The life of an oil reservoir

Posted by Heading Out on August 14, 2006 - 11:54pm

Let me start by assuming that I have a layer of rock that is 300 ft thick, five miles wide and thirty miles long. Let us then assume that this has been folded in the middle, so that it now has trapped oil within all the pores of the rock. And, for the sake of discussion let's assume that it has a porosity of 20%. Now having found this reservoir - which is, let's say some 6,500 ft below the current surface of the ground - back some years ago, the oil moguls of the time decided to drill into it and extract the oil.

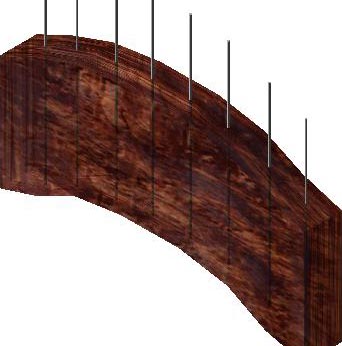

Now, this being some time ago, the first thing that our friends did was to drill some oil wells, and this being that long ago they drilled vertical wells one quarter of a mile apart. To make life easier I am now going to consider just a one-quarter-mile section of the reservoir, taken along the length. We assume that the wells are spaced quarter of a mile apart, and that they gave us this one slice. If the slice is 5 miles long, then it has 20 wells set along the section, so that each well will pull the oil out of a box that extends out one eighth of a mile laterally from the well, out toward the next. The total recoverable oil for each well is roughly 10 million barrels, or 30,000 barrels per foot of the oil well in the reservoir.

Showing location of wells quarter-mile apart and in a quarter-mile thick slice along the reservoir. The rock thickness is exaggerated and this is not to scale.

The rate at which the oil flows into the well is related to the difference in pressure between the oil in the rock, and the fluid in the well; the frictional resistance of the rock to the oil flow through it; and the length of the well that is exposed to the rock. Let us assume that the rock resistance remains the same and that production varies directly with changes in the pressure difference and the length of the exposure. And let us start by assuming that the well produces 3,000 barrels of oil a day. (i.e. 10 barrels per foot of well exposed to the rock). Then, in the course of a year the well will produce one million barrels of oil. Connect up the pipes, and away we go.

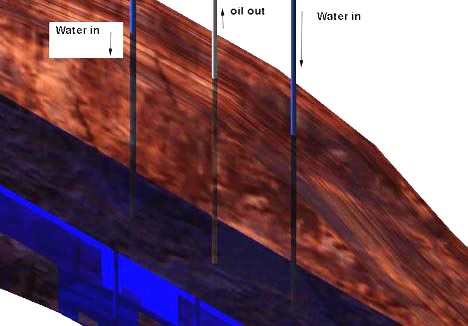

After five years we notice that the volume coming out of the well is not as much as it used to be, and when we check with the engineer he explains that, as we take the oil out of the ground, so the pressure in the oil reduces, and the flow slows down. Well, bless my bananas, and here we have just promised a new palace to one of the grandkids. So we have a chat with the lads and they tell us of this neat trick they have in Russia. If we pump water into the ground under the oil well, then the water will fill the holes left as the oil leaves, and we can keep the pressure in the oil up, and the oil flow will not drop as fast. So out we go to the site, and we drill secondary wells around the first set that had been put in, and now we pump water back into the ground around the well, and bring the pressure back up to the pressure that we started with. And from then on we are pumping water into the ground as fast, (and soon to tell faster) than we are taking the oil out.

Initial pattern of water flood, adjacent wells flood under the producing central well

Because now there is a little problem that we hadn't thought of when we started this exercise. Over the years we have taken out say 4 million barrels, now as we compress the oil back to the original pressure (we're neglecting the gas issue for now) it will only occupy 60% of the original space, or the top 180 ft of the reservoir. Now at the same pressure we will only get 60% of our original flow, because the length of the well exposed to the rock has been reduced (and flow is related to length and pressure). And this is going to get worse, each year the flow will decline as the length of exposed well in the rock gets smaller.

For example, the next year it will produce at 1,800 bd,(10 barrels/day/ft) but at the end of that year we will have removed (simplifying) 650,000 bd of oil, and so the volume of oil will be reduced by (roughly) 11% of the 6 million barrels we started with, and so the following year the production will come from only 160 ft of the reservoir, and, at the same reservoir pressure, the flow will be reduced because of the shorter exposed length. And the flow will be, accordingly also reduced by 11%, assuming that the overall area remains the same. (Some folks might call this depletion, it is the decline in production with time).

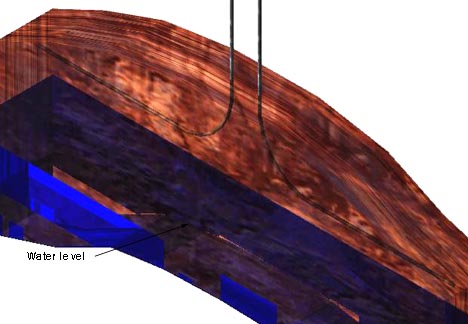

Yikes, and here that palace isn't finished yet. So what can we do. Well it turns out that there is another trick we can pull out of the hat. Apparently some folk in Italy have found a way to turn a drill so that it drills horizontally across the reservoir, rather than vertically down through it. At the same time someone else has come up with this idea, that if you just pump the water in around the edges of the reservoir then it makes a more even lift of the water:oil surface up the well, and there isn't as much chance of water stopping the well from producing while there is still oil available. Bingo, we'll have a couple of those.

We only need two because we can now drill the wells horizontally all the way from the middle to near the edge of the reservoir (one in each direction). So the holes are each two-and-a-quarter miles long and are equal in exposed length to the reservoir of forty of the original wells. Now the length stays the same, but the production drops to 1.5 barrels/ft/day. But, by pumping water into the surrounding wells, we keep the pressure up and hold that production. So now, out of these horizontal wells we get say 18,000 barrels of oil a day. And it keeps pumping. Call the grandkids and have them build an extension on the palace.

Water flood under horizontal wells, in this ideal case the water is fed from the outside of the reservoir and rises as a steady horizontal lift over time - until it reaches the wells.

But wait. When we started doing this, we had taken out of the ground about half of the recoverable oil. We had, in that slice of the reservoir some 200 million barrels of oil. We had produced half of it, and thus had 100 million barrels left. We are now producing it at the rate of 13 million barrels a year (2 wells). But it just keeps pumping, as long as we keep pumping that water in, until . . . . . .the day the water level reaches the horizontal well layer. And we're done, it's all over. Oh, there will be some indications before it happens, water cut will start to rise again, and production drops and this is really an idealized case and production will likely drop before then due to preferential water flow through the ground. But in either case, even if we get all that was there, and we won't, we didn't create any more oil by drilling horizontally, we just got it out faster.

Hmmm! Anyone want to buy a beautiful palace, going cheap, nice view of the Gulf. Peaceful neighbors!

There is one final thought. Our friendly moguls, who gave us that slice, set up the field so that while our slice was producing 60,000 bd, they had another 30 slices, or 7.5 miles of the length of the field also producing, giving them an overall production of 1.8 million barrels a day. After a while they noticed, overall, that the field was dropping in production by 8% a year (they were paying closer attention). To overcome this they just started production in another couple of slices, drilling another 40 wells to make up the drop that year. And so they continue to do this, adding half a mile a year to the length of the reservoir from which they are producing, until, after 45 years, they run out of reservoir to drill in. And in the distance they hear a rather large, rotund lady starting to sing something about "dark, satanic mills".

Now explain to me why Ghawar production is not going to tank if its not already ?

My best guess is that there still able to drill new horizontal wells to offset depletion but it would be nice to just know one fact are the older wells watering out ?

Next can you expand a bit on how the infield drilling offsets depletion how long how much ?

It seems to me that the infield drilling as you get close to depletion results in well that go through there production cycle in a matter of years two to five at most since there basically picking up bypassed oil or oil that would be slow to produce from the current wells because of distance is this true ? So they basically just increase the depletion rate in exchange for keeping production up for say 2-4 years at most. Basically the idea is there extracting out of a much smaller volume then the original field sort of like a mini reservoir a few miles around the well.

Basically the field begins to look like a lot of small fields but pressure mgt is a problem since there all connected.

I'm really really guessing on the production life cycle for infield drilling in depleted reservoirs am I even close ?

What is a normal production profile for infield drilling in old fields.

How many oil fields are now produced with horizontal wells ?

To follow and restate my main question whats the recovery on secondary in field drilling or maintence wells ?

And I have the same questions as the post I'm replying too.

What happens when horizontal wells water out. I've read that if its a multi branch well they will shutoff watered out branches I guess if its not they can put some sort of plug or sleeve in place that covers the offending section but still has a hole in the middle for oil flow.

In general can someone really expand on what happens in older fields using todays recovery methods.

All I know is they drill a lot more wells but it does not stop the decline.

A good remedial instruction on oil field extraction, and all obviously pretty correct.

Of course, the issue still returns to OIP ((Oil In Place) and URR (Ultimate Recoverable Reserves).

It always amuses me to hear people, when the issue of URR is brought up, suddenly often back peddle and say "Well that don't mean anything, what matters is how much can be produced on a daily, weekly, yearly basis, etc.", and then start talking about things like labor shortages, political or war issues, equipment shortages and failures etc.

But if we are discussing geological depletion and using the Hubbert Linearization (HL) none of these "above ground issues" are issues.

The whole idea of HL and geological depletion is based on an very correct count of the starting point. Westexas often makes the argument, the very correct one I think, that at about 50% of Qt, the production will begin to drop, and if you have been using water injection, horizontal drills, and bottle brush along with the 4D finding methods, it may drop quite harshly, since you have been able to evacuate the reservior so efficiently.

Notice, however, the importance of approximate 50% of Qt. To have that number, you must have had a very clear count of what 100% Qt was, or an accurate count of OIP and URR.

This is the problem in fields that have not been third party audited and operated by a firm that has been let us say "restrained" in it's release of information (I may be talking about Aramco, all through it's history, but even more so since 1982.

It goes without saying that the larger the oil fields discussed, the more even a tiny measurement error can mean. A couple of percent difference in URR numbers either way can mean a huge surprise either good or bad, and could move the so called "peak" date by decades. Given that Aramco themselves have estimated their own URR with as much as 100% spread in URR, and outside "guessers" have put the overall OIP and URR both well above and well below Aramco's own top and and bottom estimates,

At some point we are going to have to admit that we have NO IDEA what Saudi OIP and URR ever were, and never did. This is what we should be letting the American people know, and it is equally true of the rest of OPEC and Venesuala and Mexico, among others. It is sheer guesswork.

Westexes makes the case that HL worked on Texas, and worked on the Lower 48. To a lesser extent, it has worked on the part of Alaska we have explored and drilled, and on the North Sea. That is because we started with relatively good information.

There are places where it's anybody's guess: The U.S. Outer Continental Shelf comes to mind, as does most deep ocean prospects. Canada is still guesswork in many places and so is frontier Siberia. These are big areas.

Why would an assumption of the possibility of upside surprise be viable in some of these cases? The major reason is that from 1982 through 1998, oil prices were at historic low prices, inflation adjusted. Oil was flowing cheap and easy from Saudi Arabia, Canterell, the North Sea. Why would oil companies who were busting their butt to return any dividend at all to their own investors and shareholders, spend big money exploring in an environment in which they were having trouble even maintaining their production staff and and infrastructure? Most effort was going to the merger and acquisition efforts just to survive.

Think about that time span again, 1982 through 1998...and with a bit of lag before the money started pouring back in, even a bit longer, you might as well say 20 years.

So we could see some real upside surprises....but the inverse is true too.

I have become more and more convinced that our first and greatest effort MUST be to let the public know that we are running completely blind, and that all possible "case hardening" and contingency planning must be underway. In another string on TOD, there is a story pulled from Energybulletin about the demise of JIT (Just In Time) inventory and planning.

Right now, I cannot imagine anything more dangerous than JIT applied to energy, natural gas and liquid fuel sources. We should be expanding and diversifying our reserve storage, and shifting control outward to small companies, counties, states, maintainence utilities, even hospitals and healthcare agencies. This is the single most valuable thing we can do on a large scale now. Sorry about jumping on the soapbox, but please, think about what I am proposing. It has very little downside and great potential to prevent chaos.

Roger Conner known to you as ThatsItImout

http://resourceinsights.blogspot.com/2006/08/is-just-in-time-nearly-out-of-time_13.html

Oddly, I encountered it (and its info about wheat shortages) about 5 minutes before reading this: http://www.theglobeandmail.com/servlet/story/RTGAM.20060813.wEthanol0813/BNStory/National/home

Strange. I read the Kurt Cobb article referenced in EB and saw nothing about any actual demise in JIT practices. AFAIK, Toyota is still very JIT and trying to get even more of its suppliers to be so. Is there any evidence that JIT is in decline?

What is the 'punishment' for not doing JIT?

- need a warehouse (land and building are taxed)

- taxation on items in inventory

- oppunity cost of using the space for some other purpose (vs the oppertunity cost of not having whatever part)

Without change on taxation, why would anyone move away from JIT?Even discounting ANY taxation inventory has a running cost : the capital used (warehouse+stock proper) x interest rates.

Among the best examples that it is the very logic of markets/efficiency/profits which runs counter the safeguarding of "mission critical" operations.

Some kind of regulation is therefore in order, but that does not mean GOVERNMENTAL regulation.

The only safe regulations would be cultural/societal regulations, but establishing those takes TIME.

Any idea for speeding up such changes?

BTW, I know I am "banned" but to emphasize the sillyness of this you may notice that I was the first to publish the link to Kurt Cobb's article without anybody noticing.

Did I say morons?

(Yeah! I am still awkward, got 42 points)

VS the cost of being without.

Taxation just makes sure you let someone else hold the inventory bag.

The only safe regulations would be cultural/societal regulations, but establishing those takes TIME.

Any idea for speeding up such changes?

Oh, how about a change in the artifical regulation which favors the largest merchants like the tax code?

sillyness of this you may notice that I was the first to publish the link to Kurt Cobb's article without anybody noticing.

You want a medal or just a chest to pin it on?

By this do you mean that the taxation "incentive" results in someone else up the supply chain to bear the cost of inventory so that it makes no difference overall?

This is wrong in all cases, with "taxation incentive" or just the running cost of capital, because :

1) Being subject to the same "incentives" suppliers will have the same policy of reducing inventory.

2) Even is for some reason (dumbness or technical constraints) they do not reduce their inventory they have no reason to INCREASE it.

Therefore the portion of YOUR inventory that you dropped off by JIT is still subtracted from the grand total of all RESERVES along the supply chain.

The "total slack" of the whole chain at the consumer end is decreased.

Yeah! Inventory is doubleplusungood, well known...

http://www.theoildrum.com/story/2006/8/14/9102/35436#11

the link to Is just-in-time nearly out of time? by Kurt Cobb

was posted

At Monday August 14, 2006 at 11:18 AM EST

http://www.theoildrum.com/comments/2006/8/13/232547/321/32#32

was posted with a link to the same material.

So when you said "you may notice that I was the first to publish the link to Kurt Cobb's article " what point were you trying to make?

It's getting tiresome isn't it?

Not only am I a sucker but I am patient.

However, there is more to the point!

If you brought in this topic yourself:

Will the just-in-time religion which swept the world in the 1990s survive such a dynamic?

(so long as the tax code punishes firms for having stock on hand, yes)

It seems this was only to argue against taxation, as you repeated in this thread.

So your biases are beginning to show more clearly.

Am I wrong?

Yes, you are wrong. Feel better now that you have the affermation and attention seeking you want so badly?

So you are DENYING that you are spitting out bullshit in favor of lower corporate taxation and, as a general policy of yours, trying to deviously support the interests of the wealthy and "business as usual" at the expense of survival of mankind and earth current ecology.

Could you back up this gratuitous "affirmation"?

Not only are you a stalker, but you are a poor one. Not actually READING what is posted.

My, my, my.

The tax law exists to benefit large corporations.

Let me repeat that, because you might not understand.

The tax law exists to benefit large corporations.

Large corporations can buy a large number of items and move them through the market chain. If I wish to have built a plastic mold and make lids similar to the tattler lids, I bet I can undercut the $13 per dozen price easy. But, because I do not have a large corporations supply chain, I'm stuck with 4,183,000 lids at the end of the 1st year. As the cost of energy goes up, the remaining lids have FAR more value, not to mention increased demand of home canning lids. Which would be a fine thing (the building is paid for, the storage space is not all that great), but the taxes on inventory kills me over time. And the arms length rules prevent me from dropping the $250k on making the lids, then selling the unsold lids for $10 at the end of the year to myself. Or any of my relatives.

But you go right ahead and think that I'm all about "lower corporate taxation" because that is what gets you to post again and keep your attention seeking behavior engaged. If your attention is hear that means you are not misbehaving in meatspace, and humanity is well served.

Roger, your statement is false. Sorry, but we've got multiple lines of evidence pointing to troubling conclusions including

And there are others I didn't mention. Why do you say we're running blind? HO's story tells us about onshore oil production in older existing fields and mitigating declines there. It's one line of evidence (2nd bullet point above).

For those commenting on JIT etc., there will be an open thread today. I suggest you use it.

-- Dave

I am in a bit of a hurry and have to head out, but just to get you started....I threw together some quick finds....point to be made, we have no idea how much oil and gas is out there....I will talk more on this later....

http://www.msnbc.msn.com/id/5945678/

"A lot depends, of course, on just how much oil remains underground. Many of those who fear a production peak is imminent base their forecast on estimates of what geologists call the "ultimate recoverable resource" of about 2 trillion barrels of oil. But there's disagreement among geologists on that number. A comprehensive study by the U.S. Geological Survey in 2000 estimated that some 3 trillion barrels of oil will ultimately be produced. Adelman argues that the amount of oil left to be produced is "unknowable."

Regardless of how much oil remains in the ground, says Deffeyes, the critical bottleneck is production capacity. "I can't drive into the filling station and say fill her up with reserves."

Deffeyes argues that production capacity has grown more slowly than demand - based on production figures that are a lot more reliable than reserve data.

"Production is a pretty firm number," he said. "Oil gets counted twice: once when it gets produced and once when it goes into the refinery. So we pretty much know how much is produced, and my Thanksgiving Day prediction is entirely based on production."

In case you missed it, peak was in 2000 (at least that's what they said in 1995

http://dieoff.org/page85.htm

http://www.moles.org/ProjectUnderground/motherlode/drilling/frontier.html

The ultimate amount of conventional oil and gas resources left to be discovered in the world is an even more divisive topic. Writing in the March 1998 edition of Scientific American, two oil industry analysts argue that there is only 150 billion barrels of conventional oil left to be discovered. The US Geological Survey estimates that approximately 530 billion barrels more remain to be found.6 Another recent study indicated that the ultimate resources of conventional oil could be two to three times as great "depending on the price consumers can afford to pay."7 Natural gas, all agree, is somewhat, but not drastically, more plentiful.

Roger Conner known to you as ThatsItImout

Of course, we can't afford to pay more in energy terms than it takes to get it out. But don't tell that to an economist.

It just isn't very profitable. Think of energy expensive oil as a sort of natural coal-to-liquids plant. If it's cheaper than making methanol, it works just as well.

Except that it doesn't have great potential. I have documented the fact that the oil industry is not, has not, and never has practiced JIT despite repeated accusations. Even The Oil & Gas Journal issued an apology for having mischaracterized some practices as JIT. If they actually practiced JIT, we would all be better off for the same reasons that Toyota is kicking the snot out of GM and Ford with it: properly understood and applied, it reduces risk, cost, and quality problems simultaneously. It's no accident that Toyota jumped to the fore of the hybrid manufacturers and that they are the creator of JIT.

News of the demise of JIT has been greatly exaggerated. We would all be better off if people learned what JIT is rather than what they think it is. It is not simply cutting storage.

20 ft max each, maybe totalling 300 at times in the old days. Most new fields that I have experience with are 8 ft thick max and down to 3 ft. These are carbonate zones with porosity of closer to 8 percent and they do not produce at all unless drilled horizontally and even then require high pressure sand fracing. Maybe deepwater GOM has thicker zones with greater porosity but I haven't been there in 20 years. Most of those are drilled directional but not horizontal. Most sand reservoirs do not respond as well to horizontal drilling as carbonates. I am not a reservoir engineer however but have more experience on the drilling side of things.

The success of a well depends on "where" you drill in the zone, not just by virtue of drilling horizontally. For instance, if you stay within the upper section of the zone where the hydrocarbons are you may have a producer. Screw up and drill into the lower section where the water is and you have a very expensive water well. The experience in this type of drilling is actually quite limited in the industry. Last time I looked only 8 percent of the total rig count were drilling horizontal wells. It could be up somewhat from that now. Add to that new tricks such as dual laterals and tri laterals where the experience level is even more limited.

There is a change in mindset that a oil company has to go through to have a horizontal drilling program. In the past on vertical wells, all the decisions were made top down from the office. In a horizontal or "geosteered" well, things can change from one minute to the next depending on dip of the formation or perhaps even drilling though a fault. Top down companies pick up off bottom and circulate for hours trying to get someone to make a decision. Consequently they end up spending twice as much money on the well. They blame

"doglegs" for why they give up on horizontals.

As far as horizontals draining the reservoir sooner- perhaps , but my experience is that in the zones we drill it is horizontal or it is nothing. It is not an easy business and there is never a sure thing. Even a potential good well can be screwed up due to human nature.

Good subject for the experts here to shed light on for us?

Most geologists view crude oil, like coal and natural gas, as the product of compression and heating of ancient organic materials over geological time. According to this theory, oil is formed from the preserved remains of prehistoric zooplankton and algae which have been settled to the sea bottom in large quantities under anoxic conditions. (Terrestrial plants tend to form coal, and very few dinosaurs have been converted into oil.) Over geological time this organic matter, mixed with mud, is buried under heavy layers of sediment. The resulting high levels of heat and pressure cause the remains to metamorphose, first into a waxy material known as kerogen which is found in various oil shales around the world, and then with more heat into liquid and gaseous hydrocarbons in a process known as catagenesis. Because most hydrocarbons are lighter than rock or water, these sometimes migrate upward through adjacent rock layers until they become trapped beneath impermeable rocks, within porous rocks called reservoirs. Concentration of hydrocarbons in a trap forms an oil field, from which the liquid can be extracted by drilling and pumping.

Geologists often refer to an "oil window" which is the temperature range that oil forms in--below the minimum temperature oil remains trapped in the form of kerogen, and above the maximum temperature the oil is converted to natural gas through the process of thermal cracking. Though this happens at different depths in different locations around the world, a 'typical' depth for the oil window might be 4-6 km. Note that even if oil is formed at extreme depths, it may be trapped at much shallower depths, even if it is not formed there. (In the case of the Athabasca Oil Sands, it is found right at the surface.) Three conditions must be present for oil reservoirs to form: first, a source rock rich in organic material buried deep enough for subterranean heat to cook it into oil; second, a porous and permeable reservoir rock for it to accumulate in; and last a cap rock (seal) that prevents it from escaping to the surface.

If an oil well were to run dry and be capped, it would be back to original supply rates eventually. There is considerable question about how long this would take. Some formations appear to have a regeneration time of decades. Majority opinion is that oil is being formed at less than 1% of the current consumption rate.

The vast majority of oil that has been produced by the earth has long ago escaped to the surface and been biodegraded by oil-eating bacteria. What oil companies are looking for is the small fraction that has been trapped by this rare combination of circumstances. Oil sands are reservoirs of partially biodegraded oil still in the process of escaping, but contain so much migrating oil that, although most of it has escaped, vast amounts are still present - more than can be found in conventional oil reservoirs. On the other hand, oil shales are source rocks that have never been buried deep enough to convert their trapped kerogen into oil.

The reactions that produce oil and natural gas are often modeled as first order breakdown reactions, where kerogen is broken down to oil and natural gas by a set of parallel reactions, and oil eventually breaks down to natural gas by another set of reactions. The first set was originally patented in 1694 under British Crown Patent No. 330 covering "a way to extract and make great quantityes of pitch, tarr, and oyle out of a sort of stone." The latter set is regularly used in petrochemical plants and oil refineries.

My knowledge of how organic matter gets transformed into oil is admittedly limited. However, from the explanations I have read, I come away with a feeling that the explanations are somewhat vague and incomplete (e.g., 'subterranean heat and pressure break down the organic matter into lighter hydrocarbons').

What I haven't seen a rigorous explanation of is: By why what specific well-defined chemical reactions does this organic matter (proteins, polysaccharides,etc) turn into oil? (When organic matter is subjected to pyrolysis in the lab, the products are very much different from crude oil.)

I am not a beliver in the abiotic theory of oil formation, but I have read a few of the arguments by some of the proponents of abiotic oil, and some very interesting questions are raised.

While I no longer have the specific reference or a link to it, there is a rather lengthy detailed academic paper that asserts, through a statistical thermodynamic analysis, that the subterranean conditions of temperature and pressure do NOT favor the conversion of organic matter into the principal compounds found in petroleum.

I do not know enough about the subject to conclude one way or the other if the author(s) of this paper are correct. So, I wonder if this thermodynamic question has been addressed by any of our petroleum geologists/chemists out there. (?)

There is lots of other evidence for biotic formation, including the presence of other nutrients (nitrogen, phosphorus) in suggestive proportions, the presence of polycyclic aromatics in the oil, etc. Deffeyes' Beyond Oil is good for a discussion of this.

As for abiotic oil proponents, I suggest they go look for it some more. In the end, it doesn't matter how it's formed if you can't find enough of it to pump out.

I did read Deffeyes' Beyond Oil, and, as I recall, the discussion about exactly how oil formed was rather general, though I do remember his mentioning nutrients and various chemical markers indicative of a biological origin. I don't think he actually got into a level of detail where he proposed any specific chemical pathways.

As to the thermodynamic argument, I would partially agree that considerations of reaction kinetics and chemical environment also come into play. However, I think I would be safe to say that the proper thermodynamics are a necessary but not sufficient condition for the formation of petroleum compounds. If the thermodynamics aren't favorable, it's just not going happen regardless if other conditions are favorable.

I think the gist of that thermodynamic paper was that the energy level of the end products (petroleum compounds) is quite a bit higher than the energy level of the starting material (dead organic matter). Usually, when something is thermally broken down, the opposite occurs.

I suppose a rough analogy would be having a chuck of iron oxide (Fe2O3) in an oxidizing environment and expect it to turn into metallic iron at some future point in time. It could sit there for 100 million years, but it just ain't gonna happen.

Now, there are a variety of biological processes that can appear to go against thermodynamics, but they do this merely by importing energy into the system, the overall net effect still being consistent with the thermodynamics. But I haven't heard any explanations that the formation of oil was the result of biological reactions.

Well, I still haven't seen a rigorous, reaction-by-reaction explantion of how you get from dead organic matter to petroleum compounds.

However, I agree that this may be totally academic to the problem of finding oil, but I am curious nonetheless.

Keep in mind that the earth is by no means in a thermodynamic equilibrium, even on a relatively local level. There is molten iron down deep, but oxygen above. Different reactants/products are more mobile, less dense, less miscible than others, so it is different than just putting things in a closed vessel and heating.

Unfortunately, at the moment I cannot point you to the paper which I saw over a year ago. As I recall, it was cited in an article by one of the proponents of abiotic oil. I traced it down and found it to be a very long and detailed discourse on statisitical thermodynamics. As my thermo isn't all that strong, I really didn't follow it all that well. Some of the Russians seem to figure prominently in the abiotic theory.

I will try to dig it up once more, as I am starting to get curious all over again.

I agree that for this to work, there must have been some major natural fractionation of the various organic compounds in the dead organic matter taking place rather than everything 'just going into a big vat and being slowly cooked.'

As I mentioned in my response to Darwinian below, I suspect that there were also some very strong oxidation/reduction reactions taking place.

This is a very naive argument. One may as well claim that because ethanol has a higher energy level than corn that therefore ethanol cannot be derived from corn.

When kerogen is converted to hydrocarbons at depths greater than 7,000 feet, only the highest concentrations of the energy in the kerogen is converted to oil. The rest is like the mash left over from making ethanol and is simply left behind in the source rock.

Mind you, I myself am not promoting the conclusions of the thermodynamicists' paper, I am merely stating their conclusions; and I also pointed out that I didn't feel qualified to say they are either right or wrong. I have an open mind on the matter.

I just want somebody, somewhere out there to please show me a proposed mechanism, consisting of a series of specific step-wise chemical reactions, by which dead organic matter becomes petroleum. So far, no one has done so.

Regarding the example of the fermentation of ethanol, I'm glad you brought that up, because it illustrates another important point. I hope you are aware that when the sugars in corn are subject to fermentation, one mole of CO2 is generated for every mole of ethanol. So, as with most anaerobic biological processes, the final result is a substance that is more reduced than the original material plus a substance that is more oxidized than the original material.

So, in the case of the fermentation of corn, the combined energy level of the total the products of fermentation ( i.e., mostly ethanol and CO2) is lower than the total energy level of the original corn. Ditto for methane generation from the digestion of sewage sludge. Basically, the microoganisms metabolically oxidize some of the material in order gain the energy necessary to reduce some other part of the material.

This leads me to speculate that perhaps there may have been some very powerful oxidation/reductions reactions involved in the formation of petroluem rather than just a simple thermal breakdown. Maybe that's how the energy level of the petroleum products can be (as the paper claims) greater than the energy level of the dead organic matter.

If indeed that were the case, then I suspect that sulfur might have come into the picture somewhere along the line, given the relatively large amounts of sulfur compounds that are generally encountered in oil and gas deposits and given the wide range in valence states of sulfur.

Or perhaps even metallic iron from deep within the earth acting as a reducing agent? Of course, this is just a wild-ass speculation and not a theory.

Again, the question is: How exactly does dead organic matter turn into petroleum compounds?

The vast majority of the petroleum pumped out of the ground is thought to be of marine origin, and almost all of that likely arose from dead phytoplankton (algae such as diatoms) which sank to the bottom and were buried by sediment. Algae are very good at producing oil--it is an energy storage mechanism. These oils are long chain aliphatic hydrocarbons bound to glycerin, and is not soluble in water. Plus, there are lots of cyclic aromatic hydrocarbons in the cell which are soluble in these oils. So we're starting with something that is chemically similar to petroleum with lots of carbon-carbon bonds, plus aromatics, plus similar optical activity, plus similar even chain length predominance.

And the abiotic crowd doesn't like it because??? So, instead we get a theory by which complicated long-chain aliphatics and cyclic aromatics are formed starting with methane and oxygen within the earth's crust. Now, there is an entropy problem.

Thanks! That was a very good explanation. While not complete, it does lead me to believe that there are reasonably realistic pathways by which fatty marine organisms could eventually become oil.

However, I'd feel so much better if someone could propose some specific reaction mechanisms by which dead organic matter become petroleum.

While I find this whole question fascinating, I am not versed well enough in the relevant science to make an informed opinion one way or the other.

Kerogens are chemical compounds that make up a portion of the organic matter in sedimentary rocks. They are insoluble in normal organic solvents because of their huge molecular weight (upwards of 1,000). The soluble portion is known as bitumen. Each kerogen molecule is formed by the random combination of numerous monomers. Kerogens are the precursors to hydrocarbons (fossil fuels), and are also the material that forms oil shales."

There are quite a few "random combinations of numerous monomers" with molecular weights over 1000. I suspect any model that you do come up with is going to be statistical in nature describing processes over many years, rather than a 1 line equation.

There is, however, a very closely related process where you could start your research: Changing World Technology's turkey-offal-and-any-agricultural-waste to oil conversion plant - using what they call Thermal Depolymerization to produce a wide range of hydrocarbons, depending on feedstock.

On a simpler level, look at transesterification of fatty acids in biodiesel.

I've read "Twilight in the Desert", cover to cover. I can now "see" what Simmons meant when he talked about the "water flood".

Thanx also to ThatsItImOut for the comments on the critical importance of the OIP and URR values - and the understanding that without those, we don't know anything.

While none of this has made me any less (or more) worried, it's helped greatly to clarify the picture.

I love this site.

Suppose after the field had been depleted by about 25% or so, because there was a glut of oil on the market, you decided to cut back on your oil production. You cut back, at first by about 50% for five to ten years, then as oil prices rise, you gradually open your choke valves and produce more, but never as much as you possibly could. Then after about twenty to twenty-five years, oil prices skyrocket so you open your choke valves wide open.

Then after producing wide open for only a year or so, you notice your oil production begins to drop dramatically. At this point the question arises; what percentage of your oil have you already produced? Also what will be your rate of decline from here on out?

Of course it is not all that simple because even while you had your choke valves partially closed, you would have still noticed a precipitous drop in pressure. After all, the pressure begins to drop when you pump out the very first barrel. So you would, even with your valves partially closed, still have to have started a vigorous water injection program.

But, and this is a very important point, you would have produced well past 50% of your oil before actual production began to drop.

You were looking at an idyllic mountain home in Telluride when the local Sheik nationalized your field. You get frustrated and become a stakeholder in Pfizer.

There's the rub. From Jarrell

The issue is recovering heavy oils. Yesterday, HO mentioned SAGD (steam assisted gravity drainage). You've got to find some way to reduce the viscosity and thus reduce the flow resistance. Some form of steam injection is usually the answer. EOR may also include horizontal drilling as HO describes.Generally speaking -- from here:

Those are the issues. More expensive, smaller recovery rates, smaller flow rates... (and the downstream refining issues).Now, speaking of Saudi Arabia, the new projects listed by HO yesterday are supposed to shift production to a higher proportion of lighter crudes. The Kingdom produces 5 grades.

They haven't been able to move some of the heavier grades. Ali Al-Naimi (respected, beloved) has been complaining about this for the last year and half. But it is his own fault becauseSo, they are playing catch-up. But as light crudes decline worldwide, can they offset those declines? Almost certainly not. I will also mention that almost all deepwater production is light stuff. But that production comes with its own technical problems. Here, HO's model does not apply. There is no primary recovery phase. Water injection usually starts from day 1.

How this is all going to play out is the question. And time is the biggest factor. Deepwater fields decline quickly and sometimes start declining only a few years after production starts. Worldwide, it appears that humankind is managing the decline of light crude production. That's why some of us are concerned about these issues.

Permeabilty is a measure of the ability of a give thickness of porous material to transmit a fluid through it when a pressure differential is applied across the material.

I don't have the exact numbers, but a Darcy is a coeffiecient relating the flow of a fluid (of unit viscosity) per unit area through a unit thickness of material when a unit pressure is applied across it.

Porosity, on the other hand is merely the fraction of the total unit volume of a material that is void space. For example, a rock formation with a 25% porosity is 25% empty space.

Two different types of rock can have the exact same porosity but markedly different permeabilities. The reason is that permeability depends on pore size, pore shape, exposed surface roughness, plus other factors. The smaller, rougher, and more convoluted the pores, the lower the permeability, and hence the harder it is to move fluid through it.

The permeability is fixed by the physical characteristics of the rock and does not depend upon viscosity. However, the actual rate of flow through a rock for a given fluid will be greatly influenced by viscosity. The greater the viscosity, the lower the flow rate when a given pressure differential is applied.

So, to calculate flow through a rock formation you need to know the permeability of the rock, the viscosity of the fluid bing moved, and the pressure differential that will be applied.

How do vertical oil wells look like?

I naively imagined that they were like a straw with one hole at the bottom and one at the top.

But from your story I gather that this "straw" has lateral holes, is this correct?

Once the watercut rises above the bottom of the oil well, can they "close" the holes at the bottom so that they don't pump as much water?

I would love to see a picture of an oil well, I mean the part that is underground.

I am mildy confused though. I have seen the worldwide PPO decline rate estimated between 8% and 14%. It seems to me that with all the increased recovery technologies be it water injection, nitrogen injection, steam injection, horizontal drilling, or some combination of the above, that the decline rate of fields that use those technologies would be staggering.

Let's take a field with a horizontal wells and water injection. At some point, the water flood will reach the horizontal shafts, drastically increasing the water cut for the well along the whole length of the shaft(s). To me, that would indicate a precipitous drop in the amount of oil produced by that well. I would imagine that the production would drop by far more than 14%. Clearly, the size of the field and the length of the well(s) would play a role, but I could imagine decline rates of well over 20%-30%.

I am fairly certain that I am missing something here. Has this been included in the estimated decline rates I mentioned earlier of 8%-14%? I don't know enough about drilling or field mechanics to make even an educated guess. Experts?

I posted a graph yesterday, borrowed from "Global Oil Depletion: Methodologies and Results - Roger W. Bentley" over here

For what it's worth, I think a lot of the confusion comes from people simply using worst case per-field declines to a make a worst case global decline. Of course that would only be a valid transition if we stopped drilling new fields entirely.

What about Carbon Dioxide injection? Will that avoid some of the issues with water injection, and extend reservoir life?

CO2 injection only works in particular reservoirs (eg. Permian Basin) and extraction rates are low. This has been proposed for EOR in the Lower 48 (pdf) to recover "stranded" oil in place.

1.0/mbd by 2015. 2.0/mbd by 2025. Might as well go ahead and do it, we'll need it.Or here concerning target reservoirs.

Check it out: Stranded Oil in the Residual Oil ZOne (pdf). Everything you want to know.

Exactly as I have imagined it since discussions two years ago. Clearly rate of extraction tells you nothing about field capacity unless you know how the oil is being removed.

I am disturbed that many influencial people keep saying, that because there have been high extraction rates in the past, this means there is lots of oil left to pump. That does not logically follow based on your post.

However, while useful, especially for those small e&p's that buy old fields from the majors, eg ard and gpor (this is a plug for my personal favorites), the net result has never been enough to reverse the overall decline in major producing regions, eg the US lower 48.

The last 2% might be worth as much as the first 98%, so there may indeed be substantial $ rewards for those wringing the last few barrels from these old fields. But, these crumbs will be gleaned by little guys - these efforts are both capital and personnel intensive, which is why the majors, with higher cost structure and still with a few bigger fish to fry, not least funding major bonuses and stock options, are happy to sell off their old leases to much smaller companies.

CO2 injection, is an option where it is available, but CO2 is a gas that requires additional wells to be drilled - for CO2. It is availble in some parts of the South where igneous plugs have uplifted into limestone reservoirs. There is talk of CO2 sequestration from power plants, but I am not aware of a working system at present.

Another option is fire flooding where compressed air is pumped at high pressure igniting the downhole formations. This technique has been used in a few places.

As far as visualzation of an oil well- the hardest part is the distance involved. Say two miles down and only 10 ft thick. This is problem that even people in the business have. The drawings that were in Headingout's post are good from an educational standpoint, but are not very accurate from a technical standpoint. Imagine a 6" diameter hole extending two miles into the earth, then bending at 90 degree and extending for a mile or two horizontally. Also visualize the pipe snaking though the undulations of the subsurface production zone. (just as the surface is not perfectly flat, neither is the subsurface).

What is happening underground is reflected in Well Logs- Mud Logs, Gamma Logs, even sometimes resistivity. That is the eyes of the geologist. We learned years ago that seismic data cannot be used for steering purposes. Not to offend geophysicists reading this but they were never willing to stick their necks out in a definitive manner. They are more content to let the drill bit tell them what the structure is doing and modify their model based on logs. I lost a lot of faith in geophysicists in my early experiences in horizontal drilling. Ive seen them do pretty good work in 3d however but that is a different story.

That is why I used the term "enhanced" instead of secondary or tertiary. I was specifically talking about new field development. The waterflood or fireflood is designed before the field is exploited. Injection does not start at the beginning however because most land fields are developed by smaller companies and they need the cash flow ASAP because most of them have stuck their neck out on the wildcats. The injection wells lag a few years but they have been planned from the start.

Most offshore wells in the US are drilled directionally not horizontally because they need to spot the wellheads close together and also the unconsolidated sands in the GOM have relatively high permeability and high porosity compared to carbonates. Injection wells are a high possibility in the shallow water old gulf wells- to my knowledge they are not injecting in the deepwater yet but I could probably find out.

Regarding Saudi Arabia, I used to be impressed with story's of wells flowing at 25 k barrels per day. Until a friend of mine that had worked there for years told me" Thats all injection pressure". As I said the production wells are aligned along the structure so indeed when the water cut hit s that contour on the structure it is a water well instead of an oil well. I agree with Matt Simmons on Saudi Arabia.

The Saudis' flooded the market back in the mid 80's with the intention of getting rid of guys like me. And I would say for damn near 20 years they succeeded. Look at the history of the oil industry going back to Standard Oil. They performed the classic strategy of getting rid of competition. They also stuffed the alternative energy business down the toilet.

I need to check my facts on offshore water injection but it was my understanding that Canterell, the North Slope, and North Sea were all employing seawater injection and production wells from the same platforms. You are correct, it is directional drilling but it ends up looking very similar. I had visualized the platforms directly above the production wells with directional drilling used to pressurized the field. Of course I could be wrong. I guess I could use a tutorial on offshore drilling techniques as well. Thanks, I enjoyed the article.

I am a bit provinicial in my oilfield knowledge and I would not doubt that all of those fields are water flood. They have do something with all that production salt water anyway. I was thinking of the deepwater Gulf of Mexico play, where it would be signicant to me if they are already started injection.

Directional drilling offshore Gulf of Mexico is used to keep the production wellheads close together and access the reservoir. The well heads may be as close as 10 to 15 feet apart. A fixed platform has "slots" that are drilled according to well plans with wellbores snaking in all directions. It can be amount to quite a mess of pipe when you have platforms with 60 slots or so. Most of the deep water production has the well heads on the sea floor with production risers to a tension leg platform at the surface.

Most of the directional wells have an angle less than 80 degrees more like 20 to 45. A directional well can have more reservoir exposure because of the angles involved if it is designed that way but most are designed to drop to vertical at the end.

A horizontal well uses the same steering technology but is a totally different animal. On a directional well the "target" is a fixed geometric coordinate. On a horizontal well the target is constantly moving due to earth structure.

First the production zone has to be drilled into at an angle of about 85 degrees- so you have to have a good idea that he zone is where you think it is. This done by log data while you are drilling and constantly checking to see if everything is matching up. Then you drill into the zone and try to stay within that section for typically a mile out from the surface location of the well. In the US we are limited by legal units that are used in leasing - the Section (as in Section, Township and Range- a Section being one square mile) and drill from one corner of a section to the other.

Take a drinking straw and bend it to a 45 angle- that is a directional well. Take one and bend it at a right angle- that is a horizontal well.

Ill check out those photos - most guys in the oilfield like to email blowout photos.

In my part of the world on horizontals it is open hole production where you could say the end of the straw is open. This is because the rock is harder than the cement in a typical sidewalk and maintains its integrity.

Most vertical wells are produced through perforations that are shot by explosives through the casing, cement and into the formation. I guess you can imagine sticking needles into the drinking straw.

Pretty basic stuff I guess for the folks on this board.

There is a book, I don't know if it is still published that many interested in this subject might find useful:

"A Primer of Oil-Well Drilling", Published by the Petroleum Extension Service, University of Texas at Austin, My copy is dated 1979. It is a little dated on some of the technology now but its the best written basic book that I've seen. 95% of the info is still good.