Why are gasoline (and oil) prices so low -- and where are they headed?

Posted by Gail the Actuary on December 8, 2008 - 11:20am

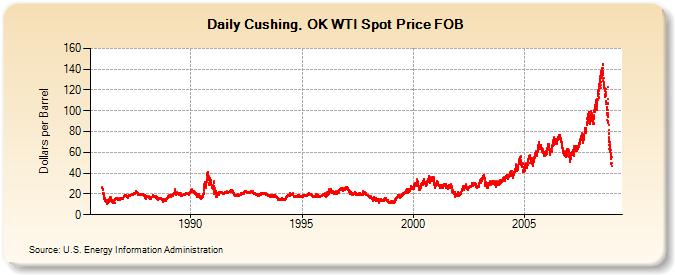

Why are gasoline prices so low? And why do they continue to drop? The recent drop in oil prices has truly been extra-ordinary. Gasoline prices are down almost as spectacularly, and the price of diesel is down is well. If we look at the graph, it doesn't look at all like anything we have seen before. What is happening, and where is this headed?

I am becoming more and more convinced that the drop in gasoline prices has a huge amount to do with all of our credit problems (which in turn are related to limits on the oil supply). These credit problems are causing more and more defaults on debt and more and more bankruptcies. These defaults and bankruptcies have a double impact on oil prices--partly from reduced demand, and partly from distressed sellers disposing of futures contracts at low prices, because they are easy assets to sell.

We often hear that "soon" oil prices will hit a bottom, and start shooting back up again. I am less and less certain that this will be the case. Instead, I am concerned that we may on a relentless path to a point far below the point where energy companies can expect to have any chance of making money. We may be on a path toward more and more bankruptcies and defaults of all types--energy companies, owners of commercial real estate, homeowners, financial institutions, auto makers, airlines, and many more. If this is the case, there will be a huge strain on governments, and some may find it necessary to default on their debt.

In order to ultimately get past this crisis, it may be necessary for governments to establish new currencies in which debt is severely limited, and at the same time unwind the debt in the existing currency. I expect that a huge amount of derivatives of all types will need to disappear as well, so that financial assets start bearing a close relationship to physical resources.

Supply and Demand

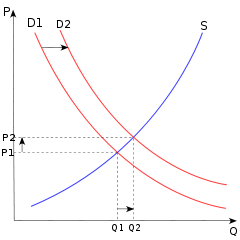

Most of us who have taken any economics courses have some idea of the expected workings of supply and demand.

The theory is that in a competitive market, price will act to even our supply and demand imbalances. If supply is too great, price will drop, and more users will find themselves able to purchase the products and use them at the lower price, bringing supply and demand back into balance again.

Is oil priced too high, or is credit too unavailable?

I think what we have happening now is a mixture of (1) supply and demand of the physical product, and (2) credit issues, both of which are focusing on commodity prices of all types--oil, natural gas, coal, copper, corn, and many others. With respect to supply and demand of the physical product, when the US was busy building huge numbers of houses to keep the economy going, and workers around the world were buying many new cars, there was a great deal of demand for these commodities. Once we started building fewer houses and cars, less oil was needed for manufacture and transportation. This type of physical supply and demand is what we expect to underlay a curve of the type shown in Figure 2.

The second problem is debt, and it doesn't work as nearly as rationally. Debt, and the repayment of debt, works as long as there is a growing economy, because with the growth, there are funds for a reasonable percentage of debtors to pay back their debts with interest. When a government senses that the economy is not growing as fast as it would like, it can encourage more and more debt, to try to keep the economy going. It seems to me that since 2001, we have had a considerable amount of government encouraged debt, to try to get the economy to expand faster than its natural rate.

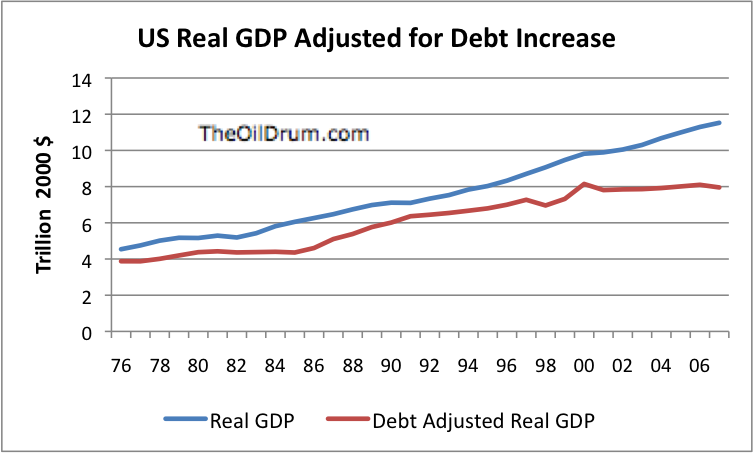

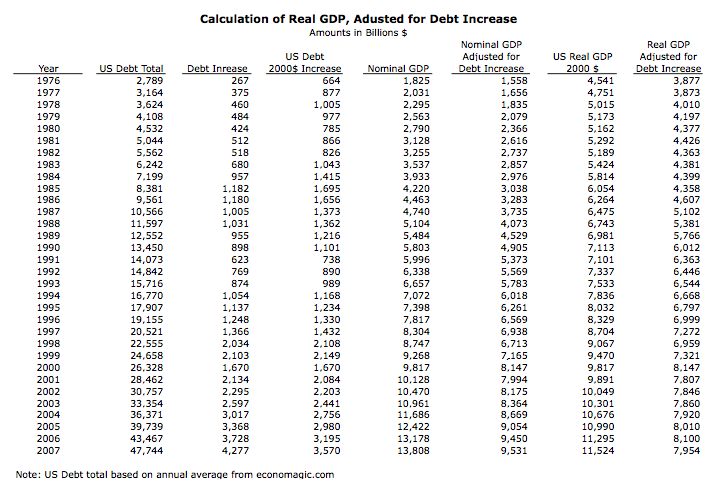

It is not entirely clear what the impact of the growth of credit on real GDP is. One estimate might be that an additional dollar of debt adds an additional dollar of real GDP. One could debate whether this relationship is correct, but clearly there is some impact. Using total debt amount estimates from economagic.com, this is a rough calculation of real GDP, without the inclusion of debt:

Based on the calculation shown in Figure 3, and graphed in Figure 4, there has been no real growth since 2000. Instead, we have been seeing more and more debt-based pseudo-growth.

Without real expansion, debt will eventually start to unwind--there start to be too many defaults. The debt probably would have started to unwind on its own, because of the slowed growth rate, even apart from the oil price increases. The increases in oil and food prices between 2005 and mid 2008 helped prick this debt bubble, but the underlying debt set the stage. The underlying issue that slowed the growth rate was limitations on resources. These resources are not becoming more abundant, so it seems to me that it will be virtually impossible to get the real growth to increase again to the point where it again makes sense to have very much debt. I would argue that it probably never made sense to have the level of debt that we have had in the past few years.

So what does this have to do with the supply and demand curve? Oil prices can be expected to keep dropping, as long as there is more and more credit imploding, resulting in fewer people being able to buy products made with oil. Given the huge amount of debt outstanding, and the lack of growth to make this debt "repayable", more and more defaults seem likely.

We can ask ourselves, "At what price of oil (or of gasoline) will credit stop imploding?" since the answer to that question will tell us when the price of oil can be expected to start rising again. I believe the answer is, "Whenever governments can figure out a way to get the economy to start growing fast enough so that debt (and its repayment with interest) 'works' again." I would argue that governments will never be able to make this happen. We have reached a point where resources (oil and other finite resources) are in such limited supply that the best we might be able to hope for is a level economy for a while. More likely, we are going to see decline. Because of the lack of growth, we are at a point that we need to unwind the debt we have, and learn to live without the vast majority of it.

What does this mean going forward?

To me, Figure 1 is truly scary. If the price of oil and other commodities continues to drop, we are likely to see more and more energy companies going bankrupt. Some of these may be large--we have heard rumors about the financial problems of Glencore, a large privately owned international trading company. The economies of Texas and Louisiana are likely to take major hits, as will Russia and some Middle Eastern countries. Even with the low energy prices, many of the problems the US has are likely to continue (too few houses and cars being built to "pump up" the economy, declining prices on homes and commercial property, and many workers laid off).

The amount of debt we have outstanding is extremely high. The debt shown in Figure 3 is not really all of the obligations of the US public and US government, since it excludes things like Social Security and Medicare liabilities. According to one web site, the amount of debt Americans have outstanding is $53 trillion, plus unfunded governmental promises (including Social Security and Medicare) of $64 trillion, and plus trillions of dollars of related to derivatives. Not counting the derivatives, this amounts to $386,091 per person. I don't know whether these numbers are precisely correct, but it is clear that with limited resources and a declining economy, there is no way that amounts similar to these amounts are going to be paid in full.

I am sure that the Bush and Obama administrations and other administrations around the world will try to fix the problems, but I fear many may not be successful. If they somehow are successful, the current oil price collapse may lead to a rebound, but it is likely that we will still have to face the need to unwind our debt later, even if we somehow make it past our current crisis.

I don't know whether it is necessary to go through a full economic collapse and restarting process, to get past all of this debt. I find it hard to imagine that governmental leaders will sit down, look at the situation rationally, and start thinking about how to unwind the debt. But eventually, and I fear, sooner rather than later, we will need to get rid of most of this debt, and start over again with a monetary system that is more closely tied to resources and discourages debt. It is possible that forward-looking leaders could even start the new monetary system before the old one is phase out. The new monetary system might, for example, start out as more of a rationing system for food and energy products, and eventually be expanded to cover other products as well.

I am afraid I don't have all of the answers. My problem is that when I see a trend line based on oil prices pointing almost straight down, and I can't see a good reason for prices to suddenly start rising, I start worrying that the consequences of the current price collapse could be far worse than any of us on The OIl Drum have been talking about.

These are a few of my recent posts that are related:

Impact of Credit Crisis on the Energy Industry - Where Are We Now?

An Overlooked Detail-Finite Resources Explain the Financial Crisis

Jeff Rubin: Oil Prices Caused the Current Recession

It seems that if you built the actual supply/demand price relationship curve.... It would appear nearly vertical since May 2005. A 1 million barrel change either way is a $100 change price. A lot of things in nature go asymptotic at the limits.

Bill O'Grady at AG Edwards foretold of this about 3 years ago.

Does it have to be any more complex than that??

FF

Exactly, the current chart for oil is not that unusual for those who follow charts. Many stocks looked about the same after the dot.com bubble. Having followed the corn/soybean market for many years, it is not that rare to have soybean prices go to about $15 in a blow off and then in a relatively short time fall back down to under $5.

When 500,000 people lose there jobs in a month and most of them drive to work there is a large reduction in oil demand. If they each used 2 gallons/day for commuting, that's a reduction of 1 million gals/day in demand.

Add in the observation that many have parked their low mileage vehicles and switched to smaller cars and demand is reduced further. Since prices are set at the margin in a free market, one extra gallon of gas causes the price to fall until a buyer is found. The same thing is true for an extra bushel of corn.

Commodity collapses such as this can take years to stabalize and form a base before retesting the old highs. After the collapse of 1980 it took 28 years for crude oil prices to again match the inflation adjusted price of 1980 during the July 2008 spike.

I tend to disagree with your premise that it will take a long time.

If you look at Figure 2, I think at 85 MMBPD we are near the upper limit on Q. P is moving violently. A little delta Q plus or minus gives a lot of delta P. It will be a roller coaster ride of epic proportion....

I don't know how else the peak in Q would manifest itself.... is it not the only way???

Regards

FF

FF and x, I haven't seen that a 1 mbpd change means a $100 price change. So far a 15% price change for a 1% change in supply or demand seems to continue on the mark.

Did you see the comment the other day from the TODer in the shipping biz? He was pointing out that the drop in price meant that ships were moving faster, because costs of crew, etc. were outweighing costs of fuel. And he said that this shortening of the pipeline had, in effect, put an extra 2 mbpd on the market.

Plus, diesel has been controlling the price for some time, and we've had a sharp drop in diesel consumption in the U.S. over a very short time.

Add in the extra production reported for October and the normal 15% for 1% model gives you the makings of a slide to something like $zero.

OPEC will cut on the 17th. And contango is now at a record. We are looking at a bottom forming, and that's a very good thing.

A bottom forming? Well, prices blipped up today, but this global recession is barely out of the crib. Remember 1998? Oil hit $10 a barrel. Remember 1980? Oil demand fell by 11 percent in three years (globally).

I hate to say it, I try to be optimistic, but this global recession looks much worse. Where is refuge from this downturn? Europe? Asia? North America? South America? Manufacturing? Retailing? Real Estate?

Nada, nada, nada. Oil demand could easily fall by 10 percent (maybe more), while supplies rise by 2-3 mbd in nex couple of years.

I see honking gluts of crude to the moon for years and years.

Oiil may hit $10 a barrel again. Increases in crude oil demand will be long and slow in coming, if we are lucky to get any increases at all within three years.

Oil is deader than yesterday's newspaper.

We might want to re-think hytseria about supply. Price seems to moderate demand, especially above $100 a barrel, while stimulating supply. Add in recession, and you get glut-a-rooni.

One thing is clear, production is inflexible, not demand.

The oil industry has become much more concentrated, with the great bulk of production in the hands of a few dozen national producers. An oil minister's worst nightmare is for his country to cut production - for any reason - and watch prices rise as a result, with his adversarial neighbor reaping a windfall. Meanwhile, his own country becomes more and more vulnerable, because its income has been reduced because of low production.

As a result, the countries pump as much and as fast as possible. 85 million barrels every single day is a lot of oil. That oil has to be sold and however low the price must go to clear that day's market, it will be cleared. If the production does not leave the country, the outcome is the same as a cut in production, so sales strategy and promotion are a part of the production process as well.

Of course, there are unintended consequences, some of which are well known. The low price reduces investment in new production, repairs and maintainence or petro infrastructure and the production of alternative energy sources. A less well considered outcome is the loss of income to our suppliers; these countries are the source of much of US stimulus and bailout funding, as well as customers for USA- made goods and services. The highly valued dollar becomes an additional difficulty. The possibility that declining revenues might result in domestic unrest - and Al Qaeda attacks on oil infrastructure - also increases.

What is infuriating is the deleterious effects could be avoided by the government placing a floor under oil prices or, at least gasoline prices. $4 dollar per gallon gas would give the government policy leverage with our suppliers and encourage conservation and help finance alternatives. It would demonstrate someone in Washington knows what they are doing and that hard choices can be made, rather than have the choices made for us by circumstance.

SfromV-- from your lips to G-d's ears. A gasoline tax to dampen demand and build infrastructure. I recommend incresiong the federal gasoline tax by 50 cents a gallon for next eight years, while cutting taxes on middle class.

I am not so sure production is inflexible -- just slow. And subject to lunatic thug-state politics.

A good reason for USA to go it alone, energy-wise.

Refuge is so last century, so very very over.

Not only is refuge for wealth over, but also for people. Even the top GM executives have no place to run, no place to hide! And now, in the cruelest cut of all, no jet to take them there.

Ah, well. "We will always have Paris." But of course Bogie - uh, Rick - really meant, "We will always have Paris, in our memories."

Hmm bottom forming ?

I don't think so at least with the way I read the charts. I think oil will have to go to 30 before a bottom forms. Now that its blown through the support level at 50 the next one is at 30. It could turn now but thats pretty doubtful.

And to be clear I continue to assert oil could readily hit 150 or more in a matter of weeks just depends on when the market wakes up and what the real demand supply situation is.

But I'm pretty sure that in the interim we should see 30 first. It will be interesting to see it turn before it at least touches 30.

Now if the market blows through 30 god knows what the floor price would be I don't think we have any other fundamental base for a floor forming.

However I think that if we do hit 30 like I suspect we will see some serious cuts in supply that are probably unwarranted. We have a little resistance at 40 but I suspect the current bear market rally in the stock market will falter and this will work to allow oil to bust this temporary support level at 40 sending it on down to 30.

I don't think this bear market rally in the stock market will really take off until we see the bond market bubble collapse so I think we will see a number of still born bear rallies.

Whats worse however is if oil does punch through and head for 30 its going to send North American NG to 4 which is going to devastate the US UNG plays.

Now if this is the "real" bear market rally then oil could turn now and stocks turn first and that takes out the bond market. In any case we are certain to see yields turn around on the bond market eventually it get very volatile as the interest rates drop so I can't see the bond bubble lasting much longer.

Also although I think the current oil market is dysfunctional it is betting that KSA can do nothing to control the slide in oil prices and I really think that prices will continue to decline at least to 30 now until it becomes obvious that we do or don't have enough oil. So once the market answers this question it will become functional again.

It as three low price equilibrium points 50, 30 and say 15 although I've got no idea where the last one is. If we have plenty of oil it will settle on one of these three. If not then we don't have any long term stable points until we hit 200.

Really sticking my neck out I think we will smash below 40 before the end of the week and potentially see 30 in the next two weeks.

Your technicals are all technically correct. I think there's a whole different explanation for the bottom falling out of the market. KSA is run by a royal family who don't need to maximize short term oil revenue as much as they need to do maximize their influence on energy markets and prop up diversified investments in US securities.

It's just naked monopoly power. Destroy the energy competition, get back any money lost on mortgages (Allah be vindicated), and help orchestrate another spike. I wonder how their US managers have been redeploying KSA assets during this bloodbath? My suggestion is "follow the money". Easier now that there's so little left.

Can you imagine if KSA was run by the Taliban? They would have no hesitation in stopping oil sales -- they'd probably consider it a virtuous move.

No wonder the U.S. will do anything to support the current rulers.

It could only be a brief burst of extra supply, or extra congestion at the receiving dock. In the long run, ships only transport what buyers buy.

Faster ships mean fewer ships can supply the same demand, which means fewer cargoes are on the high seas at any one time, which means a reduction in on-the-seas storage, and more competition for cargoes, so shipping rates should decline.

It depend also to the fact that the price is dependent on the last buyer's price and the prices converge to this price level very fast.

As soon as there was a reduction in demand of oil, the price would collapse.

As the major market and the richest one was hit by a crisis, the acceptable price dropped for many people. So the unsold oil needed to be sold off at lower prices.

Also, a big part of the high price levels of oil were the gut of money made available from the FED and other Central Bank via the Real Estate bubble. People with money in hand looked for place where put the money in investment outside the real estate and many invested in oil contracts.

Here is the curve you are referring to (it includes monthly average composite aquisition costs for crude oil relative to C+C production).

It includes data up through September 2008 when the price (and production) had begun to fall back down the curve.

That's asymptotic.

That's peak oil.

Thank you.

FF

Is that US costs? Refinery acquisition costs? FUD?

If refinery acquisition costs, it tells us nothing, other than we were in a financial bubble, or rather, because we were in financial bubble, the true meaning of this graph is unknown.

(I sent you an email)

Thanks for the emails.

The cost values are the composite monthly refiner aquisition costs.

These are found at: http://tonto.eia.doe.gov/dnav/pet/pet_pri_rac2_dcu_nus_m.htm

They are actual costs (not real, chained to a particular date or year). It really does not matter which cost data one uses from the various options the EIA uses...you get the same type of curve.

I could have just as easily run the data with the WTI spot market price average (one of the daily values I track) for each month compensated for delay and autocorrelation and I still would end up with the same general curve.

It is worth noting (since you can't see it explicitly in the data) that the "curve" is really an average of a curve path that shows hysteresis. That is more evident at lower production rates.

Trooper:

"a curve path that shows hysteresis"

What do you mean by hysteresis here? Is the way down different from the way up?

Yes, that is what hysteresis implies, as in certain electronic waveforms. This also comes up in thermodynamics, where a non-reversible cycle leads to losses as in an inefficient non-ideal Carnot engine.

As noted by WHT, yes, it's a different path down. It's not a huge difference but it appears when you plot the path rather than just the points.

It is a concept that has real life applications. Your home's thermostat and HVAC is an example of a control system that operates on the basis of hysteresis.

Is "asymptotic" the correct word to us to describe the situation? If you do use the term, then you are implying that there is a daily production rate that we cannot exceed. So that something like 1/(x-xmax) turns into a singularity at the x=xmax asymptote.

It is a correct concept. What it suggests is that the differential cost (or incremental cost) of that next barrel of oil becomes not only larger but possibly infinitely large when a limit is reached.

If the supply, or more accurately the rate of supply, were infinite then this uptick would be an anomaly.

There are several ways to look at it:

1) It's a (short-term) capacity issue...that if we really had the capacity to just add another 5, 10 or even 25 million BPD, the curve would not curve and instead we'd have a zer-slope or slight negative sloped line with scatter to it. What we really ran into, besides a financial bubble, was a place where all the spare capacity was "used up" and to the extent that fields and refinery were available, they were running "flat out." Given a couple of more years the real sustainable capacity will be significantly increased so that we do not run up against these limits in the future.

2) It's a short-term capacity issue created artificially. In other words, people would like to produce more and have the capacity to turn the valves much further open than they were/are. They refused to open the valves to drive the price to higher levels rather than flooding the market and causing the price to go down (dramatically) or increasing the flow so that the marginal/increment cost remained the same once a price point was reached.

3) This is the peak (geological) characteristic: as production flattens or declines, prices go up (and eventually and incrementally destroy demand). Too rapid a rise causes a widespread collapse and it may not allow a restart of the economy on the way back down (like an aircraft with insufficient thrust to overcome gravity, the climb will stall and then begin a fall. If you have enough time and distance, you might gain enough lift to regain controlled flight. If not, you "crater.").

Bill O'Grady of AG Edwards February, 2005

THX

Interesting way of putting the situation!

You talk about not having enough lift to regain controlled flight. I wonder, with all of our debt related problems, if this is not a second impediment to rising again.

Now you know one reason why "entertainment" like the TV show "Survivor" might have been created and been so successful...to get people accustomed to the idea of whom might be "voted off" or tossed overboard to "lose weight" and regain controlled flight.

Of course, on the way down you can imagine you are in controlled flight whether you are or not. Its only the sudden stop at the end (and the crater that is formed) that is the problem.

Gaia like crater.

Very nice graph. I sent a copy to The Oil Drum staff, in case any miss your comment.

Lots of possibilities here. Factor in what Krugman had to say about such a curve regarding multiple equilibria that Khebab pointed out further below in the thread:

Just for fun, I created a quick plot of the number of bushels of corn required to purchase a barrel of oil (using the $/bushel cost) plotted against annual average oil production since 1960.

You can see the artificial peak of the oil embargoes of the 1970's in the data. But notice that on a commodity swap basis it is (in general) costing using more corn (equivalent) as the production flattens as we approach 75 million BPD of C+C.

Of course, one othe things noted about the agricultural production is the yield (and the variation each year). Here is the amount of land area production required for a barrel of oil using the cost equivalent method above.

It's the number of acres of corn production required for a barrel of oil, considering both the yield and the respect price of corn and oil. The curve is slightly different indicating the effects of lower yields in the early years. However, the general characteristic is the same.

A picture is worth a thousand words!

G

Is that inflation adjusted?

Is there anywhere I could look at the raw data for it?

No, but this is:

(I don't go with fancy backgrounds, or non-zero scaled axes)

Not quite so impressive. The loops pre 1986 are the two OPEC oil shocks. The run-up after that remains pretty startling

Data from:

http://www.eia.doe.gov/emeu/steo/pub/fsheets/real_prices.xls

http://tonto.eia.doe.gov/merquery/mer_data.asp?table=T11.01b

G.

Mine is more cool, because it has "The Wall" in it. ;o)

EIA data.

-best,

Wolf

I look at this graph and I see two completely different curves -- a hockey stick and a pointy football, and I think, what's going on?

Could it be that one curve is driven by the buyer's demand for oil, and the other curve is driven by the seller's demand for cash?

It remands me of the butterfly curve with the strange attractor, where a point goes round and round on much the same orbit, and then without warning flips onto a completely different orbit for a while, then flips back again.

The point is, these flips between orbits are completely random, although once the orbit is established it is fairly predictable.

Which makes me think -- betting on the oil price is a risky business. You can never guarantee if you are betting on orbit A that it won't switch to orbit B.

Inflation adjustment is shown in a post above this one. I would point out, though, that part of the effect we see is the fall of the dollar relative to other currencies and then its sudden rise. I will post those separately.

I would also point out that inflation adjusted data does not provide much insight into different periods of time that may refelct completely different social-economic conditions at both micro and macro conditions. The Raleigh of 1973 where in just going two miles from the campus I was in to rural/agricultural farmland is a thing of the past. And the OPEC oil embargo price shock of 1973, where gasoline prices at the local Starflite gas stations went from $0.199/gallon to $0.439/gallon (where you fed dollar bills into a vending machine type reader) does not necessarily reflect a "constant" expenditure percentage for our lives. What we saw this past summer(2008), in terms of cost cause and effect might be similar, yet other forces were at work then and now.

BTW, the background is the Delaware Bridge on the way to the NJ Turnpike.

The raw data I used is:

Refiners Aquisition Cost (composite) found at:

http://tonto.eia.doe.gov/dnav/pet/pet_pri_rac2_dcu_nus_m.htm

The monthly production data are from the Monthly Energy Review, specifically Table 11b (Under International Petroluem) at:

http://tonto.eia.doe.gov/merquery/mer_data.asp?table=T11.01b

That's the "easy" data to retrieve. I'm working on (in my spare time) extracting the cost and production data even further back in as fine a resolution as we have here (that requires more time in the NCSU Library). The EIA has annual values available.

Here is the same data converted to € from 1994 to present.

The production data and the cost data all on one chart with $ and €.

Regarding 'starting over with new monetary system', the situation in Zimbabwe (shown here in pictures) is like its from a science fiction novel. New $200 million notes issued this weekend, after discontinuing the one hundred billion dollar notes last month.

I think you are right that debt/credit, or lack thereof, is going to underpin whatever our future social (and financial) system looks like. The impacts on future energy infrastructure are ominous. Already we are seeing massive cutback on natural gas capex, from drops in demand and drops in price well below drilling profitability. Today, Dow Chemical announced 20 plant closings. I have an essay on 'natural gas armageddon' in the queue, as the drop in rigs is about to go off a cliff because Henry Hub is below $5.7. Given that we deplete at close to 40% per year in aggregate in North America, a production cliff will soon follow unless prices go up soon, and alot. (Note: I was supposed to have this for today but my computer crashed so Gail wrote the above piece on very short notice - thanks Gail)

Ah, but producers know the price drop has gotten out of hand, so contango has gotten out of hand as well, and both producers and speculators are now taking oil off the market and storing it for December 2009. They are locking in $57 for their oil by doing that, which means they are locking in an 11% profit. Which means the spot price will be coming up. Which should alleviate some of this deflation pressure.

http://bloomberg.com/apps/news?pid=20601087&sid=aSywZ2vJlJf0&refer=home

Both producers and speculators are now taking oil off the market. The price has moved up sharply this morning, and the buck is sharply down. About fr1gging time, as I'm sure you'll agree.

Moe

Im not worried about oil (as much) - a) it's an international market and b) it depletes (overall) at less than 10% p/a. Natural gas is domestic market and there is no real contango to speak of until you get to the back years. Since its depletion profile is 40% per year, we have a real problem if enough rigs are layed down. Plus many of the larger producers are hedged. What happens when their hedges come off?

Same here the NG situation is far more important. But as I tried to show in my long post below the question we should be asking is are the commodities markets actually functioning at the moment ?

For some reason it seems that people have made the assumption that we can have our banking system lock up yet the commodities markets continue to function smoothly. If our commodities markets are actually broken and dysfunctional then it makes little sense to even look at price at the moment. We probably have no clue what is happening and neither does the market.

http://declineusa.wordpress.com/2008/11/02/no-letters-of-credit-lc-means...

http://www.enterprisenews.com/business/x1129044808/Credit-crisis-batters...

Now what happens when a market is disrupted ?

http://www.cattlenetwork.com/Content.asp?contentid=261358

How on earth can we even talk about supply and demand with this much disruption in the market ?

Will it settle out sure it will. All of the commodities are consumable at some point the supply chain will clear itself of all the imbalances caused but disruption of trade and the smoke will clear. Obviously I think we will find that not a lot has actually changed from earlier this year but that not important right now whats important is to recognize that the global trade network for all goods and services is currently not functioning well. Its suffered a massive disruption and it will take time for it to establish new business lines. Probably given the shear scale of the disruption we won't see a return to normality until outright shortages start appearing in certain areas around the globe. This will be shortages of oil, oil products, food and various finished goods.

Once we start seeing these and then see them clear then we know the markets are now functional.

And back on topic to Nates post this will in my opinion happen with a vengeance in the North American NG market.

We will see very low prices for NG probably touching 4 dollars followed by tight supplies and then and only then

will the market begin to correct and re-establish a functional market. Oil I expect to go to 30 now before a bottom

forms and I fully expect the same thing incredibly cheap oil coupled with tight supplies in certain regions.

You are premising your argument on the financial markets correcting. What is it that will make the financial markets correct? It seems to me that there is so much debt (and derivatives) that need to unwind, that it will be almost impossible to get the financial markets to correct. Somehow they need to reconnect without all the debt, and I don't see how that can happen in the near term.

No I don't expect the financial markets to correct. For them to correct the banking system would need to be cleaned out the loans written off and the banks obviously made healthy. I expect our current financial crisis to become the new black. With little credit available.

Lets consider two different types of markets under financial crisis i.e broken markets. One for durable goods in excess and one for needed commodities. In both cases we assume the markets are broken i.e financial issues makes it difficult for former buyers to secure financing.

In both cases the primary effect is cash is king. Your not worried about the price you get your worried about the buyer paying. Lets say this effect is order of magnitudes larger then any other. In a cash is king type market prices are driven down very low as wannabe buyers are unable to enter the market. From a macro economic stand point the velocity of money or number of transactions falls through the floor. Market price becomes irrelevant as sellers are simply trying to find worthy buyers. The demand situation becomes a enigma.

From here we have a divergence as commodities are generally sold according to very basic needs this includes oil and food. For a given economy and given population the oil and food needs are fairly constant. I.e supply and demand do not change much. Prices are set on the margin but lets not even look at prices yet.

In the case of consumable goods what you would see is that the market will begin to clear the cheap goods as they are consumed. Supply and demand are probably imperfectly supplied with the cash buyers getting a inordinate amount of supply while credit based customers seek new financing. Eventually of course they are forced to accept onerous financing terms or face shortages. Generally this means that depending on the supply chain buyers of commodities are forced at some point to buy using some sort of financing. Money is always available for a price. This is simply a market in turmoil thats becoming reestablished under a new financial scheme. Once it does "real" demand can again become important. No one really knows what this is for sure but until willing but unable market participants secure funds its impossible to tell. Given the critical use cases for food and oil government intervention at some point will happen in various countries to ensure supplies. Exactly what happens is on a case by case basis but the financial system is robust and it will reestablish itself.

Now for durable goods that are in excess you can just about forget it. They will fall in price for a long time until the excess supply is liquidated credit will not be extended and the market remains in a cash is king situation for ever.

As you can see what I'm saying drives a market back to functioning is when all potential market participants reestablish funding for critical commodities this is effectively forced and actually fairly quickly depending on the timescale of the market. By this I mean generally since these are critical markets they have a number of buffers built in to protect against shortages as these buffers are drained down the forced buyers will reemerge.

Now all I'm saying is that nobody can say anything about the current market its simply dysfunctional. I can't and the pundits proclaiming demand destruction are simply fools. All you can say at the moment is that most of the global market is dysfunctional because of the financial crisis. Once the various markets have established new means of funding then they will begin to operate. This does not imply that we go back to the old ways instead its a better bet that hard money loan shark type credit will become increasingly used with exorbitant interest rates. We can also expect direct government intervention in some markets with generally the use of printed money and the certain results of that approach.

Now I have no way to prove that the markets are currently dysfunctional and for the most part simply not operating.

However I can say that if I'm correct then we will see a paradox occur nominally low prices for oil and food and spot shortages start appearing throughout the globe. Thus a dysfunctional market can only be proven in a sense after the fact once it results in shortages. The cash is king effect smashes prices and blocks people that need the commodities but cannot afford them. To some extent the fact that commodities are selling at or close to a loss is also a indicator. But thats not clear cut.

Now as far as oil goes I said you don't really know the truth until the market clears well this depends on the market for oil it works on a four month cycle closely aligned with the seasonal variation. We are in the Nov-Feb winter season thats really half of Nov and half of March. The first point at which you can really say that the market for oil has almost certainly stablized would be near the end of Feb early March.

I expect us to get a clear signal sooner but I'm guessing on that using basics you have to wait till you have in a sense cycled through and exhausted supplies bought earlier. It takes time to ensure that any participants on the sidelines because of financing needs solve their problems and meet their base needs.

The oil market will clear and so will the food markets the participants have no choice. The final price at that point will depend on supply and demand and the new market equilibrium established. Maybe its low prices maybe its high time will tell but we simply don't know yet. Now I will say this given that the problem is the number of customers or demand is whats unknown and the natural direction is down if the market price spikes like I expect before March then its a safe bet that supply does not meet demand i.e a price spike is indicative of a supply shortage its not certain but its a fairly good signal. If the market is actually well supplied then I suspect the outcome will be some nominal prices between 30-50 a barrel out well through March and then for some unknown time after that maybe years.

Thus the longer it stays low the higher and higher the probability is that the market is well supplied and all market participants that need oil have the financing to buy oil.

Moe, you are correct on the locking in by speculators and hedge (wealthy ones) investors, but of course you know what that means...they make 11% while retiring middle class baby boomers now attempt to retire on half the money they had only a year ago and are having trouble making 2% after tax returns...this will be the biggest transfer of wealth from the middle class to the wealthy in the shortest amount of time in known world history, plus the several trillion dollars in cash and protection given to the financial community by the federal government.

It has amazed me that the anger of the fifty something year old baby boomers has not been off the charts, as everything they have invested for over the last 25 years is being wiped out, and now "peak oil" is being used as a cover.

This financial crisis has NOTHING to do with peak oil. Do you think the banks, hedge funds, and speculators would have behaved one bit differently if commodity prices had never went up? They caused them to go up, continuing to jump in and out of markets from the dot com days, to the housing boom, to the Asian bond bubbles to the commodities boom...this crisis began on the day the repeal of Glass Steagall occured in 1999, and if you want to blame somebody for this catastrophe you can look back to Phil Gramm and the Republicans who voted for that repeal in a party line vote. Without turning the wolves at the crooked banks and thier trillions loose on the what had been relatively stable markets and creating a "market for volatility" that the hedges and speculators jumped on, the massive moves in collateralized debt or in commodities would not have been possible.

This was a looting operation pure and simple and now the banks and hedge fund thieves are attempting to use "resource constraints" as some kind of cover. It's deplorable and I for one resent the posters on The Oil Drum (including the respected ones like Gail) helping the bastards disguise this massive theft from millions of Americans.

Oil prices will go back up and possibly with great speed, as will other commodities, because due to the way the game is now played, the more volatility the better for the speculators. This will only get worse and worse until they have killed the goose that layed the golden egg, that being the American and possibly the global economy. This is occuring because we are ALLOWING it to occur. It has nothing to do with resource "constraints".

RC

Pretty well sums up the situation.

Exactly. For the hedge funds and huge wealth pools, volatility is a benefit because they can afford to analyse it, research what causes bottoms and tops (if they're not causing it themselves), and cream off the assets of simple long-term investors.

If you are (or were) "in the market", unlike me, how confident were you that your stop loss trigger settings (or your mutual fund manager's) were fully confidential from those who could short your stock, then arrange a perfect drop to collect your stocks at one penny below?

The "market" has been just a dirty casino for years.

Then why are hedge funds losing money at record rates? Why is the entire banking system on its knees, begging for government bailouts?

Money is being destroyed in vast quantities, and a lot of that money is (was) being held by hedge funds, investment banks like Goldman Sachs, and ordinary banks like Citi. There is a transfer of wealth happening, but only because governments have been shoveling taxpayer money to these crooks. But that is only cushioning their losses. If these folks were geniuses, they wouldn't be insolvent.

With the help of governemnts (mainly the US & Japan), the financial wizards thought they had created a scheme for huge, endless, risk-free profits. They were wrong, and the entire system has now blown up in their faces. Imagining that these same people manipulated the bust as well as the boom is, IMO, delusional.

They thought they could forever fleece the sheeple and suffer no consequence themselves. Not exactly known for deep introspection....

I pretty much hate the banksters, hedgies, and finance crooks more than anyone as they have sucked the profits out of everything including the future but they didn't cause the diesel shortages earlier this year that more than doubled my operating costs.

Your anger is understandable but misdirected. Yes, it is a looting operation, but not pure and simple. Capitalism has been around for a while now, capital has concentrated into ever larger blocs, and those large blocs have tightened their grip on the reins of power, even as they wage war to the death with each other and other powers. Crisis is endemic to capitalism, and exploitation of crisis by the biggest and strongest players is endemic to capitalism.

Standard texts paint this idyllic image of the thrifty entrepreneur building up his business through thrift and hard work, and this is America. But the road to the really big money fast is to use other people's money, leverage it to the hilt, and skim off the top. And you need to avoid risk by taking out insurance, swaps. But the ultimate risk insurance is an in with the feds, owning them outright if possible. And it is the inevitable logic of capitalism that it work out this way, especially in a country where there is no organized opposition.

Actually, its far worse than I've just presented. Intertwined with all the above is the military-intelligence-industrial-financial complex. You focus on the screwing of the boomers. Yet it's far, far worse than that. The boomers (and the middle class generally) are being destroyed financially, yes. But they are not yet being bombed.

However, none of this is all that new. What is new, and that's where I come the defense of TOD, is that the world's ecology and its resource base are now at the tipping point. The games that could be played before can't be played again, not with the same result. No more New Deal. No new American Century. And this is because the resources for it not there, or in diminishing supply.

I've lost plenty of money -- the investor in me is smarting. But there's a lot more at stake here than money. It's survival for my children, and grandchildren -- and yours. We'll need to start thinking beyond our portfolios. We are being robbed of much more than our portfolios. The deepest problem is not the looting. If only they were Somali pirates, you could pay them off and they let you go. But these guys will not let go of the helm -- they will destroy us all.

I do not know to what degree oil and resource shortages played in triggering this crisis. But they did no more than trigger it. Its roots lie in state-monopoly capitalism. Major parts of the third world have been in crisis for decades and longer. It was possible to export depression and keep the home front intact. That's no longer possible. But resource constraints ARE going to play a major role in the outcome. That's what's new.

"We'll need to start thinking beyond our portfolios. We are being robbed of much more than our portfolios."

Thank you for saying that.

Cheers

Well played. What I wonder is this. Was there a way to bail out the people without bailing out the banks. Wall street, of course, and its lackies like CNBC and the rest of the general media, tell us that, despite the disgorging of trillions of dollars, that this was all necessary to save the likes of you and me, assuming we are not already beyond saving. Or is this one big sham? My gut tells me that there was another way, a way that somehow got money directly to the great unwashed, that could have bypassed Paulson's buddies, the guys who were and maybe still are making 25 million plus. Not much time was spend analyzing alternatives before the great trillions were unloaded. Most of us spend more time evaluating what car we are going to buy.

For the subprime crisis the economy could have been bailed out from the bottom up and cost far less than the trillions of dollars that the U.S. government has already spent. Using loan officers of banks the government could have helped people pay their mortgages. In exchange the government would get fractional ownership of the house based on the amount of money taxpayers ultimately pay toward the mortgage. The government also would get seniority over the bank and borrower (government would get its fraction paid back first) when the house is eventually sold. This would have spread the governmental payments out over the lifetime of the mortgages, 20 or 30 years, people would remain in their houses, defaults on mortgages would plummet, mortgage backed securities would be worth their full value and the credit default swaps would not have been triggered. The price of houses would be allowed to correct downward placing the loss principally on the borrower. Lending practice would have to be cleaned up to prevent a reoccurrence.

"Robbed of far more....."

Yes we are being robbed of being told the TRUTH.

The news media are not telling about the people and the absolute pain they are surely enduring.

Loss of job? This can easily mean starvation. So where is the ugly stupid news media in all this? Lying. Failure to be honest and really report the news.

Coming off their feeding frenzy about the balloon they tied to Obama's tail...they can't I suppose now tell us how really really bad it is.

So we still seem to live in a make-believe word. Seems only the Denningers are screaming and TAE of course.

Airdale

"Robbed of far more....."

Yes we are being robbed of being told the TRUTH.

The news media are not telling about the people and the absolute pain they are surely enduring.

Loss of job? This can easily mean starvation. So where is the ugly stupid news media in all this? Lying. Failure to be honest and really report the news.

Coming off their feeding frenzy about the balloon they tied to Obama's tail...they can't I suppose now tell us how really really bad it is.

So we still seem to live in a make-believe word. Seems only the Denningers are screaming and TAE of course.

Airdale

Davebygolly,

Couldn't agree with you more when you say "state-monopoly capitalism", I think Naiomi Klein says "Corporatism" in her book "Shock Doctrine". Although the corporatists appear to have been caught mostly with their pants down on this downturn and are now having to eat their young to survive.

BRAVO!!!! Would that I could uprate this post 100 instead of just 1...

There's a dissertation worth of research to be done on the role of the ICE and big Finance pushing markets both up *and* down. I suspect that in a run for liquidity, big Finance executed a big sell-off. And it didn't hurt that Pemex started selling their projected 09 production when the price hit $100/bbl. My understanding is that by the time they finished their sell-off (at 90% of projected 09 production), the price had fallen to $70. Now we have a contango, but it looks like the players are running out of room for storage. That doesn't sound like peak oil so much as peak bad finance.

I do not see how the price could rise with great speed because the price would exceed the funds available to refineries to purchase the oil. With tight credit, they would not be able to obtain loans nor letters of credit. This would force refineries to purchase oil based on their available cash rather than how much they need causing demand for crude oil to decline (price goes down) and a shortage of refined products (price goes up). The rate of increase of the price is limited by the ability of the refiners to purchase the oil. Except for short term spikes, I suspect the rate of increase in price that occurred earlier this year is close to the maximum.

I don't think you can say it has "NOTHING" to do with peak oil. The cost of living was rising sharply throughout 2007 and the first half of 2008, for reasons that have everything to do with resource constraints (not just oil - also arable land and water).

This rising cost of living must (as in 'how could it not') have had a hand in the bursting of the subprime bubble, which led to the financial crisis we know and love.

It seems to me that you're too busy looking at the fine details of how people are screwing each other to see the bigger and ultimately more important picture of how we've screwed the planet (overshot its carrying capacity, as William Catton would put it) and now the planet is starting to return the favour.

If the US hadn't peaked around 1970 and was still increasing production even now, what do you think the financial situation would look like today?

A good way to create a new currency is to base it on the market forces.

Say a currency backed by gold and/or silver.

So the governments and central banks would unable to inflate the reserve of money with printed paper.

One of the things I noticed in the above pictures of Zimbabwe is that most of the people in the pictures seemed to be giving genuine smiles.

Man, if I received a 50 Billion Dollar bill in my change, I'd be smiling too!

;-)

I thought at first that maybe these Zimbabwe notes may have some value as "collectibles". - However, upon checking, mementos of the German Hyperinflation of the 1920s are still available today at modest prices...

http://www.hobbizine.com/page0014.html

http://www.arlingtonstampco.com/german-notes.html

Hi Gail: Denninger makes the observation that the increasing debt leading to increased GDP is almost broken-as you can see from your chart, the additional dollars of GDP resulting from each additional dollar of debt have decreased steadily over the years-eventually each additional dollar of debt actually DECREASES GDP as the debt burden has overwhelmed the economy. Jim Willie labels this a DISLOCATION. The bottom line is that the USA needs a major devaluation of the currency sooner or later because mathematically this just doesn`t work at all-the USA dollar value is one of the last insane bubbles IMO.

I think the problem is that everyone needs a devaluation. The US is no worse than many other countries, and some of them are much worse. Somehow, we collectively must get out from all this debt, and get moving again.

If we don't use debt to fund major projects, they can only be funded through savings or cash flow. This will mean a very different kind of economy. The government will need to play a bigger role in major projects (and not by floating more debt--by taxing constituents).

I have a hard time seeing this happen, until governments try and try again to make more debt work.

I don't see how deflating the money makes a difference.

What we have is 4% of the population producing food. 16% producing health care. 20% doing finanace. The rest... ~60% are esentially reselling Chinese goods.

This is what overshoot looks like. An economy based on "marketing"???

What essential goods do 80% of the working population provide?

It doesn't fix the fundamentals-try to understand that re the levels of debt there are only two choices: 1.default 2. devaluation. The fundamentals are a mess as you state.

Deleted.... same as my short rant above.

So... Drupal has a hickup, gives me a database error return when I submit, then double posts... and someone thinks eliminating the dupe is bad???

Grrr...

Gail

"everyone needs a devaluation"

what that means is gold and commodites go up

this is what happend in the 30s

"A devaluation?"

No..we are in a death spiral....sooooo

We needddd ummmmmhhhh OH ROADS!

Yes we need to rebuild the roads. Yes by Jimney that will take care of it..Those road crews paydays will surely SAVE THE USA.

Where pray God is this man(Obama) coming from? I hope the light breaks thru to him soon. Ohhhh and lets not forget the Auto Makers.....we need new vehicles to drive on those new roads or rebuilt ones.

To me he is not making sense.

Airdale p

I'm confused about this comment. Surely there are 3 different ways for the government to get money to do things: (a) Tax (hits the targeted taxpayer); (b) Borrow money from the market place (increases demand so increases interest rates, hits other borrowers, and perhaps future taxpayers); (c) Print money (hits holders of money and lenders). When they print money they "borrow" it from a special account, but that is just keeping track of how much money has been printed/unprinted: it isn't any sort of "debt that has to be repaid". At the moment the government can print a lot of money before it even prevents deflation, and surely it has as much obligation to prevent deflation (which impacts the borrowers who are poor) as it has to prevent inflation (which impacts lenders who are presumably better placed to cope).

Bob.S

Remember, borrowing does not really "Get" money. It sort of postpones getting it. The purpose of getting money is to pay for something. When borrowed, the paying for something is deferred at the original cost plus the additional cost of interest.

The government can tax or print. Considering the the current debt and spending, how much could taxes be raised to generate a budget surplus now to pay down debt? Even without interest, how much of a surplus could be created per year? 100B, 200B? how long would it take to pay down a 10trillion dollar debt at 100 Billion surplus per year?

The US Government is printing money now. They are injecting it into the economy by buying back 10 year Treasury notes. That is US debt that is being paid back without running a surplus. If you think that this creates a different bit of debt somewhere else that needs to be paid back, then we disagree about a matter of fact.

Stoneleigh (who predicted lower oil prices) had this comment yesterday:

http://www.theoildrum.com/node/4843#comment-441354

As I recently said, while I am not surprised by price volatility, I am surprised at the depth of the current decline. In any case, as I said a few days ago (and as I suggested to my own family members), it's probably past time to start thinking about contingency plans for extended family members to consolidate in one location, as in the TV series "The Waltons."

As you implied, the truly scary thing about Figure One is that the energy business is probably the healthiest sector of the economy (excluding I suppose the niche businesses that are thriving from doing things like cleaning up foreclosed houses).

However, some historical perspective. Even at current prices of about $45, oil has risen at an average rate of +12%/year since 1998 (average annual price of $14). In contrast, GM stock has fallen at about -30%/year over the same 10 year period.

Also, three top 10 net oil exporters--Norway, Mexico and Venezuela--are in terminal or long term decline, probably joined now by Russia, with Saudi Arabia showing a year over year increase in net exports that will be about about 700,000 bpd below their 2005 rate. My guess is that at the current worldwide net export rate, the world will burn through about 30% of all remaining cumulative conventional net export capacity in the next five years.

I think that it is possible that a combination of involuntary + voluntary net export reductions will cause the average 2009 price to be above the 2008 average price of about $100.

I think peak oil will, ironically, protect us from an endless deflationary spiral, and spur the transition to a healthier, more sane economy than we've seen in the past.

WESTTEXAS

"My guess is that at the current worldwide net export rate, the world will burn through about 30% of all remaining cumulative conventional net export capacity in the next five years"

could you expand on that comment. show how you got that number

I agree with you - I think a major gap in our understanding is that the decline rate - 5% 6% 7% you pick it, is always calculated on the 85MBD number, whereas you should start there - 5% of 85 is 4.25, but then take the 4.25 out of the available excess capacity of 47 MBD

so the real decline rate that will hit us is 4.25 / 47 = 9%

price is determined on the margin, on the available excess, or global export capacity. it gets really scary if you take 7% and go out 3 years. the global export goes from 47 to 31. this would create a shock situation with panic hoarding

Let's start with an assumption of about 1,100 Gb of remaining conventional total liquids production (which we have to use for net export numbers). Slightly more than half of total world oil production is (net) exported. For the sake of argument, let's assign 600 Gb in remaining production by the exporters. Current annual net oil exports are about 16 Gb.

Let's go back to my original Export Land Model (ELM). The initial conditions were consumption equal to half of production at final peak. Production decline rate: -5%/year. Consumption Increase: +2.5%/year. If we assign some reserve numbers, only 10% of post-peak production would be exported from Export Land; 90% would be consumed locally.

Khebab's middle case, if memory serves, is that about 25% of the remaining production from the top five net oil exporters would be exported; 75% would be consumed locally. For the sake of argument, let's assume that 40% of remaining total production from all exporters would be exported, with 60% consumed locally. This would give us, based on the above assumptions, about 240 Gb of remaining cumulative net export capacity worldwide, which we are currently burning through at the rate of about 7% per year (16 Gb per year). Five years X 16 Gb = 80 Gb. 80 Gb/240 Gb = 33%.

You said that eventually we will need to get rid of this debt. How will that be done? Paying it off, or just getting creditors, including China, to write it off. Perhaps we could restart the tradition of the biblical Jubilee.

Regardless, you paint a picture of negative to zero growth at best. Given the probable decreases in investment in new oil supplies and the abandonment of current projects, supply issues will eventually make the price of oil snap back with a vengeance, strangling in the crib any attempts at renewed growth. It is critical that the incoming Presidential administration understand that. Obama's approach, which I gleaned from his interview on Meet The Press yesterday, is that times are too hard to do things like encouraging alternatives with carbon or gas taxes. So, in his view, we wait until times are better to do anything about our carbon dependency (other than the usual bromides like higher mpg and building standards).

However, planning, such as it is, going forward will continue to be based on the growth paradigm regardless of whatever analysis people like you bring forward. I would suggest that it would be prudent to plan based on a zero, negative, or very limited growth paradigm. That is, what kind of society should we have if we can't count on growth anymore to try to buy off the poor with promises of trickle down economic benefits? Or do we just let the jackals determine how the spoils are "shared"?

It's looking to me like it's, simply, a function of "Recession," "Busting the Commodities Bubble," and Ethanol.

Just for the record, I do not see that we ever had a commodities bubble. We had a functioning economy, which is a very different thing.

We wouldn't have had a housing bubble either, except that the top 1% hogged all the profits from decades of productivity gains for themselves. That's what made getting more people into home ownership unsustainable.

Also, I don't think ethanol really has much of an effect on oil prices. The price of oil has been controlled by diesel, not gasoline. What ethanol has had an effect on, for good or ill, is gasoline prices.

The price of a gallon of gasoline has dropped $0.45/gal more than the price of diesel in the last year. We, also, use twice as much gasoline as diesel. It looks to me like Gasoline is driving the bus.

Moe, what would, in your opinion, be the result of increasing the demand for gasoline by about 8% (roughly the amount of ethanol we've added in the last couple of years?)

The "we" must refer to the United States, since in Europe, diesel usage far outweighs the use of gasoline. There have been a fair number of weeks where we were importing virtually unwanted refined gasoline from Europe by tanker.

Boonjug, since you get approx. 22 gal of gasoline, and only 12 gal of diesel (within fairly close parameters) out of a barrel of oil, I guess I could have been referring to the World.

The interesting country might be China. That's where the growth is and they use 2 gallons of diesel for every one gallon of gasoline.

You could argue that if the front side of the curve was more rational. It's a far harder arguement to make given the rapid rise in commodities prior to the summer.

It seems to me that debt will mostly go away through defaults, unless the government can somehow figure a way to engineer hyperinflation. There is a real chance of governmental change, if it gets to the point where a government must default on its debt.

We take current governmental structure as a given, but huge changes beget other huge changes. If governments fail to deal successfully with the current debt situation, I can imagine some of them being replaced. Some countries may subdivide into smaller organizations (for example, individual states or groups of states are possibilities for the United States). Others governments may merge.

We think of peak oil as being the ultimate problem, but I expect that much of the world will consider imploding debt to be the ultimate problem.

The "ultimate problem" is a human population in gross excess of the biosphere's carrying capacity. The exploitation of reduced carbon has allowed this population hyperinflation and the consequences of pumping massive amounts of oxidized carbon into the atmosphere and surface ocean will end it. Debt implosion and even peak oil are mere symptoms of the "ultimate problem" of human overpopulation and its consequent environmental impacts.

You're right, but this has been true for millennia already. The fall of the Roman empire could be attributed to peak wood, for example. What's different this time around is that there's no more land for the empire to expand into, and after oil there's no "better" fuel for the empire to exploit. This is only one of hundreds of bubbles we've blown since the dawn of history, and it won't be the last, but for the reasons you gave it's probably going to be the biggest.

I wouldn't be so sure about this.

I'm no history expert, but I'll list a few: Egyptian Empire, Roman Empire, Ottoman Empire, British Empire, Spanish Empire, Viking Empire, Incan Empire, Aztec Empire, Mayan Empire... many came and went due to resource exhaustion and environmental degradation. Unless there is global nuclear war, I'm just as certain that after this American/Oil Empire, there will be dozens and dozens of other huge empires, gradually trending downwards in size and scope.

If you have a response to this, please let it be more than "nuh uh."

Viking empire? Where the Vikings ever organized enough to have an empire?

yeah maybe "empire" is the wrong word. we could say "viking conquest," oh ye of short reply

Just curious, on what exactly it is that you base your certainty?

I think I'm willing to entertain a certain darwinsdog's like skepticism to that point of view.

Anyways I propose that the answer to why it may not happen this time around, might be somewhat along the lines of, not one of those empires had come up against truly global limits to growth. It seems we may be reaching those limits now.

Then again a huge empire may be a relative thing. Maybe when the world's population hits the one billion mark again after a couple of centuries of growth from the few hundred thousand that will start from scratch in a decade or two?

My certainty comes from the fact that there have existed empires of one kind or another, almost continually, since agriculture began. Just as we are hitting limits to growth before colonizing the stars is feasible, the Roman empire hit its limits to growth before colonizing America was feasible. In both cases the limits were "global" but our world happens to include the entire planet, while theirs included just a continent or two.

Rome collapsed, and civilization reorganized itself around lower-energy economic activity, during times which saw the rise of many smaller empires.

When the oil empire falls, unless there is a global nuclear war, the people of the world will not simply vanish. They will have no choice but to reorganize into whatever society works without fuel. History tells us that without fuel, oceans are not crossed without high-profit cargo such as gold, spice, or slaves. Things will probably move in that direction over time.

When ocean travel is expensive enough, it is possible for a small empire in China to exist almost totally in isolation from a small empire in America - as did happen for thousands of years.

So, I'm certain these things will happen because 1) it already happened a lot and 2) we won't have the fuel for a planetary empire again.

darwinsdog, I know I can always look forward to your cheerful optimism ;-)

It is physicaly possible to replace most of the oil use with more electricity and preference changes in consumption. And electricity can be made from many sources. The most important resources are an industrial infrastructure, enginering and workman skills and stable institutions making decade long efforts with multiple generation payoffs doable. And the people who can do the work now both want pensions and a future for their kids so what is stopping us?

I think of an example: Imagine you lend some money to your neighbour who wants to open a new business. But one day his enterprise burns down and your neighbour is completely broke. The only thing he can do is tell you "Sorry, your money is gone".

So I fear there is only one way out:

To admit that our System is Down and needs a Reboot.

I think rebooting the system is a good analogy. We need to hit Control - Alt - Delete and start over.

I think it's an absolutely rubbish analogy. Where are those keys for a start? Where is the outside operator pressing the keys? Where is the power supply and the operating system pre-set-up to load on reboot.

I think much of the coming depth of the situation is precisely that we can't just "reboot" like this. In the interval that "the system is down" we all starve. Also consider the related matter of the huge difficulty James Watt had getting his steam engine made, because no-one then had the tech to bore with the required precision. One business partner went bust before Boulton took over. (I live here within sight of the factory and house of Boulton by the way!)

Your idea of a parallel money system starting up (such as rationing coupons) is interesting, but historical experience indicates that governments are useless at managing fundamental system crises let alone declines, and so the odds are we'll need to prepare our lifeboats instead.

The situation you outline is very sobering. Good work. Its said that a population oh humans needs about 80 years to repeat a disastrous decision, eg. 80 year intervals between serious tsumani caused deaths in earthquake-prone shorelines (local people loose the memory of previous events, start settling vulnerable shorelines), 80 years between major investment disasters (1930's to present)

Wired magazine, in an item about Harry Dent etc. includes

"Its said that a population oh humans needs about 80 years to repeat a disastrous decision"

This fits in well with the Kondratieff long wave, which commonly averages 50 to 60 years, and is sometimes referred to as a two-generation wave. One generation, say for example the Great Depression, is badly burned. Their children, the older half of the Baby Boomers (born 1945 to 1955), heard the stories and took note. The next generation, the younger half of the Baby Boomers (born 1955 to 1965), is too far removed to hear the stories, because by the time they are adults their grandparents have died off. The current generation, born in after 1985, has not really known hard times but are about to learn.

I have long suspected that the economic growth of the past few years has not actually been growth -- as in creation of value above consumption of value -- but has been economic voodoo conjured up by financiers and traders and the like. Of course, their karmic powers were weak to begin with, and Shiva loves a riot, so that spell could not hold and here we are.

But, I don't understand why all the articles that point out these things often speak in terms of "fear" of this reckoning. Perhaps it's a matter of perspective, but I sense that in many cases the rhetoric that paints this financial unravelling as terrifying and awful is often a matter of political correctness. It's wrong, after all, to say anything against the Machine, though we're not exactly sure why.

For those who are psychologically dependent on the financial system, I imagine this would be a strain. But as a young person (early 20s), who has not developed that dependence, I find this all fantastic. The disruption of hegemonic control by an elite few. The unraveling of the megastate of the US Empire. This calls for a celebration.

I'm going to suggest that these are all good things and that they should be celebrated rather than feared. Could it get worse than a global empire that monitors our phone calls, feeds us propaganda and toxic food, wages war on plants, poisons the air, water, and soil, and wages resource wars that destroys countless lives?

Hooray for the death of the Empire!

I am not sure your lack of fear is warranted if your livelihood is dependent upon having a reasonably functioning economy. If there is no dependency on your part, good for you. I take your point that we could use a bit less empire, and I take that as positive.

The vast majority will be experiencing a fair amount of suffering and deprivation if this develops into a depression and stays there for as long as it did in the 1930s. Continuing the current trend of extreme income inequality will mean that even in a more benign economy, say zero growth, the poor, lower middle, and middle classes will be in for rough sledding.

I am still curious though. How is that you are not dependent upon the financial system. Or were you assuming that the economic system would continue on just fine while the financial system imploded? I understand that at your age you may not be dependent upon the stock market, but unless you are independently wealthy, you still need a job.

Do I need a job? Yes, at the moment.

But do I need a job in order to live, and live well? No. I can identify wild plants, know a thing or two about gardening, silviculture, and mushroom cultivation. I'll eat fine. I know a little about herbs and medicine.

I don't have a complete background of skills necessary to take care of all of my own needs at this point, but I'm on my way. Just like the death of the American Empire, I'm not going to learn these things overnight.

For those who desire to have the internet, xboxes, cell phones, cable tv, fast food and air conditioned houses as integral parts of their lives, I imagine this will be a tough time. For those who are cool without those things, this period in time will be a time of opportunity as the map opens up to new possibility.

I'm not naive. I know it will take a lot of work on my part. And I know this Depression will bring chaos, shortages, and suffering to most of society, my own life included. I don't expect I'll dodge all the bullets whizzing about, but I'll this failure of the Corporate System provides us with an escape hatch from dependency of them. if this period means that folks will come through stronger and more reliant on themselves and their communities rather than dependent on impersonal government and corporate entities, huzzah!

As a young adult a "real job" in the mainstream economy is the last thing you need. Provided that you're healthy, strong & adventurous, what you need to do is to hit the road and see the country if not the world. Work in the underground economy doing honest labor for which you're paid in cash, when you need it, then move on. Jobs are for oldsters for whom security has become more important than freedom. I speak from experience here. Have fun while you still can!

Many thanks for the encouraging words. Trust me, the last thing I want is a career or a regular job. As it is, I have a part time job to save up some money for the next year. I don't know how much traveling I'll be doing but I will be homesteading it up on some family land, planting an orchard, starting a garden, and playing at self-sufficiency.

I was gladdened to see Gail mention local currencies. Apparently these are becoming popular:

http://www.newsweek.com/id/170372

I am working on a local currency based on food right now. It works by accepting Federal Reserve notes to purchase grains and dry beans and placing them in storage. Credit slips are given that denote the US$ purchase price, and how many pounds worth of food it is worth (e.g., $10 will buy you 12 lbs of pinto beans or 15 pounds of triticale or 14 pounds of white rice...etc.).

These values are locked in for a year from the date of issue of the credit slip, but if not redeemed by then can be traded for new credit slips with current prices. The goal here is to create a currency with a decent "store of value" backed by something tangible (and an alternative to gold, which I have never been able to convert directly into food).