Forecasting the Permanent Decline in Global Petroleum Production

Posted by Gail the Actuary on December 11, 2009 - 10:33am

This is a paper that was published back in 2000 in the Journal of Geoscience Education. What is unusual about it is that it forecast a peak in oil production in 2008. The author was a young woman named Marie Plummer Minniear, who was studying for her master's degree at the University of Toledo. Her advisor was geologist Craig Bond Hatfield. This piece was written before many current writers (such as Matt Simmons and Richard Heinberg) started writing about the issue. Many thanks to Chris Kuykendall for bringing this paper to our attention.

Abstract

In recent years, several published reports have assured the public that all is well with the global petroleum supply, citing new oil-production technologies and a record-high oil-reserve figure. Oil production has exceeded demand since late 1997, driving oil prices downward. Global oil consumption, however, is continuing to increase while new oil discoveries decrease. Petroleum is a finite resource, and the production rate will peak and then permanently decline when approximately half of the producible resource has been consumed. The United States has already experienced this; petroleum production in the United States has been in decline since 1970 despite new production technologies and energetic exploration. At recent rates of increase in oil production, the peak in global petroleum production will arrive in about 2008. All is not well with the global petroleum supply, and our society must begin to prepare for the changes that a declining petroleum supply will bring.

Forecasting the Permanent Decline in Global Petroleum Production

In recent years, geologists who warn of the impending oil crisis have come under increasing criticism, often from economists. An example appeared in Business Week magazine in 1997. The authors reported that geologists have a long history of underestimating oil reserves, citing an example from 1874 when the Pennsylvania state geologist "direly warned that 'the U.S. [has] enough petroleum to keep its kerosene lamps burning for only four years'" (Coy, McWilliams, and Rossant, 1997). Coy, McWilliams, and Rossant also note that oil reserves are at an all-time high and emphasize ever improving technologies, unconventional petroleum resources, and the law of supply and demand. They concede that "nature only gave us so much oil," yet perpetuate the mistaken idea that our economy is in no danger from reduced oil production and rising oil prices. In fact, Massachusetts Institute of Technology energy researcher Michael C. Lynch is quoted as saying, "Oil-price forecasters make sheep seem like independent thinkers…[t]here's no evidence that mineral prices rise over time. Technology always overwhelms depletion" (Coy, McWilliams, and Rossant, 1997). Similar arguments are provided by Adelman and Lynch (1997) and Linden (1998). Such arguments commonly point out failed predictions of oil crises that go back a century or so. Everyone, however, agrees that oil is a finite resource. This means that the permanent decline in global production of conventional petroleum unquestionably is approaching. The important question is: When will it arrive?

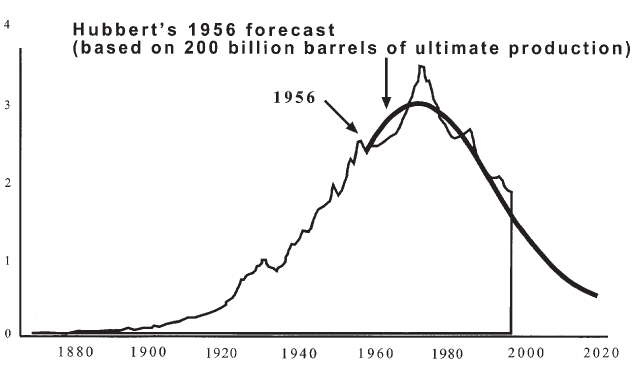

Petroleum geology has benefited greatly from advances in technology and increased knowledge. So much more is now known than 100 years ago that it logically follows that recent assessments are more reliable than the older ones. Some early forecasts, however, have proved to be remarkably accurate. In 1956, for example, M. King Hubbert published an estimate of the peak and subsequent permanent decline in crude-oil production for the contiguous 48 United States. Central to this prediction was the concept that for any petroleum-producing region characterized by unrestricted production, the permanent decline in production would begin when approximately half of the total producible resource had been consumed.

According to Hubbert (1956), the peak in U.S. crudeoil production would occur between 1966 and 1971, based on estimates of ultimately recoverable oil (all oil that will have been produced by the time of exhaustion of the producible resource) of 150 billion to 200 billion barrels. The peak arrived in 1970, and crude-oil production in the United States has been in decline ever since. Figure 1 illustrates the accuracy of Dr. Hubbert's 1956 forecast. Figure 2 shows the history of global petroleum production, which, of course, is still increasing, as was U.S. oil production prior to 1970. Previous estimates, like the 1874 prediction referred to by Coy, McWilliams, and Rossant (1997), were the product of limited information. But even then, geologists recognized the finite nature of fossil fuels. Their numbers were in error, but the concept was not.

It is also true that improvements in technology and resulting lower production costs have made previously inaccessible or unprofitable deposits now viable. However, the newly profitable fields are too small to make a significant contribution to the global reserves or supply. For example, Business Week proclaims, "The British-Borneo platform can profitably drain fields with as little as 30 million barrels, 'and we'll probably push it lower'…" (Coy, McWilliams, and Rossant, 1997). While this is good news for the oil companies, 30 million barrels represents one-half of one day of global production at the 1997 level and even less today (American Petroleum Institute, 1998). If it is possible for new production technology to allow the production rate to continue to grow beyond the mid-point of ultimate production, then the subsequent decline in production rate will be accelerated.

The supply-and-demand cycle is familiar to all but does not apply indefinitely to petroleum or any other finite resource. It assures us that any shortage will create higher prices as demand exceeds supply; the higher prices then cause an increase in the supply, thereby meeting the demand and eliminating the shortage. These relationships are valid for renewable resources and have proven true for conventional petroleum in the past; however, after conventional petroleum production enters permanent decline, supply will continue to dwindle despite the escalating cost. No amount of money can supply a product that no longer exists, no matter how great the demand. This is not to suggest that our global oil supply will abruptly dry up and disappear but to illustrate the fallacy of blindly applying economic law to a finite resource like petroleum.

As stated by Coy, McWilliams and Rossant (1997), officially reported global reserves are higher than ever, but these reserve figures are unreliable. One tactic used to inflate reserves is to include unconventional petroleum sources in the estimate. Venezuela doubled its reserves in 1988 by including 20 billion barrels of heavy oil, which had been known for many years (Campbell, 1997). Unconventional sources, such as heavy oil, tar sands, and oil shale, do represent an enormous amount of potential petroleum, and people often incorrectly assume that these resources will easily make up the differences when conventional sources falter. A common view expressed by Dr. Peter Odell, and many others, is that large-scale exploitation of non-conventional petroleum resources is currently limited only by lack of demand and corresponding absence of profit, and that as soon as it is profitable to produce, non-conventional resources will be ready to seamlessly fill the gap left by a shrinking conventional petroleum supply (Odell, 1997).

On the contrary, at this time petroleum cannot be produced from unconventional sources at rates approaching more than a small fraction of production from conventional sources as required by global demand. Canada, for example, is currently producing petroleum from oil sands, a nonconventional resource. Syncrude Canada Ltd expected to ship 76 million barrels of synthetic crude in 1997 – one year of production equaling approximately 1.17 days of conventional global production at the 1997 rates (Oil and Gas Journal, 1997; Basic Petroleum Data Book, 1998). The comparison is not meant to belittle Canada's oilsand endeavors; on the contrary, they should be applauded for their farsightedness and imitated. Nevertheless, unconventional petroleum resources are no substitute for conventional sources at this time and will require significant development, considerable time, huge capital investments, and innovative new technology in order to fill that role when needed.

Unfortunately, the development of unconventional resources is not being aggressively pursued at this time. The oil shortages of the 1970s spurred activity in the research and development of alternative energy sources, but many of the efforts were abandoned as soon as the price of oil dropped. In order to someday produce any alternative energy source in an economically feasible manner and in sufficiently large quantities to be a viable substitute for conventional petroleum, an enormous investment of time and money is necessary immediately, as is a commitment to continue that investment regardless of fluctuations in oil prices. What should have been a wake-up call in the 1970s has largely been forgotten (Hatfield, 1997b).

Odell (1997) also says that market prices will "bid up sufficiently to generate new non-conventional oil supplies." As he points out, there will most likely be an increase in the cost of petroleum and the multitude of petroleum products we all use every day. Companies are not in business to lose money. Unconventional petroleum is more costly to produce than conventional partly because of research and development expenses and also because it cannot be produced in great quantity per year. Oil companies will not begin serious exploitation of unconventional petroleum resources until they can make a profit doing so, and there is little profit in synthetic crude when oil prices are low. According to the economists' law of supply and demand, oil prices will begin to rise as production falters in the near future. At the higher prices, it will then be profitable (as well as necessary) to exploit unconventional petroleum resources. Any increased costs will be passed on to the consumer, of course. The world will not run out of oil altogether, just out of cheap oil.

Coy, McWilliams, and Rossant (1997) also proclaim that, due to new technologies and abundant capital, we have "the recipe for a potential explosion in oil production." New oil-production technology, such as that employed in recent years in the North Sea, could delay the beginning of global oil-production decline for a few years beyond the mid-point of ultimate production. But, in that case, the subsequent decline will be accelerated. Considering both conventional and unconventional petroleum sources, production and prices may fluctuate for years with production increasing at times and prices decreasing. But in the end, production of conventional petroleum will permanently and irrevocably decline, and unless demand has been reduced or cheap unconventional sources (or other non-petroleum substitutes) are sufficiently developed, prices will rise as supply becomes inadequate. With existing technology, unconventional energy sources will be considerably more expensive than conventional oil.

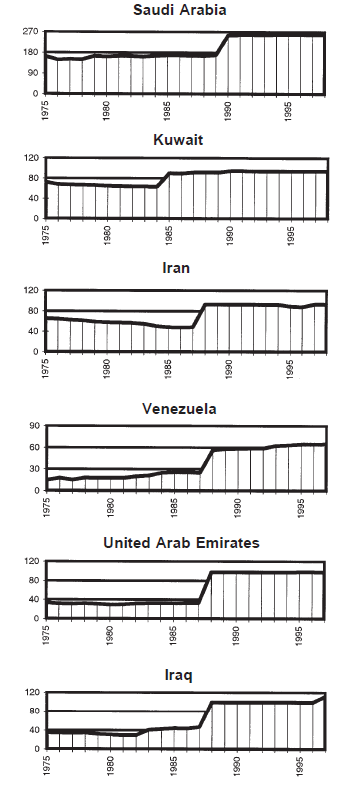

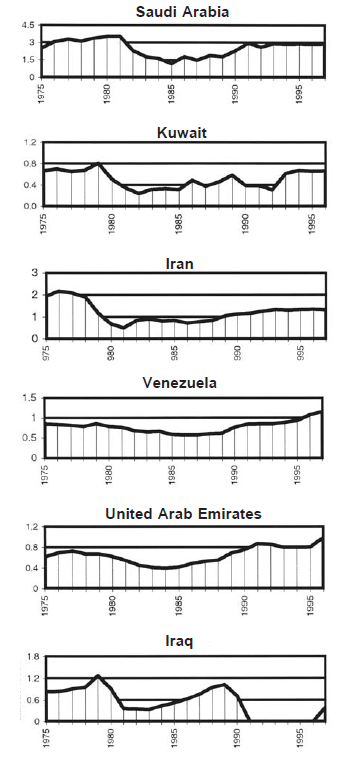

As Coy, McWilliams, and Rossant (1997) stated, reserve estimates are at an all-time high. However, determining the amount of conventional petroleum reserves with any reasonable precision is nearly impossible. A total reserve of 1,000 billion barrels is widely used (American Petroleum Institute, 1998) but is widely regarded as suspicious by geologists for several reasons. In 1988, 1989, and 1990, many OPEC nations reported fantastic increases in their reserve figures, as is illustrated in Figure 3. The OPEC nations' production quotas were based on the sizes of their reserves; the countries reporting the largest reserve figures earned the greater shares of the total OPEC production. Venezuela's reported reserves increased by 125%, the United Arab Emirate's by 197%, Iraq's by 112%, and Iran's by 90%. Kuwait's 50% increase is modest by comparison (American Petroleum Institute, 1998). This created an apparent increase in global reserves of 27%, or about 300 billion barrels. These wild increases are considered unsubstantiated and unreliable (Cambell, 1997; Hatfield, 1997a; MacKenzie, 1996).

In addition, many countries, including several of the top oil producers, have reported no changes in their reserve estimates for several years. China and the former Soviet Union are among those that report no differences from year to year. Iraq and Kuwait report no changes in their reserves after the gigantic increases of the late 1980s. Yet, annual production in those countries has been vast and has greatly exceeded new oil discovery (American Petroleum Institute, 1998). Actual reserves are decreasing rather than remaining static. Some countries are believed to be understating their reserves. C.J. Campbell (1997) believes that the former Soviet Union, the United States, China, and the United Kingdom, all major oil producers, have underestimated their oil reserves. Any additional reserves these countries may possess, however, will not have a significant impact on the global production peak because their unreported reserves are only a fraction of the unsubstantiated reserves reported by the OPEC nations. Given the unreliable information used to calculate the global reserve, it should be viewed with healthy skepticism.

One reasonable suggestion is that a figure for global reserves of approximately 730 billion barrels be used. This revised estimate attempts to correct for the gross reserves inflation of the late 1980s by OPEC but does not claim to factor in all suspected overestimating and underreporting. The figure of 730 billion barrels is derived in the following manner. During the ten years prior to the wild increases of 1988 - 1990, global reserves were increasing at an average rate of 0.65% annually (American Petroleum Institute, 1998). Disregarding the unsubstantiated increases starting in 1988, the 0.65% growth rate was then applied annually for each year through 1997. This interpolation yields a suggested global reserve of 730 billion barrels rather than the reported 1,000 billion barrels. It is worth noting that the average annual increase in the reported global petroleum reserves from 1988-1996, excluding the enormous leaps in 1988, 1989, and 1990, was only 0.37% – less than the 0.65% of the previous decade. In reality, any estimate, including this one, given the inherent problems with the available data, is more likely a product of manipulation and educated guesswork than solid data.

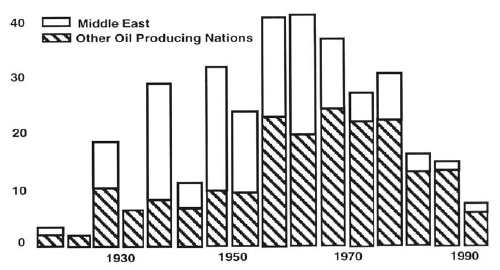

An optimistic estimate for yet to-be-discovered oil is 650 billion barrels; this figure is well above most estimates of conventional oil yet-to-be discovered (MacKenzie, 1996). Six hundred and fifty billion barrels may indeed be a generous estimate. The global rate of discovery of new oil peaked in the early 1960s and, despite our increased knowledge and understanding, our improved technology, and our record-high rates of exploration in the 1980s, has continued to decline (MacKenzie, 1996). Ninety percent of all production comes from fields more than 20 years old. (Campbell, 1997). In fact, most additions to the global reserve estimate are the result of revisions rather than actual new oil discoveries. The previously mentioned OPEC nations are a prime example. In reality, actual discovery of new reserves is now less than 6 billion barrels per year and falling, whereas production exceeds 24 billion barrels per year and is rising. (Campbell, 1997). Figure 4 shows the steady decline of new discoveries.

The discovery of new major oil fields is highly unlikely. The requisite geologic factors are well understood, and the sedimentary basins well known and explored. This is not to say that no additional oil fields will be found but that the new discoveries will consist largely of smaller fields (MacKenzie, 1996; Campbell, 1997). This is a normal phase in the life cycle of a finite resource. Large fields are the easiest to find and of course are discovered early; in the declining phase of finite-resource exploration, intensive searching locates the smaller fields previously overlooked (MacKenzie 1996).

But it is the gigantic oil fields that supply the bulk of the world's energy. As of 1996, 94% of all discovered oil has been in the 1,331 largest oil fields, while the almost 40,000 smaller fields contain only 6% of the world's discovered oil – 94% of all discovered oil occurs in 3% of the fields (MacKenzie, 1996). The giant fields are critical to the global oil supply, but discovery of larger oil fields is highly unlikely, and discovery of smaller fields, while probable, will not significantly affect the global reserves.

Giant oil fields are those that contain between 500 million and 5 billion barrels of recoverable petroleum, and supergiants contain between 5 billion and 50 billion barrels. In order to add to the proven reserves the 650 billion barrels that are optimistically assumed to exist, 130 new giant fields each containing 5 billion barrels would have to be discovered or 1,300 new giant fields each containing 500 million barrels. The former is impossible and the latter ridiculous. Mankind's history of petroleum exploration has yielded over 40,000 oil fields, of which 328 are giant fields (Ivanhoe and Leckie, 1983; MacKenzie, 1996). Thirteen new supergiant fields (assuming the maximum of 50 billion barrels each) would provide the expected 650 billion barrels, but as there are only 40 known to date (averaging only a fraction of 50 billion barrels each) (Ivanhoe and Leckie, 1983; MacKenzie, 1996), this is equally improbable. Because of the extent of global exploration since 1970, enormous oil fields in the numbers necessary would have been discovered already if they existed. There may be a few giant fields yet undiscovered and possibly a supergiant will surprise us all, but clearly this does not add up to 650 billion barrels. The small oil fields (6% of all oil discovered to date) yet to be discovered will not make up the difference. Even if the full 650 billion barrels of yet-to-be-discovered oil really did exist, assuming that the current rate of discovery (6 billion barrels per year) remains constant rather than continuing to decline, it would take over 108 years to find it all and longer still to produce that oil. The peak in global production would not be postponed even under these idealized hypothetical conditions.

A more reliable figure than those for the reserve estimate or the amount yet to be discovered is the amount of oil produced so far, and that is widely accepted as approximately 830 billion barrels (American Petroleum Institute, 1998). Using all these figures, an estimate of the ultimately recoverable oil can be calculated. Assuming reserves of 730 billion barrels and 650 billion barrels yet to be found, and bearing in mind the problems associated with those figures, these quantities, in addition to the 830 billion barrels already produced, yield 2,210 billion barrels of ultimately recoverable oil. This is just above the average of the most widely accepted range of estimates. MacKenzie (1996) reports that of the 40 estimates of ultimate oil production made between 1973 and 1993, 70% fall within the range of 2,000-2,400 billion barrels.

The bottom line of the debate between many economists and geologists is how long the conventional supply will continue to be available in increasing quantity and at low cost. The global production rate will begin to decline when the world has produced approximately half of the ultimately recoverable oil; the question is: When will this threshold be crossed? That estimate depends on the amount of ultimately recoverable oil, for which estimates vary, and on the rate of increase in the annual production rate, which also varies from year to year and is not precisely predictable. The average annual rate of increase in production for 1994 and 1995 was 1.74% (American Petroleum Institute, 1998). Assuming the ultimately recoverable oil (Q) is 2,210 billion barrels and that growth in the production rate continues to average 1.74% annually, the midpoint will arrive in 2009. However, after 1995, the production rate grew faster than 1.74% annually. Global petroleum production increased by 2.59% during 1997 (American Petroleum Institute, 1998). Assuming that Q equals 2,210 billion barrels and also assuming a steady 2.59% annual increase in the production rate, the midpoint arrives in 2008. These estimates are calculated using a low, but reasonable, value for the ultimately recoverable oil. For comparison, calculations based on higher totals for Q have also been completed. Because future production rates are difficult to predict, a widely used average rate of 2% annual growth has been used. Assuming that Q is 2,400 billion barrels, the high end of the most widely accepted range for Q at 2% annual growth in production, the threshold will occur in 2012.

Suppose that geologists, as they are often accused of doing, have somehow grossly underestimated the amount of petroleum yet to be discovered. Richard Miller, with the British Petroleum Research Center, believes that geologists have indeed made this error and that the ultimately recoverable oil figure is 4,000 billion barrels – not 2,000 to 2,400 billion barrels (Miller, 1992). Assuming that Q is 4,000 billion barrels – nearly double the average accepted estimates, at an average increase in the production rate of 2% per year, the midpoint and beginning of the permanent decline in global conventional petroleum production will arrive in 2032. Doubling the amount of oil, adding 2 trillion barrels, only increases the period of growth in oil production by 20 years.

It is important to remember that the suggested peak in production is dependent on continued growth in the production rate. If the production rate were to stop growing or even be reduced by a drop in demand or by political disruption, the beginning of the permanent decline in global production would be delayed several years beyond the midpoint of ultimate production.

From 1979 to 1983, global production declined 16%. L.F. Ivanhoe (1996) states that, were it not for the 1973 and 1979 oil shocks and the succeeding restrictions in the production rates of the OPEC nations, global oil production would have peaked in the mid-1990s. Figure 5 shows production for several OPEC nations from 1975 to 1995. Overall production was restricted from 1979 to the mid 1980s as the increase in demand for OPEC oil dropped due to temporary fuel conservation as well as increasing production from non-OPEC nations. This restriction on OPEC production will delay the peak in production for the OPEC nations. Clearly, such fluctuations can affect the timing of the peak in global production. However, the global oil-production rate has grown more than 20% since 1982. The greater the increase in the production rate, the sooner the peak in production and inevitable decline comes. More today means less tomorrow.

This also illustrates the misleading nature of many reports, including the following from The Economist (1995), "Proven reserves of oil are now enough to supply the world for 43 years at current rates of production…." The offending phrase is "at current rates of production" – meaning zero growth in the oil-production rate – a situation that has never existed for very long, and considering the explosion in demand from newly developing countries and from prosperous economies like the United States, is not likely to exist in the near future. A four-decade supply at the current consumption rate is a three-decade supply with 2% annual growth in the consumption rate. Furthermore, the view expressed in The Economist implicitly – assumes that high production rates can be maintained until exhaustion of the resource and then suddenly drop to zero. Jean Laherrere points out that one cannot simply divide the reserve amount by the annual production and assume the global oil supply will last that many years. Maintaining production at a steady annual rate requires continual additions to reserves. All oil fields decline during the second half of their life; current production rates can only be maintained if new discovery matches production (MacKenzie, 1996). But, as has been discussed, discovery has been declining for more than three decades and has not kept pace with production, which has been increasing.

Conclusion

Many of the numbers presented here are uncertain but are accurate enough for the warning to be heeded. Petroleum is a finite resource, and the production of conventional petroleum will probably peak within the next 15 years and then begin its permanent decline. It may not decrease at a steady rate, but it will decrease. The era of inexpensive, abundant oil is drawing to a close. Even if we chose to believe the improbable 4,000 billion-barrel estimate for the ultimately recoverable conventional oil, there still would be only roughly 35 years until the decline begins, assuming growth in the oil-consumption rate does not exceed 2% annually and also assuming that the discovery rate reverses its 35-year decline. That improbability would see many of us comfortably into retirement and beyond, but what of our children and grandchildren? In recent history, a woeful lack of foresight and responsibility on behalf of the coming generations has been demonstrated; will we also leave them to inherit this problem?

Petroleum production and demand are continuing to increase, and discovery has been declining for 35 years. Unconventional sources such as tar sands and heavy oil are slow and expensive to produce. Immediate conservation and improved efficiency of petroleum use, as explained by Hatfield (1994), are necessary to extend the conventional supply long enough for alternatives to be developed. In fact, Hatfield maintains that with a permanent 2.4% annual decrease in global petroleum production, our conventional reserves would last indefinitely. Such a permanent decrease would, of course, hamper economic growth globally and be disastrous for developing nations. It would be prudent then, to develop large-volume, economically feasible, environmentally benign alternatives to petroleum before such a decrease is naturally and irreversibly imposed.

Our global community must begin to lessen its dependence on petroleum; not only is it a limited resource, but it is also an environmental disaster. Unconventional petroleum sources can be developed for irreplaceable petroleum products and non-petroleum substitutes for others. Earnest endeavors and commitment now may provide an easier transition for us and for our children, but, easy or difficult, the transition is coming. The public and, indeed, many of our government and business leaders are apparently unaware of this problem or have chosen to ignore it. At the December 1997 conference on global climate change in Kyoto, Japan, the finite nature of the petroleum supply was not a topic. The main discussion concerned reducing greenhouse-gas emissions voluntarily. What our leaders apparently fail to realize is that greenhouse gas emissions unavoidably will be reduced in the near future as petroleum production peaks and then declines. Nature has imposed a limit for us.

Acknowledgments

Deepest thanks to Dr. Craig B. Hatfield for introducing me to this area of geology, for the benefit of his expertise regarding this subject, for overall guidance and encouragement, and for the critical review of this manuscript.

References Cited

Adelman, M.A., and Lynch, M.C., 1997, Fixed view of resource limits created undue pessimism: Oil and Gas Journal, v. 95, n. 14 (April 7, 1997), p. 56-60.

American Petroleum Institute, 1998, Basic petroleum data book: v. XVIII, n. 2: American Petroleum Institute, Washington DC.

Campbell, C.J., 1997, Better understanding urged for rapidly depleting reserves: Oil and Gas Journal, 1997, OGJ Special, (April 7, 1997), p. 51-55.

Coy, P., McWilliams, G., and Rossant, J., 1997, The new economics of oil: Business Week, (November 3), p. 140-144.

Hatfield, Craig B.,1994, A permanent solution to the fuel supply problem: Journal of Geologic Education, v. 42, p. 432-436.

Hatfield, Craig B., 1997a, Oil back on the global agenda: Nature, v. 387 (May 8, 1997), p. 121.

Hatfield, Craig B., 1997b, A permanent decline in oil production?: Nature, v. 388 (August 14), p. 618.

Hubbert, M. King, 1956, Drilling and production practice, American Petroleum Institute, Washington DC, p. 7-25.

Ivanhoe, L.F., and Leckie, G.G., 1993, Global oil, gas fields, sizes tallied, analyzed: Oil and Gas Journal, v. 91 (February 15, 1993), p. 87-91.

Ivanhoe, L.F., 1996, Updated Hubbert curves analyze world oil supply: World Oil, v. 217, p.91-94.

Linden, Henry R., 1998, Flaws seen in resource models behind crisis forecasts for oil supply price: Oil and Gas Journal, v. 96, n. 52 (December 28, 1998), p. 33-37.

MacKenzie, James J., 1996, Oil as a finite resource: When is global production likely to peak?: World Resources Institute, Washington DC, (March), p. 1-22.

Miller, Richard G., 1992, The global oil system: The relationship between oil generation, loss, half-life, and the world crude oil resource: The American Association of Petroleum Geologists Bulletin, v. 76, n. 4, p. 489-500.

Odell, Peter R., 1997, Oil shock: A rejoiner: Energy World, n. 247 (March 1997), p. 11-14.

Anonymous, 1997, Investment incentives driving Canadian oil sands activity: Oil and Gas Journal, v. 95 (June 9), p. 25.

Anonymous, 1995, The Future of energy: The Economist, October 7, p. 23-26.

Was there something more substantial than this narrative behind the work? Did the peak year 2008 come out of some kind of model or simulation? I can't tell.

Perhaps something more on the lines of this:

"Monte Carlo of Dispersive Discovery/Oil Shock model "

http://mobjectivist.blogspot.com/2009/12/monte-carlo-of-dispersive-disco...

There is room for so much more interesting research, which makes the "review" kind of thesis a tad predictable.

WHT, we shouldn't underrate the work of Marie Plummer Minniear. Although this text sounds like an old hat to TOD readers now Minniear was well ahead of her time, as she was among the very first to write about the topic.

Let's see what other people will write in nine years about Oil Shock model. Maybe "WHT already had it in 2009!"?

I am just trying to get to an understanding at how she arrived at her estimates. She actually has two estimates above. One is for 2009 assuming a 1.74% exponential growth rate and one is 2008 assuming a 2.59% growth rate.

Let us assume the production was P back in 1996 when she had her numbers. And the amount of reserves needed to go through to get to 1/2 Q is q. I don't think she is using Hubbert Linearization, so I think she is using some type of exponential growth formula. At a growth rate G this is:

Time = 1/G * ln(G*q/P+1)

Plugging in q of 500, G=0.0259, and P=30, I get Time=14 years

for one case and Time=15 for G=0.0174.

For the start times of 1995, this comes to around 2009 to 2010.

See what I mean? That is all I am looking for. Just an explanation at how she arrived at her numbers.

edit: (Someone else can figure more accurately what she is assuming for P and q, because I have to get to work)

Woo, some student made an obvious assumption in 2000. Never mind that Campbell and others had already predicted peak oil years before.

Much, much more amazing is that in 1896 (no typo) Svante Arrhenius published the first calculations of global warming from human emissions of CO2. Now that takes my breath away, especially since about half the American population still doesn't get it.

Now there's an unsung hero.

Blah. The CRU emails prove that AGW is a scam. I'm sure Svante Arrhenius was involved in it.

To understand the early errors in greenhouse modeling and recent discoveries see:

The new climate theory of Dr. Ferenc Miskolczi

New Developments in the Science of Greenhouse Effect by Ferenc Miskolczi, Miklos Zaqgoni

Hagen, Miskolczi’s theory indicates that any warming from elevated atmospheric carbon dioxide will eventually be offset by a change in atmospheric moisture content. He is a maverick who has become the darling of the deniers and right wing blogosphere. IOW, crap science. Start thinking, please.

For a really well done history of the science, look at http://www.aip.org/history/climate/

The link is to a server operated by the American Institute of Physics (AIP), which is involved in the publication of scholarly physics journals. It is not quite true that Arrhenius got it and it has taken the rest of us a century to admit that he was right. I found the details of the history an interesting read. Realize that when Arrhenius wrote, no one had any idea of the complexity of molecular band structure in the infra-red. A lot a new science had to be discovered before there could be real scientific explanation of how the warming actually happens.

From her paper q=Q/2-Cumulative=2210/2-830 = 275

q=275, P=23, G=0.0259 gives peak @ 2006

q=275, P=23, G=0.0174 gives peak @ 2007

according to the exponential growth equation

This doesn't take into account the rounding of the peak. So the fact that this calculation occurs at earlier dates than she states implies that she probably did something a bit more sophisticated.

If I were going to do that sort of prediction I would assume the peak is the top of a parabola. So you get an equation for production versus time that looks like P(t)=P0(t0) +(t-t0)*P'

+(t-t0)**2/2*P''

You know P0 and P' which are start year production and rate of increase in production. Then you adjust P'' until at the time of the peak of the parabola you've consumed half the URR.

Now none of these methods will vary by much, since T0 is so close to peak, that the difference in P(t) between the different models will only be a few percent. The parabolic method will give roughly half the average growth rate from T0 to peak, so you would expect a moderate extension in time to peak. I'm not interested in

doing the algebra, but if you assume MHTs last numbers are correct its gotta put you in the right ballpark.

Thanks, very good point. The parabolic approach is good, but then why does she mention the two different growth accelerations? An upside down parabola is a growth deceleration in fact.

I probably waste too much time reverse engineering assertions that don't come with any formal explanation. That was my whole point in posting my first comment. As a counterpoint, my own most recent blog posting includes the entire source code for my analysis. I do this intentionally so no one has to deal with the ambiguities of any assertions I make. You still need some knowledge in math, but everything is there and you don't have to assume stuff from thin air.

The method follows Hubbert's papers he primarily estimated various growth rates.

Given a certain acceleration and and estimate of URR then the production curve is parabolic.

To some extent its important to understand the actual methods used by the one peak prediction that proved to be correct after the fact.

As far as I can tell all other methods failed including this one.

He also practically nailed it for world peak in my opinion with only a brief flurry of production from horizontal drilling causing and issue at the expense of faster post peak declined.

http://www.hubbertpeak.com/hubbert/natgeog.htm

A better paper here.

http://www.hubbertpeak.com/Hubbert/energypower/

For all intents and purposes both curves turned out to be right. As far as I can tell historical production before the 1970 oil crisis and careful accounting was much higher than recorded thence the low case 1,350 GB underestimated offshore reserves by at least 100 GB if not a bit more. Plus the combination of real efficiency increases and technical advances distorted the curve by a few years.

But given everything the estimates of reserves and future production made before oil became seriously political proved to be far more correct than research that included obfuscated corrupt data after oil became a concern.

In fact if oil production turns out to by seriously asymmetric then the 1,350 GB estimate may actually prove to be almost perfect also our peak production was lower than even his low URR estimate even though it was significantly later in time.

Hopefully my paper will be published soon but as far as I can tell Hubbert is 2:0 if you include some of Ivanhoe's observations based directly on Hubberts own statements.

Regardless the reasons for the differences are quite reasonable and fit well within Hubberts own explanation of his process.

Later estimates in my opinion suffer from a fundamental logical flaw best illustrated with the shock model.

This includes above ground shocks.

http://www.theoildrum.com/node/2430

The flaw is that post shock data has a high potential to be politically altered to make the situation look far better than it really is. The larger the shock the higher the probability that data corruption will occur.

The shock model assumes that the truth is told on both sides of the shock without proving this is true.

And obvious example right now is that our economy is in far far worse shape now than is reported politically even to the extent that official numbers are obviously corrupted. I'd argue the shock model as written does not take into account this increase in fraud required to present BAU despite shocks. By including fradulent numbers it ends up being a overestimate.

This is not dissing the model or WHT mathematical work simply saying that using data after a number of shocks has occurred and assuming its true is inherently risky in the sense your probably including ever more garbage.

At the minimum some sort of corrective shock dealing with pre vs post shock distortions needs to be considered.

The last logical problem is of course the tall tale or the big lie once the decision is made to forge data then it becomes ever more difficult to revert to the truth lying generally requires ever larger lies to cover the old lie as the real situation degrades. I don't know the logic behind this its generally considered common sense i.e the knowledge that lies can and do snowball is so common I don't even know what the rigorous definition is. I'm sure there are plenty of papers covering this problem of the white lie turning black. Googling fails to find the scientific definition of the process as its intrinsically commonly accepted. However surprisingly it seems to never be included in discussion of social/economic shocks of all sorts with the data on both sides of the shock treated as equally valid despite the obvious benefit to lying.

I'm not really trying to cause a lot of heated debate just saying that there are good reasons for most of the later estimates to be incorrect and weight the earlier approaches far far higher. The chances are they where probably closer to correct than any later estimate for the reasons outlined above. It has nothing to do with the procedure just data corruption intrinsic in the shock model itself.

IMHO :)

I see. So you have pinpointed the exact technique that Marie Plummer Minniear used in her analysis.

Which is exactly what?

As to the rest of your critique, I only vaguely understand your concern. The Shock Model does not corrupt any data, it follows the law of conservation of probabilities. All probabilities need to add to one and you can check this very easily. So whatever cumulative you have for discoveries eventually equals the cumulative amount of production. Nothing is "corrupted".

If you want to understand the actual dynamics of oil discovery and depletion then seriously look into Dispersive Discovery and the Oil Shock Model. That describes the temporal dynamics accurately as it follows from first principles. If you just want to do heuristic curve fitting, Hubbert is your guy. So I agree that Ms Minniear likely did some sort of curve fit, but will never know what she did exactly unless we get a hold of her thesis.

I will try to respond fully to your questions and concerns later in the week. This has caught me by surprise at a particularly busy time.

Sounds to me like we need a theory of peak data accuracy. My guess is that we are long past it. The open lie of shifting to "all liquids" is enough to convince me that other obfuscations are happening in harder to track areas.

Bingo. (partially)

The fact that oil depletion analysis exists completely in fat-tail and Gray Swan territory means that we have to pay attention to deviations from the expected.

What I have discovered I think is very critical. With the huge spread in reservoir sizes that we observe, we can still predict an expected peak as a mean date, but the spread around the mean is still large.

The post that I link at the top of the comments discusses this curve in depth. What occurs to me is that many of the misfires in getting the peak date has to do with the uncertainty about the mean. Of course with the potential peak behind us, this can become progressively more accurate in the Bayesian sense. Yet it does explain away the previous wild estimates. We simply did not know which AH would play out at the time.

Again, outstanding work WHT. That histogram is a real eye-opener! I've often thought, and I think I've said it before, the peak-oil debate is poorly served by fixating on precise predictions, and yes, that would include fitting any one arbitrary curve to production data.

The future can't be known, including URR. Even Hubbert said as much and explicitly gave a range for possible URR in his analysis. The take-away point that seems to be getting lost is that even for a wide range of estimated URR/discovery the resulting production curve is robust. Which is to say that even adding several hundred billion barrels to URR, and/or discovering new supergiant fields in the so-called "fat tail", only moves the peak date out by a few years.

Your histogram illustrates that brilliantly.

Cheers,

Jerry

I'm guessing your using random discovery times ?

Nice graph !

It would be interesting if we had a collection of peak oil predictions over the last several years. Although the sample size is small it would be interesting to see how the real predictions fit against this graph. As far as popularity goes it seems that they are highly polarized with the "Peak Oilist" predictions clustered around the peak of this graph and the cornucopian's well out on the long end of the curve.

The real problem is probably not that but that the oil industry and our society seems to be in the cornucopain camp at least as far as the public is concerned.

This of course is problematic if any of the more realistic scenarios are even close to correct which they seem to be given the above graph. Exact timing is not that important as your dealing with a major cultural change and the date is certainly getting late.

However back to corruption of the data itself I'd say that this is a excellent graph of probably truth if so and if our oil industry and world leaders are bent on claiming that peak is really out around 2030-2040 then it stands to reason that there is a strong chance that publicly presented data may well be adjusted to match desires not fact. If the position is poorly supported by the facts and this seems to indicate it then adjusting the facts to fit the position is probable.

Today in all probability peak oil is in the past thus one would expect acceptance and discussion of mitigation would be common instead it seems that the anti peak oil camp has only upped their attacks on the concept. This denial itself is troublesome.

What seems to have happened is that trust has been lost not only in regards to oil but across the entire breath of our society. In and attempt to keep things the same at all cost I think the most important part which is the trust of the people in their appointed leaders has been the first causality. This alone will eventually ensure that BAU will fail as the truth becomes impossible to hide.

Personally what I have found is the more I researched a topic from housing, the economy to oil all that happened was I became increasingly skeptical about the official line. My belief simply steadily eroded over time.

To some extent it seems that our leaders are leveraging the intrinsic uncertainty in peak oil to simply promote their own agenda the same as true across a wide range of issues. This is not only not good but longer term potentially dangerous as betting everything on the least probable outliers has a high chance of failure.

It seems that a situation that would have been painful for everyone is being steadily transformed into one thats deadly by simply refusing to admit at the minimum what the most probable outcome is. De-leveraging and resilience and optimizations should be the focus of our worlds governments this simply is not happening.

Hubbert was a geologist rather than a mathematician, and his methods were pragmatic rather than theoretical. Based on geological principles and considerable experience with oil field declines, he knew he was looking at some kind of bell-shaped curve.

Mathematically, it's not the same bell-shaped distribution curve you see in statistical analyses, but it's somewhat similar in shape. It's highly unlikely to be parabolic.

What kind of bell-shaped curve is open to conjecture, but any kind of reasonable simulation based on any reasonable assumptions is likely to result in some kind of bell-shaped production curve. You can't really be sure what kind of bell-shaped curve because you don't have all the data, but the mere fact it is bell-shaped tells you a lot. After you hit the peak, it's pretty predictable what the decline is going to look like. The hard part is predicting the peak in advance.

The real problem comes from people who see the first part of a bell-shaped curve, and assume that the curve is going to go off into infinity without ever stopping. No - that's mathematically impossible in the real world. Resources are never infinite in the real world.

I'm currently working on the post on the economics involved in the development of oil/NG drilling projects. I got a little ahead of myself recently by responding to questions regarding Kurt's article describing the "net present value" commonly used in such evaluations. At Nate's invitation I'll be posting the more formal report in late January. But I'm compelled by Gail's report to again offer my very biased view of the various future reserve numbers offered by different sources. Much debate over the magnitude of these estimates and the potential affect on peak oil. Thus I'll repeat a seemingly absurd proposition that the amount of oil/NG left has very little bearing upon how much more oil/NG will be developed in the future. Again, details will follow in January. But, very simply, the ultimate AMOUNT of oil/NG recovered by a drilling venture has almost no bearing in the decision process utilized in the industry that determines which wells get drilled and which don't. Extrapolating that "fact" to the future global picture it matters little if there are 500 billion bbls of oil left to develop or 5000 billion bbls of producible oil left out there. Thus, IMHO, the debate over exactly how much is left is pointless. The AMOUNT will have virtually no bearing on how much, and more importantly, how quickly these resources will be developed.

Obviously the development of these resources will be dependent upon the profitability under whatever demand and pricing factors are in effect at the time. Less obvious is the fact that the production rate of these future projects will be the primary factor in this development and not the amount of ultimately recoverable oil/NG. The simplest scenario: two drilling projects, A and B. Project A will ultimately recover 1 million bbls of oil at a 15% rate of return on the investment. Project B will ultimately recover 100 million bbls of oil at a 2% return on the investment. While it might be quit beneficial for the global community to see project B drilled, it will not be drilled under current free market capitalism. The sole responsibility of the market is to generate acceptable profit levels. It has never been, nor ever will be, the Sheppard of our energy resource security IMHO. Neither I nor anyone I've every work with in the oil patch has accepted such a responsibility. More simply put, that's not what I'm paid to do. As a side note it is this consideration that may give China a tremendous advantage in the future acquisition and development of oil/NG. They are not completely decoupled from free market considerations but are not as restrained as virtually every other resource developer. A good but somewhat deceptive example has been the gains in global oil production from the Deep Water fields. Certainly some huge proven reserves developed in the GOM and even greater reserve volumes projected for DW Brazil. Deceptive in the fact that it hasn't been the size of these reserves which caused them to be developed but the relatively high flow rates generated in the fields. If these reservoirs could not produce at such rates they WOULD NOT COMMERCIAL even if the reserve volumes were the same. The massive capex and especially the time lag between discovery and development demand such rates. BP's huge GOM Thunderhorse Field would never have been developed had not technology been applied to maximize flow rates. I'll also point out that such efforts to maximize flow rate typically lead to reduced ultimate recovery compared to more modest flow rates.

I'm again getting ahead of myself and will offer details of my position in January. But to overstate my opinion, debating the amount of future oil/NG are out there to develop falls into the same philosophical arena regarding the number of angels that can fit on a pin head: all talk and zero substance. I apologize if that sounds a bit harsh but it's the reality I deal with daily.

And to emphasize my position: it almost 3 AM and I just returned from logging a drilling project. The primary NG objective wasn't there but several smaller oil secondary objectives were present. The decision faced around midnight by me and several joint venture partners was whether we should complete the well or plug and abandon it (we'll be completing it, BTW). The entire discussion focused upon the potential flow rate the well might generate. The ultimate recovery was an insignificant portion of our chat. In fact, we really don't have enough control to make even a half decent guess as to how much oil is actually in place.

I've read your posts on this subject with interest.

Somehow my gut tells me NPV and EROEI are closely related say first cousins that should not interbreed or else the result is not good.

I've not yet distilled the relationship perhaps Nate can do it but my gut tells me that these two concepts have more in common than you would think at first glance.

Maximum Energy is also entwined deeply.

In the big picture its live for today f&*ck tomorrow. I.e by forcing the viewpoint to the shortest time period to make a return somehow it eventually causes serious problems. In finance its obviously popping bubbles but its deeper than that.

Again non of this is distilled yet in my brain I think when you posts I'd like to see what Nate says but I think you can see how what your saying fits with Nates approach.

I agree memmel...in one form or another EROEI impacts the reality. But quantifying it still seems undoable in a meaningful sense. many oil/NG projects are developed even when the overall costs aren't fully returned. It's that sunk cost factor. Antoher well I drilled a few weeks ago missed its primary but found a small oil sand. We completed that sand because the completion costs would be returned at a satifactory rate. But looking at the total sunk cost we're going to lose money on the venture...just not as much if it had been a dry hole. In this case what's the EROEI of the completion? Use the completion cost alone or the entire project cost? It's an even bigger issue when you try to factor the embedded energy in big DW drilling rigs.

My goal isn't to try to offer any sense of all those interplays. They certainly exist. Just the one: an oil/NG reservoir won't be devloped if it doesn't satisfy the time value relationship. And at the end of the day PO is a flow rate issue and not a reserve issue IMO. But exactly how is EROEI determined? If a time factor isn't involved can it be meaningfully applied to oil/NG development? The EROEI of two projects might be the same but if one takes 5X as long to make its return are they truly equal? Does NPV-EROEI make sense?

I think at the highest level NPV = Maximum Energy.

And here lest define Maximum Energy very loosely its between the most efficient approach and lest efficient approach that yields the best return on energy invested.

And not not only is it loose but I used the word best. What this means is how a resource is developed is not controlled by strict engineering/thermodynamic and even overall geologic depletion. We certainly don't extract at maximum efficiency for example to get the highest URR. In fact I suspect one reason many think a lot of oil is left is simply because we are even now far less efficient than we could be.

Also we don't extract at say absolute maximum flow rate this would require some sort of coordinated global company that always uses the best technology to get the best flow rate.

As you can see exactly how we extract oil in the real world is somewhere between maximizing total returns and maximizing production rates.

Now of course this is inherently time based but assuming your right about the key equation NPV and I have no reason to question this its a common accounting method. Then we can identify best=NPV in my loose definition of Maximum Energy.

Given a way to identify accounting with energy then its simply matter of tying Maximum Energy to its resulting EROEI curve.

Now of course this mean the worlds oil resources are extracted with a huge preference for production that can flow the most early on in its production history. In fact in general nothing else really matters however you have not gone into the economics of old field i.e not new developments. We will let you save that one for your next key post after NPV of new fields :)

And I really need Mr. Hagens to chime in on this concept I'll bring it back when you post your key post.

I think that what you're talking about is close to describing the difference between western (capitalist) oil companies and, say, Chinese.

Point vs. total value.

Rgds

WeekendPeak

And who is investing like mad in oil at the moment ?

As far as I know Chinese budgets are still cycling on the old communist 5 year plans.

Someone is really really concerned about production five years from now. And thats assuming what China is doing now is for problems that will occur at the end of five years.

Alas Nate WT read may damn paper !

So I can get it published and not have to dance around what I think I know.

Suffice it to say the Chinese got caught with there pants down the reaction is correct massive investment in long term oil flows but there brush with capitalism may still prove to be fatal.

I don't think they will pull it off simply because all China has to offer at the end of the day is making stuff and the one thing thats in massive over capacity now and will get ten times worse is manufacturing capacity for stuff we really don't need.

In a lot of ways China is far far more leveraged than the US as they have a massive amount of manufacturing designed to provide goods for the BAU world while one suffering from serious lack of oil can quickly develop the local manufacturing needed to provide the far more limited amount of goods needed for survival.

I don't think many people understand that China itself is massively leveraged on things remaining like they are now.

Huh? What the Chinese are doing in the post-Mao era bears no relationship to anything that Marx or Lenin would recognize as being communism. If anything, they are more capitalistic than the US. They are extremely sharp businessmen, make no mistake about it.

They are doing rather well at the moment, and there's really nothing to stop them until their incomes catch up to the US on a per-capita basis (at which point it will become tougher). Of course, they have four times as many people as the US, so that implies an absolutely enormous demand for resources.

I heard, from a reliable source, that the oil production at Thunderhorse has recently fallen to about 60,000 bpd (most production numbers for the field that I have seen were for barrels of oil equivalent). They were reportedly having problems with water encroachment, because of high vertical perm. Of course, onshore one would reduce the production rate. As you highlighted, that presents a problem in offshore areas.

In any case, I haven't read anything further regarding actual production, but I would think that the actual production numbers should be showing up in regulatory reports.

Intersting WT. If they channeled water you know how difficult, if not impossible, it is to unring that bell. At least offshore they can go over the side with the water. But then the big question remains:what's their max oil/water seperation capacity?

My take on Rockman's line is that oil production is economically analogous (roughly) to the nuclear power industry. When I got out of the Navy I applied to several nuclear facilities in GA. None were hiring because none were being built. Why invest in something the bean counters (and the banks) say is risky at best and will loose money near-term? Whether or not we need nuke plants now (or oil) always takes second place to economics. Sure, we need the energy, but we can't afford it. We can't even afford clean air.

This sounds like a potential bet. One thing I've learned having lost my job as you maintain large stocks of wine and beer in the event of losing your job. I don't drink often but enjoy myself when I do and I inadvertently let my stocks get a bit low :(

Thus I'll bet you a case of beer that it won't show up in US production reports which will continue to perfectly track estimated future production perfectly.

Of course I'm a desperate and thirsty man suffering serious consumption rate to reserve issues of my own :)

Ouch! It isn't as if BP didn't suffer a severe one-two punch in the head as a result of the damage the platform suffered in hurricanes Dennis and Katrina. If true, this would be more of a kick in the gonads.

I used to work for a predecessor company, but fortunately I bailed long ago.

ROCKMAN

I look forward to your post in January, but your analysis applies to commercial projects (generally non OPEC) only.

I don't think normal commercial ROI analysis applies to govt controlled projects, which are the majority today

Opec is profit driven as well. They still have to ask someone for the money and show a return.

poly -- the majority oil produced in the world today is done so by corporations: US, British, Dutch, French, Brazilian, Saudi, Iranian, Chinese, etc. Certainly some gov't have varying amounts of control over how these corporations function. But with the exception of China I've seen no indication that any of them utilize economic analysis outside of the norm that I describe. Of course, when "it" hits the fan the rules might change dramaticly in some countries. Maybe even in the US. The auto and bank industries got their bail outs. Why not ExxonMobil next?

Great idea! I am very curious if you'll find out better data about the (marginal) cost of new oil projects, which is fundamental for the future oil price (having scraped off other factors like speculation or excess storage). Last year I compiled a list of cost data, which resulted in a huge range - from US$ 2 (sic!) per barrel to well above US$ 100.

drillo -- the various cost numbers you refer to can give some sense of the economics involved. But it's difficult to judge the validity of any project without have a good handle on the cash flow vs. time factor. But that's the type of details you never see folks release.

Is oil production simply a function of oil price?

(Basically Rockman is arguing that unless the oil price is much higher than the oil investment it won't be produced.)

In classical economics, investment shifts the supply curve to the right, producing more oil for the same price so the total amount of investment divided by the quantity extracted is at or below the initial price.

If 'new oil' has a more sharply sloped supply curve, then the price must be higher. This is a demand based Peak Oil model( price too high for people to afford). Obviously for oil businessmen this is a live or die situation but not for society at large. People can buy more efficient cars or substitute other fuels; electricity,natural gas, ethanol or convert some oil products to non-oil types.

Society, not the oil industry, needs to determine the response to PO, because

the geological forecast is that there is nothing the oil industry can do to produce more oil regardless of price in the next few decades.

PO will trigger a market failure.

maj -- I can't even argue to effectively that price has a much impact of resource development as most might think. Granted a higher oil price would generate a higher return/faster payout if all others factors remain the same. But history does not bear this out too clearly. Higher prices also encourage operators to accept higher risks. Prospect A only has a 20% chance of success and at $40/bbl "I" don't think the risk is justified. But at $90/bbl I'll take a shot at it. But the probability of success hasn't changed. And the ROR of a dry hole is zero regardless of how high the prices. The price boom of the late 70's led to over 4600 drillings rigs running in the US and huge exploration budgets. But the amount of reserves developed were not even close to being proportional to the monies spent. I worked for one company, during the height of that boom, that spent $550 million drilling wells in the U.S. Cumulatively that effort produced only $40 million of production. Higher prices will lead to more drilling but, if history repeats itself, the reserve/flow rate increases will not be proportional to the capex expended.

I fully agree with you: the future is in the hands of "society". We, the oil patch, are not responsible for easing the impact of PO. Our responsibility is to maximize profits. And sometimes that means drilling fewer wells...not more. How have I functioned during such times? When prices spike upwards I've focused on selling production to fools who think prices will keep climbing indefinitely. Drilling during such a period has been a low priority. And when prices collapse and no one wants to risk drilling dollars is when I refocus on drilling if I'm lucky enough to have an agreeable capital source as I do today and also during the mid 1980's. I generated a very profitable shallow NG drilling program when prices were just under $1/mcf. All I can do is repeat the same basic plan to be profitable in the oil patch: buy low - sell high. Folks who think the oil business will act as though it has some moral imperative to help society will be very disappointed.

It does? That's different from the economics I took. In the economics I took, you produce more oil at a disproportionally higher cost.

Technological change can shift the supply curve to the right, but where is the stunning technological breakthrough that we have experienced lately?

On the other hand, resource depletion shifts the supply curve to the left. You can produce less oil for the same amount of money, or alternatively, the same amount of oil for more money. Or less oil for more money. This seems to be the current scenario.

While we don't have any novel new techniques, 3D/4D seismic, horizontal drilling, and hydro-fracing have all been around for a while, the question does arise, has their development crossed some sort of threshold whereby they are suddenly effective enough to substantially change things? For instance the slow improvement of metalworking and boilermaking gradually passed some point where practical steam engines were possible (rather than mere curiosities), and suddenly we had an industrial revolution. I don't know how to answer that question, but I think it is an important one to pursue.

No, these are just techniques for eking a bit more production out of our existing oil fields, and as you say, they have been around for a while. There's no new threshold which has been crossed. It's just business as usual.

The SAGD process did move about 170 billion barrels of Canadian oil sands into the "proven reserves" category a few years ago, which is not to be snickered at, but in relation to global consumption, this is not enough.

EOS -- To add to Rockie's comment, enhanced recovery methods have been continuely refined for over 50 years. The only true step wise change I've seen in the last decade has been the development of horizontal drilling. But even hz has become fairly well refind by now. Being a career development/production geologist I try to stay up on developing technologies. Refinement of proven techniques continues. But I'm well connected to the Halliburton's of the world and I've heard nothing of any ground breaking new methods even contemplated let alone under development. If the service companies had any new tricks to offer they would be pitching them at us relentlessly.

If you invest in capacity, more supply will become available lowering the price along the demand curve. Cost isn't borne by the market but by the investor. The investor makes up money as the demand curve shifts to the right raising the equilibrium price.

A good example of technology shifting the supply curve is the shale gas.

A shortage does shift the supply curve left with prices rising along the demand curve(demand destruction). What has happened recently is that the demand curve has shifted to the left while available oil supplies are pretty much the same.

When oil supply begins to seriously recede, people won't wait for prices to shoot up but will reduce consumption as soon as they can causing another depression.

It seems to me that this is the same reason why solar PV is not getting developed at a more rapid rate. The return on investment is stretched out way to far into the future. Free market capitalism requires greater returns.

This ties in well with Nates post of yesterday:

Our species is not prone to forward thinking, especially investors. It is evident to me that increasing volatility in all sectors these days amplifies this.

At least in this case, there is no case to be made for adding a risk premium to the discount rate. If you assume the PV isn't likely to self destruct you should be able to use something similar to a longterm interest rate for the discount rate.

Good point !

Also interest has to play a role in why this is true not just capitolism.

If you had real money not debt loanable at zero percent interest then long term low return projects are just as good as any depending on the actual profits and cash flows.

I don't actually have a good handle on a zero growth real money economy. Looking back into the past actually does not help a whole lot as through a lot of history many large civilizations expanded for a long time into frontier area's and the overall rate of change was much slower i.e the natural rate was low as they relied on exploiting renewable resources often unsustainably.

Endo Japan is one of the few reasonably large examples of a closed cycle advanced culture.

Given we have populated the globe and advanced technically what happens next when we are forced to live sustainably is difficult to really understand.

However no matter how I do it it seems like high tech enclaves will form surrounded by a rapidly depopulating sea of misery and despair.

This fits very very well with the dark ages following the fall of Rome. You still had the high tech eastern roman empire but it was effectively and enclave.

And it fits well with Chinese history where you have the warlords and generally they did not lose technology so eventually their boom busts cycles steadily improved technically while cycling between enclave and empire.

I don't see this more basic cycle being broken regardless of technology it seems to be something even more fundamental in the rise and fall of human civilization.

I can't see any closed cycle, zero growth society maintaining much of a professional standing military, since militaries are black holes to capital and resources. Citizen militias would be about it. Can't we all just get along!?

It seems like without population control, there needs to be a military to bleed off excess population. It's either that, birth control (which depends on oil) or some kind of infanticide/sacrifice ritual, or a lot less sex, which I don't think people will go for.

Maybe someone will produce a sterilization pill. Everyone gets one at sexual maturity and half of the pills are placebos. A global fertility lottery, if you like.

That would work too, except I would suggest that a one-child policy would be fairer and have a similar net effect. The one child per woman policy could be enforced by sterilization pills. Medical treatments designed to increase the probability of multiple birth would be illegal, rape wouldn't count, ect...

A fertility lottery would cause an incredible amount of rage compared to a one child policy, which would be bad enough.

I know there is a popular conception of 'life on the farm' involving a lot of kids. Obviously, 'life on the farm' in the future cannot involve lots of kids, because there will be no room for them to expand to. This implies either a level of sexual restraint that I have never heard of any culture imposing upon itself (does anyone know of any examples of this?) or some kind of population bleed-off ritual or birth control, which may not be possible.

(double post)

Even with an effective universal one child policy being immediately implemented, world population would continue to rise for a number of years, because there are so many more people of child bearing age in the world than there are people at the end of their natural years.

The only (non-draconian) policy goal that could even potentially stop or reverse population growth immediately is one that aims for one child per couple but delayed till at least age thirty. Trends are already starting to go in this direction, but not fast enough. Many policies, especially educating women, can help accelerate this trend.

Above, the Edo (not "Endo") Period in Japan was mentioned as an example of a non-growth civilization. Population was in fact stable during this period without major wars. It is unclear whether this had to do with intermittent famines or with wide spread practices of infanticide (a practice very wide spread in the ancient world both East and West).

While certain aspects of the period are unenviable (total lack of individual rites, existence of underclasses _eta_ "filthy" and _hinin_ "non-humans," strong authoritarian control, to name a few), some policies may be worthy of consideration in our current predicament.

First, the farmer was given a very high status, and a back to the soil movement was strongly encouraged. Mostly there seems to have been enough food both for the rural population and for thriving cities like Tokyo (Edo), over a million, and Kyoto and Osaka with somewhat less.

After some calamities from deforestation, the Japanese instituted strict forestry practices that are still held up as some of the best in the world.

At the beginning of the period, the Shogunate banned guns. On the one hand, this was a way to consolidate control. On the other hand, it gave some value back to the samurai class as traditional swordsmen. It also was a fairly rare (even unique?) example of a culture consciously turning its back on a major destructive technology.

http://www.amazon.com/Giving-Up-Gun-Reversion-1543-1879/dp/0879237732

Without getting into a second amendment spat, I would be interested in people's thoughts on what technologies they think we should choose to turn our backs on in the interest of long-term sustainability.

We tend to think of all tech as good tech, and I am certainly not proposing here the opposite, that all tech is bad tech. But I do wonder if there are certainly technologies that people think it would be better to either not have developed, or to tightly control or ban even after they are developed (nuclear weapons come to mind as one such candidate).

Rock. If you assume that in preparation for peak (as if humans were capable of foresight) consumers transitioned to a steady state economy, then without growth long term interest rates should be a lot lower than at present. That should lower the discount rate, which would allow more projects to qualify. Also if the oil price increases NPV should go up proportionately (although some development costs would go up as well). Both of these would help to bring more production about.

I do think the size of reserves matter. The problem is that the cornucopians assume all reserves will be easy and cheap to develop. The reality is we have X amount of cheap oil, Y amount of moderately expensive oil, and Z amount of super expensive oil. And of course the production/depletion rates will vary as well. If a lot of cheap, but slow to access oil remains (think Bakken formation here, not prohibitively expensive, but low permeability means production rates are low) then we could well get into the high reserves but constrained production scenario. I also suspect that even if the expensive stuff is profitable to develop, it doesn't necessarily follow that enough physical and human resources will be available to create enough production to satisfy nominal demand.

EOS -- I think I made a boo boo by not explaining why companies use that 10 -15% DR. It has nothing to do with interest rates. Companies stuck with the same DR when the primes was 14% as well as when it fell below 5%. It really is judge one more fudge factor. Oil/NG projects, especially exploration drilling, is such a quessing game that trying to apply tight economic analysis to it is arther pointless IMHO. I always tease explorationists like WT about running economic analysis on the wells. Why are you wasting the paper? Every exploration project calculates as a great investment because, due to the lack of detailed info (it is a wild cat, after all) the generator is free to estimate enough reserve potential to make it an economic success.

I think I'll include a detailed and, perhaps shocking, explanation of the economic analysis process used in evaluating oil/NG projects when I make my formal post in January. On par with the "Wizard of Oz" it will show exactly what the man behind the curtain is actually doing.

Excellent post WHT, I especially like the histogram of the peak dates for 10,000 MC runs. FWIW, the climatologists seem to agree with you about curve fitting, I found this little gem through the RealClimate blog:

http://geoflop.uchicago.edu/forecast/docs/Projects/hubbert.html

It's a nifty little interactive tool for plotting hubbert curves to oil production data. Vary three parameters, peak year, peak width, and total reservoir size, then hit the "tell the future" button to see the curve plotted against actual data. It really gives one a sense of just how arbitrary any one curve can be given the uncertainties.

Cheers,

Jerry

I certainly agree.

If we ever get hit by a PeakOilGate (whatever that would be), I would rather have something more then arbitrary curve fitting practices to justify my predictions.

I think that might be irrelevant. Neither the attackers nor their target audience can tell the difference between good science, and quakery plus ad-hominem attacks. The best science in the world is no defense against that sort of attack. Its a good example of why science doesn't work like a democracy, where the most popular theories are accepted and least popular rejected. You need the judges to have a true interest in applying the scientific method. Otherwise the forces of disinformation have the advantage.

Yes, but you forget that arguing from a position of knowledge makes a person that much more confident. Maybe I am strange in that way, but I always feel the most confident if I believe in what I say and I could back it up if need be. That is why I would make a horrible encyclopedia salesman or tele-marketer.

So if you had "something more then arbitrary curve fitting" you think you could shut Lynch up?

I am learning how to fight the denial by what I observe. If you watch the climate science debate, all the skeptics concentrate on is criticizing the curve fitting. You can have a dozen good agreements with theory and if one is suspicious, that is enough for them to latch on to (see the tree-ring te,perature proxy discussion).

A lot of the debate centers on game theory and psychological tricks. The arguments that captivate people's imagination are often the most nit-picky of sorts. It looks as if one trick that Lynch uses is to make a depletion scientist appear naive WRT to his use of math. Fellow denialists like to pile on because it makes them seem smarter and more confident with their own (misguided) viewpoints. Those people that are neutral stay out of the debate because they don't want to look stupid choosing the wrong side. And unless the argument is free of nit-picky math failings, the balance of people's opinions is split.

Instead seasoned debaters use various, well proven techniques of "rhetoric" to fire up certain areas of the irrational mammalian brain.

Firstly you need to understand that the human brain is an energy constrained organ.

Only a limited number of regions can fire up at one time.

The math processing neo-cortex is an energy hungry area that calls for enormous concentration and pooling together of resources. It can be easily shut off by firing up the fear centers of the brain. (For more detailed information, see for example here and also left click on image to the right)