Where we really stand with respect to oil and natural gas supplies

Posted by Heading Out on September 29, 2009 - 10:39am

A few days ago, I gave a presentation in Poland that talks about how much difficulty the world is having maintaining its oil production. The presentation was not set up to be a response to Jad Mouawad's recent New York Times article, Oil Industry Sets a Brisk Pace of New Discoveries, but in many ways it is one. Our recent discoveries really have not been enough to make up for our many production problems elsewhere. We are having problems not only with oil, but with natural gas. The solution the financially distressed world is increasingly considering is . . . well, read the story to see.

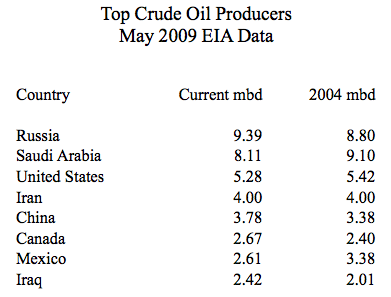

I began with a slide that shows the current top crude oil producers in the world (based in EIA May figures) and noted that, at the moment Russia is at the top.

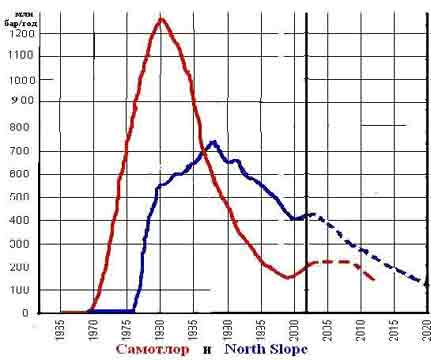

Then I showed a slide of a well in Samotlor and noted that the Russian historic large fields are running out. Samotlor has declined from 3.2 mbd to 750,000 bd and is pumping, in some wells, 90% water. The Russian strategy has been to find and produce a region until exhausted, and then move East to find the next major deposit. That has worked fine as a strategy until now when they have reached Sakhalin Island – on the far East of the country – the next logical place to look is . . . . .

Alaska, and sorry folks, that is already in play, and in fact rather played out.

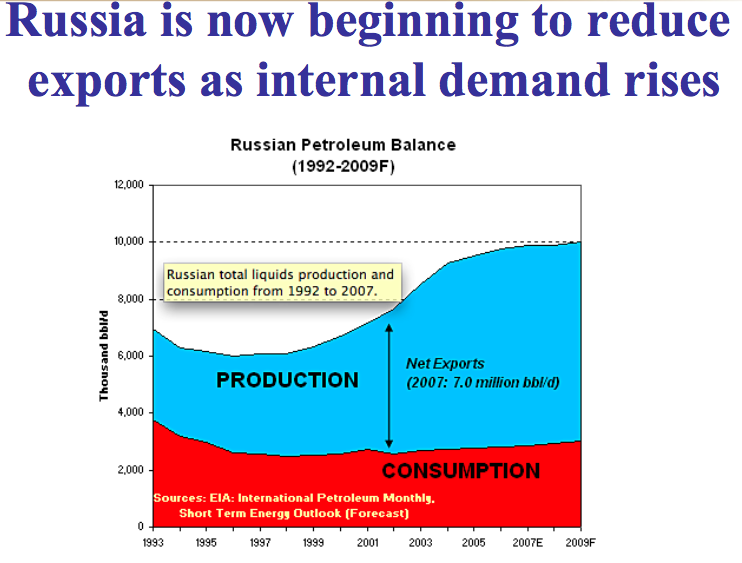

Which is a good point to introduce the Export Land Model and so I talked just a little about the fact that as a country’s oil peaks and starts to fall, domestic consumption becomes more important and exports suffer a much greater decline than the actual fall in production. Then I showed how this was already happening to Russia, and the impact that this would have on Poland.

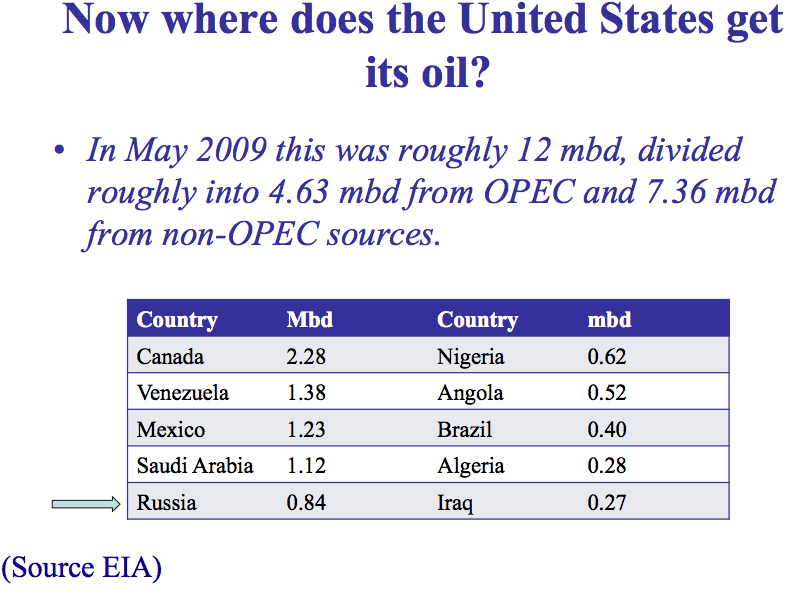

To make life even more complicated in terms of those in Eastern Europe with a reliance on Russian oil, I put up a slide showing that the United States is now importing some 840,000 bd of Russian oil, in order to meet its needs, and thus Europe is now competing in the global market for that oil.

Why must America compete in that market – I used a graph showing the collapse of Cantarell (not to mention the other fields in Mexico) and the 100,000 bd fall every three months to show that America has to go to the world market to find the oil that it now needs.

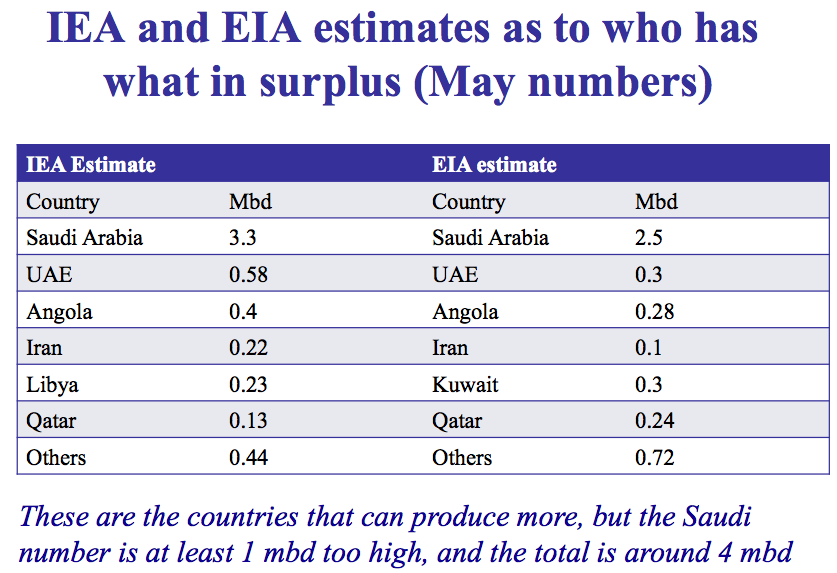

Non-OPEC crude oil production has peaked and is in decline (I used an Oil Drum graph showing the fall since 2004) and so when one looks at countries that have a surplus of production over current supply (comparing IEA and EIA data) the stand-out is Saudi Arabia at either 3.3 or 2.5 mbd (depending on whom you believe) with the next largest being the UAE at somewhere between 0.3 and 0.6 mbd.

(And here let me briefly digress to point out that those who wave the NYT story have little clue of the time that it takes between discovery and full field production – nor do they understand oil field depletion, or that just because we have passed peak production does not mean that there is not a whole lot of oil out there that is still waiting to be discovered – only that it is going to be less than the huge volumes that we have already found and exploited).

The problem, as I pointed out, is that the Saudi number includes, among other fields, Manifa, and Yes! we know it is there; Yes! we know that it can produce 1 million bd; but we also have to recognize that until a refinery is built to process that oil (which will not now come on line until after 2013), the use of that production number is a fiction. And thus there is less than 4 mbd available as a current world reserve.

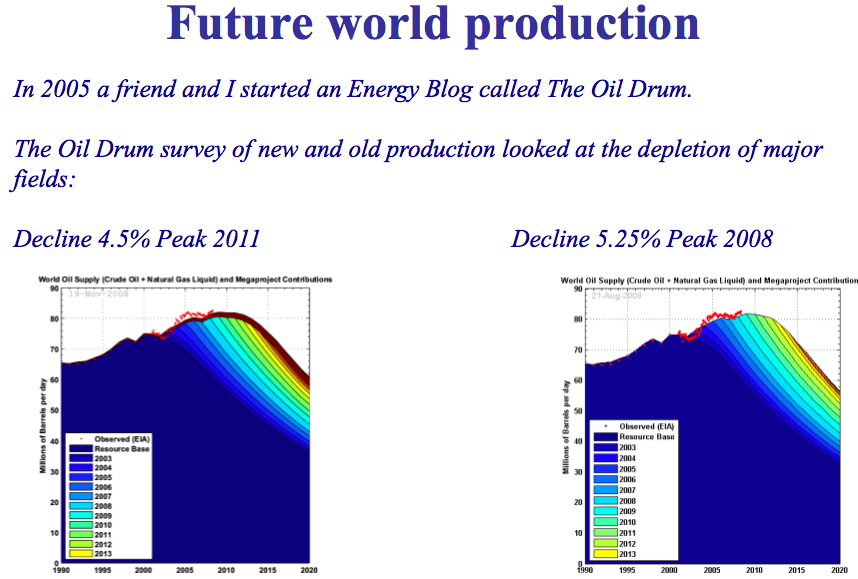

So what else do we need to worry about? Well, it was time to introduce oilfield depletion and so I put up the two contrasting graphs that I use from the Oil Drum that show decline in current fields when you use 4.5% depletion and then 5.25% (the significant point I indicated was the transition of peak oil from 2011 to 2008).

I then showed a slide with the Financial Times quote that the oilfields in the North Sea were depleting at 9%, and followed it with Dr Fatih Birol’s comment that the depletion rate is 6.7%.

I tied the whole issue together by showing the need that the Western world will have as their economies rebound (about 3 mbd) with the increases in demand from China and India (already 1 mbd and rising) to show that by 2011 we will need some 5 mbd of additional oil over today, but at best have only enough on line to get 4 mbd. (The first Oops Moment).

So now I turned to the second fuel – natural gas – (time was now running a bit tight so this got a little less intense treatment, but also focused on the Polish need).

I began with a slide showing that, over time, natural gas fields were lasting a shorter period of time before they ran out, but then followed this with a slide of Turkmenistan, who has been supplying some 40 bcm to Russia (or thereabouts) for transfer (at a profit) to Ukraine, Poland and Western Europe.

To ensure that supply last year (and there were posts on this at the time) Gazprom signed an agreement to pay the prevailing Western price for natural gas to Turkmenistan. Since then there was a collapse in the world price of natural gas, putting Russia in an awkward postition--a contract to buy at a high price, and to sell at a lower one. An “accident” to the pipeline between Turkmenistan and Russia happened a few months later, meaning that Russia has not had to accept expensive NG that it has to sell at a loss, since then.

However, just as Russia pressures Turkmenistan to accept a new agreement to sell the gas at a cheaper price, the new pipeline from Turkmenistan to China will open in a couple of months (and I showed the map) meaning that, as China has been willing to pay the higher price (about $8 per kcf as I posted recently) they have underwritten a cost increase for NG to Western Europe, and beyond that is unlikely to go away.

I then quickly put up a map showing the gas shale deposits in the United States and commented that this might at first appear to indicate that we are entering the “Age of Natural gas”.

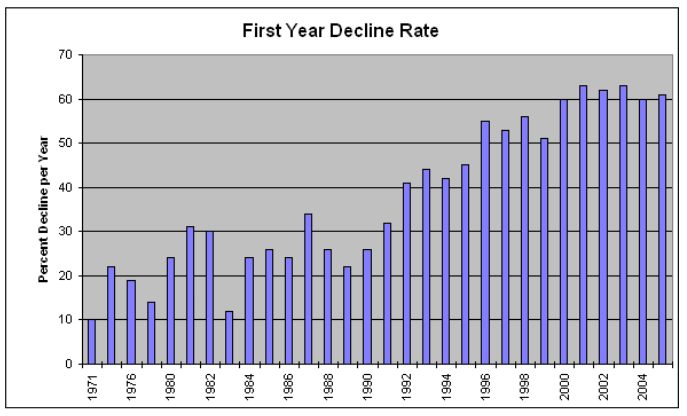

But then I followed this with Swindell’s graph showing that the new wells suffer 60% decline in the first year, and commented that with the high cost of wells, and the current low cost of NG in America (I tried converting prices to zloty per thousand cu m., but may have got a number wrong – we passed a gas station that was selling NG at 2 zloty per liter) the new wells that we need for next year are not being built. Thus we may be competing with Poland for LNG from Qatar.

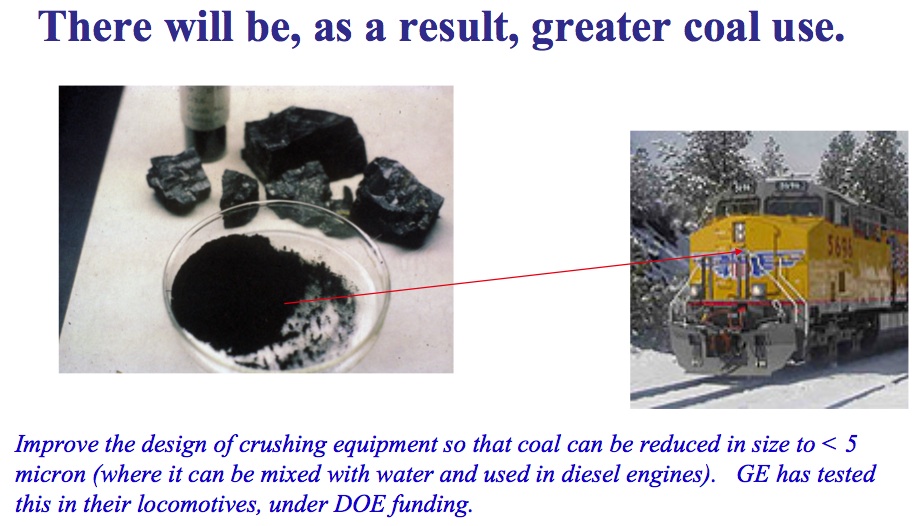

What is left? I turned to coal (Poland currently gets around 85% of its electrical energy from this source) and I put up my final slide, showing 5 micron coal – which when mixed with 50% water will run a diesel locomotive (and I added a picture of one) as GE have demonstrated.

Which barely gave me time to note that for many countries in the world coal, is the only available, viable and economically practical fuel (for example, Vietnam and Botswana) at a time when (with a map from “energy shortages”) - which I contrasted with comments from the G-20 Summit - the world is already having serious problems and it was time for me to conclude.

I don't thinks it's too early to start thinking of the Holiday Season

Clean coal carolers

http://www.youtube.com/watch?v=x8Gy-kgL8yA

As the lyrics say there must have been some MAGIC in clean coal technology...

Sorry FM,

I promised to reduce my Christmas Stocking's Carbon Footprint..

Bob

Unfortunately it seems that North America will be afflicted with a glut of NG for at least another year, possibly two, and I wouldn't be surprised if it was even longer. There are just too many people still drilling (even though the official figures are down for rig counts). Northeastern British Columbia is the latest hot play, and the B.C. government seems determined to repeat every mistake the Alberta government made.

I'm staying with private-equity conventional oil. There are optimists going long on NG, but I think they will have a extended wait. It isn't just shale gas; east-central Alberta (Drumheller badlands area, etcetera) has dry coalbed methane that people are rushing into.

The Alberta government actually depends more on NG royalties than oilsands (conventional oil is no longer significant), and the fallen NG prices have put a crimp in the budget. The Tory government is still spending like mad and recently issued $600 million in bonds, destroying our status as a debt-free province. They were spending during the boom to keep our infrastructure functioning, and are now spending as a stimulus programme.

For some strange reason, it is usually the Tories in Canada who spend like drunken sailors and the Liberals who cut with a broadaxe.

It's a proven fact, and not simply limited to Canada. Witness recent US history, where every republican government from Reagan onward passed on larger deficits than they inherited, while democrat governments tend to inherit financial messes and pass on stable surplus budgets. Analysis holds only slightly weakened when politics of US congress is included.

It makes more sense when the rise of Neo-liberal ideology is considered (Friedman, Chicago School economics, Austrian School economics, etc). It is a radical pro-wealthy philosophy which co-opts many populist movements and re-directs them toward benefit of wealthy. Tax reduction, strong defense (spending), reduced regulation, greed is good, creative destruction, etc. etc.

Yes-however, that is the past. What you term neo-liberal philosophy has worsened into an oligarchy-whose strings do you think they are pulling right now?

Let me quote from the Calgary Herald

The story gives a gas price of $3.30/kcf which is quite a bit below $4.

years calgary? try decades and decades of cheap plentiful natural gas. Maddog over at peakoil.com said they are close to getting to 2$ for shale gas drilling. Gluts gluts and more gluts of natural gas as long as we are alive.

Hello Tommy tuna,

Makes one wonder how long before we see 'accidents' to North American pipelines, ala Russia/Turkmenistan, to jack the price back up to profitable levels.

Already happening? How about two TransCanada pipeline explosions in the last 3 weeks?

Pipeline blast in northern Ontario spurs evacuation

TransCanada Pipeline Struck by Blast, Gas Rerouted

Here's the reddit and SU links for this post (we appreciate your helping us spread our work around, both in this post and any of our other work--if you want to submit something yourself to another site, etc., that isn't already here--feel free, just leave it as a reply to this comment, please so folks can find it.):

http://www.reddit.com/r/reddit.com/comments/9p70o/our_recent_oil_and_nat...

http://www.reddit.com/r/energy/comments/9p70i/our_recent_oil_and_nat_gas...

http://www.reddit.com/r/environment/comments/9p70k/our_recent_oil_and_na...

http://www.reddit.com/r/Economics/comments/9p70m/our_recent_oil_and_nat_...

http://www.stumbleupon.com/refer.php?url=http://www.theoildrum.com/node/...

Find us on twitter:

http://twitter.com/theoildrum

http://friendfeed.com/theoildrum

Find us on facebook and linkedin as well:

http://www.facebook.com/group.php?gid=14778313964

http://www.linkedin.com/groups?gid=138274&trk=hb_side_g

Thanks again. Feel free to submit things yourself using the share this button on our articles as well to places like stumbleupon, metafilter, or other link farms yourself--we appreciate it!

Thanks Dave, for the post.

If you click on your map with Russian oil discoveries, you can see they really do march across the map from west to east, 1 to 6.

Aren't there other perhaps smaller fields that they by-passed along the way? Or fields to the far north? I would imagine cost per barrel would be escalating in these less desirable areas.

Gail:

Yes there are other fields, I just picked on the big ones to try and illustrate the point that you can't keep expecting to find new big resources in the same way that you relied on in the past.

Interesting there is a claim that Russia will produce 60% of new fields from the Head of the Oil and Gas Problems Institute of the Academy of Sciences. I suspect that this recognizes that they may find significant more oil, but it will be in many smaller fields, rather than the smaller number of big ones they have been able to exploit in the past.

wasn't the coal slurry experiment something which happened in the late 80's / early 90's? If that is right there must be a reason why that "train of thought" was stopped, no?

Rgds

WeekendPeak

Reading a report on the program written in 1995 it says

Very prescient!

Thanks for the reply. I skimmed the paper for a comparison of diesel / coal efficiencies but nothing jumped out at me in the 2 minutes I looked at it.

But let's even if the same or better it won't change the fact that we are comsuming non-renewables.

Rgds

WeekendPeak

Some of the earliest Diesel engines used pulverized coal; however, I do not recall that it was slurried.

Coal can have high ash levels and I wonder how this ash is removed from the cylinder?

Some of the high quality coals have been depleted.

You lost me here:

So a possible one year N.American short fall forcing us to compete on the market for LNG negates the possibility of an "age of gas"... I think you need to explain that one better, b/c it doesn't add up.

We have a gas glut. When it tapers, prices rise, more wells go up. It's not an all or nothing "if we don't sow our seeds in the spring, we'll be hungry come winter" situation. A short fall raises prices which lowers demand and increases production (provided more supply is possible... it pretty clearly is).

Sorry, you have to take that within the context of where I was giving the talk.

I would agree that there is a present gas glut, however the argument is a bit long to condense into the post that I wrote, and I may have over condensed what I actually said in the talk. Simplistically the sale of NG from Turkmenistan to China will keep the price of Turkmen gas high to the European market. At the present time in the United States the development of the gas shales has helped bring about this glut, but the short term life of the wells (and I have written about this several times with differing evidence) means that there has to be a consistent drilling program to maintain production. But at the time of writing the price of gas was below the price quoted to justify a major drilling effort. That could mean that there would be a shortage in the US in the short term - that could be met by importing gas from Qatar - which is currently activating new LNG trains (and Poland is considering putting in a terminal).

Should that occur then the prices for gas could remain high for Poland - because Qatar can import gas into the US at prices below the $4 price at which the gas from shale becomes viable.

"....the development of the gas shales has helped bring about this glut, but the short term life of the wells ....."

many don't seem to realize just how short term the life of these wells can be. an analysis of the haynesville shale, based on a few dozen wells, shows that typically one-half eur will be produced in 6 months.

All true to the best of my knowledge.

I was simply commenting on the way you said someting to the effect of "all of the shale gas seems to suggest a possible 'age of gas'... but wait, low prices could keep it from being produced!"

It was confusingly worded. As long as you aren't arguing that cheap gas that we can afford to import will keep shale gas from being extracted EVER... we're in agreement.

There is the other (distinct) possibility that we won't be able to afford the higher gas prices needed to drill. (same with oil).

The world seems to like credit, though, 83 years after your book's publication. In the case of NG there are major producers who can subsist without LOCs. It would be nice to know how that breaks down against share of production; and at any rate as the smaller companies fold owing to the credit contraction the majors will just buy up their assets at fire sale prices and carry on. Drilling didn't grind to a halt in the Great Depression, either; it was often very hand to mouth, roughnecks literally being paid in beans, holes being plugged with bailing water and flour. (details from the book Wildcatters, about the history of the Texas O&G industry from the 20s onwards)

real wealth was subject to the inescapable entropy law of thermodynamics and would rot, rust, or wear out with age...virtual wealth, in the form of debt, compounding at the rate of interest, actually grows without bounds.

Isn't that kind've the function of inflation, and the discount function?

Yes. So do away with debt and have equity share agreements between the lender and the borrower.

If the borrower wins the lender wins and if the borrower losses so does the lender.

Lending at interest has been condemned throughout history for a very good reason.

It is an unjust claim on the future of the borrower.

Think of how it would feel to be racing against time to pay back the "time interest" loan.

Now think about how much better it would feel to know that time wasn't a factor but only positive results......that is the lender was also interested in the success of the enterprise and not just collecting from you.

Another poster had ideas along these lines as well.

We need to destroy the debt based monetary and financial systems and replace them.

That would mean that the only way to borrow money would be to give away some of your business to the lender.

If lenders have too much power, wouldn't they take advantage by demanding a very high % of one's equity? This is what commonly happens with venture capitalists (often as high as 90%), and entrepreneurs generally describe it as feeling very abusive.

Abusive ?

You can't set down for a week after just meeting with them. If you take there money and happen to get thrown in jail you welcome the relief.

And you forgot about Angel investors who are the direct spawn of Satan yes they are angels but not from the branch most people think.

I worked for startups for 15 years in various capacities including starting my own the way people trying to create something new are treated in the country by the financial elite is what drove me out of the business.

For a long time regardless of success or failure the flow of creativity at startups was a powerful drug for me but in the end the repeated games played buy the money men and corruption of management by them caused me to give up on traditional startups.

Although not a great track record I've personally been involved with companies that have lost close to 500 million dollars if not more over the span of my career. I know the inner workings of our dysfunctional financial system first hand. Almost all of these losses can be attributed back to the upper management and financial side. The underlying problem is as outlined in Nates posts and the story of pigs. The financiers are happy to keep taking and taking and taking till they have nothing. I've seen it so many times I've lost count. Its the rare startup that survives this and in general the only ones that make it are ones where one of the key partners is providing most of the early financing and generally they got this money in the computer business from having successfully beat the bankers with and earlier startup. Sort of a catch 22.

In my opinion if we did things differently we would have a lot more succesful small companies in the world making reasonable profits and beating other investment opportunities and adding real wealth.

In a real sense I think the steady move to more and more financial innovation instead of real investment is a result of the banking industry having so abused the creation of new businesses that a lot of people like me simply gave up forcing the vultures to go elsewhere.

Thats not to say there are not plenty of problems in new business outside of the financial but that the nature of new businesses they are nothing but problems its how you resolve the challenges thats the important thing as intrinsically they always face major hurdles.

Sorry for a rant but you touched a nerve here I've witnessed a lot of selfish destruction and its not been pretty.

Yes-IMO unless the USA somehow wrests power from the financial elite the country as a whole is literally finished. There is no way the USA can cope with the downslide of peak oil and at the same time support an increasingly corrupt, powerful and parasitic financial sector. You have the financial sector, the military and the sickness/health care industry to support-there isn't enough blood in the host for all three.

We need a parallel currency issued by the government based on something other than debt.

Kennedy tried to do this in 1963 issuing silver certificate dollars and even spoke of a secret organization that was ruining the country.

6 months later he was dead.

Any fool can see just by looking at the evidence that is publicly available that he wasn't shot by Lee Harvey Oswald.

The country has been run by banksters since 1913.

In 1913 the Federal Reserve Bank was established to lend the countries currency to the country at interest.

In 1913 the 16th Amendment was passed to tax the income of the American citizens to pay the interest to the Federal Reserve bank.

The Federal reserve is a consortium of PRIVATE Banks that profit mightily from the worthless paper they lend for the American people to use.

We have been ripped off blind by an handful of greedy, psycopathic, control freaks and now the game is over.

We have no leadership as proven by the outrageous actions of the past year going up questioned.

Something has to give..........something has to be done.

http://video.google.com/videoplay?docid=-515319560256183936#

If that were the only arrangement allowed there would be plenty of money around to make deals. Just make good deals for yourself and if you don't get what you want then move on to the next investor.

All the money that used to be lent at interest would now be looking for investing ideas.

The only reason vulture capitalists sack start ups is because they are too risky for conventional lending or investments.

If you have a good idea people will line up to get a shot.

And you don't necessarily have to give away part of the company either. You can write any deal you can think up and have accepted by the investor.

Like I said if you have a great concept with merit you won't have any trouble finding investors.

That doesn't sound realistic. You said earlier: "If the borrower wins the lender wins and if the borrower losses so does the lender."

Well, if the lender is taking greater risks, then the lender will demand a larger share of the profits in return.

How does equity or profit participation strengthen the position of the borrower? If borrowers had such a strong position, couldn't they just negotiate a lower interest rate for a conventional loan?

The risk is to be determined by the lender. Let him decide and or request to modify the terms.

The borrower could not allow voting rights to the lender.

The main point is that the "money" doesn't "grow" just based on time but only if the venture succeeds.

The whole problem we have right now is that on paper the loans have grown but the actual real wealth in the economy has not or more correctly gone down.

You are looking at it from the standpoint of an entrepreneur. I am trying to come up with a more accurate way to keep paper value and real value close to one another.

Have you seen the movie I linked above.

The Money Master?

If you haven't I think you will like it and get a lot out of watching even though it is 3 1/2 hours long.

One last thing.

I believe that creative thinking is far, far more valuable than a sack full of phony money or anymore digits in a server somewhere in cyberspace.

So who is really taking the risk?

Nate, this story is instructive, but to another scenario... but I'm not seeing your connection to the shale gas situation.

The "moral" of your story, unless, I am missing something, is that just because you are owed something intangible (credit) doesn't mean that you can always collect tangible goods (gas) in the future.

How does that apply to the shale gas situation? Unlike the negative pigs, the gas IS there. It IS extractable. So how does all this funny money we've been trading on Wall Street hoping to make a quick buck affect the gas in the ground or our ability to extract it?

I don't get it.

Do people in the financial sector really think this way, Nate? If so, I really despair. Economists don't view debt as net wealth from a social prospective, since there is both a creditor and a debtor. And interest payments are generally viewed as either a transfer of income or wealth from borrower to lender. In a similar fashion, money creation by itself doesn't create any wealth. Bonds are a speculative asset, since default is always a possibility. Economists view real wealth as either physical assets, like buildings and machinery, or intangibles, like "human capital" (skills and education), which yield a future stream of income generated by production of goods and services. There is also an increasing focus on natural capital (resources, environmental quality), even if this has been slow to penetrate the models widely used in some areas (macroeconomics). Borrowing , which may be facilitated by fractional banking, is beneficial from a social perspective insofar as it finances investments in these activities.

How old fashioned don't know know money is made via securitization and tranching and packaging of debt and the use of complex models to get a AAA rating on stinking garbage.

Actually making something was thrown out back in the 1980's we have not done that for years.

The American economy has successfully transitioned to running on financial magic I don't see that changing.

Supporting our new magic economy is our willingness to kill people so as long as we can do that all is good.

What a quaint post.

Sorry for being snarky your right but compare what your saying to the way the system actually works.

The same conclusion holds. No net wealth is being created by activity in the financial sector alone.

The material that Nate quotes has exactly zero conceptual value. Virtual wealth is a stand-in for some notion of book value. How much would an informed buyer actually pay the bank for the farmer's loan? Far less than the original loan. So what precisely does the story illustrate? That lenders will keep lending to try to avoid realizing a loss? Well, duh.

Yep basically thats the point of the story.

The problem of course is the debtors are just as much into the game as the lenders. Everyone wants to keep playing as long as possible. The fact its really now just a game is lost on most people.

It does have and important side effect no attempts at alternatives are viewed using sound economic concepts like you described instead they are view through the warped financial system we now have.

The distortion is itself basically a natural economic force at this point and effects all decision making.

In the pig story the part left out was the bank getting bailed out allowing the can to be kicked down the road a bit more.

The tricky concept of moral hazard becomes more real everyday. And I fear until the system itself is exposed and rejected we simply won't see a move back to "real" economics.

We have literally completely decoupled our financial systems from any semblance of reality or sanity how on earth are we as a planet going to be able to make the right decisions under the current conditions ?

I argue we have passed he point of no return and are in the process of the financial equivalent of the creation of a black hole. Its to late to pull out and only after the financial system collapses can sound economics become viable. Now a financial collapse may or may not take our civilization down with it who knows but I don't see a way out.

I don't take issue with anything you're written above. A popular conceptual approach used by economists is to think about the "real" and the financial economy separately. The article of faith, which has perhaps proven fatal to the discipline, is to think that the financial economy is grounded in the real economy. The strong form of the efficient market hypothesis rests on some variant of this assumption. The current crisis suggests that faith is misplaced.

I don't see how, because if it is, there's no point to stressing the role of compound interest.

Here's a story about the virtual population. The current population is x. The current growth rate is g. Based on compound growth, the virtual population will be y=x(1+g)^(2100-2009). I suspect very few people on these boards believe that the real population then will come anywhere near to that number.

By the same token, in the real world, a certain about of debts are defaulted on. Hence my question to Nate about whether people actually think about compound interest as the story implies. Soddy undermines his own premise about debt-based "virtual" wealth growing without bound when the farmer eventually goes under, requiring the loan to be written off.

Like a lot of the heuristic stories on the oildrum, it's not clear what the parable is supposed to illustrate. If anything, this just seems to be bad lending practices. Moral hazard is still a problem without compound interest, as long as the upside and downside consequences are asymmetric for players in the financial sector.

Hello Heading Out,

Thxs for this keypost plus your fascinating Tech series of keyposts,too.

We have previously seen lots of TOD weblinks to US Military Studies of future energy problems, so we know that the Pentagon is Peak Aware.

What I haven't seen is the Military Topdogs [4-star Chief of Staff from each branch] arm-twisting the Pres. and Congress to move towards meaningful mitigation, as the Armed Forces will obviously be at the spearpoint of postPeak cascading blowbacks. You would think a gentle historical reminder that earlier Roman Emperors & the Roman Senate were overthrown by their Praetorian Guards would be sufficient to make Congress think more often of: "Et Tu, Brutus?".

Jay Hanson has much earlier discussed the classical phenomena of the military or warlords asserting control when times get tough. I would hope that enlightened Peak Aware Generals would become more political early, so that their young men & women, under their command, will not have to be posted on American streets [or delayed as long as possible]. IMO, the recent battalion at the G20 is not a good sign.

At the tipping point of devolution into Mercs vs Earthmarines: even the military will not be able to assert control as their forces fracture into disparate & desperate smaller entities.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

"At the tipping point of devolution into Mercs vs Earthmarines: even the military will not be able to assert control as their forces fracture into disparate & desperate smaller entities." Posted by Toto

Think Lebanon, 1975, writ large.

Antoinetta III

Briefings I've been at focus less on oil availability and more on the total logistical costs, monetary and otherwise, of distributing fuels to where they are needed.

DoD currently estimates that every $10 increase in crude oil prices adds about $100 million a month to DoD's fuel bill. One billion dollars a year is not much out of a $500 billion budget.

Getting fuels to users in the field takes a massive logistics effort that affects theater and field-level operations. In some instances fuel delivery has tied up half or more of all available non-combat land vehicles in an area. It can also tie up a significant fraction of combat and security forces to protect the logistics effort. This can and has influenced military commanders' decision-making.

The US military currently uses a "buy it forward" policy for procuring FF liquids where they try to but required supplies as close to the point where they are needed as possible, allowing for transportation availability, security, etc.

It is the possible effects on that policy that drives much of the military's Peal Oil awareness.

Peak Oil implies increasing occurrences of local and regional shortages of fuels available for purchase. Of course, the US can usually outbid most other local purchasers, but at some point this is unlikely to help build support among locals who end up suffering fuel shortages.

So far, most briefings have not included any possibility of the military not getting the fuels it needs. Instead, Peak Oil has generally been examined as a factor that would affect getting the fuels to where they are needed. As such, long-range planners are being pushed to factor it into future requirements for oilers, aircraft tankers, rail tank cars, fuel trucks, storage tanks, etc.

Interestingly, when asked about the assumption that the US military would always be able to get the fuels it wants, or most of them, a recent briefer said that the military, acting through the US government, could always exercise "eminent domain" rights in the USA.

I understand that the DOD has made some reasonably strong efforts to reduce fuel consumption, including wind at bases, solar at the front line, and vehicle electrification.

What have you seen?

Big pushes are for improved insulation, better mission planning to reduce fuel demands, more effort to ensure vehicle operators are aware of fuel consumption in various operating modes, etc. Also emphasis on the basics like turning off lights when not needed, controlling a/c and heat settings, combining trips to save gas, etc.

There is quite a bit of concern developing regarding the condition of the electrical grid here in USA and the effects on installations and operations as it continues to age and the loading on it continues to increase.

There are a limited number of projects for things like solar and wind, but so far they are mostly demos or proof-of-concept. A number of years ago I worked on a project to demo and evaluate ground heat exchange for on-base buildings. Nothing really came of it. Same for a PV pilot project.

A big issue developing at the front lines is the rapid increase in demand for electricity over the past decade as numbers of electrically operated devices continues to grow. There is not much of a reliable civilian electrical grid in Afghanistan and only somewhat more so in Iraq, especially outside of major urban areas so most bases and larger outposts have to set up and operate their own generators and distribution grid.

Lots of work being done on small electrical powered vehicles for use in wide range of locations and plenty of interest in elctric or hybrid vehicles for use at US and large overseas installations. Electrification of combat vehicles is perceived as still having too many negatives but I understand that DoD has researchers actively looking at ways to solve or get around those.

Excellent job. Is this presentation posted in PDF or .ppt format anywhere, it looks interesting. The NYTimes was a typical piece to make everyone comfortable about driving (and purchasing their new) SUVs. Nothing to see here people, move along.

I have a copy, but it is too big for the server we use for The Oil Drum. Maybe Heading Out has a copy he had uploaded. Otherwise, I can e-mail a copy to readers who request it.

Gail,

norme2 at charter dot net in MN would like an emailed copy of Heading Out's presentation in Poland. Looks like another nail in our coffin.

Hazelnuts are in and winter is in the air here....

Coal is the last fossil fuel reserve left aplenty (relatively speaking)... so much for the quixotic attempts to cut CO2 emissions.

One can understand Poland's logic. Oil too expensive and constrained. Natural gas supplies dominated by Russia. Renewables too expensive and unreliable. Coal is their best bet.

Here's a quick review of Poland's historic use of fossil fuels from the Energy Export Databrowser:

We can see the decrease in consumption when martial law was imposed in 1981 and the painful transition to a market economy after 1990.

Most importantly we can see the dominance of coal over oil and gas. Coal is Poland's only indigenous source of energy, accounting for >95% off all energy produced.

But what of the production and consumption trends for coal in Poland?

Polish coal production has been in steady decline for the last 20 years. Poland is, for the first time, at a point where production barely meets consumption.

It is unclear to me whether the mines can be resuscitated but the trend is not friendly. Rather than search for new sources of fossil fuel, it seems to me that Poland should embark on a massive energy conservation campaign if they are concerned about rising prices for natural gas piped in from Russia. (I would imagine that communist-built Polish apartment blocks could greatly benefit from better insulation.) Even LNG from Qatar will only last so long before the global market drives the price of LNG higher. Consuming less is the only way out of this predicament.

Happy Insulating!

-- Jon

Hello Jonathan.s.callahan,

Just a quick note that I greatly appreciate your regular postings of timely graphics and comments as I feel it is a terrific addition to the ongoing discussion. Huge Kudos from me!

And thank you for the thanks totoneilla. I love contributing and plan to continue.

I created the databrowser so that it would be easy for anyone to generate high quality graphics to contribute to any energy related discussions they find themselves in.

Next time you have a question about a particular country or trend, go investigate and then post a chart yourself. It's easy!

Happy Exploring.

-- Jon

Jon:

There are lots of differences between coal and other fuels, not the least of which is that there are generally multiple seams of coal found, often very close to one another.

The first conference that we attended was on where the coal industry is going. We were there just after the tragedy in Lower Silesia and there is a considerable debate in the country over future of the coal industry as a result of that - but it was rather along the lines of "why don't we import cheaper coal from abroad, rather than mine it here?" than do away with coal.

When your economy depends on Energy and they are now well off relative to the communist years, being told to cut back is not going to be a popular option. Rather they are looking at thinner and deeper seams (of which they have a lot) and considering other methods of extraction that will work more efficiently than shearers in those conditions.

HO,

Thanks for the details on the political climate in Poland. Of course people will want to import something from abroad if it can be obtained cheaper that way. But that seems a short-sighted approach. The Ukraine recently stopped exporting although Russia and Kazakhstan still do for now. South Africa's exports are on the wane and China is trying its best to lock up all the resources in SE Asia and Australia.

As I am used looking at energy trends over the past 20-40 years, I look for answers to what I imagine we will see over the next 10-20 years. What I see in that time frame is the following:

Unfortunately for the Poles, it looks like the coal and natural gas (including LNG) supplies that become available on the export market will be going largely to China or to G7 members with money. I really don't expect to see Poland outbidding other importers for the coal and natural gas that are available 20 years from now.

And I also wish to take issue with the following attitude toward conservation:

Over the summer we replaced the 90 year-old single pane windows left in our house, got a new roof and insulated the walls and attic. The house is now cooler on hot days, warmer on cold days, better ventilated on stuffy days and quieter whenever the windows are closed.

I don't see this as "cutting back". It's actually a huge quality-of-life improvement that will also happen to reduce our heating bill significantly.

So why shouldn't better insulation and better windows be the first order of the day in Poland? It generates local employment and reduces dependence on foreign energy resources. It seems to me like a no-brainer.

I must be missing something.

-- Jon

Jon,

We did the same thing with our windows (except we went from thermopane to 4-lite thickness), and were delighted.

The problem: it's a big project, and most people don't have the time to add another project to their lives. They're too busing raising children, taking care of parents or spouses, making a living, etc, etc (we could only do it because we were moving into a new house).

The non-cash costs of such projects (personal time and aggravation) are much larger for individual households than they are for larger business: that's why businesses are much more responsive to things like higher energy costs.

Such things work best with new construction, but housing turns over slowly, especially in older countries like Poland.

HO,

Your figures for the US are simple crude, around 5.25MB. Sometimes people describe US production using figures for overall FF liquids, which are very roughly around 8.5MB (including propane, NGL, etc).

Could you comment on the differences between the two, and why one would be more realistic/useful than the other for this discussion?

I put together this little chart of the current composition of US All Liquids:

I tend to use crude and condensate number, since this is what one generally is able to get for other countries (or for individual states, or for other breakdowns). It is also the one that has the most Btu content. I think it is also the traditional way of accounting for oil production.

Natural gas liquids and ethanol both have less energy content than petroleum. Ethanol is usually quoted as something like 70% of gasoline, but gasoline is on the "low end" of the petroleum spectrum in Btu content to begin with. I would need to check exactly where NGLs are, but I think they are similar to ethanol.

Refinery gain is the difference in volume after refinery processing, compared to before. Much of the petroleum processed in refineries is purchased from abroad. So if we lost the imports, we would lose the gain.

It seems like the US started using "all liquids" to make our production sound better, especially compared to our imports. To me, all liquids is really creative accounting. It seems like it should be Btu content that is counted, not volume. And counting refinery gain on oil we import as "our oil" is a little like counting energy generated in nuclear power plants as US produced, even though 90% of the uranium is imported.

I think all of the "other" category is "refinery gain', but I am not 100% sure. Anyone notice anything I am missing?

Gail,

Thanks.

Where did you get your numbers? I prowled around the EIA site, and couldn't get a good breakdown.

crude and condensate number... is also the traditional way of accounting for oil production.

Isn't the total usually used for overall US and world oil production - the roughly 20M and 85M numbers?

counting refinery gain on oil we import as "our oil" is a little like counting energy generated in nuclear power plants as US produced, even though 90% of the uranium is imported.

Well, refinery gain comes from hydrogenation with natural gas, which is 85-90% domestic.

I think all of the "other" category is "refinery gain'

Hmmm. I wonder how much of that is propane, ethane, etc - I think propane is about 1M B/day?

The Crude and Condensate (Table 1.1d), the all liquids (Table 1.4) and the natural gas liquids (Table 1.3) all come from International Petroleum Monthly (IPM).

Ethanol production came from here. I had to convert it from barrels produced to barrels per month by dividing by the number of days. I was just using data through June, so I used only those months, to be comparable to IPM.

I agree that hydrogenation with natural gas is important in the refinery gain, and that is our natural gas. So there is some point in counting it.

Are propane and ethane liquids? I don't think they would be included here, unless they are.

If you mean liquid at STP (standard temperature and pressure) of 0C and 101.3kPa, then propane and ethane are not liquids.

Propane has a boiling point of -42.09 deg C

Ethane has a boiling point of -88.6 deg C

Does the FF industry use different definitions? I'm not sure.

I tried to figure out where I could find them in the EIA data. There seems to be some in both natural gas and some in petroleum.

According to one description of natural gas,

But propane and ethane seem to be shown as part of Liquefied Petroleum Gasses, as items listed on Petroleum Products Supplied exhibits, so that would seem to be part of "petroleum".

I have heard that producers can get a better price for "Natural Gas Liquids" than Natural Gas, so, they cool it and pressurize it, to get the liquid form. It may very well be the propane and ethane they are selling as natural gas liquids. So they may not be bound by standard definitions.

It seems like refineries would have some affect on this as well, possibly making liquefied ethane and propane from what was originally natural gas.

I am still learning on this. If someone can supply more information, it would be helpful.

One thing your missing is NG imports into refineries some comes as volume gains from hydrogenation but a lot is simply burned for thermal needs. Aka Cokers. The relationship between inputs and outputs esp in complex refining is ... complex :)

And of course internally you have the decision of buying external NG or burning your own lighweight fractions variations in this are market driven and driven by the quality of the oil your refining and last but not least low sulfur requirements add and additional refining step requiring hydrogen most is recycled but there are losses. And I've got no clue how the steam requirments vary refinery to refinery but generally steam and for that matter electrical generation is a factor. Is it purchased on site if so NG fired flex fuel ????

I've tried to figure out the thermal efficiency of modern refineries i.e btu's in vs btu's in product without a lot of success they don't publish enough information. However my opinion in trying is that they are not that far off from 1:1 these days and can be considered more of a synthetic fuel plant than a simple refining with large net energy gains.

This goes a long way to explaining why syn fuel plants that try to upgrade lower grade sources such as coal or NG don't do well we are already close to syn fuel starting with our current oil supplies.

Chemically the intrinsic problem is when you set up conditions to cause carbon carbon bond formation or chain lengthening you also get coke which literally mucks everything up. Oil refining is generally breaking carbon bonds so it has less of a problem however even then its hitting the limits of conversion at reasonable prices. If I'm right and they are close to a btu balance then if we want to wring more gasoline and diesel out of a barrel we face a huge wall as refineries would have to add capacity to form heavier chains from lighter chains or traditional synfuel making the btu calculation distinctly negative.

If someone has a full btu balance for any refinery I'd love to see a post on it. Its something I'm obviously interested in and of course the big link is external NG sources and this ties modern refining and thus crude to NG price fluxes as internally refineries are really doing these btu calculations off prices. They just don't seem to publish it.

they are not that far off from 1:1 these days and can be considered more of a synthetic fuel plant than a simple refining with large net energy gains.

I'm confused - I always assumed refineries operated at a net loss of BTUs. Are you excluding the nat gas inputs from the calculations?

As far as I know they don't in fact early refineries and the simpler ones use the lighter fractions gases etc to run the refinery. In the simple case they are net positive.

But yes I think as you get into complex refining its much closer to 1 BTU in to get 1 BTU of liquid fuel out.

And to be clear its a matter of I think its that close no way did I ever really get the data to figure it out.

You can get most of the inputs and outputs for refineries i.e how much NG they use etc. But this does not tell you how much of the gaseous side products they are burning off. In general only some of the propane is sold from refining as far as I can tell with some going back to be burned. The cokers seem to use a lot of NG for example and of course US Refineries are beyond custom. Steam and electric inputs are not well quantified.

Its been almost a year since I did it maybe two at the time after looking my conclusion was that high NG prices are a big problem for complex refining esp running the cokers. Thus financially depending on how things go they are better off not turning them on and generating more low end products.

Feel free to dig if you wish input/output lists seem readily available. Its late but email me and I'll find my old links if your interested in this.

I wonder how much carbon the politicians can afford to eliminate. It is in coal, oil, and natural gas. One goal was a steady reduction of carbon emissions until 80 percent of carbon emissions will be eliminated within 40 years. If it causes starvation there might be a political backlash. The sea has been rising for almost 20,000 years anyway.

LNG train completion is ramping up, this is creating new liquids production. Conventional natural gas production usually yields more liquids than shale gas.

Not long ago OPEC was presumed to have 4 million barrels per day spare oil production capacity. Iraq was presumed to have room to grow production millions of barrels per day. Venezuela is sitting on billions of barrels of Orinoco heavy that is much cheaper to produce than Athabasca tar. Brazil might triple its proven reserves after peakers were saying there were no more giant oil finds to be had.

There was a show about Arctic Dinosaurs on PBS. 70 million years ago the North Slope of Alaska was closer to the north pole and there were dinosuars inhabiting the area at least part of the year. There were plant fossils showing temperate zone plants grew there. We really have very little control over the climate.

Nature doesn't care about what our politicians allow or don't allow or what we think or don't think. It just responds to CO2 emissions. This is one response, dust storm over Eastern Australia, caused by climate change

http://earthobservatory.nasa.gov/IOTD/view.php?id=40274&src=eoa-iotd

The sea level difference between an ice age and a warm period is around 120 m. In the last warm period 120 K years ago, sea levels were 2-3 m higher than now. The melting of the Greenland ice sheet would result in 6-7 m sea level rise.

Totally wrong. You have to distinguish between

(a) natural climate change, e.g. in the last 500 K years, between glacial and interglacial periods, triggered by orbital changes and then magnified by CO2 and other feed back loops

and

(b) climate change as a result of our CO2 emissions from burning fossil fuels which, geologically, is the reversal of an earlier geo-sequestration of CO2 into coal, oil and gas which cooled down planet Earth until ice caps formed

Nature doesn't care about what our politicians allow or don't allow or what we think or don't think. It just responds to CO2 emissions. This is one response, dust storm over Eastern Australia, caused by climate change

http://earthobservatory.nasa.gov/IOTD/view.php?id=40274&src=eoa-iotd

The sea level difference between an ice age and a warm period is around 120 m. In the last warm period 120 K years ago, sea levels were 2-3 m higher than now. The melting of the Greenland ice sheet would result in 6-7 m sea level rise.

Totally wrong. You have to distinguish between

(a) natural climate change, e.g. in the last 500 K years, between glacial and interglacial periods, triggered by orbital changes and then magnified by CO2 and other feed back loops

and

(b) climate change as a result of our CO2 emissions from burning fossil fuels which, geologically, is the reversal of an earlier geo-sequestration of CO2 which cooled down planet Earth until ice caps formed.

Crude - the incredible Journey of oil

http://www.abc.net.au/science/crude/

Under natural climate change in the last 500 K years, CO2 concentrations were never higher than around 300 ppm. We are now around 390 ppm. So we have kicked planet Earth out of that rhythm.

You really got to LEARN about climate science:

www.realclimate.org

http://www.columbia.edu/~jeh1/

The gas glut in the US won't last long once cap-and-trade is introduced. I predict an early effect will be to run gas peaking planting harder to avoid the higher carbon costs of burning coal. I understand Poland wants the EU to give them a bigger carbon allowance. A predictive fuel switching model is needed that covers a range of factors

- tougher carbon pricing in some countries than others

- investment lags eg in developing powdered coal engines

- competing use of gas for both transport and stationary generation

- increased transport electrification

- general economic slowdown due to energy costs.

For example I think a possible surprise affect of current Peak Oil and postponed Peak Gas is early logistic Peak Coal. In 2007 pundits thought Peak Coal would be around 2030. I wonder if it could be as early as 2020. Rich, near-surface coal deposits will be lying untouched because we have no diesel to dig it up and electrical generation has made a big switch to gas. Like pipe smoking or wearing corsets, the resource is still there but the world has moved on.

Gentle Cough!

When I started coal mining we did not use diesel, and in many coal mines you will find that it is not used to this day (problems of diesel particulate in the air) but that is underground. Surface machines can be run on electricity and many of them are, particularly the large excavators.

While I understand the arguments for Peak Coal it is unfortunate that those making them seem often unable to differentiate between current reserves and those much larger resources that will become reserves when the price or need increases - as it will.

Countries such as Poland have learned the hard way that relying on "friendly neighbors" to provide the energy you need is a dangerous practice. Thus they work to ensure a domestic supply.

I noted just recently the dash of realism that is beginning to pervade the thinking of the British Government and their approval, in consequence, of 15 new coal mines.

There isn't any country that will let the lights go out, if coal is available.

This means that we don't face Peak Energy: we face Peak Oil and Climate Change.

With luck, we'll start building out wind and solar even faster. When it starts hurting revenues for investors in coal, we'll need to find a a way to buy them out to maintain the pace of the transition.

We need to stop butting our head pointlessly against those who will be hurt by a transition to renewables - that's the path to the paralysis we see now. We need to find ways to buy out/compensate those who will be hurt.

Peak energy is still possible even with a switch to coal, especially if the whole economic house of cards comes down.

The Capitalistic System Will Collapse

http://news.kontentkonsult.com/2009/09/capitalistic-system-will-collapse...

I would agree. We depend on globalization to keep our whole system together. With major debt defaults, followed by an unwinding of globalization, we could see collapses in many areas where supply would seem to be adequate.

As I asked Aangel,

Isn't that peak demand, not peak supply? Is it fair to use the same phrase, when it's really something else?

Peak supply and peak demand are really two sides of the same coin. If there are inadequate funds to pay (because of credit collapse, for example), it looks like peak supply.

It may look like peak supply, but is it?

Isn't cause and effect important here? If we have plenty of something, and the economy collapses because of something unrelated, then isn't it misleading?

Heck, if the economy collapses we'll see "peak iron", but a limit in the supply of iron will have nothing to do with causing the collapse.

Aren't we, here at TOD, trying to analyze causes, not just describe effects?

Yes, but you're drawing a distinction without a difference for our purposes. If you want to have a supply conversation, that's totally fine, but it doesn't change the fact that for the 6.8 billion of us on the planet the absolute amount of energy likely peaked in 2008 — for whatever reasons.

To be precise, we should probably say "peak conventional, fast-flowing oil which then causes peak of all liquids" but we don't say that.

you're drawing a distinction without a difference for our purposes.

But what is our purpose? If we want to explain what's going to happen, and why, then cause and effect are important.

we should probably say "peak conventional, fast-flowing oil which then causes peak of all liquids"

Ah. You feel Peak Oil will cause financial collapse, which will then reduce demand for other forms of energy.

Yes, I agree: if that's the argument, then we should say so, because that's not the same as "peak energy", except in a trivial sense.

I would argue that the term Peak Energy embodies an argument that oil can't be replaced, because of inadequate supplies of replacement energy - IOW, physical supply limits. If the argument is that oil won't be replaced because our financial systems are crashing (either because of Peak Oil, or for non-energy reasons)..that's a whole different ball of wax. In that case, the statement that we face Peak Energy will just confuse people.

Credit is closely tied to all of this. Credit is an enabler of both production and demand on the way up. Credit indirectly helps pump up economic growth, since it enables investment in all types of industry and purchase of goods made by industry.

But once the high price of oil started interfering with the credit mechanism (through more and more defaults, as people and businesses paid for oil products, and missed debt payments as a result; or through indirect routes that had the same result--cut back on purchase of non-essentials goods, leading to lay-offs, and those laid off defaulted on their debt) we ended up with a reverse cycle:

Less credit made less money available for investment both in oil and in products that use oil. Less credit made it less possible for consumers to buy things that required oil--hence lower demand. This declining credit feeds the downward cycle we are on, and makes it worse. It appears as reduced demand, but it also results in reduced supply, since prices are lower, and since less funds are available for investment.

It is interesting that based on Federal Reserve data, US consumer credit peaked in July 2008--the same month as oil prices and production.

Good post. The next big thing TM is when supply starts hitting structural demand limits i.e it becomes increasingly harder to reduce demand as oil prices increase. I argue that initially the result will be simply rising defaults as oil is critical while for people on the verge of spiraling down into default paying debt is not.

This is fundamentally different from what happened on the way up and even the price spike and crash during 2008.

On the way up people expected to pay off their debts and made every effort to remain current even if it meant taking on new debt to pay old. (HELOC). The also where far more willing to cut back a bit on extravagant expenditures to make debt payments. During the crash itself you simply had everything freeze up people rapidly cut to the bone on all fronts reducing oil consumption and halting taking on new debt. Most however continued to service existing debt. Defaults have been rising but from very very low levels and are just now moving to new highs. It hurt more because of the fact they where well below norm and moved up not that the started near normal and moved up.

In a sense the current recession if you look at all the factors is simply a return to longer term trends. Its actually not yet a real recession outside of the growth in unemployment as the excessively long low unemployment rate unwinds but even this is a bubble popping effect and not yet really core contraction.

We have not really had our true recession yet ...

Now however as oil prices rise instead of more cutbacks on the demand side I argue we will simply see more and more people on the edge of default decide to default. As this causes housing prices to decline the number one factor in the decision to default in the first place more and more people will default.

Oil demand however won't change much it flattens as it hit the structural limit and further conservation requires reasonably painful changes in lifestyle for Americans at least I believe most that are deeply indebted will choose to default and keep current oil usage levels about the same.

Now another factor starts to take hold given the defaults most Americans who default lose the American dream of the McMansion and SUV many manage to keep the SUV's as long as possible if not at some point they buy a cheaper car often with poor gas mileage. Regardless at some point either the unemployment runs out or they give up and take whatever job they can find which keep their oil usage up but results in a dramatic drop in overall income and of course zero access to credit. This puts a floor under oil usage and of course if prices continue to rise then in general these people make further lifestyle changes to ensure they get oil.

Lets say a former underwater home owner first keeps the SUV and goes and rents a comparable house later on say he loses his job and even loses his car at this point he/she takes a big dive in living say moving in with relatives and eventually finds some minimum wage job gets another car probably a clunker and maybe their own apt. Oil prices rise however now this person takes on a roomate or moves back with mom and dad clinging to the car and the job suddenly rising oil prices are far less effective at reducing demand.

Other people who are earlier in this downward spiral effectively begin to follow the same path as home prices fall the net effect is you get a steady debt deflation and price deflation on non-essential items such as homes and new cars and steady demand for basic commodities such as food and oil.

Oil prices have to rise to the point that they become impossible to handle for the poor i.e 15-20% of the income and reducing housing costs no longer work. However as all this is happening rents will finally be coming down significantly as the flood of housing coupled with denser living arrangements i.e roommates and moving in with relatives pulls the floor out from under rents. At this point falling rents begin to significantly offset higher oil prices this can go on for some time.

Only once rents reach the point that being a landlord is not worth the hassel does this finally stop and also of course as rents fall further drops don't help much. Lets say the average rent in the US is 684.

http://answers.google.com/answers/threadview?id=486753

I'm guessing from what I know about poorer states

http://www.city-data.com/housing/houses-Jackson-Mississippi.html

That this can easily drop for Jackson its 551 with a low of 451. First of course the low end can go lower and the upper end can approach the low end. Overall under serious economic strain no reason whatsover rents can't easily fall to 300 on average. Thus I think a 50% drop in rents is easily possible.

Now 300 a month buys you a LOT of gasoline and basically can cover more than a doubling of prices.

Lots of other factors are at play but it should be obvious that if the trend is correct the economy can absorb significantly higher oil prices at the expense of a massive devaluation of its housing stock and reduction in rents and of course cessation for the most part of buying new cars or taking on any long term debt along of course with a awe inspiring increase in defaults.

Only after all of this is done do you really have to finally deal with more painful lifestyle changes at the structural level to reduce oil usage. We have a long way to go and if I'm right along the way oil prices will rise higher then most people think is possible.

The underlying situation is fairly simply people default on all debt increasing cash flow. People eventually take large wage cuts to have any job and people reduce housing expenses significantly buy make use of denser living arrangements. Until this fails to offset rising oil prices I argue prices will continue to rise.

Now once people really start making lifestyle changes as far as oil usage goes we will see what happens but I suspect all it will do for a while is slow the rate of increase in oil prices until the number of effectively lower class people increases significantly. My best guess is at least 50% of the current middle class will have to be reduced to lower class living standards before conservation finally starts to balance against supply and prices start to moderate the rate of increase. They won't fall significantly but they will also finally stop rising.

Given we are a long way from this point and its a multi year process and quite slow in the interm there is plenty of room for prices to be a lot higher than they are now. Given the above and minimum wage levels esp the assumption of falling rents in my opinion we are talking about 10-15 dollars a gallon in todays dollars being the real cap or pain point. Only when we hit the wall at this point will we finally begin to wean ourselves off oil. I obviously question if its not to little to late.

oil is critical

I don't understand. If fuel prices double, why not just buy a Prius (which will reduce fuel consumption by 50%)? Or, if Priuses are suddenly back-ordered (because everyone else has the same idea), put in your order and carpool with one other person (which will reduce fuel consumption by 50%) until it comes??

If they double again, put in an order for a Volt (which will reduce fuel consumption by another 80%), and carpool in your old vehicle with 3 other people, or your Prius with one other person until it comes.

Carpooling - the horror.

A Prius is expensive. A big piece of the oil price savings is built into the front end cost. You can buy a whole lot cheaper car, and the total of the car and gasoline price for the alternative will be less than the Prius + gasoline (unless gasoline is very expensive).

A Prius is expensive.

It's only about $24K - that's less expensive than the average new US car, at $28K.

A big piece of the oil price savings is built into the front end cost.

A little of it is - a Prius maybe costs about $3k more than other comparable cars with similar size and options - something roughly in between a Corolla and a Camry.

You can buy a whole lot cheaper car.

That's true - you could buy a $12K very small car. Not as large, or as nice to drive, but it will get you there.

and the total of the car and gasoline price for the alternative will be less than the Prius + gasoline (unless gasoline is very expensive)

True. But, all in all that's not very much money. Memmel was talking about people going broke because of gas prices. He said: "Oil prices rise however now this person takes on a roomate or moves back with mom and dad clinging to the car and the job suddenly rising oil prices are far less effective at reducing demand....Oil prices have to rise to the point that they become impossible to handle for the poor i.e 15-20% of the income and reducing housing costs no longer work."

Here, we're talking about not that much money - less than people spend, on average, right now. On average, people buy $28K cars, and get about 22MPG. A Prius, at $24K, and 50MPG, would be much less expensive to run than the average car now. Gas could go to $6/gallon, and the overall cost of running the Prius would the same or less than the average car right now.

Why would this be a problem for people to afford?

I agree - the cost of oil imports played a significant role in injuring the credit-based money supply. The US was borrowing to pay for it's imports, and using residential property as collateral. When the housing bubble burst (helped along by fuel bills), we had a bank panic. Now, we're substituting T-bills for mortgage debt, which seems to work better.

We seem to be recovering from that panic, though only time will tell. It wasn't the first bank panic we've ever had, and it probably won't be the last.

So, back to the question: doesn't it confuse things to describe a demand problem as a supply problem? That is, if we had plenty of energy, but we were in a depression due to a faulty financial system, wouldn't that be a financial problem? Or, if you feel that our financial problems are due to Peak Oil, wouldn't the problem be PO, not peak energy?

The issue causing the problem is peak oil, but once you get peak credit involved, it starts cutting off demand for other energy products as well (natural gas, coal, uranium, ethanol). So we may end up with peak everything, but not really because of a shortage of everything. It is more because credit can't grow without oil growing, and when credit cuts back, everything else cuts back. Lieblig's law of the minimum--but no one really thinks of credit as essential.

The issue causing the problem is peak oil, but once you get peak credit involved, it starts cutting off demand for other energy products as well

Ok, so peak oil causing other problems. So, not really Peak Energy as a cause.

credit can't grow without oil growing,

Here's the key idea. Why would we think that credit can't grow without oil growing? Wouldn't it be like kerosene for lighting 120 years ago - something that is needed in the short term, but which we could replace with electricity (from other sources)?

Now, it's true that rising import bills might choke off US economic growth for a few years (in effect, acting as a speed limit to the US economy), until the US greatly reduces it's dependence on oil imports. But, that doesn't eliminate growth, it just reduces it to the rate of efficiency growth (which can grow quickly, if it has to); it's a short term problem; and it's mostly for the US and other importing countries.

Hi Gail,

A few months ago, there were several comments about the book "Web Of Debt". I read the book and thought it had a message that was profoundly different from my understanding of money, credit, debt, etc.

Some of my more academic friends have trashed the book for its lack of scholarly rigor. Did you (or anyone else) read this book? I am trying to figure out if the author's basic assertions are fundamentally correct, or if she is just a clever nut-case.

I haven't read "Web of Debt", but from the Amazon summary and reviews it sounds like it is pretty much correct in what it is saying. Our current system is based on debt. It can't work long-term. Peak oil will exacerbate the problems of our current system.

Our current system is based on debt. It can't work long-term.

Because interest has to be repaid? If growth were to stop, interest rates would go to zero.

Why would people put their money in the bank, and why would bankers make loans? Because inflation would be kept at a sufficiently high level to make them want to. Inflation might be at 2%, and interest rates at 2.05%.(the .05% pays the living costs of a small financial sector).

What about that .05% - how can that be repaid in a zero growth economy? Because debt levels stay constant, so absolute interest costs don't rise.

Nick,

I think you have touched on the key flaw in the "our current system based on debt cannot work in a zero growth society" thesis.

Of course debt can be repaid by individuals or countries, especially if interest rates decline. I have never had a bank loan or mortgage based on an expectation of increasing income, and I suspect most people would will be able to service debt without a rise in income. It's always rapid rises in interest costs or a loss of income that makes repayments difficult.

Furthermore, whats wrong with low growth low interest rate economy and a decline FF in energy use, as FF are replaced by renewable energy? We may be running out of FF but not sunlight and wind.

Thanks, Neil.

Yes, I agree. I can't tell why the "our current system based on debt cannot work in a zero growth society" thesis is so popular on TOD.

Also, there's this idea that oil is somehow irreplaceable. So puzzling.

How are you doing? I haven't noticed many posts from you lately. Have you gotten discouraged? TOD seems to have gotten a bit more pessimistic lately. We seem to be seeing more of these "how are we going to survive collapse?" stories that just assume that collapse is a given (based, apparently, on the idea that oil can't be replaced).

Don't we usually understand "peak" to mean peak production due to supply limits? If we have peak energy due to economic collapse, that would be a peak due to a reduction in supply, right?

Kind've like how mercury and lead saw a peak in production, and then started declining because regulators decided they were too toxic, and so demand declined.

So, can we really call a peak due to declining demand "peak energy"?

I am willing to place substantial bet that these fifteen new coal mines are the first of many that will be opened over the next decade or so in any country with a little coal available.When it becomes obvious that the lights and heat are fixing to go out in the NEAR TERM-meaning in this case the duration of the average voters memory in relation to the next election cycle-the environmental backpedaling will be awesome to see.

Maybe one Christian out of a thousand really and truly taks his religion seriously-I know plenty who are very good people and donate generously of thier time and money but NONE personally who have been willing to give up all thier worldly goods and live as Jesus did.

When tshtf we will find that the average environmentalist is much like the average Christian -willing to give up something for his cause but not willing to make any serious sacrifice.

Thus when I see somebody advocating a European level gas tax I can safely assume that he either can easily afford the tax-that he will not have to change his grocery,clothing ,or recreational shopping habits in any significant way to pay it; or else that he has adopted a lifestyle that requires little driving.Most of the people in my community earn only very modest incomes and such a tax would be a disaster for them as they all must commute.For this reason alone many vote a straight republican ticket-If you make only ten dollars an hour and must drive twenty miles to work ,Algore is a scary man.

My personal estimate is that the best we can hope for is to get as many renewables in place as possible and to get palatable policies in place to promote conservation.

By palatable I mean easily acceptable to the public-a higher mileage standard is palatable ,a higher gas tax is not.

A tax credit for adding a heat pump and insulation is palatable- sharply higher electricity taxes are not.Furthermore these types of interventions are not so easily reversible as some other policies.Ccs can be abandoned in a hurry but a fleet of more efficient cars, once built, will not be abandoned.

Once people become accustomed to listening to thier noeghbor with a good heat pump brag about how low his utility bills are, such systems can be mandated in new construction.

Another way of saying what I 'm trying to get across is that people can only be herded and not very easily-major industries can be TOLD what they are going to do-assuming of course it can be done.

There's been a lot of discussion of how to overcome resistance to change, especially to the changes needed to deal with climate change. I think a lot of it's been pretty unrealistic.

We need to stop butting our head pointlessly against those who will be hurt by a transition to renewables (and other new ways of doing things) - that's the path to the paralysis we see now. We need to find ways to buy out/compensate those who will be hurt.

This applies especially to coal consumption: there isn't any country in the world that will let the lights go out, if coal is available (This means that we don't face Peak Energy: we face Peak Oil and Climate Change).

With luck, we'll start building out wind and solar even faster. When it starts hurting revenues for investors in coal, we'll need to find a a way to buy them out to maintain the pace of the transition.

-------------

We need to stop butting our head pointlessly against those who will be hurt by a transition to renewables - that's the path to the paralysis we see now. We need to find ways to buy out/compensate those who will be hurt.

A classic story: Manhattan needed more cab drivers, but faced resistance from the current drivers, who would face more competition. The solution? Giving the licenses to the old drivers, so they could sell them and get the benefit of the new resource. It accomplished the result, and yet the existing drivers were happy.