Kern River Production Estimates versus What is Economic

Posted by Gail the Actuary on February 12, 2009 - 6:41pm

I wrote a post a few days ago about my visit to Chevron's Kern River Heavy Oil facility.

This morning, I received an e-mail from Jean Laherrère of ASPO-France with some graphs of historical production and forecasts that he had prepared for Kern River. The e-mail gave permission to post these graphs, if I "found them of value". I thought a separate short post on the subject might be worthwhile, since most readers are no longer looking back at late comments on my original post.

When I compare Laherrère's forecast with what I learned in my visit, it seems to me that the production forecasts developed using linearization are not tied in well with what is actually economic. Unless one makes careful adjustment for economics, it seems to me that this approach could significantly over-state the amount of oil that will ultimately be produced.

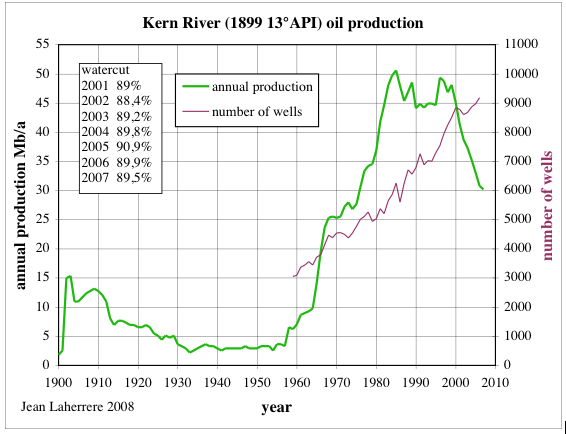

Kern River Historical Production, Number of Wells, and Water Cut

In Figure 1, Laherrère displays historical data. Based on the information I was provided on my visit, initial production was done using gravity drainage only. It began to decline almost immediately after production began about 1900.

In the late 1950s, owners began trying to use heat to get more out--first with "bottom hole heaters" and "hot waterflood," and eventually with "steam flood," which produced the burst in production. Since about 1999, production has been declining at about 6% per year. The number of wells in use keeps rising, and the watercut remains fairly constant at about 90%. Laherrère notes that the decline in production is symmetrical with the increase.

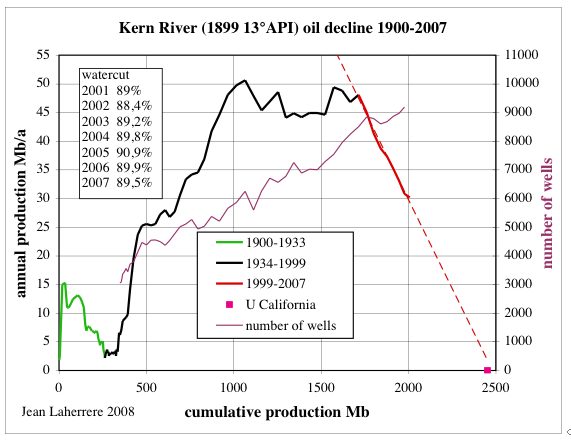

Kern River, Annual Production vs Cumulative Production Forecast

This curve fitting approach shown in Figure 2 is based on the assumption that the logistic curve fits production data. Based on this approach, Laherrère estimates future production will be 450 million barrels (difference between production to date and the point where the fitted line crosses the x-axis), which is in good agreement with a forecast made by the University of California.

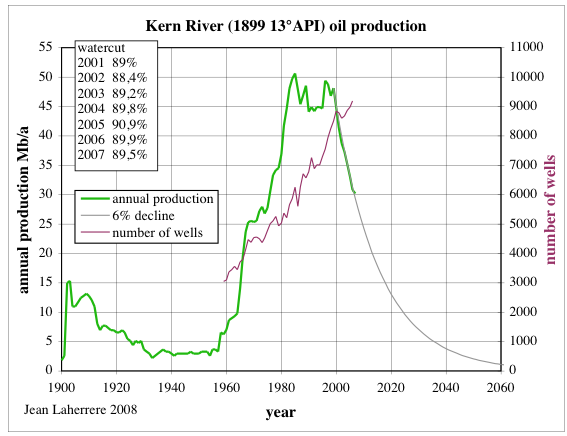

Kern River, Expected Future Production by Year

In Laherrère's e-mail to me, he says, "The decline since 1999 is about 6%/a and the remaining 450 Mb can be produced up to 2100 (0,1 Mb/a) but likely economically stopped around 2060 (1 Mb/a)."

My View--Future Production

My view is that if production is declining by 6% per year, it is likely to be economically stopped far sooner than 2060. According to Laherrère, production in 2060 is expected to be 1,000,000 barrels for the entire year, or 2,740 barrels per day. If the number of wells continues to increase by about 200 per year, by 2060 the total number of wells will be about 19,500, and the average production per day per well will be about .14 barrel, or 6 gallons. The number of steam injector wells will need to increase proportionately, since Chevron adds these near groups of about five producer wells, also driving up costs.

It seems to me that Chevron is likely to reach cost constraints relatively soon, if production is dropping at 6% a year, since we saw in my previous post that the cost of producing this kind of heavy oil seems to be quite high relative to the current price available. Even if the price bounces higher again, the recent price drop will make companies less willing to believe the higher prices will last.

I also think at some point Chevron will start hitting bottlenecks. For example, if more and more steam injector wells are placed, one would theoretically need more and more natural gas to produce the steam. How does one talk a natural gas pipeline company into building a bigger pipeline to what is obviously a declining field? How does one justify adding new boilers, if they are fairly expensive?

One consideration Rockman and other readers mentioned in the comments to my previous post was the need to clean-up the site and cap the wells, before the site can be abandoned. This may help to keep the site open longer than otherwise will be the case, but one cannot count on this being the case indefinitely.

In the case of Kern River, I don't see that the forecast using linearization gives much insight as to how much additional production will actually be economic. Has anyone looked at this issue in general? With declining Energy Return on Energy Invested (EROEI), one would expect that at some point there would be a cut off, since it does not make sense to use more energy to produce oil than can be obtained in return.

Cost constraints are likely to limit production in a similar manner to EROEI. Recently, cost constraints may not have been as apparent, because they were masked by the rapidly rising price of oil. Now that the price of oil is lower, and capital is more scarce, we may find that economics play a greater role. Linearization likely produces accurate estimates as long as economics are favorable, but does not seem to give insight as to when economics (and EROEI) will cause production to stop. If we truly want to estimate future production, we may need to overlay linearization estimates with an economic analysis indicating how long production is likely to remain cost-effective.

excellent follow-up, thanks as usual Gail

I just figured out a question I've wondered while passing through the Kern field for years - why do all those pipes runing everywhere have strange upward pointing loops every so often in their run? - these must be steam pipes, and those loops prevent water (from cooling steam) from continuing past the loop?

I think you may be right about those loops Mac. All NG pipelines have "drip stations" where they catch water and hydrocarbon condensate from the NG stream. Again, far from my knowledge base but I do know moving a multiphase flow through a p/l is much more complicate (and inefficient) then if it were 100% gaseous or liquid.

I agree with you Gail. Linear extrapolation generally works over short periods when variables are kept constant. But I can see the ultimate recovery being as high as some might project. But it won't be done by Chevron or any other company of size IMO. OTHO, it will likely take much longer to get there. And it the end, as we all know all so well, it's more about the rate then the ultimate volume recovered. There will come a day, after all the steam generators have been sold for scrap, when the decline rate will drop to 1% or so. Back to gravity drainage.

One anecdote to explain: about 8 years ago I dealt with a two-man oil company. Actually one man and his wife. They operated about 20 wells in a shallow gravity drainage reservoir (one I was trying to acquire for a fire flood). The wells made 1 to 2 bopd. Here was the problem trying to buy their wells: normally one uses a discount value (15% common) to adjust the value of the income over time. I.E. $100 of oil produced next year is only worth $85 of present value. But these wells fell into what one could call "constant value". If I used the standard discounted cash flow model their wells might be worth $200,000 today and would net that back in 5 years. But if I went 5 years into the future and calculated a value it would still be $200,000 (very low decline rate). He and his wife owned a small ranch and had produced these wells for 26 years at that time. (The field had been discovered over 50 years earlier). Would you sell an income source that could generate you an income (assuming everything stays constant) of $50,000 a year for the next, let's say 100 years? And sell it for just 5 years of income?

And this was back when oil was $20/bbl. I figured that by the time oil hit $50/bbl these two folks were perhaps the highest income earners in their relatively poor county. And all they did was spend the mornings riding around lubricating some pump jack which were small enough to fit in your car’s trunk. Actually rather cute. No commuter traffic…no office politics…no worrying about getting laid off. Basically: no rat race. Long after Chevron stops operating (and perhaps doesn’t even exist any more) there will be a bunch of small operators taking that oil out at a barrel per day per well…or less.

Needless to say they didn’t sell. And, to be honest, I became a little jealous of them. As another such operator said” If I sold my wells I would have to buy something else to make a living. Why bother…this is as easy as it gets.” Sitting here every day watching more folks back their offices up makes me long to be sitting under an oak watching my baby pump jacks bob along.

Rock-

I have found quite a bit of oil in the past 10 years. From 660-3500' deep. But my best wells are 660' deep. They average about 6 BOPD after 8 years but have no decline. They never made more than 15-20 apiece. They will never be sold as long as I'm cogent.

I had a 220' well that made 8 BOPD for years. That was my favorite well.

FF

While your comments are to Rockman, I got to thinking: If the decline rate of Kern River is 6% per year with lots of infill drilling, the decline rate of individual wells is likely even higher than 6% a year without infill drilling--say 7% or 8%. Kern River likely doesn't have many wells with long life-spans. The wells only drain fairly small areas, and run out quite quickly.

Gail,

That makes sense but I bet you it's because Chevron shuts down steam injection in units when producion rate drops below economic limit WHEN the cost of steam injection is included. But I bet you a nickle those well can still make a bbl a day or so by gravity drainage but the labor and maintenance efforts aren't worth it to Chevron. But I bet if you owned 10 of those wells and were netting 7.5 bopd (10 bopd less 25% royalty) = $9,000/month ($40/bbl) less ops costs (guessing around 20% = $1800/mth) you be making around $86,000/YR. Chevron can't cover salaries, benefits and over head on that type of cash flow. But a high school drop out whose worked in the oil fields for 15 or so years could run this op in his sleep. And that would be $86,000/yr going into his checking account.

That's why I'd bet this field and hundreds more will still be producing in the next century. So one could legitimately predict huge volumes of oil for ultimate recovery. Those numbers would be impessive as long as you don't point out the many deades it would take to reach those levels. The combined daily production will be completely insignificant as far as US demand goes but they will still be producing. In the example I gave above the couple were still making a nice income off of those wells with little or no deline and the reservor had only recovered about 12% of its in-place after 50 years of production. That's why I believe the last oil company funtioning in the US won't be Exxon or Chevron. It will be Joe's Oil Company and Bait Shop.

Without steam, with existing equipment, the amount of oil being produced by gravity drainage alone will drop from 10 bopd to something like 2 bopd. If owners switched to progressive cavity pumps, they could get more, but it is not clear to me that it would be anything like the 10 bopd. Individual owners would also have a hard time keeping up the cogeneration facility. It is not clear that their electrical supply would continue for this reason. Without electrical supply, how much of the operation could continue? The progressive cavity pumps might take oil out, but what would happen to the 90% wastewater that needs to be treated or reinjected?

Gail,

Even 2 bopd by grav drainage might be optimistic. But that's why the little guy can prosper in such an environment. With chatter about billion bbl oil fields and 88 million bopd figures I know it's hard to get our minds around someone making a good living off of 10 bopd. Again, none of this has any bearing on civilization’s future but I'm still tickled by those efforts.

Just one more little aside: even when only gravity drainage is all that's left you don't need all those pump jacks and oil tanks let alone steam plants. Long ago a farmer took over a group of shallow oil wells on his property. The previous oil operator had abandoned those wells after stripping the field of every pump jack, oil tank and even scrap metal lying on the ground. The land owner built a pulley on his tractor and ran a “swab line” off the power take-off of the tractor. A swab line is essential just a length of wire cable. He would roll up to a well and repeated pull the swap line in and out of the open casing head. With each pull came a little oil which he pumped into a small wheeled oil tank he pulled behind the tractor. I forget the numbers but he made a much better living off his oil production then farming. And the story doesn’t end there: as word spread and folks began duplicating his efforts a company in OK started producing tractors already set up for similar operations.

I wasn’t kidding: I’m sure after all the big oil companies are gone there will be thousands of one or two man operations still producing oil. Granted that amount wouldn’t fuel one small American city let alone the globe. But that wasn’t the initial point. Kern River will be producing commercial oil 100 years from today. And in time may well produce all the oil some predict. Not exactly a “Mad Max beyond Thunderdome” world. But you can tell how I admire the nature of a man to profit when a corporation cannot.

I don't think either of you two are catching my drift (see below).

Chevron has burned trillions, if not quadrillions of Btu of (our) natural gas to produce oil they have sold for a (handsome) profit. Over time, they've paid only a fraction of a dollar (per million Btu) for this. All the CO2 in that natural gas (or crude, when they burned that) is now contributing to the climate problem.

A sizable fraction of those Btu's still remain underground in the Kern River Field, suitable for recovery by existing pumping methods through the porous formations. The recovery of the electricity (including development costs) could be done within the investment budget that Chevron already has.

At some point they will want to "shut down" the oil production and abandon everything because it isn't "profitable" to produce the oil any more, and they expect us to approve of this???

Excuse me, but I don't think so!! If the Energy Commissioners of California are worth their salt, they should not allow it to happen. They have renewable energy goals that must be met. The Kern River "thermal" field (along with other San Joaquin fields) could make a significant contribution toward meeting those goals at minimal additional investment. It certainly would be far less costly than the electricity from CSP plants SoCal Edison has committed itself to buy.

"First they ignore you, then they laugh at you, then they fight you, then, You Win" M. Gandhi

Sorry Guy. I caught your drift but was distracted. I'm sure in some fields thermal recovery efforts could be attempted. But I doubt KR would qualify. Most of what I know I've gained from Gail's posts but I suspect it would be difficult to effectively move the water thru those heated sections. Secondly, unless Chevron leases allow thermal recovery those buried BTU's belong to the mineral owner. And lastly, it's not likely any regulatory body could compel Chevron to take on the task. But if the state of CA would want to take on the task and spend their money I sure Chevron would be glad to donate those leases to the state.

Didn't Gail say that 80,000 bpd of crude was produced with 90% water cut? That would produce about 720,000 Bbl/d (30,000 Bbl/hr)of water at a 230 F in-hole temperature. Let's say the water arrives at 194 F (90 C) on the surface gathering tank after heat losses in the gathering process.

At 350 lb per barrel they're handling 10.5 x10^6 lb/hr. If this is cooled from 90 C to 50 C (122 F) for treatment, this is equivalent to 10.5 x 10^6 x 72 F = 756 x 10^6 Btu/hr. At a "heat rate" of 15,000 Btu/hr/kw (not counting the harvesting of CAPE in the atmosphere) , were looking at a potential of generating 50 x 10^3 kw = 50 MW TODAY, from material that is already being gathered and which constitutes a minor fraction of the overall field.

During the summer, this output could be nearly doubled during "high demand" peaks, from the heat contained in the troposphere.

To me, it doesn't matter what Chevron can be legally compelled to do. They are broadcasting commercials on television trying to convince everyone how "green" they are with they're "willyoujoinus" campaign, even saying it was important to use "less" energy.

The question then becomes: "Will they put their money where their mouth is?" If so, even I might consider joining up.

We were told that the pipes with the big loops are steam pipes, and the loops are to permit expansion and contraction. I am sure there could be other functions as well.

That makes sense too - thanks Gail

_All_ long runs of pipe on the surface in the Calif. desert require loops. The problem that is mitigated by the loops is expansion and contraction of the pipe due to temperature changes. Hot in the daytime Sun. Cold in the desert night. Of course, the steam pipes are not _always_ hot. They do have to provide for the contraction that must happen when they do maintenance on the boilers, or when there is a boiler breakdown. Mostly the loops lay horizontally. If they are vertical that might be because of something to do with steam condensation, but I doubt it. Water in the line would best be handled by having downward pointing Tees where it can collect and be bleed off.

BTW, I think I have seen such loops in refinery pipes in New Jersey.

these are expansion loops in the steam pipes. Because there is such a large temperature change when first installed (or down for maintenance) and operating temperature, these loops need to be installed every so often to handle the thermal expansion / contraction.

The loops can be in the horizonal or the vertical depending on the space available.

Very well done Gail and thanks for all this research and analysis.

Well done also for your prediction that the financial instability would be the first thing to hit.

Cheers,

Bruce

First and foremost, I would like to recommend that no part of the field be shut down without recovering "geothermal" heat, actually created by the injection of steam formed from the burning of natural gas. At the surface the water cut coming out of the wells is at the boiling point. It may be necessary to cool it before treating it for reinjection or for agricultural use. THIS HEAT SHOULD NOT BE THROWN AWAY, AND IF THAT IS WHAT IS HAPPENING, IT'S TANTAMOUNT TO AN ECOLOGICAL CRIME.

It's heat content (above 140 F) should be first be transferred to the air entering an Atmospheric Vortex Engine, where up to 25% of the heat (above 550 R) can be converted to electricity.

That water cut which goes to agriculture need not be applied directly to the crops if it contains trace impurities. By cooling the air entering a greenhouse with this water its (vapor pressure) can be used indirectly to reduce evaporation in arid regions--see http://seawatergreenhouse.com

I got another e-mail from Jean Laherrère this afternoon. He said, "I feel strongly that all easy oil (Kern River is easy oil because infrastructure is there) in the US will be produced, only stopped not by economy but by EROI

Pumping oil takes some energy but if the volume is reduced the time of pumping will be reduced also.

The only problem is the availability of gas to make steam, but cold production of Orinoco extra-heavy oil is working fine (but with horizontal wells and progressive cavity pumps)"

So perhaps by changing to different infrastructure, it will be economic to produce more.

He also said, "I was shocked by the fact that in the end many giants (East Texas oilfield, Brent, Yibal, Cantarell) display a sharp increase in decline because operators used technilogy to produce at the fastest rate they could, but it seems that Kern River, being an unconventional oilfield, is in a different category."

I think the sharp decline at the end is precisely what we should expect in most fields, because companies seek to maximize their production, as long as it is economic. Once it ceases to be economic, they pull out as quickly as possible. It seems to me that the time of the pull out has not yet come for Kern Valley, but it will eventually. It will depend on how high the price is and how low costs can be kept through technology.

It would appear that using progressive cavity pumps on "cold" heavy oil is just another way of "mining" bitumen. This technique could result in a positive "net energy" for many shallow formations allowing for a high recovery, if one knew exactly where the remaining oil is located.

I don't know it for a fact, but it would appear that "subsidence" of overlying land provides a means of maintaining reservoir pressure in much of the area, allowing crude production to continue for many years. When subsidence stops being a drive, then mining will have to be used. Clearly, the cheap electricity one could obtain from an AVE would benefit this method.

Or, a process like the one Shell uses on Shale Oil might be developed (in-situ coking) some day, which also uses a lot of electricity. Ultimately, the heavy oil must be upgraded to transportation fuel, with the net CO2 emissions (cradle to grave) per gallon burned in a vehicle approaching twice that of conventional light crudes.

Maybe much (~80%) of the CO2 can be captured from the exhaust using an amine solvent, with this being reprocessed to free the CO2 when fully loaded. Two more storage tanks required on board, however--one for the regenerated amine, and one for the spent (loaded) amine. Unlikely.

Kern River has shown little subsidence, as far as I know. You may be thinking of the Wilmington field in the LA basin, which slumped considerably. Rembrandt included graphs from Laherrère in his post A Primer on Reserve Growth - part 2 of 3, including both fields. Geologic shifting has also increased production in some examples Rembrandt also covered, but I don't think we'll utilize it as a reliable EOR technique anytime soon. Mining Kern River? As Rembrandt points out the oil was originally extracted by hand, but how many fields could be dug up in this manner I couldn't say.

Regarding low level production, there's both a Stripper Well Consortium and a National Stripper Well Association. Wish I had me some of that 2 bbl/d action!

The first Post said: "In the recent past, production has been declining at 2% or 3% a year. Chevron's goal in the near future is to hold the decline rate to 1% per year." but this post gives 6%.

Does Chevron agree that production has been declining at 6%? How do they reconcile that with the 1% goal?

Some background on what happened. Before I went to visit Chevron, I found a little information about prior production--a graph that was a few years old, and a little information about recent production. Using what was pretty incomplete and not up to date data, I made a rough estimate that production was declining at 2% or 3% per year, before I visited the facility.

When one of the speakers was talking about Chevron's future plans, he showed a slide saying that their plans were to hold declines to 1% per year. I raised my hand and asked what the recent decline rate had been - then mentioned that I was guessing it was something like 2% to 3%. The speaker said, yes, that was right.

I suspect the speaker didn't really know, and I had estimated it off a not-too-up-too date graph, so I ended up with a bad number. Sorry about that! There must be some agency that compiles production by field, but until I saw Jean Laherrere's e-mail, I hadn't seen the year by year production amounts.

Gail,

That doesn't really make sense. The speaker was talking about their plans for this year's production decline - you'd expect him to know what last year's decline was.

More importantly, how can Chevron reconcile 6% history vs 1% plans? This goes to the heart of this story. Perhaps Chevron's historical data is different from Jean's (and, presumably, more accurate).

Is there any way to ask Chevron at this point?

Gail - CA does have the Petroleum Industry Information Reporting Act mandating that producers/refiners/retailers/etc. submit reports on their activities, weekly/monthly/annually. But nothing is said their regarding the confidentiality of same data. Perhaps it's as simple as contacting the California Energy Commission - email at that link if you're curious. I've snooped around their site looking for field data but no luck. The company level import reports from the EIA, on the other hand, are well nigh exhaustive - wish us public people could tell what was going on in the fields. The 2006 Annual Report of the State Oil and Gas Supervisor I linked to in your previous piece does have complete data on fields for that year and 2005, but nothing from a historic standpoint.

I've done a lot of reading on the supply situation for PADD 5, and the CEC's publications are really outstanding.

"The Dude" shows the following table from this report by the California Energy Commission:

This seems to support what Jean Leherrere is saying about the 6% decline rate.

It seems to me that the speaker ( and chart) was talking about 1% as the hoped-for 2009 decline rate. We really don't know what the decline rates were in 2007 and 2008, but we can approximate them by comparing recent production of 80,000 barrels a day, to the production shown for 2006. According to the chart above, production for 2006 was 30.8 million barrels, which equates to 84,383 barrels a day. A drop to 80,000 in two years would equate to a 2.6% average decline rate for 2007 and 2008. So in referring to 2007 and 2008, the 2% to 3% decline rate might have been right, but for the most recent published data (which was probably what Laherrere was using), it was about 6%.

These numbers can bounce around a bit. For example, if several horizontal wells were successful in the last year or two, this might have helped keep the decline rate from dropping as fast. They mentioned that the best of the horizontal wells was producing 500 barrels a day initially (460 barrels a day now), and this one well would have the effect of decreasing the decline rate by 0.6%.

hmmm. So, we have 2.6% for 2 years. That's a fairly substantial deviation from "Figure 3. Forecast of future Kern River oil production, based on fitted data".

Further, we have stated plans from Chevron to maintain 1% for years (plural). Wouldn't it make sense to ask Chevron to respond to your projection of 6%, which is based on older data?

I don't really want to push them too hard on the subject.

The forecast appeared to be part of a "corporate plan" that may have been put together about the time WTI traded for $147 barrel. It looked like Chevron was planning on adding some type of new production--there are areas that haven't been drilled in the past (hard to heat, deeper) that could be economic with $147 oil, but are probably seriously in doubt with current oil prices. My impression was that the speaker was just presenting this plan.

Well, it's reasonable to guess that production will decline faster than Chevron's 1% plan with current oil prices, but we should note that it is a guess, especially given that current prices aren't especially low by historical standards.

Also, the NG co-gen electricity is more competitive at current NG prices. It's possible for steam-related E-ROI to become completely irrelevant: if the co-gen electricity output pays for the NG input, then the steam is free to Chevron.

Finally, isn't the logical implication of this discussion that if high oil prices return, Kern River production could be maintained at or returned to production levels that are very close to today's?

I think if they return to this level of production, it will probably be only for a little while. Much of the oil is already out.

You are right, though, that if Chevron forgoes new production now while prices are low, they could theoretically go in and drill the high priced areas later, bringing production up at that point.

"I think if they return to this level of production, it will probably be only for a little while. "

Sure - the big question is how long. I'd be very curious what Chevron has to say: what's their projection over, say, the next 10 years?

I understand your hesitancy to bug them. OTOH, this kind of followup is absolutely standard for journalists, which is really what a blogger is.

In fact, it's generally considered a good standard of journalism to follow up like this, and allow your subject to comment on your conclusions. I would think they'd be eager to comment on a story that suggests that their field's overall production is nosediving at 6%/yr, and might have to cease production in the foreseeable future.

Interesting Article: I agree with Rockman that when the Kern River field is no longer economic for Chevron, a collection of smaller outfits will likely take over operations with gravity driving the production. In Kansas where I am originally from, there are many such Mom and Pop operators working and making a great living on production from a few wells that are strippers to convention oil companies.

However the thing that I have found most intriguing from the recent articles about the Kern River field is the co-generation of electricity. It got me thinking that the thermal energy required generating oil from the Green River formation, such as by the in-situ EGL Method, could be used for more than one purpose. This heat could be recaptured during heating and production through a variety of methods, and be used to generate electricity; this could lead to greater economic viability in the development of some of the estimated 1.5 trillion bbls of oil entrained the oil shales of the Green River Formation in Utah, Colorado, and Wyoming.

ex,

I wouldn't be surprised if someone is missing a good deal with cogen. Gogen was a big topic 20 years ago but I haven't seen much in the last 10 years. But here’s a real life win-win story. A friend took over operations of a very heavy oil field in AL. This stuff made Kern River look like gold. It wasn't even refined. The sole market was for asphalt. A barge came up the river once a month and he had to run steam turbines for 3 days just to get this crud mobile enough to flow down hill to the barge. Between that effort, low value of the crud and pumping costs the field was barely marginal. My friend put in a small electric generator and took the hot water of the jacket and continuely circulated it through heat exchangers in the oil tanks. He ran all the pump jacks off this power plant and I think sold excess from time to time. The oil always stayed hot and thus eliminated the steam turbine phase as well as eliminating $35,000/month for chemicals to treat the paraffin problem. By the time it was done the field was making a nice profit. And he also took care of another problem he discovered after they bought the property: a pretty little lake down hill from the oil tanks had about 8' of crud sitting just inches under the water surface. Apparent for many years they would have occasional over flows and the crud slowly crept down to the lake bottom (and probably had a little human help to do so from time to time). He discovered this sludge when he tossed a rock into the lake one day. Instead of going "splash" it went "thud". A huge remediation project to dig it out and pay for disposal. But he just had it dug out and paved all the dirt lease roads with it…lots of wells so lots of bumpy roads. In the end the whole field took on a fine manicured look and they sold he field for a nice profit. No big technological break through…just applying know methods and using common sense.

One question that's been on my mind for a while is: how will the downslope of the curve be affected by the uniqueness of extraction equipment? Drilling a well is far from simple, there are very specific formulations for drilling mud or alloys of pipe, and a whole host of specialized tools - drill bits, kellys, collars, cables, bushings, special tools for extracting jammed pieces, wrappings to prevent soft soils from crumbling in, and I could go on - and this is just mundane onshore stuff. You can get some idea of what I'm talking about by looking at the sections on production at the Google Books preview of Nontechnical Guide to Petroleum Geology, Exploration, Drilling, and Production.

Broadly speaking, if the economy begins to really slip will the manufacturers of this equipment be able to stay in business? Or get their production to where it's needed? Also, what's the typical lifetime for this equipment, say, in your average onshore field?

One question I would add is, to what extent are we relying on imports? I would expect there are fewer imports in the oil business than in other businesses, but these could become a problem as we run into greater financial difficulty.

Gail/Dude,

You can break the equipment into two broad groups: Dumb iron and electronics. Drill pipe, casing and the such are the obvious dumb stuff. Some are imported (15 years ago the Japanese flooded the US market with cheap casing). But a good bit of the steel products are still made here (at least the final manufacturing stages). I suspect the transport costs tend to make up for any price differential of any foreign products.

The electronic stuff: logging tools, directional drilling, etc are mostly made here although some components might be made overseas (chips, circuit boards).

When drilling was going strong the service companies had difficulty keeping up inventories of both groups (last week we permanently lost a $2.3 million piece of directional drilling equipment in a well in S. La.). Such accidents can quickly put a strain on the supply train. Like every business increased activity leads to new companies joining the effort. But when a big slow up hits as it just did, many of the smaller guys will fold or be bought up by the big guys. No matter how slow it gets there will always be a Halliburton or Schlumberger waiting to gear back up. Probably the slowest restart will be from the drilling contractors. They'll sit idle for a while but the loss of cash flow will eventually push many out of business. And since there's no secondary market for drill rigs they'll first start selling motors, pumps and the such. But eventually they start cutting up the steel and selling it for scrap. I doubt we'll see another rig building rush as we did the last few years even when prices turn around. Who knows how long the general credit market will take to recover. And I think this latest volatility won't be forgotten. Companies/investors/money lenders will add some sort of volatility risk factor to the decision making process IMO that will hold re-expansion back.

Since this thread is getting long in the tooth (already relegated to page two),I feel obliged to close with a few of my own observations.

Chevron has been the leading major oil company in California for decades, operating in what can only be described as a "hydrocarbon-producer's paradise". Like operators in no other state in the union, Chevron has benefited from a lack of severance tax (FREE OIL), overall moderate corporate taxes and a legislative body, which, in addition to providing other corporate perks, was full of members only too willing to fall over one another when it came time to approve even more spending on freeways, year after year. This subsidy to encourage the use of fuel (think Chevron Product) pushed California into the lead (among populous states) for per capita fuel consumption.

Things really started to cook for Chevron in 1958 when Major League Baseball moved to California. As a result of new fan interest, Chevron discovered it could easily reach an audience receptive to the "virtues" of Chevron gasoline (containing Techron and its antecedents), as extolled to them by Russ Hodges and Lon Simmons, in the north, and the golden-throated Vin Scully in the south. As a result, love for driving by Californians seemed to grow even faster than their love for baseball. Even today, there are huge pictures of (animated) cars in the baseball stadiums. Profligate car and gasoline use became even more popular here than Mom and Apple Pie.

Business continued to grow and grow over the years until, like Exxon, in the past three years Chevron's Profits have topped the charts.

But what do Californian's now have to show for their largess? 1) A nightmarish spaghetti-like road system congested from 6 AM to 8 PM, including weekends, with equally nightmarish maintenance costs. 2) Abandonment in the suburbs without a job at best, or being foreclosured, as a result of the symbiotic relationship developers have had with oil companies over the years. 3) The highest gasoline costs in Continental North America (excl. Alaska) 4) The biggest state budget deficit in the history of the world, by far, with the oil-company rats deserting the sinking ship by refusing (through lobbying) to agree to installation of a state hydrocarbon severance tax.

But I digress, so let's get back to the "dog and pony show" given by Chevron to Gail, who, to her credit and in spite of not being an engineer, was able to perceive a certain inconsistency or "stress" in the presentation.

In a statement on policy, Chevron CEO, David O'Reilly touts efficiency gains through Cogeneration:

"Worldwide, Chevron operates cogeneration units at refineries, production facilities and other sites, with a combined electrical generating capacity of about 3,500 megawatts. These units, also referred to as combined heat and power units, generate electricity about twice as efficiently as the average power supplied by a local utility company."

This seems to coincide effectively with what Gail was told during her visit to the Kern River facility.

HOW COULD THIS BE??? Utilities supply electricity with an average efficiency of about 35%. Are we to understand by this that electric production at Kern River approaches 70%???? O'REALLY??!!

Given the 90% water cut confirmed by the table, I have estimated that currently about 1/3 of the produced water is directed to (sold for) agricultural use, while about 2/3 of it is treated and re-injected in the form of steam (roughly confirmed by information from other blogs). At 300 MW of electricity produced, this would conform to a natural gas (imported from Wyoming) heat-to-electricity conversion efficiency (based on LHV) of between 15 and 20%. The wastage to exhaust of was stated by Chevron to be 20%, with the balance of the heat originally in the gas (60-65%) going to steam production in the HRSGs at 350 psi. The HRSG's would probably be equipped with economizers giving an exhaust temperature in the neighborhood of 400-450 F.

How could the efficiency value of 70%, which could easily be inferred from the numbers supplied by Chevron, be reconciled with the actual value of 15-20% based on the total amount of NG used at Kern River? You tell me, but I can assure you Chevron already has developed a way of reconciling it (through judicious word-smithing) or they wouldn't have printed it.

The bottom line is that the "Oil Recovery" function of the Kern River Oil field needs to be shut down because below 80,000 Bbd, with 90% water cut, it is no longer efficient because at least 1 Bbl of "clean" fuel, NG, needs to be burned for every two barrels of dirty Heavy Oil that is produced, consistent with historical numbers I have seen). That gives an overall carbon footprint (after upgrading) which is three times what is generated from use of conventional crudes.

However, instead of throwing the workers out on their *sses, and destroying the lives of their families, as Corporations typically would do, I recommend the whole operation be converted to a "sustainable living" project based on recovery of the heat that has been injected into the formation for decades, and conversion of a portion of this (up to 20%) into electricity. This would not only preserve the jobs of the present workers, it could supply jobs for many more.

The warm waters from the exhaust could also supply greenhouses for extensive food production on a year-round basis. (see seawatergreenhouse.com)

I would encourage Chevron to consider this as an alternative to the "cut-and-run" behavior typical of most corporations during economic downturns. By so-doing, long-suffering Californians, from whose largess Chevron has itself greatly benefited, would recover a small, but significant portion of the great riches that were once theirs.

For you readers, remember that it's the Fiduciary responsibility of all Corporations to Maximize Profit, by whatever (legal) means necessary, including, but not limited to, offering advertising statements to the public that may be construed to have various meanings.

"heat-to-electricity conversion efficiency (based on LHV) of between 15 and 20%. The wastage to exhaust of was stated by Chevron to be 20%, with the balance of the heat originally in the gas (60-65%) "

17.5% electricity output, plus 62.5% steam output, gives 80% usage of the input energy. 70% appears to be conservative.

"At 300 MW of electricity produced, this would conform to a natural gas (imported from Wyoming) heat-to-electricity conversion efficiency (based on LHV) of between 15 and 20%. "

Could you provide your calculations?

" at least 1 Bbl of "clean" fuel, NG, needs to be burned for every two barrels of dirty Heavy Oil that is produced"

Ah, but even if Chevron's NG to electricity conversion is only half of the usual, that means that half of the value of the NG has been captured by co-gen. So, that gives a ratio of 1 boe input to 4 barrels of oilput.

Below are spreadsheet numbers based on 90% water cut. This volume of 30,000 barrels per hour (720,000 BPD) doesn't agree with another blogger who was there who reports only 550,000 BPD of produced water.

In the case below, I assumed half of the produced water was recycled, and half re-injected as 80% quality steam at 350 psia. In this case, 300 MW only represents about 15% of the heat content of the NG. it also corresponds to 2.5 Bbl of crude per Bbl (FOE) of NG, about halfway in between your number and mine.

oil production BPH 3333

water production BPH 30000

power production MW 300

power production 10^6 Btu/hr 1024

water recycled Bbl/hr 15000

water exported Bbl/hr 15000

water recycled lb/hr 5250000

BFW temp deg F 212

BFW enthalpy Btu/lb 180

Steam Temp (sat. @ 350 psi) degree F 432

Steam quality percent 80

Vapor enthalpy Btu/lb 1205

Liquid enthalpy Btu/lb 410

Heat absorbed Btu/lb 866

Heat absorbed 10^6 Btu/hr 4547

Heat absorbed + work 10^6 Btu/hr 5571

Heat exhausted 10^6 Btu/hr 1393

Total heat released (as NG) 10^6 Btu/hr 6963

electricity extracted % of NG heat 14.7

HHV of Product Oil Btu/lb 18800

LHV of Product Oil Btu/lb 17860

LHV of Product Oil (volume) 10^6 Btu/Bbl 5.81

NG as % of Oil 39.0

Oil to Gas Ratio 2.56

hmmm. I'll have to take a little time to work thru those numbers.

In any case, what about the value of co-generation? Lots of plants generate electricity, and throw away the waste heat. Here, Chevron gets that heat for free.

Now, they also sacrifice some of the potential generation in order to get the steam at the right temperature, but you have to account for the added-value of the electrical generation to appropriately compare the value of the inputs and outputs.

There is no doubt that at the current 80,000 BPD production level, the EROEI, when electricity is properly valuated, is still positive. This may continue to be so for a few more years. I would further concede that there is no doubt that Cogeneration has played a part in keeping the Kern River EROEI "above water", even though Chevron seems to find words that convince some it's the greatest thing since sliced bread.

The alternative for the use of natural gas, instead of cogeneration, would be to increase the efficiency of the primary gas turbines, and then generate 600 psi steam instead of 350 psi in the boilers and, after superheating it, put it through a second steam turbine, and possibly even third turbine, ultimately to get over 50% electricity production per Btu of gas burned, rather than just 15%

It would be fitting on Chevron's part if they would just SAY what the cogeneration efficiency (elect + steam + losses) is instead of playing games.

When you give proper credit to electricity (say 3 x steam-equiv. Btu's) you may calculate something like 4 barrels of crude obtained per FOEB of NG. But then it takes another FOEB of NG to upgrade these 4 barrels of heavy crude, so by the time the upgraded crude arrives at the refinery gate for sale you're back down to getting 2 bbl of "clean-light" crude per FOEB of NG consumed.

Then what happens if you put a $50-$100/ton tax on the carbon dioxide created in the overall process? Maybe Chevron would be better off at that point just selling the high value NG (CH4) for use in cars and buses, rather than going the heavy crude route?

My main concern is that efficiency is not nearly as high as it "could" be by recovering low-grade heat values, which now go out the stacks or are lost due to lack of insulation of surface piping and and equipment. 100-150 more MW could easily be recovered as electricity and exported by diverting the so-called "waste" heat into an AVE (http://vortexengine.ca) for electricity recovery.

Within 5 years, the process of recovering the "underground" heat could begin, producing "another" 100-150 MW.

I don't object so much to "what" Chevron is doing (after all I'm HOG) as much as I do to "how wastefully" it is doing it. Kind of like driving around in a Hummer when all you need is a Corolla or Fiesta. If they even would "slow down" they could also increase efficiency.

Since Big Oil Companies aren't much used(read, have no incentive) either to slow down, or to recover values (like dung-beetles do in what they consider detritus), I suggest the Kern River field be turned (phased) over to a "non-profit" group interested in "sustainable living", even though it could only be "sustained" for another generation or two by the underground heat reservoir. By then, however, a lot will have been learned.