Produced Water, GOSPs and Saudi Arabia

Posted by Heading Out on December 20, 2009 - 11:04am

To the uninitiated the thought of a gas or oil well is one where a pipe goes down into the ground, and out of it flows either a steady stream of oil or natural gas, that is fed straight into a pipeline and then delivered to them (often at what they consider to be an outrageous price) with no further treatment. Or the crude oil that comes out runs straight over to a refinery where (with minimum effort and maximum profit) it is transformed into the gasoline or diesel fuel that they must then again buy at great cost in order to drive in to the liquor store to buy some beer.*

The reality of oil and gas production is considerably different, and fluid that comes out of the well is not the ideal that the uninitiated imagines. So today’s topic will deal with the initial separation of a couple of the parts. This is a part of a series of tech talks that I write on Sundays about various aspects of fossil fuel production. It is a relatively simplistic explanation which seems to fit most folks needs, though it also has considerable help from those with more technical knowledge who add comments.

There are three major fluids that come out of a well, and these are gas, crude oil and water. If the well is a natural gas one, the oil component will not be the heavier fractions that we associate with an oil well, but rather the higher end liquids such as propane and these are referred to as the natural gas liquids (NGL). NGLs include ethane, propane, butane, iso-butane, and natural gasoline. But today I am going to talk about the water.

Back when I first started writing about this separation oilcanboyd was kind enough to point me to the Produced Water Society.

The Produced Water Society is a collection of engineers and industry professionals with the common purpose to study and improve the separation, treatment, and analysis of Offshore and Onshore Produced Water with the goal to meet the discharge and reinjection requirements of the industry and the environment.

And just to be clear about what Produced Water is:

Produced water is mainly salty water trapped in the reservoir rock and brought up along with oil or gas during production. It can contain very minor amounts of chemicals added downhole during production. These waters exist under high pressures and temperatures, and usually contain oil and metals. . . . . . . The treatment of produced water is a major component of the cost of producing oil and gas. Wells may start out producing little water but sooner or later all oil wells produce a much larger volume of water than oil. The ability to efficiently and economically dispose of this water is critical to the success in the oil production business.

Back in April 2007, oilcanboyd quoted volume flows for the lower 48 US States as being 4.8 mbd of oil, 128 mbd of brine (the typical term for produced water). His number was considerably higher for the water than that offered by the Argonne report given below, though they admit that their count could be significantly under true values.

The changes in pressure, temperature, and the possible access to oxygen when the water reaches the surface, means that the water can precipitate out dissolved minerals and hydrocarbons such as paraffin, which can plug wells that are being used for disposal,

65% of the produced water generated in the US is injected back into the producing formation, 30% into deep saline formations and 5% is discharged to surface waters.

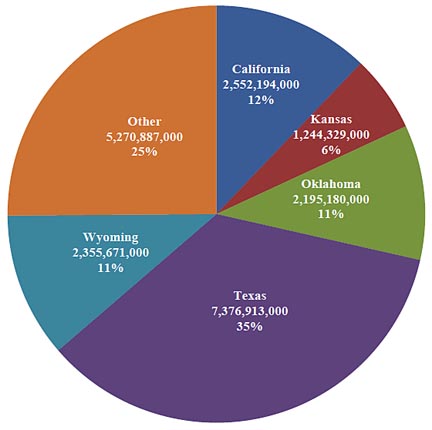

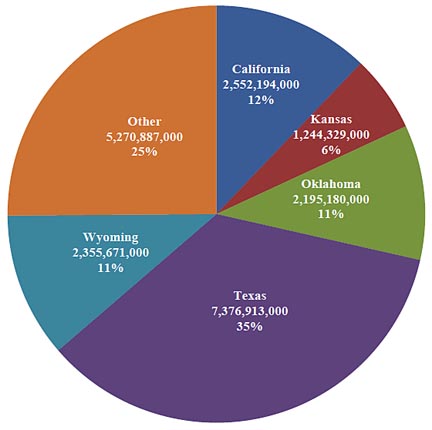

Argonne National Labs recently reviewed the status of this brine, providing not only a review of the process, but also the summary of conditions for each state. They show the relative volumes of water produced, in 2007, by the five largest producing states:

To try and give some sense of the scale of these numbers they point out that Washington DC and its local communities collectively use some 300 million gallons a day, which is only 13% of the amount of produced water that must be dealt with. The water comes from the roughly 1 million oil and natural gas wells that are still producing in the United States. Texas, while the largest producer of natural gas (6.9 tcf in 2007) lagged offshore in the amount of crude that it produced. The national average amount of water produced per barrel of oil was 7.6 barrels of brine, which produced about 87% of all the produced water developed. The average gas well production was around 270 barrels of water per mcf of natural gas. Some 59% of this is reinjected into the producing formations in onshore facilities (only about 9% offshore) in order to enhance production. These relatively large volumes that must be processed and disposed of can control the economics and life of the operation. As the Argonne report notes:

early in the life of an oil well, oil production is high and water production is low. As the production age of the well increases, the oil production decreases and the water production increases. When the cost of managing produced water exceeds the profit from selling oil, production is terminated and the well is closed. This is contrary to the typical production cycle of a coal bed methane (CBM) well. Initially CBM wells produce large volumes of water, which decline over time. Methane production is initially low, increases over time to a peak, and then decreases.

Because the US fields are, in the main, much older from a production point of view, than the average well in the total world, the average water flow is higher, and the report estimates that the global value is around 3 barrels of water per barrel of oil.

Because of the high salinity (generally greater than that of seawater) the amount of sodium and salt in the water make it difficult to use for agriculture (which has a very large demand for water in its own right). However in states where the water is reinjected to maintain reservoir pressure even the volumes available may not be enough, and thus one finds, for example in Alaska, that the 842 wells using this EOR used about 1 billion barrels of water in 2007. Given the recent controversy over the disposal of water from the development of the Marcellus shale in New York, it is perhaps interesting to quote the numbers for that state.

The most recent available report is for 2007. According to the 2007 data, 13,113 wells were reported to the division. Of the total, 7,387 were natural gas wells, 4,874 were oil wells, and the remaining wells were gas storage, dry holes, and solution salt wells. The database provided production volumes of 55,001 Mmcf for natural gas and 377,514 bbl for oil. The state-produced water volume was 649,333 bbl from active wells for 2007, which included 215,050 bbl that were associated with water injection wells.

Handling the water from these wells is thus not a small matter, especially in the larger production fields around the world such as Saudi Arabia. When Aramco decide to increase production from a field, or to add another field to their supply network, they cannot just drill another well, hook it into the line and see their exports increase. Because of the nature of the fluid that actually comes out of the hole, it has to be run, first through a Gas Oil Separation Plant or GOSP. Here the oil, formation water and gas that come out of the well together are separated, so that they can be piped to the different treatment plants. (And as a side point readers might want to look at some of the articles on oil production from Saudi Aramco World since they are written more for a family audience than a technical one.)

These plants are generally rather large--the one in the article treats 450,000 bd of oil--and they take considerable time to build, install and connect up. Thus when new production is planned one has to wait for the plant to be in operation before the wells themselves can be productive. The new addition at Khurais, for example, required a new central processing plant, and when Haradh Stage 3 began, it had to first have the new GOSP in place and running by the second quarter of 2006. Thus the production increments in the country are controlled by the rate at which these can be brought on line. In addition the older ones had to be upgraded, particularly in the controls for the system. (Side comment, though the KSA centralize their GOSPs, they don’t have to be that big. We have had an individual well unit hauled through our yard behind an SUV). But we’ll talk about them a little more another time.

Putting this all together the oil and gas industry have been handling, without significant public complaint, relatively large volumes of water for a considerable time. The processes are handled through the state agencies (which is where Argonne got much of their information) in a set of processes that seem to be under control.

* across the street, last week.

That full 25% of the pie not shown in the top 5 states fascinates me...is the breakdown pretty widely dispersed below the top 5, or pretty narrowly bound to a small number of other states...the dispersal of producing wells throughout the nation is fascinating...

RC

Not to nitpick but if 1 barrel of oil comes up with 7.6 barrels of brine then that is a total of 8.6 barrels of liquid. That comes out to 88.4 percent water cut. Not that it makes much difference but when applied to world water to oil production it makes quite a bit of difference.

3 barrels of water and 1 barrel of oil for every 4 barrels of liquids produced. That is a 75 percent water cut. Anyway I had no idea it was that high. Saudi Arabia, as late as 2006, was bragging of a water cut of only 29 percent.

Saudi Arabia’s Strategic Energy Initiative: Safeguarding Against Supply Disruptions

I am inclined to believe that this is just another gross exxageration by Saudi Arabia.

Ron P.

Ron:

Sorry to be late replying but I was traveling today, and it looks as though it may be a little more difficult to get to where I was going than I had originally thought but we shall see how the weather out East develops.

In regard to the top point the statement isn't that the 7.6 barrels of brine was 87% of the fluid produced, but rather that it was 87% of the produced water- which means that the rest of the produced water came from something else (such as the frac'ing fluid).

Westexas will tell you, in regard to fluid flow down there that there are wells that produce less oil:water than that, but as long as the net is profitable, then they will continue to do so. (Being on the road I don't remember the numbers but I believe I remember numbers where the water cut is in the high 90's).

Aramco used to have a lot of wells at around 33%, but the advent of horizontal wells and maximum reservoir contact wells has got them into a lower number for the moment. The thing with Aramco statements is that you have to very carefully parse what they actually said, but in this case I don't have a lot of problem with the general statement.

Thanks Heading Out, three questions:

1) Do you have any links to more detailed descriptions of how GOSP plants work?

2) How are the treated water and the removed contaminants used or disposed of?

3) You gave the world water/oil ration as 3. I remember seeing an ASPO conference presenter from last fall saying it was around 8. Do you know how the various estimates are generated? Any thoughts as to which is closer to the truth, or maybe they just confused the US and world values.

Thanks, Pragmatic.

Pragmatic, the gas will naturally boil out of the oil as the pressure is reduced. Once upon a time it was just released at the wellhead and flared off. Now it is released in stages as a different type of gas is released with each stage of decompression.

The water is just reinjected.

Don't know about the water cut. I would like to see that answer also.

What Are Gas Oil Separation Plants?

Reinjection Plant

Ron P.

I felt that the post was going to be too long to get into the GOSP itself and what happens downstream so that will come in a later post - sorry!

Thanks for another great report, HeadingOut. If the average "drill here, drill now" guy or gal would take the time to educate himself/herself about even a fraction of what you've covered in these reports on TOD, maybe we'd begin to see a little more civility in the public discourse about energy, geopolitics etc. I'm not going to hold my breath, though.

Saudi Aramco World is indeed a nice little publication, isn't it? You're spot on when you note that it's written at a very readable level, with a minimum of techno-speak.

Many thanks for this series of articles.

Can you tell me what happens to all the sulphur in the oil? Presumably some of the initial gas released is hydrogen sulphide and sulphur dioxide. What happens to that?

And when the Saudis refine their high sulphur crude what do they do will all the sulphur?

Hydrogen sulfide yes, sulfur dioxide no. Sulfur dioxide is produced by burning sulfur. Burning high sulfur coal or even burning oil with sulfur in it will produce sulfur dioxide. From Wikipedia: Since coal and petroleum often contain sulfur compounds, their combustion generates sulfur dioxide.

Also from Wikipedia: Hydrogen sulfide is obtained by its separation from sour gas, which is natural gas with high content of H2S. It can be produced by reacting hydrogen gas with molten elemental sulfur at about 450 °C...

Small amounts of hydrogen sulfide occur in crude petroleum but natural gas can contain up to 90%.

The Saudis take the sulfur that was removed during the refining process, heat it into a liquid. They have huge towers that look a little like silos but are made of metal. There is a rotary sprayer at the top of each tower. This sprayer sprays hot liquid sulfur and as it falls to the floor it cools forms into small pellets. This called the "pelletizing process" The sulfur then can be shoveled and loaded on ships like grain.

True story: While I was in Saudi, 1980 to 1985, an incident happened at the sulfur pelletizing plant. They were supposed to shake down the tower every few hours or so to remove caked sulfur from the walls of the tower...but they forgot. Then they proceeded to turn on the shaker but someone realized this was a very bad idea. Too late. They all ran and got out just in time. The excess sulfur dust filled the tower, somehow ignited, and blew it to smithereens. Fortunately no one was hurt but the pelletizing tower was destroyed.

Ron P.

A bit OT but the Minimal Housing Group at McGill University some 40 years ago built some houses from waste sulphur ---- interlocking blocks site manufactured. Sulphur melts at a low temperature so could be moulded easily and accurately and then stacked (think Lego). Some problems with freeze cycles etc. I haven't a clue where this is now. I thermal transferred ink onto molten sulphur tiles as an experiment -- worked easily and well using newspaper comics.

I wonder if you could find those houses by their smell. I read somewhere recently that the human nose is sensitive to sulphur at the level of parts per trillion. A very useful adaptation since hydrogen sulfide is a pretty good indicator that the food you are about to pop in your mouth is rotten.

The human nose is sensitive to H2S at very low concentrations. Pure sulphur has almost no smell.

I don't know if there are bacteria that can convert pure sulphur to H2S - if there are, those houses could become uninhabitable very quickly.

H2S is very much more deadly than cyanide.

Tonu - you piqued my interest with that comment, for others here is an article result from a quick google search:

http://vads.ahds.ac.uk/diad/article.php?year=1973&title=296&article=d.29...

1973, and in a part of Canada with cold winters... viable in a constrained future??? we may have to dig up their research and put it to the test yet...

Thanks again Tonu!

Rabbits! That's the problem with being on the road, I can't post some of my pictures of the start of the sulphur pyramids that they are building up at Fort McMurray. It depends on the market what it can be used for, some goes into sulphuric acid, but if the market isn't there you pour it into blocks and make a big pile and who knows a million years from now someone will be writing papers about the strange religion that build pyramids out of sulfur.

(But if I can't show my pictures, there are always those from the japanese .)

Oh, and thanks for the kind words, but it is the input from those who actually do what I write about that makes the series so valuable.

Thanks again for this series, HO.

Question: do the GOSPs ever have to deal with emulsions? Are there natural surfactants in the produced liquids? Or do you have liquids with manmade surfactants as a result of enhanced recovery techniques?

DYI - Emulsions do happen. In time you can break down the emulions mecahanically to a degree. But time is geneally your enemy in the seperation process. Thus often chemicals are used. Runs the operating costs up but that's better then ramping up the facilities.

I wish I had more time to write about production equipment. That’s where I live. Very basic, the oil, gas, water, and sometimes sand enter a hydrotreater. The flash gas compressor takes suction from the hydrotreater to remove the gas. The hydrotreater normally will have an electric grid that helps to corral the gas at the top of the hydrotreater. The gas is drawn off and flows to the flash gas compressor. The water and oil separate in the hydrotreater. There’s usually two hydrotreaters and sometimes three to separate the oil from the gas. The velocity of the fluid as it passes through the treaters is critical since if flow is too high there will not be enough time for the oil and water to separate. The water is drawn off for further processing. The sand is separated in the sand separators and bagged for deposit ashore. The oil is processed to get the salt down to specification. Nalco, one manufacturer who fabricates different kinds of production equipment, has a very good web site to visit. They include flow diagrams.

Thanks for the great series Heading Out! A couple of questions about GOSPs:

1) How much energy does this process take, both the separation and re-injection, in terms of the energy extracted?

2) Is there a production bottleneck now at the GOSPs, or is one anticipated as water cuts rise?

Hopefully someone else has a better feeling for the first part - though it generally isn't a lot (I'll try and remember to address this in the GOSP post) but in regard to production bottlenecks it is a matter of scale. For some of the larger ones the system is sized to deal with certain proportions of flow and if there is a change in the composition of some significant size, then the plant will need to be modified, and that takes time. Thus it is sometimes easier, when you are tapping from a number of wells, to try and adjust flows to keep within the OGSP initial design tolerance for as long as you can.

With about a 75% average global water cut its tough to believe we are at even 50% of URR. I'd argue water cut is a far better measure of final URR than production as your for all intents and purposes done once water cut passes 90%.

Next of course extensive use of horizontal drilling will supress the rate of increase in water cut and keep production high at the expense of a rapid increase in water cut later. Give that horizontal drilling has been in increasingly widespread use since the 90's and field life times of 20-30 years are common one has to imagine that later is now.

http://www.roxar.com/oilinwater/

This suggest that water cut is increasing at 5% ever ten years. Assuming globally that somewhere past 80% water cut global oil production will be significantly lower than now suggest we have at best about 30 years of oil production left on any significant scale with perhaps 10 or so anywhere close to the current production levels. The logistics of handling the water alone would suggest oil production must decrease signficantly as water cut increases outside of other factors.

Assuming something around 80-90 years for our oil age and using the above range of 10-30 years of significant production left puts us in the range of 70-90% depleted depending on when one would define a oil based economy as uneconomic. The simple HL method predicts peak to often be around 60% of final URR. It makes quite a bit of sense to assign at 10-30% boost for production from technology advances aka the super straw effect. At the well level a ten fold increase in production vs a horizontal well is common. At the field level and over time this is of course offset by faster decline rates say 50-75% faster so and overall improvement in the rate of extraction of 10-30% seems reasonable.

Thus I simply don't see the oil age lasting much more than ten years and this has nothing to do with cost but simply the production levels will fall to the point that and economic system based on oil is simply not viable at any price.

Ignoring how we got in our current economic situation it should be intuitively obvious that we can never reach the heights of 2004-2005 no matter what happens. Oil is already hovering strongly around 70 an economy boosted either naturally or via blowing another bubble to the levels of 2004-2005 imply a much higher real price of oil using todays prices as a sort of baseline.

Indeed from their lows at the beginning of the year we have seen oil prices double even as the real economic situation of individuals has deteriorated significantly over the same time period. Economic growth at say 5% given we are seeing rising prices with a deteriorating economy imply extremely high oil prices that would be difficult to even predict.

In short its impossible to ever again reach the last heights we are effectively permanently mired in a shrinking economy. Given the tight coupling between the economy and oil it intuitively makes sense we are much close to the end regardless of official announcements. From water cuts to deficits the entire system seems on review to be in its last ten years if that.

In fact how long we stay in a economic situation similar to the last decades is probably measured in months not years. This does not mean necessarily that a deep crash is months away but a rapid divergence from a situation resembling the past could well happen in a matter of months not years. This could be high oil prices collapse of a large weak economy, war etc etc or a mix of a number of serious situations including calico swans. In short any critical review tends to suggest we simply don't have much time left for anything close to BAU and further out but not all that much further even maintaining our economic system in a crippled state is doubtful.

If we did have plenty of oil left say 50% or more depending on when you put peak oil it just seems to me that we would be able to last longer i.e conservation should readily extend the oil supply. Even more aggresive use of technology should slow the decline. Time would exist to bring our economic system back to sanity and indeed one should wonder why it went insane in the first place. Our rulers are greedy but far from stupid.

My own conclusion hopefully backed up by a paper when its succefully translated to english is that peak oil is well in the past we are already well down the decline slope for oil production and both oil production and the economy are crashing in tandem. The insane housing bubble was a desperate last attempt to keep things going against the relentless fall in oil production. Thus all the variable are indeed tightly coupled not independent.

Water cut was the first smoking gun that lead me to start questioning the facts sense then I found another independent measure in perfect agreement with the above scenario. Thus two variables water cut which is not understood by the public and thus not considered a political number and my second which is independent of political taint give the effectively the same conclusion.

Coupled with our economic system both suggest we are rapidly approaching the end of anything resembling BAU and economic collapse and insanity did not proceed the collapse of oil production in fact they occurred simultaneously in a tightly coupled fashion. Indeed this global economy was built on high volumes of cheap oil so it only makes sense that it will end when both are no longer true.

Nice wrap up Mel ! "Calico swans" ? LOL Make my day !

Thanks.

I've been doing a spin dection program for a while.

I just happened to hit on one of the best written spin pieces I have seen to date.

http://www.marketwatch.com/story/opec-has-its-wish-but-it-wont-last-for-...

This is going to be tough to beat the quality is outstanding !

I'm surprised why people still believe anything they are told.

Also came up with a killer quote tonight.

http://peakoil.com/current-events/weekly-us-petroleum-and-ng-supply-repo...

If that does not make it onto a TShirt or bumper sticker then I'm losing my touch.

LOL XL ! Always felt that you are way ahead of the curve of the ordinary PO crowd ;-)

One more thing :)

The problem with Taleb is he assumes our inability to conceive of something actually matters. Black swans by definition are something we did not think could exist.

He is full of shit. What we think does not matter one bit. The truth could care less what people think. Humans have this concept that if they cannot conceive of something it is simply not real. Yet math tells us that our ability to understand means zero in the mathematical sense.

As and example a asteroid hit the dinosaurs even thow they could not even develop the mental capacity to understand the event. For them it was a black swan event.

We know about the possibility therefore and asteroid hitting the earth is not a black swan even given Taleb's definition. In both cases your ability to understand had zero bearing on the event.

To even consider that its relevant is the height of stupidity the smartest people on the planet if that believe they know anything are the most stupid.

Most people think like he does and the collective problem is obvious i.e as long as you believe what you think you know matters your pretty much assured of getting creamed since the "black swans" are simply a figment of your unimagination. Your inability to grasp the concept of being unable to understand ensures you will meet your asteroid. Call it a black swan if you want but your naming scheme is irrelevant your just a stupid dinosaur.

I know I am a stupid dinosaur and with that I'm assured to be slightly smarter thus I am not one. In excepting this you gain a minute level of true intelligence just a bit higher than the rest but just making it off zero is a bitch few make it that far. I can't even imagine what making it to 1 is like simply being not zero took half my life.

Your conspicuous knowledge, longanimity, visceral wisdom and training submit made for a grapheme aggregation with lots of techniques which were leisurely to see and do . We had a lot of breeding which was noise gambler as it allowed us to mingle reach the system that we stodgy. I perception presumptuous to practicing what I learned. Way to go - thanks a mil for reaching so far!

Sara

Sydney Flights

Intresting response I'll try and decode.

I've for example specialized in web browers for embedded devices and most of the time get paid for this "knowledge".

However it rests on top of a huge pyramid of assumptions and "knowledge" i.e my worth is based on the full underpinnings of the entire edifice of what people think they know. Collapse it and what am I ?

Smart enough to know not much but thats about it.

Enough dunno.

Does it really matter ?

Not really if I can keep my kids fed and my family happy thats enough for me.

My three year old decided to shave the cat the other day and she seemed to enjoy it and let him do it.

What more do you want than a cat allowing itself to be shaved by a three year old ?

By definition its a black swan but its actually something we forgot about called life.

memmel - you are not omniscient - that is spam.

memmel,

I think that was a paisley swan. IOW, spam.

LOL and I was willing to try and make sense out of it :)

What the heck I was on a roll last night. I just think innate human arrogance is a big problem. We intrinsically feel we are the center of the universe.

Its a real problem it has nothing to do with being right or wrong but believe your right or wrong and worse that your belief somehow matters.

Its hubris if you will and it seems to be at the heart of many of our problems.

Even overpopulation can be attributed to the poorest people believing they can raise at least some of their kids to the age those kids will care for them.

Maybe the can maybe they can't but they believe they can and they believe it matters. Its something intrinsic in human nature and when you average it at the group level its almost always has a poor outcome. Opposing this is of course the traditional village/clan where the group is able to overcome this individual hubris. I really think that stable human society must have a clan/village basis to allow the safety net of the clan/village to deflect and absorb this individual centric view point. And not just physical villages but true fully independent groups with only the loosest connections to larger authority groups.

I don't think its a optional structure i.e we simply cannot have stability without the formation of larger close knit groups of a few hundred people.

Neighborhood, clan, village, extended family etc etc. This group level is a must.

@sara: Is that a fake dyslectic ? :¦

memmel -- Water cut may be a good generalization but like everything else there are exceptions. I've studied a series of Texas fields which have cumed over 2 billion bo. But due to the high viscosity of the oil they coned water (premature water production) within the first year. Most are now in the 98%+ water cut stage. In general about 80% of their URR came at water cuts of 70% or higher. Thus it took over 40+ years to deplete these fields. Granted these may stand as exceptions but it also highlights the frustration with the lack of detailed info we have on OPEC fields. Even in unusual cases as I just described you can still make pretty good projections once you've established the production profile. Of course, the downside of the possibility that some of the mega fields suffer the same dynamics is that while their URR might be higher then suspected it also means it will take a much longer (slower production rates) to make that extra URR. And, as you know so well, it's the max daily deliverability and not the URR that's critical to the world economies.

Agreed, but this occurs with relatively light oil as well. I have a small fractional interest in a well that has consistently made 30 barrels a day at only a one percent oil cut [99 percent water], that has been flat for 15 years. The oil produced is about 40 API. The well [and several surrounding wells] was developed in the 80s to produce from a reservoir with a massive water drive that had been drilled and produced much too rapidly for optimal production back in the 1930s.

The theory when we bought into that deal was that other cased holes owned / sold to us by that operator in that area had similar or better potential giving us considerable upside. As to the other cased holes, we have made some wells, but so far very complex geology has prevailed over hope.

RW -- Do you think you might have high residual oil sats between the producers? That's what been proven with my high vis oil.

Rockman, we don't have the logs to demonstrate it, but "yes" at least in a relative sense.

The 1980s redevelopment wells were spaced to avoid the residual coning effects from the old producers [which were produced way too fast.] These 1980s wells started life with small REDAs and quickly worked their way up to the 250+ horse power class in many cases. Accordingly, there is good reason to suspect that the previous operator made the same mistake [and for the same reasons] that they did back in the 1930s.

Sticking with beam pumps or maybe small REDAs would probably have recovered more of the oil in the top few feet of the formation between the producers, but disposal wells were drilled as part of the redevelopment program, so the previous operator was never that strongly motivated to keep the water cut low. Oh well, but then again bad choices by the previous operator are the reason it is still producing for us.

Always good to put out the 'max daily deliverability' reminder. It can get lost, especially when a blizzard blows in. Thanks ?- )

Even given exceptions its too high an rising. In your example its a constant.

Thus if it was just the fact that a lot of oil fields produce a lot of water naturally then we would not go from 70-75 over a ten year period.

In general as far as I can tell fields with high water cut either naturally or from pumped water tend to produce at a steady low production rate for a long time and probably eventually have both a high URR and a low decline rate.

This suggests that for oil there is a very long and relatively fat tail well out into the coming decades. Look at the US which produces about 2mbd from small marginally profitable wells at high water cuts. Assuming at some point such small operators are feasible for other fields then we would at least see some of this at a global scale. Given the nature of oil production outside the US and also the location of a lot of fields its hard to believe that they will be produced in a similar manner.

Also of course in the US you have a large number of fields produced at a loss.

Plenty of oil thats eventually not even marginally profitable is produced every day.

In fact the fact that such and old tired province such as the US can on average profitably produce more oil suggests its competitive with the rest of the world. Back when the US peaked and we first attempted to aggressively extract cheap imported oil eventually crashed the US oil industry.

Now the production of these marginal barrels is competitive. Same for that matter for ultra deep water etc. This is in my opinion a situation that fits with the world being at 50% or less of its URR. Our real percentage has to be higher. Heck even public sources admit to acceleration in the natural decline rate. And a lot of whats left is locked up in steady but low production rate high water cut recovery. Using the US as and example it seems 50% is not a bad guess and thats being very generous as other large producing regions simply are not in peoples back yard.

So assuming we are now at 75% of URR and 25% is left and 50% of that 25% is not recoverable at today production rates that leaves 12.5% as a guess at the URR of fast oil or about 250GB our around eight years at our current rates assuming a URR of 2000GB.

Obviously when prices rose a tremendous amount of investment poured into the oil industry and they also made large profits it simply did no good all the money in the world is simply not going to increase production rates.

Its simply not a healthy industry just peaking or before peak in production and its customers or better addicts are now doing well either.

The only information that suggests we are near or not at peak is information from oil produces themselves thats for public consumption. Other information thats assumed to not be of public interest from global water cut to Ghawar papers is far far less rosy. Heck Tanker rates today are in the toilet you could rent a VLCC as a party barge. Investment has collapsed. Refining capacity is way beyond whats needed now etc. You can believe the spin or you can decide way to much evidence points to a industry well past its peak and facing a steepening decline rate and worse throwing money at the problem does no good. All the money in the world simply is not going to change the production rate of a bunch of watered out fields by much.

Finally all you really have to do is look at all the data but ignore production and reserve claims. If you do so I can't see how you cannot come to the conclusion that the oil industry is well past its prime and probably facing ever accelerating decline rates. As far as I know any industry that extracted a finite resource has followed the same basic pattern of peaking in production declining and thence seeing high prices which where unable to influence production rates as the decline was intrinsic.

For renewable resources such as crops its even more obvious if weather conditions result in a poor yield you get a poor yield period. The agriculture industry can do nothing to prevent it.

I very much agree with you about future global production not matching US history. As I said earlier, if ExxonMobil had owned all the oil prodiction in the US we probably wouldn't have half as many wells producing as we do today IMHO.

That's very likely true, based on the history of the company. When the old Standard Oil Company monopoly was broken up into 20-odd separate oil companies around a century ago, the largest piece was Standard Oil of New Jersey (a predecessor of ExxonMobile. Note that Standard Oil -> S.O. -> Esso -> Exxon.)

Within a year, the value of the 20-odd separate oil companies was double the value of the original Standard Oil, and the big winner was monopolist John D. Rockefeller, CEO and largest shareholder (although he still was P.O.'ed at the government for breaking up S.O.)

One of the pieces was Standard Oil of Indiana, a predecessor company of today's BP. They had invented thermal cracking (i.e. high-octane gasoline) but the Standard Oil monopoly wouldn't let them put it in production. Within a year of the breakup, S.O. of Indiana had the world's first thermal cracker up and running, and was producing the world's first high-octane gasoline.

S.O. of New Jersey resisted the trend to high-octane gas, but it was inevitable. Everybody wanted it because it ran better in their engines. It used to severely annoy the CEO of S.O. of New Jersey that he had to write a huge royalty check every year to S.O. of Indiana for the use of the patents. They tried to argue that as the senior company of the old S.O. monopoly, they should have the right to use them for free, but that didn't convince the judges.

Standard has left quite a legacy, I never read much on it just pick up bits and pieces now and again. I believe Rock's comment had more to do with the current situation where a very large number of stripper wells now producing rather meager individual outputs for lots of small time operators is not something that would be brought to us by sole ownership of all the wells by and outfit like ExxonMobile or any govt. for that matter.

Off this topic: Sorry I couldn't get back to carry on our earlier discussion on Himalayan glaciers, but it would seem one should be cautious when making comparisons to the Holocene Optimum, it doesn't seem too much of a stretch to assume that the big ice sheet melting in eastern North America back then created climate conditions that are not in the cards for a polar temperature ramp up that doesn't have that huge mass of ice to contend with.

I offered the example of Standard Oil of Indiana inventing thermal cracking as a case in which a smaller, more agile company is more effective than a big, ponderous monopoly at pursuing market niches.

If the US had a state oil monopoly like PEMEX, it would have run out of oil long ago. If Mexico had thousands of little oil companies like the US, drilling up all the available prospects at minimum cost, its current decline in production wouldn't be nearly so rapid.

Developing Mexico's giant 19 billion barrel Chicontepec field requires drilling far more wells at lower cost than PEMEX has ever drilled before, and the bloated state monopoly is not efficient enough to do it. They're going to lose money on every well.

I just didn't connecet a predecessor to BP with smaller and more agile (I'm of course more familiar with the BP of the slope and the heavy handed colonial style politics with which they deal with our overmatched state gov), though I did have an inkling that was why you brought up that example, thanks for the clarification.

One hears little good about Pemex. Do you think Aramco will show similar inflexibility when their fields hit the skids or is the management and/or field geology so much different there the no comparisons can be drawn?

The problem with S.O. of Indiana (later Amoco) was that they ran out of oil in the US Midwest, and had little success exploring internationally. The fact that they were really good at refining it if they found it didn't help much. As a result, they were bought by BP, which did have a lot of international success in finding oil. BP was a major beneficiary of heavy-handed British colonial style politics in getting access to Middle Eastern oil, and later to British North Sea oil. After that, they just bought up American oil companies.

I doubt that Aramco will do much better than Pemex when their oil wells start sucking nothing but water. They still suffer from being a huge, inefficient company which is used to having large amounts of surplus revenues, and those don't do well at eking the last dribs and drabs of production out of oil fields at minimal cost.

Like Pemex, Aramco has one monster field that accounts for most of its production, and a bunch of others that theoretically have a lot of oil, but have serious technical problems in getting it out. Once their one good field goes bad, life becomes much more difficult for them.

"The average gas well production was around 270 barrels of water per mcf of natural gas."

i think you mean 270 bbl of water per MMcf.