Water Floods and Improving Oil Flow

Posted by Heading Out on October 4, 2009 - 11:05am

This is part of Heading Out's Sunday tech talk series.

I am going to insert a topic here before going on to Carbonates, as I had mentioned doing in the last post, because it will help to explain a developing problem that comes when extracting oil from rocks such as chalk. And, because I used this example in my original post, let me again start by creating an analogy.

The oil business is one of great complexity and there are some challenges even in trying to explain some of the basic reasons why, when price goes up, producers can't just turn a tap and pull more oil out of the underground reservoir.

I was trying to think of a way of explaining it, and offer the following, in the hope that not too many of those who know reality will be offended at the simplification.

Way back at the beginning of the current Elizabethan era it used to be fun, after dinner, to float cream on top of coffee. I still do it when the cream is of the right sort, and it gives the coffee a different taste. Putting the cream over the coffee is a bit of a challenge, you start by using the back of a spoon, and when you get better pour it down the side of the cup.

So now we have quarter of an inch of cream floating, unmixed, on top of the coffee. This can be very simply considered to be the oil floating on an underground pool of water in the porous rock underground. Now take a straw, put it into the cream and try and remove it without sucking up any coffee. If you suck gently you might be able to get a lot of the cream up, especially if you bend the straw to run across the top of the cup. But if you suck too hard then you not only pull the coffee into the straw and can't get any more cream from that particular place, but you also mix up the cream around that point into the coffee, and you lose the chance to recover that cream later. Separating the cream from the much larger amount of coffee beneath it is not really an option (though as you will see it is needed with oil and water).

Oil is somewhat the same, in that, if you try pulling it out of the ground too fast, you can cause changes in the flow pattern that drop the total amount you can get out from any one well, and the immediately surrounding rock, pretty severely. I will return to this topic of fluid control in a later post (and yes I know, there is an alcoholic version of this example, but it would be (grin) socially highly irresponsible to encourage folk to try doing this with different layers of liquor - especially since I can't remember which colors you have to use and which liquor you have to float on which to get them to stay separate. Research may be needed.)

So, if we can’t just change the differential pressure between the well and the surrounding rock to get more of the oil out, then how can we do it?

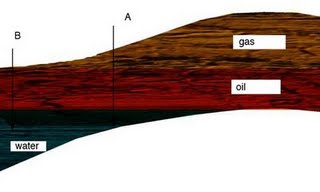

Given the volumes of space that the oil occupies, and the distances and rock it must pass through to get to the well, it would be easier if the oil continued to flow out of the well by itself. But if the natural driving forces that I mentioned last time (the pressure difference and the gas and water pressures) have all played their part then the next step is often to pump another fluid back into the ground to fill the space left by the oil and thus to recreate, or better to keep up the pressure in the oil, so that there is still a differential pressure that is pushing the oil out. So let’s go back to the section of the rock that contains the oil, and which I have used before:

There are two ways to inject fluid to keep up the oil pressure. One is to pump in a gas, under pressure, into the rock just over where the oil is, and this will move the oil to the well. If you have that sort of imagination it is similar in effect to going from the small toy water pistol that I could just about hit my baby brother with when he was really close, and still a child, to now having one of those more modern Super Soaker water guns that pump air under pressure behind the water. Now you put out more water faster, and can hit that obnoxious kid over on the next block.

However when this is tried in an oil well, while the gas works, you have to get it from somewhere, and it also turns out not to work as well as pumping in water below the oil. And so pumping water into the ground is often used, after the initial pressure has dropped, to keep some pressure in the well and help with what is known as secondary recovery (the initial flow being called primary).

In developing the large Saudi oil fields Aramco decided to speed the process up by combining the water flood with the initial extraction since, in this way they could keep a higher pressure in the rock, and the oil would thus flow out faster (the Super Soaker approach). The idea, as I recall, originated in what was then the Soviet Union, water injection being used at Samotlor, for example, in the 1970’s, for which I will quote from John Grace’s “Russian Oil Supply”, later.

It I possible, though it depends on individual project economics to also include a surfactant with the water (think detergent) so that the oil can be more efficiently driven ahead of what is known as a water flood.

When the technology was first developed pre-existing wells were used to pump water into the ground in a relatively localized operation so that, for example in the illustration above, I might use four wells surrounding well A to inject water so that locally I could raise the pressure, so that A would continue to produce.

However, with larger fields this tends to be less efficient, and so what is now more common in larger fields, is to start at the edge of the field , say at B, and inject water along the edge of the field. This not only increases the pressure in the overlying oil, but also, as the water level rises, it helps “sweep” the oil from the edge of the field up towards the center. Thus, over time, the oil would pass the well at A, and a new well would be drilled closer to the crest of the field, while A would then become a water injection well.

Now there are two problems (this being a simple explanation) with this way of increasing production. The first is shown with a simple mathematical calculation. Let us say the original well at A was drilled through 100 ft on oil bearing rock. At a given differential pressure the well produced some 100 barrels a day. Now we inject water under the oil, and this replaces the oil as it is removed. So, after a while the bottom of the oil layer in the well has risen by, say 25 ft. With the layer under that now being water. If we maintain the same differential pressure across the well, we will see a 25% drop in production, because we are now only drawing oil from the 75 ft of rock that still has oil in it. We will also see additional water coming out of the well with the oil.

Initially this might not be much of a problem – but over time this “water cut” can become very significant. Here is that quote from John Grace:

Water cut also played a major role (in the collapse of Samotlor production). The water injected into the ground with such fervor in the seventies had to be pumped back to the surface in the eighties. Water climbed from 24% of the fluid lifted by Samotlor’s wells in 1980, to 68% by 1985 – an extraordinarily quick rise. The field was drowning in water, all of which required pumping, and processing to recover any oil.

The current water cut at Samotlor is around 90%.

Saudi Aramco, as I mentioned, also extensively uses water flood to assist production. Some of the most productive regions have been the Ain Dar/Shedgum portions, which are to the north end of the main field. These are the regions that have been producing at around 30% water cut, and are some of the oldest of the producing regions of the Kingdom, with a current water injection rate of 2 mbd It is thus interesting to see look at the new water pumping stations that are being installed. The new construction for the Qurayyah Seawater Treatment Plant to be used to supply seawater for the Khurais expansion that has been put in and will provide the fields with 4.5 million barrels of water, to help in pressure maintenance and production. The overall water capacity of the plant has, however, grown to 14 mbd. Of this flow some 2.5 million will now go to the Ain Dar/Shedgum fields.

(Note I will try and remember to update a sort of “worked example” of all this with Abqaiq that I have previously posted next time) to help make this perhaps a little more real.

As always, a most interesting series.

I have wells in the Medicine River field of central Alberta. A few months ago I got a notice from a company that will be running a disposal well nearby for petroleum companies who want to dispose of saline or otherwise toxic water. They will be injecting at the edge of the Medicine River field (just the one well) so it will be interesting to see how it works with our production. The field is under compulsory pooling orders so all of us will benefit. The disposal company doesn't own any production but they make their money from the petes wanting to get rid of their wastes.

Over time I expect to see more carbon-dioxide injection from companies looking for cap-and-trade credits.

The drink is Pousse-café : from bottom to top, grenadine, yellow chartreuse, and green chartreuse http://en.wikipedia.org/wiki/Pousse-caf%C3%A9.

# Creme de Cassis

# Grenadine

# Anisette

# Creme de Banana

# Creme de Menthe

# Creme de Cacao

# Coffee Liqueur

# Cherry Liqueur

# Blue Curacao

# Blackberry Liqueur

# Apricot Liqueur

# Orange Curacao

# Triple Sec

# Amaretto

# Peach Brandy

# Apricot Brandy

# Blackberry Brandy

# Peppermint Schnapps

# Peach Schnapps

# B & B

# Grand Marnier

# Sloe Gin

# Kirsh

# Cream

High density first, low last.

HO - thanks we do read them ;)

I know one thing you have commented about in the past is the difference between horizontal and vertical wells when it comes to water cut, and in particular how different things can be near the end, when the layer of oil is thin, compared to the layer of water.

As I understood it, with vertical wells, the water cut gradually gets higher and higher, until it is no longer economic to get the oil out, since the vertical well reaches through both the oil and water layers. But with horizontal wells, pretty much the whole well can be in the oil layer, until suddenly the water level rises to meet the well. So the water cut can go from being quite low, to very high, in a short time.

Do you see this to be as being an issue with Saudi wells, or with other big wells we are aware of?

Gail -- If he allows I'll catch this one for HO. How critical such an issue might be at Ghawar will hinge on the position of the horizontal wells. Easier to describe with a simple model: all wells in the field are horizontal. Current oil/water level still below the lowest well. Model A: all the hz are at the very top of the structure and thus very little water is produced until the entire reservoir is nearly depleted. At this point the water hits all the wells at the same time. The water level reaches the top and "poof" the field is gone. Model B: the wells are evenly spaced down the structure and the water level reaches each hz well over an evenly spaced time period. Each time that happens there's a step-wise jump in water production as well as a drop in oil rate.

Now the real world. Ghawar is a mixture of vertical and hz wells. I've yet to see anyone offer a credible accounting of their distribution. The situation likely falls between Model A & B but by what proportion? The KSA knows but they aren't saying. And even though the movement of water through the different portions of Ghawar is anything but regular they have monitor wells that can track the reality fairly close. Over at least the last 20 years I have been told by more than one source the KSA has some of the most powerful computer models (run by top Swiss engineers I'm also told) constantly revising the future production profile. Not that I would bet my life on the accuracy of anyone's model but the KSA has a much clearer picture of the future then we'll ever know. Until it happens, of course.

And the same goes for Cantarell Field in Mexico. Except upside down, of course. As the N2 gas cap expands and moves the gas/oil level downdip, producing wells eventually "gas out": the N2 volume reaches such levels that the well is permanently shut-in. Again, no details on the distribution/types of wells at Cantarell but given the dramtic drop in oil rate it's easy to guess now. I don't expect Ghawar to eventually have a similar drop off. The dynamics and reservoir character are much more complex. But in either case fairly predictable if you have the data.

Gail:

This was one of the reasons that I wrote the reminder to myself to write about Abqaiq, since that post will illustrate some of the problems that they have with zones of high permeability that make it important, even when horizontal wells are used.

Aramco have gone to SMART wells which have valves and packers in them to try and control the inflow of water through these zones, but I will try and write a longer post later in the series to describe them in more detail, but I need to put the foundation in first.

Gail in my opinion your touching on the underlying elephant in the room with modern oil extraction if my fast collapse model is correct. Certainly there are obvious potential problems with older horizontal wells and they simply don't age like traditional vertical wells. In general as they age they develop a lot more problems than your vertical wells often expensive problems.

Good for the internal oil business horizontals esp oil ones can be big money makers as you have to try and fix problems with them. Hopefully Heading Out can do a good post on the differences between the wells.

However thats not actually the real problem its the root cause but above it is a accounting trick if you will thats been played. How do you calculate recoverable reserves with horizontal wells ?

Well obviously the first problem is the technical problems with the wells in general they are non deterministic and they happen when they happen and if they can be remedied they will if not well you have a real problem.

If you read the literature from the oil industry it seems accounting for reserves in fields that use horizontal wells is done in two basic ways that are really not all that different in the end. In the first method your conservative and basically use traditional vertical well recovery to estimate total reserves and each year your horizontals keep producing better than the conservative estimate you basically leave it unchanged. You URR never decreases until obvious problems start to crop up and must be discounted. Effectively you never run out of oil until you do.

The next method is to assume some high recovery rate for your magical horizontal wells generally 50-90% and call it good. Basically you assume some fraction of OIP is the URR. In essence this is assuming perfect performance from your horizontal wells or that almost all problems will be solved.

Now if you go and read the literature from the oil industry you will find that 99.99999% of the time the production decline of a field is unexpected and is a technical problem that will soon be fixed. Now of course this is whats made public internally one has to imagine that the shock and surprise is far more subdued.

Given the above at horizontal drilling and other advanced technologies have been developed you get and increasing problem with the validity of reserve estimates overtime how well they actually track reality decreases.

Now of course in my view the reserve numbers today are generally so bogus they are simply GIGO. With no pressure to really do the right thing as far as reserve estimates and with a lot of the oil under the control of National oil companies and or extracted from countries corrupt leadership including the US its difficult to even force any sort of review of reserve estimates. Everyone in general benefits from being optimistic and there is very little oversight to ensure that optimistic does not turn into a blatant lie.

Now of course as outsiders without the real numbers we generally are forced to estimate peak oil using either heuristics with production (HL) and or published reserve estimates. Both approaches can fail dramatically for the same underlying reasons that reserve estimates are difficult in the first place for horizontal wells. The approaches used on the oildrum are certainly more conservative than the industry uses but this does not mean they are correct it just means we have a better upper bound estimate.

Now of course this estimate point to peak oil almost certainly occurring over the next few decades and even the oil industry is finally coming to champion peak oil in 2030 ( safely far enough out to not require drastic action).

However I'm convinced that given the intrinsic nature of the problem everyone is wrong outside of Bakharati (sp) and Ivanhoe.

http://www.hubbertpeak.com/ivanhoe/

Both really discounted reserve growth like I do in fact I really just independently replicated Ivanhoe's work.

You can do a really simple though experiment to decide if we really are in deep trouble.

Assume that reserve estimates are correct and that peak is symmetric that we could embark on a technical advancement campaign rivaling the the computer age or aerospace.

We have done this.

Therefore the production profile is probably asymmetric today a classic shark fin. All you need to know is that near the end of the long undulating plataue causing a shark fin profile is that oil will rapidly become hard to get and keeping production high will be increasingly difficult and this difficulty will itself rapidly increase. Before this who knows the interaction of technical advances and demand can have any result however if they are rapid enough and demand grows slow enough a long period of low prices is highly probably with technology steadily insuring production capacity exceeds demand. Given our technical capability it seems sensible that we could easily beat demand as long as the growth was bounded.

In a world with central banks and effectively planned economies sensitive to price and really wage inflation a natural feedback loop exists even without assuming nefarious tin foil hat concept to keep supply of oil and demand balanced.

All thats left is the question did we really increase reserves or not ? If not then we crash if we did then we can reasonably expect a long plateau in oil production that may or may not slowly decline. With any shark fin effect happening well in the future and probably not important as intrinsic demand would still increase and require alternatives to solve the supply and demand problem. Just because its a shark fin intrinsically does nothing to tell you the length of the top region and and undulating plateau for decades is possible if you add in a new round of discovery in deepwater this would occur much later at a higher production level as the base price for oil increased.

We would have semi-expensive oil for decades to come.

Or not if not then we are 70-80% depleted and production will collapse and even after a rapid economic collapse the price of oil would rise quickly surpassing old highs.

The only difference between the two models is that the optimistic one would predict that following a sharp economic contraction oil production capacity would not change much and oil would be cheap for many years until demand rebounded back to its previous highs. We would not see any price increases post contraction and if we did its purely for above ground reasons nasty speculators and OPEC cutting back nothing to worry about.

Or its intrinsic and the sharp collapse model is correct and oil will steadily at first then quickly move to breach old highs as production fell below the new reduced demand level. And of course as demand contracts it gets harder to further contract and the production collapse is steady.

For now you can choose which model to believe soon the true one will be evident.

It sounds like the reserve issues with oil horizontal wells are not too different from the reserve issues for natural gas with fracking and all of its horizontal wells. The big issue in each case is how long oil / gas recovery will continue, and how much decline there will be.

With vertical wells with little fracking, the answer was pretty well know. Now with horizontal wells with a lot of fracking, the results look great at first for natural gas. The also look great for oil. The question is how much you forecast the results to stay good out to the future.

If it is really a matter of the oil is whatever it is, and the new methods just suck it our more quickly, then current reserves may be overstated. If methodology keeps getting better, and more really is extracted, it could be fairly different.

Exactly well almost lot of gray :)

For example new technology actually allowed us to develop the shale oil in the first place. We have large reserves of tight shale gas so despite the decline rate of the wells technology did unlock substantial new reserves. Even with that the future is questionable.

However with oil the number of new tight oil reservoirs unlocked by new technology is much much lower than was the case for NG.

So if you willing to question the NG case and what it really amounts too despite to large generally real increase in reserves that are now technically available should you not even be more skeptical of what exactly has happened in the oil patch ?

Obviously I've self converted and gained enlightenment but am I a raving lunatic or close to the truth ?

The truth is the truth and fundamental assumptions can prove very very wrong. Heck one need only look at medical literature from the past or even astronomy to show many cases where the accepted truth proved to be fundamentally wrong based on what are really small mistakes in assumptions or "facts". And this is in areas that are relatively easily to test with experiments. In the fuzzy world of oil and global politics with the truth itself a slippery concept a huge mistake is I'd argue even easier to hide and we know some big ones have lasted for a long time. The right answer if your interested in the truth is to accept that a fast collapse is possible and seek evidence to either support or deny the claim i.e do your best with all information available to determine what the truth is. I suspect you will find that most of the facts that would lead you to discount it tend to be highly concentrated in statements made by The worlds large oil companies both public and national. The only facts that discount the assertion turn out in the end to simply be statements made by the very people that are most interested in hiding the truth if its as bad as I think it is.

For me at least with all the work I've done the fact that the "facts" kept ending up grouped in this area as just statements from the oil companies was in itself the determining fact. In areas where the facts might be determinable i.e the US and US reserves of oil companies you get this interesting result that reserve estimates tended to be constant year after year implying they where simply a production of future production out a few years with no real underlying hard estimate of reserves. This sort of rolling production estimate is right until the day its wrong. And of course other oil industry projections are absurdly high. There is a heck of a lot of unsubstantiated beliefs in the facts that could be used to disproved a fast collapse.

Of course the nature of a shark fin collapse is not obvious until its really to late the difference from the various possible truths and a shark fin collapse only show up at the last minute so although there are very obvious signals in the rate of increase of oil production and GDP growth per capita GDP and per capita oil usage all pretty much unanimously indicating the key early signature of a shark fin patter which is a two step rate of change in oil usage. I.e you go from a fast exponential to and effectively linear increase via a sudden turn.

This is the left corner of the fin if you dismiss this turn you left with the final collapse as proof. The first turn is obviously in the data its simply a matter of how you interpret it. If it is a shark fin curve today the second turn is already in the data so now it simply a matter of waiting a bit for verification. So as far as I'm concerned its the only theory of oil production that will be provably false in the near future short of another massive economic collapse or war with Iran or other major oil producer before we really start heading downwards.

And last but not least I'm really confident that we either start seeing the effects of rapidly falling oil production within the next 6-12 months or my theory is baloney.

So baring war or economic collapse you need only wait six months and lets see and depending on how things go maybe another six months.

Lets say oil is say 90-100 a barrel then its tough to prove or disprove the shark fin you need to wait a bit longer since it implies oil hitting say 200+ over the next twelve months without any major recovery and even despite a steady economic decline.

If its 70 then probably not on a shark fin.

If its 50-60 then 90% probability not and the next six months is just ensuring my timing is right. Getting the timing right is a complete art but there are some very strong limits i.e oil production simply can't collapse for a year without something happening to oil prices unless your in economic free fall :)

If I'm wrong whats need is this implies that the current 70 price range is almost certainly the result of OPEC cuts not any significant change in oil production and if they produced at capacity the oil price would be say 30-40 right now.

Only the shark fin model offers a fundamental basis for the current prices. Also I'd note its the only one that results in a drop then rapid rise following a rapid economic collapse. If you collapse the world economy over a span of months by a substantial % say 5-10% you can briefly outrun the collapse of the shark fin model if you early in the down curve and its not really taken off. But this glut quickly dissipates. Thus the only possible way to get oil prices down even briefly is a collapse to rival the great depression.

The one thing that could delay the effects of and onset of the crunch from collapsing production happens to be the one thing that happened.

However if your convinced we are on a shark fin curve no way TPTB can't be aware of it and your left wrapped in a ball of tinfoil and even lead foil as you get all kinds of interesting results with the model.

The best one is Bush actually invaded Iraq after it was obvious we where on a shark fin if we where on one as the "peak" as much as it exists in the model was back in 1998 or so. In fact if you bought into the model you would have known a lot by the 1980's and even more by the 1990's. The top of the fin is 10-15 years long over basically from 1992-2007.

The problem is if TPTB actually believe it was the truth and they would have data that would allow them to actually know then looking back in history makes things very disturbing esp given the US peak and obvious decline by the 1980's.

All the tumultuous above ground factors effecting oil and all kinds of financial moves suddenly become very sensible if your goal is to maintain power and get rich as possible despite the steady approach of the end of the oil age.

I would not have done it any other way. In fact Carter stands out as the single president in recent history that was not playing the oil game.

And the one that did not play ball got handed the Iranian revolution as a present.

Like I said some friggin serious tinfoil is required as to much makes perfect sense. The fact that everything "clicked" is in itself the most disturbing part.

maybe some of the uncertainty you detail is the result of the anti-po full court press, not unlike the full court press deployed to defeat health care reform, climate change legislation, evolution, public education.

there is also a full court press to try to convince the public that the us, and the world, have quadrillions of cubic feet of ng "reserves", more than a hundred yrs supply, 6(or pick a number) ksa oil equivalents in the usa.

Thanks for the science :)

I might add that tracking the dollar price might not be the very best indicator, as there are currency games ongoing that might disguise scarcity, i.e. the free-market pricing mechnism for oil is not the perfect pricing mechanism you might assume.

China has a variety of barter/fixed-price oil trades with various countries (most recently IIRC a deal for iranian crude part-payed by refined gasoline) that bypass the dollar-denominated pricing mechanisms, and the IMF et al may be busy gaming the dollar's strength in order to prevent financial implosion, which could possibly leave bbl priced lower in dollars than non-dollar-currency countries are effectively paying to import oil ....

Thanks for the thoughts, Memmel. Interesting to ponder the possibilities. Lemmee reach for a beer, I need one ...

Dollar price is not the best indicator but it has been pretty good at predicting the 'Peak Oil Runup'; dollar price hasn't missed a beat since the North Sea and Prudhoe fields started to decline. Whether it can be more indicative or not is beside the point; it measures most accurately the shift in market balance toward producers and away from customers, away from a 'total growth' to an allocation regime. Top o' the head, I would say about end of 2004, when oil nudged past $40 a barrel. The choice became buying oil or buying debt. This is an abstraction, the real allocations were buried under layers of derivative transactions.

I still put peak @ 1998-99 on a dollar basis. Keep in mind all the 'alt trades' for crude revolve around the dollar/crude trade; they have to! In otherwords, these trades hedge dollar liquidity, they don't dare escape the the price range suggested by the dollar/crude trade. Otherwise, all and sundry would pile into it or the dollar price of crude would raise to meed the 'new' price.

There a probably other ways to date Peak Oil. On a value basis, (value of physical good for physical good) it seems to have taken place in the early- to- mid 1970's. On an energy productivity basis, it appears to have happened a lot earlier, maybe in 1955. When was Peak Reserves? Undoubtedly in the past as well. Keep in mind the peak resource took place before that Drake fellow drilled that well in Pennsylvania.

It's been downhill ever since.

Same place I ended up 1998-2000 :)

Now ponder our later invasion of Iraq and its real relationship with peak oil despite the games.

Nice article. Water flood were used extensively in western Pennsylvania during the 1930's and considerably enhanced oil flow from the depleted fields. The production curves for the state clearly show an offset peak related to these activities.

Thanks for posting this.

So that readers don't get the impression that we can eventually get all of the oil out, once you flood a formation formerly productive of oil, even with surfactants, you still leave a coating on the rock and in the pore spaces of the formation. The worse problem, however, is that once you invade the gas portion of any zone, you have to coat "new" rock with oil, so you both leave a great deal of original oil in place AND lose some to the coating process. Even worse, most of the time, where there are pockets of lower permeability where formation material is not ever broken down, you never get that portion of the oil. This is an area where very sophisticated CO2 floods can bring further production out of old fields, but only in certain circumstances and with extremely high pressures. The only one I was able to obtain accurate information on plans to use about 3,500 PSI, but will have to obtain regulatory authority to use such pressures, and that is doubtful at the present time. The high pressure is to put CO2 into the formation as a liquid, and one with the same miscibility as the oil it is to displace.

Water floods also use other methods, such as polymer gels to cause the water, always prone to taking the path of least resistance, to change flow patterns and thus create a better "sweep" of the productive part of the formation. Many of the polymer gels out there can be broken down using bleach, but "don't try this at home !!", so that the flood can be re-started to again change the sweep patterns. (Bleach is an oxidizing agent and can cause rapid combustion, so working with these types of chemicals is not easy, and freqently is not safe either, even with the best of precautions.)

Thanks, woodychuck:

I'm going to write a little bit about the increase in production (and also about some of the problems) when I write about Carbonates and Ekofisk next week.

Sounds like supercritcal C02 not just a liquid. The worlds ultimate solvent.

http://en.wikipedia.org/wiki/Supercritical_carbon_dioxide

I don't know your temps but looks like thats what your talking about doing.

Outside of maybe mixing in some additional solvent however supercritical C02 is close to the top I'd argue what your describing is hitting the limits of chemistry.

Impressive given we still have a trillion barrels of oil left to extract we should not even be considering this for 50 years or more.

Surely you can find other ways to invest your money in the oil patch with better returns.

I'm not trying to be rude just think about it for a bit. If what your saying even reasonably makes sense then where are we really at in the big picture ?

Simply realizing that ever more advanced technology is required to extract oil suggest that future oil production will not mirror the past otherwise at some technical level we would have slowed the deployment of new technology until it became cost effective and the deployment rate would be governed by the relatively cheap price of oil.

You can of course make different arguments but and in many cases the above is actually true but what happens when it fails and price no longer pushes new technical developments ? Where are we when technology can no longer maintain oil production levels at any price ?

Memmel, the project I referred to is not mine, but I was at an event where the engineer was describing what he intended to do for the company he was employed by. I was listening intently since I have two wells which offset their 30,000 Bbl / day waterflood now, and was really concerned about the CO2 since it creates corrosion at immense levels.

In part, they are looking at CO2 sequestration credits, or what they hope will be such. And, they realize what the term Peak Oil means. Their project is slated for about 6 years out, if it happens at all.

When I asked about the corrosion problem, he replied that is not a problem when you own a chemical company - which they do and I do not.

I do think it speaks volumes about where a decent sized domestic producer (not me-the folks who are targeting the CO2 flood) thinks the industry is, however. And, I do think we are a long way from the time when technology advancements can no longer maintain oil production at any price. There are simply too many already known areas where production of oil and / or gas WAS unprofitable at low prices and will be profitable at prices not too far above what we have now. Oilman Bob formerly of the TOD had one in the form of an area around an old salt dome which watered out and could not be pumped due to a problem with unconsolidated sand messing up the pumps at the time of early abandonment. I know where there are some as well, but do not think that there is enough assurance of stable high prices to go after them. In today's market, I can't make enough off of selling prospects which I might be able to use later, so I am not doing anything with them. Out of 6, only one has had someone slide in under me, and they are making good money now, but won't if prices slide below $40 or so.

How to say this from the "big picture" the assumption most people are making is that oil production will stay close to what it is today. And the most important thing is overall production levels globally. However your talking about bottom of the barrel type projects i.e ones on the edge of financial viability with a traditionally high price for oil.

What I'm trying to say is no way these projects hope to keep production volumes any where close to todays at any price. This means of course as you recognize higher prices for oil. However higher oil prices have a negative impact on GDP growth which of course slows or reduces economic growth thus the absolute demand for higher priced oil also declines. So even if we assume you can keep production high at high prices the chances of demand remaining robust for expensive oil are about nil. And the way our economies work we would have to grow as oil got more expensive to afford the ever increasing price which grows intrinsic demand for oil.

Somwhere in these arguments lies the fact that its not going to happen and underlying these economic catch 22 is EROEI. It can't happen because we can't afford it at any price. The money game does not work.

What can and in my opinion probably will happen is oil prices will increase but investment in the oil industry will pull back dramatically if it does not then we get another overshoot and crash however this time around given the overall shrinking of the economy the oil industry is fighting to get a ever bigger piece of and ever shrinking pie. This is fundamentally different from the situation running up to the peak pricing in 2008 all the way up the overall economy was growing then flattening.

From now on out the oil industry will face receding horizons as production falls and prices increase the flow of funds will probably reverse with more and more money cashing in on gains and getting out. What one will see is cash rich oil companies with falling production unable to increase shareholder value leading to ever larger dividends and stock buybacks. This is draining capitol out of the oil industry and it won't be reinvested. And as the absolute volume of oil declines every single part of the oil industry outside of existing production will face massive overcapacity and substantial losses. From pipelines and shipping to refineries and gas stations not only will they not make money but they will be suffering massive losses as overcapacity grows at all segments. Integrated oil companies will increasingly see profits fall as they subsidize their upstream businesses with profits from downstream production.

In a very real sense you will be competing for capitol to bring online marginal projects against Texaco using its cash influx to buy back stock and pay huge dividends. You should get the feeling your swimming upstream towards Niagara falls.

This situation is very real and a perfect model exists in the form of the slumlord. The come in and buy up houses for rent as the economy contracts and this in itself causes values to lower as the economy contracts further and values continue to decline they cannot afford to maintain their properties leading to even lower values finally areas become full blown slums during the entire process any money made is steadily extracted all the way down till the buildings are condemned and destroyed. For the first time in recent history the oil industry will experience what its like to be in real decline and see long term cash flows reverse and steady capitol extraction cripple the industry.

Underlying this are EROEI concepts believe it or not EROEI is detectable with regular economics and its response is to suck the effected business dry.

Of course we have to wait and see how things turn out but I suspect that many of these marginal projects will never be funded or the window of opportunity to get them funded is narrow. There is no glorious future for the oil industry as oil gets scarce it just moves to the looting stage of capitol extraction like its predecessors. And of course throughout all this the potential for a price crash depending on the differentials between production and demand and price is always present. Even if I'm right and we don't see a crash like we did last time at least until prices are much higher this time around the higher they go the more and more the fear of a crash will increase. So you have a very real psychological problem to deal with. This fear plays a large role in why the cash flows reverse. However obviously once they reverse out of fear the chance of a crash actually lesson as production declines from lack of investment sending the fear of a crash higher and chances of a crash lower :)

Understanding the paradox that falling EROEI and falling total production cause and industry to collapse despite every spiraling prices is both difficult and simple you have to understand why ever higher prices which don't lead to increased production expand and effect the overall economy not just the local problem of oils expensive there fore this marginal field is profitable. Unless you can increase overall production to allow the entire system to grow to absorb the higher costs you get the above sorts of paradox's you don't get a free lunch of high oil prices and robust demand.

In the past substitution even partial substitution has repeatedly put off the day of reckoning its possible that this trick has also run its course and substitution and efficiency gains cannot break us out.

What I find really interesting is that the only way we probably will actually extract all the marginal remaining oil is if a substitute can step in and fill the gap and allow oil production to remain high as it serves a ever declining market. This keeps prices high and production profitable and allows growth to ensure demand remains robust yet allows the overall industry to decline in and orderly fashion. Without a valid substitute things don't work out quite like many people expect. Think about how NG has to date played a large role in allowing demand for all types of oil products to continue to grow even as the traditional use cases shrank or became competitive with NG substitution.

The substitution in and of itself was required to allow the market to develop a new mix form.

Be careful how long you wait and also recognize there fear of a crash has real reasons and its not impossible so protect yourself against losses. In my opinion there is a window of opportunity to bring online the remaining marginal oil resources before the overall financial picture sours to the point that no more will be attempted. These should be profitable if we don't have another crash in prices or its not bad or your well enough off to survive the rough patch. After that in my opinion the rate at which marginal resources are brought online will go into steady decline even as oil prices increase like I said above.

I've exchanged a few emails with Nate Hagens over this because the financial side is fascinating since the underlying decline in EROEI and overall production suggests that somehow the financial world has to recognize the truth and reverse cash flows regardless of the price of oil and suck money out of the oil industry not put it back in. AKA the slumlord effect but in the case of oil its a bit different because your talking about rising rents for fewer and fewer rentals as you decline to try and match the two problems. Assume you have and arsonist stalking the neighborhood randomly burning houses and all insurance is dropped or steady hurricane or tornadoes. With no insurance no investment. So its not quite a perfect match with slumlords and the fact you need to add in this "natural" disaster to get the problems to match up better implies injection of EROEI and declining production into the equation. So you can see how by injecting a bit of random natural disaster into the slumlord effect I can in a sense balance it to match with the oil industry.

I'm repeating myself I know but although I feel like I grok EROEI and economics and the paradox of falling investment with rising prices I'm not sure I can explain it well.

You make some good points. It is going to be very difficult to downscale oil as the amount of production drops and EROI decreases. The industry won't be able to charge a high enough price to cover all its costs, without cutting off purchases.

So far, oil companies have been able to stay close to level by increasing the natural gas portion of their mix. But at some point, even this will be difficulty--especially if the price for gas stays low.

"The worse problem, however, is that once you invade the gas portion of any zone, you have to coat "new" rock with oil,..."

i don't think i can buy that(certainly not 100%). why wouldn't the rock originally saturated with connate water still be coated with water ?

introducing a third phase(oil or condensate) into a gas reservoir is never a good idea, and oil or condensate could be irreversibly trapped in the pores , but i question whether the oil or condensate would actually coat the rock.

The problem with connate water saturation and oil coating is not traditionally a problem - oil floats on water, on matter how shallow or deep, and you would have to push the oil down or have a very stratified zone to have a situation where the oil would have to displace water. Where oil is forced by any means into a water portion of a zone, it will not all be recovered. It is oil displacing gas which is the problem, and this is being done where, as is frequently mentioned here on TOD, producers are forgetting about maintaining the gas cap and producing the gas to get the revenue from the sales. And, as the oil invades the gas zone, oil is lost as it invades the permeable zones where gas previously was. If the gas was in a less permeable part of a formation, it probably would not be as great of a loss, but a loss nonetheless.

I do not think that you can keep the oil from becoming trapped by what I refer to as coating. No matter what you call it, you won't recover all of that oil by any means. Now, I must say that all of my experiences are from using artificial lift. I have had an interest in only one oil well which flowed in a commercial quantity, and once the flowing stopped, we were able to dramatically increase production above the original level by pumping it.

ELWOOD -- the short answer is that a rocks permeability (to a specific fluid) is relative to that fluid's saturation. For instance, a rock with 70% oil and 30% might only flow oil because the rock's permeability to water at a 30% saturation level is zero...the water won't flow out. As oil is produced the relative saturation of the water increases to the point where is does flow water with the oil. You're right about the connate water coating the surface of the rock grains. But as oil is pushed into pores which previously contained no oil, the oil saturation is below the level required for the rock to be permeable TO OIL. In other words if you pump oil into a wet sand to the point where the oil saturation is 20% or so the rock will still only flow water. That 20% oil saturation is classified as "immovable". In some very low porosity rocks immovable oil saturatins could be as high as 60%.

i'm a reservoir engineer too, and a geologist, and i'm a doctor, a lawyer, a movie star, i'm an astronaut and i own this bar. not only that, but i am a nobel laureate handyman too.

Just like with the oil/water/gas, to layer something alcoholic you go with the densest (highest sugar & lowest alcohol) to the lightest. Perhaps something along the lines of a coffee liqueur covered by a layer of whiskey-cream topped by some sort of clear, orange-flavoured spirit. Name it after some classic warplane and you have a winner.

HO Informative post.

A while back (2007) Stuart Staniford gave what I thought was a good explanation of fractional flow and how it works. http://www.theoildrum.com/node/2393

Would a reprise of this be relevant here?

Thanks

Great reference ET...thanks. Will take a while to absorb. Seems to have more KSA details in one spot then I've ever seen before.

I hope to get around to those posts (there were several by different contributors) before too long - but there are certain things that have to be explained as one evolves into the more technical discussions, and it will take a little time to get there.

Nice explanation. My guess is that this explanation will be too complex for the average person to grasp and they will continue to blame the government and the traders as oil prices increase. I used to read comments from average Joes on Gasbuddy.com when gas prices were high and that leads me to believe that the people being affected the most by high prices are the ones who will least understand what is going on.

A little real life humor for you Von. A fellow geologist was sitting in a bar in New Orleans back in the gasoline crunch of the late 70's. A drunk at the bar kept going on about the damn oil companies this,that and the other. The geologist was about to get in his face when the drunk said something that diffused the whole situation. He said "Hell...they don't need to drill more oil wells. They need to drill more gasoline wells." Funny but also sad how many Americans wouldn't get this joke.