Peak Oil - Whom to Believe? Part 1 - There's Plenty of Oil, CERAiously

Posted by nate hagens on May 21, 2008 - 10:14am

(*Note: this post/series originally ran in March, 2007 but is a good introduction/refresher to Peak Oil issues--if you're new to this, read this piece and/or Gail's Peak Oil Overview in the top menu bar)

|

|

If you're like me, you might have spent a moment or two in recent months pondering how billionaire oilman T. Boone Pickens, oil banker Matthew Simmons, and many others are suggesting that the world is reaching Peak Oil now, and at the same time, Cambridge Energy Research Associates (CERA) headed by Pulitzer Prize writer Daniel Yergin, and others such as Exxon Mobil, are not predicting a Peak in global oil production until circa 2040 followed by a slow gradual decline. How can such smart and successful people disagree by decades on a topic so vital?

Is it possible they use different data sources? Do they mean different things when they say "Peak Oil"? Do they get different secret handshakes from Saudi princes? Do they have different agendas? Are they using different boundaries of analysis? Is one of them kidding? This 3 part post will address how people can differ so much on something so important as a peak and subsequent decline in world oil availability, addressing both factual and psychological reasons. Does the world have plenty of oil? Maybe, but as I will discuss below the fold, this is not among the questions we should be asking.

Part One is a general background and history on why people can disagree so much on peak oil.

Part Two will explore the many factual areas that are confusing and lead to different conclusions.

Part Three will look at social and psychological reasons for disparate opinions on this critical topic.

BIG PICTURE

Humans like to eat and have sex (1). We also are designed to compete with each other and other species for resources (2)(3). This function of population times demand will continue to increase, ceteris paribus.

We live on a planet subject to natural laws. The procurement of oil, a finite resource critical to our globally interconnected society, follows the general laws of diminishing return, - more 'heat loss' occurs as we find and pull out the more difficult oil. Technology is thus in a battle with depletion, and so far depletion is winning. What once returned over 100:1 on an energy investment is now below 20:1. (4&5) The ease of finding, harvesting, refining and distributing liquid fuels to society, will continue to decrease over time, ceteris paribus. Yet we continue to rely on abstract (fiat) accounting methods to measure our real resource base - furthermore, the debt and credit that allow the world economic system to grow are increasing exponentially, while at the same time the real economic driver, cheap availability of high flow rate liquid fuels, is becoming more scarce.

Peak oil, as will be discussed below, has many definitions. Simply put, it is about the intersection of the above two trends. It represents the general time frame when human demand for the energy services derived from oil will permanently diverge from our capacity to provide them. In effect, though the resources exist, we will not be able to afford the prices necessary to procure them for a global democracy.

Modern human culture, capitalism, globalization, food production, and essentially all aspects of life as we know it (unless *we* are Amish, 3rd world, or off-the-gridders), centers around oil, electricity and natural gas. Peak Strawberries or Peak Snapple obviously wouldn't be as big of deal.

Peak Oil is not a theory. It is a fact. Only the timing, magnitude, and implications are open to interpretation. How we interpret them should be a top priority for us individually and collectively. This post addresses why there are so many disparate opinions on this subject - many are concerned - many are unconcerned - many flip/flop from being concerned to unconcerned, etc. Why?

PRE-AMBLE

There exists considerable rancor between increasingly polarized groups on this topic. Many names for the two camps have been used: cornucopians/doomers, optimists/pessimists, pollyannas/cassandras, etc. I prefer to group them as the 'relatively unconcerned' and 'relatively concerned', as it is the level of concern that will motivate near term actions and policies. So far, the 'unconcerned' group (which includes the 'unaware') comprises the vast majority of the population.

I obviously am in the 'concerned' camp. For people interested in my motives, here they are: - I am getting my Ph.D. in Ecological Economics specializing in the energy/human nature side of the Peak Oil problem. Like my fellow Oil Drum contributors, I offer my time freely because I believe this issue needs to be urgently addressed, especially at the regional, local and community levels, due to the long time lag between policy change and meaningful response. Neither the mainstream media nor the scientific community have connected enough dots to communicate the urgency with which this problem needs to be addressed. My writing here is an attempt to get people in macro-policy and decision-making positions to think in ways that exposure to typical media and stimuli-laden schedules may not elicit. If my efforts result in a slight course change of current misguided energy and environmental policy or help citizens or communities better prepare, the effort will have been worthwhile (and, if I should randomly receive an email from a single, attractive off-the-grid farmer, I would view that as a positive externality (female only pls...)

AND NOW, A WORD FROM THE UNCONCERNED

CERA and Exxon are probably the most vocal oil optimists (not all oil companies are inherently optimistic, as evident by some Chevron and Shell ads). Here are three recent reports and interviews by CERA and Peter Jackson:

- Why the "Peak Oil" Theory Falls Down - Myths, Legends, and the Future of Oil Resources

- Peak Oil Theory Could Distort Energy Policy and Debate

- There is No Evidence of A Peak in the Next 10-15 Years

Some of the main points of these pieces include:

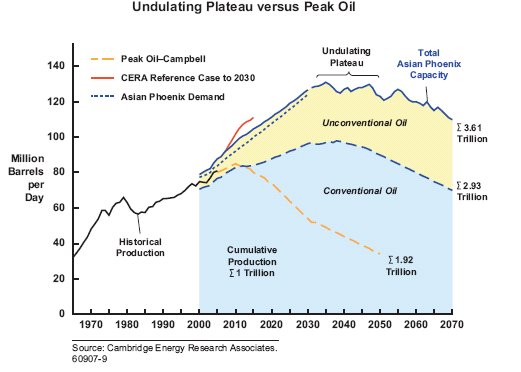

- Based on a detailed bottom-up approach, CERA sees no evidence of a peak before 2030. Global production eventually will follow an undulating plateau for one or more decades before declining slowly. Global resources, including both conventional and unconventional oil, are adequate to support strong production growth and a period on an undulating plateau.

- We hold that aboveground factors will play the major role in dictating the end of the age of oil.

- Despite his valuable contribution, M. King Hubbert’s methodology falls down because it does not consider likely resource growth, application of new technology, basic commercial factors, or the impact of geopolitics on production. His approach does not work in all cases—including on the United States itself—and cannot reliably model a global production outlook. For example, production in 2005 in the contiguous 48 states in the United States was 66% higher than Hubbert projected.

- The peak oil theory causes confusion and can lead to inappropriate actions and turn attention away from the real issues. Corporations, governments, and other groups, including nongovernmental organizations, need to have a coherent description of how and when the undulating plateau will evolve so that rational policy and investment choices can be made. It is likely that the situation will unfold in slow motion and that there will be a number of decades to prepare for the start of the undulating plateau.

A FEW WORDS ON WHY THE CORNUCOPIAN THEORY FALLS DOWN

Before I add my own thoughts to this debate, here are some recent rebuttals of CERAs claims, predictions and analysis:

- Dialoguing with Dr Peter Jackson - Is the Future of Oil Resources Secure?

- The Forecasting Record of CERA and other Commentators

- Does the Peak Oil "Myth" Just Fall Down? - Our Response to CERA

- An Open Letter to Peter Jackson of CERA

- Its CERA Week and Houston We Have a Problem

- Peddling Petro-Prozak - CERA Ignores 10 Warning Signposts of Peak Oil

- Does TheOilDrum Threaten CERAs Market Share?

Some of the main points of these posts include:

- CERA conflates reserves with resources

- CERA conflates productive capacity with productive flows

- CERA misprepresents what King Hubbert modeled, and how subsequent modelers use linearization methods.

- Approximately 50 countries have already peaked, more are peaking or about to peak (China, Mexico)

- So far the discovery forecast that CERA uses from the USGS is 77% too optimistic (see here)

- CERA's track record on individual countries is poor because its been too optimistic (see here)

- CERA needs to publish production intervals (i.e. a lower bound + a higher bound) not just production capacity.

- The Hubbert high forecast was spot on for the lower-48 (1% error on the 2005 cumulative production after 40 years!)

- Unconventional sources are slow sources of oil (low flow rates)

- The Super-giant fields with high flow rates are dying (Ghawar, Cantarell, Burgan etc.)

- Reserve growth remains unproven at the world level and is based on observed reserve growth for the US (Attanasi et al.) which is likely biased due to the inclusion of censored statistics

- CERA fails to acknowledge (or realize) that the long list of 'above ground factors' exist precisely because of increased geologic constraints on 'below ground resources'

- The best technology in the world and higher prices did little to change the production profile of the United States, which peaked in production in 1970.

MAN ON THE STREET

As with my last article on discount rates, I thought I'd include an interview with one of my friends, who happens to be an energy broker at a middle-tier Wall Street firm. His name is John (not really).

Nate: Yo Johnny - how's it going?

John: Not lousy Nate. I'm sure your environmental friends are dancing a jig on this TXU deal but they are going to be singing a different tune in 2009-2010.

Nate: Why is that?

John: They defeated the construction of new coal plants. Texas needs that energy man - there are going to be blackouts in a few years and not just sporadic ones. Someone else will have to build those coal plants.

Nate: I didn't know that - perhaps we can talk more about that another time. I'm writing another Oil Drum piece. Did you ever read my last one on how we steeply value the present over the future?

John: Um, I actually started it then got called away - It looked real good. But maybe you should put the summary points up top so busy people can get the special sauce without spending 20 minutes trying to read everything - you are kind of wordy you know.

Nate: Thanks for that. So what do you know about CERA - I am thinking about writing a piece criticizing their criticism of Peak Oil. Are they respected? Do your clients talk about their research?

John: They are respected. Probably upper 25%. Real mensa types.

Nate: How can they realistically disregard net liquids and flow rates and instead focus only on productive capacity, which in the end is basically just an academic exercise?

John: Hey man - they are not policy wonks - they try and make money for their clients and thus themselves. CERA is a cash cow for IHS Energy. Their clients think the same way mine do - their long term strategy is to make short-term profits. So if they paint the oil picture a certain way thats advantageous to their clients, they make money. And it's all about money man. And what do you mean, net liquids?

Nate: Actually it's not all about money. But thats a different topic. Do your clients agree with the cornucopian rhetoric behind those recent peak oil denial reports from CERA?

John: Cornucopian rhetoric? Man have you turned into a philosopher or something? Like I said, my clients are looking at how to make money in the oil markets over the next 6 months. They realize Peak Oil probably is for real but still view it from an investment perspective, not a life perspective. My smartest clients think that CERA is using 2007 geology with 1970 cost structures and 2050 technology in their projections - but the story still sells. CERA has smart people but they're definitely drinking the kool-aid.

Nate: Do your clients understand net energy? That producing energy requires energy and this comes out of a shrinking pool as the quality resource depletes?

John: I think less than 5% of the street thinks of things that way, and most of those are the analysts. The ethanol debate started people thinking about net energy but most everyone still thinks in dollar terms.

Nate: But don't they realize that oil is finite and dollars are not, meaning this increase in oil prices is going to accelerate once we permanently cross peak in net oil available for purchase?

John: There is the beginning of such conversations. Obviously with $60 oil, the E&P sector should be printing money, but alot of companies' costs are going up more than their revenues. New finds of oil are really expensive, especially domestically. Chevron, with all the hoopla a few months back, has still not sanctioned Jack II. I'm guessing it's cost related.

Nate: But do you thi---(phone rings)

John: Nate buddy. I gotta hop. This is one of those clients whose long-term strategy is short-term profits. Later.

Nate: Bye

REASON #1 - THE PHRASE "PEAK OIL" MEANS DIFFERENT THINGS TO DIFFERENT PEOPLE

When someone says 'oil has already peaked' or 'peak isn't until 2020', what do they mean? Peak Oil can (and will) have many definitions. It would benefit policy debates and discussions if there were a universal, agreed-upon definition. The most common is the year in which global crude oil production reaches its maximum sustained level, followed by a permanent decline. Some (Ken Deffeyes) define Peak as the date when 50% of the world's oil has been used irrespective of the annual flow rate (presumably, we could have used 50%+ of our oil and still have rising production if technology is allowing us to borrow from what would have been a bell shaped curve.)

Other definitions differ in what is included as 'oil'. The most restrictive includes only oil graded as "Light Sweet". More common definitions include condensate and Natural Gas Plant Liquids (NGPL). Still broader definitions include the heavy oils, the Orinoco oil sands, and the Alberta tar sands. And the broadest measure of 'what is oil' might include corn and sugarcane turned to ethanol, palm nuts turned to biodiesel, and coal turned to diesel fuel. This is referred to as "All liquids" and is what is commonly reported as total oil production in the media.

Ultimately, we want oil for the energy services it provides. None of us should care about how much daily or annual gross oil production of this and that there is, other than these statistics being precursors to a more important statistic: net liquids available to the non-energy, non-governmental sectors of society. This is the oil that is able to 'do work' for the world economy. As I will discuss in Part Two, gross statistics are misleading on three counts: 1) NGPL and ethanol have lower BTU content than crude oil yet are counted the same 2) procuring energy requires energy - a low energy requirement product is counted the same as a high energy input product and 3) following best first principles, depletion eventually overtakes technology, until one day an energy break-even point is reached in the extraction of a resource, irrespective of price. Thus future projections that assume oil in 2040 has the same ability to do work for society, after its energy costs have been subtracted will prove to be optimistic.

References:

- Malthus, Thomas, "An Essay on the Principle of Population" 1798

- Williams, George "Adapatation and Natural Selection" 1968

- Lotka, Alfred J. "Contribution to the Energetics of Evolution" 1922

- Cleveland, CJ, "Energy Quality and Energy Surplus from the Extraction of Fossil Fuels in the US" Ecological Economics 1992:6 139-162

- Cleveland, CJ, ""Net Energy from the Extraction of Oil and Gas in the United States"(pdf)

Coming up next

MORE FACTUAL REASONS WHY PEOPLE DISAGREE ON PEAK OIL

and

Nate-

Great post as usual. Regards CERA, I thought I would repost some information I put into yesterday's Drumbeat (late in the day).

According to data available on Bloomberg, Yergin has recently been selling a significant amount of his IHS (CERA's parent company) stock. Per Bloomberg, he has sold more than 53,000 shares in the last 30-45 days or about one half of the stated 113,000 shares he held at 3/31. Lots of other recent insider sales as well. Maybe their past predictions are having an effect on business after all.

That is amusing. I assume that clients in the auto business are pissed off. Lots of unsold SUVs.

Nate - Lots of great information. You and I must travel in different circles because I have found that when I present the Peak Oil Theory to people there is little resistance (with $4.00 a gallon gas you have their attention). They almost immediately believe it.

But the immediate question is : "What do we do about it?

I personally believe that Americans need to do the following:

Do a complete inventory of their energy usage and make a concerted effort to halve that and then put long term goal together to halve that again. Some of these might be:

1. Quit eating meat

2. Move closer to work

3. Look for opportunities to live in walk communities with mass transit

4. Cut the size of your living space. (Clear out the junk)

5. Buy and consume based on need not want.

6. Limit children to 1 or none.

This last one meets stiff resistance. As Kurt Vonnegut pointed out: "Humans have a flaw. They love to F**k and they adore little children."

Can't put it any plainer than that.

I would phrase number 5 and number 6 differently. Also why should you stop the pleasure of consuming? Saving energy can be a lot of fun! For example if you use your bicycle every day you can afford to buy a really nice bike.

1. Move closer to work

2. Commute by bike

3. Go shopping by bike (except for furniture etc.)

4. Eat less meat (like once a week at most)

5. Cut the size of your living space

6. Limit children to 2 (this still leads to a reduction of the population)

7. Use energy saving appliances (and use smaller ones and use them less often)

My experience is that people are blaming politicians that everything gets more expensive. Politicians blame oil companies that they did not invest enough into oil exploration. Nobody wants to admit, that we just have to consume less oil and that the real problem is that oil is still too cheap.

"Nobody wants to admit, that we just have to consume less oil..."

We will consume less oil whether we "admit that we have to", or not. And the people who come out of the coming genetic bottleneck, may or may not be genetically disposed to a different mind set than we have going into it.

Perhaps some of us are enlightened enough to see ways that our behavior should be changed to fit our reduced resources, but how can this enlightened view be spread to all mankind in the time available? And what are the details of this enlightened view? Just having fewer children will leave the world to the offspring of the unenlightened.

Nice to see population growth at least made each list.

If people are going to commute by bike (which is a good idea) there needs to be a shift in how urban planners do their dirty deeds in America. We can't have centralized commercial and industrial areas and sprawling residential areas and have many people biking to work. Start intermingling the two to the greatest extent possible.

And biking to work also requires a change in the idea of a bike lane. Painting a stripe down the side of a street doesn't cut it. Put a curb where the stripe is or put the bike lane on the other side of the sidewalk. Anything less just leads to bicycling tragedies.

You also will need more mass transit in the future. If we had been smart, around 1970 we would have faced the music and started building high speed rail. Instead, in cities like Portland and San Jose, we belatedly decided to use 100-year-old abandoned technology - trolley cars.

All we need is another idiot spouting crap. Let me put it in caps so you don't miss it: THE SAFEST PLACE FOR A CYCLIST IS IN THE STREET CYCLING WITH THE FLOW OF TRAFFIC. I'm not making that up. The statistics backing up that statement may be found on the late Sheldon Brown's website (RIP). Sorry, but I've long since lost the link. But put "Sheldon Brown" into google and that will take you to his website. Ferret out the stats for yourself. Compared to cycling in the street with the flow of traffic, cycling on a bicycle path leaves you between 1.4 and 1.8 times more likely (depending on the study) to have an accident. Cycling on the sidewalk with the traffic raises your accident probability to around 2. On the sidewalk against the traffic, you're around 4 times more likely to have an accident.

You might ask yourself "why this counterintuitive statistic?" Well, first you have to understand that "strike from behind" accidents almost never happen. The stats. show that only 8% of car-bicycle accidents are the "strike from behind" variety. However, 80+% of car-bicycle accidents happen at intersections. (BTW, I'm quoting police-reported accident stats here.) Obviously you don't ride a bicycle regularly because every serious bicycle commuter knows this intuitively: The more visible you are, the less likely you are going to be struck by a car. Hence the safest place is IN THE ROAD in the traffic. Cycling on the sidewalk, or on a bicycle path that is not officially part of the road, simply removes you physically from the road and psychologically from the motorists' awareness. As I mentioned, most accidents happen at intersections. If the motorist hasn't seen you, you are more likely to be struck.

So please stop spreading unsubstantiated lies which will result in more bicycle accidents and cyclist deaths. The best sort of bike lane is in fact, a painted lane in the street with NO CURB OR BARRIER separating you from the cars. It forces motorists to be aware of your presence, which in turn, lowers the chance that you are going to get into an accident. If you haven't heard the cognitive mechanism that underpins this, search for "inattention blindness," or type '"Daniel Simons" gorilla video' into google and check it out.

I saw a posting today by West Texas distilling a news report of SUV's loosing heaps on trade-in value and some dealers actually refusing to take them (SUV's) for trade-in on new purchases.

So, why not poke congress to develop some sort of legislation whereby a person can write off the value ( need to use something like 80% of sale price perhaps since the value is dropping so ) of an auto that they can't sale and can't afford to drive. I guess the irs would have to take possession of the vehicle and I have no idea what they'd do with it. Transform it into oil well rigs perhaps. Or make bunkers to protect themselves from the auto insurance companies, tire mfg, and all the other auto related folks who'd be after their hide.

This was lots of fun to write.

My wife and I saw this all coming nearly 30 years ago and decided to have only one child, aborting a second. The wisdom of our decision is now clearly apparent.

Somewhere in an alternate universe a 30 year old physicist finally solves the cold fusion problem and calls home to tell his proud parents.

Even if we had cold fusion, the idea of continuing a growth based BAU type economy/society is a complete waste. There will ALWAYS be limits to growth and the continuation of this type of thing. cold fusion or whatever you have, your still putting off bigger problems for later, there is only so much land area and arable food. The problem with the world is we are relentlessly pursuing growth and are encountering diminishing marginal returns, this is a problem only we, not technology, will solve.

Back in this universe, there is no way that a 30 year old physicist is going to get something usable from the Cold Fusion effect. Firstly, because the youngest guy in the field that I know of is 48 - all the potential young people have got scared off by the severe career damage that results - and secondly because all the research that can be done on a shoestring has already been done. Cold fusion is a quantum nanotechnology / surface physics phenomenon, and only a really well-funded lab or corporation could do meaningful work in this area. Thirdly, the CF / LENR community represents a much smaller fraction of the science community (i.e. no more than about 40 active research groups worldwide) than does Peak Oil in its corner.

TOD-ers, you have no idea what it is to struggle against a really dominant cultural paradigm, believe me.

My point was murdering a child in the name of peak oil might be counter productive. We may need that individual. By all means use protection and birth control, but to try to place some noble afterthought on abortion that they were trying to help the environment is crap.

The same ethics could be used to unplug all the people on life support, then kill all that can't or won't work. Or maybe we just let the next SARS sweep the aerth and kind of thin the herd you know?

I did get your point, and it is a fair and valid one, but I couldn't let an opportunity to plug Cold Fusion (my favourite subject) go by.

Sorry for being such a philistine.

How sad.

Yes how Sad...that you would need to heap guilt on. Here is an interesting video for you:

http://video.google.com/videoplay?docid=1484635787266506285

A rush to judgement stems from an inability to express empathy...

As soon as a society devalues children and human life in general enough to either stop reproducing or killing children outright, that society is truly doomed Or as Spock would probably say (just watched Star Trek 4 with my THREE beautiful/intelligent children) "it is illogical to kill your own children, or work for the extinction of your own species"

At the far end of the cornucopian spectrum (the name 'Lynch' comes to mind), there is a line of thought that this is not true. The hackneyed quote about the stone age not ending for lack of stones is apparently the scientific basis for this 'alternative theory'. Basically, if the price of oil gets high enough, we will simply segue into 'alternative' energy sources (follows impressively long list, including bat guano, nuclear fusion and rapeseed...) and the rest of that no longer needed nasty crude oil will remain in the ground. Hence, no peak, hence, just a theory.

Remind the cornucopian philosophers that stone is not a fuel.

Problem is that it is; Most stone has uranium and thorium in it, and limestone has carbon in it which can be used to synthesize hydrocarbon fuels.

The only question is price.

you set up a straw man there. what about driving higher MPG cars? what about hybrid cars? what about plug-in hybrid cars? what about electric cars? what about scooters and motorcycles? what about car pooling? what about walking or biking a few days a week? now that's an impressive list!

I forgot, what about solar panels on the roof? what about the whole car being a solar panel?

Have I done something wrong? Broken some rule or upset someone? My post yesterday has been deleted. I used no offensive or naughty words, made no comments about individuals, but if my post has been deleted I must have upset someone. If a post is deleted then at least THE OIL DRUM could advise by email the reason WHY!

I will repeat yesterdays post as best as I can remember, I don’t normally go through past posts but I wanted a screenshot for my records as I failed to keep a copy. Today I will keep a copy.

“The price of unleaded petrol (gas in the USA) in the United Kingdom per US gallon is USD$8.45, the price of diesel is USD$9.35 per US gallon. This price has just resulted in a stabilisation of demand not a fall in demand. In Australia where I live unleaded petrol is currently USD$5.80 per US gallon in central Sydney whilst the average price is around USD $6.00 per US gallon, in Australia this has also only led to a stabilisation of demand. Oil is an inelastic commodity, in other words it takes very large price increases to lower demand a small amount.

The weird notions that somehow the US economy faces some sort of economic disaster if gasoline prices rise much further are bunkum, the USA is no different to Australia and US consumers will just grin an bear it and pay up for gasoline as long as they have the available money and make their expenditure cuts elsewhere. Plenty of other advanced nations have lived with higher prices than the US is currently paying and have done so for many years.

The inelasticity of oil in a major problem as the world market (that is the non-producer and non subsidised countries) is now the worlds middle classes bidding against each other in an auction for the available supplies, therefore the sky is the limit on pricing, the final price will be is what the consumer in a first world nation will pay. This means that prices could go very high and $130 per barrel is very cheap considering the UK customer is prepared to pay $350 per barrel and even that price has not resulted in a minute drop in demand.

Oil supplies have peaked to a bouncy plateau which may go up and down from time to time around the figure of 87 million barrels per day, and will go into decline at the rate of around 2% per year in the next 2-4 years. Demand at current prices that is $130 per barrel is still rising (a number of producer nations don’t pay this price and the producer prices in those nations can sometimes be freebies but they are still competitors for the available production other nations subsidise they to are competitors).

It’s clear that the decline in production will be much greater than the 2% per annum if the loss of production is only reflected in those supplies available to the world free market and the decline could be around 5% per annum 2010-2020.

Therefore the nations currently buying from the world market will have to halve consumption (as a whole) as the product won’t be there and the price will be very high, current futures markets are pricing oil very optimistically. This will lead to a couple of behaviours by producers. Producers like Mexico will realise that they will be unable to afford to buy at future prices and will therefore cease exports to preserve supplies for national use. When the future price is going to be higher than the current market price producers will cut supplies to markets hence the current market price will rise to approach the future price, contango’s in a storable commodity market won’t exist for long.

Once oil prices reach a certain point (sometime this year or next year) there will be a sharp fall in the availability of product maybe 3-4 million barrels per day for the reasons stated above and no governments are prepared for this.

No schemes, Manhattan Projects for alternative fuels will be able to cover more than a few percent of the decline and to get production going will take in excess of 5 years, therefore any alternative fuels schemes need to be abandoned before their commencement. It’s not the price of oil or alternative fuels that is the problem it’s the unavailability at any price.

A number of things need to be done, no more road building, airports or transport infrastructure based on oil.

Ending recreational fuel use by the banning of private aircraft, boats, snowmobiles, gasoline blowers, mowers and trimmers. The closing of the large majority of auto plants, aircraft plants and plants manufacturing gasoline powered devices the future of these businesses is terminal already and we don’t need people investing in equipment they may never be able to use.

Imposing large taxes on all energy use oil, gas, electricity and coal. The taxes levied could be used in funding reductions/abolitions in other taxation areas and funding construction for the new economy. Rationing systems will never be a workable proposition they are too corrupt and they create a whole criminal class exploiting the systems as was the case during WW1 and WW2.

A war economy established to:

A massive energy conservation scheme, mandatory rules governing all houses, vehicles and appliances and equipment.

Firstly, rebuild and secure the electricity generating and distribution system as current systems are too dependent on oil/water for their operation so the equipment needs to be replaced in 20 years by a combination of Wind, Solar, Geothermal and Nuclear no matter what the final cost to consumer (if they don’t pay now there may be little power in the future).

Secondly and simultaneously with the above in 12 years, electrification and track rebuilding and extension of continental railway systems for both passenger and freight (there will be no time for “super trains”).

Thirdly, construction of mass transit systems in every city of above 50,000 people. Transit systems to built on existing roadways (no time for any other solution), to make all cities car free in 20 years.

The next president of the US is going to have to make the hard decisions and make them quickly; the levels of personal freedoms we have enjoyed for generation will be lost forever. No mistakes can be made and no pandering to the alternate fuels lobby and promising to find more. Any delays by any countries in restructuring their energy systems will just lead to systems of tribal warlords running countries as they do now in energy deficient nations. An organised reduction in energy use by countries is essential.

Most of the price of petrol in the UK is made up of tax.

As such it remains in the economy, it is just redistributed.

This is very different to sending the money abroad, and Pickens argued yesterday that at any rate for the US even $100/barrel oil would bankrupt the economy.

The effects are likely to hit very soon, probably by the end of this year or the beginning of next.

the resulting depression will then depress demand, at high cost.

Any recovery will be throttled by still high oil prices, as it is not cheap to produce now, and the oil exporting countries are going to need every cent from their diminishing reserves.

Right and in addition the UK was until recently an exporter. Even today I dont think they are importing 60% of their needs like the US. So while much of the price is tax, the remainder is also mostly staying in the UK (via BP and others).

I think Australia is a more compelling comparison, distances are greater and the population is more spread out, and in recent memory prices were similar to the US (you need to go back to the first gulf war). The australian car market still has plenty of V8 models in the lineup.

Another consideration which I dont hear much when we compare countries, is just how awful the weather is in the US compared to the UK. Yes thats right (maybe read it again so it sinks in)

Most people think British weather is awful, but the reality is that British weather is VERY mild. Summers do not typically include consequtive steaming hot days with high humidity - homes do not need Air conditioning, most cars do not have air conditioning.

In winter snow and ice is usually confined to short periods of time or to the higher elevations.

I moved from Britain to the midwest (Indiana) in the year 2000. The winters surprised the hell out me. Why in the world did anyone settle in Chicago long ago? The winters are miserable.

So sometimes we need to remind ourselves that cars are more than just convenient transport for the American. they also could be defined as a mobile climate controlled box that enable folks who live here to do business without dehydration or frostbite.

Or to put it another way, without cheap energy and the car the US would never have been an attractive place to live for the average person.

The real "founding fathers" of the modern United States of America are Henry Ford and JD Rockerfeller.

Europe we know from history would have managed OK without either...

I take your point about climate. I have friends in West Virginia, and it seems that there are small windows in the spring and summer when temperatures are reasonably, the rest of the year is either very hot, with very high humidity, or freezing cold.

On your point of UK oil supplies though, production is dropping like a stone, as is natural gas.

The US is far more favourably placed for energy supplies.

In practise, they will shortly release vast areas to drilling, which if not a solution will extend some level of production for many years.

It doesn't look to me like a post was deleted. I see nothing here to warrant a deletion, other than bad formatting and/or length. :)

Calm down.

It wasn't deleted, it's on page 2. After 300 or so posts the comments get broken up into seperate pages.

Now this sucks for a whole set of other reasons, but has nothing to do with your post being deleted.

What's IHS's track record like, anyway? On a thread about Iraqi reserves I dug up this document: Petroleum Resources Of The Western Desert of Iraq

Perhaps IHS are envious of OPEC's ability to create oil out of thin air?

Newbs who are Happily Motoring or whatever might enjoy the interviews with Nate at Global Public Media.

I get the impression that lying is an artform in the Middle East. From claims of a 100 billion barrels in Iraq's western desert to Chalabi and his lies about WMD, they just seem to have an affinity for spinning wild yarns. Since our culture for the most part takes adults on their word, we continue to be so surprised by the uncovering of these outrageous lies. Maybe we all need to start rejecting everything said unless it's backed by a team of specialists with the proven data to back up their claims.

They haven't got much choice but to claim huge reserves.

If there is not a lot of oil to be had there the US is out of there, and the regime falls.

That's one of the more blinkered cultural comments I've seen in awhile. I don't know where you're referring to as "our culture," but I'll work from the assumption that it's the USA. If that's the case, consider an outsider reviewing headlining news stories in the States over the last few years, and looking only at politics (esp. Plame outting and cover-up; official pitching of Chalabi's WMD lies even after they were known to be such; Abramoff scandal and fallout therefrom; any big election; and so on) and big business (Enron; Worldcom; Arthur Andersen in both of the former; Adelphia; Xerox; Qwest; Tyco; Merck; and so on [and on and on]). Would said outsider come away saying, "Now there's a culture that embodies a paragon of honesty and virtue," do you think? Probably they would be more inclined to say, "I get the impression that lying is an art form in the West."

So, given the variety of definitions of liquid fuels & considering obvious differences in EROEIs, should we be talking about 'peak energy' instead of 'peak oil'? This seems to be more the foundational concept. If less total energy via liquid fuels is available tomorrow relative to today, this is more important than an assessment of the availability of liquid fuels between the 2 timepoints (which CERA can obviously exploit via questionable inclusion criteria).

Naturally, quantifying 'total energy' as such will be more challenging, but the results will be much more difficult to dispute. Is there some data available that presents projections of EROEI over time by volume of available liquids?

Nice article. I think that's the first one I read, which goes into human behavior. What you wrote does clearly show up why Peak Oil is a problem, whatever exact meaning you assign to the terminology. People like to compete with each other. Competition takes place in a 'mature' environment (based upon oil). In my opinion the only way to avoid peaking means that the majority of people in the western civilization would have to get off-gridders. (I believe most people in the first world think that not being able to drive a car already means living an off-grid life...) Who wants to start with that when it appears to mean losing the competition in the near or middle term?

It is all relative. If you live in Saudi Arabia and have connections, perhaps you could believe there were billions of tons of oil remaining in the world. If you lived in Japan and did not own any oil stocks, perhaps you would believe you did not have much oil.

If the world oil production had peaked, would this start to appear on the charts? In the short term what has been seen is what technical analysts call noise, small fluctuations in production. The overall trend has been about flat to slightly rising depending on whose data you use.

Should we expect a decline in oil production.

Yes we should be aware the probability of declining oil production is increasing. The rate at which a decline will occur is also a controversial topic.

At what price will they begin to refine oil shale? The United States has a trillion barrels of oil locked in oil shale. They used to not be able to get tight gas out of shale, now they can. Someone might figure a way to get the oil out of oil shale. Oil shale has been used in electric power generation in NW Europe for years. Coal to gas or liquids might emerge.

Conservation and energy efficiency become essential means of survival.

Nate, if you're monitoring today's thread,

I recall the post from last year and always thought it would be great to go back and talk again to "John", let us know how the Wall Street energy broker feels now.

Nate:

This is very helpful.

In terms of our outreach efforts to the public, I know that a lot of people have taken pains to avoid the phrase "we're running out of oil." But I have recently come to question this. At the following link (PDF) is found the survey you've probably seen run by WorldPublicOpinion.org, concerning the future of oil supplies.

http://www.worldpublicopinion.org/pipa/pdf/apr08/WPO_Oil_Apr08_pr.pdf

What is interesting about this survey is that this "offensive" term is the very phrase the surveyors used in questioning the public. The question the survey asks is, should governments make long term plans under the assumption that "enough new oil will be found" or under the assumption that "oil is running out and it is necessary to make a major effort to replace oil as a primary source of energy"?

Now here's the kicker: 57% of the U. S. public agrees with the latter statement, that "oil is running out." Majorities of the public in other countries, including Mexico (83%), France (91%), Iran (68%), Egypt (79%), and Russia (53%), are also found in support of this statement -- every country surveyed except Nigeria, where only 45% agree with it.

I don't know quite what to make of this. Is it time to declare victory in our efforts to educate the public? Have we already won?

Or even if declarations of victory are premature, perhaps we should deliberately pick up the slogan that we're running out of oil? We could of course hastily define "running out of oil" as meaning "even though there's oil still in the ground, the flow rates will of geological necessity decline." That is, define "running out of oil" as meaning what we refer to as peak oil.

I know, I hate popularizing an idea in a way that somewhat distorts it. But consider the advantages: by adopting this phrase, we're starting out with 57% of the U. S. public on our side. People may not understand "net energy" or "flow rates." But they seem to understand "running out." Just a thought.

Keith

Oh Yeah! LOL

Nate, great summation of the issue, can't wait for the subsequent posts. Can someone explain to me how CERA makes money for it's clients by predicting incorrectly (continually) future oil production. Is it for investor confidence? I am foreign to the investment world.

One relatively minor comment:

In the second paragraph of the "Big Picture" section, you attempt to use thermodynamics to describe the situation as a result of basic physics. However, what you are describing is the Law of Diminishing Returns which is an economic concept. While it is true that you can't get all of the energy out of a process that was put into it (thermodynamics), that doesn't tell us anything about our situation, and that isn't what is being described in the article.

--

JimFive

I can't find Gail's overview. I was planning to start a peak oil thread on another website I am a member of. Posting cross reference to Gails overview would help a lot. Can anybody help?

PEAK OIL & OIL DEPLETION =

ANCIENT OLD COW PRICIPLE

The oil companies, governments, auto industry and news media refuse to understand peak oil and oil depletion. The best comprehendible example is the "Ancient Old Cow Principle." The old cow has been milked for too many years, but now gives diminishing milk and butter. The old cow is new relentlessly being milked to the last drop. Somehow, the oil companies, governments, auto industry and the news media find this "Ancient Old Cow Principle" incomprehensible, in spite of the fact that they have successfully milked (bilked) and shoveled huge piles of manure for decades. Force feeding (more oil depletion allowances) does not appear to rejuvenate the old cash cow any longer. The old cow is just worn out. This is not very difficult to understand, but the oil companies, governments, auto industry and the news media still have to argue that the "Ancient Old Cow Principle" is simply too complicated to fathom. For more information, please see my website: www.MZ-Energy.com