential. But it does take a big jump in infrastructure to do so. Oddly, time is one of the critcal facors. without spending a small fortune on chemicals sufficient tankage must be built to allow enough storage time for the oil and water to seeperate. I also suspect that non-economic issues will way heavily in the decision making process.

As I said...a whole bunch of "what ifs" w/o much info to predict what will happen.

1990 the East Texas field produced 35.6 million barrels of oil.

By 2005 the field was producing under 5 million barrels of oil a day. The field was 42 miles long and in the town of Kilgore, TX there were 44 wells per city block at its zenith.

Ghawar is not the same from north to south. The northern fields were better having super-porosity and produced higher yields. Some stated that Ain Dar was watering out, Shedgum had a huge gas bubble, and the water front was advancing every year at Uthmaniyah. A Saudi Arabian oil official indicated that the decline rates of its fields were 8% per annum. Its depletion rates were said to be 2% per year, that means that it might take fifty years to deplete a field. If a field was in its 49th year of 2% depletion per year, it might still deplete 2% of its OOIP. Due to the fact that Saudi Arabia has hundreds of reservoirs, they may bring new oil projects to replace old. As they were scheduled to push production to higher rates at Shaybah, a field not yet in decline, there was evidence that the 2% figure might rise. Then the bottom fell out of the oil market and the Saudis are cutting back. Peak oil! they wrote, this is the peak! I do not believe we have seen the peak, for if the price of oil rises, so may production. There are trillions of barrels of tar that might be turned to sweet light crude if the price is right. The rise of oil to $147. barrel spurred conservation efforts and lowered demand. It is the end of high oil prices for an interval.

"If a field was in its 49th year of 2% depletion per year, it might still deplete 2% of its OOIP."

i take exception to your definition of depletion rate. and anyone can define depletion rate anyway they want, but i believe the conventional (campbell, etal)definition is the annual rate as a percent of remaining.

http://eos.postcarbon.org/solutions/documents/cc_dep_protocol.htm

Percentage of original is the way Saudi Aramco defines depletion, because it sounds more impressive that way.

yes, some things are lost in translation. i often hear ooip refered to as reserves. i have also heard the term "reserves in place" and that is correct only if one is counting the amount recoverable that is now in place.

take the term urr, ultimate recoverable reserves, that is really an oxymoron. the only time urr has any meaning is on day one, before any oil is produced. already produced cannot be called reserves. a more descriptive term would be ultimate recoverable oil or reserves plus cummulative.

"Bets on them drilling >31k wells in the thing? "

there is more than one way to skin a cat as aramco has already demonstrated. is your 31 k model based upon how it was done in east texas in 1930 ?

and if drilling an excess number of wells is the key to high recovery, then spindletop should have been around 99%.

has there been any updated data on abqaiq ? as far as i can tell, abqaiq is as good an analog as there is for ghawar.

my wag on ghawar is 65% recovery, based upon what other steep dip, low viscosity oil reservoirs have produced. dude mentions east texas above. other examples are lost soilder and wertz in wyoming(not in the same leaque with east tex, abqaiq or ghawar).

It's producing about 350 kb/d, and falling.

Indeed, much of Saudi Aramco's optimistic enhancement of Ghawar's recovery factor (and their country 's overall) is because of Abqaiq.

In the post Abqaiq and Eat It Too, I compared these simulation cross-sections (Abqaiq at top, 'Ain Dar (Ghawar) at bottom):

These are both rather depleted areas, but less oil is left behind in Abqaiq.

In his work on Ghawar, Stuart Staniford looked at recovery rate from the standpoint of residual water saturation:

Summary of evidence on initial and final water saturations taken from

SPE 93439,

SPE 98847,

SPE 105114, and

SPE 105259.

Circles are rock-flush based evidence, squares are simulation cross section evidence, and triangle is Croft quoted number for initial saturation. Boxes with centerlines illustrate averages and uncertainties as described in the text.

So you and Stuart wag in harmony.

Ah.... good old SPE 93439.

We always return to it to reverse an oil price slide.

LOL

FF

So that's what it takes to get you to chime in!

I'll write that down.

Joules-

Great work you've been doing.

FF

"...but less oil is left behind in Abqaiq."

it would appear so based upon your two x-sections, but of course isn't abqaiq more mature, i.e. more pore volumes throughput ?

Not necessarily. This is a mature part of 'Ain Dar compared with the northern nose of Abqaiq. The former has a lot more wells, and has probably been producing as long.

Even if it were the case, you could imagine the situation when the the oil-rich rock dwindles further. They will then be flushing with lots of water to get much smaller amounts of oil out -- a bunch of stripper wells. Losts more GOSPs, bigger water pipes. Start training plumbers now.

"Start training plumbers now."

and i don't see why that can't or won't be done(mccain has trained 1000's and alledgedly they are all named joe).

and frankly, i don't know why a big field, a really big field is any different than a small one, there are challenges with every one, some bigger than others.

the saudi's have had access to the finest plumbers and state of the art technology throughout their oil production history. and imo,they have done an excellent job of managing their resources. ifo don't subscribe to the theory that private enterprise can manage oil resources better than aramco.

take east texas for example, imo, "that one" has not been well managed and yet the recovery is very high.

and how many 62 year old fields are still flowing ? besides ghawar, i mean.

Well, consider doing EOR with CO2. To enhance recovery, you need to get the CO2 concentration above a certain threshhold. With a lot of small fields, you can just apply it to one at a time -- making use of the CO2 as it becomes available. With a huge field, you need everything up front to make a difference. I don't know where they would get that much CO2, for one thing.

There are a lot of 62 yo fields in the US still flowing a lot of water. ET is the poster child for high recovery, but would you take that to mean it doesn't matter how a field is developed? It stands out because it is a fluke. I certainly can't criticize how Aramco manages Ghawar, but the statements from the "suits" at the top regarding its prognosis shouldn't be taken at face value because some of them are clearly nonsense (i.e. "current flows for decades to come").

In the end, the focus (for the EIA, the IEA, USGS, et. al. and hence this post) is on reserves yet peak oil is about flows. If Ghawar and all other big fields produce a small percentage of their current flows under EOR or stripping for a long extended period and therefore have a high recovery, it doesn't really help much. If you get 10% more of the OIIP out of Ghawar, that would be like an Abqaiq in volume. But it sure wouldn't flow like Abqaiq.

"There are a lot of 62 yo fields in the US still flowing a lot of water."

you misinterpreted what i meant by "flowing". what i meant was flowing under natural energy as opposed to being pumped(artificial lifted). i probably didnt make that clear.

the only leap of faith i take is that aramco is producing at gravity stable rates as they claim. and that seems to be demonstrated by their results, still flowing(naturally) after 62 yrs. and a well will not flow (naturally) with a real high water cut.

and my 65% wag does not include any co2 injection, that is based upon the typical recovery for a "gravity stable" project such as abqaiq. and i am not assuming that ghawar will continue to flow at 5 million barrels per day. my assumption is that ghawar is, or soon will be in decline.

sometimes in waterflood projects, the operator after first assuming that rate doesnt affect recovery makes a series of pw calculations and concludes that the highest injection rate provides the greateest pw for the remaining reserves. in some cases the ultimate recovery is not affected substsantially, only the amount of water that needs cycled.

and in some cases injection at an excessive rate will result in total failure (recluse field in wyoming for example).

Ghawar would be flowing much more slowly without the water injection. How is it under natural flow now? I'm not sure I see the difference between sucking it out vs. pumping with water injection.

"Gravity stable" is not a precise term. If by this you mean that the reservoir is refilling with water evenly across the field with the remaining oil at the high points, there is plenty of evidence that this is untrue. I will eventually post on that topic.

yes, the pressure in the reservoir is maintained by water injection and this allows the individual wells to "flow" , i.e. without a bottom hole pump or supplemental gas lift but these wells would not be "flowing"(without a bottom hole pump) if they were experiencing a high water cut.

gravity stable means that the displacement by water is occuring at a slow enough rate to allow the oil and water to separate due to the difference in density. and gravity stable is not a precise term.

in fact you could argue that if the displacement was truely gravity stable, there would be no water production until one day the water shows up and the oil is done. but ghawar is not a homogeneous reservoir and an average displacement rate (even though we may call it gravity stable) will cause oil in some zones to be displaced by water sooner than others. so i will allow the saudis to claim gravity stable displacement and take that too with a grain of salt.

so an instantaneous gravity stable velocity, v, would be: v=C*(k/u)(dp/ds)

v can be replaced with q/a where q is the flow across an x-sectional area - a

dp/ds can be replaced by (dp/dh)*(dh/ds) where dp/dh is the bouyancy and dh/ds is the sin of the dip angle.

k is permeability

u is viscosity

C is a constant

in a practical sense, this is nearly impossible to calculate. but the results from abqaiq and ghawar would indicate that aramco is maintaining a low water cut by reducing the rate of withdrawl.

typical recovery from a water drive or waterflood at a rate above gravity stable, whatever that is, is in the 40% range.

From Global Liquids Supply Outlook by Bob MacKnight, PFC Energy, March 28, 2008.

Click to enlarge

From another slide

They do not officially deplete. They just raise the recovery factor.

This is common knowledge among oil analysts. None of those analysts work for the IEA because they use a demand-driven model as described in both their freely available WEO2007 and WEO2008 methodology documents.

Those were the first documents I looked at before I looked at the report itself. From the WEO2008--

Nice to be reminded the future of our cultural hemoglobin will appear due to empirical convergence! I rail on the sidelines against econometrics, but history will show that its fundamental assumptions were created in a unique time in human history. The correlation/causation bugaboo will cause these models to crash only after they crash. The only hope is to continue this type of debate and continue to ask difficult public questions on what is possible and what is not.

Having said that, this report is still a significant step in the right direction, believe it or not. In previous reports, the IEA just extrapolated past demand forward, and added some optimistic wedges

on what non- OPEC would do ( based of USGS assessment), and then just basically filled in the (large) remaining gap with what OPEC could do. This was completely based on faith that OPEC would deliver whatever was needed. In this report, at least the kimono is partially off the emperor - considering the political difficulty of such a change in tactics, the people choosing the intro language should be encouraged. I'm beginning to overcome my initial disappointment and recognize this WEO is a huge change in the philosophy of IEA forecasting. Clearly their numbers are wrong (or at a minimum based on absolutely-best-case) and a long way from where we should be, but in the bigger scheme this is a pretty big step forward.

More steps and quickly please! Hire some biophysical analysts. Econometrics not going to save the day.

Thanks for the chart Dave.

Dave,

PFC is an energy consulting company, similar to IHS. That chart by MacKnight shows a 80 Gb possible overstatement of Saudi's official reserves of 260 Gb. In other words, MacKnight states that Saudi's true remaining reserves are about 180 Gb. How do we know that Saudi's true remaining reserves are not closer to 100 Gb? A critical analysis of creaming curves and recovery factors might help.

The Saudi reserve creaming curve, from MacKnight, is shown below. The reserves include P1 and P2, similar to URR. Does MacKnight give a data source for his chart? No, he just states "This is a creaming curve for Saudi".

Historical Saudi Reserve Additions

MacKnight's employer, PFC, probably uses IHS data, just as the IEA WEO 2008 uses IHS data. There are four creaming curves in the chart below from Laherrere's ASPO 2005 talk.

www.peak-oil-crisis.com/Laherrere_PeakOilReportMay2005.pdf

The PFC creaming curve appears very similar to the IHS 2004 reserve creaming curve. If PFC had used the WM 2004 reserves creaming curve then their reserves gap of 80 Gb would have been almost doubled to about 150 Gb.

Also, note the big shifts upwards in the reserves creaming curves from 2004 to 2005 for both IHS and WM (Wood Mackenzie). Are these shifts justified? I don't think so. These shifts were probably due to a Feb 2004 Saudi Aramco presentation by Baqi and Saleri, who both presented some unaudited numbers and charts.

http://www.saudiaramco.com/irj/go/km/docs/SaudiAramcoPublic/Speeches/Spe...

Consequently, IHS and WM did not want to upset Aramco, so IHS and WM increased their reserves data.

Here is another creaming curve of Saudi oil initially in place from Zagar's ASPO 2005 presentation. This creaming curve is probably from IHS as well.

Saudi Arabia, Can It Deliver?

www.cge.uevora.pt/aspo2005/abscom/ASPO2005_Zagar.ppt

The last step up in the curve occurred around the 80th wildcat and most likely represents Saudi Arabia's most recent large discovery of Shaybah in 1968.