Why peak oil is probably about now

Posted by Stuart Staniford on March 1, 2006 - 6:12am

This is a quick summary of past analyses with links for further detail.

There's a very good chance claimed OPEC reserves are exaggerated.

Here's the history of how much OPEC nations have claimed to have in their proved reserves (oil that they should almost certainly be able to produce with existing technology and prices).

History of OPEC claimed proved reserves in billions of barrels (also known as Gigabarrels = Gb. A barrel is 42 US gallons). Source: BP Statistical Review of World Energy. Click to enlarge.

Note that OPEC production quotas are in part dependent on proved reserves - giving these countries an incentive to exaggerate. The huge jumps in reserves were not associated with the discovery of any particular large new fields. These time series are extremely implausible on their face and suggest mendacity. The truth may be starting to come out. Recently, Petroleum Intelligence Weekly got hold of internal Kuwaiti documents indicating their true reserves were less than half the claimed value. This is a key point. 2/3 of the world's claimed remaining reserves are in OPEC countries, and all scenarios that assume peak oil is more than ten years away assume that OPEC can substantially increase production from present levels.

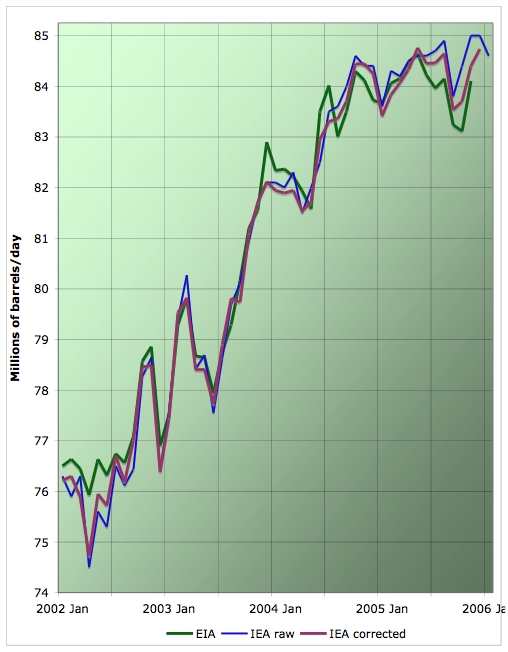

World production stopped increasing in late 2004.

As of right now, production has been flat-but-bumpy since late 2004. The peak month of production is presently May 2005. This is true despite high oil prices giving strong incentives to produce more oil. Lack of refinery capacity is often cited as an alternative explanation for this. If this were true, heavy hard-to-refine oil would be cheap. It isn't.

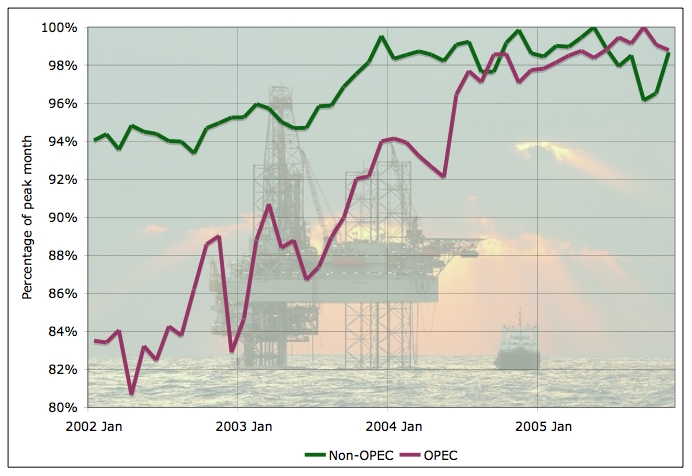

Both OPEC and non-OPEC oil production appears to be approximately plateaued at present:

Average daily oil production, by month, from various estimates for OPEC and non-OPEC as a percentage of their highest month (May, 2005 in the non-OPEC case, September 2005 in the OPEC case). Click to enlarge. Believed to be all liquids. Graph is not zero-scaled. Source: EIA.

Decline rates of existing production are very high

The major international oil companies have not been able to increase production for some time, despite strenuous efforts (the notable exception is BP which has had access to resurgent Russian production via a subsidiary).

Average daily oil production for top 10 publicly traded international oil companies. Source: Petroleum Review.

An analysis of Exxon's production suggests the problem. Their existing production apparently declines at rates varying from 6% to 14% per year. Thus all the new projects they bring on stream each year just serve to offset the declines in their current fields. This strongly suggests they are at or near peak. More recently, it emerged that in 2005, they hardly replaced any of their oil reserves - instead almost all of the quoted energy reserves they developed were actually natural gas (in Qatar). Shell is even worse off - they only replaced 60%-70% of production in 2005, and only 19% in 2004.

The situation does not appear to be much better in OPEC. According to the US EIA, Saudi production is declining 5% to 12% each year. So they have to bring on that much new production just to stay level. Similarly, Iranian production is estimated to decline 8%-13% each year.

This to me is the most compelling argument that we must be close to peak oil production. The amount of new production required every year just to stay level is enormous. We know this was the main symptom of US peak - all quotas were removed (oil production in Texas was managed via a quota system), and despite strenuous efforts to increase production, it never could climb higher. It is noteworthy that a number of OPEC officials were quoted in 2005 saying that OPEC was producing everything it could with effectively no quotas.

Hubbert Linearization points to peak oil

Given that reserves data cannot be relied on in many important cases, peak oilers are fond of using an extrapolation method from production statistics originally due to Hubbert. While the technique has its uncertainties, and may not be applicable to all countries, it did a decent job of predicting the US peak in production back in the 1970s. This method suggests the world is close to peak now. This is the basis of Professor Deffeye's famous Thanksgiving 2005 prediction. My own analysis suggests a peak of May 2007 ± 4.5 years (so Professor Deffeyes prediction, for which he doesn't cite an uncertainty, is within my error bars - there are differences between different production statistics which lead to slightly different answers).

At least one major oil company is warning us

Chevron has been running an ad campaign called Will You Join Us. They are warning everyone that it is getting extremely difficult to find and produce more oil, the world is consuming much more than it discovers, and we should be thinking about conserving. Why on earth would they want us to conserve their principal product if there was plenty of it?

The price of oil keeps going up.

At around $60, prices over the last year or so are the highest they've ever been in the absence of a major oil shock. They are also very volatile - any hint of disruption can cause a several percent change in price in a day. Prices are now high enough that demand has stopped increasing at least for the time being, and stocks keep building - suggesting the market is nervous and wants more oil on hand.There is no evidence of Saudi spare capacity

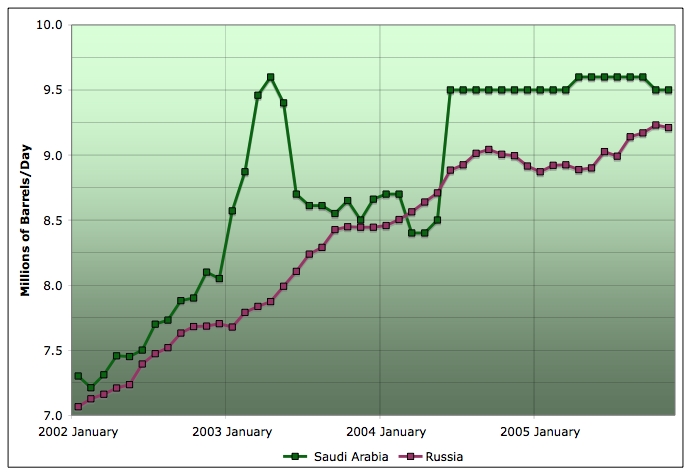

Saudi Arabia is claimed to have some spare capacity (the only nation for which this is currently claimed). There is no evidence of it in production statistics. Their reported production has been flat for a year, and they did not increase production at all in response to the hurricanes in September 2005. It's possible they have some spare production from the Manifa field; however, it is unrefinable due to high Vanadium levels:

There are geopolitical and climatic risks to the existing production level

Whether its suicide attacks on Saudi oil facilities, tension over Iran, Nigerian rebels, the Iraqi resistance, or hurricanes, little things keep going wrong and threatening to turn into bigger problems. If any one of these situations significantly worsened their impact on oil supply, given the very tight market already, we would immediately be in a serious oil shock that would likely set in motion major demand destruction extending over a number of years.

In Summary

While no one piece of evidence is conclusive, I find the overall picture here to be suggestive that oil production is close to its peak value and is not likely to increase too much more. Whether May 2005 will stand as the highest ever month of production or some month in 2006 or even 2007 rises a little higher is certainly hard to call. However, I would be quite surprised if the world is able to bring enough new production on stream to overcome those high decline rates in existing production for much longer. And with each passing year, it's only going to get harder to do.

I suggest this post to be left permanently somewhere in TOD's front page, it's perfect for newer readers, and aswers some clamis made these last days by some of them.

Of the four biggest currently producing oilfields two are just entering terminal decline: Cantarell in Mexico, Burgan in Kuwait. There is not clear public data on the other two largest fields: Ghawar in Saudi Arabia, Da Qing in China, but many suspect they are possibly in decline or about to decline. These fields currently provide about 10 mbpd of global oil (all liquids) production of almost 85 mbpd.

EOR (enhanced oil recovery) is now in widespread use. These techniques tend to keep production higher for longer but then it tails off more rapidly = faster decline rates. See information on North Sea fields as an example.

It's fairly clear that we are at or near the plateau of peak oil now, it is almost certainly within 10 years, very probably within 5 years. Then we can look forward to the decline, let's hope it's not too steep.

If you think that alternative fuels, conservation and the like can fill the gap you should read the Hirsch report on mitigation:

http://energybulletin.net/12772.html

In brief it concludes we need at least 15 years of massive action to prepare for peak oil: "...without timely mitigation, the economic, social, and political costs will be unprecedented. Viable mitigation options exist on both the supply and demand sides, but to have substantial impact, they must be initiated more than a decade in advance of peaking." We don't have that decade, and I see no signs of massive mitigation action.

Perhaps then you will read the doom and gloom sites about peak oil and realise they are, perhaps, not quite as mad as you might otherwise have thought. Peak oil will probably result in the greatest upheaval in human society since its converse: the industrial revolution, but will happen much, much faster.

My paper is at:

http://www.lightrailnow.org/features/f_lrt_2005-02.htm

I have been intrigued by the WW II experience of Switzerland, About 8 months oil in storage, but they made it last 6 years. They functioned reasonably well with minimal oil use by using electrified transportation.

I agree with you in principle. I also think that if we made all our homes more passive solar efficient we could reduce energy by more than 10% per household. The technology and studies are there. The problem is actually doing the work.

People have to spend money and resources changing things. There is no incentive or leadership to do this currently. Our national focus is to spend money on all the wrong things. Like tax breaks for oil companies, Hummers, etc. Until our national policy recognizes and rewards innovation towards energy efficiency (conservation?!) nothing significant will get done. Too many competing interests that want people to spend their money on something else.

The debate has left the scientific/technological arena and is in the political/lifestyle area. We know what we could do. What are we going to do?

Besides my local work in New Orleans (a "Shining City in a Swamp" ? :-), I wrote the referenced paper during my summer evacuation.

I posted it on a Light Rail website (other good stuff there). I eMail EVERY person I see quoted in national media talking about energy (called Hirsch at home during business hours, so far, too busy to talk to me).

I joined this group to get more exposure and convince others here that my ideas are PART of the solution/rational response (with some success I think). I am reasonably well known in Light Rail circles (known in part for antipathy towards Amtrak >:) and have done work for DC & Austin streetcars.

Work, work, work, all unpaid, BUT with some possibility of future, limited success.

BTW, I would appreciate a critique of my paper by anyone interested. I plan on doing a rewrite soon.

Don't forget to link to that (unless you did above and I missed it).. It sounds like a great idea. I have seen different reports on rail, often politically-biased, on how efficiently you can operate rail systems. Though I understand Amtrack was often expected to be able to operate in the black without the kind of infrastructure help such as Highways and Airports would get, and was therefore at an unfair disadvantage, I also wondered about the ability of even 'Heavy Rail' to introduce efficiency developments in their Techn. that would improve their competitiveness.

From an energy standpoint, how does Rail-freight stand up against Trucking, and Busses as opposed to Passenger Trains? I can't imagine that Rubber on the Road stands a chance against steel wheels, but I don't know where to find the info, and I don't know how the Maintenance of Track and other Equip. costs play into the numbers.

http://www.lightrailnow.org/features/f_lrt_2005-02.htm

Critique requested.

Freight rail uses 1/8 as much diesel as 18 wheel freight per ton/mile. OTOH, Greyhound is a bit more fuel efficient than Amtrak (Amtrak moves more steel/pax than buses and other inefficiencies).

I am not a fan of Amtrak.

That's just onr of the reasons I think Hirsh is optimistic wrt mitigation.

According to the Union of Concerned Scientists, on heavily traveled intercity rail corridors where trains are powered by diesel locomotives (like Santa Barbara - Los Angeles - San Diego or Chicago-Milwaukee), passenger trains are slightly more energy efficient than an intercity bus (like those operated by Greyhound) with an average load factor, but 2-3 times more efficient than a Boeing 737, 3-4 times more efficient than a typical passenger car, and more than four times as efficient as an SUV.

On electrified routes, like Amtrak's Boston-Washington D.C. Northeast Corridor, passenger trains are more efficient. The reason is more than just the motive power. High speed trains (including those that Amtrak operates) have regenerative braking systems so that when they slow, electrical power is returned to the overhead wire in such quantity that Amtrak often ends up selling spare electricity to utilities along the route. Thus, the BTU efficiencies work like this, according the UofCS: high speed train is twice as efficient as a Greyhound bus, five times more than a 737, seven times more than standard sized passenger car and nine times more than an SUV.

I hope this helps. But if you really want to change energy usage, build/rebuild communities into compact, mixed-use neighborhoods where people can take care of most of their day-to-day needs within a 15-minute walk or bike ride of home. Anything else that's farther away, that's what the buses and trains are for.

Last time I calculated, Amtrak was 73 pax-mpg and SW was 52 pax-mpg. With new aviation technology, that gap will narrow.

Amtrak consumes about $1.5 billion each year in operating subsidies. The fed share of capital spending for light rail is about the same $.

Light rail is a century+ long improvement that can transform cities, save thousands of lives and massive amounts of oil. Amtrak $ are lost with zero impact the next year.

A $1 spent on Urban rail capital spending is worth $50+ spent on Amtrak operating subsidy when the long term effects are considered.

Intracalifornia and NEC pax rail are worthwhile fro relatively close city-pairs. Lomg distance AMtrak is not, IMO.

* Berliners take DB to Hamburg ALL the time. Very few rail to Madrid or Barcelona, Spain, despite the very expensive & fast rail between the two.

A while back I totaled up ALL of the serious plans that have been considered and ran out of projects before hitting $250 billion.

Among these projects are:

NYC 2nd Avenue subway and extra PATH tunnel underneath Hudson Ocean

LA "Subway to the Sea", Gold, Expo, Downtown Connector

103 miles total "Subway in the Sky" in Miami

BART to San Jose, eBart, Muni trolleys

St. Louis extra 30 miles

New Orleans 35 miles streetcars

Dallas plans till 2030

Houston plans as approved by voters

Salt Lake City 30 year plans (they may vote to triple taxes to build faster)

Portland Green Line + next line

Seattle plans, current + north extension

Phoenix 30 (25 ?) year plans for almost 100 miles

Denver project for 117 miles (?)

Minneapolis-St Paul 11 miles

Memphis plans (~50 miles)

Atlanta extension to north suburbs

Charlotte

DC Purple, Dulles & Green extension to BWI

and more (above from memory)

NOT enough for complete transformation. The US has been exercising "birth control" and pushing buses for a long time. Once the above get funding, many more viable plans will appear. "Stars" for new lines are Miami, Denver, Salt Lake City & Dallas. Likely to be built IMHO.

Once built, even prePeak Oil, they attract development and generate their own ridership.

Note that costs are at least 1/3 higher than they need to be due to low volume and "the FTA process". I think above could be built for ~$150 billion.

Operations: $490.05 million;

Capital/debt service: $772.2 million;

Efficiency incentive grants: $31.38 million.

Second, Amtrak's revenue-to-cost ratio is 72 percent. I would encourage you to look at the revenue-cost ratios for light-rail systems. I love light-rail systems, but I think you're being too reactionary in your dislike of intercity rail.

Third, there is an extensive market of corridors up to 300 miles (an arbitrary number some faceless person decided was the dividing point). Think of all those city pairs in the Midwest, Northeast, Southeast, Northwest, Texas, California and even into Arizona and Nevada. Compare the population density and travel density data of these corridors against those in Europe. I think you will be surprised. Heck, even Ohio has population density numbers that are only slightly less than those of France -- where a 500-mile TGV route between Paris and Marseille is traveled in just three hours (equivalent to Cleveland to New York City, or Pittsburgh to Chicago).

Fourth, I'm sick of people bashing the long-distance train. Show me another mode of transportation that can cover 2,500 miles in less than 50 hours while stopping in more than 50 towns and cities along the way. Prove to me another mode can do it better and for less money than the passenger train.

Now, if you want to debate the ability of Amtrak management and their workers to be good custodians of the passenger train, then I will probably agree with you. But we also should blame Amtrak for the way it is funded. It's a stupid funding mechanism that only Congress could have dreamt up. Oh wait, that's who did it!

My biggest problem with Amtrak is not that it exists, but is has very little social value and hence, is not worth the public subsidies that it gets.

- It saves very little energy

- It kills 70 to 90 people every year (mostly members of the General Public) A quite high rate for the few pax-miles.

- It slows down and screws up operations of the tax paying, and essential freight railroads.

- It provides very little service to small towns, Greyhound does more for less public subsidy.

5)If I was given a choice between 2¢ for building more Urban Rail or $1 for Amtrak, I would take the two pennies in a heart beat !

What do we have to show today for ~$50 billion (2005 $) in Amtrak subsidies ? What would we have if that wasted money had been put into Urban Rail ?

- NYC 2nd Avenue subway

- LA's "Subway to the Sea"

- Almost double the post-1973 Light Rail miles around the country

Instead we have a mode that carries 2/3 of 1% of intercity pax-miles (from memory) and requires $1 in public subsidy for every $ in fares.To your points-

- "Debt payements" are just maintenance under a different name. Instead of paying in the current year, $ were borrowed and paid back later.

- Please note, FY 2004 Fare Revenuw was $1,256,424,267, so $1 in General Fund Subsidy for $1 in Pax Fares. 50% fare recovery looks like to me.

Light Rail is socially useful and worthy of subsidy (local BTW), Amtrak is not socially unseful, see above.3) First, Americans will ride the rails significantly less than Euros & Japanese, NOT more. One reason, every large & medium size city there has good Urban Rail systems to feed intercity rail, we do not outside NEC, Chicago & SF. Intercity rail without Urban Rail is next to worthless.

Any way, it is 250 miles/400 km (straightline) not 300 miles where EU & Japanese stop taking very expensive high speed rail and start flying.

My favorite Example is London-Brussels (~225 miles). Second most expensive rail line in the world. Ditch to slow down cars. Eurostar gets a bit less than 1/2 of the market, BUT when $2 billion more in improvements are made in the UK, they should get a bit more than half. Eurostar is talking abut offering just two trains/day to Amsterdam (with stops in Antwerp & Rotterdam) vs. 9/day to Brussels. Add a bit of mileage and pax % fall off quickly. There is no talk of a non-stop between the MAJOR financial centers of London & Frankfurt. Pax would rather fly "that far".

Same results in Japan.

So rail-centric societies will not take high speed rail for 300 miles (straight-line) or more in large numbers, with superb subway, etc. connections at the station, why will Americans take Amtrak in any numbers ?

4) There is no social or economic need to "2,500 miles in less than 50 hours while stopping in more than 50 towns" WHY ??

One of AMtrak's faults is too many stops. Half or more should be cut out.

Greyhound can service the small towns, and would serve more if it were not for tax subsidized Amtrak. "Ambus" is very much part of AMtrak.

If you insist on cluttering the tracks of the freight trains, get a 2 crew Colorado Rail Car (MUed if there is demand), run one shift between two cities with airports (giving mid-day service to small towns) and unmanned stations along the way. Vending machine food, sleep in a hotel overnight if one want to go further the next day (rolling a steel hotel along is TERRIBLY energy inefficient !! A sin ranking with driving a Hummer)

Better - No "middle of the night" "service", much more energy efficient (no sleepers, much less rolling mass)

Cheaper - Certainly !

5) David Gunn was the best manager AMtrak ever had, or ever will have. HE made it better, downhill from here.

How can I say we've ignored rail when Amtrak has received since 1971 $30 billion (some capital, some operating subsidy, and $3 billion of it railroad retirement for pre-Amtrak employees that count against Amtrak's subsidy)? Easy. When rail's primarily competition (highways) has received $2 TRILLION in the same period, it's amazing that rail has even survived in this country (be it freight, intercity or urban rail).

Are you aware that a number of freight railroads -- Norfolk Southern, BNSF, Kansas City Southern and a number of regional railroads -- have lobbied states and Congress to run operating passenger trains? If I were king for a day, I would eliminate much of the Amtrak subsidy and would allow these and any other interested freight railroads to take a federal income tax credit on the property taxes they pay on routes used by intercity passenger trains. Considering that freight railroads pay $500 million in property taxes each year (and their competition pays none), the credit would help offset part of their costs of operating passenger trains.

We need passenger trains, especially when it becomes to expensive to fly post-peak. I live in Cleveland, and we have more than a half-dozen flights a day to EACH of the following cities within 300 miles of here -- Chicago, Washington DC, Baltimore, Detroit, Toronto, Pittsburgh, Buffalo, Columbus, Dayton, Cincinnati, Indianapolis. I can tell that few people are going to want to sit on a bus for up to eight hours. Why do this when a train can cut that time in half? Just between Cleveland and Chicago, there are more two dozen flights carrying 600,000 people per year -- representing less than 15 percent of the travel market. Much of the Ohio Turnpike was already widened to three lanes each way for $1.4 billion -- offering NO reduction in travel time. Where is the yield in that? Except it made us more dependent on oil.

I'm sure the highway lobbyists love reading your messages. They can say amongst each other "see, even the rail advocates can't agree on a future course. Let's just keep paving." I know, because I've heard them say it for the 20 years I've been in the rail industry.

I'm not your enemy, Alan. We both have much to gain from a nation less wedded to pavement, sprawl and oil. I hope someday you'll come to realize this. Best of luck to you in your future endeavors.

My paper does give an intercity "semi-high speed" (max ~110 mph) electrified freight & pax (freight "carries the freight" with pax an add-on) possibility. Three corridors added to the NEC (which once did carry freight and should again). DC-Miami (NEC extended), NYC-Chicago-KC (IF more cities expand Urban Rail) and San-San in California. Link early in this thread. Quite frankly, I see semi-high speed freight as a way to take market share from air & express trucking (perishable fruit, veggies & fish, packages, JIT inventory deliveries) with pax a very noce add-on.

Amtrak tickets, absent any subsidy, will STILL be more expensive that air past post-Peak Oil. There is a small and shrinking fuel cost advantage for Amtrak. Last time I checked (in 2004 ?), Amrak was 73 pax-mpg for diesel, Southwest was 52 pax-mpg for Jet-A. When the 737 replacement flies, it should be pushing 70 pax-mpg (a bit less for shorter hops).

So unless/until rail electrifies, I quite disagree with your statement "We need passenger trains, especially when it becomes too expensive to fly post-peak". Air has significant labor advantages as well over Amtrak.

And sleepers (a rolling steel hotel powered by a diesel generator) is just terribly wasteful ! MUCH more efficient to sleep in an insulated brick hotel powered by the grid.

Mexico has luxury buses in regular scheduled service, often express. Once oil increases in price, congestion may decline and these may appear here. There is no good reason for buses to take twice as long as AMtrak.

In the meantime, let "who ever" run 2 crew Colorado Rail cars (2 or 3 joined together) between Chicago & Cleveland a few times/day (subcontract the maintenance).

Given the lack of Urban Rail in Baltimore (limited) Detroit, Pittsburgh (limited), Buffalo (very limited), Columbus, Dayton, Cincinnati & Indianapolis, people will want to drive there in any case since they will need a car to get around once there.

My proposal is let any railroad that electrifies avoid paying local property taxes since they are in Interstate Commerce.

I have sympathy for the freights and see them as a major part of any solution. Amtrak is messing up freights in several areas (UP Los Angeles to El Paso, they are double tracking @ 50 miles/year, Sunset Ltd is a headache for them).

There is a market for intercity rail when you have 1) large cities within 250 (not 300) miles straightline apart 2) Viable Urban Rail systems (one can get to most places by rail) in both cities 3) freights have room for extra trains and 3) the cities are large enough.

However, providing intercity rail where there is a market is "not a big deal" outside the NEC. Relatively little fuel saved vs. driving and almost none vs. air. Few, if any, lives saved. No impact upon urban development patterns (Urban Rail affects sprawl significantly, Amtrak doesn't).

In these limited cases, I see intercity pax rail as a "nice to have", not the essential of Urban Rail. I will be greater supporter of intercity rail (in the above cases) WHEN we have a massive building boom for Urban Rail. As stated elsewhere before, "The Best is the enemy on the Good".

Uh... no. There is no way a "737 replacement" is going to be anywhere near 34% more efficient than a current-generation 737. No way. What's your source?

As for "52 pax-mpg" for Southwest - is that a calculation based on total fuel consumption and total passenger-miles over a certain period? Or is it some extrapolation of cruise fuel burn rates? Turbofans are very inefficient in dense air (almost an order of magnitude more fuel burned per hour near sea level as in cruise, all while travelling half as fast), and it takes a lot of energy to get an aircraft to altitude, energy that is not necessarily returned on the way down, especially if extra drag is required (flaps, spoilers, landing gear). Short flights such as those Southwest operates should be relatively inefficient, especially when considering local maneuvering (e.g. taking off into wind and landing into wind can mean heading in the wrong direction at both ends!). Add in fuel burned taxiing and running the APU on the ground and ... well, I can't find the data online but I'm almost certain your "52 pax-mpg" figure is off. I'd be happy to sit corrected though - what's your source?

85172795000 Available seat miles

60223100000 Revenue pasenger miles (this matches claimed 70.7% load factor)

1287000000 Gallons of fuel burned

Ergo 66.18 ASM/gal, 46.8 RPM/gal

Wow, I'm impressed. I'll bet they're not including fuel consumed for servicing vehicles, but even so, that's quite efficient.

Now some sanity checks:

7.94 cents Operating expense per ASM

6.37 cents Operating expense per ASM, excluding fuel

Ergo fuel is 1.57 cents per ASM

They paid 101.3 cents per gallon, so that's 64.5 ASM/gal, which is close to the above.

The only 737-700 fuel burn statistic I could find was 792 gallons per hour in cruise. Assuming, say, 400 knots (450 mph) that's 0.568 miles per gallon. Assuming a full plane of 149 people, that's 84.6 passenger-miles per gallon. One would expect the cruise figure to be somewhat higher than the overall figure, so it all seems to hold together.

Think of it the other way, though: the most efficient aircraft in the world is barely equivalent to an efficient car at highway speed. With one occupant. A 47-passenger highway coach at, let's say, 6 mpg (right ballpark), gets 282 passenger-miles per gallon. A 3000 hp diesel-electric locomotive is said to get about 0.3 mpg (761 L/100 km is the figure I came across), but it can haul a 10-car double-decker commuter train with 162 seats per car - if it's full, that's 486 passenger-miles per gallon! If you want to get truly silly, consider that it is permitted for people to stand on the train. Bombardier lists the crush load capacity of their bilevel coaches as 365, so in theory you could haul 3650 people at 0.3 mpg, which is 1095 passenger-miles per gallon!

A full diesel train is still a far better use of fuel than a fleet of 737-700s.

Electric traction is even more efficient.

In short: the Europeans have it right.

On another topic: you are mistaken about the distance "limit" for high speed rail. SNCF's market share from Paris to Marseille (783 km) was 45% even BEFORE the opening of the last section of high speed line (which brought trip time down to 3 hours). SNCF's director general said "We thought that three hours was the psychological limit for high-speed rail, but delays to air services have helped rail a lot," Pepy explained. "On average one-third of airline services are delayed by more than 15 minutes, whereas globally 90% of TGVs arrive within five minutes of schedule. It will be a real challenge to maintain this in the future. The Paris--Lyon line is already full. We have reduced train headways from five to four minutes, and we are now aiming for three minutes."

Every four minutes. A high speed train every four minutes!

http://www.highbeam.com/library/docFree.asp?DOCID=1G1:81006309

Air source heat pumps with Natural gas backups for coldest days (rarely below 32 F/0C) works well here. Heat is a minimal concern.

I'm in Ottawa interested in the same thing. Can you provide more details here or email me?

The truth of this statement depends (and will depend) on the price of oil. At $60/barrel, this statement is very likely true. At higher prices, one cannot make the same assumption.

Because we use more energy per capita than any other country our economy may be most vulnerable to its rising cost.

The willingness to hold US $ can be saturated, IMO. When, I do not know.

Herewith another John Maynard Keynes quote:

"When you owe a thousand pounds to the bank, the bank owns you. When you owe a million pounds to the bank, you own the bank."

We owe so much money (i.e. they have bought so many U.S. Treasury securities) that the Chinese and our other big creditors defecate Hershey Chocolate Syrup whenever they think about the the dollar collapsing. The dollar will be propped up as long as possible.

Then it will go the way of the peso.

There are also vicious feedback circles related to: $ as reserve currency / oil priced in $ / US deficits and debt. When the levee breaks you won't believe how fast things change. The US will become, in current terminology, a third world country within a year.

http://www.worldoil.com/Magazine/MAGAZINE_DETAIL.asp?ART_ID=2696&MONTH_YEAR=Oct-2005

I don't believe the United States can remain a functioning democracy and have an Empire that wishes to occupy and control the world's remaining oil supplies. This strategy is not only undisireable and grossly expensive, it's also wasteful of resources which should be diected elsewhere. Let's invest a trillion dollars into research into alternative energy - not the war in Iraq.

Or is the Truth as follows; simply put they've looked at alternatives, realized they don't exist on a realistic timescale and have just decided to grab everything they can, while we still can? Personally, I think this policy is impossible and self-defeating in the long run. One country cannot rule the world, there are too many variables to contend with. It'll take over a million soldiers just to pacify Iraq. Where will the men for an Empire come from and who pays? It's almost as crazy as us trying to "control" the world's climate!

This argument always seems to be a non sequitur to me. It says that they did the sane and rational bit (realise the problem, look for alternatives), then come up with a crazy solution. Surely if they are sane and rational to do the first bit, then why would they suddenly become irrational?

Addtionally, the US has been involved in wars in something like 30 different countries since WWII. Their global domination plan has been ongoing since WWII ended - i.e. they have a consistent policy of controlling global resources. So today's wars really prove nothing about a new realisation of PO whatsoever. They are a continuation of very old policies which assume resources will last indefinitely.

Hisorically leaders have had the ability to analyse situations and see problems in a "rational" fashion, yet subsequently embark on course of action, which in hindsight, appear "crazy" to us. Recognising a problem that's staring you in the face isn't that hard. Finding a solution, among the mulitude of alternatives available, is. I just think the Bush administration has chosen the worst of all the alternatives they (probably)looked at.

I also think we've a new historical paradigm. I call it the "post democracy era". Here, far more than in the recent past, we're going to be using raw military power on a large scale to ensure our access and control of vital raw materials. I don't believe it's just more of the same. I think it's bigger and far more dangerous.

Unfortunately, this is rarely how it is actually done. Usually, the decided course of action comes first (whether consciously or unconsciously), and then the 'fact finding' and analyses are performed to support the decision that was already made. I've seen this done countless times in the business world. The people doing the analyses already know what the leader's desired (albeit unspoken) conclusion is and then fit the analyses accordingly. The process can be very subtle and give the outward appearance of objective analysis, but the analysts somehow usually come up with the 'correct' conclusion.

The Bush regime has honed this process to near perfection.

What the Bush people are doing regarding its effort to militarily dominate the Middle East may be morally reprehensible and a recipe for global disaster, but it is perfectly rational. As best I can tell, the logic seems to go something like this:

- They have the oil.

- We have the most powerful military in the world.

- Ergo, we can take control of the oil.

- If somebody doesn't like what we're doing, that's tough.

Implicit in this chain of thinking is the notion that the US already has a military machine costing over $400 billion per year, so it might as well get some good use out of it. The question is never raised as whether we could significantly improve our energy situation by diverting just a small fration of the total defense budget to something constructive.I see absolutely no sign that the current mindset is going to change as long as the Bush regime is in power. In fact, I don't have much hope that it will change all that much regardless of which party is in power.

Boy is that statement accurate. I have also seen this approach used in business by people who should know better.

This is my biggest worry box with the current administration. They just believe that if they want something to happen (hydrogen fuel cells, for example) they can just lay out a plan and expect success. The world doesn't work this way. Some of the most innovative things (like GoreTex) were complete accidents while looking for something else. And most people still don't see the value even after they are invented.

Innovation tends to work best when there is a clear problem to solve but no known solution. That is a mindset the current administration doesn't have. Not only will they not define the problem, they think they have all the answers already.

I agree!

To amplify on my previous post, it's been my observation that bad decisions are less the result of faulty logic and more the result of faulty premises or assumptions. One's world view and prejudices are usually deeply imbedded in those assumptions.

Faulty logic is usually not the main problem. Many people who are criminally insane are perfectly capable of highly logical 'if-then' thinking and can arrive at insane decisions that flow quite logically from insane premises (e.g., my neighbor is trying inplant wires in my head to control my mind, therefore if I don't kill him I will lose control of my mind). That IS a logical decision; the problem is with the premise.

The fundamental premise of the Bush regime seems to be that the US is engaged in a deadly zero-sum game of Survival regarding diminishing resouces, so we much grab as much of it as we can as soon as we can. The secondary premise is that we must have a military the size of the rest of the world's combined in order to accomplish what is called for by the first premise.

"Once you eliminate the impossible, what remains- however unlikely, is Politically Unpopular, and will therefore be shelved"

We often make assertions of the sort "if we invested the money we spend on military in renewables/alternatives we would not have a problem". That statement may be true by itself but is probably taken out of the context.

Ok, let's say we achieve energy independance. Peak oil does not harm us and the lights are still on. What happens next? Peak NG? Peak minerals? Peak water? Peak "cheap-labor-from-the-third-world-filling-WalMart"? Will we be able to solve all these problems and keep maintaining our lifestyle?

I think what we see now in Iraq is just a part of the long-term military securisation of the resource flow from the Third World to us, the so called "democracies". Up until now we had other means - WTO, IMF, "free trade" etc. They worked while third world countries were weaker, and resources relatively abundant. This starts to change and we need other means. Iraq is not a fiasco. Even the chaos it is now is a warning to the others - see what happens to your country if you don't do what we say?

It's all about keeping our Global Domination. The military force is just one in the arsenal here, others are the threat of military force, supporting corrupt third world goverments, isolating, destabilizing and denying given rights for countries that don't obey (Iran being a bright case) and many others.

I can say that we have been fighting this World War III for decades already and it is simply going to get worse.

This is just like the Islamic extremists - what rational reason would you have for blowing yourself up? Most of us here cannot see that. However, if you alter your base assumptions about the universe, life, etc., then such a conclusion might even become inevitable. So I don't see people acting irrationally necessarily, however I do see them starting from different assumptions which then lead to different conclusions. The challenge then is in getting people to agree on basic assumptions.

Also, how much variance can one expect in the exact date of the Peak using each of these methods?

(This is actually something that I have been thinking about due to a speech by Matthew Simmons that I recently listened to online. I will try to find the link later today.)

Our ability to make longer term adjustments declines as well when a recession hits.

The consequences for the US and poorer 3rd World are likely to be worse than the global average.

My question for you and TOD in general is whether the "peak in light/sweet" that we hear about is more accurate? Are you skipping the detail for a general audience, or do you think that the heavier end of conventional oils (my messy langauge there) are peaking too?

I thought that the new drilling in Sauid Arabia was part of the shift, and that their oil minister's line was sort of "hey, there is no peak oil ... we've got plenty of sour."

API S% WT

MANIFA-LOWER RATAWI 26.00 3.70

MANIFA-MANIFA 30.20 2.80

- more here

Now, with respect to that "wide discount" ... is there a well-known world price for heavy and/or sour crudes ... or are they all different enough to be less fungible?

I've been lurking TOD for 6 months, progressively educated. I find a real interest from relatives, friends and collegues in this subject and often direct them to TOD.

The problem is for the beginner the information is spread out as it is added over time. I would much appreciate a list of the most important series suitable for the beginner. A crash course of PO, CO2 and GW.

Stuarts series on these subjects together forms an exellent introduction, problem is to find it easily.

BTW, motivated by TOD, I cut my carbon footprint 90%, through green energy contract and biogas vehicle. That wasnt hard or expensive and that kind of example is now spreading in my proximity. But it takes motivation to get people into conservation.

Educate to Motivate

Put a Beginners Collection button on the frontpage.

There is a great deal of basics to learn before one can comprehend some of the finer points discussed here.

Each of us comes to Peak Oil with a different set of bags.

To be effective, the introduction sites should be geared to different kinds of immigrants coming to the land of the PO-aware:

I think we should intentionally NOT explain PO to marketing and advertising people (he says with an evil laugh, on his way to a meeting with the marketing guys!).

Twilight,

You are of course correct.

Every profession needs a different analogy to explain the PO problem to them.

We all know how the Invisible Hand provides for all our needs. Just the same, there are limits. There is a finite amount of certain resources ....

We all know how the Great Spigot under bar provides for all our needs. Just the same, there are limits There is a finite amount of certain resources....

We all know how the Great Pot of Foundation Powder provides for all our needs. Just the same, there are limits There is a finite amount of certain resources ....

This site has really made me stretch my mind. Discussions on this site have prompted me to study economics, for instance, a topic that never interested me before. Associating with smart people has that effect...

One general introduction would suffice as long as it is a good one. If the discussions remain as thought provoking as they have been to date, people will keep reading.

Because we saw it coming!

My own story is that I was working at an oil & gas fueled plant on the Gulf Coast about 1970 and going to night school for pre-engineering. We just had the biggest oil discovery in CONUS in a decade at the other end of the county (the Jay oil fields) yet we couldn't get fuel suppliers!

So "what's with that?" I asked myself. The answer was that US production was near a peak and we had to start importing big-time. Add a very messy oil spill on my favorite beach and the die was cast.

After decades of harrassment from looney-toon environmentalists and general lefties, it's frustrating to see the box we've painted ourselves into.

Call it the Cassandra Curse.

Let's get cracking!

My division is of people that choose to make rational and informed choices and people that choose to be affected by cheap words and emotions. In Bulgaria, France and Sweden for example, the left parties support nuclear power even more than the right-wings, for a lot of reasons but mostly because it works (and does not ruin the grid by 'decentralizing' it). In Bulgaria it was a right wing party that sold the national interest in the negotiations with EU, agreeing to promptly stop 4 nuclear reactors in Kozlodui.

The greens are formaly in the left camp, but when you think about it they don't have a lot in common with the left ideas. They stay there because as a tradition the left is more liberal and accepts all kinds of ideas, including idiotic ones. Which of course is its biggest weakness.

As I've said before, If I HAD to live next door to a power plant, I would much rather it be a nuke than a filthy coal-fired one. Which is not to say that nukes don't have their problems; but hell, this is a matter of survival, and we must select the options that provide us with the best hope of making it.

Please understand that my opinions of the critics of nuclear power have been formed over long, hard years of political controversy and bitter fighting.

The methods used by the critics have neither been civil nor have they been constructive. I have often and repeatedly experienced social ostracism, economic discrimination, and downright public hostility to my person. Of course, I lived in Marin County, California, just north of San Francisco.

If I seem to carry on this battle, in the tone with which I have grown accustom over the years, with a presumption of hostility, please forgive me. I'm still getting used to the broader support for nuclear power I have unexpectedly found here.

I will be glad to answer any questions about the technology to the best of my ability.

As best I can tell (and I can't tell very much these days), nuclear power is at the dawn of a renaissance, mostly as the result of desperation, in that the oil game is coming to a close. It should be encouraged, though we all know it is not without its problems .... but what isn't?

We really need something to bridge the long gap between fossil fuel euphoria and the Great Power Down. And nuclear power seems to fill the bill. Perhaps one of its biggest selling points is that it doesn't contribute to CO2 emissions and global warming. Circa 1966 and 1967 I took several courses in nuclear engineering (the technology of the future at the time) of which I have retained next to nothing. Maybe I should start brushing up. Hey, better late than never!

He wrote a famous book called "The Soft Path," that essentially argued for much more efficiency, decentralization, solar and wind power.

He also popularized the concept of "hybrid" cars.

As far as the economics of nuclear power, I think we need to take a clean-slate fresh look at the latest generation of nuclear power technology and compare its economics with that of fossil fuel in a likely post-PO world scenario.

Nor it is just a question of economics, as national security is also a factor. We don't have to import uranium from a Middle Eastern energy cartel, and that fact alone is worth something.

Are the French some kind of super-geniuses that can make nuclear energy work while the rest of us are dull-normal chimps too dumb to make it work? Somehow I doubt that.

- The national government decided to do it themselves. As a government they got ultra-low interest rates to finance the stuff.

- They picked one design (not a breeder) and mostly built just that. Made spare parts a lot easier and got them economies of scale.

- They got public buy-in early-on. They never had cheap oil or gas so the public never got used to it.

- They started when oil was really cheap. Helps a lot on the investment costs.

Now, in the U.S., my guess would be that the only way a reactor gets built is if the reactor builders use their own money. Put up a demo plant somewhere. No public utility is going to sell bonds to pay for what is still the most investment intensive power when they can't show the public anything.Once the public feels a few more of the shockwaves inherent in the energy crunch, perhaps they will be more receptive to all options, even the distasteful ones.

That's the golden quote right there. And it applies to all forms of alternate energy, not just nuclear.

Even in France, it didn't go completely smoothly. There were riots over where the waste would be stored. (Still not resolved, so far as I know.) And they shut down their fast breeder reactor (the largest ever built), because it was so expensive compared to their PWR plants.

Are the problems solvable? Certainly. But it won't get any easier when the cheap oil is gone.

Are we dull normal chimps compared to the French ?

In their hearts, the French believe so ! >:)

if the technical aspects are valid, this analysis would help to explain the lack of investment in nukes: http://www.stormsmith.nl/

That's what happened with the famed turkey parts plant. On paper, it sounded so good that some of the readers of Discover magazine accused them of pushing a perpetual motion scheme when they published an article about it.

The reality was not as impressive. The plant was supposed to cost $5 million to build. It ended up costing $40 million. Rather than the $15/barrel oil they promised, the cost ended up being something like $80/barrel. I'm sure those numbers would improve with time, but I suspect they will never be as good as they looked on paper.

thus making the dollar cost of oil irrelevant. you are right that the cost of oil, whether in dollars or EROEI, will make all alternatives more difficult to implement.

Everything is more difficult when you have no free work spurting out of the ground!

Yes, I understood that. Cost in energy is the only legitimate way to evaluate energy alternatives.

Unfortunately, it's not easy to calculate. Look at the continued controversy over whether ethanol can be energy-positive or not.

sorry

not easy to calculate

maybe not even possible! but i tend to think if the profit is really there, it is obvious and gets exploited forthwith.

confusion being sown over the merits of ethanol is part of the setup for yet another major boondoggle methinks.

not that the self-limiting feature of growing crops for ethanol wouldn't be good for what remains of humanity, and the planet.

What is your opinion of pebble-bed reactors?

I heard a program on NPR the other day where the boosters for this technology described them as inherently much safer, and much less expensive to build. Then again, it was the people who were pushing the tecnology who were saying this, so there is the inclination to take it with a grain of salt...

Of course it is too late for such discussions, but if we fiddle around even more you can imagine what will be the end results. When the shortages begin the public will begin demanding nuclear and the government will hurry to give tax breaks and loan guarantees, while the safety control will suffer severely.

The weakest premise I've seen from people building scenarious about the future is that the society will somehow orderly descend to lower power and give up all those nice civilisation advances. I don't agree - we are going to burn or nuke everything on our way if it starts getting to there. Our only chance to save our asses and the planet is to act rationally and deal with the reality in advance.

It's going to be much harder now that the cheap oil is gone. Perhaps even impossible.

Cheap oil is gone, but there is quite a lot of the stuff left that can be used far more rationally. I can WAG that 50% of what is used in USA for example is pure waste. We can discover another Saudi Arabia here just by imposing a 5$ tax on the gasoline.

Building the nuclear plants and (to a lesser extent) the renewables does not require that much oil per se. The tough part will be building the infrastructure to use the new energy sources, but it is also not doomed in all cases. Yeap, there would be hard times until we fix our mistakes but what's the big deal? Our grand-parents survived wars damn it, and they did not even use oil at all!

What I fear is just one: greed. Greed can finish us, if it makes us stick to the past and not adapt to the future.

However, he thinks it will be much harder to achieve the latter outcome because we waited so long. It may still be possible, but we have to start now, and it has to be a massive effort.

There were a lot less people here back then. Both in the U.S. and in the world. That is my main concern.

And even if we do succeed in switching over to other energy sources...the growth we've enjoyed for the past century will be a thing of the past. I think that will change our way of life deeply, in ways we can barely comprehend now.

I know that nuke steam turbines typically have thick blades unsuited to cycling (but more durable), but how much could they cut back for 5 or 6 hours at night ?

Nukes are not very efficient thermodynamically at max load. How much fuel is saved by cutting back from, say, 1200 MW to 800 MW at night (or is most fuel savings lost to lower efficiency) ?

I see high % wind and high % nuke in the grid as antithetical. A 50% wind/50% nuke grid simply cannot work.

I am a strong supporter for maxing out hydro (still opportunities out there, many small) and massive pumped storage plus lots of wind.

One viable mix would be (by total energy) 60% wind, 15% hydro power, 15% hydro pumped storage, 9% other renewable (geothermal, bio, solar thermal) and 20% nuke (Note 19% into pumped storage during surplus > 15% out @ peak need).

3 MW nuke needs 2 MW of pumped storage to "work" in such a grid since nuke does little to support the weakness caused by a wind grid (hydro is perfect) and cannot be easily "throttled" efficiently AFAIK.

Also, I see the 14 "planned" US nukes as jockeying for the 6 GW of large tax credits, The first 5 or 6 reactors to get the tax credits will be built, plans for the rest will go into dusty files. Your thoughts ?

Its a pity equipment for electrolyzing water into oxygen and hydrogen is so expensive.

Better to write:

Guys & Gals

We do get "all types" here :-)

Some women might like being 'one of the guys', but in my experience, only pre-boomers take being called a 'gal' without a funny look. Maybe it's different in the deep south. One might use 'folks' too, but I'd be inclined to leave it to the taste of the commenter.

"A little knowledge is dangerous ..." the saying goes.

Not that I'm any sort of expert on nuclear reactors, but the plants are extremely complex gizmos. Nothing is as simple as our grade school teachers led us to believe when they gave us those colorful comic books with the black control rods and yellowcake fuel rods.

Did you know for example that Boiling Water Reactors (BWRs) are constantly dumping radioactive material into the air? Right here in the good ole' US of A. Whoa, don't panic yet or think I'm nuts. It's true but it's also a don't care. When water (H2O) passes through the reactor core, it is bombarded with neutrons and protons. O16 atoms in the water are temporarily transformed into radioactive oxygen and radioactive nitrogen. This stuff is "offgassed" into the atmosphere. Luckily they have very short half lives.

Point is, that nuclear reactors are extremely complex systems with thousands of weird chemical and nuclear reactions going on inside of them. The environmentalists may not be as "looney" as you quickly paint them. Why aren't Peak Oilers looney freaks as well? What makes us different? Chicken Littles have been predicting the end of oil for almost a hundred years. They have always been wrong. New technologies are constantly emerging and surely some of them will prevent any problems from peak oil or from nuclear reactors from affecting us. The markets always provide. --just kidding (had you going for a while huh?) Let's not throw "looney" paint on the environmentalists all that quickly. A little knowledge is dangerous.

Quickly paint them? I've been actively engaged in the public debates for decades!!!!!!!!!!!!!

They have either had hidden agenda or hidden phobias because the logic of their arguments has always been wanting. They are very short on constructive criticism and long on irresponsible fear-mongering. There has been no love lost between the advocates of nuclear power and those opposed.

The recent trend for responsible, forward-thinking environmentalists to support nuclear power is LONG overdue and most welcome.

As to "dumping radioactive material into the air," guess you've never heard of off-gas treatment systems. We delay the non-condensibles from the steam for several half-lives of the activated H2O components so that none is released. Further, other gases are adsorbed on cold activated charcoal or liquefied for storage. Coal plants release more Curies and more radiotoxicity.

As to LevinK's comments, they show insightful analysis but little practical difference in the field in the US. The biggest fear from the conservative elements in the US is that the further investment in nukes will be wiped out by political activists.

Looks like the Marin County lefties got your goad. Time to move down here to the South Bay where the under-employed engineers are more accepting of rational discussion as opposed to emotional hysterics. However, due to San Andreas and Hayward fault lines, I don't think the neighbors are going to be accepting of a reactor in this area.

Didn't know we had so many TOD readers in the Bay area :-)

the Jay oil fields

Well now, that's just a few miles up the road. And there's some wealthy folks around there because of that oil. Missing some teeth, but wealthy. [ducks for the incoming return fire]

Resistance to offshore drilling is pretty stiff around here. The recent hurricanes have shown how fragile our local liquid fuel supplies are. No significant pipelines or refineries nearby. Mostly barged in.

So one of my bookmarked thoughts since my own personal coffee-spitting moment (boy, was it ugly...a very bad day..the "F" word kept coming out in regular intervals in ever-increasing depth and emotion) is to watch how sentiments change around here as fuel starts to get tight. Of course, development time and real world logistics will make sure that hardly any of those gallons ever make it into our tanks. But John and Jane Doe won't get that.

P.S. which oil & gas fueled plant on the Gulf Coast? Just curious.

Last week, I gave an informal seminar to about 20 people in a university. I have been following theoildrum since blogspot days, but I had to spend so much time to just find one basic bit of information. I ended up basing my presentation mostly on the wolfatthedoor.org.uk site.

If you are looking for a post that appeared 6 months ago, you have to spend a lot of time looking for it. The tags feature is nice, and it could have been very useful, but for many posts, the tags are all standard: "peak oil", "hubbert peak", etc. But I'm not sure if more tags would help or just add to the confusion.

For example, suppose you would like to quickly access key points about the Ghawar oilfield in Saudi Arabia. I am sure there must be some posts that exclusively deal with Ghawar, but can you locate them easily? Then, if your attention turns to the general topic of "giant oilfields." Would'nt it be nice to have all the links to various TOD posts in one place?

Maybe someone should start a web site (or even a blog), that is aimed at organizing information at this site. So, more articles like this one are more than welcome here.

Here are the URL's in their full glory:

http://www.theoildrum.com/story/2006/1/20/193723/259

http://www.theoildrum.com/story/2006/2/14/164650/917

http://www.theoildrum.com/story/2006/1/5/31649/28371

http://www.theoildrum.com/admin/story/2006/2/4/4015/39115

http://www.theoildrum.com/story/2005/10/22/16565/298

http://www.theoildrum.com/story/2005/11/16/182053/32

http://www.theoildrum.com/story/2006/2/15/202152/001

http://www.theoildrum.com/story/2006/1/11/6047/13568

http://www.theoildrum.com/story/2006/1/22/04219/1102

http://www.theoildrum.com/story/2006/1/20/162942/196

http://www.theoildrum.com/story/2006/2/24/31343/5317

http://www.theoildrum.com/admin/story/2006/2/24/11925/2060

http://www.theoildrum.com/story/2006/2/4/63551/68914

http://www.theoildrum.com/story/2006/2/3/2193/34505

http://www.theoildrum.com/story/2006/1/4/24729/30210

http://www.theoildrum.com/story/2006/2/2/21034/63481

Not intuitive, eh? I suppose after the story comes yyyy/m/d, but what do the next two numbers mean? Could it be possible to come up with a logical directory structure?

Also, if there was a way to view the site with just the headlines, it would be possible to view links to a lot more posts than it is possible right now. The default number of stories with summaries one can see in a single page is 15, but with only headlines, 50 posts could fit in the same real estate.

The last point is a problem that I have myself. One brother insists that oil will last another 100 years. True in one sense, convential production will still be at 1 million b/day in 2106, but he likes to burn great quantities of gasoline every year (10,000 liters/year for his family, he boasted)

:-((

A couple of points. Some would argue (I don't make this argument myself) that it is merely speculators who are driving up the cost of oil. It wouldn't hurt to add a sentence or two to discuss this point.

Secondly, the conucopians argue that there are new sources just around the corner. Deep water. Oil sands, shale. CO2 injection. Each of these has their own problems and limitations of course. Adding discussion of these things would likely make this type of introduction far too long, but a paragraph with links to some of the previous stories here at TOD could be a helpful reference.

There is no numbers or facts to support that theory. Some Finance or Economist people (ex: Lynch) are saying it's speculation. People in the oil business say it's not. I rather believe in the second group opinion.

- Deep water: maybe but probably small production rate

- Oil sands: a lot of oil but a very small production rate (maybe 10 mbpd in ten years)

- Oil shale: science fiction for now

- C02 injection: maybe on some fields but cannot be generalized.

Evidence of an incoming oil crisis is compelling.Critics will argue also that higher prices will make smaller field economical (lower cut off).

That is if they complete the nuclear power plant to cook the raw material before running out of NG

PO is now, or maybe even yesterday and they still have "plans" for nuclear reactors in a decade or two and probably better hybrids in 5 years. I guess plug-ins will come around 2020 and hydrogen cars by 2070. We are saved.

Speculators just get the price to wherever its going a little faster than it would get there all by itself.

Speculation merely refers to price pressure based on expected future conditions, as compared to today's supply and demand. It is pretty clear that the supply/demand situation today is in good shape. Stockpiles continue to grow. If that were all there is to it, you'd expect prices to fall.

The reason prices are staying high in this situation is because people are concerned with the future. In the short term, supply interruptions are a potential problem; and in the longer term, meeting demand is going to be an increasing challenge. These are the factors which are cited to explain the coexistence of high oil prices with growing stockpiles that suggest a glut of oil.

This kind of concern about the future, the effects of expected future market conditions on today's price, is exactly what we mean by speculation. It is one of the most important and useful aspects of the market system, that anticipation of the future affects price signals today. Speculation and speculators get a bad name because they are said to add volatility to the market, and in the past they may have tried unethical actions like getting into a monopoly position. But the truth is that without speculators there would be no futures markets, and the many important functions those markets provide would not exist.

So yes, speculators are very plausibly responsible for today's high oil prices, but we should be glad of it. They are betting on future tightness in the oil market, and the fact that prices are high indicates that there is substantial agreement on this issue. This sends a price signal today to ignore the apparent supply glut and to continue to conserve, because of likely shortages tomorrow. And that is exactly the appropriate action in this situation.

- Commercial Crude stocks do increase - a little -, because of declining input to refineries since January (far before the seasonal maintainance sessions)

- strategic petroleum reserve (SPR) stays low and isn't refilling

- gasoline stocks increase because of the high level of imports (from where ? Abqaiq ?) and despite a heavily declining domestic production in a context of increasing consumption

- heating fuel stocks are beginning to decline, because of higher consumption, imports don't seem to keep pace (see weekly EIA report)

Meanwhile, consumption for all finished products increases except kerosene (in its jet fuel form). What does that mean while world production of crude oil stagnates ? (In January we could even see a decline in production, at least from OPEC, if we can believe the article forwarded by heading out from MEES). In my oversimplified view this means that some other countries are forced to decrease their consumption. In other words, there is a real strain on the supply/demand equation which means increased competition. Or can anyone demonstrate that world production is increasing, refuting stuarts arguments from confirmed sources ?Now I can shorten it to: "Ditto".

RR > We are certainly in a world where airlines are very nervous about where fuel prices will go. I don't pretend to be an expert on fuel prices, but before we all get too carried away with $100+ per barrel being certain, I've seen 2 presentations recently by chief economists and both said they thought the long-run oil price would be significantly below current levels! Someone pointed out that back in

the 1980s the generally accepted view was that by the year 2000 prices would be $100/barrel in 1980s prices! In the end it will come down to demand/supply balance.

IMO, there is substantial risk of very high fuel prices in the time frames of fleet planning. I wrote my brother that, IMHO, there was an 80% chance that world oil production will drop y-o-y sometime between 2008 & 2011 with "adverse economic consequences".

Russia has stated that they will peak in 2010. Kuwait (Burgun is #3 producing oil field) is in decline, and Mexico is facing fast (12%) to extremely fast decline (44%) in Cantarell (#2 oil field). UK declining steadily, and some experts question the reality of Saudi projections (amidst rumors of higher water cuts in #1 Ghawar). And on & on.

Unconvential production has long lead times (8 to 10 years in most cases) and often resource constraints (natural gas for extraction of Canadian tar) and uniformly adverse effects upon Global Warming vs. convential oil production.

A good technical discussion from the "Peak Oil" perspective is www.theoildrum.com . About 25 topics down they had a good review of Russian prospects.

Alan about to head back out to the French Qtr !

Air fares are to a large extent driven by fuel prices over a period of years. Therefore I predict:

The 787 will use at least 20% less fuel than the 767 it replaces (note intricate details on delta between two models).

I am famous/infamous on "Orders" for predicting that Boeing will EIS a 737 replacement, using 787+ technology, in 2012. The "737E" or 797 will use at least 25% less than the newer 737s and Southwest will launch it in 2007/2008 with an order for 400 a/c. Southwest is at 52 pax-mile/gallon and climbing.

I first made this prediction about 4 years ago, and "so far, so good".

At $25/barrel, fuel was ~10% of aviation costs (including refining costs). At $125/barrel, this translates into ~1/3 of all costs. ALL sorts of variables in that "~10%" number.

Raise average ticket prices by 50% and airlines can make money. Price elasticity of demand (direct, higher ticket prices, indirect, economic recession+) will cut demand significantly. But there will be demand for new fuel efficient jets !

Southwest Airlines is the only US airline that can afford a "refleet". They have saved ~$1 billion already by hedging jet fuel and will likely save another billion by time their last hedge expires in 2009.

We may see 737 size a/c offering direct service between Chicago and Frankfort twice a day and 787 once a day. Transfer to ICE there for high speed rail travel throughout Germany from there. Repeat for MANY other city-pairs.

- If price goes up 50%, then number of tickets sold will go down a great deal. Nobody knows how much.

- If fewer tickets are sold, fixed costs remain the same, thus average cost per passenger mile goes up.

- The way the tourist industry works (airlines plus hotels plus, to some extent, rental cars and cruise ships) is that it is highly capacity sensitive. In other words, lots of empty hotel rooms and half-empty airplanes kill you.

- There is a tendency for the "kinked oligopoly demand curve" to come into effect. What this means is that competitors are forced to match anybody's price cut, but in general most price increases are not matched--even when everybody is losing money.

Therefore, I stand my prediction that oil at $70 per barrel will make a huge difference, and $100 oil a major transformation in tourism.Correlation does not imply causation; we all know that. Nevertheless, take a look at the trend of jet-fuel prices and plot it on a graph against total losses of U.S. airlines. Somebody has done this somewhere, but offhand cannot remember where; actually I think several sources have done versions of this.

Kerosene is too precious to use as jet fuel for much longer.

We will see a major capacity reduction, likely via Chpt 7 bankruptcy (liquidation) of a couple of major airlines at some oil price.

I am interested in the market dynamics (in theory) when there is one player with several, major competitive advantages and the rest are struggling.

Southwest has had 30+ straight years of profits.

Herb is the best airline manager in the history of aviation and he has assembled the best management team in the industry (i.e. managerial advantage) and best workforce in the industry (hire 1 out of 100+). Also now best paid, but near bottom in labor costs due to VERY high productivity. Recent dramatic increases in employee productivity (~10% since 2003).

Debt is half of owners equity, VERY solid financials, which lowers costs of operation. Unlike all others.

Lowest customer complaints in US for 14 straight years.

Fuel hedges at decreasing % till 2009. (From memory, ~60% of fuel required at $36/barrel in 2006, ~30% at $39 in 2009).

Traditionally does not exploit monopoly markets (intraTexas 90+%, intraCalifornia 80%, Texas-New Orleans). Also, not seen as a "predator" by competition, but a fearsome "rational competitor".

Managed growth in 8% to 12% range, decent capacity factors "no matter what" (they idled 15 737s when Katrina hit major market and they redeployed within weeks, and made money).

Boeing will build the 737 replacement (at least one model) to their specs. They alone can afford hundreds of these more efficient (fuel AND maintenance) a/c in US domestic market.

They do NOT aspire to 100% of the market. Their "niche" is large and growing but probably not more than 40% or 50% of US market. They want a 15% minimum growth in profits in 2006.

I cannot recall another industry with a single player with such competitive advantages.

In a shrinking market, what is the likely result ?

Some have blamed low US fares on SW, (evil ones driving everyone else to liquidation whilst they make money), BUT low fares appear in markets not served by them.

BTW, at high enough efficiency (say 70 to 75 pax-mile/gallon), there will be demand for air travel even at $250/barrel oil. Just not as much. 73 pax mpg is what Amtrak uses today.

What will become of the insanely overbuilt hotel industry I do not know. For a foretaste of the future, look at the hotels that were built in anticipation that there would be a "New Economy" and no dot.com bust--look especially within a ten mile radius of the Silicon Valley area. Maybe we should move the hurricane homeless into them, at least then the tall white elephants would not have such horrendous vacancy rates.

The hotel chains are likewise, as you said, in for a lot of pain, but I suspect a higher percentage of that industry will survive as the remaining travel shifts to rail and road.

Don, what happens when you have a contracting market and one player with enourmous competitive advantages that 1) does not serve the boutique market and 2) does not profit maximize when it has a local monopoly ?

My economic theory fails me in that case.

In answer to your specific query, my answer my strike you as unorthodox, but it is based on much observation, research, and thought. My answer is that how well an organization responds to change depends on who is in charge. Two specific examples from universities:

- Under Robert Maynard Hutchins, the University of Chicago went from pretty good to top quality in both undergraduate education (I know; I was lucky enough to be there as an early entrant.) and also research. While I was there, Milton Friedman gave me tennis tips, back when he played with George Stigler and a couple of other bright guys.

- The University of Calif. under Robert Gordon Sproul became what I think without dispute was the greatest public university in the world. He was one of the most amazing men I have ever met, and he broke every organizational rule in the book--e.g. he had over 100 people reporting directly to him, and he knew by name every single tenured faculty member and could recognize them by face when they spoke at faculty meetings, and he had the brilliance to recruit top people and then pretty much turn them loose as much as possible. No president or chancellor of UC since the retirement of RGS came close to filling his shoes, and although UC Berkeley is still one of the first-rate universities in the world, it is not as good as it was fifty years ago, when you had a pretty good chance of taking introductory physics from a Nobel Prize winner, and when not only the physics department was by far the world's best (if you include Lawrence and Livermore and Los Alamos, all run by U.C. Berkeley) but also had many of the finest departments in the world in several disciplines.

So, what is the future for SW airlines? Tell me who the successors of the founders are. How good are they? IMO, those are the key questions.bit below average fuel hedge (for an airline) to becoming the most heavily hedged airline in the world. Perhaps $2 billion saved.

A finance guy, he seems to understand the people culture at SW. He dressed up as a member of KISS for Halloween. "Aw Shucks" personality.

He is seen as being more aggressive than Herb (who started as a 2 plane airline that had to avoid the elephants and not irritate them) and a bit more of a risk taker (better a proactive risk than a reactive risk is my read of his philosophy).

Below him is a very good group of people who get along. Their economic & operational research before moving into new markets is legendary, highly secret and often surprising.

EVERY employee is expected to make decisions and take responability & initiative. Doubly true for middle managers.

I have watched them closely and no apparent weakness in any area; operationally, scheduling, ground operations, maintenance, relations with Boeing, are ALL among the best in industry or clearly THE best in industry.

In the world, their only rival for managerial excellence is Singapore. As I said, manadement is one of their competitive advantages, along with cheap fuel, good finances, etc.

The President is Herb's former secretary, who is in charge of maintaining their corporate culture (which she does well). A few years away from retirement.

Herb was supposed to go to part-time status on Oct 1, 2001. Never happened. Exact roles are a bit murky, but Herb has final say on new cities and rate of expansion.

Southwest "took a gamble" after 9-11-1 and did not lay off anyone, or reduce flight schedules. As a result, they had profits when all others lost $$$$.

BTW: Did you ever contact Twin Cities Transit supporters ?

The airline industry started as an extravagance that only the rich & famous could afford.

It will end the way it started.

110 p-mpg is a reasonable extrapolation from the 787.

http://www.nytimes.com/2006/03/01/business/01flight.html

Several new microjets such as the six-seat Eclipse 500 are due out soon. It's hard to see how this is going to turn out, but the FAA thinks there will be 1,650 such planes flying by 2010.

Alan, you raved about the new Boeing's but did not mention the Airbus A380. I'm inferring you do not think it will fare well.

Also, what happens to Southwest when its hedging contracts run out? Might it not be more difficult to successfully hedge fuel costs in the future?

Southwest will also do reasonably well without future hedges. Remember, they are the only ones that can afford more than a few high efficiency a/c when they become available (I forecast a launch order for 400), they have low operating costs, great management, etc.