DrumBeat: December 16, 2008

Posted by Leanan on December 16, 2008 - 9:30am

Robert Bryce: OPEC Was Right About Oil Prices. Now What?

Back in June, I wrote a piece for The American in which I argued that oil prices were being driven higher by the immutable law of supply and demand. Today, with prices plunging to near $40 instead of the $145 level seen in mid-July, it’s abundantly obvious that speculators were a key driver, probably the main driver, of the surge in oil prices that occurred between late 2007 and July.So, to be clear, I was wrong. The leaders of OPEC were right. So, too, was my pal, Ed Wallace. In May, Wallace, a savvy journalist from Fort Worth who writes for the Fort Worth Star-Telegram and Business Week, published several articles which he showed how the unregulated futures market was being used by speculators to push prices upward.

Don’t be fooled by low gas prices — the crunch is nearly here

In Greek mythology, the enchanting songs of the Sirens lured unwary sailors to shipwreck and death. Today's Sirens are the roadside signs singing sweetly, "Cheap gas! Cheap gas! Drink deeply and be at ease, weary traveller!"After suffering record-high oil and gas prices earlier this year, it's understandable that we see cheap gas as anything but a danger. We're in a recession. Times are tough. It's a relief that the cost of getting around and heating our homes has plummeted. It's also an economic stimulus at a time when we need all the stimulus we can get.

But before we drink deeply and relax, let's have a good look through the telescope at what lies ahead.

Panel: Navy will need oil for decades

Bartlett especially is a believer in the “peak oil” concept, O’Rourke said, the idea that the world will pass a point at which oil production declines, with potentially disastrous consequences. Nuclear power frees the Navy from oil’s financial and operational puppet strings, Taylor and Bartlett have said, but Navy leaders have resisted because of the high upfront costs of building nuclear ships. O’Rourke suggested that a new generation of efficient, hybrid electric propulsion plants could let the Navy point to a cheaper alternative to nuclear power.

Will postponed investment push peak oil forward?

...Mr Chris Skrebowski, a member of The Oil Depletion Analysis Centre (ODAC), a UK charity established to promote the awareness of oil depletion, is one of those who argue that, though there is still sufficient oil in the ground, oil companies will not have the capacity to meet demand and peak oil will occur by 2012, if not before. To arrive at this conclusion, he meticulously looks at all new development projects to which the oil companies are committed, calculates the depletion of current oil provinces, and comes up with a probable net effect on production capacity.It is true the current postponement and slow-down in projects support Mr Skrebowski's contention and those who think like him, but are they right? I much doubt it because history is not on their side. Back in 1998, the oil companies took their foot off the pedal and changed down a gear, but they soon accelerated when conditions started to change in 2003. I see no reason why they cannot do the same once oil prices pick up again and reach, say, the $60 a barrel mark. Offshore production in deep waters is costly--some say in pre-salt offshore Brazil it could be as high as $40 a barrel--and so is production from tar sands, but both should be sufficiently attractive at a price of $60 a barrel.

Pirates attacked five Iranian oil tankers this year

LONDON (Reuters) - The chairman of Iran's oil tanker fleet called for tougher action to fight piracy in the Gulf of Aden on Tuesday, saying that five Iranian supertankers laden with oil had been attacked by pirates off Somalia this year.In a statement Mohammad Souri, chairman of the National Iranian Tanker Company, one of the world's largest, said world oil prices could rise if strategic sealanes went unprotected.

Turkey: Iran, Iraq could supply gas for Nabucco

ANKARA, Turkey (AP) -- Turkey's president said Tuesday that natural gas from Iran and Iraq could help fill a pipeline that would transport the commodity from the Caucasus, through Turkey, and on to Western markets.Abdullah Gul said "the most important issue regarding this project is to obtain enough gas." Gul said Turkey could import gas from Iraq through a new pipeline which is yet to reach the Turkish border, and buy more gas from Iran to feed the Nabucco pipeline.

Basra seeks to flex muscles in Iraq

(CNN) -- A move is afoot to make the oil-rich province of Basra a more potent political and economic power in Iraq.Lawmakers have started a drive that would give the Shiite-dominated province the status of a federal region -- the same legal power as the multi-province autonomous region of Kurdistan in northern Iraq.

US takes greater Basra role as British troops prepare for exit

Even before British troops begin their withdrawal from southern Iraq, US forces are already stepping in to finish the job of securing the oil-rich province.At the dusty British military headquarters at Basra’s airport, the Stars and Stripes flies alongside the Union Flag in a symbolic demonstration that after nearly six years in southern Iraq, the British era is coming to an end.

Lukoil Cuts Spending on Forecast of Cheap Oil to 2010

(Bloomberg) -- OAO Lukoil, Russia’s largest non- state oil producer, is cutting production and investment costs on expectations that oil prices won’t rebound until the middle of 2010 at the earliest.“According to the forecasts of Lukoil experts, the period of low prices will continue for a minimum of 1 1/2 to two years,” the Moscow-based company said today in an e-mailed statement. “That means the company will have to correct its plans, budget and investment program.”

Algeria's gas fields seek to set eco-example

IN SALAH, Algeria (AP) -- A gas field in the Sahara Desert is seeking to set a global environmental example with a project to bury carbon dioxide instead of spewing it into the atmosphere.A joint venture of Algerian and international oil firms in In Salah, one of Algeria's largest natural gas fields, has invested $100 million to capture the greenhouse gas as it's emitted and inject it deep underground.

Despite economy, 3 companies stay on alternative-energy path

President-elect Barack Obama has made renewable energy a centerpiece of his plan to resuscitate the U.S. economy and fight global warming.Yet the credit crunch and nose-diving energy prices are prompting companies to scale back or cancel alternative-energy projects. In 2008, total spending on clean-energy projects is expected to fall 4% to $142 billion from 2007, research firm New Energy Finance says. But venture capital and private-equity firms are still investing in emerging technologies, it says. This year, such investments will increase to $14.2 billion from $9.8 billion in 2007.

Here are three companies that are forging ahead...

Abrupt Climate Change: Will It Happen this Century?

A new report, based on an assessment of published science literature, makes the following conclusions about the potential for abrupt climate changes from global warming during this century.Climate model simulations and observations suggest that rapid and sustained September arctic sea ice loss is likely in the 21st century.

The southwestern United States may be beginning an abrupt period of increased drought.

It is very likely that the northward flow of warm water in the upper layers of the Atlantic Ocean, which has an important impact on the global climate system, will decrease by approximately 25-30 percent. However, it is very unlikely that this circulation will collapse or that the weakening will occur abruptly during the 21st century and beyond.

An abrupt change in sea level is possible, but predictions are highly uncertain due to shortcomings in existing climate models.

There is unlikely to be an abrupt release of methane, a powerful greenhouse gas, to the atmosphere from deposits in the earth. However, it is very likely that the pace of methane emissions will increase.

Saudi Arabia Says OPEC Will Cut Output 2 Million Barrels a Day

(Bloomberg) -- Saudi Arabia, the world’s largest oil exporter, said OPEC will cut production by about 2 million barrels a day at tomorrow’s meeting.“Supply is somewhat in excess of demand, inventories are also higher than normal,” Saudi Arabian Oil Minister Ali al- Naimi told reporters today after arriving in Oran, Algeria. “To bring things in balance there will be a cut in production of about 2 million barrels.”

Obama says drilling must be part of larger plan

WASHINGTON (Reuters) – President-elect Barack Obama said he was not happy that Congress allowed the long-standing moratorium on offshore drill to expire without producing a comprehensive energy plan."I'm not thrilled with it simply lapsing as a consequence of inaction without broader thought to how we are going to achieve energy independence and reduce our dependence on foreign oil and fossil fuels," Obama said at a press conference naming key energy nominations for his administration.

Large gas reserve found in Xinjiang

URUMQI -- China National Mineral Resource Committee disclosed Sunday that it found a major gas field with a proven reserve of 100 billion cubic meters in northern Xinjiang.It is the first reserve of this size ever discovered around the Junggar basin, according to Chen Xinfa, general manager of Xinjiang Oilfield Company, a subsidiary of China National Petroleum Corporation.

U.S. company to build biggest wind power park in Bulgaria

SOFIA, Dec. 16 (Xinhua) -- U.S. power giant AES Corporation and the Bulgarian government Tuesday agreed on the building of the biggest wind power park in Bulgaria, which was the largest renewable energy investment in the country, local press reported.The agreement will allow the AES to build a 270 million euro (363.6 million U.S. dollars) wind power park close to the town of Kavarna in northeast Bulgaria, with 52 wind power generators and a total production capacity of 156 MW.

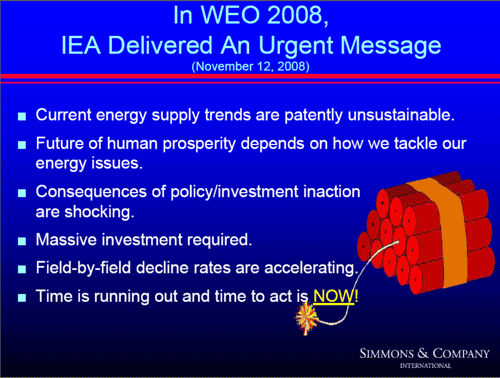

New Presentations by Matthew Simmons

● The Risk Of Misjudging Peak Oil: A Real Physical Crisis

● Have We Inadvertantly Created Unfriendly NAFTA Energy Neighbors?

● Can Colorado Help The World Adjust To Post-Peak Oil?

● Can Hawaii Adjust To A Post-Peak Oil World?

● The Era Of Cheap Oil Is Over

● Oil Services: Riding High On A Wave Of Upstream Activity

Somehow fertilizer seems an unlikely subject for a Faustian tale about pride, vanity and ambition. Yet here it is: Chemists Fritz Haber and Carl Bosch won Nobel Prizes for their contributions to humanity as young men and reached the pinnacle of German science, only to be brought low by their own, very human failings.Haber and Bosch invented industrially made fertilizer during the first decade of the 20th century, developing a method of synthesizing and mass-producing ammonia from hydrogen and atmospheric nitrogen, hence the title of Thomas Hager's book, The Alchemy of Air. The need for such a process was urgent. Agricultural crops required nitrogen, but by the late 19th century the parched flatlands of Chile's Atacama Desert were the world's only major source of nitrates, and supplies were running out. With most arable land already cultivated and populations on the rise, a Malthusian nightmare loomed.

Eating Isn’t Option When Minnesota Corn Burns in Houston Cars

(Bloomberg) -- Mike Vis hooks a pump to a grain silo in Minnesota and siphons out enough of his corn to feed 91 people for a year. This batch will fuel vehicles in Houston for 21 seconds.American roads, hungry for corn in the form of the motor fuel ethanol, never figured in the livelihoods of earlier generations of Rock County growers. In the 1930s, some considered it a sin to burn corn in home furnaces.

“They felt it was a food, and there’s always hungry people in the world,” said Andy Steensma, the mayor of Luverne, the county seat.

Today, burning crops like corn, soybeans and sugar cane for fuel is policy in the U.S., Brazil and the European Union -- while almost 1 billion of the world’s 6.8 billion people are hungry, the most in a generation. About 95 percent of what Vis grows feeds vehicles in the western U.S. -- the destination for ethanol produced in his local plant -- not people or animals.

Recession prompts some couples to delay having kids

Many economists fear that the current recession will become one of the worst since the Great Depression. When that hit in the 1930s, the birthrate dropped precipitously, and the effects of having fewer people in the workforce rippled through the economy two decades later."If you can't pay your mortgage, the last thing on your mind is to have another child," said Dr. Khalil Tabsh, chief of obstetrics at UCLA, who expects to start seeing a drop in pregnancies.

Baby booms and busts are reliable, if lagging, economic indicators, intertwined with the rise and fall of the nation's fortunes. For three-quarters of a century, economic downturns have triggered declines in the U.S. fertility rate, which, at about two children per woman, is the highest among rich nations. The fertility rate hit its post-World War II low of 1.7 in 1976, after the oil shortage and a severe recession.

Opec 'has no other option but to cut production'

At this point, Opec really doesn't have any other option but to cut production. No member nations can afford to have crude prices this low.

Mexico oil output woes, hedges dim OPEC appeal

MEXICO CITY (Reuters) - OPEC's call for Mexico to help shore up oil prices is likely to fall on deaf ears among policymakers already fretting about sliding oil output and as a massive hedge shields 2009 government revenues.OPEC ministers urged Mexico and other large oil exporters such as Norway and Russia to join in deep production cuts as the cartel struggles to stem a $100 collapse in oil prices since July.

But while Russia has offered cuts and Norway was quick to reject the request, Mexico has remained silent.

"I don't think Mexico will do anything. Their output is already declining naturally so I can't see them cutting more," said Eurasia Group analyst Enrique Bravo.

Political risk is critical for oil markets once more, and the grave danger is that no one knows where the 'ceiling' might be once the world economy rebounds.

Ernst & Young: O&G Industry Should Look Forward to Strong Growth, Demand

The credit collapse has created liquidity challenges for O&G companies, however, and impacted the volume of company and asset transactions. Short-term financing is more difficult to obtain, debt rollover is challenging and capital-raising events have been postponed. There's a downward pressure on credit ratings and letters of credit have been challenged. While the first half of 2008 saw only a minor (2 to 5%) decline in transaction activity, the second half witnessed a much more marked 30% decline according to Ernst & Young LLP's Energy Center. This slower pace, however, is not expected to last long.While the number and dollar value of deals are down, the decline could actually be a signal that a new wave of consolidations is about to begin. The vast majority (more than 70%) of the nearly 600 respondents in a Dec. 9, 2008 Ernst & Young LLP webcast thought it'll be more than 12 months before the O&G mergers and acquisitions market returns.

Buckling under: As roads and bridges crumble, infrastructure needs grow

A litany of problems is straining the breakbulk and heavy-lift shipping industry, including fuel costs, capacity constraints and a critical shortage of vessels, equipment and skilled labor. In part, the industry is a victim of its own success, riding a worldwide boom in energy, mining and infrastructure projects.But the infrastructure crisis may pose more formidable challenges. In addition to physical constraints that are driving up the cost of moving goods, there is widespread concern that shippers and carriers will end up paying more than their fair share of the massive bill for maintaining and improving the nation’s road, rail and waterways infrastructure. Add to that an economy in turmoil and the uncertainties of a political transition in Washington, and you have a jittery industry facing an uncertain future.

Pickens Embraces Obama's Energy Team Appointments

DALLAS, Dec 15, 2008 (BUSINESS WIRE) -- T. Boone Pickens today offered the following statement on President-elect Barack Obama's appointments for his Administration's new energy and environmental team...

Pakistani trucker strike won't choke Canadians' supplies

KANDAHAR, Afghanistan – A truck drivers' strike that has choked the flow of military supplies to Afghanistan won't affect Canadian troops stationed in the landlocked country, insists the commander of Canada's overseas forces.Lt.-Gen. Michel Gauthier said the Canadian military does not truck in vital supplies via the treacherous stretch through the Khyber Pass that links Pakistan with Afghanistan.

Why Toyota wants GM to be saved

A GM failure would cause production problems, crush already weak demand and potentially open the door to low-cost competitors.

Largest coal-electricity project cluster starts construction

On December 15, construction of the largest scale coal-electricity project cluster in China's energy construction history started on all fronts in northern west China's Yinchuan City.Reporters learned that eight new coal, power and coal chemical construction projects started simultaneously.

GE Wins $3 Billion Iraq Turbine Order, Largest Ever

(Bloomberg) -- General Electric Co., the world’s biggest maker of power-plant turbines, won an order valued at about $3 billion to provide electricity-generating equipment and services to Iraq.It is the largest single order in the history of the GE Energy segment, Steve Bolze, who runs the power and water division, said in an interview today. GE, based in Fairfield, Connecticut, will provide 56 of its 9E model turbines capable of supplying 7,000 megawatts of electricity, nearly doubling the country’s generating capacity.

J. Craig Venter: There's no silver bullet to solve energy crisis

The nation appears united toward transitioning to more-fuel-efficient cars. But that transition will require difficult political choices and long-term thinking that are not normally the hallmarks of government. The policy rubber meets the political road.Our appetite for change should not fluctuate based on the price of oil today or next week or next month. Just as that price has dropped of late, it will surely rise again.

San Diego Gas & Electric is betting that a startup company with an untested technology to generate solar power can provide it with much of the renewable energy it will need to meet a state mandate by 2010.The plan is at the heart of SDG&E's arguments that the Sunrise Powerlink, a proposed 1,000-megawatt line across the desert and mountains, is needed to bring renewable energy from the Imperial Valley.

Arctic melt passes the point of no return

Scientists have found the first unequivocal evidence that the Arctic region is warming at a faster rate than the rest of the world at least a decade before it was predicted to happen.Climate-change researchers have found that air temperatures in the region are higher than would be normally expected during the autumn because the increased melting of the summer Arctic sea ice is accumulating heat in the ocean. The phenomenon, known as Arctic amplification, was not expected to be seen for at least another 10 or 15 years and the findings will further raise concerns that the Arctic has already passed the climatic tipping-point towards ice-free summers, beyond which it may not recover.

Twelve months to save the world – no, really

People have always told stories about the end of the world. Sometimes these stories have been realised, as war and the other horsemen of the apocalypse – strife, famine and death – have laid waste to cultures great and small.Only twice, though, have they had the potential to threaten human civilisation and the planet’s biota as a whole.

Once was during the Cold War, with the threat of a global nuclear conflagration.

The other is happening right now. If left unchecked, climate change is likely to make large areas of the planet unsuitable for human and other life by the end of this century. That’s not my personal opinion, it’s the conclusion of the more than 2,000 climate scientists who contributed to the 2007 report of the Intergovernmental Panel on Climate Change (IPCC).

Major Oil Projects Come Undone With Price Collapse

The list of projects delayed is growing by the week. Wells are being shut down across the United States; new refineries have been postponed in Saudi Arabia, Kuwait and India; and ambitious plans for drilling off the coast of Africa are being reconsidered.Investment in alternative energy sources like biofuels that had flourished in recent years could dry up if prices stay low for the next few years, analysts said. Banks have become reluctant lenders, especially to renewable energy projects that may prove unprofitable in an era of low oil and gas prices.

These delays could curb future global fuel supplies by the equivalent of four million barrels a day within the next five years, according to Peter Jackson, an energy analyst at Cambridge Energy Research Associates. That is equal to 5 percent of current oil supplies.

UK: Slowdown hits energy investment

Vital spending on energy infrastructure such as power stations and gas storage sites is threatened by the financial crisis, which has hit the supply of investment funds, the industry regulator has warned.Alistair Buchanan, chief executive of Ofgem, told the Financial Times that energy companies were having to manage "some tremendous pressures", including the rising cost of finance.

Oil Stored at Sea Expands as OPEC Meets on Output Cut

(Bloomberg) -- Oil companies booked 25 supertankers to store crude, enough to supply France for almost a month, as OPEC discusses output cuts to shore up prices that have plunged 69 percent in five months.The supertankers, equal to about 5 percent of the global fleet, can carry as much as 50 million barrels. The ships may not all be fully loaded, Jens Martin Jensen, interim chief executive officer of Frontline Ltd.’s management unit, said by phone today. The Bermuda-based company is the biggest supertanker owner.

OPEC Says Oil Demand Will Fall Next Year as Recession Spreads

(Bloomberg) -- The Organization of Petroleum Exporting Countries, supplier of more than 40 percent of the world’s oil, said demand will fall next year as the global economy contracts, cutting fuel consumption.The 13-member group forecasts that world oil demand in 2009 will decline by 150,000 barrels a day, or 0.2 percent, to 85.68 million barrels a day, according to a monthly report released today. That’s 1 million barrels a day lower than forecast last month, and the fourth consecutive cut in its estimate.

OPEC to annnounce output cut of up to 2 million bpd

LONDON (Reuters) - OPEC oil producers are likely to announce their biggest-ever supply cut this week in a bold attempt to stem a collapse in oil prices, a Reuters poll suggested on Tuesday.All 14 banks, companies and research groups surveyed on December 15 thought the Organization of the Petroleum Exporting Countries would reduce output by at least 1.5 million barrels per day (bpd) when it meets in the Algerian city of Oran on Wednesday.

The average forecast was for an even bigger cut -- probably around 2 million bpd, which would be the deepest cut in production to be agreed since the group, which pumps more than a third of the world's oil, was established almost 50 years ago.

As the oil cartel's latest meeting begins, Russia is under pressure to support a deep output cut.

China's refining losses totalled $26 bln in Jan-Oct

BEIJING (Reuters) - China's state-run oil giants Sinopec and PetroChina suffered refining losses of 180.4 billion yuan ($26.34 billion) from January to October, a senior government official said, according to a statement published on a government website on Tuesday.

Tapis, Once World’s Most Expensive Oil, Loses Benchmark Status

(Bloomberg) -- Malaysia’s Tapis crude oil, once the world’s most expensive grade, is losing its status as a benchmark for Asian refiners buying grades from Australia, Indonesia and Vietnam because of declining output.Oil-pricing service Platts, a unit of McGraw-Hill Cos., will today use Dated Brent, a crude produced in the North Sea, to assess the values of Asian grades, the company said in a statement to its users. The change comes as traders raised concern about Tapis’s suitability as a marker because of a drop in spot market transactions.

Latin America Leads in 2008 Crude Oil, Gas Discoveries

Seven of the ten largest oil-and-gas discoveries worldwide this year occurred in Latin America, reaffirming the region's promising potential for hydrocarbon exploration.

Peak oil warning (video)

UK companies warn government against an impending oil supply crisis.A recent report from the Industry Taskforce on Peak Oil and Energy Security warns that supplies of cheap, easily accessible oil will start to diminish by 2013.

The industry lobby group, which includes Virgin, Yahoo, Solarcentury and transport operator Stagecoach, wants the Government to dramatically increase investment in clean energy and renewables to avoid an energy crisis.

15 Christmas gifts, 'ghosts' haunting Scrooge

Is this the last Christmas before the Great Depression 2? Or a new bull?

If we can dismiss the human suffering associated with job losses for a moment and instead view “employment” as an “energy consuming activity” – it might help one begin to grasp the true nature of exactly what’s confronting the industrializing and industrialized world.

In the U.S., about 60 percent of our oil use is related to transportation; about 45 percent of our oil use is in the form of gasoline. Thus it's not a big surprise that Americans drove fewer miles in 2008 than in 2007.However, in the rest of the world, oil used more often for space heating and power generation than for transportation. Oil accounts for 39 percent of total world energy use; natural gas is 25 percent (ppt).

UK: Energy groups warned on unfair bills

Energy regulator Ofgem has called for speedier action from suppliers to slash unfair pricing from energy bills.

Nigeria: Fuel Crisis Looms Over Unpaid N62 Billion Debt

Major oil marketers are warming up to plunge the nation into another round of fuel crisis over N62 billion unpaid claims owed them by the Federal Government through the Petroleum Product Pricing and Regulatory Agency (PPPRA).

EDF close to buying half of Constellation - report

EDF sees gaining a foothold in the United States, the world's biggest nuclear energy market, as a key element in its global expansion strategy.

In breezy Britain, wind farm cooperatives take off

LONDON (AFP) – With annual returns of 10 percent coupled with low risk, wind farm cooperatives are drawing growing numbers of investors in Britain -- good news for Europe's hopes to lead the world in renewable energy.Along with being a safe investment during turbulent economic times, the cooperatives are drawing interest from those concerned not just with global warming and climate change, but also with energy security.

"It's not only a climate issue, but it's also a problem with energy supplies," Clive Burke, a shareholder in the Westmill cooperative near Swindon, southwest England, told AFP.

"We are exceeding the ability of our planet to support our energy needs."

Three Things Obama Will Do to Advance Alternative Energy

It is clear now that the new administration will do the following three things right after January 20th...

Don't expect recession to mean lower carbon emissions

Environmentalists who hope a slowing global economy will mean big falls in greenhouse gas emissionsare likely to be disappointed,Because despite a gloomy economic forecast for 2009, the annual growth in emissions of 3% is only likely to slow modestly, and may even rise over the long term because of the downturn's impact on global climate talks and the funding of renewable energy projects.

Obama unveils climate change team

CHICAGO, (AFP) – President-elect Barack Obama named his energy and environmental chiefs and vowed a new dawn for US leadership on combating climate change after eight years of Republican foot-dragging.Obama nominated Nobel Prize-winning physicist Steven Chu as his energy secretary, placing the renewable energy expert on the frontlines of climate change policy and ending the nation's "addiction" to foreign oil.

Protests heat up over Australia's climate plan

SYDNEY (AFP) – Angry protests erupted in Australia on Tuesday as environmentalists accused the government of "surrendering" by pledging to cut greenhouse gas emissions by only five percent by 2020.As senior scientists called for deeper cuts, hundreds of people attended a wave of rallies around the country to urge stronger action on climate change or risk the loss of natural treasures such as the Great Barrier Reef.

Australia: Households need pricing buffer

THE Federal Government has defended its decision to give some households more help than they need to meet rising costs incurred by the emissions trading scheme.Under a $9.9 billion two-year program some low-income households will receive up to 20 per cent more than the estimated rise in the cost of living.

The Government's white paper says the reason for overcompensation in some cases is because the modelling has been based on a carbon price of $25. But it says the price of carbon may rise to $40, forcing prices up even more, and it wants to ensure that less wealthy households have enough to cover their costs.

Over 2T tons of ice melted in arctic since '03

WASHINGTON – More than 2 trillion tons of land ice in Greenland, Antarctica and Alaska have melted since 2003, according to new NASA satellite data that show the latest signs of what scientists say is global warming.More than half of the loss of landlocked ice in the past five years has occurred in Greenland, based on measurements of ice weight by NASA's GRACE satellite, said NASA geophysicist Scott Luthcke. The water melting from Greenland in the past five years would fill up about 11 Chesapeake Bays, he said, and the Greenland melt seems to be accelerating.

From http://business.theage.com.au/business/chinese-flirt-with-recession-2008...

China flirts with recession!

Canada flirts with depression:

PM's economic flip: 'I've never seen such uncertainty'

Financial Uncertainty: My rational mind tells me how bad things are but I refuse to believe they are that bad.

Wishful thinking, optimism and hope will make the credit crunch disappear and than we can renovate the kitchen, 20 inch rims for my hot ride, big screen HDTV with surround sound, blackberry, all you can eat luxury cruises and that trip to Venice!

It's not really a "credit crunch" this is too benign a phrase and doesn't really indicate the shear scale of the crisis we are experiencing. I think "global financial meltdown" is closer to the truth, follwed by a deep and profound economic depression lasting for years.

"Hard to read" = "Unwilling to accept"

As I mentioned previously, the PTB are preparing us for the real situation. This is why Harper called the election in October. He already knew. After a conversation with an old friend downtown I am bot reassured and even more concerned. While people seem to understand disaster is looming and there will be a need for collective action, more and more iI am convinced that collective action will be fascism with all its scapegoating and false promise. I expect harper to win a majority next time.

What do you think is the "real situation" that required calling the election in October? Harper "already knew" what ???

I'm not being sarcastic or anything, I just honestly don't know what you are talking about. I understand the creeping fascism part, but I mean specifics - is there some sort of event or something you are anticipating?

I was commenting on Leanan's quoted piece on Harper where he is admitting the possibility of a depression. The government knew how bad the economic outlook was and called the election to make sure the vote preceeded any bad news about the economy. Note that in the campaign they were still talkin g budget surplus and lots of other good news stuff. The opposition wasnt any better. All parties shied away from saying anything meaningful about the economy during the campaign. I am afraid Canada is served no better by our political class than is the USA. Perhaps we are served worse in that we are a much more docile and pliable group than are the people of the USA and therefore bestow more implied responsibility upon our leaders. We are more likely to accept fascism I think. No I don't expect a one event catastrophe like hitting the ice berg but I think a gradual but rapid deterioration and with it an increase in fear in the population.

Conservatives keep big lead in the polls.

http://www.canada.com/topics/news/national/story.html?id=1072845

Canwest News Service and Global National poll said the Conservative party would garner 45 per cent of the vote and score a majority victory if an election were held today. (Dec 13) The poll showed 65% wanted Ignatieff (new liberal leader) to work out a compromise with Harper

http://www.ottawacitizen.com/Public+wants+compromise+coalition+poll+find...

Shaping up as either a likely Conservative majority or the coalition chickening out.

Yes the polls are squarely for BAU. I think we will see either a strengthening of this poll trend or something really wild by the time parliament reconvenes. If January does turn out to be full of bad economic news and lay offs opinion will really be in flux. Harper might have been smarter to let the coalition be in charge for a few months of economic disaster and let them take the blame. The coalition parties havce not made any proposals that seem to be effective. It is likely that an automotive bail out will hold the balls in the air for a few extra months. But a few billion dollars will get burned up fast and then what? It isn't even guaranteed that "loan guarantees", the method that the Canadian gov't is proposing to use to help the companies will even work. Up to now the MSM have been saying that banks won't lend because they are afraid the borrowers wont pay it back. What if the real reason is that the banks need to hold the cash to pay off their own obligations near and mid term? They wont want to lend the cash even if repayment is guaranteed if they need the cash sooner. It will be interesting over the next few weeks.

Russia's industrial activity plunges

VK,your comment that China is flirting with recession is a masterful understatement.

IMO,China is on the edge of a precipice.Look at the basics,they are not new.

A massive overpopulation problem,environmental degradation on a huge scale which affects food production and public health,unsustainable use of coal for electricity generation,ethnic divisions which have already caused civil strife and so on ad nauseum.

The economic downturn will be the shove that sends the whole dirty shebang over the edge.

It is interesting that in Australia,we are not hearing the "China will save us"mantra anymore.Not even from Beijing's representative in Canberra,our somewhat less than esteemed Mr 5% PM.

Re: Oil Stored at Sea Expands as OPEC Meets on Output Cut

"The big rumour going around in the last ten days is that the tanker market is tight because everybody's storing oil on tankers. I talked to the chairman of the world's largest tanker company on Monday and he said that they'd checked around and he thinks there are between 4 and 6 VLCCs chartered to, in the future once they are empty, store oil. There are none so far."

- Matt Simmons

How to reconcile the two?

Go slow/Minimum Fuel Cruise tankers.

Alan

Place your tankers near Somali waters.

http://blogs.cfr.org/setser/

http://www.treas.gov/press/releases/hp1326.htm

The October Treasury International Capital (TIC) data tells a striking story — one marked by a massive surge in demand by both private and official investors for “safe” assets. Foreign investors bought $182 billion of Treasuries — including $147.4 billion of short-term Treasury bills. There is no real mystery why bill yields dropped so low even as the supply of bills surged. And foreigners added $207 billion to dollar bank accounts.

Sum that up and it works out to close to $400 billion in demand for safe dollar denominated assets. If that kind of monthly inflow is annualized it is a shockingly large number.

It isn’t hard to figure out why the dollar rallied.

What % of this demand for safety is billed to the future taxpayers of the USA? Place a future liability of 8.5 trillion against the USA taxpayer, give the asset value to banks, have the banks invest in Treasuries-a scam worthy of Madoff.

Re Madoff, research his ties to powerful USA government players-to say they are impressive is an understatement. Denninger today makes a good point when he comments that only an idiot would think that one person acting alone could pull off a 50 billion dollar fraud.

I don't think it had much to do with safeness.

That's just the party line or standard excuse given by the financial media, when they fail to understand.

Setser and others have covered various potential reasons for the rally to dollar:

- being forced to show liquid collateral (US treasuries is the world's biggest liquid collateral market)

- being force to pay USD nominated loans

- fighting for dollars in the market when Fed suddenly starts to increase the holding rate for depository institutions for dollar nominated assets (smell something funny here?)

- a gigantic margin call on the whole world at the same time with lots of currency carry trade activity having happened previously

However, if one thinks it was due to a bigger "safety" of USD or USD nominated treasuries, I think one is mistaken. Liquid, yes. Safe? No.

US is bankrupt, will be even more so in the coming years and its chance of ever paying back its debt without a serious haircut or engineered inflation is in serious doubt.

Most FX commentators also seemed to agree that the dollar rally just wasn't built to last nor would USA want it to last, hence any idea of safety there was a temporary illusion as well.

Now, I'm no expert - far from it, but I really hope people would stop using the "safe US assets" as a standard excuse for everything.

If US assets were so safe, why is the whole mortgage industry in dire straits? Why are all investment banks at the end of their rope? Why is Detroit bankrupt? Why are US equities down so much? Why is USD falling again against the trade-weighted currency basket?

I think the relative safety of US assets in this time and age is greatly exaggerated.

I could of course be wrong, I've been known to be wrong every so often.

Inflation anyone? ;-)

http://www.bloomberg.com/apps/news?pid=20601087&sid=axzPzMe7x2ZM&refer=home

The Golden boys at Goldman Sachs also reported a 2.12 billion dollar loss! Their first since...ummm, have they ever made a loss?? Now you know times are really tough!

http://www.bloomberg.com/apps/news?pid=20601087&sid=a20cEQfkqGtM&refer=home

Is it striking to anyone that these economists and analysts KEEP getting it wrong and are paid to be wrong? It's nearly always worst than they expect.

EDIT: ok this is ridiculous, average pay is nearly 365,000 dollars? For a 2.12 Billion Loss, the companies share price has gone from 200+ to at one point 52.

http://www.bloomberg.com/apps/news?pid=20601087&sid=aQjVhGLMflj8&refer=home

It's official: The presses have been fired up

After rate cuts: The Fed's new ball game

With rate cuts doing little to help boost the economy, the Fed has begun to print money to finance its liquidity programs.

Why borrow that which you can print....?

pre-ww2 germany here we come...

I'm not entirely sure its a fair comparison. From what I understand, the weimar republic owed substantial sums that weren't denominated in marks, while US debt is dollar denominated. When the US prints money inflating the money supply, the value of the debt decreases. When the weimar republic did it, the value of the debt remained static...

Beijing Metro

http://jamesfallows.theatlantic.com/archives/2008/12/beijing_metro.php

So if you build mass transit, people will come?

The most exciting quote I read from the Craig Venter article up top:

Only a matter of time before they perfect this process. Imagine we could burn coal for electricity, collect all the carbon dioxide and turn it into a liquid fuel.

Right. We could store water in a dam, use the water to drive turbines/generators and then use the electricity to pump back the water. It's called a PMMK-II. Would like to see one in action.

Srivathsa

TAD

Did it ever occur to you that Time may be the one thing we don't have enough of? Imagine the irony of discovering the perfect replacement energy source just as the lights dim and finally go out? Find the perfect solution only to have the Greater Depression slam the economy so hard that no scalable development could be funded? ...

I sense a law of thermodynamics being broken here... Er, wait. OK, sunlight is the energy source. Now this makes sense... Coal + 02 = CO2, then CO2 + sun = O2 + C-based fuel. This *might* actually work... But, so *might* ethanol...

Just because ethanol doesent quite work in the Staes (at leats yet), does not mean it doesent work at all...

The way that its most realistically envisioned is using big nuclear reactors to synthesize hydrogen from water, and cook CO2 out of limestone, and use the resultant quicklime for cement production.

Run the CO2 + H over appropriate catalysts and you get whatever hydrocarbon fuels you want. Over time the cement or quicklime absorbs CO2. I cant imagine any cost effective strategy for directly extracting CO2 from the atmosphere.

This incidentally places an upper limit on the production price of liquid hydrocarbon fuels, with the price of reactors, cement kilns, and synfuel plants being well known after decades of experience. Beyond this price any hydrocarbon will stay in the ground because it will be cheaper to make it from rock.

The way that its most realistically envisioned is using big nuclear reactors to synthesize hydrogen from water, and cook CO2 out of limestone, and use the resultant quicklime for cement production.

So long as one ignores the realistically poor job of management that has been done WRT nuke power...yes.

Sounds like a fancy way of saying "we are trying to growing algae using the exhaust from power plants".

Now where have I heard about that before...?

I guess it's only a matter of time until 'they' perfect fusion power, anti-gravity, zero-point energy devices, time travel, and warp drive, right?

I understand you are optimistic, but nothing lasts forever.

And then we can burn *that* fuel and put the CO2 right into the atmosphere! Genius!

"nothing lasts forever..." , while apparently, Hype still Springs Eternal.

AntiDoomer, can you understand why this kind of hype is not actually doing much to inspire real hope here? There are things worth working towards, and worth investing some hope into, but splashing rampant postivity around as if it was a bottomless trust fund is ultimately DIScouraging.

How do you know it will succeed in time? There are all sorts of potentials for this kind of chemistry or industry to prove itself unviable, as we've talked over again and again.

Bob

Global energy usage

Some people just can't picture that 85% of our current energy useage is from Fossil fuels

Oil 37%

Coal 25%

Gas 23%

Nuclear 6%

Biomass 4%

Hydro 3%

Solar heat 0.5%

Wind 0.3%

Geotherman 0.2%

Biofuels 0.2%

Solar Photovoltaic 0.04%

From http://en.wikipedia.org/wiki/World_energy

for Nuclear to replace Fossil fuels we will have to double the current number of Nuclear power plants, and then double that, and when we have built that number we will have to double that again. At that point we would be producting enough enery to replace the Oil and Gas but not even starting on the coal.

I don't know how we're going to do it, Not a clue as to how we will be feeding the 6.7 billion poeple we have on this planet.

Where will exports from the top 20 exporters be at this time next year? It's been over 40 mbpd since the middle of 2004.

Ed

Q: How are we going to do it?

A: We're not. The future is austerity, living with a lot less. Get used to it.

I could get used to living with a lot less austerity.

I don't see austerity in the long term. If the energy crunch doesn't kill us off we can overcome it by renewables. Time is the thing.

France did it decades ago.

Cool

But France imported 1.736 mbpd in 1993 and was still importing 1.792 mbpd in 2007 (eia)

Now for electricity it's 75% nuclear power.

But we have to worry about the future and the world

Ed

And I expect they'll be importing for decades to come, because liquid fuels will be cheaper to produce elsewhere. You demonstrated concern about the scalability of nuclear power in replacing coal. France has shown that it can do that. We can technically demonstrate how you can replace liquid fuel production with nuclear (or solar or wind) synthetic fuel plants; Realistically I expect we'll manufacture synthetic fuel from coal and tar sands for some decades before full closure of hydrocarbon production.

But I also expect nuclear power to begin making a dominating position in global electric power production in several decades.

This may be different. I do not think algae to fuel will replace fossil fuel but it does show some promise as an decent alternative resource. I think we will need as many options as possible. It is biological on a par with secondary wastewater treatment, certainly not fusion energy technology. It does not compete directly with food production. The big issues seem to be filtering and drying. The fast growering algae are real small and do not aggregate as well as bacteria. The larger ones are easier to filter but take more time to double in population.

Denninger points out that there is no way Madoff was a one-man operation.

Everybody in the "housing bubble" was similarly complicit, from the home "buyers" to the pension funds investing in the sliced-and-diced "assets".

I think "we" should "officially" replace the term "Ponzi Scheme" with "Madoff Scheme". (Or is it "made-off scheme"?)

"Capitalism is a pyramid scheme" - Herman Daly

And those ethical enough not to participate lose financially. Our current economic system is like that - those ethical enough to be unwilling to destroy the planet in the most voracious manner lose out.

"And those ethical enough not to participate lose financially."

See Hardin's:

http://en.wikipedia.org/wiki/Tragedy_of_the_commons

A lot of people (still influenced by conscience) see where this is all heading and they are striving to halt civilization (at least slow it down) but this is a runaway train and it's going to have to come to a halt as a result of it's own entropy. The best thing you can do is prepare for the worst and get out of the way!

Joe

I don't know where to put it so this doesn't seem a bad place:

Remember Peak Copper? Three years ago, http://www.321energy.com/editorials/watson/watson121605.html predicted a peak of Chile copper production in 2008 and since Chile produces about a third of the world's copper this is probably also the world peak.

At http://www.incakolanews.blogspot.com/2008/11/chile-copper-production-dow... you can see that october 2008 copper production in Chile was 7% down from a year earlier. I looked up the original (in Spanish):

"La menor producción de cobre, se produjo a causa de la disminución de la ley de cabeza (ley del mineral que va a la planta de tratamiento) en los yacimientos actualmente explotados del país, además de una mayor dureza de la roca, que influye en el incremento del tiempo de los procesos de extracción, así como también en el aumento de los costos unitarios de producción."

rough translation: "Falling copper production was caused by diminishing mining grade and by greater hardness of the rock."

Geological factors are at work here, not simply less copper produced because of falling prices, so I think we can say that WORLD COPPER PRODUCTION HAS PROBABLY PEAKED

Wow... what does it mean when our mineral base depletes?

I think the biggest saving grace for minerals (except Fossil Fuels) is that they are not consumed after they are mined. This might just mean that we need to recover them from our landfills and other places... I have quite a bit of copper pipe in my house (which was built in 1968) that I would pull out, replace with PVC and sell if it were economical to do so. So, this is bad from a growth perspective, but not horribly bad as we'll just do less with copper and other minerals and replace them with more abundant materials.

Differences between metal resources and hydrocarbons:

1. Recyclable: They aren't consumed, and total world stock of a refined metal need not go down, especially valuable metals such as gold and platinum.

2. Substitutable: As prices of some metals go up (copper) there are often very desirable substitutes for many applications (aluminium)

3. Log normal distribution: Most metal stocks are log normal distributed in ways that one would expect something of a completely abiotic origin, and as such a doubling of the price can yield over ten times the resources.

1. A lot of metal is lost to corrosion.

2. Depending on the properties of the metal (thermal and electric conductivity, corrosion resistance, toxicity, magnetic properties, bi-metallic electochemical potential, etc.) substitution may be impractical.

3. The Second Law. Once those metals are diluted and dispersed among a zillion defunct products, it's no longer energetically feasible to recover them. Ex: The silver "leased" to manufacturers who had no means and no intent to repay the loaned metal. It's still all there, in milligram quantities inside switches and outlets in houses all over the country, but it will never be worth the effort to collect it all.

I'm not sure what you're trying to say. Its energetically feasable as long as you have energy by definition; Since you've brought up the second law I suppose to complete the sentance you need both energy and a heat sink...

If we're talking about the point in the future where we don't have energy and a heat sink, we've exited the point of conversation where we can make reasonable projections.

The Second Law states that disorder is an energy cost. That copper or silver or whatever has to be "mined" again if you intend to recover and reuse it from widely dispersed, low-concentration products like electrical appliances.

By definition, if we had enough energy we could get any stable metallic element in any desired quantity, by diverting asteroids, say.

The whole point is that "Peak Cu" is defined by a declining ore concentration in concert with declining energy availability, and the fact that those copper atoms mined long ago are still extant does not mean that they're available for reuse at resonable cost.

You're mixing physics with economics, the possible with the plausible.

We are in no way facing declining energy avaliability. We'll have 10^17 watts of energy shining down on the earth for several more billion years and since you bring up the second law, we're in no danger of the sky growing too warm from thermal pollution that ends in heat death any time soon. Invoking the second law is meaningless in this context.

From a purely energetic standpoint, recovery of copper from widely distributed electrical appliences may well be more energy efficient than mining and reducing new ore because the energy cost of refining the ore is quite large compared to simply collecting finished products. The economic cost of paying people to manage such infrastructure and the opportunity cost makes such ventures unlikely on the scale of maximum energy efficiency though simply because we have so much energy that other scarce resources are more important for such investment decisions.

Yes, and you're mixing the energy which is running the bio-sphere with the kind of energy that runs our Gadgets and movable boxes with wheels and wings .

No. I made no mention of assuming energy being used for any particular purpose besides refining metals at all. Civilization may end up being entirely artificial at some point, or running with a far smaller ecosystem, whatever that means for human population. The biosphere doesn't use 10^17 watts of work either. The vast majority of it is absorbed and reradiated as heat with no work extracted.

you say ..

Yes it does, as a matter of fact all insolation is what makes the world/bio-sphere work like it does (!) The reradiated heat is a necessity, or else it would have gotten to hot! and the "inefficient" photosynthesis wouldn't have been possible to take place (the way it does)

The wasted heat is needfull during the night one can argue - if we only got enough "day-time" energy, we would have had some very "stiff" nights .

Same goes for an ICE, which also only works with its wasted heat. Imagine a combustion without heat-

Such is stuff!

The environment would function the same if the albedo is the same. Much more work can be extracted from what presently is simply absorbed by rocks and dirt.

"We are in no way facing declining energy avaliability."

We are facing ONE, in the scenario you describe. There is plenty of sun, but we just didn't build enough adapters (ie, collectors) ahead of time. Building these sun-adapters takes energy, money, labor and time, which are also limited in their availability.

So how are we NOT facing a decline in availability? It is there, but largely not 'Available.' Big Difference.

We certainly are facing a decline in agreed definitions of what 'avaliable' means apparently.

That we are facing a decline in global energy production capacity is a seperate subject; One I would disagree with because of demonstrable scalability of nuclear power along with myriad other technologies including wind and solar.

It's already collected, every day the little green machine comes to your driveway and picks up your Trash. All you have to do is get the Mafia out of the picture and a few government nitwits out of the way. Here is a technology that works, and JUST NEEDS TO BE IMPLEMENTED.

From www.pyrogenisis.com

Plasma Resource Recovery System

Based on the expertise and experience gained in waste gasification and vitrification, PyroGenesis has developed the efficient 2 stage Plasma Resource Recovery System (PRRS) designed to uniquely treat a broad range of wastes, including industrial, hazardous and clinical wastes. Depending on the size and the composition of the waste stream, PRRS has the potential to be a net energy producer generating enough energy to not only operate the system but producing an excess which could be sold back to the grid. PRRS is scalable, fully automated and is targeted at processing between 0.5 to 100 TPD of waste (equivalent to approximately 150 to 30,000 tonnes per year). PRRS is significantly smaller when compared to similar capacity incinerators, produces no ash or dioxins and is a cost competitive alternative to conventional alternatives.

PRRS consists of four main processes: waste pre-treatment and feeding, plasma thermal treatment, synthesis gas cleaning and energy recovery.

Waste does not need to be pre-sorted and can be introduced into the PRRS graphite arc furnace in virtually any form (shredded material, sealed containers, liquids, sludges).

PRRS uses a graphite arc plasma furnace followed by a plasma-fired eductor to convert the organic fraction of waste into a soot-free synthesis gas (containing mostly carbon monoxide and hydrogen) and the inorganic fraction into a stable, inert slag which is a glass-like material that can be used as a construction material as well as a metal which can be recovered as an ingot.

The synthesis gas cleaning system is designed to remove any acid gases and capture any trace amounts of particulates or volatile heavy metals. The cleaned synthesis gas can then be used as a fuel in a boiler, an internal combustion gas engine or a gas turbine for the production of electricity, steam, and/or hot water......

Absolutely nothing, should be going to a landfill.

Power Down.

We need to get these suckers in houses. Make them small... About the size of a 55 gallon drum... Folks can toss in their garbage, incinerate it, use the surplus energy to power and heat (or cool with absorption chillers) their homes... All they would have to do is just put the slag out to the curb once a month for pick-up and recycling.

Imagine that. Solving our garbage, resource and energy problems all at once.

I'd buy one...

Hmm, so we'd need an endless supply of disposable products to process?

I know PVC pipes are used for drain lines, but has long-term consumption of drinking water from PVC pipes been proven to be safe?

PEX- polyethelyne- is the copper replacement. I imagine PEX is presently manufactured from petroleum products.

I don't think so, but the alternative to having piped potable water is much worse so I'll live with PVC.

By code PVC is only allowed as waste & vent piping. Potable water must be in PEX or CPVC. Don't expect the help at Home Depot to know that, I recently "educated" their plubming professional about the International Building Code. Copper is still the best pipe for potable water. The alternatives are more about saving on labor costs than material costs, i.e. no torches and solder.

I also have recommended copper, but spray paint it black (often when "making it up" before going under the raised house) and put dabs of tar on it as a "last step".

This drives the salvage value down significantly (paint + tar) and tar makes a mess when handled, and may leave tarry fingerprints if stolen. Copper has good flow characteristics as well (little pressure drop, especially with long radius 90s).

Galvanized steel is still code (AFAIK), and not a terrible choice (life of ~75 years).

I remember polybutylene plumbing (sp ?) and do not trust PEX.

Best Hopes,

Alan

Although the plastics are easier to assemble, it is still very satisfying to watch a properly heated copper joint soak up the solder. Just watch the torch around the flammables!

When I moved into this 120 yr old farmhouse 40 yrs ago, i spent a lot of time in the crawl space soldering copper tubing to get a plumbing system. Lots of burns, nose to nose with bad spiders& centipedes, crap falling in my eyes. And once a helper had wired all the pipes to 120VAC instead of ground. Fun!

Later, after fixing too many bad solder joints full of water, I discovered I could just epoxy them together. No burns, no leaks, no torching the drapes of spiderwebs. Never any leaks. Now, am I gonna die from that? Or I mean, die any sooner than anyhow?

From the Simmons presentation above

The Risk Of Misjudging Peak Oil: A Real Physical Crisis (PDF)

Houston Energy Institute, December 10, 2008

Thanks for that link undertow. The potential source Simmons offers for much of the oil price collapse seems compelling. I’ve been in the oil patch for almost 34 years and have seen these cycles before but they’ve never shown such rapid rates of change. Demand destruction has always brought prices down but took many months and, more typically, a year or two. Likewise, consumption growth has always had its effects but with a slower time line. Similarly, once prices started moving in one direction or the other, the momentum was such that it took fairly long time periods to slow the trends let alone reverse them.

The price collapse, and to a lesser degree, the price run up, seemed much to rapid to be just a function of supply/demand imbalances. The comparison to the MG overload of “paper barrels” of oil seems very similar to what we’ve seen the last 12 months. At the time I was on the fence as to the ultimate effect future traders had on the actual oil market ("wet barrels"). But his description of the MG blowup appears to be a good model for what we've just witnessed. Not that I would bet lunch on his prediction of a quick turn around in oil prices, his argument does lend credibility to that possibility IMO.

I just checked the presentation and not only is there precious little in the way of evidence but it also doesn't address the problem that all speculator-driven explanations for medium- or long-term prices have: how come the wet barrels market clears at the paper market price? By "clears" I mean that quantity for sale is more or less equal to the quantity bought.

Here are a few explanations that I can dream up:

-secret inventories (the public ones aren't big enough to buffer a significant imbalance for more than a few monthes, never mind a big imbalance)

-producers raise and cut production so that the market clears at the paper price (but why would they do that?)

-buyers and sellers are very price-insensitive (but then why do actual supply or demand disruptions not cause bigger price moves?)

Got a better one?

I think it makes more sense (Occam's razor) to assume that the paper market is doing what it's supposed to do: trying to predict the medium- and long-term wet price.

Over the short-term, of course you'd expect the wet market to follow the paper market: any significant imbalance between the two is an opportunity for the wet players to make easy money by playing with their inventories.

Yesterday I noticed a new Chinese all you can eat buffet opening in the area called…

Double Chen

I kid you not.

Parking was over half full too.

all you can eat, or all you can stand ?

Purina People Chow.

Speaking of which... How will our animals fare Post Peak? They have been getting obese just like us... how will they get by?

How many ways are there to skin a cat?:)

I prefer dogs - more meat.

haha! that was freaking funny! thanks for the perspective on that.

I was at the gym last night, and they were giving away candy, cookies and peanut brittle...could not stop laughing. BTW, I live in the 3rd fattest city in the nation.

Re: Arctic melt passes the point of no return

and Over 2T tons of ice melted in arctic since '03

For those deniers out there, we don't have much time left to stop major changes in climate. It may already be too late to "fix things"...

E. Swanson

But Black Dog... We need the Arctic ice to melt so we can drill the Artic Ocean for oil!

Besides, there's probably a ton of oil under the Antarctic ice cap... We'll wait for that bugger to melt and drill Antarctica is well... /sarcasm

Yeah, we're totally screwed. I can't wait until the Gulf Stream shuts off and turns the northern half of Europe into Siberia, because if I recall that's driven by temperature differences. We're changing the planet in very strange and sudden ways... And most of the outcomes are likely to be bad.

Though all the connections seem vague and indirect, clearly the real economy is intimately tied to the real environment. I'm fascinated by how tight that coupling seems to be. When I think of it in Odum's terms, as a giant pulse of the most concentrated emergy - a pulse that reverbrates through all coupled systems - it makes logical sense. But looking at it happen on the ground is a different thing.

The low hanging fruit is gone from the environment. The sinks are full. The human environment - the economy - reflects that and crashes. One would expect that in an extreme case.

cfm in Gray, ME

The weather here in Europe changed in the Spring of 2007 and has been gradually getting cooler since. I've not seen any reports as to why this is happening. So for the moment I'm assuming that the Arctic melt is causing a cooling of the Northern hemisphere. Possibly via atmospheric expansion pushing the jet stream further south?

If there is some connection between cooler weather in Europe and Arctic melting then I wonder what happens in say 2015 when the Arctic sea is ice free? Just conjecture, but if we're just a few years away from a major tipping point, I'd sure like to know about it.

Something from 3 years ago...

Britain faces big chill as ocean current slows

And this was 3 years ago... Before the rapid acceleration of ice melt and thaw we've seen as of late.

Bundle up, Europe... Gonna be a cold one...

Yeah, the Odden Ice Tongue didn't form during the Winter of 2008, as mentioned in the article. However, the US Climate Science report referenced above in the PR release from the USGS Abrupt Climate Change: Will It Happen this Century? didn't mention the Odden, even though I attempted to point this out during the public comment period for the CCSP 3.4 report. There is some variability in the THC, so it is difficult to claim that the THC has really changed lately. But, I think that there is enough evidence to connect the cooler conditions over England with a slackening of the sinking in the Greenland sea. Note that the same thing appears to have happened during the late 1970's and early 1980's (along with the appearance of the Great Salinity Anomaly in the Nordic Seas), a period during which Europe experienced several very cold winters.

I suppose we won't know until Winter has passed...

E. Swanson

Yes it's kinda creepy. Parts of the Southern Hemisphere have had an unusually cool/cold winter, spring and now summer. So the cooling is extensive. I'm hearing words like 'Arctic amplification' and 'Pacific oscillation' not quite sure what they mean though. I dread going back to heat waves, drought and huge fires.

Lack of Sunspots is my guess.

It's likely that some of the cooling is related to the lack of sunspots, since satellite measurements of the solar "constant" show a small variation in phase with the sunspot cycle. Whether or not there is a longer term variation of any importance is still a matter of intense debate, IMHO.

E. Swanson

Keenlyside, N. S., M. Latif, J. Jungclaus, L. Kornblueh, and E. Roeckner, 2008: Advancing Decadal-Scale Climate Prediction in the North Atlantic Sector. Nature, 452, 84-88.

Britain has just had the coldest start to a winter for 30 years. London had snow in October for the first time in 70 years. The big freeze is beginning.

move a little to the south and what do you get?

25 degree celsius in november, and just one big snowfall per year. is used to be different

anyway, i'd rather choose the spots with more heat

Let's look at some facts.

What was reported was the coldest first two weeks in December for 30 years. The next two weeks are forecast to be at or slightly above normal across the UK.

As for November

November 2008

UK overview

October 2008

UK overview

Here's the Met Office Winter long range forecast

Winter 2008/9 forecast

Updated 25 November 2008

So we've had the coldest October since 2003 and the coldest November since 1998 in England but above average in Scotland.

In other words it's been a bit chillier than we've been used to over the last few years and everybody starts screaming ice-age. Sigh....

Glasgow the temperature is forecast to peak at 11C (52F) on several days this week. That's warm for mid/late December.

I don't think anyone is screaming ice-age. 2008 is still in the top ten warmest years IIRC. My view is that the warming of the Arctic is forcing the warm Arctic air down into Europe. We see this as cooling because the warm Arctic air is cooler than the normal atmosphere we are used to. If that makes sense :)

I was mainly addressing that comment to "weatherman". Should have been more specific.

--from CR

Word is just leaking out but I heard they may let go 4,000 people with 7 months of severance and a year of health insurance on the radio this morning.

Seven months of severance for a big box retailer like that?

That's pretty impressive... especially given the draconian decisions that Circuit City made a year or two ago trying to compete with them.

Not as impressive as keeping their employees in the first place of course... but we can't have everything.

I'd bet this is a better package than their "normal" deal in an attempt to get some employees to self-select leaving (rather than mass layoffs).

Well TODers...

Consumer will be doing less consuming from now on. I lost my job today.

They gave me the "it's not you, it's the economy" line. Really wish I had started ELPing sooner.

I was going to follow WT's advice and demand a 10% pay cut, but they got to me first.

Hope this doesn't happen to any of you, it really sucks.

All I can say is good luck to find something else...in a more resilient sector.

Hey, sorry to hear that. Getting let go sucks.

You are probably not in the mood for cheering up, but you can think of this as an opportunity to make the big change to an ELP life. The advantage of being let go early is there are lots of resources to help you change now. In another few years, it will be "your severance package is two tickets to the soup kitchen. Oh, you have kids? well one extra ticket then. They can share."

Good luck! Keep us posted on what you end up doing. Who knows: Micro houses? Insulation contractor? Wind turbine blade quality control expert?

My wife got laid off from a publishing job. It does suck. It sort of throws the "reality" towel right in your face.

What line of work were you in?

I worked for a hedge fund.

My wife's graphic gigs have slowed down, but not stopped---

She is exceptionally gifted, and major corps use her work, but it is unsettling.

One cannot do a drive by in San Francisco and not kill a graphic artist.

Sorry to hear it. You won't be the last, I fear.

The whole country is not in equally bad shape. Some places are in much better shape than others. I'd suggest taking a hard look at the prospects of where you are at vs. other potential locations. For some people, loading up the car, mailing in the keys, and striking out for some better location WHILE THEY STILL CAN might be the best plan. You really do need to try to line up some type of income as soon as you can, even if it is not permanant, even if it is not full time. It is not going to be any easier to do so after January. Remember that there will still be hundreds of thousands of people retiring every year, so it is not true that there will be no hiring at all. Some places will be much better for a job hunt than others, though.

No time to mope, you've got to make some hard, quick decisions and take some quick action. This one is not like the past few recessions.

Good luck!

I don't have any figures on this so I could be all wet but with the Stock Market collapse and a lot of retirement funds being swallowed up in the black hole of financial losses I would think that the number of people opting for retirement might be way down (which is a bad thing for job-hunters).

Consider this: They spent thirty years convincing everyone to buy into the Real Estate and Money Markets and now a lot of us are in trouble.

I was thinking of that Madoff case today...how they got everyone to put their money into an elaborate Ponzi scheme. About ten years ago I invested over $100,000 into a fund called USA Capital, a Real Estate Devlopment Corp. They had awesome brochures and the sales guy was a close friend of mine. Over two years ago their assets were seized and right now I'm involved in a class action suit to get some of my money back. (Good Luck!) I was caught up with the idea of making 14% return on my investment. I was so impressed I rolled my return into the company and I told all my friends.

They're no longer my friends. But I look at it this way: I spent years of euphoric, uninterrupted sleep contemplating my imagined wealth. Maybe it was worth it?

Joe

Not only did the salesman use his friendship to convince you to buy, he engaged in viral salesmanship by converting you into a salesman who sucked in your friends based on blind trust and crafty salesmanship.

Don't read this as imputing blame on any one person. It's the system. It's the "specialization" system at its best.

There's a fair likelihood that your close friend, the sales guy did not know the fund was a scam. He was just doing the job he was hired to do, namely to sell. He was just one small specialized cog in a big machine. One bee in a giant virally expanding hive.

But then again, aren't we all mindless bees buzzing around and doing our "specialized" jobs? Doing it to perfection and not understanding the consequences?

(Perhaps we are all Habers as noted upthread (here), but don't know it yet.)

Yes, I am sure that some oldsters will want to defer retirement. On the other hand, lots of employers will want to cut their payroll. Given that employees near the end of their career are usually more expensive (near top of pay grade, plus they drive up health insurance premiums), they may find that their employers have made their retirement decision for them.

Good luck Consumer. Same things has happen to me 3 years ago.

I went from a jobs as a system engineer to part time college teacher. All this in a city with an employement rate of 3.5%. It is amazing how imaginative are people when its time to find a good reason why not to employ someone with a PhD!

I am very sorry to hear your bad news. My son lost his job too. I wish you luck in finding something suitable or anything at all.

I asked my son if his wife was looking for work. He said no. My comment was that my mother had a job as secretary during the great depression and my dad lost his job. They were able to pay the mortgage on their house. These are hard times, it hurts to see people around you losing their security. Good Luck!

Sorry to hear that. I too am worried as my employers is forcing us all to take some "vacation" time this Christmas. Unlike union auto workers, we do not get 95% of our pay while sitting at home.

What were you doing in this hedge fund? Be quite specific. I may be able to point you toward other opportunities.

I worked in the back office, "operations" area. Doing trade settlements, keeping track of derivative positions, reviewing derivative contracts, making payments on our CDS positions, and resolving differences with our Prime Brokers. I would set up accounts with new Prime Brokers and make sure that the reporting was in place, etc. I pretty much handled all of the back office work so that our traders could just do the trade and then forget about it.

I will update my email in the user section. I live in Minneapolis, but don't necessarily need to stay here.

Re: GE Wins $3 Billion Iraq Turbine Order, Largest Ever

Regrettably, it appears these turbines will be simple cycle (10,100 BTU/kWh heat rate), not combined cycle (6,570 BTU/kWh).

Cheers,

Paul

Howabout those Iraqi's?? No need to conserve anything there...U.S. Military is involved with this one folks.

BTW,

I am starting a program to send every old shoe in the country to Mr. Treason in the White House, and all the Treason Munchkins in Congress.

Please mail them directly, asap. The Post office knows the address.

Power Down.

Great idea of sending shoes to the Shrub-->make sure to coat the soles with fresh manure--IMO, a dumb plant needs all the recycled O-NPK possible!

If this is a great success, then hopefully we move on to sending barrels of pinky fingers so we can 'fully digitize' the Oval Office [see my prior postings on this topic-->Full credit to the Borneo tribe that initiated this idea].

coat the soles with fresh manure

US Postal laws has rules about sending manure in the mail. As in not legal type rules.

And one source was claiming the shoe tosser has a broken arm and ribs...which no one is admiting to doing.

Solar assisted combined cycle power plants should be standard anywhere that there is sufficient solar insolation.

Add in some wind powered compressed air storage to feed the gas turbine with compressed air and I'm sure you could cut the gas usage right down.

Another good option could be efficient slow speed diesel engines making use of waste heat in a steam cycle such as http://www.power-technology.com/projects/wasa/ running on heavy oil and making use of solar assist on the steam cycle would further improve its efficiency.

"New" features of change.gov

Open for Questions: Response

and

Join the Discussion: Transition Economic team responds

Perhaps some of you who are capable of asking tough (energy) questions can submit if you have not already. I do not feel qualifed and frankly, while I still think Obama deserves 100+ days in office, I am more disheartened than I was 30+ days ago.

The current crop of Q&A is, to me, underwhelming but it's the first set.

I haven't read through much of the BLOG yet.

Pete

On the Haber- Bosch book.. whew! 'Interesting times' hardly begins to cover it..

I wonder if the bargain was Faustian, Malthusian or what?

"Genius played a role, as did guile. But Haber also forged ahead by consciously forswearing his Jewish heritage to embrace German nationalism. Albert Einstein, a lifelong friend, at first gently mocked Haber for his willingness to please, then felt sorry for him as they grew older. ...