Why are oil (and gasoline) prices so low?

Posted by Gail the Actuary on October 22, 2008 - 11:10am

We all know that oil prices are lower than they were in the recent past because supply is greater than demand. In fact, OPEC oil ministers are meeting this week to try to fix supply, so it will be more in line with demand.

All of this seems a little strange, though. We are going into the winter months, when demand for oil normally rises because many people around the world heat their homes with oil. We are using somewhat less gasoline in the United States, but apart from the hurricane disruptions, not very much less than earlier this year. While we are going into a recession, it doesn't seem to have hit with full force yet. What other factors may be involved in the current lower prices? In this post, I will discuss factors besides those we usually think of as supply and demand that may be involved.

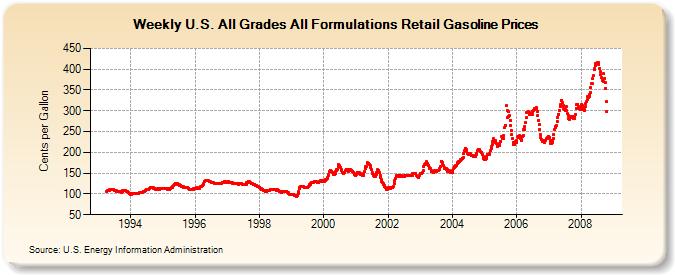

While this post is primarily about oil prices, the decrease in oil prices can be expected to have an impact on gasoline prices as well. The drop in retail gasoline prices has not been quite as dramatic as the drop in oil prices because gasoline prices are affected by other factors in addition to the price of oil. Robert Rapier has a post talking about some issues affecting gasoline prices. See also my article from July Why isn't the price of gasoline even higher?, talking about the differential between gasoline and diesel prices.

1. Credit problems of oil intermediaries

The oil industry has many more players than most of us are aware of. The International Oil Companies use contractors to do many functions that we think of as oil company operations. Oil is shipped by oceangoing vessels and by pipeline. Refiners are often separate from the oil company that produced the oil. Gas stations are often independently owned.

One of the issues is that sellers want to be sure that they are going to be paid for their product. They are unwilling to sell to buyers with poor credit. This is removing some players--and some demand--from the system.

According to Credit Woes Hit Supply Chain, Push Prices Down:

"The credit crunch is putting on a brake at every level of supply," said Antoine Halff, deputy head of research at brokerage Fimat USA. "Levels of credit are evaporating, so producers and refiners are having a hard time selling--they want to make sure their customers are good for the money," Halff added.

Also, from the same article:

Shippers - who bring tankers from the ports to consuming countries - are also seeing a reduction of available credit, with some of them going under as a result. . . [This is] leading to a scarcity of available capacity for shipping.

If an oil company can't ship the oil, it can't sell it. We also read that banks are involved in the process:

To make matters worse, some of the major investments banks that are currently under stress--such as Morgan Stanley (MS)--are also an important part of the oil chain. "They hold storage, are active physical traders and some of them actively participate in the physical delivery process," said Petromatrix's Jakob.

2. Liquidation of positions by hedge funds and other speculators

Hedge funds have been under pressure from several directions to liquidate their positions in oil:

• Investors in the hedge funds have been disappointed in their performance, and are liquidating their positions. Oil futures are easy to sell, so the may be sold first.

• Hedge funds are highly leveraged. In the past month, many of them have received margin calls because of declining values of the securities they held (oil futures, stocks, bonds). Again, oil futures are easy to sell quickly.

• Banks are under pressure to reduce their lending because of their low reserve margins, and because of concern that hedge funds may not be good risks. They have been putting pressure on hedge funds to reduce their leverage.

Since hedge funds and speculators realized early this year that the price of oil was rising, most of them had net long positions. When there was a need to sell these futures contracts (because of margin calls or for other reasons), the sales of these contracts tended to bring down the price of oil.

3. Hedging of future oil prices by oil companies

Once oil prices reached high prices (say, > $120), even for long-dated futures, it made economic sense for oil companies to lock in future sales at those high prices. To the extent that oil companies locked in future sales using long-dated future contracts, this would add sellers to the long futures market, changing the balance in the futures market. The addition of sellers to the market would tend to bring down futures' prices.

I understand that long-dated futures contracts are quite illiquid, and that oil companies may not, in fact, be using them for these purposes. Does anyone have any real-life experience with oil companies using futures contracts to lock-in long term prices? It would seem strange to have contracts whose benefit is primarily for speculators.

4. Rise in the value of the dollar

We read in a Bloomberg article:

Oil Falls More Than $4 as Dollar Rally Dims Commodities' Appeal

Oct. 21 (Bloomberg) -- Crude oil fell more than $4 a barrel as the U.S. dollar rose to its highest in more than a year against the euro, dimming the appeal of commodities as a currency hedge.

Oil climbed earlier on expectations that OPEC, supplier of 40 percent of the world's oil, will reduce output at a meeting in Vienna this week. Investors looking for protection against the dollar's decline earlier this year helped lead crude oil, gold, corn and gasoline to records.

``The strengthening of the dollar is the main factor pushing most commodities lower, and oil is always the leader,'' said James Ritterbusch, president of Ritterbusch & Associates in Galena, Illinois.

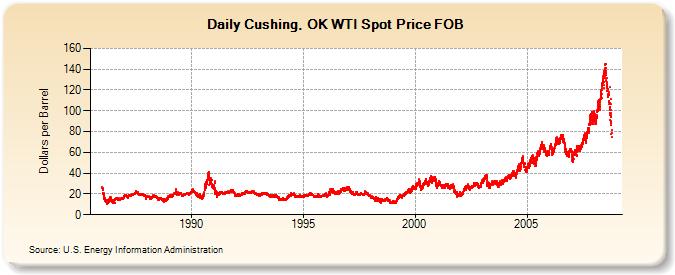

Basically, the higher the dollar, the lower the price of a barrel of oil (measured in dollars). The dollar is high now, so the price of oil is low. One analysis showed that one quarter of the increase in the value of oil from $20 barrel in 2002 to $147 in July 2008 was because of the falling value of the dollar. Since july, the price of oil seems to decline as the value of the Euro declines relative to the value of the dollar.

5. Trend Trading or Systematic Trading

Many investors use computerized programs that attempt to analyze an investment's momentum, either up or down. These programs are designed to buy more of an investment, when the price of the investment seems to be heading upward, and to sell the investment short, when it is heading downward. If a large number of hedge funds, pension funds, and other investors have computer models that do the same thing, the simultaneous buy and sell orders will tend to reinforce the upward or downward trend in prices. These programs may have contributed to the unusually high oil prices seen earlier this year, and the big drop in the past month.

6. Drop in Asian growth

One of the reasons for the run-up in prices earlier this year was the concern that Asian demand was growing rapidly, and that world oil supplies could not keep up. There may have also been some stockpiling of oil prior to the Olympics. Now there are indications that growth in Asia is starting to cool, and we read articles such as this one:

Asian meltdown may force oil to tank

The fact is, unlike many other commodities, “Asia is important for crude oil because its marginal demand is entirely coming from Asia,” said Michael Lewis, global head of commodities research at Deutsche Bank. The bank estimates that in 2009 as much as 360,000 barrels per day of oil will be required by China, which is lower than the 450,000 bpd for the current year. At that rate, “China will be responsible for 80 percent of global crude oil consumption growth,” said Lewis.

Similarly, industry estimates put India’s oil demand at 100,000 bpd in 2008 and predict it to remain unchanged for 2009, even if the country’s gross domestic product were to slip marginally from its current 7.5 percent.

Hoping that Asia and particularly China and India will not falter due to the global meltdown may be optimistic under the current conditions.

7. Small size of the oil (and other commodities) market, relative to the rest of the market

The amount of commodities for sale is tiny in comparison to the dollar value of stocks, bonds, derivatives, and other investments. If investors get the impression that commodities are a good source of diversification, or are likely to rise more than other investments, it doesn't take very many of these investors to raise (or lower) prices in oil markets. Investors tend to read the same investment advice, and hear the same forecasts, so may tend to make similar decisions.

Research by Morgan Stanley indicates that commodity markets tend to move together. In the past, commodities have tended to follow long cycles, but "peak everything" may change this pattern.

8. Increased volatility when supplies are very tight

When supplies are very tight because of peak oil, both the supply curve and the demand curve are nearly vertical. A small change in demand (or supply) can result in a huge difference in price.

Many years ago, whale oil was used for lamps until it became depleted. Historical graphs show that its price was very volatile, once production passed its peak value. The price of petroleum is likely to be very volatile post-peak also.

What's Ahead?

Certainly, we can expect more volatility.

There is room for a difference of opinion on the course of the dollar near term. On one hand, the United States is doing less badly than some other countries in the current financial crisis. If this trend continues, the dollar could rise even higher than it is currently, as investors look for safely.

On the other head, we have been reading speculation about alternative currencies, such as this one, regarding a tri-polar currency. It seems likely to me that eventually some change will occur that will make the value of the dollar drop substantially, and raise the price of oil.

In the not too distant future, we can expect a fair amount of "shake out" among smaller companies in the oil business, with many of the less well capitalized being acquired by others or going out of business, as indicated by this article:

Falling Prices, Credit Woes Threaten Small Oil Firms:

Most at risk are small outfits focused on exploration and production that urgently need cash to keep drilling. Even a few months ago, these companies had no trouble borrowing money and selling stock to finance operations, based solely on the value of their reserves. But with access to capital drying up, their funding opportunities are dwindling rapidly.

Between problems with credit, and the cutbacks from OPEC, the supply from oil is likely to drop significantly in the next few months. This drop in supply should put upward pressure on the price of oil.

All of the cutbacks related to credit are hard to follow through the system. There is a possibility that some of them will show up in unexpected places, leading to shortfalls and/or price spikes.

I do not expect the problem with long-term credit to ever really go away. (This is the subject for another post.) Because of this, long-term supply is likely to drop even faster than previous analyses have suggested. Assuming no major changes in the monetary system, this would seem to imply higher prices, long-term.

In response the question in the title:

Heck if I know.

Here's what I do know: It's a suicidal response.

It cements Peak Oil by putting a halt to additional drilling programs.

It kills alternative energy program developments.

We're moving from the slide to the cliff and this accelerates the progression.

The most surprising thing to me (but probably not to The Automatic Earth folks) about the credit meltdown is the extent of the collateral damage to the food & energy producers. So, not only does this have negative implications for future energy supplies, it's also a big negative for food supplies.

In any case, based on the HL models, Saudi Arabia is about 60% depleted, Russia (at least their mature basins) is about 80% depleted, and Norway is about 70% depleted. These three countries accounted for more than 40% of total world net oil exports in 2005. Saudi Arabia is going to show three straight years of annual production below their 2005 rate, Russia has resumed its production decline, and Norway is in long term decline.

Tell me about it. My dad and two brothers are oil men. I'm a farmer/rancher.

I'm sitting on a silo full of corn and a tapped out credit limit at the local bank. Do I sell the corn for more than it will cost me to replace it so I can plant more, or do I sit and wait for people to get hungry enough to allow me a profit on the work I have already done?

My dad/brothers have leases for natural gas projects now in moth balls.

They're preparing to drill a few potential oil wells, but I'd say this is just momentum at work--they had already been planned and initiated before the price collapse. The leases were expensive, acquiring a drilling rig and the necessary pipe and casing was also difficult and expensive.

Being Austin Chalk type wells he's drilling, potential production comes in a flurry and goes away quickly.

$145 oil was too high, too fast. $70 oil works for existing production but not so well for new hard to find and expensive future development. Existing production as we all know is in decline.

Hell, buying existing 3-D seismic studies run $40,000 a square mile in these parts.

In situations like this, the "winners" are those who lose the least. Look at the bright side. You and your family could be in the auto, housing or finance business.

In regard to my little corner of the oil patch, I'm doing the same thing that I was doing at $140 oil and at $20 oil, looking for small, but commercial overlooked conventional oil fields.

YOU CAN LISTEN TO A PODCAST (mp3 file) OF THE ABOVE POSTING BY GAIL THE ACTUARY AT THIS LINK:

http://rapidshare.com/files/156479234/TOD-gta-oct2308.mp3.html

Here's a big factor; coordinated interest rate cuts have reduced the profitability of the Yen (and Dollar) carry trades, where investors borrow @ the low rate in Japan and invest the funds in other countries with higher yields. The across the board reductions in interest rates are having a strong effect world wide on commodities:

http://www.bloomberg.com/apps/news?pid=newsarchive&sid=a1ZBc6K1VKxI

Here's another take from the Japanese viewpoint:

http://www.bloomberg.com/apps/news?pid=newsarchive&sid=aXoln3JUe0Bg

Carry trades tend to cancel the benefits of accomodative policies as they encourage investment outside the countries that initiate the policies in the first place.

DUH!!!

Thanks! This probably explains part of the change in currency valuations.

I don't watch currencies in general. I watch the Yen-Dollar exchange rate. I've been puzzled by recent stories about the dollar going up in value, because it is definitely going down against the Yen.

I've also been puzzled by the reaction of gold & oil. It seems to me the dollar is dropping in absolute terms, just not as fast as Euro. It is notoriously difficult (impossible, really) to put an absolute value on a fiat currency. The closest thing is probably to use gold & oil. What I thought should have happened is that gold & oil stay relatively flat against the Yen, go up a bit against the dollar, and go up a lot against most other currencies.

That hasn't occurred. Since (like most people) I'm convinced I know more than the market when it comes to prices of things, it has led to some bad trades and a lot of cursing at the irrationality of the market (rational==agrees with me; irrational==does not agree with me).

There has been quite a bit of discussion about an apparent disconnect between "paper gold" prices and prices of real gold, if you can find it. The real gold is about double the price of the paper gold. See this CNBC Video showing Jurg Kiener, CEO of Swiss Asia Capital. He tells CNBC's Maura Fogarty & Rebecca Meehan that if the paper market collapses, gold prices may double very quickly.

<sarcanol> Don't worry about evil, wicked profit. If food keeps going up, there will be price controls after the election. People prefer shortages to earning and paying for what they consume. </sarcanol>

Well then, shortages they'll get.

Like I said, suicidal behavior.

Plant a green fertilizer like alfalfa.

Like Westexas, I was genuinely surprised by the collateral damage in food and energy. It isn't that I wouldn't have anticipated declines, but I wouldn't have thought them to respond so quickly - in fact, I have the sneaking suspicion, at least with food, that the declines in price are a little over rapid, and that we won't see more volatile price changes.

Biofuels will obviously be the big factor in food prices in the coming years - best hopes for the end of the ethanol boom.

Sharon

Sharon, I don't understand your statement ". . . we won't see more volatile price changes."

The recent decline in food prices is not unusual in the history of agricultural markets. Food markets tend to be highly volatile because of demand inelasticity, time lags, and variable weather, to name a few reasons. Financial crises, I think, tend to increase volatility of food prices. Current financial (and eventually economic) crises seem to me to set the stage for a further increase volatility rather than the reverse.

I'm not an expert on food prices, but I have studied--and taught--economic history, and the price volatility of agricultural products is notorious.

Over the long-term, food prices will rise as oil prices rise. But along with the long-term trend I think increasing volatility is likely, both in oil prices and food prices.

By the way, I very much enjoy reading your posts and comments.

Could a drop in demand from restaurants be part of the drop in price for food commodities? No job means no lunch break at McDonalds. No job means no payday dinner at the local steak house.

Undoubtedly you are correct that decreased buying of food by restaurants has contributed somewhat to the decrease in demand for certain foods, but it hasn't had a major impact on the prices of wheat or corn or soybeans. Why not? Because people have not cut back on eating: Rather what they have cut back is their spending on food by eating less frequently at restaurants. I like eating at some restaurants and I hate waiting in line for a table. A couple of years ago, waiting lines were common. I haven't had to wait for a table for the past year and a half.

I have talked to one TOD reader who sells high-end lettuces to restaurants. He said he has decided to discontinue this, because there is less demand for this kind of thing. I presume he will switch to growing something that grocery stores would be likely to sell.

I was not surprised by a drop in a oil prices brought about by the financial crisis, nor by the financial crisis itself -- many, many people saw that coming. But I was surprised by the extent of the drop. In that respect,

8. Increased volatility when supplies are very tight.

is the most relevant point, the whale oil anecdote most interesting. If the tendency is for production to follow a bell curve, and demand to follow an undulating curve, well, somewhat sawtooth like, overlaid on the production curve, then price is apparently A*gap + B. What's surprising is how big a multiplier A is.

Not only is the market totally irrational (blind is perhaps more accurate) in the long term pricing of finite resources, it is totally irrational even in the very short term pricing.

One of the several things gov't should be doing is taxing the gap to smooth the price curve and assure that it goes only up, fast enough to reflect depletion, both to gather revenues for the necessary restructuring and to send the right message about the need to restructure.

Edit: I will be very surprised if the low oil prices lasts even a year, given all the countervailing forces.

Yes. The volatility is really something. If I were working in the oil and gas industry, I wouldn't know how to plan. If people are buying oil futures on margin, they are really getting slammed (unless they are short). One wonders what secondary fall-out there will be, from the volatility alone.

In the absence of any certainty about the future price of oil, you would tend to delay starting any project that needed, say, $80+ oil to turn a profit. Which is what, most of the new projects?

Fewer participants in the market, leading to even more volatility. At some point, the market is pricing itself; the effect of the markets' lack of stability rather than the worth of the participants' products. I suppose a lot of liquid players in energy are waiting for a trend with money in their pockets.

Since trades in one market are often hedges against trades in another, the imbalances wrought by negative real interest rates on one hand and the unpredicability of risks on the other spills from interbank lending or currency exchange into commodities, for example. A few months ago the trade 'Du Jour' was short financial stocks and long commodity indexes. Hedge funds poured billions into that trade. Then .. the Chinese post- olympic surge failed to take place. There was a short-covering rally in bank stocks. Hedge funds started getting redemption demands and that particular trade collapsed.

This is a stupendously wicked market. Everyone is getting killed, the best place to be is on the sidelines.

cowboy,

The oil patch hasn't slowed up too much yet from the drop in oil prices. Companies don't adjust their pricing forecast based upon short term swings in prices. Even when prices hit $147 most operators were using $70 -80/bbl in their forecast. And even then many dropped prices around 10% for years 2 and 3 with a minor inflation rate afterwards. We tend to use a yearly average price in running our economics. I would suspect most companies have dropped their price some lately. A few, like my client, are considering slowing up drilling activity some but even with that we'll still be running at record levels. Truthfully, a little slow up wouldn’t hurt. It might help drop rig and steel rates some. These factors have started cutting into the bottom line pretty good the last 6 months.

Now if prices stay down here through the winter that would be a different matter. But as far as a significant slowdown in drill I would attribute much of that to the credit crisis more so then oil pricing.

Rockman,

I have a little bit different observations from my side of the oil patch. I am the finacial analyst (aka moneyman) for the exploration dept. of a mid-sized permian basin player. We are definately cutting way back on what we will drill next year. The slowdowns haven't happened yet... we are still drilling wells that were approved earlier this year, but as soon as is feasible, we will be releasing rigs not under contract and our drilling pace will drop by over 50%.

I appreciate your on-the-ground feedback. This is the way we see what is really going on.

This is where it gets scary.. if a large amount of small scale workover/step out drilling is postponed or cancelled over the next couple of years, that will show up as a significant decline a couple of years out.

see www.binaryseismoem.weebly.com

We have to take into consideration technological progress.

It reduces AE program development, at least. Back when oil was still $20/bbl, we still had AE programs and AE was still growing, albeit at a lesser rate.

The United States has much more to worry about than its credit and banking problems. Jim Willie, who has been forcasting the collapse of the United States Banking system for several years, in a recent interview he says the US DOLLAR has months left, not years. Also he states foreign countries already have another world currency planned. Its just a matter of time before it is put into place. The US DOLLAR is not going to be the world currency much longer.....dropping the USA to a third world status very quickly.

You have to admit, we have been buying Oil and Goods with worthless monopoly money and toxic financial instruments for the past several decades. What are we going to trade for that Crude Oil now?

Here is Jim Willie's Interview:

http://www.contraryinvestorscafe.com/broadcast.php?media=141

some of the factors you cite are forcing functions, related to supply and demand but not the root cause. imo, the forcing functions are overriding fundamentals.

a story on the mainstream media today claims that today's (so far) drop in price is because demand concerns are trumping opec expectations. if this is true, how can it be anything but speculation ?

***** caution wild oscillations ahead *****

If we continue to use May, 2005 as the index world (C+C) production rate, 74.2 mbpd, the cumulative shortfall between what we would have produced at the 5/05 rate and what we actually produced increased in the second half of 2005, through 2006, through 2007--and through July, 2008, 2008 production is now flat at 74.2 mbpd (preliminary EIA data, subject to revision). I wonder how much money the industry spent in order to basically keep crude production flat? And what happens if we can't maintain that spending rate?

"74.2 mbpd" (or 860-odd barrels per second). That's still a lot of barrels, right?

Regards, Matt B

Hey, just logged on and noticed I've just passed my first anniversary here. Should I celebrate? Or should I ask myself if I've learned (or acted upon) anything?

Ans: Nowhere near enough, sadly, though it did take me ten months to discover Al Bartlett. Average Joe, average IQ, slow learner.

Such is life.

Yeah, and I am sure that is why the US dollar has been sinking...NO! It has been rising against foreign currencies for some time now. Now at a seven month high.

http://mjperry.blogspot.com/2008/10/king-dollar-greenback-makes-comeback...

To get a better perspective take a look at the US dollar vs. foreign currencies since 1975 look here.

http://research.stlouisfed.org/fred2/data/DTWEXM.txt

Try to keep things into perspective. As other economies grow and countries become more prosperous the US dollar may not be the "world currency" just as the British pound is no longer the be all and end all of currency. Still I would not exactly call the pound a third world currency would you?

Finally, I think you may have missed that quite a few countries are also having a bit of a banking problem and it is obvious you haven't compare their "bailout packages" compared to GDP vs. the US.

"When the tide laps at Gulliver's waistline, it usually means the Lilliputians are already 10 feet under."

To paraphrase Churchill, the Dollar is the worst possible currency -- except for all the others.

The only realistic alternative to the dollar is the Euro, and their problems are, if anything, far worse than ours. A poll a year ago showed that 70% of Germans wanted the Deutschmark back; and I'm hearing rumors that they may expel Italy from the currency union. Germans don't want to pay to bail out Spanish banks. European banks are leveraged far more than American banks (very surprising to me, since I assumed they would be more highly regulated); and of course they bought all our mortgage backed securities (God knows we didn't have the savings to buy too many of them.

Japan has been fighting off a deflationary recession for two decades, and China is utterly dependent on massive exports to Europe and the US -- which are drying up very quickly.

At the beginning of the year I considered diversifying to FDIC backed, Euro based CDs, but as I examined their unenviable position, I realized that the dollar isn't that bad after all.

What about the honest, real and universal currency gold?

It's not honest(doesn't prevent the issuing of Mortgage Backed Securities, Credit Default Swaps, fractional reserve banking, dodgy loans; doesn't track the size of the economy at all...).

It's not real(few actual, useful applications outside of jewelry and gold buggery; nowhere near enough of it to support the world economy without fiduciary money which enables expansion of the money supply regardless of what gold is doing, which is presumably what you're trying to prevent).

It's not universal or currency(try barterting for something with gold and you'll find that fiat money is preferred unless you're willing to pay a huge premium).

Its funny that while capitalists are worried about increasing govt control they don't care about total govt control because of fiat currency. When your govt can print as much money as it like then basically your value is no more than that of a slave and your country is no better than a socialist, fascist country.

please note that as far the general public is concerned gold is just another fiat currency . yes I know you disagree BUT I can't tell if that gold piece you gave me is real unless:

its a gold coin - backed by a government there and can be faked.

(so how do I know its real ? I have to have faith its real AKA fiat currency )

or has a note from the supplier that its real

so the note is on faith AKA fiat based therefore gold is fiat

do not forget joe beer keg has an IQ of 100 ( sometimes less :) )

Forbin.

Willie's scenario, along with Bob Moriarity's who I believe also sees the same, pose very frightening implications if proven correct.

Willie's sources appear to be spot on:

ECB's Nowotny Sees Global 'Tri-Polar' Currency System Evolving

http://www.bloomberg.com/apps/news?pid=20601087&sid=apjqJKKQvfDc&refer=home

All I can say is we're living in historical times indeed.

Dispatch

Gail wrote:

This is actually blatantly misleading.

There were no major disruptions in July (the last month for which we have revised US gasoline consumption data).

July 2007: 9.64 million barrels per day

July 2008: 9.07

That's a decline of 6%.

When was the last time we had a decline of that magnitude in July? 1979 (-9.8%)

The fact that you are a nice old lady won't stop me from giving you a very public drubbing if you are not more careful!! :-)

http://tonto.eia.doe.gov/dnav/pet/hist/mgfupus2m.htm

So demand goes down by 6% and the price goes down by 50%? The current oil price is driven by hysterics. We will have shortages if the perception driven price stays low, then we will have hysterics in the opposite direction.

That's the general consensus here. The question is, with ever growing volatility, how far past the peak must we be to see it in the rear view?

Don't overlook the fact that that 9.07 bpd of gasoline included about 700,000 bpd of ethanol. That's probably up close to 300,000 bpd over last July.

So, demand is not only dropping, but gasoline's share of that demand is dropping. One insight into this might be the fact that diesel demand is dropping a bit slower than gasoline demand (hence the widening spread between diesel prices, and gasoline prices.)

At least, that's the way it's looking to me.

You are right about the increasing use of ethanol. My impression is that they really maxed out the use of ethanol during the shortage following the hurricanes. I believe most of the "blending components" included in gasoline are ethanol, so you can see what happened from this EIA exhibit.

The developing world is using more diesel than gasoline, and Europe has always used predominantly diesel to fuel its cars. That leaves left-over gasoline that they are willing to sell at relatively low prices. When we take up some of the demand with ethanol, that reduces the demand for gasoline further.

One thought I had was that I might have added another item:

9. Reduced oil demand due to Hurricane Gustav and Ike.

With all of the disruption and closed refineries, US imports of crude oil and other items dropped way off following the hurricanes. It can be seen from this EIA exhibit, US imports of crude oil and petroleum products were averaging over 13 million barrels a day. Once the hurricanes hit, our imports dropped to something more in the 11 million barrels a day range.

This temporary decrease in US imports looked like a demand drop to the world export system.

The loss of the gasoline and other products in the Southeast also temporarily added a downward push on the economy of the area, contributing at least a little to the economic problems we are seeing now. I was just reading today that Georgia's job losses were second highest in the nation in September (after Michigan).

All I know is that the Merritt was packed last weekend and this was the first time I had seen it like this on a non-holiday weekend in a couple years. MY guess, based on anecdotal evidence, is that we are backfilling the drop in demand as we speak.

Matt

I understand someone who sells SUVs and other big cars says that demand is back up. It doesn't take long.

All you have to do is look and you will see there has not been any fundamental change in the rolling stock. There are a few more Fits and the odd Smart Car hear and there but there has not been any real fundamental changeover to more efficient cars. Nor has there been any fundamental change regarding driving, culturally. I don't hear people making value judgements about gas conservation. I heard people saying they were driving less when gas was 4.39 in NYC. Now I don't. I see the demand destruction as cyclical, not secular. Price will go back up because low prices will reignite demand.

matt

Define "fundamental". From the EPA:

"Based on publicly available sales data...subcompact, compact, and midsize cars have been the only vehicle classes to have met or exceeded sales projections by automakers, while sales of midsize SUVs, large SUVs, and large pickup trucks are 15 to 25 percent lower than automaker projections. It also appears that 4-cylinder engines have gained market share from 6-cylinder and 8-cylinder engines."

Roughly speaking, 10% of the market has shifted from large to small vehicles. That may not meet your criteria for "fundamental change", but it's certainly a significant change, and it means that a substantial portion of the current demand reduction is long-term.

The portion of the drop in demand which was caused by "high" prices at the pump can be expected to substantially reverse now that prices are "low" again. That was a simple behavioral change, not a structural change. It didn't go on long enough for significant structural change. Offsetting that will be a general tightening of belts due to actual job loss and fears of job loss.

"I understand someone who sells SUVs and other big cars says that demand is back up. It doesn't take long."

Last weekend I stayed at a hotel on "Auto Mall Road" in Tucson, a 3/4 mile auto dealer extravaganza leading to the Tucson Mall. And from Friday through Sunday it was worse than dead. I could jaywalk across the 6 lane highway without bothering to look over my shoulder.

It was truly astonishing.

If the rest of the country is this way, GM and Ford won't be around by next summer.

MPG with ethanol blends is worse than with straight petrol, so 1 bbl of ethanol does not displace 1 bbl of petrol, but X < 1 bbl.

Any idea as to what X is? I suspect it's as low as 0.2.

I think ethanol has about 2/3 of the fuel mileage of gasoline.

Gasoline is not very good for fuel mileage to begin with--diesel is better.

Ethanol BTU's produced are more commonly about 70% of gasoline BTU's, varies according to process used, so some ethanol BTU's might be 2/3 of the gasoline BTU's.

In 2007 the United States consumed about 142 billion gallons of gasoline.

The EPact law requires 21 billion gallons of cellulosic ethanol by 2022.

The EPact law caps grain/sugarcane ethanol production at 15 billion gallons.

Up to about 10 percent of our gasoline additives may be made from corn or other food sources.

Total ethanol might supply 25% of our needs by 2022 according to EPact standards, yet the cellulosic ethanol cost estimates vary, I read a recent operating cost figure of $6.00 a gallon, have not seen it in operation, nor did I get an estimate of effects on wood products prices, or forestation regrowth, costs of wood delivered, cost of interest on capital invested, administrative, employee costs etc. It seems like the government has invented a way to drive up prices at the pump.

During a peak within the last few years the United States supplied about 21 million barrels per day of petroleum + products. I recall it from reading the Weekly Petroleum Reports.

Recently the United States supplied little more than 18.7 million barrels of petroleum + products per day. The drop in products supplied was accompanied by huge inventory gains. Inventory gains are normal in mid-October, less likely during the winter blasts of January.

The drop in oil + products consumption seems to be more than 20%, more than the yearly change of ethanol production. Thus you have a situation where $4.00 gasoline scared people to the point of changing their habits. Not only in the United States, but likely elsewhere in the world too.

Feb 5, 2008 ... It calls for the production of 36 billion gallons of biofuels—mainly ethanol and biodiesel—annually by 2022, with 21 billion gallons coming ...

www.enn.com/pollution/article/30643

On a monthly basis (before the Hurricanes hit) the lowest recent product supplied was 19,412,000 in July from here.

The comparison to a year ago tend to slide downhill:

Jan 08 / Jan 07 = -2.2%

Feb 08 / Feb 07 = -7.2%

Mar 08 / Mar 07 = -3.9%

Apr 08 / Apr 07 = -3.7%

May 08 / May 07 = -4.3%

Jun 08 / Jun 07 = -5.6%

Jul 08 / Jul 07 = -6.4%

The 18,400 was for a while after the hurricanes, when some of us (I live in Atlanta) were going without. It wasn't the price of the gasoline. It was the fact that there wasn't any.

Several months ago TOD posted a link to a study testing several recent models of cars. I do not recall where the study cane from but the mileage results under controlled conditions were suprisingly high.

Mileage results in this test were much higher than I would have expected given the relative heating values of ethanol and gasoline.

Aardvark,

in the real world, with real people, driving real cars running on a 10% ethanol blend your 0.2 is, probably, pretty close.

Many of the "newer" cars running on a twenty, or thirty percent blend will get pretty close to the same mileage as on straight gasoline. There are some cars that won't do as well.

What is wild is that gasoline consumption drops a huge 6% YOY and the USA YOY goes from importing 66% of its oil to refineries to 72% now. The drop in domestic oil production is outpacing the drop in gasoline consumption.

US oil production is up this year, regardless of whether you want to look at YOY of the most recent month (July08 vs. July07) or year-to-date vs. the same period last year.

It's worth checking data rather than making assumptions about it.

US oil production is up this year

Post-Gustav and Ike, not true. Down almost a half a million b/day currently.

Just because post-hurricane stats have not yet been published does not alter reality.

Alan

And neither do temporary disruptions make a trend. Arguing there's a downward trend between 2007 and 2008 based on one week's hurricane-disrupted oil production is misleading at best.

The fact of the matter is that an apples-to-apples comparison - US crude production, pre-hurricane disruptions - shows no decline. That's not to say that US crude production is not in long-term decline - it is. All I'm saying is that the original claim - that US oil production is falling faster than US oil consumption - is contradicted by the available data. (Factoring hurricane disruptions out of both production and consumption, of course.)

That's like saying Galveston remains the same when you factor out hurricane disruptions.

Pitt: I read it off the weekly report released Wed-domestic oil supplied to refineries (YOY change). Good thing you don't make assumptions much.

In that case, what you're seeing is post-hurricane disruption; don't mistake that for long-term decline.

The data and graph here, from that same weekly report, shows that the majority of this drop has already been restored, and that the large majority should be expected to be temporary (based on similarity to 2005, where the 4-week average dropped by 26% (end Aug to mid-Oct), but recovered to 95% of pre-hurricane production by May06, and - despite ongoing decline - was up to 99% of pre-hurricane production by Dec06). (Interestingly, the weekly report's historical data disagrees with the IPM monthly data; the weekly is consistently higher for 2007 and consistently lower for 2008.)

(Speaking of imports, for crude or crude+products they're down significantly YOY (~-0.5Mb/d), on a 1-month, 2-month, 3-month, 6-month, and YTD basis.)

I'm not saying that US production is not going to continue its long-term decline. All I'm saying is that the original claim - that "[t]he drop in domestic oil production is outpacing the drop in gasoline consumption" - is either (a) directly contradicted by the available data, or (b) misleadingly attributed to natural decline when it's the effects of hurricane damage.

I don't. You'll notice that I've backed up everything I've said with links to the relevant data, as well as often checking robustness by looking at several different time-periods. You, by contrast, didn't provide any evidence for your claims. When pressed, it turned out you were making generalizations based on a few weeks worth of hurricane-affected data.

That is one reason why it's important to provide evidence: you can see when data is being misinterpreted or misrepresented. As it was in this case: temporary disruptions from hurricane damage are not a reasonable basis from which to make claims regarding ongoing trends.

"It's worth checking data rather than making assumptions about it."

If you subtract the extra day for Feb. it amounts to a whopping 1.038 million barrels for the first 7 months. That amount was almost lost in August alone before the hurricanes.

I expect that by year end we will be down about 60 million barrels of total production for the year, or an additional 6 days of imports.

The difference between this year and last is statistically insignificant (35,860 vs 35,892, through July)), probably well within the margin of error of reporting. It is just noise on a long-term downward trend.

To be fair, Gail wrote: "not very much less than earlier this year."

In that, the statement is roughly accurate (EIA data):

Jan: 8,814 thousand bbl/day

Feb: 8,842

Mar: 9,069

...

Jul: 9,072

I suspect the point she's trying to make is that total product supplied in the US is about the same now as it was during the months with oil above $100/bbl. In other words, demand may be down significantly compared to last summer, but it's not down as significantly compared to the time that oil was reaching mid-$100s prices. Pause and think about it a moment. What might matter more when considering the present oil price: How much gasoline was consumed in the US last summer relative to the time of $130/bbl oil (Jun/Jul 2008), or how much is being demanded right now relative to the time of $130/bbl oil? It's a question worth consideration.

-best,

Wolf

Ask yourself, when did the market first have very good statistical evidence of the very substantial decline in consumption in July? Only 3 weeks ago when the EIA released the final July number. The early estimates made at the end of July didn't show a sharp decline at all. Thus, the numbers were subsequently heavily revised down

But, of course, June consumption was off big too. When were those numbers known? 7 weeks ago.

But traders don't just sit around waiting for the EIA's numbers. They use everything they can get their hands on. And there were indications....nicely documented in the Drumbeats that a shocking change in US consumption was afoot. Most traders have no seen anything like this in their adult lives, if at all. It hasn't happened in 30 years. The light dawned gradually.

At least some of the other factors Gail mentions play a role, too. Especially the current Panic.

But for reasons unknown, Gail is profoundly unwilling to give changes in consumption their due. In fact, she doesn't like to explain trade fluctuations in terms of market mechanisms at all.

At times I've even suspected she is a Marxist. Which would be great, as I'd love to see an explicit (updated) Marxist perspective on things. But it should be done in the open.

[BTW the revised august consumption number will be released in a few days and it will rock your world]

Sure-Gail is a Marxist and your buddy Hank Paulson is being forced to do his thing because of the mess Bill Clinton made (or was it Jimmy Carter?)

If I want to write a post of < 2,000 words, I can't cover every topic at the same time. In this post, I am trying to discuss factors other than what we usually consider a decrease in demand that are affecting price.

The reason changes in consumption are not being discussed is because that is not the topic of this post.

Gail,

I do not know how you, westexas, and the rest do it. It takes me an incredible amount of my limited free time to read the posts here on TOD. First I have to read and try to understand the main post of up to 5,000 words. Then, there is the trudging through all the comments. Hundreds sometimes. Sometimes the reaction is "huh"? and I have to re-read it carefully. Othertimes it is "You're an idiot!" and I mentally list all the reasons why. Perhaps it is because I am not 'in the biz' so it takes a bit more for everything to process. Regardless, I know I use more mental energy here than I do in most parts of my day and I certainly learn more here in an hour than I did in every hour in college. (Anything with Stuart's or Khebab's name should be available for Professional Development Hours!) Thank you and the others for all your hard work!

You are welcome. We enjoy it!

Marx says that the laws of survival of the fittest(free market competition) will lead to the concentration of all wealth in the hands of oligopolies and mass production techniques will swell the working(or non-working) poor; the polarization of these two classes(class struggle) will lead to World Revolution.

The Panic of 2008 has and will eliminate a lot of competitive players from the market, concentrating the remaining wealth in fewer hands. Mass production of housing has created a glut. The next step was to make phoney credit available to the masses so they THINK they can afford to buy those houses, unloading junk on the proletarians. In terms of actual wealth, therefore the 'proletarians' has become poorer(but 'debt rich'), while the rich become even richer.

Marx would conclude that market economics are illegitimate, a complete con-game, designed to trade Manhattan Island for silly glass beads. If the system self-destructs, that is to be expected.

Did YOU expect the market to meltdown?

They had Nassir Taleb(Black Swan) and mathematician Benoit Mandelbrot on the PBS Newshour last night--experts on chaos theory. They haven't a clue what's going to happen and think things are wildly out of balance.

And yet you still look for market based explanations, which tell us precious little even when things are going well.

Well, when in doubt blame it all on the Marxists(or Gail).

I have been a fan of Benoit Mandelbrot for a long time. I bought the hardback version of his (Mis)Behavior of Markets when it came out in 2004. The quants putting together structured securities should have read his book back then.

I just did find this document.

The American Wage Structure 1920 - 1947

by

Thomas Ferguson James K. Galbraith

August 1998

http://129.3.20.41/eps/mac/papers/9809/9809010.pdf

What this document describes is comparative wages between and across industries and groups factored for social phenomena such as unionization and strikes, overseas competition and entry into the workforce of women and immigrants. It is interesting to me that the term of this examination covers the period that I maintain was actually the Great Depression, not just the period from 1929 - 1939.

If you scroll down the pages you can see that wages across almost all industry groups were flat; after a sharp decline caused by the panic of 1921 and the rebound in 1922, there was practically no increase in wages during the period of 1922- 1929.

In the meantime, the Gross Domeastic Product for the period 1921-1929 increased from $68 billion to $101 billion (in constant dollars).

http://www.huppi.com/kangaroo/GDPreal.htm

Marx was partly right, concentration of wealth is destabilizing. Without earnings, the working public cannot afford to buy the products that they make. Without accumulated wealth, there is no money to 'trickle up' to the investment class. The (predictable) outcome is collapse. But ... that's not the issue here, exactly:

This is where Marx is incorrect. The consolidaton within industries is rather the collapse of the uncompetitive into each other. Between and among these business organisms, there is little real wealth, only debt denominated in ways that cannot be clearly calculated. The risk value often exceeds the 'book' of the combined businsses. Rather than making the remaining participants in the shrinking markets more powerful, it makes the system as a whole more vulnerable. At the bottom, there must be some wealth to concentrate.

Here is where the joke of the producing class is on the wealthy. As from 1922 onwards to 1929, this country has had near- flat or declining wages since 1982. At that point the real wealth generation went 'on vacation' and the public started its credit binge. Low interest rates enabled the binge and allowed the financail markets to escape the boundaries that declining investment capital would ordinarily impose. Debt is magical ... for awhile.

Now, the investment class needs the productive class more than ever ... and they are falling out of work! How ironic!

PS; the Ferguson/Galbraith paper credits the rise of unionism and the effect of government hiring during the WWII period to compress wage disparities and bringing a long term period of prosperity. "The Great Compression"

Good work !

Given that we are probably at the end of multi-decade trends that primarly started after the end of world war two its good to look at stuff like this.

The debt trend for example probably extends all the way back to WWII but would be difficult to pick out clearly in its early phases by the late 1970 and 1980 it was obvious and given a big kick when we left the gold standard.

Although we look at some of the short term issues facing society right now in the bigger picture the birth and death of the baby boomer generation following WWII and the policies associated with this generation is also happening right now.

Its fascinating to watch everything start coming to a head at the same time.

Another trend that started about 1970 was a trend toward lower and lower cost labor.

First women were added in this country. Then we started to add labor from abroad for manufacturing. More recently, we have been adding labor from abroad for services.

This really is part of the flat or lower real wages in this country, and the need for debt to finance a growing life-style.

Right we forget about this. And even as jobs where exported overseas over the last several decades businesses that remained in America moved to using illegal aliens as cheap labor. So your right the first trend was women entering the work force then a growing number of illegal immigrants.

Pretty interesting mega trends overall. What really funny is it succeeded in replicating the mistakes of the past as the workers became unable to also be consumers.

One thing I've never really grasped about American capitalism is this obsession with driving down wages. I know its good for short term profits but the absolute fixation on driving down costs with a focus on wages is just weird.

Germany of example gets a good name for fine engineering etc but they don't have this myopic focus and generally the rest of Europe does not. Also I don't see it in Japan.

Maybe its not unrelated to the increasing use of oil imports which meant over this time period money was not being recycled into the US economy but being sent abroad.

Over these same years that the US has been so focused on cheap labor more and more of the other costs of production was money that left the US first for raw materials then eventually for finished goods leaving only the so called service economy.

For Japan imports have been constant so it was not changing.

For Europe they had the North Sea and Russia although not technically part of the EU is economically welded at the hip so overall the EU's energy/trade balance has only altered recently.

Not sure if this is a real correlation but the differences between the policies of the US towards workers and the other advanced countries is striking.

I see this as a part of the "market always knows best" mentality the US has.

In almost every corporations, wages and benefits are by far the largest part of the expenses in absolute dollars. When a corporation is required to drive down the costs, management will find most effective to focus on the largest expenses first. Of course this is at odds with the macroeconomic requirement that workers need money to be consumers. But corporations have no responsibility to implement macroeconomic policies. Their responsibilities are to manage their own costs and revenues.

This is a case where the best policy at macroeconomic level doesn't always result from the cumulative effect of microeconomic best decisions from the decision maker point of view. This happens when there is an imbalance in power when workers negotiate working conditions with employers. There are times where corporations have more ability to force down wages than employees have freedom to find better jobs elsewhere. If you apply free market policies strictly, over time you get a trend of wages going down and depletion of the consumers ability to consume.

The remedy would be to have policies that give workers more power to negotiate their wages. Investing in education to beef up the competency of the workforce and make it competitive against offshore outsourcing is an example of such policy. But in the US this kind of government action is viewed as "socialism" and is considered to be bad.

Data...

The point you seem to miss or not care a hoot about is the fact that $2.50 gas is even less affordable than $3.50 gas for a huge portion of the population.

There is no positive in this.

It is not giving the right message at all.

At times I've even suspected she is a Marxist. Which would be great, as I'd love to see an explicit (updated) Marxist perspective on things. But it should be done in the open.

This is a truly peculiar comment. Marx himself would not have been averse to explaining "trade fluctuations in terms of market mechanisms" in some cases. So your Marxism detector is seriously flawed.

I am a Marxist. It means I concur with some of Marx's ideas. I'm also a Darwinist, I concur with some of his ideas. I'm also a Shumacher(ian?)(ist?) Same reason. Also a peak oiler, a peaker in general. I could go on and on. We all carry intellectual baggage, if that's what you want to call it, of one sort another.

One could turn around and start guessing what the influences on your thinking are. But it would be quite pointless because what's at issue is what you say and whether it is right, not what lurks behind what you say.

Marx, BTW, is dead, so don't hold your breath on an updated perspective. People who call themselves Marxists today cannot agree on the time of day, any more than can Catholics.

I do not get hysterical about one month with a 6% reduction in gasoline usage. In the whole scheme of the world's supply of oil, I don't see one month's reduction of the US gasoline usage during summer months, when there is a lot of discretionary driving, to be all that earthshaking. My point wasn't that there were no changes in demand; it was that the changes in price seem out of proportion to usage changes. I also talk about the inelasticity affecting price in point 8.

When we look at the weekly gasoline consumption amounts, comparing 2008 to 2007 from the weekly survey, which is all we have to look at recently, this is what we see:

The drop-off, to the -3% and -4% reported, started in the summer, when there is a lot of discretionary driving. The big drop-off, to -5%, came during the disruption following the hurricanes. The hurricanes started right after the summer, so we really haven't had much of a chance to see what driving would be in the absence of hurricanes.

I'd venture to say that there are at least 2 reasons why this dramatic falloff in consumption ... not seen in almost 30 years.... makes you uncomfortable.

1) Lower prices mean people worry about peak oil less and you are in the peak oil worry business. Fair enough, you are an activist.

2) If US consumption can fall rather rapidly (as it did in the early 80s), peak oil will be less of catastrophe than many believe. Yes, there's the rub.

Many in the peak community have yet to come to grips with the fact that demand can plunge. This has implications, among other things, for household planning. One doesn't have to worry as much about a more fuel efficient vehicle if one believes there is going to be a global recession.

EDIT:

Say I'm trying to decide whether to wait for the new electric cars on the way from sources domestic and foreign. The fact that people are cutting back and gas prices are falling is a big deal because it means that perhaps I can afford to take my time and hold out for better technology.

It may be (and I have no evidence to support this supposition) that there are the easy, low pain changes that Americans can make to reduce consumption, and that's what we have seen this and in the 1980s. There is enough wasteful use under normal, low oil price times that cutting out that part is pretty easy.

That doesn't automatically mean that cutting further would also be as easy. Presumably each decrease in consumption will be more difficult from the last, because one would assume people tend to cut the less painful things first.

Datamunger,

You are missing a couple of points:

1. The first 10% or 15% is relatively easy and painless to conserve.

After that the demand becomes very inelastic.

2. Eventually declining exports catch up with conservation.

Not necessarily. With time, new technologies that use much less oil (or none at all) come to market. Conservation might be quite a bit easier in 2013 than it is now.

Rail is cheaper than trucking. But it takes time to increase an inventory of locomotives and rail stock. Structural changes (which offer the possibility of enormous savings) take time.

But, yes, if we had to cut 30% over the next month alone, then the first 10% would come easier than the next 10% and so on.

RE net exports. Depending on how technology, conservation, recession work out, it's possible that decline in demand will outpace a decline in net exports forever. We'll see.

The problem of course is that our model, case histories, and some current examples (e.g., Mexico & Venezuela) show that net export decline rates tend to accelerate with time.

Some Net Export Decline Rates:

Mexico:

2005: -6.4%/year

2006: -6.5%/year

2007: -16.4%/year

2008: -32%/year*

*Estimated

Venezuela:

1998: -3.7%/year

2007: -10.2%/year

Norway:

2002: -2.5%/year

2007: -8.9%/year

News Item Regarding Russia:

http://www.barentsobserver.com/russian-crisis-with-positive-outcome.4521...

As time goes on, we are, IMO, going to see more and more exporters showing accelerating net export decline rates.

Of course, Saudi Arabia has shown a year over year increase in net oil exports, but I estimate that their net exports in 2008 will be about 8.4 mbpd, versus their 2005 rate of 9.1 mbpd, not exactly a promising trend.

Unfortunately, it is not as easy as getting the latest gadget or gizmo to save us. It takes about 15 years for the US vehicle fleet to turn over. New vehicles get sold to others, then other, then others until you get to my 1980 POS ford ranger that I plan to drive until the wheels fall off.

Also, new ideas tend not to work in strange and unpredictable ways. Then we have the problem of scalability. And who is going to maintain all these fancy new toys? (let's not mention who will be able to afford them with the resession/depression). Don't get me wrong, new tech will help, but it is a thin reed to rest your hopes on.

True, but misleading. DOT surveys show that over 50% of driving is done by vehicles which are at most 5 years old. Consequently, substantial fleet turnover happens relatively quickly.

The good news, Mad_Man, is that our entire fleet can use E30 quite efficiently. That will give us some time.

It's not just about people 'worrying'. If lower prices send false signals about future supply, the ensuing complacency could be detremantal to peak oil mitigation and planning.

Not necessarily. Superficially, falling consumption seems like a good thing but it all rests on the manner in which it occurs and the wider economic implications. If (when?) 'demand destruction' affects the poorest disproportionately or causes a debilitating economic depression the results could indeed be catastrophic. Falling consumption is not good for the growth on which the current economy depends.

As someone posted in a previous drumbeat, here's the U.S DOT federal highway administration estimate for total miles driven:

Yeah, there's a reduction, but for 2008 YTD so far it's ~3%.

Also, here's the monthly averages:

Again, there is a reduction, but for urban highways we're still in the noise for summer months and hurricane season (i.e. statistically I'd say you can't tell if the reduction is due to hurricanes or it happens to be July or September when people drive less than June). Looks like a lot of people didn't take road-trip vacations this year, but month on month data does appear to correlate with a reduction in demand that is persistent.

(quotation since modified)

More evidence that peak oilers are soooo resistant to accepting the reality of declining oil consumption.

Small? It was a fracking earthquake in the automotive world and we now have all three NA automakers on death watch. Basically dead in the water.

Take a look again at that hook-shaped graph. Most here have seen nothing like it in their adult lives. Stare at it and be amazed. (and it's a 12 month average, btw, which dampens the affect of recent declines).

With falling prices, of course, demand could increase again. But what we've seen so far this year is truly historic and the ground is littered with corpses.

I'm not resistant to the reality of declining oil consumption. The reason I said "but small" is because I was trying to emphasize that it's not 6% as in July 2008, more like 3% persistent reduction with periodic interruptions during hurricane season. After reviewing it I changed it because it read the way you seemed to interpret it, so I apologize for that.

Secondly, you say three auto makers are on death watch and there is a huge decline in consumption, but what is it you think that peak-oilers have been warning about for years and years? Believe it or not, I think that this is TSHTF as "we've" always said. Obviously it's not playing out as the Mad Max scenario or as anybody quite envisioned it, but I think that if you're trying to use this as proof of a cornucopian viewpoint is correct, you're not going to convince anybody -- the economy has partially collapsed and it's a good bet that geologic constraints on oil production had something to do with it.

I do wonder though if demand will increase again and what it will do with decreased prices. I'm guessing it won't recover completely because people are looking at their savings and retirement accounts and are going to say "Why don't we take that vacation to state park again instead of driving X hundred miles to Florida."

If the usage had kept going the way it was headed up until 2004 then we would now be at 3200 or so. It is not just 3% down it is 3% down from zero and 7-9% growth that did not happen over the last few years.

The first 10% is easy. Well we can go down another 7% easy and that drops oil prices to $20/barrel for two to four years and that is even with reduced production from OPEC.

More time for more biofuels.

More time for increasing percentage of fuel efficient cars, hybrids and electric cars.

More time for more nuclear power worldwide.

More renewable power build up.

More time for oilsand production increases [some slowdown in projects but that means projects go ahead at an orderly pace with less exhorbitant worker wage inflation]

More time for Bakken supply ramp up with pipelines built.

Thus a more orderly transition can be realized.

The thing that catches my eye more on this graph is not the little hook at the end of declining demand...but the steep curve going from 1983 to 2007. How much more can the little hook go down I guess would be the question. We still consume a lot comparitively (to the rest of the world).

I would be good to see this graph by country. Worldwide.

Gail,

One problem/issue with following the VMT is it is a lagging indicator. Meaning, the traffic counts are dropping faster than this graph shows. Just today, I put together a presentation using this data (same graph in fact) when I noticed the July 08 counts for Florida (latest available) is lower than the five previous years. The individual state data only goes back to 2002/03. While my 12 month moving total shows a dip, it does not show the inertia that is behind this.

http://www.fhwa.dot.gov/ohim/tvtw/tvtpage.cfm

My impression is that truck mileage is going down faster than car mileage. This would be the case if we are building fewer houses, and don't need to transport all of the materials and furnishings for them. As far as I know, the DOT data combines trucks and cars.

I would agree that if it is a 12 month moving average, it is more of a lagging indicator. I thought some of the data I had seen was simply on a quarterly basis. I found Bureau of Transportation Statistics monthly data, but it is only through January 2008.

I believe it is too. Diesel usage is plummeting, though it takes a bit of work to dig it out.

http://www.fhwa.dot.gov/ohim/mmfr/mmfrpage.htm

In Florida, diesel is down from 1.8 million gal per month, to 1.6 million (if I remember correctly)

The trouble is trucks and cars are not usually broken out. The only public report I know about is just for Florida and comes out once a year (in April). The “T” factor is the percentage of trucks.

http://www.dot.state.fl.us/planning/statistics/trafficdata/

How much of the 6% is due to the housing crisis? New contruction: contractors and employess with their pickup trucks, illegal immegrants on job sites, materials and appliances etc.;resale housing -travel by real estate agents etc.

It will be interesting to see if the demand destruction continues or if it was a one time occurence.

David

Considering that work trucks generally run on diesel, I wouldn't expect that to be that large of a factor. However, you're right that it's plausible enough to look into. Does anyone know where we could find those sorts of statistics?

Believe it or not the congestion from said work trucks probably causes a significant increase in demand. Congestion has been a huge problem the last few years.

http://pubsindex.trb.org/document/view/default.asp?lbid=848721

To translate it increase fuel consumption by 80%. No construction traffic less congestion and the people who don't like looking at the real number believe we are going to keep having these wonderful drop in fuel usage.

http://www.fhwa.dot.gov/policy/otps/060320c/index.htm

On a tangent with less people committing to suicide loans for homes almost doubling their housing costs vs rent a lot more people will have higher cash flow monthly same of course with those that move from expensive home loans to renting. And as you can see above you get increased productivity as congestion drops.

And finally in some cases what we take to be less traffic around us is probably often simply less congestion. The long housing boom has caused us to forget what its like with a functional road system.

Who you callin' old, buster?!? She can't be much older than me! :)

According to the EIA's latest PDF, the 4-week moving average for finished motor gasoline for the period ending 10/17 jumped by 81K bbls/day. For a 4-week moving average to jump like that implies about a 324,000 barrel delta between the week that fell off and the week that was added. That's the first increase after 8 decreases, and it occurs at a time of year when consumption is normally dropping.

Total petroleump products supplied saw a jump of 102,000 barrels/day, though total products supplied usually does increase slightly this time of year (about half that much).

The decline in consumption we saw through July was caused by high prices. That is entirely different than a decline caused by economic meltdown. Unfortunately, the numbers between August and now are completely FUBAR by the hurricanes, and almost nothing of value can be said about them, except that they were affected by the hurricanes. No one really has clue what the effect of economic meltdown + much lower gasoline prices has had on consumption, and they won't until the hurricanes are far enough behind us to mute their effect.

You can get most of the week by week numbers from here that are shown in the PDF on an averaged basis. I tend to use the week by week ones instead of the moving averages because I can see better what I am doing.

When you click on the view history, it gives you an HTML history that is not in a very nice format. You can also download an Excel history that shows week by week amounts in a long column.

Oil is a marginally priced commodity: Absent hedging, the price of the "last barrel" (or perhaps, million barrels) determines the price of all the barrels, due to oil's mobility and fungibility. In an era of very tight supply and stupendous global growth, the competition for that last barrel is intense, and amplified by "speculators" betting on it continuing. Fast forward to a deep global recession, vast deleveraging, speculators liquidating positions, economies shrinking, and all of a sudden nobody wants that last barrel.

So: We have price spikes, followed by economic upheaval, followed by demand destruction. But wait, there's more! As Westexas points out, large fields are depleting rapidly, net exports more so. After a period of reduced oil prices, demand will creep up again, crossing the ever declining production/export line, and the price for that last barrel will shoot up again. So we've got a nice little roller coaster ride:

Globabl Growth + Depletion --> High Prices --> Economic recession + lower prices --> Demand recovery + Depletion --> High prices again

And so on. A cycle of deflation followed by inflation, and over again. Enjoy the ride folks.

You forgot the baseline cause of the spike and canyon effect: "Hooray, the energy crisis is over (again)!" Those that can afford todays new discounted gas prices - the expense account crowd - can go back to their hummers and SUV's and we can forget investing in future supplies. There's no capital anyway.

All the alternatives are effectively bankrupt - yet again - at least if they are marked to market and not subject to floor contracts with no counterparty risk. All new exploration, except the most basic infill variety, is over or at least considered rampant speculation. All of this sounds familiar.

Here's a good example: Future North Sea oil production has been discounted to zero on the markets. Wow. that's great! Free oil...if you can just put in the templates and platforms. Demand does not seem to have really gone away, just evaporated at the margin. Just wait until that marginal demand returns.

Sure, China's growth rate is decreasing. It may drop to as low as 8% this year. Due to wealth effects, Geely Auto still sees demand for their small cars growing at 20% per year. I know, they'll use the vegetable oil they use to fry sweet and sour chicken balls and India will rely on the proven incendiary power of vindaloo curry. That's a lot of chicken balls...

There is another possibility--it is certainly possible that things simply 'unravel' and go from bad to worse. More specifically, a long-term deflationary trend is now possible; if prices continue to drop and businesses fail, we could see something quite unexpected: No recovery. We would enter a long, indefinite period of disruption so severe we could only look to examples of collapse where people are left bartering and those in debt, or close to the financial edge, face homelessness, etc. A new world currency would certainly be a sign we've entered a more bizarre, greatly-impoverished world economy. Previous historical disruptions such as this have seen war, fascism, and revolutions as nation states fight over resources and markets to satisfy, and occupy, increasingly desperate populations.

Then again, chaos theory, as mentioned above, suggests that prediction is not possible given the complexity of these circumstances. (I find it hard to imagine even my own circumstances a year from now, much less those of a nation or the world.)

It is my hope that governments (or 'the people' who potentially hold all political power ceded to their 'representatives') have the wisdom to address these issues in a manner that doesn't exacerbate financial insolvency, social inequality, peak oil, and global warming. And if those governments fail to swiftly address these problems, may they be replaced just as swiftly. There isn't much time or leeway for error and corruption.

Gail, we are not using "somewhat less" petroleum fuels recently. We are using significantly less. Here is the link to the latest EIA report:

http://www.eia.doe.gov/pub/oil_gas/petroleum/data_publications/weekly_pe....

Granted every source I look at varies a bit but it looks like about 8% less compared with the same period in 2007. We are consuming the same amount of Oil as we consumed in 1999. Good thing too. We now are producing less than 5 million BPD. The last time we produced as little as 5 million was 1946.

We are using quite a bit less petroleum products, but the petroleum products we are using less of is petroleum products other than gasoline.

I think at least some of this is delayed demand, with people not filling up their fuel tanks with winter heating oil during the summer. I am sure that there have been huge cutbacks in the building industry this year, and this is carrying over into related industries, as people buy less furniture and other goods. Perhaps what I should say is that government statistics are not yet recognizing a recession very clearly in their data. (This is, of course, mostly do to bogus inflation adjustments.)

The purpose of this article was not to analyze precisely how much US demand had dropped off. The point is that there are a lot of other issues affecting prices as well.

The main reason that a recession has not been officially announced is because of the way data is gathered and time lags in aggretating and correcting this data.

Recessions have never been announced during the first quarter of the recession. The informal (not correct, but close) definition of a recession is at least two consecutive quarters of negative real GDP growth. Suppose we went into a recession beginning in the third quarter of this year, as I'm pretty sure we did. The recession is continuing on now in the fourth quarter. The recession will not be officially recognized as such until some time in 2009 (maybe February) when the fourth quarter data is complete.

By the way, for most purposes it matters not a whit whether you use official numbers or Shadostats numbers: They tend to show equal changes--different amounts but identical trends.

To elaborate a bit more on the lower distillate stocks, this is the graph from this week's This Week In Petroleum report.

The place we use home heating oil is in the Northeast, which is part of "East" on the graph. We were reading earlier this year that people were not filling up their oil tanks, because of the high cost. Now, when we look at the East's inventory, it looks decidedly light compared to the previous two years. I wonder if credit issues causing intermediaries to cut back on inventories of home heating oil.

Massively complex systems with many feedback (negative and positive) loops and many inertia (creating time lags) are inherently impossible to predict. Any index parameter such as prices become volatile and unpredictable as a key forcing function drives the system toward bifurcation (attractor switching or phase shift). So the only thing you can say with any confidence is that prices will be volatile.

In the current context my suspicion is that the slow down of energy flow through the economy, due in part to peak oil, but also due to declining net availability resulting from falling EROI, is more like a braking function. Same argument. Suddenly applied brakes in one part of a complex system can have catastrophic effects in the system as a whole.