DrumBeat: May 30, 2009

Posted by Leanan on May 30, 2009 - 10:16am

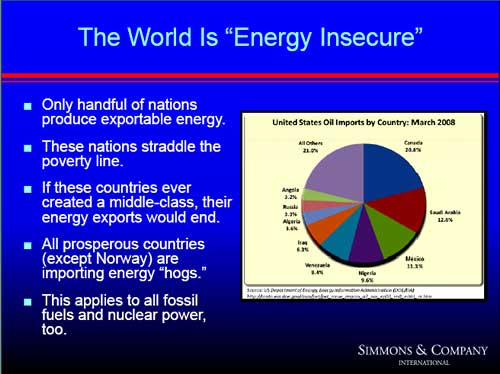

New presentation by Matt Simmons: Two Energy Oxymorons: 1. Energy Independence 2. Energy Security (PDF)

Review of RAND study, Imported Oil and US National Security (May, 2009)

RAND Corporation has brought its considerable expertise to bear on the national security implications of US oil import dependence. The study, "Imported Oil and US National Security" (127 pgs), was conducted by a team of analysts within RAND’s Infrastructure, Safety & Environment (ISE) department, led by Keith Crane. While this study examines this issue solely from an American perspective, many of its observations are applicable to other import-dependent nations. Although there is much of value in this report, I wish to challenge its central recommendation on how government should deal with price spikes and physical shortages.

Gas price surge may stall recovery

NEW YORK (CNNMoney.com) -- The rising price of gasoline is putting pressure on cash-strapped motorists and throwing barricades into the path of a speedy economic recovery.

Latin America is a study in contrast of how countries manage their oil. In Mexico and Venezuela, state and oil industry live in a symbiosis flaunted as resource nationalism – but their state oil companies are looking increasingly like wounded giants. Brazil's Petrobras, managed with a more open attitude, now overshadows its sisters to the north. This shows that pragmatism, not xenophobia, is a better safeguard of national interests.

Brazil leans toward oil production sharing-minister

RIO DE JANEIRO (Reuters) - Advisors to the government "strongly support" a production sharing model to develop Brazil's massive subsalt oil reserves, as Latin America's largest economy considers changes to its Oil Law to fund social welfare programs, Energy Minister Edison Lobao said on Friday.

Venezuela Oil Minister Seeks Cash, Partners in Japan

(Bloomberg) -- Venezuela’s Oil and Energy Minister Rafael Ramirez met with Japan’s Prime Minister Taro Aso today in Tokyo as the South American country seeks financing for energy projects.

U.S. natural gas rig count slips to 6-1/2-yr low

NEW YORK (Reuters) - The number of rigs drilling for natural gas in the United States fell by 8 this week to 703, the lowest level in 6-1/2 years, according to a report issued Friday by oil services firm Baker Hughes in Houston.

National Grid takes £30m fight to Court of Appeal

National Grid, the energy networks operator, is to take its fight against a £30 million fine from Ofgem, the industry regulator, to the Court of Appeal, the company said yesterday.In February 2008, National Grid was fined £41.6 million for restricting competition in the domestic gas metering market, the highest fine to have been imposed in Britain’s energy industry.

GM plans to make small car in USA

NEW YORK (CNNMoney.com) -- General Motors, with bankruptcy looming, pledged Friday to build a small car in the United States in an idled car plant that will be revamped.

Some China analysts are crying foul: If IVA growth figures are being cooked, surely that means China’s recent GDP data have been overstated too. China’s statisticians use IVA output to estimate what accounts for nearly half of China’s GDP.China’s association of electricity generators has a solution: it’s stopped publishing consumption data.

Court orders Curacao oil refinery to cut pollution

A court has ordered a Curacao refinery run by Venezuela's state-owned oil company to cut pollution or face heavy fines, a victory for activists who have complained for years about the thick haze of smoke that often blankets the capital in the Dutch Caribbean island.

Collateral Damage And Response To The Food Crisis: It Wasn’t Supposed To Be This Way

But lest we forget, let’s remind ourselves that it wasn’t supposed to be this way. Trade liberalization and the reduction of government involvement in food markets were supposed to make food supplies more reliable. Instead, FAO documents interventions by 102 countries to ensure stable food supplies while IFPRI documents 54 projects in which food-importing countries are positioning themselves so they are not at the mercy of the market when food supplies are short.

ADB calls for low-carbon transport systems

The Asian Development Bank Saturday called on its Asian government borrowers to design mass transport systems in a way that would slow the rapid growth of their greenhouse gas emissions.

Why our 'amazing' science fiction future fizzled

Corn says Americans' faith in the power of technology to reshape the future is due in part to their history. Americans have never accepted a radical political transformation that would change their future. They prefer technology, not radical politics, to propel social change."Technology has been seen by many Americans as a way to get a better tomorrow without having to deal with revolutionary change," Corn says.

Gulf Arabs look east after EU trade deal hits wall

MUSCAT (Reuters) - Gulf Arab oil producers are expected to sign trade pacts with China, South Korea, Australia and New Zealand starting this year after talks with the European Union for a similar deal hit a wall, an Omani official said.The Gulf Cooperation Council (GCC) -- an economic and political bloc of six nations -- suspended talks with the EU late in 2008 after a disagreement on human rights and democracy derailed two decades of negotiations.

The alliance that includes world top oil exporter Saudi Arabia, the largest Arab economy and a member of the G20, is now looking at EU's rivals in the east, Abdulmalik al-Hinai, undersecretary for economic affairs at Oman's Ministry of National Economy, told Reuters in an interview late on Friday.

EU cool on Russian appeal to help Ukraine on gas

BRUSSELS (Reuters) - The European Union is unlikely to meet a Russian request to help Ukraine with payments for billions of dollars worth of Russian gas, European Commission President Jose Manuel Barroso said on Friday.Barely four months after a pricing dispute between the two ex-Soviet states in January that disrupted supplies to Europe, Russia last week rejected a Ukrainian proposal to defer payment on up to $5 billion in gas storage fees. Moscow, backed by Italy, has urged the EU to help Ukraine.

Clouds gather over energy prices as storm season starts

NEW YORK (MarketWatch) -- Fewer hurricanes are likely to gather over the Atlantic during the tropical storm season that starts Monday, but it would only take one or two aimed at key facilities to fan already rising oil and gas prices, analysts say.The National Oceanic and Atmospheric Administration is expecting 14 storms compared to 16 last year, and fewer major hurricanes.

Still, this hurricane season again threatens to halt energy production and swamp key agricultural regions, raising the cost of natural gas, gasoline and even some food, and possibly waylaying a U.S. economy recovery.

The price of Venezuelan crude oil rose above US$50/b in mid-May for the first time in eight months. Yet this level is still too low to alleviate financing pressures on the government. Officials outlined a modest fiscal adjustment in March, along with plans to meet government financing needs with new debt issuance, but this may no be sufficient to close the budget gap.

Oman to up oil output to 830,000 bpd by end-2009

DEHRADUN, India (Reuters) - Oman will raise its crude oil production to up to 830,000 barrels per day by the end of this year, oil minister Mohammed bin Hamad Al-Rumhy said on Saturday.

Petro-Canada, the former state oil company, is -- shareholders and Competition Bureau willing -- about to disappear into a merger with Suncor. Although it has, in theory, been "just another oil company" since the early 1990s, for the first half of its existence it was a major factor in Canadian politics. It was rarely a benign one.

India aims to end fuel subsidies

India's government said it may eliminate diesel and gasoline subsidies as soon as July, quicker than expected, ending a policy that had crushed state refiners' profits, strained government finances and inflated oil demand.

U.S. Says ‘Significant’ Gas Resource Found in Gulf

(Bloomberg) -- Drillers discovered “significant” possible energy resources in gas hydrate in the Gulf of Mexico, the U.S. Geological Survey said today.The gulf “contains very thick and concentrated gas- hydrate-bearing reservoir rocks, which have the potential to produce gas using current technology,” USGS said in a statement. Gas hydrate is comprised of natural gas and water.

How the American Oil Industry Can Save Your Retirement

According to new analysis by the American Institute for Economic Research, federal tax revenue fell $138 billion last month compared to just one year ago. News headlines will likely focus on how the drop could severely hinder Washington’s ability to pay down the projected $1.7 trillion budget deficit. That’s missing a major point -- how the drop will impact American workers’ outlook for prosperity and retirement.Pundits will also certainly ignore the role our oil industry could play in easing these problems. Let’s look at both issues.

Web Video of the Week: Understanding Peak Oil

The whole discussion of oil supply and demand can be slippery and complicated. How long will it last, and when can we expect to see serious impacts on our everyday lives? If you're looking for an entertaining and captivating overview of this issue, we've found it. Watch this feature length documentary online now to learn about the history, present and future of global oil production and consumption. It could change the way you plan your tomorrows.

New industrial revolution on way, says HSBC

BRITAIN is set for a second industrial revolution as the traditional industries of manufacturing and farming are replaced by robotics, gaming and wind farms, a major new report predicted today.

22nd Century Darwinians Challenge the Church in "Julian Comstock"

Peak oil has left the world a churchy, early-industrial shambles in Robert Charles Wilson's new novel Julian Comstock. An engaging cross between post-apocalyptic series Jericho and Susanna Clarke's Jonathan Strange & Mr. Norrell, it may be the best science fiction novel of the year so far.

Top six tips for surviving post-peak oil gas-archy

When we have to get all Thunderdome-y to get gas, what are V-8 loving horsepower junkies like ourselves supposed to do? Doing anything with batteries other than using one to start the car is like putting a steak in the microwave, and even thinking about it is cause to be backhanded. (I’m lookin’ at you Neil Young.) The solution has to be loud, go fast, burn something and preferably retain the internal combustion engine. I have come up with the top six totally unscientific and completely non-reality based solutions to get us through dryer times.

Liftoff for the New Apollo Energy Project

AS the space-shuttle program ends, some people question whether America still has the guts for bold new projects, in space or elsewhere. The House Energy and Commerce Committee answered that question affirmatively last week, when we launched an adventurous new national project to build a clean-energy economy for the United States and the world.

Worried about drought, Washington State is planning to dam the Similkameen River. Opponents say the project would trigger destructive floods in B.C.

We all know that the financial stakes are enormous in the global warming debate — many oil, coal and power companies are at risk should carbon dioxide and other greenhouse gases get regulated in a manner that harms their bottom line. The potential losses of an Exxon or a Shell are chump change, however, compared to the fortunes to be made from those very same regulations.

Risk too high for non-state carbon capture -Statoil

MONGSTAD, Norway (Reuters) - Industry refuses to invest in carbon capture and storage (CCS) projects without strong state support because of a lack of clarity on future emissions rules, Norway's StatoilHydro (STL.OL) said on Friday.

The man who could change the world

America has been slow to respond to climate change, but its new Secretary of Energy, Nobel prizewinner Steven Chu, is determined to make up for lost time. He calls on fellow scientists to step up to the plate.

Atlanta Roofer Blasts Obama Energy Adviser on Proposal to Paint Roofs White to Slow Global Warming

KTM also points out an additional dilemma around materials used. Specifically asphalt roofs, which is the roofing material used to cover about 80% of all residential homes in the United States cannot be sufficiently painted to last for extended periods of time. Essentially the choice color of your asphalt shingle roof is limited to whatever color shingle you pick out during installation.Paint has a difficult time sticking to an asphalt roof. In addition, painting an asphalt roof will cause the paint to bubble and blister as a result of moisture getting trapped. This is magnified if freezing conditions occur, which can cause cracks in the shingles. Finally, KTM has confirmed with CertainTeed, a leading manufacturer of asphalt roofing shingles that painting an asphalt shingle roof will void the manufacturer's warranty.

At a meeting on population and resources early this year at the University of California in Berkeley, one session focused on global energy trends. Richard Nehring, a consultant tracking fossil fuels, noted that Africa (below and above the Sahara) has vast deposits of natural gas (CH4), many of which are suitable for extracting butane and propane, valuable household fuels. This leads to a glaring question.We know there are orphan drugs — potential treatments for diseases in poor places that don’t get pursued because there’s scant profit. But is natural gas in Africa essentially an “orphan fuel”?

Republicans say Democrats' proposal will do little to ease climate change, only raise costs

WASHINGTON - Republicans on Saturday attacked the climate change proposal crafted by congressional Democrats and endorsed by President Barrack Obama as doing little to reduce global warming while saddling Americans with high energy costs.

In politics, the urgent but not necessarily terribly important always trumps the important but not palpably urgent. In the US today, getting out of the economic downturn is urgent, but not a matter of life and death. Moving towards sustainable energy use and cutting back on man-made contributions to global warming is a matter of life and death, but not immediately so in the US. When there is a conflict between a speedy exit from the recession and saving the environment, the environment therefore loses.

At Zero Hedge a guest blogger believes that Goldman Sachs is taking TARP money and running up the price of crude.

http://zerohedge.blogspot.com/2009/05/guest-post-good-bad-and-gdp.html

Assuming that the guest blogger is right (although I think he/she has some facts wrong and out of context), if Goldman Sachs didn't exist the price of oil/gasoline may be rising as much, almost as much, or possibly even more.

We are in the midst of the greatest and fastest expansion of fiat money the world has ever seen. The consequences are bound to be sudden and extreme.

As I have mentioned very many times over many years here, inflation in the US is not only virtually inevitable – hyperinflation is distinctly possible. Hyperinflation not only can occur with poor employment conditions, but those conditions actually encourage governmental policies that bring about hyperinflation. One does not have to look further than Zimbabwe for proof. This from a country that doesn’t have nitrogen cooled supercomputers to pump out billions in new money in seconds.

No need for conspiracies to explain the high price of oil, there are two good reasons for higher prices. Most importantly - the fact that world oil demand probably now exceeds supply (the latter being reduced by about 3 mbpd by the core OPEC countries). Then also - that excess world money, whether in the form of TARP funds, money that no longer that can be economically invested in oil infrastructure, or regular investment money that doesn’t like 0.20% interest rates on T-bills, will also flow towards the purchase of commodities.

The guy doesn't allege a conspiracy-you are the one bringing up that red herring.

"our own government supplying GOLDman Sachs and other bad market manipulators with TARP money"

Yep. I guess you are right. That forum is not alleging any conspiracy, just an ordinary, every-day, illegal collusion.

My understanding is that there were no legally binding restrictions placed on these firms that received taxpayer money (re their use of the funds)-there were implied promises stated by politicians to the media, but these were basically motherhood statements. The taxpayer funding was to re-capitalize these businesses run by corrupt management. That isn't a conspiracy in any way, any more than Bernanke loading a 12 trillion dollar contingent liability on the taxpayers is. A conspiracy implies illegality and secrecy, and all this is being done out in broad daylight (but 95% of the public could care less).

I think it's been mentioned here before, but the downslope after the peak is apt to give rise to speculative bubbles. As for the dollar, it's a piece of paper which is worth whatever you and your counterparties believe it is worth, end of story. Interestingly enough, a krugerrand is a piece of metal for which the same thing is true.

You know, after stumbling on TOD in 2005 I started following the writings of some of the 'goldbugs' and putting retirement money into Central Canada Fund, etc. They'd run these stories to the effect of "Oh noes, they're printing money faster than evar!" perhaps accompanied by footage from the Bureau of Engraving of currency sheets sliding off the intaglio press. Then the selloff in '08 demonstrated that nothing of value is immune to market fluctuations. Nothing. Turns out the goldbugs don't have any more idea than I do whether the market, the dollar, or platinum will go up or down next week.

As for Goldman blowing some of the speculative bubbles, nothing they do shocks me any more. Could well be true. But for Zim$ style inflation, I wouldn't expect it any time soon. The 'bugs' have been making this same dire prediction for forty-odd years and just might be right this time. Or not.

I’ve researched the issue of hyperinflation very thoroughly. Weimar Germany entered its period of paper mark depreciation when its combined internal budget deficit and external trade/finance deficits were very similar to that which exists in the US today.

Hey - don't take my word on that, read up on that yourself.

Also you might also want to know that 'Black Swan' author Nassim Nicholas Taleb is now betting on hyperinflation.

Good luck to those betting on deflation.

http://online.wsj.com/article/SB124380234786770027.html?mod=djkeyword

Not even close. For a start, Weimar Republic obligations were denominated in something they couldn't print. Second, the US hasn't engaged in any quantitative easing at all.

This doesn't mean that eventual inflation in the US isn't a threat (after economic recovery), but the analogy of Weimar republic is ridiculously wrong.

I was looking at Matt Simmons new presentation.

One thing he says is

With respect to being water intensive, I thought most of the issue was with produced water -- reinjecting it, or treating it for sale, or putting it in ponds, as in the Canadian oil sands. It seemed to me that the water intensitivity comes when one gets to electricity production. There, one generally has water-cooled power plants, and water is taken from a stream, used once, and put back in the stream (or evaporates).

What am I missing? When I visited BP's tight gas facility out in Wamsutter, WY (in a desert), I didn't see any water entering the facility, except for the use of employees to drink. When I visited Chevron's heavy oil facility in Kern River, California (also in a desert), they were a net exporter of water, selling the produced water they had treated for agricultural purposes.

I noticed a comment at the bottom of one of Simmons's slides where he suggests that human population could reach 15-25 billion. Apparently he doesn't think we have already overshot, and apparently he hasn't yet connected how food production is tied to oil/gas production.

Gail, when the shale gas test well was being drilled south of my property last fall, I saw truckloads of water going south--maybe a hundred truckloads over a week or so. I was told they were using it for fracing. This was just for one well that was never even produced (yet.)

Marcellus Shale Water Resources and Natural Gas Production

The US drilled 32,630 Exploratory and & Development NG wells in 2008, so maybe 97,890,000,000 gallons as a high figure? Whatever that amounts to in the broader scheme of acre footage etc.

This EPA pdf has this to say:

A subject worth investigating further. I've already posted a story about three US states conducting investigations into groundwater contamination from UNG drilling; this may well dampen the whole Galbraith-style euphoria for UNG.

Thanks for the information.

One thing that may have made a difference was that BP was developing the area rather slowly. There were a large number of producing wells that had excess water. It may have been that some of the water used was from these other wells.

Another thing that was different was that the wells were all vertical (or directional, four out from the same location). Since they were shorter wells, maybe the fracing took less water.

According to one reference:

you make a great point and maybe rockman can give more detail.i personally dont think the marcellus shales will be exploited to the degree chk and others think.not only are millions of gallons of water used for fracing what about the contamination of groundwater,cows are dying,folks are getting skin rashes,and other ailments.the barnett shale,haynesville,and woodford might be fully exploited but in my opinion that may be the end of tight shale gas in the u.s. r.m.

Kern River uses steam(huff and puff). It uses and recovers a lot of water.

Here's a great report- could be named 'everything you wanted to know about water requirements for heavy oil'.

http://www.evs.anl.gov/pub/doc/ANL_EVS_2321_heavyoilreport.pdf

I am pretty sure they water they used for steam was from reprocessed water that had been produced from other wells. I believe that about half of the produced water was used in their own operations, and half was sold for agricultural use.

Seems unhealthy.

Gail,

Your link doesn't go to Simmons' presentation. FYI.

Slight change of topic: anyone else been unable to get to Simmons' site for the past week or so? I get timed out every time.

Cheers

Gail's link works fine for me.

And I haven't had any problem getting to Simmons' site.

Her link has been working for a while now. As for Simmons and co., still get timed out, even when I try the home page rather than the direct link to presentations.

Maybe Korea doesn't like his attitude.

:)

Cheers

If:

1. Peak Oil did in fact occur in 2005, as Simmons indicates from data collected, and

2. The price of oil is apparently very sensitive to supply/demand fundamentals, as we can see from the recent rise to 66 dollars a barrel, even during a recession, with

3. 64 of the 98 oil producing countries in decline, and

4. High oil prices dampen economic recovery, keeping us in a protracted if not permanent recession, then

5. Oil hitting 147 a barrel, was a perfect storm oil price crescendo which marked our transition into post peak, with

6. The ramifications of post peak upon us now, and not in some distant future.

I wrote this because even though peak oil has occurred by most informed viewpoints, there still seems to be this idea we have time to do whatever is needed to alleviate or correct the situation. Even Simmons mentions a 5-7 year window of opportunity. No, if we are in fact past peak, and there is no viable Plan B, then we are destined to ride the energy descent all the way down. Post peak is not some futuristic event, it's happening now.

I'm operating that way. My goal is to be in Oregon before the end of the year getting settled in, creating community and running a couple businesses.

I can only assume the window of opportunity comes from 1. the slow speed of decline near the top and 2. the depth of the economic collapse, which may keep demand falling as fast as or faster than decline rates for a while.

But did the clock on the 5 -7 start in '05 or does it start now?

Cheers

Doesn't much matter if we don't do anything to take advantage of the "opportunity".

Cslater;

I feel that part of the window for responding also involves getting to use the remaining material flows and even the waste streams from our persisting consumer-fantasy.

I'm grabbing glass and mirrors, plexi, plumbing supplies and similar energy-rich construction materials that offer great and durable payback in terms of various energy capture systems, but which today are still flung around like 'expendables'. Bike Hardware and Discarded Exercise equipment is often made from pretty high-quality components, and lends itself to any number of smart 'AfterOil' accessories.

I know there are more industrial scale versions of this that are possible.. but I'm mainly looking to ways that homeowners can avail themselves to dumpster-scraps to improve the fixtures on their lifeboats.

Bob

The question of whether to adjust the color of one's roof seems to be more complicated that Steven Chu's talk indicated. According to the link above, painting asphalt shingles really doesn't work--it won't stick, moisture builds up underneath, and it voids the warranty.

The only real option is a new metal roof painted white. This is generally a lot better from a water catchment point of view (asphalt in roof water is not what one wants to drink). A white roof works in warmer climates, but increases heat needs during winter. With the higher cost, it seems like only a few homes in Southern states will make the change.

We spent decades making cheap homes out of whatever materials were least expensive. Max square feet and as large a palladian window as possible. The knowledge to build energy efficient homes was there, but energy was virtually free. Can you imagine if we made those homes with really well insulated walls and used the available techniques to make them use virtually no energy to heat? Passive solar?

We didn't. The roofs are made from oil because it was so cheap, and they cannot be painted. They won't last long anyway, nor will the rest of the houses, but trapping moisture in them will destroy them quickly. How much energy would be used, and how much carbon would be released in making new roofs?

This whole thing is a red herring - the goal is to sell people something, anything! You must spend money, and they will keep trying until they find something that will make you take on more debt. The word is MARKETING, and Obama is Marketer in Chief.

Most of the houses built in the last few decades are inefficient, poorly designed, poorly constructed crap made of cheap materials. They can't be turned into something energy efficient and viable with any easy fixes. It's not just the roofs.

Hi Gail, much of the "White Roof" topic was covered in a Drumbeat a few days ago so I won't repeat that discussion except to say to your statement that a white roof "increases heat needs during winter" is not necessarily true. (see past discussion)

It was interesting to see the asphalt roofing industry make such a quick rebuttal to the idea. Since asphalt shingles are all dark roofing materials (even those with the light colored granules still are considered dark) I guess they are feeling mighty threatened by this idea :^)

The asphalt spokesman also neglected to say that there are thick elastomeric coatings that are made to "paint" over shingles and asphalt roll roofing. I have a almost flat roof garage that had very leaky roll asphalt roofing. Putting a thick white elastomeric caoting on it cured the leaks and really cooled the garage in the summer.

Here is my elastomeric coating source and a collection of application pictures and a picture of a white coated shingle roof

You mentioned higher costs...white metal roofs do have higher UPFRONT costs only. A metal roof that costs $5000 and lasts 50 years must be considered against asphalt shingle roofs that cost $3000 but must be replaced every 15 or 20 years (3x3000=9000)

Also I think the newspaper reporters were a bit mixed up about the word "paint" - probably they just use it because it is catchy and quicker than saying "Replace or cover dark roofing materials with a white metal or elastomeric coating".

It's not the moisture from above that is the problem, a lot of moisture comes up from below. I realize that attics and/or interior roof surfaces are supposed to be vented, and vapor barriers used, but I would not count on that too heavily. Also, I doubt your $5k figure for a typical installed metal roof (having just put one on).

White roofs are a great idea for new construction or replacements.

In the mean time, go down to the local store and get a few $12 Chinese box fans, open the windows, turn off the A/C.

EDIT: This kind of retrofit would be a far, far better thing to do with our grandchildren's theoretical tax money than TARP or oil wars.

Greg, your prices are out of date--try doubling them.

I started using elastomeric twenty yrs ago hail won't touch it,roofer unfriendly.It's about the only paint you can get a life time guarantee on.My trim on the house is 18 yrs old still looks good.Have used it through the house over lath and plaster 300% stretchability.

White elastomeric roofing compounds do make houses cooler. I have felt the difference in houses and heard the testimonials here in Albuquerque.

Metal roofing provides the best durability of all the roofing options(50+ years). It also is rather fire-resistant in case those pesky brush fires throw embers onto your roof. White metal roofing also reflects insolation.

The problem, as usual, is cost. Metal roofing is expensive, but you get what you pay for. Also, most of the houses here have the 'adobe style' flat roof architecture, so one would need to pay the big bucks to retrofit the house with trusses and create a pitched roof, then sheath it with the (white) metal roof material. Pitched roofs have the added benefit of shedding water effectively...flat roofs are of course much more susceptible to leaking...last time there was a heinous rain event in Albuquerque many of the folks in my neighborhood had roof leaks...either from the roofs or cracked stucco parapets.

Metal roofs can also be easily recycled after their long life.

There are several houses in my neighborhood with retrofitted metal peaked roofs...a great investment if one can front the scratch. Metal roofs integrated with PV panels would be all the better...again, if one could afford it. As long as we are in love with King Coal and those vested interests, burning powdered ancient compressed and heated vegetable matter will be the paradigm, and that will get the government love instead of subsidies for distributed PV, which would be much more resistant to power grid/plant/substation failure due to natural disasters or terrorism.

Hi Greg, an interesting fact is that in Europe, the old, cheap asphalt roofs were banned in many countries decades ago. This due to the fact that cheap asphalt roofing does not last and just ended up in the landfill. The newer asphalt roofs do last much longer and if you check my previous post, you will understand one of the biggest unknown reasons why this is so.

Metal roofs used as a catchment area is possibly the cleanest roof catchment method. However, the surface composition of painted roofs likely releases not very friendly chemicals from the paint. Good for washing, toilets, etc. but not for drinking.

Unpainted galvanized (zinc coated) roofs or pure zinc roofs probably offer the best choice for capturing drinking water and are less expensive than the painted versions.

Getting back to Green Roofs that would reduce energy use is where this thread started. There is one type of roof system that has shown great promise over the years. The "Upside Down" roof system consists of (usually flat) a membrane roof with insulation and/or landscaping on top of the membrane. A green roof in more ways than one. It insulates, it can be green with plants and it has a life span that appears to be approximately 4 times the traditional flat roof.

Today, the modern membrane roof should last between 30 and 60 years. In the past, membrane roofs (Tar & Gravel) lasted 10-20 years. Approximately 80 years ago there were several "upside down" roofs constructed in Germany and the USA using old technology (presumably Tar & Gravel). These roofs are apparently still functioning today. The reason for the increased life span is the reduction in the"cycling effect" of these membranes caused by covering and protecting the membranes from daily heat and cold which caused tremendous expansion/contraction factors.

So with modern roof membranes in "upside down" roof systems, we could easily have membrane roofs lasting 200 years plus. Far more significant than just painting your membrane roof white!

In countries such as New Zealand where the vast majority of roofs are of corrugated galvanised steel, all paints sold as "Roof Paint" must comply with water collection regulations. This ensures that after an initial drying and outgassing period, levels of contamination from paint chemicals are within safe limits for potable water. Most cities and towns have reticulated water, but a high proportion of rural dwellers rely on roof collected rainwater as their main household supply.

An alternative (more expensive initially) option is "Coloursteel" where the galvanised steel is also powder-coated before roll-forming so that painting is not required after installation.

Although I have mostly lived in places with reticulated water supplies, for many years I have used roof collected rainwater for all drinking water. It certainly tastes better than the Chlorinated, Fluoridated, Alum Flocculated substance that comes out of the town-supply tap. It is this latter substance that I consider only suitable for flushing toilets and washing cars.

I have never heard of asphalt tiles being used as a roofing material in NZ. I doubt that a short life, flammable substance such as this could be used under our building regulations.

Cheers

Merv

Apologies for not including this PDF link in my earlier comment. "Biodiverse Vegetated Architecture Worldwide: Status, Research and ..."paste into Google Search for excellent article on this subject of "Upside Down or Inverted Roof Systems".

Cheers, Nic

We need the ability to change building color by season. Nanomaterials anyone?

State of the Cryosphere:

Two things are worrying me. They may be nothing but sea ice moving in its strange and funky way, but at least bear with me.

1. If you look here http://arctic.atmos.uiuc.edu/cryosphere/NEWIMAGES/arctic.seaice.color.00... you will see that current sea ice extent shows open water or greatly reduced ice extent north of Svalbard, Franz Josef Land and Severnaya Zemlya. In 2008, this did not occur until Aug. 10 or so. This the end of May. What scares me a bit is that during last year's melt season, those islands seemed to act as an anchor for the ice sheet.

This makes sense as the usual winds and currents push ice into the east Arctic area. If this early melt in those areas means the ice pack will lose its anchor early, then we should expect sea ice to break up more readily.

2. There is general weakness throughout most areas of the ice. The area of deep coloring north of the Canadian archipelego is very, very slight. If that thick ice is melting and/or floating away, what then? This would, in my opinion, be a harbinger for an ice-free or nearly ice free Arctic summer withing just a few years which would be expected to play havoc with global climate systems.

A. This may be nothing more natural variability.

B. This may indicate Arctic Sea Ice has definitely passed its tipping point.

Cheers

PS: That piece by Solomon is beneath ANYONE, let alone the oil drum. At least articles by principals here, and guests, explore a legitimate question wrt climate change, but Solomon?

False equivalence, ladies and gents, false equivalence. Did not the word "profiteers" tip you off to the pejorative nature of this disgusting rant?

Hi ccpo, you aren't the only one concerned. We're following developments in a thread at peakoil.com.

ccpo,

It's important to understand that the so-called "concentration" variable is not an exact value of the fraction of open water in the area of the graphic. It's calculated from the satellite data and surface melt can produce false values. That's why I watch the "extent" value, defined as the boundary of sea-ice of less than 15% "concentration". With that note, it is probably important that surface melt pond areas are changing as this would indicate that the melting is going on faster than in previous decades.

Here's another source for sea-ice extent, using the older passive microwave sensors. There's an animation given for the last month of data, as well as a snapshot of the graphic from last year on the latest date. You will notice that there's not much difference between the latest graphic and that from last year. Also, looking at the animation, you will see how "bugie" the data can be as this sensor is probably the one which has been reported to be giving poor data.

http://polar.ncep.noaa.gov/seaice/nh.html

E. Swanson

Thanks, B_D, but I get really accurate guesses from looking at both, but emphasizing concentration. After all, that's what tells you the condition of the ice.

I know you've got a peeve about melt ponds, but they don't concern me as far as interpreting the data because they are caused by the same thing as all other ice melt: temps. Since I look at trends, not given days or weeks, I find no deleterious effect from not worrying about ponds. Also, I look at images from at least two sites and sources, and sometimes more, so feel I have a fairly good sense of what the mean/avg. is.

Thanks for the site link.

Cheers

I was interviewed on Zapata George Radio (released this morning) about my blog series on "Steps to an energy solution" (series starts toward bottom of the page). Some of you may have heard the interview with Nate Hagens a few weeks ago. Also, Matt Simmons and JH Kunstler have been on.

If you are interested you can stream it from: http://www.zapatageorge.com/zapatag/web_radio

Question Everything

George

Hello TODers,

Kudos to Matt Simmons' slideshow presentation for the huddled masses, but nothing new to regular TOD readers. How about we give the ag output of Iowa and/or Nebraska to OPEC in exchange for a full, transparent audit? KSA, UAE, et al greatest postPeak fear must be their growing need to import ever greater quantities of foodstuffs [you can't eat crude oil].

As we have the SPR for oil, wouldn't it be better for all concerned if the remaining oil exporters had a multi-year Strategic Food Reserve [SFR]? You are not going to be able to convince an offshore rig worker in KSA to leave his family if he thinks they will be starving or threatened by food looters. This might give the world a few extra mitigation years before even this cannot be sustained.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

Hello TODers,

http://news.yahoo.com/s/ap/20090530/ap_on_re_us/us_stress_map_sun_belt_s...

------------------------

Has economic twilight fallen on nation's Sun Belt?

------------------------

Nothing new for us TODers as JHKunstler and Jay Hanson, plus others, have predicted this many years ago. I have also tried to give regular updates on my Asphaltistan in the hopes of dissuading others from coming here to ultimately make our Overshoot even worse.

It will be interesting to see what happens going forward: I think those areas that can achieve some degree of 'spine & limb' buildout of Alan Drake's standard gauge RR & TOD ideas, plus my narrow gauge 'ribcage' extrapolation of SpiderWebRiding and full-on O-NPK recycling, have the best chance to achieve some measure of Optimal Overshoot Decline.

Recall my earlier posts on how Chicago, starting in 1899, hand dug 60 miles of narrow gauge track to help relieve the surface traffic jams of vital goods. I think this is easily postPeak achievable in many of the Sunbelt locations as relocalized permaculture and increasing urban density move forward as energy and vital resources deplete.

The question is if the deluded leadership wants to move in this mitigative direction, or just continue BAU until the Thermo/Gene fast/crash scenario unfolds [ultimately leading to Jay's Requiem scenario]. Time will tell...

What would be interesting is to statistically figure out the average speed/lb of all resources used in a major city, say starting out from a 100 mile local radius [My SWAG limit for fully developed SpiderWebRiding]. Unfortunately, I don't have the skills to figure this out myself.

Sure, you might have out-of-season fruit flown in by jet, but it still moves slowly from the airport to our mouths. Perhaps NYC's avg speed/lb of all resources might be 10 mph now, but look how much depleting energy they are using to achieve this goal. Obviously, the Nuahtl Tlameme backpacking scheme [55 cargo lbs/25 mile radius/3 mph] won't work for any major city, just as it didn't work for ancient societies.

But millions of people pedaling Spiderbikes [SWAG: 200-300 [500?] lbs/100 miles range/10-15 mph] may allow for a more graceful course into Optimal Overshoot Decline. This would allow many FFs to be diverted to more productive ends like modern dentistry and medicine [including birth control].

Looking at the Matt Simmons slide shown up top I wonder where Australia and Canada fit in. Both are middle class countries (not straddling the poverty line) that are major energy exporters. Between them they have most of the world's uranium. Canada exports oil from tar sands and Australia exports a lot of coal. I suspect the 'exports keep them poor' line won't hold for some NG exporting countries as well. The points made by Simmons may apply somewhat to crude oil but I don't think are always true for other energy sources.

I had the same thought when I read that one - Matt is being a little cavalier with the truth (or saying "energy" when he means "oil").

Re: Simmons's new presentation:

My understanding is that Canada is a major net exporter of oil, coal, natural gas, uranium, wood, and electricity, which seems to largely cover the major energy sources.

Unless I'm missing something large, Simmons is.

Hello TODers,

Interesting article speculating on future potash trends [key sentence below bracketed by me with *****]:

http://www.resourceinvestor.com/News/2009/5/Pages/Two-mining-juniors-poi...

------------------

Two mining juniors poised to challenge Canada's potash producing cartel

The dominance of Canada’s high-powered cartel of three major potash producers may come to an end if a couple of small but well-financed potash exploration upstarts continue their winning ways.

..However, Friedland is one of world’s most adept mining financiers, with close ties to deep-pocketed business interests in Southeast Asia. ****He is acutely aware that China would love to own its own Canadian potash supplies, rather than being beholden to a seemingly omnipotent Canadian potash cartel.**** One that dictates the high prices that China has to pay for an increasingly indispensible nutrient for its burgeoning agriculture industry.

Chinese potash inventories are reported to be very low but the Chinese government has yet to sign a new annual supply contract with Canpotex Ltd. – the joint international marketing unit of Saskatchewan’s three big producers. Negotiations have become protracted as Chinese importers continue to balk at paying dizzying record high prices. A recent spot price of around $750 per metric ton represents a nearly four-fold increase over 2007’s average prices.

------------------------

I have posted much before on how geo-strategic the Elements NPKS will become as we go postPeak. IMO, the politics will become increasingly fierce as more become aware of the critical nexus where depleting FF-energy meets depleting agri-fertilizers. This is no different than occurred earlier in history. Recall when Germany cut the US off from potash in 1914, and the Guano and Atacama Nitrate War even earlier. For TOD newbies, please google War of the Pacific, and/or read this weblink:

http://www.americanheritage.com/articles/magazine/it/2004/4/2004_4_63.shtml

---------------------

DOES GUANO DRIVE HISTORY?

Men have climbed mountains, sailed the seas, and fought and died for it.

----------------------

Have you hugged your bag of NPK today?

Bob

A local farmer in UK told me back in 2007 (and he got it from British farming press) that the sudden price rise for his NPK was mostly accounted for by the K. (This was before the oil spike.) The story was that US rapid re-conversion of set-aside land for massive ramping up of corn ethanol had been anticipated by US traders who had bought up more of world's mined stocks. Last year I read some stuff that mining investment was gearing up, but there was still a bottleneck.

Canada is not the only big world exporter of potash; the interactive map at Potashcorp website gives;

Canada 8.17Mt

Russia 5.25Mt

Closely followed by Belarus, Germany, at over 3Mt each, and etc.

http://www.potashcorp.com/media/flash/world_map/

I guess a lot of price 'gaming' going on out there.

best

Phil

Hello Phil Harris,

Thxs for your reply. Yep, it is hard to tell how all this will play out postPeak. Recall when China's CNOOC wanted to buy Unocal, but this IOC was considered strategic, so it was merged with Chevron. Similarly, it is hard to picture Canada or even Russia letting China buying up any part of their K-ore reserves, but who knows?

Consider the Connection to:

Environmental Communication:

Their are 6 honest "concerned" folks.

Their names are:

Who, What, Where, When, How & Why

Please Google or, AIM Search:

CTC123GREEN

CTC = Consider the Connection

123 = 3 PHOTOS = 3000 WORDS

GREEN = Going Green

Thank you for all you do for the environment.

Hello CTC123,

Welcome to being a new TODer. Many of us here are very deeply concerned with the accelerating decay of the planetary ecosystem. In regards to guano, I have many postings detailing the decline of bats and White Nose Syndrome which is just wreaking havoc among the North American bat species:

http://www.batcon.org/index.php/do-something/stay-informed/white-nose-sy...

-------------------

White-nose Syndrome

A Rapidly Spreading Threat

Just four winters after its discovery near Albany, New York, White -nose Syndrome – a mysterious but deadly threat to American bats – has spread beyond the northeastern United States and now infects at least nine states. With mortality rates exceeding 95 percent at some sites, WNS has killed hundreds of thousands of bats.

..American bats have never faced so dire a threat. If causes and solutions are not discovered very soon, extinctions are likely and WNS could spread across the United States and Canada, creating an ecological catastrophe. Like birds by day, bats are primary predators of night-flying insects, including many costly agricultural and forest pests.

----------------

My recent google of this topic shows that essentially no progress has been made to stem the losses.

http://www.emagazine.com/view/?4694

------------------

Bats on the Brink

..A hearing on white-nose syndrome is scheduled for the House Natural Resources Committee on June 4.

-----------------

If I was 0bama: I would offer an aftertax prize of one billion dollars to whomever finds the cure. This would still be much, much cheaper than the subsequent cost of most bats going extinct.