Iraq Could Delay Peak Oil a Decade

Posted by Gail the Actuary on January 6, 2010 - 10:22am

This is a guest post by Stuart Staniford, former Oil Drum staff member. It was originally posted in Stuart's blog Early Warning.

Iraq could delay peak oil a decade--with the emphasis on the could.

I have been associated with the view that the stagnation of oil supply growth from late 2004 on was likely to be the onset of a "bumpy plateau" of oil production - that oil production would not go too much higher, although it wouldn't decline quickly either. You can see articulation of this point of view, for example, at old Oil Drum pieces like Why Peak Oil is Probably About Now, and Hubbert Theory says Peak is Probably Slow Squeeze.

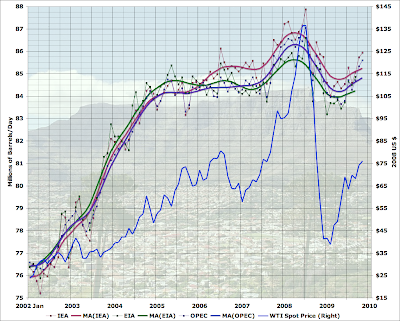

Generally, events of the past few years have been reasonably kind to this point of view. The major producers (eg Russia and Saudi Arabia) seemed to have more-or-less reached production plateaus. Overall global production bumped up a little in late 2007 and early 2008 in response to the very high prices, but not much. Similarly it fell in 2009 in response to the great recession, but not much. Bumps on the bumpy plateau, it has seemed to me (and this would be even more true if you looked at the data ex-biofuels). Now production is going up again. Here's what the latest data for global liquid fuel production looks like (with the monthly price on the right axis):

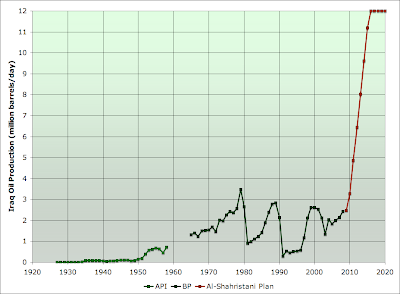

However, I think it's important to note that a potential game-changer has developed recently that could render that point of view obsolete (which is a kinder, gentler way of saying "wrong" :-). A couple of years ago, Iraqi oil production was declining and it didn't seem too likely the country would stabilize any time soon to allow that to change. However, the post-surge stabilization of Iraq has now allowed Iraqi oil production to start creeping up, and in 2009 the Iraqi oil ministry has announced large numbers of contracts with major oil companies to bring production up from the current 2.5mbd or so to 12 mbd over the course of the next 6-7 years. It is also announcing a series of projects to increase the physical export capacity of the country in line with these oil production projects.

It seems to me that the possibility that Iraq may actually succeed in doing this should be taken seriously. If it did succeed, that would act to delay the final plateau of oil production by a decade (ballpark), make that plateau be at a higher level (95-100mbd ballpark), and significantly moderate oil prices in the meantime, with even some possibility of causing a serious breakdown of OPEC discipline and a period of significantly lower prices akin to the 1980s-1990s lull (though probably not as long or as deep a lull as that). If that were to occur, it would likely have profound consequences for alternative energy projects, biofuel companies, and automobile fuel efficiency. A period of lower oil prices will put adaptation projects on hold for the duration.

At the same time, even in this scenario, there's a real chance of another oil price shock before the main rise in Iraqi oil production arrives.

At this stage, it seems too soon to say the Iraqis definitely will succeed. But the scenario that they might seems worth serious consideration. In this post, I'd like to take a first look at the situation, including:

- Status of Iraqi oil reserves

- History of Iraqi oil production

- Shape of the announced oil production plans

- Character of the architect of the Iraqi plans, oil minister Hussain al-Shahristani

- Indications of the improving stability of Iraq.

- Implications and conclusions.

Iraqi Oil Reserves

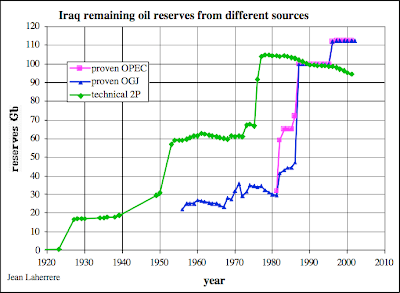

There doesn't seem to be too much dispute that Iraq has enough reserves to support far higher production than has actually occurred in the past. Jean Laharrere (well known oil industry veteran and coauthor with Colin Campbell of the 1998 SciAm peak oil article) recently summarized the situation as follows:

The "technical 2P" numbers here are from proprietary Petroconsultants (now IHS) data and claim to represent the best estimates of the petroleum engineers of how much oil is likely to be recovered (ie with 50% probability, as opposed to the 90% probability required for proven reserves). "Gb" = billions of barrels of recoverable oil.

There is a great deal of controversy about the potential of Iraq's western desert, which is largely unexplored. IHS has claimed that there might be as much as 100Gb there in addition to the known reserves, but since none of this has been confirmed with drilling, it remains speculative (and Laharrere for example doesn't accept this estimate). Big Gav had an Oil Drum post Iraq's Oil: The Greatest Prize Of All? some time back with more background.

However for my purposes today it's enough to note that even if there is only 90Gb, with an initial 5% depletion rate (in line with industry practice) that could support a rate of 12 million barrels/day (the depletion rate is what fraction of the known reserves are produced in a year). So the announced Iraqi plans would not seem to be precluded by lack of reserves. As we will see below, the field by field reserve estimates and production plans that have been made public also seem generally consistent with the plan.

Historical Iraqi Oil Production

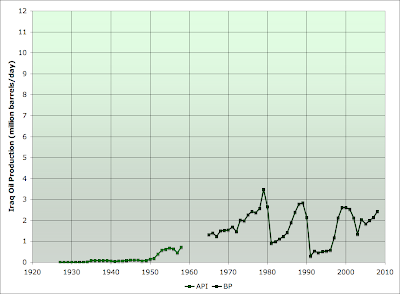

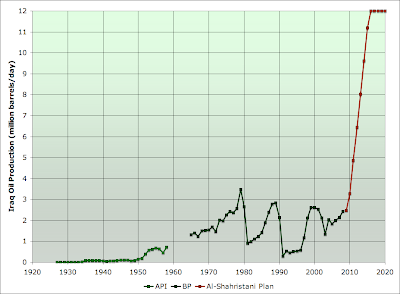

This next graph shows annual average Iraqi oil production over the long term - since the beginning (with a gap for 1956-1964 which falls between my two data sources). I deliberately made the y-axis scale run from zero to 12 mbd to emphasize that Iraq has never produced anywhere close to its potential.

Production was increasing rapidly and roughly exponentially until 1979 when Saddam Hussein took power. Since then, it's been one war or crisis after another, and production has never even reached the 1979 level again, let alone continued up close to the now proposed 12mbd.

A more detailed graph shows the monthly production over the last decade according to various data sources:

We can think of this in several eras. Prior to early 2003, Iraq's oil production was under the control of the United Nations Oil-for-Food Program which apparently resulted in highly variable production. Then in the spring of 2003, the US invasion resulted in an almost complete cessation of oil production for a short period. Following the US invasion, there was a partial recovery in oil production, but this gradually decayed amidst worsening violence, reaching a low of about 1.5mbd in February 2006. Following this, and especially after the 2007 troop surge and associated developments the country has been getting more stable and oil production has been steadily increasing.

If we simply extrapolated the existing rate of improvement forward, we'd get something like the following:

We'd cross 3 million barrels/day by the end of 2012, perhaps reaching close to 3.5mbd (versus about 2.5mbd today). This would not be very game-changing.

However, Iraq has now announced plans that are much more ambitious than that.

Iraqi Oil Production Plans

Iraq held two rounds of auctions for oilfield management contracts in 2009 that the large international oil companies have responded to. The first round, in June, were for fields that were already in production and set up contracts in which companies get paid a fee per barrel for all production over the existing level. The second round, last month, were for fields not yet on stream. The Iraqis seem to have driven hard bargains - the oil companies are being paid a flat fee per barrel that is generally under $2/barrel in the safer parts of the country, and thus will not benefit from high oil prices - all price risk/reward remains with the Iraqis. Nonetheless they were able to attract some bids from large competent oil companies with a track record - the likes of Shell, Exxon, Statoil, and Lukoil, and have been signing preliminary contracts with them. According to the oil ministry, the total contracts awarded amount to 12mbd of production, and this could be achieved within six years. The BBC reports:

Iraq's oil capacity could reach 12 million barrels per day (bpd) in six years, the country's oil minister says.

Hussein al-Shahristani told reporters in Baghdad that oil producers would not necessarily operate at full capacity, but would take into account demand.

From various news reports and other sources, I have put together the following table of the fields and contracts that have been announced. So far, I have been able to account for 11.2mbd out of the 12mbd, and 65gb of reserves, on a field by field basis with actually announced contracts/awards.

| Field(s) | Plateau (mbd) | Co. | Resv (gb) | Depletion | Fee ($/b) | Links |

|---|---|---|---|---|---|---|

| Rumaila | 2.85 | BP, CNPC | 17 | 6.1% | $2.00 | 1 |

| West Qurna Ph I | 2.33 | Exxon, Shell | 8.7 | 9.8% | $1.90 | 1, 2 |

| West Qurna Ph II | 1.8 | Lukoil, Statoil | 13 | 5.1% | $1.15 | 1 |

| Majnoon | 1.8 | Shell, Petronas | 12.6 | 5.2% | $1.39 | 1, 2, 3 |

| Halfaya | 0.535 | CNPC, Total, Petronas | 4.1 | 4.8% | $1.40 | 1, 2, 3 |

| Zubair | 1.125 | ENI, Kogas, Occidental | 6.6 | 6.2% | $2.00 | 1, 2 |

| Gharaf | 0.23 | Petronas, Japex | 0.86 | 9.8% | $1.49 | 1, 2 |

| Badra | 0.17 | Gazprom, Petronas, Kogas | 0.8 | 7.8% | $5.50 | 1, 2, 3 |

| Al-Ahdab | 0.115 | CNPC | N/A | N/A | $3 | 1 |

| Qaiyarah | 0.12 | Sonangol | 0.8 | 5.5% | $5.00 | 1, 2 |

| Najmah | 0.11 | Sonangol | 0.9 | 4.5% | $6.00 | 1, 2 |

| Total | 11.185 | 65.36 |

Given that there are still ongoing talks about Kirkuk, Nassariya, and other smaller fields, the 12mbd number seems like not much of a stretch for the sum of the contracts by the time all talks are finalized. Some of the depletion rates appear fairly high, but not outside known industry practice (it's not hard to find projects in the Megaprojects Wiki that have 10%-15% initial depletion rates), and some of the fields may have more reserves than is initially known. In other cases, however, we may see only a decade of plateau production, and/or the plateau is an aggressive estimate (though obviously in every case we have well known oil companies signing up to do this).

So how fast is all this supposed to happen? Well, it's supposed to start in the middle of this year, as reported by Bloomberg:

Iraq will get about $200 billion a year from the development contracts awarded to international companies in the two rounds. The winning bidders will spend about $100 billion developing the deposits, al-Shahristani said after the auction ended in Baghdad yesterday. The work is scheduled to start about six months from the signing of the deals.

and there are multiple press reports of al-Shahristani being quoted on achieving the 12mbd of capacity in six years. Six years is not a crazily short period for a large oilfield development in a flat desert - a fairly undemanding operating environment by oil industry standards (modulo the security situation, which I devote a section to later). If it was done that fast, and if we speculate that production climbs linearly from the middle of this year through the following six years, that would look as follows:

Note that the red line is capacity, which might or might not actually get used (depending on demand, prices, OPEC arrangements, etc).

Of course, Murphy will probably have his say here, and we might guess this process would take longer than the the currently planned six years - maybe a decade might be a better guess, even assuming no major relapse into violence and civil war in Iraq.

Indeed, initially I was sceptical that the country could physically export anything like that much oil any time soon -- present export capacity is only a few million barrels/day -- but plans are in progress to address that. According to a recent Dow Jones story Iraq Has "Master Plan" To Boost Oil Exports - Oil Min:

LUANDA, Angola (Dow Jones)–-Iraq is working on a "master plan" to construct new infrastructure to boost the country's oil export capacity, after the award earlier this year of 10 large contracts to international oil companies, the country's Oil Minister Hussein al-Shahristani said Wednesday.

Shahristani also said new offshore pipelines would be constructed to replace ones that connect Basra and Khor al-Amaya terminals with crude deposits in Basra. A network of new oil pipelines will be also built in southern and northern Iraq.

and

Two floating oil terminals are already under construction at the main Basra oil terminal in southern Iraq and work on two others will start soon, Shahristani said, adding the four platforms would be able to handle 2 million barrels a day. Basra and the nearby smaller Khor al-Amaya port currently can handle up to 1.6 million barrels a day.

"I expect these [floating] terminals to go through fast-track development to be ready in time when we have increased production," the minister said.

Foster Wheeler announced in February that it was awarded a contract by the Iraqi government for the basic engineering of new oil export facilities to supplement the existing Basra terminal. The new offshore facilities would include new single point mooring tanker loading buoys, together with oil pumping, metering and pipelines, to achieve an export capacity of 4.5 million barrels a day, Foster Wheeler said at the time.

and

The ministry is planning to build a new pipeline to go with the existing strategic pipeline that connects southern and northern oil fields.

The ministry will also build a new pipeline to go with the existing northern export pipelines that links Kirkuk oil fields with the Ceyhan terminal in Turkey, Shahristani said.

Similarly, Resource Investor reports:

“The amount of work required for the infrastructure to handle such a massive production and to transport it and to export it is huge,” said Shahristani. He said a pipeline and export master plan will be completed soon after assessing the needs of the fields awarded for development.

“There will be another port there and also a network of pipelines extended from the north of Iraq to the south and from the east to the west of Iraq to export oil from different areas,” he said. Such a move will diversify recipients, increase delivery to those already served, and allow it to separate the different qualities of crude instead of selling it as a concoction of one.

He at least seems to appreciate the problem. I'm sceptical that all these moving parts can come together in only six years, but clearly it can't be altogether ruled out either.

Hussain al-Shahristani, Iraqi Oil Minister

It's worth spending a little time on the question - who is this guy who apparently plans to turn the oil world upside down? I found a couple of profiles of him that are of interest. A 2004 profile in the Times of London, when al-Shahristani was a contender for prime minister, had this to say:

Dr Hussain al-Shahristani, 62, a Shia Muslim nuclear scientist tipped to become the new Iraqi prime minister, is widely respected and regarded by many Iraqis as the best man for the job at the moment.

While imprisoned and tortured at Abu Ghraib prison for 11 years under Saddam Hussein for "religious activities" he refused to help build a nuclear weapon for the country.

He had a dramatic escape from the notorious jail when it was bombed in the first Gulf War and fled to Iran with Bernice, his Canadian wife.

A devout Muslim from a prominent family, he has little political experience, but has close ties to Grand Ayatollah Ali Sistani, Iraq's most powerful Shia Muslim cleric whose support is essential for the viability of an interim government.

and

A diminutive bespectacled man, Dr Shahristani won a scholarship to Moscow before studying at Imperial College in London, where he graduated with a bachelor's degree in chemical engineering in 1965. He went on to get a PhD in nuclear chemistry from the University of Toronto in 1970.

There he also married the woman who typed up his dissertation, Bernice Holtom.

In 1978 he was appointed chief scientific adviser to the Iraqi Atomic Energy Commission. He was in a board meeting there the following year, when security officers turned up to bundle him off to be questioned.

He had thought he was respected enough to be safe in complaining to colleagues about the wave of executions and arrests of Shia Muslims. But he was sentenced to 20 years after another captive at security headquarters accused him of "religious activities". He was tortured by being hanged from the hands and having electric cattle prods applied to his genitals.

For a few months during his long imprisonment he was removed from the horror of Abu Ghraib, where he said that he witnessed the results of horrific torture.

Saddam's half brother and head of the secret police Barzan al-Takriti, who housed the scientist in a palace, asked him to help the regime build a nuclear bomb. Dr Shahristani said that he did not have the expertise. He was not believed.

His work had been in food safety, decontaminating mercury-laden grain. He was punished with ten years' solitary confinement back at Abu Ghraib.

Some more color comes in a Wall St Journal piece Big Oil Ready for Big Gamble in Iraq:

But Mr. Shahristani, architect of the plan, is under attack from many quarters. Falling oil prices have triggered a budget crisis, and he is being blamed for not boosting production enough to make up the difference. Lawmakers and some oil officials, meanwhile, say the auction will give foreigners too much access to Iraq's resources. Mr. Shahristani also has been called to appear before parliament for questioning about alleged corruption and mismanagement at the ministry.

"He should not continue," says Jabber Khalifa al-Jabber, secretary of the parliament's powerful Oil and Gas Committee. "Let someone who is qualified do the job....I can't name one accomplishment."

Prime Minister Nouri al-Maliki's spokesman, appearing earlier this month with the oil minister, voiced confidence in him and reaffirmed that the auction would take place as scheduled.

In a recent interview, Mr. Shahristani, 66 years old, says he has done nothing wrong, and that lawmakers critical of him have a political agenda. He says he looks forward to answering questions from parliament about corruption and mismanagement.

"I'm not a political animal, and I don't enjoy politics," he says. "The only reason I've accepted and continue with my responsibility is to protect the Iraqi wealth from unclean hands."

Deals in Iraq often are reached over cups of tea late at night, but Mr. Shahristani doesn't like schmoozing. In a capital built on patronage, he has denied plum jobs to longtime friends. He's earned a reputation as a stickler for rules, including cumbersome purchasing regulations that other oil officials blame for slowing down Iraqi oil development. He has refused even small gifts, such as neckties, from visiting oil executives, he says.

and

Around that time, Mohammed Baqir, a family friend who had helped Mr. Shahristani escape from prison, asked for his help in finding government jobs for relatives. Mr. Shahristani refused. "Shahristani's problem is he is too straight and clean," Mr. Baqir says. "As a politician, you need to be flexible."

After a new government led by Mr. Maliki was formed in 2006, the prime minister named him oil minister. His new ministry, like other government agencies at the time, was overrun by militia members, and corruption was rampant, according to Mr. Shahristani and other current and former oil officials.

Over the next two years, hundreds of ministry employees were murdered or kidnapped. By the end of 2007, many top technocrats had fled the country, and various political parties had filled the ministry with patronage employees, according to Mr. Shahristani and the other officials.

Mr. Shahristani fired 250 members of the ministry's security staff thought to be militia members, and replaced top security officials with people he trusted. He turned over evidence of wrongdoing to the ministry's inspector general, and fired or transferred those suspected of malfeasance.

"Before, there was lots of interference in the ministry from political blocs, but he got rid of all that," says Abdul Mahdy al-Ameedi, head of the ministry's contracts department.

The purge stirred resentment. Some employees claimed they were wrongly targeted. Others accused Mr. Shahristani of being too by-the-book. He cracked down on absenteeism and introduced a card-scan check-in system. He scaled back bonuses.

Both articles are well worth reading in full. It's hard to judge a person from thousands of miles away via a handful of news reports. But al-Shahristani has just held very transparent auctions in which he drove very hard bargains with international oil companies (there are multiple reports of oil companies initially refusing to bid, and then finally agreeing to Iraqi terms). Combining that with the reputation for probity and it seems that Iraqis may have been well served by their oil minister. Dr al-Shahristani will return to full time science next year following national elections in Iraq. In the meantime, he has certainly set a fascinating process in motion.

Barriers to the al-Shahristani Plan

Violence and Civil War

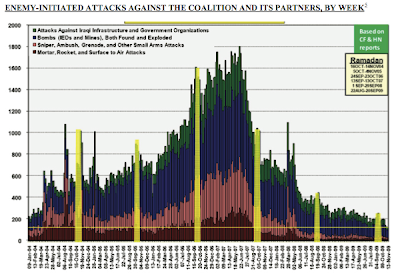

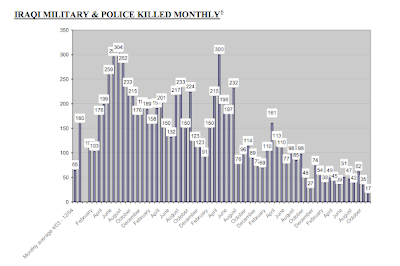

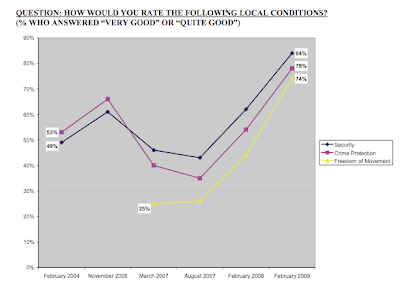

Iraq still periodically makes the news for outbreaks of violence. However, the country does seem to be making progress in stabilizing. Obviously the most relevant index for our purposes is the fact that oil production has been increasing as documented above. Beyond that, the best compilation of data that I'm aware of for assessing this is the Brookings Institute Iraq Index. There are a ton of graphs there, and I just picked a few.

Firstly we have the number of Iraqi civilian casualties of the violence:

As you can see, we are still having a couple of hundred casualties a month due to bombings etc. Iraq is not a normal country yet. However, the rate is massively lower than a couple of years ago, and is still trending down.

Attacks on coalition forces are also way down and still dropping:

As are deaths amongst the Iraqi security forces:

Iraqi public perception of the situation is improving correspondingly:

And although the data is unfortunately not up to date, the improvement in security for oil and gas infrastructure is clear:

However, there are still some problems:

(AFP) – Dec 19, 2009 BAGHDAD — Oil exports from northern Iraq have been halted by a sabotage attack on the pipeline to the Turkish port of Ceyhan, oil ministry spokesman Assem Jihad said on Sunday.

"A 55 kilometre (34 mile) section of the pipeline was damaged in the attack, causing a large oil spillage. Exports have stopped and technicians from the northern oil company (NOC) have gone to the site to survey the damage," Jihad told AFP.

The attack took place around 325 km (200 miles) north of Baghdad.

"We are asking the multinational forces to carry out more patrols to protect the pipeline, which was sabotaged for the fourth time in six weeks. We will not know when exports will resume until we have surveyed the damage," the spokesman added.

The pipeline usually transports between 420,000 and 450,000 barrels per day of oil, although it has the potential to ship 600,000 bpd, according to Jihad.

Total Iraq exports stand at around two million bpd of crude oil, and all its exports from the north flow through the pipeline to Ceyhan.

Improved security along the pipeline has limited the number of attacks in recent years. But after an 18 month period of calm, sabotage resumed on October 26.

All-in-all, it appears that if present trends in Iraq continue, it's quite conceivable the country could be stable enough to allow for major infrastructure investments such as the al-Shahrastani plan. Clearly, major oil companies are betting that this will be so since they are signing up to spend lots of money in order to produce oil for a fairly small per-barrel fee.

Political Risks

The Iraqi parliament has never passed the famed oil law, and eventually Prime Minister Maliki and his oil minister got tired of waiting and just went ahead and auctioned the oilfield service contracts anyway, even without a really clear legal framework.

There will be national elections in Iraq probably in March. This could lead to a government change and then the unclear legal status of the contracts could potentially be a problem.

My guess would be that with facts on the ground in the form of existing contracts under way, combined with the fairly beneficial terms of the contracts to Iraq and the transparent way the auctions were conducted with many players bidding, will mean that the plan will continue under a new administration. Having all that oil revenue is going to appeal to a government of any stripe. According to Reuters' reporting, most of the major players currently say they will honor the contracts:

Maliki's State of Law coalition, one of the main contenders in the March polls, will surely honour the oil deals should it hold onto the clout it currently enjoys.

Some political groups say they will respect the contracts, but that could change in political wrangling during the formation of a new government after the March election.

The Supreme Islamic Iraqi Council (ISCI), which heads the Iraqi National Alliance, a coalition likely to be Maliki's main challenger at the ballot box, will also stand by the contracts, said Jalal al-Din al-Sagheer, a senior ISCI member.

"Of course it will be obligatory for the next government to honour these deals, regardless of reservations of any political entities right now. For that reason we advise that these contracts should be shown to parliament (before they are signed) so there is political consensus to ward off future problems."

Salim al-Jubouri, a senior member of the Iraqi Islamic Party, an important Sunni Muslim political group and frequent critic of Maliki's Shi'ite-led government, agrees.

"What this government signs will also be a commitment for the next government. They are signing in their official capacity (as government officials) ... and in the end it will be very difficult to go back on these agreements," said Jubouri, who is also the deputy head of parliament's legal committee.

"Maybe those individuals who signed can be held to account for their mistakes, but the deals will remain valid."

The Islamic Party is the biggest member of the main Sunni group contesting Iraq's March polls.

Iraq's ethnic Kurds are another of Iraq's key political players, and they are seen as powerbrokers and kingmakers because of their skilled manoeuvring.

"These contracts will hold because they are legal, and they have no connection with political differences between the government and parliament," said Feriyad Rawanduzi, spokesman for parliament's Kurdish bloc.

However, clearly there has to be some risk of a new government mishandling the country resulting in relapse into civil war, or deciding to declare all the al-Shahristani contracts illegal and renegotiate them, resulting in a big delay. However, informed observers are growing increasingly optimistic:

Fresh from a weekend trip to Iraq, U.S. Rep. Jim Marshall said he saw a strong sense of optimism that the country will survive as a democracy, and he witnessed an unprecedented effort to move equipment from Iraq to Afghanistan as a troop surge is readied.

This was Marshall’s 16th or 17th trip to Iraq, he said, giving him a series of snapshots of the situation there. He traveled briefly with Army Chief of Staff George Casey and met with Iraqi Prime Minister Nouri al-Maliki, as well as some of the country’s department ministers and American soldiers.

“There was a real sense of optimism this time around that I had not seen in prior trips,” said Marshall, D-Georgia. “You can’t guarantee this, but it does seem that the momentum (for democracy) is now to the point that it’s just not going to be reversed by al-Qaida ... or Saddam (Hussein) loyalists.”

Obviously, there's high uncertainty, but it sounds to me more likely than not that something like the al-Shahrastani plan will occur, albeit probably with some delays.

Implications and Conclusions

The implications are complex, and not altogether clear. First, the impact on global oil production. If you believed, like me, that in the absence of this plan global production was now on a bumpy plateau, then the effect of the plan on global liquid fuel production is summarized in this next graph:

Here I made a "Bumpy Plateau" scenario from a sine wave! Obviously, I'm not claiming to actually know when the bumps will occur, or exactly how big they would be, so the particulars here are just to illustrate the general idea of what I was expecting. However, as you can see, adding a large and rapid expansion of Iraqi production changes the picture in a qualitative way - we spend the next six-seven years in a serious expansion of global production, followed, presumably, by a new plateau at a higher level until global declines become serious enough to overcome efforts to develop new production.

The implications for oil prices at one level are simple: they will be much less than they would otherwise have been! However at another level, there is a lot of complexity. Firstly, given the speed with which global production is currently recovering, and the possibility of various delays in implementation in Iraq, there is some potential for the world to burn through current OPEC (mainly Saudi) spare capacity before the Iraqi expansion really gets going and cause another oil price spike in 2010/2011.

Once Iraqi expansion does begin in earnest the question becomes how the rest of OPEC responds. Right now, Iraq is not under a quota, but the last quota it had in 1998 was only 1.3mbd. Obviously, this is not going to work, and the Iraqi's have broached the subject, as Alsumaria reports:

Ministry of Oil called OPEC Organization to reconsider the share of its members according to the reserves of each of the same. Iraq Oil Ministry stressed that Iraq will bid in the upcoming years to export 12 million barrels of oil per day. Oil Ministry Spokesman Assem Jihad said in an interview with Alsumarianews website that trying to hoist Iraq oil output in the upcoming years is a natural right of Iraq as it owns huge oil reserves. Oil Ministry Spokesman called OPEC to grant Iraq its natural right in exporting crude oil so as its share becomes fair with regards to its oil reserves.

This is obviously going to cause considerable concern:

Once Iraq more than quadruples its output capacity, OPEC will have to take steps to prevent Iraq from flooding the market, and force Baghdad to realign its supply policy with other members and stick to an output target. If not, the current level of supply and demand which OPEC has worked hard to achieve, which provides oil at a price it deems reasonable to producers and consumers - currently around $75 a barrel - will come under threat.

"This will certainly cause ructions within OPEC because Iraq has huge resources and we can only assume that the Iraqis are going to pump as much as possible because they need the money," Judith Kipper, the director of the Energy Security Group of the Council on Foreign Relations in Washington, told Deutsche Welle. "If they get to the predicted number of barrels produced per day, this is really going to be a real issue within OPEC."

however, it's not clear how much leverage OPEC really has:

"If Iraq refuses to abide by the OPEC output level rules, then there's not much OPEC can do. Iraq may be land-locked but it has a couple of major pipelines which could be restarted and if relations with Syria and Lebanon ease then we could see Iraq pumping its oil to a Syrian or Lebanese port, bypassing OPEC countries."

Hazhir Teimourian agreed: "Iraq flooding the market will be very bad news for Saudi Arabia and OPEC and neither could do anything to stop it," he said. "Why should Saudi Arabia be the only ones to export eight or nine million barrels a day and we have to stick to a lower OPEC output? In fact, Iraq could actually leave OPEC and go it alone. OPEC and Saudi Arabia will just have to take it."

I see two general classes of scenario here. In one case, if the global economy recovers well and global demand grows nicely in coming years (the million barrels/day extra each year from developing countries, plus a bit more from the OECD), then it's quite possible the Iraqis and Saudis will be able to strike a deal and co-ordinate the Iraqi rise in production in such a way that oil prices remain in the $60-$80 range that has now become the new normal.

On the other hand, if they are unable to work together effectively, prices could collapse. In particular if there is any material hiccup in global demand, there is a serious risk of a breakdown in OPEC discipline (such as it is) and a price collapse. For example, if there were a double dip recession in the OECD due to the aftermath of the global financial crisis, that could do it. Alternatively, if it's true that there is a Chinese asset price bubble and it burst and caused a Chinese recession, that could also cause a slump in global demand. Either way, the world could then find itself awash in spare oil capacity, which would be very likely to bring prices far below the new normal, at least for a while.

In general, the development of this Iraqi capacity, assuming it happens, seems to me likely to bring about an era a bit like the 1980s-1990s, in which energy issues retreat to the background for a while. I don't think prices are likely to fall as far or for as long as they did in those decades, but still I think there may be some qualitative similarities. From the perspective of the Iraqis obviously this plan is a good thing, and who can begrudge it to them? At the same time, in my view this is not really a good thing for the rest of us, as it allows us to postpone the inevitable for a little while longer. To use Richard Heinberg's party metaphor it's as though Dick Cheney and his crew managed to organize one last trip to the liquor store before everyone was too blind drunk to drive. Now the party can stagger on till everyone is really wasted. Sprawl in the US and Europe, sprawl-enabled-obesity, SUVs, growing Chinese auto-dependence, growing carbon emissions etc, all get a new lease on life.

In particular, just as the 1970s efforts at alternative energy were seriously damaged by the low oil prices of the mid 1980s and 1990s (as Alaska and the North Sea came on line), there is a risk that the current crop of biofuel and alternative energy companies, as well as hybrid and electric car efforts, will all suffer through an era of low oil prices, only to not be there when we really need them ten years from now.

I'm not saying for sure any of this will really happen. But it seems like a real risk, which I shall continue to track.

Thanks, Stuart, that is a good start.

One question on the West Qurnah field. In the WEO 2005, http://www.iea.org/weo/2005.asp page 391 (table 12.7) it's there under producing fields with 9.4 Gb remaining proven and probable reserves at end 2004. That seems to be phase 1. But phase 2 can't be found in table 12.8 on page 393 (major undeveloped fields) So where has this phase 2 come from? And with a whopping 13 Gb. I think what is needed is a full match of all fields and total reserves.

I don't think that the other OPEC members will allow Iraq to produce 12 mb/d even if that were possible. They are already fighting now about small wells

Iraq, Iran troops in oil well stand-off

http://www.brisbanetimes.com.au/world/iraq-iran-troops-in-oil-well-stand...

The WEO 2005 had 5.4 mb/d in 2020.

Kjell's best case was around the same by 2020 in slide 57:

http://media.theenvironmentinstitute.com/2009/peakoil-kjellaleklett.pdf

Have a look at the state of these pipelines:

Dec 7, 2009

Pump It Up: The Development of Iraq's Oil Reserves

http://www.time.com/time/magazine/article/0,9171,1943091,00.html

So, peak oil delayed by a decade, and even then, lots of natural gas reserves to use in our modified vehicles for another 20-40 years.

Ok, so let's all decamp from TOD and meet back here in 2020, mkay?

I expressed much the same opinion a few years ago, but I now see it as more likely just to extend the plateau than to actually add significantly to yearly production rates.

Very well written presentation, over all. One complaint (and I harp about this wherever it comes up, even though it seems to have become standard) is with your use of total liquids. This relatively new measure conceals more than it reveals--especially if it includes biofuels, which, given its low EROIE is basically double counting.

At the least you should also include graphs with just crude oil.

I would love to hear your views about what this all means for the real reasons we are in Iraq and Afghanistan. Do you think that the existence of non-US companies in the bidding process negates the idea that we were in it for the oil?

There are so many reasons that 12.+ MB/D is not realistic that it is difficult to know where to begin.

First of all, as noted by Ron and others, is the pechant of the Arabic people to hyperbole. Just as I do not believe the reserves quoted by SA, I do not believe the production potential claimed by Iraq.

Second, even if that was possible, about the time it begins, al Qaida or some other jihadist group will blow up the pipelines and/or well heads. Especially if they see that doing so would harm the economies of the West, or perhaps just to gain notariety. It would be too easy to expect them to just let it go.

Next, is the history of the region. Even during the late aughts, when prices neared $140/bbl, S.A. could not increase their production, despite increasing wellheads and employing advanced forcing techniques. I understand that Iraqi fields have been neglected; they were not exploited like the rest of the Middle East, yet given that fact, I still believe that their reserves are overstated, and that the projects announced are stated in the most wildy optimistic way possible.

On the other hand, if Ron and I are totally wrong, and production actually exceeds 5 mbd, the impact will still, IMO, take too long, and will simply level but not reduce prices - for 8 to 10 years, maybe. Regretably, it will also reduce the impetus (if there is any)to develop alternative fuels.

The result of this, paradoxically, may be to enable hyperinflation in the Western economies - allowing another bubble of some sort in some area other than oil. In fact, it may already be too late to avoid it. Because this is in the nature of a black swan, by definition we cannot predict where it will happen.

But perhaps I am being unduly pessimistic. I certainly hope to be wrong about this, and yet I must continue to prepare for what I see coming. My best take is that we could have a few extra years to get our ducks in a row.

Quack, quack.

There are two main reasons why I think Iraqi production will never top 5Mbpd.

1) If all those reserves were really there, I think Saddam would have exploited them more. Let's be honest, he was never backward in coming forward and doubling his revenue would have bought a lot of arms. If it was really there I think it would have been known about and exploited.

2) The higher the oil production, the more there is to fight about. While various war-like groups are squabbling over the crater - its relatively undirected violence. However if there starts to be serious money, then those various groups will want a big share and thus fights break out and that caps production. Even now groups in the north and south don't want the money going to the centre - that will get much worse as production rises.

The final thing to bear in mind; if Iraq got close to these numbers they would take the role of swing producer from Saudi. That's a jealously guarded role, and I don't think they would be above seeding a little discontent to limit Iraqi production. And on the other side, Iran needs money...

Re Saddam, it may have been possible that the international sanctions against Iraq actually did work, preventing him from doing what he wanted. It is possible that Iraq really does have a lot of oil still in the ground. But likely in damaged reservoirs - which of course "nobody knew about when drawing up the contracts". Cue years of legal battles.

Reasons #2 and 'final' are most important, to my mind. I would add a third main reason: Dr. Al-Shahristani's reform of the Iraqi oil ministry won't stick - or if it does, a new ministry will be created which will neutralise it..

Nepotism and political patronage are very hard to get rid of, and come creeping back as soon as the pressure is off. Al-Shahristani is already moving on from the ministry.

Another reason: the new service contracts are a departure for the IOCs. Are they just going to go along, or are they going to kick against the traces, to try to capture more value for themselves? This one is unknown.

A supporting reason is the decrepit state of Iraq's infrastructure - both of the capital itself (roads, phones, regulations, etc) and its supporting system of repair and maintenance activities.

As I noted a while back, Iraq has much more oil than some of you guys seem to believe.

This oil is reasonably well known about - read John Blair's book "The Control of Oil", which discusses the early days of Iraqi oil discovery and how many large finds were suppressed, in order to minimise Iraqi oil production (the country's role has always been the global "swing producer" of oil, with the West trying every trick in the book to keep production levels low).

http://anz.theoildrum.com/node/4675

If it's there, it's in heritage fields. These are all the finds AAPG/IHS documented for Iraq 1998-2009, excluding 2003/2005:

AAPG Discovery Data

Did I miss something, or are Michael Lynch, Daniel Yergin and Peter Huber Arabs?

To the extent that they must rely on the representations of the oil minister of Iraq, their judgment may be clouded. As I said, for the same reason that I doubt the reserves quoted by the Saudis, I doubt the reserves claimed by the Iraqis. I may be wrong... and I hope I am. I just doubt their claims, and if someone wants to make a public pronouncement that they believe those claims, well, they may be right. Again, I hope so. Extending the time for peak oil is a huge deal... but only if we do something with the extra time.

My point was that, the 12.8 mbd is conjecture... pie in the sky in the great bye and bye. And it will have to be developed and sent to consumers, which is more likely than not to be prevented by simple means employed by fanatics. With so many ways to deter that development, and with less than 100% conviction that that much oil is even available, my opinion is that:

1. If it is there and developed, it will not help a whole lot.

2. If it does help, we (meaning the human race) will blow it again.

3. If it does help, it may well help to destroy our economy by facilitating BAU and the inevitable hyperinflation that is being actively promoted by our government and corporate masters.

4. We would gain, maybe 10 years, probably more like 8, with the full 12.8. Which would come off the the back end of oil availability, making the coming fall worse. Iraqi oil has been factored in to available oil, based on likely production figures. Any time that production is jacked up, it removes oil from the remaining reserves at a faster rate, causing a steeper Hubbert curve on the down side.

So. Mike and Dan and Pete are not Arabs. But they believe Arabs, and take them at their word on their reserves? What's the difference?

In this case, you don't have to take the words of any residents of the Middle East if you are willing to take the word of Jean Laharerre.

Lets see. Americans said Iraq had a lot of WMD. Saddam said they didn't. So, eiher Americans are liers or they have a penchant for the hyperbole. You pick.

Also, I guess all the doomers are Arabs.

You asked Stuart, not me, but I'll still give my opinion. It's indisputable that we went there for the oil. The best single book making the case tht I know of is Antonia Juhasz's Tyranny of Oil. It get's openly admitted once in a while, e.g. Alan Greenspan in his memoirs says: “I am saddened that it is politically inconvenient to acknowledge what everyone knows: the Iraq war is largely about oil,...” Gen John Abizaid also says it's about oil. What else could it be about? Read Juhasz, you'll have no doubt.

That the U.S. hasn't been able to grab everything for itself is because lacks the strength to do it. It needs allies, and needs enemies who are somewhat mollified. The Afghanis were supplied Stinger missiles (by the US) to shoot down Soviet heliocopters. What do you think would have happened to the US invasion in Iraq or Afghan if Russia, China, or others had supplied comparable items to Iraqis or Afghanis?

Iraq oil producion was held in check by the sanctions regime even while Saddam was there -- it was effectively held in reserve. US military power still has its hand on the spigot, since it can incite more trouble if it's in its interest to tighten supplies, and, if not, with luck, gradually open it, or give hope of opening it. The power can be exercized in the geopolitical great game.

Another approach is to pull out a map and look at the places where the military action is. I did that with my wife recently. Aahhh ... .

Thanks, dave, for the note and the book recommendations. As I recall, even General Franks admitted it. I am reading Peter Maass's excellent "Crude World" and he vividly describes the eerie calm around the well protected Ministry of Oil in Baghdad after the invasion while the whole rest of the city was a chaos of looting.

My two cents: The Iraqis defeated US objectives with both military and political means. Just do a little research on all the political wrangling over the new oil law in Iraq, how long it took to pass it, and how different it came out from the original US vision. The insurgencies served to put a lot of pressure on the US to compromise with Iraqi demands, since they gutted the credibility of the US using force to impose its will. The fact that the US failed in many of its objectives does not retroactively change the reasons Cheney pushed the invasion forward in the first place. Had the US succeeded in installing and strengthening its original puppets (Chalabi or Allawi), you can bet that the oil contracts would have gone mostly to American companies through back-room deals.

The Iraqi oil law has not been passed. They have simply given up trying.

Well...exactly.

Stuart's chart shows Iraqi production jumping to about 3.3 mb/d by the end of 2009. According to OPEC's Oil Market Report they produced 2.465 mb/d in November. And according to Schlumberger'r rig count there were zero oil rigs in Iraq at the end of November. So needless to say Stuart's projection is already off by about .83 mb/d.

Also his chart shows Iraqi production at the end of 2010 at about 4.9 mb/d or almost double current production. Will they increase production by about 2.3 mb/d in 2010? Not a snowballs chance in hell! With fighting still raging and not one rig currently drilling, increased production in 2010 will likely be nil to negative.

Also notice that the majors who will be doing the drilling, putting their employees in harm's way are getting a pittance for their efforts. For the lion’s share of the increased production, above current production, they are getting from $1.15 a barrel to $2.00 a barrel. Only for the very tiny fields will they be getting more. But for about 95% of the new oil produced they are getting almost nothing. Will they be able to ship rigs and other drilling supplies to Iraq, hire employees to work in combat zones and drill new wells for less than $2.00 a barrel? Are you kidding!

Finally notice that most of this new oil is coming from their tired old giants that are already in rather steep decline. Is that possible?

Please, please, someone tell me what I am missing here. Is this possible?

Anyway, my prediction, and you can save this and throw it up to me later if I am wrong, is that Iraq will never produce more than 5 million barrels per day and even that will be a decade down the road if at all. (Just for the record the contracts give them two decades to accomplish the task.)

Ron P.

Ron:

I think you are misreading the 2010 point as 2009 on the chart.

As I say in the piece the chart is no more than a straight line between today and what the Iraqi oil minister is saying will be the case in six years (something I document more thoroughly here. I'm not claiming either that I believe in the Iraqi minister's project planning, or that a linear implementation is likely - it's just the simplest way to make a chart that illustrates the audiciousness of what he is claiming will happen. Obviously, the thing that makes it all matter, however, is that he has succeeded in signing Big Oil up for a series of pieces which do appear to add up to something pretty close to 12mbd.

I agree with you that, even if it was done in six years, the rise would have to be backloaded as it's going to take years to get in place all the needed infrastructure to rise much above the pre-war level of 3.5mbd. Of course, the chart would have looked even more dramatic if I had backloaded the rise...

Sorry Stuart I completely misread your intentions. I apologize.

I have harped for years on this very subject. That is the subject of their audiciousness! I am so glad that you agree with me. The point that I have harped on is they really do not expect their words to be taken literally. I find it truly shocking that many Westerners really do.

As I said, I misread you. I read almost all your post but skimmed a couple of paragrapsh. Perhaps that is where I failed.

Thanks,

Ron P.

SS, Ron is not misreading your chart, we are at the start of 2010 and the chart tells production is 3,3 mbd - extremely wrong - in other words.

A chart that opens your essay in such an exaggerative manner, just saves me the time of reading your post. I'm simply not buying into the idea that Iraq will be able to produce 10 mbd more in 5 short years. I can accept Ron's judgments as fair, 5 mbd sometimes into the future. After all, Iraq is a complicated place assembled by the victors of WW 1.0 and they (Iraqis) have not forgotten that, quite the contrary IMO ... Personally I can imagine 3 seperate countries on that swat of land, which is not good for the pace of oil out of there.

EDIT : Alright SS sorry, I'm getting the gist of your post in reading Ron reply here. (But my reflection still holds water)

Ron said the 2009 post was 3.3mbd, but that's the 2010. As I said in the piece, it's a simple linear interpolation between now and what al-Shahristani says will be the case in 6 years.

Let me interject a personal opinion here. I have quite a bit of the kind of experience needed for developing oil fields, so I'm the kind of person needed for the proposed development scenario to actually happen. Because the industry has slashed expert staff repeatedly for the last quarter century, there aren't that many people around with this kind of experience.

No one has asked me to go to Iraq to work on any of these proposed projects, but if they did, I don't think they could pay me enough. That's not to say I wouldn't go for any price: I'd certainly consider working in Iraq for a 1/2% overide, adequate security guaranteed by a competent third party, and a consulting fee of (say) $500/hour.

I don't think the amounts the foreign companies have agreed to for these contracts are adequate to secure the experienced staff they need to accomplish the task in the immediate future. Their only hope of achieving the proposed results is to train new experts from scratch: and that takes a lot more than six years.

It will only take one single successful attack on one of them new foreign oil-crews to make their eager of going to Iraq go away (at least for a while).

Norwegian Statoil(with Lukoil) got a contract there recently, but their int_staff will be stationed in Dubai for some reason. I wonder what that fact will do for project-progress?

I agree. One attack and the eager is gone.

Iraq is a nest egg, not an omelet.

Good point. In the past, I have on occasion picked a vendor that was more expensive than a competitor (all other things being equal) when I knew their profit margin was healthier. I did that so that there was adequate incentive for them to do the work. Projects with the least profit often don't get the proper attention of the vendor (and certainly not the leadership of the vendor) and if the project is important to me, I need it to be important to the vendor, as well. Paying the least doesn't always get the job done or done well.

There is a very real chance that the oil companies took these sub-par offers just to get in the game. Now they wait until the right time arrives to re-negotiate — when the negotiation is out of the public view. Until the re-negotation occurs, which will give them better margins, they may just sit and wait.

Time will tell. If we see them moving in equipment and personnel in significant quantities quickly, then this theory will be disproved. If 12 or 24 months pass and nothing is happening, then I think there will be at least something to the theory.

Hi Aangel,

You beat me to the very same point-and if oil is only fifty dollars a barrel , the Iraqi govt would have plenty of room to adjust the piece rates per barrel upward.

As an armchair historian my guess is that if the current Iraqi govt with our backing does actually manage to get the oil flowing significantly faster while holding down the violence AND is also smart enough to spend most of the money where it does the average Iraqi some noticeable good, then the people themselves will take care of the security problem by turning thier backs on the insurgents.

The violence could fall off a lot faster than we might expect.IF the govt can maintain control for a couple of years.

Furthermore finding the skilled workers might not be as hard as it sounds-I have no experience whatsoever in the oil industry but over the years I have noticed that when work is short a good carpenter can learn to do plumbing in half the time a novice needs , and that a good plumber can learn to carpenter likewise in half the time it took to learn his original trade.There are tens of millions of highly skilled workers out of work these days who already know the basics of any trade-industrial safety, reading drawings, scheduling, shipping and receiving, operating various machinery such as cranes and loaders, etc.

I used to fit up iron a piece at a time on the job and weld it up with a stick machine.Nowadays a dozen pieces are welded up in a fab shop with wire feeder welders which are four or five times faster and require only ten percent of the skill.The subassembly arrives by truck and likely as not bolts to the next subassembly.Jobs formerly held by skilled labor in short supply are thus broken up into component parts and handled with semiskilled labor much cheaper and faster.

Technical advances in equipment and reorganization of the way the work is done can work wonders in speeding up jobs.

I understand and appreciate the attitudes of the people who see Cheney and company keeping the party going for another decade " before everybody is too drunk to drive" but that attitude shows a sad lack of understanding of day to day reality.

I see a lot of comments to the effect that we need to crash right now or yesterday but somehow I don't think the people making them have thought thru the FACTS of a hard crash -thier daughters on the streets soliciting, thier parents dieing for lack of medical care , thier wives lacking makeup and dental care,dressed in layers of old clothes, former office dwelling sedentary husbands trying to find jobs as laborers.

Most of us have our heads up our collective butts and just enjoy playing holier than thou.

If our armed forces weren't in the middle east, somebody else's -somebody not nearly as nice-would be.

I agree that IF we had done the right thing back during Carter's day we would not be in the current mess and have said so before.But IF is the biggest two letter word in English , a nuclear bomb of a word.As the old folks say around here "If toad frogs had wings they wouldn't have to bump thier ass on the ground ."

I might be entirely wrong but it seems to me that since reality is what it is, another decade or two of bau might be the best we can realistically hope for.It's not that I wouldn't prefer something else, but that I don't think (barring the Pearl Harbor wakeup call I mention here frequently) we are likely to get anything else -it's either more bau , probably a sort of crippled up bau, or collapse.

The renewables industry has made some truly impressive strides in the last decade, and conservation technologies are coming along fast too.Several other fields show similar promise, such as the recycling of organic wastes, sustainable farming, and genetic engineering.

It seems altogether possible to me that in another ten years , even though the lack of an immediate hot market might slow down buildout, research will have given us renewables and conservation technology that is able to compete on the basis of price and dependability.

In that case I think it will be politically and economically feasible to enjoy an economic boom that might last for quite awhile on the basis of rebuilding the economy to run on renewables backstopped by conservation.

"If our armed forces weren't in the middle east, somebody else's -somebody not nearly as nice-would be."

Wow. If over a million civilians killed and nearly five million displaced is what you call "nice," I don't want to be around when you get nasty!

http://en.wikipedia.org/wiki/Lancet_surveys_of_Iraq_War_casualties

"On 28 January 2008, ORB published an update based on additional work carried out in rural areas of Iraq. Some 600 additional interviews were undertaken and as a result of this the death estimate was revised to 1,033,000 with a given range of 946,000 to 1,120,000.[90]"

Maybe our ordinance shredded bodies of women and children in a kinder and gentler way than other, nastier countries would have?

http://en.wikipedia.org/wiki/Iraq_refugees

"According to UNHCR estimates, over 4.7 million Iraqis have been displaced since the US-led invasion of Iraq in 2003"

By comparison, Hitler's invasion of Poland killed between 150,000 and 200,000 civilians. By your standards then, Hitler was Ueber-nice (though it was his explicit policy to eradicate as many Slavs as possible since he saw them as a mongrel race).

http://en.wikipedia.org/wiki/Invasion_of_Poland

"The Polish September Campaign was an instance of total war. Consequently, civilian casualties were high during and after combat. From the start, the Luftwaffe attacked civilian targets and columns of refugees along the roads to wreak havoc, disrupt communications and target Polish morale. Apart from the victims of the battles, the German forces (both SS and the regular Wehrmacht) are credited with the mass murder of several thousands of Polish POWs and civilians. Also, during Operation Tannenberg, nearly 20,000 Poles were shot at 760 mass execution sites by special units, the Einsatzgruppen, in addition to regular Wehrmacht, SS and Selbstschutz.

Altogether, the civilian losses of Polish population amounted to about 150,000–200,000"

You have to have pretty darn rosy colored glasses on to insist that modern war carried out by the country with the largest military on a densely settled country is anything other than horrific for most of those on the receiving end. We like to think that we are "exceptional" in our morality. But we are an empire, and we carry out the imperatives of empire with as much if not more ruthlessness as any empire that preceded us. "Limits of Power" by Andrew Basevich, a military man himself, does a nice job of delineating these realities and how we got here.

By the way, you are likely right that there would have been conflict in the region, but the argument, "If I didn't do it, somebody else would have" is not generally held in high regard on most scales of morality. (Along with patriotism, I believe it has been called the last refuge of scoundrels.)

Dohboi I never said we we nice, only that we are nicer than other superpowers of past times.

If I remember correctly Hitler ran up his score in Poland took less than thirty days , excepting for a few thousands on his way out.You might add in the five to seven million Jews , gypsies and assorted others done away with in the camps, plus the millions in the rest of Europe and Russia who died at his hands between 1939 and 1944 if you want to be intellectually honest.Then we don't look worse than Hitler anymore do we?

I read a lot of history and Hitler went to war primarily for the resources-oil, iron , farmland , coal, possessed by the countries he invaded, although megalomania played a serious role.There is no doubt in my mind that we are in the ME primarily for the oil,but there are some important secondary reasons which I don't have time to examine here.

I don't claim that we are any better morally, but we do make a serious effort to keep the carnage down if for no other reason than that it doesn't play well on tv around election time.

By saying that someone else not as nice would be there I meant somebody like Hitler, or the Japanese who carried out the rape of Nanking, or Stalin , who starved over twenty million of his own people.Or maybe Pol pot, or the current dear leader of North Korea, who seems determined to starve his own people.Or maybe Idi Amin.Or Genghis Khan.Or General William T Sherman.

I agree that we are an empire but I hold that any objective observer of big power politics would rate us as the teddy bears of all time in terms of going easy on the little folks.

Now as far as morality is concerned, I hold that the world is a Darwinian place, and that morality is defined by the winners, as history is written by the winners.Losers get unmarked graves.

Incidentally I happen to champion the role of religion in society, although I am an athiest/agnostic and a confirmed Darwinian in terms of understanding the world and biological reality.I may be the only person in this forum who seriously defends religionon a regular basis.

One of Dostovesky's characters says in the Brothers Karamazov something to the effect of "then if there is no God, anything must go" meaning ?

Meaning to me that unless we agree that there is some ultimate higher authority,morality is whatever we define it to be.

(The Greeks we hold up as the founders of western civilization were famous pederasts, the old Romans and some of my own ancestors owned slaves, some of my distant cousins and perhaps grand parents a long way back were sold into slavery by the Norsemen who raided Ireland.I hardly need to go into the status of women in the mideast.The human race does not have a whole lot to be proud of-my best most dedicated liberal buddies have all seen thier parents off to the old folks warehouses to die of loneliness and broken hearts.)

Ditto half the conservatives but only half because the other half take seriously "Honor thy Father and Mother".We looked after my own Momma at home for twelve years until the Thursday before Christmas.If I am physically able and it is necessary I will do the same for Daddy.

This is true only on the grand scale however-on the smaller scale of family , nieghborhood, tribe, we have a built in morality that seems best defined to me in brief as us and them.In short, it's either us -or them.

When the group is small enough, Greenish's Capuchin monkey fairness meter" emerges and comes into play.

I don't LIKE this formulation-BUT IT FITS THE FACTS, AND FACTS ARE STUBBORN THINGS.I contend that as a description of the reality of this world, it is elegant, parsimonious, and not only testable but well tested.

There would be no Quakers unless there were short tempered Baptists to protect them.

Orwell said that ordinary peaceful men are able to sleep quietly in thier beds at night because "rough men stand ready to do violence on thier behalf."

I wish things were different-I REALLY, REALLY do.But wishing doesn't make it so.

That one made it onto my growing list of quotes. Funny, sad, thought-provoking, and, alas, true.

... sweet jesus, the blockquote worked! must have been that tutorial that went up a few days ago...

Welllll.

No short tempered (or long, for that matter) Baptists were protecting Quakers when they were sent to prison in droves for not addressing the magistrates with the properly formal (at the time) 'you' rather than the informal/intimate (again, at the time) 'thou.'

Quakers and other pacifists have persisted even in fairly harsh regimes.

Further more, none of the wars the US has conducted since at least WWII could be seen as protecting its citizens, Quaker or otherwise, from invasion. They are wars of empire in a vast game of global control.

Ironically, the Department of War became the Department of Defense at the exact time it's role was most clearly turning away from defense and toward making wars that had little to do with our immediate safety.

What is becoming ever more clear is that we have killed over a million children, women, and non-combatant men, and displaced millions more, all so that we can continue to drive our SUV's and control the remaining sources of the precious black liquid, and even that goal may be slipping through our hands.

I'm sure the mourning mothers of their obliterated babies are thanking Allah that they died under the kinder and gentler hands of US ordinance rather than Pol Pot. Or perhaps not.

"Incidentally I happen to champion the role of religion in society, although I am an athiest/agnostic and a confirmed Darwinian in terms of understanding the world and biological reality.I may be the only person in this forum who seriously defends religionon a regular basis.

One of Dostovesky's characters says in the Brothers Karamazov something to the effect of "then if there is no God, anything must go" meaning ?

Meaning to me that unless we agree that there is some ultimate higher authority,morality is whatever we define it to be."

I am staunchly Athiest and I could not kill animals. What the heck, I cried when my dog was put to sleep. I would not consider killing anyone unless it was self defense. I am against all these unjust USA foreign wars. So please Sir, don't tell me that I need religion to have morals. Good day.

Hi Jimbo,

An organized body of people willing to share and reinforce your morality might come in handy.I'm not religious either, and I too cried over my dog when he died.Got another one and I will probably cry over him too when his time comes.The thing about morals is that they only mean something when they are shared -and although religions are often hijacked by bad characters , all that I know of do come with built in moral codes and the means of spreading and reinforcing the code.

Religions are survival machines.I don't see why such an educated and perceptive group as the readership here have such a hard time with this concept.

you need to study up on the history of the quakers.

Hmmm... I'm not sure whether you're responding to my response or to the original statement.

Personally, I wasn't taking this statement literally...

but, it can't hurt to know a bit more about Quakers, either... especially as I am a pacifist (and, in fact, I attended a 'friends' school for a period).

Not defending anyone here but how many Poles did Hitler kill between the invasion in late 1939 and his death in 1945? 2003 through 2008 is about as long. I can't imagine how many he would have killed with our destructive capability. Hitler (and the great farm collectiviser, Stalin) were beasts of a different color. But it is very likely most Americans value an Iraqi life as a commodity worth significantly less than the value of a full tank of gas and vice versa. Best of luck talking morality if TSHTF in any sort of big way.

Unless you mean local armies (such as Saddam's), or intervention of an indirect nature (e.g. military aid), you're probably wrong.

The US accounts for 40% of global military spending, or as much on defense as the next 8 or 9 countries on the list, including Britain, which of course has repeatedly gone there with us. If you look at how much trouble we had in Iraq, it's doubtful that any other country, or even a coalition of countries, would have thought they had the resources to try what the US did.

If we were not the big dog somebody else would be-that dog might even be Saddam.The nature of the beast is that if THE alpha is sufficiently powerful no one can challenge.But if there is no clearly dominant player so powerful as to be virtually untouchable then the second tier players invariably slug it out.

If Saddam had managed to run us out of the ME and we became isolationist, he would have control of the area by now and probably have nuclear weapons and delivery systems too.The Saudis wouldn't last six months without us backing them up.

But if we had never been involved, either somebody in Europe, perhaps a coalition, or Maybe China would have dropped the boom on the ME, while the dropping was still good.

They would have had no choice-the people over there are reminded of the Crusades every day in school and they are just as easily provoked into a war as we are.

As I said before , I wish things were different.

With this way of thinking, there is no limit to what can be justified. It was precisely Hitler's thinking. Why shouldn't it be Germany?

So you're talking about indirect intervention ("us backing up the Saudis"). Sure there would be a 'great game' going on there. My point was that no country or coalition besides or without the US would have attempted an outright invasion and occupation of Iraq.

Just a quick calculation... $100 billion capital investment and $200 billion potential revenue ($2/barrel). Not a really exciting investment prospect for the risk involved. I can't see the oil companies really jumping to develop this in a short period of time without other incentives.

Also, the new export capacity was only planned at 4.5 million per day. So if they pump 12 million, there's nowhere to ship it. The port facilities limit these grandiose plans to roughly half.

You think $100 billion in profits isn't exciting to anyone? Okay...if you say so.

Great post Ron P., and especially for standing by your prediction of >5 mbd production.

There are so many high level liers in the Middle East, it's uncanny. It seems to be part of their culture. Look at Chalabi who supplied the Bush Admin. with so many lies about WMD, they started a war that will end up costing the U.S. at minimum a trillion dollars.

Now all these oil companies have been fed what I think will end up being a crock of lies, and they fell for it so hard they are willing to work for a mere pittance per barrel. When those companies finally figure out they've been conned, imagine how foolish they will feel and in the pocketbook.

If I'm wrong about this con job, then the members of TOD can throw it back at me too. I agree with less than 5 mbd max. production.

Ron, this is the question (for Stuart) to answer.

Clearly you meant this fields (and Kirkuk) from the list above:

Rumaila 2.85 mbd 17 Gb

West Qurna Ph I 2.33 8.7

West Qurna Ph II 1.8 13

Majnoon 1.8 12.6

Wiki 'list of oilfields' information gives not one of these fields in decline. Neither Kirkuk and other mentioned fields.

That the fields are old and 'tired' doesn't say much IMO: what counts is the percentage of depletion and if they are badly damaged or not. This are two of the important questions to be answered before judging if the theoretical 12 mbd is possible.

Stuart,

Thanks for this article, it does give one scenario that might well provide future supplies to meet the depletion that we anticipate, and you wrote about earlier, that is coming in existing field production. However one of the reasons that I write the tech talks on Sundays is to show folk that getting the oil out of the ground is a lot more than just drilling a hole and connecting a feed pipe into the pipeline to carry the oil to the nearest port. Thus I believe that the creation of the needed infrastructure to handle even a fraction of this increase will require a lot larger investment in money and time than has yet been committed. Look for example at the investment that was required for the GOSPs to handle the additional flow in Saudi Arabia .

I think it is wise to be cautious about this effort, which seems to be part of the potential future production that has underpinned the optimism that CERA has had about long-term oil supply, I certainly wouldn't change my hybrid for an SUV on the anticipation.

I am a little hard pressed to come up with a list of mature producing regions that have shown a five fold increase in production in 10 years, but I suppose that many things are possible. However, I suspect that a more likely best case scenario for Iraq is a low single digit rate of increase in production.

One item that is, as usual, generally overlooked is net exports. Iraq has shown a pretty substantial annual increase in consumption of 6.2%/year (as of 2009 EIA estimate) since hitting a recent low in 2003. At this rate of increase in consumption, if we look forward to 2020, Iraq would have to increase their total liquids production rate at 2.2%/year--just to maintain their 2009 net export rate.

Good point about coming back from the grave. CERA etc are always on about this, Venezuela being a good example, regaining 92.7% of their 1970 peak (3.75 mb/d) in 1998. But of course in the meantime they've descended back to 68.35% of same peak in 2008. Maybe that's why Hugo kicked out the majors this time...

Come to think of it, why didn't those uppity majors and service companies boost Venezuela to some lofty pittance, 4 mb/d even? They got all that juicy tar! At least 46 discovery wells 1998-2009, too, almost all of them oil. What is the qualitative difference between a nation like that and Iraq? Dominance of giant fields?

HO:

I agree on the need for GOSPs, water injection supply etc. Essentially one can view the al-Shahristani plan as a huge set of megaprojects, to be conducted in parallel, the like of which the world has never seen. I take a look at it from that perspective here using the Saudi projects as models:

Perhaps I should make a new graph along these lines...

Great to see you posting again, Stuart. It is also nice to see the EU starting it's renewable energy grid, which is a small version of the one you wrote an article on.

One important aspect that appears to be missing from this article is the decline rate expected (or occurring) from mature fields. Even the IEA made a dramatic shift on this point. You are seeming to point only at existing production as the benchmark forward.

A tremendous amount of detailed work Stuart/Gail...appreciated by all I'm sure. I'll skip on all the political/military possibilities. Accepting some huge assumptions as to how much known oil is left in the ground to develop I did some back-of-the-envelope calcs and the drilling phase could achieve the goals. A tough environment as you say, but if ops were unrestricted very large drilling bases could be set up quickly: 12 - 18 months. Then it becomes strictly budget driven. In fact, based on some of your details, I can see well deliverability exceeding export ability for a time. Once you have enough rigs on the ground drilling horizontal wells (if that's the best way to roll) it would be a snap to add 200,000+ bo/month.

Beyond all the security/logistical questions: let's say they can develop such deliverability and have a very stable gov't with a healthy economy (big assumptions for sure but let's accept it for the moment). By the time such a scenario could develop it seems possible that PO (with respect to all other producers) will become an accepted fact as the remaining exporters hit an undeniable wall: the KSA, Brazil, USGS et al can claim all the "proven reserves" they want but daily deliverability will tell the truth. In such circumstances maybe the then Iraq gov't would see the advantage of limiting production to preserve their assets. IOW, they now control oil prices and could choose to deliver just enough oil keep the global economy going but not enough to sink prices. Essentially what the KSA claims they are trying to do today. That might make you wonder how the KSA feels about a stable Iraq.

I was thinking along these lines as well that if Saudi Arabia production decreases, and if Iraq could even come close to the planned projects, it would represent a significant shift in power within OPEC.

This plan represents different pros/cons for different major players. It would seem that this plan could be viewed as a threat to Saudi Arabia and some other OPEC producers. It might be best for the OECD for this plan to play out more slowly to extend the plateau (if top-level governments are aware, but silent, of the implications of peak oil). Iran might have other thoughts (e.g. weakening Saudi Arabia might be in their interests). There may be significant forces with interests in either achieving this plan, in slowing it down or in stopping it. Should be an interesting power play.

Hi Rockman,

I was hoping to see a comment from you - I believe you add a much needed reality check to the technical side of these discussions. However, you have pretty much ruined my day! Given your assessment of the technical feasibility of achieving their production goals, here is what occurs to me:

As global oil production declines and prices rise, Iraq oil will be pumped. One way or the other, these fields, pipelines and ports will be be defended - and the defense might be very brutal. I can not imagine that local gunmen are going stop this oil from flowing when the price is right. No amount of political/military opposition will get in the way for very long.

For the next 6 to 10 years: