Higher Inventories but Demand Drop Slowing?

Posted by nate hagens on January 14, 2009 - 2:07pm

The weekly inventory numbers are out. Inventories are again higher.

Crude Inventories - Graph from Johnson Rice

Here are the numbers:

DOE: Actuals

Crude oil: Up 1.1 million barrels

Motor gas: Up 2.1 million barrels

Distillates: Up 6.3 million barrels

Complex: Up 9.6 million barrels

API: Actuals

Crude oil: Up 0.7 million barrels

Motor gas: Up 3.6 million barrels

Distillates: Up 0.4 million barrels

Complex: Up 4.7 million barrels

Here is what was expected:

Crude oil: Up 2.5 million barrels

Motor gas: Up 1.9 million barrels

Distillates: Up 1.1 million barrels

Complex: Up 5.5 million barrels

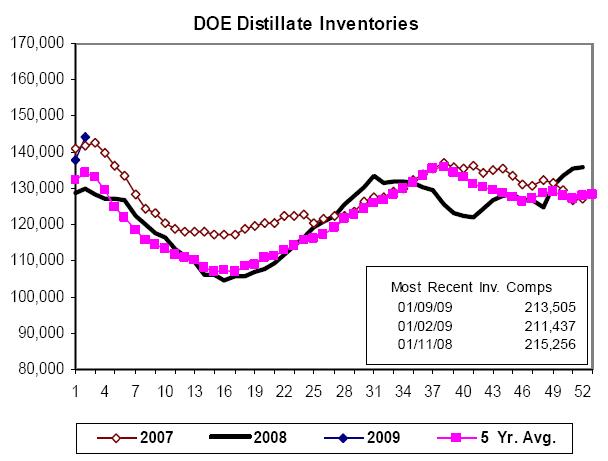

A big build in DOE distillates - heating oil, firm of late due to cold weather and Russian/Ukraine situation is down 8 cents

Distillate inventory - graph from Johnson Rice

And for those interested in monitoring demand, the following table summarizes the year-over-year change in implied gasoline demand based on trailing four week averages.

12/19/2008 1/2/2009 1/2/2009 1/9/2009

DOE -2.7% -2.2% -2.2% -2.1%

MasterCard Survey -2.1% -3.0% -4.0% -3.6%

An analysis by research firm Johnson Rice:

We view the DOE report as bearish, based on the large build in

distillate stocks. Healthy distillate margins have been supportive of

refiner crude demand; any weakening of these spreads due to rising stocks

(distillate stocks are now at a 5-yr high for this time of year) could

exert more pressure on the complex. After two weeks of warmer than normal

temps, cold weather and the increase it should spur in heating oil demand

has arrived in timely fashion.Distillate stocks increased by 6.3 million barrels to 144 million barrels,

14 million barrels above yearago levels and 10 million barrels above the

five-year average. Not surprisingly the rise in distillate stocks is

underpinned by rising ULSD/low sulfur diesel stocks, reflecting economic

weakness. On the other hand, hi-sulfur heating oil stocks have trended

sideways over the past few weeks, in line with normal seasonal patterns.

This week s build also reflects reduced export volumes; four week trailing

average implied demand is down a reported 2.4% y-y.Crude stocks rose by 1.1 million barrels; imports of crude averaged 9.7

mmbpd. Stocks at Cushing continued to creep higher reaching 33.0 million,

vs. 32.8 million the prior week. Crude stocks of 327 million barrels are 29

million barrels above the 5-yr average.Gasoline stocks rose by a seasonally normal 2.1 million barrels as refiner

yield remains tilted towards distillate. Imports were relatively low, at

797,000 bpd. Discretionary ethanol blending has declined, which also

introduces slightly more tightness into the gasoline pool. At the present,

gasoline inventories of 214 million barrels are in line with the 5-yr

average, and gasoline cracks have improved from the below-breakeven levels

seen throughout most of Q4. While cracks have improved, implied demand

remains soft; 4 wk trailing average implied demand is down 2.1% y-y.

The battle between depletion and demand is currently being won (lost?) by demand. But for how long?

Discuss.

The inventories are higher because the imports just keep coming. OPEC claim they are cutting production but there is no sign of it in imports. Demand is winning for sure and OPEC are losing by pumping away into lower prices.

Well. . . the last four week running average net import number was 11.5 mbpd (through second week of January). This was 700,000 bpd below the annual average number for 2007, and 400,000 bpd below the net import number for second week of January, 2007 and January, 2008 (both four week running averages).

It's pretty clear that have seen the decline in demand outpacing the long term decline in net oil exports, but I expect to see a combination of voluntary + involuntary net export reductions to soon cause the decline in net exports to outpace the decline in demand.

Assuming a current net export rate of 20 mbpd from the top five (versus 24 mbpd in 2005), our middle case is that in the next four years, at a rate of 20 mbpd, the top five will have (net) exported about one-third of their post-2008 cumulative net oil exports--one third gone, in four years. Over the same time period, I expect to see our #3 source of imported oil, Mexico, at or approaching zero net oil exports.

...any views on when the Supply-Demand Gap will close back up at present rates?

Nick.

My guess is by mid-year, but it's a multivariable equation.

Here we go again :-)

In june of 2008 Supply = Demand, at 147 $ and today january of 2009 Supply = Demand, at 37 $ pluss change ...

There is no such thing as a Gap, IMveryHO.

If there is a Gap there must be a difference somewhere, so then, where is that difference?

storage

Yes sure, but then again there is always storage along the line , between producer and ultimately the gas-station.

Q: Where are those "supply minus demand"-storage tanks actually ? Do those tanks have a "supply minus demand"-sticker sticked onto them or ... are they simply inside our virtual imagination ?

Doesn't the contango tell you that there's an imbalance?

It seems to me that these loaded tankers sitting around are adorned with such a sticker for instance.

contango ... imbalance? ????? what ?

HFat you have to think harder at my question. The tankers you refer to are already sold to my knowledge, thus not part of my claim.

To understand the gist of my claim, you need to understand the basic idea of how oil is traded. It's an auction, consisting of discreet sales of units of 1000 barrels..... therein is the answer.

OIL IS TRADED AT AN AUCTION - therefore DEMAND ALWAYS = SUPPLY

An auction has an item - one item - and the asking/bidding price always narrows in towards each other ..... and suddenly those prices match, viola SUPPLYING PRICE = DEMANDING PRICE. It's like the stock exchange and you never hear of the idea of a supply-demand GAP there ... :-)

... you see ?

Another way to look at it is that you demand oil at 10 dollars /barrel today .... I'm not holding my breath neighter should you. Q: When do you believe Supply will be coming down to your price ? Ever ?

I understand what you're saying but it's a tautology.

What's more interesting I think is to look at the consumers' demand as opposed to the gross demand which includes hoarding. In that sense, supply has been stronger than demand in the last few months leading to unusually high storage. This is not a sustainable state of affairs obviously.

The reason I brought up the strong contango is that it's an indication of market participants expecting higher prices going forward. Additional buyers intent on hoarding the stuff have been showing up on the market, keeping the spot price higher than it would otherwise be.

There are probably many empty tankers still. Additionally, many tankers currently in transit could easily be turned into floating storage as the OPEC cuts are diminishing the amount of oil in transit.

Alright, back to my initial point.... Supply-Demand Gap. There is no such thing . Thats my point.

If a comodity is in short supply (acquiring-) price will go up , on the contrary it will go down. (basic trading knowledge).

Philosophy:

There is no gap in "anything" unless you set a "fixing point" - a standard "no gap" position. Think of a door, as long it's closed there is no gap, open it .... there you go, gap there is ... big / small defined by the angel of opening.

Lesson :

1) ... unless there is an universally accepted price for an oilbarrel at say 100$ there vil never be any gap in supply/demand.***That will happen every day***

2) or .. say if there is set a standard for "how many barrels that should be traded per day globally , say 85 mb/d" , one can start to argue "there's a gap" if there comes to a deviation from that number. ***That will happen every day***

So the idea of "a gap" has no value IMHO.

(I guess this gap-thing will continue, with or without my help :-)

Yes, this gap thing is somewhat silly. I figure it's a kind of colloquialism. But I'm sure you could understand what the poster above meant with this "gap", especially after it's pointed out to you that more storage is probably what is meant.

Words can have different meanings. There's no point in correcting people who keep using what you think are the wrong words over and over, is there?

HFat ; "I figure it's a kind of colloquialism."

Yes, I could agree with this, if this oil-supply-demand-gap-definition was well defined and understood, but I don't think it is. Many readers (people) swallow the consept that there is "gap-oil" somewhere ...

The reason I made a sceene of this is that I find these gap-arguments very misleading , to the extreme actually.

See what Noutram asks here "...any views on when the Supply-Demand Gap will close back up at present rates?"

HFat ,do you understand this ?

"... Gap will close back up?" I ask : which gap ? and back to ... to where .... to what ....?

With all due respect to all / Noutram : I don't understand this gap-thing ! you all are talking about.

edit:

As for all daily global oilproduction there is always "a gap" between oil in progress/temp.stored oil and actual sold oil for thet very day. Today this gap is more than last summer. BUT that has nothing to do with this SUPPLY-DEMAND gap "we" are talking about , no ? In this case there is always a SUPPLY-DEMAND gap. Always.

at what point does tanker storage peak out?

Oil is produced, stored, refined, transported and finally consumed by the end user. When production is greater than consumption by the end users, inventories rise. Excess quantities of oil on the market (that has to be stored somewhere) mean that current price does not clear the market and price is bound to fall given all other things being equal.

When inventories are falling, it means that production is less than consumption. Price again does not clear the market and is bound to rise, given all other things being equal.

westexas - When do you expect Mexico to stop exporting in today's environment? Matt Simmons has been saying that by the end of this year (2009) we should see little to no exports...

http://www.bloomberg.com/apps/news?pid=20601086&sid=aCH3J3wXRtcI

--

--

Seems to indicate exactly what you are talking about, exports declining much faster than production declines!

I'm assuming some decline in consumption, which would stretch their net exports out a little longer. Note that Mexico both exports and imports refined product (they are a product importer on a net basis).

In any case, my estimate for Mexico for 2008 is for net exports of about 1.0 mbpd, versus 1.4 mbpd in 2007, and 1.9 mbpd in 2004.

My rough guess is that Mexico, by the end of 2009, will have (net) exported about 90% of their post-2004 cumulative net oil exports. Matt is putting it at 100%.

Hi, WT ... I agree, Cantarell and Gwahar are the ones to watch ... however, the next leg of deleveraging will commence shortly; I suspect this will center on state and local governments going belly up en masse. Sprawl is expensive and the states are going to find out the hard way the price tag on all that 'growth'. For the past few decades credit- inflated property values and state income tax receipts (on inflation) have generated the illusion of limitless real estate- derived prosperity. Exponential demand for government services has been part of that growth regime.

The illusion is now shattered. In stead of productive assets, the growth represents limitless liabilites!

A large part of state/local government expenditures is payroll. Employment will simply get crushed. Demand has a very long way to fall.

This next leg will require an additional $2 - 3 trillion bailout on top of the $8.5 trillion already on the table. This amount will keep schools open and some police on duty. At the same time it will be the end of the bond market as we know it. It will dawn on both American citizens the the chimps in government and business that this situaion is a) dire, b) not going to end by itself and allow the government and business to take credit, and c) light years/parsecs beyong the abilities of Manfred J. Obama & Co.

Obama does look good in a suit ...

As we all know, in a deflationary environment, products, services and assets ALL decline in price relative to currency or in this case, credit; the decline triggers unemployment as a consequence. In this environment, the unemployed have benefits but these are trifling and soon run out. To the penniless, nickel gas is out of reach.

My only hope is we get some good rock and roll out of all this crap. If we trade national bankruptcy and the impoverishment of millions for the end of rap, disco and 'smooth jazz' it will be a good trade! The other 'cachet' item I'm waiting for is the news that Ben Bernanke has thrown himself out a high window ... that I might live so long ...

No no no--Bernanke has given up on helicopters and is taking sailing lessons and getting his new wooden sailboat ready for a nice loooong V-A-C-A-T-I-O-N!!

(I hope he reads TOD BTW!)

Hello Grandpa!

WESTEXAS

you said

Assuming a current net export rate of 20 mbpd from the top five (versus 24 mbpd in 2005)

how did you arrive at that?

the data does not support it

The EIA showed 23.9 mbpd for 2005, 23.2 for 2006 and 22 for 2007. I estimated 22.5 for 2008, through 9/08. I was assuming around 20 currently based on voluntary + involuntary reductions in net exports.

Supply may very well be a whole lot more inelastic than is appreciated. I think there are 2 reasons for this.

for example,once an offshore facility starts producing you have to earn back the daily lease rate for the rig. As long as the revenues cover your costs you will produce regardless of your views on pricing. And as it gets harder to get oil out of the ground and the costs increase the pressure to produce increases.

Secondly, stopping and (re)starting a field can damage it.

WeekendPeak

"Secondly, stopping and (re)starting a field can damage it."

please explain that claim. what is the mechanism by which the alledged damage occurs ?

I am not an expert on this, but I do play one on theoildrum...;-)

My understanding from the stocks I have owned is when there is strike or some other demand side event, turning off the wells does no damage and is even healthier (especially if the shut in production gets sold at higher future price.)

I'm being trite -please someone in the industry (Rockman?) chime in on the specific advantages/disadvantages of shutting off a gas or oil well. Do onshore/offshore wells differ?

I am also not an engineer but if OPEC does cut back on production could it allow the wells to develop more pressure, thereby allowing greater production for some time in the future once full scale production resumes?

In general you are correct Nate. Especially for water-drive reservoirs including those with water injection efforts like Ghawar. In fact, high production rates at Ghawar are rumored to be hurting the reservoirs and perhaps loosing URR. There are a few odd reservoir situations, such as NG wells which are cutting water or condensate. Enough vertical velocity of the production stream is needed to keep the well from “loading up”. I won’t guess a number but such cases represent a very low percentage.

Completely shutting down surface equipment isn't the best thing to do but it’s not too damaging. The negative effects generally involve the loss of cash flow especially if they can’t cover operating costs. I’ve very rarely seen a US operator reduce production because of lower prices. Usually just they opposite: pull the wells as hard as possible even if it hurts URR.

I'm not an industry professional, but I am the son of one of the best and a brother to two more. I have worked a little in the oil fields, but its not my thing.

There are big differences between fields and the formations from which oil is produced.

While some fields may benefit from being shut-in, others may suffer, even be lost.

For instance, around Luling many wells are extremely corrosive. While being pumped and treated, tubing, pumps, etc. do well; when left unattended they disentegrate.

Some formations will build up gas pressure, others won't.

There are so many variables, it's impossible to say how shut-ins will affect production in general terms.

I tend to think along the lines of Matt Simmons:

Rust never sleeps.

I got that claim from a guy who used to operate offshore rigs. He didn't explain the mechanism - though i vaguely remember something about a pressure drop which sometimes occurs, thereby reducing the URR.

I'll dig and see what I can come up with.

WeekendPeak

You might want to ask "elwoodelmore." I believe that he is a petroleum engineer.

It seems like low refinery utilization is going to be a problem, both in the US and around the world. This is another Johnson Rice graph:

If refineries aren't working at close to full capacity, it seems like the more marginal ones run into financial difficulty. It seems like the way we have managed to attract oil imports over the years is by having refineries, when others didn't. Now with more refineries opening around the world, and total production and demand likely falling, there will be less oil in relationship to refineries, and some of the refineries will need to close. I am guessing some of the US refineries will be ones to close.

Big West is still closed:

Flying J California refinery remains closed after 10-day shutdown

They say it's closed for "maintenance" but when Flying J declared bankruptcy, Shell cut them off. They're looking for a new supplier of crude oil.

Here are some US "Import Land" Data, 1997 to 2007 (last year for which we have annual data, EIA):

Consumption:

1997: 18.6 mbpd

2007: 20.7 (+1.1%/year*)

Crude Oil Production:

1997: 6.5 mbpd

2007: 5.1 (-2.4%/year)

Total Liquids Production:

1997: 9.5 mbpd

2007: 8.5 (-1.1%/year)

Net Imports:

1997: 9.6 mbpd

2007: 12.2 (+2.3%/year)

*Annual rate of change over 10 year period

At a -2.4%/year decline rate, US crude oil production would be down to 4.0 mbpd in 2017. So, an ongoing long term reduction in net exports would have to be achieved after consumption fell enough to first offset the long term decline in domestic production.

Using four week running average numbers, the total product supplied through the second week of January, 2007 was 20.2 mbpd, versus 19.7 mbpd for the same time period in 2009 (decline rate of -1.2%/year). Net imports fell from 11.9 mbpd (1/07) to 11.5 mbpd (1/09), four week average. It looks like the EIA is estimating a domestic crude production drop of about 350,000 bpd over the same time period (1/07 to 1/09).

Note that post-peak exporters wanting to maintain constant net exports have a similar problem--their consumption would have to fall at about the same volumetric rate that their production falls. In the case of Mexico (in order to maintain flat net exports), I estimate that a production decline rate of -10%/year over a four year period would require an annual decline in consumption of about -16%/year over the same time period (dropping by half about every 4.5 years).

Interesting, though *depending on if/how quickly the economy rebounds* I would suggest US crude production will fall much faster; due to rising prices previously shut-down wells have been reopened, this added capacity softens the decline. However, as SHTF, we will see more "drill baby drill" sentiment, which again will artificially increase production. However, with this higher production, the wells will be depleted even more quickly. Things are still being decided by the market, which will just increase the rate of burn. Perhaps this recession is the best scenario we can hope for; a series of bumps in the business cycle deep enough to destroy demand, but not so long that people forget the last time they couldn't afford gas.

According to the MMS website as of January 14th, 2009 some of the damage from hurricanes Gustav and Ike was not yet repaired:

"From the operators’ reports, it is estimated that approximately 11.0 % of the oil production in the Gulf is shut-in. As of June 2008, estimated oil production from the Gulf of Mexico is 1.3 million barrels of oil per day. It is also estimated that approximately 15.0 % of the natural gas production in the Gulf is shut-in. As of June 2008, estimated natural gas production from the Gulf of Mexico was 7.0 billion cubic feet of gas per day. Since that time, gas production from the Independence Hub facility has increased and current gas production from the Gulf is estimated at 7.4 billion cubic feet of gas per day."

With high oil prices the GOM production was supposed to increase to 2 million barrels of oil per day; with current conditions some drilling budgets will be cut.

The United States is yet taking large net imports about the same as this time last year. The difference is the price of oil is less than half the price as last year and instead of oil inventories falling they have been rising. That is demand decreased not due to price, but due to financial collapse. Even in collapse most people are working and the United States is dependent on oil imports.

Do these numbers allow for Alaska bringing new large fields on line. Resistance to opening North Slope areas (on and off shore) for drilling will fade in within a decade once prices have stabilized at higher levels. At its peak Prudoe Bay was producing over 2mbpd itself. No one in the know seems to be saying if new fields will equal or surpass those numbers. Fantastic rumors abound.

Environmentalists-at least those with a foot in the real world-will come to realize a broker future U.S. will do a much dirtier job extracting oil from touchy spots than the richer current U.S. would. When we are broker everything will be for sale with precious few restrictions.

The North Slope produced a peak 2.1 million bopd, but recently that has fallen to about 700,000 bopd and tanker traffic to Alaska was diminished. The main Alaskan production is from fields outside of the Prudhoe Bay structure. There was a recent BLM auction of leases in the Alaskan Petroleum Reserve east of Prudhoe. Within the last few years drilling has shown the eastern end of the reserve did not contain commercial oil deposits. The western end of the reserve is where the valuable oil and gas acres are.

http://www.rigzone.com/news/article.asp?a_id=71442

I do not object to ANWR being set aside for the time being, however I think that in the future people will find a way to pump oil there, just as they found away around treaties with Indian tribes in previous generations. Sort of nice to leave a few oil and gas areas for the future.

Then there is the 'mythical' motherlode of a capped well, off shore I believe. Last time I was on the slope a guy claimed to have been a safety officer after the fact on the famed capped site (it has a name or number of some sort). I would imagine all big fields have stories about the big strikes that are being kept secret. I've always figured they fit right in with stories about making those beastly heavy 1970's cars get 100 mpg with a bit of timing and carburator work. But 'the truth is out there.'

I do agree that the longer we hold off on ANWR the better up to a point. A new pipeline will take a lot of energy to build, it will be less wasteful to pump out the neighborhood while Aleyeska is doing a more or less decent job of maintaining the current pipe. The seas around the Acrtic Ocean will not be ice free year round for a long time so North Slope oil will have to go overland to Valdez to make it to market several decades hence just as it is doing now.

Of the money we have seen thrown around thus far let me ask you this, that 168 billion that our country borrowed to give away to us in the form of an "economic stimulus package" ...did it do a darn thing to create jobs or stimulate our economy? NO, nothing. And we borrowed the money from China.

This past year the high cost of gas nearly destroyed our economy and society. More people lost jobs and homes as a direct result of that than any other factor in our history.

Fannie and Freddie continue to get all the blame. Of all the homes I have seen lost in my area SW FL and believe me I have seen many, none were due to an adjustable mortgage. They were due to lack of work.

Families went broke at the pump alone. Then added to that most saw record rate hikes at their utility companies. The high cost of fuel resulted in higher production and shipping costs that were passed on to the consumer, in most cases higher prices for smaller packaging.

Consumers tightened their belts, cut back, went out to eat less or stopped totally. Drove around on tires that needed replacing longer, some even quit buying medicines they really need.Unfortunately cutting back and spending less results in even more layoffs. A real economical catch-22.

And, as we are doing the happy dance around the lower prices at the pumps OPEC is planning to cut production to raise prices. They are even getting Russia in on the cutbacks. Oil is finite. We have used up the easy to get to reserves already. It will run out one day.

We have so much available to us. Solar and Wind are free sources of energy. Of course to get the harnessing process set up is somewhat costly it is still free energy.

It would cost the equivalent of 60 cents per gallon to charge and drive an electric car. The electricity to charge the car could be generated by solar or wind at least in part and in most cases totally.

If all gasoline cars, trucks, and suv’s instead had plug-in electric drive trains, the amount of electricity needed to replace gasoline is about equal to the estimated wind energy potential of the state of North Dakota. What a powerful resources we have neglected.

Jeff Wilson has a profound new book out called The Manhattan Project of 2009 Energy Independence Now. http://www.themanhattanprojectof2009.com Powerful, powerful book! Also, if you think electric cars are way out there in some futuristic lala land please check out the web site for a company Better Place. http://www.betterplace.com/ they are setting up infrastructures in San Francisco, San Jose and Oakland as well as the state of Hawaii to accommodate electric car use.

I think we need to rethink all these bailouts and stimulus packages. We need to use some of these billions to bail America out of it's dependence on foreign oil. Create clean cheap energy, create millions of badly needed new green collar jobs and get out from under the grip foreign oil has on us. What a win -win situation that would be for America at large

Why did tney not blame the fact that real estate speculation was causing home prices to rise at double digit rates for these later financial hardhips? I was filling my car twice a month with about 11 gallons of fuel. That cost about $88. a month when previously it cost $44. a month. The mortgage payments, taxes, insurance, utilities, ahd maintenance of homes around here were much more than that. Those big home are not going to help them find jobs. It is an energy sink and a tax liability. The hot water heater might be leaking within ten years. Those are expensive items to replace.

A couple of comments obviously if you look at DOE vs Master Card the error in the demand calculation is large i.e the exact change in demand is something like 3% +/- 2%

But even with that we may well be seeing two effects showing up in the MasterCard data.

One for people with money now that gasoline is cheaper such that 20 dollars gives at least a half tank for most people people pulling in to top off and by something may well now just pay cash instead of charging at the pump.

I think this effect is small but it certainly exists I know for a fact I tend to pay cash for purchases under 20 while using a credit/debit card for bigger purchases so the size of our bills vis the purchase effect is real.

Next and probably more important is it looks like we are seeing a real loss of access t o credit i.e people aren't charging gasoline because they no longer have credit.

Eyeballing the figures it looks like about a real 1%-2% difference which fits VERY well with the rise in unemployment.

As unemployment increases there is churn in the people who are unemployed with a lot of the ones who have been unemployed for a while generally finally taking part time or low wage work by the time they do this they have no credit.

So we may be seeing what I thought we would see which is even as unemployment increases the fuel usage starts to flatten as people use more gasoline to make less money and use more gasoline searching for work as jobs are difficult to get. They may drive to say five different businesses in one day turning in applications for example.

As time goes on we would expect the MasterCard survey and the DOE to continue to diverge over time and also same with the VMT reports VMT will flatten but loss of credit will be continuing.

But when you look at the values for each of the products supplied, everything is down except residual oil.

Imports of gasoline and blending components has dropped pretty significantly over the past 4 weeks and the import of kerosene jet fuel is nearly nonexistent.

In the past this has looked like the "waste byproduct" of Europe where diesel fuel is much more important. For the moment, it looks very different.

Here is what I think is happening.

First and foremost we have seen a tremendous amount of contango lately in the oil market in fact the difference between the front month and further out futures has reached historic proportions. You can make a lot of money buying oil and storing it for a few months for later delivery.

Next this has brought speculative interest into the oil markets again but its speculators with storage facilities that act as a proxy for producers. This can be seen in the large builds at Cushing which are a result of the way the Nymex market works and to some extent along the gulf cost. The fact that PADD V or the west coast is not changing much is your key indicator that its not oil building up because of demand decline. The West Coast market is isolated from the rest of the US and as you can see its well supplied but neither good nor bad.

So this means in my opinion that speculators are now sitting on between 30-60 million barrels of oil or so. Or basically a lot of oil. They have built inventory by buying the front month cheap and selling delivery contract for later months speculating that the front month will fall.

Now as the front month price falls people that have purchased futures for delivery will close out at a certain spread to stop the loss vs the front month. I.e they will settle their nearer term futures contract esp the front month for cash.

This is in my opinion the important issue with the current oil market the speculators who went short with oil for delivery are making out like bandits as their contracts are settled for cash and not delivery. Then if they have more storage they buy a few front months to keep filling.

Now it gets a bit more complex because these speculators as a group are setting on enough oil that they are now market movers and act like a virtual exporter. As long as they don't actually have to deliver or can refill storage with the contango going there way they can keep playing the game. In general whats happening is they are not actually delivering a lot of oil but most often settling for cash.

They have enough oil that has produced a nice profit playing this game over the last several month that they can even sell it cheap i.e the same oil has rolled trough the contango arbitrage a few times that they would only need say 10 dollars a barrel to break even thus they have oil they can in effect flood the market with on the front month forcing down the price of the front month contract to keep the game going.

Whats important to understand is physically this is the same barrels of oil that have been around for several months. As long as the contracts are settled for cash its not going anywhere and its not oil coming out of OPEC or being delivered to the US recently. Some of this oil has been in storage now for 3-4 months.

If I'm right then I can tell you whats going to happen assuming that at some point real monthly oil imports begin to fall. The market will go into backwardation once it does these guys will close their longer term delivery contracts for cash and begin to sell the oil on the front month for real. If they can't force the contango then they will finally start selling down their stored oil on the front month. I'm pretty sure this unwind of the "carry trade" will create some impressive backwardation similar to what we have seen for contango.

From here on out US storage will begin to fall and the price of oil will rise steadily.

Now thats what I think will happen the other route is that the contango in the market collapses and the price goes into backwardation with falling prices in the futures month.

When is the game up ? When the speculators run out of places to store oil and when consumers start taking delivery on the front month and not hedging i.e we finally start really burning the oil. Basically at some point the market will realize that the front month contract is going to fall and the contango will collapse.

Whats important is that the US now has a lot of oil in storage thats owned by speculators and has been setting there for months as a hedge for shorting the market.

Its not oil delivered by OPEC !

Assume that it's around 50MBBL that is being stored. At 12MBBL per day of imports, that's only around four days worth. If that's all the excess inventory it takes to drive prices down so far, it's a really breathtaking example of how oil really IS priced at the margin, and how fast it will go UP when contango ends.

Yep its only about 5 days of oil but understand that on average the US has about 20 days or so of oil so 5 days is 25% of the JIT inventory for oil.

It does not take a big surge to smash prices in a just in time delivery system like what we have for oil.

The only question is when will these speculators get forced to change position.

That goes back to what I've been saying for a long time until the steep contango is broken and we go into backwardation we don't know the real price for oil.

Either the further out months will eventually get smashed or front month supply will become tight. One would think that the market should have figured out the game thats being played at some point and dumped their long dated futures. I guess there is a sucker born every minute.

To be honest I actually hope that the long term futures will get wiped out sending us into backwardation since that would be a golden buy opportunity. But I suspect that what will happen is that the front month will go up setting up a rising backwardation situation. Its not as good and opportunity as a price smash given that the current price is simply unsustainable.

I've of course thought that the current situation would have been short lived since its and obvious losing game and that the speculators would have had to dump there oil weeks ago. I did not think that people would settle so many contracts for cash instead of delivery leaving the glut to play another day. This suggests of course that its also speculators on the short term long side getting their fingers burned repeatedly because they are settling for cash instead of delivery.

It does however show that someone with a couple of super tankers worth of oil and a pile of cash can make some serious money in the oil markets.

And last but not least I've always been of the opinion that any speculation in the oil markets that could really move the market needed real honest oil to execute and despite the price changes this year I've seen nothing to indicate that real oil was not the major driver. Not that I disagree with Nate about hedge funds unwinding oil trades but the important part of that unwinding earlier is they dumped stored oil onto the market not just the paper trades. Without the physical oil situation the paper trades would not in my opinion have caused the persistent price changes.

And last but not least I think a lot of people miss the fact that speculators in the oil market own significant amounts of storage vs the daily flow of oil so they are capable of physical speculation.

memmel's follow-up comments help to understand a little with the speculator's role in the build-up of physical inventory. It seems as though as more contracts chase the contango spread and pour into the front months, the spread should narrow (Economics 101, right?). To the extent the spread does not narrow, it indicates that the physical demand situation is weakening even faster than the broader market expects. The contango arbitrage can continue as long as this is true, but if demand growth (unexpectedly...) resumes the arbitrage would have to unwind (after perhaps a few months of dumping front-month oil to extend it a while, as memmel indicates).

A couple of observations about the role of speculation occur to me: 1) any discussion of price should account for physical trade (classic supply/demand) but also the paper trade (volume of contracts, put/call ratios); 2) econ 101 says that speculators provide liquidity and reduce volatility of the commodity, but perhaps this is only true when supply is stable and growing.

In futures lingo, people in the oil business, such as producers, refiners and retailers are "commercials" who are hedgers. Commericals are the "smart money"

The non-commercials, like hedge funds are the "speculators". They are the "dumb money".

Everyone else is in the "sucker class" as Jessee Livermore would say.

The commercials build inventory when prices are low and reduce inventory when prices are high. They also play the crack spread.

During the price spike, rising prices on falling inventory indicated speculation because commercials should have been trying not to get stuck with high priced inventory.

In the late 1990's I remember low oil prices causing a shortage of storage.

Perhaps someone has looked to see the periods of contango and backwardation related to inventory at that time?

Well on the commercial side we have one other group and thats the physical oil speculator willing to buy and store but with no refining capacity or other use for the oil.

They have a lot of storage and of course other commercial players can readily play the role of physical speculator if it makes more sense to sell the oil via futures contracts vs refining it so its not just pure storage plays.

The best thing to do with a barrel of oil right now is sell it in a few months.

Also I'd not be surprised in the least to find out a few commercials are effectively doing naked shorting selling delivery contracts for oil they don't physically have.

The huge price spike we got back in October I think had to do with to many people asking for physical delivery I suspect the recent spike are the result of similar games going on.

Eventually this game will unwind and a few players will get crushed as the market goes into backwardation. In my opinion the day the front moth spikes up enough to send oil into backwardation and if it holds then all hell is going to break loose as people unwind longer term future sale contracts push the futures months even lower vs the front month. The only issue is whats the price point where this contango is finally broken and exactly how it unfolds. No telling. Understand that despite our new low prices we have just recently seen the highest contango ever recorded.

Found a old article but the situation is the same just the prices have changed.

http://www.theoildrum.com/node/4023

And more recent.

http://community.investopedia.com/news/IA/2009/It-Takes-Two-To-Contango-...

Note this article has and error is 2 million barrels to a super tanker not 200 so ...

And you have to watch double counting lets say I get a barrel of oil in October and I sell a futures contract on it and futures prices fall and my delivery contract is settled for cash. I can sell the same barrel of oil again and again and again and it will be counted as inventory the entire time. Its not that we got say 11 barrels of oil in month A sold all of them and bought 12. We got 11 sold say 8 and bought 9 for a total of 12. Three extra barrels came in one month then only one extra speculative barrel but Delivery was 11 then 9 so even as exports declined inventory actually increased. Lets say average was normally 10 barrels. Obviously for the supplier to force to drain down inventory they would need to make a steep cut if they normally shipped ten and demand is 9 and you have 12 in inventory then they would need to ship 4 barrels one moth or a 60% cut to balance supply and demand if they can. Obviously the supply chain for oil is long so it takes time to draw down a inventory surplus. And its non trivial to shutdown fields. The real underlying problem is a combination of a surge and even a fairly slight drop in demand like this results in a large inventory overhang. And it seems this is in the hand of speculators who are milking it.

We had a lot of these shadow barrels at the start of 2007 also I could not figure it out. From tanker traffic imports etc I figured out at least 20 million barrels of extra oil hit the US as the prices increased but inventory kept increasing well beyond what seemed to be entering the US. The trick is that the oil was being held over several months. So a barrel was shipped in say October and counted in inventory for say 3 months before it was finally sold. The oil that made inventories increase was only imported once. What we have right now is really a 20 day supply and 5 days of excess oil thats being held month after month used repeatedly to back futures contracts that are cleared for a profit as the front month falls and no delivery of physical is made.

The key is that as long as contracts are settled for cash i.e the people like hedge funds that went long and got burned as the front month collapsed or speculators you can go short with the same one barrel of oil multiple times. Given the collapse in prices I'd say that the commercials who hedged have made out like bandits selling one barrel like five or six times in some cases so they are only in the oil the carrying costs if that. Of course this means as needed they can kill the front month since they can sell oil that has now effectively cost them nothing.

The irony of course is if the Hedge funds will capitulate and quite throwing good money after bad betting that the price of oil will rise then these barrels will clear and the price will rise.

I don't understand the term: "physical oil speculator". Anyone buying oil on the spot market, storing it and short selling later months contracts is not a speculator, as she or he has locked in risk free profit. Speculation implies risk taking. Or am I missing something? I'm not financial expert I must add.

I think the mistake your making is first when do they lock in a futures contract.

Also of course there are all kinds of hedges that can be performed.

The physical oil is simply a must if to cover delivery contracts.

Or some physical oil somewhere is enough. Obviously for example people selling future delivery contracts in say 2015 have not pumped and stored the oil for delivery.

So these contracts are in a sense a naked short. The rules I've read for delivery seem fairly weak primarly getting bad only on failure.

So I could sell a contract for delivery even if I don't have the oil then buy one to receive oil later at a lower price and then I did a pure financial play taking the difference I never delivered physical oil.

The stored oil for the oil speculator hedges the cases where they are forced to deliver but one barrel of real oil in storage right now could be subject to a number of futures contract. Financial speculators never take delivery.

Maybe Nate can expand on this or some one else that can explain it better because the futures contracts are paper barrels and more futures are outstanding then physical oil not all get settled for real oil.

You can read more.

http://www.nymex.com/lsco_fut_descri.aspx

and here.

http://www.tkfutures.com/crude_oil.htm

and here

http://www.tkfutures.com/basics.htm

By holding physical oil they can actually make delivery if asked. I.e they don't have to take the other side of the trade to settle for cash. As far as I know there is no requirement for people going long oil to match perfectly with those that have oil for sale so when all the contracts are settled you may have been willing to make physical delivery but instead all the speculators that went short bought the long contracts so

after the dust settles as far as I know you don't actually have to make delivery if the net for physical is less then the offers. But you may actually want to deliver the physical i.e you really wanted to sell say your redoing your storage tanks or something. Maybe someone with more knowledge can answer these types of cases.

What physical delivery? Future contracts are traded usually because you don't want to deliver or receive. You can always net your position to zero. I read somewhere that only 1% of nymex future contracts are actually physically delivered. In future contracts you can have much more oil than it is produced, it's not the problem, future contract does not need to be covered by physical oil at all. The best way to look at the futures and other derivatives is to look at it as a bet. When I bet you that price of oil will rise or fall, neither of us has to actually produce or receive oil.

Contango arbitrage is probably done by commercial players (at least when spread is narrow). And it's not speculation, as there is no risk involved (well, almost no risk, storing oil and holding it has some risks of course).

That has not quite been the case last summer though. I have the NYMEX open interest charts right here and as oil prices reached their peak, non-commercials completely closed out their net long positions. At least this time, the timing of the non-commercials has been fantastic. Long throughout the bull market, and flat when it turned. The commercials have been the "suckers".

Of course now the commercials are in a better place to profit from the contango. You cannot play the contango game on paper, you need physical product and setting up physical oil operations (esp in a short time frame) is hard to do for your typical non-commercial "speculator" (ETF/hedge funds/banks/pension funds).

Correct, the hedge funds bailed out at the top.

This time there was a new twist, the unwinding of most commodity positions because there was a liquidity crisis.

I would say contango means inventory raising, backwardation inventories falling. When production is larger than consumption, the only thing you can do is store (or cut production, but that's another story). You'll store in oversupply only when you can make profit of it and that's when later futures are higher than spot. As storage is finite and is gradually filled (the least expensive storage first), contango has to grow wider (higher cost storage has to be used). At some point all storage will be used and spot price should crash, forcing producers to cut.

Correlation between price & inventories:

http://tonto.eia.doe.gov/FTPROOT/presentations/factors_gasoline_prices/s...

Or until the new administration does a test release of the SPR of 20 Million Barrels to make sure the system works....like G H Bush did and Clinton. To quote Warren Buffett, lets see who is swimming naked.

Or when the Obama team does a test release of the SPR, 20/30 million barrles like Presidents G H Bush and Clinton....we may find out who is swimming naked. The whole speculation crowed exists because they have not been afraid that the SPR could be used to help stop them,

I don't get it.

You're saying that, when people who are sitting on stored oil and who are shorting the long-dated paper in order to make money off the contango decide to sell their physical and close their paper position, it's going to end the contango by supporting the front month and depressing the farther out futures? It doesn't make any sense to me! It looks like you've got the cause and effect relationship between storage and contango backwards... but maybe I simply missed your point. Care to flesh out your reasoning a bit for the slow crowd?

Also, in the grand scheme of things 30-60mb isn't very much. As a buffer for OPEC cuts (which I presume a lot of the contango in the near months is about), it is arguably inadequate.

As someone who has traded oil, and indeed stored in contango, I think you might be reading a little too much into it. I would not care less where the price of oil is...as long as the carry is there and storage is available oil will go into storage be it terminal tanks or floating storage, when the carry is no longer there it will be released onto the market. The one thing I will say at the moment is the depth of the contango and the outright price will encourage more participants since tying up money when oil is $100 + will be less attractive contango or not.

Threads getting hard to follow :)

Well the reason its important is I think the contango is being driven by expectations of a OPEC cut.

The point is its still not a natural market the contango is driving excess storage this is not stable we will run out of storage eventually.

The market has not returned to stability its moved to low prices with a lot of contango causing storage builds.

Beyond this its my opinion that the reason for the glut was a one time counter seasonal surge by KSA that would eventually get absorbed the market is in general saying the same thing by remaining in contango and storing oil.

Personally I can't go long in this sort of market because the price could collapse across the futures chain. Even though I think with the contango oil is still undervalued. It theoretically can still get a lot worse. Regardless I'd have to see the market make a stable decision then if I think its wrong I'll buy.

The problem is that the structural situation could easily lead to a price collapse across the futures chain esp if storage is filled. If OPEC does not cut production they may literally be forced to cut as they simply have no buyers. This could easily temporarily send oil to ten dollars a barrel.

I don't think it will go that way but regardless the current market is simply not stable. Certainly we have lower prices then first half of 2008 but we still don't have a oil market thats anything close to stable.

Looks like inventory administrators had a good grasp of reality all the time. They sold when oil was expensive, and now are buying it back.

A lot of the big traders that used to work for the Investment Banks and Hedge funds have moved to work for real companies in the oil trade. I don't have the dang link and am busy at the moment but you should be able to google for it.

This means some of the guys that where trading when the oil price was rising are now say working for refineries on the buyer side. Some with oil producers etc.

They obviously know how to play the oil market to make money.

And last but not least I'm suggesting that there is as much speculation going on now but short oil as there was when oil was rising.

Also despite all the gloom and doom I think that what allowed this to develop was the combination of a act of god the hurricanes and the saudi surge. It resulted in a lot of oil floating around as KSA sent a surge of oil and the refiners could not take delivery.

Any oil speculator with lots of empty storage could recognize the opportunity. I think the current situation would have set up without the hurricanes but they certainly helped and of course the financial turmoil played a big role. Overall changes in demand effect the nature of the market and the way its playing out but I think they are less important for why speculators have been able to build up a large inventory of oil allowing them to hedge their trades on NYMEX with real oil.

And last but not least Saudi Arabia was played as a sucka so expect them to cut and cut deeply given that they where hoodwinked. No doubt in my mind that Bush played a role in convincing them to surge and that Bush was a stooge being played himself.

Memmel's speculation is very interesting and compelling. Was the following url posted on Theoildrum - http://www.cbsnews.com/video/watch/?id=4713382n ??

And we still have some commentators here who believe that oil pricing has been just a result of supply and demand this last year, not driven by speculators. Oh yeah!! Murray

Just to clarify the position of one of those commentators you reference. Oils price rise and decline WAS due to speculators - but not oil traders/speculators - speculators of the sort that invest in financial over real capital. Huge difference. (Duh- if it was an oil bubble, why has every other commodity but gold and live cattle plummeted as well?)

(Duh- if it was an oil bubble, why has every other commodity but gold and live cattle plummeted as well?)

Chicken broilers, potash fertilizer, electricity haven't fallen. I suspect commodities that have price setters (or regulators) and or have a limited or non-existent futures market were immune to the "credit" flu.

It is interesting the gasoline prices are quite stable with almost no recent drop. Small increases in the Pittsburgh area over the last 2 weeks.

Regarding the effect of a period of shut in.

Two very important words, as usual, "It Depends".

I am not an engineer, but have owned and operated some production.

Porosity, permeability, reservoir rock characteristics, depth, damage from over production, oil gravity, just a few of the variables.

Water drive or gas drive reservoir? Heavy secondary recovery such as heavy water flooding at Gahwar and others causes coning of oil flowing to vertical well bores that are being pulled hard. Let that rest for a while and the oil water contact will eliminate the cone and assist new renewed production, for a very short time. Eventually they become water wells, and imagine that with the oil water contact hitting a horizontal well, as Simmons has illustrated in his presentations.

No knowledge of deep gulf of mexico issues at all, but the natural geologic pressure would perhaps have a rest be productive on the short term? Again it depends.

Senor "West Texas" knows very well that lots of strippers can only be pumped after several days, (weeks?) of rest to let the oil return to te well bore. My tiny royalty checks from some strippers have stopped at these prices.

Mr Nate, I am msot eager to see your natural gas hits the cliff piece. Coming soon?

There was a saying in Texas that if you shut in a well and reopened it later, you would find less oil. It was probably because the ranch next to you kept pumping.

I look at what happened on a local level and extrapolate: when oil prices were high every rig was working, every well that could be produced was produced.

All the activity during that period is showing up in production figures today--figure you get about a year's increased production due to that.

Now I see rigs stacked, drilling prospects scuttled.

In a year or so, I suspect you'll see that reflected in production numbers.

yup.

and in a year from now will we be more or less able to pay for the reduced production???

Exactly

Rig stacking might have an even greater affect on NG production rates then many expect. We’re cutting loose 40% of our rigs drilling unconventional NG. Those wells decline so fast that the high replacement rate was all that kept volumes stable. If the slow up last throughout 2009 we might see some much higher NG prices as early as next winter.

Has anyone noticed that Brent crude is almost 8 dollars more per barrel than New York? Won't this attract the attention of middle east oil suppliers and decrease supply to the U.S. ? This is the widest spread I've ever seen. What will keep these tankers which are being used for storage from being diverted to Europe to take advantage of the higher price/demand?

If Europe is willing to pay a lot more for oil than we are, our economy might continue to wither indefinitely.

It's not the first time there's a large spread actually although it might well be a record percentage-wise.

WTI isn't a very good proxy for US crude... not now anyway. That oil is merely traded in NY but it's actually in OK.

There's a glut (or at least people are afraid of a glut) in Cushing. Presumably Brent is firmer because it's easier to deal with a glut there by storing the stuff in tankers and such. Perhaps there's market manipulation going on as well. In any case, I don't think one should read too much into it as far as the US economy is concerned.

Exactly, WTI has delivery in Oklahoma, you cannot easily physically arb this to Europe. On these near-dated contracts the difference can be very wide as local supply/demand will be the major factor.

Also, consider the options for physical oil players:

buy feb WTI, store it for 1 month, sell in march = $7 (before storage/operational costs)

buy feb WTI, transport it to Europe, sell it there once you arrive in march = $10 (before transport/operational costs)

If you can arrange this quickly, you can make good money. But if you are not fast enough, the opportunity isn't really there anymore:

buy march WTI, transport to Europe by april: only $5 before transport.

Basically, these physical oil traders are doing what OPEC should really be doing: remove physical barrels from the market. Only now the profit falls in the hands of storage players in the US rather than producers.

What percentage of Cushing crude is unloaded in Louisiana coming from overseas, are those deliveries made at Brent price or WTI price?

I dont think I can link to a specific story on FT Alphaville so here is the text. Aplogies if this is out of line..........

As FT Alphaville has been reporting for weeks now, WTI is losing its position as the global oil-price benchmark.

In case anyone still disputes the fact, Thursday’s WTI/Brent spread has reached a preposterous $9 dollars. As the FT’s trusty energy correspondent Javier Blas informs us, that’s the widest spread in 17 years.

Meanwhile, the differential between WTI and other US grades is widening too. The Mars blend is trading $1.5 above WTI, which is amazing considering it is a medium-sour crude, while Light Louisiana Sweet was trading as much as $8.30 per barrel more than WTI. This follows another epic build at Cushing, Oklahoma - the physical delivery point for Nymex WTI. The facility is now holding a record 33m barrels, which means it only has about 1m barrels of capacity spare.

Until the Cushing scenario is resolved (unlikely until the contango in WTI disappears), the Nymex light sweet crude contract remains a pretty useless global price benchmark. Paul Horsnell, from Barclays Capital’s commodity research team agrees. In fact he puts it even more eloquently (our emphasis):

The dynamics of the US crude oil market have become increasingly bizarre in recent weeks, and have now reached the point where the US crude oil price mechanism itself has got stuck in a fairly vicious loop. The mechanics of the market, and the logistical compromises that have had to be made to generate a market price along a pipeline system, are themselves creating additional distortions. Those distortions are, in turn, feeding back into ever greater stress on the market mechanism. That feedback is creating a wild thrashing about in the front end of the WTI curve, and an increasingly dislocated and disconnected set of time spreads.

As that effect has grown, in terms of being a reflection of general market conditions, WTI has become about as useful as a chocolate oven-glove. Please feel free to insert any other comparison of your choice with something that is perhaps not best fitted for the purpose. Most important, WTI is currently sending the signal that it is all but impossible to arbitrage across either time or region. Front month spreads of $7 per barrel (see Figure 18) and Brent-WTI spreads also of $7 per barrel (see Figure 15) are so far away from any sustainable equilibrium that they imply a mounting degree of market breakdown. This is not the first time this has happened with WTI; it is, however, the most severe instance.

The view from JBC Energy meanwhile is:

Such a wide spread is making it much more difficult to import foreign Brent-related grades such as Russian Urals and West African Bonny Light. With so much crude stored in landlocked Cushing and not enough pipeline infrastructure to redistribute it, WTI Cushing has once again become dislocated from other US grades .

So there you have it, WTI is broken and, in our opinion, irrelevant as a true indicator of the global oil price. Can the oil price is falling scare-stories please stop now? At the last look Brent was trading at $47 per barrel.

A market distortion can only end badly, with a correction. In this case it will probably be a rapid correction to the upside when the speculators run out of pipeline oil to play their games.

I've been bitching about the contango for months :)

We had a lot of there is plenty of oil crowd on the oildrum recently.

I'm glad its finally reached the point that its bad enough that the world is recognizing that the signal the market is giving may be false in the sense that some physical speculators have in a way taken control for the moment.

This situation was set up by KSA counter seasonal surge preceding the US elections so at least one real oil producers is complicit in gumming the works so to speak.

Glad to hear that bonnie light is getting hard to get thats the important import for the US.

The spread is up to 12 dollars this morning get ready for the short squeeze.