Drumbeat: August 19, 2009

Posted by Leanan on August 19, 2009 - 10:18am

Opec’s greed will herald the end of the oil age

Proclamations of economic recovery in the past week in Japan, France and Germany, and soon in Britain and America too, may signal the end of the Great Recession of 2007-09, albeit bumpily. As things stand, though, this month may also signal the beginning of the end of something far more historic and significant: the age of oil.Given how bleak the world looked as this year began, it feels remarkable to be seeing growth again so soon. But it is even more remarkable that the world is emerging from such a severe financial shock and slump with its most basic fuel, crude oil, priced at close to $70 a barrel, seven times its price of a little over a decade ago and double the level it was as recently as March.

So this must mean the rebound is even stronger than we think, with demand for oil soaring again? Not at all. Admittedly, this is a pretty opaque market, with many countries treating oil stocks as an official secret. Still, analysts at Banc of America Securities-Merrill Lynch reckon that global oil demand has been three million barrels a day lower in the second quarter of this year than in early 2008. They don’t expect it to get back above that until 2011 at the earliest.

No, the explanation for this potentially recovery-sapping (and certainly wallet-threatening) resurgence in the price of oil, and thus petrol at the pump, lies on the supply side. So, too, does the prospect of prices rising higher still, towards the extraordinary $147 a barrel reached in July 2008, or even beyond.

This point in the analysis is where the planetary gloomsters start citing a concept called “peak oil” (or, to the real oil nerds, “Hubbert’s peak”). This is the idea that the planet’s oil reserves are nearing (or, in some eyes, are past) a time at which the output from oilfields starts to decline. Don’t pay them any attention. The world is not running out of oil. What it is short of has been investment in oilfields and production. And the reason for that can be found in a different four-letter word: Opec.

Oil Surges to 2-Month High as Supply Drops Most in 15 Months

(Bloomberg) -- Crude oil rose more than $3 a barrel after a government report showed that U.S. inventories declined the most in 15 months as imports tumbled and refineries increased operating rates.Stockpiles dropped 8.4 million barrels last week, the most since the week ended May 23, 2008, the Energy Department report showed. Imports slipped 1.41 million barrels a day to 8.11 million, the biggest drop and lowest rate since September when hurricanes struck the Gulf of Mexico coast.

“Refiners were probably nervous about rising stockpiles and the outlook for lower gasoline demand in the months ahead, so they reduced purchases,” said Rick Mueller, a director of oil markets at Energy Security Analysis Inc. in Wakefield, Massachusetts. “You can’t help but pay attention to the massive drop in imports.”

Crude Oil Market Disconnect: A Problem Emerging

Last week crude oil prices bounced back above $70 a barrel before closing at $67.51, down $3.01 on Friday. As the chart of oil prices for the past six months shows, there has been a strong recovery this year, especially following the correction in July. Last week, oil prices closed above $70 on three of the five days, and on Friday the week before, they nearly reached $73 a barrel. This price action came in the face of continued government reports of crude oil inventories building and Frontline (FRO-NYSE), a large oil tanker operator, saying that the volume of crude oil in ships being used as storage had increased from 80 million to 100 million barrels.

Pemex plans to drill 200 oil wells

Pemex is looking for contractors to drill 200 oil wells in the southern district as the state oil company struggles to stabilise plummeting oil production.Drilling is scheduled to start in early October and last for three years, according to documents on Compranet, the government procurement website.

Pemex has ramped up investments despite the oil price crash late last year and early this year, providing opportunities for oil services companies such as Halliburton and Schlumberger at a time when activity has slowed in major markets such as the US and Canada, reported Dow Jones.

U.S. Gets $115 Million for Offshore Oil, Gas Leases

(Bloomberg) -- BP Plc, ConocoPhillips and Petroleo Brasileiro SA were the three highest bidders in a $115 million sale of new leases to drill for oil and natural gas in parts of the western Gulf of Mexico.“We are demonstrating our continuing commitment to domestic energy production,” Liz Birnbaum, director of the department’s Minerals Management Service, said today in New Orleans, where the sealed bids were opened.

Canada, ultradeep water assure US Gulf oil supply

HOUSTON (Reuters) - Growing volumes of crude oil from Canada and the Gulf of Mexico should assure U.S. Gulf Coast refiners adequate supplies for years to come despite fast-declining imports from Mexico and Venezuela.Imports from the two major Latin American suppliers have dwindled by 24 percent in the past four years, but the huge refining region they serve is unlikely to run short due to billions of dollars planned for new pipelines from Canada and exploration in the deepwater Gulf, analysts said.

Canadian oil sands production alone could make up for both losses, said analyst Martin King of Calgary-based FirstEnergy Capital Corp. "You're essentially switching to Canadian crude from Mexican and Venezuelan," King said.

Why oil won't return to triple-digits

NEW YORK (CNNMoney.com) -- Oil prices have surged nearly 50% from the start of the year, but don't expect a return to triple digits anytime soon as worries about the pace of an economic recovery will continue to drive near-term volatility."The market is manic right now," said Phil Flynn, analyst at PFG Best. "This is more uncertainty than I've seen in a very long time: big rallies followed by big breaks, and that's reflective of feelings about the overall economy."

ANALYSIS - Angola's excess oil implies OPEC to hold steady

LONDON (Reuters) - Increased oil output to a year-high from OPEC's president Angola, flouting agreed limits, has helped stack the odds against any formal change when the producer group meets in September.

Dam Disaster May Push Up Electricity Prices

Energy Minister Sergei Shmatko said Wednesday that electricity prices will have to increase after a disaster at the Sayano-Shushenskaya hydroelectric plant knocked out a quarter of RusHydro’s power production.

Germany wants a million electric cars by 2020

BERLIN — The German government unveiled plans Wednesday to get one million electric cars zipping around the country by 2020, offering sweeteners to jump-start national giants like BMW and Volkswagen into action."It is the federal government's aim that by 2020, there will be a million electric cars on Germany's streets," said Berlin's "national electro-mobility plan" which was approved by the cabinet.

"In 2030, this could be over five million. By 2050, traffic in towns and cities could be predominantly without fossil fuels," the proposals added.

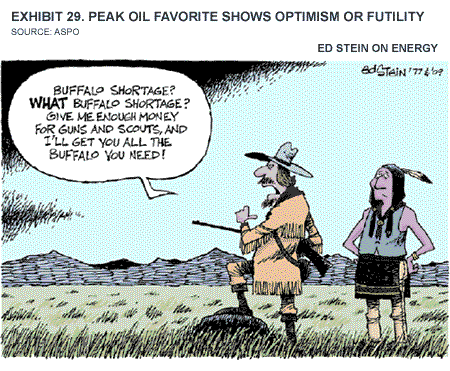

Oil and gas explorationists in the U.S. energy business have come from a long line of optimists that have populated the country. Give them more resources and they'll find more oil and gas.

95 killed on Iraq's deadliest day since U.S. handover

BAGHDAD, Iraq (CNN) -- A series of bombings rocked Iraq's capital within one hour Wednesday, killing at least 95 people and wounding 563 others, an Iraqi Interior Ministry official said.

Ahmadinejad may face tough fight over oil minister

TEHRAN (Reuters) - Iranian President Mahmoud Ahmadinejad will on Wednesday nominate a relative novice as oil minister and seek to bring women into the cabinet for the first time -- but he may face a hard fight to win approval from the conservative parliament.The outcome will be a further signal as to how secure Ahmadinejad's grip is on power after political setbacks following his contested re-election in June that led to street protests and political turmoil.

West Australia Becoming the Saudi Arabia of Natural Gas

Western Australia is set to become the "Saudi Arabia of natural gas" as other deals follow the signing of a A$50 billion (US$41.315 billion) agreement to supply liquefied natural gas to China, Premier Colin Barnett says.

Petrobras pumps up home production

Brazil's state-run oil company Petrobras said today domestic oil production rose in July to 1.938 million barrels a day compared to 1.927 million barrels per day in June.Production was up 3.8%, when compared to July 2008, the company said in a statement.

Kuwait oil min says unaware of U.S. refinery plan

KUWAIT (Reuters) - Kuwait's oil minister said on Wednesday he was unaware of any plans to revive a refinery project in the U.S. state of Louisiana."I'm not aware of such a project," Sheikh Ahmad al-Abdullah al-Sabah told reporters at Kuwait's parliament.

Kuwait's Arabic language daily, Al Watan, citing unidentified sources familiar with the matter, reported on Wednesday the Louisiana refinery would be considered compensation for Washington after Kuwait cancelled a multi-billion petrochemical project with Dow Chemicals Co. (DOW.N) last year.

Kuwait scrapped the deal after some lawmakers voiced opposition.

UK Ettrick oilfield starts, to pump 20,000 bpd - Dana

"Over the next few months the field is expected to produce at rates of up to 20,000 bpd as the wells are tied into production," Dana Petroleum said in a statement.The field will add to supplies from the UK North Sea, which have fallen to about 1.3 million bpd since peaking in 1999. The quality of Ettrick oil is similar to that of Brent, one of the benchmark UK crudes, Dana said.

Mexico's Fiscal Crisis Demands Action

Mexico's public finances have been heavily oil dependent since the late 1970s. Deep recession has caused non-oil revenues to plunge as oil production falls steeply. Urgent measures are required to address a fiscal crisis that erupted practically overnight. It is unclear whether Congress will agree to necessary tax increases and budget cuts.Revenue shortfall. The combined fall in oil and non-oil revenues has proved lethal for public finances. The total, 480 billion pesos, is equivalent to 4.2% of gross domestic product. The amount partially is offset because fiscal transfers to states and municipal governments are tied to revenue, and have fallen. However, the fiscal gap still totals 421 billion pesos.

'Commodities super-cycle to last for 20 years'

In 2007, she claimed the current commodities super-cycle would last another 20 years. But given the economic implosion since that time, could it still be true? "Absolutely," says Carmel Daniele, founder, CEO and CIO of CD Capital. "The crisis that occurred last year after Lehman's collapse just interrupted the cycle," she explains, adding that it "is actually going to seal the next stage of the super-cycle. . .it will make it stronger and last even longer."

Recession Robs Spain's Youth of Jobs and Hope

Take Eva Reina López, for example. She's 20; her father's an electrician and a widower. Reina did everything right. After getting her secondary school degree, she no longer wanted to be a burden on her father, who had raised her alone since she was six. So, instead of enrolling at one of Madrid's universities -- which had been her father's dream for her -- Reina followed her boyfriend to a small city in León Province nestled in the mountains of northwestern Spain. And there -- in her mother's hometown and where Spain's socialist Prime Minister José Luis Rodríguez Zapatero began his political career -- Reina learned how to weld. After six months of training at a company called Coiper, which manufactures towers for wind turbines, she secured an employment contract for six more months. The government in Madrid is promoting wind power as Spain's great industry of the future.In January, it was all over. Coiper can no longer find buyers for its products. The government froze subsidies for sustainable-energy ventures after the economic crisis hit, which has caused wind-farm construction to stagnate. As a new employee, Reina wasn't entitled to claim unemployment benefits, and she only received welfare payments of €400 a month through June. Her boyfriend and other permanent employees have had their working hours reduced. Now they sweep the empty production rooms, waiting for the news that the company is shutting down for good. "There aren't a lot of choices here in Ponferrada," Reina says. "What will we do if everything here closes?"

More Coloradans Losing Utilities For Unpaid Bills

DENVER -- Xcel Energy cut off gas or electricity to nearly 30,000 delinquent customers in Colorado in the first five months of the year, 15 percent more than during the same period a year ago.

Tips for a lower power bill, from the source

This could be a great day to wait until tonight to turn the dishwasher on, or hold off on laundry until the later evening hours. Also turning off unnecessary appliances, like idle computers or TV chargers, and turning up the air conditioner by a few degrees, consistent with health and safety.

Turkey wants lower price on nuclear project

ANKARA (Reuters) - Ankara wants a lower price from a Russian-led consortium aiming to build Turkey's first nuclear power plant as the government prepares to finalise its decision on the project, Energy Minister Taner Yildiz said on Wednesday.Yildiz said talks over electricity prices from the planned nuclear power station were ongoing after a tender last year, in which a Russian-led consortium of Inter RAO, Atomstroiexport and Turkey's Park Teknik submitted the sole bid.

Thailand: New push for coal and nuclear

The government will put more effort into educating the public about the essential need for clean coal technology and nuclear power in order to balance fuel usage, says Energy Minister Wannarat Channukul.Energy policymakers are again revising the 15-year power development plan (PDP) to place greater emphasis on coal, nuclear and renewable fuels and less emphasis on natural gas.

"Coal-fired power and nuclear power are the most preferred fuels, considering their low costs and emissions,'' Mr Wannarat said on Wednesday.

Thailand: Pipeline incidents a policy wake-up call

Thailand's power system is at risk of blackouts as policymakers have failed to manage the fuel balance, especially gas supplies, energy experts admit.

Russia tackles Siberia oil slick

Chemical pollution from Monday's explosion at Russia's largest hydro-electric power station has killed fish and spread down a major Siberian river.

Empty car parks to sprout vegetable plots

A London council is converting its disused spaces into areas for local people to grow produce in an attempt to make its food supply sustainable by 2050.Hundreds of unused and abandoned spaces in Enfield are to be converted into fruit and vegetable plots in the hope of the area becoming "London's breadbasket".

Informal growing spaces around the borough, such as car parks, disused garages and empty spaces around blocks of flats, are to be converted into vegetable plots, while two of its rundown parks will become community orchards. The scheme is part of a borough-wide strategy announced today with the aim of reinvigorating food networks and improving sustainability.

"The potential Enfield has for helping to feed itself and London is huge," said council leader Mike Rye. "We have a great agricultural and market garden heritage to build on - in years to come Enfield could become known as the capital's breadbasket."

Powers line up to stir Afghanistan's pot

In his distinguished diplomatic career spanning four decades, there is not a trace of record to show that Richard Holbrooke, United States special representative for Afghanistan and Pakistan, dabbled in energy security issues. His current visit to Pakistan - en route to Afghanistan - has been officially projected as aimed at helping his host country find a way to overcome its electricity shortage....Holbrooke's "cover" has been blown and his real brief is exposed - evolving a joint approach with Pakistan apropos the next moves to be made on the Afghan political chessboard. Indeed, regional capitals are watching the next US-Pakistani move.

Heating Oil to Approach $2 by End of August: Technical Analysis

(Bloomberg) -- Heating oil for October delivery is poised to approach $2 a gallon by the end of August after surging past a key resistance level yesterday, according to a technical analysis by Lind-Waldock & Co. in Chicago.

What Would High-Speed Rail Do to Suburban Sprawl?

Any transportation investment can create large economic ripples only if it significantly increases the speed at which an area with cheap real-estate gains access to a booming place that doesn’t have any comparable, closer available land area. For example, in Spain, the city of Ciudad Real seems to have gotten a big lift thanks to high-speed rail because people can now live in Ciudad Real, where housing is cheaper, and commute into Madrid.This logic has led some to think that high-speed rail will do wonders transforming Buffalo into a back office for Manhattan. Buffalo is 376 miles from Manhattan, so a 150-mile-an-hour rail line will take two and a half hours, which is not going to be significantly faster than air. Moreover, vast amounts of low-cost space are closer to Manhattan than the shores of Lake Erie. Faster connections between Buffalo and Toronto might do more, but in that case speed is hampered by the burdens of border crossing.

Thank goodness someone is crunching numbers on the Ottawa light-rail project. That person is Municipal Affairs Minister Jim Watson and his elves at Queen's Park who are putting some sanity into this rush for expensive rapid transit.Watson, a former mayor, says there were public concerns about costs in the first cancelled light-rail plan, which weighed in at $884 million. He's right.

Report of Toyota Battery Deal Sends Sanyo Shares Up

TOKYO — Toyota Motor will buy batteries for hybrid cars from Sanyo Electric to keep pace with growing demand for cleaner vehicles, a person with knowledge of the matter said Wednesday. The news sent Sanyo shares up 17 percent at one point.

Nissan, Showa Shell to Develop Electric-Car Battery Chargers

(Bloomberg) -- Nissan Motor Co., Japan’s thrid- largest automaker, plans to develop an electric-car battery charging system with Showa Shell Sekiyu KK, a Japanese refining unit of Royal Dutch Shell Plc, the companies said in a joint statement today.

Green power safer for workers than fossil fuels

As if helping to save the world from the worst effects of climate change were not enough, renewable energy may also curb workplace injuries and deaths.That's because fossil fuels – as the term suggests – have to be dug or drained from underground, and mining is one of the deadliest of industries. Oil and gas extraction account for 100 deaths each year in the US alone, coal another 30, not to mention many more non-fatal injuries.

Economic Climate Opens Door for Small Wind Energy Projects

Very few large-scale wind projects are able to obtain financing under the current economic climate. But falling turbine, steel and labor prices have created the perfect environment for mid-scale wind energy projects to thrive. Although total new installed capacity in 2009 may not rival the impressive 8,900 MW installed in North America in 2008, a golden opportunity exists for smaller wind development.

A radically different greenhouse gas strategy

Go with the technologies that could enable a few advanced and wealthy countries to regulate the amount of solar radiation that reaches Earth.

Get The Colbert Nation behind 350

One of my biggest enviro-heroes was on The Colbert Report on Monday. Bill McKibben, author of Deep Economy — a book I LOVE — talked with Colbert about WTF the number 350 stands for exactly, and what’s going down Oct. 24.Honestly, as much as I heart Bill, I really came to appreciate, through this clip, how skillful hosts like Colbert really have to be to keep things funny and engaging when talking about doom and gloom subjects like the potential for climate catastrophe.

Smart Grids May Help U.S. Boost Power Capacity by 13%

(Bloomberg) -- The U.S. may be able to increase power capacity by about 13 percent without adding plants by adopting “smart grids,” or energy networks that manage demand more efficiently, an engineering academic said.The U.S. may need to build 250 power plants of 1,000 megawatts each, about 25 percent of the current capacity, to meet electricity demand by 2030, Saifur Rahman, a professor at Virginia Tech College of Engineering, said in an interview today. Electricity networks equipped with so-called intelligent meters may help to cut energy use and halve that need, he said.

“Power plants need water, land and access and the target cannot be achieved, and there’s pressure on utilities to keep capacity flat,” Rahman said. “Half of the new capacity can be achieved with energy efficiencies and managing demand.”

Oil prices sink, trailing global stock markets

Oil prices fell below $69 a barrel Wednesday after a selloff in world stock markets cast doubts on the speed with which global demand for energy might recover.Comments by Kuwait's oil minister expressing satisfaction with present prices also appeared to keep the market in check. With an OPEC meeting coming up next month, the comments strengthened expectations that the Organization of the Petroleum Exporting Countries would not cut output.

Kuwait says OPEC should maintain output levels

KUWAIT CITY (AFP) – The Organisation of Petroleum Exporting Countries should maintain output at its meeting next month because oil prices are satisfactory, the Kuwaiti oil minister said on Wednesday.Asked if OPEC needs to increase or cut output, Sheikh Ahmad Abdullah al-Sabah said the cartel "should maintain output," adding that he hoped prices would remain between 70 and 80 dollars a barrel.

"Current oil prices are not bad at all," he told reporters, adding that he was optimistic that demand will pick up in the near future.

Oil firm says no Iraq payment yet

Norwegian oil company DNO, the first to drill in post-war Iraq, has said it has yet to receive payment for its oil exports from the country.The payments have stalled as DNO's partner, the Kurdistan Regional Government, and Baghdad argue over how to share the oil revenue.

Russia eases back on Ukraine flow

Russian gas exports to Europe via Ukraine fell by 36.9%, year-on-year, in the January to July period, according to data released by Ukraine's Energy Ministry.

South America: U.S. Military Bases in Colombia and the Dispute over Resources

The imminent agreement between the United States and Colombia over the use of seven military bases by the Southern Command (SOUTHCOM) forms part of the major dispute over commonly held resources throughout the South American region.First, a few recent updates:

• Venezuela has become the number one country in the world in potential oil reserves, following the announcement by the Venezuelan state-owned petroleum company PDVSA that locates an estimated 314 billion barrels in the Orinoco Heavy Oil belt. According to PDVSA, the findings show Venezuela knocking Saudi Arabia down to number two in the world with 264 billion barrels.1

• Fatih Birol, chief economist of the International Energy Agency (IEA), affirms that the oil crisis will hit much sooner than previously expected. "The world is heading for a catastrophic energy crunch that could cripple a global economic recovery, as most of the world's major oil fields have passed their peak production." Birol maintains that the figures the IEA had previously used were incorrect and he predicts that peak oil production will be reached in 10 years (2020 rather than 2030).

Iran commerce minister may move to oil

TEHRAN - An Iranian government newspaper said that current Commerce Minister Massoud Mirkazemi may be nominated as the new oil minister replacing Gholamhossein Nozari.Mirkazemi, an industrial engineer who has little known experience of the oil sector, would be a surprise choice for one of the cabinet’s most high-profile positions.

Yemen is producing 287,000 barrels of oil per day, down from an average of about 300,000 bpd last year, Oil Minister Amir Aidarous said today.

Canada inflation rate hits 56-year-low

OTTAWA (Reuters) – Canada's annual inflation rate hit a 56-year-low in July, when prices fell by 0.9 percent from a year earlier on sharply lower energy prices, Statistics Canada said on Wednesday.Analysts had on average expected an annual decline of 0.8 percent. July's figure -- the lowest since the 1.4 percent drop recorded in July 1953 -- is far weaker than the Bank of Canada's target range of around 2 percent annual inflation.

Venture Expects North Sea Field Sales to Accelerate

(Bloomberg) -- Venture Production Plc, the Scottish oil and natural-gas explorer fighting a takeover bid by Centrica Plc, is considering buying North Sea fields on expectations disposals will accelerate.“There is certainly evidence at the moment that there is going to be more activity, mostly oil assets to date rather than gas,” Chief Executive Officer Mike Wagstaff said today by telephone. “It’s always an important part of our business.”

Japan's Chubu seeks 2-3 spot LNG cargoes for Sept

SINGAPORE/TOKYO (Reuters) - Japan's third-largest utility, Chubu Electric Power Co, is seeking two to three spot cargoes of liquefied natural gas for September, in the aftermath of a strong earthquake last week, traders said on Wednesday.

Liberian oil tanker, British ship collide

KUALA LUMPUR - Malaysian rescuers scrambled on Wednesday to search for survivors and contain a major oil spill after a Liberian oil tanker burst into flames in the Malacca Strait, officials said.The tanker collided with a British bulk carrier late Tuesday, resulting in a massive explosion and flames visible from the beach town of Port Dickson in the southern state of Negeri Sembilan.

13 dead, 61 missing in Siberia plant explosion

MOSCOW – Rescue workers found a body Wednesday in the destroyed engine room of Russia's largest hydroelectric plant, raising the accident's death toll to 13, an emergency official said.Sixty-one other workers are still missing at the massive Sayano-Shushenskaya power station in southern Siberia after an explosion Monday blew out walls and caused the turbine room to flood.

Three of the plant's 10 turbines were destroyed, and three were damaged, the plant's owner said. The giant plant has been idle since.

Stray voltage drains Hydro budget

Toronto Hydro revealed yesterday that its stray-voltage scare last winter cost it $14.3-million, and said two trucks have begun patrolling the city's streets each night as the utility shifts its attitude to its aging infrastructure.

Woodside Values Its PetroChina Accord at A$45 Billion

(Bloomberg) -- Woodside Petroleum Ltd., operator of the Browse liquefied natural gas export project in Australia, said an initial agreement to sell the fuel to PetroChina Co. from the venture is valued at about A$45 billion ($37 billion).PetroChina will buy as much as 3 million metric tons of LNG annually over 20 years under an agreement struck in 2007, Chief Executive Officer Don Voelte said today. The deal size rivals the $41 billion PetroChina will pay Exxon Mobil Corp. over two decades for gas from the Chevron Corp.-led Gorgon project under a contract signed in Beijing yesterday.

Record $50bn gas deal was our work - Coalition

Australian Greens Senator Christine Milne criticised the Government for selling the gas from Gorgon too cheaply."These deals have been shown time and time again to have been done in a way that is very cheap and in the long term not in the best interests of the country," she said in Canberra on Wednesday.

Resources Minister Martin Ferguson needed to tell Australia what his plan for peak oil was, given that gas was needed as a transition fuel to cleaner energy, she said.

"We need to have gas.

"If Martin Ferguson thinks we're going to liquefy coal to run our transport fleet while selling gas to China then clearly he doesn't understand climate change."

Act Now on the Right FIT for California

California is on the brink of passing into law a game-changing Feed-In Tariff (FIT) policy that will unleash the tremendous potential of renewable energy and provide a massive economic boost in the state.

FCJ Interview with CA-10 Candidate Anthony Woods

CA-10 is a vast geographical District that encompasses Contra Costa, Solano, Alameda and Sacramento counties. It is currently serviced by BART, which connects three lines to San Francisco. However, interconnectability within the District via light rail systems does not exist, a typical problem that American suburbs must address to avoid a mass exodus from the hinterlands to urban areas when oil prices return to unaffordable levels.He said there’s a very real need to expand regional light rail and high-speed rail to help deal with the onset of peak oil, the point in time when the maximum rate of global petroleum extraction is reached, after which the rate of production enters terminal decline.

Woods said building more freeways is not forward thinking and would create “a bigger parking lot.”

“We need to get out of the mindset of our transportation issues being solved just by laying more pavement,” he said.

Going green helps Letchworth GC become a Transition Town

THE green, green grass of home is flourishing in one North Herts town.Letchworth GC has now qualified as an official Transition Town and joined over 200 other like-minded communities in their quest to live greener lives and be recognised as part of the Transition Network.

Transition Town Letchworth (TTL) are a group of volunteers who are keen to work with individuals and local organisations to inspire and encourage changes in attitudes to food, transport, and waste and energy consumption.

The Unstoppable Delusion Train

Imagine you are riding comfortably on a sleek train. You look out the window and see that the tracks end abruptly not too far ahead ... The train will derail if it continues. You suggest the train stop immediately and the passengers go forward on foot. This will require a major shift in everyone’s way of traveling, of course, but you see it as the only realistic option.To continue barreling forward is to court catastrophic consequences. But when you propose this course of action, others – who have grown comfortable riding on the train – say, “We like the train, and arguing that we should get off is not realistic.”

In the contemporary United States, we are trapped in a similar delusion. We are told that it is “realistic” to yield to the absurd idea that the systems we live in are the only systems possible or acceptable based on the fact that some people like them and wish them to continue. But what if our current level of first world consumption is exhausting the ecological basis for life? Too bad. The only “realistic” options are those that view this lifestyle as nonnegotiable. What if real democracy is not possible in a nation-state with 300 million people? Too bad. The only “realistic” options are those that view this way of organizing a polity as immutable. What if the hierarchies our lives are based on are producing extreme material deprivation for the oppressed and dull misery among the privileged? Too bad. The only “realistic” options are those that view hierarchy as inevitable.

Tesla Roadster turns 12.64 sec. at Pacific Raceways dragstrip

A Tesla Roadster Sport turned in a 12.64 1/4 mile time at Pacific Raceway near Seattle; that’s 102 mph at the far end! James Morrison's Roadster was one of four on the track at Pacific Raceways, Friday night, August 7th; here's the action on YouTube.

Ruling leaves North Georgia with water crisis

Georgia Gov. Sonny Perdue calls the ruling "a game changer." Says his spokesman, Bert Brantley: "It was unexpected. The fact he (the judge) would set the level back to a specific date was certainly very surprising."Charles Bannister, county commission chairman in Gwinnett, a growth powerhouse that gets all of its drinking water from Lake Lanier, says: "It's devastating, or could be," he says. "Gwinnett would become a desert, perhaps."

If U.S. District Judge Paul Magnuson's July 17 ruling set off trepidation here, it ignited celebrations downstream in Alabama and Florida. Those states have long eyed Atlanta's unchecked growth with concern, alleging that Georgia had no right to take unlimited drinking water from Lake Lanier.

Seattle voters reject 20-cent grocery bag fee

City leaders had passed an ordinance to charge the bag fee, which was to start in January. But the plastics industry bankrolled a referendum to put the question to voters in Tuesday's election.Plastic bag makers have lobbied hard to defeat the fee, outspending opponents about 15 to 1.

Coca-Cola, Pepsi on Beijing's worst polluter list: govt

BEIJING (AFP) – The Beijing plants of US soft drink giants Coca-Cola and PepsiCo have been listed as among the top 12 factories causing major water pollution in China's capital, the city government has announced.

Are Chinese Citizens Ready for A Green Revolution?

For China, a country with plenty of environmental laws but far too little enforcement, the news was a minor revelation. Two chemical factory officials convicted of releasing carbolic acid into a river - tainting a water source for 200,000 residents of coastal Jiangsu province - were sentenced on Aug. 14 to prison terms of 6 and 11 years. In the past such acts might result in little more than a fine. The state-run Xinhua news service noted it was the first time defendants who "caused environmental pollution were jailed on charges of spreading poison."

Climate plan calls for forest expansion

WASHINGTON — New forests would spread across the American landscape, replacing both pasture and farm fields, under a congressional plan to confront climate change, an Environmental Protection Agency analysis shows.About 18 million acres of new trees — roughly the size of West Virginia — would be planted by 2020, according to an EPA analysis of a climate bill passed by the House of Representatives in June.

That's because the House bill gives financial incentives to farmers and ranchers to plant trees, which suck in large amounts of the key global-warming gas: carbon dioxide.

US unions, green groups to stump for climate change bill

WASHINGTON (AFP) – US labor unions and environmental groups on Tuesday announced plans for a nationwide campaign to boost support for legislation to promote "clean energy" and battle climate change.

To truly help the environment, try 'cash for cluckers'

If we are serious about wanting to put the brakes on climate change, we should be offering "cash for cluckers." Encouraging meat-eaters to trade in their chicken for chickpeas and their pork chops for "fib ribs" is the best way to help the environment.

Study: Global warming sparked by ancient farming methods

(CNN) -- Ancient man may have started global warming through massive deforestation and burning that could have permanently altered the Earth's climate, according to a new study by researchers at the University of Virginia and the University of Maryland-Baltimore County.The study, published in the scientific journal Quaternary Science Reviews and reported on the University of Virginia's Web site, says over thousands of years, farmers burned down so many forests on such a large scale that huge amounts of carbon dioxide were pumped into the atmosphere. That possibly caused the Earth to warm up and forever changed the climate.

Deserts Expand Faster as Earth Brightens

As the world warms over the next century, global deserts could expand by as much as 34 percent, according to a new study, swallowing an area roughly the size of the United States.

Oil Industry Backs Protests of Emissions Bill

HOUSTON — Hard on the heels of the health care protests, another citizen movement seems to have sprung up, this one to oppose Washington’s attempts to tackle climate change. But behind the scenes, an industry with much at stake — Big Oil — is pulling the strings.Hundreds of people packed a downtown theater here on Tuesday for a lunchtime rally that was as much a celebration of oil’s traditional role in the Texas way of life as it was a political protest against Washington’s energy policies, which many here fear will raise energy prices.

I would be very interested in what the techies here think of the claim that a smart grid could save 13% of electric energy. This would be a pretty large "wedge."

Smart grids may save electricity, but they will further reduce the grid resilience if, as intended, they squeeze out the last drop of excess capacity from the system.

I would think that cutting peak load would be dipping into the excess capacity less.

Correct, as regards excess power plant generating capacity. As I took it, Nelsone is referring to transmission capacity, as opposed to generating capacity.

Exactly. Here in the Pacific NW we already have excess generating capacity, especially in the Spring, without sufficient transmission capacity to send it East. So we sell it cheap or even give it away to California.

Not unlike the oil net-export problem, we in the NW would prefer to keep our own lights on over "spreading the pain" if and when rolling blackouts begin - An insufficient grid will help keep our electrons closer to home.

Levelling us all out to one all-encompassing network will simply guarantee that when the blackouts come, no place will be spared.

Hello Nelsone,

I agree

"we in the NW would prefer to keep our own lights on over spreading the pain if and when rolling blackouts begin-An insufficient grid will help keep our electrons closer to home.", but honestly I had never thought of it quite that way until you wrote that.

My whole "Plan B" is predicated on having a functional grid here, even if we are otherwise picking with the chickens.

One thing that concerns me is the fact that Idaho has some of the lowest electricity and NG prices in the nation and the big states are always looking at the Bonneville Power Admin. with evil intent, at least when prices were up during the Bush years.

When prices do start going back up we may yet get our BPA taken away and broken up.

Let's hope not.

The better the grid, the easier to share cheap power, and the less likely those who are near it are to get the benefit of it. The rates of those currently with cheap power may go up because of the sharing (also, because of their share of the new transmission lines).

The better the grid, the less reason to build a new power plant close by. So NIMBY goes up even more than now.

The better the grid, the more likely expensive power is to be completely bypassed, The organizations selling it are likely to go bankrupt, removing one piece of capacity.

The better the grid, the easier to get coal fired electricity from Wyoming (or wherever).

There are a huge number of ramifications of a better grid. I seriously doubt more than little bits of one will be built. There are too many losers who will fight it. Also, no one will want to pay the cost.

No to mention making the grid all the more vulnerable to an EMP, whether man made or possibly solar in origin.

What do the main strean astronomers have to say aout solar emp?

I don't know that the word EMP is appropriate, but geomagnetic storms have caused problems in the past. The best example of that was the storm that was responsible for taking out part of the power grid in Quebec in 1989.

Perhaps you would prefer CME a coronal mass ejection or solar flare, either way it is an eletromagnetic pulse that would probably fry any smart grid in its path. The point is the so called smart grid would be very vulnerable.

From WIKI ......Impact of a CME

""When the ejection reaches the Earth as an ICME (Interplanetary CME), it may disrupt the Earth's magnetosphere, compressing it on the day side and extending the night-side tail. When the magnetosphere reconnects on the nightside, it creates trillions of watts of power which is directed back toward the Earth's upper atmosphere. This process can cause particularly strong aurora also known as the Northern Lights, or aurora borealis (in the Northern Hemisphere), and the Southern Lights, or aurora australis (in the Southern Hemisphere). CME events, along with solar flares, can disrupt radio transmissions, cause power outages (blackouts), and cause damage to satellites and electrical transmission lines.""

Had the Carrington Event happened yesterday, you would not be reading this. And probably would never be again.....

Let's see, the Hydro-Quebec event of 1989 occured after a major CME, during a solar maximum which occurs about every 11 years. The next solar maximum will be in 2011-2012. Get ready!

But this isn't the same as an EMP. I sure hope we don't have to worry about an EMP for it suggests a much larger (and nearer) threat...

13% savings is certainly achievable versus the current BAU. We need to keep Jevons' Paradox in the back of our minds however. The most likely vector for the Jevons effect is that if wildly successful savings are achieved, they will be soaked up with electrified transportation. So the grid will remain stressed and likely less resilient, as nelsone notes above.

If we build out small wind, solar pv, small chp at the residential/small commercial level it might mitigate the grid resiliency issues. It's a costly transformation, however, and ironically success in saving energy via a smart grid would undermine the cost/benefit analysis of adding new (even clean) generation.

"If we build out small wind, solar pv, small chp at the residential/small commercial level it might mitigate the grid resiliency issues."

Thanks. That was my thought, too.

I think the intermittency would make the problem worse, not better.

This is exactly the issue I was hoping someone with more expertise than I have could resolve.

As I understand it, the (or a central) point of having a smart grid is to better handle varying sources, users, and storage capacities while increasing the awareness of availability and price to all concerned.

I would have thought that all of those things would make the whole more robust, but perhaps it makes the system actually more fragile? How expensive would it be to protect the smart grid against this fragility?

I believe that a lot more than 13pct could be saved by cutting back on usage. Fans could replace a lot of AC at minimum cost in discomfort. AC in one room instead of the whole house when it's unbearable. LED lites for reading (I use in restaurants at nite because I don't see so well in dark). There's so much waste that a whole lot more that could be done.

Hi Dave,

As you no doubt appreciate, there are other forces that will likely pull us in the opposite direction. For example, more than 80 per cent of the new homes in this province are electrically heated and more than 90 per cent are equipped with electric water heaters. I don't expect these numbers to change appreciably within the foreseeable future; if anything, I expect electricity to grow share going forward.

In these parts, we're also far from saturation with respect to air conditioning. Yesterday, it was muggy 31C and, today, as I type this, its 30C. As much as I resisted the urge, I finally gave in and turned mine on last night because I was miserable and couldn't sleep. Those without a/c but who have the financial means to plunk down $99.00 for a window shaker at Wally World will likely do so if our summers continue on this path (all it takes is a couple hot spells to tip the balance). And if heat pumps become as popular as I imagine, these cooling loads will grow even more rapidly.

So, I agree, there will be some cut-back in usage, especially if rates escalate higher, but I suspect other factors will negate a portion of the savings; by how much, I don't honestly know.

Cheers,

Paul

Won't going from resistance heating to year round heating and cooling with heat pumps more than save the extra A/C being used in those very very short Canadian summers ?

Hi Neil,

It would, but the vast majority of homes built east of Ontario employ baseboard strips or, in some cases, electric thermal storage -- the former due to its low installed cost and simplified installation, and the latter because of NSP's attractive off-peak rates which are available exclusively to ETS customers. Relatively few homes at this stage utilize heat pumps, with the exception of a higher end home where central air is desired.

In Atlantic Canada, the growth in electric resistance will always out pace that of heat pumps due to its lower first cost, but a/c loads will likewise grow because the number of window units and central systems will increase over time, just not at the same rate.

Cheers,

Paul

From the NYT today:

More Fake Letters to Congress on Energy Bill

E. Swanson

From the same paper: http://www.nytimes.com/2009/08/18/opinion/18herbert.html?em

Sounds like a bunch of crock to me, climate change denialism is purely ideologically driven. The folks behind it need to fought tooth and nail!

http://www.uctv.tv/search-details.aspx?showID=13459

"Imagine you are riding comfortably on a sleek train. You look out the window and see that the tracks end abruptly not too far ahead ... The train will derail if it continues. You suggest the train stop immediately and the passengers go forward on foot. This will require a major shift in everyone’s way of traveling, of course, but you see it as the only realistic option.

To continue barreling forward is to court catastrophic consequences. But when you propose this course of action, others – who have grown comfortable riding on the train – say, “We like the train, and arguing that we should get off is not realistic.” "

This is, of course, a well worn analogy, but quite a nice expression of it here.

By the time you see (have a concrete observation) the tracks ending up ahead, the train will have too much momentum to stop in time. The engineer must be able to and actually read the map well in advance and correctly determine his location along the track to stop in time. Generally the untrained passengers are too stupid to do what is necessary.

Moreover, the other passengers will look at you and say:

"Who are you? We don't know you. You are not a celebrity. Why should we trust you? For all we know, you are an escapee from a local mental asylum."

So your insistence that the train should be stopped will go nowhere.

Remember that episode from Twilight Zone (original series) where plane passenger is sure he sees a monster sitting on the wing tearing away at the plane's engine?

_____________________

Stewardess, come quickly. There's a monster out there.

"The engineer must be able to and actually read the map well in advance and correctly determine his location along the track to stop in time."

The problem is that the engineer long ago decided that track always magically appears whenever it is needed so no map-reading or even concrete observation is needed.

Consider IEA's use of economists to determine future oil reserves--they just said that there will always be reserves sufficient to cover demand because that is what their economics text books (ideological limitless-growth propaganda) told them. It is only last year that the actual geologists did a careful field by field assessment that they started pointing out that without massive investment, track would soon run out.

Your point, though, is well taken. The train now has too much momentum. We needed to start taking measures at least twenty to thirty years ago for the transition.

We now just all need to assume crash positions (aka bend over and kiss your *ss goodbye).

Generally the untrained passengers are too stupid to do what is necessary.

Let's not get too smug about how smart and indispensable "we" are and how dumb and useless the other passengers on the train are.

One of the allegedly dumb others sitting on the train near you is a dentist. Next time you get a toothache post-peak, you may find out she is not as dumb & useless as you thought.

One of the allegedly dumb others sitting on the train near you is a plumber. Next time your pipes back post-peak, you may find out ...

We all need each other.

The article on "ancient farming" methods is truly an unfortunate "academic" essay to reach the mainstream media. It lacks in some very basic areas

I'm not saying that slash and burn agriculture isn't a poor practice. I've seen some pathetic contemporary examples where hillsides were cleared by burning and then plowed up and down! But the notion that "ancients" burnt enough to impact climate is absurd.

The crux of his argument is that the ancients required 10 times the acreage per person. Not only is it not clear where he got this number, but his assumption that every one of those acres was forested is clearly a stretch.

He further disregards the dynamism of ecosystems in the short term (something many archeologists are also frequently guilty of). Yes, a tribe using slash and burn will move plots frequently, but those abandoned plots don't sit fallow, and what grows there will take up carbon. And this is the fundamental flaw I see in his argument - carbon levels in the atmosphere are part of a flow - it is not a cumulative effect. Only when the maximum flow that the ecosystem can handle is exceeded to we run into problems.

And frankly, I'd have to doubt that early farmers were burning anything close to the number of acres that were burning naturally each year.

But the kicker that demonstrates this guy, Ruddiman, is loony tunes is his suggestion that the Younger Dryas did not become a full fledged ice age because a few ancient farmers started clearing fields with fire. At the end of the YD the number of farmers in the world probably was limited to a few thousand spread across the area encircled by the Taurus and Zagros mountains. That was some job they did preventing an ice age.

I generally agree with the thrust of your argument; blaming slash-and-burn horticulturists for such massive (planetary) environmental destruction seems far-fetched, but I wouldn't be quite so dismissive of the idea. Here, and in many previous posts, I fear you cling too strongly to an XVIII century noble savage view of humanity.

There's some archaeological evidence that pre-contact Amazonia was much more populated, and therefore deforested, even away from the varzea floodplain of the main stem Amazon and lower reaches of the major tributaries, than many researchers had assumed. And there's very good evidence of widespread pre- and early-contact burning of forests here in western Oregon. The authors of this article raise a provocative question worth exploring.

On the other hand, a recent article on Madagascar argues “The long-held assumption that Madagascar has lost 90 percent of its forest cover due to fire and slash-and-burn agriculture may be overstated, argues new research published in Conservation Letters.

Analyzing 6000-year pollen records in four sites, Malika Virah-Sawmy of Oxford University found evidence that vegetation in southeast Madagascar has for millennia been a mosaic of forests, woodlands and savannas, rather than continuous forests as generally believed.”

http://news.mongabay.com/2009/0812-madagascar_historical_deforestation.html

Fair enough. I may indeed sometimes be guilty of over promoting a simple life style, but much of that is due to my perception that most here seem to think our current life style is somehow better. The acceptance of "progress" even among those proposing "sustainable" solutions is overwhelming.

What I'd like to get across is that the value of a lifestyle is not found in its material wealth or ease, but in other more important aspects of our existence. Accepting that our current material wealth is "better" than past comparably poor eras ignores the rather extensive damage the concentration on material wealth has done those more important aspects of life.

Thanks for giving me the impetus and reason to clarify that.

Our forebears were not naive natives living in some Eden like paradise. They lived hard scramble lives requiring constant effort to provide for themselves and their loved ones. But neither were they child like intellectually. They explained the world to themselves in much the same way we do - though no doubt using different language and concepts.

The primary difference I see is that they filled their world with meaning. We fill our world with "entertainment."

Okay - I'll get off the soapbox now.

Thanks for the Madagascar reference. The advances is sediment core analysis over the last couple of decades is literally rewriting our knowledge of prehistory. I've been reading Steven Mithen's "After the Ice" recently and am finding it very informative and enjoyable. Worth the read for those interested in pre-civilization human life.

shaman - Michael Williams in 2006 published Deforesting The Earth - From Pre-history to Global Crisis.

Fire was the first wide-spread technology of humans so it reasons that not only did early farming groups use it widely so did hunter-gatherer clans.

Joe

Joe,

I believe there is a substantial amount of evidence pointing to the use of fire to keep large tracts of land open and more productive of large grazing animals.

Fire has been used to clear very large acreages for actual crop production but maybe the evidence is not so clear in this respect as to the acreage.

Some where in the work of Nanthaniel Hawthorne there is a fine description of a large fire set by Indians to keep thier lands open and easily hunted. Only a small portion of the burned over land was used for crops if I've got my facts straight regarding native Americans.

Got any good book titles handy?

OFM - Just started reading Jerry Mander's In The absence Of The Sacred

Mander took 10 years to write this book, and a lot longer thinking about it. It is a critical analysis of the impact of technology upon our culture and upon the way we have chosen to live--as well as the way we have had choices unilaterally made for us without our consent.

He doesn't invoke God or theism but he makes a strong case that we should individually begin the process of questioning our personal lifestyle choices.

Joe

Highly Recommended.

It really changed my thinking, I still remember it well (> 10 years ago...).

Thanks for the interesting reference, Joe. I'll add it to my list of books to check in to.

To be clear, I'm not questioning the role of fire in neo and paleolithic societies. I'm questioning the, to me, absurd notion that slash and burn farmers were responsible for global warming.

The role of humans in the disappearance of the North American megafauna is one of those prehistory mysteries that we may never have a convincing answer to. The biggest problem with the human oriented kill off theories is that there simply weren't very many humans in North America at the time. Indeed, some argue that it wasn't until the Younger Dryas reopened the land passage between Siberia and North America that the ancestors of the "Native Americans" came over (the earlier migration being supplanted by the late comers).

Anyway, interesting stuff.

I don't consider myself well informed on this topic, but I did find Brian Fagan's books on climate history to be very interesting--recommended, as long as you're compiling a reading list!

thanks jeff - Looking through his bibliography it appears that most directly related is "The Long Summer: How Climate Changed Civilization" - is that the one you were thinking of?

On the reading list; I'm apparently not very selective because my list is already longer than I will have time for in this life time. My wife makes fun of me because I frequently have half a dozen or more books "in process." But I continue to add books to the list and the priority changes all the time. I feel sorry for today's kids who are not being taught the value of a book - everything these days is 140 characters or less.

I don't have much of an opinion about how much arming such activity could have caused. However, you have to recognize that the longer lived GHG are cumulative (and the needed changes much smaller than the recent industrialized changes), so that a small level of emissions operating over several hundred or a few thousand years could still have a significant effect.

While true from a chemistry perspective - is this true for the global ecosystem as a whole? (that is a serious question).

My understanding was that carbon is regularly cycled out of the atmosphere via plant absorption and gravity (so-called carbon sinks).

When I originally read Ruddiman's paper in Climatic Change a few years ago I found him pretty persuasive. It wasn't just farmers as you understand it but also hunter gatherers like the Australian Aborigines who were modifying the environment with fire.

China is buying up oil fields in South America, Africa, and IRAQ!

So, the US is fighting the wars and spending billions in IRAQ so that China can have more oil.

WHen the US needs more oil, China will say its going to cost you dearly!

When the US goes broke from debt, then China will rule the world.....

What portion of Chinese oil consumption do you suppose actually ends up indirectly as U.S. oil consumption (i.e. without American demand for Chinese-produced goods, how much oil would China use?).

To answer one of your questions: Yes, the US attacked Iraq to ensure global oil flows that facilitate greater global consumption and BAU in our country. To many, this was obvious from the get go. To others, we attacked Iraq because of aluminum tubes or some such nonsense.

Good point, and when China sucks the US dry of all money from goods sales, they will sell to other countries who still have some money left.

The US is the one who will fall/fail due to lack of strategic planning.

Unless the US is planning to convert countries in the Middle East into US States?

Provinces and territoirs more likely-couldn't go upsetting all the poltical applecarts so carefully balanced by a few generations of gerry manders.

There may be a few well meaning liberals who will insist on statehood but I expext the "bizness democrats"(a term I haven't heard for a while) to give them a very sharp elbow in the ribs if they say it very loud or often.

Which once more shows that there is no acceptance or understanding of PO. A few extra million barrels a day in the short term makes things worse later.

Liberal nonsense.

The current war started when Iraq attacked and invaded Kuwait. The price of oil was an issue. And also Iraq accused Kuwait of stealing it's oil in the border region. The US responded because it has a security agreement with Kuwait. I suppose liberals think the world would be safer and more secure if the US abandoned all of it's security agreements.

Sorry, that was the '91 war, not the current war. No security agreements involved. Nice try at rewriting history.

Always remember..... Bush2 killed more Americans and Iraqi's than Saddam ever did while he lived.

But they hung Saddam......Bush2 is in Texas living the high life.

That ranks pretty closely to the most dismally uninformed statement I have seen on TOD.

"Liberal nonsense" is just frosting on the cake.

This is a lie. Ask any liberal in a position of power why the US bombed Iraq, and they will say that the cities were bombed first to stop WMD, then the cities were bombed to empower Iraqis with Democracy*. They will then say that no WMD was found.

They won't say that this killed 1,000,000 Iraqis and made 3,000,000 into refugees.

Ask any liberal in power, and they will say exactly what you just said about Kuwait.

Obama, who you may agree is liberal, is now escalating wars against Pakistan and Afghanistan. While claiming to withdraw from Iraq, he is leaving roughly as many troops there as we left in South Korea after the Korean War.

If you look at the actions of liberals in power, they will not seem much different from those of conservatives. The liberals sure do talk pretty sometimes, though.

*Japanese war museums claim that Japan bombed Chinese cities to empower Chinese with Democracy

Maybe. China is certainly rising but I think the 'China rules the world' meme is overblown. Anybody remember Japan, Inc. in the 1980s? 'They're buying our golf courses! They bought Rockefeller Center!' Japan's reign was short, as it turns out.

China is not Japan (they would bristle at the suggestion). China's rush to acquire basic resources looks shrewd. But I think they will have just as difficult a time perfecting their rights to these resources as US multinational companies have had with oil and gas resources (or invading US forces, for that matter). When a deal goes against a host country with resources, they will fight tooth and nail to recalibrate the deal. China played this game in its salad days, and it will be a delicious irony when they are on the other end, IMO.

Unlike Japan at its peak, China already is the #1 customer of many of these countries (which is the most reliable means of control).

China faces some extraordinary environmental challenges. These could severely constrain its economic growth.

China also faces extraordinary population and cultural problems.

China faces extraordinary economic and political problems.

China is a bubble economy that hasn't burst yet. Their people are restive.

I think China is in even worse shape than the US, economically. It' a poor (3d world) country with very low wage earnings. This wage problem in the US morphed into a large piece of our current crisis. How can it fail to do otherwise in China?

How long with the foreign currency reserves last when the Chinese banks start to fail and the government needs to come up with a lot of cash to cover losses?

If the banks don't fail, (because the government successfully pumps up the cash) how will the Chinese avoid hyperinflation?

If the China economy crashes, (When the China economy crashes) will the unemployed and desperate tear the country apart?

IMHO In my lifetime, China will become the economic powerhouse of the world.

...a far more dangerous, debased, depleted and corrupt world...

Now that resources are dwindling permanently, even the faux morality of the West will become an impediment to maximizing consumption and production. China can step in and provide economic activity without safety and environmental regulations.

The USA did the same thing to "Old Europe" in the last century. Europe today has a stronger social contract than America (e.g. everyone has a right to healthcare and retirement) but Europe has little power.

Likewise, in our future the USA will have a stronger social contract than China - but little power.

The USA has huge natural resources, but the limiting resource is fuel, and within five years the USA will become a net importer of all fuels by BTU.

Those who believe that natural resources confer political power should think of the Native Americans, who were annihilated despite having awesome resources.

They didn't really have "awesome resources." The continent did, but the Native Americans were not a country.

And of course, it's not just a matter of sitting on top of resources. You have to use them.

I think peak oil means it will become a lot harder to be a global power. In fact, I'm wondering if there will ever be a true global power again.

Yes, there were global powers before oil. But the driving engine there was expansion. I think we're past "peak expansion."

A major difference is that China is determined to be the #1 economy. The main goal of the USA is to benefit the economic success of a relatively small elite, even at the expense of the overall economy. Every third world economy or declining country operates like this. In China, the financial sector is used by the government to promote its agenda, in the USA the government is used by the financial elite to promote its agenda.

Damn Brian, we agree on something. ;-)

Ron P.

BrianT: A very good way of putting it. . . and a very good reason for all patriotic Americans to weap for their country!

There is only one thing left for us to do: Starve the Beast! Liquidate personal indebtedness, don't take on more, live within our means, boycot the commercial banks (try credit unions instead), and in general dry up the cash flow that keeps these moneyed elites on top.

Forget about mass protests in the streets. The nation with the largest military establishment and budget in the world, and the largest prison system in the world, has no fear of those. They are utterly powerless to force us to spend our money, however.

Everybody on Three.

One, two, Three stop paying taxes!!!!!!

That will cripple them immediately.

But it takes <3.

Does anyone think that taking back a country is easy and without risk??

If no one paid any taxes then there would be no police or fire protection. No protection from swindlers, robbers, killers or anything else. No roads except dirt paths would exist. No schools would exist. No government would exist therefore there would be no base currency. It would be a barter economy.

In the words of Thomas Hobbs "the life of man, (would be), solitary, poor, nasty, brutish, and short".

Ron P.

OK ,I will qualify my statement.

NO Federal tax.

Property taxes fund local services.

I am not even going to argue this because you know that criminals are in control and the only solution will be to challenge the criminals.

Nothing worth having comes free including FREEdom.

I don't blame you for not arguing this point because it is indefensible. If there were no federal government then there would be local governments except thugs and warlords. And other countries would still have strong central governments. If we had no federal government in 1941 we would have one today anyway. And we would all be speaking German.

Ron P.

States formed National Guards to provide the Republic with a military.

They still do. Do you really believe that nonsense statement about the Germans being able to take America?

It is not an all or nothing deal.

The States can easily provide for National defense with a much, much smaller and focused "Federal" government.

Everything could be and should be brought back to as local a level as possible.

There, I argued the points.

Absurd! Yes Germany and Japan could have easily taken the US if we had only local national guardsmen to protect the country. They would be only local troops with no government to supply them with planes, tanks and other weaponery.

If we had only local governments there would be little to no cooperation between them. Would the National Guard of Nebraska have landed at Normandy? With what and commanded by whom? There would have been no Pearl Harbor because there would have been no Navy to have been bombed. The Japanese would have ruled the Pacific with no losses whatsoever. And you think the California National Guard would have protected the West Coast from the mighty Japanese Army? Good God man, think!

Your argument is truly absurd. The only reason you believe it yourself is you have really not put any deep thought into it.

Ron P.

Ron: The USA couldn't even handle Vietnam. There is no way Germany or Japan could have taken the USA-at best they could have controlled some major cities. The place would never have been conquered-outside interests/countries would have continuously supported the rebels causing trouble.

I started writing another comment and then realized that he just wants to argue.

The idea that either could have supported an invasion across an ocean is ridiculous and Germany and Japan both knew that.

Also most of the American military machine was built after the Pearl Harbor attack as a result of factory re-tooling.

I was not saying that a national Defense is unnecessary but that the organization should include more say from the individual States so in the future the Feds can't just run rampant and do what ever they please with the military power.

The more local the decisions are the more likely the people will pay attention to them.

No, what you want is no rebuttal from your ridiculous claim that we do not need any federal taxes, meaning of course no Federal Government.

But under your system there would be no feds, only individual states. And if there were no federal government there would be no United States, only states. And if the federal government dissolved today there would be no military, no social secuerity, no medical care for people over 65. The mess of states would be nothing but a total mess.

If you are arguing for no federal taxes then you are arguing for no federal government pure and simple. And that is the case you must make.

And I dearly would love to here that one but I seriously doubt that I will.

Ron P.

The tax protest is to get the attention of the Feds.

Under my system the Feds would be accountable to the States and hence one level closer to the people.

Where did you read that I said no federal taxes and hence no federal government?

Please, give me some credit.

Don't you see that the Feds have gone off the reservation?

On the points you bring up I mostly agree with you but they are not the points that I brought up.

First you said:

Then you backed off from that:

Then you backed off a little further.

Well, common sense will tell you that without some kind of federal tax there can be no federal government. Perhaps you think everyone in the government will work for free and that will make them more accountable to the people.

Yeah right! You don’t pay them and they don’t work. There would be no federal government without money, tax money, to support them.

Methinks you still have a little backing to do.

Ron P.

OK, you got me on wording.

What I wanted to communicate was tax protest but as that goes since the Feds basically are unaccountable they will just add more digits via keystroke and pay the gov workers. The whole thing is out of control.

You win this one but I will remember.

And next time I will be more precise.

Can't afford to be sloppy on this site.

Thanks for the concession Porge. Please bring up your "Tax Protest" thread some time in the future. I have a good reply for that one to. But not now.

Take care, Ron P.

Oh NO!

Oh and it is not polite to gloat!

I don't think that's true. Or at least, I don't think it will necessarily hold true in the future.

In particular, I think China may eventually see disengaging from the rest of the world as more advantageous than dominating it.

I agree that they are more interested in building and running a closed economy.

They have used the Chimerica relationship to motivate their peasants to work as industrializing slaves to build a modern economy.

This seems obvious to me.

Also, the west will eventually have to fight with them over resources.

China is already the #1 customer of many countries, which means they indirectly control politically many countries. The Chinese control is a lot more subtle than the US version.

The Lechworth TT article got me thinking about the difference between the GB & the US.

The Community Thing

It looks like no one can post here without making at least one positive reference to community. If I didn’t know better it seems to have religious overtones. The other day one TOD person guaranteed that I would die a terrible death at the hands of some unknown malignant force because he perceived me as a “loner” and not a community member. I guess if I believed that the case I would “gun up” and form my own militia community for mutual protection. If you can’t beat em join em.

I am a social person but I have no idea of how community relates to knowing how the gory details of the future play out. I guess I am a loner as far as thinking about family, food, water and shelter. Those seem an individual effort. I grow vegetables for neighbors and am prepared to raise lots of spring time plants for everyone if we get to that point. My plow and tiller can make gardens galore. Renting a hall and showing a Return to or Death of Suburbia DVD doesn’t strike me as helpful.

My local community: 30% don’t give a hoot (loners) or will be opposed to anything for political reasons. 25% are addicted to legal/illegal substances – no help there. 5% are just plain crazy. 10% are religious nuts who have no need for outside community in this world. 5% are thieves – don’t need them. 10% are control freaks/megalomaniacs – should be avoided in groups.10% are wheeler dealers and are just looking for an edge. There are overlaps as it is possible to have crazy alcoholic Republicans who are megalomaniacs and thieves.

The 5% or so who might be interested in my community are mad at me because of my “Too many people in the world – COMMIT SUICIDE” sign in my front yard. (Really - I’m just kidding).

Really thoughtful people are wondering if it is best to let the whole thing crash or attempt some small bottom up moderation. Others argue for techno fixes. I sure don’t have the answer but I don’t think random community will play a large part in the timing or outcome. Lady luck, rate of decline and locale will probably mean more. The Shakers had the last US community that seemed to work out in the medium haul. The Amish are being assimilated. Community might be helpful so I’m looking for some guidance or thought on how it might work and not just some slogan du jour.

And I thought those were actually prerequisite qualifications for being a Repubulican. Of course let's not forget that you have to be a right wing religious fundamentalist as well.

A true gentleman who appreciates my humor.

Maybe propose an energy efficiency project to a local college. Great if you can find a researcher who marches to their own drummer... if not, there might be some student groups that haven't "bought in" to big-time consumerism. The young (an vocationally uncommitted) seem to be more openminded.

Personally, I've found that the people who work at sustainability-based businesses (even the small, low-tech ones) seem to know way more about green-tech than many of the educated acquaintances that I know. Most are happy to talk with like-minded folk.

""The other day one TOD person guaranteed that I would die a terrible death at the hands of some unknown malignant force because he perceived me as a “loner” and not a community member. I guess if I believed that the case I would “gun up” and form my own militia community for mutual protection. If you can’t beat em join em.""

Noooo, what I said was...........

"" The community is what you are after. The attitude of the Lone Gunman, trying to survive with a Tractor and a few tanks of fuel will not cut it. You will lose all you have worked for in a matter of minutes, should a bad guy come knocking.""

And I still stand by that. Anyone, and I mean anyone, that thinks they can survive what is coming by dropping a few seeds in the ground, stocking up on a few tanks of gas for a small tractor and living high on the Hog, are in for a very rude awakening.

A "terrible death", more likely wil befall your family, after the bad guys get rid of the alpha male and his little tractor. They will take their time with the rest.

SECURITY,,,will be numero uno. The only way to get that is thru a comunity banding together. If that requires a Militia, so be it.

From your lips to Zoltar's ears, Tekno.

You don't know that any better than anyone, and I suspect that there will be hermits and wee clans out there that 'get away with it' just as well as organized larger groups. Variety is more than just a spice in life.

Your little movie scene is touching.. but narrow.

"There's no safety in numbers, or in anything else.." James Thurber

Sorry, but I do, know better than most everyone. You seem, as do so many, to put on the blinders of the MERIKAN, and live in a Pablum world of niceties. I would suggest you live in a third world country for a while, as I have done for many years. Then maybe, you would see the violence and death that is coming first hand.

I doubt many here on TOD would survive more than a few hours in a place like Somalia.

I think you would be shocked. There's a lot more experience on this board than you recognize with this statement.

Of course, most of the people here wouldn't do well in Somalia in particular due to being obvious outsiders, but should similar events transpire in their stomping grounds they won't be as helpless as you claim.

Wrong, wrong, dead wrong. There is a grain of truth in that today but the world of tomorrow will in no way resemble the world of today. If you have a small farm with cows, chickens and a garden but no protection from the community you will not last past the first wave of desperate hunger that sweeps the land. They will kill you, rape your wife and daughters and take anything from your farm that they can carry off.

What a dream world you live in.

Ron P.

That is exactly what I have been advocating for many years. How can anyone believe that when law enforcement disappears that everyone will still be kind to those who have a lot more than they, when their children are starving. No, they will do anything to survive even if that means killing someone in order to survive themselves.

Ron .

Darwinian,

A militia there will be,maybe even an ordinary sheriff too.Whether his authority is recognized farther than a days walk may be open to question.