Can you believe EIA Weekly petroleum demand estimates?

Posted by Gail the Actuary on February 27, 2009 - 4:06pm

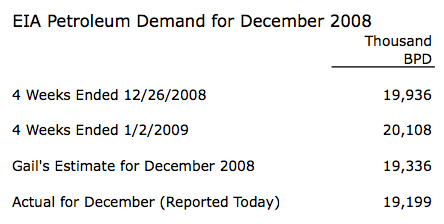

On the post I put up yesterday called "A Few Thoughts about Petroleum Demand, Inventories, and Price", a couple of people commented that my forecasts of expected petroleum demand didn't match up well with recent weekly surveys. There is a reason for this, which is illustrated by EIA's demand numbers for December which were released today:

If one looks at the weekly forecasts, they are considerably higher than the monthly actual amounts. This seems to happen on a regular basis. For the year 2008, EIA's forecasts averaged 654,000 barrels a day higher than I would have estimated based on weekly data. This is about 3.4% high - not great if that is the basis for statements about how demand is running.

The 654,000 barrel a day high bias is mostly on the "other than gasoline" portion of demand. Weekly gasoline demand averaged "only" 193,000 barrels a day higher than the corresponding monthly amount, or about 2.2% high. Other than gasoline weekly demand estimates averaged 461,000 barrels a day high, or 4.4% high.

Part of the problem seems to be misestimation of petroleum exports. These have been chronically underestimated, and affect diesel more than anything else--with is part of my "other than gasoline" pot. But other portions have been mis-estimated as well--tending in the direction of what amounts used to be. Thus, if exports are increasing, the estimates tend to be more in the direction of too little exports. When driving dropped off during the summer, the estimates tended to show too little impact. During the hurricane disruption, the weekly estimates tend to show too little impact of the hurricanes.

The EIA makes two kinds of comparisons to a year ago:

• Comparison to the original four week average demand estimates

• Comparison to the four week average demand, adjusted to the actual level (correct exports, etc)

Without looking carefully at the data, one cannot tell what one is looking at. If the high bias continues to be in the data, what you really want is a comparison of the most recent four week average estimate with the weekly estimates a year ago, before they were corrected to the actual level. This seems to be the approach TWIP uses.

The Weekly Petroleum Status Report seems to use the adjusted four week total as the base for its comparison. Thus, it compares the amount from a year ago, at its true lower level, with a current estimate, which if experience holds up, is probably too high. Using this approach, one gets the indication that total products supplied is only down 0.8% for the most recent four weeks. This is true if somehow the EIA suddenly started estimating the recent numbers without the high bias. If the weekly numbers still have a high bias, the real indication is that demand is down something like 4% (3.4% average bias, plus 0.8% change gives expected demand down about 4.2%).

Of course, at some point EIA may start getting the weekly estimates right, in which case one doesn't have to worry about this issue. Until then, if you see something that looks like great news about demand bouncing back, check carefully to see how the numbers are calculated.

Definitely a difference, in the one case demand up .8%, in the other down .7%. However, in either case we see that demand is substantially recovered from last fall, meaning that the biggest reason for the slide was price and not recession. OTOH, Jetfuel demand is responding sharply to the recession.

IF GD is the model we will only see one year with reduced oil price/demand. Perhaps this model works better for Chindia because in the thirties cars and trucks were both new and wonderful in the US, saving money over the alternatives. But Chindia is a big place, even if the model only fully applies there we will see sharply reviving demand. The question, then, is 'did we pass the down year in 2H08 or will it be 2009?'

I don't understand your comment about in one case demand up .8%, in the other down .7%.

In the case of the 0.8% decrease in demand total petroleum products for the four weeks ended February 20, 2009, if it had been adjusted by my average out of balance, it would have increased to a 4.2% decrease in demand.

If we go to the corresponding amounts a year ago, we find that demand for the four weeks ended February 22, 2008 was 20,582 kbpd. If current estimate at February 20, 2009 is 19,723 kbpd. Comparing those two estimates, we find that demand is down 4.2% from a year ago. I don't know where one gets as small change as you are showing.

My graphs are showing demand still sliding. This is the graph for other than gasoline demand, which includes diesel and jet fuel, since this really represents commercial demand. The new data shows that the actual December value is a bit lower than what I have shown on the graph.

Interesting links on tax refunds:

California

http://www.latimes.com/news/local/la-me-budget17-2009jan17,0,4472460.story

Kansas

http://www.latimes.com/news/local/la-me-budget17-2009jan17,0,4472460.story

Personally, my NC and federal refunds are at the "end" of the normal receipt time.

Where is the source for this 19,119 number. I cannot find it on there website. Only a reference to the actual in Upstream.

PooBah

Yes, that is also my question. The number I get is 19,993 reported here just three days ago:

Petroleum Overview

They also give the numbers for January 2009. That number is 19,565 thousand barrels per day.

Ron

Look at the monthly thousand barrels per day amount on the Product Supplied exhibit.

Total petroleum products are 19,199 on that exhibit.

Gasoline is 8,921 kbpd, from that exhibit. I estimated 8,941, so I was very close.

Total ex gasoline was the difference between these two amounts, or 10,278. I estimated 10,395.

Weird! Their numbers for July thru November are exactly the same as in the petroleum overview. Strange that they would have a 794 thousand barrel per day revision in just three days.

They seem to have two sets of numbers - one set that they use for some purposes, and one set that they use for other purposes. The website only shows the original weekly estimates, but there are clearly another revised set hiding somewhere.

Note this announcement of today's numbers:

The 794,000 less is comparison to their weekly estimates, converted to a monthly basis. These weekly estimates have been (at least lately) consistently high. They won't publish the revised numbers as well as the originals, because then people could see how different the two sets of numbers are.

Gail my friend and colleague. Please get some sleep. Maybe take some vitamins too.

I will write something up for tomorrow...;-)

Gail I read a report on how the stats where collected that discussed montly vs weekly issues.

I can't find it it might be here but I'm not seeing it.

http://www.eia.doe.gov/oil_gas/petroleum/survey_forms/pet_survey_forms.html

The report basically stated that a lot of work was done to minimize the month on month variation in the monthly data.

This could easily have resulted in a systematic bias downwards if they removed to much data. In general with stats if you attempt to lower the error term your removing outliers if these outliers are not randomly distributed then you will introduce a systematic bias either low or high.

Bias issues seem to have been a problem for some time.

http://www.oxfordenergy.org/comment.php?9907

This report is well worth reading.

Here is one graph from the report.

1997 Missing Barrels- IEA estimates from June 1998 to June 1999

And a juicy qoute

So well before we had our strong price changes we see that even the best figures available have been found problematic.

wrt natural gas, the doe uses "balancing items", as one might expect, in producing their various reports.

http://www.eia.doe.gov/oil_gas/natural_gas/data_publications/natural_gas...

footnote e (balancing items) "represent quantities lost and imbalances in data due to differences amoung data sources"

for dec '08 the balancing item amounts to -215 bcf(wrt consumption), about 7 bcfd.

eyeballing the annual pattern, this might just be compression of ng in pipeline inventory. as demand increases each heating season, the balancing items go negative and when demand decreases at the end of the heating season, balancing items become positive again and remain so until the following heating season.

so my point is that the doe's method of collecting limited data and applying a statistical model to estimate totals is far from perfect. i dont know that the doe has any authority to demand data from producers and utilities, they rely on voluntary reporting and make up the gaps by the majic of statistical analysis. we should probably expect noisy results.

I think you're possibly referring to the "Accuracy of Petroleum Supply Data" section from the PDF version of Petroleum Supply Monthly

It doesn't appear every month but does appear in the latest edition published Friday. I've posted the summary in a post below but there's a lot more information in the PDF.

I think this chart from the document you link to gives an idea of the problem:

If you look at the categories listed, they have fairly decent coverage. The problem is the categories that are not listed. Exports are now fairly important in the calculation, but the percentage coverage would seem to be precisely 0%. There may be other categories that are left out altogether, also.

And on further reading of the article I found the following

I think part of the problem is that "The weekly estimates for exports are projections based on past monthly data." If this were done well, it would not be a problem.

If one looks at the data, the weekly estimates bounce around quite a bit, but are consistently low. The following is average actual petroleum exports for each year, followed by the average of EIA's weekly estimates, and the average error with respect to export estimates, all in thousand barrels per day.

_________Actual____Average Weekly__Average Error

2006____1,317_______1,146 _______ 171

2007____1,433_______1,228 _______ 208

2008____1,831_______1,421 _______ 410

The average estimate for 2009 so far is 1,519, so unless we have suddenly started exporting less, it is likely low also.

Exports are the place that seems to have the biggest error, but the other errors seem to be in the same direction.

In a way, it reminds a person of the initial reports of crude oil production from International Petroleum Monthly. The initial estimates are almost always high, because they are based on what should happen, not what the real world situation is. When the real data comes in, it reflects the closures for whatever reason, and is almost always lower.

This is how the EIA puts it in the latest Petroleum Supply Monthly (PDF)

Hello Gail,

We recognised this at the end of the last year, when the EIA said September oil demand was 17.8 mbpd (monthly data), while four-week average for September was 19.02 mbpd. We wrote to the EIA and their explanation was:

"The weekly surveys are timely but preliminary, while the monthly data are considered to be final, accurate estimates. As you noted, however, the degree of discrepancy is the issue here, much larger than normal.

There are three principal sources of error here in the weekly data:

exports of distillates and other oils were underestimated in the weekly, while gasoline production, and other oils production were overestimated. Weekly stock levels were also underestimated.

Exports data are not collected by EIA; rather they are obtained in aggregate from monthly Census surveys. Hence, since these data lag the weekly reference period by up to 3 months, weekly estimates are derived from models, based on the historical monthly Census series. As a result, they tend to err actual exports, particularly when actual exports fluctuate significantly as they have since the beginning of this year, given strong economic incentives to ship large volumes of middle distillates to Europe and South America.

The gasoline and other oils weekly production overestimates are a direct result of significant hurricane disruptions to both physical oil flows in the Gulf of Mexico and oil company reporting accuracy."

I hope this helps.

Cheers,

c

Thanks! That fits with what I am seeing.

Some of the errors are consistent enough that a person can produce a better estimate themselves, just by looking at past history, and adjusting as if the recent errors are likely to repeat themselves.

P.S.GUPTA [SR EDITOR CONSULTING]

SUBJECT"; MONEY SPENT ON SECURITY ON SECURITY & ELDERS GIVE ADEQUATE RETURNS BY NATURE"

Private oil companies on undersea oil hunt will have to share the government's cost of providing security to men and infrastructure such

as floating platforms and specialised vessels they deploy off India's shores.

The government's decision comes in the wake of mounting terror threats, which have made guarding the country's offshore

assets an expensive proposition as more and more firms set sail in search of hydrocarbons treasure.

So far, only state-owned explorer ONGC has been chipping in with expenses incurred by defence forces for securing the seas and airspace around offshore installations like those anchored around the Mumbai High cluster of fields.

Now, private companies which are pumping or hunting for oil/gas will have to share the costs in ratio of their area of operation.

"The number of companies operating in offshore areas has risen considerably after six rounds of the government's acreage auctions. This means a huge exposure as offshore operations take huge investments that need to be secured. Besides terror or military threats, security also includes steps taken to ensure safety and avoid accidents from, say drifting ships hitting platforms," an oil company executive said.

The oil ministry will notify the decision in a month, which will be effective from April 2007. To start with, ONGC will pay upfront the entire oil industry's burden of the security expenses every year.

The companies operating in offshore areas will then pay their share to the flagship explorer through the Directorate General of Hydrocarbons, the regulator for exploration firms. However, only those firms which have deployed men and machines for six months will have to share the security costs.

Though private companies agree with sharing security costs, they want this to be treated as part of expenses towards starting commercial production from oil/gas fields. If government accepts the suggestion, it will allow them to recover share of security costs from revenues earned from hydrocarbons. While the jury is still out on this aspect, the government will make changes in the oilfield contracts to enable DGH to collect share from private companies operating in offshore areas.

At present, security of coastal or high-sea oil operations is dealt with through the Offshore Defence Advisory Group. ONGC spent Rs 27.5 crore on installing a vessel and air tracking system and spends Rs 1.26 crore every year on establishment cost of the group. All these and future recurring costs will have to be shared by private firms.

+++WHAT ABOUT ON SECURITY OF ELDERY SR RETIRED CITIZENS???

AWAITING VERDICT ON 25 TH FEB,2009 FROM COURT ABOUT ONGC MINDSET

+++ THE WORLD OIL CO,S WATCHING RESPONSE OF ONGC MINDSET????

P.S.GUPTA[SR EDITOR CONSULTING]ASIA, TOURING ASIA, says: Sub Water turns poison for growing Vegetables/fruits grown using industrial waste water. *There are no action on bylaws in india TO KEEP CHECK ON INDUSTRIAL WASTE LET OUT BY THE INDUSTRIES CAUSING HAVOC TO THE MASSES &BRING CHANGES TO LAWS at par with usa to act agaist offenders for not using industrial waste water for growing vegetables,since add to the poison intake,can harm to serious disorders in human body,specially the childern & the old.Bordering a grey putrid open drain filled with untreated industrial waste, Mahal looks like any other city in Delhi/mumbai/Calcutta/Ahmedabad/Madras etc yellow mustard fields, eagle-shaped water storage tanks and homes displaying photographs of young men who have migrated abroad. *In the government elementary school, an unusually high number of children complain of rashes and boils, housewives talk about a sharp rise in the number of miscarriages, and old men insist their hands and fingers are turning numb. *A major two-year study by PGIMER, Chandigarh, to probe the effects of industrial waste and pesticides on human health in 25 Punjab villages located near five open drains has come up with some startling findings. The study found varying degrees of DNA mutation in 65% of the blood samples taken. It also detected genetic damage in some cases. *That's not all. The drinking water in these cities/villages has turned toxic due to a high concentration of heavy metals such as mercury, copper, cadmium, chromium and lead. In Mahal, these chemicals have seeped into the village's groundwater from the polluted drain water causing these unlikely ailments. No surprise, there's also evidence of these metals entering the food chain. According to the study, pesticides have also been detected in vegetables, even in human milk and blood samples.For the residents of Mahal, the numbness, the miscarriages and the rashes are the price of living in a toxic hotspot. *There could be worse in store. The Principal investigator, Dr J S Thakur, outlines the possible scenario caused by genotoxicity, a condition in which lethal chemicals gather in the body leading to DNA damage. In future, more children will be born with congenital malformations — cleft lip, half or no skull, growth retardation. Pregnant women will have more sudden, "spontaneous" abortions. Instances of bone deformities, along with gastrointestinal, skin, dental and eye problems will rise. And so will cases of cancer. "There is clear evidence that irrigation of fields with highly contaminated drain water and exposure to pesticides is leading to reproductive and genotoxicity. The genetic damage may not be visible right now. But it will manifest itself in future," says Dr Thakur. *It wasn't always like this. Oldtimers in Mahal recall that before Partition, the drain was a cheery monsoon rivulet full of birds and fishes, where village boys often went for a swim. That's long changed. A recent study by the zoology department of Amritsar's Guru Nanak Dev University /delhi/mumbai/ahmedabad showed that the drain is now completely devoid of aquatic life. *The Tung Dhab drain, a subsidiary of Huddiara nala, runs parallel to Mahal's agricultural fields. Dr Thakur points out that the drinking water in these areas has turned highly toxic. People in parts of rural West Bengal have been drinking arsenic-laced ground water for decades and suffering the consequences. Arsenic can cause cancer. But the ground water in these parts of rural Punjab has many more deadly chemicals. Residents point out that water drawn from handpumps turns yellow in no time. *TIME HAS COME FOR HEALTH MINSTER/GOVT AGENCIES/REGULATORY BODIES TO CERTIFY *ALL INDUSTRIAL WATER TO BE TREATED THROUGH SAWAGE TREATMENT PLANTS *WATER TO BE USED BE CHECKED FOR REMOVAL OF SOLUBLE IMPURITIES USING R.O.PLANT *WATER IF FOUND FIT TO BE USED FOR GROWING VEGETABLE/FRUITS ONLY AFTER GETTING CERTIFICATE OF APPROVED LAB. *ALL OFFENDERS BE PUNISHED UNDER EXISTING LAWS,MEANWHILE LAWS BE MADE MORE STRICTER,SINCE 1,99,000 CRORES ARE BEING SPENT ON TREATING AILMENTS ARISING DUE TO POISON FOUND IN VEGETABLES/FRUITS. * NGO,S,COMMUNITY SERVICES,VILLAGE PANCHAIYTS,CITY WASTE WATER TREATMENT PLANTS,HEALTH SERVICES ,SWAMI RAMDEV JI,POLITICIANS FOR EDUCATING MASSES ,TO KEEP CHECK ON CAUSES RATHER THEN THE TREATMENT PART AS A STRATEGY TO MAKE INDIA HEALTHY.

6 Feb, 2009 l 2010hrs IST

{ ACT WITH A GESTURE OF RESPECT TOWARDS YOUE SR CITIZENS,ELDER PARENTS WHO WORKED TIRELESSLY FOR MAKING ONGC A TRUELY GLOBAL CO.

Subject: Re: ONGC TO ENSURE SENSE OF BELONGINGNESS,RESPECT & HONOUR TO THE RETIRED EMPLOYEES/OFFICERS AND NOT FORGET ROOTS RESPONSIBLE FOR ITS EXISTANCE SPENDING THERE LIFE TIME 40 TO 45 YEARS OF SERVICE.

--------------------------------------------------------------------------------

P.S.GUPTA[SR EDITOR CONSULTING],world affairs, says:

"SUBJECT ONGC GLOBAL OIL CO STILL LACKS ITS BONAFIDE IN LOOKING FOR ITS RETIRED EMPLOYEES TO ENSURE SENSE OF BELONGING TOWARDS ITS EXTENDED RETIRED EMPLOYEES FAMILY"

[1]* OIL & GAS CORPORATION IS STILL NOT ACCEPTED IN THE DEVELOPED WORLS,SINCE STILL HAS TO IMPROVE ITS IMAGE OF A WELFARE ORGANISATION TO LOOK ITS CONTRIBUTION TO THE SENIOR RETIRED EMPLOYEES.

AS COMPARED TO THE ARMY,RAILWAYS& OTHER GLOBAL OIL CO,s IN THE WORLD AND UNTIL IT SOLVES WELFARE PROBLEMS OF RETIRED EMPLOYEES , IMMEDIATELY,MAY NOT HELP IT TO BOOST ITS FAIR,DIGNIFIED IMAGE OF ACCEPTABILITY TO CATER SIMILIAR STATUS TO OUTSIDE WORLD, OF EARNED ITS REAL NAVRATNA STATUS.

[2] *GROUP INSURANCE POLIOCY FOR THE RETIRED EMPLOYEES, TO BE PAID BY THE ONGC AS A MORAL DUTIES TOWARDS HAVING SERVED WITH THERE LIFE CARRIER,THOUGH HAVE BEEN GETTING EXTREMELY LOW WAGES,AS COMPARED ON TODAY.

[3] * TO PROVIDE FAIR/RESPECTABLE PENSION + D.A TO MEET EVER RISING COSTS FOR THEM AND THERE DEPENDENTS,THOUGH GIVEN ON SMALLER THOUGHT TO EMPLOYEES JOINED BEFORE 1959 TERMED " AGRANI SAMAAN " ,SOME OF THE TOP EX EMPLYEES GETTING MISERABLE DUE TO PRICES TOUCHING THE ROOF.

[4]*LTA WITH SPOUSE ONCE IN A YEAR , OR AT PAR WITH RAILWAY.

[5] * ORGANISATION MUST INVOLVE IN PAYING HOMAGE TO ITS RETIRED EMPLOYEES IN THERE LAST RIGHTS INCLUDING SIMILIAR CONTRIBUTION TO ITS EMPLOYEES,THOUGH RETIRED NEEDED MORE ASSISTANCE.

[6]*COMMON DIRECTORY OF ALL RETIRED EMPLOYEES TO BE CREATED BY ONGC ON WEBSITE TO BE UPDATED BY EMPLOYEES WIH THRERE CPF NOS,INCLUDING FEEDBACK. THESE WERE SOME OF THE PARAMETERS ONGC IMAGE IS SUFFERING IN THE WORLD WHILE WINNING CONTRACTS THE WORLD OVER,HENCE NEEDS IMMEDIATE ATTENSION BOTH OF GOVT OF INDIA,AS WELL OF MINISTARY OF PETROLEUM FOR MEETING JUST MORAL VALUES TOWARDS THERE EXTENDED EMPLOYEES. '

[7]* FEEDBACK CHANNEL NEEDING ATTENSION.

[8]*DIRECTORY MUST INCLUDE RETIRED EMPLOYEES FREE TO SELECT [PAGES FOR REFERENCES.,;ongc may charge cost of directory from retired members if so like:

*ANY ORGANISATION NOT LOOKING INTEREST OF ITS RETIRED EMPLOYEES WHO GAVE THERE BLOOD TO GROWTH TO THE ORGANISATION,FORGOT HISTORY OF THE ROOTS,CAN NEVER STRENGTHEN,NEED IMMEDIATE ATTENSION OF MINISTARY FO PETROLEUM/GOVT OF INDIA FOR THE RIGHTFUL DECISION OF NAVRATNA RESPECTING HIGHEST VALUES WHO GAVE GLORY TO THE OIL & NATURAL CORPORATION OF INDIA.

+MANY OF THE EX ONGC,s ARE IN POSITION TO HELP EVEN MORE FOR ONGC/INDIA TO WIN MORE CONTRACTS BY VIRTUE OF ITS CONTACTS,BUT WHY NOT MAKE THEM RESPECTABLE FIRST.

MAY GOD BLESS THE BOARD OF DIRECTORS FOR BETTER WISDOM,UNDERSTAND REASONING,MORAL VALUES AND ENERGY FOR IMMEDIATE ACTION,AND CREATE SAME CO-ORDIAL HARMONY WITH THE ROOTS,SINCE THERE IS GENUINE FEELING OF TRUE FAITH OF THE RETIRED EMPLOYEES TO ITS CAUSE OF GROWTH, AS A WORLD GLOBAL CO.

1 Feb, 2009 l 0627hrs IST

ENTIRE INDIA APPRECIATE UPA GOVT HELPFUL & WISE DECISIONS WRT THR OLD & RETIRED SR CITIZENS FOR THERE PENSION IN RECENT BUDGET,WILL IT ADVICE TO ONGC TO MORE HUMBLE AS WELL.

--------------------------------------------------------------------------------

P.S.GUPTA SR EDITOR CONSULTING WORLD AFFAIRS, TOURING EU/USA, says: SUBINDIA WILL SAVE 39 BILLIONS DOLLERS IN OIL/GAS IN NEXT 5 YEARS IF ACTION TAKEN NOW "It also witnessed some very challenging times when the global rise in oil prices led to a spiral of price rise in commodities, resulting in higher inflation which we brought under control through prudent economic policies," India must start discussions by joint committe on policy matters for importing oil or have oil stakes in world oil exporting countries/world oil cos,can save nattion 39 billion dollers if action taken now rather then the world crude prices jump again. INDIA MUST DIRECT ONGC TO CORE AREA OF ITS OPERATION TO KEEP NATIONAL INTERESTS ABOVE,FAILING WHICH AGAIN IT WILL FACE HUMILATION OF BUYING OIL @ £95PER BARREL,145 doller a barrel, LOT OF OIL BLOCKS ARE AVAILABLE IN THE WORLD SUCH AS RUSSIA,SOUTH AFRICA,EGYPT,OMAN SOUDI ARABIA,MALAYSIA,IRAN,IRAQ ETC ETC , AT A VERY COMPETITVE PRICE IN THE OIL PRODUCING COUNTRIES,WHICH IS THE CORE SECTOR OF ONGC Bahrain: State Companies: The Bahrain National Oil Company (BANOCO), wholly owned by the Bahrain Government, and is the holding company for the Bahrain Petroleum Company (BAPCO) Joint Ventures: Bahrain National Gas Co. (Banagas) is owned 75% by the government of Bahrain, 12.5% by Caltex, and 12.5% by the Arab Petroleum Investment Corp. Bahrain Aviation Fueling Co. (Bafco) is the aviation refueling service at Bahrain International Airport. It is owned by Banoco, 60%; Caltex 27%; BP, 13% Original Concession Holders: Bahrain Petroleum Co. Ltd., an equal partnership of Texas Oil Co. and Socal, also offshore concession granted to Continental Oil Co. Continental Oil Co. of Bahrain, Continental Oil Co., Pure Oil Middle East Inc. (Union Oil of California) Major Foreign Oil Company Involvement: Harken Oil, of Grand Prairie, Texas, who is backed in part by Bass Enterprise Production Company of Fort Worth, Texas Harvard University, a major shareholder in Harken through an affiliate, and George W. Bush Iran: State companies: National Iranian Oil Company (NIOC) - oil and gas exploration and production, refining and oil transportation; National Iranian Gas Company (NIGC) – manages gathering, treatment, processing, transmission, distribution, and exports of gas and gas liquids; National Petrochemical Company (NPC) - handles petrochemical production, distribution, and exports. Original Concession Holders: Anglo Persian Oil Company, replaced in 1954 by Iranian Oil Participants Limited, a joint venture of British Petroleum, Jersey, Socony, Texaco and Socal, Gulf, Royal Dutch/Shell Group, Iricon Agency Ltd., Richfield Oil Corp., Signal Oil and Gas, Aminoil, Sohio, Getty, Atlantic Oil, Tidewater Oil, San Jacinto Petroleum Corp., and CFP Iran Pan American Oil Co., American International Oil Co. (Standard Oil of Indiana) Iranian Offshore Petroleum Co., Tidewater Oil, Superior Oil, Sunray DX, Cities Service, Kerr-McGee, Atlantic Richfield, Skelly Oil Lavan Petroleum Co., Atlantic Richfield, Murphy Oil, Sun Oil Co., Union Oil of California Major Foreign Oil Company Involvement: Gazprom Petronas Shell Total Recent Developments: (Concluded at least negotiations with): Elf Aquitaine Japex, the state-owned Japanese Exploration and Production Co., PetroCanada Ultramar (Canada) The U.S. Treasury has allowed two American companies (Chevron, Coastal) to import Iranian crude Iraq: State companies: The Oil Ministry oversees the nationalized oil industry through the Iraq National Oil Company (INOC). Autonomous companies under INOC include: State Company for Oil Projects (SCOP) - design and engineering of upstream and downstream projects; Oil Exploration Company (OEC) - exploration; Northern Oil Company (NOC) and Southern Oil Company (SOC) - upstream activities in northern/central and southern Iraq, respectively; State Organization for Oil Marketing (SOMO) - crude oil sales and OPEC relations; Iraqi Oil Tankers Company (IOTC) Original Concession Holders: Iraq Petroleum Company (Mosul Oil Company and Basrah Oil Company), Royal Dutch/Shell, Anglo-Persian, CFP, Exxon, Mobil, Atlantic Richfield, Gulf Oil Corporation, Standard Oil of Indiana [Amoco], and Participations and Explorations Corp., under auspices of the Near East Development Company. Recent Developments: U.S. previously operating in Iraq include Haliburton, Howe-Baker Engineering Inc., Mobil Oil, and Pullman-Kellogg. Iraq's State Oil Marketing Organization (SOMO), -- pending U.N. approval --is in discussions with: U.S. companies Coastal Corp., Phoenix, Chevron Corp. and Mobil Corp. Iraq has current contracts with Coastal, Russian Sidanco and France's Total S.A. The Oil Daily reports that Shell, BP, Chevron, and Coastal are among the companies interested in buying Iraqi crude Kuwait: State Companies: Subsidiaries of Kuwait Petroleum Corp. include: Kuwait Oil Co. (KOC), Kuwait National Petroleum Co., Petrochemical Industries Co. (PIC), Kuwait Oil Tanker Co., Kuwait Foreign Petroleum Exploration Co. (Kufpec), and Kuwait Petroleum International (KPI, London) Original Concession Holders: Kuwait Oil Co. Ltd., subsidiary of BO (Kuwait) Ltd., and Gulf Kuwait Co., Kuwait Shell Development Co. Ltd., owned by Royal Dutch/Shell Group For Kuwaiti portion of Neutral Zone: Offshore: Arabian Oil Company Limited, Japan Petroleum Trading Co. Ltd. Onshore: American Independent Oil Co., joint venture of Phillips Petroleum, Signal Oil and Gas, Ashland, J.S. Abercrombie, Sunray Mid-Continent Oil Co., Globe Oil and Refining Co., and Pauley Petroleum Inc. Major Foreign Oil Company Involvement: British Petroleum Co. Plc Chevron Getty Oil Co. Gulf Oil Japan's Arabian Oil Co. (AOC) Mobil Corp. Royal Dutch/Shell, Shell International Petroleum Co. Ltd. Texaco Total Oman: State companies: Petroleum Development Oman Ltd. (PDO) controls all oil resources. Oman Oil Company (OOC) is the overseas investment arm of the Ministry of Petroleum, until recently headquartered in Houston and headed by John Deuss Joint Ventures: Petroleum Development Oman Ltd. (PDO) controls all oil resources. PDO is a partnership between the Omani government (60%), Shell Petroleum Co. Ltd. (34%), Total-CFP (4%), and Partex (Oman) Corp. (2%) CXO Ltd. Is a joint venture of Oman Oil Co. Ltd. and Caltex Original Concession Holders: Petroleum Development (Oman) Ltd., Shell Group, CFP, Participations and Explorations Corp., and John W. Mecom Mecom-Pure-Conoco, John W. Mecom, Pure Oil, Continental Oil Major Foreign Oil Company Involvement: There are two American concessionaires: Occidental/Gulf and Amoco. Ashland Oil manages Oman's sole refinery, and U.S. firms lift Oman's crude. Qatar: State Companies: The Qatar General Petroleum Corporation (QGPC) Joint Ventures: QGPC owns 65% of Qatar Liquefied Gas Co. (QatarGas) the rest of the interest is divided among France's Total SA. (10%), Mobil Qatar Gas Inc. (10%), Mitsui & Co. Ltd. (7.5%), and Marubeni Corp. (7.5%) QatarGas Upstream, partners are Total, 20%, Mobil 10%, and Mitsui and Marubeni, 2.5 each QGPC holds 66.5% of Ras Laffan LNG Co. (RasGas); Mobil 26.5 ; the Japanese companies Itochu Corp. and Nissho Iwai, respectively, 4% and 3% Qatar Vinyl Co. (25.5% QGPC, 31.9% Qapco, 29..7% Norsk Hydro, and 12.9% Elf Atochem) Qatar Fuel Additives Co. (50% QGPC, 20% Chinese Petroleum Corp., 15% Lee Chang Yung Chemical Industry Corp., and 15% International Octane Ltd.) Original Concession Holders: Continental Oil Co. of Qatar, Continental Oil Co., Pure Oil Middle East Inc. (Union Oil of California) Anglo Saxon Petroleum Company, Shell Major Foreign Oil Company Involvement: ARCO Qatar Inc., (as operator for a consortium of Germany's Wintershall A.G. and Preussag A.G., British Gas Co., and Gulfstream Resources Canada Ltd. of Calgary) Chevron Over-seas Petroleum (Qatar) Ltd. and its partner Magyar Olaj Gazi (MOL), the Hungarian Oil & Gas Co. Ltd. Elf Petroleum Qatar. Enron Maersk Oil Qatar Co. Marubeni Methanex Corp. (Vancouver) Mitsui Mobil Oil Qatar Mobil, MOL Occidental Petroleum of Qatar Ltd.. Pennzoil Qatar Oil Co. Phillips Petroleum Co. Royal Dutch Shell Wintershall Saudi Arabia: State Companies: Saudi Aramco Samarec Petromin Petromin Lubricating Oil Refining Co. (Luberef), [Mobil Oil Corp. holds a minority interest in this company] Petromin Lubricating Oil Co., Saudi Arabian Basic Industries (Sabic) Original Concession Holders: Arabian American Oil Company, Socal, Texas Oil, Jersey, Socony-Vacuum For Saudi portion of Neutral Zone: Getty Oil Co., Japan Petroleum Trading Co. Joint Ventures: Star Enterprise (U.S.) Saudi Refining Inc. (50%), Texaco (50%); Ssangyong Oil Refining Co. (S. Korea) Saudi Aramco (35%), Ssangyong (65%); Luberef - Mobil (30%) and Petrolube - Mobil (29%) Samref, an export fuels company- Mobil is a 50% shareholder Subsidiaries: Aramco Services Co.. (Houston), Aramco Overseas Co. (Netherlands), Saudi Petroleum International Inc. (New York), Saudi Petroleum Overseas Ltd. (London/Tokyo) Major Foreign Oil Company Involvement: Mobil Shell UAE: State Companies: Abu Dhabi National Oil Company (ADNOC) has controlling interest in 21 domestic oil and natural gas companies. Joint Ventures: Abu Dhabi Co. for Onshore Oil Operations (ADCO) is held by ADNOC (60%) and a consortium comprising British Petroleum (BP) (9.5%), Shell (9.5%), Total (9.5%), Exxon (4.75%), Mobil (4.75%), and Partex (2%). Abu Dhabi Marine Operating Company (ADMAOPCO) is held by ADNOC (60%) and a consortium comprising BP (14.7%), Total (13..3%), and Japan's Jodco (12%). Zakum Development Company (ZADCO) is operated by ADNOC (88%) and a consortium (12%) comprising BP, Jodco, and Total Original Concession Holders: Union Oil Co., venture of Union Oil Co. and Southern Natural Gas Co. Abu Dhabi Marine Areas Ltd., BP, CFP, Continental Dubai Marine Areas Ltd., Continental Oil, BP, CFP, Deutche Erdol AG, Sun Oil Co. Phillips-AGIP-Aminoil, joint venture of Phillips, AGIP, and Aminoil Major Foreign Oil Company Involvement: BP Caltex Petroleum Corp., Miutsui & Co. Ltd. Parrex Pennzoil Shell Gas BV Total BUT SORRY IT IS LOST IN DOWN STREM UNITS WHICH WILL DO NO GOOD TO ONGC OR INDIA, THIS ISTHE TIME FOR TOTAL REVIEW OF POLICIES FOLLOWED BY THE GOVT OF INDIA APPOINTED INDEPENDENT DIRECTORS FOR HIRING BLOCKS NOW,SINCE SUCH A OPPORTUNIST TIME WILL NEVER COME SINCE OIL IS SELLING AT NEAR LOWER PRICE & WILL START JUMPING AGAIN; EXAMPLE A RUSSIAN COMPANY which has Oil Leaseholds in the Lower Volga Region of the Russian Federation BUSINESS OPPORTUNITY OF THE COMPANY Client owns an oil exploration company (the "Company") in the Lower Volga area of Russia, which has two oil exploration licenses, one that covers an area of approximately 12 km2 ("Area A") and a second of 102 km2 ("Area B"). The licensed areas are in an area adjacent to the Caspian Sea with geological trends of reef structures that remained after the pre-historic seas retreated. These licensed areas show very promising geological, seismic results and tests show evidence of significant oil and gas reserves. COMPANY The Company was organized in 1998 to explore the region for hydrocarbon deposits. The principals of the Company have excellent knowledge and experience with hydrocarbon geology of the region and good industry and political connections. The Company received a license for additional exploration (there had been previous exploratory work) in 1999 for Area A and an exploration license in 2000 for Area B. The Company has officially certified the discovery of oil in Area A, which is the last step to obtain a license to exploit the reserves. The licensed areas lie along the east (left) bank of the Volga River, both onshore and offshore. The Company is a privately held, Russian registered company with four shareholders and two subsidiaries. GEOLOGY The licensed areas are in a region characterized by reef structures that were left after retreating historic seas. These reef areas collected organic compounds and were later covered by sediments. The hydrocarbons generated appear to have a large reservoir thickness and high pressure, which should produce excellent productivity. The petroleum exploration of the licenses has focused on Devonian age structures and to a lesser degree Carboniferous age. New seismic data has confirmed more than one trend in the Devonian reefs, which extend under the Volga. These are estimated to have a potential for 43.5 million tons of oil with 19.2 million tons recoverable and 6.8 billion m3 of natural gas of which 3.1 billion m3 are expected to be recoverable. The Carboniferous potential is small by comparison with an estimated 122 thousand tons of oil estimated recoverable (only in Area A).. As a reference point, an existing reef deposit 10 kilometers to the south of the Company's license areas produces 870,000 tons of oil per year (17,500 barrels per day). Four wells have been drilled in the two license areas. A well was drilled in 2002 in Area A to a depth of 3,350 meters, which identified oil producing layers at 3,122 meters (1.3 meters thick) and 3,153 meters (9.2 meters thick). A second well was previously drilled in Area A by another company. This well was purchased by the Company and perforated in the same layers as the first. A well was drilled in Area B to 3,800 meters that hit the edge of the deposit and identified water-oil contact. Oil was found at 3,227 meters. The well can be further explored through sidetracking. A second well was drilled in Area B in 2004 to 3,500 meters. A productive layer was discovered at the foot of the well, but rock porosity was very low Established resources of hydrocarbons available on those oilfields AREA A OIL C1 GAS Reserves of Hydrocarbon 339 000 tons 50 million m3 Recoverable Hydrocarbon 122 000 tons 18 million m3 AREA B OIL C3 GAS Reserves of Hydrocarbon 42 836 000 tons 6 810 million m3 Recoverable Hydrocarbon 19 121 000 tons 3 123 million m3 MARKET AND INFRASTRUCTURE The region where the Company's licenses are located has produced over 67 million tons of oil and a billion cubic meters of natural gas over the past 55 years... While the west bank of the Volga River in the region has been largely explored, the east bank is less developed. The fastest and the least capital consuming output gain of hydrocarbons in the region is possible in the areas near the banks of the Volga. The industrial output of oil and gas in the region is now concentrated in the near east bank of the Volga. These areas are characterized by high resource potential, relatively shallow oil and gas deposits, and thorough exploration. Consequently new reserves in these areas can be put into industrial operation within 1-2 years. There is a well developed pipeline and refinery infrastructure in the area. The region's advantageous geographic location, availability of considerable natural, technical, and scientific resources; and well balanced industrial and agricultural economy make it one of the most developed in Russia. FINANCIAL INFORMATION To date, the Company has been engaged in the exploration of its licensed areas and therefore has had no revenues. The Company will require substantial investments to continue exploration and development of its licenses. OPPORTUNITY FOR POTENTIAL BUYER This is an opportunity to acquire an oil company in an area with very good geological exploration information and in a region of Russia with a high level of proven production. This is an ideal opportunity for an international or Russian oil and gas exploration company to acquire potential new reserves. "ongc present strategy" ONGC has refused deputation of its employees to OMEL and OMESL and has stopped the JVs from opening an office in Delhi or recruit people here. On ONGC losing trained manpower to private players, director AK Balyan said there was no reason for alarm as fresh talent was being inducted continuously and skillsets of existing manpower was continuously upgraded through training programmes. "Exit of any trained manpower impacts the company but it is not critical," Mr sharma CMD of ONGC said. "WHAT ONGC/INDIA spent on import of oil from 2002 to 2007 india's crude oil import bill is likely to rise by 10 per cent to $13.25 billion in 2002-03 while the country is projected to remain in net deficit in liquefied petroleum gas (lpg) production in 2002-07. india is likely to import 95.159 million tonnes of crude oil in 2002-03 as opposed to current year estimate of 72-75 million tonnes, according to planning commission's 10th five year plan working group report. demand for petroleum products is likely to inch to 107.09 million tonnes in 2002-03 as compared to 103.03 million tonnes consumption likely in 2001-02.. the country would be surplus in petrol, diesel, jet fuel (aviation turbine fuel) and naphtha but would have to import 1.275 million tonnes of lpg, valued at $272 million, in 2002-03. lpg imports in 2003-04 are likely to be 1.587 million tonnes ($339 million), 1.539 million tonnes ($329 million) in 2004-05, 2.430 million tonnes ($519 million) in 2005-06 and 3.391 million tonnes ($724 million) in 2006-07. the foreign exchange outgo on import of 105.443 million tonnes of crude oil in 2003-04 would be $14.68 billion. import of 113.58 million tonnes of crude in 2004-05 would be $15.82 billion, 113.751 million tonnes in 2005-06 would cost $15.845 billion and import of 113.038 million tonnes in 2006-07 would cost the country $15.746 billion. demand for petroleum products is estimated to rise to 111.231 million tonnes (mt) in 2003-04, 113.586 mt in 2004-05, 118.662 mt in 2005-06 and 123.644 mt in the terminal year of 10th five year plan (2006-07). india's self-sufficiency in crude oil production would peak to 30.3 per cent in 2002-03 then decline to 29.3 per cent in 2003-04 and ultimately to 26.7 per cent in terminal year. during the 10th plan period, demand for lpg is likely to rise by 8.2 per cent. from 8.055 mt consumption in 2001-02, demand for lpg is likely to go up to 8.766 mt in 2002-03, 9.528 mt in 2003-04, 10.310 mt in 2004-05, 11.123 mt in 2005-06 and 11.966 mt in 2006-07. diesel demand is pegged to rise by 5.6 per cent in 2002-07, increasing from 39.815 mt in 2001-02 to 42.146 mt in 2002-03, 44.508 mt in 2003-04, 46.966 mt in 2004-05, 49.555 mt in 2005-06 and 52.324 mt in 2006-07. petrol is likely to witness a steeper 7.3 per cent growth in the five year period, going up from 7.07 mt in 2001-02 to 7.620 mt in 2002-03, 8.202 mt in 2003-04, 8.813 mt in 2004-05, 9.419 mt in 2005-06 and 10.067 mt in 2006-07. india is likely to export 2.820 mt ($439 million) of petrol in 2002-03, 2.751 mt ($429 million) in 2003-04, 2.613 mt ($407 million) in 2004-05, 2.210 mt ($344 million) in 2005-06 and 1.463 mt ($228 million) in 2006-07. diesel exports are likely to be 7.186 mt ($1.005 billion) in 2002-03, 10.12 mt ($1.416 billion) in 2003-04, 13.75 mt ($1.924 billion) in 2004-05, 11.65 mt ($1.63 billion) in 2005-06 and 8.34 mt ($1.168 billion) in 2006-07. pti crude oil import bill pegged at $13.25 bn new delhi: india's crude oil import bill is likely to rise by 10 per cent to $13.25 billion in 2002-03 while the country is projected to remain in net deficit in liquefied petroleum gas (lpg) production in 2002-07. india is likely to import 95.159 million tonnes of crude oil in 2002-03 as opposed to current year estimate of 72-75 million tonnes, according to planning commission's 10th five year plan working group report. demand for petroleum products is likely to inch to 107.09 million tonnes in 2002-03 as compared to 103.03 million tonnes consumption likely in 2001-02. the country would be surplus in petrol, diesel, jet fuel (aviation turbine fuel) and naphtha but would have to import 1.275 million tonnes of lpg, valued at $272 million, in 2002-03. lpg imports in 2003-04 are likely to be 1...587 million tonnes ($339 million), 1.539 million tonnes ($329 million) in 2004-05, 2.430 million tonnes ($519 million) in 2005-06 and 3.391 million tonnes ($724 million) in 2006-07. the foreign exchange outgo on import of 105.443 million tonnes of crude oil in 2003-04 would be $14.68 billion. import of 113.58 million tonnes of crude in 2004-05 would be $15.82 billion, 113.751 million tonnes in 2005-06 would cost $15.845 billion and import of 113.038 million tonnes in 2006-07 would cost the country $15.746 billion. demand for petroleum products is estimated to rise to 111.231 million tonnes (mt) in 2003-04, 113.586 mt in 2004-05, 118.662 mt in 2005-06 and 123.644 mt in the terminal year of 10th five year plan (2006-07). india's self-sufficiency in crude oil production would peak to 30.3 per cent in 2002-03 then decline to 29.3 per cent in 2003-04 and ultimately to 26.7 per cent in terminal year. during the 10th plan period, demand for lpg is likely to rise by 8.2 per cent. from 8.055 mt consumption in 2001-02, demand for lpg is likely to go up to 8.766 mt in 2002-03, 9.528 mt in 2003-04, 10.310 mt in 2004-05, 11.123 mt in 2005-06 and 11.966 mt in 2006-07. diesel demand is pegged to rise by 5.6 per cent in 2002-07, increasing from 39.815 mt in 2001-02 to 42.146 mt in 2002-03, 44.508 mt in 2003-04, 46..966 mt in 2004-05, 49.555 mt in 2005-06 and 52.324 mt in 2006-07. petrol is likely to witness a steeper 7.3 per cent growth in the five year period, going up from 7.07 mt in 2001-02 to 7.620 mt in 2002-03, 8.202 mt in 2003-04, 8.813 mt in 2004-05, 9.419 mt in 2005-06 and 10.067 mt in 2006-07. india is likely to export 2.820 mt ($439 million) of petrol in 2002-03, 2.751 mt ($429 million) in 2003-04, 2.613 mt ($407 million) in 2004-05, 2.210 mt ($344 million) in 2005-06 and 1.463 mt ($228 million) in 2006-07. diesel exports are likely to be 7.186 mt ($1.005 billion) in 2002-03, 10.12 mt ($1.416 billion) in 2003-04, 13.75 mt ($1.924 billion) in 2004-05, 11.65 mt ($1.63 billion) in 2005-06 and 8.34 mt ($1.168 billion) in 2006-07. 2008 TO MARCH 2009 Decline in capital inflows as a result of ongoing global financial turmoil may see India's foreign exchange reserves depleting by $39 billion during 2008-09, says a report by global banker Goldman Sachs. India's foreign exchange reserves, which were around $310 billion in March 2008, have been declining steadily and may go down to $271 by the close of current financial years, the report said. The decline would mainly be on account of rising current account deficit, it said, adding "capital inflows fell to $13.2 billion (in Q1 2008-09) from $17.3 billion in Q1 of 2007-08 and $25.4 billion in the previous quarter (Jan-March)." As per the latest RBI data, the country's foreign exchange reserves declined to $292 billion as on September 19, 2008, which can be attributed to higher trade deficit and declining portfolio investment. Pointing out that the current account deficit will remain high during the year, the Goldman Sachs report said, "it would be a bigger concern with oil at $150 a barrel than at current prices.." It further added, "with oil prices coming off substantially, one of the biggest threats to the current account deficit has been alleviated." Even in the event of a sudden stop in capital flows, the report said, country's buffer of forex reserves would be sufficient to fund the current account and external debt payments. At $271 billion in March 2009, the report said, the country would have sufficient reserves to meet 10.3 months of import bill, down from 15 months of imports in March 2008. * ONGC TO OPERATE ONLY IN EXPLORATION & DRILLING FOR OIL/GAS AS ITS CORE AREA OF OPERATION. * AROUND THE WORLD NOW WITH 75 % FUNDING BY THE GOVT OF INDIA & REST BY ONGC. *TO PRODUCE 70 % OF TOTAL PRODUCTION FROM STAKE SALE *IN FOREIGN COUNTRIES TO BE PRODUCING 30 % FROM ITS EXITING FIELDS. * ONGC MUST PREPARE ITS TALENT OF SCIETIFIC AND TECHNICAL MANPOWER INCLUDING RETIRED SINCE THEY ARE EXPERIENCED FOR 30 TO 40 YEARS AND MADE ONGC WHAT IT IS TODAY. *ONGC MUST HAVE ON BOARD THE ex scirtists/engineers SCIETISTS/PRODUCTION/DRILLING ENGINEERS TO AVOID VACCUM. ONGC GLOBAL OIL CO STILL LACKS ITS BONAFIDE IN LOOKING FOR ITS RETIRED EMPLOYEES TO ENSURE SENSE OF BELONGING TOWARDS ITS EXTENDED RETIRED EMPLOYEES FAMILY OIL & GAS CORPORATION IS STILL NOT ACCEPTED IN TH DEVELOPED WORLS,SINCE STILL HAS TO COME OUT OF ITS IMAGE OF A WELFARE ORGANISATION TO LOOK ITS CONTRIBUTION TO THE SENIOR RETIRED EMPLOYEES AS COMPARED TO THE ARMY,RAILWAYS& OTHER GLOBAL OIL CO,s IN THE WORLD AND UNTIL IT SOLVES THEM IMMEDIATELY,MAY NOT HELP IT TO BOOST ITS FAIR,DIGNIFIED IMAGE OF ACCEPTABILITY TO CATER SIMILIAR STATUS FOR OUTSIDE WORLD, ON THE FOLLOWING PROBLEMS STILL NOT RESOLVED: * WHY NOT CREATE A TERRITORAIL ARMY OF ONGC SCIENTIFIC/TECHNICAL TO BE USED FOR FOREIGN ASSIGNMENTS ,EMERGENCY OPERATIONS WHEN NATION NEEDS WHERE RETIREMENT AGE IS 75 YEARS,SINCE ONGC WILL SAVE LOT OF MONEY,TO BE USED AS SPECIALISED CONSULTANTSANY WHERE / EVERY WHERE,BEING DONE BY ALL REPUTED GLOBAL CO,S. *TO MEET SOCISL NEEDS,CLUB FACILITIES BE EXTENDED &COMMON MEETING PLACES TO BE DEVELOPED WHERE MORE THEN 250 MEMBERS RESIDE. *INSURANCE POLIOCY FOR THE RETIRED EMPLOYEES, TO BE PAID BY THE ONGC AS A MORAL DUTIES TOWARDS HAVING SERVED WITH THERE LIFE CARRIER,THOUGH GETTING LOW WAGES,AS COMPARED ON TODAY. * TO PROVIDE FAIR PENSION + D.A TO MEET EVER RISING COSTS FOR THEM AND THERE DEPENDENTS,THOUGH GIVEN ON SMALLER THOUGHT TO EMPLOYEES JOINED BEFORE 1959 TERMED " AGRANI SAMAAN " *LTA WITH SPOUSE ONCE IN A YEAR OR TWO,INDIA AND ABROAD. * ORGANISATION MUST INVOLVE IN PAYING HOMAGE TO ITS RETIRED EMPLOYEES IN THERE LAST RIGHTS INCLUDING SIMILIAR CONTRIBUTION TO ITS EMPLOYEES,THOUGH NEEDED MORE SINCE THEY ARE ARE ALREADY RETIRED. *REMEMBERING THOSE IN THERE LAST JOURNEY & SUPPORTING WITH MORAL AND FINANCIAL SUPPORT BY THERE RESPECTIVE UNITS OF PROJECT SITUATED ,THUS ENSURING BELONGINGNESS TO ONE EXTENDED FAMILY. *ONGC MUST ENSURE ITS MORAL RESPONSIBILITY FOR BETTERMENT OF ITS EXTENDED FAMILY IN ITS ABOVE STATED WELFARE BESIDES CERTAIN NICEST THINGS LIKE MEDICAL , GLASSES,TOOTH MEDICATION AND PROVIDING EAR LISTENING DEVICE *COMMON DIRECTORY OF ALL RETIRED EMPLOYEES TO BE CREATED BY ONGC ON WEBSITE TO BE UPDATED BY EMPLOYEES WIH THRERE CPF NOS,INCLUDING FEEDBACK. THESE WERE SOME OF THE PARAMETERS ONGC IMAGE IS SUFFERING IN THE WORLD WHILE WINNING CONTRACTS THE WORLD OVER,HENCE NEEDS IMMEDIATE ATTENSION BOTH OF GOVT OF INDIA,AS WELL OF MINISTARY OF PETROLEUM FOR MEETING JUST MORAL VALUES TOWARDS THERE EXTENDED EMPLOYEES. ' * ONGC MUST HAVE RETIRED EXPERTS IN THE TERRORIAL ARMY,SINCE THE RETIRING AGE IN THE WET IS 75 YEARS & INDIA LOOSING OPPORTUNITY BENEFITS OF POOL OF ITS EXPERIENCED PERSONS. *ONGC SHOULD FUNCTION ON 3/5 YEARS CONTRACT SYSTEM AT PAR WITH THE WEST TO REMAIN IN COMPITION TO SERVE INDIA WITH BEST TALENT. * I THINK ONGC HAS FORGOTTEN ITS ROOTS OF ITS SENIOR NOT MAKING THEM ON THE BOARD AND UTALISING THERE TALENTS. *ONGC MUST HAVE UNDERGROUNG RESERVE OF RCUDE OIL OF THE ORDER MAINTAINED BY USA TO MEET DIFFICULT TIME,ALLOW buildind STORAGE by REFINERIES IMMEDIATELY, WHY ONGC/GOVT OF INDIA NOT HAVING LONG TERM CONTRACTS SIGNED NOW,IS IT WAITING FOR OIL PRICES TO JUMP AGIN WHY IT IS NOT EXPEDITING GAS CONTRACTS/LNG/LPG FOR NEXT 5/10 YEARS? WHERE IS THE ENRGY COMMITTEE FINDINGS/PLANNING COMMISSION STRATEGIES TO DEAL TOMARROW? WHERE IS THE CRASH PROGRAMME TO DEAL WITH ENERGY UNTIL NUKE POWERED PLANTS COME BY 2030. WHY INDIA GOING SLOW TO FINALISE CONTRACTS WITH USA & the west for high technology nuke powered technology, OBAMA IS ALL AGREEABLE FOR TOTAL FUNDING ON 20 YEARTS BASIS ON ZERO INTEREST,let the experts work on it till the politicians are fighting politics, sure prime minster MR MANMOHAN SINGH WILL BE SERIOUS NOW WITH ALARM BELL RINGING. "WHY GOVT OF INDIA MINISTARY/INDEPENDENT DIRECTORS NOT ASKING ONGC TO REPLY TO ABOVE STRATEGY TO KEEP INDIA FACE FROM SKY HIGH PRICES,NOW NOT WHEN THEY ARE IMPOSSIBLE? THE POINT IS PREPAREDNESS ON PART OF GOVT/PLANNING

******* IT IS TIME FOR THE GOVT OF INDIA TO WAKE-UP CALL OF THERE ELDERS ADVICE TO SAVE THE DEMOCRATIC INDIA,WOULD BE SUPER POWER TOMAROW FOR CONSULTIVE,COORDINATED,ACTION ORIENTED& RESULT PRODUCING ACTIONS TO SAVE 39 BILLION DOLLERS,IMMEDIATELY AS PER WORLD SCIENTIST/ENGINEERING TECHNOCRATS BRILLINAT REPORT,NOT MEARLY LYING IN POLITICAL FILES/CORRIDOR OF POLITICS.****************************************************************************************