Simple mathematics - The Saudi reserves, GOSPs and water injection

Posted by Heading Out on April 9, 2007 - 10:30am

I thought that, with the indulgence of the more technically qualified of the commentators, I might take a little time to explain in my own way, some of the many issues that were debated here at TOD over the past week. So, this post is going to be a little bit of a simplified technical explanation of some of those issues--and I will try to bring in some of the comments explaining the issues that appeared somewhat far down the list in our comment threads as well.

But first there was an interesting piece of data that I hadn’t seriously noted until I saw the article. It relates to the actual size of the reserves that remain in Saudi Arabia, a subject I usually shy away from since production rates are more interesting. However, given the numbers it is worth consideration and debate as to what these particular values mean.

Just recently there was a Conference on National Oil Companies that was held at Rice University. And given the recent debate that we have had on these pages relating to Saudi reserves, I looked up the pdf paper on Saudi Aramco . Those that have been reading some of the debate might therefore be as intrigued as I was to read the comment on Saudi individual field reserves.

Although Saudi Arabia has approximately 80 oil and gas fields, more than half of its oil reserves are contained in only eight giant fields in the Eastern Province in the northeast part of the kingdom. These eight fields include Ghawar (the world's largest oil field, with estimated remaining reserves of 70 billion barrels) and Safaniya (the world's largest offshore oilfield, with estimated reserves of 60 billion barrels). Ghawar's main producing structures are, from north to south: Ain Dar, Shedgum, Uthmaniyah, Hawiyah, and Haradh. Ghawar alone accounts for about half of Saudi Arabia's total oil production capacity. The six other fields with substantive reserves are: Abqaiq (17 billion barrels); Shaybah (14 billion barrels); Berri (11 billion barrels); Manifa (11 billion barrels); Zuluf (8 billion barrels); and Abu Sa’afa (6 billion barrels).

(Source - “Saudi Arabia,” Arab Oil & Gas Directory 2005 (Paris: Arab Petroleum Research Center, 2005), 372.)

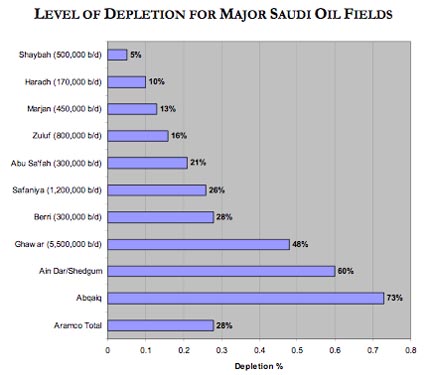

The paper also gives 2004 depletion rates for the various fields, using the same numbers that have been quoted from the CSIS debate between Matt Simmons and Saudi Arabia.

Now what is interesting is that if you take the depletion amounts that Aramco report, say 73% for Abqaiq, and you look at how much has been produced, in this case about 8.5 billion barrels, then what is left is the reserve. This is not complicated arithmetic – it comes out to 8.5 x 27 / 73 = 3.1 billion barrels. So when we are told that Abqaiq has 17 billion barrels left (which is more than it started out with) it seems not unreasonable to ask where ? It becomes more logical to suggest that the numbers that Aramco have been citing, such as those given above, were the reserve size anticipated when the field was developed, rather than that remaining in this point in time.

Because, by their own numbers, there is less than 3 billion barrels left. The same arguments, as I recently noted, also apply to Northern Ain Dar and probably most of the other fields. For Ain Dar my very rough initial calculation suggested that they were 70% depleted, a calculation made some 3 years after Aramco had said that they were 60% depleted, and with an assumed 2% a year consumption of the remaining oil since that time.

(The conference papers look as though they deserve more study, since they also cover China, Brazil, Russia, Nigeria, Norway, Iraq, Iran, Indonesia, and Venezuela.)

OK, let me now wander a little nervously into the debate on Ain Dar, and the production potential for the next few years from that field. I am going to try and be a little simplistic in my descriptions, but will try and note that as I go along.

The northern parts of the Ghawar oilfield is, as Stuart and Euan have illustrated , a little like a mountain range, in that it is higher in the center, and falls away on either side, however, the slope of the sides is much more like that of the beach down on the coast, than it appears in the pictures, because of the way that the scales of the pictures have been drawn. And one of the major points of discussion last week was exactly where on that beach we were standing, and how deep the tide had already become. When the field was first developed vertical wells were sunk down through the roughly 200 ft thick layer of oil bearing rock, and, under the pressure at which the oil was confined, flow rates of up to 15,000 bd per well were achieved.

However, as the oil flowed into the well, so the pressure confining the remaining oil within the rock also began to reduce, lowering the rate at which the oil was produced. In order to keep the pressure up, Aramco then began to inject water into the rock, hoping in this way to replace the oil being removed, and thus keep up the pressure.

Originally they did this by injecting water into wells that surrounded a production well, creating a localized stability, but they soon realized that this was not efficient, and so they switched to injecting water into the wells that were on the outer edge of the field, adding the water at the bottom of the well so that it flowed under the remaining oil in the field, helping to remain at pressure, so that it would continue to flow into the well, and displacing some of the oil as the water penetrated the rock.

Picture shows water flowing horizontally into the rock from the injector well, despite some easier paths through the rock that would carry it selectively higher, if not controlled.

(And as a small technical point I believe there is a slight erroneous assumption in the paper that started the whole Ain Dar discussion – when using seawater as an injected fluid it will enter the rock at a lower temperature, and cool the rock and oil in the vicinity. Since the ability of water to interact with the oil:rock interface is temperature dependent – see among other things the post on the oil sands , assuming that the residual oil behavior around an injection well is equivalent to that in the reservoir is not necessarily correct.)

Now it depends on how easily the water will flow into the rock and how the relative cracks and fractures are in the rock, as to where this water will go. If the bedding planes and fractures are relatively horizontal (as in the picture) then the water will flow out relatively smoothly under the oil filling in the voids and holding the pressure. That is the case here, in general, and so the pressure in the oil reservoir was relatively well maintained, and the production pressure was maintained to hold the pressure, and keep the flow going to the well. (If the cracks run more upwards or vertically then the water would not get very far from the well but would give a column of water rather than a sheet – more on that later).

However, for the deeper wells on the outer part of the reservoir, the water level would start to rise. Simply we are going to assume that the rock above the water level produces oil, and that below it produces water. This isn’t quite true but it makes it easier to make the point. Let us assume that the well is drilled through 200 ft of rock. Then after the water has been injected for a while the bottom 50 ft is flooded. Now the well is making 50 ft of water and 150 ft of oil. So that the fluid that comes out of the well is 25% water and 75% oil. This is acceptable since, as I mentioned the other day, the fluid flows to a common treatment plant called a Gas Oil Separation Plant (GOSP) that can separate the gas, water and oil into separate flows. It is normally set up to handle a mixture within a certain range. (For the sake of the example let us say 25 – 50% water).

So as the water continues to rise, because the field is rising toward the center of the bow, so more oil wells begin to encounter water in their lower regions and those on the outside of the field see the water content (cut) still going up. Now at some point the water from a well will get to be more than 50%. If the GOSP was just treating that one well then the GOSP would have to be shut down and reconfigured to handle the higher water content. But because the plant is taking oil from a number of wells going upfield the overall average can be kept within the GOSP operating range, and oil can continue to be recovered, as the remaining oil column in the outer wells gets shorter.

However there comes a point when just too much water is coming from too many wells into the GOSP, and at this point Aramco goes into the well, and lowers a plug of concrete down into the well, to seal off the lower portions of the well. Now the producing portion of the well will still shrink, but considers what happens if, for example, the plug had been set 80 ft. below the top of the reservoir rock. The overall production from the well will drop from say 2,000 bd of fluid from the original 200 ft long well, to 800 bd of fluid from the remaining 80 ft. But if the plug has been set at the water line (the oil water contact or OWC) then now the 800 bd will initially be all oil, rather than the flow being 60% water and 40% oil.

The downside to this is that now as the water level rises the percentage water in the mix goes up much more rapidly. A 10-ft rise in water level from 20 to 30 ft changes the water cut from 25% to 37.5%, rather than from 60 to 65% had the well still been 200 ft thick. And so the well will only be useful for a limited time, but that does allow more oil to be recovered.

This is further helped if, as they have started to do in Ain Dar, the wells that are drilled later in the production cycle are drilled horizontally near the crest of the bow-shape. These horizontal wells will produce oil with almost no water, and thus, in balancing these with wells producing say 60% water (and equivalent flows) then the average water cut going into the GOSP would be only 30% and the plant could continue to operate efficiently. (Bear in mind it is set up for a lower as well as an upper water cut level).

Now lets go back to that illustration that I added up near the beginning. You will notice that the rock model has cracks in it that go up through the rock at an angle. These are easier paths for the water to follow, and thus, if proper control is not applied, the water can move more quickly through these than through the rest of the rock. If, at the top of the layer that water reaches a horizontal well, prematurely, it can flow sufficient water into the well that the mix drops below the oil levels needed for economic return. At that point any oil remaining in the rock on either side of the cracks will be lost, as the wells shut down. This is why a skilled level of control is required to manage the movement of the water through the rock, trying to keep the whole OWC relatively horizontal, so as to get the most oil out of the rock.

So far it seems that at both Ain Dar and Abqaiq Aramco have been able to keep this flood under good control for some years as the water has migrated through the field, and the oil has been recovered. However, in the sense that the water is replacing the oil, it should be born in mind that unless there are water breakthroughs, then the arrival at the horizontal wells will be after the remaining targeted recoverable oil has been removed. However, as a precaution, this is why the more recent maximum reservoir contact (MRC) wells have valves in them that can shut off the flow from the lateral branches that sprout off along the length of the horizontal well. In this case, should a lateral start to make a high water cut because of water breakthrough into it, the valve can be closed, and only that flow reduced. This has been found to work.

At last count the recoverable oil still left in Northern Ain Dar amounted, by my calculation, to about 2.4 billion barrels, and so I still suspect that they will be producing from this part of Ghawar for around a decade yet. (Though perhaps not at the same levels). (And then they will go back and pump it, but that is another story).

I hope that you will all help HO get as many readers as you can for this piece.

Thank you,

The Management

The only thing I would add is that rotating the high water cut wells is also a important part of their water management.

So if they have 9 wells with 70% water cut they only include flow from say 3 of them at any one time.

And they claim that the 6 shut-in wells as production capacity with is technically true but they are unable to produce them.

As the field waters out this claim and reality take different paths.

'Productive capacity' - when selling the sizzle is the only option.

Its like claiming the reproductive capacity of humans is millions of children per man because they produce millions of sperm. Technically true but you left out some important parts of the equation.

Or the idea that you can reduce the lead time of a baby's birth to one month by having nine women pregnant at the same time.

And yet, that projects don't work this way seems hard for many to grasp.

'We will find a solution when we need it' - we recognized a need for solution by 1980, and it seems as if the general response has been to increase the number of problems so as to increase the number of solutions which will be found when we need them.

I think that the quote about reaping what you sow is not meant to support what seems to be a now commonplace idea in America - the idea that sowing problems provides the chance for a thousand soutions to bloom.

"One year's weed - seven years' seed," as the old gardening saying goes. I hope it won't come to that, because we've been sowing problems for alot more than one year.

Another important point is pretty simple. What goes in must come out. If you pump water into the field you have to produce it or produce oil displaced by the water. If you don't produce a well because it has a high water cut and instead produce only wells with low water cut the well in the high water cut region will eventually find itself as a pool of oil in a flow of water.

Bad things happen when the water front bypasses a well. The water is flowing through the cracks not the oil the water mixes with oil. The oil becomes immobilized from fractional flow effects etc etc. This means that at least for the side water drive case you have a use it or lose it situation.

Since the conditions that allow water to pressurize the well so you can produce oil are not constant and you cannot produce the oil at your leisure. This means that if they are having water problems and cannot produce all the wells fast enough a lot of them may degrade quickly as they are rotated out. And you have to pump the water in our you lose pressure in the whole field.

I think this is one of the big underlying problems that ARAMCO is trying to address.

I am not sure that I am completely understanding your point. Fluid is only going to flow where there is a differential pressure between the rock and the well. If there is none, with the well shut in, then the water level will equilibrate under gravity to maintain the more horizontal nature of the flood and will have time to penetrate the rock on the sides of the cracks and potentially therefore extract more oil overall, because of the "resting" time.

The overall intent of the water flood is to replace the oil that is flowing out of the totality of the operating wells, so as to maintain the fluid pressure in the rock above that in the well and maintain flow volumes.

My guess from his thinking is that Aramco is facing a real problem in terms of GOSP and real production in the near to middle term, not necessarily in lost production over time. Though that too, in a quantifiable manner, as with any trade-off.

The permutations possible to achieve a high rate of production within a defined band of water/oil and essentially fixed number of wells are steadily shrinking, if the assumption that the Saudis have been successful at mixing oil and water, so to speak, is true.

I'm pretty convinced at this point, especially after wondering at the time about the last Saudi oil surge - storage tanks didn't really make that much sense (my best guess involved tanker routing/filling), especially how it flowed and ebbed so quickly. This appears a satisfying explanation, without any additional infrastructure or conspiracies - merely a careful selection of which wells flow. Easy, possible to weigh in terms of cost/benefit (economic and political), and simple to keep quiet. And easily possible to operate in a short time frame, with lead times of days or weeks, not months or years.

This feels right, and has some fascinating implications in terms of modelling - it should be possible to actually construct testable scenarios from these insights and data.

These last few days have been as fascinating in its way as watching groklaw in its heyday, applying the open source model to the legal process for the benefit of anyone who wrote GPL'd software.

I agree with you. They have room to play some games here with resting wells the question is how much room and for how long.

Right now at least for a lot of Ghawar it seems the ability to

juggle is coming to a end and any production increases will be a lot lower than before.

Can you expand on tanker routing/filling I'm not sure I understand how this can have the effect your claiming.

Damn - just lost the post. The point about tankers was that they can be used to create a local surge in an importer's market, but it would involve careful and longer term planning, and requires certain assumptions to be made - for example, that the Saudis have invested in enough excess storage/port facilities to allow them to use tankers as a 'production' surge mechanism (for example, by leasing 'idle' tankers ahead of time as storage, and then having them steam above their average speed to their destination). This would merely be an illusion, but for a couple of months, it would also be real - that particular importer's storage tanks would be brimming, the refineries would be humming, the price would be sinking, and the electorate would be happy.

But the thinking about the wells is much more elegant, and has the feel of truth.

Not a bad idea. I'd not be surprised to see them use every trick in the book to show some sort of surge later this summer. They can also withhold from the local market.

Say decrease the subsidy a bit and allow some very tight markets.

Its hard to figure the total the could do say for two months

Say 200 kbd at least from maximizing production.

500 kbd draining the 33 million in tank storage.

maybe 100kbd with your tanker idea but more important its a good idea for stretching the oil available with whats basically a shell game. This gives them a 700kbd short term surge ability lets say I'm off by being conservative I'd guess they would try for 3 months instead of two if they have more resources. Cutting supplies to the local market could net say 50-75kbd.

Also they could step it up slowly in 200kbd increments each month instead of ramping up immediately this would spread the time period over maybe 4 months with only 1-2 months actually at a high rate. In fact with this game they might even do 1 million bpd for one month.

They can also do simple tricks like agreeing to send two tanker loads to someone so its booked as a export then cut the shipment later. This fits into your tanker game playing

so they oversell then play games supplying the markets.

Also note its probably easy to create a logjam at the terminals but sending tankers to close together.

A one time surge for 2-3 months should do a good job of empowering peak oil pundits.

This is why I think its important if they drop again and prices are still high or don't surge again later if we have hurricanes. If they are pulling tricks it cannot last.

But the oil/water around the wells your not producing is not static.

Lets say you have three wells in a region under water flood.

You produce one of the wells the best one all the time.

The water your flooding with has to go somewhere so it going into displacing the oil around this well.

Lest say the second one your producing as you say if you produce it quickly enough it does exactly what your saying the resting allows the system to come to equilibrium and you get more oil.

Now the third well lets say it has some sort of surface technical problem but had good flow rates before you shut it in. After a few months you come back to produce it and everyones happy and suddenly it crashes. Why ?

Well you produced a lot of oil in the region and so water has moved into and around this well its now not connected to the region and is a bypassed pool of oil surrounded by water since the water flows better than the oil if you produce and drop the pressure you get mainly water not oil. This is the fractional flow problem. Resting wells only works within a limited range under water drive or your getting tons of bypassed oil.

Look at it this way lets say you did something crazy and started just pumping water into the field and only pumping out from the water layer the water is not going to stay under the oil it will flow through any and all cracks it can find creating pockets of bypassed oil.

Think of a sponge half soaked with oil in a closed container with water forced in from the bottom the water will flow through the whole sponge taking the path of least resistance. If you don't relieve the pressure by displacing the oil the water will find the path of least resistance and you end up getting only water channeling through the oil layer.

I think the grand strategy is to actually give up to some extent on this issue and come back and use electric pumps to extract this oil once the water drive is turned off then you don't have the water channeling problems.

No problem but the rate of production is much lower.

With respect, I can't see it. I found a preview page of a paper examining process performance of Saudi GOSPs. It stated that what came out of the wells was a tight water-oil emulsion (30% water original design), stable enough that demulsification was required in the first separation step. If we're talking any kind of an emulsion in the well when they close it off, gravity is going to take centuries instead of months to separate the two phases.

I think their is some confusion on the water issue.

My understanding is that the field originally had a pretty high water saturation to begin with. This water is the cause of the emulsion not the water from the water drive.

I don't think the salt water being pumped in for the water drive is mixing to form a emulsion. Instead its driving this emulsion. This emulsion has been present from the beginning.

I could be wrong.

pssst ........ an emulsion is not generally a problem in the reservoir due to the higher temperature, and lower oil density and viscosity (because of the disolved gas). the water density doesnt change much from reservoir to gosp.

So do you know if the emulsion is from the water content of the OIP or is it formed from dry oil interacting with the water flood. Or both ?

My guess is that the emulsion water was already there ?

the emulsion probably occurs in the wellbore, wellhead and pipeline where turbulent flow occurs. gas comes out of solution , expands and cools the flowstream off. sort of like a milkshake , chocolate milkshake, dark chocolate.

the emulsion could occur with the native formation water,

but i assume the injected water only increases the problem. other things can contribute to an emulsion. the droplets like to form around particles of iron for example (corrosion product). i think solid parafin can also contribute. i dont know if parafin is even a problem here.

you are taxing my memory, this goes back to the days in the texaco field office long long ago in an oilfield far far away. when i left i told them i was leaving because of low pay, low employee moral and lo-cation.

and this leads up to another story. one solution to excess water production, which i am sure the saudi's are or have looked at is a free water knock out. this will remove a large % of the water before it enters the gosp. they still have to do something with the water.

HO - I've not yet quite reached Saudi Saturation (Ss) yet.

The bar chart you present is intriguing - in particular the claim that Aramco is 28% depleted. I have a quick sum:

(5+10+13+16+21+26+28+48+73)/9 = 26.7%

My point is not the 1.3% discrepenecy but the fact that these numbers don't seem to be weighted for initial reserves in place. Surely with Ghawar 48% depleted it will pull the weighted average depletion towards that figure?

Are you able to repeat your Abqaiq sum on the other fields?

Can you remind us of how you arrived at the estimate for reserves in 'Ain Dar?

Do we have any other data on Safaniya, Berri and Zuluf to support the depletion figures? I got an emerging picture in my mind about Ghwar - and am starting to think now about the possible state of these other fields.

Thanks, Euan

Euan:

I have only just started doing this type of summation, and have only done it for North Ain Dar and for Abqaiq , with Abqaiq production sourced here , and I need to ferret around to find the data from the other fields.

Simplistically in both cases I took the volume of rock in the field, multiplied it by the porosity, took a stab at the oil saturation and the overall field recovery rate, and came up with a recoverable oil volume. turned out that it wasn't that far from the numbers that Aramco have been quoting.

I agree with you on the overall Aramco depletion average. We have discussed this on this site in the past, since the CSIS meeting information is one of the few places where there has been this type of information given, and so it has come up - I just can't cite where at the moment.

HO - another simple sum:

500+170+450+800+300+1200+300+5500=9.22 million bpd

Abqaiq is listed as zero, zilch, nothing! Seems to be confirmed by this plot from the pdf link you provide.

Have I got this right, Abqaiq was not producing in 2004?

I've not read everything - so don't know if this has been discussed before....

Euan ;-)))

I saw that, and was somewhat surprised, since when I have gone back in the past to check on numbers I was under the impression it was producing around 400,000 bd . I just Googled "Abqaiq production" and came up with this site which confirms the 17 billion reserve number, but also notes that they have only 5 billion barrels left (which would seem to confirm the theory that the Aramco reserve figures are for the anticipated total recoverable volume, rather than being for the amount that is now remaining). And if they are producing some 150 million barrels a year, and if their recovery percentage is dropping, then I continue to suspect that the life is the field will be under 20 years, unless, of course, they are resting it.

HO - do you think anyone has remembered to switch Abqaiq back on yet;-))

On a more serious note - I've had a number of discussions in recent weeks with a number of committed posters where it was clear that our differinig views of the Arab OPEC world got in the way of getting close to understanding each others positions.

So its noteworthy IMO that in 2004 it seems that Abqaiq was not just chocked back but shut down altogether - allowing the juices in this old lady to resegregate and for aquifer pressures to be restored. Oil prices were rising in 2004, I believe the world was beginning to scream for light sweet crude and Saudi Arabia have one of their biggest (but most mature) producers of light sweet shut down altogether.

Your calculation for the remaining reserves in Abqaiq - 3 billion barrels - puts the juice left in this old lady up there with the biggest North Sea fields before they had produced a drop of oil.

Reserves booking

Highly educational to see that the Saudis seem to stick with the initial reserves estimates and do not decline these for production - this ties with the flat line annual reserves returns.

Data release

I am utterly gob smacked at the amount of data on Saudi fields and production out there. It seems that they may release it all. But rather than publish an annual spread sheet - it is drip fed into a myriad of obscure sources - they probably hadn't accounted on an orgainsed and motivated mob like TOD finding and collating it all.

Saudi status

Over the weekend the debate on Ghawar made me much more accutely aware of the depleting status of this reservoir. And I am still trying to find the right balance between grave concern about the depletion of Saudi reserves and the fact they can afford to just switch off a field like Abqaiq for a whole year.

Thanks for the post - I Dugg it and Reddit. Going to watch a movie with my kids now.

Euan

Euan,

Thanks for sticking to your guns over the past few days. I think you calmed and slowed Stuart and F_F down as much as they made you concerned. Great to see everyone get by the early issues and deal with the data in a hard nosed way. Outcome may have been the same, but the thoroughness of discourse was amazing.

All positions always need a devils advocate to work through the various options. You provided that balance and it must have felt like a lot of personal attacks at the beginning. Thanks again and keep representing your viewpoint here. It is a critical to the overall picture.

Thanks also to all the other posters who fleshed out the debate over the weekend. Wonderfully technical education about oil extraction.

I was looking at WT's export land model and doing a bit of sniffing on the internal demand numbers. The end result was I feel its low for KSA probably by 200kbd - 500kbd. First I really question the accuracy of reported demand and next I wonder if its a sensitive number for them. And finally if I'm right simply not reporting a field when the production is unexpectedly going toward internal demand is a interesting solution.

Below is a piece of email I sent to WT. He was not able to answer but its a piece of the puzzle that is I think worth looking at if KSA is having production problems.

In the export land model how do we know what total

production was I assume we have to take KSA's word on it like we do with Russia.

http://www.ndu.edu/inss/Repository/Outside_Publications/McMillan/200601X...

This shows the same internal 2mbd internal generally reported but

shows exports at 9.8 mbd

and a much higher total production. I think the paper is a bit bogus.

And I wonder if the consumption numbers are not low if you again

assume a 5% increase in consumption of 30 years using simple

percentages.

Take this chart.

http://en.wikipedia.org/wiki/Image:Saudi-Arabia-demography.png

This says that KSA population has doubled since 1980 so you would

expect oil usage to at least double also they have become more

affluent during this time period.

2mbd of internal consumption simply seems low.

http://www.eia.doe.gov/emeu/cabs/saudi.html

They went from 10 million to 24 million between 1980 and now. If you

do simple constant usage you come up with 2.4 mbpd now of internal

demand.

Just as a rough estimate california has about the same population and

we assume about the same fuel usage per capita.

http://www.energy.ca.gov/oil/index.html

They burn for fuel 54 million gallons a day 44 gasoline and 10 diesel

Californias population is actually 33 million so its quit a bit higher

but its the closest I know of to KSA.

In any case assuming 20 gallons per barrel for both you get 54 /20 = 2.7mbpd

for 33 million this gives 0.08 per million so for KSA this gives 1.9

mbd just for fuel usage

I'm just wondering if 2mbp right now is low it may be closer to 2.5

mbd if we just assume and we should that fuel usage in KSA is not as

efficient as in the US.

2.5/24.0 = 0.1 mbd per million I'm assuming a 20% lower efficiency for KSA.

The point is I think 2mbd for KSA may be low how low not sure but this

means that they probably have been producing more oil than they claim

for some time over many years.

I'm not saying its as high as this estimate but it does mean KSA has

probably produced more

oil than we realize. Say its only 0.2 mbd over 30 years this is like

5mbd more produced. Or maybe an additional 2Gb of oil produced. Not

sure I did this right.

May case is even though this is relatively small it adds up over time.

And it means that potentially some of the spare capacity KSA claims is

not really spare its being used for internal consumption to keep

exports up. Or was. I just don't think its that far off to assume that

internal demand may be higher that what is presented. This means KSA

might be a bit further out on the depletion curve then what we are

estimating from official numbers.

More important if it is higher then they have not actually been

resting wells as much as they

claim instead simply a bit more oil has been diverted to internal use.

This

http://www.nationmaster.com/country/sa-saudi-arabia/ene-energy

Gives 0.672 barrels per day per 10 people for KSA

And for the US

http://www.nationmaster.com/country/us-united-states/ene-energy

Gives 0.677

Buuut checking on another Gulf country UAE which may actually provide

good stats we

get what I'm saying.

http://www.nationmaster.com/country/tc-united-arab-emirates/ene-energy

1.21 barrels per day per 10 p

This is much higher than the estimate for KSA which makes me doubt the

KSA figure.

.121 * 24 = 2.9 million barrels a day.

So now we have a smoking gun that far more inline with some of what we

are seeing.

So lets just assume that I'm right this means KSA has been moving

almost 1mbd extra into

internal consumption for some time. So some of KSA decline is simply

your export land model at work and the fact we have underestimated KSA

consumption.

As another example Oman

http://www.nationmaster.com/country/mu-oman/ene-energy

claims only

0.207 barrels per day per 10 p

Which does not make sense Iran also comes in at 0.21.

Israel comes in at 0.43 Quatar about the same. I don't believe the

numbers for Iran or Oman.

Now another country I believe Kuwait.

http://www.nationmaster.com/country/ku-kuwait/ene-energy

1.306 barrels per day per 10 p

We know that Kuwait UAE and KSA have about the same life styles so you

just have to

think that the KSA estimate is low.

Another possibility mentioned the other day is that Abqaiq is sometimes included in the Ghawar numbers. Of course a third logical possibility is that it doesn't produce oil any more :-)

Casino Royale - "shaken or stirred?" - "do I look like I give a damn" - one of the all time classic movie lines.

Abqaiq stone dead - I thought about it - logical - hmm? :) - but a remote possibiliy.

The big picture relevance here is that Abqaiq is 73% gone and HO estimates reserves at around 3 billion barrels - that's bad enough for me.

The Big, Big picture is Ghawar - apparently still producing 5+ million bpd - 6% of global oil supplies - so the technical detail there is important - tilted contacts, tar mats, saturation profiles, fractures and dual porosity the lot - and I suspect / hope we have another couple of good sessions to come on Ghawar!

Put it like this. There is a paper from the Fall 2001 issue of SA Journal of Technology called "Use of Short-Radius Horizontal Recompletion to Recover Unswept Oil in Abqaiq Field".

This seems to be the same as that thin band of red you see on all the cross sections. It goes on to report that the 13 wells that were evaluated produced for ~400 days (although one was still going at 1586 days). Given that Abqaiq had only 47 producing wells in the 1990s, that's a sizeable percentage they were trying to bring back from dead in 1998-2000. There is also a quote from a smartwell company than they were contracted for "two subsequent installations in Abqaiq in December 2004" - which might explain the production from around then.

I'd have to say I'd guess Abqaiq was at the same state as Ain Dar, but about 4 years earlier, that it watered out 2002-2004 and that they produced a little from the very peak by drilling 2 MRC wells in 2004. Likely they won't last that long.

Abqaiq looks dead.

I think its still producing. But moving it to internal production then not exposing it fits my other work. Why they would do that I don't have a clue but the internal consumption number look like they have been consistently understated for some time.

If I was right about consumption being higher than reported then I had the problem of where the heck they where getting the oil to meet demand.

I thought they would have had to lower production numbers across a few fields to hide the extra oil and that would raise questions.

And I think they have a good reason to hide it since it helps them claim this is shut-in production.

I thought if this a while back but could not figure out how they could hide it without raising questions but not reporting Abqaiq solves this problem.

I ran across this:

At the 8th Arab Energy Conference in Amman, Jordan. (May 15, 2006)Mohammed al-Qahtani, manager of production and facility development said,

"The Abqaiq field still produces 400,000 b/d and the water cut is only 40%," he said. "We've been able to recover so far 50% of its oil initially in place and we estimate that we will be able to recover in excess of 70% with water flooding and without enhanced oil recovery."

With the help of enhanced oil recovery and other technologies in the future, that figure may increase to 80%

"Ghawar has been in production more than 55 years, producing on average 5 million b/d over the past 10 years with a water cut of 33%"

Assuming they are really able to recover 80% of the 17bb in Abqaiq, using those numbers I get

17 bb * .8 = 13.6bb

17 bb * .5 = 8.5bb

13.6bb - 8.5bb = 5.1bb as of May 2006

but that only works out if the 17bb "proven reserve" is the total not expected recoverable.

Also, isn't 80% kind of high?

80 % is kind of high, in fact higher than any oil reservoir i have ever heard of. the typical figure for gravity drainage is about 65 %. 70 % would certainly be within the realm of possibility. and they may be able to extract a few % above that with "enhanced recovery". but because of the excellent recovery from their gravity/water displacement, it seems kind of doubtful they would be able to "enhance" recovery by 1/7 th.

Orchid,

I'm sure you've seen this on other threads. For the benefit of those not familiar with the state of play, Abqaiq is the relatively small structure off to the far right on this diagram. The blue colour is believed to prepresent a dry oil column at the top of the Arab D reservoir, the yellow and orange represents swept (water wet) reservoir from which it is unlikely further volumes of oil may be recovered.

Looking at this I'm fairly happy to accept the resevoir is 73% depleted as indicated on HOs numbers in his post - so the 50% figure suggested by Mohammed al-Qahtani is an optimistic point of view - many working in the oil industry have this optimisim because their jobs depend on it.

Knowledge that Abqaiq still produces 400,000 bpd is useful to have - why production is stated as zero for 2004 is another question.

If you followed the deabte over the weekend (see Stuart's posts links below) then we see that swept reservoir in Ghawar has water saturation around 60%. The initial water saturation is around 10% and this translates to around 56% recovery by the primary and secondary (water drive) recovery mechanism. So I think 80% recovery is unrealistic, though if they are able to rest the field for prolonged periods this would certainly help boost recovery long term. It also needs to be noted that on this plot, orange colours (= high water saturation) creep in at the base of the flanks of Abqaiq - which has excellent reservoir characteristics.

The other thing to bear in mind is that peak oil is about flow rates. Once the dry oil column has gone on Abqaiq flow rates will plummet - maybe to 50,000 bpd - and much of the final recovery will be at much reduced rates.

http://www.theoildrum.com/node/2441#more

http://www.theoildrum.com/node/2437#more

I think recovery is usually calculated as a percentage of OOIP, not as a percentage of pore volume, right? As a percentage of OOIP, 'Ain Dar appears to be running over 70%, and Abqaiq is probably higher.

percentage using pore volume or ooip are interchangeble as long as the pressure and oil composition remained the same (ie same oil fvf). and percent recovery of stock tank oil is based on ooip.

this is generally not the case, however the saudis have alledgedly maintained the pressure above the bubble point (pressure and temperature at which oil begins to evolve from solution with the oil). at some point in the future, the saudi's could deplete the reservoir by abandoning injection and they might actually recover a small fraction of the remaining oil.

these reservoirs are refered to as black oil reservoirs (not because of the color) because it is assumed that the composition of the reservoir oil does not change over time. in the strict sense a black oil contains only methane, disolved in the oil and c7 and heavier components. the oil behaves as a liquid in the reservoir and stock tank and the gas can be handled with the real gas law (pv=znrt). based on the data presented here and in other articles and papers, (fvf = 1.34, sgor= 550) these are probably "black oil" reservoirs for practical purposed. i doubt however, that they meet strict criteria for a black oil.

It has been suggested for years that KSA and other OPEC nations state reserves in terms of the total original size, not remaining. Otherwise how can one logically explain the insistence that KSA has 260 billion barrels of reserves... now and has had 260 billion barrels of reserves since the late 1980s? Are they discovering new reserves to exactly equal production year after year after year? Or is it more logical to conclude that reserve statements are of the original recoverable total? (And that these have been inflated is another topic.)

Ghawar Is Dying

The greatest shortcoming of the human race is our inability to understand the exponential function. - Dr. Albert Bartlett

Look at Abqaiq:

8.1 BBL produced at 73% depleted, leaves 3.5 BBL to produce. Sum = 11.6 BBL, but Aramco quotes 17 BBL "reserve." 11.6 BBL / 17 BBL = 0.68 = 68%. 68% seems close to an exceptional recovery factor, such as you might see at an exceptional resevoir such as Abqaiq. Perhaps the 17 BBL is the OOIP, as Deffeyes (I think) suggested?

HO - your discussion assumes all oil or all water flow from any given portion of the well screen - a step function fractional flow curve, if I am reading you right?

The fact that reported OPEC reserves have not fallen isn't necessarily a sign of misreporting. Non-OPEC countries show much the same effect:

http://peakoildebunked.blogspot.com/2006/04/297-how-about-those-anomalou...

Reserve growth is certainly a part of that, Halfin, but how much reserve growth is real? That was called into question recently by Petroleum Intelligence Weekly, the same people who blew open the story on Kuwait and Burgan.

Further, you are ignoring new discoveries which feed into those numbers for non-OPEC countries. Even Russia has extensive discoveries listed since 1980. But KSA has none.

Finally, you are ignoring the "inflation hump" that occurred as a political act throughout OPEC in the late 1980s when the quota system changed to be based on reserves.

Ghawar Is Dying

The greatest shortcoming of the human race is our inability to understand the exponential function. - Dr. Albert Bartlett

One of the things I've noticed, having spent the last couple of years reading the various posts on TOD, is that managing an oilfield and the various wells, is far more complicated than I imagined.

It also appears to be an "art" as well as a "science". It's a fascinating interface between; man, technology and nature. It reminds me of sailing in way. Where is Don Sailorman when one needs him?

One of the problems one has in getting this story about Peak Oil out, is that people just have virtually no understanding of geology. I know when I started to study geology I was amazed how complicated it was and how enormous and powerful the forces at work were. As a child I thought the world around me was virtually static. I knew about volcanoes and earthquakes, but everything else seemed stabel almost immutable. With a child's eyes the mountains were not moving anywhere, the ground beneath ones feet seemed solid, the earth was a rock.

But then one gets into geology and everything gets turned on its head. What seems solid is not. Everything is moving and changing, not only around one, but under one's feet. Mountains are growing and mountains are falling. The earth is really alive, almost like a living, breathing and enormous organism, and we are just hanging onto the biosphere with our puny fingertips.

In geology time and space take on a different meaning. Geological time is just so long. I think geology leads one towards a kind of humility about man's place in the world and a respect for nature as learn more about it.

Christ, this really is starting to sound like my second Sunday sermon, sorry.

The reason I began to think about this is an argument I had with two dinner guests yesterday at party we went to. I knew I should have kept my mouth shut, but after reading TOD it's becoming increasingly difficult. One of the guys is rather famous and a fraud. He pretends to be a sceptical environmentalist, but he's really a charlatan out to make a buck, he also loves the limelight. I had always thought he was a climatologist, then I thought he was a statistician, but it turns out he's none of the above, he's a political scientist, a spin-doctor at heart! A guy with a clear political/economic/social agenda, which determines his "scientific" writings on the climate issue.

Anyway, after half and hour, we were close to a duel at dawn in the woods. My wife dragged me away into the night and some fresh air.

I then met an environmental journalist in the garden. He'd overheard my conversation with the sceptical environmentalist. The journalist is a smart and educated guy. He's written about environmental issues for twenty years. We got onto oil and his attitude was that the subject was very seventies! I asked him how much oil he thought we used on daily bais, worldwide. He replied that he imagined the figure was around twenty million barrels. When I told him it was around 85 million barrels, day after day after day, he looked really surprised and a little shocked. After all, it's a really big number, day after day, after day. Like he said, "Where does it all come from?"

He had no idea how much energy apart from oil we use, and had no appreciation of how difficult it is to keep those production numbers up. There is an awful lot of education to do. Energy supplies are almost another planet!

Anyway, to close, finally. It seems like our incredible civilization can almost be compared to geology. On the surface it appears so strong and so stable, at least for most of the people I mix with, yet underneath there is another, usually invisible world, a foundation which is anything but stable, and which is, in fact moving, and we are still hanging on by our fingertips.

Nice observations of the ball of mud we live on.

Good story, writerman. I went to Easter dinner yesterday and kept my yap shut to the great appreciation of my wife.

Writerman,

Your comments are interesting, and point to the human minds difficulty in putting our (the human race) scale into perspective when compared to the size of the planet. Sometimes, it's fun to go back to basic concepts:

Wiki article on Earth:

http://en.wikipedia.org/wiki/Earth

When we hear things like hundreds or thousands of square miles, we should think about the land area of the Earth:

148,939,100 km? (29.2 %)

Notice that does not include the ocean surface, which is more than two thirds of the surface of the globe.

The volume of the Earth is astounding:

1.083 207 3x10 to exponent 12 (twelve zeros behind that number!) cubic kilometers.

All of the geology of the human race, including our deepest exploratory wells, actually are only glimpses of the "outer layer" of the onion. We are essentially drilling in puddles even in fields like Ghawar, with no way to know what lies beneath.

But, look at our lit cities, we have lit the Earth to such brightness we can barely see the stars at night, think of it in context to the size of our planet...we must be gobbling up every nook and cranny with our lit cities, right?

A wonderfully thought provoking illustration is a photo of Earth lit by man:

http://en.wikipedia.org/wiki/Image:Earthlights_dmsp.jpg

We are a planet that is for the most part still in the dark, still unlit by humankind at night, and some of the lights seen in the photo are (a) flare fires in the Persian Gulf oil industry and (b) fires set in "slash and burn" agriculture in South America (both sad commentaries on our real state of development)

But the oil consumption, it has to be huge compared to the size of the Earth!

Well, it depends on how you look at it.

http://www.theoildrum.com/node/2186

Posted by Khebab on January 18, 2007, an article called "Getting a Grasp on Oil Production Volumes" was absolutely revolutionary to my thinking. It describes oil plus condensate production of the world in terms of cubic miles of oil (CMO)

What it revealed was that in the year 2006, the world consumed, get this, one cubic mile of oil. Astounding. Go back to Wiki Earth, check the volume and size of the Earth, and humans, with all of our waste, our consumption, our glowing high tech road rockets, airplanes, speedboats, big McMansions, Chinese growth, Indian Growth, European and Japanese industry, and the rolling wave of roads, cars and trucks now expanding throughout the third world, ALL OF OUR WASTE in bad design....and we managed to consume per year only a bit over one cubic mile of oil. ASTOUNDING.

If I had guessed before having seen the article by Khebab, I would have guessed that the oil production of the world would have been easily 50 or more cubic miles per day. I did an unofficial poll of my friends/coworkers, many of whom are energy savvy compared to most folks, and they likewise guessed that the world easily consumed 50 cubic miles, some guessing as high as 100. Khebab's article intended to impress the audience with how huge our oil consumption was. It backfired. Due to the repeated hammer blows over 25 years of "CRISIS, CRISIS, YOU CONSUME TOO MUCH, CRISIS" most people had assumed our consumption of the Earth's resources were far, far higher than they actually are.

I keep the link to Khebab's post on my desktop. When the doom and dispair goes completely wacky, I pop it open.

And then, to have some fun, I go to:

http://en.wikipedia.org/wiki/Solar_power#Availability_of_solar_energy

"The land area of the lower 48 United States intercepts 50 trillion GJ per year, equivalent to 500 times of the nation’s annual energy use."

"The amount of solar energy intercepted by the Earth every minute is greater than the amount of energy the world uses in fossil fuels each year."

This for those who scream at anyone who believes that continued human existance is completely impossible because the Earth is a "closed system".

"Where does it all come from?"

We have not even began to scratch the surface yet.

We face an oil and gas problem, but the problem is about the limits of the human mind far more than it is about any real world limit on energy resources. We are creatures of habit. Our energy science is still at about the stage that medicine was in when it used leeches and bleeding, about the state of psychology when it burned witches and attempted cure by exorcism and torture. The direction of our efforts and most of our discussion is so misguided as to be farcical gibberish.

We will be so wrong, in the big picture, that it will seem as though we must have not attempted any thought at all.

But, we have to shoot in the dark, build in the blind, and on work with what

primitive tools we have. It's the only way forward.

Roger Conner Jr.

Remember, we are only one cubic mile from freedom

One barrel of oil equivalent = 6.118 x 10^9 J.

One barrel of oil equivalent = 159 liters or 159,000 cm^3 or 10,056.9 in^3.

One cubic foot = 1,728 in^3, so a barrel of oil has 5.82 ft^3.

A cubic mile has 5,280^3 = 147,197,952,000 ft^3.

A cubic mile has 147,197,952,000 ft^3 / 5.82 ft^3 = 25,291,744,329.9 barrels of oil, so it seems that world production is a bit more than this. However, I'll stick with this number.

So, a cubic mile of oil equivalent = 6.118 x 10^9 J * 25,291,744,329.9 barrels = 1.547 x 10^20 J = 1.547 x 10^14 MJ.

This is the equivalent to the energy output of 36,974 megatons of nuclear weapons. In other words, a full-scale global thermonuclear exchange. One cubic mile of oil is enough energy to destroy civilization as we know it.

Yeah, I guess you could say we're one cubic mile away from "freedom".

-best,

Wolf

PS. I suggest that you put all that energy equivalent to a more human-like (or horse-like) scale. The amount of energy in a cubic mile of oil equivalent roughly equals 2 x 10^10 horses working eight hours a day for a full year. On a human scale, a cubic mile of oil has incredible potential. This much energy, applied over the surface of the earth year-over-year can result in incredible change. And we see the results every day.

Like you, I was surprised to learn what a small volume that is (it's actually closer to 5 cubic kilometres than 1 cubic mile, but that's a minor quibble). However, when I saw the comparison to other forms of energy production that are being proposed as replacements, the magnitude of the energy involved became clear:

That 5 cubic kilometres per year is equivalent to the output of:

• 200 Three Gorges dams, or

• 2500 nuclear power stations, or

• 5,000 coal power stations, or

• 1,500,000 Wind turbines, or

• 4,500,000,000 solar panels

The physical size of a resource is an enormous red herring. After all, the pit of the Hiroshima bomb was the size of a grapefruit. Does that measurement really have anything to say about the power of the bomb or its human consequences? Does its truly minuscule size mean it would be even easier to replace with some other, equally effective energy source? In the same manner, that cubic mile you're so fond of denigrating has a power and a significance out of all proportion to its physical size.

Size isn't everything.

"Size isn't everything."

True, but big numbers are not everything either. The examples given for instance in Khebab's original post were:

1.5 million wind turbines (or, not and, an important distinction)

91 million solar panels (I think your number of 4.5 billion is a typo)

Now 1.5 million wind turbines or 91 million solar panels sound like an impossible number, until we recall that last year, there were over 60 million light autos and trucks built worldwide. Would we agree that an automobile is a rather complex device, requiring a wide array of input materials and complex fabrication procedure?

Yet we easily accept that we can build 60 million plus autos per year. We do not even think of the other energy consuming appliences: How many TV sets were built last year? Washing machines and dryers? Home cooking ovens?

It is fascinating to me that humans can accept our ability to produce energy consuming units of great complexity well in the tens of millions of units per year, but are completely unable to accept that millions of units of energy producing units could be built. It is noticable that while we are in absolute awe of the power of oil, we easily dismiss as completely unusable vast quantities of solar energy and wind. Our worship of oil borders on a mental illness. I am sometimes concerned, that indeed we will not change as we need to, but for only one reason: We simply do not want to change. End of story. Or perhaps many dream of the return to the medieval world that is now so romanticized in the mind of many, a simpler, slower time of slavery and serfdom. What we want will in so many ways decide what we get. In the end, it often does.

Roger Conner Jr.

Remember, we are only one cubic mile from freedom

Energy-density matters. And having cheap energy-dense material available has been quite the bonanza. That's the real point, I suspect.

-best,

Wolf

No typo. Here's the original graphic:

It compares one year's worth of oil to fifty years' worth of other sources. I scaled the others to a single year, and rounded down for rhetorical effect:

4 Three Gorges (*50 = 200)

52 nukes (*50=2600)

105 coal plants (*50 = 5250)

32,850 wind turbine (*50 = 1,642,500)

91,250,000 solar panels (*50 = 4,562,500,000)

The rest of your apologia equates complexity with energy density. That's a hard argument to support.

It compares one year's worth of oil to fifty years' worth of other sources. I scaled the others to a single year, and rounded down for rhetorical effect:

4 Three Gorges (*50 = 200)

52 nukes (*50=2600)

105 coal plants (*50 = 5250)

32,850 wind turbine (*50 = 1,642,500)

91,250,000 solar panels (*50 = 4,562,500,000)

Since he used 1.5 million wind turbines and not 32K, it appears that he was questioning your solar panel figure, not forgetting to multiply by 50.

The rest of your apologia equates complexity with energy density. That's a hard argument to support.

Was your point to show how "undense" the alternatives to our yearly oil consumption would be, or to show how much of an effort it would take to replace that energy??

I think he made a good point, pointing out that 1.5 million wind turbines is entirely possible from a production standpoint. Someone else pointed out how many airplanes the US made during the 4 years of World War II (I think it might have been 240,000). The windmill problem though is more than just making them. There still needs to be a good way to store that energy. And there needs to be a change in attitude regarding placing them somewhere. Everywhere they try and put them (even in the endlessly flat farmland of the midwest) there will be some local opposition and there is local red tape to endure. It seems like 1.5 million wind turbines could be built far sooner than we could get approval to place 1.5 million wind turbines in the ground. As seen in the Cape Cod project, getting approval for the most productive wind turbines - offshore - is especially problematic and time-consuming.

The problem is infrastructure it took 100 years to build out the infrastructure to produce 60 million cars a year.

Underlying mhis is the big project problem although we have made tremenduos advances in many areas we are not able to complete large project all that much fast than we did 100 years ago.

The Brooklyn Bridge took 13 years to complete and it was started in 1870 also consider it was the first steel cable suspension bridge.

A recent bridge the Zakm bridge in boston

http://www.bostonroads.com/crossings/zakim/

Took from 1997-2002 or 5 years. So in about 100 years

we have increased the speed we can build bridges by only

260% and this is a much smaller bridge using well understood technology.

The Queensboro Bridge was build in 8 years 1901-1909

So for a contemporary bridge slightly newer than the brooklyn we have a 160% difference in time.

As you can see over a 100 year span we have not been able to really change the time it takes to build infrastructure all that much.

If we don't address peak oil quickly this will be on of the top problem factors. We can build anything just not that fast.

Maybe it will make you understand better when I tell you that the remaining oil on earth is variously estimated at between 30 and 60 cubic miles. There's not all that much stuff out there, is there?

Ghawar Is Dying

The greatest shortcoming of the human race is our inability to understand the exponential function. - Dr. Albert Bartlett

"Maybe it will make you understand better when I tell you that the remaining oil on earth is variously estimated at between 30 and 60 cubic miles. There's not all that much stuff out there, is there?"

It sure isn't much, is it? But I would have to see a source on that one.

Not that I don't trust you, mind you, but that is an issue I have discussed before....it has become fascinating how on the TOD and other "peak" sites, oil gas, and coal just seem to disappear at a rate out of all relation to the rate the world consumes it! Known reserves of only a year or two ago just vanish!

Even more astounding is that people in the oil and gas industry don't even notice it....they still think there is oil there!

One is confronted with accepting that yes, we have a real issue concerning oil and natural gas supply....but then being asked to acccept a logic of "running out NOW that is factually a stretch.....but no amount of doubt, no amount of reserves are accepted by the doomers as acceptable.

I must tell you that many in the general public see it as con. They can't figure out how fields known to exist just disappear without warning (some of them virtually never having been exploited). Some see the whole thing as a giant disinformation campaign by the oil companies, and each stretching of the logic increases the number of people who see it just that way.

This has now been driven to the breaking point: Simmons has commited himself, as has Pickens to a "peak now" position, and not just among us insiders but in full view of the world press and public. TOD posters have said that this summer is the big IT, the full crash. If IT doesn't happen by the end of this summer, many will begin to have serious doubt about the whole thing (I know, many said the big IT, was last summer, and the summer before that one and the summer before that one, but that was among the insiders....now, the world is watching on Bloomberg and CNBC. The insiders are very forgiving. The outside world will slice you to pieces if you make fools of them). We'll meet back here after Labor Day weekend (the last big driving holiday of the summer!) and talk about it. :-)

RC

Remember, we are only one cubic mile from freedom

Roger, last year we consumed approximately 1 cubic mile of oil. Last year the world consumed just over 30 billion BARRELS of oil. 30 billion barrels is therefore approximately equal to 1 cubic mile.

Remaining reserve estimates vary between 900 billion barrels to 1.8 trillion barrels. Divide that lower and upper bound by 30 billion barrels and you get... voila! 30 and 60 cubic miles.

This is, of course, at current rates of consumption. If the rate of consumption changes, then this comparison will have to be modified.

Ghawar Is Dying

The greatest shortcoming of the human race is our inability to understand the exponential function. - Dr. Albert Bartlett

jbunt

Roger

Everything that man has ever created or produced,in the last 50,000 years, every house, every car, every road, every piece of equipment, every consumer good of any kind, every airplane, every office or other commercial building, every thing used that you can ever imagine, all food eaten, all waste, all oil produced, all weapons, all bridges, all mounuments, all graves, all sports stadiums of any kind, (things that contain empty spaces, such as buildings and houses, are assumed to be filled with furniture, equipment, paper, other things, etc.) can EASILY fit in a 40 mile cube (64,000 cubic miles). Is man really capable of destroying the earth? Sorry, somewhat off the point, but always has been acecdoteling interesting to me.

What has impressed me about geology is how much it is affected by life on the planet. One usually thinks of rocks, even if moving around, as a different, inert realm, but life interacts in extensive and significant ways with the geology of the planet. The term 'petroleum geology' embodies this in one nutshell, but there are hundreds of other ways that the geology of the planet is intertwined with the life on the planet.

This notion is beautifully encapsulated in the German short movie, Das Rad (It helps me gain a sense of perspective when I'm feeling doomey).

http://www.youtube.com/watch?v=Kj3rT_yYCw8

I see the calculation you are trying to make HO, but one potential issue is this: "However, for the deeper wells on the outer part of the reservoir, the water level would start to rise. Simply we are going to assume that the rock above the water level produces oil, and that below it produces water. This isn’t quite true but it makes it easier to make the point."

So the question is, exactly how "not quite true" is it? In short, of the ballpark "30%" that you think might be remaining in 'Ain Dar, Shedgum, how much is going to be produced after every well in the field is producing 90%+ water? Maybe 'Ain Dar/Shedgum is going to produce a few hundred kbd of extremely waterlogged oil for decades so the last few gb of oil comes out of it in that form. It seems to me you need a theory of just how big that is to sustain the inference that you're trying to make.

Secondly, Fractional_Flow has argued that the Saudi depletion extent figures that you rely on essentially involve unrealistically aggressive assumptions about sweep efficiency (based on an analysis of the pie chart in the Baqi/Saleri CSIS presentation). So you'd need to address that issue too.

The 3gb versus 17gb observation in Abqaiq is certainly a good catch! And this is a very nice clear exposition of the overall history which should help more people to understand the issues under debate.

Unfortunately, I"m going to be mostly out of circulation for the next couple of days, so it's not likely I'll be able to respond at greater length, or carry out those analyses myself. But perhaps others will take up the ball.

Stuart:

Um, well I was hoping to try and keep away from the "and how much oil is there in the water" issue with this particular post, since I was trying to give a more general explanation of the overall situation, rather than the more detailed specifics of exactly how the water:oil mix changed as the water front went through. The intent was for those who might not want to get into the details of the discussion, but rather get some sense as to the more global understanding of what the discussion meant at the larger scale.

In terms of the how the OWC contact behaves I thought that dropping in the little bone about temperature effects would be an indicator that the subject is even more complicated than it has been taken to be so far, and thus getting an accurate feel for where the field is going may be more difficult.

If I understand what you and Fractional Flow are saying it is that the water flood has progressed further than one would expect, given the fact that there is an anticipated recoverable potential remaining of say 2.5 billion barrels, and that, as a result, the recoverable volume is significantly less.

Given that the original paper said that they were good for at least 15 years and tht they are only just starting to use horizontal and MRC wells I think I am still a little more optimistic than you. But that really wasn't what I was trying to do with the post - so, sorry!

HO, I am not sure about others, but I viewed your post as educational in that you were attempting to explain general principles with a passing reference to Ghawar, and that your examples are not necessarily to be taken as gospel, only as one theoretical example of what might be going on. In that sense, I find your post very helpful and I want to thank you for that.

On the other hand, I find Stuart and FF discussing particulars about specific areas of Ghawar using as much real world data as they can get their hands on. In other words, they are using these principles you discuss here though there conclusion may differ because the data is different than the hypothetical example.

Is that an accurate summary?

Ghawar Is Dying

The greatest shortcoming of the human race is our inability to understand the exponential function. - Dr. Albert Bartlett

I think that is a fair statement - we often get into quite technical discussions that can leave someone that isn't at least partially familiar with the technology at a loss. So I try and step back a little to explain more of the overall situation without getting into the technical details. Also I make some reasonably acceptable assumptions that are only very approximate for the purposes of illustration to show what is going on. Actual initial water content, residual water content and similar numbers, while informative, would make the post more specific than I wanted this particular post to be. That doesn't mean that I won't come along at a later date and do a post on that.

You do an excellent job of that, sir. Please do continue as I've always learned something new from your articles.

Ghawar Is Dying

The greatest shortcoming of the human race is our inability to understand the exponential function. - Dr. Albert Bartlett

I reread your words, and I see that you aren't really making any specific claim about North 'Ain Dar production levels. I would certainly agree they may well be producing something from 'Ain Dar for a decade or more, so perhaps we are in (very large) error bars of one another...

And I think your explanation of the overall picture is wonderfully clear.

Question for the oil experts about oil drilling...

I understand that you need sufficient pressure in the ground to lift oil out of the ground.... and maintaining that pressure is why you inject water.

Has any thought been given to, essentially, digging a really fat hole and putting a pump at the bottom of that hole, so that downward gravity flow brings oil to the deep pump which then pumps oil up to the well head?

Is this feasible? Ridiculous? Would it make the slightest bit of difference in the total amount of oil you could get out of a field?

Just curious. Thanks.

Downhole electric pumps are used for some oil wells. You don't need a big hole. Not to mention a big hole would be horribly expensive.

Although I think from KSA's reserve numbers they intend to pulverize the rock and run it through the dishwasher.

They could also try underground nukes for digging the hole.

I read about how we could use nukes to pulverize and heat up the oil shale so we could pump out the oil. This would be preety cool. We have enough nukes to keep this going a loooong time.

Does radioactive gasoline sell at a discount?

We had to worry about sour "high sulfur" oil. But in the future, high actinide "hot" oil?

GW Bush would probably consider it a great way to handle both demand and create demand destruction in Africa with a single solution.

You know, in the mining industry block caving a two hundred thick chunk of rock is not a really big deal. So we could put it through a dishwasher if we really had to.

Yes, this is done routinely. Whenever you see oil wells with the large "grasshopper" moving up and down above the well, that is an engine which is operating a pump at the bottom of the well. I spent one summer in college maintaining and fixing such oil wells.

This is close to one of my questions. I'm quite a beginner with oil production and would appreciate any comments or explanations.

With water, the well is drilled, and water is allowed to rise in the casing to "static level", or the hieght in the casing the pressure pushes it up to. As pressure drops over time, the pump position or height is lowered.

Is this method so much more expensive with oil? Or is is not possibble at the depths of oil wells? It would seem cheaper than a GOSP, and bypass these troubles of water cut, and perhaps allow a greater oil recovery.

Also, I guess from reading HO's piece, that when an oil aquifer is hit originally, a perforated casing that extends the length of the aquifer/column, or 200 feet in HO's above example, is set below the hard casing thru rock to the oil.

Is this inference correct? It seems in contrast to any sort of foot valve which may be moved through the aquifer/column.

You are close to right. The oil is a reservoir is at considerable pressure, and by setting the pressure of the fluid in the well (by partially closing a valve at the surface) the difference in pressure between the oil and the well can be controlled so that the oil moves to the well in a controlled fashion.

Here, in order to keep the flow going, they also inject water to replace the oil, so that the pressure of the fluid in the rock stays about the same. Because they deal with much greater flows than a normal water pump, and because the oil contains some water even at the beginning of the process, as well as some gas, it is better to bring it all to the surface and separate it there, rather than dealing with it down-hole.

Heading Out and Oilmanbob-thanks for responding, and HO, thanks for the overview post. I was fascinated and amazed over the weekend with Stuart and the ensuing discussions. I can wade through these with Twillight and other sources, going way back to the little Geology and Geomorph in college, but these overview articles are great. Please keep them up.

I try to understand them through my experiences with water wells and pressures, and tho they are horses of a different color, I keep coming back...

So is the casing perforated for that section in the original oil column??? A perforated casing is the only way I can imagine being able to fill the lower 80 feet with concrete for a plug, otherwise you've plugged the inlet of the pipe.

"You are close to right. The oil is a reservoir is at considerable pressure, and by setting the pressure of the fluid in the well (by partially closing a valve at the surface) the difference in pressure between the oil and the well can be controlled so that the oil moves to the well in a controlled fashion."

So the big thing when first drilling is maintaining excess pressure. Otherwise the well would just blow the lower viscosity fluids, water and gas, untill equilibration with the atomosphere, leaving most of the oil still bound to the reservior rocks below. Maintaing these high pressures from the start enables a larger share of OOIP to be recovered. Basically correct?

It seems this would preclude the water well methodology of just changing the pump level with declining aquifer pressure. I understand each reservior is unique, and that you intend to post an article on pumping, but it would appear that most of the reserviors capped would thus have their oil too tightly bound for standard pumping to work, esp after the initial high pressurized drilling.

Since, as OilmanBob relates below, the pressure maintainence was not part of older field development, I assume the reworking of old Texas-US fields will be some sort of water/gas injection. Correct?

Does anyone know the pressure (psi's) they will be working with should Jack be developed? As I understand it, this oil is beneath 4-6000 feet of ocean and earth. We've definitely picked the low hanging fruit.

Doug Fir, I think reworking old oil fields is going to be the third most realistic way for America to achieve more energy independence, the first and most important method being conservation and second switching quickly to alternative fuel sources.

As far as methodology, every well in every field is different, its very hard to generalise. Lots of the reservoirs do respond to waterflood and gas injection,and in West Texas they do lots of CO2 injectiontoo. A lot of the fields discovered in the 1900-through the 1920's would become productive if companies would invest in 3D seismic and drill new wells for stranded oil. There have been successes stimulating heavy oil reservoirs with heat and solvents, and even bacteria injected in wells that reduce the viscosity of oil so the oil flows more easily into the boreholes.

But almost all of the cheap to produce oil in America is gone. You asked about the Jack Field that Chevron and Devon found. Its in 7,000 feet of water and has 28,000 feet of sediments to drill through. The wellhead will have to be set with robots, and the water pressure at the wellhead is about 10,000 lbs. It will be at least another 7 or 8 years before a drop of oil is produced and take oil prices of at least $100 per bbl to have a prayer of making a profit. The cost is rising so rapidly for new production that many companies are investing in the Alberta Tar Sands, which costs $100,000 per barrel per day of production in capital costs, plus $20 per barrel in processing costs. And that huge rise in lifting costs is maybe the most important message of Peak Oil. Our civilisation is living on its capital.

doug fir, you've got it about right how a bottom hole pump is set and operates in a well. The problem is even though oil floats on water, water flows preferentially through the rock, and once water has displaced the oil it will flow preferentially into the well bore. Its the same with gas, if the gas cap expands into the oil it can strand oil because of its preferential production through the rock.

The idea of waterflood, or gas injection is to raise the pressure in the rocks to force the oil into the wellbore. The well operators also try to choke back the flow by using small orifices in the well tubing so as to maintain pressure evenly in the formation.