DrumBeat: January 30, 2009

Posted by Leanan on January 30, 2009 - 9:53am

Mexico’s Peso Stuns UBS With Biggest Drop Since 1995

(Bloomberg) -- The steepest decline in Mexico’s peso in 13 years blindsided everyone from UBS AG economists to Gustavo Huitron, the local marketing manager for Mercedes-Benz.After weakening 20 percent last year, the currency fell to a record low of 14.4484 per dollar today. RBS Greenwich Capital Markets in Greenwich, Connecticut, now predicts another 4.5 percent drop by June 30. The peso’s worst performance since 1995’s so-called Tequila Crisis is being driven by the U.S. recession and falling oil prices, which are cutting Mexican exports and government revenues.

Shell gets tough on costs as oil prices bite

LONDON (Reuters) - Royal Dutch Shell Plc has intensified its cost-cutting efforts in response to the collapse in oil prices and also plans to step up efforts to improve what it said was a "mixed" safety record.Shell's head of Exploration and Production Malcolm Brinded told employees in an email seen by Reuters that staff had to make "tough choices".

"We simply need much higher sustainable savings this year and I ask for real actions from all of you .... Shed contractor staff, challenge requirements, eliminate consultancy work, reduce travel massively, cut overheads everywhere," he said.

The E&P boss pleaded for fewer meetings and "75 percent fewer slides".

Number of active oil rigs drops by 43

HOUSTON — The number of rigs actively exploring for oil and natural gas in the United States dropped by 43 this week to 1,472.Of the rigs running nationwide, 1,150 were exploring for natural gas and 309 for oil, Houston-based Baker Hughes Inc. reported Friday. A total of 13 were listed as miscellaneous.

A year ago, the rig count stood at 1,763.

Petrobras CEO Revises Plans to Hire 14,000 by 2010

(Bloomberg) -- Petroleo Brasileiro SA, Brazil’s state-controlled oil company, will revise its plan to hire more than 14,000 workers by 2010 as plunging oil prices call for cost cuts, Chief Executive Officer Jose Sergio Gabrielli said.

Valero Will Shut Two Refineries If Union Strikes

(Bloomberg) -- Valero Energy Corp., the largest U.S. refiner, said it will shut its Memphis and Delaware City, Delaware, refineries if union members strike.The company will operate its Port Arthur, Texas, refinery with a contingency workforce, the company said today in a posting on its Web site.

Nigerian Militants Call Off Cease-Fire in Oil-Rich Niger Delta

(Bloomberg) -- Nigeria’s main militant group in the Niger River delta said it was calling off a four-month cease-fire and would start attacking Africa’s biggest oil industry beginning tomorrow.The Movement for the Emancipation of the Niger Delta, MEND, said in a statement today that it was ending the cease-fire because Nigerian military forces attacked the base of an allied militant group.

Byron King: Why Oil is Too Cheap

Houston's most famous investment banker Matt Simmons is one of the great advocates of this aboveground focus, particularly on the issues of industrial capacity. To be fair, Matt discuses the Hubbert-like geological constraints. But Matt devotes much of his argument -- correctly -- to nongeological issues in the oil patch. For example, Matt discusses how there is not enough oil field equipment, from rigs to high-strength subsea valves. Or there are too few trained personnel, or not enough well-drilling, or there's just plain systemic corrosion ("rust") that will limit future oil output.And Simmons is entirely right about his points. It's always an informative use of time -- and a true pleasure -- to watch Matt give a talk. Over the long term and at the rate things are going, Matt is exactly on target. There will not be enough oil to meet eventual world demand, because of underinvestment in drilling, inadequate personnel, insufficient industrial capacity and other inefficiencies in the overall industrial process.

Norway plans carbon capture project

Norway plans to build a 5.2 billion-kroner ($812 million) research center for developing technology to capture carbon dioxide from burned fossil fuels as a way of combating global warming, the oil minister announced Friday."This is a milestone in developing technology for CO2 capture," said Minister of Petroleum and Energy Terje Riis-Johansen. "It is a difficult project, but it is crucial that we succeed because handling CO2 is a critical tool in fighting global warming."

Cotton farmers using sustainable practices

Energy will be another crucial challenge for cotton farmers with estimates that peak oil production will occur in either 2016 or 2037, depending on which source you believe. “Either way, it’s not that far off,” Barnes said. “Cheap energy is not in our future and we need to look at the effect of energy use.”He said irrigated cotton is only slightly more energy expensive than dryland production but is “substantially more yield and quality stable.”

Nitrogen, however, “doubles the energy footprint for cotton.” But, he said, researchers are getting a better handle on the energy contained in the cottonseed itself. “The seed contains two times the energy needed to grow a crop.”

Barnes said cotton’s energy footprint compares very favorably with its most important competitor, man-made fibers, which are made “from a product that will disappear in 100 years.”

GM needs to prove to the government that it will be able to cut unsecured debt by two-thirds. Some think creditors have no choice but to accept a swap for stock.

Caterpillar laying off 2,110 more workers

CHICAGO - Caterpillar Inc said Friday it is laying off an additional 2,110 workers, bringing the week’s total to about 22,000, as the company scrambles to cope with a downturn in demand for its construction and mining equipment.The latest cuts affect plants that build products for the mining and energy industries, customers that had helped sustain Caterpillar as other key markets, like residential construction, swooned.

The recent dramatic pullback in commodity and oil prices has forced those customers to rethink their plans for investment in new equipment.

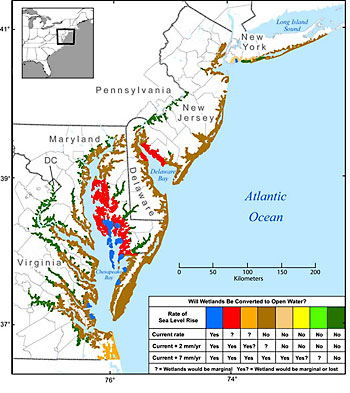

Sea levels rising at nearly double previous estimates due to global warming

Scientists predict that global sea levels could rise nearly 40 inches by the end of the century, according to a recent report from the U.S. Environmental Protection Agency.The new estimates nearly double the worst-case scenario presented in 2007 by the Intergovernmental Panel on Climate Change, which projected a global sea level rise of 7 to 23 inches by the end of the century.

Parts of New York City would be at risk of submersion even with roughly 16 inches of local sea-level rise, according to research from Columbia University.

Because the additional water would weaken or destroy wetlands and flood protection, major storms could submerge Coney Island, much of southern Brooklyn and Queens, portions of Long Island City, Astoria, Flushing Meadows-Corona Park, Lower Manhattan, and eastern Staten Island, one study showed.

UK energy saving policy 'failing'

The UK government is failing to support its own measures designed to deliver energy savings, an expert has warned.Philip Sellwood, chief executive of the Energy Saving Trust (EST), said local authorities needed more funds in order to ensure savings were being made.

While ministers were quick to promote new policies such as "zero carbon homes", existing building regulations were not being upheld, he added.

Tata Motors Has Loss on Lower Sales, Foreign Exchange

(Bloomberg) -- Tata Motors Ltd., the Indian truck maker that owns Jaguar and Land Rover, posted its first quarterly loss in seven years as tighter credit and slower economic growth hurt vehicle sales and it had a foreign exchange loss.

Airlines in financial crisis, aviation group says

Airlines around the globe are in their most widespread financial crisis since World War II, the world's largest aviation trade group said Thursday.The International Air Transport Association (IATA), which represents 230 airlines worldwide, reported that December's international air passenger traffic fell 4.6% year-over-year, and only about 74% of plane seats were sold. International air cargo volume fell an unprecedented 22.6% year-over-year, a sign of plummeting consumer spending.

Pa. Natural Gas Operations to Face New Rules

A Pennsylvania industry task force, comprised of state Department of Environmental Protection and representatives of the natural gas industry, met this month for the first time to develop new rules for controlling wastewater pollution from drilling operations and methods to treat wastewater. They also discussed ways to streamline the permitting process.

Indian Court Lifts Ban on Reliance’s Gas Field Sales

(Bloomberg) -- The Bombay High Court temporarily lifted a ban on the sale of natural gas from Reliance Industries Ltd.’s largest field off India’s east coast, paving the way for supplies to fuel-starved fertilizer and power companies.“The court has lifted the ban as an interim measure till it pronounces the final judgment,” Additional Solicitor General Mohan Parasaran, who represents the Indian government in the dispute between Reliance Industries and Reliance Natural Resources Ltd., said by telephone from Mumbai.

John Michael Greer: The ecology of social change

Survey any of the major historic outbreaks of mass scapegoating and violence and you’ll find it in a context where socially acceptable belief systems failed to keep up with a changing world. Behind the European witch hunts, for example, lay the collapse of late medieval worldviews that hardened into dogma as they were cracking apart at the seams, just as the fatal mismatch between German fantasies of global dominion and Germany’s actual status as a little country without oil reserves or defensible borders in an age of sprawling petroleum-fueled empires played a major role in setting the stage for its catastrophic 20th-century history.What makes the situation in contemporary America interesting, from this perspective, is the way that its mainstream culture and its self-described alternative countercultures have fallen into versions of the same double-bind. Many posts here, and of course quite a bit of excellent analysis by other authors, have outlined the way that the narratives of the cultural mainstream in contemporary America built a worldview of perpetual progress and limitless abundance on the temporary foundation of cheap fossil fuels, and have been made hopelessly irrelevant by the end of the petroleum age. Less often discussed and, I believe, less often noticed is the way that most current proposals meant to replace the current order of society with a better one also rest on beliefs about the world that hold up very poorly in the face of experience.

OPEC’s El-Badri Says $70-90 Is ‘Reasonable’ Oil Price

(Bloomberg) -- Abdalla el-Badri, OPEC secretary- general, said $70 to $90 a barrel is a “reasonable” oil price to support investment in new production.“It’s a reasonable price where we can invest and that’s the most important thing for the world,” el-Badri said in a television interview at the World Economic Forum in Davos today. “We control 75 to 80 percent of the world reserves, we need to develop that reserve so we can have more supply to the world.”

StatoilHydro says Venezuela payments not delayed

OSLO (Reuters) - Norwegian oil and gas producer StatoilHydro, a partner in a big Venezuela heavy oil project, said it has not seen any delays in financial dealings with companies in the South American country.This week Venezuela seized a rig owned by ENSCO International after the U.S. company halted operations because of unpaid pills, stoking concern over the future of Venezuela's state-controlled oil sector.

Don't Expect Oil Prices to Break $50 Until Q2 - FirstEnergy Capital

The “stability for now, upside later” argument for crude oil prices appears to be holding true for both WTI and Brent pricing, which has done little to set any directional bias so far in 2009. But one thing FirstEnergy Capital analyst Martin King says he can be sure of, is that his call for the price bottom in mid-December remains correct.“This is a market, though still dealing with some oversupply issues at Cushing, Oklahoma, that has begun to realize that corrective forces are at work,” he said in a research note, adding that OPEC production cuts is a powerful force that is finally getting some attention. “If anything, these cuts look to be more serious than many market pundits originally thought.”

Mexico is Latin America's second-biggest economy and the third-biggest oil supplier to the United States. It could also prove an unexpected challenge for President Obama, says David Stevenson.

Mexican president seeks foreign oil investment

MEXICO CITY: Mexican President Felipe Calderon sought to sell the heads of the world's biggest energy companies on his nation's oil industry on Thursday, touting new openings for foreign firms, his office said.Oil executives he met with on the sidelines of the World Economic Forum in Davos, Switzerland, said the current slump in crude prices could lead them to rethink production and exploration plans, a statement from Calderon's office said.

10 Predictions for 2009 by PimJohn van Gestel

Just a quick note on oil. The media are continuing their plug on demand destruction based on the current economic crisis. The bigger picture they are not focusing on is supply destruction. Oil is not something that replenishes itself and we are seeing the top oil producing wells now in depletion. Another issue I see is that with the price of oil being driven down so heavily, producers have put new projects on hold. So with the top producers now in decline and no new projects commencing, I believe we are going to get into an energy crisis within the next couple of years.

Yemen's Main Oil Pipeline Blown Up, Flow Not Affected

Unknown attackers blew up Yemen's main oil pipeline that carries crude oil from the north-central province of Marib to a Red Sea export terminal Thursday, but export operations were not disrupted, security sources said.The sources, who asked not to be named, said a technical team was assessing the damage to the pipeline that carries around 80,000 barrels of crude oil per day.

DOE report paints bleak picture of our electric future

There's a long tradition of using Fridays to release reports you'd rather not see attract attention, and the Department of Energy has used the last Friday of the Bush Administration to release a big one. Its Electricity Advisory Committee, composed primarily of power industry executives, has released a series of reports on the future of the US electric grid. These include focused looks at the potential for power storage and the smart grid, but it's the overall evaluation that's badly off the administration's message: the government needs to make a significant intervention in the power market, it's completely failed to do so for the past eight years (and longer), and conservation needs to be part of anything we do.

Reactivating Nuclear Reactors for the Fight against Climate Change

Even environmentalists are reevaluating nuclear power as a possible solution to global warming, but can it really help?

David Strahan, an expert in how the decrease of available oil in the world affects councils, also spoke yesterday.He said: "Councils must focus on private and public transport.

"Biofuels are inadequate – a better idea would be to charge fleet vehicles via wind turbines – or look at electric vehicles."

When Giants Fall: An Economic Roadmap for the End of the American Era

The altered dynamic of key resource markets has set the stage for a debilitating and increasingly divisive struggle for advantage. Financial Times commentator Martin Wolf has made reference to a “zero-sum world,” where a shortage of productivity-enhancing energy might turn back the clock to a time when gains could be achieved only at others’ expense. The prospect of a further disorderly unwinding of numerous global imbalances—apart from the extraordinary eruptions already seen—also signals serious trouble ahead. So does a reversal of the productivity gains of recent years, brought on by heightened geopolitical unrest, rapidly diminishing economies of scale, and adverse demographic trends.

It's cheaper to drill - but no rush for rigs

The record rally in commodities from oil to metals had doubled the cost of building a refinery in Saudi Arabia, tripled the budget for a super-clean fuel plant in Qatar and drove up the price of pumping oil and gas.Soaring costs made companies think twice about investments despite oil's run to nearly $150 a barrel in July.

Now, partly compensating multinationals and producer countries hurt by the collapse in prices to $40, cost inflation has eased on the projects they need to safeguard future output.

"Cheaper material costs will at least partly offset the drop in oil prices, supporting project economics despite the downturn," said Antoine Halff of Newedge brokerage.

Putin’s Grasp of Energy Drives Russian Agenda

MOSCOW — The titans of Russia’s energy industry gathered around an enormous map showing the route of a proposed new pipeline in Siberia. It would cost billions and had been years in the planning. After listening to their presentation, President Vladimir V. Putin frowned, got up from his chair, whipped out a felt pen and redrew the map right in front of the embarrassed executives, who quickly agreed that he was right.The performance, which was carried on state television in 2006, was obviously stage managed, but there was nothing artificial about its point. It was a typical performance for a leader who has shown an uncanny mastery of the economics, politics and even technical details of the energy business that goes well beyond a politician taking an interest in an important national industry.

Energy chiefs debate the cost of energy

DAVOS, Switzerland (Reuters) - Energy leaders at the World Economic Forum debated the true cost of fuel on Thursday as they grappled with the implications of world recession and how to navigate out of it.Record-high oil prices close to $150 a barrel in July last year added to the pain of economic slowdown, and now much cheaper prices of near $40 a barrel could help the global economy to rally.

But for consumers, producers and the planet, oil at that level could be too cheap as it slows investment in new supplies of fossil fuel as well as in alternative energy.

UK energy workers walk out in foreign jobs row

NORTH KILLINGHOLME, England (Reuters) - British energy workers staged unofficial walkouts on Friday when anger over the use of foreign workers at an oil refinery spread to about a dozen sites across the country.

Nigerian oil workers threaten to stop oil export over suspected corruption

LAGOS (Xinhua) -- Nigerian oil workers in the Department of Petroleum Resources (DPR) on Thursday vowed to shut down Nigeria's 21 crude oil export terminals by Feb. 11, 2009 over management's suspected corruption activities.

ConocoPhillips Hopes Russia Can Provide Future Haven

Much of Russia’s oil is locked away in distant, hard-to-reach places. Without strong oil prices, it would be difficult to justify investing in expensive projects.However, depending on the deal ConocoPhillips managed to strike with the Russian government, it might be able to correct for another of its deficiencies — its habit over the past few years of making acquisitions in lieu of developing resources of its own. The implication that it could be looking for its own development opportunities is supported by the company simultaneously launching a $6 billion bond offer and Mulva saying that he’s no longer interested in new acquisition opportunities.

Exxon posts annual profit record

NEW YORK (CNNMoney.com) -- Exxon Mobil reported the largest annual profit in U.S. history Friday, making $45.22 billion on the back of record oil prices.But Exxon's quarterly profit fell over 33%, as crude prices dropped precipitously in the last quarter as recession spread through the globe.

With the price of its crude oil close to $30 a barrel, Venezuela is confronting a new reality after years of largess. While the country has massive reserves of extra heavy oil in the Orinoco belt, it must find a way of surviving falling oil production and prices, as well as ensure investment in future oil output.

George Soros: The game changer

To prevent the US economy from sliding into a depression, Mr Obama must implement a radical and comprehensive set of policies. Alongside the well-advanced fiscal stimulus package, these should include a system-wide and compulsory recapitalisation of the banking system and a thorough overhaul of the mortgage system – reducing the cost of mortgages and foreclosures.Energy policy could also play an important role in counteracting both depression and deflation. The American consumer can no longer act as the motor of the global economy. Alternative energy and developments that produce energy savings could serve as a new motor, but only if the price of conventional fuels is kept high enough to justify investing in those activities. That would involve putting a floor under the price of fossil fuels by imposing a price on carbon emissions and import duties on oil to keep the domestic price above, say, $70 per barrel.

Benjamin Netanyahu, Peak Oil, And a World On The Brink

Yes, an attack on Iranian nuclear sites by Israel could prompt a massive disruption in the oil markets, causing crude oil prices to soar during a vulnerable time in the American economy. Indeed, the issue is even multiplied by the fact that the world may be facing a peak oil situation, where oil production has no more room to grow. This could be the final trigger that sends the world economy into a panic, as it may test Saudi Arabia, in particular to make up for production disruptions that would likely occur from Iran.

Tanzania: Crisis? That was only a taste of things to come if we don`t act

There are many shortcomings with the operations of the oil sector in the country.Some of these start right back with the liberalisation and the conditionalities from financial institutions, scholars from the University of Dar es Salaam say.

But they contend that government can still get the situation under control: Four outspoken University of Dar es Salaam dons have described the oil crisis that paralysed the country earlier this month as a wake-up call for the government to re-examine the oil industry.

Japan tax tribunal dismisses Nippon Oil tax appeal

TOKYO (Reuters) - Japan's Nippon Oil Corp said on Friday the National Tax Tribunal rejected its request to nullify extra taxes imposed on the refiner in 2006 on gains from energy derivatives trading. Nippon Oil contested the Tokyo regional tax office's decision that the refiner pay an extra 12.5 billion yen ($139.5 million) in tax on swaps trading to hedge against moves in crude oil prices. Nippon Oil said in a statement on Friday it would examine the tribunal's decision and decide on the next course of action.

Tokyo Gas eyes new LNG terminal

Tokyo Gas, Japan's biggest natural gas utility, is looking to build a new liquefied natural gas receiving terminal in Hitachi, northeast of Tokyo by 2017-18 to meet projected growth from the industrial sector.

The world needs abundant, cheap, clean energy (review of Energise!, by James Woudhuysen and Joe Kaplinsky)

Fears about climate change are well-placed, but the answer is not to moralise about personal energy consumption, but to invest boldly in new forms of power supply.

Frugal family tips to save money on energy bills

When looking for ways to cut home energy costs, it helps to disregard some things your mother told you. You do not, for example, need to wash your clothes in hot water to get them clean, says Steve Luxton, a home energy auditor for CMC Energy in Fort Washington, Pa.And turning off the lights when you leave a room doesn't hurt, Luxton says, but the overall reduction in your energy costs will be minimal. If you really want to slash your energy bills, he says, get rid of that avocado-green fridge in the basement. While old refrigerators provide a good way to store your beer and Costco purchases, they're huge energy wasters, he says.

When Technology Fails: How to Survive the Long Emergency

When Technology Fails is -- at its root -- a comprehensive handbook of survival skills. Those skills range from building an emergency shelter and purifying water to foraging for food and dealing with medical situations at home. Obviously the future is uncertain, but can you give us a list of your Top 10 most crucial survival skills?

Seed bank for the world threatened by financial crisis

ARDINGLY, England (Reuters) - A seed bank that is trying to collect every type of plant in the world is now under threat from the global financial crisis, its director says.The Millennium Seed Bank Project aims to house all the 300,000 different plant species known to exist to ensure future biodiversity and protect a vital source of food and medicines, director Paul Smith said.

The project is on track to collect 10 percent of the total by 2010 but the financial crisis is drying up funding, casting serious doubts on future collections, he said.

Buzz grows for modernizing energy grid

Alternative energy is taking it on the chin this recession, with solar and wind developers canceling projects and laying off workers. But a far more obscure slice of the energy sector is hotter than ever: the electricity grid.

Rising electricity prices 'to benefit renewable sector'

The Sustainable Energy Association says a significant increase in electricity prices will boost the renewable energy sector.The Western Australia Office of Energy has recommended a 78 per cent increase to the charges for household electricity over the next two years, to bring prices into line with supply costs.

Indian wind power giant Suzlon swings to Q3 loss

NEW DELHI (AFP) – Suzlon Energy posted a third-quarter loss as it was hit by foreign exchange losses and payments to replace faulty equipment but forecast a recovery in 2010.The company, the world's fifth largest turbine maker which dominates the Indian wind generation market, reported a consolidated net loss for the three months to December of 589.7 million rupees (12 million dollars).

Air Force drops plan to make fuel from coal in Montana

WASHINGTON — The Air Force on Thursday dropped plans to build a coal-to-liquid plant to produce fuel for its aircraft, a plan that would've reduced dependence on oil but increased the emissions of the heat-trapping gases that cause global warming.

Sulfur in Heating Oil to Be Reduced

The suppliers will reduce sulfur in heating oil to 0.0015 percent from 0.2 percent. Brandon Wright of the Petroleum Marketers Association of America said that consumers should see a small increase in the price of oil as a result of the change, but that it would be offset by savings from more efficient furnace and boiler operation in their homes.

Snow study shows California faces historic drought

SAN FRANCISCO (Reuters) - A new survey of California winter snows on Thursday showed the most populous state is facing one of the worst droughts in its history, Governor Arnold Schwarzenegger said.The state, which produces about half the United States' vegetables and fruit, is in its third year of drought and its main system supplying water to cities and farms may only be able to fulfill 15 percent of requests, scientists said.

The snowpack on California's mountains is carrying only 61 percent of the water of normal years, according to the survey by the state Department of Water Resources. Last year the snowpack held 111 percent of the normal amount of water, but spring was the driest ever recorded.

Pole-to-pole flight finds CO2 piling up over Arctic

NEW YORK (Reuters) - Scientists who flew a modified corporate jet from pole to pole to study how greenhouse gases move found carbon dioxide piling up over the Arctic, but also higher than expected levels of oxygen over the Antarctic.

Gore hails Obama's climate goals despite crisis

DAVOS, Switzerland – Nobel Peace Prize winner Al Gore urged President Barack Obama and other world leaders to seal a quick deal to fight global warming despite the pervasive financial crisis.Gore called Obama "the greenest person in the room" for making environmental funding a big chunk of the $819 billion economic stimulus bill passed by U.S. lawmakers this week.

Professor Gore's Climate Change Lecture Warmly Received by Senate

For a few minutes, it was like a scene from An Inconvenient Truth: Al Gore, the former vice president, lecturing about global climate change, skipping authoritatively from one data point to the next, wielding statistics, graphs, and charts about shrinking ice caps and greenhouse-gas emissions.His audience, this time around, was the Senate Foreign Relations Committee, in its first hearing since President Barack Obama's inauguration. Its choice of Gore as star witness was layered with political symbolism, highlighting the priority that congressional Democrats, bolstered by their enlarged majority and new White House support, are giving to climate change issues.

New Jungles Prompt a Debate on Rain Forests

CHILIBRE, Panama — The land where Marta Ortega de Wing raised hundreds of pigs until 10 years ago is being overtaken by galloping jungle — palms, lizards and ants.Instead of farming, she now shops at the supermarket and her grown children and grandchildren live in places like Panama City and New York.

Here, and in other tropical countries around the world, small holdings like Ms. Ortega de Wing’s — and much larger swaths of farmland — are reverting back to nature, as people abandon their land and move to the cities in search of better livings.

These new “secondary” forests are emerging in Latin America, Asia and other tropical regions at such a fast pace that the trend has set off a serious debate about whether saving primeval rain forest — an iconic environmental cause — may be less urgent than once thought. By one estimate, for every acre of rain forest cut down each year, more than 50 acres of new forest are growing in the tropics on land that was once farmed, logged or ravaged by natural disaster.

Rising Acidity Threatens Oceans

The oceans have long buffered the effects of climate change by absorbing a substantial portion of the greenhouse gas carbon dioxide. But this benefit has a catch: as the gas dissolves, it makes seawater more acidic. Now an international panel of marine scientists says this acidity is accelerating so fast it threatens the survival of coral reefs, shellfish and the marine food web generally.

Glaciers around the world found shrinking for 18th year

BERLIN - Glaciers from the Andes to Alaska and across the Alps shrank as much as 10 feet, the 18th year of retreat and twice as fast as a decade ago, as global warming threatens an important supply of the world's water.Alpine glaciers lost on average 0.7 meters of thickness in 2007, data published yesterday by the University of Zurich's World Glacier Monitoring Service showed. The melting extends an 11-meter retreat since 1980.

Are you kidding me?

Sometime the simplistic thinking and blind optimism of some people just blows me away.

They have found out what causes the brown cloud that hangs over South Asia and the Indian Ocean for about half the year. Makings of a deadly brown cloud Two thirds of the particle matter that make up the cloud are from burning organic matter, wood and dung, for heating and cooking.

But not too worry, the fix is in.

Got that? First make sure all power is generated by green technology, whatever that is, then simply cure poverty so everyone can heat and cook with that new green energy and no more brown cloud.

Damn, why didn’t I think of that?

Ron Patterson

I believe that most of TPTB honestly think anything they say is true and/or will become true.

A tech I worked with had this reply to a sales manager that asked us how things were going: "Just working our a$$ off trying to keep the promises you made." Kinda sums up my working career, somebody with a tie makes a promise, I spend however long it takes trying to make sure it happens.

I will never understand why the ones that say things get paid more than the ones that are expected to do those things. Maybe some of that will come to an end with the current financial mess.

I've been the Engineering guy covering Sales' promises for decades now. I asked a Sales VP once, "Why do you make these promises, when you know it can't happen?" He said, "An unhappy customer is better than a satisfied prospect."

I used to hold out for transparency and truthfulness when I was younger, but once I learned the above I discovered how to play the game better. A touch of cynicism and a bit of apathy helps a lot, too.

ceii2000 & paleocon:

Your problem is that you have been working for US corporations. US corporations are mostly run by idiot jerks, with future idiot jerks-in-training beneath them. Yet other idiot jerks are to be found in the corridors of power in Washington.

You wonder why the US is rapidly going bankrupt and becoming a has-been laughing stock? Well, that is a very big reason right there. We have been raising up the worst possible people to positions of power in a systematic way throughout the country, and it is finally starting to really take its toll.

Sorry, that might offend a few people, but sometimes the truth does that.

You know, I accept USA bashing pretty well, I even understand where most of it comes from. But I've travelled a lot, not as much as some here but I've seen things. In my travels, to extremely poor countries and rich ones I have gotten one thing pretty well ingrained in my pea brain. People are people.

I don't think this is a culture thing, I am pretty sure it is systemic to human 'civilization'. I'd bet if you sat around listening to the Roman Legion gripe about the things they cared about on a daily basis you would hear things like, "What idiot decided we could build a road up that mountain?", "We can't afford x% (or XII%) more taxes!" "Followed closely by "How come those idiots didn't pay me this week?", and "You did notice Hannibal has ELEPHANTS! didn't you?" etc.

People in high level positions, and low level even, have a tendency to hire/promote people that they agree with and that agree with them. Why wouldn't you? It would make no sense to hire somebody that completely disagrees with you so you can argue with him all the time and get nothing done.

So critical thinkers and troubleshooters end up in mid to low level positions where they don't make 'decisions' and yet they can get the work done promised by Kings, Presidents, Caesars, Tsars, CEO's, etc. Sorry I am smart enough to admit, I don't even want those positions. My daughter said it the other day, the only people we should elect president are those that don't want it. She's 15 and I'm quite proud of her.

My daughter said it the other day, the only people we should elect president are those that don't want it. She's 15 and I'm quite proud of her.

sounds like hitchhikers guide to the galaxy , the last person you'd what to have in power is the person who reall wants its

best policies are made by a disinterested party !

cheers

forbin

I used to work for a computer corp, in a marketting/engineering capacity. We had an operating systems group whose only answer to any request was no! We always had to force the issue by making promises to customers (who we woulda lost if we didn't). It worked out Ok, though often we had to show them how it could be done.

Did the company earn or lose money?

Yeah, right.

They're stupid. We're smart.

And the best part is we got them fooled about it.

Reminds me of the Nancy Reagan Homeless Foundation motto, "Just buy a house!"

Seems like all those hungry people around the world would be better off if they stopped skipping breakfast.

I could go on, but you nailed it without me.

If anyone is looking for some background on brown clouds, and aerosols in general, and their relationship to climate changes, here is a lecture at MIT from last year that may be of interest:

http://mitworld.mit.edu/video/589

Darwinian,I do actually agree with you,I really do however they could try a couple of these for starters.

http://www.solarcooking.org/plans/

Then again, I know, there is of course the problem of the sunlight not making it through the brown haze and the ever present cultural resistance to these ideas...

http://www.cd3wd.com/cd3wd_40/VITA/SOLREGY/EN/SOLREGY.HTM

I know,I know, why even bother. Let the poor stupid ignorant bastards choke to death in the smoke of their last burning trees. It might help to cut down on the population a bit, eh?

Why does everything have to be so complicated ;-)

Best hopes for an ultra simplified future. Though not even the primordial soup was that.

Exxon has massively profitable year:

Profits did drop 33% in Q4, so with current prices they will apparently remain profitable but definitely less-so.

GDP is down 3.8% in Q4:

Still, some analysts were predicting a drop of more than 5%, so it's "better than expected". Or the numbers are fudged up this quarter and will be adjusted down next quarter.

The GDP number is "good news." Some were fearing it would be as bad as 8%.

Meanwhile, Denninger has changed his mind about a short-term rally. He thinks unless Obama, Bernanke, etc., mend their ways, we are headed straight for Dow 2,000.

I never did quite get what was supposed to drive the rally, unless Obamamania was somehow more powerful than the credit crunch. The proposed bail-out seems to do little of value, and still the banks remain in a quagmire of obfuscations and decaying loans.

I don't put much faith in technical analysis, though, especially when just a week ago there were nice pictures with S&P 900 or 1100, and now it's S&P 200.

Longer term, the gold-bug view that the DOW and gold will reach parity seems likely, but who knows how fast, and at what levels? DOW 2000, gold 2000 would be one such possibility.

Denninger's analysis makes good points, as usual. The "bad bank" notion seems to be gaining support, though I can't see why we would do that without collapsing the existing banks first. Just transferring their bad debt while leaving their shareholders and execs whole seems completely wrong to me. Why does Congress have no backbone? What can we do about it?

What can you do about it?

Well, you can't do anything really. Get over it.

I think I'll deal with it, but I don't think I'll get over it. I think I can hold this grudge a long time.

Gold is up. Stocks are down. Still, I think we have some time before the wheels fall off -- Britain seems to have it worse in every way, yet they're still afloat.

Dear Paleocon,

A sign of the times:

http://www.dailymail.co.uk/news/article-1132128/Pictured-The-machete-wie...

Rgds

Dropstone

Surrey always was a wild and lawless place.

Hmmm...add hoods and a machete and a friendly neighborhood watch suddenly seems much more menacing, doesn't it?

Look, I am upset probably as much as you are if not more. I did realize though, that being angry doesn't do good to me or to my family.

Anger would be good only if I was planning to riot and I am not. We could have prevented a great deal of trouble by being smarter in past and we haven't been. That's why I am not willing to riot with angry masses that don't understand anything and helped to create this mess in the first place.

Obama is going to become a MESSiah. You are right, we probably do have some time, but I wonder if it isn't just months.

I'm not going to riot. But if any of the big banks or financial firms that are largely to blame for this mess think that they are EVER going to get any of my business, ever again, they can think twice.

Why anyone continues to do business with them is beyond me.

Because it is do or die in the business world. That's why I have never been a businessman and never will. It just doesn't fit my personality.

If you want to do a big project, you need to get capital somewhere.

I'm not going to riot.

Not even a little small one or a quiet one?

From 'Mad Max' to merely 'Disgruntled Max'?

"Obama is going to become a MESSiah. "

You mean he is going to "O bomb a" the economy just like all the rest of the bone headed politicians?

The market is going to take care of it, one way or another. Denninger thinks that's why nothing really has been done so far.

I'm sure they'd love to stick the taxpayers with the estimated $4 trillion bill, but they can't.

If it wasn't impossible, I think they'd have done it by now.

The banks do not need to "mis-mark" the bad assets. They can carry them on their books at the market price and the assets remain at that nominal price until there is an actual trade that sets a new valuation for them.

For example I own stocks that are underwater but I do not realize a loss until I sell. Then I have a new market valuation. If I do not sell then I can avoid a new valuation and proceed on the optimistic basis that the stocks will recover.

The problem the banks face is that no body wants to trade these instruments due to the fact that the potential liabilities are huge. As Shunyata posted the other day the valuation on CDOs can drop to less than zero. On my stock investments my liability is limited to the amount I have invested. With CDOs there exists a "negative" liability which, due to the associated leverage, is huge. One figure that has come up is that the total liabilities associated with derivatives equals ten time world GDP.

So the banks are tip toeing around an insane level of liabilities produced by conditions that everybody assumed would never happen - the proverbial black swan event.

As has been said, it gets worse before it gets worse: there is a real possibility of a spike in interest rates due to the number of nations seeking to borrow. Such a spike in rates would have negative impact on all debt service costs (both for individuals and for countries) and likely result in escalating defaults which would in turn further weaken the position of the banks.

The difference being that if you go ask for a loan and list your stocks as collateral, you'd be expected to value them at current market price, versus what you paid for them. Ditto for your house and cars. We should expect no less for the banks.

As Denniger points out, the stock market is a clearinghouse that allows pricing information to flow to all players and potential players in an indiscriminate manner. This allows for easy valuation of stocks to the "market price."

There is no such mechanism for derivatives. The issuer of a derivative is free to quote one price to you and another to someone else. There's no way for you to know if you're getting screwed or not. This also makes it impossible to "mark to market" because you don't know what the market is. When Lehman went under, many derivatives were sold at auction and this established a publically disclosed "market" for certain specific classes of derivatives. This had ripples across the economy as firms had to re-value any like derivatives in their possession to these market prices. Now all the efforts are being put into plans that make it easier for firms to hide the true market value of these instruments. Most recently the FASB (Financial Accounting Standards Board) has proposed an accounting rule change that makes it easier for firms to lie about the value of their assets. Normally rule changes proposed by FASB are given a 90-120 response period for the accounting community to respond to the proposal and point out any possible pitfalls etc. With this rule change, the FASB only has a 7 day response period.

It's a railroad job for sure.

TS

Yesterday's TAE dealt with this topic also.

January 29, 2009: Con Firm Nation

TS

The United States GDP is about: $14.58 trillion (2008 est.) -- CIA.

Tax receipts other than Social Security and Medicare were over 1.6 trillion dollars (2007 est. Wikipedia).

The defense budget was estimated to be over 480 billion dollars for 2008.

If these banks have trillions in derivatives losses, it might be better to close them down than bail them out. They are not of very high value to us. Derivatives are paper contracts not backed by reserves other than the capital of those who wrote them. In this case those who wrote them were holding the capital of others in trust, and may have violated that trust by not holding reserves like insurance companies are required to do.

That is grossly deceptive (which is by design). Chalmer's Johnson put the real total at almost twice that. We gotta add in all the other pieces, such as intelligence, veterans affairs (medical care for past service members), retirement for past service members, homeland security, extra appropriations for the two hot wars we are currently involved in. It makes it pretty hard for the concerned citizen to figure out how much we are really spending.

the search for wmds..........er i mean wars are not part of the budget, but to balance the check book the govt borrows ever increasing amounts. national debt is a better guage, imo than any self serving "budget". and as a reminder, bush inherited a debt that was increasing at the rate of $21 billion/yr and managed to double the debt in 8 short (or long) years. apparently the tax cuts didn't quite work out as planned.

and i heard rush limpjaw on cnn the other day "obama's stimulus plan will destroy capitalism and the feee market"

Entities used to be able to carry things at historic cost on their ballance sheet until they sold, but the accounting rules now require that they be revalued to current market value ("mark to market"). Figuring out what the "market" might actually be for some of these things may be rather complicated; it doesn't take a genius to see that historic cost aint' it, though. However, the truth probably is that the banks really don't want to be forced to really do this honestly, because they know that to do this honestly, right now, would mean that they would instantly have to go into bankruptcy. Denniger is pretty much right on target as far as that goes.

The bad bank idea could work out for the taxpayers if we do a decent job of pricing the assets. By that I mean, the current market price is too low because of excess fear, and the model thats used pays more than current market, but a lot less than par (original value). Of course nationalization is really the better technical solution. But the USA public -and especially the political chattering class, si so ideology besoten that we couldn't do it right. So a gimmick, like the bad bank will be tried instead.

I don't think you have thought this one through-forget what the MSM is saying-if these assets had inherent long term value they would be getting snapped up by investors. This whole scam is a gift from the taxpayers to a few banking interests-the problem is the taxpayers can't afford it so it puts the place on the Iceland track. This irrational market argument could be applied to the RE market-just have the taxpayers buy up the unwanted RE (so inherently valuable), put a floor under the market and we are back to the races. It would be a lot cheaper (but doesn't follow the proper ideology of only stealing from the median to give to the connected).

When I read stuff like this, I wish I had a bag of NPK around and got intimate with it.

You have a readily available "bag of NPK" already -- in your intestinal tract.

As for getting intimate with it: Have you hugged your butt today?

;-)

First of all, nothing goes in a straight line. Anyone would sold back in September predicting the end of the world knows that they would have more money if they had just slept in that day.

Second, why 2000? A simple calculation shows you can get DOW 2133 with just food & energy stocks even if everything else goes to zero.

XOM 77.34 536.4101014

CHV 71.33 494.7263064

KO 43.29 300.2481677

KRAFT 28.94 200.7203043

MCD 28.52 197.8072937

J&J 58.18 403.5213305

2133.433504

I seriously doubt WalMart and the drug companies are going anywhere anytime soon, either.

BTW, since I'm seriously net short. I would benefit greatly from this prediction, but fortunately, the reason I have money in the first place is because I don't pay attention to alarmist like Denniger.

Leanan, are you a closet doomer? No judgements, I'm just curious.

Not sure what you mean by "closet doomer."

I am not optimistic about the economy. I'm cashing out my IRA this week.

Interesting that. My SO remembers me saying 'You sould strongly consider getting out out of stocks for your 401K. When the paperwork showed a 35+% loss - I'm shown the paperwork.

The question then became 'Errr, you tyold me there were no options other than stocks - why not the bond funds'

Answer "In my mind, bonds are stocks"

What took you so long, Leanan? How long have you been mulling it over? Or were you just waiting for calendar roll over as part of plan? I find the cashing of IRAs to be a fascinating insight into congruence and the way we think/feel about our future. That might or might not be your case - it was mine. And if I'm going over personal boundaries, just whack me with a 4x4.

cfm in Gray, ME

Part of it was inertia. Part of it was the thought that there might be a "Santa Claus rally" and/or a honeymoon for Obama.

I've been mulling it over, off and on, for over a year. It's a relatively small amount of money, and I thought about keeping it in stocks as a hedge - just in case we don't get the deflationary flavor of apocalypse.

But it's gotten to the point that I just don't trust the markets any more. Or the government. I'd always known that the playing field wasn't level, and that mutual funds and IRAs were just part of the Ponzi scheme, more for the benefit of the wealthy on top of the pyramid than for the little people on the bottom. But the extremity and brazenness of the graft tells me it's time for the little guy to get out.

I'm in the same boat, Leanan. I had all the intentions of cashing out this week, but did not. I plan to next week and hope and pray the market doesn't dive before then. Interestingly, I had quite an extended conversation with my broker about this over two weeks ago. I am positive I'm her smallest client, yet I gave her an earfull. I do have several positions that are making the total portfolio positive (if you can believe that): Cross Timbers Royalty +17%, Market Vector Gold Mine +9% and, drum roll, Evergreen International Precious Metals - a whopping +126%! The biggest loser: Mega Uranium LTD -81%.

Don't know if a Roth IRA would have been better for me, but I didn't and there you have it.

And while those positive ones are very tempting, I'm of the mind to get out of everything. Lots of margaritas this weekend.

i've been emptying my ira some each year since finding about PO & take another chunk- for preps- probably this year, & leave the last for 2010. it is also a kind of hedge like Leanan's thinking.

Leanan called it "inertia". You, Edgy, are of a mind to get out of everything. But you haven't yet. There is something very Shakespearean in screwing ourselves to the point of acting on what we *know* to be the right thing but do not entirely *feel* or *want* to feel in our amygdala brains. But once done, I felt a little bit of congruence flow back into my being.

A foot of snow this last storm. Shovelled, not plowed thank you. I cancelled the snow plow contract this year. What makes less sense than using fossil energy to push aside snow so I can drive to the gym (or to The Bear for a brew or two or more)?

I realized in looking at my garden plan, that NOT plowing the driveway - a 75' radius circular drive plus turnouts and stuff - means I can change all the plantings and edgings around the driveway. The point being that until one takes a step - whether cashing in IRA (and buying solar PV panels) or not plowing the drive, one can't see the next step - in my case adding close to another 1000 sq ft of *permaculture* plantings. Can't get there from here, the Maine expression goes. Gotta go through Pownal first.

Bridges? Some are meant to be burned, not rebuilt, modernized or widened. Take away a traffic lane, make it a bike lane and capacity problems are fixed.

cfm in Gray, ME

Hi Leanan,

Do you have a 401k or equivalent?

No. But if I did, I'd bailing out of it, too. Unless there was a match. And I expect a lot of matching contributions will be going the way of the dodo.

I suspect Walmart will crash the same time the dollar does. No cheap Chinese stuff = pain for Walmart.

McD's will drop as employment does. It's a luxury -- just a cheap one.

All the oil companies will spike up with prices going up then go down with ELM.

It'll take some time, but I think all of those will happen.

Selling in 2007 was a good move. Selling now is better than 2010, IMHO. Another 50% down would leave few if any safe havens for your investment dollars.

Wal-Mart was hurt by the spike in gas prices. Their stores are out in the boonies where land is cheap, and their distribution model is based on cheap energy. If gas prices increase without the economy recovering, Wal-Mart could be hurt.

I also think Wal-Mart could fall even without higher gas prices or a collapsing dollar. Wal-Mart, like McDonald's, is doing okay because people are trading down. But eventually, we may reach the point where people simply have to do without. Most of the things people buy at Wal-Mart are things they don't need. (Even Wal-Mart didn't do as well during the holiday shopping season as expected. They just won the "least ugly" contest against other suffering retailers.)

As for drugs...a lot of those are luxuries, too. Viagra is $15 a pill. People are already switching from brand name drugs to generics, and to overseas pharmacies where drugs are cheaper. I think many people will be forced to give up even medications that are not luxuries. Lose your job, lose your health insurance.

I think there is also a significant fraction of society that is "stocking up" and "planning ahead" for harder times. Once I get up to a year's supply of dry goods and canned supplies, my Sam's bill will go down a good bit. IF this is true for many, we're still early into retailer drops.

For Christmas, there were lots of big TVs and game systems that were sold to families with new Netflix subscriptions but no more movie budget. When a job goes away, that TV and those games will have to last indefinitely.

Ditto for cars -- I have invested a lot in my personal fleet to buy better gas mileage. I don't pretend this will keep me driving forever, but I think I'll manage the next 500K miles without many maintenance concerns, and if my employment holds even $10 or $20 gas won't break me......but the key point is I'm not going to be buying any more cars for a long time, either.

I think we're just now getting to the second inning. Obama's at bat, but deflation can throw a pretty good curveball.

Yeah, that's good analysis. That's why the fall is so much quicker than the rise. Western world could dissolve in less than a year.

So good luck with those 500k miles. I don't think anybody is going to actually make them (with the possible exception of professional drivers).

Back in December my mechanic told me that my vehicle could last 200k miles. I thought - wtf, I won't be needing that anyways ;)

It's a hell of a lot easier to break things than to make things.

OTOH, maybe pharmaceuticals are going to lower their prices if they wish to keep selling drugs. I suspect they have got quite a bit room left.

Of course, recession might reduce the size of research labs. so yeah, peak drugs too lol

But if they lower their prices, they lower their profits. Which won't help their stock prices much.

I'm not saying drug companies will vanish, just that they might not be good investments. (Though Cramer disagrees.)

I think they will do better than most companies, as boomers strive to convert money to longevity, but as the dollar weakens many people won't be able to afford the care levels of today. If they do well enough to set new highs, it will likely be denominated in dollars that aren't worth much, so there is plenty of room for fudging semantically as well.

The fact that Cramer disagrees makes it more likely, IMHO. We are likely getting close to peak medicine, and peak care as well.

I commented on:

Regarding stock prices, I agree. Forget Cramer, he is as much nut as Kramer. For God's sake, he was cheering for BSC few days before the collapse back in March.

Cramer is a good indicator, why western world is basically finished. We should need to use brain, not just yell randomly.

I don't think lowering prices will be enough. If people don't have jobs and don't have insurance, even lower prices will be unaffordable.

Nationalizing healthcare...now that would make a difference.

Wouldn't nationalizing healthcare just crash the Gov't that much faster? A socialist medical system might be more efficient than insurance companies (which really have zero, or less, interest in containing costs), but it's nowhere close to as cost-efficient as a cash customer-provider relationship.

I don't think it's sustainable, long-term. But neither is capitalism.

Hi, Paleocon.

This is sounding suspiciously like a conversation with a Libertarian friend I had recently ;-).

The customer-provider relationship may be more efficient in some cases, but typically they do not include systems that spread the risk across a large number of people. Thus seeing a specialist may be more cost efficient when assessing the individual procedure but you still have to come up with the $20, $30 or $50k personally.

Is there a system in the world that exclusively employs the customer-provider relationship that is turning in good results based on national health statistics? (honest question)

If health insurance worked like auto insurance there may be risk-spreading with some actuarial basis in costs. With health insurance covering everything, especially the much-lauded "check ups", it's mostly a cost-plus service where the insurance company always makes money and the agreements get ever more complex for the individual and the provider who carry the complexity costs.

You don't need insurance for most expected things -- you need a savings plan. For the 2-sigma and further out events you need real insurance, but with a deductible (again, you can save for that). For auto insurance, you can pick 20 companies at will, and pick from a list of coverage options depending on your personal situation and risk tolerance. Why not for health-care?

In many health policies there are personal and family limits that actually cap benefits just when you need them most -- as the insurance company has to be sure to limit the downside cases. This is also true for auto insurance, but you can readily get a million-dollar umbrella at affordable cost that ONLY kicks in for the really big situations once regular insurance is expended.

Medicaid, as a single-payer system coupled with welfare is an amazing thing. No copays, no limits to speak of, and little oversight. Yet there are lots of rules on which doctors can be seen and how much procedures can cost.

The real solution for health-care costs, though, is to be able to say "enough is enough" for the elderly and otherwise chronically infirm. We as a society have no good way to say how much a life is worth, or how hard to work to save one. If insurance pay-outs were capped at the same limits as state Worker's Comp loss valuations there would be a lot fewer heroic life extensions. It's hard to talk about but we'll end up there anyway, at the limits of what society can afford, only with layers of bureaucracy and graft making it worse. As with so many situations in our society, we all want to pretend we're rich, and it's just not scalable and sustainable.

I think there will be health care rationing eventually. And it won't just be for the elderly. Premature babies cost about a million dollars a month. (I hope that mom of premature octuplets has good insurance.) Yes, they have their whole lives ahead of them...but OTOH, society hasn't yet invested much in them, either. It's more economical to just have another baby.

Transplants are another really expensive treatment. And then you have to take drugs for the rest of your life. There have been cases in China where people got transplants at the expense of the government or a charity, but then could not afford the anti-rejection drugs.

Transplants in China "at the expense of the government:"

http://www.france24.com/en/20080807-ugly-business-chinese-organ-harvests...

http://en.epochtimes.com/n2/content/view/10840/

Two birds, one stone: zero-sum population games. It pays to be rich, or a Party member.

Perhaps, but I'd have to see what is "expected" to you. Where are you drawing the line? One person's "unnecessary" expense is another's "good national health policy."

Also, it sounds like you'd agree that during a relatively long life of say 70 years there is going to be at least one instance in which a major medical emergency occurs (your 2-sigma event).

So we're back to needing a way to spread out medical costs, as you point out, and I'm not seeing yet how the direct customer-provider relationship can make any difference in these critical (and expensive) circumstances — except for the wealthy. Perhaps you're not asserting that and you are restricting that relationship to just the inexpensive procedures, yes?

Yes, I think most people would need insurance, but it should cover actuarial events and be individually purchased and controlled. Much like when a hail-storm damages your car or a tornado tears down your house -- you have coverage for that, but not for new car tires and tune-up, and not for a new roof after 20 years. Those latter things most people save for .

Even in these critical cases a person can to an extent negotiate and control their own care more flexibly than an insurance company does today. Choices of procedures, medicines, and docs are often a side-affect of the managed-care solution today.

Also, for a significant health event the health insurance company could assign a claims worker, as would the car and home insurance companies above. Having ONE person to deal with who understood your situation and your bills would be a big help. Today you generally get that only if you ask to have one assigned, and have a big enough claim history to warrant personal attention by the insurance company. Mostly today you deal with an endless stream of functionaries who know little, can tell you less, and refuse to put anything in writing.

I don't if in my view there can be a "good national health policy", but there may be one that is less-bad at least. State and local would be my starting point, before relegating it all to the national gov't.

I think one person dealing with each policy holder would be good...some shops push much more decision-making power to the front line people.

But private insurance still doesn't strike me as a good way to achieve my goals for health care:

In my research on the topic, the system as it stands here is a mess. Although I now live in California, I'm a Canadian citizen and I had none of those concerns while I lived there. And three years ago when my father was in a car accident while I was visiting, he was given top-notch care, I spoke only to the doctor (not an insurance person, not even once) and I didn't have to wonder if my parents would be financially wiped out if things began to spiral down.

The system here is good if you have a lot of money. If you are middle-class or lower, or lose your job, or want to take a risk and start a company but can't because you're not sure you'll get coverage if you leave your current plan or run the risk of the copays bankrupting you, in those respects the system here is just awful.

I am not saying that I haven't gotten good service here. It's generally been excellent. However, I can afford a reasonably good plan, I'm healthy, I'm relatively young and I haven't had a major medical incident. I tremble at that thought, actually.

The health system here often has me wonder if it would be much better for my wife and I to move to a country with a national health care system at some point (Canada or some other place).

Also, don't forget that as people become poorer, their insurance, which is general attached to their employment, will disappear at the same time their employment does.

I think we should do what the British did after WWII and make health care a national priority. It's just not a priority here now.

I moved from the US to a country with national health care (Japan) and it has been a big relief though I've never needed any treatment. My sister back in US is very envious and considering emigrating somewhere else (we have close family in 2 European countries so it would be possible to get help with visas etc.)

Yup. Had a baby. Tried to induce for a couple days. No go. Had a C-section. In th hospital a total of 8 days. Cost? Something like $1,500.

Babies check-ups or visits for colds, etc? $2.60.

Premiums? About $45/mo. if you have a job as employers match. Adding spouses, etc? No extra cost. And this is regardless of job, excepting part time.

Americans are dead stupid on this issue: "My freedom! I'm not a socialist! I'm not a commie!! (But I am an utter and complete fool and idiot.)"

Cheers

Thanks for your candor, ccpo. I was one of these people until a few years ago. I've done a 180° on many topics and National Health Care is one of them. There are many others I've changed my stance on as well. It seems the more I learn about the true nature of our country, the more I'm angered, frustrated, confused, disillusioned, et al.

TS

Agreed 200%. Lots of wrongway incentives. Even having insurance in this country is scary, you don't know if they will deny payment for needed proceedures. And the system leads to lots of inefficiencies, like having to make multiple visits for something that could be covered in one, but the medical center can collect more co=pays, and insurance payments by stretching it out.

Interestingly, we had three "expensive" babies. Sweet Lovies the lot of them- 2 slightly premature twins (about 2-3 weeks premature) and one "heart baby." Big insurance payouts for all three. When it came time for my husbands vasectomy (immediately following the surprise twins), the insurance company gave him grief and said they wouldn't pay for the doctor he wanted to go to ($900).

I said "You should be PAYING us $50,000 for the vasectomy!" Sheesh.

I think the problem is that people switch insurance companies so often (i.e. when they switch jobs).

Your insurance company is thinking "what's the chance that they will still be on my plan if/when they screw up their alternate birth control and have that next baby". Same reason most don't want to pay for the smoking patch. Why should they pay for me to quit smoking, when I'm more likely to be on another plan when I get lung cancer?

Social contract. We're living in a zombie paradigm and need to forge a new social contract.

You need to test this assumption. I do not have figures handy but have seen data that indicate the the US has the highest per person health care costs of any OECD country.

Part of this will be due to the fact that it is fee for service. Order up more and more tests and the Doctor bumps up her revenue and the patient feels like something is happening.

Part of it will be due to the fact that the US introduces advanced (and pricey) medical equipment (cat scans) before anyone else.

Only a small fraction of people have a cash customer-provider relationship. Most have a customer-insurance-provider relationship.

It is almost impossible to determine the actual cost to you for an insurance-covered procedure. The doc has his set fee, but there is a different one negotiated with the insurance company, who may or may not "allow" all of it before applying their coverage less any copay less any deductible. It's even harder when the doc or hospital has an outside lab do some of the work.

Much hospital care is overseen by residents, who are often quick to call in every test known to man. I'm sure they learn from it, but it's an expensive (publicly paid) piece of their education.

Home healthcare supplies are a racket, too, if insurance-covered. We've had supplies where the 20% copay of a charged cost was greater than I could buy the same things outright on the internet for, shipping included.

In much of Africa all health care is your suggested cash customer-provider relationships. What that means is if you don't have the cash then you die from an easily treated disorder. Very few people can pay so life expectancy is short. The United States had a similar system before WWII. Life expectancy has increased since health insurance became common and infant mortality has dropped substantially. But in nations with universal health care those measures have improved even more.

I once met a man from Netherlands who was an engineer and whose sister was a physician. Her salary was much higher than his but after tax income wasn't much different. When asked why someone would go into a profession where the taxman took such a large bite he answered that she did it to help people get well not to get rich. Americans harbor this illusion that a good education is a license to get rich. This leads professionals like doctors to charge what the market will bear and to force newcomers through a hazing process called internships to limit the number of competitors.

What I see in those like you is an attitude that certain groups of people do not deserve to live.

Completely inaccurate inference. What's "deserving" have to do with it? I object to the "I pay, my company negotiates, the insurance company decides, and the provider takes what he can get."

My company gets a tax break for MY insurance. Why? It's MY money he's spending on healthcare anyway.

The doctor negotiates for my care regimen with an insurance company, not me. Why?

The doctor also negotiates for his pay with my insurance company, not me. Why?

The insurance company lives on the spread between what I pay (through my employer) and what actual costs they incur. It is these "overhead" roles that I cannot support.

I don't get to negotiate the plan, negotiate the terms, or know the precise costs, yet I pay for it all Why? The sole value of insurance should be to spread risk. What we have now maximizes overhead through mandatory services.

If you want to get into "deserve to live" I think we could have a lively discussion on the value of human life, but that's only necessary once you have an inclusive plan where somebody other than the individual determines their right to services.

The answer to all of your "why" questions is simple - this country is run by corporate interests. They write the laws, the rules, and the regulations. It really is that simple.

Exactly, and replacing that with gov't interests would be no better. Probably worse.

Damned if you do, damned if you don't.

Guess we just have to learn how to think for ourselves (ouch!).

To paraphrase an old, anonymous writing supposedly found in a church somewhere, "I dream of a day when I will hear somebody say, 'I'm going to stop talking out my arse.'"

FACT (and the only fact you need to know): US is the ONLY industrialized nation without universal health care, yet has the most expensive, and no longer best, health care in the world while failing to serve tens of millions while driving many more - even some with health care - into bankruptcy.

Jeers

+1

"Another 50% down would leave few if any safe havens for your investment dollars."

INVEST in Super Insulating your house!

I'm not sure this way of looking at it makes much sense. First, going from 8,000 to 2,000 represents a 75% decrease. So, one should look at the possibility of the DOW stocks losing that much value.

Banks have had no trouble losing that kind of value.

If unemployment and credit crisis get really bad, there's no reason consumer-driven companies won't lose that kind of value.

And then there's the fact that the PE ratios on these things indicate a belief that, going forward, the companies will be worth more in the future than they are now. If, however, that belief reverses itself and negative growth is seen as the norm, then there's no telling where PE ratios could end up. If they're at 15 right now, a 75% drop in price moves them to roughly 4, which might seem about right if the companies revenues start an inexorable decline.

speek,

From what I've read during past severe recessions average PE has dropped to around 6.

If the current PE is 15 with an 8000 DOW, a drop in PE to the historical norm of 6 would result in a 3200 DOW.

If E were to fall 40% from where it is now that would give you a 2000 DOW.

What amazes me is that the DOW should still be at 8000. With the inumerable problems pulling the real economy down (as well as the seemingly unsolveable problems still facing the financial sector), I don't see how corporate earnings can possibly avoid taking a hit. However, if we look at the 1930s--predicated on a debt bubble that pales in comparison to the current one--it took years for the stock market to finally bottom out, at about 10% of the pre-depression level.

Naw, that's way too low. S&P PE ratio 1942 - 2002 As you can see from the chart, the PE dropped to around 7 in 1980. Hasn't approached that point since. It last hit 6 in 1949. However PE is a tricky thing. If the a $100 stock dropped to $50 while their earnings dropped from $5 to $1.25, then their PE ratio would go from 20 to 40.

The PE of a company can very easy go up in a recession, and it often does exactly that. If it does that just means that their earnings are dropping faster than the price of their stock. If their PE is low that usually means they are making pretty good money as compared to the price of their stock.

Ron Patterson

Hi DownSouth,

Just out of curiosity. Are you the same DownSouth who's been Mish- and Schiff-bashing at Naked Capitalism?

:-)

CO

Yes, it's poetic justice to see these two leading advocates of the libertarian canon go after each other. We'll probably see many more of these Goyaesque reenactments of Saturn devouring his own as the little piece of ground upon which the libertarians stand grows smaller and smaller.

What we have is one libertarian dogmatist broadsiding another because he failed to profit sufficiently from America's demise. These two have thus managed to create from the throes of a nation in pain a territory for infantile self-expression and intellectual anarchy. They write as if people's lives exist only in light of their belated regard.

Here the basic unit of human experience that assures us of some possiblity of emphatic and symbolic identification with others is blasted in the interest of the twin evils of (1) winning at any cost and (2) specious ideological conciets. Consistent with the entire neoclassical project, prefabricated human beings are sketched on sheets of paper and superimposed upon the community; then when someone thrusts his head through the page and yells, "Watch out there, Jack, there're people living under here," they are shocked and indignant.

I stumbled upon the perfect metaphor for these two dualing libertarians today:

So, in this Manichean conflict between the plantation owners and the Basque merchants, who should I choose?

And in the knock-down-drag-out between Mish or Schiff, who should I choose?

But wait! Did I hear some faint voice at the back of the room inquire: "And what about the slaves?"

I have no idea why you would single out Mish or Schiff for attack. In the money management business in the USA circa 2009, it is relatively uncommon for the money manager to deal in good faith with the client whose capital he has been entrusted. There is a widespread attitude that the clients are sheep to be sheared. The whole industry is infected with cockroaches, Wall Street in the extreme, but also pension managers and mutual fund companies. Those two guys you targeted have not been caught advising clients one way and putting their own interests the opposite way (which is pretty remarkable in that field). I agree that Schiff has exaggerated his prowess, but Mish has been pretty straight all the way as far as I can tell.

DownSouth,

You express your views with admirable fluency but I think you may be overstating your case (I myself am a post-libertarian who has been mugged by the exponential function). Libertarians are a pretty good antidote to statism and -- whatever their shortcomings -- were good at predicting the onset of this end-game crisis. They got their timing right enough -- peak debt beat peak oil to the brink of the abyss. And Mish at least has made uncannily accurate predictions -- in the short term at any rate.

Of course their perpetual worship before the altar of economic growth is risible but at least they recognise a global crisis when they see it coming -- more than one can say of other pundits. And, yes, they want to save their skins and that of their clients even it means short-selling their native country. But I'm interested in their insights, not their morals. Remember that you can still earn a lot from people whose morals you abhor.

Anyhow, your comments are always a pleasure to readl.

CO

In this tri-polar universe I find myself attracted to all three poles. But like a moth attracted to fire, if one gets too close to any one pole, he's bound to get burned.