Close, but no cigar

Posted by Stuart Staniford on March 1, 2006 - 2:59am

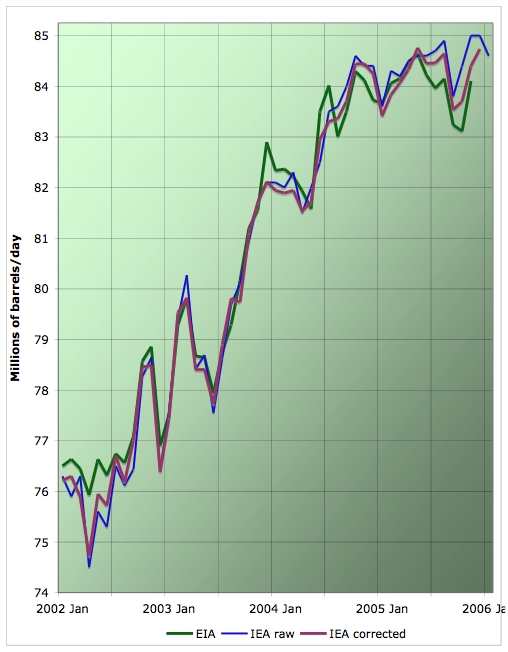

For those of us amusing ourselves by tracking the monthly production numbers to see if the global oil industry can disprove the near-term peak hypothesis, the latest news is the IEA's current Oil Market Report. Like November before it, December has been downgraded significantly from the initially claimed 85 mbd -- in this case to 84.735 mbd. This is breathtakingly close to May 2005's 84.755 mbd, but doen't quite graze the bulls-eye (pedants are free to note that the difference is certainly much less than the uncertainties in these numbers, but let's just enjoy the game).

So May 2005 reins supreme still, and the IEA reports that the forces of entropy and chaos gained ground in January, with even their initial claim coming in at only 84.6 mbd. Since oil stocks are high, one has to assume that demand remains at least as flat as supply, which will not be good news for those looking for better GDP growth in Q1 2006 than the 1.1% we had in Q4 2005 in the US.

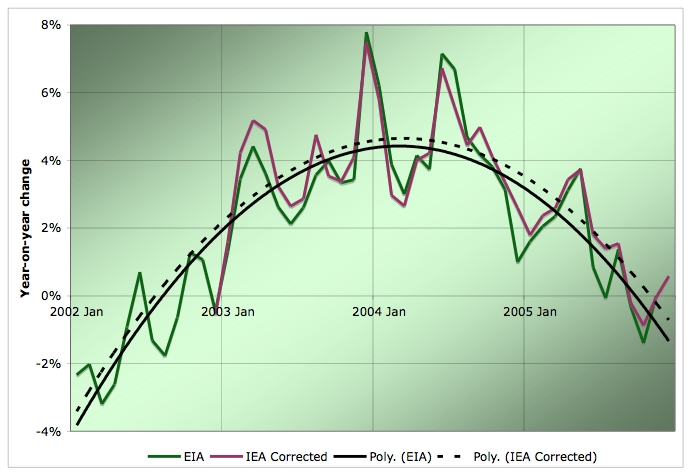

The corresponding updated graph for the year-on-year changes looks like this. Overall, the positive December numbers do not look outside the overall trend yet, given that January is likely to be a little poorer.

However, I think it would be premature to say with confidence that no month in 2006 could exceed May 2005 - clearly that remains a distinct possibility. However, there seems little possibility of a radical rise. The EIA's projected gradual rise to 86.5 mbd by Q4 2006 looks like rather a stretch to me. That would be a 2.9% increase over the EIA's report of the situation in Q4 2005 (84.1 mbd averaged over the quarter). Certainly it assumes that things will go a lot better in 2006 than they did in 2005, and it's rather hard to see the basis for this optimism.

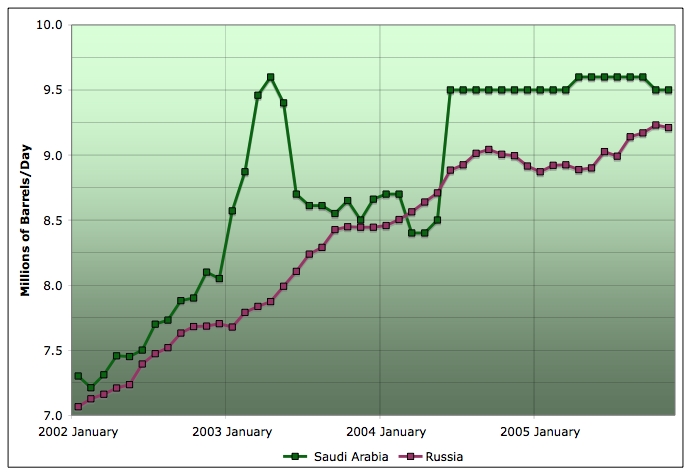

Of the run-up in supply since January 2002, about half has come from just two countries: Saudi Arabia and Russia. So it's of particular intest to look at their supply, which is shown in this graph (through November):

It will be interesting to see if the bringing on stream of the Haradh III development recently announced by Saudi Aramco results in any increase in reported production (HO discussed this the other day). The Saudi's have been claiming to have around 1.4mbpd in spare capacity, but there's no evidence of it in the production statistics (eg they were not the ones increasing production in response to the US hurricanes).

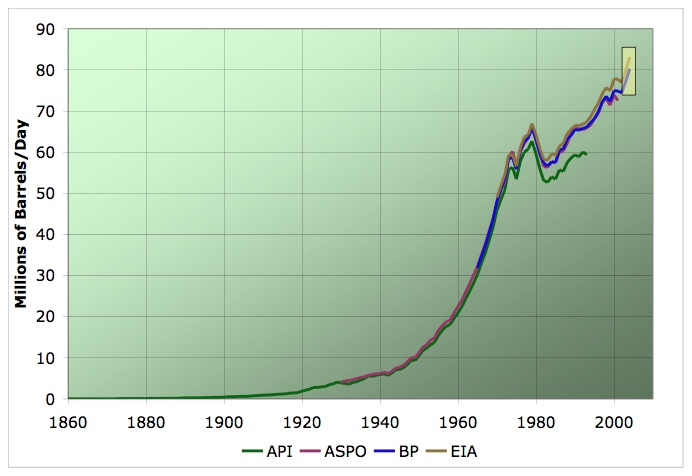

Finally, to keep Halfin off my back, I note that all these graphs concern only the very recent history of oil production: the period in the little yellow box in this graph of production since the beginning of the oil era.

Average annual oil production from various estimates. Click to enlarge. Believed to be all liquids, except for API line which is crude only. EIA line includes refinery gains, others do not. Sources: American Petroleum Institute, ASPO, BP, and EIA.

I've been convinced for some time that thanks to above-ground factors, like infrastructure tightness and the way the knowledge of the impending peak will influence oil suppliers, that a bumpy plateau was inevitable (and also very good news).

concerning a massive Saudi investment in refining capacity. Now some may see this as an increase in capacity to cope with an increase in production but could I mischeviously suggest that it is to handle the heavy sour oil they are now producing as no one else can? This would perhaps confirm a peak in light sweet "from the horse's mouth"

Then looking at your earlier graphs, we see the last surge of this linear growth coming to an end this year. It seems we are about to enter the flat/no growth zone.

Will Iran & Israel again recreate a crisis to mask the transition to flat/no growth?

If there is a military crisis, will people realize that ultimately we will never produce as much oil in one year ever again?

It is interesting to put these numbers of the plateau in the context of Deffeye's recent postulation that Peak happened on December 16. Whether it's December 16 or May 2005 will seem relatively unimportant in short order.

I think the math is all good (and thanks to all who work so hard at it!), but I think we can step back and with a "fuzzy" eye say that the math, the news, and crazy things like the State of the Union address ... are telling us "peak oil" is (fuzzy logic) true, right now.

DUETs, Deep Universal Eternal Truths are more often to be found in the works of great literature than in the works of engineers or scientists. Equally great truths are to be found in CHARLOTTE'S WEB, and THE TRUMPET OF THE SWAN as in STUART LITTLE.

For my macroeconomics class I used to assign "Pride and Prejudice" and have them give me a macroeconomic analysis of England c. 1800 based on their reading. Also, I often would read a poem to begin class.

How can we live without reciting aloud at least one poem a day? (Not very well.)

Probably all four are entering terminal decline phases, led by Cantarell. Internal Pemex reports indicate that Cantarell should start declining this year at a rate as high as 44% per year.

# Oil consumption and extraction/refining have met at 85m bpd - and perhaps extraction/refining rates cannot be increased from here

# In the developed world, GDP is growing in the US, Europe and now even Japan

# In the developing world, India and China are rocketing along

# So, demand for oil continues to rise in the developed world+ and even faster in the developing world

# However, the US is running the largest deficit on external account in its history and the largest in the world++, which

brings with it the threat of a US dollar collapse, imported inflation and a rapid deceleration in the US economy followed by the world economy

# So, on the one hand, there is potential for the demand for oil to collide with an extraction/refining ceiling and for prices to explode

# On the other hand, a significant deterioration in the world economy could cause demand to soften and allow oil supply to comfortably match demand

# If the former happens, then the effects of peak oil are likely to be felt reasonably soon

# If the latter happens, then the effect will be deferred

# Additionally, even with a significant softening in demand, supply side shocks (problems with Nigeria, Venezuala or Iran or the discovery that either Ghawar or Cantarell or both have hit a precipitous rate of backside production decline) could still mean substantially higher push prices in the near future

# Moreover, even if we just assume away the oil problem, we have looming shortages of natural gas and water together with relentlessly increasing soil degredation around the corner...

+ From 1990 to 2003 there is a 99.5% correlation between US GDP (independent variable) and US oil consumption (dependent variable). I think this offers a fair opening point to anyone wanting to argue that increases in GDP simply measure the rate of increase in our usage of fossil fuels...

++ As well as having the largest budget deficit in its history and a property bubble

As Westexas points out, the house is full of elephants but the "real world" is currently focused on swelling oil inventories.

But look on the bright side: we're probably mad :-))

China obviously is directly connected to our economy and would take a big hit; and, if they redirected some of their dollar holdings to Euros, of course, our hit gets worse.

But that arguably would ease oil prices enough elsewhere that Japan, the Asian tigers, and Europe all might have relatively lesser recessions.

The Fed also has a strong anti-inflation bias. There seems to be an overwhelming consensus that it is inflation we should be concerned about. It seems to me that Bernanke mentioned dropping money from helicopters merely as a means of dismissing concerns over deflation out of hand, not because he did in fact have any intention of printing money. I suspect he believes, as you suggest, that deflation can be easily avoided. The implication is that he sees inflation as the real enemy, as did the power-that-be on the eve of the (deflationary) Great Depression.

I agree with you that changing perceptions and expectations would drive up interest rates, but I see this as compounding deflation (and increasing the chances of a liquidity crunch) rather than as a result of inflation. I agree with your forecasts for the the DJIA and the NASDAQ by the way, probably within ten years and likely within five.

Premise: Congress created the Fed and Congress can destroy the Fed or take away its power.

Premise: All Fed members know and fully appreciate the above premise.

Premise: Because of political pressure, the fed will have no choice but to monetize the debt. (Note: This has happened before and will happen again. How else did we get from a 100 cent dollar in 1913 to approximately a 4 cent dollar today?)

Premise: To stave off a rerun of deflation and the Great Depression the Fed will not only use its Open Market Operations magic wand (with which they legally create bank reserves and hence [potentially] money but also its Ultimate Magic Wand (UMW, not to be confused with United Mine Workers;-) of lending however much they feel like to pretty much whomever they feel like. Through the use of these two Magic Wands, the Fed will not have to ask the Treasury to directly print money.

However, under (if I recall correctly) Civil War legislation the U.S. Treasury has the legal authority to print as much currency as it feels like doing. Us oldsters can remember "U.S. Treasury" $5 bills; you youngsters cannot.

Note that it will not only be Congress putting pressure on the Fed to inflate, it will also be the Treasury Department. How else will they be able to finance a deficit of three or four or five trillion dollars per year?

Final observation: The Supreme Court has no power to stop any of this, because the laws giving the Fed and the Treasury its powers have been tested in the courts and have stood up to every challenge.

Note that I make no predictions. I do not know what will happen.

Now here is a query: In the opinion of the readers of this column, does the new Fed chairman have steel balls? Volker did. Most Fed chairman have not had these. Greenspan? Brass balls.

If I had to propose a potential course of events, I would suggest that Bernanke is likely to raise interest rates initially in order to establish his anti-inflationary credibility. With the housing market teetering on the brink, this could be enough to precipitate a housing market crash. Bernanke would already be trying to ride a tiger by this point, which could come relatively early in his tenure.

Bad debt could leave many financial institutions vulnerable, but attempting to bail them out would threaten the role of the dollar as global reserve currency and the continuing influx of foreign capital. International dumping of the dollar could proceed rapidly, although within the US the value of many assets classes could still fall relative to cash in the rush to cash out and cover debts.

I envisage a cascade of bank failures as defaults snowball and savers try, and fail, to reclaim their savings. A liquidity crunch could follow, severely limiting purchasing power and therefore energy consumption, among other things. I very much hope to be wrong, but the power of a positive feedback loop in action can be truly awesome. I have no faith in the ability of one institution to stand in the way of such a chain of events, magic wands notwithstanding.

If I understand you correctly, you are suggesting that all of the Fed's efforts to inject liquidity into the system in order to prevent deflation and bank failures might be insufficient, or that while nominally sufficient, these measures might backfire by causing panic selling of US Treasury notes and a subsequent crash of the dollar relative to other major currencies. So Bernanke could choose inflation as a monetary tool and yet end up triggering deflation anyway.

One thing you said puzzled me though:

"I envisage a cascade of bank failures as defaults snowball and savers try, and fail, to reclaim their savings."

So you are saying that the FDIC would not be able to honor its commitments, causing peoples' savings to just be wiped out? I would think that the Fed and Congress would act to prevent that at all costs because that's the type of thing that could result in a revolution. Think about millions of unemployed mortgageholders who then lose their homes because they can't make their mortgage payments using their savings. That situation would be very ugly.

I am also saying, as you point out, that deposit insurance is not likely to be worth the paper it's written on, as it was never designed to actually bail out a systemic banking crisis. It's existence has lulled savers into a false sense of security IMO. I would expect the Fed and Congress to find themselves overwhelmed by the monumental scale of bad debt in the system, and unable to prevent a liquidity crunch. As you say, the social and political consequences would be severe, especially considering that there may also be energy supply disruptions and price volatility simultaneously courtesy of peak oil and natural gas. Needless to say, I don't think we are looking at a slow squeeze here.

That is indeed a grim picture. Considering your disagreement with "conventional" wisdom (specifically the efficability of the Fed) about how such a financial would unfold, how do you think the holders gold and silver bullion would fare?

I had an uncle, since passed away, who was a "gold bug" and believed the U.S. financial system would eventually melt down. It seems to me that although bullion holder would fare better than the hapless depositors jilted by the FDIC (the bugs still have their store of value), the practical aspects of using that bullion might be problematic. In other words, a clerk in a grocery store would not be able to accept anything that wasn't legal tender. So using it in retail stores for necessities doesn't seem feasible. So you have identify people who have what you want and find out if they will accept gold. Hopefully these are people you already know and trust, otherwise you might just end up trading gold or silver for lead, so to speak.

Interesting times indeed.

Personally, I would look first to getting out of debt, then to hedging your bets with some basic self-sufficiency measures (as economic disruption can lead to inconsistent availability of necessities) and finally to holding some form of liquidity (although this is easier said than done in a liquidity crunch as you might imagine). If you can't afford a house without a mortgage (unless it's a very small one), then I'd rent and let someone else take the house price risk. The equity you extract could serve you well if you can manage to hold on to it. I see money as the lubricant for the economy. Without it, the economy seizes up like a car engine run with the oil light on. That's why a liquidity crunch is so disruptive.

Beware of governments trying to separate you from what wealth you may have managed to preserve. In Russia the government got all the money out from under the beds of the nation by reissuing the currency and then making it very difficult for many people to exchange their old rubles for new ones in time. Many lost their life savings. In Argentina, the government converted dollar savings accounts into Argentine currency then allowed that to devalue drastically as the currency peg fell (debts remained denominated in dollars). They also converted short-term government debt into long-term and then later defaulted on it. There are no risk-free answers.

There really is no other option than attempt a controlled inflation given the current situation, and that is what the Fed will try to do. I don't honestly know how that will play out, though it will take a decade or more if successful. Unfortunately it may get out of control and often runaway inflationary periods end with a nasty bout of deflation.

- Another Great Depression, with falling price, bank failures and all the rest or

- Hyperinflation to wipe out intolerable debt burdens.

Keynes pointed out the superior political influence of the debtor class.Politics rules.

http://energybulletin.net/12764.html (and hence WSJ article)

http://www.vitaltrivia.co.uk/2005/12/45

http://www.rigzone.com/news/article.asp?a_id=27734

The 44% decline rate is the most pessimistic projection. Pemex predict a 6% decline rate 2005->2006, around 15% thereafter, but that equates to the most optimistic scenario.

Adam Porter did an interview with a "senior Pemex engineer" last November, scroll down to Oilcast#28:

http://oilcast.com/

Good background info on Cantarell:

http://home.entouch.net/dmd/cantarell.htm

It may be too early for these graphs to mean anything, but I like seeing them anyway. :)

It would be cool if you took this monthly data, and defined a standard URL that could be linked to that would always contain the up-to-date graph.

While maybe not as obviously valuable as the hour to hour tracking of a hurricane, I do think it would be useful to have a specified page to reference that would be a part of TOD site.

-Ptone

An important point that Stuart made is that with stockpiles high, if production is dropping a bit into January, that is a sign of decreased demand at these high prices. It's not an indication that we have reached a level where we just can't produce any more, as a simplified Peak Oil analysis might suggest.

Oil prices have dropped modestly over the past few weeks despite continuing international tensions, and most observers attribute it to increased stockpiles, which are a sign of decreased demand. That may well be, as Stuart says, an indication of slower GDP growth. The bond markets, with their yield inversion, at least hint that a slowdown is looming. OTOH much so-called expert opinion is relatively bullish, and as I mentioned before, markets expect the Fed to continue to raise rates at least two more times.

Your crystal ball is as good as mine, but I would not be surprised to see a repeat of the oil production pattern from the 2000-2002 time frame, which unfortunately is not clearly visible on either Stuart's short- or long-term graphs. A softening economy led to flattened and slightly decreased oil consumption during those years, and if we do see a GDP slowdown in 06 it could be the same thing all over again. The difference is that this time we'll be dealing with an oil price of perhaps $40-50/bbl instead of $20/bbl, which will make it that much harder for the economy to get back on its feat.

Oops, and I should add that it will be quite a feet when it does so.

If that's true it means the stockpiling for gasoline can begin earlier.

I'm not putting much stock in their crystal ball, but here's a quote that should give us pause thinking about next winter in case we have a colder than normal year:

So, 27% warmer January, but still paying double digit percentage increases in heating costs...

http://www.econbrowser.com/archives/2006/02/oil_shocks_and.html

and see how personal savings hit zero right at the end of 2005, the end of a 20 year trend. How much longer was that going to go on, even without an oil shock? Plus, the Fed started raising rates a year and a half ago; that was bound to have an effect eventually. Not everything is about oil.

If I recall correctly the personal savings rate first went negative a few months back, July? US consumers have become adapt at conjuring spending money: borrowings, credit cards, mortgage ATMs, not saving. All these are like buffers in converse and make the risks of magnified change in response to shocks much greater.

Also, the Fed's continued rate-raising has a great deal to do with the increase in oil prices, which is the main inflationary threat on the horizon.

From the Feb report:

"* Global oil supply in January suffered from weather-related and other outages amounting to 450 kb/d. Offsetting increases, however, held world supply at 84.6 mb/d, only 135 kb/d below December."

There are temporary supply constraints for GoM (hurricane hangover), Russia (cold weather), Nigeria (local troubles, and valid IMO). Therefore there is scope for production to increase.

I continue to think that Saudi could pump a little more if there was a real excess of demand. However, I think they will not until they deem necessary and I think they will keep Haradh III on low throttle until they need it to mask Ghawar decline.

Barring significant geopolitical / supply disruption I don't expect demand to be supply constrained before mid 2007. Demand does look (so far) worryingly immune to price, though.

A slowdown of the US economy is a 99% given within the next year IMO. The official economic stats won't show it for 6 to 12 months but the odds are it has already begun in a significant way. I mostly disregard the Q4 2005 GDP at 1.1%, it will be revised up to about 2% and Q1 2006 will show over 3% on official stats I guess. It probably won't be until the Q3 2006 GDP data comes out that recession is seriously spoken about in the mainstream.

Anecdotally I've noticed a significant slowdown in UK in the last month: quiet bars, deserted restaurants and the like. If that persists into April it could be indicative of a dip, how's such things looking in US and elsewhere?

The oil price is at a critical juncture just now. It's declined quite fast to $59.57 (March WTI Nymex future tonight close). The April future takes over in a couple of days and that's at about $61. Will it bounce from here or keep going down? I'd bet on a bounce but it's a close call, we should know before the weekend, the reaction to tomorrows stocks data will probably decide. I don't expect to see oil below $50 in 2006 nor probably evermore in this economic reality.

When the slowdown happens it won't be one like before. Even if it starts like previous ones and we even begin to come out of it, the distortions, possible constraints and geopolitical risks make it near certain that some fundamentals break and the whole economic landscape will change for the worse.

On a more positive note, I am becoming more cheery by the day that the probability of silliness erupting in late March has declined, still possible but relatively minimal. Next hurdles feel to be second half of May / 1st week June, then late September / early October, but I haven't felt those out much yet.

Your anecdotal Hawaiian condo sales info could be very relevent for discretionary high end spending especially for west coast USA. US unsold inventory is at about 18 year highs atm, if I recollect correctly, and that built quite quickly from last midsummer.

At a guess (and it is only that, because I do not know how to get the data) more Japanese own property in Hawaii than do Californians.

You may be entirely correct. However, I have heard it said that some big Japanese money now uses fronts to conceal its origins. By its nature, it is imossible to verify or refute this "rumor" without a great deal of research.

Japanese tend to buy what they perceive to be cheap. In other words, they conform as closely to the model of "economic man" as anybody. The buying panic of the eighties did fade, as you quite correctly point out. However, given the available data, I am hesitant to come to any strong conclusions.

From my limited knowledge of California real estate, it seems to me that many Californians have been insanely accumulating horrendously overpriced properties--and doing so to the exclusion of much investing in real estate elswhere. This is merely a "horseback empiricism" type of observation, however.

As usual, great work.

1 Commercial stocks would not be so high if crude loans from the SPR were repaid. ANd, gasoline stocks would not be so high if product loans from eurasia were repaid. I suppose they must be repaid before the next hurricane season begins, otherwise from whom would we borrow next time? It would be great to see a thread reviewing the size and due date of these loans.

2 Freddy claims August was the peak.

Close, But No Cigar.

I'm still waiting for that smoke. Maybe it will come from Cuba? Excellent.

But of course the production figures are decisive, unless as some have pointed out, their significance gets blotted out by war, depression, or other complexifying issues. It's a very strong "unless".

Jon started the interview by asking when we'd be reduced to a Mad Max situation. (Tertzakian said it might not come to that. He didn't rule it out, though.) They talked about possibly invading Canada for their oil. At the end, Stewart suggested that we continue to use more and more oil and simply prevent China and India from using any. (Tertzakian thought that was a very bad idea.)

Excellent point. Totally agree.

It would be fully logical for dollar holders such China and Japan, in the face of peaking oil, to shift their purchases from US treasuries to maintain a high dollar, to oil resources. This would have the double-barreled effect of forcing a high dollar oil price on Americans even in the face of falling demand and recession.

Oil is still reasonably inelastic. It's easy to imagine very high dollar oil prices if the dollar is allowed to assume its equilibrium market value. Given those two facts, and America's inability to compete with labor costs in the developing world, and its lack of savings and debt overhang, it's easy to envision a very,very serious recession in the US.

Given a severe recession, what happens next?

Answer: I do not know, and neither does anybody else.

However, were I a betting man I'd put odds of five to three that

- the U.S. Federal Government will use massive fiscal stimulus, to the tune of two to five trillion dollar per year deficits to fight the recession and

- to finance these deficits (rougly ten times the current deficits) the Fed will be forced to monetize the debt.

N.B. The national debt is not the same as the deficit. It is the accumulation of many years and decades of deficits (less a few wimpy little surpluses).When our national debt becomes six times greater than our nominal GDP, that is when I dig up my supply of weapons and ammunition.

-or-

is its interest in gas fields because it will want to engage in some large scale GTL action, which would help the overall ALL LIQUIDS chart a teensy tiny bit longer.

??

Any thoughts?