DrumBeat: January 21, 2009

Posted by Leanan on January 21, 2009 - 9:50am

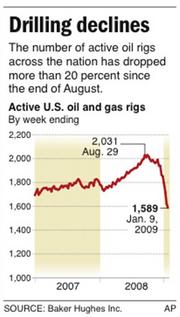

Texas oil country sees the downturn coming

The perils of plunging oil prices

The soaring price of oil punished airlines through the first half of 2008. Now we're seeing how they got pounded again on the barrel's way back down. UAL, parent of United Airlines, reported on Wednesday a $1.3 billion loss for the fourth quarter. While a drop in passengers accounts for some of the decline, the company's cash losses and write-downs on fuel hedges added up to a staggering $936 million, a classic case of the cure causing more harm than the disease.

Antarctica is warming, not cooling: study

ROTHERA BASE, Antarctica (Reuters) – Antarctica is getting warmer rather than cooling as widely believed, according to a study that fits the icy continent into a trend of global warming.A review by U.S. scientists of satellite and weather records for Antarctica, which contains 90 percent of the world's ice and would raise world sea levels if it thaws, showed that freezing temperatures had risen by about 0.5 Celsius (0.8 Fahrenheit) since the 1950s.

"The thing you hear all the time is that Antarctica is cooling and that's not the case," said Eric Steig of the University of Washington in Seattle, lead author of the study in Thursday's edition of the journal Nature.

It is Gap Oil not Peak Oil that is the problem. Rising demand for oil will exceed the quantity of it that can be withdrawn from the earth, resulting in a supply-demand gap. Once production does peak the gap will be enlarged from both sides, drawing down the supply side against rising demand. This I suggest should be termed "Gap Oil". Energy efficiency and a reduction in our demand for oil is paramount and a growing dependence on what can be grown, to create a sustainable "bioeconomy".You heard it here first: GAP OIL. I am coining this term since I haven't seen it used before but it succinctly sums-up the prevailing situation regarding the provision and price of oil. We hear much about peak oil, and often this is misunderstood to mean that the world will imminently run out of oil. However, this is neither the case nor the definition of peak oil. Dr Richard Pike, the CEO of the Royal Society of Chemistry and a former oil-man, has made convincing arguments that there is more oil - about twice as much - to be recovered than the 1.2 trillion barrels worth that is generally accepted. That may well be true, but it does not impact on the rate of recovery of oil per se, which is the crux of the issue.

Mexican crude production down 9.2 percent in 2008

MEXICO CITY (AP) -- Mexico's state-run oil monopoly said Wednesday its 2008 crude production was down 9.2 percent from 2007.Petroleos Mexicanos, or Pemex, blamed bad weather and declining reserves at its biggest oil field, Cantarell.

Pemex produced 2.79 million barrels of crude a day in 2008, down from 3.08 million barrels daily in 2007. Exports dropped 16.8 percent to 1.4 million barrels a day.

Pemex said production at Cantarell fell 461,000 barrels a day in 2008, to close out the year at 1.01 million barrels daily. But production rose to 702,000 barrels a day, from 513,000 daily in 2007, at the second-largest field, Ku-Maloob-Zaap.

Williams Discovery Mainline Restored After Hurricane

(Bloomberg) -- Williams Partners LP said the 30-inch mainline of its Discovery offshore gas-gathering system in the Gulf of Mexico returned to service after repairs for damage sustained from Hurricane Ike last year.The mainline is now delivering 150 million cubic feet of gas per day, its approximate volume prior to the hurricane, the Tulsa, Oklahoma-based partnership said today in a statement.

Petrobras Says It May Build Refinery Without PDVSA

(Bloomberg) -- Petroleo Brasileiro SA, Brazil´s state-owned oil company, said it may build a planned oil refinery in northeast Brazil on its own if it fails to agree on a fuel-supply contract with partner Petroleos de Venezuela SA.PDVSA, as the Venezuelan oil producer is known, wants above-market prices for heavy crude to supply the Abreu e Lima refinery near Recife, Paulo Roberto da Costa, head of refining at Petrobras, told reporters today in Sao Goncalo, Brazil.

“Petrobras very much wants to build the refinery with PDVSA,” he said at the event in Rio de Janeiro state. “But it will build it on its own if it has to.”

The cost of the biofuel boom on Indonesia's forests

The clearing of Indonesia's rainforest for palm oil plantations is having profound effects – threatening endangered species, upending the lives of indigenous people, and releasing massive amounts of carbon dioxide.

Automakers aim for green nirvana in Detroit

Up until now, most hybrid-electric cars have been built with fuel economy, not comfort or prestige, in mind. That means thin soundproofing and tinny stereo speakers, and probably no multi-adjustable leather seats or cushy ride.But Cadillac, Lincoln, Lexus and others are planning luxury green models that will offer great gas mileage without asking the driver to wear an automotive hair shirt.

ASPO Newsletter - January 2009 (PDF)

1100. Imaginative Data Reporting

1101. U.S. Election.

1102. Non-Conventional Oil and Gas

1103. Major Oil Company Production

1104. A Prestigious Peak Oil Taskforce

1105. Iraq re-visited

1106. The Energy Challenge facing the United States

World food crisis will be 'survival of the fittest'

A looming world food crisis, caused by climate change and economic growth in emerging nations, will come down to 'survival of the fittest', according to the Working Party chairman of a new report published today by the Royal Society of Chemistry and the Institution of Chemical Engineers.'The Vital Ingredient – chemical science and engineering for sustainable food' says changing weather patterns, crops being used for fuel rather than food, and emerging Chinese and Indian middle classes will all contribute to a breakdown in the global food supply chain.

The report describes meeting energy and food demand despite declining fossil fuel resources - without permanently damaging the environment - as the greatest technological challenge facing humanity.

Peak Moment: The Twilight of an Age (video)

In his book, The Long Descent, John Michael Greer observes that our culture has two primary stories: “Infinite Progress” or “Catastrophe”. On the contrary, he sees history as cyclic: civilizations rise and fall. Like others, ours is exhausting its resource base. Cheap energy is over. Decline is here, but the descent will be a long one. It’s too late to maintain the status quo by swapping energy sources. How to deal with this predicament? He lays out practical ideas, possibilities, and potentials, including reconnecting with natural and human capacities pushed aside by industrial life.

Ecuador sees no benefit in another OPEC cut

QUITO (Reuters) - Ecuador sees no benefit in OPEC slashing oil output again at its next meeting if world prices do not start to recover, Oil Minister Derlis Palacios said Wednesday.Palacios said his country, which is a marginal producer of around 500,000 barrels per day, would lose money if it agrees to cut output again with prices at current levels.

We can expect renewed shortages of oil and price hikes way beyond $150 a barrel very soon, and this will have economic, political and geopolitical implications beyond what many expect. This could forewarn of a new world (dis)order, with the “rise of the rest”, as we see the world move into post-globalization, post-AngloSaxon fragmentation – what the late Samuel Huntington and others have called “civilization clash”, when international rivalries are exacerbated by power blocs, jockeying for advantage, to ensure the secure supply of oil at the best possible price.

GM loses sales title to Toyota

NEW YORK (CNNMoney.com) -- General Motors lost the title of world's largest automaker to rival Toyota Motor in 2008, according to sales figures released Wednesday by the troubled U.S. automaker. It was the first time in nearly 80 years that GM did not sell the most cars in the world.

LONDON/NEW YORK (Reuters) - Global oil demand is seen contracting more sharply this year than previously expected, as the deepening economic crisis spreads to the developing world.World oil demand will decline by 430,000 barrels per day in 2009 to 85.43 million bpd, according to a Reuters poll of 10 analysts, banks and industry groups.

The large predicted fall is a significant shift from a Reuters poll in November, which forecast demand would slip by 20,000 bpd in 2009, following a similar decline in 2008.

"Demand growth in emerging nations almost offset the demand contraction in the developed world in 2008, but with demand growth now expected to almost halve in 2009 in the developing world, that is no longer the case," said Francisco Blanch, head of commodities research at Merrill Lynch.

President Obama asked us to choose hope over fear but at least on the day of his inauguration, the market chose fear over hope. Wide spread fears were played out all over the market place as the UK bailed out some banks reminding us that this crisis is not quite over.Oil fell hard in the back end of the curve and gold soared and treasuries fell as traders feared another global meltdown and seemed to be preparing for the worst instead of the best. Platitudes and finger pointing did not inspire the type of confidence that the market wanted to hear.

Do WTI Oil Prices Reflect Underlying Market Conditions?

The volume of oil stored in tankers has climbed to 80 million barrels, based on 40 VLCCs each holding roughly two million barrels of oil. According to Frontline (FRO-NYSE), the world’s largest operator of VLCCs, the current rate to charter these tankers is about $75,000 a day. That translates into about $1.12 a barrel per month for storage. As long as a buyer of crude oil can cover this cost for storing the oil, he will engage in these time-spread trades. The contango condition (future crude oil prices being substantially higher than current prices) that exists in the crude oil market today as it relates to West Texas Intermediate (WTI) oil has begun to raise questions of whether the price for this crude actually reflects the oil market's underlying fundamentals, or rather is a victim of a regional market imbalance between supply and demand.

Join Wendell Berry and Bill McKibben in Civil Disobedience Against Coal-Fired Power Plants

There are moments in a nation's -- and a planet's -- history when it may be necessary for some to break the law in order to bear witness to an evil, bring it to wider attention, and push for its correction. We think such a time has arrived, and we are writing to say that we hope some of you will join us in Washington D.C. on Monday March 2 in order to take part in a civil act of civil disobedience outside a coal-fired power plant near Capitol Hill.

Assuming that CCS turns out to work, it will take decades to deploy in new coal-fired plants and to retrofit old generation facilities. In addition, moving carbon dioxide around from power plants to locations where it can be stored geologically will require constructing a pipeline infrastructure that rivals the hundreds of thousands of miles of gas and oil pipelines. While there might be a moratorium on new coal-fired plants in the U.S., the rest of the world will not be joining it. The International Energy Agency's World Energy Outlook 2008 projects that fossil fuels will still account for 80 percent of the world's primary energy production in 2030. Nearly 90 percent of the increase in world electricity demand will be driven by the economic growth of developing countries, especially that of China and India. In other words, coal will still be fueling civilization for the next couple of generations.

In Canada, a Push for Obama-style Green Stimulus

The proposal for a Green Economy Action Fund is backed by unions, environmental organizations and other Canadian civil society groups with a combined membership of over 850,000 people.The plan calls for $22.7 billion in federal investments and $18.6 billion in low-interest loans to stimulate the green economy and catalyze provincial action. Dollars would flow to retrofit buildings, ramp up renewable energy, expand public transit and support clean-tech manufacturing.

The dynamic is this: An energy transition from Bush’s Plan A to Obama’s Plan B is likely to be felt as a major and decisive shift in U.S. national consciousness, as well as in policy detail. This shift of plans may be as wrenching and controversial a change in national character as has been achieved since the gradual awakenings of the civil rights era. It should be no surprise that a shift of this magnitude would contain some risk of failure, and the possibility that Plan B might fail therefore merits open and serious discussion. We should be talking about whether Plan B is really a risk worth taking – and even if so, whether some investment should simultaneously be made in the low-risk, high-reward Plan C.

Big Oil Races to Become Big Clean

The realization that diversification of energy is in everyone's interest has shifted perceptions and the big oil companies, the likes of BP and Shell, have taken the lead in alternative energy.

Astrophysicist Neil deGrasse Tyson

With this new administration, is there a sense in the scientific community that there is at least an attitudinal change coming to Washington with regard to science?What's driving attitudinal change is the fact that we need solutions to our energy crisis and we need them fast. You can't get those solutions from politics. You have to get them from scientists and engineers. So the value of science to the nation, I think, is currently being driven by our economic needs. But what people need to keep sight of is that the bigger value of science and technology to a nation is so that you can thrive as a nation going forward, so that you can thrive five years out, ten years out, twenty years out. And investments in research and development today pay dividends on those time scales, not on the time scales of the re-election of politicians. Someone has to have foresight beyond their own election cycle.

Oil Addiction: Don’t Count on Mexico to Supplant Mid-East Crude

Whether the calls for reducing America’s oil dependence on the Middle East that played such a big part in Barack Obama’s campaign will find a home in today’s inaugural address is an open question. But one thing is increasingly clear: America won’t be able to count much on Mexico, still its third-biggest supplier, to help it wean off Persian Gulf oil.

Mexico sees refinery costing up to $10 bln

MEXICO CITY (Reuters) - A planned new oil refinery in Mexico could cost up to $10 billion, the head of the state oil company Pemex said on Tuesday.

Gaza Aftermath May Impact Israel Oil Pipe Development

Israel's offensive in Gaza will certainly have an effect on the country's status as an energy corridor, experts say. But whether it will be positive or negative depends on Israel's ability to prevent further attacks from Gaza and the country's battered relationship with Turkey.A little-known 254-kilometer Israeli pipeline, from the Mediterranean port of Ashkelon to the Red Sea port of Eilat, could rival the Suez Canal as an oil shipment route between former Soviet Union producers and Asian consumers.

China to seek 60,000-90,000T Feb naphtha on shortage

SINGAPORE - China, normally a net naphtha exporter, has emerged to seek spot cargoes for February delivery to fill a shortfall in domestic production, regional traders said on Tuesday.Traders estimated that the country could need about 60,000-90,000 tonnes of the petrochemical feedstock to plug the shortfall, as its top refiners cut runs to their lowest in about 2-½ years due to slow overall fuel demand.

CNOOC Cites Strong Production Growth, Anticipates Busy Schedule in '09

CNOOC has announced its business strategy and development plan for year 2009.The total targeted net production of the Company in 2009 is 225-231 million barrels of oil equivalent (BOE) (with WTI at US $60.0/barrel), compared with the estimated net production of 194-196 million BOE (with WTI at US $100.1/barrel) for 2008.

During the year, ten new projects are expected to come on stream, eight of which are located in offshore China. In overseas, OML130 in Nigeria and Tangguh LNG project in Indonesia will start production this year. These new projects are major contributors to the production growth in 2009.

The Philippines: The coming perfect storm

According to Energy Secretary Angelo Reyes and the big oil companies, there is no hoarding of liquefied petroleum gas, the most common cooking fuel in the Philippines that is also fast becoming an alternative fuel for thousands of taxicabs all over the country. There’s just none that can be bought anywhere.The oil companies have long been predicting price increases for LPG, and now we have a full-blown shortage in our hands even if petroleum prices remain depressed the world over. But, Reyes and the Big Three say, there’s really no evidence of hoarding.

Who do they think they’re fooling?

Indonesia: Gas stations dry up due to supply reroute

A number of gas stations in Jakarta reported they were out of Premium gasoline Tuesday despite the state-owned oil company claiming supply to the city would not be threatened by the massive explosion at one of its Premium gas tanks at its Plumpang depot in North Jakarta on Sunday.

Alaska: Rural energy crisis isn't a surprise

The increased attention the residents of Emmonak are receiving is long overdue. The crisis isn't, however, a surprise to the governor or anyone in the Alaska Legislature.Recent press reports fail to note that Alaska's rural fuel cost crisis was a loud topic of debate during the August special session, when the governor and other policymakers were told fuel costs were going to reach and exceed $9/gallon in some villages. The following summary is being provided to give those reporting on this issue some context on this issue, and the efforts many made to prevent the problems faced by residents in Alaska's small communities like Emmonak.

"We will work our way through these financial problems, but what would be really unfortunate is that once things bounce back, oil prices will bounce back too," said Matt Simmons, chairman of Simmons & Company International, at a roundtable held in mid-December. He says that supply shortages could help oil prices soar through $147 as unhindered as a hot knife cuts through butter...."Oilfields aren't like emptying a bucket or taking boxes out of inventory," says Robert Hirsch, a senior energy adviser at Management Information Services, speaking at the same roundtable as Simmons. "You can't keep pulling oil out of the ground at the rate that you did in the past because of the basic geological processes."

In the midst of a global recession, much of the explanation for falling prices has focused on the supposed collapse in demand for oil, particularly from Asia's rising economic powerhouses, but talk of China's falling oil imports is misleading. It is only growth that is falling – from 28% in October to 17% in November.

According to Simmons, the story of supply destruction is a more immediate problem. "We're unwinding supply right now just as fast as we've ever done and it's like a bulldog chewing on somebody's behind," he says.

Oil around $41 amid grim economic news

VIENNA, Austria (AP) -- Dismal global economic news pointing to deteriorating energy demand kept oil prices in check Wednesday, with crude oscillating around $41 a barrel.The market continued to focus on bad news from the banking sector, with investors concerned that a deepening global slowdown will further undermine demand for crude. But indications that OPEC was showing unusual discipline in taking extra barrels off the market gave prices some lift.

Japan’s Power Sales Drop Most Since 1972 on Recession

(Bloomberg) -- Japan’s industrial power sales fell the most in more than three decades, plummeting 13 percent in December from a year earlier, as automakers such as Toyota Motor Co. and steel companies shut plants and scale back output.The drop was the biggest since May 1972, when the Federation of Power Companies of Japan started compiling data, the group said in a statement today. Sales to steel companies declined 25 percent last month, exceeding the previous record in February 1981, and sales to machinery manufacturers sank 18 percent.

Russia gas heads to Europe after Ukraine dispute ends

MOSCOW (AFP) – Russia started pumping natural gas to Europe after ending an energy war with Ukraine that left millions in deprived of winter heating."We can now tell our citizens that gas is finally on its way," European Commission president Jose Manuel Barroso said after the taps were turned on again. "Our monitors on the ground report that the gas is flowing normally."

Can Ukraine leverage gas deal with Russia?

After weeks of tense negotiations that involved the European Union, Kiev reached a compromise with Moscow over how much Ukraine would pay for its gas imports and how much Russia would pay for sending gas across Ukraine's transit pipeline network to Europe. Those parts of the deal made the news.What is not so well known is that their agreement also involved RosUkrEnergo, a Russian-Ukrainian energy trading company that has played a considerable role in thwarting Tymoshenko's efforts to push through economic reforms.

Kazakhstan bumps up gas transit price

Kazakhstan has raised transit fees for Uzbek and Turkmen gas being piped to Russia by 21%, Energy Minister Sauat Mynbayev said today.

Iran: OPEC needs non-OPEC help to steady oil market

TEHRAN: Iran's oil minister said demand for oil had declined more than supply and cooperation between producers inside and outside OPEC was needed to reach market balance, an official news agency said on Wednesday.

3 oil firms compete for Iraq oil field

BAGDHAD (AP) -- The Iraqi Oil Ministry is studying offers submitted by three international oil companies to develop a prized oil field in southern Iraq, an official said Wednesday.Ministry spokesman Assem Jihad said Italy's Eni SpA, Spain's Repsol and Japan's Nippon Oil submitted bids for a service contract to develop Nasiriyah oil field.

Oil tanker attacked off Nigeria

Unidentified armed men have abducted a Romanian crew member after an attack on an oil tanker off Nigeria's southern coast, security sources say.The MT Meredith, loaded with 4,000 tonnes of diesel, was badly damaged in the attack early on Wednesday.

Crime, not politics, drives Nigeria oil delta unrest

LAGOS (Reuters) - Kidnapping oil workers and blowing up pipelines may have focused attention on Nigeria's oil delta, but three years of militant attacks have locked the region into a spiral of crime which is hindering much-needed development.

New Nigeria oil firm to rival Petrobras, Saudi Aramco

ABUJA (Reuters) - The new head of Nigeria's state oil firm NNPC has pledged to press ahead with reforms that would break up the company into profit-driven units able to operate like counterparts in Brazil, Malaysia or Saudi Arabia.

Chevron reconsidering Indonesian deepwater venture

Chevron Corp., the second-largest U.S. oil company, will review a $7 billion project to extract natural gas in Indonesia’s first deep-sea drilling venture because of the global recession.Chevron will consider the cost and schedule to develop the Ganal gas fields off the country’s part of Borneo, Suwito Anggoro, president director of the oil company’s Indonesian unit, said in an interview in Jakarta today.

Police departments look for more fuel-cutting cars

CAHOKIA, Ill. (AP) — Police Chief Richard Watson admits his department's newest patrol car is a curious departure from its big-horsepower Ford Crown Victorias. But the four-cylinder Pontiac Vibe GT has plenty of pep for policing, he said, and gets twice the gas mileage.Law enforcement agencies across the country looking for ways to cut corners and reduce costs after last year's $4-a-gallon gas are increasingly turning to more fuel-efficient cars.

Clock is ticking for GM and Chrysler

NEW YORK (CNNMoney.com) -- General Motors and Chrysler LLC have four weeks to win deep concessions from unions and creditors to prove they are viable, or they risk losing the $17.4 billion in government loans that are keeping them from bankruptcy.

Blacks feel auto industry's pain; it was road to middle class

The financial crisis in the auto industry has been more devastating for African Americans than any other community, threatening a half-century's economic gains by the black middle class. From blacks who left behind subsistence jobs in the South for high-paying factory jobs in the North during the Great Migration, to entrepreneurs who translated hard work and the gift of selling into their own businesses — they're all getting hammered."One of the engines of the black middle class has been the auto sector," says John Schmitt, an economist who studies the issue at the Center for Economic and Policy Research, a liberal Washington think tank. In the late 1970s, "one of every 50 African Americans in the U.S. was working in the auto sector. These jobs were the best jobs. Particularly for African Americans who had migrated from the South, these were the culmination of a long upward trajectory of economic mobility."

Which company did best under Bush? Southwestern Energy

The runaway winner: Southwestern Energy, (SWN) the natural gas exploration and production company that had a compounded annual return of 48%, says Capital IQ. That's far better than Apple, up 31%, even though it dropped in the last days over concerns for the health of CEO Steve Jobs. Apple may have been the most regaled highflier of the Bush era. Google, (GOOG) which was not included because it first joined the S&P 500 in 2004, has had a 28% compounded return since.

New group prepares for high gas prices

There’s a group of Lawrence residents who definitely aren’t betting on cheap gasoline prices being around for long.The city’s new Peak Oil Task Force met for the first time Tuesday with discussions of how the future may include the need for more food to be grown locally and more jobs to be closer to home because fuel prices will be at new highs.

Stand Up to Corporate Power: 5 Ways to Get Free

Making lifestyle choices that protect the environment, reduce global injustice, reflect social responsibility, and contribute to richer communities can also move us away from corporate control.

Customizing legend is bringing Batmobile panache to Prius

LOS ANGELES — He built the Clampetts' jalopy for The Beverly Hillbillies, TV's original Batmobile, the Monkeemobile and KITT, the chatty Trans Am in the first Knight Rider series.Now auto-customizing legend George Barris, 83, says he's taking a bold voyage into the 21st century: He's trying to give dowdy hybrids like the Toyota Prius his distinctive, flamboyant touch.

Little cars get big electric boost

Regular Prius models, which sell for $22,000 to $28,000, get 40 to 45 miles a gallon depending on how aggressively they are driven - they switch to gas use when traveling above 35 mph.When adding the A123/Hymotion 5-kilowatt-hour battery, a driver can expect 80 to 95 miles a gallon. Each battery operates on 50 percent to 70 percent of the charge, taking the driver about 40 miles using both gas and battery power. After a battery is spent, the engine switches to the car's 11 to 12 gallon gasoline tank. A driver can then plug the battery, which is estimated to last a decade, into a standard 120-volt wall outlet for charging.

Top 100 Stories of 2008 #1: The Post-Oil Era Begins

If biofuels aren’t the answer, what is? Surprisingly, the thing that replaces oil might not be a liquid fuel. It might not, strictly speaking, be a fuel at all. Nor is it some exotic source you have never heard of.It is electricity. And it is already making its way into an auto dealership near you.

Sun 'could supply Gulf's day-time energy needs'

ABU DHABI (AFP) – Oil-rich Gulf Arab states enjoy year-round sunshine but they remain slow in adopting environmental technologies to let them harvest their abundant solar power, industrialists said Tuesday.

SCOTTISH & Southern Energy and Iberdrola – the Spanish owner of Scottish Power – are launching a joint bid to build new nuclear power stations in the UK.

Excerpts and Commentary on Ben McGrath’s “The Distopians” – Jan 26th, New Yorker

In a blog that he maintains, Club Orlov, he categorises his readers into three basic cultural categories;1. “back-to-the-land types,” united in their opposition to industrial agriculture;

2. “peak oilers,” who worry about the shock effects on energy markets of reaching the maximum global crude-extraction rate; and all-around Cassandras, and

3. “people who sometimes derisively are called doomers.” (The doomers are currently enjoying a little less derision, which is a mixed blessing, because it is axiomatic among true believers that mainstream respect means that it is too late for anything to be done.)

Orlov has recently acquired a fourth audience, composed of financial professionals, who have been, as he said, “bolstering my gut feeling that the United States is bankrupt.” A number of them have placed orders for multiple copies of his book, and he took some pleasure in imagining them passing it on to their friends and families this past holiday season as a grim kind of stocking stuffer.

Ecology: The moment of truth—an introduction

It is impossible to exaggerate the environmental problem facing humanity in the twenty-first century. Nearly fifteen years ago one of us observed: “We have only four decades left in which to gain control over our major environmental problems if we are to avoid irreversible ecological decline.” Today, with a quarter-century still remaining in this projected time line, it appears to have been too optimistic. Available evidence now strongly suggests that under a regime of business as usual we could be facing an irrevocable “tipping point” with respect to climate change within a mere decade. Other crises such as species extinction (percentages of bird, mammal, and fish species “vulnerable or in immediate danger of extinction” are “now measured in double digits”); the rapid depletion of the oceans’ bounty; desertification; deforestation; air pollution; water shortages/pollution; soil degradation; the imminent peaking of world oil production (creating new geopolitical tensions); and a chronic world food crisis—all point to the fact that the planet as we know it and its ecosystems are stretched to the breaking point. The moment of truth for the earth and human civilization has arrived.

It's a new day and we're still at peak. What's the deal? I thought Obama would change our situation.

:)

I spent all morning raking the $50's out of my yard it rained last night.

FF

Obama will be busy all week un-screwing the anti-environment executive memos issues by former President George W. Bush in the 11th hour of his reign of stupidity.

I guess that's why the "Earth in Balance" crowd at the event yesterday was allowed to trash the National Mall.

GD Bush.

FF

One thing a treehugger learns is the meaning of "wind chill" and how it feels to be out in the cold without walls to hide behind. Besides, a true treehugger wouldn't have wasted the gas to make the trip to the Mall...

E. Swanson

I used an electric train from Baltimore and shoe leather. And the down from several renewable birds, wool from renewable sheep, etc.

:-)

Alan

That would be burning coal and a dead cow for transport, and numerous dead birds for warmth (I'll grant you the sheep!)

;-)

I used Cable and a big dog on my lap to keep me warm.

Looks like you had lots of fun, tree hugger.

FF,

Apples and oranges (maybe)...but...I caught one comment on the radio from an inner city school nurse who said that this morning the big change she noticed was the number of boys at the bus stop ready to go to school. (She hadn't seen some of them for weeks.)

His time would be better spent undoing the Glass-Steagal mess and addressing the financial regulatory issues first, and then getting bank regulators ready for the flood of collapses that must follow.

I'm all for the environment, but the bulk of Obama's time needs to spent getting the US solvent again.

There's no solvency in a fucked up environment. Get your priorities straight.

My parents who live in the east bay area CA, just called to tell me they are rationing water in there area. Said it has been high 70s for weeks, often gets into mid 80s where they live.

Brother in Monterey bay CA rationing water, 70s, dry air, (thats just freaky)Surfs great he says.

Just saying...

Alberta has just initiated cutbacks on the water available to tar sands plants. This is a first and a bit of a suprise. Hopefully there are folks out that way who will post further details. Not sure about the surfing.

Suncor Says Reduced Water Has No Impact on Oil Sands Output

Boy, are you good. Fast too!!

Sorry about the BR's. Comes with the custardy trousers.

The surfing here is great at the moment...

Not gonna happen.

Executive orders where the 1st thing BO was a-signing. By 'tradition'.

http://despair.com/tradition.html

Michael Economides says oil is going back to $100 and very soon. Oil Price Over $100, in a Blink

He says the average cost of new oil is $70, therefore without oil above that price there will not be enough investment in the oil patch to keep production up.

It is hard to be more bearish than Michael Economides but I am afraid I must be in this case, but while hedging my bets. I agree oil will go back to $100 but only if the economy recovers. And that, I believe, is simply not going to happen.

Oil production is falling like a rock. It is no coincidence that oil production peaked in the very same month that the price of oil peaked. With oil over $140 a barrel, everyone was squeezing every barrel out of every crevice they could find. But with oil below $50 a barrel, stripper wells are being shut down along with other marginal high cost production. New production is also being stifled. And it is all because of demand destruction.

Oil production, on average, stopped growing in 2005. I have argued that this, along with the very high cost of oil and other energy sources, was what drove us into this current recession. However I will not belabor the point. One can argue that the recession has other causes, like the sub-prime mortgage crisis, and they are partly correct. But I believe the combination of energy production peak and high price was very large contributing factor.

But my primary point is that our debt based economy requires growth and growth cannot return until growth in the energy supply returns. That is not going to happen. Oil production would have peaked in 2005 were it not for the price climbing well above $100. And even with oil above $140 a barrel, production only barely inched above the 2005 peak.

Bottom line, low oil production is trying to drive the price of oil back up while the deep recession is trying to drive it right back down. Which will win the battle? I am betting on the latter.

Ron Patterson

Economides has always been an odd duck--a Peak Oil opponent, but an oil price bull.

In any case, consider the fact that all of the money spent by the industry worldwide in the past three years basically kept crude production flat, and on a cumulative basis--what we would have produced at the 5/05 rate, versus what was actually produced--we have a sizable shortfall. So what happens as drilling falls off and as unconventional projects are delayed or canceled?

And then there is the net export story. We will have to see how it all plays out, but the eight year crash in Indonesian net exports all happened at prices below the current US oil price (an average of $21, within an annual range from $14 to $31, as Indonesian net exports crashed).

Even if it were possible to jump start the economy, I don't think that we would have the volume of world oil exports necessary to power a recovery.

Interesting. I support the idea there will not be a recovery to the previous economic modes of operation. (Hopefully something else will grow out of this misery)

But I have a question on net exports. With the oilprice now crashed, does't that mean consumption in producing countries is/will also decline?

With the oilprice now crashed, does't that mean consumption in producing countries is/will also decline?

The Baltic dry has flatlined.

The Ukraine just became part of the Russian Commonwealth.

Portugal, Ireland, Greece, Slovakia, the Baltic triumvirate

of Latvia, Lithuania, Estonia.

Which will be the first to Sovereign default.

Will riots consume them before or after.

mc, I just potulated this question in light of ELM theory, and I don't see how your reply answers this.

But the interesting times have arrived, that's for sure.

mc, I just potulated this question in light of ELM theory, and I don't see how your reply answers this.

So let me try again.

Oil is being pumped out as fast as possible now.

But world trade is grinding to a halt.

World wide depression will crush oil consumption

back to (fill in the blank).

What ever consumption turns out to be, sovereign collapse

will over ride. Example: If the US collapses back to

1960 rates of consumption, the ELM has to be re calibrated.

Oil exporters will for a short time longer, look to

put out everything possible to fend off collapse.

People are just not realizing how rapidly cars will

give way to trains in the US. This time next year

in a SWAG, we'll be using 3 mbd less.

IMHO

As I said, we will have to see how it all plays out, but looking at a chart of world oil production (and thus consumption) in the Thirties, worldwide it looks like we only saw a one year decline in consumption, in 1930, with consumption in the late Thirties being above the 1929 rate. Also, as Downsouth has pointed out, there were three million more cars on the road in 1937 in the US, than in 1929. Regarding cars, big difference now is that hundreds of millions of consumers worldwide want to drive a car for the first time, versus mere millions in 1929.

Regarding US consumption, the last four week running average of total product supplied was down by about 500,000 bpd over a comparable time period in 2007, while the EIA estimates that US crude production fell by about 350,000 bpd over the same time period. In order to show a long term reduction in net imports, the US first has to cut consumption enough to offset the decline in domestic production. This is true of all post-peak net oil importing countries.

Thsnk you for your reply, WT.

I thoughtfully read each of your postings.

"in the Thirties, worldwide it looks like we only saw a one year decline in consumption, in 1930, with consumption in the late Thirties being above the 1929 rate."

But oil was almost floating out of the ground then and the pop

was what 75 million?

Now we're at 300 million, floating in debt, working a paradigm

that must be hitting on all cylinders.

"Regarding cars, big difference now is that hundreds of millions of consumers worldwide want to drive a car for the first time, versus mere millions in 1929."

And they want phones, meat, and electricity. they're not getting those

things either. But back to the US, we're using 25% of world resources.

With Global Trade coming to a stand still, that will change rapidly

in 09.

Trains will be huge this time next year. Interstates will be

empty or full in the exit lanes from our mega cities.

Mexico, the UK and Pakistan the states to watch.

"the US first has to cut consumption enough to offset the decline in domestic production. "

Consider that a done deal. The instant Obama tries to implement

his "bad bank" idea. We've got days.

I saw State Street mentioned Zero times on Bloomberg CNBC.

As it has gone from 35 to 15 in one day.

"Banks, which recently accounted for 12+% of S&P 500 market-cap, generate more than 25% of total dividends for the index (proxy SPY). In addition to a general slowing of dividend increases across industries, the large banks that make up the bulk of the S&P financial sector (proxy XLF, and closely tracked by KBE) are dramatically reducing dividends. If the combination of business needs and TARP rules force virtually all large banks to reduce dividends to $0.01 per quarter, the S&P index would have to decline into the 600's to restore the current 3+% index dividend yield."

http://www.safehaven.com/article-12384.htm

Keeping the $ strong is all our government will have left.

To keep our empire intact. As our Empire collapses

(another thing we didn't have in the Thirties), so will

our import of oil.

Your ELM is the marker, and I do keep up with your posts.

Keep 'em coming.

James

Googling "historical oil prices" I could find nothing prior to 1946. However I would be very interested in finding out what the price of oil were in the late 30s verses 1929. I would bet that prices, during the depression were extremely low. Also there was likely a great glut of very cheap oil during that period. It was an era of very abundant oil and very cheap oil.

My point is that I do not believe we can compare oil consumption during the current recession/depression with that of the Great Depression for obvious reasons.

One more point. Cheap oil and an ever increasing supply of oil enabled us to eventually pull our of the Great Depression. Now we have cheap oil but an ever decreasing supply of oil. Whatever happens to the price of oil, supply will continue to decrease. There will not likely be a recovery from the coming Great Depression.

Ron

Here is a chart showing posted oil prices. It would appear that oil prices in the second half of the thirties were higher than in the first half, when the East Texas Field flooded the market (and briefly drove price down to about 10¢). If memory serves, the Texas RRC finally was able to restrict the East Texas Field enough to push prices up to the $1.50 range by around 1937 (all nominal prices of course).

And the Oil Poster chart shows a steady Thirties era increase in world oil production & consumption, from 1930 on:

http://www.postcarbonbooks.com/sites/default/files/ubercart_images/large...

And here is a very interesting take on the question of oil prices in the Thirties:

http://mjperry.blogspot.com/2008/11/oil-shock-of-1930s.html

Saturday, November 15, 2008

Carpe Diem: The Oil Shock of the 1930s: Another Factor?

And here is a response by "Spencer" to the above Carpe Diem post, showing annual BP inflation adjusted prices (it would be nice to find the actual nominal prices):

In any event, from the 1931 annual low, the BP data appear to show an annual rate of increase in oil prices of +11%/year from 1931 to 1937.

Spencer has a followup post showing the increase in nominal gasoline prices in the US. They increased at +2.7%/year from 1931 to 1937.

It seems to me that from 1931 to 1937 oil prices had to rise in order to balance rising demand against supply that wasn't rising fast enough.

It was my understanding that oil got as low as 15-20c a barrel at one point during the depression. This would be $1.50-$2 by the generally accepted multiplier of 10.

The U.S. went off the gold standard by order of Richard M. Nixon in the 70's. The currency was allowed to float without gold deposits to back it.

The banks are insolvent:

http://www.bloomberg.com/apps/news?pid=newsarchive&sid=aS0yBnMR3USk

Oil producing countries had gasoline to burn when the price of oil was over a hundred dollars a barrel. A sharp drop in oil prices and they may have difficulty making tha oilfield payrolls and paying the children's college tuition bills, much less go for a joy ride across the desert.

If the price of oil goes up three dollars it will not help some of the highly leveraged (deeply indebted) oil explorers who need to pay their interest payments or go to try to burrow more in order to make the interest payments, stuck with sky high drilling costs.

As noted up the thread, the flood of oil from the East Texas Field briefly drove the price of oil down to the 10¢ range, which is reflected in the low annual inflation adjusted price in 1931, but the interesting thing to me is that we saw rising consumption after 1930 and rising prices from 1931 to 1937.

I wish that were true.

As for your broader point about depression, well, I think that's pretty straightforward at this point. Yeah, we enter depression if the Anglo-American banking system collapse runs to completion, and then there's no telling how low we can go in demand. Depression risk is rising quickly.

Back to trains: The Obama stimulus plan proposes to spend barely 1.00% on rail.

G

"But world trade is grinding to a halt."

--That's interesting. I sell media (books,AV) on the internet.A decent part of my sales are to Europe,Japan, and Australia. Sales to these locales are off, but are no softer than they are for domestic sales.I certainly see nothing as severe as what you are suggesting.

Riots come in the spring

It's too cold in the northern countries to riot right now

Ed

Not even then.

People are getting too fat and old in America and Europe to riot. Though this opens the interesting question of what obese middle-aged bourgeoises do when they can't take it any more. Join fascist parties? Road rage (rioting while wearing a 4000-lb metal skin)? Phone local hate radio shows in support?

Believe me, I think we need riots. The kids are disappointingly mature and responsible these days, compared to their parents. Oh wait, the kids are too fat to get out the door.

Riots are just a waste of time and accomplish nothing. TPTB know how to handle those.

Everyone withdrawing their deposits from the banks at the same time? Now THAT is something that would truly make them go pale and start to shake in their boots!

"Riots are just a waste of time and accomplish nothing."

Agreed. About 6 months ago, some South Africans burned the trains because they didn't leave the station in a timely fashion. I hope they realized in retrospect, as they were subsequently walking for miles and miles, that torching the train was a pretty stupid idea. Same for the Indian protesters burning power company utility offices, vehicles, parts warehouses, and transformer substations, then wondering why the blackouts got worse. Duh!

Successful Peak Outreach would prevent this kind of 'shoot yourself in the foot' stupidity because people would seek to protect their infrastructure while transitioning to more energy-efficiency.

TPTB know how to handle those....truly make them go pale

Yup. Things that TPTB care about AND have no power to prevent/change is the way to go. General riots - Meh, they have plans, A general strike? So long as most people are shackled by the need for FRNs - that won't happen.

"Riots are just a waste of time and accomplish nothing."

"The tree of liberty must be refreshed from time to time with the blood of patriots and tyrants."

-- Thomas Jefferson

So where else do we start?

In times like these what else can be done, make another post on a blog.....?

+1

As much as I advocate for "peaceful" solutions, I don't see any way for meaningful change to sprout in our present situation.

The masses don't have any power within the bounds of our legal and economic framework.

Does anyone see any way to realistically bring change within our present system?

TS

Enough people stop paying their credit cards off and the system crashes fast. That's a great place to start.

Even simpler, everyone stops paying their credit card balances.

Don't forget posting curses to the new chief exec whose administration is only hours old.

Iceland's government is on the point of collapse as angry protesters stake out the parliament in Reykjavik

This despite winter season in Iceland (and on the back of one of the world's longest running democracies).

Wow. It's barely making the news on this side of the pond, but I found this link:

Iceland protests grow, premier vows to stay on

I wonder, are they rehearsing for Up Helly Aa in Shetland next week ? /snark

http://images.google.com/images?um=1&hl=en&client=opera&rls=en&q=Up+Hell...

http://www.shetlandtourism.com/pages/up_helly_aa.htm

Joke aside, the "mob" attacked the premiers car and "hammered and egged" it,shown in a 1/2- minute section on Norwegian tv-news

As I said up the thread, we will have to see how it all plays out, but we do know that Indonesian net exports crashed at about -29%/year (over a 7 year period), with an overall accelerating net export decline rate, at an average oil price that was about half of current US oil prices.

All I can point to is our little mathematical model, versus two real life case histories, all showing accelerating net export decline rates, with three different rates of increase in consumption (+0.2%year, +2.5%year and +4.1%/year):

http://www.theoildrum.com/files/image005.png

With a production decline rate of -5%/year, if "Export Land" wanted to maintain flat net exports of one mbpd (from a peak production rate of 2 mbpd and consumption of one mbpd), their consumption would have to fall at a -15.6%/year rate (falling by half about every five years) over a 10 year period. They would have to reduce their consumption from one mbpd to 0.21 mbpd over a 10 year period.

Here is Indonesia's consumption response to an average US oil price of $21 from 1996 to 2003 (when their net exports fell at -29%/year):

http://tonto.eia.doe.gov/country/img/charts/ID_cons_large.png

Increasing consumption in oil producing countries has been driven primarily by the booming economy in those countries. Their economy has been booming primarily because of high oil prices. Now that prices have plunged, their economy will almost certainly suffer. This should mean that their consumption will also fall but how much I would not venture to guess.

But we can be assured that their exports will drop even further due to declining production and little to no new investments in exploration and production.

Ron Patterson

Since each Saudi citizen is dependent on the state the loss of oil revenues will result in a very unhappy population.

I would also expect the various Princes to liquidate assets in order to maintain current consumption. Since T-bills form a large part of those assets we may expect a global repricing of the worth of a US dollar and a likely rise in US real interest rates. This would have further negative feedbacks on the US economy. My hunch is we are all going to be Orloved as it will get worse before it gets worse.

Cheers!

BOP - don't use <BR> tags. They make your posts look very strange in Firefox (though IE seems to weed them out). Just use hard returns.

Contrary to what a lot of people seem to believe Saudi citizens do not live off the dole. There is no dole in Saudi Arabia (except for the royal family of course). But the loss of oil revenues will affect every citizen. Saudi Arabia has one of the fastest growing populations in the world and one of the highest unemployment rates. Officially it is about 11% but most realistic estimates put it at above 25% and unemployment among those under 25 is far higher than that. And it is likely to get a lot worse.

Ron

Add to that the fact that you can't grow food there, and please to enjoy the chaos.

Officially it is about 11% but more realistic estimates put it above 25%? Wow, Saudi Arabia stole our statistical methodology.

economides appears to have established himself as an expert so he can charge big consulting fees. he has written some valuable articles as well as some that appear to solve problems that dont exist.

http://www.spe.org/elibrary/servlet/spepreview?id=00031149&speCommonAppC...

In a major game of "beggar thy neighbor", Russia, Saudi, and VenMex had their turn first.

Now the UK is at bat.

US will be next/last. Watch the TBT and US dollar.

Have popcorn roll film.

FF

Hi FF,

How do you see that UK is "at bat in a game of beggar thy neighbour". Being a UK citizen and resident, all I can see is UK playing a game of "beggar thyself" or perhaps, indeed, "bugger thyself". It's already incredibly ugly and I cannot see any way for it to improve.

We have no manufacturing industry to take advantage of our weak currency. Even if we did, we would have to import almost all the natural resources required to manufacture anything. If we could do that and still make a margin, we are a faced with a domestic workforce that believes in an "entitlement society" and, generally, has no concept of the meaning of hard work. A sizable minority views a blue collar job as something they could do for a few weeks and then go on long term paid sick-leave for spurious job-related illnesses which nevertheless have been signed off by a doctor...

The only export industry we really have is in financial services and I do not think I need to point out the parlous state of that particular game of smoke and mirrors. I will be astonished if less than 90% of our banking system is NOT nationalised by the middle of this year.

Hi bunyon,

I was just referring to the race to devalue currency fastest first.

First they devalued the oil- it didn't work and now the currency race is about to begin.

FF

Ah, ok. As I said in my first reply, a severely weakened currency is not going to do a lot to help the UK in my opinion, though possibly we will lose those foreign (EC) blue-collar guys who actually do a hard day's work for a fair day's pay... that will please the Little Englanders (and serve to ensure our already poor infrastructure crumbles all the quicker).

All the UK media can talk about is how we need our currency to be strong, though they don't say why! Earnings and jobs are down the pan and round the bend and set to get worse. If there is little or no discretionary income, a stronger currency (engendered by higher interest rates) is not going to help at all.

I don't think you can say this devaluation is deliberate. Interest rates in all the major countries( except the Euro zone) are at or near zero. Even in the euro zone they are only 2% and likely to fall further. The reason the pound is weak is due to investors lack of confidence in the British economy.

When Britain crashed out of the ERM in 1992 the shadow chancellor, one Gordon Brown said "a weak currency is the sign of a weak economy and a weak government". Quite

The UK needs a strong currency so that by 2020 or so we can afford to buy in nearly all our oil, gas, coal, uranium, cars, iPods, computers, food, fertiliser etc etc.

Sadly, only wealthy people get to borrow lots of money to enable them to live beyond their means and unless we have a weak currency we won't be able to export anything to earn a wealthy living!

A paradox - I'm not sure how/if this works out!

Agreed, it is complex. Personally I'd go with weak currency rather than strong, IF it made us realise that we have to be far more self-sufficient in just about everything, but particularly energy. IF we utilise the renewables available to us in the form of wind, wave, tide and (some) solar thermal, it is just, barely, possible that we could start to rebuild some sort of manufacturing base....

However, our currency is being weakened by creating (borrowing) money to throw down the (already broken and unfixable) financial toilet. Better to use it to build a new sustainable energy infrastructure. I keep saying this, in the full knowledge it will NEVER happen.

As to the banks, I'd nationalise the lot of them right now, do a massive debt for equity swap (ie crystallise the loss) and retrain the tens of thousands of bank workers to do something useful in the renewable or sustainable field of work. That's not going to happen either (and I fully appreciate that my "plan" is less than half-baked....).

A story about devaluation.

The Japanese yen used to be a silver coin the size of a US dollar. By the Depression it had already greatly shrunk. After the US victory, the exchange rate remained at 50 yen per dollar until 1948, when the American Occupation devalued it suddenly to 360 yen per dollar.

Now the question is, why did the devaluations before 1945 not accomplish what the 1948 devaluation did? Is it because prewar Japan lacked a clear plan to turn its exporting advantage into long-term prosperity? Is it because the Depression and the Smoot-Hawley trade act derailed what in fact was beginning to be a successful strategy? Is it because the global institutions created by the US in 1944-45 (fixed exchange rates, GATT, etc) created an environment in which a devaluation could finally get Japan ahead? Or is it because the US used its vast weight to make sure that Occupation Japan had plenty of markets?

The ordinary Japanese were certainly just as hard-working after the war as before.

It certainly doesn't look good.

From the NY Times this morning more confirmation that the banking industry is a basket case that nobody knows what do with:

Meanwhile, the underlying assets upon which the entire sand castle is built continue to erode. The National Association of Homebuilders is predicting housing prices to fall another 29% in 2009, putting housing prices the end of this year at 47% below the peak. OUCH!

http://www.calculatedriskblog.com/2009/01/national-association-of-home-b...

Denninger knows what to do with it. And it won't cost taxpayer money, either.

I am at this moment living the absurd juxtaposition of reading Denninger and listening to Geithner confirmation hearing.

Life can be bizarre at times.

And so you note the DJIA just went negative.

Cram Down and TARP repealed.

Denninger exactly right.

Plus the perp walk. And the end of the Fed Res.

The only purpose of the Fed Res was to prevent just what is happening.

Andrew Jackson was exactly right. That's why they tried to shoot him

at point blank range. Both pistols misfired.

The only purpose of the Fed reserve was to ensure that the elites controlled the money supply, and as such control everything. The Fed was not created to prevent what is happening, but to create what is happening, to further erode the civil liberties and wealth of the lower classes. The US dollar has lost over 95% of its value since the creation of the Fed. Inflation is up 1300%. Returning to a sound monetary system is the first step in returning America, and the world, to solid ground. Any other measures to deal with this financial crisis, peak oil, or environmental issues will fail until this is addressed.

+1

+2

and now we have Geithner and Bernanke, both Fed Heads making the decisions.

Not good.

+3

I am in complete agreement with Denninger's solution.

The problem is that the people who own those bank stocks and bonds that Denninger and I want to render worthless, or near worthless, are the same people who also own the United States government.

This is indeed a free market fundamentalist's dream, now that even the government is bought and sold to the highest bidder. The libertarians should be elated. I'm sure they would be disappointed, however, to find out that it's not one of their own, nor even a recent, innovation. Seventeenth-century Spain beat us to the punch:

The NYT articled also notes this:

The use of the word "nationalization" seems to be new, coming from the NYT. Maybe Denninger and the others who have made similar comments, such as the folks on the Automatic Earth, are finally being recognized.

E. Swanson

It's amazing to watch what happens when Disneyland bumps up against reality, no? A year or so ago when Denninger and Automatic Earth started saying these things they seemed quite radical. Now they are mainstream.

Reminds me of what Kevin Phillips said about the twilight years of the British Empire:

It might hit 75. If that. Huge resistance.

Then gradually decline.

I am betting on the latter.

And Matt Simmons missed it-

""We will work our way through these financial problems..."

No we won't. But the UK will precede us into the new Panic of 1873.

"http://www.doctorhousingbubble.com/

The psychology of many here in California during the boom was that the avalanche of debt would never catch up to them. I still think that people don’t realize how big a $500,000 mortgage is (that was the peak median price of the state according to one data source). Now with prices half off, people think this is the bottom and will somehow come back up. They will not.

Unrelenting depletion rates plus lack of financing for new megaprojects can only mean one thing: decline of supply. The big question is: how elastic is demand, really? Everyone has always assumed that it is very inelastic. We are now discovering that this is not quite true, it is more elastic than we thought. As the economy continues to get worse, demand is probably going to become more and more elastic.

I always thought that those charts showing demand continuing up to the right while supply curved downward were misleading at best. Now we are beginning to see what is really going to happen: a race between supply and demand to the bottom.

I think demand elasticity for oil has taken everyone by surprise, particularly OECD demand elasticity. However, I think the demand destroyed so far has been the easy part and it took several months above $100 and a banking meltdown to achieve that.

The next slice of destruction will be a lot harder to achieve and will likely require a higher price spike. This could take a couple of years at the least because this depression we are in is not going away in the medium term (if at all). This means that depletion will have to bring supply down to match demand before prices can rise again. I'm thinking maybe 2011 for this to occur.

Does this mean you give zero weight to the ability of OPEC to curb supply?

Not zero weight, and I accept that I had not considered their influence on all this. However, they do cheat a lot, they cheated even with $10 oil in 1998, so maybe not as much significance as some will assume. OPEC national budgets have been decimated by this price collapse and it's now a clasic prisoners' dilemma for them.

Decline rates in the 800 biggest fields are so big, and no new fields are going to be developed at these prices, so supply will drop far more quickly than most analysts are currently predicting.

If OPEC does have an impact, they are going to cheat a lot more when/if we get to the marginal price of a new barrel, which appears to be in the $70 area.

I think we will continue to see high volatility in a $30 to $70 range for the next two years. Below $30 we drop below marginal operating cost for some of the most expensive production (eg tar sands), above $70 OPEC runs the risk of new production becoming viable. Extreme vovlatility is OPEC's best friend, it totally ruins the ability of non-national oil companies to make rational planning decisions.

It also ruins the ability of alternates to find funding. This is turning into 1986 redux. The only differenece is that in 1986 it was the industry that took the hit while the rest of the economy galloped forward.

Price volatility will insure that expensive oil projects will not be developed unless prices remain high for a VERY long time, when the next spike take place, investors will not rush to develop the oil sands, and deep sea oil, they will wait to see staying power, this will insure that supply will lag demand rather then run ahead of it; what will happen with oil development is more or less what happened with copper at $4 a pound, copper traded at depressed levels for so long (under $1 a pound), that even at $4 juniors could not develop their reserves (this is confirmed by a conversation that I had with NovaGold CEO early 2008, where he couldn’t convince TCK to develop their massive BC copper reserves at above $2.5 pounds price point), the next time we visit $100 oil, we will have to stay there for a couple of years, before get a new supply of expensive oil in my opinion.

Regards,

Nawar

I agree with you Nawar.

When the industry contracted after 1986 no one who survived that contraction wanted to invest until they were absolutely sure the price would remain high and on an upward trajectory. It was only in the last few years when prices spiked above $70 that CAPEX expanded and new projects were greenlighted.

What is interesting is that the same effect will impact all other production. We likely face global overcapacity in everything from copper to computers. Production capacity will be closed to match the available demand. Fewer producers, lower overall volume, and difficulty sourcing credit will result in high profits for those firm that survive and high prices for all consumers. So we likely face a bout of inflation which will be accelerated to the degree governments print money to escape the current debt trap.

Always : supply = demand (at a sudden and agreed upon price), since crude is traded at an auction. Highest bidder takes it (units of 1000 barrels), end of story.

Just like a "Mona Lisa". ..... The "Crude Mona Lisa" will get more scarce in the future and you will all see what I mean.

Are you saying that from now on demand will remain below production? This can't be right. One way or another, there will be ever more aggressive attempts to jump start the economy (local and global). It can be done -- if nothing else works, war will do it. The gov't itself becomes the consumer of last resort, i.e it supplies demand. This cannot fail to work in one sense. But because any revival will immediately press up against resource constraints (unlike post-WW2), wild inflation will become the next catastrophe.

How soon? On that I'm less certain, but I don't think it will be so long, and maybe very soon before oil reverses course. There are just so many factors that are operating against the suppy-side.

In any case, there can be debate about what form the disaster will take. But that we face disaster is less and less debatable.

Common wisdom is that WW2 "jump started" the economy (US & global) following the Great Depression. I don't buy this. To my mind, what happened is that the world, led by the US, ramped up fossil fuel (especially petroleum) exploitation, leading to economic & population growth. WW2 may have facilitated this ramping up, but it would have occurred anyway. It may be more accurate to say that the ramping up of FF exploitation facilitated WW2. To me, saying that WW2 lifted the world out of economic depression is a classic case of mistaking correlation for causation.

The reason for saying WW2 did it is that the New Deal didn't (for the most part). The economy seemed to just bump along at a low level. There was a lack of demand, millions out of work. The gov't supplied it with war spending. None of the New Deal spending was sufficient. What would have happened anyway is irrelevant. It seems that some massive gov't spending was required. Time alone does not do the trick.

We've had another example since then. Japan has never fully recovered from its crash in the late 80s (or was it early 90s?) Japan also spent a lot, but not enough apparently. They built infrastructure up the gazoo, highways to nowhere. Another war wasn't really an option for them. I would like to think it's not an option for us either, but I'm not at all sure it won't be. (Or wider war -- we're already have a few going.)

P.S. Ah, I forgot -- Nazi Gernmany. Rearmament pulled them out of the Depression long before we came out of it.

I googled "cost of World War Two" and "cost of New Deal programs" and from the first things that came up got figures of $5 trillion and $500 million, both in inflation adjusted dollars, respectively. This isn't a very reliable methodology, admittedly, but gives a couple ballpark estimates of relative costs. If these figures are anywhere near accurate, WW2 cost 10x what all the New Deal programs cost. Hence, comparing the effects of New Deal spending to that of spending on the war isn't all that meaningful. But maybe you're right, and $500 billion just wasn't sufficient to jump start a depressed economy and $5 trillion was.

Recent links, mostly Leanan’s:

Era of cheap oil is over , Rebound in oil prices could be years off , Forget "peak oil", West's demand growth peaking , Saudi Arabia and the need for $75 oil , The reasons why crude oil could double this year , Only a matter of time for higher energy prices ,Dramatic shift lies just ahead in oil production , Iran: OPEC needs non-OPEC help to steady oil market , New group prepares for high gas prices , Top 100 Stories of 2008 #1: The Post-Oil Era Begins , Oil Price Over $100, in a Blink

I am getting dizzy. Leanan’s links are amazing, and definitely show the conflicting opinions out there. I keep thinking about the line from, IIRC, Catcher in the Rye, “Lennie, tell me again how good it is going to be when we get there.”

From all of the above, it seems like it is anybody’s guess. But, is it really?

While the economic turmoil is freaking out the spot markets, six months out, it looks like there is hope for both economic relief from outrageous prices and an impending disaster due to budget cuts in the oil industry as a whole.

The whole world wants and needs to know what is going to happen, so even Economides chimes in again, and Leanan pointed out to me his cornucopian leanings a year or so ago.

I would like to see if there is some meeting of the minds here, without all of the posturing by the regulars, about what, how and when things will get sorted out, and will they be as good or bad as some of the links above would indicate?

My own hope was that we would have an opportunity for the oil and gas industry to “catch up” in the sense that there is additional production possibilities which will come on line, someday, like Jack # 2, and the Petrobras et al offshore developments, which will serve to delay the time where we are ALL in gas lines, except for a few who planned ahead sufficiently to avoid that mess. (If projects were to catch up while demand is down, it might well create an oversupply situation and give us a break. Geopolitical factors won't be effected, but all else could be the same.) The world needs to do a transition, but all I seem to find are "now or never" solutions. Heck, even getting a divorce takes time, so I do not think that we can make a worldwide transition in only a “few” years. All of the options for alternatives are virtually going to have to be on the table, so what mix will actually work? I would say that if everyone were to keep their heads, we can do something, realistically, in about 10 years. Maybe not enough, but a pretty good start.

Does the world have the time to transition or not?

Things are never going to "get sorted out." Transition implies that there was some sort of steady state to begin with, from which human civilization will shift to another steady state. This isn't the case. The fossil fuel culture has been an extraordinarily brief interlude in human history. My grandparents farmed with horses, my granddaughter will likely starve. As a kid, I tore around the American Midwest in disposable muscle cars (disposable in the sense that I wrecked them). This bubble in energy waste was never sustainable, never steady state. Hunger has haunted Homo since the time of speciation, never let up for hundreds of millions, and is about to become the norm in the developed world once again. Except this time, there will be no temporary reprieves, all the nonsense about thorium fission & electric trains notwithstanding. The chemistry of the atmosphere & surface ocean, biogeochemical cycling dynamics, ecosystem integrity, etc., have all been so profoundly perturbed that the carrying capacity (K) of the biosphere for Homo has been wrecked. When forced, as we surely soon will be, to live under K sans fossil fuel inputs, life will be as brutal & short for us internet pundits of the West as it has always been for the teeming throngs of the real world. Dreams of some "transition" to some ecotopian powered down egalitarian agrarian society are just that: dreams. Get real, all you dreamers. Starvation impends for all.

Jolly good. Well, that's that then, eh ? Tell you what - you go and sit in your cave with your tins and guns and in the meantime we'll figure out the solution.

OK so we drop to 25% of today's output in 30 years or so at worst ? So ? You think we'll be using that 25% of oil to make Bratz and drive Hummers ? Or driving next-gen agriculture and building reactors and windgen ?

Please try and seperate the USA ( & Canada ) from the rest of the world. You lot waste staggering amounts of energy on utter nonsense and that will change.

I seem to remember life in the 70s when we used a lot less energy than we do now in and I wasn't dead. My grandmother says the same for the 1950s ( altough she is dead ). Take that amount per capita and compare to modern USA and the difference is scary.

IMO new steady state means much lower energy and until productivity in recycling and energy sourcing catches up ( and it will - unless you want to play the "this time it's different game" ) we'll be a bit miserable on rice, beans and water at worst. Maybe the 3rd world will hit hard - but we CAN feed, clothe and house ourselves many many times over if we stop wasting on crap and think straight.

I checked this morning and I am not dead so maybe be can figure out a way from A to B. As my self-made multi-millionaire father-in-law says - "nothing is as bad as it seems or as good as it seems" - gets you a loooong way that. Oh and "there's no decision to be made until there's a decision to be made" - so stop thinking about how big your Victory garden will need to be in 2030 and start by making sure you're finances are in order and hedged.

Sure you will. Keep telling yourself that, if it makes you feel better. Fear is a great motivator for rationalization & self-delusion.

Actually, I think you are both part right and part wrong.

Darwinsdog is correct in saying things will not be sorted out. And absolutely correct to note the dynamic aspects of our social existence as oppossed to our desire to believe in stasis. However, he makes a fundamental misreading of history that leads him down a path as mistaken as it is gloomy. Granted that we will see massive starvation and death of all types during the next few generations as we come down off of the absurd population levels engendered by cheap fossil fuel energy. But it is wrong to suggest that fear of starvation is the fundamental condition of our species (do not accept Hobbes' formulation, he knew not of what he spoke). While I agree that we will not "transition" to to an "egalitarian agrarian society," do not make the modern's typical error of thinking that the only alternative to industrial/post industrial society is agrarian. The vast majority of human history was spent in social organization neither industrial nor agrarian.

Orbit500 is correct to argue that life is possible at greatly reduced consumption levels. And absolutely right to reject the self-fulfilling survivalist implications of surrender to doom and gloom (though I didn't see the dog actually say that). But the continued concentration on standard of living in his response is indicative of the very problems that will make Darwinsdog's observation about sorting things out come true. We frequently talk about our modern society as based on cheap oil, or on industrial production or on this or that material base. If we are to make a transition to a livable, meaningful life on an individual basis (I've already said it won't happen globally in our life-times), we must recognize that it is this predilection toward the material that must be surrendered. When we stop worrying about whether or not we can live at some % of our current consumption and start concerning ourselves with things like our relation with the natural world, our relation with family and neighbors, our internal search for meaning, the search for beauty, etc (all things we moderns have lost or denigrated), then we can start talking about "tomorrow."

Um, humans are animals and always have been. Give my a bone to each of my 2 dogs and they each want the others and their own. That's NEVER going to change. Some people may spend their days watching little fluffy clouds but the paradigm of life is improvement and competition.

Humans are so succesfull because we adapt. We make our living anywhere, everywhere and with anything. I am not arguing for a continuation or focus on materialism as that can be argued to express itself in many ways unrecognisable between cultures - the Ethiopian with 20 goats is just as driven as the banker with 3 Porsches.

This drive is ironically what will preserve and guide us. You can't arbitrate it away with eco-talk or destroy it with anything short of extinction.

Nothing 'individual' will happen. I keep saying this - if the food supply goes then we all go. Except for an elite of course.

If I'm wrong then I'll be proven so but I see a stable global population and a different energy paradigm not spiralling doom and destruction. That has been predicted so many times down the millenia its not even funny any more.

For those places which have not yet reached the stable phase of the population curve then yes, things WILL be apocalyptic on a localised level. Think Pakistan ( you go, Mr Wisdom - let's compare notes in 10 years after 70% of you are dead and you've exchanged nukes with India over water ) etc.

Yes, Rome collapsed and we had to put up with badly made pottery for a few centuries.