Saudi oil production revisited

Posted by Heading Out on August 13, 2006 - 11:25pm

The attached rough map is derived from one in the OGJ and shows the current oilfields along the Saudi coast, different colors to help with differentiation. (To give a sense of scale the island of Bahrain at the bottom is about 30 miles long).

Among the things to note are:

In June 2005, Saudi Aramco's senior vice president of gas operations, Khalid al-Falih, stated that Saudi Arabia would raise production capacity to more than 12 million bbl/d by 2009, and then possibly to 15 million bbl/d "if the market situation justifies it." Falih added that by 2006, Saudi Arabia would have 90 drilling rigs in the Kingdom, more than double the number of rigs operating in 2004.

Since a check on the number of active drilling rigs has shown only about 30 rigs actually drilling, until recently, this is a sign that they are getting serious about meeting that commitment.

(UPDATE: Tonight according to Baker Hughes they have 47 active on land, and 6 offshore). To digress just a little, however, J drew attention to the recent contract that will take 5 offshore rigs, from the Gulf of Mexico to Saudi Arabia at the end of the year.

The interesting thing is that if we look at the announced plans to increase Saudi oil production, the extra oil is to come from the following fields;

Haradh - 300,000 bd, due in February, 2006 (UPDATE: and now in production)

Khursaniyah 500,000 bd, due in late 2007

Shaybah - 500,000 bd, due in 2008 (this is down in the Empty Quarter)

Khurais - 1,200,000 bd, due in 2009.

and Nuayyim - 100,000 bd, due in 2009 and which has been added since the initial announcement about increases in production. (This is almost due South of Riyadh and off the previous map, and may be a part of the initiative to open up the Central Arabian fields.)

All of these sites are on land (see earlier map here and current map of the offshore fields). None of the increased production is to come from offshore. So why are they bringing in these platforms?

The answer lies in another quote from the EIA page.

One challenge for the Saudis in achieving this objective is that their existing fields sustain 5 percent-12 percent annual "decline rates," (according to Aramco Senior Vice President Abdullah Saif, as reported in Petroleum Intelligence Weekly and the International Oil Daily) meaning that the country needs around 500,000-1 million bbl/d in new capacity each year just to compensate.

These numbers have been much discussed, in earlier posts here and conjectured about by a number of authors. But this is an upgraded set of values and I will write more on this in a specific post, following this one. But it is worth noting that this drop will require a significant number of additional new wells each year, over and above the new production wells. And in light of our earlier comments this is where the extra 60 drilling rigs will come into play. (60 rigs x 6 wells per year x 3,500 bd per well, is close enough to 1 mbd per year of new production).

As for the drilling rigs from the Gulf, they will most likely be used at Safaniyah and Marjan, since the Qatif and Abu Safah fields that were brought on line this year are still a little early to see much depletion and also will likely still have the drill platforms there that were used for the initial increase in production.

It should also be remembered that about 2 mbd of Saudi production is now used internally, and the EIA page shows a steady increase in that demand.

The contract to start the Khurais development, due on stream in 2009, has just been given to Foster Wheeler Energy Ltd. (That link to the OGJ is no longer valid, but merely said

Saudi Aramco let a front-end engineering and project-management services contract to Foster Wheeler Energy Ltd. for full development of supergiant Khurais oil and gas field in Saudi Arabia.The field is to produce 1.2 million b/d of Arabian light crude by 2009 as part of Aramco's program to raise production capacity from 10.5 million b/d at present to 12 million b/d by 2009 .

To repeat the numbers from a couple of earlier posts that specify the totality of Saudi Production. According to Cordesman and the CSIS they intend to bring production up to the following numbers

Abqaiq - 400,000 bd

Ghawar - 5,500,000 bd

Berri - 400,000 bd

Safaniya - 1,500,000 bd

Abu Sa'fah - 300,000 bd

Zuluf - 800,000 bd

Marjan - 450,000 bd

Haradh - 170,000 bd

Shaybah - 500,000 bd

Munifa - 1,000,000 bd

This gives the 11 mbd that they claim to be able to currently produce - though it includes Munifa, of which we have commented negatively earlier.

(UPDATE: The 1 mbd from Manifa will now likely start coming on stream in 2009, there is some info here, here, and here. It is the last of these that points out that

Following its discovery in 1957, the field was developed but later mothballed due to the heavy quality of its crude.The problems with the oil are also given here.)The launch of Manifa's development remains on hold until the kingdom builds refineries capable of handling its heavy 28 degrees API gravity crude, the CSIS report revealed.

"The combined costs of fitting this field and the lack of refining capacity for the heavy crude it produces is responsible for the delay in putting this field on line," said the report, entitled Saudi Arabia's Upstream and Downstream Expansion Plans for the Next Decade: A Saudi Perspective. To this end, Saudi Aramco has plans to build two new refineries: a joint venture 400,000 bpd refinery in Yanbu and a new grassroots refinery at Jubail, also projected to have capacity of 400,000 bpd.

When this is added to the new production outlined above, and when you include an anticipated 800,000 bd loss due to old fields declining, the sum comes in just over the required number.

What it does not do is include more than one year of current declines in production from the existing fields (and again this might be the role for the new rigs being brought in).

(UPDATE: Earlier this year the CSIS (ibid) came out with a new book “The Global Oil Market: Risks and Uncertainties,” by Cordesman and Al-Rodhan. In writing about Saudi production it says, relative to the numbers above:

An estimated 2.3 to 2.4 mmbd of new capacity will come onstream between 2005 and 2009 , but an estimated 800,000 bd of that will go into replenishing the natural decline curve. The end result is a net addition of roughly 1.6 mmbd to the current sustainable capacity of 11.0 mmbd.The program has been put on the fast track, and the book suggests that the additional production may come on stream before 2009. At the risk of appearing slightly cynical of this, oil depletion is not a single event, but occurs each year, so that if the drop in production is 800,000 bd/year and there are 5 years from the beginning of 2005 to the end of 2009, then my arithmetic says that they have to increase production by 4 mbd just to sustain their current numbers. On the other hand, with in-field drilling, as the Saudi Minister has said, they can keep this down to about 2% - and while this agrees with Cordesman’s number, it also requires all those drills, that they don’t seem to have yet. The book goes on to note that current Saudi spare capacity comes from Safaniyah – where there are two on-shore wet handling facilities with trains of 0.6 mbd each, coming from 60 wells that have been “recompleted” in lower formations. )

An earlier estimate of production in Saudi Arabia at the beginning of the year was as shown below, with the flow given in thousands of barrels a day (kbd):

Abqaiq 400 kbd;

Abu Sa'fah 200 kbd;

Berri 300 kbd;

Ghawar 4,500 kbd;

Hawtah 200 kbd;

Hout 300 kbd;

Khurais 300 kbd;

Marjan 270 kbd;

Qatif 800 kbd;

Safaniya 700 kbd;

Shaybah 600 kbd; and

Zuluf 500 kbd.

This adds up methinks to 9.07 mbd.

UPDATE: An Oops! - When I first wrote this I had a map that did not survive, and in recreating the post I chose the wrong one - herewith the other:

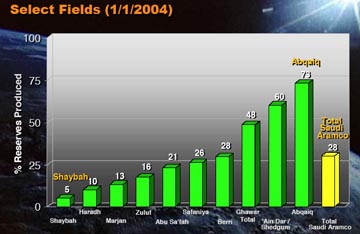

And to continue to add info to the site, herewith a graph from the Saudi presentation to CSIS, in response to Matt Simmons, from a couple of years ago:

While Vanadium can be (must be as it poisons the catalysts) extracted from oil, the cost and difficulty of doing so is high. The amount of Vanadium in even the most contaminated oil is worth less than 1 cent per kg oil - which I believe is far less than the cost of extracting the Vanadium.

But that is treating oil like a convenient form of coal. Which in 1957 it was, pricewise.

Hundred would be a bargain.

It would raise oil prices, forcing the world to invest and implement in alternative energy sources.

It would also dramatically slow production, disrupting Hubbert's peak and saving more oil for after the peak.

Sorry if this is a threadjack.

We need more rigs, crews, and pipe, for starters. Leaky pipes might be a world wide phenom considering how old most fields and their infrastructure are.

The consensus at TOD is that higher oil prices need to be part of a long term Peak Oil solution.

However, a dramatic escalation of the Middle East conflict involving a conflagration in the Strait of Hormuz isn't without the potential for all sorts of other (not all that controllable or pleasant) consequences.

On balance, I think we'd prefer a different path to higher prices.

Agree!

A very interesting point. The irony is that Hubbert's peak is a model which reflects a world in which people may be dying for oil (the USA then) but not one in which they are not only dying for oil, but also killing for oil (the world now).

Paradoxically, overly rigourous adherence to the Hubbertian model makes the peak oil community too optimistic, in that they tend to believe that the resource-wars mayhem won't really begin until after the peak, since otherwise their model wouldn't fit as neatly as they would like it to. But as you suggest the mayhem may have begun already.

So any hope of you smart TOD guys designing an updated depletion model that factors in resource-war driven production mitigation as well as creaming curves?

WWI: Germany wanted the Baghdad-Berlin railway to deliver oil, the British didn't want them to get it.

WWII: Germany made runs at the North African and Azerbijan oil fields, Japan temporarily captured SE Asian oil.

The Cold War: ended in part with USSR peak oil plus Saudi Arabia flooding the market with cheap crude to cut off the USSR's hard currency supply.

US-Iraq War I (1990-1991): self explanatory

It never ceases to amaze me that over half of people who believe in geological peak oil deny that the constant warfare of this century is all about oil as well.

WWI is far more complicated; it was not about oil.

WWII was Nazi-Germany's quest for "Lebensraum", and oil was needed to fuel the war machine.

The cold war was about ideology. It was fought with oil, among other means.

http://www.amazon.com/gp/product/074532309X/

If the collapse of the Soviet Union is a reasonable proxy for a post peak global collapse (this could even be optimistic since there wasn't a serious war involved) then oil production could fall away very rapidly indeed. FSU production fell by 50% in under 5 years.

See this graph from Laherrere:

Click to enlarge.

I guess this was economic collapse leading to oil production collapse, but couldn't the global case see peak oil causing economic collapse which in turn destroys oil production?

Will OPEC still be producing ~30mbpd 3 years post peak? I wouldn't bet on it!

This is not necessarily true ... prices can get high enough that people can no longer pay at the pump - which means pumps can no longer be paid to pull oil from the ground.

That's intolerably simplistic, but everyone MUST keep very clear that petroleum does not follow simple supply and demand, as I noted in a previous post. It is perfectly feasible that the US will nationalize our oil ... it is possible that global conflicts may continue to spread and escalate ... we could all be back on rationing stamps for food and fuel ...

For every direction there are numerous outcomes, and this forces us to not only work diligently to accurately predict such things as global peak of production, but even things like; (1) how the market will work on developing alternatives and non-conventional sources, (2) how politics and foreign policy will shift and change to deal with changes in supply, (3) how domestic policy will change - with our "way of life" changing as well ...

There is only one thing that can simply be stated - production of hydrocarbon fuel and raw materials, necessary to the maintenance of the western world's current way of life, will begin to decline in the approaching years.

No one is certain how few or how many , nor can we accurately determine at what price per gallon the US economy, and even that of the world, will finally tip over into true depression, so we must all work diligently to make accurate predictions, while at the same time altering friends, family, local/regional/state/federal politicians of your concerns, and preparing for what may be the most challenging times you and your loved ones have ever faced - be that in 3 years or 15.

Many on this board miss the distinction between real GDP and nominal GDP. Nominal GDP will likely keep growing, real GDP will likely contract if we peak and don't plateau ( or even just grow supply slowly). Interest rates are likely to go a lot higher than people expect unless we get a housing crash.

The Dow Jones looks OK if you look at a chart of the 1970's (in nominal terms), until you inflation adjust it (real terms), then it looks remarkably similar to a chart of the 1930's depression.

Going forward the its likely to be a stock-picker's market like in the 1970's - index trackers are going to suffer, in my humble opinion. And most stocks will decline in real terms I suspect, with possible exceptions around energy, infrastructure, and mining related themes. Precious metals also did well in the 1970's.

"I guess this was economic collapse leading to oil production collapse."

AFAIK most contemporary historians contend that it was the glut of oil in the 80s that was the chief 'culprit':

Oil glut => collapse in oil price => collapse in Russia's oil revenue => collapse of Russia.

Today:

oil scarcity => increase in oil price => increase in Russia's oil revenue => Putin rules OK.

Tomorrow:

Russian oil all gone up in smoke. Russia in deep doodoo...

Regarding what caused the Soviet Union collapse was the collapse in oil production, thus a collapse of hard currency earning.

You can find a communication done by Marek Kolodziej during the ASPO IV International Workshop on oil and gas depletion in Lisbon, Portugal. The document is entitled : Former Soviet Union Oil Production and GDP Decline: Granger Causality and the Multi-Cycle Hubbert Curve

You can find all the presentation there

In the case of petroleum, demand destruction only works so far, because you're talking not only about the raw materials that lend to the creation of everything in modern society (everything made of anything synthetic that your mind can dream of - and a million more that you won't) but petroleum also is the primary fuel source powering how those things are grown, manufactured, mined from the earth, transported by land, sea, and air ...

... when you hear someone talking about how demand destruction will ultimately help to keep the prices down, you have permission to slap them, because the "demand" cannot go away unless you take away the demand for food, for fresh water (pumped thousands of miles from the Colorado, Columbia, Mississippi, Missouri), for more than 98% of all pharmaceuticals (including the anaesthesia that will allow your child to sleep during an emergency surgery), for the fuel to power massive earth moving machinery after any kind of natural disaster ...

Do you see? There can be no demand destruction without destruction of those with demands - a horrible thought, and one that can certain inspire nightmares - but as the cost per barrel inches higher, those are the kind of nightmares we'll all be having.

I appologize for interrupting the thread any further - but when someone asks a question - I think an answer is appropriate. While some may disagree with an element of one point or another - the concepts are all there - we all have seen basic discussions like this - so let's save the thread from an ongoing barrage of "how I'll survive" posts afterwards.

... when you hear someone talking about how demand destruction will ultimately help to keep the prices down, you have permission to slap them, because the "demand" cannot go away unless you take away the demand for food, for fresh water (pumped thousands of miles from the Colorado, Columbia, Mississippi, Missouri), for more than 98% of all pharmaceuticals (including the anaesthesia that will allow your child to sleep during an emergency surgery), for the fuel to power massive earth moving machinery after any kind of natural disaster ...

Do you see? There can be no demand destruction without destruction of those with demands

------------------------

Au contraire.

Demand destruction is a very useful concept and it explains why oil will be available for essentials long into the future.

If one believes in an early peak, it is not unreasonable to believe that one can personally take steps with a decent chance of reducing the affects of future scarcity.

In fact, a decent understanding of how demand destruction works could help avoid the panic evident in Gargoil's post.

Significantly higher rates of demend destruction (= depletion) as predicted by some on this site can IMHO only lead to acceleration of these trends and successive bouts of economic crises. As Chris Vernon says, the actual decline rates and oil prices once we are clearly past peak are essentially unknowable as all sorts of political aspects (oil producing countries restricting exports, wars, recessions, lack of investment and expertise, collapses of some economies) will come into play and push the purely geological considerations into the background.

Can you elaborate?

How can you have "demand destruction without destruction of those with demands?"

I am trying to gather a "decent uderstanding" of all things Peak Oil.

Please educate me.

Can you elaborate?

How can you have "demand destruction without destruction of those with demands?"

Demand destruction means that people's capacity to consume oil is diminished, not that they themselves are destroyed.

Essentially there is currently an immense cushion against real hardship in the way we live. Much of what we use could be used for other, more essential, things.

ie. energy and resources consumed in entertainment, comfort and luxury can be redirected for basic sustenance. eg. Fuel used in trips to Vegas could go to running tractors and combines and irrigation systems, milling flour and baking bread.

So, for one simple example, tourism and entertainment could whither away completely without anybody starving. But it is much broader than that. Very few of us work in industries that could not be pared back massively without threatening survival.

Note that by starving I mean actual starvation, not unemployment, income loss, poverty etc.

So what happens to the growing number of unemployed in a nasty peak oil situation?

Remember that even ancient Rome, never noted for compassion, doled out free food for the poor on a very large scale: as much as 30% of the population at some points in its history. (reference: "Collapse" by Tainter) Why? As far as I can discern this was done because the urban poor become very dangerous when hungry. They can easily trash your society. But it's also likely that they are fed because they are a useful pool of manpower at times and simply because they are fellow citizens.

Currently, if you haven't noticed, the poor in America are actually fat! Never before in history has this been the case. An utterly astonishing development. And another indication of the huge cushion we have against real hard times that actually threaten life and limb.

So, to get back to the idea of "demand destruction":

Say someone with a nice job in the airline industry loses their job because high oil prices wipe out air travel for fun. When savings are exhausted, they join the ranks of the poor. Their demand for automobiles, luxury goods, restaurant meals, steaks, movies, McMansions etc has been destroyed. But they live on, getting by on the dole (perhaps a ration of rice and beans) and casual labor.

It's possible that such people could learn to enjoy neighbourhood soccer games in vacant lots and open air performances by local musicians. i.e. They may discover their lives don't completely suck even though they have no money.

This is far from ideal. And I certainly have few moral qualms about living high on the hog the way most of us do now. So there is nothing redeeming, in my view, about having to give up the luxuries that we love.

But my point is: "demand destruction" at its worst means being involuntarily busted down to the simple life -- or, more likely just reduced to a simpler life. You lose some of your capacity to consume very large amounts of oil. It does not mean death and starvation, perpetual misery except in unlikely extreme cases. Most of the world currently lives in a state of demand destruction. Only in their case demand was never constructed in the first place.

Asebius.

Thanks for the clarification.

However I think there is only a fine line between your demand desctruction and the scenario described by Gargoil

... when you hear someone talking about how demand destruction will ultimately help to keep the prices down, you have permission to slap them, because the "demand" cannot go away unless you take away the demand for food, for fresh water (pumped thousands of miles from the Colorado, Columbia, Mississippi, Missouri), for more than 98% of all pharmaceuticals (including the anaesthesia that will allow your child to sleep during an emergency surgery), for the fuel to power massive earth moving machinery after any kind of natural disaster ...

I see the distinction you are making. What I don't see is any sort of mechanism or natural stop that keeps society from sliding right past your scenario into Gargoil's world.

How much oil do we actually use on trips to Vegas? Even if we cut out all such pleasure usage from our economy will there be enough oil to make fertilizer, plastics, gas for shipping/trucking, heavy manufaturing etc?

Or even if sufficent oil is available could we consumers still afford the end products? So even if insulin is avaiable can I afford it? Especially considering the huge world wide recession/depression?

This by the way is not a rehtorical question. I am genuinly curious.

One of the universal measures of general quality of life is time/income spent on leisure, as opposed to work. We have quite a bit of progress to show in the Western world in that area in the last century. Most of our economy isn't jobs devoted to the necessities of life or making tools that promote the necessities of life, but on frivolties like travel agents, priests, lobbyists, celebrities, the press, geriatric care, telecoms, phone sanitizers, what-have-you.

But in an emergency wherein our energy supply is removed, we could be plunged back to where most of the lower-middle class income is spent on heating our homes, putting food in our mouths, protecting ourselves, et cetera. Without the leisure spending, the large portion of the nation whose work has very low-order benefits to our lives will find themselves unemployed.

Basically, a recession of a magnitude we've never encountered fully.

It's what we're talking about when we say that if alternatives are not found to oil, great hardships will occur - the optimists among us who believe that it won't cause the fabric of society to be destroyed and result in massive die-offs.

What I don't see is any sort of mechanism or natural stop that keeps society from sliding right past your scenario into Gargoil's world.

Agreed. But even my example scenario is quite extreme and unlikely any time soon.

Even if we cut out all such pleasure usage from our economy will there be enough oil to make fertilizer, plastics, gas for shipping/trucking, heavy manufaturing etc?

I would argue that our "non-essential" use of oil is several times greater than our "essential" use. Bernanke pointed out recently that we use twice the oil per capita as some other developed nations (Japan, for instance). They live much like us, yet use half as much oil.

So it's possible that oil reserves could be stretched substantially without impacting lifestyle much. Once you get into a situation where lifestyle is impacted, the savings are even greater and the reserves get stretched further for essentials.

As noted by other posters, the pessimists believe that if the nation were forced into "powerdown" mode, the social fabric would soon rip leading to largescale collapse despite the fact that substantial resources remain.

I'm an optimist on this issue. But my optimism is not based on a positive view of human nature. Rather, historical examples like the Great Depression, WWII rationing etc, show the social fabric can take a lot of punishment. For a more extreme example look at the Cuban "Special Period".

So even if insulin is available can I afford it?

In very difficult circumstances, maybe not. But odds are you'll get it, anyway. During the Great Depression, America took a big lunge to the left and, in key ways, never looked back. Peak oil would almost certainly drive it further left as far as the average citizen was concerned.

I replied:

Agreed. But even my example scenario is quite extreme and unlikely any time soon.

What I should have said was that there is indeed a continuum with Gargoil's world further out on one end than the scenario I outlined.

But it is not easy to slide along that continuum. Reason: society has immense capacity to redirect resources and to adjust to shocks like diminishing reserves of cheap energy. Society is not a house of cards.

I see. Thanks for the reply.

I've read too many doom and gloom predictions lately. Its nice to hear a more optomistic tone.

Not likely at all!

In order to prevent the urban poor from "trashing the society" BOTH Panem et Circenses were needed.

Why would it be different today?

Tourism for the masses is a recent invention and may well soon disappear. Mass entertainment, however, cannot be dispensed with.

And if that happens there will be calls for rationing etc. - in itself a form of demand destruction. I wouldn't bet on free market pricing being permitted if supply ever gets tight.

With today's technology and better planning, they might get by with 0.1% of US oil use per capita.

i googled it with no joy!

Many thanks.

So, were they unable to obtain all those rigs, or were they merely lying? The answer is pretty crucial, it seems to me.

In either case, their 12 million bbl/d in 2009 would seem to be surely, demonstrably kaputt, n'est-ce pas?

Question two : does the market know this?

Just to see if I've understood : the 90 drilling rigs were intended, for the most part, to offset depletion on the existing, mature fields. This doesn't create any new reserves but accelerates the drawdown of extractible oil, so that the decline will be all the more precipitous when it comes (as demonstrated most remarkably in the North Sea). Have I got that right?

I do not believe the Saudis were lying. I think they believed they could get 90 such rigs back in 2004. The reality has turned out to be a bit different.

The "market" knows nothing. Individuals know things and most individuals are either unaware of this data or don't care resulting in the collective actions of the most-holy-omnisicient-benevolent "market" not knowing jack squat.

North Sea? I'm more worried about a Yibal style collapse for Ghawar.

However I noticed one 'small' bit of negative crit on the book trying to debunk peak oil. It is a report by a petroluem engineer Jim Jarrell entitled 'Another day in the desert..........'It took a while to find a link to the actual report but here it is:

http://www.rseg.com/sample/MP_Simmons10_05.pdf

I just wondered if anyone had seen this report or what they think about what it says, and comments etc..

I think their critique of the depletion/decline argument is the most off base. Their discussion completely ignores what has happened at Yibal in Oman,the North Sea fields and others with horizontal drilling and decline. They could have written this in the late 1990s when The Economist ("Oil less than $10.00 is inevitable") and the oil companies thought this tech would yield a long-lasting bounty of abundant oil that would be slow to decline. They made the same arguments made in this critique of Simmons. However, real world experience of the last 5 years have shown they were completely wrong and that decline crashes after a relatively short period of production boost. It is as though the author was time locked in 1999 and hasn't seen the real outcomes yet.

http://www.theoildrum.com/story/2005/11/14/233959/10

http://www.theoildrum.com/story/2006/1/18/13443/5542

http://www.theoildrum.com/story/2006/1/24/235629/454

http://www.theoildrum.com/story/2006/4/25/11239/2308

Also, if we start with 9.1 export, take away 3 years of depletion of .8 per year and then add 2.4 from new wells we are back to 9.1 after 3 years. But internal demand is increasing so we won't even get this far. Plus it looks like they can't get all the rigs they need to even meet adding 2.4.

Am I missing something? It looks like KSA is in decline.

Jack? I can't handle this on my own.

It has opposing views to this book, That is why i posted the link!

Marco

I have read Simmons and the paper you link to is from ROSSSmith Energy Group and the engineers that author the critique site credentials so they may claim to be experts (this may make them qualified to critique but it cannot be assumed that they are objective given the affiliation). They have listed numerous critiques - I have copied one below as an example:

"Furthermore, water injection does not erase the possibility of having secondary recovery, as Twilight states. It is secondary recovery."

If I remember correctly from Simmon's, he was clear that it is secondary recovery and that is WHY secondary recovery is not possible once decline sets in since it is already done - initiating secondary recovery erases the ability to employ secondary recovery later - this was the point and a good one. The critique seems to be focusing on semantics.

Further, they argue Aramco is showing good field management and that this somehow discredits Simmons: this does not make sense to me - Simmon's does not argue Aramco has bad field management, on the contrary, he says they do and it was in the 1970's before nationalization that poor management occured at its worse - and also political interference could result in overproduction at times - Aramco may disagree but it is an authoritarian regime.

Good field management does not change the geology of eventual depletion and decline and Simmons focuses arguments on that. Good feild management also does not erase the possibility of political interference as ARAMCO is state controlled. Saudi Arabia is in decline despite whatever might be said and all the critiques in the world are not going to change that.

If the 12 million per day plus does appear in future... I would not hold my breath

CEO.

It's time for school. Time to go to faculty meetings, argue about curricula, answer clueless emails from freshmen, and figure out what I want to make my students write about this semester.

I'm giving the TOD a quick read each day, knowing that the conundrum laid out by the updated "Limits to Growth" will shoot down all and any hopes of technologically finessing our way out our long deadly slide toward the abattoir of overshoot.

For those clinging to the idea that we will slip by the reaper while whistling and looking innocently toward the heavens, I supply a bit more hope, a bit more fool's gold.

http://www.energybulletin.net/19262.html

"But unlike earlier consolidation waves, this one is occurring deep in the manufacturing food-chain, and being driven by surging commodity prices. Copper is up a stunning 192% over the past two years, nickel 103%, natural rubber 72%, and oil 67%. Another cause: severe price fluctuations that have roiled production, causing costly shutdowns and missed deliveries. The price of cold-rolled steel in the U.S., for instance, has been on a roller coaster, surging to $700 a net ton in June, up from $590 a ton a year earlier, but about on par with prices in June 2004."

Natural rubber is a renewable, and sustainable resource. The price rise of this supports my belief that we are just seeing the efects of quite rapid growth in China et al.

We can see efficiency gains in use of 20:1 for electric freight railroads and comparable with Urban Rail if "the other TOD" is included. Gains this large can, IMHO, "change the game" if implemented early enough and widely enough.

Recycling metals is much more efficient than mining low grade ore. Modern design COULD build extremely durable and efficient goods.

"More of same" will NOY work, I agree. But a radically more efficient society may not fit the models used here.

The United States is not even starting on that path, but we are not the only society.

Not really the "good thing" to do, if there is any chance of mitigation (NOT escape) it is certainly not by increasing the drowsiness of "the crowds", including here at TOD.

I like Kurt Cobb better : Is just-in-time nearly out of time?

Indium:

http://www.webelements.com/webelements/elements/text/In/key.html

don't know about availability but i do know any large ramp up would crimp supply's causing this and all the other electronic elements that require this metal to skyrocket in price.

gallium:

http://www.webelements.com/webelements/elements/text/Ga/key.html

sorry the reaper will get us, the only thing we can control is how bad it will be. The more we hold him off the worse it will be later.

Low efficiency can be a problem in some areas.

The energy efficiency of the cheap printed version they are pinning their hopes on ( rather than lab samples using expensive processes) is 2 to 2.5 times less than the best silicon cells and means they reqire a corresponingly larger area for a given power output. Where space is not limited this is not a problem if their projected costs materialise as they will be cheaper per kilowatt rating. However the bulk of photovoltaic generation to date is in domestic grid connected applications. In Europe there are many urban areas where the vast majority of houses do not have the about 30m² of south facing roof space that 9% efficient cells need to get the 3000kWhr per year average annual electrical consumption (without heating).

I'm presently in the market for a home PV system, grid tied, no battery backup (too expensive, batteries don't last).

Three seperate estimates of a 3500kW system are all in the $30K USD range (installed). I get 5.5 hours of "full sun equivalent" a year here in the deep south, or 19.25 KwH/day, assuming ideal conditions.

By the same token, I can buy grid power for just $0.032 cents per KwH. Thus, such a PV system has a payback period of 133 years. Doh!

Not feasible.

Sadly, I live in central Georgia, and we have no rebates and fairly cheap electricity here presently. I do agree, however, that electricity costs are only going to continue to rise, they are up here about 15% since this time last year. Still....geeze, 47 years?

That is a hard pill to swallow. Or to convince my wife that it is a wise move.

My solar is part of my post-peak security strategy given that I am quite concerned about what will happen to the economy. I am paying off the house as fast as I can, and with the solar roof I have that should produce another 30 yrs, I will be supplied with electricity for as long as I expect to live there well into retirement, not having to worry about the cost inflation. If I really get concerned, I'll add battery backup.

Until the power companies underinvest and you have to pay the cost of not having power. A bed and breakfast will have very pissed customers if the power goes off.

Happy Scenario

(in-field drilling)

2% depletion

10.15/mbd (existing base)

2.08/mbd (internal consumption, 1% growth)

2.4/mbd (new capacity)

==============

12.55/mbd (total)

10.47/mbd (oil or refined products available for export)

Unhappy Scenario

(no in-field drilling)

7% depletion

8.851/mbd (existing base)

2.16/mbd (internal consumption, 2% growth)

2.3/mbd (new capacity)

==============

11.151/mbd (total)

8.99/mbd (oil or refined products available for export)

Comment: The truth may be somewhere in-between. Where are the rigs? I assume some number of them will be up and running sometime in the period considered. I assumed in both that Manifa and refining will come onstream in 2009.

I did not actually go into the really unhappy scenario -- no rigs for in-field drilling, further delays, eg. Manifa after 2009 because of refinery delays.

Obviously, the in-field drilling did not occur last year and doesn't seem to be happening this year either. That rules out the happy scenario right out of the starting gate.

A note on drilling: Saudi Arabia tests potential for unlocking heavy-oil reserves

An insider who was at ASPO-USA told me "The comparison between a sandstone reservoir and a carbonate reservoir can be quite different in this respect. Carbonates are much more receptive to horizontal production." First, steam injection (if successful). Then horizontal drilling. Then down the road...But a quick look at "Twilight in the Desert" says that the field is in a "grainstone" , and that it had been producing at 50,000 to 60,000 bd and then after the first Iraq war a 2,000 ft horizontal well, at the top of the reservoir, flowed at a rate 7 times that of an equivalent vertical well at the same locationt. They were, at that point, using horizontal sidetracks (though I thought those - by definition - were relatively short).

However they found a new extension at the Eastern end of the reservoir in a sand, this was developed in the late 1990's increasing production, which peaked in 1998, at 91,000 bd.

Not much of this is consistent with the Chevron story.

I thought the Chevron story (reprint, July 10 from WSJ) was worth passing on. There is the obligatory swipe at people concerned about oil production.

I don't know if it would be a "blow". Even if Saudi Arabia giveth, Cantarell and others will taketh away. Give me a break.Anyway, this may be new development since Twilight in the Desert was written. From Chevron folks (pdf).

Clearly what use is spare capacity if no-one can use it. And why is everyone assuming that the Saudi's are not producing whatever they can. Even if they had extra heavy oil considering that they are the lowest cost producer ( at least according to them and some analysts) shouldnt they be abale to sell at a lower price.

Damn that Jabba the Hutt. First he freezes Solo in carbonite, now he has locked up the oil. Quick, get my lightsaber.

oil bearing reservoir?

The KSA has made the claim that with in field drilling they can reduce depletion rates from 7% ( or more ) to 2% can someone show on other mature fields where this has been the case I see nothing from the North Sea ,Cantrell and Texas to support the fact that you can indeed control decline rates as the KSA claims. Instead it looks like esp with modern extraction methods that your going from a decline rate of 14% or more to 7-8% at best with infield drilling. I just don't find the KSA claim of 2% believable.

This has been the number one problem I have with peak oil. The individual field decline rates seem to hover around 10% and yet overall decline rates of 2% or so are claimed. If you go with the math it looks like your facing a yearly decline rate of 8% at least or more that you need to make up with new drilling.

I'd love to be proved wrong. Show me how you can magically get fields declining at 10% or better to provide a overall rate of 5% or less.

Abd Allah S. Al-Saif,

Senior Vice President for

Exploration and Producing,

Saudi Aramco

Just to let you know -- I've just posted a belated and brief reply to your reply to my comment on your 'CERA's Perception Management' posting. Thanks]

2006

Haradh 300+/kbd

2007

Abu Hadiya/Khursaniyah/Fadhali 500+/kbd

Khursaniyah NGLs 300/kbd

2008

Hawiyah 370/kbd

Nuayyim 100/kbd

Shaybah 300+/kbd

2009

Khurais 1200/kbd

That's would put new production from these fields in the neighborhood of 6/mbd (all liquids) in 2010. Manifa is not onstream until 2011.

Anyway, those are his numbers. Any comment, HO?

Anyway, here's the other calculation. Altogether over the 2006 to 2009 period, Saudi Arabia will produce 4.629 Gb of liquids from new fields or extensions to older fields. That's 15% of what I roughly calculate the world will use this year alone.

if Skrebowski is right

Likewise Shaybah came on line 1n 1998, and on very good days can produce 590,000 barrels per day. The new Shaybah project is supposed to come on line in 2008 and add 300,000 bp/d to that capacity. However many of these new projects will just draw these old reservoirs down faster.

As I said in an earlier post, Aramco manages for maximum production and not necessarily for what is in the best interest of their fields. Drawing more oil, much faster, from Shaybah and Haradh and these other fields, may simply make them crash much faster.

Again, most of these new projects are in old reservoirs. These new wells and gosps are how Aramco hopes to get their decline rate down from 8 percent to 2 percent. They may indeed succeed but this means they will simply have to pay the piper later on in a much higher decline rate.

The choices seem to be, either conserve now or use it even faster thus making the coming crash all the harder.

Of course short-term minded capitalism will insist upon full out idiocy: hyper-consumption masquerading as efficiency.

The planet will fend for itself. Soon old lady Gaia will shake herself awake and destroy the pesky mosquitos who dip their straws into her hide.

Will she notice the passing of one species? I think not.

2 questions:

1/ are you ironic in your rig total comments? If not, where are the additional (40+) rigs going to come from?

"Since a check on the number of active drilling rigs has shown only about 30 rigs actually drilling, until recently, this is a sign that they are getting serious about meeting that commitment."

2/ Heinberg said this on Aug 4:

http://www.energybulletin.net/18904.html

"At the ASPO conference a well-connected industry insider who wishes not to be directly quoted told me that his own sources inside Saudi Arabia insist that production from Ghawar is now down to less than three million barrels per day, and that the Saudis are maintaining total production at only slowly dwindling levels by producing other fields at maximum rates. This, if true, would be a bombshell: most estimates give production from Ghawar at 5.5 Mb/d."

Is he the only one stating this?

Clearly what use is spare capacity if no-one can use it. And why is everyone assuming that the Saudi's are not producing whatever they can. Even if they had extra heavy oil considering that they are the lowest cost producer ( at least according to them and some analysts) shouldnt they be able to sell at a lower price.