DrumBeat: December 10, 2008

Posted by Leanan on December 10, 2008 - 9:52am

U.S. gasoline use to decline most since 1979-80

WASHINGTON (Reuters) - U.S. gasoline demand is expected to decline more sharply this year and next than in any other two-year period since 1979-1980, the federal Energy Information Administration said on Wednesday.Hit by high pump prices in the first half of 2008 and the weak economy, America's gasoline consumption will decline this year by 320,000 barrels per day, or 3.4 percent, and another 50,000 barrels per day, or 0.6 percent, in 2009, the Energy Department's analytical arm estimated.

In its weekly review of the oil market, the EIA said although the U.S. economy grew in 1979 and 2007, the number of vehicle miles travelled declined in both those years in response to huge increases in fuel prices.

Russia Looks to Join OPEC’s Plan to Cut Output

MOSCOW — Faced with falling oil prices, Russia is preparing to announce that it will work with OPEC in coordinating a reduction in output, the minister of energy said Wednesday.Earlier this fall, a Russian official floated the idea of storing oil, rather than exporting it, to help the Organization of the Petroleum Exporting Countries stabilize prices, but this is the first time that the Kremlin has offered to reduce output.

GOP senators voice opposition to auto bailout

Republicans revolt as House begins procedural votes on the loan package Image: Republican Senators

Petrobras’ Chief Says Pre-Salt Viable After Oil Slide

(Bloomberg) -- Petroleo Brasileiro SA, Brazil’s state-controlled oil company, can make money on its so-called pre-salt offshore fields after oil fell about 70 percent from a July record, Chief Executive Officer Jose Sergio Gabrielli said.The company has several options for development of pre-salt fields such as Tupi, and will have no problem meeting its investment plans, Gabrielli told reporters in Rio de Janeiro. Tupi, a 5 billion to 8 billion barrel field announced last year, is the largest discovery in the Americas since 1976.

Eco-criminals get their own most-wanted list

WASHINGTON - The government is starting a different kind of most-wanted list — for environmental fugitives accused of assaulting nature.These fugitives allegedly smuggled chemicals that eat away the Earth's protective ozone layer, dumped hazardous waste into oceans and rivers and trafficked in polluting cars.

And now the government wants help in tracking them down.

Back at Junk Value, Recyclables Are Piling Up

The economic downturn has decimated the market for recycled materials like cardboard, plastic, newspaper and metals. Across the country, this junk is accumulating by the ton in the yards and warehouses of recycling contractors, which are unable to find buyers or are unwilling to sell at rock-bottom prices.Ordinarily the material would be turned into products like car parts, book covers and boxes for electronics. But with the slump in the scrap market, a trickle is starting to head for landfills instead of a second life.

China crude imports slump in November

BEIJING (Reuters) - China's crude oil imports in November hit their lowest this year as the country's giant refiners reined in buying due to brimming storage and weakening demand amid a spreading global economic recession.The world's second-largest oil user shipped in 13.36 million tonnes of crude last month, or 3.25 million barrels per day, official customs data showed on Wednesday, a 14.6 cut in daily volumes from October and 1.8 percent down on November last year.

The lower import figure came despite diving crude oil prices and renewed efforts by China to build strategic stockpiles.

Oil jumps 8 pct as Saudi cuts supplies

NEW YORK (Reuters) - Oil prices jumped 8 percent on Wednesday on signs that OPEC kingpin Saudi Arabia has slashed supplies to customers for January as the economic crisis continues to slow demand.Saudi Arabia told major customers it was reducing supplies substantially next month in a move that could bring the kingdom's output below its implied OPEC target of 8.47 million barrels per day.

"There are quite severe cuts -- they are going to be seriously cutting back," a trader with one major customer said.

CIBC cuts WTI crude oil price forecast

(Reuters) - CIBC World Markets lowered its forecast for West Texas Intermediate (WTI) crude oil prices for 2009 and 2010, citing near-tern demand concerns, and cut its price targets on several oil and gas companies and trusts, including TriStar Oil & Gas and Enerplus Resources."It is our opinion that oil prices are unlikely to make a significant recovery in the face of a deep recession," CIBC said, in a note to clients.

CIBC cut its WTI crude oil price forecast for 2009 to $50 per barrel from $70 per barrel, and for 2010 to $65 per barrel from $80 per barrel.

Dodd: Automakers should consider making buses

Among the caveats included in a 31-page bill to provide General Motors and Chrysler access to $15 billion to stay afloat through March is a requirement that they study the feasibility of making public transit vehicles.Senate Banking Committee Chairman Chris Dodd included the provision after broaching the idea to business leaders of General Motors, Chrysler and Ford during a hearing last week where they presented their proposal for a $34 billion bailout.

The Connecticut Democrat noted during the hearing people aren't buying cars right now, but many municipalities and states are eager to boost mass transit.

Climate change experts 'lose faith' in renewable technology

Support for renewable energy technology to fight global warming is weakening in the face of worldwide economic problems and the true scale of the carbon reductions required, a survey published today has suggested.Figures presented at the UN climate talks in Poznan, Poland, show that climate experts have less faith in alternative energy than they did 12 months ago.

The survey shows less support for wind energy, solar power, biofuels, biomass and hydrogen energy as technologies with "high potential" to reduce carbon levels in the atmosphere over the next 25 years.

There was also less support for carbon capture and storage, new nuclear build, small-scale hydropower and natural gas stations as viable ways to hit targets for reducing greenhouse gas emissions.

Oil-rich Iraqi region may vote on self-rule

BAGHDAD - Iraq's election commission will run a petition drive to see if there's enough support for a referendum to decide whether the oil-rich province of Basra will become a self-ruled region, officials said Wednesday.

Lufthansa lowers passenger fuel surcharge

FRANKFURT, Germany - Airline Deutsche Lufthansa AG said Tuesday it would lower its passenger fuel surcharges as the cost of oil has fallen.

Time for OPEC to wake up and see the crisis

On the geopolitical front, the Saudis supposedly want lower oil prices to curry favour with the incoming Barack Obama administration. Lower crude oil prices support the U.S. economy and undercut three of the United States' most intransigent foes: Iran, Russia and Venezuela. Those three countries require between US$70 and US$90 per barrel to balance their government budgets, compared with US$50 per barrel or less for Saudi Arabia and its conservative Persian Gulf allies. In return for pushing for lower prices, the Saudis want the United States to exert sufficient pressure on Israel to force a fair two-state agreement with Palestine....The real reasons for OPEC not cutting its production ceiling at the Cairo meeting are much more mundane, according to my source. First, OPEC was concerned it would lose credibility if it was to agree to new cuts and it later found compliance to the 1.5 million barrels-per-day (bpd) cut announced at the Oct. 24 meeting was poor. Reuters has since estimated that OPEC-11 production was down a solid one million bpd in November compared with the previous month.

Second, despite not wanting lower crude oil prices, Saudi Arabia was willing to live with prices at about US$50 per barrel for a few more weeks to pressure the cheaters within the cartel into greater compliance with previous cuts.

Venezuela Debt Rating Outlook Cut to Negative by S&P

(Bloomberg) -- Venezuela’s debt rating outlook was lowered to negative from stable by Standard & Poor’s amid concern President Hugo Chavez will be reluctant to cut spending as oil revenue plunges.S&P maintained Venezuela’s foreign debt rating at BB-, three levels below investment grade. Oil, which has fallen 69 percent from a July record, accounts for about 90 percent of the South American country’s exports and about half of fiscal revenue.

Fission, Fusion and Nuclear Waste

Creating commercially useful power with fusion, in which small atoms are combined to produce energy, always seems to be decades away — and too costly. But physicists at the University of Texas at Austin have come up with a reactor design that would provide a second purpose for fusion: destroying long-lived nuclear waste arising from the splitting of atoms — or fission.

Gas demand firms as prices keep dropping

NEW YORK (CNNMoney.com) -- Gasoline demand rose on a year-over-year basis for the first time in eight months as prices at the pump declined for the 83rd day in a row.Demand ticked up a modest 0.3%, year-over-year, for the week ended Dec. 5, according to Tuesday's MasterCard Advisors' SpendingPulse report, which tracks national retail sales. The last time demand showed a year-over-year bump up was the week ended April 18, when it rose 3.1%. The report includes all sales, whether they are cash, check or by credit card.

Russia signals it might join OPEC crude output cut

Crude oil rose after Russia signaled it may coordinate a production cut with OPEC next week to end the five-month, $100 slump in prices.Energy Minister Sergei Shmatko said Russia will announce proposals for cutting output by Dec. 17, when the Organization of Petroleum Exporting Countries meets, Interfax reported. The group, source of more than 40 percent of the world’s oil, may trim production by as much as 2.5 million barrels a day next week, hedge-fund manager Boone Pickens said Tuesday.

Saudis Try to Re-Invent the Internal Combustion Engine

Clearly the Saudis are concerned about the future of their primary export. They see the western world coalescing around new technologies for transportation that minimize, if not eliminate, the role of oil. That vision is clearly not consistent with the best interests of the Saudi royals.So the Saudis are working to change both the reality and the image of oil. It therefore makes perfect sense that the Saudi’s would host Lesley Stahl and her crew for a tour of their gigantic new fields, their super-high-tech production technologies, their western-style liberal social mores (within Saudi Aramco), and…yes, their very-high tech R&D efforts to improve the way oil works so it will burn cleaner and more efficiently.

Tentative deal reached on auto bailout

WASHINGTON - House leaders have scheduled a test vote on a bill to provide government assistance to the financially ailing auto industry.The Democratic leadership is sufficiently confident of the prospects that such a bill could successfully be brought to the floor that they scheduled a procedural vote for later today.

Survey: Oil may lose top rank as cheapest energy

Over the next 20 years or so, oil and natural gas will lose top ranking as the world's most affordable energy sources, according to a survey of energy executives released Wednesday.Deeper wells in more inhospitable places, both political and geological, have altered presumptions of doing business in the oil patch.

Nearly three out of four executives and managers surveyed last month by Deloitte LLP said oil and gas is the cheapest available energy sources for now, though only 23 percent believe that will be the case in 25 years.

...The sampling revealed a growing concern about the sustainability of oil and natural gas in the coming years. Future sources of fossil fuels, the cost of producing them and the price consumers will pay are some of the biggest uncertainties facing the industry.

Global LNG Supply to Surge to 2012, Crunch Later

A 50% surge in global liquefied natural gas production capacity over the next three years, at a time of shaky demand, may make for a buyers market in LNG for a few years but the supply crunch will return later, an executive from BG Group plc said on Wednesday."We are about to see a supply surge ... It is really unprecedented," Elizabeth Spomer, BG North America's senior vice president told the CWC World LNG Summit in Barcelona.

Cheaper crude: who wins, who doesn't

It's been an amazing year for oil — the biggest, fastest run-up in the price of a barrel was followed by the greatest, quickest decline.

Gazprom Neft May Allow Foreign Partners to Develop Arctic Oilfield

Russia's Gazprom Neft, the oil arm of gas export monopoly Gazprom, is considering attracting foreign partners to develop a major Arctic oil deposit, a Gazprom Neft official said on Tuesday.Gazprom Neft Deputy General Director Boris Zilbermints told a conference that foreign companies may be considered as partners in developing the Prirazlomnoye field in the Barents Sea.

Russia looks to Bolivia-Argentina gas pipeline - Medvedev

MOSCOW (RIA Novosti) - Russia is ready to take part in a project to build a gas pipeline linking Bolivia and Argentina, President Dmitry Medvedev said on Wednesday.Speaking after talks with his Argentine counterpart, Cristina Fernandez de Kirchner, Medvedev said: "We have the opportunity to develop cooperation in the gas sphere, including in the construction of a gas pipeline to link Argentina and Bolivia."

Iran to participate in Iraq's oil projects

TEHRAN (Xinhua) -- Managing Director of Iran's Oil Industry Investment Company Ahmad Nasiri said that Iran would participate in Iraq's oil projects, Iran's semi-official Fars news reported Wednesday."Iran will cooperate with Iraq on nine oil wells drilling programs in north Baghdad," Nasiri was quoted as saying.

Global financial crisis setting in for shipping

The turbulence from the global financial meltdown is finally crashing down on the shipping industry, which appears to be increasingly headed for the docks because fewer companies are ordering goods to transport.Thanks to a backlog of orders, shipping was initially immune when the world's economy started its downturn in September. Now, those orders are running out, as is time for what has been a boom industry in recent years.

Kenya: Piracy might cause shortages, warn oil importers

Even as the push to match local pump prices to falling international crude oil prices gathers momentum, oil importers in the region are warning of uncertainty in the market due to increasing piracy along the Somali coastline.

Corporate Colonialism and the Politics of Economic Integration

In October 2008, Grain, an NGO which ‘promotes the sustainable management and use of agricultural biodiversity’ released a report titled ‘Seized! The 2008 land grab for food and financial security’. The report documents two ominous trends which have the potential to drive food prices up further and spell the end of small-scale farming.The report explains that governments of countries which have a shortage of arable land, or with high population growths, are resorting to buying up or leasing farmland abroad in order to secure necessary food production. The report also points towards corporations and private investors who are looking towards investing in foreign farmland as new sources in revenue in the midst of the financial crises, as an alternative to meagre returns on the crumbling paper asset model. The result is fertile agricultural land becoming increasingly privatized and concentrated in fewer hands, which could ‘spell the end of small-scale farming and rural livelihoods’ around the world.

Energy crunch may offset recovery, experts predict

When crude prices hit unprecedented highs last summer, followed closely by gasoline and diesel, consumers reacted by driving less and conserving more.Then prices began an equally dramatic fall to levels not seen since 2004, exacerbated by the growing global recession.

However, increasing delays in new production projects could create an energy crunch and choke off an economic recovery when demand rebounds, Richard Jones, deputy executive director of the International Energy Agency, said Tuesday in a presentation at Rice University’s James A. Baker III Institute for Public Policy.

"We believe these developments have diverted world attention from energy security and climate change," he said. "In times of economic hardship, it’s all too easy to lose sight of longer-term concerns."

World oil demand to fall for first time in decades

WASHINGTON (Reuters) - Global oil demand will contract for the first time since the early 1980s as world economic growth slows to a near standstill, the U.S. government said on Tuesday.The forecast for 2008 and 2009 is bad news for energy companies and oil producing nations that depend on robust prices, but could benefit cash-strapped consumers by sending gasoline and heating costs lower, according to a U.S. Energy Information Administration report.

Weak economy to ease energy costs for consumers

WASHINGTON (Reuters) - One bright spot in the current economic slump is that Americans will get a break when filling up the pump next year and heating their homes this winter, the U.S. Energy Information Administration said on Tuesday.The EIA said in a report that it expects U.S. regular unleaded gasoline to average $2.03 a gallon in 2009, down significantly from the 2008 average of $3.27 and off earlier forecasts of $2.37 for next year.

"A fall in gasoline prices allows consumers to spend less on fuel and more on something else," said Jerry Taylor, a senior fellow at the Cato Institute.

"So in that sense, falling gasoline prices are akin to a tax cut in that a tax cut allows consumers to spend less on government and more on something else."

Refiners rush to store cheap crude

NEW YORK (Reuters) - A big discount in oil prices for prompt delivery is leading U.S. energy companies to fill up their storage tanks at a time of the year they normally run down stockpiles for tax purposes.The trend could spell bloating inventories in the world's largest energy consumer into the new year, keeping pressure on prices that have already slumped more than $100 a barrel since July as economic turmoil hits consumer demand.

Total Says Economic Woes Won't Delay 2009 Start-ups

PARIS -(Dow Jones)- The economic crisis will not cause French oil major Total SA (TOT) to delay any exploration and production projects due to start in 2009, the company's head of exploration and production said Wednesday.There will be "no changes ... not to the production start-ups that should happen in 2009 time-frames," Total's Yves-Louis Darricarrere told reporters on the sidelines of an event organized by the company to discuss the theme of peak oil.

"In a general way we are maintaining our investment program," he said.

Coalition of all parties needed to promote living within our means

In their book, government is bad: long live their 'free market' god, whose prophet was Milton Friedman, and whose faithful followers were Margaret Thatcher, Ronald Reagan and George W. Bush. All three promised to show the world the way back to freedom and prosperity; all three said that government was the problem and privatization the solution!Now with the collapse of 2008, economists are switching gods: John Maynard Keynes is king of all whose bible says that massive government intervention can put us back on track.

But is it too late for that also? Both assume that, because population, resource extraction, and available energy grew throughout the 19th and 20th centuries, the economy can continue to grow in perpetuity. That was never possible. Yet the people in power still think that all they need to do is come up with the right mix of money, market forces and government regulation, and, pronto, all will be well again. No one considers that Earth's supplies of fossil fuels, topsoil and water are limited, and that someday soon the lack of these resources will drastically reduce economic activity.

To me, what old-school Harper and new school Obama are trying to do looks like an exercise in futility. Welcome to a ring-side seat watching the battle between the Ottawa-based free marketers and the new-to-the-game Washington state controllers over who is capable of restoring perpetual growth. I bet that neither can win, because we have reached a significant physical obstacle to growth -- peak oil -- that spells ruin to all economic philosophies that fail to take this new reality, of living in new times, into account. New times call for co-operation, for getting on board together, for unity and consultation.

Factory prices slide in November

LONDON (AFP) – The price of goods leaving factories dived in November owing to a sharp drop in crude oil prices, official data showed on Monday.

Russia's oil company interested in developing Iran's oil fields

TEHRAN (Xinhua) -- Gazprom Neft, Russia's fifth largest crude oil producer company and the oil arm of gas export monopoly Gazprom, has expressed its interest in developing oil fields in southern Iran, Iran's satellite Press TV reported on Wednesday.

Kazakhs to draw up reduced spending plans

Kazakhstan will draw up contingency spending plans in line with a potential drop in global oil prices to $25 per barrel, the Central Asian nation's prime minister said Wednesday.Plummeting commodity prices and an economic downturn prompted by severe exposure to foreign borrowing has forced energy-rich Kazakhstan to drastically reduce growth forecasts for the coming years.

Oil: From Bubble to Bust - And Back Again?

A blind monkey throwing darts would beat the average investment bank oil analyst, whether forecasting weekly inventory levels or the future oil price.At the peak of the historic investment bubble in oil futures back in July, they were falling over themselves to predict $170-200 oil in 2009. Now it's $25. Everyone from central bankers to the CFTC and leading economists (or 'misleading' economists as people like Paul Krugman should be labelled) claimed the price was based on fundamentals.

They were wrong then, and they'll be wrong again.

Indian crew jailed over SKorea's worst oil spill

SEOUL (AFP) – A South Korean court on Wednesday jailed the Indian captain and chief officer of a Hong Kong supertanker after ruling they were partly to blame for the country's worst oil spill, court officials said.

The Case for Making Bigger Cars

Ironically the Big Three might be better off if they stuck to what they're good at: gas guzzlers. Why is Ford (F) the healthiest of the three? There's one big reason: the F series pickup truck. And the brightest of GM's (GM) dim bulbs is Cadillac, a marque which has never been known for its fuel economy.Detroit knows that it needs to get smaller. If it's going to downsize, it should stick to what it's good at, rather than try to compete with Japanese and European manufacturers on turf it conceded to them decades ago.

Pickens "anxious" over wind farm project financing

NEW YORK (Reuters) - Texas oil tycoon T. Boone Pickens said on Monday he is "anxious" for his company's multibillion dollar plans to build a giant wind farm in Texas as the economic crisis chokes off project financing.Mesa Power LLC is planning to build the world's largest wind farm in the Texas Panhandle, but financiers for the project have disappeared in the economic downturn.

"Where's the money is the question. I don't know how we'll do it. I'm anxious to see what Obama comes up with. There is no money to finance a wind project now," Pickens told reporters at a briefing in New York City.

"I'm a little anxious."

American Lung Association Announces Support of Pickens Plan

The American Lung Association, a leader in the fight for cleaner air for decades, announced its support of the Pickens Plan at a press conference today with Mayor Michael R. Bloomberg and T. Boone Pickens, the legendary American business leader and philanthropist. Developed by Mr. Pickens, the Pickens Plan focuses on reducing America's dependence on foreign oil by investing in renewable energy, such as solar and wind power, and using America's vast resources of clean natural gas for fleet transportation.

T. Boone Pickens Named 'Texan of the Year'

Famed business pioneer and innovator T. Boone Pickens has been named Texan of the Year by the Texas Legislative Conference, the well-known annual statewide forum that is marking its 43rd year. The announcement was made by Advisory Committee Chair and State Rep. Edmund Kuempel.

Congress should expand Yucca Mountain capacity: DOE

WASHINGTON (Reuters) - Congress should expand the capacity of the planned U.S. nuclear waste dump at Yucca Mountain in Nevada and delay a decision on whether to commission an additional dump site, the U.S. Energy Department said in a report released on Tuesday."Unless Congress raises or eliminates the current statutory capacity limit of 70,000 metric tons of heavy metal, a second repository will be needed," Energy Secretary Sam Bodman said in a statement.

Better Control for Fusion Power

Nuclear fusion could prove an abundant source of clean energy. But the process can be difficult to control, and scientists have yet to demonstrate a fusion plant that produces more energy than it consumes. Now physicists at MIT have addressed one of the many technological challenges involved in harnessing nuclear fusion as a viable energy source. They've demonstrated that pulses of radio frequency waves can be used to propel and heat plasma inside a reactor.

'Sweden cleanest, Saudi Arabia dirtiest'

Poznan, Poland - Sweden does the most of any country for tackling emissions of greenhouse gases, while Saudi Arabia does the least, according to a barometer published on Wednesday by watchdogs at the UN climate talks.But the annual "Climate Change Performance Index" placed Sweden only fourth on its list, for no prizes were allotted for the top three places.

Polluters' windfall: Carbon into gold

BRUSSELS: The European Union started with the most high-minded of ecological goals: to create a market that would encourage companies to reduce greenhouse gases by making them pay for each ton emitted into the atmosphere.Four years later, the carbon trading system has created a multibillion-euro windfall for some of the Continent's biggest polluters, with little or no noticeable benefit to the environment so far.

Not waving but drowning: Island states plead at UN talks

POZNAN, Poland (AFP) – Dozens of small island nations threatened by climate change have taken their case to the UN talks here, saying rising seas are already lapping at their shores and may eventually wash some of their number off the map.

Obama vows to end global warming 'denial' after Gore talks

CHICAGO (AFP) – President-elect Barack Obama said Tuesday his administration would brook no further delay in tackling climate change after discussing global warming with former vice president Al Gore.Sitting between Gore and his vice president-elect Joseph Biden following the hour-long meeting, Obama told reporters: "All three of us are in agreement that the time for delay is over. The time for denial is over."

Scientists try to mitigate climate change effects

POZNAN, Poland – Scientists studying the changing nature of the Earth's climate say they have completed one crucial task — proving beyond a doubt that global warming is real.Now they have to figure out just what to do about it.

So what are the possible prospects of human and labour rights in a post peak worlds? Will these be scaled back, will equal rights take a step back to an era of long ago? I remember some arguments where today's society treats men and women fairly equally as machine's have enabled the replacement of muscle power, thus rendering the physical strength of men kind of meaningless. In a post peak world, this inequality might quickly return.

Up until a few generations back I believe that people didn't have much choice, they did what their parents did, they lived where their parents lived and they married whom their parents chose for them. Will we see a return to such a situation? Will society become more conservative?

What of things such as human rights, justice, education etc? What sort of changes do you expect? Humans are social creatures and our society and life is built around social interactions IMO.

I would suggest you take a look at Elizabeth Warren's "The coming collapse of the middle class"..on youtube.

It is about the effects of women entering the workplace around 30 years ago.

I've seen it Airdale. Very informative and surprising.

I'm a big fan of Elizabeth Warren, but she doesn't "get" peak oil or the idea of resource constraints. I don't think she really understands what drove so many women into the workplace. She says it's competition for a house in a good school district...but why didn't that happen before? Because a good education wasn't required to have a middle class life before. And it wasn't just cheap labor that drove jobs overseas. It was cheap energy.

This is from Charles H Smith's excellent blog http://www.oftwominds.com/blog.html (he gets peak oil though not quite fully I believe, a prescient writer none the less).

This is one of the reader comments

Is what's happening these days a sign of declining NET energy per capita across the world?

Those countries which have recently experienced an increase in energy per capita have seen their living standards go up eg China and recently India (In the cities especially).

Sometimes the blog author talks of his time studying in Honolulu, Hawaii and how relatively inexpensive it was than.

Any words from TODer's who studied in the 60's, 70's and 80's? How was life back than?

Energy = Money

Once one understands that, everything else falls into place.

Granted Energy = Money but there was a different mind set then. I went to a state college in Texas 1950-1952 and room, board, books and tuition cost my parents less than $2500 for two years but anything else I had to work and buy for myself. I had a part time job in our massive dormitory where I lived that paid 50 cents/hr and on that less than $7 per week I had a good life. There were certainly no frills and I spent most of my time studying engineering subjects. BTW: My prewar Nash 600 got something over 25 mpg but the battery was shot and I had to park on a hill or have lots of pushers. Pushers had a different meaning then. I immagine the population has doubled since then and twice the people living on essentially the same amount of resources or less is at least part of the price increases. I haven't visited anyone going to college but I would immagine their living a lot better than we did with two men to a ~130 sq/ft room. Two beds, two desks, two chairs and two wall lockers in each room.

Wrong. Energy = money,

but money doesn't = money.

Energy is depleting and going up in value. Money is not depleting, and at some point will go down in value. Now credit = money,

but credit is depleting and therefore, for the moment, increasing the value of money. But if you print enough money, then you can stop credit from depleting since everyone gets paid off, in depleted money.

Understand?

The solution to the whole problem is quite simple: just print more energy.

Costs are higher now due to the cost of government, including transfer payments. These costs were much lower in the 70's. Higher energy prices play a part also, as does the relative amount of all resources, including land, due to the larger population (100 million added in USA since 1970).

I went to college from 46 to 50 on the GI bill, saved up on that to buy a year old car when I graduated, had lots and lots of job offers, got a scholarship to grad school, worked for NACA for 7 years, and then went on to teaching in 1960, earning $9K/yr, comfortably supporting an at- home wife and child.

My whole long education cost me nothing out of pocket.

When I "retired" in 1996 I was "earning" more than I want to admit, my wife was working full time, but we didn't have nearly the leisure time or sense of ease we had when I started. Net gain??

I have now reverted to my natural state of fixit man and junk hoarder, and feel better about it. Fixed a busted shower and a strangely psychopathic telephone line today, as well as a bit of Murphy's messups at the lab, and so to bed.

I remember a student strike at the University of Minnesota in 1963 when they raised tuition to $100 a quarter!

And the double whammy is that cheap energy is what made providing all of those higher educations possible. Before cheap energy, it was not possible for a large percentage of the population to stay in school into their mid 20's.

Yes. I don't think people realize how expensive our education system is. When I point out that we're not likely to be able to support the current level of education, let alone increase it (to "innovate our way out of peak oil"), people say, "But it doesn't take a lot of energy to run a college campus." That's not what I'm talking about. I'm talking about the costs of supporting an elite class. Whether it's priests, doctors, kings, or scientists...they're a burden on society. Perhaps a useful burden, but a burden nonetheless.

Unless we crash all the way back down to the hunter-gatherer state, we will always have elites...but there will be a lot fewer of them.

I think we will probably have to go back to more of an apprentice system. Graduate high school, maybe go to a two-year program, then apprentice and get on the job training.

Is there any real reason why people can't learn to do stuff as apprentices? It may make you less mobile, e.g. if the company apprentices you for X years, they may demand X years of service from you.

Most of what I know how to do at my job, I learned by doing my job. It would help if people had reading, writing, math and critical thinking done by the end of High School.

There's no reason people can't learn as apprentices. But I don't think we'll see a lot of scientific innovation that way. With the low-hanging fruit plucked, it's become pretty hard to add to our body of knowledge without a lot of expensive equipment/infrastructure.

I think it may be hard to even maintain our current level of knowledge. It's not just learning. It's the leisure to do work that is not immediately productive. Few people are going to farm all day, then teach their kids nuclear engineering in the evenings.

My Indentures still hang on my wall - there is a considerable benefit to understanding the practical realities of an industry by going through an apprenticeship. It allows a much deeper understanding of what goes on than one gets in the classroom, and the hands on training that is increasingly rare for undergraduate students. Computer modeling of a situation does not carry with it the understanding that standing knee deep in water trying to install a roof support carries about the real risks of mining, for example.

I always tried to get apprentices. Good ones were highly beneficial to us and to themselves. Computer simulations are a curse unless well mixed with the awful truths of the real world. My problem with my foreign students was that many were extremely reluctant to actually put their hands on machines instead of math models thereof. As a result they often would present an obviously absurd result quite happily, too ignorant of reality to recognize just how foolish it really was.

OK, so you have finished your simulation. Good. What is the piston amplitude?

Just as you see here- 10 meters.

TEN METERS! The whole thing is only .3 meters long!

It must be longer. The piston amplitude is 10 meters.

I used to agree with you, but now I'm not so sure. I think that we've accumulated a lot of data and results that would be hard to get without our present infrastructure, but very often the avalanche of research is not very well digested. There's never time to go back and work things through, put everything in perspective. Go back and read Marx' Capital. I'm not trying to be political here. It'll be a long time before you'll see a work of scholarship such as that.

Today's research is very, very mission oriented, very reductionist (which is necessary), but very neglectful of the larger cycles in which the item of study in embedded. I believe there will be plenty of stuff to do and think about even when we have a lot less equipment to do it with.

It's vital that we retain we've accumulated however. I don't know that we'll ever be able to duplicate our probes of the other planets, nor build larger particle acclerators. Oil and metals were, I fear, a one-time gift.

How many people read Marx now? How many people will read him in our likely poorer and darker future?

I don't think it's possible. We'll have to do triage, as Greer puts it: try to save the most useful information.

And even then, we can't count on retaining it forever. One thing we know from studying the collapse of previous societies: knowledge can be lost, even very useful knowledge.

A saying going around Russia these days:

"Everything Marx told us about communism was false, and everything Marx told us about capitalism was true!"

They already have that program. It's called the U.S. military. Four years of service and they'll train you in some mind-numbing technical job that prepares the apprentice for a mind-numbing job in the civilian world. Upside: If you're bright enough you get to work at a video screen with a toggle controller moving unmanned drones around 1/2 a world away. Downside: For the dull of wit the majority of training will involve small weapons and getting your ass shot at in real time by people from countries that you can barely pronounce and hate your guts more than you'll ever know.

But it beats pumping gas!

Leanan,

I kind of agree with you, but I wonder what timescale you are thinking of?

One could decide to give a higher priority to funding education, at least in theory, but this would require a re-think or debate about how and where we use society's resources.

It's striking how expensive higher education has become in the United States and this is not a positive development. The cost has rocketed in recent years. If I remember correctly, over the last couple of decades college has increased on average by over 400% far outstripping healthcare which has "only" more than doubled!

The second point about the costs to society of supporting an elite class is problematic. It depends on how one defines an elite. Priests, doctors, scientists, teachers, musicians, writers aren't really the elite. We can easily afford them. However, the "elite" we really can't afford, the elite that matters, is the capitalist class. They are not only extraordinarily expensive they are also almost totally redundent, having outstayed their historic sell-by date by decades. We don't need them anymore. The top 1% of the US population squeezes out and controls over 40% of the wealth of America. The top 3% getting on for 75% of societies wealth. These are extraordinary levels of structural inequality, like a blight on the entire country.

These people, with lavish lifestyles supported by a giant social pyramid of poor and ordinary working people earning tiny fractions of their incomes are also incredibly powerful politically as well as economically. In reality virtually the entire country is organised for their benefit, as the distribution of wealth shows, and it's their narrow, selfish and entrenched interests that shape society. Yes, they are a burden, but a burden we no longer need to carry on our backs like beasts.

We all, the vast majority of ordinary Americans, people who work for a living, not the financial aristocracy, has a harsh but simple choice for the future. Either we get rid of the elite or they will get rid of us, one way or another. They lead and rule the country and they are leading us over a cliff. The elite won't disappear, the rest of us will first. The elite controls the apparatus of the State giving them enormous power, coercive power which they will use to maintain their lifestyles and position at the very pinacle of the social pyramid.

Because there are going to be so many poor people relative to the tiny minority at the top, it'll be a long time, I would contend, before their numbers will drop significantly, compared to the great mass of the population that'll be hit hardest by the coming Great Depression.

Probably what we need to save are the two year technical schools and community colleges. Bill Gates wants to help community colleges:

http://money.cnn.com/2008/11/25/magazines/fortune/GatesFoundation_Wallis...

By "elite," I mean people who don't support themselves. That includes most of us, of course. A hundred years ago, 97% of Americans were farmers. Now, 3% are, and they feed the rest of us.

If we really have to run our civilization on a solar budget, I think we're eventually going to get back to something close to those numbers. A lot more of our economy will be devoted to basic subsistence, which means less for other things. College will once again be for the wealthy only.

Any chance we could start by eliminating the priests and the kings first?

They don't really exist other than as an adjunct to economic development (ie. the adaption of unrefined humans into units of economic productivity). With economic collapse their "raison d'etre" will be undermined and they will be rationalised to the new reality. Along with entertainment, leisure, etc used to pacify the animal needs of humans and ease their confinement within the economy.

Rights, laws, constitutions, democracies are all optional and are allowed while they serve the State. When they don't, they're amended or replaced as required.

When did social innovations like the minimum wage, labor rights, Social Security, and unemployment insurance become a fact of life in America. It was during the 1930s which most agree was the worst economic decade of the 20th century. Easy economic times lead people to believe that individual effort is what makes for the good life. You didn't have to be the very best to have a good life in a prosperous world. It is when people who were previously well off become impoverished that they see how interconnected our fates are and how collective action is the way forward. A certain threshold of pain needs to be crossed before progressive political programs and fair tax and trade policies become enacted. Something like 150 million Americans without health insurance may be needed for us to get universal health care enacted. When people see how unlikely their chances of becoming wealthy are will they go back to 50%+ top tax rates. Of course there will be loud voices in opposition just as there were in the 1930s and there is the risk that the military will side with Wall St and against Main St and a true fascist dictatorship could emerge.

http://www.gulf-times.com/site/topics/article.asp?cu_no=2&item_no=259889...

Iran’s crude output may fall 25%; exports will cease: report

Net Exports from Iran (EIA):

http://tonto.eia.doe.gov/country/img/charts/IR_net_imports_large.png

Consumption:

http://tonto.eia.doe.gov/country/img/charts/IR_cons_large.png

Our middle case has Iran at about 1.5 mbpd in net exports in 2015 (worst case of about 0.5 mbpd), versus 2.7 mbpd in 2005 and 2.3 mbpd in 2007 (EIA): http://www.energybulletin.net/node/38948

The "fast decliners" are the exporters with relatively high consumption as a percentage of production, e.g., Export Land, the UK, Indonesia and Mexico--all around 50% at final peaks. Iran, in 2005, was not too far below 50%. In 2005, their consumption as a percentage of production was 38%. It increased to 43% in 2007. Of course, when they get to 100%, they stop being a net exporter.

Here are the recent annual EIA numbers for Saudi Arabia's consumption as a percentage of production:

2005: 18%

2006: 20%

2007: 23%

2008: 23%*

*My estimate

Westexas,

Any idea how Iran's lack of refining capacity will influence "net" exports? I can imagine their net exports will not be too much influenced by their consumption.

Of course, the net export calculations take into account Iran's gasoline imports. They actually had a little bit of success in 2007 in slowing their rate of increase in consumption, via a rationing program. Here is the EIA data table:

http://tonto.eia.doe.gov/country/country_time_series.cfm?fips=IR

In general, once an exporting country starts showing lower production, the rate of change in local consumption just changes the slope of the net export decline, e.g., at a +2.5%/year rate of increase in consumption, Export Land goes to zero net oil exports in 9 years. At no increase, they go to zero in 14 years.

With regards to Iran's rationing program - has it been a success? What form do those on here believe a rationing program should take - Tradeable energy quotas? http://www.teqs.net/

Or something else?

I found this quite interesting:

http://www.historyandpolicy.org/papers/policy-paper-54.html

Rationing returns: a solution to global warming?

Although according to the paper- rationing will be more likely to be accepted if it is seen as a temporary solution -though I can't see anything temporary about our predicament.

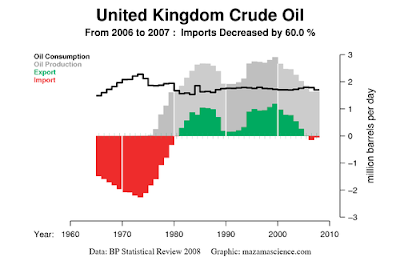

The BP 2008 Statistical Review numbers are very slightly different from the EIA numbers but the basic story is the same for the recent past -- increased domestic consumption of oil with flat production. Here is the plot from the Energy Export Databrowser:

Of greater concern is Iran's dependence on Natural Gas to fuel growth:

Converting to common units, (million tons oil equivalent) the BP 2008 numbers are:

Although the global recession will undoubtedly hit Iran, I would imagine that they are not as tightly bound to the global market as other nations. It's unclear whether they will see a fall off in demand as sharp as in some of the export-dependent nations.

But their rapidly growing population will continue to put pressure on energy supplies.

So from an external perspective, Iran's oil production and consumption are of keen interest as they reflect on oil available to the global market. But from an internal Iranian perspective, the annual growth in production of Natural Gas is perhaps of more concern as it has been a key factor in stabilizing their domestic energy infrastructure.

Iran will only be politically stable as long as the current regime can provide a minimum level of jobs and access to energy. Things may get interesting if anything upsets this balance.

Here is the expanded version of the net export/import aspect for natural gas. Most recent EIA export/import data for natural gas in Iran:

Verleger, quoted at Platts, says OPEC needs to cut 7mbd to restore "balance" to world oil markets. But they can't. Therefore, we will have oil accumulating in storage and tankers for years, no place to call home. The Saudis seem supremely uninterested in ever getting back their tanker, seized in Somalia. Wonder why.

Reversals in crude oil demand usually take up to 10 years to reverse back. See the 1979-89 period.

Oil everywhere all the time for years and years. 10 years anyway.

Well, I think that natural gas will soon so abundant and cheap that that most ground transportation will switch to CNG, and we can make synthetic liquid fuel (GTL) for air transportation. At the 2007 rate of increase in production, just the Barnett Shale alone will be producing about 7,000 TCF per year in 2031. If my math is correct, this works out to the energy equivalent of about 3,000 mbpd of oil equivalent production per day--versus a puny 86 mbpd or so of total liquids today.

So, no worries, PARTY ON DUDES!

Stacking oil barrels on top of each other at a rate of 7 million barrels per day (Verleger's estimate if excess production today), it would take 60 days to reach the moon.

Now, that is what I call a glut. And that is in the first two months. We have 10 more months each year after that.

A tsunami of oil.

There's no way in hell demand hasn't bottomed.

You're assuming we're not about to be plunged into the Second Great Depression I assume? I certainly hope not but if Ilargi/Stoneleigh (and others) are right - you ain't seen nothing yet.

I personally hope they're wrong but fear they may well be right.

During the 1979 to 1989 period the U.S. permanently reduced crude oil consumption by replacing fuel oil with natural gas to power electrical generators. Currently the production from existing oil wells is declining at a rate of about 6% per year, possibly 9% per year according to the IEA. With a low price for crude oil many new oil well projects are being shelved until the price rises. At a 6% annual rate of decline and assuming no new wells, the world production would drop from 75 Mb/d to about 40 Mb/d by 2019. The rate of decline would exceed a one time reduction of 7 Mb/d, or 9.1%, in less than 2 years. Making a forecast does not make it rational.

Actually, the US didn't do that. Many units that had been converted to oil and gas from coal were brought back to coal firing. The easily retrievable number as seen here:

http://www.eia.doe.gov/emeu/aer/txt/stb0805b.xls

Notice that both oil and gas usage for electrical generation dropped significantly while coal consumption increased. In addition, new installed capacity (listed by primary fuel) was added and brought on-line as follows during that 11-year stretch:

Bituminous coal: 30.3 GW

Distillate Fuel Oil: 1.8 GW

Geothermal: 2.2 GW

Lignite: 7.5 GW

MSW: 1.6 GW

Natural Gas: 17.9 GW (mostly simple cycle peaking turbines)

Nuclear: 53.8 GW

Residual Fuel Oil: 2.7 GW

Subbituminous Coal: 51.9 GW

Solar: 0.3 GW

Hydroelectric: 14.1 GW

Wind: 1.0 GW

Total for all sources (including others not listed here): 189.3 GW

During that stretch we installed almost as much nuclear capacity as the entire nuclear capacity of France AND just over 50 percent of the new installed capacity were of one of the forms of coal.

platts is short on details. it is not clear at all that they did anything other than pull that one outta where the sun dont shine.

is there a bigglut of naievete here ?

Why does Iran don’t build refineries? Any good explanation?

Iranian crude is of fairly low quality. I suspect the economics are similar to Mexico with its Maya crude better to send it to the complex refiners and buy gasoline on the open market.

One would think that if the refined the crude themselves it would be at a significant loss plus the capitol investment.

By importing they can control the subsidy level.

I will note that the fact that Iran is susceptible to a cut off of gasoline imports always made me wonder about the sanctions and the nuclear issues. If the west was serious one would think it could cut the gasoline imports to force Iran to comply.

They have the Abadan refinery, which used to be the largest in the world.

The "fast decliners" are the exporters with relatively high consumption as a percentage of production, e.g., Export Land, the UK, Indonesia and Mexico--all around 50% at final peaks. Iran, in 2005, was not too far below 50%. In 2005, their consumption as a percentage of production was 38%. It increased to 43% in 2007. Of course, when they get to 100%, they stop being a net exporter.

According to the BP Stat. Rev. 2008, Iran consumption/production was 36% in 2005 (1578kbd/4359kbd) and 36% in 2007 (1621kbd/4401kbd). Iranian oil consumption decreased in 2007 over 2006, and even the average annual increase over 2003-2007 was a miniscule 41kbd per year. Hardly anything to get excited about, considering that their current (2007) value of production minus consumption is 2780kbd, or about 68 times the size of their annual consumption increase.

Also, the UK isn't an example of the export land model. Why do you keep pretending that it is? Its consumption has been flat for decades:

I have some doubts about the BP data since for example they show that the UK was a net exporter in 2007, when the UK and the EIA show them to be a net importer (the EIA shows increasing consumption in Iran in 2007, albeit at a slower rate of increase).

Regarding the Export Land Model (ELM), I always find it interesting when I am criticized for misusing a model and a term that I originated. The crux of my argument regarding the ELM is that production declines in an exporting country magnify the resulting net export decline.

For example. Let's assume flat consumption at one mbpd, and production of two mbpd, with a -5%/year decline rate. A -5% production decline rate results in a initial -10%/year net export decline rate, and while the production decline rate stays the same, the net export decline rate accelerates with time. The rate of change in consumption just changes the slope of the net export decline, once production starts falling. This is the point we made in our top five net exporters paper, when we compared the year over year changes in net exports from Export Land, the UK and Indonesia:

http://www.energybulletin.net/node/38948

On a positive note, it's good to see the Obama administration talking about much needed action on climate change, the article from yahoo regarding his meeting with Gore was encouraging, he has taken steps to close down Guantanamo bay and atleast they are already talking about an energy plan and alternative energy and embracing the web more and more with his weekly youtube address and change.gov site.

There is plenty to be skeptical about, some would be cynical even. But it's a start. :-) The journey of a thousand miles begins with a single step.

"...some would be cynical even..."

Thats my queue.

Obama: We are going to get tough on climate change and we have just the Global Military Presence to do it.

The American Lifestyle is non-negotiable.

or maybe he will say "Americans we need to cut our FF consumption in half in 2009". Clap Clap Yeaaaaaaa!

"We are going to get tough ... Global Military Presence ..."

Un-manned aircraft search for point sources of CO2 emission. Cruise missiles disable point sources of CO2 one at a time. Zero troops on the ground.

Sounds like a plan - a really scary plan.

The American Lifestyle is non-negotiable you say, but surely there are a lot of people who have been quite willing to change it on their own. Those on TOD, other peak oil survival blogs, with the coming depression possibly more people will have to change their lifestyles.

It's just a matter of education. There are plenty of smart people in America who have already made smart choices, more information and knowledge about peak oil would force the rest to follow.

VK - I don't know if you have read (stomached) many of my posts but I have made profound changes in lifestyle andbelieve it or not I am very low key about it.

None the less I am constantly derided by family and friends for my decisions.

I know of no one that is making anthing more than a token effort at change. They hear about the constraints and say to me "I bought a Prius OK so lets talk about something else.

Minimal hopes

I've read many of your comments, you have made many efforts to educate those around you. Kudos to you for that. In the end I guess we can only keep the effort up. My thoughts on the matter fluctuate considerably depending on what news item I read. From doomer to cornucopian in a day! Think Nate Hagens wrote about this, related to the recency effect on memory.

What gives me hope is that coming from a developing country,with some smart thinking,conservation, education and adaptation, the West can retool. A LOT of energy is being unneccesarily wasted IMO. America could survive on 2 million barrels per day and have a little luxury. If people were willing to scale back their lives.

I know it's really hard to change people, my friends and family listen to what I have to say but no one has really changed their outlook. The way I see it, they'll have to change eventually, regardless. They can either do it willingly or take the harsh blows of reality.

Being a doomer, I see a different scenario. A time of chaos followed by a forever time of hardship. Mad Max is a bit much but fights for water, food and heated shelter are reasonable. The electrical grid is the critical function because without it, there will be no money except 'hard' currency. We intend to keep a very low profile during this time and those that survive those three or four months will be smarter by far than before.

I don't believe in timelines and I will be very happy if this scenario does not happen but we are ready psychologically, which I believe is the most important part.

My parents dubbed me The Master of Doom.

I tend to get invited only once to parties not sure why :)

However my parents are a cornered audience I tend to do better with people that cannot escape.

Mike, we're in good company. I too have been called a Doomer. But both of us have a ways to go, me further than you. Roubini is called Dr. Doom and at least you're a Master of Doom. How does one become a Doctor of Doom? Does one need a Ph.D. in Doomology? Perhaps I need my Masters first...

LOL I suspect you get your Doctorate first year after TSHTF. Its a fast track program.

My poor kids are going to have to suffer with old fart dad that predicted all this crap would happen and stories of the bad old days when we had so much we could eat meat every single day.

To be honest outside of getting active in my local community once I get out of Orange County CA I'm done

no matter how things turn out. I'm done and realize I'm missing living.

I really just want to grow tomatoes and hopefully eventually have some decent vines and make drinkable wine.

Do some fishing and catch fish that are actually edible and enjoy watching my kids grow up.

Sounds nice. :-)

America will wake up from the energy party of the last 50 years with one helluva hangover... I can just her her now...

Disneyworld... Must have... Walmart... Ahhh... The headache, the pain... Must have... Hummer... Suburbs... Incandescent bulbs... Domestic oil... All gone... I gotta throw up...

Spain's hard times squeeze immigrants' toehold

Life has become miserable for many immigrants, yet they don't want to go home. They're too ashamed to return with nothing.

World Focus had a story last night about Spain and unemployment.

http://worldfocus.org/blog/2008/12/09/tuesday-december-9-2008/3172/

It starts at about 19.5 minutes into the broadcast

8 really, really scary predictions

Actually, not that frightening. Most of their doomsters nevertheless see a light at the end of the tunnel, and sooner rather than later.

Wow. He's saying that the folks that will be doing the best are the ones getting government handouts. Intertesting...

Good times...

$1000/barrel oil?

Bank of the United States of America?

Wow. Good article, Leanan...

More like Hedge Fund of the United States of America ;-)

Maybe I can add to the doom and gloom! :D

This from bloomberg, http://www.bloomberg.com/apps/news?pid=20601087&sid=aKlTQb6af0jc&refer=home

Q Ratio Signals ‘Horrific’ Market Bottom, CLSA Says

I reckon it'll go to 400 well before 2014. Maybe middle of next year?

Interesting bunch! So White, so conservative, so capitalist in outlook. Anyone with a little intelligence, a half-way adequate education, and eyes in their head could have forseen the crisis coming. It was obvious. The property bubble was really the canary in the mineshaft, a symptom of far wider and deeper crisis in the very structure of the US economy, and economy which has been gutted. US manufacturing has been gutted in favour of the financial sector where one could make obscene profits by literally creation money out of thin air. A feat that was beyond even the alchemists, they dreamt of turning base metals into gold, Wallstreet managed it though. Although one could argue that Wallstreet, more powerful than Washington, were even worse than the alchemists and far, far, more dangerous for society as a whole.

Getting America healthy again is going to require surgery, cutting our the parasite that's squeezing the life out of the country, and these experts and their ideology, mostly represent the public, acceptable face of the parasite eating away at the guts of America.

Ordinary Americans have seen their proportion of the country's wealth shrink compared to the ruling minority at the top. The current crisis is the result primarily of this income squeeze. The debt and property bubble hid the true extent of the dire state of the real economy from view. The super-rich did fantastically well by sacrificing America's manufacturing base and moving production overseas, substituting it with cheap imports and making massive profits. For the ruling class, who are definitely not an "elite", it's irrelevant where the profits come from; China or Detroit, Mumbai or Chichago, as long as the profits are substantial. Then at the other end they made massive profits for years selling ordinary Americans debt in massive quantities to pay for the imports they were bringing in from abroad, what a profitable scam! Then when ordinary Americans are drowinig in debt and cannot take anymore and the system collapses, what happens? The financial aristocracy demands to be bailed-out by the State using ordinary Americans tax dollars!

So ordinary Americans, decent, hard-working people, though fantastically abused, are screwed over at least three times, by an tiny aristocracy of a couple of million people who don't give a damn about the rest of society and the harm they do, the lives and dreams they destroy. One couldn't make it up. Where the hell is Robin Hood when he's needed?

That's the real scary elephant in the room. Once that bubble busts... look out.

As I'm just finishing writing a violent, erotic and political, novel about a group of upper-class anarchist revolutionaries in Zarist Russia, I'm in full-on revolutionary mode, so to speak!

This is big problem, the reckless risk of underming the value of the dollar in order to rescue Wallstreet from it's own excesses. For how long can the United States demand economic "tribute" from the rest of the world? Americans financing their lifestyles with foreign debt is unsustainable in the long run, or even the relatively short run.

The "elite" the financial aristocracy who run America are running the country into the ground, destroying it, and they don't care. They are so powerful, so obsenely rich and influential that they can maintain their luxurious lifestyles for a very long time, whilst ordinary, hard-working, Americans go to the wall, just like in the 1930's.

What's terrible, and potentially dangerous, is how little say or voice ordinary people have in the way the country is run. They might as well be peasants in eighteenth century France, watching the antics of the aristocracy living in their lavish dreamworld in the parallel society of the court at the palace of Versailles, and we all know what that frustration, anger and opression led to in the end. Like the French peasants, how long will ordinary Americans accept their lack of influence over the way the country is run and where it's going? For how long will they accept that they are being robbed blind by an arrogant, greedy and profoundly incompetent, ruling class? When will ordinary people get their fair share of the country's wealth that they created? Why cant' one have a society which serves the interests of the 97% of Americans and not the 3% who call the shots?

Obviously I think the answer, solutions, to nearly all of our problems and challenges; global warming, peak oil, environmental degredation, poverty, are fundamentally political in nature. We simply cannot ignore the core political questions anymore, how we distribute power and wealth in society, who gets how much and why, who really benefits from the way we currently organize society and how long can it go on like this?

Wow,

I always sensed Writerman to be sorta like,middle of the road.

But the last couple posts above seem to be way way way off the road.

What happened one wonders?

However I agree about the Elite.So then? Is Obama an elitist?

I dare to think he just might be. Or surround himself with elitists as he appears to be doing. The coveted class then.

Yes we Merkuns have been used. Common ole Mr. Joe Sixpak has been done in. We have been lied to and cheated. We dreamed. We dared to dream.

Now we awaken and all has been stolen from our dreamstuff.

Many are in denial. Many awaken and just shake their heads.

So I ask. When does the sheer pure out and out PANIC start to occur?

When? When will ordinary man finally speak? Ohhhh he did..at this last election. Ahhh got it.

We have been had.What has to happen won't be what Disneyland East proposes. It will all fall back on the common man. Then the elites can come back once more.Once the dust settles will they squirm out of the woodwork,out of the mists,out with their smarmy smiles and sharp blades hidden,trophy bimbo wifes dragging along behind them. Lawyers at their elbows. The cry of the wild lobbyist will once more be heard in the land. Accountants in tow. Yeah...I can see it as a distant vision.

Only 14 more shopping days to Christmas.Wow.

And then the retailers will be done for ,tis said.

I got tired of all the piped-in decades old Christmas Carols,so ain't going back agin to the mall. Got my bourbon and got my Rocky Patels.

Got my fruit cake ingredients.

Airdale-I just wanta see one more good vampire movie with Kate Beckinsale before it all ends. In tight black leather too. The fangs don't bother me.

Does the history of Bastille Day ring a bell? It might just be coming again!

We can grow our smoke and our own homebrew, ain't too many things a country boy can't do.

We can skin a buck and run a trot line, a country boy can survive!

Airdale,

I'm a lot like a method actor. I get into a kind of mindset, or role, based on the characters in my stories and kind of turn into them for the duration. I try to get under their skin and make them real for me and the reader. My family notice the change in me and give me space to channel. Last night I was in full-on Katinka mode I suppose. She thinks, if one is going to live, one has to live gloriously, in total freedom and without fear, or not live at all. She's both; brave, foolhardy, idealistic and a little mad, but I like her character!

Writerman,great to hear that you are at least looking into the Anarchist thing.Have you researched Emma Goldman?She lived for many years in the USA and was finally expelled not long after WW 1.She returned to Russia but found the Bolsheviks were about the same,or worse standard than American capitalists.She spent the rest of her very eventful life in Western Europe.

Anarchism seemed to become more popular,and not just in Czarist Russia,in the late 19th,early 20th centuries.This was the peak of laissez faire capitalism.No coincidence and very much relevant to the situation today.

We have many lessons to be learned from the Anarchists.

I too think we've got a lot to learn from and about the Antichrists.

The main character in my book, which is called "The Tattooed Lady"; not to give too much away, ends and starts, back in the same cell, in the same jail; once unde the Czar, once under Stalin. That's supposed to make a point.

Shurely Shome Mishtake? You mean anarchists - right?

Anarchists are brewing trouble in Greece.

http://www.reuters.com/article/worldNews/idUSTRE4B91LB20081211

I think this will blow over eventually, but it is definately a sign of the times.

While Greece is ready to disintegrate (and has been for a couple years now), what we're seeing right now is not that.

short synopsis, in Greece, especially Athens, it is an almost weekly phenomenon where middle-class kids go out vandalizing

and making trouble- while feeling really cool that they're really rebelling against The Evil Capitalists... they smash some

windows, set a dumpster on fire, and when the cops inevitably come, they throw some rocks and then retreat to the univeristy (police

aren't allowed on uni campuses in GR) and then reconvene at coffee shops to brag about it. Sometimes it turns into a bigger scuffle with

the cops, and again- the kids are looking to demonstrate how oppressed they are and how they are resisting.. The cops in GR have been

_really_ hands off, the public has a historic sensitivity to police violence from occupations, civil wars, previous regimes, etc, but

sometimes things escalate. This time, the kids came much more prepared with rocks, molotovs, etc, and as it escalated, the cops

shot a kid. Then every univerity town across the country erupted. In the following days, politicians of every color have been trying

to capitalise on the trouble, while run of the mill hooligans have turned window-smashing into full on looting. The politicos are

looking on expecting the current government to fall and the ones who expect to take over are making sure things got out of hand _just enough_

to take advantage of the situation.. it will calm down (already is, to some extent) and it will go back to business as usual.

But very fundamentally Greece is sleepwalking. The whole country runs on imported money buying imported goods, the public sector

is strangling any independent productivity, and the government's only reaction to anything is to spend money on highway construction.

However, Greece does have, outside of the cities, quite a high degree of real day to day liberty- nobody's going to get in your

face and tell you what to do or not do, and the suffocating EU micromanagement is just a far-off story..

sucks to be an independent shopkeeper in Athens though.

Wholesale inventories, sales plunge in October

Half of 'rescued' borrowers still default

Then golley gee, rescue them again.

You do this about 3 times, and (hopefully) you can push down the foreclosure rate to 1/8 of what it should have been. /Sarcasm off

Seriously, they aren't dealing with the root of the problem... Too much outlay (i.e. too much of a mortgage, possibly with a resetting ARM, into a depreciating asset) and not enough income (taking a lower paying job and/or becoming unemployed). Unfortunately, there's going to be no help for these folks in the next few years. I can't possibly think of a solution other than to write off the a chunk of their mortgage to a point that these folks can afford them (i.e. write down a $300K loan to $120K.)

I'm not sure even that will help. If people don't have jobs, they can't make mortgage payments.

I say we go back to a simpler plan.

"If you can live in the house, maybe keep a garden and a couple of chickens, a goat or whatever, the place is yours."

Seriously. People need to live somewhere. Houses and buildings fall apart or are vandalized when not occupied and cared for at least a little bit. Neighborhoods are safer when people live in them who are trying to make a go of it. Everybody wins -- except for the crooks at the top who have been running the real estate bubble scam.

Homestead. Sure, there would be problems, but this does seem like the most just and straightforward solution to me.

Miami Activist Moving Homeless People into Foreclosed Houses in Miami

Sounds good. I'll stop paying my mortgage, too.

BIS warns of collapse in global lending. Pretty Grim stuff from Ambrose Evans as usual http://www.telegraph.co.uk/finance/newsbysector/banksandfinance/3685332/...

Notice the percentages involved, these are huge drops. And I suspect that they will get worse.

Some owners may intentionally fall behind on mortgage

Can't access the link, but find it hard to believe Spain has had as nmany immigrants as Britain has in the last decade.

Why? Spain is the gateway to North Africa. Spain and their Canary Islands receive boatloads of refugees and asylum seekers, and they have/had a booming trade in food production (Andalucian greenhouses) and vacation home construction. Spain has been Europe's California and Florida combined.

Spain has had huge numbers of BRITISH immigrants for decades. Goes a long way to balancing the extra immigrants to Britain.

A lot of people retired to Spain. Their pension went a lot further than back home.

"Nuclear fusion could prove an abundant source of clean energy."

In 2007 at the ASPO-Ireland Conference in Cork, Michael Ditmar convinced me that fusion would never happen because of a lack of tritium resources on earth. Are there any out there who can offer additional commentary on this subject?

DC

We can breed tritium from lithium 6. Oh I forgot, the world is running out of lithium too.

Not according to this table... (PDF WARNING!)

Not to say *I'm* right, but are we facing peak Lithium...?

Check Sustainable Energy Without the Hot Air, in his view it depends primarily on lithium resources. Here's a an interesting bit by way of introduction:

A different resource in short supply might also be money, even without the financial crisis. See RMI's paper on the (lack of) competitiveness of nuclear vs. other energy sources:

Forget Nuclear

Not that I suspect controlled nuclear fusion will play any sort of prominent role in the global energy supply picture for the next couple of centuries, but the notion that lithium reserves are in any way a limit to nuclear fusion is ignorant.

http://en.wikipedia.org/wiki/Lithium

"Estimates for crustal content range from 20 to 70 ppm by weight."

Thats ten times the abundance of uranium.

The example of France seems to indicate a different outcome than this work that comes from an institution that clearly has no axe to grind with nuclear power.

That's what heavy water reactors are for.

D2O is irradiated with neutrons from a fission reactor to produce tritiated water. Tritiated water is then separated from the heavy water for additional processing to produce tritium.

Heavy water reactors (e.g. CANDU) are indeed a good method of producing tritium as a byproduct. However, there is another known process. It is not popular and has been ridiculed, often by those who have not taken the time to try to understand it or by those with a vested interest (bias) against it. This is the process known as "Low Energy Nuclear Reactions" (or "Cold Fusion"). Please see the following web-site for a great introduction to the topic:

http://www.lenr-canr.org/

There have been more than 1000 peer-reviewed publications verifying the technology since 1989, including many from government labs such as Los Alamos, and the China Lake Naval Weapons Lab, but it is still considered to be "pathological science" by many. Of course, such claims have often been made against nearly every major scientific advance throughout history. If you want a good comparative example, check out the early controversies during the first 5 or 6 decades of the 20th century against the Big Bang Theory of Cosmology (or the heliocentric model of the solar system in the 16th and 17th centuries).

Cold Fusion has repeatedly demonstrated that many different nucleii can fuse (usually at pretty low rates), under certain highly favorable chemical conditions (e.g. during high deuterium loading of a palladium metal lattice, almost 1:1 seems to be required). One of the by-products of the fusion of deuterium is tritium (although the principal product has been shown to be Helium 4 in many Cold Fusion reactions).

As I understand the current state of the politics about Cold Fusion, it is currently being evaluated as an alternative technology for the production of tritium. However, I would suspect that purchasing tritium from the processing of CANDU moderator would be more economic at the current time. Nevertheless, if Cold Fusion can be scaled up, and somehow I suspect that this would be easier than scaling up Hot Fusion (LOTS lower heat densities!!), the need for tritium for fusion would be removed. Deuterium is present in sea water at concentrations of about 1% of naturally occurring hydrogen. Unlike Hot Fusion claims of abundant energy "free from sea water", Cold Fusion actually seems more likely (to me) to deliver on that promise.

Please take the time to read the LENR website with an open mind. Propaganda can bite both ways.

Good Luck to us all in this turbulent difficult time,

Ian

A number of years ago I worked in the D-area of Savannah River where we recovered tritium from tritiated water brought from the K-reactor (heavy water), so I am familiar with the processes involved. I used to joke that I didn't have to worry about random drug screening because my urine was sampled so frequently for bioassay and my exposure to tritium was well-monitored.

And just a brief observation, if cold fusion worked as promised it would completely obviate any need for hot fusion. Nuclear binding energies are what they are.

Not for a lack of tritium - 3He-3He reactors are like 3rd or 4th generation reactors - so WAY down the line

the biggest problem (other than the enormous expense - and who is going to finance these kinds of experiments in this economic environment?), is the engineering problem(s). Containment is #1 - even the proposed ITER reactor is likely to have major issues with containment and materials degradation. One of the physicists involved with ITER said he thinks they will have to constantly shut down and replace materails that are breaking down around the reaction. And ITER is 20 years away! (IF funding were to keep construction happening).