Drumbeat: January 11, 2010

Posted by Leanan on January 11, 2010 - 10:26am

Devaluation Sparks Chaos in Caracas

CARACAS -- President Hugo Chávez's decision to devalue Venezuela's bolivar and impose a complicated new currency regime may paper over some growing cracks in the economy, but it is also setting the stage for bigger problems down the road for the country's oil-rich nation and its populist leader.Over the weekend, there were signs that Mr. Chávez's slashing of the "strong bolivar" currency could create as many problems as it solves in Venezuela's economy, provoking a wave of anxiety that sent Venezuelans scurrying to spend cash they feared could soon be worthless.

At Caracas's middle-class Sambil shopping mall, lines at cashiers reached 50-deep. Carmen Blanco, a 28-year-old accountant, waited to buy a 42-inch flat-screen television she doesn't need because she already has one at home.

"It doesn't make any sense to keep my savings," Ms. Blanco said Saturday. "I'd love to see how things work in a normal country."

China car sales 'overtook the US' in 2009

China has said it overtook the United States to become the world's biggest car and van market in 2009.The China Association of Automobile Manufacturers said 13.6 million vehicles were sold within the country last year.

That compares with just over 10 million vehicles in the US, which was previously the world's largest market.

Ford sweeps Detroit Auto Show awards

DETROIT (CNNMoney.com) -- After finishing off an enviable year for a domestic automaker, Ford Motor Co. won both the North American Car and Truck of the Year Awards presented Monday at the start of Detroit's North American International Auto Show.The Ford Fusion Hybrid sedan won Car of the Year and the Ford Transit Connect van won Truck of the Year.

Carolyn Baker And Keith Farnish Dialogue About The Great Transition

I would probably recommend, if I was forced to be prescriptive, the following first stages of withdrawal:1) Reduce your consumption of new, non-perishable items to an absolute minimum, which will require a certain level of willpower and tenacity, particularly if you have children and live in an urban or suburban location. Combine the reduction in "newsumption" with the purchase of pre-owned items and the repair of existing items, and this becomes a lot easier.

2) Localise your activity, including where your food originally comes from (if you grow it yourself or communally, then you cut out all sorts of economic ties); how far you travel to obtain goods and services - including how far people providing these to you have to travel; how far you travel to "work" (see later); and where your energy comes from, so if you can generate it yourself, so much the better.

Houston firm announces big find deep beneath Gulf shelf

Freeport Exploration Co. today announced what it said could be one of the largest oil and natural gas discoveries in the shallow waters of the Gulf of Mexico in decades.The discovery was made at the Davy Jones ultra-deep prospect located on South Marsh Island Block 230 in about 20 feet of water and 10 miles off the Louisiana coast, the New Orleans company and Energy XXI, one of its Houston partners in the project, said in statements this morning.

BP poised to become bigger than Shell again

BP Plc is poised to unseat Royal Dutch Shell Plc as Europe's largest oil company by market value for the first time in more than three years after reviving output growth and cutting costs at a faster pace.

Economists: Appliance rebates waste government money

Taxpayers will lose a significant portion of the $300 Million they are shelling out for the federal government's appliance rebate program and the energy-saving program could actually increase energy usage, two University of Delaware economists say.

UK gas reserves down to six hours as imports fail to arrive

Britain's reserve of stored gas stood at just six hours at lunchtime today as imports from Norway failed to arrive.National Grid issued an appeal for more gas to be pumped to the UK after unusually cold weather led to a shutdown of the Ormen Lange processing centre in the Norwegian Sea, interrupting gas flows to the UK at a time of peak demand.

It is the fourth time this month that the company has issued the notice to the market. The so-called gas balancing alert has been issued only five times in total since the system was introduced three years ago.

On Thursday, January 23, snow began to fall in the South East. It was the start of Britain's most severe and protracted spell of bad weather during the 20th century.Housewife Florence Speed was one of millions who shivered. 'I was frozen today,' she noted in her diary. 'Gas is on at such low pressure. Worked with scarf over my head, mittens on, and a rug round my legs.'

/EIN PRESSWIRE/ The recent cold spell in the UK has residents turning up the heat, but the lack of wind and subsequent failure to produce wind energy put into doubt the future of wind farms as a reliable energy resource.During the cold surge, wind farms in the UK produced a fraction of the energy they're intended to produce due to the absence of wind. According to analysts, such conditions in the future means the UK could be in for a tough time when the country completes its goal of having wind energy account for 25% of the nation's electricity 10 years from now.

Saudi Aramco oil & gas project focus

“While oil fields in many basins throughout the world are becoming increasingly mature, the share of the Middle East in global oil supplies will steadily rise. I am proud to say that Saudi Aramco has played, and will continue to play, an even bigger role as one of the key suppliers of oil to India, Asia and the whole world,” said Al Falih.Here are the project specific excerpts from his keynote address.

Chesapeake warns of US gas dip

Oklahoma-based Chesapeake Energy said today there was a risk US gas prices could fall back to low levels if the economic recovery faltered, prompting the gas producer to boost hedging in recent months.

Pakistan: Power cuts upset life, candle demand up

Electricity loadshedding has affected the daily routine of the twin cities’ residents besides increasing the demand of candles and emergency lights.The power outages during the day and night have disturbed the study routine of school going children and have also annoyed housewives in fulfilling their daily chores.

Old Maoist Policy Makes China’s Chill Worse

China’s power supply system has been pushed to the brink again amid unusually cold weather. Holdover policies from China’s Maoist past aren’t helping.China’s energy sector remains one of the few industries where there are strong remnants of the old planned economy. While the prices of most things are set by the market, energy is still tightly controlled by the central government.

For example, while coal prices have been liberalized, state-set electricity prices have been kept relatively low. That’s discouraged power producers from keeping costly inventories of coal.

Attack on Pipeline Further Strains Nigeria

An attack on a crude-oil pipeline operated by U.S. oil giant Chevron Corp. is the latest in a series of political and security setbacks for this embattled West African nation.

Fusion breakthrough a magic bullet for energy crisis?

Sceptics and environmentalists may be locked into endless arguments around global warming, but there's little debate that an energy crisis looms large.A Florida based research team, however, may have found a solution to the world's energy woes that could provide a clean and near limitless supply of energy in as little as a decade.

Jobs await those with cutting skills

Local food is part of the reason for this shortage, and for all the right reasons. The independent meat processors represent small- and medium-sized companies, and despite the recession, they’ve held their own. They’re poised for more growth as local food movement grows. Consumers are turning to them for homegrown and specialty items that most big box stores can’t provide. Specialized workers are needed to accommodate these needs.

BP, Chevron Urge California to Reject Carbon Auction Proposal

(Bloomberg) -- Oil refiners BP Plc and Chevron Corp. want California officials to reject a proposal that would force industrial companies to spend as much as $21.9 billion a year on pollution rights auctioned by the state government.California plans a cap-and-trade program starting in 2012 that would create a market for carbon dioxide permits, also called allowances, to cut emissions. Legislation to create a national cap-and-trade program in 2012 is stalled in the U.S. Senate and California is one of several states planning their own actions if a federal bill doesn’t pass.

Driving the Volt past the limit: Drained of its battery power, the Volt finally reveals how it performs when running on gasoline.

What happened was both imperceptible and impressive. Forced to start generating its own electricity on the fly, the Volt's performance changed not a bit. Criticisms that the Volt running on gasoline power would perform like a cinderblock look to be wrong. While not all the questions about this car have been answered -- some will have to wait until wait until we have thousands of them on the road --we now know how the Volt will drive on gasoline power.

LNG Developers May Give Up Bigger Stakes in ‘Buyer’s Market’

(Bloomberg) -- Developers of Australian liquefied natural gas projects may offer potential customers larger stakes in their ventures as they jostle to win fuel-supply contracts, analysts said.“A number of projects are targeting final investment decisions in 2010, so there’s a lot of direct competition,” Mark Greenwood, an analyst at JPMorgan Chase & Co., said by phone today. “There’s certainly demand out there in the 2015 timeframe, but a number of projects are marketing gas at the moment, and customers have choice.”

Researchers to map High Arctic island

An upcoming research expedition to an Arctic island could help kickstart a new wave of oil and gas exploration in Canada's Far North.The research team, led by Keith Dewing of the Geological Survey of Canada, will travel to Ellef Ringnes Island next summer to collect data from areas where petroleum resources were first discovered nearly half a century ago.

Russia's output of crude oil up, gas down in 2009

MOSCOW (Xinhua) -- During the past year, Russia's crude oil output increased while the gas output plunged, said the state enterprise Central Dispatching Department of Fuel Energy Complex (CDU TEK) on Monday.Statistics showed that the crude oil output climbed 1.2 percent year-on-year to 494.2 million metric tons, while the natural gas output slashed by 12.4 percent to 582.4 billion cubic meters.

Coal shortage, electricity rationing continue in China as cold weather lingers

BEIJING (Xinhua) -- China was still suffering from coal shortage because of the lingering cold weather and electricity rationing continued in five provinces and municipalities, including the country's major coal producer Shanxi Province.As of Sunday, coal reserves in 598 major power plants were decreasing and could sustain for nine days. Coal storages in 205 power plants could not run for seven days, a national alarming level, according to the National Power Dispatch and Communication Center.

Talisman budgets for shale gas spending

Talisman Energy Inc. TLM-T plans to spend $5.2-billion on capital projects in 2010, a 10-per-cent increase over 2009.The Calgary-based international oil and gas company says North American shale properties will receive $1.6-billion of that, or more than one-third of the total.

S. Africa Must Choose Between Jobs and Power Supply

(Bloomberg) -- South Africa’s power regulator will this week be told by labor unions and companies that the electricity price increases that the national power utility says it needs to avoid blackouts will slow economic growth, boost inflation and cost jobs.

Tullow Oil Plc Plans to List in Uganda, Daily Monitor Reports

(Bloomberg) -- Tullow Oil Plc plans to sell shares on the Uganda Securities Exchange in April, Daily Monitor reported, citing Elly Karuhanga, the Tullow Uganda Chairman. Tullow held talks with the Uganda Security Exchange and the Capital Markets Authority about the planned cross-listing of the London-listed company, the Kampala-based newspaper reported. Tullow is to cross-list in Uganda to allow locals benefit from its success, it added.

A pipeline to prosperity in Afghanistan

Last month saw a dramatic shift in one country’s control of its largest natural resource when the 1,833km China-Turkmenistan natural gas pipeline was inaugurated. The pipeline runs from Turkmenistan’s Samandepe gas field to central China. This was a geo-political coup for Turkmenistan, freeing Ashkabad from Russian domination of pipeline routes coming out of central Asia. Securing multiple pipeline routes out of the Caspian Sea as a means to circumvent Russia was also the basis for the Baku-Tbilisi-Ceyhan oil pipeline, which freed Azerbaijan from Moscow’s domination.

Nigerian Group to Protest President’s Absence, Power Vacuum

(Bloomberg) -- Nigerian opposition figures and rights activists plan a protest march in the capital, Abuja, tomorrow over the power vacuum they say has been created by President Umaru Yar’Adua’s absence from the country since November.Save Nigeria, which includes opposition parties, pro- democracy groups and human-rights campaigners, is organizing the march, Bamidele Aturu, a supporter of the group, said on Jan. 8 by phone from his law office in Lagos, the commercial hub.

Road Projects Don't Help Unemployment

Even within the construction industry, which stood to benefit most from transportation money, the AP's analysis found there was nearly no connection between stimulus money and the number of construction workers hired or fired since Congress passed the recovery program. The effect was so small, one economist compared it to trying to move the Empire State Building by pushing against it....Transportation spending is too small of a pebble to quickly create waves in the nation's $14 trillion economy. And starting a road project, even one considered "shovel ready," can take many months, meaning any modest effects of a second burst of transportation spending are unlikely to be felt for some time.

The U.S. Department of Energy's decision to dole out $47 million in research funding to improve energy efficiency in data centers is an interesting approach to the problem. It's also one that will stir up some controversy for years to come.

10 Alternative Energy Options Plays for 2010

Do you like to take risks, want to fight climate change and prepare for the impact of peak oil? If you would also like a chance to make a big return on your investments, here are ten investments you can make that might do all of those things.

TransAlta to expand N.B. wind farm

TransAlta Corp. TA-T says it will spend $100-million to expand the Kent Hills wind facility in New Brunswick, southwest of Moncton.The Calgary-based company announced Monday that the electricity produced at the expanded wind farm will be sold to New Brunswick Power under a 25-year distribution agreement.

Irrational fears give nuclear power a bad name, says Oxford scientist

The health dangers from nuclear radiation have been oversold, stopping governments from fully exploiting nuclear power as a weapon against climate change, argues a professor of physics at Oxford University.Wade Allison does not question the dangers of high levels of radiation but says that, contrary to scientific wisdom, low levels of radiation can be easily tolerated by the human body.

EU Carbon May Avoid Drop on Utility Buying, Deutsche Bank Says

(Bloomberg) -- European Union emission-permit prices may avoid a decline in coming weeks as utilities buy the allowances, according to Mark Lewis, Deutsche Bank AG’s carbon analyst in Paris.“The incumbent generators have a daily need to buy,” while industrial companies with surplus permits don’t have an “equivalent” need to sell, Lewis said today by telephone. While Lewis has forecast prices will probably fall as factories sell some spare allowances, that’s not guaranteed, he said.

Australia: Federal and Victorian governments hunt for carbon storage places

THE federal and Victorian governments will start looking for greenhouse gas storage basins in Bass Strait next month, kick-starting up to $6 billion worth of appraisal and development expenditure over the next 15 years.Victoria's Department of Primary Industries plans a seismic survey in February and March of potential storage areas south of the big producing fields in Bass Strait's Gippsland Basin.

Kurt Cobb: Making society forecast-proof

The trouble with forecasts is that they are almost always wrong. That's in part because the accuracy of forecasts deteriorates rapidly with time. I might predict quite well what I will be doing tomorrow. But predicting accurately what I will be doing exactly one year from today or exactly 10 years from today is exceedingly difficult if not impossible, even if I already have something planned.How much harder it is then to predict the state of complex systems such as the world's energy delivery systems 10, 20 or 30 years hence.

...And yet, we have premised our entire future on business-as-usual forecasts made by leading energy consulting firms and government agencies. Strangely, some of these forecasts come without even the slightest hint about how unreliable they may be. A forecast from the highly influential energy consulting firm Cambridge Energy Research Associates tells us we have precisely 3.74 trillion barrels of remaining recoverable oil in the world. It concludes that a peak in world oil production is still at least 20 years off and is to be followed by an "undulating plateau that may well last for decades." Neither a range nor an error bar can be found in this forecast.

Oil rises above $83 amid strong Chinese demand

Oil prices jumped above $83 a barrel Monday amid signs of strong Chinese demand for crude, a weakening U.S. dollar and a strong flow of speculative funds into commodities.

Cost of gas up 14 cents in the last three weeks

CAMARILLO, Calif. - The average price of regular gasoline in the United States is up 14 cents over a three-week period to $2.74.

U.S. Economic Energy Efficiency: 1950-2008

As the above graph illustrates, the amount of energy (in BTU) required to produce a dollar of GDP has been dropping steadily, from close to 20,000 BTU in 1949 to 8,500 BTU in 2008. Just how fast has that drop been occurring?

Corruption-plagued Iraq joins oil transparency group

BAGHDAD (Reuters) - Iraq joined a global transparency initiative Sunday in a bid to heal its reputation as a nation plagued by corruption and misuse of its vast oil wealth.

Russian energy group with the power to plunge Europe into darkness

Gazprom has so much natural gas under the tundra of Siberia that its energy resources are equivalent to all the oil and gas fields owned by western energy companies put together.

Saudi Aramco Maintains February Oil Volumes to Asia

(Bloomberg) -- Saudi Arabian Oil Co., the world’s largest producer, will supply full volumes of crude to refiners in China, South Korea and Taiwan for February.Saudi Aramco, as the company is known, will provide 100 percent of cargoes sold under long-term contracts next month, according to a Bloomberg News survey of refinery officials in the three Asian nations, who asked not to be identified because of confidentiality agreements with the company.

Shell Shuts Ormen Lange Gas Field After Bad Weather

(Bloomberg) -- Royal Dutch Shell Plc said its Ormen Lange natural-gas field, Europe’s third-largest, halted output this weekend and remains closed because of bad weather.“Production at Ormen Lange has been shut as a result of continued bad weather in Norway” and Shell is working to resume operations, David Williams, a company spokesman, said today by telephone from The Hague. Shell operates the Norwegian field.

U.S. government to release emergency heating subsidies

WASHINGTON (Reuters) - The U.S. government is set to provide more than $1 billion over the next several weeks to help low-income families pay their energy bills, an agency spokesman said on Friday.

Oil tops China-Nigeria talks agenda

ABUJA — China's Foreign Minister Yang Jiechi held talks with Nigerian officials Friday on oil exports to energy-hungry Beijing.China was looking for imports but negotiations with Nigeria had only started, said Yang, who is on a tour of Africa.

There are plenty of peak oil investment funds, but this is the first peak demand - or post-oil, as they call it - fund that we’ve heard of. The idea behind London-based Beetle Capital is not only everything peaks, but that the world is already in a peak oil phase and will soon enter a phase that is not just post-oil, but post-growth.

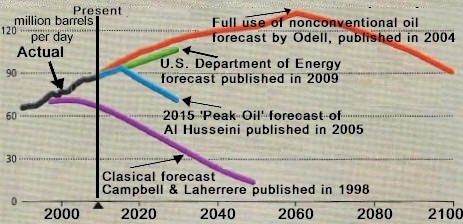

Forecasts vary widely for future world oil production. The classical Hubbert type model (seen in the report as purple line showing peak oil as having already occurred) remains popular among many learned analysts. Some analysts have tweaked their variant of Hubert's bell-shaped curve and place peak oil as a near term event. Other, more optimistic forecasts, such as one by the U.S. government (seen in green), take into account expectations for the discovery of new oil fields and technology's push to get more oil out of old fields. Full development of non conventional sources such as tarsands and oil shales may keep the curve rising for several decades (depicted in red line).

Baby Boomer Demographics, Household Formation and the Hoax Economy

The other obvious difference today is the massive debt overhang occurring concurrently with peak Boomer peak demographic drag effects AND Peak Oil.There is no historical or demographic precedent in modern western history for what we face. One has to go all the way back to the Middle Ages to find anything remotely similar in terms of scale of combination of resource depletion, population constraints, risk of large-scale pandemics, and climate change.

World Future Energy Summit dissects renewable energy issues

As one of its several founding convictions, the International Renewable Energy Agency (IRENA), which is closely associated with the summit, quotes Saudi Arabia’s King Abdullah on its website to argue that diversification away from oil is a wise insurance policy. The Middle East is rich in oil, but once the “oil boom” is over, “…all of us must get used to a different lifestyle,” the king said. “Peak oil” in Saudi Arabia and Kuwait is expected to occur in 2014 and 2013 respectively, according to IRENA. On the website it points to the potential profit that lies in alternative energy projects, particularly in solar energy projects in areas with abundant sunlight."Preparing for the future is not a threat," said IRENA interim director-general Helene Pelosse. "Many oil producing countries are blessed with sun — renewable energy thus presents them with the unique opportunity to diversify their national energy mix."

Our view on alternative power: Cape Wind battles reflect lack of energy seriousness

The steady winds that blow along the nation's coastlines are an untapped energy resource that could reduce the need for coal, oil and natural gas. In fact, one group proposed placing enough windmills in Nantucket Sound to supply 75% of the Cape Cod area's electricity needs.That was nine years ago.

The battles since then vividly illustrate why wind energy still provides just one-half of 1% of the nation's energy, and why all alternative energy accounts for less than 5%. Virtually everyone agrees that the country's dependence on coal and foreign oil is destructive. But when the time arrives to actually do something, the response is too often "not here" or "not now."

Opposing view: Not every location works

Cape Wind could not have picked a worse location to crowd with 130 massive steel towers. The desecration of tribal land is just the tip of the iceberg; the Coast Guard has told fishermen they will have to earn their livelihoods elsewhere, and the FAA has called the project "a presumed hazard" to aviation safety. Cape Wind presents a menace to tourism, a danger to threatened birds and marine life, and an end to the majestic beauty of Cape Cod and the Islands.

China Drops ‘70% Home-Made’ Rule for Wind Turbines

(Bloomberg) -- China, the world’s third-biggest producer of wind power, has dropped a rule stipulating that more than 70 percent of the wind turbines used in the country must be made domestically, whether by foreign or local companies.The policy has been scrapped recently and there is no longer a quota, Shi Lishan, deputy director of renewable energy at the Beijing-based National Development and Reform Commission, said by telephone today. The change will spur foreign investment in the industry, according to a China Business News report.

Economists start to consider that money can't buy happiness

With the issue of climate change becoming ever more urgent and a growing recognition that economic growth does not make people any happier, there are growing calls for growth and the endless consumption of ever more material goods to be downgraded as political goals.The pursuit of growth and endless rises in consumption every year have become part of the national psyche, since Harold Macmillan told the electorate they had "never had it so good". The idea that more, bigger and cheaper is better is a powerful one, and it will be hard to dislodge. It affects the way we think, the things politicians aim for and how journalists report events.

Campaign to get kids walking, biking to school to fight global warming

Advocates of a Marin campaign to get more kids walking and biking to school are expanding their initiative, fueled by a $175,000 grant to combat global warming.

Meg Whitman's climate change strategy

In what may be a risky political move, the GOP candidate for governor has come out strongly against the state's law on regulating greenhouse gas emissions.

Report: 2009 was a warm year in USA

Despite an unusually chilly year in the Midwest, the national U.S. temperature was slightly above average in 2009, according to the National Climatic Data Center.This marked the 13th consecutive year the nation experienced a warmer-than-normal average temperature. Since the late 1980s, 21 of the last 24 years have been unusually warm in the USA. Beginning in late 1800s, when accurate weather records began, the country has been warming at a rate of about 0.1 degree per decade, according to the climate center.

Pope denounces failure to forge new climate treaty

VATICAN CITY – Pope Benedict XVI denounced the failure of world leaders to agree to a new climate change treaty in Copenhagen last month, saying Monday that world peace depends on safeguarding God's creation.

U.K. to Meet Carbon Goals Only Due to Recession

(Bloomberg) -- The U.K. is only on track to meet its self-imposed greenhouse gas reduction targets because of the recession, a panel of lawmakers from the nation’s three main political parties said.The Environmental Audit Committee said Britain should step up efforts to reach an international agreement on capping emissions of heat-trapping gases and ensure they peak “as soon as possible.” The findings were published in a 51-page report in London today.

Farm Bureau Fires Back Against Climate Bill's 'Power Grab'

The largest U.S. farm group will "aggressively" fight back against any attempts to change the landscape of American agriculture -- including the farm bill or animal rights campaigns, American Farm Bureau Federation Bob Stallman said yesterday.

Our collective response to the emerging catastrophe verges on suicidal. World leaders have been talking about tackling climate change for nearly 20 years now — yet carbon emissions keep going up and up. "We are in a race against time," says Rep. Jay Inslee, a Democrat from Washington who has fought for sharp reductions in planet-warming pollution. "Mother Nature isn't sitting around waiting for us to get our political act together." In fact, our failure to confront global warming is more than simply political incompetence. Over the past year, the corporations and special interests most responsible for climate change waged an all-out war to prevent Congress from cracking down on carbon pollution in time for Copenhagen. The oil and coal industries deployed an unprecedented army of lobbyists, spent millions on misleading studies and engaged in outright deception to derail climate legislation. "It was the most aggressive and corrupt lobbying campaign I've ever seen," says Paul Begala, a veteran Democratic consultant.

Tenth Annual Weblog Awards: The 2010 Bloggies

Most people on Twitter seem to be putting us in the Topical Blog category, but there are other places one could nominate us.

You have to submit three blogs in each category that you submit to...then you also have to submit an email address and click on a link they send you to confirm your vote.

After 371 days of unemployment, I head back to work for the man today. During this break, I managed to do a few epic triathlons that I always had on my list, but no time to train for. World's Toughest Half Ironman in May and Escape from Alcatraz in June. I also took a month on the road in my motorhome sucking down cheap diesel and visiting friends and relatives I hadn't seen in some time. The second half of the break was mostly spent in hospitals. I finally had my wrist surgury done and my daughter had a few surgeries to fix various broken items.

I've learn a few things in the last year a relearned a few. First, most people just don't want to be doomers. The concensus I gathered in my journeys is that those who are truly aware are choosing to deal with it as it comes. And those who don't assume things will get back to normal and wouldn't know The Oil Drum from an oil drum. Most people however, blame most problems on the President. Any president, and always the one they didn't vote for.

The financial crisis has largely turned into a hoax. Anectode in point, that new mercedes convertible I bought last month with no money down? No job either and no one cared. The new job pays 11% more than the old one, with many more benefits. And I seriously thought the old job payed too much. No stock options though, but I'll take the cash. Through various asset sales, I did manage to lower total outstanding debt by over 100,000, which was costing my 2000 a month in after tax payments. The net on the mercedes is +56 from the old payment.

I benefited to the tune of 12,600 from the stimulus in the form of COBRA subsidies and the unemployment bump, as well as a few tax changes. That's in addition to the 23,000 in regular unending unemployment checks. I can live pretty okay for a while on 3000 tax free a month plus all the acorns I squirreled away for just this emergency.

First order of business today. Crank the 401K to the max and set up direct deposit with 1000 a month going directly into my unemployment savings account which ended with a balance of 1800 dollars. I had enough to last a year, and made it. It will take one year or two to save up enough to last another year, but I'm removing the cap this time.

All in all, another year and I'm still here. I can't say I'm optimistic about the future, but I can tell you I won't be online reading collapse articles at work anymore.

-Hoax it may be but I think that many people have woken up to how precarious their finances where becoming and rather than ever increasing debt we are seeing attempts to repay that dbt in record amounts in the West. Since the creation of credit was an increase in the money supply the downslope of repaying debt is inherantly deflationary. Counter to this we have the loose money policy of the FED and such humbug as 'QE' -injecting money, the Bernanke helicopter drop...

This money is going straight back to the banks and they are practically rabid in their hunt for profits/the next bubble.

I wouldn't be surprised if we see another bubble forming a lot sooner than most people expect. Follow the money.

Nick.

The new bubble is the security state. Be very afraid.

The other new bubble is the disease state. Be very afraid.

Better yet, turn off the TV and don't succumb to induced hysteria.

You made it through a year with no job, managed to get the gov't (me) to pay for it, bought a new Mercedes, and got a new, higher paying job, THUS collapse isn't happening and can never happen?

I've never taken drugs, but sometimes I think I should; I never get to see the wacky, psychedelic stuff some people see.

Cheers

Why don't you drive your Mercedes convertible and park next to the folks in line at your local unemployment office and tell them about your good fortune and that the financial crisis has largely turned into a hoax, I'm sure they'd be more than happy to tell you where to go and what to do with your fancy car...

Yup... you crank up your 401K, and be sure to max it out in emerging nations stocks!

Thing I like the most about this fiction was the part about

That means ya get money from yer old man, or a trust, eh? He gave you or you inherited appreciated stocks? Nice way to avoid the "hoax." Wish everyone had your wonderful fantasy life.

'..once I built a Railroad, now it's gone,

Brother can you spare a dime..'

A new Mercedes convertible?

Possibly a diesel VW might have been a better investment given the probable future fuel cost trendlines. There are some really nice VW Golfs. And it would be nice to have one with room to sleep in the back and carry your bicycles, if things go really bad, or if you feel like mountain biking someplace remote.

Two years income in the bank is safer than one year, because, you never know, you know. Some crashes last longer than a year. Other than that, more power to you. Keep your powder dry and don't take any wooden nickels.

Re: Shell Shuts Ormen Lange Gas Field After Bad Weather

Should be flowing at about 70 mcm/day

The UK National Grid has now issued a 4th Gas Balancing Alert due to insufficient supplies. Being discussed at Is the United Kingdom facing a natural gas shortage?

There is a current physical shortfall in supply of about 20mcm (about 5% of total demand) projected by National Grid for today thus the GBA. At current flow rates that rises to a projected shortage of 40mcm tomorrow (current physical supply 403mcm, projected demand tomorrow 443mcm).

I "moved" the Is the United Kingdom facing a natural gas shortage? above Drumbeat, so it would be easier to find.

Link up top: World Future Energy Summit dissects renewable energy issues

Saudi King says Saudi Arabia to peak in 2014!

2014 is one year after Manifa is supposed to produce its first oil. Manifa is the last hurrah for Aramco.

Ron P.

Actually, only the first quote in that sentence is attributed to the Saudi King, it is IRENA that is predicting the Saudi and Kuwaiti peaks.

If this is true, it must mean that Ghawar is going the way of Cantarell. With Khurais, Shaybah, Manifa, etc. coming online or increasing production, other big fields must be in big decline and those other big fields must be Ghawar and Abqaiq. The same thing may be happening with Burgan. It looks like Matthew Simmons was right after all.

Saudi's most depleted fields are:

Abqaiq

Ghawar

Berri

Safanayeh

Am not sure if Abqaiq is producing any oil. Its production did not show up in a 2004 Rice study.

The folks at Rice didn't have any better information than anyone else. According to Saudi Aramco, Abqaiq was producing 400k barrels/day in 2006. And they were still drilling more wells there.

http://www.theoildrum.com/node/3923

According to Jean Leherrere:

Abqaiq reached peak production in the 1970's.

Sometimes ARAMCO shut in production of fields to abide by OPEC quotas.

I have frequently used the quote by the Saudi oil minister, in early 2004--that they were determined to support the $22-$28 OPEC oil price band, and I think that he was telling the truth (in early 2004), since they significantly increased their net oil exports in 2004 and 2005, in an attempt to bring oil prices down.

But then we have the 2006-2008 data points, when their net exports fell below their 2005 annual net export rate of 9.1 mbpd by a significant margin, as oil annual oil prices hit $100 in 2008.

If the 2010 annual oil price exceeds the 2009 annual price, and if 2010 annual Saudi production does not exceed their 2005 rate, they will have shown five years of production (and net exports) below their 2005 rate, as oil prices increased year over year in four of the five years.

IMO, 2005 was probably the final production peak, but far more importantly, I think that it is extremely unlikely that the Saudis will ever again exceed their 2005 annual net export rate.

Hi Westexes, I may have missed it because I had a period of abstinence from TOD but did you ever publish your ELM report?

Regards, Nick.

On my "To Do" list.

I continue to be rather uncertain as to where the difference is between how much the KSA CAN pump, and how much they WILL pump. I'm inclined to think that they have made a basic strategic decision to try to conserve and stretch out their reserves as long as possible, rather than pumping as much as they can, as fast as they can. I also suspect that there is intentionally a lot of secrecy, disinformation, and obfuscation so that their true situation and intent is not crystal clear. The only reason they have not cut back more is that they don't want to crash the economies of their customers, and they don't want to give their customers more incentives to develop renewables.

Is anyone going to this conference? It starts Monday, January 18. One choice is free visitor registration. I am sure it will be reported on in the press, too. I would be interested to learn more about the 2014 / 2013 peaks.

Why Peak Oil is Peak Idiocy: Endless Oil

Endless oil! Whew, what a relief.

Ron P.

This morning I ran into this old, grizzled, thick-faced tom cat sitting in the cold; I mentioned to him this theory of oil abundance... he looked at me as if I were an idiot, then chased me away.

That was the top story in the Jan. 7 DrumBeat.

Sorry Leanan. I saw the date "Posted on 01/10/10 at 4:53pm by CarpeDiem" and assumed it was new. But I checked Jan 10 drumbeats and did not see it. I guess Jan 10 was the date they reposted it. :-(

Ron P.

I see the author of the above article is, you guessed it, an economist.

Ron -- You and I both have to agree this guy is right. There will be oil production 100 years from now. Granted not too much but you really can't argue with such a simplistic statement . And that's where the talking heads like Leo will always have the advantage over us. The truth of PO can't be relayed in a 10 second sound bite.

Nope, ROCKMAN.

Maugeri is flat out lying.

People in responsibility in a crisis who promote lies are no better than Madoff(just waiting to get caught).

Maybe we need a Nurnburg trial for lying oil execs (like Hansen suggested for CO2 polluters).

Oil as a fuel now providing 38% of the world's power will be long gone in 100 years.

There will be oil production 100 years from now.

So long as there are humans with access to heat and knives there shall be oil from animal fat. So long as the lever or screw is able to be employed - the oil from plant seeds will be exploited.

Rock oil - only if there is a certain level of tech. Only in the worst doomer crash will rock oil be cut off.

eric --Your post reminded me of one of those Mad Max spin offs. The one where the good guys were defending a refinery from the bad guys. Seemed like a worse case doomer scenario. But my point wasn't so much about how much or who might still be pumping a few very old oil wells. It was the loose choice of language folks on both sides of the fence use. Let's go out 300 years. Whether it's needed or not folks can still boat out into the Santa Barbara Channel and collect some of the 175,000 bbls of oil that naturally seeps out of the sea floor there. That's why such statements as "we'll never run out of oil" is technically true but completely misses the point about PO. And, in many cases IMHO, intentionally so. But the cornucopians can easily sell the idea to Joe6Pack because 1) it's true and 2) J6P doesn't really want to accept the truth.

The Forbes link doesn't work any more, but here is a summary of a June, 1998 article about Maugeri's predecessor at ENI, Franco Bernabe, who accurately forecast recent events:

Mark J Perry teaches 'Good News' economics and finance at University of Michigan in Flint, MI.

Carpe Diem!

An example of a 'blind' economist.

Flint, MI could surely use some "Good News."

Export Land Energy Efficiency

UAE to first publicize energy efficiency, then outlaw incandescent bulbs and low efficiency air conditioners.

http://business24-7.ae/Articles/2010/1/Pages/09012010/01102010_c2530dcb1...

Best Hopes for Small Steps,

Alan

I still wonder about air conditioned sand at beaches and snow skiing in Dubai ...

Alan, all small steps together still is a small step.

Look at this (old news):

The city should be completed in 2016. By that time however, the world population has increased with about 400 millions.

The article also mentions this:

"One cannot leap a great chasm in two bounds" - Anon

"then outlaw incandescent bulbs and low efficiency air conditioners."

Great that ought to crank up the mass manufacturing of air conditioners with a limited life span, and create mounds of tossed out air conditioners.

Best hopes for LESS not more.

Any steps are encouraging but they're going to have to do a lot more than swap out light bulbs to reign in their electricity use. Here's the UAE Natural Gas plot from the Energy Export Databrowser:

Best Hopes for a Realistic Appraisal of the Situation,

-- Jon

Re: U.S. Economic Energy Efficiency: 1950-2008

Note to Gail the Actuary.

Energy consumption does not necessarily increase in lock step with economic growth in the US economy, a fact noticed by many commentators in the decades after the first OPEC/Arab Oil Embargo.

E. Swanson

That's likely because of manufacturing decreasing as a percentage of the whole economy in the US, in the latter decades because it moved to different countries.

I'm not sure what point exactly you are making, Eric, but it's more reliable to look at the world as a whole when studying energy intensity.

It's just like studying food production. The food importing countries are using "ghost acres" outside their borders to feed their population. If one doesn't account for that it might look like a country isn't in overshoot, when in fact it is deep into overshoot.

LOL

When we pay off all of the debt we have accumulated over the last few decades then I'll agree until then I'd argue we simply abused or credit lines to create faux wealth as real growth stalled.

You have to be very very careful about how you calculate wealth in a fiat world. Growth != Wealth until the bill is paid. As long as debt is growing we have had no real growth or increase in wealth.

Now of course all kinds of stuff aka wealth has been created using credit the question is whats its real value ? I'd argue given the debt bubble its true value is its firesale price which is very low.

Thats the problem with debt bubbles not only do they wipe out the debt holders but because they induce rampant over production the value of the created goods is well below the cost of manufacture.

Thats what causes depressions as you have massive debt induced overcapacity competing with previously manufactured items sold at firesale prices.

And this is important because commodities such as food and oil are insensitive to oversupply over the long term. Production follows demand unless it cannot thus in general both food and energy become relatively more expensive or lose less value vs all other asset classes simply because supply can be adjusted downward always.

This of course means during a recession/depression and absolute higher % of income is spent on food and other asset classes are cheap primarily because there is no demand plus disposable income drops even if you have a job. The only savior if you will are falling rents and housing related costs.

This is important because its cheap housing that actually leads to rising disposable income and thus rising consumption as overcapacity falls.

The irony is that by bolstering housing prices you subvert the major mechanism that allow economic recovery.

Now of course if you can succesfully expand credit one more time you can fake a recovery this is our traditional recessions. By loosening credit guidelines esp for housing you artificially boost demand causing housing prices to stop falling and increasing again. This stops the natural cycle of default and balancing of demand and supply leading to higher asset valuations and thence growth.

It works until you can no longer expand credit.

At this point of course the supply of houses is in ridiculous excess vs the demand for basic shelter leading to the big one. And thats the problem there simply is no real bottom once your ability to expand credit fails since buildings are very durable.

The modern driver for housing is crowding. People move to denser living conditions causing rents to fall on empty units. Eventually rents and the population level balance and people spread out to occupy the empty units only at this point does natural crowding happen and organic demand for housing grows.

Finally you have a floor on housing prices and since its a very durable good it acts as a store of wealth allowing prices in general to grow. Of course during both phases of increased demand the first being a balance between rents and filling existing buildings you have household formation and already see increased demand for a huge range of goods from pots to cars.

You should not extend credit in the first place but far more important is to allow a bottoming to happen at intrinsic organic demand levels to let supply and demand imbalances to settle to their true market levels.

We are now so way way beyond this point that its probably impossible now to actually balance the market.

Housing supply is so far in excess of organic demand I doubt we can naturally recover.

In the end its a food/clothing/shelter/transportation issue the rest of the economy runs off the basics.

Until they balance you simply cannot have real wealth creation. The only place you have room to wiggle is in shelter.

And example of endemic bottomed economies can be seen in the ME where housing construction pretty much permanently lags population growth and debt bubbles are difficult to create. However the underlying population growth esp amongst the very poor complicates the issue. Its a unnatural economy but for different reasons they are effectively in a plain people bubble.

About two years ago or so I predicted that the US government would spend trillions of dollars of new money to bail out the financial system. At the time most thought I was wildly pessimistic, if not outright crazy. So be it.

What you are describing about the housing market now is why we are eventually heading for very severe inflation in the US, although probably not as extreme as the South American style hyper-inflation we see in the news today - above (the kind where you buy something, anything, because it will cost more tomorrow).

Because the US government now not only guarantees almost all conventional mortgages, plus buys most of them - plus - issues fiat money from the Federal Reserve to buy them, it is a clear and direct line between the housing market crash and the highly inflationary attempt to push housing prices back up.

Without getting into the specific reasons why we got to this point, all future attempts to bail out the housing market in the post peak oil era will fail - and failures will come faster and with more severe consequences over time. That is because ever greater amounts of government bailouts will be required to offset the increasing negative effects of rising energy prices and falling capital investment. This will force inflation adjusted incomes to fall and business to cut production. Attempts by the government to expand production by creating make work jobs will only lead to further inflation, and further erosion of living standards.

It is not even clear just how much of a new housing based bubble the Fed can create, but first there will be inflation, and then a high-inflation/stagflationary depression - where excess inventories of all types will cause many goods to deflate in price, but essential costs - especially food and energy will rise even faster than other prices fall.

I prefer to not use the term inflation because I don't think it really fits.

If banks have losses of say 1 trillion dollars and the US Gov buys the bad assets at par then the amount of inflation is minimal i.e very little money has actually entered the economy. Note they are not also paying all the interest which would have been inflationary. Whats happened is 1 trillion dollars worth of debt is now on the governments balance sheet and not backed by any asset and not even causing a faux increase in GDP.

Theoretically the debt will become more valuable as the economy recovers and the US would effectively be able to eventually sell it close to par. Thats the plan. In a weird way it makes sense because if we don't then we crashed any way and if we don't buy the debt we crash.

Now of course the US Government itself has to borrow to create this money certainly a good bit is printed by the feds i.e the debt is zeroed using printed money but the inflationary pressure is global i.e interest rates rise on the US Government debt because its increasingly less credit worthy not just because of inflation of the money supply.

In fact the overall money supply will probably continue to steadily contract however its best to say its being rapidly devalued vs commodities esp which can maintain and in the case of oil even increase in price probably food also.

However peoples traditional concept of inflation does not work because wages will be falling in real and nominal terms. Dollar for dollar people will actually make less and less even as the currency is being devalued.

This is because the money is never borrowed into circulation most of it is used to simply zero accounts the rest at best will never leave Wall Street and circulate in the world of high finance.

In short its gambling money for wall street to goose all liquid markets.

Thats why I call it rich mans inflation poor mans deflation. In this case the US Government itself is in the wealth cadre borrowing like a drunken fool to pay others bad gambling debts and worse giving them more money to gamble with.

Now the real problem of course is it is poor mans deflation which means tax revenues are going to plummet. As far as housing goes I really suspect that that bubble will bust this spring esp if oil prices sky rocket. I think what will happen is transactions will simply cease. I really think that the US has finally reached the point that its drained the pool of suckers willing to buy homes at high prices. All the mortgage plan has done is blow up a natural dead cat bounce to double or triple what it should have been pulling forward god knows how many years of demand. And causing rents to start really falling.

So you should see tax revenues continue to plummet and housing price eventually nose dive near the end of the year after transaction volume is gone. But its simply not coming back this time around there really simply are not any buyers left.

Someone noted that the number of cash buyers was evenly split with the number of people using FHA loans this suggest that right now whats happening is people are buying houses in bulk with cash and flipping them to FHA buyers at a markup. The real sales to someone actually living in the home are already 50% less than whats reported or close to that. Sure some are supposedly going to be held as rentals but as rents fall and interest rates rise most of these will be dumped back on the market as housing prices fall. I question how many actually plan to really hold.

Next I also question how many of the cash deals are really cash and how many are LLC's set up with investor money thats used to borrow more to buy up real estate. A lot of that investor money is probably HELOC money that had been drawn out and put into and account. Just because the house sale is a cash deal says nothing about how the money was actually raised esp assuming its companies doing a lot of the buying.

Given that I suspect there is a plenty of money willing to match with 20%-50% cash I have to imagine that many of these cash deals really have LTV's at anywhere from 80%-50%. Better than direct loans but still borrowed money. As housing prices fall and rents fall you know these guys will be forced to dump.

They will have no choice as they can't cash flow enough to cover the loan and the expenses etc. They really can't actually hold.

In any case the key now is falling tax revenue and ballooning government debt this is the real deadly combo since it will force interest rates higher and inflation is trapped inside the government itself and a few of its cronies never making it to main street. We will get all the typical effects of inflation i.e high prices and high interest rates plus all the effects of deflation falling wages and falling prices for assets that require loans. Anything bought with debt will crash and anything bought with cash will skyrocket. And of course wages will crash.

This is purely from financial trickery however if you throw peak oil on top your really light a fire as commodities would have been pushed up in price already with real shortages the pressure is to the moon.

And rising oil prices push up food prices narrowing profit margins on all other commodities.

Hot money flows could well keep the stock market buoyant a lot longer than most people think for example. But its all a mirage. None of the printing is making it very far the vast majority of it simply balloons the Government balance sheet and enriches only the elite of the elite.

I don't think there is a good modern example of this back in the 15th century onwards it was quite common for this to happen and for Governments to go bankrupt and have their internal debt problems literally detach the currency from the real economy and devalue it even as deflation occurred on the street.

http://en.wikipedia.org/wiki/Spanish_Empire

http://www.sciencedirect.com/science?_ob=ArticleURL&_udi=B6WFJ-4D7K19S-1...

Thus this is in my opinion "new" in the 20th century and should not be equated to recent past history.

Another excellent paper.

http://eh.net/Clio/Conferences/ASSA/Jan_96/motomura.shtml

If you notice its a period of large empires at war using basically the same financial games we do today then you got it.

Whats important in my opinion is how the "real" economy was effectively distinct from the tax based mega bureaucracy. And both where effectively equal in size i.e government was as large as the rest of the economy. I believe the above paper is really important for understanding whats happening now.

Thus the US is in the same position unable to raise taxes however unlike Spain it can print and does.

However just like then very little of this money makes it into the real economy thus government induced inflation cannot act like traditional 20th century inflation because consumer debt is actually falling not increasing.

In fact the governments are now aggressively competing with their own citizens for money thus putting even more pressure on outstanding debt and leading to more defaults.

It simply is not traditional 20th century inflation its a government thats headed rapidly to collapse and a currency collapse traditional inflation fails to happen as the money never flows into the real economy.

The closest example you have in the 20th century is Japan and to some extent Russia. But the US is not Japan and they played this game for decades against a backdrop where the rest of the world was inflating. The Yen carry trade certainly helped matters along. They never ever succeeded in inducing inflation no matter how much they printed because of crony capitalism soaking all the money up.

As far as general economics go I expect the following.

1.) Sharply rising commodity prices esp oil because of peak oil in addition to speculative flows.

2.) Stock market to actually remain buoyant but with ever higher volatility. It will swing increasingly erratically but somehow not crash as expected it will later but it could well do big swings well into 2011. The swings themselves will keep people gambling i.e its fully decoupled from reality and one day it will just simply crash on its own accord probably with no notice.

3.) Interest rates rising simply because the credit worthiness of Governments is falling. How fast is unknown but attempts to print and buy your own debt just inflame the matter once your credit rating is falling. There is simply no escape from this trap no government that depends eventually on banks to borrow from ever has escaped and in the end its banks doing the real lending.

4.) Falling wages and eventually falling housing prices however more important will be a plummeting transaction rate it does not matter if prices are forced higher if no one is willing or able to buy.

Without sales defaults will sky rocket. Then falling prices but sales volume will either not rebound or may even well fall even as prices fall. Thats the price we will pay for intervention. The propped up market price is now so divorced from the ability of the market to pay that there simply are not enough buyers period. Falling wages rising unemployment and rising commodity prices will work to deplete the potential buyer pool far far faster than any government program can act. Falling rents and inability to flip will dry up the cash buyer pool and soon falling prices will make these buyers net sellers as they try to escape the next downturn. Thus given how slow housing moves in general its a surprisingly fast crash. Although not a prediction I'd not be surprised in the least to see housing prices fall 50% by the end of this year to first second quarter of next year.

Next I think the Feds will be forced to stop propping up Fannie and Freddie as the FHA explodes and the next big one hits.

5.) The next big bomb is defaulting state and local governments at some point next year I expect one large state or local government to default sending interest rates spiraling on their bonds and halting the ability of these entities to borrow. The government will be forced to do some bailing out but it won't matter and it will force it to give up on propping up housing. And on top of course commercial real estate defaults and failing smaller banks will begin in earnest. This coupled with rising interest rates will finally push the US Government to the limit where it has to choose one bailout not all.

So basically I see use starting to hit the wall early next year in fact I'd argue all the key ingredients are now in place for the beginning of the end. We won't make it long enough to have traditional inflation probably not even hyper inflation. The financial system itself will collapse before we can even have the time to really even try and induce inflation.

However although its starting now the various rates are not yet known it could take 2 years it could take five no telling. We just have to see how things unfold. But the whole reason I replied is I just don't get the feeling we will make it to the hyper inflation scenario you describe. I think that instead we will see a currency event of some sort where one of the major currencies collapses taking all of them down and some sort of replacement attempt. And yes this is the specter of a one world currency but I really think we go right to that with the bankers effectively taking overt control away from the governments. In exchange of course I suspect the ones that play along will get a jubilee and the ones that don't wiped out in hyper inflation. The reason is outright defaults will beat inflation in a sense forcing the bankers to act.

Of course underlying all of this the real reason I think it happens this way is underneath all the fiat money games its growth that makes it work coupled with debt supported asset price inflation for debt based purchases. Once this is gone and its obvious its gone then the fiat currencies don't inflate their value goes directly to zero. Debt in fiat currencies which is all bankers have to offer has no value. I.e they literally are not needed. Thus the new financial regime will attempt to institute a new fiat controlled by the bankers in a desperate attempt to keep the fiat money regime. Of course given peak oil it will simply fail no matter what games they play. The collapse is endemic and can't be stopped via financial games no matter how desperate.

This is a very good summary and probably you should organize it with your other recent posts and present it as a topic for discussion at TOD, or perhaps some similar venue.

I agree with almost all of what you said, and no, I do not think we will the reach the level of inflation in the US occurs where people buy things today just because they will be higher tomorrow - although in regards to food and energy supplies people may eventually be buying today because those goods will be unavailable the next day.

In regards to the current Federal Reserve policy, yes the buying of home mortgages does not necessarily result in an increase of the money supply. However the net amount of money + credit circulating within the US is increased by the amount of new fiat money, so there is some considerable effect. More specifically, those selling their homes to new buyers getting mortgages are the ones eventually getting the fiat money. So what do they do with that? They could put it in the bank, buy stocks, gold, or given the widespread investor panic, buy Treasury bills. Bill yields are near zero. I say investor panic because market services believe that the net amount of money entering the stock market through mutual funds over tje last year is zero - and I assume that includes mutual funds within retirement plans and IRAs. As to why the market is going up - a combination of zero interest rates and rising inflationary expectations, but also worldwide inflationary policies.

Essentially the US dollar retains it value only through defrauding the masses, and the world, it retains some type of intrinsic value, when in reality, it has little value. If there is a sudden collpase in the dollar's purchase power, that may actually be our best hope to avoid future high rates of inflation - or perhaps better said - high rates of inflation as compared to net after tax (federal + state) income.

Yet another large North American E&P puts its money where its mouth is regarding investments in shale gas. This time it's Talisman Energy, with major commitments to the Montney and Marcellus Shale regions and an increase in drilling. This continues to belie the notion that shale gas drilling is falling or uneconomic. From their press release:

Smart (i.e. small) cars do not sell in USA

Mercedes looks for partner for brand

http://www.washingtonpost.com/wp-dyn/content/article/2010/01/10/AR201001...

Best Hopes for $6/gallon gasoline,

Alan

I think the SmartCar is a toy, at least in the US. A Prius is more fuel-efficient, and there are a lot of regular cars that are cheaper than the Smart. In Europe, a really tiny car might be an advantage on those narrow, winding streets. But in the US, the only reason to buy a Smart is to make a statement and look cool. That's the kind of spending that takes a big hit in a bad economy.

The Smart Car "works" in any area with limited on-street parking, such as near most college campuses or in my neighborhood. It can take parking places that no other car can.

Not attractive in places like Phoenix (where >50% of the land area is devoted to the automobile).

Alan

I don't think that's really much of an advantage in most of the US, including old northeastern cities like New York and Boston. Because parking is so much of a premium, parking spaces are delineated (via painted lines, meters, etc.). Some have "compact only" spaces, but you don't need a SmartCar to use those. You could pack more cars into a "theater parking" lot, but that's an advantage to the parking lot owner, not the driver.

Unless you are the driver who founds the parking lot full because of a lot of big cars and you have to look other places to park the car and come to late for the start of the show.

Usually they tell you where to park the car in those types of lots, and if there's no space available, they don't let you in. Many parking garages here have automatic counters. If there's no empty spot, the entry shuts until someone leaves.

I've driven in a lot of places where parking is nightmarish, including Manhattan and downtown Boston, and I have to say, I've never wished I had a smaller car so I could fit in a space. A Corolla is plenty small enough.

Yes. A lot of SUV's are parked on the middle of the line of a parking lot taking 2 places, at least where I live. Some with a smaller car do that also, to avoid a scratch.

People only do that around here if there's plenty of parking. If you do that where parking is tight, you're likely to get your car keyed or worse.

True Han. But I personally know three different folks whose cars were damaged as a result of their efforts to avoid dings. Vigilantes are alive and well...at least Houston parking lots.

If you really have to drive a car in a city, then the obvious choice is a 1987 Chevy van or some similar tank that can't be damaged.

A friend who moved to western Massachusetts said they wondered why the fire hydrants had ten-foot vertical poles attached. They were told it was so the fire department could find them under eight-foot drifts.

What about a 1982 Mercedes Benz 240D ?

I do not expect to find it "tipped" :-)

True story, I was a passenger in a 4WD Subaru in the Highlands of Iceland as it was driving/swimming through 1 meter of fresh snow. Straight down the middle between rows of 2 m tall orange sticks.

I asked, what do you do when the snow is more than 2 m deep ?

"You should not be out driving then".

Best Hopes for Icelandic Drivers,

Alan

And then they return from shopping to find their tires have been slashed.

A Smart car requires an extremely small parking space, slightly more than a dog it seems...

Must have been a rocket scientist:-)

When I saw it, I thought that the owner had mounted Casters on the back, and was tipping the car up to roll into even smaller spaces. What would that mast be for?

When I saw the mast , the first thing popping up was : here we have a "Google Street view"-photographer car driving through the wrong 'hood'... Thereafter ... ehh maybe a large 'Remotely Controlled Car'. But apparently not so, thusly I gave up this whole guesswork :-)

That's what did the most damage I think. Most people don't choose to buy a small car, they do so because they don't have the money for a larger one. So once you're working with that demographic price matters a lot and there simply are too many high-quality alternatives that gets you more bang for the buck than to spend the money on a SmartCar.

As an aside, I don't think many potential purchasers had heard of SmartCar tossing, so that likely had a negligible impact, but such a small car on North American roads would have been its own deterrent.

New Dutch Sport: Smart Car Tossing

http://www.treehugger.com/files/2009/07/new-dutch-sport-smart-car-tossin...

I think there are people who would choose to buy a fuel-efficient car. However, the SmartCar is not all that fuel-efficient. It seems like a high price to pay for a small return.

Something like a MIni Cooper or Honda Fit do seem to be a lot more practical.

Buying a SmartCar is a dumb choice.

LOL frickin' Dutch rednecks. Wasn't sure if you were serious - this is really an article about Smarts being dumped into canals. I can see testosterone crazed yanks running them over with F350s just for the sport. When I lived in Pendleton Oregon (home of the in the early 90s there was a cafe with a Spotted Owl burger on the menu. No, nothing fowl :) just ground beef; owner was simply making a statement about the controversial endangered tweety birds, who were being protected at the expense of logging jobs, or so the rational went, anyway. Reality was of course a bit more complex than that, but the Spotted Owl was a potent symbol of hatred.

Nonsense. Smart people don't buy a bigger car than they need to. They have better places to put their money.

I've never bought a car bigger than I needed. Of course, I was a business analyst, so I analyzed it from a business perspective.

Really rich people don't own cars at all. They just have cars available wherever they need them and people to drive them wherever they need to go.

New American sport: Shooting people who touch your Smart Car.

He didn't say "smart people," he said "people."

I freely admit - I've bought a larger car than I needed. I bought a Ford Taurus, a mid-size sedan, though I was single and rarely transported anything other than a few groceries. As a new engineering grad, I felt it was a good idea to "buy American." And the Taurus was one of the few American cars that got a decent rating from Consumer Reports.

I don't regret it, either. It had some issues, but all in all, it was a good car.

Leanan, in Europe a small car is an advantage in finding parking space. Narrow streets are history in most countries.

I think buying used cars with better fuel efficiency and living in a walkable community is the way to go. Many questions surround the viability of batteries in cars. Using lithium ion, for example, batteries only last three years. Some of the new answers may cause more problems in the future.

Do you have a reference for the LiIon 3 year lifespan? There are a lot of chemistries being tossed around in the Lithium arena, and I'm sure it's too soon to make a sweeping call like that. The Ebikers seem to be happy with the LIFE-PO4 batts, but I don't know when a lifespan assessment is a function of improper charging and battery management, batteries used for racing and over-amping, or simply a vehicle that still has to have the components balanced to each other and to the use of the vehicle.

I DO know that the NIMH's in RAV4-EV's have been getting 10k-miles and up on the packs, with a per charge range of 100 miles or better.

I am in no way opposed to walking biking and using local transit as the primary means of getting around.. if a community or county can actually move significantly in that direction, but EV's are not the lingering question mark that people make them out to be. They have to be well designed and built, but then can be phenomenal vehicles.

How much Lithium does it take to produce batteries for all of the vehicles needed to replace the present IC fleet?

When do we see peak Li? Electricity is great, especially from fusion, but carrying it around can be a problem, eh?

We don't have to replace the 'whole' fleet, and very likely can't.

People might want to, but if you, like I believe we're facing limits, then what's wrong with identifying tools that will work for us? It doesn't have to presume that this will simply become the "Stepford Car" that magically supplants all its predecessors..

And HOW MANY times does one have to plant this friggin' disclaimer into every discussion that proposes any system which can generate or use power more effectively and with less pollution? To presume any one suggestion is supposed to be universally applied is unhelpful to the conversation.

Of course carrying electricity around is problematic.. but we will still do so, won't we? And There will be other chemistries besides Lithium-based, as I mentioned above, plus Lead batts will not just disappear..

Come on.. this kind of 'Yeah But' gets done to death. It's not even Devil's Advocacy at this point, it's just contentiousness.

I've no problem with EVs, and I assume they will be a useful tool in our future. A small utility EV could be a great way to get produce to market, etc - 30mph and a 50mi range would be fine (and hard to achieve). I just don't see the personal automobile as a widespread part of out future.

The problem is that our society is so addicted to the automobile and cannot imagine anything other than a world with cars just like they are now, only powered by electricity instead (i.e. no real changes). If we approach things with those blinders on then we may well miss opportunities to do much more helpful things (like electric light rail) in a futile attempt to preserve the car culture.

In other words, while YOU may be being realistic about the future of the technology, I don't think the rest of the planet is.

Sure, I can buy that.

But I've also found that many of these discussions become unnecessarily mired in 'other peoples illusions', which is ultimately an imaginary barrier.

Their blinders aren't ours, I feel confident enough in saying. We can remember that talking about a good EV design doesn't mean we've forgotten about Bikable Towns, or Interurban Transit, Paving Limitations, etc.. I do think we will continue to carry loads on wheels, and will need/choose to power those carts..

In this particular forum, those 'Mass Illusion' objections become dead-end sidetracks to the idea, as if we're just shooting down everything that comes up 'because it can't be a silver bullet'.. Here at TOD, I have to expect that this is a familiar enough refrain..

WAIT!!.. I know, we need an Acronym! (a SAD, to give it a proper TLA.. ** a 'Standard Acronym Disclaimer' will be our next 'Three-Lettered Acronym')

OCTIMABB(NASB) .. or 'Of Course, This Is Merely A BB (Not A Silver Bullet)

.. but I'll forget that and have to write this all out again soon enough. Anyone else know a good acronym for the equivalent of 'Now Please don't try to expand this idea in a linear progression out to the extents of the Known BAU world, Because that's not what I'm saying here..'

as Churchill said, 'Sorry my remarks were so long, I didn't have time to make them shorter..'

Bob

What you said is true, and is the point I wanted to make. Anyone who expects a single technology, or one alternative to solve all of our problems needs an adjustment in their view of reality. Though, I am interested in how much Li it takes to power a vehicle, and the energy need to produce that, plus the extent of environmental harm that may be created in so doing. Many of the exotic technologies sound fine until you learn that refining the ores cause degredation of the local water and air, and it takes so much energy that there is no real reason to continue.

Boron 11 sounds good as a fusion component. I know that Boron is relatively abundent... isn't borax made up of that? Yet, being somewhat ignorant of the details, I don't know if B-11 is something different than what is found in common borax, or has to be refined by killing snail darters or something.

The same with Li. So far as I know for sure, the only drawback is their propensity to ignite easily. My question was, what does it take to get the stuff, and how long will it really last, and what does it do to us in the meantime that I don't already know about? Unintended consequences are very much a concern.

Sorry if you thought I was just raining on your parade.

The important thing is that Li can be recycled.

Anyway, each 24kwh nissan battery consumes 4 kg.

http://www.glgroup.com/News/Nissan-breaks-silence-on-lithium-consumption...

So, 35 million tonnes can create 8.75 Billion batteries ;-)

evnow, from that 35 only 15 is 'known reserve base'. Important to know is how much lithium is easy available (high

concentration in big mines), especially as in the past peak oil (and gas) world the energy needed for mining is not cheap and in competition with other activities. So, how much lithium can be extracted yearly from the 'giant mines' ? What happens with the price of lithium during soaring demand ?

I bought an ebike that was already 6 months old and the batteries died 2 yrs later. I also work with medical equipment and again the batteries lose their ability to charge after 3yrs. All of these items were Li-Ion.

Not all Li batteries are made equal. How long they last depends on how well they are managed - in terms of charging, discharging, both rates and depth. Nissan Leaf, for eg., says the battery will have 80% capacity left over after 5 years. GM Volt is conservative and will have 40 miles range even after 10 years (CA regulation calls for 10 year warranty).

The new Li batteries by A123 for eg, allow 100,000 cycles (yes 100k, no typo) on 10% discharge and thousands of cycles on 100%.

There are several Li batteries in various stages of development/commercialization that will greatly increase the desnsity and longevity of batteries in the coming years. On the Li battery technology curve we are just getting started.

With typical lithium ion and lithium polymer batteries, such as what are used in almost all laptops and cellphones the biggest factors affecting lifespan are over charging, over discharging and heat. And as typically used they suffer from all three factors and tend to only give 2 to 3 years of useful service. However, I've got some 6 year old cells still giving reasonable service that I've used on an electric bike because I take care to minimize all three of those aging factors.