Is the United Kingdom facing a natural gas shortage?

Posted by Rembrandt on January 11, 2010 - 10:30am

I "moved up" this post from Saturday, so the continuing British natural gas shortage could continue to be discussed, without having to look too far. - Gail

A cold spell facing the United Kingdom has caused anxiety over the security of the country's natural gas supplies. The Conservative Party warns that a gas shortage is about to hit the UK due to a lack of storage capacity. In response, National Grid, owner of the UK gas transmission system, states that there is "no danger of the UK running short of gas".

Anxiety increased when National Grid gave a gas balancing alert, asking power suppliers to use less natural gas, a message which was repeated again last Thursday.

In this post, I explain some of the issues underlying the current UK natural gas situation, including a growing long-term mismatch between the supply that the United Kingdom can itself provide, and UK customer demand.

Natural gas demand at unusual highs

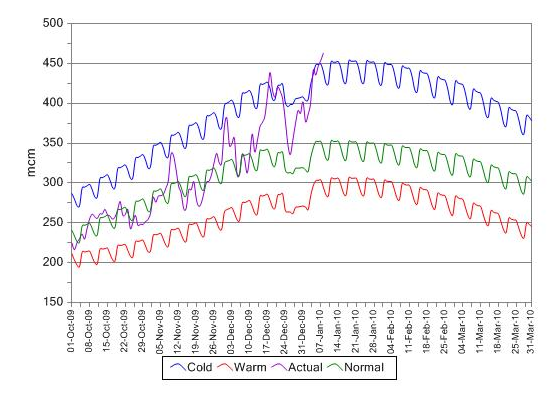

The United Kingdom's current winter is the coldest one since December 1981, with sustained temperatures between 0 ° and -15 ° Celsius (5 ° to 32 ° Fahrenheit). These low temperatures pushed gas demand up to 463 million cubic meters (MCM) on 8 January 2010. This level was higher than the previous record of 449 MCM reached in 2003, and more than 100 MCM above normal seasonal demand.

Although the weather is expected by the UK MET office to ease a bit next week to just above zero degrees Celsius (32° F), National Grid expects that the warmer temperatures will only lead to a slight drop in gas demand, to about 450 BCM. Because the drop is expected to be so small, the temperature increase is not expected to relieve much demand pressure in the short run.

Gas supply

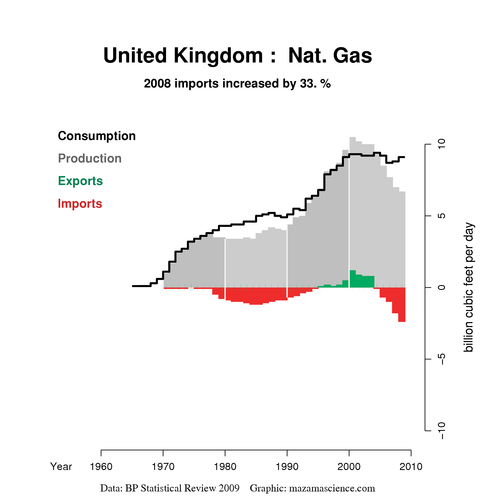

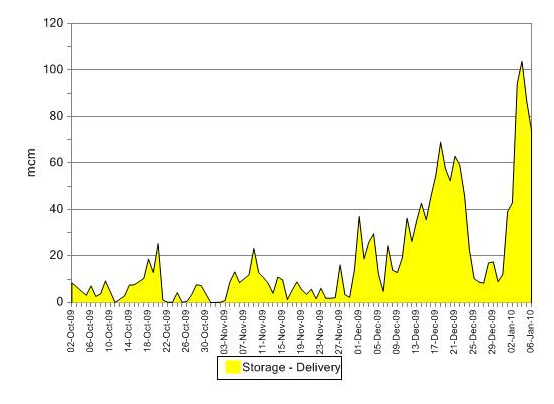

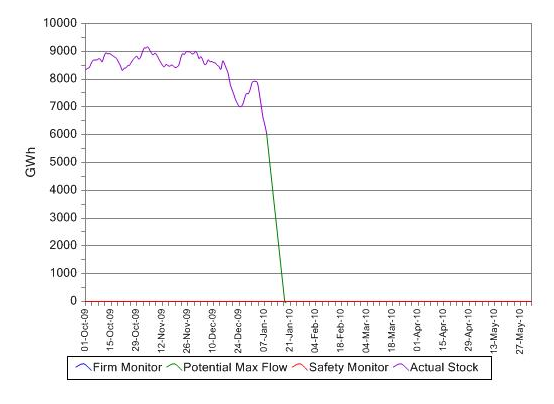

Natural gas production in the UK reached it highest level, or peak, in 2000, and has declined from 108.4 to 69.6 billion cubic meters (10.5 to 6.7 billion cubic feet per day) in 2008. (See Figure 2 below.) Due to the decline in natural gas production, the country has become reliant on imports for more than half of its consumption during high demand periods. Because production is now lower, storage capacity is utilized to balance supply and demand when imports fail to provide sufficient supplies. So far this winter, more than 50 million cubic meters have been drawn out of storage to meet demand. The UK Conservative Party is concerned that as the cold weather continues, gas storage will be depleted, resulting in shortages.

The largest portion of gas imports come from Norway, through the Langeled and Vesterled pipelines, which have capacities of 25.5 and 12 billion cubic meters per annum respectively. One of the problems that caused some panic last week and led to one of the gas balancing alerts was a temporary interruption of gas flows through both pipelines. This happened when gas production at Troll, Kvitbjoern and Visund fields was halted due to technical difficulties, causing a drop in deliveries through Langeled and Vesterled from an aggregate 103 to 35 million cubic meters. This outage was fortunately quickly corrected over a day’s time.

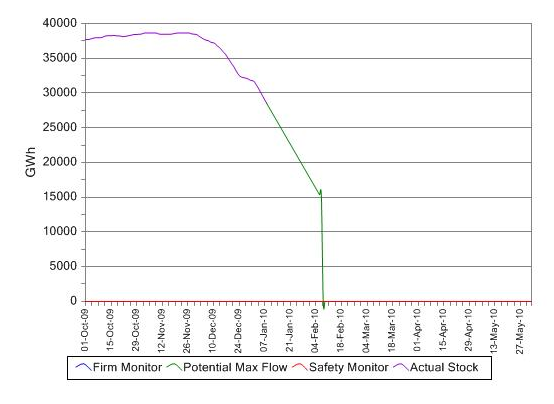

Besides these temporary issues, there is a longer-term issue, because of high natural gas demand in relationship to supply, as illustrated in Figure 2. Because of this high demand, storage is being depleted rapidly, shown in the graphs below by National Grid. This long-term issue does not appear to be recognized by British political leaders, and in fact, the information they are providing seems to offer the opposite message:

UK Energy Minister Lord Hunt: “It is working flat out at the moment. National Grid has confirmed there is plenty of gas in the system. People in their own homes should be in no fear at all. There is no risk to their gas supply.”

Current consequences

Because of the National Grid's current inability to provide adequate natural gas through a combination of pipeline supplies and storage, nearly 100 factories had to stop using gas as a precautionary measure. These factories have interruptible supply contracts--that is, contracts which charge a lower price for gas, in return for agreeing to be interrupted at times of high gas demand when National Grid requires it. By Friday the number of companies who were told to stop using gas were reduced from 95 to 27.

Over the long term, the UK's ability to supply its own natural gas can be expected to continue to decline, and storage can be expected to remain fairly limited. The UK can be expected to need to import more and more gas, either through pipelines or as LNG. Because of these issues, the situation needs to be monitored closely.

The UK natural gas situation is of course a prime example of Net Export Math. The three key characteristics of net export declines (given a production decline in a net exporting country) are: (1) The net export decline rate tends to exceed the production decline rate; (2) The net export decline rate tends to accelerate with time and (3) Net export declines tend to be front-end loaded, with the bulk of post peak net exports being shipped early in the decline phase.

Here is the UK natural gas net export math, consumption was basically flat from 2000 to 2003, (EIA, BCF per year):

Production:

2000: 3825 BCF

2003: 3632

Decline rate: 1.7%/year

Net Exports:

2000: 452 BCF

2003: 273

Decline rate: 16.8%/year

In simple percentage terms, a 5% decline in production from 2000 to 2003 resulted in a 40% decline in the volume of net exports, and the UK became a net importer in 2004.

Not a problem. We'll just import it like France and Germany do. We have at least 2 LNG terminals now as well as the pipelines to Europe. However, not as secure as having your own supply.

... and we'll pay for it how? Have you seen the UK's balance of payments and the ever increasing size of the debt to other nations?

Tell us how it will be done and how long for.

From an energy point of view the UK is in a much better state than France or Germany or indeed 23 of the 27 Euro nations that import nearly all of their oil and gas - even so we may indeed import like France and Germany i.e. no imports.

I think paying for it is a different issue to availability of supply. Plus, I suspect we are already paying market prices for North Sea gas, ie I don't think we get it at a discount. As for balance of payments, we'll just need to export/sell some more financial services :)

Good point JN2. I hear Iceland is looking for a few good bankers.

Back in March there was a post on the Pharyngula blog about The Icelandic Elf School. They teach students and visitors about the five different kinds of elves or hidden people in myth that are believed to inhabit the country of Iceland.

At the time I posted this somewhat snarky comment in response. I still think that it may serve as a reminder as to what the eventual fate of Bankers everywhere, may be.

Hi, Rembrandt.

If the Norwegian pipelines became unavailable, how many days of combined storage does the UK have at current rates of usage?

Currently Long range storage would last around 62 days, medium range storage has around 10 days and short range has around 2 days at max flow rates. The max flow rates are limited by the size of the pipes.

http://www.nationalgrid.com/NR/rdonlyres/93FA9431-6AED-4203-80A5-8211E33...

There is a lot more analysis that could be done with respect to the current natural gas situation in UK, including analyzing the extent to which flow rates on pipes are a problem. Staff member Rune Likvern is looking at the situation in more depth. He should have a report ready sometime within the next few weeks, I would expect.

A colleage of mine is doing his PhD on scenario based analysis of the impact of gas supply on the national grid, so no doubt he'll be in big demand once he's finished after this. Perhaps I'll post his findings when he's finished if anyone's interested. Remarkably, no one has ever done this before, which should be reassuring for everyone!

Less of a spell more of a curse ;¬)

On the subject of the recent weather and possible climate change.

I sent the following email to several friends last year and resent it yesterday with the following subject line:

Subject: Blast from the past, recent weather. Better than the met office try and find it in the media.

On resending it got back. What is NAO?

Here is my stab at an explanation:

North Atlantic Oscillation - interesting. Coincidentally I was chatting to a chap at a Christmas party, he said he worked in climate research in the field of oceanography, or something like that, too much wine can do strange things to the brain. Anyway, he said that they have actually measured a "slowing down" of the Gulf Stream caused by the "marine motor" of cold water sinking off the coast of eastern Greenland, "slowing down." Of course this is highly speculative science at present, because the measurements and data incomplete; but according to him, his "hunch" was that the Gulf Stream was becoming more "unstable" which could, over time, have profound implications for northern Europe and beyond. We could, for example end up with both hotter summers and colder winters.

I posted a link yesterday to an article by Jeff Masters at Weather Underground on this: The U.S. and European cold blast: blame the NAO

I don't believe it is quite accurate to say "the country is finished..."

If we were to talk about anything except human populations, we would be speaking of the oscillations of various populations as the environment changed, and perhaps changed predator-prey relationships.

The ancient Highlanders managed to survive for thousands of years up in Northern Scotland without oil -- and even after they cut all their trees down.

What is certain is that most of us will not much longer be able to drive to the supermarket for beer and lounge in front of the big screen to watch a football game.

As Grand Britannia we are, there is a direct link between indigenous energy production and GDP.

Take that away and look at our competition:

You don't trust anything American with Intelligence in the name do you? :-)

Hi Haemo

Did I add figures or comment on the coal entry for France, non in fact I only commented on the 70+% nuclear electricity generation.

Haemo?

If you are responding to me, I was just pointing out that according to the CIA factbook France has a coal industry, in reality it doesn't - more or less 100% of their coal is imported.

Totally irrelevant. This is the 21st century. This kind of economic analysis belongs in 1956. Let's keep it there

Danger mouse

He's terrific, he's fantastic!

Rembrandt, nice summary but when you say "The UK Conservative Party is concerned that as the cold weather continues, gas storage will be depleted, resulting in shortages", don't fall for the party political point scoring. Of course everyone is 'concerned' including the Government, but in my corner of Lincolnshire where there is an ongoing planning inquiry into a proposed gas storage facility, it has been the local Conservative MP, Sir Peter Tapsell, and the local Conservative county councilor who have been supporting the nimbys who are opposed to the scheme.

It'll be interesting to see what the Lincs MPs do when they're facing the prospect of replacing the UKs dwindling North Sea gas by techniques like underground coal gasification (UGC). The carboniferous Yorkshire coal fields slide under Lincolnshire on their way to the North Sea.

The British Geological Survey have identified large areas of Lincs as prime targets for UGC (and maybe coal seam methane). The carboniferous coals are too deep for conventional mining under Lincs, and they're largely mined out under Yorkshire/Derbyshire/Nottinghamshire.

There are also very thick seams of coal under then North Sea from the same strata - I wonder if they're targets for UCG using our offshore drilling expertise?

I suspect so!

The APPGOPO group in the House of Commons will get a presentation on North Sea UCG on the 19th January.

http://appgopo.org.uk//index.php?option=com_events&task=view_detail&agid...

If you log on to the APPGOPO home page a couple of days or so after that you should be able to see a video of the presentation.

Intention and licences have already been granted to an Anglo American company.

http://business.timesonline.co.uk/tol/business/industry_sectors/natural_...

So Clean Coal Ltd reckon they can supply 5% of the UKs energy requirements from the 2015+ timeframe with North Sea UCG eh. It was interesting to see them claim that each site would cost an estimated circa £152 million - a deep mine would cost ~£400m according to UK Coal if I remember rightly.

A company called Island Gas Resources reckon that they can replace 15% of our gas supply with coal bed methane.

If we ever manage to built projects like the Severn Barrage then that's another 5% supplied.

Every little helps I suppose, but I'm still glad I put a solar hot water panel on the roof and a shed load of loft insulation!

But I wish the shower that's been in power since 1997 had kicked this sort of stuff off circa 2003 instead of panicking now when an election looms.

You got it, to little and no capital left to get the projects done.

I could write an article on the speed with which new project proposals have been cranked out in the last few months.

Reality is hitting home I think rather than just politics.

Yes, I should try and do some solar myself at least 300W so I can keep online.

Personally, I think the onshore UCG projects may get done in a 2011-2015 time frame, due to the extra costs of offshore UCG. This will be over the heads of the local NIMBYs in Lincs and such places (due to the probability of one or more oil price spike(s) in that time frame concentrating minds).

Because of the National Grid's current inability to provide adequate natural gas through a combination of pipeline supplies and storage, nearly 100 factories had to stop using gas as a precautionary measure. These factories have interruptible supply contracts--that is, contracts which charge a lower price for gas, in return for agreeing to be interrupted at times of high gas demand when National Grid requires it. By Friday the number of companies who were told to stop using gas were reduced from 95 to 27.

Read my post "That's why it's called interruptible. Doh!" at www.nohotair.co.uk. Readers Digest version: The UK gas grid is performing incredibly well in exceptional circumstances. To have only 27 sites out of the 2000 who are on interruptible contracts asked to cut back is very positive news, not the negative that people who don't understand the basic concept of interruptible supply used by every gas grid on the planet earth like to push.

Prices actually ended up lower on Friday than they did on Monday. Another sign of market failure?

And: What is the BFD with import dependency? (Big Deal are two of the words). The UK needs a realistic, and frankly less paranoid view about energy supply. Insisting on import dependency is unrealistic, and goes against all ideas of free trade. There is enough gas available from LNG markets that is significantly cheaper than North Sea gas. The exact same situation is happening with LNG displacing Russian gas. The exact same thing is happening in Alberta where expensive to produce natgas is being killed by shale gas that is cheaper to produce and three thousand miles or so closer to the market.

UK, European and World (LNG) gas prices are all feeling the impact of the shale gas technology changing the game in the US. There are two strands here:

1. Today, as the US is effectively removed as a market for LNG apart from at the margins, the gas that was targeted there has just about the only option of going to Europe. Asian demand is kept up on long term floating pipeline deals. () Japan by the way has zero production and not far from zero storage. Doesn't seem to have ruined their economy! That means the world gas glut is handling the demand. Watch the UK news and you'd think it's plucky little Britain in some kind of frozen Dunkirk. The reality is that the freeze has been Europe wide since December and in Northern China from November. North America has had a cold winter in the usual places, but also far south as well. Central Mexico and Mexico City are having severe weather. But all this cold mayhem isn't heating up gas prices. Maybe the markets know something Peak Oilers would rather not know?!

2. The real game changer is the coming globalisation of shale gas technology. Imagine for example the impact on LNG and gas prices if China started duplicating the US shale experience. There is no reason why not, and Chesapeake, Statoil, Petrochina and Shell, among many are busy looking for it. The entire world will have as much gas as they need.

Notice today how the UK press is in a panic about salt, now they see gas shortage as non story.

This is possibly shill nonsense, according to his profile this is his only comment in 33 weeks 5 days.

Perhaps the government is working him ragged and so he has just never had the time until now, LOL.

I haven't commented before because I couldn;t quite decide if Peak Oil is paranoid nonsense or what . But now someone is talking about something I know a lot about I thought I had a right to offer an informed opinion.

Read www.nohotair.co.uk. Start off with the Myth of Natural Gas Scarcity page and take it from there.

Just had a brief look at the ridiculous site indicated.

My only comment is look at the UK's balance of payments in the unlikely event shale gas could be produced in mainland Europe to replace declining UK gas reserves.

Making a coffee it feels shilly around here.

Balance of payments! What is this 1967? Even Thatcher never worried about that !

http://www.youtube.com/watch?v=teMlv3ripSM

Thanks Nick for your post. Found it interesting. I think Rembrandt's article is about long-term potential security-of-supply problems, whereas what happened this week is an infrastructure due to the very cold weather - not a problem with sourcing gas.

Its a pity "Slighty" can't actually make any constructive comments beyond calling your shill and posting stupid links.

There have been several problems "sourcing gas" this week - in fact there's still almost no gas flowing down the Langeled pipeline as I write this. Just losing that one pipeline for short periods this week has forced Nat Grid into a corner. We need that pipeline back online and we need it to warm up.

The UK should have a minimum of double the current storage capacity and double the current max flow rates in order to adequately cover reasonable supply shortfall possibilities.

Just like oil there is plenty of gas in the world, but importantly, for the UK we are running out fast.

We in the UK can't have a future based on exponentially increasing debt in £s or in other currencies than our own, apart from the fact that we have to reduce CO2 emissions by ~34% by 2020 (80% by 2050) and still have a viable economy.

Is the right hand side of the North Sea gas production graph 'paranoid nonsense'?

Happy now?

I see your profile is listed as private, so we can't see your profile or previous posts.

You mean like your 3 posts in 2 years all of which support the party line. LOL

... and you registered to say all this ? Double LOL :-) BTW welcome to the Pleasure Dome

What a load of propaganda BS. Anyone who claims that we (the UK) can relax because the free market is our saviour has not slightest idea what he is talking about. I will rebutt this crazy nonsense in detail tomorrow when at my computer, not my iPhone.

This is absurd, dangerous nonsense which is sadly the prevailing 'wisdom' of the UK's energy policy for nearly two decades now and it is essential that this is shown for what it is.

HA -- As a leading member of the free market oil/NG industry I resent your comment. We are your savior (and noticed I spelled it correctly). And as soon as you accept that fact and kneel before us the better it will be for you. Granted you'll have to choose between not freezing and sacrificing many other aspects of life as you've come to know it but just remember: the choice is always yours.

It certainly is sad to see what our Brit cousins are facing. Especially how it may be forecasting the US future not too many years down the road. Best wishes chaps.

Thanks for the humor, Rockman, it's getting warm in here.

Then again, maybe for the heat, England is going to need to count on generating some Flame Wars for a couple weeks..

I'm no expert, but I'd have to agree, simply by looking at figure 1. If the top (blue) line is representative of what the designers expected, the system is operating within its capabilities.

The price of shale gas is low, but it is not at all clear that companies can produce shale gas profitably at the low prices we have been seeing recently. This is a link to a post I did on the subject.

In general, there is a problem with people's incomes not being able to handle high prices. This is an article I wrote related to how high oil prices affect consumers. The same argument can be made for high natural gas prices.

Thanks useful, Slightly

Yes, but that might only matter if the price is high because of scarcity... there is no price that one can pay for more fuels that do not exist, the price merely settles at the lowest price point that prevents more useage (because more useage is impossible).

But if it is a matter of production cost, I don't see why people couldn't simply adjust the amount of gas they use to a lower point. It is paying more for something that costs more to produce... a different matter than paying more for something because the supply of it is constantly shrinking.

One should not consider natural gas use outside of the context of overall energy use. Natural gas is used in the UK primarily for heating and electrical generation, two needs that can also be met by other fuels. To understand the natural gas situation we need to see how overall energy use is evolving. From the Energy Export Databrowser:

During the 1990's, indigenous supplies of natural gas largely replaced British coal as a fuel. Now that the UK is past peak in all three fossil fuels (coal, oil and natural gas) they must resort to imports to meet the imbalance. Other European countries (e.g. Germany) also rely heavily on imports but this reliance has evolved more slowly and they have had time to create appropriate engineering and policy infrastructure. The UK's reliance on imports is occurring at a much faster rate.

Given that electricity produced from UK nuclear power plants is also in decline, the need to plan for a future of imported, potentially expensive energy resources is of the highest importance.

-- Jon

Hooray a reassuringly real person.

Jon -- Have just picked up pieces of your puzzle over the years so please correct. The UK still has significant coal resources but agreed with the EU to move away from this source for ecological reasons. If that's true do you anticipate the UK holding to that agreement or being forced back to coal? If not coal is expanded nuclear the next best option in your opinion?

It seems very unlikely that coal could close the gap in the UK - coal here peaked as long ago as 1914 and if desperate efforts during and after WWII couldn't bring production back to that level nothing we could do now would seem able to do more than spin the decline out a bit. Essentially ever since we started exporting North Sea oil and gas we have paid for coal with the revenue (and gained more kWh in the process). Now we are paying for all fuels with made up money and this will have to stop soon.

ROCKMAN,

The UK will undoubtedly go with the cheapest readily available alternative. It is not at all clear that Britain can restart their collieries at a price competitive with imported LNG which is readily available now and for the next few years. The immediate, short-term issue of storage is something I expect parliament to address long before they talk about restarting closed collieries.

I don't really have an opinion about the political importance of adhering to EU restrictions but I cannot imagine a return to coal would address more than a fraction of Britain's current energy needs. With north sea reserves depleting and several nuclear plants scheduled to be decomissioned the UK will be importing more and more energy. They just need to decide from where.

Switching from exporter to importer is of course having a terrible effect on the balance of trade and I expect economic issues to compete for attention with energy issues once this immediate crisis is past. That is why the politicians will go with whatever is cheapest in the short run -- they won't have any other choice.

In answer to your question of what the UK should turn to to address their energy needs I'll give my standard answer -- conservation. I have no doubt that a gradually increasing tax on energy consumption combined with a feed in tariff for domestically produced electricity would induce the appropriate shift in behavior. The Germanic and Scandinavian countries have achieved impressive results with this scheme.

-- Jon

I think you have entered a cycle with an annual apex of concerted public interest. Much like, indeed directly connected, to doings on the Continent:

Hope your man up thread is correct about LNG filling this gap.

Jon,

Thanks for mentioning the conservation word. Since Christmas I've been feeling like giving my double glazing a good round of applause every morning for keeping me warm (and the walls I insulated over 20 years ago).

Let's hear it for insulation!

Thanks for the update Jon et al. From some comments it sounded as though coal might be an available but nasty option to save the day.

Given that the UK's coal fired power stations seem to be running flat out to save gas I just hope there is sufficient coal stockpiled at power stations to keep this up right now. As we don't even seem to have enough salt and grit stocks to keep the roads safe, I have to have some doubts about the coal stocks.

Jon, I find your tone and reasoning much more real-world persuasive than the Hot Air cornucopianism above.

Conservation -- with a vengeance -- will be forced on us soon enough. I expect that we're going to find, want it or not, that we-all WILL start conserving everything, as a crash priority over the next few years. Actual shortages, plus the real-world emergency of how the feck we're going to actually pay for everything (not just energy) that we need (not just want) to import, because we can't produce it here, is going to sober away the cornucopianism to oblivion.

Whatever the price the world market demands for selling us essentials, will they accept monopoly money with nothing real to back it? Apparently less and less so these days as faith in bubble economics haemorrhages away terminally. So what (real) goods and services will 60+ million Brits create to give some serious global credibility to our monopoly money?

Real, in the sense that they have genuine value that people everywhere could see that they need, and not the delusional bubble 'value' of financial 'services'?

Seems to me that Britain is in deep eco-demo-geophysical shit, and wittering about the next brief delusion of cornucopian energy isn't going to do anything to kick us back into sober sanity whilst there's still time and some residual resources for us to do something realistic about our predicament.

Looking around me, from my position of a near-invisible subsistence neo-peasant teaching myself how to live on an order of magnitude or so less stuff than my fellow-Brits still burn, I see no sign so far that many of us have woken from our obsolete delusions of ever more prosperity for ever. Some are uncomfortably getting it, but so far even they aren't actually changing their lifestyle much --because they're not yet actually obliged to. Many more are still in full delusional mode. The shock of awakening, some time very soon, will be truly traumatic for these unfortunates, I imagine.

Hot Air cornucopianism doesn't do a damn' thing to help those unlucky sods face the cold realities, whilst they still have time to take some urgent preparatory measures. On the contrary, it just offers insubstantial clutch-straws to the desire to go on believing the delusions for as long as possible, whilst the last residual real resources for life-boat building that we command bleed away.

And there is that other small matter (one of several, equally overweening), even if the shale-gas hype were true: that climate shift and global heating now seem to be moving into a full-blown state-change, from ice-house world to hot-house world, which probably is going to kill some six-sevenths or more of us untimely and terribly over the next century, if people like Lovelock have it right, and leave the survivors doing subsistence lifestyles around an ice-free Arctic Ocean and any other such oases which the hot-world state might allow us.

Wonder what the state of gas supplies will be then; and whether anyone will care.

Why is there not the level of shorage to be like France/Germany? Farcical planning see; Welton, Caythorpe, Saltfleetby.

We don't have storage at French or German levels because we have the North Sea. Why bring it out of one hole in the ground only to put it in another?

It's not only wrong price wise, it's entirely pointless environmentallly.

We do indeed have only six days of short term LNG storage available. That means if all 8 gas terminals are simultaneously hit by a meteorite, we are well and truly screwed. If the meteorite only hit seven terminals, we would then be forced down to six weeks storage from the Rough field.

Apart from that, we'll do just fine. As the last few days have proven.

A few years ago Rough storage unit was taken off line for most of the winter as the result of a fire. Fortunately it was a mild winter, or we would have had shortages.

Even then, our gas supply was hostage to to single point of failure. Such failures tend to occur when the system is most stressed, and we can least afford to take the hit. (I've found that to my cost when cycling, a badly adjusted bike will always let you down half way across a busy road junction with traffic coming from three directions simultaneously)

Another gas balancing alert has just been declared because the Norway pipeline imports have fallen again.

We only find out how vulnerable we are when the system is stressed. Five years from now the North Sea will be history.

It will another 10 weeks before we can say we did fine.

3 GBAs in a week is "just fine"? With your type of get by by the skin of your teeth thinking, no wonder we're in such a mess.

And you should really look at storage max flow rates if you think (as you appear to) that Rough could supply the UK in the event other sources were unavailable. You should also note that 2 of the SRS storage sites have already been removed from the assumed available "GBA" supply trigger due to them being depleted below 2 days of supply at maximum rates.

Gas alert lifted as supplies arrive

(UKPA) – 9 hours ago

The National Grid's latest gas supply alert has been lifted after more fuel came in from the market.

The gas balancing alert (GBA) was issued on Saturday night amid signs of an imminent gas shortfall for the UK. It was the third time in a week the alert had been issued as big freeze ground on.

But the GBA was lifted after fresh supplies arrived. "The market responded to the alert...more supplies came through," a National Grid (NG) spokesman said.

Link.

Partial flow has resumed at Langeled, the rest of the "fresh supplies" to plug the gap were/are pumped from SRS and MRS storage. And fortunately for all the weather has warmed up just a bit.

The Milford Haven shortage doesn't seem to have been cancelled as far as I can see.

Does anyone know what stocks of distillate are kept at CCGT stations?

I recall when they built Kings Lynn CCGT in the 1990's the planning consent permitted fuel distillate to be burned for 60 minutes each week. I assume planning restrictions like this would limit the qunatity kept on site.

That said I am sure in a national emergency the Sec of State could waiver the planning restriction. However it still begs the question about how much distillate would be available to run CCGT in the event our gas storage has run out.

The rules for interruptible gas sites mean that at least ten days storage capacity be held on site. There are over 2000 interruptible sites, 97 of which were interrupted on Thursday. Which means 95 per cent weren't, but that wouldn't be an interesting headline.

The 2000 sites include at least 150 NHS hospitals, many military installations, numerous council estates, and sites as diverse as department stores, banking back offices, prisons and police stations. Interruptible gas supply is used throughout the world as a peak shaving device. It's all about network capacity, actual physical gas supply has zero to do with it.

For example: A third of capacity serves the domestic market. But evidently, domestic supplies don't use much in July. To use that capacity, major end users with a steady load facto such as CCGTs but also chemical, paper, cement plants, ceramic factories, brick works, milk processing plants, breweries etc etc who use a lot of gas year round buy gas on interruptible contracts. There are some end users who have lower need for gas in the winter than summer (brickworks and cement for example). Other end users pay their money, via reduced gas bills, and takes their chances. When they are interrupted they either switch to oil, or change their processes or both.

If interruptible contracts didn't exist, then we would have a Rolls Royce system that could handle one in twenty, fifty, one hundred etc winters. But we would need to pay for the construction and maintenance costs of that system every day for years on end without using it. Economically pointless.

What you are saying is that when the UK made the dash for Gas power stations it had a choice: Upgrade the grid to supply the increased cold winter demand or find a way to cut customers off when it got cold. The UK chose the cheap route. And now after a couple of decades of taking the cheap fingers crossed options all the time we've had 3 GBAs in a week (including one on a Saturday) - that's three times as many as in the previous 30 years or so put together. Yes, all is well. Keep telling us that.

Just as well so many schools were closed last week as well as that helped keep gas demand down.

I wonder if the gas savings over the holiday period would be all that significant. The boilers are still operating, obviously, so I guess it depends on how far they turn down the heat, and in the case of older, less well insulated buildings, there may be some reluctance to drop temperatures too low for fear the pipes might freeze. In addition, the normal internal heat gains from lighting and occupants would need to be offset by the central heating system (e.g., a classroom containing twenty-five students would generate approximately 2.5 kW of body heat).

I've been reading reports of a number of UK schools running out of fuel oil over the holidays due to the disruption in deliveries. Given that oil tanks are normally kept well stocked at this time of year, especially in the anticipation of colder weather, suggests heating demands at these facilities have been much higher than anticipated. I would expect this to be true of schools heated by natural gas as well.

Cheers,

Paul

Below some diagrams based upon the most recent data from DECC (Department of Energy and Climate Change) that may help shed some light on what is presently going on with UK nat gas supplies.

Diagrams are clickable and opens up in a bigger version in a new window

The diagram above shows UK disposition of natural gas supplies from January 1996 to October 2009, based upon monthly data converted into average daily quantities.

The diagram illustrates how UK increasingly is relying on imports (red area) to cover their nat gas consumption.

The white line shows the development in UK indigenous marketable supplies and the dark blue line total consumption.

In the diagram is also shown the development of the 12 MMA (12 Month Monthly Average) for UK nat gas consumption (dark red line) and the 12 MMA for UK marketable production (orange line).

The diagram illustrates how the economic slowdown has lowered UK nat gas consumption.

The diagram above shows the development in Year Over Year (YOY) growth and decline in UK marketable nat gas from January 1996 to October 2009.

Note how the decline was limited with the growth in energy prices (oil and natural gas) during 2007 and 2008.

What should get attention is that recently the annual decline in UK marketable nat gas has been accelerating and as of October 2009 had reached an annual rate close to 14 % and preliminary data for November 2009 from National Grid shows that this acceleration in declines continued and reached an estimated annual level of 16 % by November 2009.

Chances are that the decline in UK marketable nat gas supplies could reach an annual rate of 20 % this winter.

It seems like the cold weather came as a surprise on many, but I have not seen any official forecasts that expected that UK marketable nat gas supplies could decline at an annual rate of 20 % or perhaps more.

This may serve to illustrate that when nat gas fields decline their annual decline rates is both hard to predict and is often………very aggressive.

This is a repost of a comment I had on Drumbeat January 7th 2010.

National Grid issued a GBA (Gas Balancing Alert) at 17:11

"GBA National Grid has declared a GBA for Gas Day 09th January 2010."

Another failure of supply via the Langeled pipeline.

Undertow,

Is that the third time in less than a week?

Yes, that's the 3rd GBA this week (the first was due to SRS storage at one site dropping below 2 days supply IIRC). Just as well this is a Saturday and we'd better keep fingers crossed Langeled flows resume by Monday.

Good point, Rune. I think this could be a clear sign of the effect of the "demand destruction" affecting offshore hydrocarbon production: Originally on the basis of higher prices for oil and gas new oil and gas wells were planned extending from existing offshore platforms, which were also fed by existing wells from mature wells. But when the fuel prices plummeted due to the crisis these offshore platforms had to be abandoned much earlier than expected - including the new projects extending from them: These platforms became uneconomic as the revenues from the current production became too little to maintain the platforms including the new projects. And as the new fields are too small to justify to install a new platform on their own. So they will be lost forever.

This is my trial to explain what I read somewhere about a year ago. And in fact the North Sea projects did plummet considerably:

If this mechanism is really taking effect this means that the economic decline increased irreversibly the decline of offshore production. You may guess what happens if this sort of feed-back continues...

Yes, it is the collapse scenario.

Where are those aliens when you need them.

Here is the article I mentioned, which is from Kjell Aleklett:

Hello drillo and thanks!

I think you point to a major contributing factor in the decline of marketable natural gas supplies; the fact that fields that was marginal and could be developed with favorable prices (oil/natural gas) literally over night became shelved as prices collapsed.

Further I also believe that some of the installations that were supposed to host these marginal developments were looking for a prolonged life as they had the opportunity to share some of the operating costs with some marginal fields that could not be developed as standalones.

(This is very much what Carola Hoyos describes in her article which you have copied.)

I also wonder how, what is commonly referred to as the “financial crisis”, has played a role in shelving developments (due to availability of credit or too expensive credit) and thereby set off a snowball effect.

Rune -- I don't know the N Sea players at all but I can tell you that a lack of capital is a significant factor in holding down US oil/NG development today. And this includes the relatively inexpensive onshore projects. The price of oil/NG (especially oil) is more than adequate to justify drilling for conventional reserves today. We're proof of that: we can't keep up with all the quality and economically viable projects floating on the market begging (and I really do mean begging) for buyers. We've committed over $120 million just in the last 5 months and have just started the drilling phase in earnest. And it's not because we're so much better at it then the other companies: we have the capital...they don't. Though oil/NG prices are lower so are costs. We're drilling an offshore well right now that had a cost estimate of $23 million a year ago. Current estimate: $13 million. It actually looks much better in the economic analysis now than it did when NG prices were 60% higher. But they had to come to us to raise the last $'s needed to get it drilled.

The development of smaller fields thanks to the existing infrastructure of the big fields is THE reason the Gulf of Mexico production has held up so well. Pipeline development has been a major factor in the development of the smaller NG fields especially. While the Deep Water oil is kicking in now the smaller fields on the shelf were still adding increasing amounts of oil/NG well into the 90's. I don't know if the N Sea has this same geologic potential or not. But if the capital isn't available then it doesn't really matter IMHO.

Interesting that Dennis Meadows, author of Limits to Growth, says that he expects capital shortages to be the limiting factor that causes the current system to fail, in a post I put up a few days ago.

Saw that Gail. All I see is the oil patch 24/7. And capital scarcity is chocking it to death at a time when the economics should be driving a boom or something close to it. In previous up-price times outside capital flowed in like water. Makes me wonder if we see another strong price spike if there will be much response. There will be another major oil/NG prospect seller show in Feb. Be interesting to see how many buyers show up. At the same expo last Aug there were over 300 sellers and I counted no more than 10 buyers.

The situation is the same here in Canada. Investors are not putting money into anything except sure things, and when they have a number of sure things to choose from, they are only putting their money into the best of them. Nothing halfway uncertain.

This is problematic for the US because Canada has most of the oil reserves on the continent, and I'm told probably has more shale gas potential than the US. However, in the current climate, not much of it is going to get developed until it is too late - at least for the US. Canadian authorities will make sure Canadian consumers have adequate supply - at least as far as the pipelines reach. Eastern Canada might be a problem.

There's also the Chinese factor. The Chinese have been buying up Canadian resource companies at every available opportunity. They obviously are intent on keeping Chinese industry well-supplied with raw materials and fuel in the long term.

All things considered, I'd look for another sharp oil price spike in the not-too distant future.

The sudden emergence and future permanence means that we need up to date information. To quote Carola Hoyos from April is a bit unfair;

Try these links

BBC November All Change as gas reserves soar: http://news.bbc.co.uk/1/hi/business/8303581.stm

The video itself is a bit more informative, where Statoil say that shale gas in Europe alone is at least 14 times the size of the Troll field, the largest one in the North Sea.

http://www.washingtonpost.com/wp-dyn/content/article/2009/11/05/AR200911.... CEO of BP, obviously an amateur compared to most here.

http://www.telegraph.co.uk/finance/newsbysector/energy/oilandgas/6852723...

http://www.nytimes.com/2009/10/10/business/energy-environment/10gas.html...

Ah the miracle of shale gas. That's been discussed a lot at TOD. A lot of people have a financial (and/or political?) interest in boosting shale gas prospects at the moment and you might want to search back for some recent articles on TOD to get a balanced view.

Permalink to said comment, for those interested.

What do the green areas on top of the red demarcate? LNG vs. pipeline?

Beautiful work as always!

Although gas production in the UK North Sea is falling alarmingly fast, remember that the UK Continental Shelf also includes West of Shetland, and the gas fields there start coming on line in 2012. Also, Norwegian gas production is still rising - Peak Gas for Norway is expected to be 2015. So the UK shouldn't run disastrously short of gas until the latter half of the decade: it's important not to "cry wolf" too soon.

However, note that the decline in North Sea gas comes despite ongoing development of new gas fields: we brought two on stream only a few months ago. Running hard so as not to go backwards quite as fast...

Also note that we are already using hydraulic fracking in tight reservoirs - I'm not sure how extensively - perhaps a well-informed reservoir engineer can advise? But anyway, it isn't a game-changing new technology which has still to be introduced here.

Rune, I suggest that it would be a valuable exercise to look closely at the European gas supply/demand balance for 2020. UK production will have collapsed by then, Norwegian production will at best be on plateau, gas production from the Netherlands may be falling off plateau, and the work at Uppsala (see http://aspo-usa.com/2009presentations/Bengt_Soderbergh_Oct_11_2009.pdf) indicates that Russian gas exports to the west may also be declining, as China's demand increases. Is it possible that by winter 2020 the entire gas supply will be required for domestic users, with none whatsoever left for power stations or other industrial users?

Scotty -- I know very little about N Sea geology. Is there a similar potential for numerous smaller fields as we've seen in the last 20 years or so in the Gulf of Mexico?

Sure, in fact that's mainly what we've been developing recently. Small subsea tiebacks, where 50% of the production comes in the first 2 years, followed by rapid decline.

As you know, an offshore field has high fixed costs, so there's a limit to how small we can go. Figure 5.2 in this report - http://www.olf.no/getfile.php/Konkraft/KonKraft2/KK2%20Production%20deve... - gives an impressive indication of just how small we've already gone, compared to Norway.

Our Norwegian colleagues don't bother with mini-fields at the moment, so they have upside potential. Whilst I accept Rune's point (below) that the NPD believes Norway is already close to Peak Gas, it has to be remembered that the NPD is cautious with its forecasting. No bad thing of course; particularly compared to the ludicrous over-optimism that the UK establishment has been peddling for the last decade.

An interesting document SF, thanks.

According to "your" Figure 5,2 and realizing it is on a logarithmic scale, it seems that the UK now goes after fields (or rather micro spots) representing less than 1 single day worth of national overall production. That is an eyeopener.

Norway is still not going after spots less than 1-2 weeks worth of national overall production. (good for them)

Hello Scottish forester,

With respect to forecasts of Norwegian natural gas production NPD (Norwegian Petroleum Directorate) published a fresh forecast as in September 2009 and which is shown below.

This most recent NPD forecast expects Norwegian natural gas production to grow through 2011, and keeping that plateau will be dependent on resources in discoveries and fields. In other words it may not now be ruled out that Norwegian natural gas production peaks in 2011.

NPD issued a press release ”Victoria” smaller than assumed on September 17th 2009.

And last fall there were some reports in media about Ormen Lange gas field reserves shock report on September 17th 2009.

From the above it looks like the future may arrive faster than expected by most.

I am also looking at the European natural gas supply/demand towards 2020 and beyond and may do a post about that here on The Oil Drum.

Rembrandt;

Quite the wide range of units for volumes of gas and rates of use in your article. Is it asking too much for consistency within a single post? Would help in getting your point across.

HSN

Part of this relates to different units being used in the US than the UK. Also, the National Grid has its own way of measuring things. Unless a person finds the data underlying the National Grid graphs, translates it to a new base, and remakes all of the graphs, it is difficult to get around this problem.

Sometimes a person wonders whether the confusing units have been adopted to keep reporters from fully understanding what is going on.

The basis of the units problem is that the US has its own national units, whereas the rest of the world is on the metric system. Outside of the US gas will normally be measured in cubic metres rather than cubic feet.

Many Americans don't seem to realize this. For some reason they expect people in other countries to use American rather than international units, when in fact most people in the world don't even understand American units.

People in the UK are familiar with the names of the units (they invented them), but unfortunately, in many cases the British units are somewhat different in size from American units with the same name.

National Grid ( http://www.bmreports.com/bsp/bsp_home.htm ) has just updated the Peak Electrical Demand figure for the UK on Monday to 38.9GW projected for 00:30. Peak demand for the day should be about 58GW at 17:00. I assume this is a mistake unless they know something we don't!

Still can't find any news yet on current Langeled pipeline problem.

UK Currently (last half hour) generating 48% of power from Coal, 33% Gas (rest mainly nuclear). That's a very low percentage for gas generation.

2GW of that is exports to France as we appear to be exporting flat out most of the time.

That would account for 900 tonnes an hour of coal or 4-4.5GW of gas.

I wonder if / when we will pull that plug?

Another National Grid Gas Status Update. Anyone know what this means?

http://marketinformation.natgrid.co.uk/gas/frmPrevalingView.aspx

Edit: Another Grid Status Message. Does not look good

Can't help you and I have had two accounts blocked this evening was Slightly, Chigurh and now Moss.

Perhaps it is the aliens come to help out.;¬)

Undertow, keep trawling through the jargon - you appear to be the main source of info in the UK.

It looks like the Milford haven site [refinery??] is saying 'we have run out of alternative fuel, can we have the gas back and pay big bucks for it??

Milford Haven is an LNG import site. What the updates seem to mean (and I could be misreading) is that all 100% of interruptible National Grid NTS customers supplied by Milford Haven have now been cut off but that's not been sufficient to assure supplies. A "firm capacity shortfall" means that they do not have sufficient gas to supply to contracted customers on non -interrruptible contracts. Therefore they are asking for some customers to give up the gas they have already bought in advance.

That's what it appears to be saying. It was interesting they issued this alert in the middle of Saturday Night/Sunday morning.

Langeled pipeline still only trickling supplies in. No GBA trigger for tomorrow has yet been published.

This is the main story on the BBC News website in the UK at the moment.

Brown issues cold weather gas and salt supply pledge

Sorry folks, we are all wrong:

So we should stop worrying and go back to work.

And certainly Brown is also sure that there is plenty of money in our backyard so we shouldn't worry about these rumors of a "financial crisis". He just doesn't find that money right now...

This is the same Gordon Brown who:

Abolished boom and bust - I suppose a permanent bust does abolish abolished boom and bust - but that's not what he meant.

Sold off lots of our gold reserves at the bottom of the market.

Promised low inflation and stable growth.

Promised to abolish child poverty.

Promised to abolish prescription charges for people with long-term conditions.

Promised a referendum on the new European Union treaty.

Has made Britain on of the highest taxed countries in the world with the gap between richest and poorest at its widest since the Second World War.

A senior party insider has said he presides over a dysfunctional shambles. Brown has said if Labour win the election he would serve a full term in office.

I'm off to buy some thermals!

Hi there,

I'm new to this site, and haven't got a lot of experience with the finer points of the UK national gas grid, but obviously am pretty interested to know if the heating and electricity are going to be on in the end of the week.

I've already looked at the graphs and spreadsheets referenced above, and came to the preliminary conclusion that if consumption stayed constant, then there was about 2/3 days left in the *short* term storage.

My question is this - there's obviously 3 types of storage: short, medium and long. They've all got different levels of days supply. Is there any online resource/someone here, that can explain what these 3 sorts of supply are and the what implications of using them are - eg how long would it take for gas from the "long" storage get into current circulation.

My apologies if this is a really obvious question, but I've not been able to find a Dummies Guide to the National Grid ...

cheers

I've answered my own question, from here: http://mpower-energy.co.uk/Documents/UK%20Gas.doc

if anybody else was wondering - from the above doc (their spellings):

There are three kinds of gas storage – Long Term, Medium Term and short term!

Storage Facilities by type

Long term

Long term storage is relatively fast and easy to fill but delivers gas relatively slowly into the National Grid system in terms of volume. This storage is crucial in terms of price determination especially after the Christmas period when it is unlikely to be refilled until the summer months. Capacity at Christmas is usually the capacity remaining until the end of winter.

Rough – Long term storage facility.

Location -18 miles off the coast of Yorkshire

Owned by Centrica Storage LTD.

Medium Term Storage

Less Capacity than Long range storage but can inject gas into the National Grid system at a higher rate than Long term storage facilities.

Humbly Grove

Capacity - .28bcm

Aldbrough – Capacity .42 bcm

Short Term Storage

Short term storage takes a long time to fill (approximately 6 months) but has only 3-5 days gas supply for the UK if used to its fullest injection rate. Shrot term storage can inject gas into the National Grid system at a very high rate.

Isle of Grain

Type – LNG

Owner BP/Sonatrech have booked capacity until @ 2025

Capacity – 5-15bcm delivery to 13mcm per day

Milford Haven

Type – LNG

Capacity – 10-25bcm delivery to 13mcm per day

Milford Haven2

Type – LNG

Capacity – 10-25bcm delivery to 13mcm per day

Avonmouth

Owner – National Grid

Type – LNG

Capacity – 876.1 GWh

Injecability - 2.3GWh/day

Deliverability – 156GWh/d – duration 5.6 days

Dynevor Arms

Type – LNG

Capacity – 304.1 GWh

Injecability - 2.6GWh/day

Deliverability – 49.2GWh/d – duration 6.2 days

Glenmavis

Type – LNG

Capacity – 876.1 GWh

Injecability – 4.6GWh/day

Deliverability – 156GWh/d – duration 5.6 days

Partington

Type – LNG

Capacity – 1,121.9 GWh

Injectability - 2.4GWh/day

Deliverability – 219.8GWh/d – duration 5.1 days

Serious troubles, until further notice ...

Langled halted due to icing problems - Weather Shuts In Output At Norway Ormen Lange Gas Field - http://online.wsj.com/article/BT-CO-20100111-703012.html?mod=WSJ_latesth...

Also Kårstø Nat_Gas Processing was halted (Nor- / Europipe) , but is now ramping up again - http://in.reuters.com/article/oilRpt/idINLDE60A0FW20100111

At some stage 50% of all nat.gas export was affected. UK-Remedy : Make one large thermos of tea in the morning- accept lukewarm tea rest of the day. Case closed /snark

Just great. Now we need the weather to warm up in Norway as well as the UK. Flows via Langeled have been bouncing up and down today (at about half normal flow rate currently). Missing gas is mainly being covered from MRS and SRS storage. At current drain rates we will not get through the winter if supplies via Langeled continue to suffer severe disruption.

Good news is average temp across the UK is now several degrees warmer than it has been recently but that's still well below seasonal norm. An atlantic weather system will finally creep in over the next few days though possibly bringing heavy snow followed by rain and a further slight thaw. It is also possible this weather system will bring more heavy snow to Norway but will ultimately not displace the high pressure currently sitting there. Very cold air will continue to sit across most of Europe.

I hope that permanent solutions to the Norwegian weather-related roduction problems can be found as a supply that becomes unreliable the colder it gets isn't exactly what we need...

Not that this would matter if we actually had decent storage capacity and flow rates though but I'm sure the government will blame Norway if the lights go out in the UK.

And I fell off my bicycle on black ice this morning. At a junction. With a car right behind me.

At least the UK forecast should see us through to the end of the week. The market clearly won't.

Reduce your tyre pressures. Gives better grip.

Winter mountain bike tires with metal studs. Probably not commonly found in the UK.

Common in Norway though, the pipeline in question was built for the British market, so it was probably decided that it could cope with a short skirt and sling backs.

And another Gas Balancing Alert is declared after it appears an attempt to boost supplies on the Langeled pipeline failed.

http://marketinformation.natgrid.co.uk/gas/frmPrevalingView.aspx

Energy supplies running low - I only have enough coal/wood for a few days for our open fire. Only supposed to be a focal point in our living room, not the only source of heat!

The fact that Gordon Brown issued a denial suggests we really are in trouble.

The Generally Assume the Opposite Rule at work--When a public official talks about energy supplies, we can generally assume that the truth is the opposite of what the official is saying.

UK Press coverage now

National Grid issues fourth gas shortage alert

I presume the 6 hours supply refers to Short Range Storage. If so then the most current data says SRS storage at 762GWh as of yesterday. That equates to about 70 mcm so I am not sure where the 92mcm figure they use comes from.

UK gas reserves down to six hours as imports fail to arrive

Currently I note that SRS storage is not being drained. Instead the national grid pipes are draining. That can't go on for long so we need a supply boost or further cut in demand.

I've long considered Britain to be on the same path as the US, only a few steps ahead, so I'm watching intently to see how the politicos react.

We've had many discussions here on the increasing frailty of complex systems in decline, as stronger pushes for economic efficiency erode resilience from many directions (closing of uneconomical resources, lack of new investment, deferred maintenance actions, loss of skilled employee bases, etc.)

On the one hand you could say the "system is working" to adapt to shortages -- the cutbacks to interruptible users may forestall shortages for residences...for now. But at what cost? These measures were once rarely-used "emergency" fall-backs, but by spinning the story these are now common routines. What is the fall-back for a larger emergency, if existing processes are already in use on a monthly basis?

I fully expect the mantra of "nobody could have foreseen" supply disruptions, and "worse than expected" temperatures, and "perfect storm of factors" playing out in the coming days as supply shortages, cold temps, and an unwillingness to conserve drain resources. Will Britain skate through this winter without residential shortages? Will LTS run out before the warmth of April? Will a terrorist take the initiative to make a tight situation critical? There is no way to know for sure, but the key point is that unless the gov't up-plays the situations rather than down-playing it, there will be no meaningful change for next year either.

Last year the tight gas situation was news, IIRC, in March. This year it is news in January. Different dynamics, for sure, but all symptoms of a system engineered to be barely adequate for the nominal case.

Having consulted for oil and and gas companies in both countries during my career as a business analyst, I thing you're right. I did particularly well analyzing the North Sea, because it is just as complex as the Canadian scenario, although there are only 1/1000 as many wells. Few places in the world are as complex.

I'm living in Western Canada, and despite the fact it is the third largest natural gas producer in the world, it has a lot of gas in storage to cover any eventualities. Some of the old gas plants I worked at in my youth are now just storage facilities. There's no better place to store gas than in an old, depleted gas field.

Since it is no longer self-sufficient in gas, the UK obviously needs to have a lot more storage, and to get prepared for a time when supplies are tight and uncertain. The time to get prepared is BEFORE things get tight and uncertain, not during or after.

The reference that storage is down to 6 hours is completely taken out of context.

Volumes in SRS may cover present UK consumption for 6 hours, but this is not what SRS was intended for. SRS withdrawals alone would never be able to deliver 450Mcm/d which demand has been around the last few days.

This is scaremongering at its worst.

LRS, MRS and SRS are intended to cover for shortfalls caused by deliveries being shut down due to technical reasons and/or supplement supplies during periods of very high demand that is demand above supplies from pipelines and LNG receiving facilities.

Ideally I would expect LRS first to complement supplies as demand dictates, then as the capacity from LRS is reaching its maximum, further demand could be met by withdrawals from MRS, and if/when both LRS and MRS are running at maximum capacities, SRS supplies could be drawn upon to balance supplies and demand.

Due to natural gas being compressible it is possible to store some natural gas in the pipelines, commonly referred to as line pack. The pipeline operator may use this line pack to help balance supply and demand in short term. Line pack is only a short term solution.

I am sure that an experienced pipeline operator never would use all this flexibility which line pack offers, as this would make the system “stiff” and hard to operate.

Yes, the situation is bad but that's a bizarre article - especially for The Guardian.

UK National Grid electrical prices going through the roof. Peak "buy" today so far 36p/KWH (59 cents/KWh).

Line pack seems to have increased by 10 bcm over the last few days.

Is this a flow rate side-effect or something?

I think they intentionally boosted it a bit (I think you meant 10mcm not bcm) in anticipation of further problems with Langeled supplies. At one point Linepack today was projected to fall by about 20mcm as the difference between physical supply and demand was not being made up. Currently Linepack is forecast to fall by about 3mcm today following increased supplies via Bacton Interconnector and increased LNG flow.

It may be a flow rate side effect, in that respect that the operators doing day to day operations are very professional and has detailed knowledge of the system.

If they have anticipated/identified areas where more gas may be needed they may have used linepack to move some storage (more linepack) closer to these "hot spots". This is a practical move as it takes time to move gas from storage and/or beach to most of the consumers.

You might say that linepack may be used to improve the responsiveness of the system.

The page and all its comments have been removed from the website. I guess the government decided it was not just inaccurate but damaging to the national interest.

Censorship in operation.

[edit]

Still listed when searching the web site, but the link is broken.

http://browse.guardian.co.uk/search?search=gas+reserves&search_target=%2...

I no longer see it with that search. Instead the top story is...

Russian energy group with the power to plunge Europe into darkness

The whole story (I still had it open in another window)

UK gas reserves down to six hours as imports fail to arrive

• Cold weather interrupts flow from Norway at peak time

• National Grid issues alert for fourth time this month

• Grid temporarily cut off supplies to some factories last week

Comments (18)

Buzz up!

Digg it

Tim Webb

guardian.co.uk, Monday 11 January 2010 15.15 GMT

Article history

A gasometer stands half-full in south London - National Grid says the UK had 92m cubic metres of gas this lunchtime. Photograph: Oli Scarff/Getty Images

Britain's reserve of stored gas stood at just six hours at lunchtime today as imports from Norway failed to arrive.

National Grid issued an appeal for more gas to be pumped to the UK after unusually cold weather led to a shutdown of the Ormen Lange processing centre in the Norwegian Sea, interrupting gas flows to the UK at a time of peak demand.

It is the fourth time this month that the company has issued the notice to the market. The so-called gas balancing alert has been issued only five times in total since the system was introduced three years ago.

Most of the UK's gas arrives by pipeline from the North Sea or continental Europe as well as in liquefied form in tankers, and National Grid expects other suppliers to make up the shortfall. In total, 39m cubic metres of gas – enough to meet a 10th of UK demand – which the National Grid expected to be imported by pipeline from Norway and the continent, via Belgium, did not arrive today.

The Grid's alert follows the move last week to cut off industrial users on interruptible gas contracts to give priority to domestic supply. Big companies such as British Sugar and Vauxhall's car plant at Ellesmere Port were temporarily cut off last Thursday, forcing them to turn to oil-fired generators.

The Ormen Lange field in the Norwegian Sea has been shut since Saturday because of the bad weather, the operator Royal Dutch Shell said today.

"Work is being undertaken to assess the situation," said a Shell spokesman, David Williams, adding that it was still unclear when production would resume.

A Grid spokeswoman said the company was not informed why the imports were diverted from the UK but insisted that it was "business as usual" and that she expected more supplies from the North Sea, liquefied natural gas imports and other imports via pipeline to make up the balance.

The company expects the UK to consume 436m cubic metres of gas today in total, about a quarter more than the seasonal daily average because the UK has been gripped by the coldest snap for decades.

The alert has highlighted the UK's growing vulnerability to gas imports as reserves from the North Sea dwindle. If the UK's storage facilities are full, the UK has enough gas supplies for about 16 days, based on average demand. France's storage capacity would last a maximum of 91 days and Germany's 73 days.

But gas storage owners are allowed to almost empty UK storage facilities to export to the continent.

This lunchtime, the amount of gas in storage in the UK, according to National Grid, was just 92m cubic metres. Based on today's expected demand, that would last less than six hours. But National Grid insists that there are plenty of measures that can be taken to make sure the country does not run out of gas.

Kaarstoe, a gas plant on Norway's southwest coast, was increasing production on Monday after a shutdown over the weekend due to icing, which affected natural gas flows across the North Sea.

just found this update (with sheepish note)

http://www.guardian.co.uk/business/2010/jan/11/uk-gas-reserves-imports-fail

National Grid appeals for more gas as imports fail to arrive

• Cold weather interrupts flow from Norway at peak time

• National Grid issues alert for fourth time this month

• Grid temporarily cut off supplies to some factories last week

An earlier version of this story incorrectly stated that UK stored gas reserves had fallen to six hours. After further briefings with National Grid, we understand the figure is actually seven days. The discrepancy resulted from a misunderstanding of how the supply data was presented. We apologise for the error

Comments (85)

Buzz up!

Digg it

Tim Webb

guardian.co.uk, Monday 11 January 2010 17.26 GMT

Article history

A gasometer stands half-full in south London. Photograph: Oli Scarff/Getty Images

.

National Grid issued another appeal this lunchtime for more gas supplies to be pumped to the UK after imports from Norway failed to arrive.

Unusually cold weather led to a shutdown of the Ormen Lange processing centre in the Norwegian Sea, interrupting gas flows to the UK at a time of peak demand.

The so-called gas balancing alert has been issued four times so far this month. National Grid has only used it five times in total since the system was introduced three years ago.

A spokeswoman said later in the afternoon that the market had responded and alternative supplies procured to make up the shortfall.

Most of the UK's gas arrives by pipeline from the North Sea or continental Europe as well as in liquefied form in tankers.

The alert was sparked after 39m cubic metres of gas – enough to meet about a 10th of UK demand – which the National Grid expected to be imported by pipeline mostly from Norway and also the continent, via Belgium, did not arrive earlier today.

National Grid's alert this lunchtime follows the move last week to cut off industrial users on interruptible gas contracts to give priority to domestic supply. Big companies such as British Sugar and Vauxhall's car plant at Ellesmere Port were temporarily cut off last Thursday, forcing them to turn to oil-fired generators.

The Ormen Lange field in the Norwegian Sea has been shut since Saturday because of the bad weather, the operator Royal Dutch Shell said today.

"Work is being undertaken to assess the situation," said a Shell spokesman, David Williams, adding that it was still unclear when production would resume.

The company expects the UK to consume 436m cubic metres of gas today in total, about a quarter more than the seasonal daily average because the UK has been gripped by the coldest snap for decades.

The alert highlighted the UK's growing vulnerability to gas imports as reserves from the North Sea dwindle. If the UK's storage facilities are full, the UK has enough gas supplies for about 16 days, based on average demand. France's storage capacity would last a maximum of 91 days and Germany's 73 days.

But gas storage owners are allowed to almost empty UK storage facilities to export to the continent.

The UK had about seven days of gas supplies – or just over 3,000m cubic metres – in storage today, according to the National Grid. National Grid insists that there are plenty of mainly market based measures that can be taken to make sure the country does not run out of gas. But the Conservatives say there are not enough safeguards in place if the gas market fails.

Kaarstoe, a gas plant on Norway's southwest coast, was increasing production on Monday after a shutdown over the weekend due to icing, which affected natural gas flows across the North Sea.

Yes, I have the html source saved as well. I don't think I've seen a story just "vanish" from The Guardian website before. Perhaps be corrected and updated but not completely pulled. [Edit: I see there's a corrected version up now]

Never mind it must be the Russians to blame - that's obviously the party line.

Typical western russophobic hysterics. What's the excuse for having weather disrupt your gas supply? Did the f*ckwit engineers decide that temperatures would never fall below a certain level that they pulled out of their a**? Or is it all thanks to that superior western knowhow and technology.

Story can be found in, yes, the Guardian Facebook site:

http://www.facebook.com/note.php?note_id=249996777187

Been watching the LNG import terminal stock levels falling. Latest update shows

Can't keep that drain rate up for more than a few days so I hope there's new LNG supplies incoming.

As far as I can see the "firm capacity" supply shortfall identified at Milford Haven LNG terminal (and snuck out in the middle of the night at the weekend in the hope nobody would notice) still applies so some contracted supply is not available to someone.

It took me a couple of minutes to understand what you are saying. In the US, 10/01/2010 is October 1, 2010 and 11/01/2010 is November 1, 2010. You are obviously using the British order, so you are talking about January 10 and January 11, 2010.

We hope there is another LNG ship coming shortly.

European order makes logical sense. Most significant first : day/ month/ year, and further, the metric system is King :-)

Here is the Metric_system_adoption_map

What are you -the US,Burma and Antarctica- waiting for ?

In Canada we tend to use the ISO date format (2010-01-10 and 2010-01-11) because we can't make up our mind between American and European date formats. The ISO format is unambiguous, but when you see a date like 10/11/2010 in Canada, you really have no idea what it means. It depends on whether the writer has British, French, or American origins.

An interesting party game to play in Canada is to ask people what languages their grandparents spoke. Quite a few people have grandparents who came from four different countries and spoke four different languages.

I go for the ISO format simply because if you have a bunch of computer files of the same name but with the date appended, that format will put them in the proper date order.

I think we are currently draining the LNG terminals faster than contracted tankers were booked to arrive. LNG import flows into the grid have been boosted by maybe 30-50% over the recent average rate (which I presume matched contracted tanker supply). So it seems to me we have to cut back on this flow rate soon (Langeled pipeline where are you?) or hijack a few more LNG tankers from some Somalis :)

Was Murphy an optimist?

"If you perceive that there are four possible ways in which something can go wrong, and circumvent these, then a fifth way, unprepared for, will promptly develop."

So what happens next is the UK will probably book every available spot LNG cargo from now until the end of March. Once the contracts have been signed Murphy's law would suggest the Langeled problems will immediately be fixed, Britain will be hit by a winter heat-wave and a pensioner in Blackpool will find the world's largest gas-field under their back garden.

And by the end of April we'll be drowning in LNG :-)

Looking over the National Grid website it appears to me that in the short term the storage capcity really isn't the problem.

The Non-Storage Supply (NSS) is a nominal 363MCM/day. So any greater demand has to come from storage (LRS, MRS, SRS and linepack).

The average demand from the 1st Jan to 10th Jan has been 424MCM/day.

So the amount to come from storage has to be 63MCM/day. The website data shows the average from LRS, MRS and SRS has been 72MCM/day. I don't know where the difference is from, linepack maybe.

The maximum withdrawal from storage is a nominal 134 MCM/day from all three(although the average withdrawals have been higher from LRS than nominal).

So over the next week or so LRS and MRS could handle the difference, at current use maybe not so much after that. LRS could in fact run at full tilt for another 56 days supplying 42MCM/day.

In summary just my thought is that in the next week there won't be any shortage and the national grid are conserving storage for later in the year.

Of course none of this addresses the long term issues and dependency on imports.

Well the Non-storage supply figure will assume all pipelines are working and contracted supply is being delivered. Supplies via the Langeled pipeline have now failed for the second time in a few days so additional storage flow has been called upon to plug some of that gap over the last few days while extra supplies are attempted to be sourced elsewhere or demand curtailed.

Yes, MRS can be drained at current rates for another week or so but LNG at the import terminals runs out about Friday at current drain rates and Milford Haven import terminal has already effectively declared "Force Majeure". I hope more tankers are arriving and I hope the bad weather forecast for the area of the Milford Haven terminal doesn't disrupt things further.