World Oil Production Peaked in 2008

Posted by ace on March 17, 2009 - 9:15am

As everyone knows, there is never a post on The Oil Drum that the entire staff agrees on. Nonetheless, Tony bases his findings on solid research, and a staff survey shows that most agree with a 2008 peak. A post discussing whether an alternate scenario with a second later peak might be feasible is planned for later.

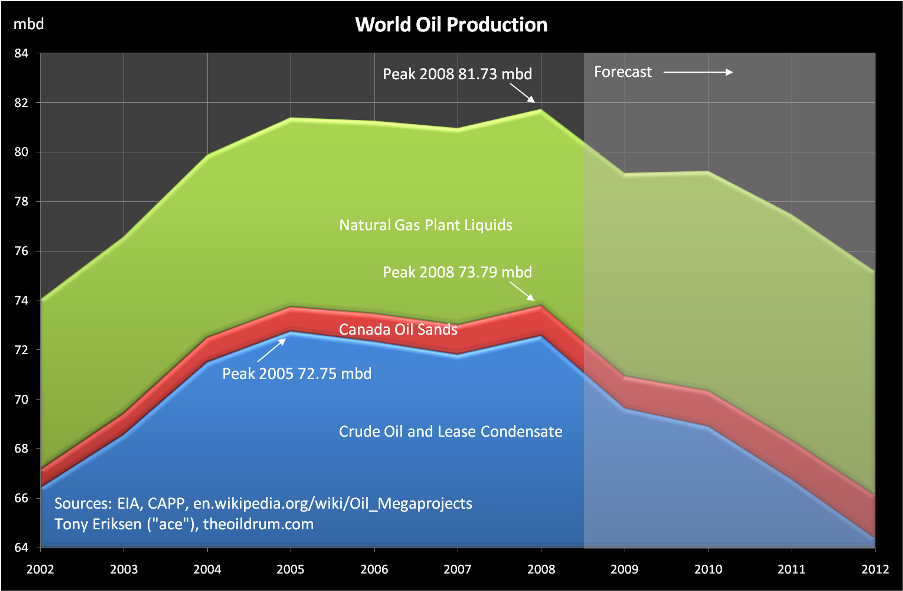

World oil production peaked in 2008 at 81.73 million barrels/day (mbd) shown in the chart below. This oil definition includes crude oil, lease condensate, oil sands and natural gas plant liquids. If natural gas plant liquids are excluded, then the production peak remains in 2008 but at 73.79 mbd. However, if oil sands are also excluded then crude oil and lease condensate production peaked in 2005 at 72.75 mbd.

The US Energy Information Administration (EIA) and the International Energy Agency (IEA) should make official statements about declining world oil production to renew the focus on oil conservation and alternative energy sources.

![]()

World Oil Production

Both natural gas plant liquids and Canada oil sands production are expected to grow over the near term. Much of the growth of natural gas plant liquids comes from OPEC. Non OPEC oil production peaked in 2004 and is forecast to decline at a faster rate in 2009 and beyond due mainly to big declines from Russia, Norway, the UK and Mexico. OPEC has the ability to increase production later this year and in early 2010. Although key OPEC producer Saudi Arabia peaked in 2005, it probably has sustainable annual surplus capacity of 1 mbd. Iraq and possibly Nigeria also have potential to increase production but these countries continue to have serious internal conflicts. By the time 2011 arrives, OPEC will not have the ability to offset cumulative non OPEC declines and world oil production is forecast to stay below its 2008 peak.

The forecast assumes that prices will rise, causing OPEC to produce more oil which explains why the 2010 forecast is slightly greater than that in 2009. If world oil demand drops further, OPEC might not increase production causing 2010 production to be lower than 2009. It is also assumed that OPEC complies with 85% of cumulative announced cuts of 4.2 mbd. This compliance is assumed from March to June of 2009. At the March 15 OPEC meeting, no additional cuts were announced, there was 80% compliance to cumulative cuts in February and full compliance remains the target by May which would reduce OPEC-11 production by another 0.8 mbd.

My forecasting method aggregates forecasts from all oil producing countries, taking into account forecast field production profiles from existing and new oil projects. Colin Campbell uses a similar forecasting method but does not directly take into account the timing of new oil projects. Nevertheless, as peak oil has passed, new oil projects can only serve to slow the production decline rate. Consequently, Campbell has also stated that peak oil was in 2008, excluding bio-fuels. Another method used to estimate the peak production year is to use this oil project database to derive totals of future annual supply additions. As these additions are insufficient to offset future existing field decline, this indicates that oil production peaked in 2008, excluding bio-fuels.

Another similar forecast which incorporates forecast production profiles from giant oil fields is Fredrik Robelius' worst case scenario from his 2007 thesis. He used actual production data to 2005 and said that "the worst case scenario peaks at just above 83 mbd in 2008", excluding bio-fuels. This scenario has closely tracked actual data since 2005 and assumes a 7% annual decline rate for production from existing non giant oil fields as at the end of 2005, delays of many large projects and low recoverable oil reserves for some giant oil fields. There are just over 500 giant oil fields in the world, each with at least 500 million barrels recoverable oil. More support is provided for his worst case scenario as Robelius' original forecast for deepwater production was for a peak of almost 9 mbd in 2012. Now it appears that deepwater production entered a 7 mbd peak plateau in 2008 due partly to decline rates as high as 20% per year from mature deepwater oil fields.

Peak oil production often occurs when about half of the initial recoverable oil reserves are produced. In the US, production from the lower 48 states peaked in 1970 when 52% of the oil reserves were produced. In this forecast of crude and condensate, the peak production occurred in 2005 which coincidentally happened when 52% of world crude and condensate reserves were produced. If Campbell's world reserves estimates are used then 49% of world oil reserves would have been produced in 2005. The discovery of future oil reserves will decrease these percentages and will also help to slow the production decline rate.

![]()

World Liquids Production

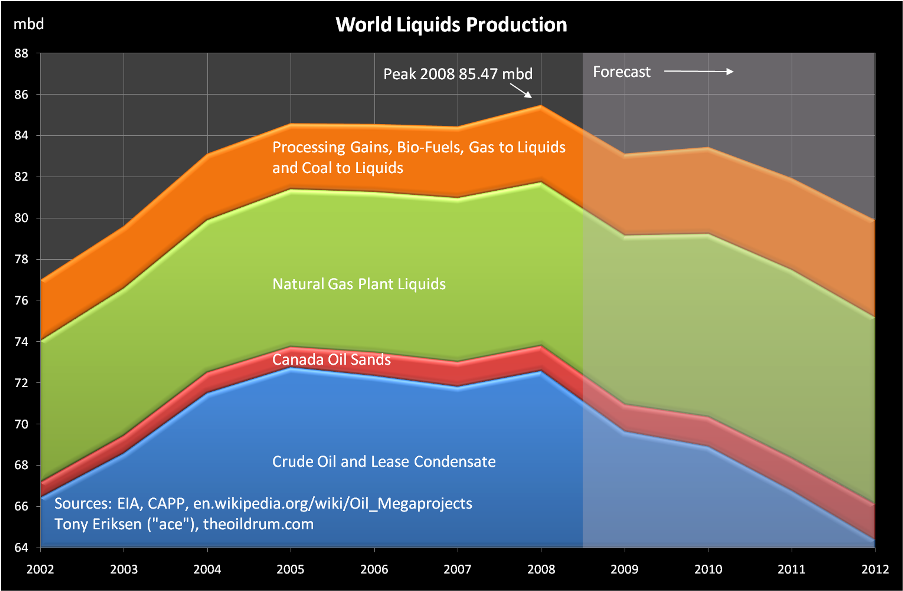

The definition of oil used by the International Energy Agency (IEA) also includes bio-fuels, processing gains and other liquids derived from natural gas and coal. Although bio-fuels production has been growing exponentially, world liquids production has probably passed peak in 2008 at 85.47 mbd as shown below. In 2008, US ethanol production was 0.6 mbd, Brazilian ethanol production was 0.4 mbd, and bio-fuels production outside the US and Brazil was 0.5 mbd.

Processing gains arise at refineries when crude oil is processed into products which have a lower density causing an increase in volume when measured in barrels. Processing gains are proportional to the volume of the crude oil inputs. In 2008, the IEA estimated that processing gains were 2.2 mbd, excluding gains from China and non-OECD Europe. As crude oil and condensate peaked in 2005, it is expected that future contributions from processing gains will decrease.

Production from gas to liquids (GTL) and coal to liquids (CTL) has been increasing but from a very small base and remains negligible. GTL is about 0.10 mbd in 2009 and is expected to increase to 0.27 mbd by the end of 2012. CTL is about 0.20 mbd in 2009 and should increase only marginally by the end of 2012. Liquids production from GTL and CTL has significant energy losses and high carbon dioxide emissions implying that it is probably preferable to directly burn the gas and coal to produce electricity.

As production from bio-fuels, oil sands and natural gas plant liquids increase there is a slight chance that world liquids production in 2010 might be close to its 2008 peak. However, given the suspension of many crude oil and oil sands projects, it is likely that future world liquids production will stay below its 2008 peak and that the world urgently needs to adopt policies to reduce consumption and focus on alternative energy sources.

In contrast, the IEA WEO 2008 forecasts that total liquids production will increase steadily to 106.4 mbd in 2030, excluding bio-fuels. Similarly, the ExxonMobil Energy Outlook 2008 forecasts total liquids to be 108 mbd by 2030, including bio-fuels. Even these two forecasts have now been cast in doubt as Cambridge Energy Research Associates (CERA) have stated this month that, due mainly to the credit crisis and low oil prices causing significant oil project delays, world liquids production could be reduced by almost 8 mbd in five years. In five years, the production forecasts of both IEA and ExxonMobil indicate 93 mbd, including bio-fuels. Consequently, both of these forecasts are now revised down to 85 mbd in five years, adjusted for CERA's supply reduction, which is less than the 2008 peak.

As the production forecasts by the IEA and ExxonMobil are primarily demand derived forecasts, rather than supply based, it is only a matter of time until the IEA and ExxonMobil, as well as CERA, admit that world liquids production peaked in 2008. OPEC also uses a demand derived forecast which predicted total liquids production of 117.6 mbd in 2030 in their World Oil Outlook 2007 which stated the underlying logic on page 24:

A central tenet of the OPEC long-term supply perspective assessment is that resources are sufficient to meet future demand. The resource base, as defined by estimates from the US Geological Survey (USGS) of ultimately recoverable reserves (URR), does not constitute a constraint to supplying the rising levels of oil demanded in the reference case...so supply projections are, by definition, plausible from the resource perspective.

In other words, first, OPEC forecasts the future oil demand to 2030 based on a 3.5% annual economic growth rate and second, assumes that future oil production will be equal to the demand because of the huge increase in the world reserve base suggested by this USGS World Petroleum Assessment 2000 report. In Jean Laherrere's analysis, he said that this USGS report was misleading and that the USGS claimed reserves growth was excessive. Similarly, Colin Campbell stated in his response that it "is ironic that OPEC puts out excessive numbers to discourage western investments in renewables, energy saving etc, and the US does the same thing to try to undermine OPEC's confidence."

![]()

![]()

Life after Peak Oil

As oil production declines, consumption must also decline. Consequently, action must be taken to reduce oil consumption and switch to alternative energy sources such as electricity from the wind and the sun. This recent Oil Drum story proposes many oil conservation ideas for individuals such as moving to a walkable neighbourhood and trading in your car for one with better mileage.

The IEA has recently published some recommendations to improve energy efficiency which apply not just to individuals but also to industry. For example, in the transport sector, the IEA is encouraging the use of fuel efficient tires and introducing mandatory fuel efficiency standards for light duty vehicles. In addition, this IEA document, called Energy Efficiency Policy, also encourages energy efficiency by providing links to almost 30 documents containing energy efficiency policies. One of these documents called Saving Oil in a Hurry suggests many conservation actions including increased use of public transit, car-pooling, telecommuting and speed limit restrictions. For further information, the IEA has its own energy efficiency web page.

If there are sudden future oil supply shortages due to events such as natural disasters or acts of terrorism, the IEA has a rationing agreement which applies only to IEA OECD member countries. As there is no global energy agency, non OECD countries such as China and India do not have to comply with the IEA rationing method. The IEA has been encouraging China and India to become members but this is highly unlikely until the IEA's rationing method is based upon oil consumption by person rather than by country.

The map below shows oil consumption per person in 2007 and also indicates the high consumption per person of the oil importing country USA. In 2007, the USA consumed twelve times more oil per person than China and in 2008, using recent data, this ratio was just under eleven. In 2009, USA consumption is forecast to fall further while China's consumption is forecast to increase, according to EIA forecasts. This implies that the USA will consume just over ten times more oil per person than China in 2009.

![]()

As oil production declines, countries such as India and China will probably increase focus on ensuring their own future oil supplies. India now has the world's largest refinery complex, ahead of Venezuela, which can process heavy sour crude oil. China has been taking advantage of low oil prices and credit constraints to secure future oil supplies from Russia, Venezuela and Iran. Once global economic growth returns causing increased oil demand, there is a risk that oil importing countries could act aggressively for their own self interests rather than cooperating to manage oil consumption in the context of declining world oil production.

Am I correct in understanding that NGPL mostly goes for Propane (LPG), along with the top fraction from crude oil refining? If this is so, then am I also correct in concluding that it appears that the supply outlook for Propane, at least in the short term, is actually improving?

Another question: If my above assumption is correct that NGPL mostly goes for Propane, then given that Propane mostly functions as a substitute for NG, is it really meaningful to include it in with the other liquids discussed above? Is this not, perhaps, a case of apples and oranges?

I'm not sure about the relative fraction of butane vs. propane, but butane is slightly heavier, and it can be blended into winter gasoline. It can be counted towards liquid fuel supplies.

No real argument from me, although I think that the key point is that crude production basically stopped growing in 2005, with a cumulative shortfall between what we would have produced at either the 5/05 rate or the 2005 average annual rate, relative to what we actually produced (EIA, C+C).

And as I have pointed out, IMO, Deffeyes basically nailed it. Despite an erroneous observation regarding 2000, he never backed away from what his model showed, a world crude peak from 2004 to 2008, most likely in 2005. And note that Deffeyes was modeling conventional production. His point was the unconventional production would just slow the rate of decline in total production.

As I have also noted, based on the logistic (HL) models, the world was to 2005, as the North Sea was to 1999 as the Lower 48 was to 1970 (conventional reserves approximately 50% depleted in all three cases). It's interesting to look at the initial three year decline rates in all three cases:

Lower US 48 (EIA, C+C):

1970 to 1973 Decline Rate: -1.4%/year

(It would take 51 years to fall by 50%)

1973 to 1979 Decline Rate: -3.9%/year

(It would take less than 19 years to fall by 50%)

Average annual US crude oil prices increased at about +15%/year from 1970 to 1979 (and at about +21%/year from 1970 to 1981, going up ten-fold in 11 years), i.e., higher crude prices, less crude production.

North Sea (EIA, C+C):

1999 to 2002 Decline Rate: -0.9%/year

(It would take 80 years to fall by 50%)

2002 to 2008 Decline Rate: -6.7%/year

(It would take less than 11 years to fall by 50%)

Average annual Brent crude prices increased at about +19%/year from 1999 to 2008, i.e., higher crude prices, less crude production.

World (EIA, C+C)

The 2008 average annual crude rate--subject to revision, generally downward--is basically flat with the 2005 rate, well within any reasonable margin or error, with 2006 and 2007 being below the 2005 rate.

If the world had maintained the 2005 rate of 73.7 mpbd, we would have produced 80.7 Gb from 2006 to 2008, inclusive. The EIA shows cumulative production over this time period of 80.3 Gb.

Average annual oil prices almost doubled from 2005 to 2008, i.e., higher crude prices, less crude production.

I suspect that the key difference between the post-2005 world data and the post-1970 Lower 48 and post-1999 North Sea data is that the world is getting some contribution from unconventional production.

Mathematically, world conventional production is to 2009 as the North Sea was to 2003 and as the Lower 48 was to 1974. 2003 was the beginning of the more rapid North Sea decline, as was 1974 for the Lower 48. It's possible that the decline in demand may be masking a more rapid decline in world crude production.

In any case, IMO the "When did we peak?" argument is increasingly irrelevant. With a collection of very old giant oil fields heading to where the East Texas Field is now (99% water cut), and with high underlying decline rates from existing wells, combined with declining investments in oil production, I think that it is unlikely that the world will ever produce 74 mbpd or more of crude oil on an annual average basis in future years.

Another chance for me to rail against comparing, adding and etc. things that are different. Why do analysts insist on putting oil sands and such output in the Peak Oil argument? Can't do that.

Peak Oil was and still is about conventional oil production. It is the decline and eventual end of oil that Hubbert and the rest like Deffeyes were worried about. It is conventional oil that has had the high return for decades. While other output may be similar, the yield and method of extraction is different enough to be excluded.

No insight is gained by mixing these oil resources. All it does is obfuscate and confuse. Could that be the reason it is done?

Let each form of liquid fuel, or any other fuel for that matter, stand on its merits or demerits. Logic requires it. Befuddled thinkers who compare, add, subtract and etc. things that are different add nothing to understanding. They do not understand basic principles of logic.

There are some things in mathematics one can not do like divide by zero. Logic has rules too and one of them is that things that are different can not be added etc.. If they are anyway the result is silly nonsense.

Like everything in life, I don't think there is one correct way to look at this situation. You keep trying to assert that your way is the "best" way and other peoples' way is the "wrong" way.

Points of view are like tools in a toolbox. Use the one best for the job.

Point of View 1

Group all liquids because ultimately it's the aggregate that's important to our end uses. This works because the liquids, with some time and effort, are often interchangeable to the machines that run them (or you can change the machine). This is a more strategic view.

Point of View 2

Distinguish the liquids to gain a better understanding of the immediate situation so that short-term decisions can be made, like "will we have a shortage of home heating oil this winter?' etc. This can often benefit tactical choices.

If you have a different way to look at things, I request that you simply say something like, "The benefit of the author's point of view is x but if you look at it from a different point of view, which I'll describe in a moment, the benefit is y."

The benefit of approaching discussions this way is that, If everyone were to do this, we wouldn't keep getting into these endless "he's wrong and I'm right!" battles here.

i don't think x is trying to start an argument.

it is not wrong to project "peak liquids". In fact, it is vitally important.

however, the article purports to be on peak oil, which it is not, in fact.

"liquids" is frustrating because it is obfuscating. those who have studied enough know the vast difference between "liquids which possess potential chemical energy" and "crude oil" understand that to oh ummm probably 99.2ish percent of the population its all the same. (But the shape of the graphs the two terms produce are not).

yeah, x. i'm with ya.

The problem with x is that he/she says you can't compare apples and oranges (different liquids), but that you also can't count fruit (EROEI).

Can't have it both ways.

Cheers

Leaving aside x's intent (I have no idea what it is) my point is that "there is no one and true and correct point of view usable in all situations" and x keeps asserting that the way people are using liquids can't be done and that his/her way is the "correct way."

There is no "correct" way to view the topic -- there are just ways that give different results depending on what the goal is.

Each point of view has value because it is able to show something that is hidden when using a different point of view.

In the diagram a. below, can you see the orange dot? Of course not, but change the background (the point of view, or filter, if you wish) and the dot becomes visible as in b.

The point of view x is advocating has perfectly good uses but is not as effective when using a different filter of goals and understanding. Same with the point of view he is asserting is "illogical" or "silly nonsense."

If you want a well-rounded understanding of a topic, gather as many points of view as you can. Each one will expand your understanding because each one reveals something unable to be seen by the others.

In this particular case, it is pretty clear to me that x is unable to see what other people are seeing. Does that make him/her a bad person or stupid? Not at all. But if he/she keeps insisting that his/her view is the only one worth examining, it does make him/her in the very least dogmatic and positional. It also turns the conversation from an exploration into a battle in which there must be a winner and a loser.

To be fair to x, your position stated above is just as dogmatic and positional. What is it they say, not making a choice is a choice? I often enjoy your posts, but sometimes I scroll right through them because they are filled with New Agey, nobody's wrong, everybody's right stuff like the above. (And I was very much of that sort of mind in the past, and it still informs my thinking.)

The obvious problem is that sometimes there is *one* best answer, and to say that isn't true is simply false so we need to be just as aware of the possibility there is only one answer as we are that it is *usually* best to take all views into account.

That said, I don't think EROEI is one of those cases where x is right.

Cheers

I assert that "right" and "wrong" exist only in language and are convenient labels. What you call "right" someone else calls "wrong" so clearly their usage depends on the context in which they are used. If it were not so, there would be no disagreements about what is "right" and what is "wrong."

Call it New Agey if you if you'd like, but it's actually epistemology, or at least that's my point of view.

;-)

It's claptrap when you take it that far, Aangel.

Murder is bad. Very few disagree, and those few are murderers.

C'mon... If you can't accept the shortcomings of your stance, you are being nothing more than dogmatic.

You keep referring back to what language is and isn't. I think you sometimes forget that the medium isn't the message, but that the medium we have is the way the message gets transmitted, which means the medium actually is a large portion of the message.

There's not much value in getting too "cute" with this stuff as you lose the real medium: the audience.

Just an observation from someone who makes their living working in the language.

Cheers

But even 'conventional oil' can be broken down into categories like onshore, offshore/deep sea/polar with different cost structures/margins/etc.

All these different sources of energy have different EROI, what's clear is that we are transitioning to an era where the cheapest most easily available energy has gone and as a consequence an increasingly greater chunk of civilisations resources will have to go to maintain base supply -let alone grow it.

And since the renewables/alternatives are 'priced' in energy units (steel, copper, silicon, etc.) as this base price creeps up so will the price of these alternatives resulting in the conclusion that they will never be a cheaper substitute when viewed on a short term basis. The main difference however is that the ongoing source of energy supplied by the renewable group once created is of course effectively limitless within the confines of our needs.

Nick.

"The main difference however is that the ongoing source of energy supplied by the renewable group once created is of course effectively limitless within the confines of our needs."

Assuming our needs are modest, that may be true. However, one should not assume that renewable resources are unlimited. Even renewable resources will be unsustainable if they are consumed above their renewal rate, above the rate that doesn't adversely impact the biosphere, or in a way that damages our environment.

Even renewables have a significant non renewable aspect. The resources required to build and service the renewables' physical plants, storage facilities and shipping/transmission facilities are not renenwable and are not equally abundant or accessible. Energy availability is only part of the equation as we start to hook up the rest of humanity.

Those are usually renewable as well. Some hydroelectricity, some aluminum source (recycled or not) = Transmission wires and more.

Steel is very recyclable, and several energy sources can be used.

Concrete is less recyclable.

Alan

"There are some things in mathematics one can not do like divide by zero. Logic has rules too and one of them is that things that are different can not be added etc.. If they are anyway the result is silly nonsense."

EROEI- If it costs a barrel to pull a barrel why pull the

barrel?

You could convert wind to oil and carry on using ICE vehicles without needing batteries to use wind for transport?

Agreed. Nevertheless, it can be argued that without hurricane Katrina in 2005 and without the olympic games in China in 2008, the monthly peak could have well been in December 2005.

Unfortunatley, our politicians still cling to the wording of the IEA WEO 2008 which says that oil production will not peak before 2030. The international energy agencies and many government departments around the world will have to take a great part of the blame for the financial crisis and the global recession. Had Colin Campbell's warnings

The World's Endowment of Conventional Oil and its Depletion

by C.J.Campbell

© January, 1996

http://www.hubbertpeak.com/Campbell/cen21.htm

been heeded and had governments officially forwarded these warnings to banks, they would have been more prudent in their investments like airport expansions, toll-roads, car-dependent subdivisions etc.

As the peak becomes more visible in the next years, the public will ask questions about OPEC's oil reserves and when the confidence in these and all other reserves will vanish, oil hoarding will start and international oil markets are likley to freeze up like credit markets now. This may happen in the timeframe of 2013-2015.

Those who in the past tried to deny peak oil in an attempt to avoid panic on their watch will bitterly regret it because if we had had an earlier confidence crisis on oil reserves, more of the oil thoughtlessly consumed since then could have been used more wisely, e.g to build up electric rail to replace oil based transport. These projects may get stuck in diesel shortages later.

It is easy to calculate that for every month the world is saving, say, 3 mb/d crunch time is delayed by 1 day.

Look peak oil itself is not important. The pricing around the peak will depend on supply and demand for several years before and after the peak the difference between peak and the current production levels will be less than 2mbd or well within the error margins and also well within what we could easily reduce consumption with a small amount of belt tightening if needed.

So peak does not matte much and even the two years before and after peak don't matter all that much.

What matters is given our ability to add production and the decline rates and decent estimate of the rate of demand change when we are down 4mbd vs demand. Once this happens we are probably permanently in and era of expensive oil. Further declines in oil output may make a bad situation worse but they don't change the intrinsic game we will never see cheap oil with a fully functioning economy again.

Now only with that argument thus this supposed peak in 2008 matter. If the real peak was in 2005 and 2008 was a result of some shifty accounting practices then we are not in the second year just past peak we are further out in year 4.

Now this is important and I suggest you can readily remove the so called peak in 2008 and justify everything that happened including all of 2008. The only small requirement is a short term surge from KSA from unsustainable sources of about 50 million barrels of oil up to at most 80 million barrels. Barely a days supply of excess oil added as the economy was crashing and the ability of the US to import oil was crippled by hurricanes. There certainly was and unmistakable and real short term surge in exports from KSA.

With that one single exception you can go back and look at the real situation assuming a peak in 2005. If the true sustainable and reasonably accurate peak was back in 2005 and if declining producers padded their numbers into 2008 then we probably did do what one would have expected and seen continued steady overall declines from peak since 2005.

Further more there is good reason to expect the base decline rate to accelerate probably in 2008 we where down 2-3mbd 2009 will probably see overall production fall further by 4mbd thus if we really peaked in 2005 by the end of 2009 production will have declined to the point that peak is unmistakable and even if OPEC is holding back some supply bringing it online on 2010 will only serve to slow the decline rate not cause a secondary plateau. Further out the current pullback in drilling becomes a real issue as supply still cant be brought online fast enough to avert steady decline.

But you can see that in a sense a peak in 2005 is important because it puts us over the edge so to speak for oil supplies. We have used up the few years of fairly slow declines surrounding the peak.

Bottom line is for 2008 all I see is that the Saudi's where able to enact a short term surge that overwhelmed the supply channel as all hell was breaking loose on the financial front. I leave it up to you to decide if the decision of the Saudi to surge as the US pulled the rug out from under Lehman and tried to safely prick the bubble where coordinated or not.

But regardless of the large number of short term events during the second half of 2008 if we peaked in 2005 then pretty much no matter what was done then we will know soon what the real situation is. Any spare capacity generated by cutbacks by OPEC will be gone in a year or less if we are 4 years post peak.

Look at the Saudi decline from 2005 to 2007. There was no workover coming on-stream 2007-2008 to explain the 2nd Saudi peak sitting on top of the rest. Local demand was surging at least by 500 kb/d so there was internal pressure to produce more. Some of that 2008 peak must have come from storage. Maybe the temptation of high oil prices during the olympic boom in China. Have Saudis damaged their oil fields in this episode? Their interest now is to "rest" their fields. We can be sure they will do everything possible to confuse us to the last minute.

I've posted numerous times and repeatedly that Saudi Arabia has short term surge capacity my lowest estimate is 0.5 mbd

it could be this.

1.) 0.5-1 mbd or real long term capacity

2.) 0.5-1mbd of surge capacity (over production)

3.) 40-100 million barrels of oil in storage.

4.) 40-100 million barrels of stored finished product ( redirect internal oil outward replace with stored product)

5.) 100 million barres to ? Storage outside Saudi Arabia in Rotterdam, Caribbean, Other leased storage

http://www.menafn.com/qn_news_story_s.asp?storyid=1093236252

http://www.midrocpm.se/Global/Midroc_Project_Management/PDF/Saudi_refere...

http://www.highbeam.com/doc/1G1-44095054.html

We have and estimated 80 million extra barrels of oil in storage right now. Saudi Arabia could readily have caused this without pumping a single extra drop of oil if its storage facilities where full.

I've never questioned the ability of the Saudi's to flood the market with up to 2mbd for 30-90 days.

I would argue I doubt they could do it for longer and I seriously doubt they can perform this flood any sooner than may once a year if not once every 18 months. To be crude they simply can't keep it up.

Next ignoring the supposed total amount of oil supply in 2008 we certainly saw a differential increase in supply consistent with a flood of oil from Saudi Arabia well within their storage capacity much less withing any spare capacity or over production capacity they may have. Set this against a rapid economic meltdown leading to a sharp drop in demand on the order of 1mbd and viola we have 50-80 million extra barrels of oil laying around putting the kebash on oil prices. And last but not least you have to assume that this was Arab light and Arab ultra light no reason to play games with the heavy stuff.

Its easy enough to do hell at any point over the last several years the US could if it wanted have unloaded the SPR and achieved a similar temporary drop in oil prices. God knows what prices would go to if the US unload 400 million barrels of light sweet onto the market.

Think about it to get the events that happen using occams razor only requires the Saudi's to flood the market from known storage capacity much less using my estimates.

One last thing looking back on the past leading up to the Election the US was extremely aggressive with Iran to the point that I and other were concerned about a war. This could have been for a double purpose bait Iran to attack as the Saudi's emptied storage and also ensure a military presence was in place to prevent and attack on KSA while they had drained down their storage and where vulnerable.

The protective bully angle is interesting and in a sense covers KSA both ways if a war started then their problems are history and the bully role offered short term cover. One has to wonder what the outcome would have been if oil prices had not collapsed. The collapsing of oil prices has been itself a powerful weapon against Iran. Makes one wonder what will happen with Iran when prices rebound.

I must agree with memmel that 2005 versus 2008 does indeed matter for the very reasons he has stated, but when considering the reasons for the tempoary production boost in 2008 there is of course the possibility that the production figures are a deliberate misappropriation of the truth in the grand tradition of the “Gulf of Tonkin Incident” “Sadam’s weapons of mass destruction” etc. The motive by the powers that be is certainly there.

Indeed. Note that if you lop off the "peek" in mid-'08 and turn it over to fill in the immediately following deep trough, you end up with a steady line around 74, pretty much where we had been since 2005.

I don't see why anyone should be thrown of by a one-month anomaly. It is just that--anomalous. Averaged over any slightly larger time frame and it disappears completely, swallowed by the trough that follows.

It is as insignificant as the fact that is can still get cold in Tibet or Minnesota even as global temperatures are increasing on average. Both kinds of data are essentially insignificant to the larger, more important pattern.

My goodness, if we can get thrown of by such an obviously anomalous blip, it does not bode well for our abilities to interpret complex charts and systems.

By the way, eyeballing the multi-color chart, it does seem as though most of the blip is attributable to Azerbaijan, Canada, Brazil and KSA. It that born out by the numbers. Are there factors in those countries that allow for sudden increases in production under the right economic conditions (like $147/bbl oil prices)? Could they have drawn down reserves during the price spike that they then filled in the following months (but reported otherwise)?

Generally I believe Canada and Brazil's numbers. Azerbaijan is actually a bit iffy to me. Not that I question their production capacity all that much but its not clear how much actually makes it out in any given month and if they are able to reliably produce at capacity. I've got no idea if its significant or not but generally I treat their number as a capacity number with real production potentially as low as 80% of capacity. Overall in and of itself its not enough to make a huge change but its once one of the anomalies that when added with other iffy production numbers works toward the overall imbalance. Assuming they continue to get reliable pipelines built then this will change for them with production approaching capacity routinely. Given the nature of the country once the distribution network is reliable one can expect that the official production number may even be slightly low vs real production and more oil is sold under the table.

I posted in this thread about stolen oil or hot oil I don't think the overall amount in any given year is enough to make a huge change in the numbers its probably less than 0.5mbd globally in illicit oil. By illict I simply mean oil not recorded as being produced generally its governments hiding redirection of profits. However this does add up over 70 years of the oil trade. We could easily have produced and additional 100GB of oil over the last 70 years thats never made it into the official production figures. My opinion is that inflation of production numbers only becomes and issue as a politcal region declines in production before this the numbers are often understated.

A lot of the sharp increase in production as prices rose in 200 might have been that with the new cash flow illicit oil was simply brought on the books instead of being sold off the books. On the same token maybe we did not decline as much as is officially stated as prices fell more oil was sold without being recorded. Again I don't think in any given year its actually that much oil its only its cumulative effect thats important but variance in the black market for oil is certainly a factor. We have to assume that it increases as prices fall and that this oil is sold at a discount acting to keep prices slightly lower then otherwise.

Anyway this is the type of stuff you need to think about when you talk about marginal changes in the oil supply less than 2mbd plenty of potential factors exist to make the absolute value of production difficult to determine with any accuracy.

Seasonal variation alone is problematic at our current levels. Production capacity is a constant and seasonal demand is variable and oil storage facilities are actually fairly large with about 20 days worth of oil in storage at any point in time and at least that much in transit on the ocean. In absolute terms plenty of factors can result in a change of about 25-50 million barrels in total amount of oil moving around in any given month if not more. That sounds like a lot but a lot of its in pipelines not just on super tankers so it a matter of pipeline loading and maybe about 10 supertankers moving differently in a given month storage level etc etc.

And yes KSA can readily flood this system with and additional 50-100 million barrels. The variance is 25-50 but and obvious addition of 50-100 makes a difference. 200 million extra barrels no doubt about it slams the system thats a flood.

That of course leaves KSA.

Agreed. The data isn't good enough to fix a precise month and anyway it doesn't matter. Oil peaked in the period 2004 to 2008.

westexas,

Very nice summary. Thank you. The central point is we are really well past peak. While the intervening production plateau did not meet true demand, thus driving the price of oil nearly to $150/barrel, it was a largely manageable period economically and socially. The downside will not be so manageable, so it is incumbent on everyone to be even more reasonable in the face of coming adversity. Public intolerance for obvious government mismanagement of the current financial debacles provides us an idea of what is to come as we enter the Post-Peak period.

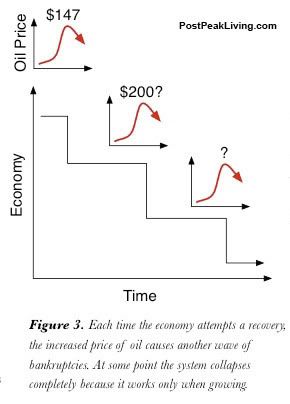

RE: Life after peak oil

Unfortunately, an ongoing challenge is going to be economic. As depletion bites harder and harder, there will undoubtedly be a push to add more capacity. As we all know, the cheap and easy low-hanging fruit has long since been picked, all that is left is increasingly expensive and difficult. Replacing depleted capacity is therefore going to require ever-greater allocations of US and global GDP. At the same time, we really need to be increasing our investments in renewable energy, because any investment in new oil production capacity is only a short-term fix at best. That's another increasing demand on US and global GDP. We also need to use energy more efficiently, and that will require some major investments as well, especially for intra-urban and inter-urban electrified passenger rail; yet another increasing demand on GDP.

Thus, we have three slices of the GDP pie that all need to expand substantially. Now, consider that the GDP pie might continue shrinking rather than growing. How are we going to do that?

The unfortunate reality, I'm afraid, is that for the most part we are simply not going to be able to do what we need to do. Instead, I suspect that what will actually happen is:

1) Consumers (households and businesses and institutions) will have to economize in their use of energy to whatever extent they can. For example, if good passenger rail is unavailable, they will simply have to car pool, or make other arrangements.

2) In spite of their best efforts to economize, the portion of their budgets allocated to energy will still be increasing.

3) This means that households and entities will have to cut back on all other budget categories.

4) This will tend to cause further downward pressure on all sectors of the economy except energy.

For most of us, Life after peak oil means a poorer life. Get used to it, and plan accordingly.

(There's a similar end-thoughts theme in Matts Post above but I will post here)

Another great post -thanks Tony/ace.

It looks increasingly clear to me that we are -at best- going to experiance maybe 2-3 more years of 'shoddy normality' / confusion while PO denial can be applied based on 'weak demand' coupled with some OPEC Tap lightening.

Beyond this point the real depletions occuring are going to be increasingly hard to mask with any statistical fudgery and very shortly afterwards we are going to witness a 'fright period' as the impacts of expensive energy sink in to the masses and no amount of money thrown at the problem makes a jot of difference.

Most people I talk to about such things are blissfuly unaware of the amount of energy in a barrel and what a squandered gift it has been. Personally I blame it on Michael J Fox -if he had been given an electric Prius in "Back To The Future" instead of that monster SUV/Truck the world would be a different place. Where is Mr. Fusion when you need it?

Nick.

Didn't Fox drive a DeLorean? How are you going to fit 1.21 jigawatts of plutonium in a prius?

He did, but his alter to Reagan in his TV show, 'Family Ties' is what really sent a whole generation over the edge and maxed the conspicuous consumption/greed paradigm. But the bust those Ayn Rand/Reagan worshipping kids have brought us might acutually buy some time now when we need it most, we will see. Who knew Michael J. was that powerful ;-)

Hi Noutram

I've not yet graduated to "energy content of a barrel" when I ask people what they think about future oil supply - but it is a really good question. Anyway, I like to ask people (random encounters) what they think about the price of gas in a year or two - and, I do this frequently. I've not yet gotten any kind of sensible answer. Lots of conspiracy theories, lots of speculation about how politicians will manipulate the supply (they won't let the price go over $4 because nobody will vote for them), dumb talk about carburators that can get 200 mph in a Hummer. One person explained to me how the government has "anti-gravity" technology in a closet and will bring it out under some bizzare scenario. Most people think it's all just a "big oil" and Wall Street's way to rob them - or the tree-huggers are preventing us from drilling up all the oil under some owl's nest. It is really amazing how most people live with their delusions.

I don't know if #1 will be all that hard of a bite, when it comes right down to it. We waste so dang much energy in the US that we'd probably *enjoy* life more if we cut 20% out of our fuel consumption. That's the equivalent of (for example) working at home one day a week. Basically, if everyone else did many of the things that most peak-aware folk do already, we could get there without too much trouble.

We had a rehearsal last summer, which pretty much followed steps 1-4, and people cut consumption. But given what we waste, less energy doesn't necessarily mean a poorer life, at least not at first.

My serial peak oil novel, FAR Future

Nice essay Ace! Thanks.

I liked the green Annual World Oil Consumption per Capita in 2007, (for St. Paddy's day?), but I have a very hard time differentiating the middle three greens unless they are side-by-side.

Two things stand out to me.

One, how is it that OPEC can have 3-4 mbd shut in, but yet not contribute more than, what looks like, a one mbd up tick to the depletion side of the graph in 2010?

Two, it would be nice to see a graph which overlaps the latest data on consumption. I mean, isn't our whole future centered around the delta between this production curve and consumption (A.K.A. the glut)?

I think its assumed that non-OPEC depletion (Russia, North Sea, Mexico) will eat up most of the OPEC shut-in once its brought back online.

Terminology (see most comments) is always a problem. There is a difference between production and productive capability and I suggest that analysts always make this distinction in postings here.

Production can be above or below consumption which answers inventory questions. Productive capacity is always equal to or higher than production and the difference may be the result of many factors: military conflicts (Middle East), weather conditions (hurricanes), transportation disruptions (burst pipeline), artificial production controls (OPEC quotas), economic conditions (shut-in production due to low prices) etc.

Hi Ace

Looking at your curve for CO+LC I notice you see no recovery in 2010/11. But the bulk of the recent drop has been voluntary by OPEC and could, at least in the short-term, surely be reversed if economies recover? It's by no means clear where OPEC are on the Hubbert curve or whether they have yet peaked but it seems reasonable to assume they could ramp production back up to where it was last summer, even if only for a short while. So a return to 2008 peak levels within the next couple of years seems possible.

Further out I agree that it will get harder to stay on the plateau as non-OPEC depletion accelerates (Russian decline will dominate this more and more going forward) and OPEC capacity limits are once more tested.

TW

A valid point watcher but also consider that as these fields produce at even a lower rate they are still moving down their individual decline curves. A current lower voluntary rate will eventually become its max rate. OTOH, I wouldn't expect to see such an overall convergence in just a couple of years. But if I had made that same bet regarding Mexico's Cantarell Fld in 2007 I would have lost that bet.

Hi RM

Well I've just polled myself and I'm unanimous in sticking with 2005. I'm going with Simmons and his deep throat source on this one.

http://www.eia.doe.gov/iea/preface.html

Is this a clue?

(BTW, as most of us know, Ace is probably sound asleep right now, down under.)

The Russian production stagnation/decline is consistent with what our logistic modeling suggested in January, 2006, and our (Khebab/Brown) logistic (HL) based model for the top five net oil exporters is that they will have shipped about half of their post-2005 cumulative net oil exports by the end of 2012, with the other half being shipped from 2013 to 2031 (middle case scenario, from mature basins).

The other issue is that the current recession is caused by the credit unwind that results when economies can no longer grow fast enough to support the debt they have taken on. The lack of growth is a function of peak oil and a lot of other resource limitations.

Because of this, it is hard to see very much of a recovery. The lever that keeps oil production low may therefore be economics, rather than geology directly. This same lever may result in actual production even lower than what Tony is forecasting.

IMO net exports of C+C have peaked and that is what is most important for me because I live in a nation that will soon need to import all its energy.

IMO any peak flow rate (of any commodity) is definitely caused by economics - the flow rate from an individual well is partly determined by geology and may well be approximately bell shaped ... but the flow for the world is dependent on the number of producing oil wells and their flows are dependent on the need to make a profit from production that consumers can afford, and is most definitely NOT bell shaped nor predictable.

The peaking is caused by the cheapest 'low hanging fruit' being produced first.

The ability of the consumer to be able to afford the price of oil is just like all the other commodities in the world whose production peaks e.g. whales, cod, firewood etc (these are not caused by geology either).

If the price of the commodity rises faster than wages then it becomes less affordable, demand will slow, and there will be a peak. IMO most peoples wage rises (and hence affordability) have little to do with the geology of oil wells.

Oil production/consumption, along with other resources, at least above some level required for basic services, doesn't drive the economy. It's the economy that drives the consumption of oil and other resources. Obviously they both influence each other, but the economy drives oil consumption far more than oil consumption drives the economy. There are only so many hours in the day and so many people in the country. With employment at 90+%, we could've increased oil production in line with the credit bubble (~70% IIRC) and we still couldn't have increased GDP proportionally, because people just weren't able to increase their output proportionally by working more, not unless everyone decided to forgo sleep for a decade or so in order to pay of their debts.

rofl- this question of causality can be usefully addressed by charting oil data price alongside economy, as someone did a while back here. As I recall it, recessions were preceded by oil price rises, as in the most recent case of 2008 from which we are still reeling. Meanwhile the level of production that is possible is not so much affectable by the economy, due to inflexibility of supply as also documented in graphs here previously. Even if we became a huge lot richer in 2010 we could make only limited impact on the geological constraints of production capability.

For these reasons I would say that energy supply drives economy much more than vice-versa (and I guess most others here would agree).

The economic cycle's boom in growth leads to both (a) quick increases in oil consumption, and (b) a bubble that leads to a recession when it bursts.

The evidence for a causal relationship is not as strong as you think.

Even if this is generally the case, it should be remembered that it cannot be assumed that growth can occur without an increase in energy (including oil) consumption, nor that a reduction in the availabilty of energy will not cause a decline in economic activity.

It's not just oil data along with economic data, but the change in economic activity (GDP) compared to consumption, which is linked (graph) in my last post. As you may see from the graph, a change in GDP tends to result in a much larger change in oil consumption, which implies that for the most part it's GDP that drives oil consumption, not oil consumption that drives GDP.

While this last recession instance was preceded with a large increase in oil prices, other commodities also saw a price increase as well, probably due to the ~50-70% increase in available credit bubbling through to other portions of the economy. Since there was no corresponding increase in economic activity to pay for this credit, the bubble eventually popped and commodities as a whole deflated. Given the behavior of the economy as a whole, oil price inflation was caused by the huge increase in credit like the other bubbles, although this was probably exacerbated by being near peak/plateau.

Going back, the early 2000s and 1990s recessions were not preceded by significant changes in the price of oil, the two in the 1970s and 1980s were preceded by price spikes due to the OPEC embargo and Iran/Iraq war, although initially the price spike was caused by the collapse of the Bretton Woods system and subsequent U.S. dollar devaluation. All the recessions before that up to the Great Depression do not appear to be preceded by oil price spikes, and before that the same all around inflation in commodities we have just experienced was seen as well.

I'm not sure trying to determine 'causality' like this is all that helpful. As I see it energy (especially oil) and other resources are prerequisites for the functioning and growth of the economy. They are required in the same way that green plants require energy (sunlight) and other nutrients in order to grow. Resources do not cause growth, but growth cannot happen without them. Resource consumption does not drive the economy (or vice versa), rather resource consumption, in a sense, is the economy.

Hi TW,

There is no audited information available on OPEC surplus capacity. Kingdom of Saudi Arabia (KSA) is supposed to have the biggest surplus capacity.

The EIA makes its own surplus capacity estimate for KSA which was 1.65 mbd in 2008Q4. It's also worth noting that the IEA thought that KSA had 1.28 mbd surplus capacity in 2008Q2 but didn't use it.

http://www.eia.doe.gov/emeu/steo/pub/3ctab.pdf

The IEA Feb OMR stated that KSA had 2.75 mbd spare capacity in Jan 2009.

http://omrpublic.iea.org/omrarchive/11feb09sup.pdf

My own view is that KSA today has only 1 mbd surplus capacity which could be sustained for the next year based on the logic in my recent story

Saudi Arabia's Crude Oil Production Peaked in 2005

http://www.theoildrum.com/node/5154

The other issue with the EIA and IEA estimate is that they are based only on statements made by Saudi Aramco about future capacity additions. For example, Saudi Aramco says that Khurais will add 1.2 mbd capacity. Will it really? Maybe it will only add 0.8 mbd capacity since we don't know how much oil reserves are in Khurais and we also don't have the field development plans.

Tony, well written and well researched giving a range of views from people who agree with you.

The decline in your forecast is controlled by crude + condensate. What underlying decline rate has been applied?

I gotta go walk my dogs - the Sun is out and spring has arrived here in Aberdeen. But I'll be back with a somewhat different perspective later on.

Cry Wolf

Tony - I guess you're asleep. Since I will likely be tasked with writing the alternative post I'll try to be brief here.

First up I also voted for 2008 peak in TOD survey, but see things as follows:

Financial crisis sinks global economy, then 2008 will most certainly be peak - 30% chance (but receding?)

I then see an undulating plateau, with production range bound 82-86 mmbpd, and a 50% chance of exceeding 2008 by 2015.

My long standing view has been 2012±3 years - and so I guess I see a 35% chance now of peak falling in that period.

So I think it is premature to make a definitive call on peak oil - those who work on this subject have been dogged by crying wolf and being wrong for decades - I would have hoped that lessons may have been learned.

I've done a back of the envelope calculation and estimate your underlying decline to be 7%. Which seems high to me. True, we may see an acceleration of decline this year and next as the industry cuts back on drilling. But assuming the economy turns around, that can be reversed to historic 4 to 5% level.

We are currently in a world awash in oil - not really what I would have expected in a post-peak scenario. Some numbers:

2008 year end production ~ 84 mmbpd

2009 decline @ 5% = 4.2 mmbpd*

2009 new capacity from megaprojects = 4.3 mmbpd

OPEC spare capacity ~ 4 mmbpd

Production capacity at end 2009 ~ 88.1 mmbpd

* applied to whole stack - some parts of stack will not be declining at all, leaving scope for higher decline in the C+C part.

This capacity will unlikely be utilised with world in recession - but the capacity and potential is there.

A summary from megaprojects:

2005 3.8 mmbpd

2006 3.8 mmbpd

2007 3.1 mmbpd

2008 5.1 mmbpd

2009 4.3 mmbpd

2010 3.7 mmbpd

2011 3.7 mmbpd

2012 3.3 mmbpd

The thing that jumps out at me is the 5.1 mmbpd new capacity in 2008. High price eventually worked its magic and I think this is a major reason why the oil price is at $40 and OPEC spare capacity has jumped.

A key passage in your essay is this:

I checked out your chart labeled "insufficient" - to see that there is in fact ample new capacity coming on to hold steady for a number of years - with the 5% decline rate used in that "insufficient" chart.

So I'm confused.

Cry Wolf

Euan,

I'm somewhat stupified here.

But receding? I can't wait to see your full post on that! I can only hope to god you aren't basing it on that statement that the recession will be over in 2010.

* Credit cards going ka-blooey

* ommercial RE going ka-blooey

* Big rise in mortgage resets in '10 - '11 period

* To get back to long term trend, which is what bubbles do, you need DOW 2-4000 and S&P 400.

Irrelevent. There was a recent string of comments on this involving RR, if you want to see some of the arguments.

With decline pre-econ crisis near that, 7 seems conservative. Apparently you are expecting an economic rebound. Based on what? I can't think of a single thing that suggests that.

OPEC doesn't have 4m spare capacity. They might within 1 or 2 years, but not now.

Cheers

Since you don't seem to understand very much about anything, I'm not at all surprised.

Evidence please rather than unsupported blow hard opinion.

Evidence please, I am using a conservative figure from Rembrandt's Oil Watch Monthly - from yesterday.

Your response was completely uncalled for, and highly inaccurate.

The numbers I refer to come from the IEA last November, as you well know.

I'm sure Rembrandt has his views. I have mine. In fact, I remember being surprised at that in his report. Mine is based on SA saying they *will* have 12.5 capacity. They have not yet said they *do.* That is also informed by al Husseini's comments of 10/'07.

When I have questioned your judgment, it has been with reason and extensively supported. I do hope you have paid attention to what went on in Copenhagen this last week.

Cheers

On OPEC spare capacity

I can look at Chart 14 in OWM and observe that OPEC crude oil production has declined 4 mmbpd 2nd half of 2008. That is voluntary restraint, characteristic of swing production.

Or I can look at Chart 52 which shows OPEC spare capacity estimate of 4 mmbpd from the EIA.

Or I can look at Chart 53 which shows OPEC spare capacity of 6 mmbpd from the IEA.

You made a definitive statement on OPEC spare capacity:

So where is the evidence to back this up?

On underlying decline rates

In the normal run of events, oil companies are fighting decline on a daily basis. Drilling in-fill wells, doing well work overs. Drilling water injectors etc. This mitigates the actual decline to the underlying decline that we can watch via production statistics. The underlying decline is then further mitigated by new field developments to give us the actual or observed decline.

So its possible to construct a scenario that decline may have accelerated in the past couple of years owing to a shortage of men and machines to conduct the various interventions detailed above - not to mention the cost of doing so. That shortage is now over for the time being. I'd imagine we'll see much well maintenance work going on - if for no other reason than to keep the service industry gainfully employed - because the operating companies need them to survive.

On fate of capitalism

What is your guestimate for the world economy tanking right now? I guessed 30%.

Actually, I made a mistake. You wrote OPEC, but I was thinking SA, and that's what I wrote. That's my error.

Decline rates: I don't think your point is a large part of the issue. Manpower was tight before. If demand were to surge, it would still be tight. Plus time to ramp back up, etc. I'll leave whether well maintenance can make a significant difference to others who would know better. Perhaps Rockman or someone like that would care to comment.

Decline is accelerating because that is what oil fields do, particularly when pushed to their limits, no? Here the above-ground issues tell us as much, if not more, than the below-ground, imo. When you watch what nations have done/are doing to secure oil supplies, there really is no doubt as to why.

Economy: Your question is ambiguous. Do you mean begin to tank? Will have reached it's bottom, i.e., have tanked, etc.?

* The world economy starting to tank? 100%. Pretty clear, I think.

* Complete collapse? Heck, I don't even know if that will happen. And if so, to what extent? And how? Beats me.

WRT oil production, it's not the question to ask. As the economy shrinks, demand drops. As decline imposes limits, consumption drops.

Chicken/egg.

BTW, Capitalism as we have been told it exists, doesn't.

Cheers

no - is correct. Decline in any given field accelerates off plateau, but then decelerates entering phase III. World production is now dominated by 1000s and 1000s of fields stacked upon the other with low decline rates - but there is likely a significant effort required to maintain this.

At the end of the day this discussion leads back to Ghawar, and the time that N Ghawar enters a phase of accelerated decline (coming off plateau) that may remove a couple mmbpd capacity from KSA in the space of a few years.

agreed.

Not accelerating? Let's see:

1999 @ 3%/yr

2005 @ 4.5%/yr

2008 @ 5.7%/yr (I may be misremembering the IEA number, but I believe it was 5.7 or 6.2...)

Looks like acceleration to me.

Phase III? By the time the world gets to where the curve is flattening out, this conversation will be moot, so the point is. Up till now, decline has been accelerating. If demand backs down enough, I could see a scenario where fields get "rested" (for lack of a better term) which should reduce the rate of decline, I'd think.

Cheers

A couple of years ago it was reported that 59% of global production was coming from fields that were either on extended plateau or were in build up phase. If there has been a shift in that structure then it would be interesting to know - Ghawar coming of plateau could achieve this alone.

Now its a hell of a lot of work to compile statistics on this kind of topic. Why don't you go and do it? Spend several weeks doing a really thorough job and report the results back to us. That would be a useful contribution.

That was a non-response. Are you saying the reported decline rates were not what I stated? I dunno... I don't recall a lot of argumentation on the issue...

And, pray tell, how am I supposed to do the numbers on decline rates? *You* can't, either.

As I said, non-response.

Euan - and for that matter everyone else.

Comments like "Since you don't seem to understand very much about anything, I'm not at all surprised."

This is not the way grown adults talk to each other.

If you a problem with a particular point, please state it. This comes very close to name calling.

I think we're all a bit more on edge than normal. Only to be expected - I recommend black humour, sarcasm and lots of alcohol. Each to themselves though.

I might sound like a doomer but I'm an ultimate optimist. Me and Zadok have agreed to meet up as very old men on a beach in northern Scotland circa 2050. Global warming will do wonders for Aberdeen ;-) Euan's putting us up even if he doesn't know it yet. It's even possible one of us will still remember our name :-)

Hi Gail,

I'm not sure you have actually read any of ccpo's prior posts but Euan most certainly has, still he shows immense restraint IMVHO.

ccpo is one of the very reasons many "are on edge".

The recent flaming in the 'Fire and Ice' thread might have added a little edge to Euan's reply here. But thanks for the reminder Gail, once posted it is out for all to see.

Strange. I've always thought of flaming as baiting and personal attacks for no reason other than to do it. Given I have praised Euan's work in the past, and have, in fact, only criticized his one post related to climate, my comments can hardly be called flaming.

FYI.

ExxonMobil put the decline from existing wells in the 4% to 6%/year range, and the CEO at Schlumberger reportedly put it at 8%/year. In any case, at the 6%/year rate, the world loses about 5 mbpd per year, from a 85 mbpd total liquids base. At 8%, we lose 6.5 mbpd.

And its blindingly obvious that that has not been happening, given supply additions in recent years.

Perhaps I am blind, or perhaps you are seeing something that I don't see. I thought the following pattern was interesting, against a long term backdrop of rising oil prices, up at about +20%/year from 1998 to 2008 (annual average).

Cumulative Increase in Crude Production (between what the world would have produced at the 10/01 rate and what we actually produced, EIA C+C):

From 10/01 to 5/05: approx. 3.5 Gb

Cumulative Shortfall in Crude Production (between what the world would have produced at the 5/05 rate and what we actually produced, EIA C+C):

From 5/05 to 12/08: approx. 1.0 Gb

As noted elsewhere, this pattern of declining crude production in response to higher oil prices was what we also saw in the North Sea and Lower 48, at a similar stage of conventional depletion.

Of course, we are seeing a boost in NGL's, and Simmons attributes a good deal of the increase in NGL's to (gas cap) oil fields in their death throes, as their gas caps are blown down.

Perhaps; EIA oil supply data:

IEA oil supply data:

Oil supply has increased by somewhere around 3Mb/d in the last 4 years. That's certainly slower than what we saw in the 90s (0.9% vs. 1.6%), but it's still a significant increase. Given the nominal capacity additions that have come online in that time, it's not plausible that 8% decline was occurring.

Euan:

I suspect that the really huge area of uncertainty from here on out is not going to be geological, but rather financial. It doesn't really matter how much is still in the ground if we can't afford to finance the megaprojects to replace depleted capacity. We truly have NO IDEA how much financing we are actually going to be able to come up with for new megaprojects in the future. I think it is a safe bet that there will be SOME new investment, but I also think that it is a pretty safe bet that the financing that is available will be perpetually less than what might be both geologically possible and what demand (and thus price levels) could theoretically support. That leaves a wide range of uncertainty, unfortunately, and there is simply no relevant precedent to provide us with any helpful guidance in knowing what to reasonably expect.

I would not be surprised if there were wild swings between massive investments in crash programs some years, and a complete cessation of investments in other years. This instability and unpredictability will only hurt matters even more.

WNC - I agree entirely that finance will play a crucial role. I'm guessing on the megaprojects list that steel has been cut for projects 2009, 10 and 11 - and they are now unstoppable. So if the oil price does not rise, some companies involved here will go to the wall - we may see a new round of mega mergers. If oil price does rise (to what?) then the supply will materialise and oil cos will be OK.

Cost of new supply is hard to estimate since service sector costs are now on the way down - the $80 cost of marginal supply can quickly become $60.

Looking forward, one of the most important questions is share of GDP spent on energy. And share of energy spent on energy. On the former, if we spend a greater % on energy then we must spend less on other things and on current trends, energy intensive industries are being selected for extinction - flying, driving etc - and that complicates matters since this will lower demand and oil price feeding back into energy investment needs for the future. This is offset by unshakable commitment of our leaders to growth and of Man to greed and a desire to travel.

At the end of the day we are discussing details of timing.

I do not agree that just because "steel has been cut" a project is unstoppable. If oil prices remain low and corporate forcasts for prices are revised downward Big Oil Companies are quite capable of mothballing a project. Look at the history of oil shale or tar sands during the 1980.

I believe that timely production from projects two or three years out is in question.

I think MEGA projects for 2009 must surely be unstoppable - barring force majeure. Anything involving a FPSO, platform, pipeline will take years to construct and the write off to abandon it now will be quite large. Usually companies want to get new projects on as fast as possible and pumping as fast as possible to recoup investment as fast as possible - and in the perverse world of capitalism, if oil prices are falling, then the faster all this needs to happen.

Where projects have been sanctioned but not begun then we may see a dash to put these back on the shelf - plenty evidence of that happening. But when (if) things begin to pick up, all the reservoir and engineering design work is done - so they can be re-instated more quickly - and probably at much lower cost.

Ok its 2009 show me the real production rates of the new project brought online in 2008 if we have the data.

Obviously we had some data to put it in the megaprojects list.

Given 2008 is now in the past lets find out how much of a real increment was actually brought online in 2008.

I have no idea but I suspect that it will be between 3-4mbd just like every single year I've seen numbers for.

For the oil industry to bring on and extra 2mbd is a 40% jump its hard to see this is credible.

Show me.

Don't shoot me, I'm the messenger of data that Tony and Sam have lovingly compiled. But I got quite a surprise looking at it. I wish they'd been jumping up and down warning of a temporary glut coming (maybe they were?)

Of course there may have been more project slippage, with some of 2008 falling into 2009. And the tallies are for project peaks that won't fall in 2008 - some of the 2006/7 peaks will have fallen in 2008 - and 2008 peaks may fall in 2009 and so on.

$147 a barrel I imagine provided a fare incentive and now the industry is a victim of its success - once again.

Don't get me wrong, credit crunch and recession is part of the oil price story. But I think this bulge in new capacity is also implicated in the $40 scenario. Our best models forecast peak around 2012, and I don't think we should abandon these models prematurely.

Euan I took it on myself to look at one field.

Agbami Field

http://www.chevron.com/News/Press/release/?id=2008-07-31

http://en.wikipedia.org/wiki/Oil_megaprojects_(2008)

Its at first oil this year and probably will flow 100kbd within the next serveral months peak production estimated in 2010.

Its totaled in the Megaprojects at 200kbd.

Also it looks like Megaprojects is more of a all liquids type list with several NGL projects.

And as far as when peak production just for this field its not 2008 not 2009 but 2010 probably likely 2011.

There is no glut I think your misunderstanding the megaprojects list and how what it lists works out to real oil production.

Real world tends to be 2-3mbd or I'll even give 2-4mbd year in and year out.

Not that megaprojects is not a fantastic project and great addition to our knowledge base but ever since it started the numbers it uses have been abused and misused.

http://canada.theoildrum.com/node/3958#comment-373370

I found my own response but your free to look back to the original comments we repeatedly have predicting a flood of oil any day now from the data thats in the megaprojects.

If your serious about using the data for real oil production then you need to find the actual flows out of these fields in 2008-2009-2010.

I suggest you will find in general that from the date of first oil flow to full production is over a period of 2-5 years depending on the field and often on pipeline support and other secondary issues. In the case of this particular field I suspect full production is waiting on a pipeline although I can't prove that.

http://www.intecengineering.com/expertise/flow/resumes/resume.asp?r_id=42

Not sure whats in place its some sort of floating storage setup but they don't explain how its transferred from the storage unit.

Maybe it is then offloaded directly to a tanker ?

In any case the point is that you must understand what the numbers are in the Megaprojects list if you wish to use it in production estimates in any given year.

I thought my comment captured what you are saying here quite well.

2010 is not 2009.

I suggest that you consider projects that come on stream in 2008 will reach peak flows 2-3 years later sometimes even longer.

So a project that had first flow in 2008 would see peak production in 2010-2011 at the earliest. You by no means captured what I was trying to say. To put it bluntly you don't understand the megaprojects list.

However it does highlight how people like CERA badly overestimate production they do effectively what you have done.

If you seriously want to use projects as the basis for predicting oil supply then you need to go back in time say to 1990 and take all the projects that have come online from that time forward track the production flows for each project from the time of first oil to say peak production at least and carry this forward. Eventually you will develop a robust empirical model for the rate of new oil production in any given year. Next of course you need to develop a good model for decline to gauge the overall production.

Now I'd suggest that the Shock Model is exactly this sort of model however it also has some obvious flaws if you look at real data i.e the megaprojects list.

http://en.wikipedia.org/wiki/Oil_megaprojects_(2008)

Look at the discovery dates of the fields one of the key elements of the shock model is that you can reliably time shift discovery forward by a certain amount to predict future oil flows. Well the discovery dates for projects being brought online in 2008 are all over the map. The assumed correlation of discovery date to production date is not present in real data. The shock models underlying assumptions are suspect and in fact all models based on shifted discovery curves make and unproved assumption.

The next assumption is that because discovery is effectively random no cherry picking has taken place i.e we did not produced the best oil first while in fact the real scatter in the lag between discovery and when a field is put into production indicates that cherry picking is certainly taking place and the best fields are produced ahead of harder to develop fields.

I could go on and on and on but suffice it to say ohh the mejaprojects predicts a wall of oil we are saved is simply the same mistake that CERA makes.

Now going local i.e to the recent price crash first and foremost my opinion is oil production has steadily declined from its peak in 2005

we have ample reason to suspect post peak production data from a number of countries. My best guess at current world production is 70-72mbd It really depends a lot on the OPEC cuts how much is real how much is just changes in reporting etc.

Next the fall in prices second half of 2008 was driven by three large but short term factors a epic crash of the economy similar to what happened at the start of the great depression a short term surge by KSA and damage to the US main import region by hurricanes. Three major events worked to create a short term surplus of oil and extreme downward pressure on prices as assets where sold.

All of these are effectively one shot deal with the exception that KSA can probably repeat a surge sufficient to cause a short term oversupply at least once a year if they wish. Sufficient storage and spare capacity of 500kbd-1mbd is all thats needed to develop surge capability. And I define a surge is 30-90 days of unsustainable exports.

Now what happens next I'd say a steady decline of at least 1mbd maybe as high as 4mbd annually depending on which model is correct that open.

And time will tell again who is right.

If the oil market stays flooded with oil through 2009 then we can say your right if prices go up then what ?

I can make a fairly accurate prediction that over the coming months the current supply surplus will be drawn down and high prices will return. Figuring out exactly when is tough my original estimate assumed we would not exceed the 5 year maximum storage before we started drawing down well we blew way through that and storage levels have remained high week after week god knows how much is setting in floating storage with no room to come onshore.

In any case once storage is obviously being drained the next question is how fast once it starts heading down then the best you can do is assume a steady linear decline that will give you the number of months before we are back in a strained oil supply level.

So whenever that is thats when we return to the high price regime. Given some estimates of a 0.5mbd shortfall and 80 million barrels of excess oil this implies 160 days to drain it down or about five months. In 2-3 months the decline in storage should thus be obvious.

So I can say that my assumptions can readily be proven wrong three months after storage declines. Now when does that start ?

Well given the above numbers I'd say storage levels would have to start declining within 2 months at most and it could start any week.