UPDATED: The Oil Market's Historic Swing to Continuous Contango--Has Peak Oil "Tipped"?

Posted by jeffvail on May 20, 2008 - 7:30pm

To the greatest extent in the history of oil futures trading, oil prices are now in continuous contango--that is, oil futures get progressively more expensive each year into the future. Does this mean that Peak Oil, as a meme, has "tipped"? Our latest oil price poll suggests that well over 70% of the sample (N>3000 now) thinks that oil will at least stay above $114 a barrel for the next two months--and almost half think it will hit $140 a barrel in that timeframe. Search volume on Google for the term is up dramatically in the past month, as is traffic at The Oil Drum. The following graph shows the dramatic swing from backwardation to contango over the last 6 weeks:

A few quick definitions: Backwardation is when prices in the future are lower than in the present. Contango is the reverse, where future prices are higher than in the present.

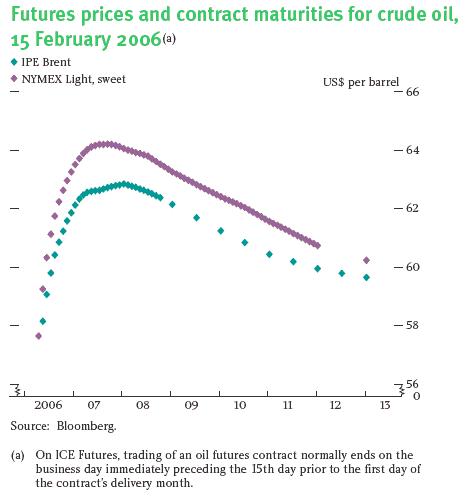

Backwardation is the historical norm in oil futures markets, and it is conventional wisdom that there are fundamental reasons for this "normal backwardation." While contango has occurred in the past in oil futures markets (most recently in 2005 - 2006), past occurrences have always been "partial" contango--where prices increase for some years, but decrease beyond that. This type of contango is explained by expectations of near-term shortages, and can be seen in this chart of the backwardation curve in crude oil from February, 2006:

The rapid swing to contango between May 16, 2008 and May 20, 2008 is unprecedented for both the degree of continuous contango and the rate of price movement (today's $9+ advance in December 2016 futures is the largest single advance in history). What was the cause of this shift? Has market awareness and acceptance of Peak Oil "tipped"? This morning both Boone Pickens and Robert Hirsch appeared on CNBC discussing oil markets, with Hirsch laying out an explicit and forceful case for Peak Oil. While the appearance of this historic contango in the oil markets is not dispositive of a sudden market awareness of Peak Oil, I think it is the most likely explanation. Either way, the situation certainly bears scrutiny and discussion...

Thanks again Jeff - as before - the 2016 futures is leading the pack (not shown in graph). Was up $9.50 to $139.50 while front month was only up $2.00 to $129 - so there is $10+ of contango on the long end...

Sorry for continuing to exclude the 2016 data. I've been compiling the price sets by hand (as I haven't found a good source of free historical data for all contract months) and for some reason neglected the 2016 data points until May 16th...

Jeff,

Can't thank you enough for the info earlier, bought two groups of futures

that right now look so, so very good.

Blair in Oregon

I think part of the shift relates to risk management ON THE PART OF PRICE MAKERS - what is the incentive to short (or sell) oil years hence -i.e. 2016 (to buyers-customers) at a discount to the spot price/front month in a tight market. The price maker has to sit on 7 years of "disruptions" and needs the price to fall just to be in court. As oil prices rise, nominal swings become bigger, and therefore a premium for long dated prices would be natural. Have been expecting this shift to kick in, above 100, for best part of 5 years. Think the curve should add 10 bucks per year (i.e. 150 front/220-250 back end). Issue of storage is lack of availability of storage facilities and oil tankers for movement of cargo.

But believe the real driver right now is pre-positioning for news flow coming JUNE

However, it will have a major impact on policy-makers and sentiment if sustained: market expects higher prices and therefore more inflation, dollar devaluation. Hoarding could be spurred by "cheap" front end versus expensive back end - could significantly boost short term demand and the front contracts.

"But believe the real driver right now is pre-positioning for news flow coming JUNE"

I guess I missed it. What news is coming in JUNE?

Thanks

My 2¢ worth:

In my opinion, we are looking at an accelerating net oil export decline rate, combined with a requirement for an accelerating rate of increase in oil prices, in order to balance supply & demand, as forced energy conservation moves up the food chain.

Let's take all consumers in all oil importing countries and break them into five groups, and then rank them by income. So, at the bottom of the bottom quintile, we have a poor Third World consumer. At the top of the top quintile, we have Bill Gates. As we go up the income ladder, the cumulative purchasing power vastly increases, which as noted, IMO, suggests a requirement for an accelerating rate of increase in oil prices in order to balance supply & demand.

I think that these two factors will interact--and are interacting--to produce the following oil price trend: $50, $100, $200, $400, $800 . . .

The question is the time period between the doublings.

well just remember that we have a rebound effect in place: the OECD is paying 125 bucks, but the Non-OECD and specifically the petro-exporters are not. So higher WTI-Brent feeds into fast growing petro-exporting nations, that then have less oil for export to the OECD, which in turns boosts WTI-Brent even more. Oil for export is the key. And the non-OECD Petro-exporters tend to have the fastest growing populations, fastest growing economies, and subsidized energy prices. Looks like a wicked circle at the moment

The opportunity cost for both groups is the same, though. Not selling the oil means not getting the $125 means not getting whatever else you could get for that $125.

--

JimFive

Not Quite.

Yes - both groups have the same opportunity cost - however, the petro-exporter simply seeks a higher price for that which remains for export, to compensate for the lost opportunity of selling output at subsidized domestic price. And as the domestic market is always fulfilled first, the projects initiated years ago, to meet projected global demand today, at originally projected lower prices, get mopped up by the higher domestic demand spurred by the (perceived) unexpected intl price rally.

Remember- non oecd petro exporters are typified by state planned economies - therefore higher revenues feed into commodity intensive domestic activities - new oil and gas projects, new infrastructure-national projects, militarization (to recycle petro dollars/geo-political insecurity). Meantime in the OECD rising energy prics feed into energy intensive or consuming activity: spr, military deployments, new alternative energy projects and infrastructure, non conventional oil.

So both groups (oecd/non-oecd) become more commodity and therefore energy intensive in behavior as the supply-demand balance converges, and a public sector crowding out effect is evident, as are rebound effects (higher oil price than expected>higher commodity demand the projected>higher energy demand than expected>higher oil price than forecast)

As such, it is had to see what will kill the loop except and outrite spike triggered by a physical supply cut

I did not mean my comment to sound like I was opposing the Export Land Model. I think what is indicated is that the price of oil is not accurately reflecting the value of oil, in the following sense: Oil is more valuable to the producer than the money the customer can offer, up to the point where the producer has an excess. Once the producer has filled his own needs then the market price gets set based on what the consumers are able to afford. Since there is no readily available substitute for oil the first X million barrels a day are, in effect, priceless to the producer.

--

JimFive

I disagree. The question is how wide the disparity between rich and poor can get before social conditions deteriorate. If one drives a car an average of 12,000 miles per year - at 20 mpg. Thats about 600 gallons of gas - at $4 that is about $2,500 - not going to impact the rich one bit. But people with car loans, house loans, vacations, etc. that might be good slug of their discretionary income - if it doubles again there will have to be new social rules. People won't just stay at home and they won't be able to commute to work at the margin. (new social rules =carpooling, curfews, odd even driving days, and the other IEA recommended measures at a minium, but may require rationing, consumption taxes, and further measures.

"..further measures", Nate? Like civil disorder and revolution, maybe......?

The difference between $60 oil and $120 oil is that forced energy conservation is simply moving up the food chain--from a poor third world consumer to lower income and middle income Americans.

Let's assume, for the sake of argument, an annual net export decline rate that looks this: -2%, -4%, -6%, -8%, -10%. . .

We get a price response, followed by a demand response, and then we get a sharper decline rate, requiring an additional price/demand response--aggravated by the fact that forced energy conservation is moving up the food chain. Wherever we are headed and whatever the consequences, IMO, this is what is driving the price. A steady exponential decline rate would show up on the following chart as a flat line. What we see is an accelerating net export decline rate:

Increased oil prices reduce almost everyone’s disposal income (it acts as a tax).

For the US a doubling in the oil price will heavily impact their already high trade deficit? How long will other nations be able or willing to finance an accelerating American trade deficit?

Some of this lenders like China will also be impacted by the increase in oil prices, and should thus (under equal circumstances) be left with less US dollars to finance an accelerating US trade deficit.

Obviously something will have to give when the oil price reach critical levels (I don’t know what that price is as of now and when in time this will happen) even adjusted for a US dollar in almost free fall.

The increase in oil prices will affect food prices, interest rates, travelling etc. thus forcing the average household to increasingly prioritize their available means.

NGM2

It does not act as a tax. A tax moves money from the citizen to the government which the government then (ostensibly) uses within the domestic economy. A high oil price (for an importer) moves money from within the domestic economy to an external economy. Since our economy is measured by how much money is moving around within it, moving money outside of the economy is bad for the economy.

--

JimFive

Jim,

Thx for the more precise formulation. (slight populistic use of a picture from my side)

For an oil importer I agree, increasing oil prices will move and increased amount of money out of the economy.

My prime intention was however to draw attention to that there must (as of now) be a limit to how high oil prices will go before it starts to affect demand.

Looking at EIA data for total petroleum products consumption it looks as this zone is being entered now, looking and the increasing number of airlines reporting cutbacks and reduction in flights, the present run up in oil prices have already stated to take some effect on demand (consumption). And there is probably more in the pipeline.

I would expect there to be a timelag from the run up in prices until it turns up in reduced demand.

NGM2

Why no put some meat on this prediction?

What is the year (or range) in which you expect oil to average $400?

After all, to learn that oil may average $800 in the year 2150 when we have long since moved on and it is used only for specialized niches isn't really a big deal.

Here’s my prediction from more than two years ago. The original unedited version said that “These factors will interact this year to produce an unprecedented—and probably permanent—net oil export crisis."

http://www.theoildrum.com/story/2006/1/27/14471/5832

Hubbert Linearization Analysis of the Top Three Net Oil Exporters

Posted by Prof. Goose on January 27, 2006 - 1:47pm Topic:

[ED: This is a guest post by westexas...]

Well, that doesn't do us much good. We need to know the price. You bandy prices around on a regular basis. Why not stick a year on them?

Well, this is this more recent quantitative assessment, that provides some hard numbers for future net oil exports, with a qualitative prediction for prices:

http://graphoilogy.blogspot.com/2008/01/quantitative-assessment-of-futur...

MONDAY, JANUARY 07, 2008

A Quantitative Assessment of Future Net Oil Exports by the Top Five Net Oil Exporters

by Jeffrey J. Brown and "Khebab"

But I find Saif Lalani 's price projections to be pretty reasonable, based on similar assumptions about net oil exports:

http://www.financialsense.com/fsu/editorials/lalani/2007/1028.html

POST-PEAK PRICES $1,000 a Barrel Oil / $20,000 a Pound Uranium

by Saif Lalani

October 28, 2007

So....$1000 within 10-15 years?

How about a range of years for $500?

Sure, it will hit $500 within a range of years.

See, that's what sometimes happens when one starts to poke at all the hand-waving going on. Eventually there is just nothing concrete. The pundit suddenly gets cagey and starts looking for a place to hide.

Yeah, I guess I wasn't specific enough about my warnings about Saudi and Russian oil production. Perhaps I was too subtle.

And perhaps I wasn't sufficiently clear about where I thought net oil exports were headed.

Or perhaps I wasn't sufficiently clear about my repeated ELP warnings to downsize ASAP, in advance of predicted rapid increases in food & energy prices.

Maybe people thought that I was too vague about my opinions about the future of suburban real estate.

My continuing apologies for my shortcomings.

I'm sure that your work has been much more precise. BTW, what work have you provided to the debate?

My current job here is to nail down a rough time line on the continuous doubling of prices that is part of your Export Land Model.

Then I might be able to advance the debate....

We can say that at their current rate of increase oil prices would double about every year, but you didn't answer my question. Is the answer none?

Unless he's been lurking for some time, I think Mr Asebius may be a pushy journalist looking for some sort of sensationalist prediction that will make a good headline. I hope he/she is. The more the MSM learns and helps spread the mesasge the better.

Nah. George has had many previous lives.

What George is is inflexible in his thinking and into picking fights. Here we have excellent and precient work from WT and Khebab giving us scenarios based on crunching numbers and constantly refining them to give people a heads up about wtf is coming down the pike.

Now, George can't be bothered to notice that what he's asking for is not what is being offered. Because he has an agenda. He wants predictions where none are offered or even possible. On top of that, WT does not seem very interested in exactly what price is seen when, but seems quite interested in when flows start reducing. Price will do what it does based on the flows.

Since George is not interested in learning more and apparently has nothing to offer to contravene WT and Khebab's work, he merely seeks his "Gotcha!" moment so he can't point back and say, You were wrong! Nothing you say can be trusted... even as exports fall through the desert floor.

At least, that's my take on George.

Cheers

Agreed. In short, George is a jackass.

In my peak oil related media appearances lately, all the journalists seem to want a specific price target and a date. I guess that's what makes news, in their book. But, like Hirsch & Simmons & others who have been put the question, I answer that there is no way to predict it, because the effects & timing of demand destruction cannot be predicted with any rigor.

IMO being asked to predict oil prices & dates is simply a "gotcha" trap, as you said. The important thing is to understand the trends. But that doesn't sit well with sound-bite media, or message board trolls...

If you go through the Hirsh 2007 update on peak projections for the DOE, and look to see which of the notable people making predictions about production, are also prepared to make predictions about price, you find they are few and far between. The reason is that production is science, market economics are sort-of-science, with a big dollop of the human condition thrown in.

It's totally unreasonable to knock someone contributing significantly to our understanding of oil supply for being somewhat vague about prices - in fact, if WT started giving price predictions, I'd be forced to somewhat discount his other work as likely to be unreliable.

Two examples I found of people talking about both peak barrels and dollars per barrel. CERA (always wrong) T. Boone Pickens (closer to right, but still wrong)

Missing the forest for the trees.

Because someone can't tell you what you will eat and when you will eat to an arbitrary precision, this means that in the future you will never experience hunger pains?

Perhaps we can pay more attention to the system, to the forest.

Hello Jeffvail,

I hope contango will increase the Peakoil Shoutout* fandango in pubs.

* When your favorite yeasty beverage glass reaches half-empty--you shoutout Peakoil in recognition of finite limitations and maximum attainable flowrates.

I am constantly trying to make this a new cultural tradition. Please encourage others to participate. I can think of no better way to posthumously honor Marion King Hubbert.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

I think a fine tradition has just been born. Thanks Bob :)

" * When your favorite yeasty beverage glass reaches half-empty--you shoutout Peakoil in recognition of finite limitations and maximum attainable flowrates. "

Bad idea. Anyone who does this in MY presence will need to drink the rest of their beer through one of those coffee-stirrers (the ones that look like a collapsed straw).

Just for you.

http://www.prometheus6.org/images/toughguy1.jpg

zen zen wakaranai.

?

I think that it's also worth pointing out that, while this has been a dramatic swing that must be apparent to traders, it has received virtually no coverage in the US press. The UK Telegraph and the Financial Times covered the story peripherally, but there has been no mention that I'm aware of on any of the network or cable news programs (including CNBC, which must require actively working to avoid the topic seeing as they talked about oil for hours today! A search of their website shows no use of the term "contango" during 2008)...

Is this ignorance on the part of the financial pundits, is it a belief that their audience isn't capable of understanding the discussion, a desire to not address the topic, or do they genuinely believe it isn't newsworthy (despite the fact that the UK press seems to feel otherwise)?

Jeff,

I've seen nothing on contango in the news slots on CNBC - I use the term "news" loosely - but there was a Fast Money segment where one of the traders cited contango as proof prices were not going down. It was quite a long rant. I believe I got the original link to that video here on the Oil Drum . . .

Cheers,

fat_tail_rider

actually on CNBC's Fast Money tonight, Joe Terranova talked quite a bit about it...lots of talk of the back end of the contracts, etc. He's the one in that video from last week.

I wonder where our old friend Hal Finny (Halfin) is now with his constant theme of 'the market knows best'???

I can't speak for him but can say that my own darkest days as a peak oiler were during the winter of last year ('07) when prices were at half this level.

That was because there was not a hope of any meaningful adjustment without high prices and the market seemed clueless about the state of things. Well, it finally caught on. And now I breath easier.

Bring it on, I say. If I had my druthers, I'd wish for oil in the $150 - $250 range for the next 10 years.

As it stands, it's a relief that high prices arrived while production is still rising.

What makes you think production is rising? It looks like it was rising, around the turn of the year, but the oil price has risen 30% since the start of the year, whilst production has been falling (EIA estimates a fall in each of the first 4 months of this year, the IEA estimates falls in each of 3 months up to April).

The far future months in the crude futures market always seem to reflect whatever is happening with crude presently. If you look back over what the futures "curve" was 5 years into the future, it's always about whatever trading was at that particular year, and was never much of a prediction at all up or down. The next time we get a snappy pullback, the oil bears may have the 5 year out price coming back down again. They may be just clueless as usual, these guys that set 5 year out price by however the wind is blowing this month. Maybe they're not really waking up to peak oil theory that much.

One has to wonder if the sharp change in pricing has anything to do with the conjecture that's been going on about a strike on Iran that I discussed here. The time frame would certainly agree - over the last month or so. That's one alternative explanation to that of all these people suddenly getting smart about peak oil theory in just one month.

I think that any time the market goes into contango, the answer is most likely a simple one. Large consumers want to lock in a price and have a known cost at whatever point in the future, and sellers are content to take the "market risk", or just accept whatever the prevailing price is at that time.

I cannot give any type of link for this opinion, but have plenty of experience in the psychology of the energy markets, and have felt that it is simply risk aversion on the demand side, and risk acceptance on the production side. Any producer today should be willing to accept the risk of selling a resource (I can't bring myself to refer to oil, gas, or any refined product as a commodity in this day and age) which is finite and depleting at market out there in the future. Small oil producers who I know have been burned by hedging and generally will not hedge - if we have a problem in the field, it becomes one at the bank if we are hedged.

So, IMHO, the contango pricing is caused by there being more buyers than sellers, and thus the price has been pushed higher at distant strike dates. Similiarly, I feel that there was a contentment among large consumers to be buying at market, since everybody else was, and as a result, we went into backwardation. Something has fueled the desire to protect themselves on the part of those consumers who are now going long, which tells me that the message on peak oil is getting greater acceptance.

BUT- the question now surely is: Is this a permanent change of view, or just a passing fashion? Like Mozart was for a while treated as a superstar but a year or two later dismissed by his Vienna community as passé.

The following is speculation. I wonder if there is some hoarding starting to appear among consumers at various levels. People are probably getting slightly jittery about the possibility of shortages. Call it a sudden disinclination to let one's inventories shrink, if that sounds better.

A little bit of hoarding in many different places could have a significant impact on prices. Fortunately there is always some physical limit on the amount of crude and products that can be stored. Building additional storage facilities would have to take some time.

All this is disturbing to say the least, but it is probably better if the price does go up quite a bit now, enough to convince the industrialized nations (especially the US) that they really have no choice but to cut consumption significantly. For non-essential use of fuel to continue as before must finally show itself as too grotesque to consider.

I just hope this round of increases doesn't turn into a panic. That would not be good for anyone. I don't think that is at all likely right now. On the other hand, such positive feedback events are essentially impossible to predict.

While hoarding is a possibility, anything which is hoarded results in a lower quality of oil or gasoline. Diesel stores somewhat better, unless it has a bunch of chemicals to upgrade the cetane rating. I think my worst scenario is for gasoline hoarders to buy up and put a bunch of product in storage, where they will keep it, and it will get gummy and lose the light ends used to bring up the octane and we will effectively end up losing a great deal of product with no appreciable value when the hoarders try to use it. Prices may be high now, but at leasst we can get what we need.

Is it possible to get the volumes of these future contacts compared with "current" contracts? I'm wondering if the volume might be low and this is a tail-wagging-the-dog effect?

You can see the open inteest and # of trades at

http://futures.tradingcharts.com/marketquotes/index.php3?market=CL

I cannot speak to the accuracy and the quotes are time delayed.

Most contracts with long dates are lower volumes, since only folks with a lot of $ at stake will go out to hedge for 2015. And, I do want to emphasize that I think hedging is the biggest source of futures contracts. In a sense, it is speculation, but by informed folks who are protecting their income positions - kind of like an individual keeping the gas tank full all of the time. Of course, it doesn't do much good to try and protect costs by just keeping the fuel tanks on airliners full since they burn it so fast.

Alaron's Phil Flynn is on the case:

I learned a long time ago--perhaps wrongly--that backwardation shows strong demand...hence the saying you never short when the futures are in backwardation.

In the last few years, went the market went from back to contango it was followed by a correction.

whatever

This would be my interpretation also. When the crowd finally jumps on the Peak Oil train it is probably time to jump off. Commodity markets are treacherous things. The trick is to be ahead of the crowd. Markets rarely move in straight lines in my experience. Corrections can be severe and at critical points doing the opposite of the crowd is required even if in the long term the direction of oil prices is up.

Crude oil seems to be on the verge of going vertical. That rarely lasts for very long as profit takers who were Peak Oil aware long ago step in to reap their gains. Seems to me that $150 might be a good spot for a several month pull back. The oil market usually tops out about now and declines into the fall.

I just sense there is a Peak Oil discovery panic similar to the one I had when I first heard about the ELM. Panics are the not the time to buy in a rising market, but the time to sell. Panics pass.

On the other hand, oil is a finite commodity so who knows?

Phil Flynn says it better than I ever could...

The Energy Report

Phil Flynn

pflynn@alaron.com

May 21, 2008

The Energy Report for Wednesday, May 21, 2008

Has the market finally priced in peak oil.... again? Welcome back to the world of oil market contango where the far out futures are trading at a higher price than the front end of the market.

One of the reasons why we keep hearing that oil has made this unprecedented and historic run is that the world was running out of oil. Of course you had to wonder if that was indeed the reason, then why in heavens name were the further out futures contracts trading as much as a ten dollar discount to the front month contracts. The far out futures months, which are supposed to have mystical powers of predicting the future, were actually signaling lower prices in the far out future ignoring the buying frenzy that was basically confined to the front end of the crude oil curve. If the world was running out of oil then why was it cheaper next year as opposed to this year? If we had less then shouldn't it cost more? Well that was at least until yesterday when the market,, after the fronts wild bull ride, somehow decided that yes indeed we are running out of oil and it decided that officially - I guess - yesterday.

What use is this for the normal human being? Seeing that until yesterday the market was in backwardation (a phenomena where the front month futures contracts trade at a premium or higher price to the back month futures) one must wonder if this signals just more wild bullishness to come or should we worry that the change is a sign that at long last a top is near in the front end of the oil curve. Because let's face it, if the backwardation signaled a falling market as oil futures rallied almost $50 a barrel from the low, perhaps the switch to contango could signal the opposite.

When I got bullish oil when we were trading the twenties my critics said you can not be bullish oil because we were in backwardation and the far out futures are signaling lower prices. If you believed the backwardation you would have been bearish when you should have been bullish. The same was true for recent times. So maybe the change to contango is a significant sign that perhaps we are closer to the end of the run at least in the front end of the market. What it also could be signaling is that right now that demand for oil is much weaker than expected.

Oil supply is plentiful and the truth is demand is lousy here in the US yet stronger than expected growth numbers in Europe and business confidence in Europe is showing that they have been shielded somewhat by the strong Euro. Still that may not matter as the market is betting on more dollar weakness. Oil got a boost by the fact that the June contract was expiring and inflation fears are gripping the globe. The dollar got pummeled on the perception that inflation wary Europe would not cut rates putting further pressure on the weak dollar. Of course in a weird way that may fuel more inflation as the weak dollar is actually a major cause of a lot of the inflation in the first place. If Europe stays behind our curve it is the classic catch 22. The bottom line is that if Europe raises rates it will hit the dollar harder thereby driving up commodity prices putting more pressure on over all inflation. Europe’s tough stance on inflation may actually create more inflation.

So if the world is indeed running out of oil and oil producers cannot keep up with demand then what is one to do? Ah yes, that’s the ticket! Sue OPEC! That’s right! That would be your first and brightest thought. Well at least that’s what the US House of Representatives Brightest thought was. The House passed a bill that would subject OPEC oil producers to the same antitrust laws that US companies to follow. Now all we have to do is get the OPEC boys to come to court and watch those oil prices come tumbling down.

What can stop the raging bull? Maybe nothing but maybe today’s oil inventory report will bring back a sense of normalcy to the market place. Once again the key will be distillates but also the market might freak out if we see a drop in gas supply again. I do not think we will see either. Then the next thing to watch for is profit taking ahead of the Memorial Day weekend!

Yes, we should all listen to Phil Flynn, who called us all "peak freaks" a couple of weeks ago:

Part 1: http://www.youtube.com/watch?v=vQ_5S0bbjwU

Part 2: http://www.youtube.com/watch?v=avQosIzdgXw

Oh gosh -- A lot of these MSM types are (probably) incorrectly blaming the current prices on oil speculators, which Krugman and others have disproven by saying things like, "If there's no increase in stocks, it's not speculators." But if what Flynn says is right and the oil traders do start hoarding? Do we have a bubble on top of the increases we've already got?

I see the futures market as kind of an eternal series of short-lived bubbles. Hence 'rallies' and 'corrections'.

An actual oil bubble will evidence itself in increasing supplies [EDIT: STOCKS] - and that's what we had about 18 months back, albeit minor.

A real bubble may well develop now, it will be evidenced by increasing OECD stocks, especially US stocks, while the rioting elsewhere gets worse. So far, recent increases are just to 5-yr average trends, no sign of a bubble yet.

I guess long-dated futures could go into an extended bubble like thing - but really, what is the 'right' price for oil in $2016? It's got to be over $200/bbl, but the market is full of (mostly) deliberately ignorant traders. I honestly believe what we're seeing is an awareness amongst the oil-trading community, based primarily on Bush's visit to the Mid East and subsequent comments, that this Peak Oil thing might (emphasis 'might') be real - previously they believed what CERA and OPEC said (ie: it's a load of nonsense)

Hello Gwydion,

Your Quote: "But if what Flynn says is right and the oil traders do start hoarding?"

What makes you think oil traders are not already hoarding 'potential energy' to some degree-->it doesn't have to be in the form of raw crude, but merely process-imbued into the concentrated, irreplaceable Elements: NPK and sulphur.

I thought my prior archived postings made this obvious, but I will try to give a more clear and condensed explanation to help bring any TOD newbies up-to-speed:

I would like to remind you and other TODers of the previous links I have posted of earlier, and still ongoing I-NPK hoarding [for example: China shutting off fertilizer exports]. This is a much easier, cheaper, safer [less flammable], and subtle Strategic Method to hoard FF-energy.

Remember, NPK is basically free [P & K ores & N saturated in air] but it takes huge gobs of energy to mine & beneficiate--3 gasoline gallons equivalent per 40 lb bag [from a prior weblink]. Then much more FF-energy and/or human-energy to move globally. We are talking bulky tons, not weightless emails.

Also, once FFs are converted into I-NPK: IMO, the economic and military leveraging multiplier is vastly increased. This is due to the No Substitute Elemental effect, the 20:1 weight advantage over equivalent ratio O-NPK, very long storage potential [consider: 10,000 year old O-NPK batguano vs fuel-evaporative rates], the easy transport quality [recall photo of guy w/sack on back], and the 20:1 photosynthesis bang above a Liebig Minimum.

Equally as important to this Econ/Mil leveraging multiplier is the Fear Factor: food > fuel, and the prior-posted FF/NPK supply chain delays or latency potential to missing the seasonal planting windows.

We can substitute human-energy for decreasing FF-energy [not always easily, of course], but missing the critical planting and NPK-application timeframes results in a dramatic decrease in future harvest yields. This is why so many experts are deeply concerned with Myanmar, Kenya, and other areas--optimal planting and fertilization phases are being foreclosed by time passing. The cascading blowbacks are brutal because job specialization is only possible when food surpluses are generated. In short: infrastructure doesn't matter much if nearly everyone is starving.

If one understands the above concepts that I am trying to express: I hope they now understand why I think I-NPK fertilizer prices will stay ahead of FF-prices unless we hugely ramp O-NPK recycling to help dampen this effect.

As usual: I am not an expert. Therefore, I welcome any elaboration or refutation by others. I am still hoping the TopTODers will do their statistical and graphical magic upon my 'Death Valley Theory' thoughts. Time will tell if they can boost this to the equivalent of Duncan's Olduvai Gorge Theory.

I hope Leanan doesn't delete for length--my greatest fear!

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

Bob, hon, this isn't too long, but it's not really on-topic. This is not an open thread.

Bob, thanks for the explanation. I hadn't made the link from petroleum to petroleum products yet with respect to hoarding. What you say is definitely thought provoking, I'm sure they're linked but maybe not in a conscious sort of way (i.e. oil traders or someone else consciously saying let's not export or let's produce X because oil price is Y). Is there any information available about stocks of fertilizer or pesticide? No idea here. I know that fertilizer and pesticide costs are going up, but I have yet to see a precise number on just how much of price increase is directly attributable to oil price. Maybe I missed it? (I'll have a look in the archives when I get a chance.)

Hello TODers,

Recall that the US Congress wants to sue the OPEC cartel. Is this info below just another sign of Peak Everything?

http://www.financialpost.com/story.html?id=527670

-------------------------

India accuses fertilizer makers of price fixing

...Complicating matters is the fact potash and phosphate deposits are concentrated in a few countries and produced by few firms, which are organized into three marketing groups, including Canpotex, which sells Saskatchwan potash on behalf of Potash Corp. and two other producers. While they have existed for years, Mr. Awasthi alleged industry consolidation had emboldened them - as well as players in the more fragmented nitrogen market - to raise prices too aggressively. "They are manipulating the market," he said.

---------------------------

For TOD newbies: I have posted many prior weblinks and discussion on I/O-NPK and sulfur, and how Peak FF's double-whammy upon this global process and supply chain will make fertilizers and food an incredibly contentious postPeak issue.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

Unless I recall incorrectly, the crude oil futures curve moved to a full length contango in January/February 2007--largely as a result of the front months getting pulled down hard on the warm-weather event. It did not last long. Also, I recall the Curve got very, very close to another full length contango in Q3 2006. However, the contango(s) that I recall were not as strong as this one is now.

That said I have the following views about the Curve. 1. The term structure is both a reflection of views--but, also becomes an inducement of certain behavior. 2. The most interesting moments are right before and right after the passage between backwardation and contango, in either direction.

The current move to contango will induce the building of storage. And, when you consider this is the behavior that will be induced, you then realize how difficult it really is to sustain a full-length contango. After all, there is now a new buyer for the front part of the curve: the buy and store participant, who will seek to purchase near(er) months/years and then sell further months/years. This puts renewed upward pressure on nearer months/years, and new downward pressure on the farther years. That's makes contango hard to sustain...

...And so, the bottom line: if this contango can be sustained, it pretty much means one thing, and one thing only.

And we all know what that is.

Gregor

Gregor,

If contango stayed at the current levels for any real length of time how significant a problem do you think this would create? If the tipping point of peak oil awareness is near-at-hand and this is partly fueling the contango that we're seeing this week, what do you think will happen if we see contango continue to march ever higher in the coming weeks?

Is there such a concept as Peak Contango or Peak Backwardation, where once the underlying commodity enters into a terminal state of decline backwardation could never mount any serious threat to futures prices again, and contango will rule the roost?

Hello Contango Jones,

IMO, an extended market contango in potash occurred in the early 1900s when potash skyrocketed to [a 2007 inflation-adjusted price] of $14,500/wholesale ton--I believe this would have been absolutely debilitating to the US agriculture and economy if this contango had persisted for decades with no relief.

Compare with the current price of potash. Back in 1914: US pop. was much smaller, and mostly O-NPK sourced too. Extrapolate this same fertilizer effect if it occurred today. Does it make my speculative postings on postPeak strategic sealane control of NPK movement seem more plausible?

In my earlier postings on this early potash resource crisis: I speculated that it might have been the primary inducement to make the US enter the WWI European battlefields.

The subsequent discovery and development of the mineable New Mexico potash deposit was a great relief--I suspect potash pricing backwardation occurred quickly thereafter.

Remember: it is not the size of the finite reserves, but the flowrates and decline rates.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

Gregor-

My recollection is that the contango between 2005-2007 never reached all the way to the longest contracts (same with previous episodes of contango), but always began to tail off into backwardation at some point. That said, I haven't been able to locate a data set (well, a free data set) with historic prices for all contracts that would let me verify this. I know some trading programs provide access to this kind of data--do any TOD readers have this?

I don't think you recall incorrectly, Gregor, and I remember when futures went into perfect contango in Jan 2007 (do a search and you will find links to comments about it on the OilDrum).

Although the structure is different this time, Jeff's opening line: "For the first time in the history of oil futures trading, oil prices are in continuous contango" isn't correct IMO (unless I'm missing something).

I've edited the main post from "For the first time" to "To the greatest extent," as I can't confirm that there wasn't a brief period of perfect contango around February 2, 2007. The forward curve was close to perfect contango on February 7, 2007 and January 12, 2007, but prices were in backwardation beyond 2012. One post mentions perfect contango on January 16th, but then specifies that it goes through 2012. I don't have the data to confirm whether or not the market was in backwardation beyond 2012 continuously within that window (either on an intra-day or day-end basis). The current degree of contango--$10 between front month and Dec. 2016--is unprecedented.

Thanks Jeff, and irrespective of what the situation was in early 2007 I totally agree with your key point that today's curve represents a sea change in market outlook.

Indeed. The full-length contango that I recall in JAN/FEB 2007 had a weak tail, in the outer months. (The contango was indeed there, but, was not super well supported by active trading). Whereas the current contango has a much more liquid tail, say, between 2013 and 2016. Lots of good volume out there now. So bottom line I do think Jeff is right to pursue the current contango as the most significant one yet, and I do think this one demands attention from everyone.

As a trader and investor, I relish this juncture as the majority of participants do not understand the moment, and have not reacted to it yet. In the halls of the smartest money, however, I am confident they are highly aware, and are already positioned at least up to a third of proposed positions. Positioning for this juncture is not, and will not, be limited to crude oil futures, per se. In fact, my thesis is that a number of other assets are about to become fantastic derivative plays, on this step-change. Bottom line: there are myriad ways to play Oil--especially right now--without being in Oil.

Jeff: it's virtually impossible to get the total historical data for the Curve without paying for it. Those with bloomberg terminals can get it, for example (I wish I was "at that level" but I am not). In a thread last year, I was chatting with Stuart Staniford discussing this same issue. The CFTC had just released a report looking at the changes in the curve over the past few years. My dream: an animated graphic showing the curve go through its changes on a daily basis, over the course of the last 8 years.

Sidebar: when both NYMEX and the ICE lengthened considerably the futures chain, from 3-5 years out to 8-9 years out, that too was a sign. That lengthening began in 2006, if I recall.

Best to all,

Gregor

http://www.ft.com/cms/s/0/c2955660-2696-11dd-9c95-000077b07658.html?ncli...

Shortage fears push oil futures near $140

By Carola Hoyos and Javier Blas in London

Published: May 20 2008 19:06 | Last updated: May 21 2008 00:52

The words OIL and CONTANGO have made the Daily Telegraph this morning as well...

Oil price 'contango' may signal market is heading much higher

Edited to add link and remove entire text of article.

Come on, Mudlogger. You've been here long enough to know better. Do not post the entire article. Post a link instead.

sorreee!

I cut n pasted the whole lot by accident and when interrupted to go to a meeting I pressed send.

Good article though ant it?

And here is another:

Looks like its mainstream now.

http://www.independent.co.uk/news/world/middle-east/the-big-question-doe...

The Big Question: Does Opec have too much power, and is it to blame for the high price of oil?

By Michael Savage

Wednesday, 21 May 2008

All this talk of prices, and no mention here of demand destruction as prices climb. Within the time frame of 2015 presumably the futures markets are factoring that in and assuming that demand will remain high. But shouldn't we assume that a spreading global recession results from increasing prices for oil? And doesn't that moderate the price?

Or perhaps the calculations of futures traders already include that? I find it unlikely that they do... or if they do, they would appear to place that oil price induced recession further out, and at a higher price point than they predict for 2015.

A global economy in a recession induced by high oil prices might hit a series of bumps going down... as global demand destruction reduced prices to a point where recovery began.... and then recovery leads to bidding up prices until marginal producers are squeezed by energy prices into bankruptcy again, producing new recession.... only to begin growth again at a new lower price point, temporarily made possible by low global demand. Each time the recession recovery is smaller and returns the planet to lower level of net economic activity because the oil available for that activity is continually declining in availability.

I call this the bumpy descent, and I'm surely not the first person to describe it. (I'd be curious who has articulated this, if anyone knows.)

The deep problem with this scenario is the structural effect of repeated recessions.... each time on a reduced energy supply base, and each one leading to a oil price escalation that creates a new crisis and a new recession. It would be a bumpy way down.

We've spent 150 years watching energy fueled expansion, but have very little experience with a decade long energy descent process. The shape of that curve is fascinating to speculate on.

Perhaps Iran storing 30 million bbls of crude in floating storage is intended as an effective deterrent to US attack. The VLCCs could be used to block the Straits of Hormuz and cause an environmental disaster. Aditionally, by taking ships out of service, freight rates rise, offsetting the cost of the strategy by raising the price of crude. Today;s move to massive contango (esp in the Brent market) is just icing on the cake to the strategy.

I doubt Iran is stockpiling oil in VLCCs to thwart a US attack or block the Hormuz. There are 12 VLCCs owned by the National Iranian Tanker Company and Iran has hired three other VLCCs from private owners, each capable of holding two million barrels for up to three months, and three Suezmaxes, each storing a million barrels for 70 days. These short storage durations are more indicitive of a failure to sell it for a price they feel is fair. You can't store oil for more than a couple months in these VLCCs, so any hoarding would have to be done on land somewhere (which they may be doing as well).

Reports indicate that the sulphurous crude in Iran's VLCCs, first assembled some two months ago, is from the Soroush and Nowrouz fields, which for price and quality reasons the country is finding difficult to market. The heavier the crude, the harder it is to sell because of refining hurdles, and the price differential between heavy and light crudes widens during the summer. Some of the refiners in the eastern Med can refine the crude, while others in the central and western Mediterranean with more sophisticated refineries won’t touch it. Bottom line: There are a lot of signals that there's too much heavy sour crude out there. Not surprising that this oil is found at the bottom of many mature wells. It's likely that more and more of this low-grade crude will be hitting the market in the coming years and increasing cost of production to get it refined.

And as usual, zero discussion of the value of a US dollar in 2015.

Good point. If the value of the US dollar were to decline at 10% a year for the next 7 years it would be worth half its present value in 2015 (rule of 72).

So $140 a barrel might be equivalent to $70-$100 in today's dollars, depending on the currency guesstimates of those buying the contracts.

It logically follows that my consistent earnings from dabbling in oil futures is because, I, as some guy who spends time reading about peak oil, has a better predicative abilities that the oil market consensus over any time period longer than about a month.

I am NOT trying to say I'm clever, I'm trying to say that crediting the average/net of energy traders (ie: the futures market) with anything resembling long term vision is evidentially silly.

I couldn't agree more that the collective "swarm intelligence" of the market isn't always better--or even anywhere close--to the selective ability of a few individuals to comprehend a new phenomenon, or one that defies conventional wisdom. I think that the data actually shows that the swarm intelligence of the markets have very, very little predictive power (and if you look at how options are priced, you could argue it also has very, very little comprehension of the fundamental risk and movements involved).

That said, I do think it is very noteworthy when this swarm intelligence begins makes a radical shift in direction and begins to (arguably) validate the predictions of a minority group, and that's what I think has happened over the past few weeks (especially the past 3 trading days). What exactly it means I'm less sure: Effective capitulation of opposing theories that were distorting market awareness (see, e.g., Yergin's recent predictions)? Actual shift in supply/demand/reserve fundamentals that can't be comprehended outside a swarm intelligence but that validate the minority view? The potential for movement of Peak Oil from a minority viewpoint to center stage in political debate? Something else?

So, while I agree that crediting the swarm intelligence of energy traders with true predictive ability would be silly (and contradicted by the evidence), I do think there is great potential significance in their behavior...

Hello Jeffvail,

Excellent points! Another 'swarming example to the flipside' might be when the dominant majority of those who thought the Sun revolved around the Earth finally capitulated, then accepted that the Earth and the other planets actually orbited around the Sun; Ptolemy vs [Copernicus & Galileo's Heliocentrism].

Historically, that battle was probably more difficult than Peak Outreach will ultimately prove to be, unless a modern postPeak Inquisition returns--Yikes!

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

I agree with the idea of the stepped descent scenario. It seems to me that some of the 'steps', ie demand destruction, would be larger than others depending on which components, people and businesses, are affected. I also anticipate the effects to be unexpected, interconnected and cascading. 'For want of a nail the kingdom was lost' type stuff.

Hopefully each step could give people a brief respite to adjust and to plan and adapt for the next step-down.

Having said that though, for an individual or family the loss of employment, home, possessions and lifestyle would not be stepped but catastrophic. do not pass Go, do not collect £200.

Fare Thee Well.

A bit of irony- look at the first paid ad on the column to the left..

For posterity: http://img337.imageshack.us/img337/2963/todlolsx7.jpg

Contango

Contango is actually a good thing to smoothe the peak. If you have oil to sell and you will be getting more money now for a late delivery than for an early delivery, oil will be preserved for the years to come. This is why actually speculation is a good thing.

I agree that contango will not exceed the market price for storage. You do not have to include cost of money, because with futures only delivery but not payment is delayed.

Contango also means that heavy oil users have to pay the real price. In the past airlines were able to buy future oil contracts at a huge discount. Now they have to pay the real price.

Steady Price Increase and Bubble

Due to peak oil, oil prices will be going up. But at the same time the price will be much more volatile. With all that increasing media attention I expect that a bubble is created on top of a steady climbing oil price. This bubble will burst some time in the next months to years. When this bubble bursts prices will temporarily go down significantly but will rebound to a level far beyond current prices in the long run.

just trying to translate for those of us who aren't savvy with the lingo and terms

won't people hoard ie create a new present demand?

hoarding will become a real time in the now end user demand.. ie demand will increase rapidly on the spot market to try and buy now before it gets expensive.

in turn creating a mad feedback?

this contango thing breaks the meaning of the market? why because the market does not handle the concept of time and depletion in a rational long term way?

Is my thinking unsound?

Boris

London

Surely we must view this occurrance as a good thing?

Think of the positive benefits:

1. Oil Company investment plans: those oil companies dithering on whether or not to gamble on the next big project will now see that the project will not come to fruition amidst a collapse in oil price. Cantango will give the green light to many projects that would otherwise be shelved.

2. Renewables: in a world of expensive oil all the substitutes suddenly take on new meaning. If my 'solar-PV-Gigawatt' thingy is only economical at prices above $100 then no one is going to invest in it if they think prices are going back to $50...

3. PO Credibility: high prices focuses attention on the underlying problem -our innefficient XYZ (societal structure, transport, methods of manufacture, living, recreation, etc, etc, etc.). In a world of cheap energy "no one gives a sh*t", in a world of expensive energy things become more precious and savored...

Now, how do we get gas prices down to a buck a gallon again? :o)

Nick.

Oman 1M above $143

http://www.upstreamonline.com/market_data/?id=markets_crude

WTF is going on?

Note that it is up $23. I'll email my oil trading friend, but what's interesting about the Upstream website is that it tracks real world spot prices. My opinion for a while has been that the physical market has been dragging the paper market higher, in contrast to conventional wisdom to the contrary.

Our model and recent case histories suggest that net export decline rates, once a region starts declining, tend to accelerate with time, which would have a predictable effect on prices.

Edit: My oil trader friend thinks that the price posting is a mistake.

$123 ... not $143 ... just an error?

He couldn't find any spot prices over $135 for any grade, but India is aggressively buying oil and there are rumors of them setting up a SPR. In any case, one would think that the Oman price situation will be clarified soon.

So while the US stops filling its SPR (in a doomed-to-fail effort of stopping the price escalation), India is creating one? I guess one of those countries is not getting why there is an S in the name..

Oh this is fantastic, it is the peak oil tipping point. I have waited for this event for years. I've pasted some oil price related quotes from some articles I read earlier this decade.

"Once the physical peak happens and physical production begins to decline, there will be no way to maintain any form of price stability. Prices will begin to spiral upward, out of sight." - Mike Neligh

"Prices simply measure states of mind. This means that economists issue opinions on opinions. In short, economists are pollsters with an attitude." - Jay Hanson

"In fits and starts prices will rise and then fall, spiralling upward because of real shortfalls in the distribution system, or in anticipation of shortage, then dropping as over-speculators take a bath, only to rise again and then fall again, but with prices always rising further and falling back slower as supply constricts." - Winston Smith

"A gap opens up between the need for oil and the reduced quantity actually flowing. Prices are set by the marginal barrel of oil sold to a market which cannot get enough." - David Fleming

"With supplies at very low levels throughout the world and diminishing prospects for large new areas of production, it will soon become clear that world oil supplies will decline irrespective of price. As the calls for OPEC to increase production become deafening, the world will soon wake up to the fact that OPEC is already producing at maximum capacity and there is nothing that can be done to increase production or keep it from falling." - Bill Powers

"By the time you get to about 2015, you reach the point where demand is far outstripping production, by several million barrels a day. Prices will go through the roof, and this will absolutely kill economies in the process." - Jamal Qureshi

Petroleum is the dominant energy source for the transportation network that undergirds the global economy, and the planet's most plentiful, most versatile, most transportable and most efficient energy source. In a very real and measurable sense the price of every other energy source we have floats on a "subsidy" of cheap petroleum." - Winston Smith

"The fear for Washington will be that not only will the future price of oil not be right, but the currency might not be right either. Which

perhaps helps explain why the US is increasingly turning to its second major tool for dominating world affairs: military force." - Coílín Nunan

"It will puzzle economists. The economy will slow down but the prices of everything will keep on rising. We will then rediscover the age-old truth: money is not a real thing; it is only an accounting device. Congress can't print oil and they can't repeal the Second Law of Thermodynamics." - Winston Smith

"The end of this decade could see spiraling food prices without relief. And the coming decade could see massive starvation on a global level such as never experienced before by the human race. Under a die-off scenario, conditions will deteriorate so badly that the surviving human population would be a negligible fraction of the present population. And those survivors would suffer from the trauma of living through the death of their civilization, their neighbors, their friends and their families. Those survivors will have seen their world crushed into nothing." - Dale Allen Pfeiffer

Quotes, me too! me too!

"And in those days shall men seek death, and shall not find it; Death shall flee from them" Rev 9.6

On the other hand. Petrobras ( now the worlds 6th biggest corporation by market value) is supposedly spending $30 Billion on 40 new Deepwater rigs to fully exploit the Tupi and associated fields 3 miles down off Brazil. Plan this to happen around 2015 - 2017. Wonder if we'll get there. Maybe they see plenty of profit at $500 per barrel about that period??

Jeff,

this is academic, I admit, but correct me if I'm wrong. Definitions in italics to differentiate from colloquial use.

(1)

Market is normal, when the futures curve for that market shows the price of contracts of later maturity as higher. In your first image, this would be the 19-May and 20-May graphs, which show the price of contract for future maturities rising as a function of time (e.g. the longer the maturity, the higher the price). Those are normal futures curves. Curves earlier (those in the graph) were inverted. These definitions are always done with a 'snapshot in time' of a futures market (and not from a period of time advancing).

Ref: http://tinyurl.com/5prwbk

So, correct statement is that Oil futures market have gone from inverted to normal.

Image from Investopedia

(2)

Prices are in contango when the prices of contracts decrease as time goes by (i.e. they fall to the level of expected future spot price). This is not the same as normal futures curve, as that looks at the price of the futures at various maturities in one point in time. Contango is when the actual price of maturities fall over their lifetime (we have to measure it at various points in time). As you conveniently have several snapshots in your image, we can also say that the prices of all maturities graphed have NOT fallen, but have risen throughout their plotted lifetime change (9-Apr -> 20-May). Example: look at Dec'10 maturities which have increased in price from relative price differential of -12USD @ 9-Apr to c. +3USD @ 20-May. This means that their price has risen over their lifetime, the exact opposite of contango, also known as normal backwardation (not same as plain backwardation).

Ref: http://tinyurl.com/5prwbk

Image from Investopedia

Again, a correct statement would be that for crude oil futures with maturities from Dec '08 to Dec '15 the prices are in normal backwardation in the current market situation.

Caveat emptor: I am not an economist, not a futures expert nor do I play one online.

I think these investopedia articles are the ones that have it backwards, but I guess the important point is that we're using the same definitions for a term, not that the definitions are "correct."

Wikipedia uses backwardation and contango as I have in this article, and cites many sources that confirm those definition. Interestingly, definitions at a separate location on Investopedia seems to confirm this definition for backwardation and contango. I'm pretty sure these are the definitions in common use (backwardation = futures price below spot price, contango = futures price above spot price), but there could be some academic disagreement here that I'm not aware of, similar to the "common" use of inflation to mean rising prices and the economically correct use of inflation to mean increase in the money supply...

On that note, I'm off to have cold drinks brought to me for the next 5 days, with no access to news or internet. Who knows where the markets will be when I get back?

"(i.e. they fall to the level of expected future spot price). "

I, for one, don't understand this, for the simple reason that nobody knows what "the expected future spot price" is, or more accurately, everyone has their own expected future spot price. Defining "contango" as an objective characteristic of a futures curve, when that definition is based on something completely subjective, seems strange to me.

Defining backwardation and contango w.r.t. to the CURRENT spot price makes infinitely more sense to me.... everyone agrees on what the current spot price is.

Is it really as easy as looking at the current price and future price to determine contango vs backwardation vs something else? Here is a good article which explains the terms and that it is not that easy: http://www.investopedia.com/articles/07/contango_backwardation.asp

You are saying, I believe, what I'm saying above. The Investopedia link has the exact same explanation as the book I'm referring to.

I think the terminology used in the article is wrong, but I need somebody who understands these for a living to confirm this :)

Perhaps like many of the Peakniks here with (apparently) a even more realistic view of the future oil price scenarios than the professional futures traders, I have had the guilty pleasure of making some good oil-related stock investments.

Of course, as this article suggests, I would have done better by investing in futures, or options on futures.

Below is an interesting comment from Jim Kingsdale regarding his strategy using futures options and LEEPS:

http://www.energyinvestmentstrategies.com/2008/02/23/my-crude-oil-future...

His strategy seems pretty low risk. Any critiques or suggestions re this?

Cheers,

-- Mike

Evolutionary psychology and peak oil:

A Malthusian inspired "heads up" for humanity.

http://drmillslmu.com/peakoil.htm

Hi Mike,

I have firmly thought that investing in futures was/is better than stocks. One of the main reasons is that when I own a futures contract I care not who comes up with the oil. If the oil is not supplied to the market the futures price goes up. Now, contrast that to a company, say XOM, who reports record profits but production has started to fall and is whacked by Wall Street. Heck XOM hasn't move much over the last 6 months while oil has increased 50%. Of course, there are other stocks that have performed much better, but my point is that I don't have to analyze and try to pick the 'right' company. I just but the futures contract and I care not who delivers oil to the market.

As far as timeframe, I have invested in long-term contracts for several reasons:

1) I have/do firmly believed in PO and thought that it was crazy for the long-term futures to be lower than near-term contracts

2) The long-term contracts (up until this week) have less volatility, therefore less drawdown, therefore less chance of blowing up my account

3) Futures are thought of as much riskier than stocks, I think that is BS. If you look at price volatility of individual stocks vs individual futures, or stock markets vs. composite futures market, the volatility of futures is less than stocks. The reason futures have the reputation of being risky is the margin that is allowed. Uhhmmm, if you don't use full margin and only use 3:1 or so, instead of the 10-12:1 allowed, then risk of ruin drops considerably.

Starting in May 2004 I invested (and I do mean invested) in a Dec 2008 contract at $29.50/bbl. I still have it. I have added a 2010, 2012, and 2013 contract late last year. I have 'averaged' 140%/yr return since May 2004 on a PO investment theme. Of course, the vast majority of the returns has occurred over the last 6-8 months. Unfortunately, I started with just several thousand dollars.

And I don't feel guilty in the pleasure of being correct in any way shape or form.

See Ya'

David

Speaking of stocks, can you make a CFD (Contract for Difference) on a basket of Airlines? Tragic for the individuals concerned (ie, the staff) their demise will be, but we might as well make money off it when it happens.

To me, this is the first good evidence that I have seen that we may be witnessing a bubble in oil. Note that I said "may".

I have spent the last six months explaining to folks how you can't have a bubble in the front month contract (outside of variability in physical storage which, in the case of oil, is fundamenmtally negligible), so don't give me any not possible to have an oil bubble nonsense.

Ask yourself what a bubble in oil would look like on the futures market.

The front month cannot be significantly tampered with by speculators to any significant degree, it is relatively tightly tied to the quantity demanded at the price. However, speculators can definitely move more distant contracts away from the fundamentals, particularly over short time periods. There can be a speculative bias in these contracts.

The proposition that there has been a tipping point in market awareness is in some ways a reasonable one - the futures market would be behaving in a similar way. In fact, i cannot imagine a way to distinguish it from a bubble in long dated oil futures. But I think it is definitely more reasonable to suspect a bubble in distant month futures rather than a tipping point in awareness.

To make it clear, I do not think there is a bubble in the front month, or at least, it must be very small. However, it is very hasty, in my opinion, to declare the behaviour of this market to be indicitive of a tipping point in awareness. Think of it this way. Which do you think is more likely?

a) A whole lot of people with a whole lot of money all figured this thing out or became convinced over the last few days. Has there actually been any new evidence which is that convincing? New evidence?

b) People have seen or heard about people they know who have made a killing in the run up over the last 15 months by buying and holding oil futures, and they figure they want some of that action too.

In a lot of ways the two scenarios are similar. One similarity is that they are both stories about a tipping point. The key difference, however, is how the holders of distant futures will react when we see the next example of typical volatility in the downward direction. If you need some help convincing yourself that b) may in fact be the more likely answer, have a look at the oil price movement over the past 15 months. It is a trend followers dream. Classic bubble juice. In any case, of the two tipping point stories, the bubble tipping point is a phenomena which is commonly observed.

WTIC at Stockcharts.com

If people are not seeing the distant contracts as potentially a bubble, it may be because they have been seduced by the (correct) "can't have a bubble in the front month" argument, and incorrectly generalized (possibly unconsciously) to the distant month contracts.

Good luck all with the trading.

wouldn't contango feed a buy now sell later boom as well where people actually physically hoard the stuff?

also if your right the bubble can not be old in formation because the speculators fiddling with the futures would have to take delivery OR sell to a genuine end user..which means the demand exists to justify the price?

I would have thought a bubble in the oil market "would look like" unexplained increases in inventories.. in which case contango may represent the start of a bubble as buy now sell later..

however inventory builds may be impossible because excess supply to hoard may not exist which brings us back full circle to supply constraint?

the inventories must change... something physical has to pop up on the radar andd the timelag is unclear to me.. but surley it can not extend for more than 4 years.

Boris

London

A few comments on oil futures:

One of the major reasons we saw a weird curve back in 2006 - i.e near term futures contracts above the front month, but back end below the front, related to "trading limits". Most banks-Traders have limits packages that specifically restrict position taking beyond 24 months- therefore is JEFFVAIL was to look at the partial "normal" (cantango) curve phenomenon then, it would show that the highest prices were on the 24th, or around the 24th month from spot. Traders were trying to factor in "peaking" but weren't allowed to place open positions beyond 2 years. Normally beyond 2 years the "intermediary" (bank-trader) would back to back flows from customers because they cannot have positions beyond that time frame. The appetite from "speculators" or investors being low, and constrained by issues of risk management (i.e. liquidity) therefore concentrated on the front contracts. Its not a good idea to own the market on long dated positions -as Amaranth did in nat gas. So while we numbskull traders werent pricing in "peak oil" to the outside observer, the fact remains that liquidity and risk management can restrict discounting of the most valid causes. if JEFFVAIL has time to do a reverse engineer of the curve it will show that peak pricing coincided with the 2 year limits package restrictions placed upon most trading desks in most intermediary participants.

Clearly, the sudden up swing in the long end indicates an aggressive desire to own the curve, possibly on the expectation of a "fundamental" change in market dynamics (or oil prices) - that could be the result of a multi year rally, or in response to OPEC firm opinion that supply is not required. For sure intermediaries (bank-traders) have not altered risk management practice (except to curtail risk), so the buyers are "outsiders" (true longs)

In theory the front end demand should materially increase with this curve formation. The backwardation reflects storage costs, carry costs - and these are being overlooked in the desire to own wti. Possibly it relates to rumors circulating today that a pressure increase on Ghawar resulted in reduced flow - Im not convinced

I think the move relates to the issue of the currency of choice for the denomination of the oil invoice, the launch of the russian commodities exchange early june, and coments from opec sec gen that the decision to abandon the usd has been made (statement apr07 in tehran)

We shall see. Its great to see so much debate about this move - and the failure of mainstream media to really grab the biggest one day move in oil because it wasnt in the front month or spot, is quite pathetic

The most important aspect of this move is that an investor, or corporate hedger perceives the need to buy the curve. Ultimately, we shall soon discover why

whatever their motive is.. are they betting on being able to dispose of the need of take physical ownership... ie not true longs?

Boris

London

The "futures" do not require physical delivery. A spot cargo is a different matter. the futures prices will be settled as per NYMEX rules - buyers and sellers do not need to square into maturity - the position will be auto-closed out by the exchange.

So attention, to some degree, should focus on why would someone pay over the spot-front month, and all the way, as far as possible -given that in a market downturn (which can be triggered by say intervention, to hike margin limits to 100% on the exchange, in an effort to deter speculation), there will be a severe "slippage" in forced liquidation of position to meet margin calls. Remember - a hedge fund, will adjust risk to margin, daily - and their investors mandate them to leverage.

So the buyers, this past days, weeks feel very confident that, despite the threat of margin hikes, illiquidity in long dated contracts, or that front end prices decline, the buyers are shunning that threat, paying 10 bucks over spot in some cases - to get long. We havent seen this before, we havent seen this appetite - so would suggest something "fundamental" is perceived, repeated perceived, as potentially kicking in - and very soon - of course their view could be wrong.

What I like is the "abnormal" activity into a risk window.

The margin on a wti contract is around 7000 dollars for specs - the contract controls 1000 barrels, so 130,000 dollars of capital (so leverage comes from the 7000:130,000 ratio. The 7000 margin is correlated to a 2STD move in price - so margin limits normally only change to reflect the historical 2std move changes. If Margin limits were hiked to 100% for specs, then a hedge fund would have to cut 95% of the position (roughly), to maintain exposure across their spectrum of activities at the predetermined level when the position was entered. or cut other positions to raise capital - but that would then skew the risk, beyond what they predetermined, before entry, was appropriate

I require a clarification here... at maturity a end owner will take physical delivery irrespective of how many times the future has exchanged hands previously?

I mean someone takes delivery at maturity?

Boris

London

NYMEX offers the option of trading 'financial' futures as well as 'physical' futures, in simplistic terms, this means (as I understand it) that

==> whoever holds the receiving (short) end of the contract will (nominally) take delivery of 1000 barrels worth of cash ($125,000 or whatever per contract), minus whatever the contract price was (say $110,000)

==> whoever didn't sell off their long position now has to front up with the money ($15,000 per contract or whatever).

So the profits and losses realised still exactly equate to the movement in the spot price of oil, but traders don't have to worry about actual gloopy stuff.

There are mechanisms to allow cross settlement and exchange of positions between physicals and financials to keep the two in exact sync.

well that explains something i didn't understand

a few questions if I may

The option between financial futures and physical futures is decided when?

do we have a transparent metric for each option?

Boris

London

I wouldn't over-weight the importance of the financial settlement futures - they're still only a minority of those traded - I just thought it was worth being explicit about the statement about taking delivery of product.

My understanding is that its at the point of taking out the contract. If you like, the financial futures are just an extra precaution against the risk of suddenly finding oneself having to handle product if you end up unable to close off positions prior to the last day. Most speculators still operate totally with the physical contracts, because they take care to close out positions ahead of the termination [this is the point when most contracts disappear in a puff of almost nothing as buyers and sellers trade out their positions - with the normal daily market processes handling everything - don't confuse that with the financial contracts]