Drumbeat: November 30, 2009

Posted by Leanan on November 30, 2009 - 9:58am

A debate rages as to the precise date of peak oil production, but in general it is undeniable that the Second Half of the Oil Age now dawns. The high oil prices, combined with the extreme distortion of the financial system, has led to what may prove to be the World’s Greatest Depression with far reaching consequences for society. Governments have been forced to rescue failing banks, building levels of debt lacking any realistic collateral. Following outdated economic principles, developed during the First Half of the Oil Age, they assumed that the provision of this largely imaginary liquidity would stimulate new consumerism and a return to past prosperity. The policies may indeed meet with a brief success, but if they do so, the demand for oil and gas will rise to again breach the supply limits, giving rise to another price shock followed by a deeper recession. It will be remembered that for every gallon used, one less remains, so it becomes progressively more difficult to raise production.

Oil Rises as Iran Seizes U.K. Yacht, Business Activity Gains

(Bloomberg) -- Crude oil rose after a British yacht crew was seized by Iran and a report showed that U.S. business activity gained for a second month.Oil advanced as much as 2.6 percent after the U.K. government said that the boat was stopped by Iranian naval vessels and that the crew members are being held in Iran. The Institute for Supply Management-Chicago Inc. said today its business barometer increased to 56.1, the highest level since August 2008. Readings above 50 signal expansion.

Big rise in oil demand after 2010 may hit growth: IEA

WARSAW: Demand for oil after 2010 could increase significantly and this may pose a risk to global recovery, International Energy Agency (IEA) chief economist Fatih Birol said on Monday."In 2010, there are signs there will be a small green sign (improvement). After 2010, with the improvement in the global economy, we may see a very strong increase in oil demand, which may pose a risk for the global recovery," Birol said in Warsaw.

Venezuela softens Carabobo oil bid terms - source

CARACAS (Reuters) - Venezuela has slightly softened conditions for the auction of its Carabobo oil project and is due to deliver the finalized terms to interested companies later on Monday, a government source said.Worried by lukewarm private sector interest in its first oil auction in more than a decade, Venezuela last month said it was lowering taxes and extending the production timeline for the project.

The Difference Between Oil Shale and Shale Oil

There’s a huge difference between oil shale and oil produced from shale reservoirs, often called shale oil. The former remains a promising, yet expensive-to-produce resource that may eventually see more development. The latter generates significant, real production growth for a host of independent North American E&P firms; with crude around $70 to $80 a barrel, many shale oil projects are generating an after-tax return on investment of as much as 100%.

Constellation buys Maryland wind project

BALTIMORE (AP) -- Power company Constellation Energy said Monday that it will buy and develop a $140 million wind project in Maryland from Clipper Windpower, one of several clean energy initiatives that Constellation is planning for the state.The 70-megawatt Criterion wind project in Garrett County will generate enough electricity to power 23,000 households a year. Commercial operation at the plant is expected next fall.

US Sept oil demand off 2.7 pct vs prev estimate - EIA

WASHINGTON (Reuters) - U.S. oil demand in September was 518,000 barrels per day less than previously estimated, but still up 523,000 bpd from a year earlier, the Energy Information Administration said on Monday.U.S. oil demand in September was revised down by 2.74 percent to 18.362 million bpd from EIA's earlier estimate of 18.880 million bpd, and was up 2.93 percent from demand of 17.839 million bpd a year ago.

Russia ups Dec seaborne oil exports 3.2 pct vs Nov

MOSCOW (Reuters) - Seaborne crude supplies via Russian oil pipeline monopoly Transneft's export terminals in December will rise 3.2 percent, or by 86,400 barrels per day, from November, a final export schedule showed on Monday.Urals supplies to the Mediterranean market URL-E will fall by 4.1 percent on lower supplies from the Black Sea port of Novorossiisk, the final plan obtained by Reuters showed.

Natural Gas: Powering the Dubai Overshoot

You’ve seen the before-and-after pictures, like a Vegas slug of glass rising in the desert. And, you’ve read the stories about indebted foreign workers leaving their Range Rovers behind, as they flee. Perhaps you’ve seen video of the indoor ski arcade? Or, caught the gaze of the photographer’s eye on the poor, underpaid migrant workers constructing the Burj Dubai. Welcome to today’s obligatory Dubai blog post. Brought to you courtesy of some very hot, sovereign default action as the UAE’s most glittery city announced overnight a request for a stay on debt payments from Dubai World. How could a country so rich in energy resources have gotten itself into such a mess?

Vast supply alters gas industry

CHARLESTON, W.Va. -- West Virginia's natural gas industry is being transformed by an increase in supply as spectacular as the oil discoveries made at the turn of the last century by the late Michael Benedum.But instead of new discoveries like those made by Benedum, Bridgeport's favorite son who was known as "The Great Wildcatter," the increase in natural gas supplies is coming from shale formations that have been known for years to contain natural gas.

Iran Atomic Sites Plan Decried by U.S., U.K., France

(Bloomberg) -- Iran’s plans to expand its nuclear program in defiance of United Nations demands were condemned by the Obama administration, while France called the move by the government in Tehran “infantile.”“It’s dangerous, but above all it’s dangerous for Iran,” French Foreign Minister Bernard Kouchner said in an interview with RTL radio today. U.K. Foreign Secretary David Miliband said the government in Tehran had chosen to “provoke” the international community.

China and Oil: Future Indicators

At any rate, there is nothing strange about this new relation with the Arab oil producing countries. China is a huge and promising market, and is the second largest energy consumer in the world after the United States. For this reason, Arab petroleum companies are seeking to have an active presence there. At the same time, China is trying to develop its relations with oil producing countries, in order to secure oil supplies by means of its own companies, and not through foreign companies. Furthermore, the expansion of Chinese petroleum companies covers most oil producing countries around the world, and not just the Arab countries; also, the Chinese companies are implementing new means and methods that have been hitherto unknown in the circles of the oil industry. One of these methods, for instance, is becoming partners in national oil companies, and securing massive loans for the countries concerned. In Kazakhstan, for example, the China National Petroleum Corporation (CNPC) bought a 49 percent stake in a local oil company, in addition to providing a five billion dollar loan to Kazakhstan in return for this deal. The Chinese oil companies have also followed similar approaches to obtain shares in Russian, Venezuelan, and Brazilian oil companies.

Russia's Medvedev inks bill transferring gas pipe tax to regions

MOSCOW (Itar-Tass) - Russian President Dmitry Medvedev has signed a bill into law transferring revenues from the tax on movable property of natural gas giant Gazprom's gas pipeline system to regional governments, the president's press service reported Monday.

Venezuela May Advance Long-Delayed Oil Auction

Venezuela's economy is tumbling just as the rest of the world begins to recover, which may create the perfect combination needed for the country's long-delayed oil drilling auction to finally get under way.Industry sources say a contracting local economy alongside stronger global growth, which has pushed up worldwide oil prices, is providing incentive for both sides -- the Hugo Chavez-led government and foreign oil firms -- to make concessions and find common ground on the terms of the so-called Carabobo oil tender.

BP, Eni to Pump World’s First Coal-Bed Gas for LNG

(Bloomberg) -- BP Plc, Europe’s second-largest oil company, and Italy’s Eni SpA plan to produce the world’s first coal-bed methane for liquefaction as global demand expands.Their VICO joint venture signed a production-sharing contract with the Indonesian government to extract coal-bed methane, or CBM, from the Sanga-Sanga block in East Kalimantan, London-based BP said today in a statement. The fuel may be sent through pipelines to the Bontang liquefied natural gas plant.

“We expect production to begin rapidly -- in a very few years,” William Lin, president of BP Indonesia, said in the statement. “Its supply to Bontang will enable Indonesia to become the world’s first CBM-to-LNG producer.”

Inflation fuels Pakistan dissatisfaction with govt

RAWALPINDI, Pakistan — Pakistan's middle classes are increasingly being squeezed by price hikes, fuelling dissatisfaction with an unstable government that is struggling to contain Taliban attacks.In a country with huge disparity in wealth, life has always been a struggle for the third of the population that lives below the poverty line but now lower-middle class and professional families find it increasingly difficult to make ends meet.

The rupee has depreciated by 35 percent in the last year while electricity, gas and petrol prices have doubled in the last two.

The country faces a crippling energy crisis, producing only 80 percent of its power needs, causing debilitating blackouts and suffocating industry.

Nigeria: Commuters stranded in Abuja as fuel queues return

Stranded commuters lined many routes in the Federal Capital Territory over the weekend after fresh fuel shortage hit the city in the middle of the Sallah celebration. Between Saturday and Sunday, many passengers stayed at bus stops for hours waiting to be lifted to destinations at increased fares because motorists either bought petrol from the black-market or spent too long at filling stations to buy petrol at the official N65 a litre rate.

The home has geothermal heating and cooling, radiant floors, Icynene insulation (spray-on foam) in the attic and vaulted ceilings, low-VOC (volatile organic compound) paints and stains, sky tubes for natural light and a heat recovery ventilation system that moves stale air out and fresh air in. There are numerous Energy Star products. The placement of the home on the lot ensures the maximum use of solar resources, and native plants conserve water.

Rush is on for stimulus's high-speed rail dollars

The prospect of bullet trains whisking travelers from city to city at more than 200 miles an hour, stalled for years in America's car-loving culture, should finally get a boost this winter.That's when the Federal Railroad Administration will start handing out $8 billion in stimulus money, according to spokesman Rob Kulat.

A Jewish Response to the Energy Challenge?

Israel is an example of a country driven to energy innovation borne by necessity. Israel does not have the vast oil reserves of its neighbors, does have abundant sunshine, and also has water shortage problems. These conditions make it an ideal country for solar energy, energy efficiency, recycling, and water desalinization measures. Israel has been experiencing a solar revolution--Arava Power at Kibbutz Ketura is an example of this. Because Israel is a small country, its clean tech companies need to expand their markets to achieve economies of scale. Israel could become a beta site for clean energy and clean fuel.

Green technology emerges as serious business in Gulf

Green technology is no more a marketing jargon in the Gulf as it has gained relevance in 2009 helping cut down operating and capital expenditure.With enterprises facing the brunt of cuts in expenses this year, investments in green technologies took the spotlight. Two years ago, it was more of a marketing tool for technology companies and not top priority for Gulf-based enterprises.

Interest in space-based solar power (SBSP) has been cyclical over the last 40 years. The first wave of interest came in the late 1960s through the ’70s, from Peter Glaser’s initial promulgation of the concept through the design studies funded by NASA and the Department of Energy. The second wave came in the late 1990s with NASA’s “Fresh Look” studies. Today we appear to be in the midst of a third wave that started a couple of years ago, primarily because of the interest in the concept by the Pentagon’s National Security Space Office (NSSO), which supported a new study of SBSP (see “A renaissance for space solar power?”, The Space Review, August 13, 2007). Earlier this year a major California utility, Pacific Gas and Electric, agreed to purchase electricity from Solaren, a startup that plans to develop SBSP systems that would be operational as early as 2016; that deal won approval from state utility regulators earlier this month.SBSP is not without its detractors, though. Some argue that the technology needed for a large-scale SBSP system doesn’t exist and would take decades to develop—if it’s even feasible at all. Others argue that even if the technology exists, SBSP would be uneconomical: it couldn’t generate electricity that would be cost-competitive with terrestrial sources, thanks in large part to the high costs of space access. SBSP advocates have argued, in turn, that not only can these problems be overcome, they must be, in order to tap the environmentally clean and plentiful energy people across the world need. In Energy Crisis, Ralph Nansen takes on primarily the latter portion of that argument.

Sustainable Living: A real game-changer in home heating

“Douglas County is the Saudi Arabia of biomass” — Joe Laurance, Douglas County CommissionerWe native Oregonians have another word for it: firewood. Our family has used firewood for heat and hot water most of our lives; it is part of our rituals of the seasons.

We cut or buy the wood in the winter, let it dry the next summer, and burn it the following winter. Then repeat. Relying on the land for energy is as natural as growing our own food. It is a part of being connected to this place.

I remember driving through the Medford area one winter in the 1980s when many people were burning wood in response to the last energy crisis.

The air pollution was thicker than anything I had ever seen in Los Angeles. Wood stoves then were simple steel boxes with an adjustable air draft.

Climategate has come and gone, like Dubai World, with only ripples in the agonizing V-shaped, W-shaped or X-shaped recession and recovery sequence. Recession and recovery of hopes and fears that COP15 will be a success or failure have also rippled.For the global economy there is a new, X-shape recovery outlook. Global Warming finance, like Keynesian recovery finance might cross out the risks of double dip, with a big new raft of funny money channelled to the right hands. Like the cash needed to cancel out "troubled assets" and bankrupt banks, it can be printed, borrowed and guaranteed in extreme high amounts but in full media view with full media support. Public opinion, as for the Keynesian recovery trillions, will matter little "because this is a complex and urgent affair". The media can be counted on to give all sides of the story, plus additional sides they invented to amuse the crowd.

THE ethanol industry, once the darling of corn growers, environmentalists and the auto industry, has fallen on hard times. Producers spent this year caught between falling ethanol prices and rising corn costs, causing many to go bankrupt. In response, they are pushing the Environmental Protection Agency to increase the amount of ethanol they can blend into gasoline to 15 percent, up from the current 10 percent. Allowing this, however, would only double down on a discredited environmental policy without solving the industry’s fundamental economic problem.That problem is simple: Ethanol prices trend higher and lower along with the price of gasoline, yet the cost of producing ethanol tends to rise with demand, since higher ethanol production exerts upward pressure on the price of corn. In a free market, corn prices might be expected to eventually fall as the market adjusts to increased demand. But because the government heavily promotes ethanol use through subsidies and regulation, the market is continually strained.

The problem is magnified because corn is a water- and fertilizer-intensive crop that requires considerable investment. Worse, since fertilizer is often an oil-based product, the cost of growing corn tends to rise at the very moment ethanol prices, which rise with oil prices, might bring a good return.

Somali pirates hijack U.S.-bound oil tanker

NAIROBI, Kenya - Somali pirates seized a tanker carrying crude oil from Saudi Arabia to the United States in the increasingly dangerous waters off East Africa, an official said Monday, an attack that could pose a huge environmental or security threat to the region.

Dubai woes give China chance to buy oil, gold: report

BEIJING (Reuters) - Dubai's debt crisis could be China's opportunity to snap up gold and oil assets, a senior Chinese official said in remarks published on Monday.No Chinese banks have yet reported exposure to debt from Dubai World, a flagship firm that last week said it was seeking to delay debt payments by six months. Some Chinese real estate and construction firms have limited exposure to projects in the emirate, state television reported this weekend.

China's $2.27 trillion in foreign exchange reserves are mostly parked in U.S. treasuries, despite calls from some in China to invest the reserves in oil and other natural resources that the fast-growing Chinese economy will need in future.

The Vicious Competition For Peak Oil

The more relevant concern, at least in the short-term, about oil should not be how much there is but who will own it. The fight for crude ownership has picked up recently. Two decades from now there may be as much annual supply as there is this year, but the Chinese may have doubled or tripled their share of that market. The obstacle to that happening is that Western oil firms such as Exxon Mobil and BP will get into bidding wars with China-based oil operations for new deposits but that bidding could become extraordinarily expensive.

OPEC unlikely to cut output - Iran national oil co

NEW DELHI (Reuters) - The Organisation of the Petroleum Exporting Countries (OPEC) is unlikely to cut output at its meeting on Dec. 22, Seifollah Jashnsaz, managing director of the National Iranian Oil Co. told reporters on Monday."We don't think there would be such a reaction," he said in New Delhi, when asked if OPEC was likely to cut output to support prices.

Correa Says Ecuador Oil Output to Rise in 2010, Ending Declines

(Bloomberg) -- Ecuador, the smallest member of the Organization of Petroleum Exporting Countries, will increase crude output next year, ending three years of declines, President Rafael Correa said.“Production will increase a little,” Correa said in an interview in the outskirts of Lisbon, where he’s attending an Ibero-American summit. “In natural gas, we are exploring and we hope that in the next few months we may have some more concrete data on what the potential reserves could be.”

Poland, Russia may not agree gas contract in 2009

KRAKOW, Poland (Reuters) - Russia and Poland may not agree a gas contract by the end of this year, Poland's Deputy Prime Minister Waldemar Pawlak said on Monday, contradicting earlier comments by Warsaw and Kremlin officials.

Natural Gas Glut Overwhelms Speculators, Defies Rally

(Bloomberg) -- When Qatar’s biggest natural gas shipment to the U.S. arrived this month, it signaled to Barclays Capital Inc. and PFC Energy that this year’s worst performing commodity investment won’t recover in 2010.Murwab, a Qatari liquefied natural gas tanker, carried the first shipment to the U.S. from the Persian Gulf nation since June 2008. Its cargo, enough to heat about 9 million homes for a day, added to the largest gas inventories for this time of year since at least 1994, Energy Department data show.

Algeria gas project delayed - Sonatrach

ALGIERS, Nov 30 (Reuters) - Completion of Algeria's Gassi Touil gas production and LNG project has been delayed until 2012 or 2013, the Algerian official news agency quoted the head of state energy firm Sonatrach as saying.

Oil May Drop to $70 on Channel, SocGen Says: Technical Analysis

(Bloomberg) -- Crude oil prices may slide toward $70 a barrel in New York after breaching the bottom of a monthlong price channel, according to technical analysis by Societe Generale SA.Oil for January delivery fell as low as $72.39 a barrel on the New York Mercantile Exchange on Nov. 27, breaking through a “descending channel” that formed after the commodity reached a year-to-date high on Oct. 21. This may trigger a decline to the next supportive layer in a Fibonacci sequence of price thresholds, Societe Generale said.

Iran restructuring its naval forces

Iran has reorganized its naval forces to give operational control of the strategic Persian Gulf and Strait of Hormuz to the naval component of the Islamic Revolutionary Guard Corps, the paramilitary organization that is playing an increasingly central role not only in Iran's military but also its political and economic life.

BP Pipeline Spills Crude Oil, Natural Gas in Alaska

(Bloomberg) -- A crude oil and natural gas pipeline spilled an unknown amount of fuel at BP Plc’s Prudhoe Bay field in Alaska, the state regulator said.The spill has affected 8,400 square feet (780 square meters) of tundra, the Alaska Department of Environmental Conservation said. The leak on a closed 18-inch pipeline carrying crude oil, gas and water was discovered at 3:05 a.m. local time on Nov. 29 about 1.5 miles (2.4 kilometers) from the Lisburne Production Center along Drill Site Line 3, according to the filing.

Tata says plans Nano hybrid cars - paper

SEOUL (Reuters) – Tata Group is planning to produce hybrid versions of its Nano, billed as the world's cheapest car, to join in the environment-friendly trend, its chairman said in an interview with a South Korean newspaper.The Maeil Business Newspaper on Monday quoted Ratan Tata, chairman of the Tata Group, as saying in Mumbai that low-priced goods would create stronger demand than high-end products in India, and the so-called low-price revolution would continue across the world.

Energy projects limit role of foreign firms' U.S. units

The Energy Department is preventing U.S. subsidiaries of foreign corporations from full participation in a $400 million program designed to develop "transformational" technologies.Affected companies including giants such as Siemens and Philips complain that the policy exceeds the requirements of the "Buy America" provision of this year's stimulus legislation. They say it will deprive the effort to achieve energy and environmental breakthroughs of unique scientific expertise and will discourage the creation of jobs at the foreign-owned U.S. facilities.

The new politics of the global energy crisis

The events currently tearing the Liberal Party apart are indications of the new politics emerging out of the global energy crisis. Australia, with the highest per capita carbon emissions and heavy reliance on cheap fossil fuels, is ahead of the pack as the “business as usual” politics of the last few decades comes to an end.Global warming and peak oil are but two of the aspects of the global energy crisis. Measures to cut carbon emissions, such as an ETS, along with peaking oil and gas resources will see all energy costs become increasingly volatile with a general and continuing upwards movement. The world economy will have to shift out of its heavy reliance on cheap fossil fuels and drastically cut energy usage as it attempts a transition to new energy sources.

As such, the ETS is just the beginning of the great changes on the way, and those political parties that fail to adjust to this hard fact will disappear.

Climate Change You Can Believe In

The consensus among the global warming deniers is that the war is over. Thanks to a handful of e-mails we now know that global warming is a gigantic hoax foisted upon an unsuspecting public by a cabal of climate scientists bent on garnering grant money to further their own careers.Okay. Suppose that is true. What now? Do we just go on with business as usual? Do we keep using fossil fuels at a fast and furious rate until ... Until what? Until they run out?

Oops. That would seem to be a bit of a problem, one that the e-mail hoax theory doesn't even begin to address. This has nothing to do with global warming. Rather, this is about the theory of peak oil, the idea that at some point we begin taking less oil out of the ground than before and that this marks the beginning of the end, so to speak, of the fossil fuel era. It even comes complete with its own whistle-blower scandal.

Well guess what? There is a whole community of self-styled peak oil debunkers who will assure you that peak oil is not a problem. Why? Because when all else fails we can switch to alternative energy sources like solar or wind or nuclear power.

An Upbeat Perspective on Peak Oil: Bart Anderson on Coming Challenges

With last year's high gas prices fading in our memories, and with the Copenhagen climate talks grabbing the headlines, the peak oil meme seemed, until recently, to have been taking a bit of a breather. Then along came an (admittedly anonymous) whistleblower from the International Energy Agency claiming that statistics on global oil reserves have been massively inflated under political pressure. So what are we to do about peak oil?There's no shortage of folks out there telling you you need to grab a gun and run to the hills. Luckily Bart Anderson, former editor of EnergyBulletin.net, is a little more optimistic. In this interview with Peak Moment TV—the folks who have brought us videos on everything from backyard permaculture and safe, legal graywater—Bart expounds on everything from the importance of building resilience, to not painting ourselves into a corner with any one solution or philosophy.

Thanks for the blessings of oil

Thanksgiving Day is a special day for those following the peak oil news. Geologist Kenneth Deffeyes, author of Hubbert's Peak, predicted that Thanksgiving Day 2005 would mark the peak in world oil production. After that, oil production would decline, irreversibly. And he may have been right. Crude oil production figures have been removed from the most widely influential official statistics, so it's not easy to check. Even if crude production numbers were easily available, the numbers are so uncertain that it's hard to see anything other than the biggest trends.When Deffeyes made the prediction, almost two years before Thanksgiving 2005, his tongue was only slightly in his cheek. Oil production data are not nearly precise enough to establish a peak day.

Was Deffeyes at least right about the year of peak oil?

Incredible Edible: How To Make Your Town Self-sufficient

While citizens of the world turn their eyes to Copenhagen, awaiting leadership with dwindling hope, one town has taken matters into the hands of the people. An idea that started around a kitchen table has grown into a reality demonstrating wisdom not seen since Gandhi. Starting from just a few herb gardens, the "Incredible Edible" project grew organically, out of the energy of local people who sought no public funds because they wanted to do it their way. Now "their way" shows the way. Prepare to be inspired.

It is important not to try rebuilding the Aspen economy on the rotten pillars of conspicuous consumption and conspicuous waste. Anyone who still thinks these are appropriate values for sustainable economic vitality is either ignorant of climate change and peak oil, or has made a few too many trips to the local pot dispensaries.In light of today's downturn, Aspen is faced with converting liabilities into assets. The most obvious liabilities are the vacant pleasure palaces whose resident mice and packrats are now visited only by property management drones making sure the gas is turned on all snowmelt surfaces and that the teak and mahogany doors are secured against vagrants.

Europe's post-Soviet greening — gains and failures

DNIPRODZERZHYNSK, Ukraine – Twenty years ago, when the Iron Curtain came down, the world gagged in horror as it witnessed firsthand the ravages inflicted on nature by the Soviet industrial machine.Throughout the crumbling communist empire, sewage and chemicals clogged rivers; industrial smog choked cities; radiation seeped through the soil; open pit mines scarred green valleys. It was hard to measure how bad it was and still is: The focus was more on production quotas than environmental data.

Today, Europe has two easts — one that has been largely cleaned up with the help of a massive infusion of Western funds and the prospect of membership in the prosperous European Union; another that still looks as though the commissars never left.

Russia vows quick completion of Iran atom plant

TEHRAN - Russia’s energy minister pledged on Sunday a quick completion of Iran’s first nuclear power station, Iran’s state broadcaster IRIB reported, weeks after Moscow announced the latest delay to the Bushehr plant.The reported statement, which did not give a specific time for the launch of Bushehr, came as Iran’s government announced plans to build 10 new uranium enrichment plants, in a major expansion of its disputed nuclear programme. Russia said in mid-November that technical issues would prevent its engineers from starting up the reactor at Bushehr by the end of the year as previously planned.

All responsible people want to assist the disadvantaged parts of the world and do what we reasonably can for our own descendants, but not to the point of self-impoverishment now for the sake of a marginal gain against a wildly unproved prognosis a century from now. This is the flimsiest justification imaginable for the mad slogan parroted endlessly by the eco-Zouaves, from Hollywood to the UN to Ducks Unlimited: "Save the Planet!," as they try to force-march the world into biodegradable pastoralism.

What Happens When Your Country Drowns?

IT'S A BRIGHT, BALMY SUNDAY afternoon and I'm driving through the western outskirts of Auckland, New Zealand, the kind of place you never see on a postcard. No majestic mountains, no improbably green pastures—just a bland tangle of shopping malls and suburbia. I follow a dead-end street, past a rubber plant, a roofing company, a drainage service, and a plastics manufacturer, until I reach a white building behind a chain-link fence. Inside is a kernel of a nation within a nation—a sneak preview of what a climate change exodus looks like.

Monbiot: Please, Canada, clean up your act

The excuses made by the Canadian government for its filibustering and obstruction become more feeble by the day. As I understand his current position, your Environment Minister, Jim Prentice, will not contribute to an international treaty until his government knows what its domestic policies will be, and he will not formulate its domestic policies until there's an international treaty. He appears to be seeking to delay and weaken any international agreement, while claiming that there is no point in setting strong national targets if the rest of the world isn't pulling its weight.Canada's tactics have caused shock and revulsion everywhere. They are dragging your good name through the mud. Stephen Harper and Jim Prentice threaten to do as much damage to your international standing as George W. Bush and Dick Cheney did to that of the United States.

China must show leadership on climate change, EU says

NANJING, China — The European Union said Monday that cataclysmic climate change cannot be averted without Chinese leadership but Beijing stood firm in pushing for the rich world to take the lead."We cannot solve the climate challenge to mankind without China taking on leadership and responsibility," Swedish Prime Minister Fredrik Reinfeldt said in his capacity as EU president at a summit in the eastern city of Nanjing.

India Says Emission Cut Offers by Rich Nations Not Good Enough

(Bloomberg) -- India, the world’s fourth-biggest polluter, said emission reduction offers by rich nations before next week’s climate change talks in Copenhagen are insufficient.“If we take all the offers that are on the table at the moment, it will add up to, at the most, about 15 percent to 20 percent reduction by 2020 as compared to 1990,” Shyam Saran, special envoy of Prime Minister Manmohan Singh, said in New Delhi today. The offers are “far below even the conservative 25 percent” projected by the Nobel Prize-winning Intergovernmental Panel on Climate Change, he said.

Rudd Carbon Bill Faces Senate Test Before Obama Talks

The political twists and turns -- Senators from the Liberal and Nationals coalition will meet today to decide whether to defer a vote until next year -- threaten to leave Rudd empty- handed when he travels to the United Nations summit on climate change. The political debate also sows confusion at electricity providers and mining companies as they prepare to deal with the proposed cap-and-trade carbon emissions trading plan.

Australian PM to meet Obama for talks

WASHINGTON — Australian Prime Minister Kevin Rudd visits the White House Monday for talks with US President Barack Obama set to be dominated by climate change and the conflict in Afghanistan.Rudd will arrive fresh from a Commonwealth summit in Trinidad where he helped steer a landmark declaration backing moves to draw up a legally binding pact to fight global warming at climate talks beginning next week in Copenhagen.

The two men will also discuss Afghanistan on the eve of a nationwide address by Obama to lay out a new strategy for the conflict including deploying more than 30,000 extra troops.

Dalai Lama urges world to act on climate change

SYDNEY — The world's leaders must prioritize the issue of global warming above all else, the Dalai Lama said Monday, adding that he feels encouraged by next month's climate change summit in Copenhagen.The revered Buddhist figure and Nobel Peace Prize winner, in Australia for a series of lectures on universal responsibility and the environment, said politicians must focus their energy on finding a solution to climate change.

"Sometimes their number one importance is national interest, national economic interest, then global (warming) issue is sometimes second," he said during a news conference. "That I think should change. The global issue, it should be number one."

Ski Resorts Fight Global Warming

Ski resorts across the country used the Thanksgiving weekend to jump start their winter seasons, but with every passing year comes a frightening realization: If global temperatures continue to rise, fewer and fewer resorts will be able to open for the traditional beginning of ski season.

McCartney calls for meat-free day to cut CO2

BRUSSELS — Paul McCartney is urging consumers to fight global warming by going vegetarian at least once a week, ahead of an address he will deliver on Thursday to the European Parliament."By making a simple change in the way you eat, you are taking part in a world changing campaign where what's good for you is also good for the planet," the former Beatle told the Parliament Magazine.

Climate research e-mail controversy simmers

The case for global warming rests on "all kinds of evidence," says climate scientist Don Wuebbles of the University of Illinois in Urbana-Champaign. "Look at what's happening to ice in the Arctic. Explain that as 'no global warming.' It doesn't take a genius to see, obviously, warming is happening, e-mails or not."Further, notes IPCC chief Rajendra Pachauri, the evidence for warming in the 2007 IPCC report comes from multiple lines of evidence besides surface temperatures, such as ocean heat, atmospheric water vapor and sea ice. The 2007 report found man-made gases have raised average atmospheric temperatures about 1.3 degrees Fahrenheit since 1905 and probably will raise them 3 to 7 degrees by 2100, depending on future emission cuts.

"The East Anglia temperature records aren't the core problem," says climatologist Patrick Michaels of the Cato Institute in Washington, D.C., which advocates for limited regulation.

Expert: Climate change affecting Midwest

Warmer winters, wetter springs and more flooding along riverfront communities in Illinois may become the norm, according to Wes Jarrell.“The time for debate about global warming is over,” he said. “It’s not a matter of opinion. It’s a matter of fact. Climate changes are already occurring in the Midwest.”

Jarrell, interim director of the University of Illinois’ Environmental Change Institute, said temperatures are generally rising, especially in the winter, and noted that the spring rains that delayed planting in Illinois may become typical.

What Is the Right Number to Combat Climate Change?

Despite all these variables, scientists from Svante Arrhenius to those on the United Nations Intergovernmental Panel on Climate Change have noted that doubling preindustrial concentrations of CO2 in the atmosphere from 280 parts per million (ppm) would likely result in a world with average temperatures roughly 3 degrees C warmer.But how much heating and added CO2 is safe for human civilization remains a judgment call. European politicians have agreed that global average temperatures should not rise more than 2 degrees C above preindustrial levels by 2100, which equals a greenhouse gas concentration of roughly 450 ppm. "We're at 387 now and we're going up at two ppm per year," says geochemist Wallace Broecker of Columbia University's Earth Institute. "That means 450 is only 30 years away. We'd be lucky if we could stop at 550."

How Can Humanity Avoid or Reverse the Dangers Posed by a Warming Climate?

So how do we keep global average temperatures from warming more than two degrees Celsius? Scientists have begun to turn their attention to answering this critical question now that the potential impacts of climate change have become clear. The solutions offered range from a tax on emissions of carbon dioxide to an end to forest-clearing for agriculture.

Climate Change Is Inevitable — It’s Time to Adapt

The really inconvenient truth: We’re toast. Fried. Steamed. Poached. More so than even many hand-wringing carbonistas admit. According to the National Oceanic and Atmospheric Administration, C02 that’s already in the air or in the pipeline will stoke “irreversible” warming for the next 1,000 years. Any scheme cobbled together in Copenhagen for slowing—forget reversing—the growth of greenhouse gases will be way too little, way too late. In the apt jargon of industry, a hotter planet is already “baked in.” James Lovelock, the British chemist who redubbed Mother Earth as “Gaia,” tells the ungilded truth: Can we hit a carbon Undo button? “Not a hope in hell.”Now here’s some good news: We can still come out OK. Because by one of those strokes of luck that seem to follow the most charmed species on earth, climate change arrives just at the moment when we have—or have in sight—an array of tools for adapting and extending human civilization to any and every environment. Homo sapiens now splash golf courses across deserts, joyride in outer space, update their Facebook profiles from the South Pole. And technological change is accelerating. By 2050—zero hour for many warming scenarios—the 2010s will look as primitive as the buggy-whipped 1890s do today.

Are there low-cost ways to adjust to a warming world? The United Nations' Local Coping Strategies Database tracks techniques already being used as communities feel the heat.

Re: The Vicious Competition For Peak Oil above. They have gotten to story very wrong IMHO. First, the war is already underway and the US is essentially unarmed. The story misses the mark in many ways. No for-profit company can compete with the Chinese gov't when it comes to securing access to future oil production. Exxon et al do an economic evaluation that includes a profit margin. China doesn't have to...they aren't looking to profit from selling that oil: they look to the revenue generated from fueling their economic growth. The public oil companies even are at a greater disadvantage when it comes to long term reserves. We hit on the metric of NPV (net present value) last week. The value of a future revenue stream is decreased the farther into the future the stream is projected. In a standard economic analysis a bbl of oil produced 10 years from today (using a $70/bbl benchmark) will generate less than $10 NPV. The Chinese have no need to use such discount rates in their analysis. They see a bbl of oil produced 10 years from now as being worth much more than $70.

Another critical point: Exxon et al are producing 100's of millions of bbls of oil in Africa every month. This oil is shipped to the EU for the most part. Granted this production is fungible and aids our oil acquisition costs indirectly. But we're talking access in the future and not pricing. These companies are under no obligation to ship any of this production to the US when supplies get tight. In fact, in many cases they won't be allowed to legally. One of the Chinese tactics is to secure the "right of first refusal" from countries such as Angola. Thus even oil that the Chinese don't own directly will be required to be shipped to China as long as they are willing to meet the market price. The only factor in our favor at the moment IMHO is that the Chinese currently need a strong US economy to buy their output. They also need the US to keep our debt to China stable. OTOH, the Chinese are using a big chunk of those US dollars to secure long term oil reserves around the world. But nothing stays static for every. The rules will change down the road. I don't know what they'll be but it's a safe bet that he who has access to oil will make the rules.

Yes. IMO the power players feel that China's economic growth is paramount for the overall economic future and the economy of the USA is not as important. Again IMO this is why every excuse is fabricated for treating China with absolute kid gloves in regard to CO2 emissions. Again IMO the USA economy isn't close to being strong enough to withstand the proposed carbon schemes and they will be the knockout punch delivered to a dazed opponent. Meanwhile, China will grow, pollute and emit CO2 until fossil fuels deplete and atmospheric CO2 levels will continue to increase, with Americans told that new measures must be brought in as the pace of US decline needs to be stepped up.

Do you have an alternate for what you describe as a 'kid glove treatment' of China?

The Chinese, the Indians, and other nations building up an industrial infrastructure have a strong moral case for their insistence that the accumulation of green house gases in the atmosphere is the critical metric. The US and the 'west' in general continue to enjoy the material benefits of the West's greatly disproportionate contribution to this accumulation.

Can you tell me in what year China's share of the total accumulation of greenhouse gases will equal that of the United States, Europe, Japan, Canada, Australia combined, given the current trend in annual emissions?

The moral case, if we accept the premise that all individual human beings are equal in the eyes of God, favours the 'developing nations'.

But wonders never cease. Contrary to your assumption about the inability of the US economy to withstand "the proposed carbon schemes", the strength of the US economy will only be reestablished through movement to a place where the consumption of the marginal unit of energy in the United States brings as much value added as it does in Chindia.

Given the colossal waste of energy in the US, for example passengerless cars as the norm, it is in practice impossible for the US to achieve this objective while maintaining or growing current levels of energy/fossil fuel consumption. The only viable route on which the US can hope to find the basis of a competitively viable industry, in general, lies on the terrain of waste elimination.

The main issue is which set of market forces/public policy will guide the process of adaptation to a much lower level of energy consumption/carbon footprint. Sadly, for the US, the public policy process is thoroughly corrupted. Decision making institutions were designed on the cusp of the industrial revolution and with the interests of the property owning class dominant. Fortunately for the US, all nations have problematic governance to some degree.

It seems that in reality, the US will only every again offer the promise of a good life in a just society if the elite(s) splinter, and the strongest faction is able to direct public policy into a lower carbon future.

As in every democratic model, the masses will be called upon to legitimize the authority of one faction or another.

Hello, toilforoil,

re: Interesting point about the "moral case."

It seems, though, that any group or nation heading in the same BAU direction will end up soaring over the edge of the peak oil cliff.

Maybe a little bit different edge, little higher or lower cliff, but there it is.

So, I guess it matters what the "favor" consists of, as in "favoring the developing nations." Not really such a favor, to use the word in a slightly different way.

It's kind of weird to me that for all the foresight those in charge of China's oil-acquisition strategy exhibit, the cliff is still not seen as such, really. (Is it?)

Aniya -- Since we can't reead the minds of the Chinese gov't all we can do is speculate. My perception is that the Chinese are fully aware of the cliff potential (or at least a significant downward slope). And that explains exactly why they are securing oil reserves in the ground. There will be no global cliff IMHO. Individual nations will (and some have already) feel the impact of PO more severly then others. If the Chinese continue to secure oil reserves in the ground they not only won't see a cliff but perhaps even a nice rise ahead. In fact, China has been steadily increasing the oil consumption for a number of years now. Eventually they may run of a cliff of sorts but IMHO that would occur many years beyond the point where it happens in the US and other countries. Even if 99% of humanity is dying of thirst life is still good for you if you're sitting under a shade tree with a full canteen. Especially if you have a nuclear device handy to protect your water.

Ironic that you should use the water analogy because that may actually be a bit of a problem for them...unless of course their nuclear devices are capable of creating H2O out of thin air.

Not to mention that a lot of their remaining water is severely compromised by pollution. I can imagine surviving without oil, without clean water it starts to become a bit iffy.

I think "peak water" may turn out to be more important in the end than peak oil.

Japan was one of the "successful" sustainable societies Jared Diamond described in Collapse. Even today, Japan is nearly 80% forested. There are a lot of reasons for their relative success, but one of them is water. They get a ton of rain in Japan - roughly twice the world average - and that means the land is more productive.

This is one reason I think Canada might do relatively well in the post-carbon age. They've got something like 20% of the world's fresh water supply.

The USA is the problem, not the Chinese as I have stated before.

Our cumulative carbon emissions are roughly 10x the Chinese, despite their much larger population.

China has a viable plan to reduce carbon emissions in the medium term, the USA does not.

50 years from now no one will care what the GDP was in 2009, but they will care about how much carbon we left in the atmosphere.

Alan

What? Cumulative carbon emissions since 1776?

In fact, Chinese carbon emissions now exceed those of the US. On a per-capita basis they are about 1/4 as high, but China has over 4 times as many people as the US.

It's all a numbers game. 1.3 billion people is a lot of people.

1.3 billion is also 300 million less than 1.6 billion that would have been without the One-child policy population restrictions put in place in 1979.

I've personally experienced the air pollution in Shenzhen, I can't imagine how much worse it would have been with another 300 million mouths to feed.

In any case, much of China's pollution is created while making the TVs, computers, microwave ovens, MP3 Players (my personal sin), air conditioners, tools, toys, and everything else that's packed in containers and arrives in places with more stringent air standards.

Alan, Alan, this is totally unlike you. You are off by a factor of over 10. We live in the age of the internet when such data is avaliable with only a few keystrokes. I know, you poster your opinion. But I have found that opinions, when it comes to China, are usually wrong.

For instance someone posted a year or so ago that China would have a much easier time after peak oil because they used mostly organic farming, using almost no ferterlizer. In fact the opposite is true. China uses over twice as much ferterlizer per hectar as does the US.

Fertilizer use (most recent) by country

And as for CO2 emissions:

List of countries by carbon dioxide emissions

Ron P.

You keep using that word. I do not think it means what you think it means. --Inigo Montoya

Errrr... I guess the word you speak of Joseph is "factor". Okay, perhaps I am using the wrong word. But what word would be correct when the number a person uses is ten times the correct number?

Ron P.

Sorry for being obtuse, I just love that quote.

Anyway, I was referring to the word cumulative. Since CO2 stays in the atmosphere for many decades, the cumulative effect is quite strong:

http://timeforchange.org/cumulative-co2-emissions-by-country

USA 303034 mio tons CO2 1900-2002

China 80804 mio tons CO2 1900-2002

Not 10X, but But the USA is responsible for most of the human added CO2, and it will take many, many years for China to catch up, if indeed there is enough Oil and coal to ever do so.

I clicked again my old link at Oak Ridge Nat'l Laboratory that has historic data (some nations back to 1800s) for carbon emissions by nation, by year and by type of fuel (solid/liquid/gas) for carbon emissions. Said link has been dead since GWB but I hoped new Admin would have restored it.

My memory was back in 1960s, 70s, etc. USA did have 10x the carbon emissions of the Chinese. Not as factual as I would like, but not entirely without foundation.

Better data shows China is catching up and cumulative data is 4x (and shrinking).

BTW, I would be appreciative if anyone found that data by nation, by year etc.

Alan

This link gives CO2 emissions by nation by year from 1950 through 2004

http://www.guardian.co.uk/environment/datablog/2009/sep/02/carbon-emissi...

Ron, you mean the tranportation part of fertilizers ? Because it is synthesized from gas.

But our sacred ideology says the market is always right, and central planning always wrong. Therefore nothing to worry about here, run along folks. We'll deal with the heretic just as soon as the thought police arrive! Don't worry the heretic will be properly burnt at the stake and the gods will be appeased. Then you will be safe to continue as before.

Good point EOS. Especially when you consider where the bulk of political energy is currently being expended. A centrally planned healthcare system that will be very dependent upon a gov't revenue stream which will be dependent upon a vibrant tax base which will be dependent upon a imported oil stream with no central planning effort to speak of.

Hi Rockman,

Interesting.

re: "First, the war is already underway and the US is essentially unarmed."

Well, there are those US troops, both official and mercenary - and the planes, etc.

It seems the US is "securing" near-term supply, via "securing" KSA (?), supply routes (?) and...?

Although one might anticipate the parallel dramatic decrease of security via the "blow back" from all those people killed, maimed, traumatized, etc.

It seems on a slightly longer time-scale, what you say is all too true.

It's also discouraging to think about the casualties of acquisition, in terms of loss of life, human rights violations, and similar results, even when the more overt "war" methods are not used.

China wins the race to the cliff.

Unfortunately Aniya I see our military escapades benefiting the Chinese more than us. We might be aiding the security of the KSA but the bulk of their production isn't coming to the US. As I mentioned to you elsewhere I don't see the Chinese running towards a cliff. They are in the process of building a bridge at the end of that cliff. Of course, that bridge will end in mid air sometime down the road but it will likely be long after much of the rest of us lemmings have taken that high dive. And who knows, by the time the Chinese hit the end of that bridge they may have constructed a nice set of "alternative" parachutes. Extra time they'll have and we won't IMHO.

To repeat the list I made earlier elsewhere (to explain my POV that China may peak Carbon @ 2016 or so)

1) 16 new nukes under construction with about 50 in planning (hard to keep track)

2) Hydro plans that rival nuke plans

3) 2 GW solar PV recently announced

4) Almost as much new wind as USA in 2008

5) A majority of solar hot water heaters in world

6) Electrify 20,000 km of railroads and build 20,000 km of new railroads with higher speeds on existing lines.

7) Shanghai will become #1 subway city in world, with Beijing possibly #2

8) One child policy (actually 1.5 in practice)

9) Energy efficiency is now a higher priority

All of the above will help extend that "bridge".

Best Hopes for the USA following China's lead,

Alan

Very intersting list Alan...thanks. Makes me wonder if the Chinese aren't looking at their accumulation of in-ground oil reserves as an options play of sort. When supplies get tight they would have the resource if needed. But if their alts take off big time they might not need that much black gold at a time when much of the rest of the world becomes desparite. Not only could they direct that production towards the US et al at a handsome profit but it would also help the US maintain an economy that could continue to buy their products.

Either eventuality they win. The same old Golden Rule: He with the (Black) Gold makes the rules.

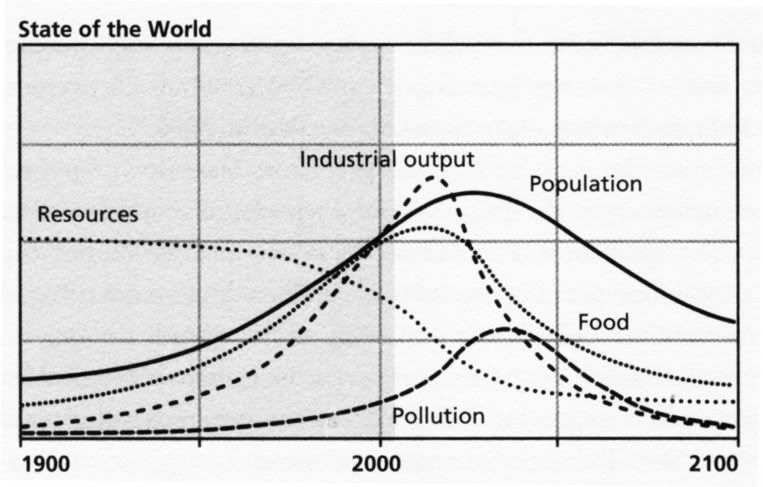

One of the things I bang on about is the systems interactions that go alongside oil decline. I found this link and although I think its simplistic and the dates are wrong, it does at least attempt to integrate a view of finance, energy and ecology.

http://stepsandleaps.wordpress.com/2009/11/26/the-collapse-of-civilisation/

Anyone found anything similar?

Nick has one:

http://www.flickr.com/photos/8745365@N04/2504887199

I too think the one at stepsandleaps gives us too much time. (Twenty-five years after peak oil the energy system collapses? The money will have dried up long before then.)

You might also want to consider the work being done by the world system modelers, including the Limits to Growth team:

CSIRO says we're on track for Scenario 1 (the one above).

http://www.csiro.au/news/The-Limits-To-Growth.html

Here is a podcast of the author of the study talking about it;

"Examining the limits to growth"

http://www.csiro.au/multimedia/Growth-Limits.html

And here is the paper itself:

http://www.csiro.au/files/files/plje.pdf

My best guess is that we are cresting the dotted line in the graph above.

Limits to Growth sits on my bookshelf, and Nick's timeline I've seen before.

The particular thing I was looking for was the explicit system cross-linkages between different domains, such that know changes in one force unexpected changes in others, which again feedback. I feel there must be more of them out there than I've seen.

For instance the collapse of the fairytale finance market has caused a curtailing in exploration/development that will induce a supply crunch in the foreseeable future. That will cause its own depression in various markets that will limit build out of alternatives, in turn making the supply crunch worse and probably destroying the global economic system ahead of any expected date.

Its these feedback loops that really interest me; connecting between domains where 'externalities' are usually considered as constants.

I think the key issue is international trade. As long as everything stays "hooked together," and countries selling oil and manufactured products let the US (and other countries) buy on credit, even though they don't have exports to support their imports, then things go along more or less BAU.

I think credit and finance is very much a part of all of this. If there are suddenly big defaults on debts, and as a result, interest rates rise, this could start a downward cycle. With higher interest rates, fewer will borrow, leading to both reduced production of goods (because of the need for cheap debt for investment) and reduced consumption of goods (credit card rate too high-> don't buy as much). More people will be laid off from work, and the situation will cycle downhill.

Oil doesn't look like it is part of all of this, but it is. If there were a growing supply of cheap oil, it would be possible to keep true economic growth going, and this would allow those borrowing money for investment to make money with the funds they borrow. The big defaults on debt would then not be as much of an issue. It is the fact that the US and others have been trying to hide lack of real growth behind debt growth for years that is now catching up with us.

Stopped by a friend's house this weekend. He asked me what I thought of the project that was funded by the stimulus package. I was confused; so he took me out front and showed me the re-paved road, the new lamp-posts, and the new utility poles. Until he pointed it out I wouldn't have noticed. Yet, a 1/4 mile further down the road the asphalt has gullies and bumps and cracks... and no plans to fix that.

Shovel-ready, but with no significant improvement.

In our area they've gone from aphalt back to the old tar-down method (as in Cool Hand Luke). They used to do it only on small secondary roads. Now I've see it being used on larger roads and highways. Can you spell DECLINE?

I had a new 9 monthold road repaved. They claimed they had screwed up the job first time around! A second version on the other end of the same road has removed about 1minute from my commute time. But I've loast a few hours because of construction delays, so it will take years before the time savings will make up for the delays.....

Concerning Black Friday and the Christmas Shopping season.

I didn't go to the malls on Friday but I did go Saturday and Sunday(yesterday). Here is what I observed in the largest mall within a 45 mile or larger radius). People come here from several nearby states due to our lower tax rates.

Saturday I had no problem finding a parking space. Even very close to the entrance to Dillards and Sears.

In side the crowd was about the same as the weekend shopping crowd used to be about 4 years ago. Never had to step out of anyones way. No trouble finding an open checkout cashier in any of the major store. The boutique storefront inside shops had some shoppers, mostly about 4 or 5. In all it was NOT busy. A fair number though.

Sunday. Quite a bit less shoppers. The parking lots were less than 1/4 full. Walmarts was as always busy but not appreciably so. The inside mall was not what I would consider a 'Christmas' season of shopping. Plenty of close in parking spots. Most all the 'handicapped' spots were emtpy. I have a sticker for my wife but I never use it to cheat.

I think many went for the bargains on Friday. Finding most were already so to 'ticketed' buyers and the biggies were already gone. Such as the cheap laptops. My friend got up at 3:00 AM and still got no laptop. So they had very few of them and what they had went to insiders from the way I hear it.

So I believe this to be a very slow shopping season. People are not dropping lots of money on frivolous purchases.

I think it could well be a blood bath for many storefronts.

Airdale

Friday and Saturday were busy here, but not badly so. Weekend before that the mall was dead.

T-day food shopping was another story. Long lines, sold out ingredients, and flaring tempers.

To generalize, I'd say T-day was "up", especially for home-cooked dishes (shortages of spices, fresh greens, canned pumpkin, etc.), but Christmas shopping is down.

Mostly that way for us personally, too. Fed about 20 on T-day, with an unusually large number of local unattached people and a smaller number of distant relatives. Most years people would come just before dinner and many would leave soon after to another engagement. This time we had a houseful from noon til 9. Ran out of drinks and turkey during Round 2 of eating. A nice change, really.

Things are not that different here-I'm reading the local papers these days more for what they are not saying than for what they are.They are spinning the shopping news the same way they are spinning the employment and real estate news.

I have been reducing my "Christmas shopping" expenditures towards zero for years by buying only practical and needed gifts.

This year I bought out a flea market guy's supply of good stuff-six pairs of nice binoculars, a bunch of fishing rods,a couple of pressure cookers, some tools.

Anybody who does not get one of these items as a gift will get a modest amount of cash and around here even the ten year olds have already learned to wait for clearance sales.

I've been buying the nieces and nephews only durable and useful gifts for years and the lesson has "took" to some extent at least as I remind them that the scooter or bicycle or telescope or basic tool set or computer program is still around but the movie tickets and pizza are gone forever.

Gifts. I picked up a woodburning kit and trying my hand at what I used to do in the Boy Scouts only more upscale.

So presents(a few) will be a photo transferred and reproduced via woodburning onto a piece of basswood or cedar. My wife claims indian ancestory so I will give her long braids and a headband on the project.

Cheap I know but well..........some real work in it.

Airdale-I'm doing my part for this economy then. Helping to crash it if at all possible. Like paying my debts off will be my Christmas present to myself. No more interest payments for the banksters.

Ooh, woodburning, what a nice hobby and perhaps a way to make a few extra bucks!

Last year the complaint was that people were shopping, but shopping for necessities. As my income has gone down with the cold weather, my spending has gone way down also.

I exhort people to go to an all-cash basis, since they'll spend a lot less - loaned money and credit card money doesn't seem as real, and it spent at something like 2X the rate.

I recently did a $100+ shopping spree at Wal-Mart, all projected necessities for the next 4-6 months.

I took care of the Christmas Consumption problem about ten years ago. I married into a jewish family.

was it worth it ?

Fleam,

A hint or two.

You could likely find lots of pieces of scrap lumber to use for woodburning. All it needs is a very smooth surface...afterwards you can 'distress' it as need be.

Sometimes leaving the surrounding bark on can add a lot of attraction to a piece,just like in woodcarving of faces,woodspirits,etc.

A good workable kit can be had at a hobby shop for about $12..and includes the three or four basic tips.

Some woodburning tutorials on the web.

http://www.nedraspyrography.com/PyrographyTutorialWoodburningfromA-Z.htm

Use graphite paper to transfer patterns,artwork,etc.

Good luck,

Airdale

I set a goal of having all my gift buying done before Thanksgiving this year, and I met my goal. I try really hard to stay away from the stores on "Black Friday", it only encourages them. . .

Instead, we went for a walk in my Mother-in-law's town (where we were visiting over the holiday), then we went with her to lunch in the local Senior center and met a couple of people we knew (we feel so much more comfortable around the older folks than the younger ones these days, we have so much more in common), then I stopped at the library to check e-mail and catch up on news a little, and then I spent a good part of the day starting to plan next spring's garden. Then we went back out to watch the community Christmas kick-off parade, such as it was. Then more turkey. Compared to fighting the crowds in the retail madhouse, there was no comparison.

I heard numerous reports of lots of guys out hunting for deer this year, and sounding like this time they really needed the meat and were counting upon it.

Saw this over at evworld.com.

Warren Watch: The electric car’s day will come, students told

Talk about rubbish. Of all the things to make a headline from. I would love to have read what Buffet had to say about "peak oil theory", "what would replace carbon fuel" and high speed trains but, no. I guess that would have been too much for the attention span of the Omaha World Herald's readership?

So, I follow up on the "Houston Chronicle reported" phrase and find a slightly better article here that at least clarified the context a bit. What motivates the Omaha World Herald to put out stories like this? What's the point? Why bother?

Alan from the islands

There was some discussion on that the day the Houston Chronicle article was published.

I noticed that as well. BYD's a bit on the ropes, their hottest seller is hybrid in no way, and their groundbreaking PHEV's a dud in the sales department. Hybrids are up .5% for total US sales - to 2.8%. What this has amounted to over the years in bumping up US fleet mileage is something I mean to look into. Cumulative to 2007 there were 515,917 Prii sold, for instance - in 2007 that amounted to .38% of cars, or .2% of cars+LDVs. That's pretty insignificant, frankly. And Prii were 55% of hybrid sales in October.

Thanks Leanan. I didn't even realize that this was just a rehash of what is turning out to be really old "news".

As for what Buffet thinks about depleting resources, a quick search reveals that is even older "news".

Alan from the islands

It's called propaganda. I wouldn't be surprised if the staff writing this stuff feel that it's their duty to try to deceive people into feeling optimistic and spending - like they are performing some altruistic service by lying.

The other day I tuned into NPR for the first time in a while, and there was a segment about how marketers were not doing a good job in targeting women - the gist of it was that somehow they were not properly attending to the desires of women and were doing them a disservice by not understanding how to deceive them into buying things they didn't need. As a society we are so inured to lying and deception that we actually see it as a virtue. Add in a big helping of ignorance, a poor education, and pressure from the conglomerate media owners, and what do you expect?

The Oracle of Omaha is just pontificating about how he imagines things will go in future, which if you're extremely rich will attract a lot of attention.

From a "put your money where your mouth is" perspective, he recently paid an enormous amount of money (even by his standards) for the Burlington Northern Santa Fey Railway (BNSF). This tells you where he really thinks things will go in future.

Look for BNSF to convert its main lines (notably to Chicago to Los Angeles) to electric trains (and buy the electricity from another company Buffet owns.)

In future, you may not be able to afford an electric car, but Buffet will probably make money from his private electric train system.

Energy and Capital weighs in:

NGVs, yawn. Download the .xls from the EIA's EIA Alternative Transportation Fuels-Historical Data: Alternative Transportation Fuels (ATF) and Alternative Fueled Vehicles (AFV) page. Table S1 says 1,134 CNG light vehicles made available for 2007, those would all be Honda Civic GXs, the only model available in both two states where it's retailed. This page linked on the GX wiki page says Honda is deliberately holding down sales of the things, skimping on any possible extras to cover the additional cost of using the NG: "Honda Suppresses GX Sales". Table C1 of the EIA doc says NGVs consumed 178,565,000 gallons of gasoline equivalent for 2007, thus 11.6 kb/d of oil saved. These things are really not ready for prime time. As with the monster Chinese stimulus not translating into out of control hybrid sales, all that dough T Boone blew on his PR campaign isn't turning the US into one big 3600 psi Happy Motoring fiesta. Chu has spoken and it's 1 million hybrids + cellulose to the rescue. CAFE on the side.

It's great that Staniford's back in the game, his latest post covers the transportation/GDP nexus and is a killer: Early Warning: US Competitiveness in a Tight Oil Era

Unemployed U.S.-born workers seek day-labor jobs

So much for the idea of jobs legal immigrants and citizens won't do...

My wife keeps telling me that citizens will never do the jobs that the illegals would take (kitchen work, cleaning hotel rooms, picking crops, etc). Back in 2007 that would have been true - people could earn more doing various other jobs.

But I keep telling her that if you have no income and no job, and have already lost the house, then that type of job is better than living in a cardboard box and starving.

Oh, we'll do 'em all right!

My life has been so far:

(1) Obtain a fixed location to live where I am Safe, Warm, Dry, and Fed.

(2) Obtain some sort of off-the-Matrix way to make money, at least 1/2 minimum wage.

(3) Obtain technical training that will make me theoretically employable.

(4) Get debt (unpayable if I lived to be a million) discharged through Chapter 7 Bankruptcy

(5) Try to find an on-the-Matrix job.

So far I am at (3) about halfway through. I should be an EMT-B in June. Then the BK needs to be done, then I can try for a "real" job. As I'll keep mentioning, I'm one of the very fortunate ones.

In the meantime, I've been peddling crafts and in the past, panhandled (yuck!). If my back was in better shape and I felt handier in a fistfight, I'd try the Home Depot stand-around route, but they don't seem to make any more than I do with my crafts.

Most people are stuck trying to consistently maintain goals ONE and TWO. That becomes the story of the REST OF THEIR LIFE.

I'd happily clean hotel rooms, shovel stables, etc. There's real money in these things, mim. wage at least! It's a bonanza! And that's why there are something ilke 300 people ready to fistfight for each job. I did hard physical work for 10 hours at a stretch in my 20s, I find my back and other parts of my body a lot less amenable to that now. But peddling crafts, peddling herbs and flowers, waving a sign for a store-sale as long as I get to sit a bit, and so on, are all very desirable jobs in my book. And in many Americans' books. Since I have to stay off of the Matrix until my chapter 7 is done, all the undocumented work by undocumented people is my kind of work.

I made $40 this weekend, horray for me! My plan for today is to go give some dumpster-scrounged Harley parts to a friend who can use them, and see if I can insinuate myself into becoming a replacement for a probably-illegal fellow getting $10 an hour or so for some work, it's doing wiring, and I'll work for $8 and know electronics and soldering and calculus etc etc.

The immigrants had just better be glad we Americans would stick out like sore thumbs down there and the immigration laws down South are stricter than ours, we'd be flooding in to do THEIR yardwork pretty soon.

Welcome to the 21st century. Why would you expect US citizens to get better jobs than other people from other countries who have equivalent education and experience?

It's one big happy planet we live on. The US ranks roughly 23rd in the world in terms of the the average quality of students it graduates. In the long term, expect to find them roughly 23rd in the world in terms of the average income they receive.

I don't think it's going to work out like that.

I think among the effects of peak oil will be the unwinding of globalization, and a drop in the value of an education. I don't believe education will be the key to success in the post-carbon age.

With a reduction in globalization the homogeneity and meritocracy of the global labor pool will drop, and likely this will permit peaks and valleys of income and wealth to persist, and even grow. Those lucky enough to be born into resource wealth will be relatively even richer in a world of increasing scarcity.

Sharing is local -- the key won't be that we'll see equalization or increased meritocracy at any scale, but that wealth will be highest where resources are relatively high and population is relatively low. Canada and Norway = Good. Chindia = Bad. North Dakota grain and shale gas = Good. Las Vegas people plus desert = Bad.

JMHO with overly broad black and white brush-strokes to boot.

Yes, I more or less agree...as long as the sparse population has the means to keep others out of their lifeboats. Whether it's via geographical isolation, military might, or some other means.

And I think the peaks and valleys are already growing. One reason the '70s Malthusians were wrong was that they expected wealth to be more equally distributed than it turned out to be in reality.

Paleocon;

Would you please "define" homogeneity and meritocracy for me so I can understand what you are talking about.

Homogeneity - the quality of being of uniform throughout in composition or structure

uniformity - a condition in which everything is regular and unvarying.

My point being that the world will be less uniform in the future than it has been in the past, from a competitive wages/wealth/opportunity perspective. And it wasn't that great even at its best.

Meritocracy - a system in which the talented are chosen and moved ahead on the basis of their achievement.

Latter point being that just because the 22nd-best-educated nation SHOULD perhaps make more money than the 23rd-best, does not mean that it will, because nothing says that wealth and income are based primarily on educational quality.

Fortune of birthright, access to resources, and guns will be the winning combination, as usual.

Exactly. The world won't be flat any more. People won't be interchangeable parts...which has advantages and disadvantages.

I suspect that there will be a law of diminishing returns wrt education, and it will become an increasingly steep curve. A little education will still be considerably more valuable than no education, though.

No, street smarts and crafty ruthlessness will rule the day.

Leanan - thank you.

Education is great. If you can get it without going into hock, do it! But what's likely to be useful in terms of a degree are very few things. Chemistry, medical things like doctor, nurse, that's about it. All the rest including electronics can be covered with a 2-year or vocational degree.

There will be degrees in theology, and a few things that are ever-present rackets, and always an enclave of serious scholars of history and The Classics, but the future is going look a lot like the American Revolutionary period, education-wise.

We have FAR too many people in college now and most of them are going into hock for this, it's not a pretty sight.

The key to success is going to be personal qualities, not a degree. The big secret is it's always been this way.

My aspirations have always been to be a Jack-of-all-trades. With military service and profesional jobs as well, I never turned down a job that I could learn something useful doing. Specialization never excited me much. Probably why I became known as a good troubleshooter in engineering circles. I could think outside the box, and systematically. I think this way of thinking will be useful. The guy that knows more than "one way to skin a cat" will go farther in the future. I did want to be a cobbler at one point. I think cobblers will be in demand. Reminds me of an earlier discussion on guilds and apprentices.

I have had discussions in the past with people regarding the question of how people learn problem solving. There are an incredible number of people who get the deer-in-the-headlights look when confronted with some sort of obstacle, and they are inclined to keep trying the same thing over and over again rather than try and think outside of the box for an alternative approach.

The consensus that we usually reach is that this type of thinking isn't something that one can easily teach. It is something you either have or you don't have. You cannot sit someone down in a classroom to teach them how to think outside of the box mainly because many students simply memorize and regurgitate and that's exactly the opposite of what you need them to learn how to do.

There is a book by deBono called "Lateral Thinking"

It teaches how to think outside the box

Con: It's written in a boring style

Pro: deBono has done a good deep dive into how the brain works and why to tend to get stuck in ruts and how to break out of those patterns