Drumbeat: April 16, 2010

Posted by Leanan on April 16, 2010 - 10:30am

Hurricane season's set to test lessons learned

TOKYO (MarketWatch) -- The oil and natural gas industry's best weapon against production disruptions during the Atlantic hurricane season this year may come from what history has taught it.After all, it's been five years since Hurricanes Katrina and Rita devastated the Gulf of Mexico region and forecasters are predicting a particularly active 2010 season.

"This year has the chance to be an extreme season," Joe Bastardi, an expert senior meteorologist at AccuWeather.com, said in February when he released his latest Atlantic hurricane season forecast.

US natural gas rig count up for 16th straight week

NEW YORK (Reuters) - The number of rigs drilling for natural gas in the United States climbed 14 this week to a 14-month high of 973, according to a report on Friday by oil services firm Baker Hughes in Houston.It was the 16th straight weekly gain and puts the gas rig count at its highest level since Feb. 20, 2009, when there were 1,018 gas rigs operating.

India's IOC buys 2.6 mln barrels of June crude-trade

NEW DELHI, April 16 (Reuters) - State-owned Indian Oil Corp. (IOC) has bought 2.6 million barrels of Malaysian and West African crude in a tender, a trade source said on Friday.The company bought 600,000 barrels of Malaysian Kikeh at a price heard to be around dated Brent plus $2.50 a barrel, the source said. The seller of the cargo could not immediately be confirmed.

Constellation Energy buys two plants for $365 mln

The acquisition is in line with the company's strategy of deploying up to $1 billion over the next 12 to 24 months to acquire assets in regions where load obligations exceed generation capacity, Constellation said.

China mineral dominance concerns U.S.

Washington (CNN) -- China's dominant position in the production of rare earth minerals has long-reaching implications for the U.S. Department of Defense, according to a recent government report.The report from the Government Accountability Office was commissioned by Congress amid growing concerns that China's potential reduction on the supply of much-needed rare earth minerals could impact critical military uses.

Obama to take a grass-roots approach to conservation

WASHINGTON — President Obama plans to direct the federal government to foster community-based efforts to save the nation's rivers, coastlines, farms, forests and other outdoor spaces as part of a new approach to conservation.Instead of just designating vast tracts of land to be protected from development, pollution and overpopulation, Obama wants the government to embrace a grass-roots approach to conservation that has quietly taken hold in recent years in U.S. cities and towns and across international borders.

Demand for oil to outstrip supply within two years

RISING oil prices pose a grave threat to global economic recovery, according to some experts.The fear has been expressed by the US military and by the automobile industry.

This week in Perth, Volvo's head of product planning, Lex Kerssemakers, said "we all know that oil is running out''.

"We need to find alternative solutions and though we are aware of the alternatives - LPG, CNG, ethanol, electric and so on - we have to introduce these to the market,'' he said.

"If we don't do it now, we won't be ready in five years when oil may be prohibitively expensive.''

Deffeyes, Kenneth S. When Oil Peaked. Hill & Wang. Oct. 2010. 176p. ISBN 978-0-8090-9471-4. $24.It's available for pre-order at Amazon.Maybe some people don’t want to hear it, but as Deffeyes argued in Hubbert’s Peak (2001) and Beyond Oil (2005), the evidence suggests (and continues to suggest) that world oil production will a bell-shaped curve—and this decade is the peak. What next? From a former Shell researcher and emeritus professor of geology at Princeton whose books sell surprisingly well.

Part 2: First Change--The Long Emergency

In Part 2 of James Howard Kunstler’s “The Long Emergency”, we examine America’s prospects for survival in the 21st century. He addresses nature’s ability to “bite back” while humans overrun their carrying capacity and disrupt the planet’s ability to maintain stable environs for all living creatures.Because President-elect Obama cried change, will he address real transformation toward a sustainable society or continue ‘fatuous change’ as he continues ‘consensus trance’? If he maintains his support of unlimited population growth within the United States, Obama cannot help but accelerate and magnify our growing environmental and societal dilemmas.

'Soul Of A Citizen' EXCERPT: 'From Drunken Party Girl To Climate Change Activist'

When we try to engage people politically we never know who will respond, or when someone will shift from reveling in their apathy to taking powerful public stands. With Earth Day coming up, here's a striking example of one such transformation.

Mexico's Pemex bullish after deepwater natgas find

MEXICO CITY (Reuters) - Mexico's state oil monopoly Pemex has made a significant deep-water natural gas discovery, a company executive said on Thursday.Antonio Escalera, a senior Pemex exploration manager, told reporters the Labay well showed that an area of the deep waters of the Gulf of Mexico near the existing Lakach discovery had big potential to be a major gas source.

Pemex Vows to Stick with Chicontepec Project

The head of exploration and production at Mexican state oil monopoly Petroleos Mexicanos, or Pemex, said Thursday that the company's goal is to keep crude oil production between 2.4 million and 3 million barrels a day in the 2010 to 2024 period.Carlos Morales said at an event that the state company still expects to produce at least 2.5 million barrels a day of crude oil on average this year.

He said that at some point, output could go as low as 2.4 million barrels a day, although Pemex's aim is for production to keep rising.

"That is the floor," Morales said.

Azerbaijan threatens to "reconsider" U.S. relations

BAKU (Reuters) - Oil-producing Azerbaijan accused the United States on Friday of siding with enemy Armenia in the conflict over Nagorno-Karabakh and threatened to "reconsider" its relationship with Washington.The comments by a senior aide to President Ilham Aliyev underscored the strength of anger in Azerbaijan, a supplier of oil and gas to the West, over a Western-backed bid to reconcile Christian Armenia and Azerbaijan's close Muslim ally Turkey.

About 2 pc GDP is lost due to power crisis: Speakers tell concluding session of ICC convention

"The Bangladesh economy has been growing at about six percent annually over the last few years. Overcoming all hurdles, the growth of the manufacturing sector even reached the double digit. The country is now poised for a take-off stage, with manufacturing leading the way. An unexpected hurdle has now appeared on the scene - that of shortage of energy" speakers opined at the concluding session of the ICC Conference on Energy recently held at a city hotel.They said that ,future investment in manufacturing will be discouraged, while existing industries may face difficulty in smooth operation, unless energy is available. The energy crunch is hitting us at a particularly critical period of our development. Currently around 1-2 percent of our GDP is lost due to power crisis.

Energy crisis renders over 0.4m jobless: ICCI

ISLAMABAD - Due to the energy shortage in the country more than 0.4 million industrial workers have lost their jobs while the industries are facing an annual monetary loss of over Rs 240 billion.

Industrialists, businessmen march against power cuts, gas shortage

LAHORE: Hundreds of industrialists, entrepreneurs, traders and shopkeepers on Thursday staged a protest against the prolonged and frequent electricity cuts and the natural gas supply shortage.Around thousand workers also joined hands with their employers in the protest against what they called “government’s incompetence” in controlling the countryís energy crisis.

Venezuela May Build Power Plant at El Palito Refinery

(Bloomberg) -- Venezuela may build a 745-megawatt power plant for its El Palito oil refinery as a national energy crisis causes rolling blackouts, Electricity Minister Ali Rodriguez said.

Fire trucks running out of fuel

The response mechanism of the Jamaica Fire Brigade could grind to a halt Thursday in the wake of reports that the Department's trucks are close to running out of fuel due to the non-payment of the gas bill.

Late shipment leaves Haitians scrambling for gas

PORT-AU-PRINCE, Haiti — Haitians scuffled at gas pumps and waited for hours at filling stations Thursday as the quake-ravaged country struggled with fuel shortages caused by a delayed shipment from Venezuela.Drivers chased rumors of available gasoline across the hills of the rubble-filled capital. Some abandoned their cars to carry empty milk jugs, soda bottles and buckets on foot to collect as much fuel as rationing station owners would allow them to buy.

Hillary Clinton: ‘We Have a Lot to Learn’ About Energy Policy From Other Nations

(CNSNews.com) – Secretary of State Hillary Clinton told officials from more than 32 Western Hemisphere nations on Thursday that the United States is looking to those nations to develop better energy policies and practices.

US to help region end foreign oil dependency: Clinton

WASHINGTON — Secretary of State Hillary Clinton on Thursday pledged US aid to end Caribbean and Central American dependency on foreign oil, as she slammed "powerful political interests" against such measures.She also said it was "shameful" that the region had some of the highest electricity rates on the planet, despite nearby countries like Canada, Venezuela, Mexico and the United States having vast crude oil reserves.

Energy and Climate Partnership of the Americas (ECPA) Ministerial

We can open doors to those who live in remote regions off the grid or in cities growing too quickly for power companies to meet rising demand. And we have too many people in our hemisphere who spend too many hours in time-consuming tasks because they lack the technologies, including the most basic, namely electricity. We can create jobs for a growing population of young people throughout our hemisphere determined to seize their chance to make a better life. And by decreasing our reliance on fossil fuels, governments, particularly in the Caribbean, that now depend on imported oil can spend that money on social and economic development while decreasing their carbon emissions and protecting the natural environment that is one of the real treasures of our hemisphere.

Israel’s Green Efforts Featured By CNBC

Israel perhaps has more to gain than anyone else from going clean. Right now Israel is almost fully dependent on fossil fuels that pollute the country. Israel still gets it’s oil from secondary sources because Arab nations won’t sell to Israel directly. It’s expensive and Israel is helping fuel its enemies.

Russia faces huge tests to grain export ambitions

Russia's spell of rapid growth in grain exports will come to an end unless it solves its logistical difficulties and finds a way of cutting the cost of growing crops, US officials have said.The Black Sea state has, over the last decade, raised its wheat exports by nearly nine times, accounting for 70% of the world growth in wheat trading.

Its share of the world grain exports has soared from 2% to 9%.

However, plans to raise that share further, to 15% in eight years time, mean overcoming huge logistical and agricultural problems, a report from the US Department of Agriculture's Moscow bureau said.

Many theories have been put forward to explain the shortage of local meat. An increase in the price of animal fodder is one main reason why the crisis has escalated, according to the owner of the Gezaret Al-Amana butcher's shop at Souq Al-Attaba in Cairo.At the Attaba market there is a huge area selling meat, and the butchers there have their own version of the crisis. The owner of the Gezaret Al-Amana shop, who is both a retail and wholesale butcher, said that he had stopped dealing in veal over the past three weeks because of its price.

Fodder prices had increased dramatically a year and a half ago, he said, causing farmers to slaughter more calves and cows to circumvent the high prices of feeding their cattle. "As livestock numbers decreased, the farmers increased their prices, a situation that has affected the local meat supply," he said.

It is true that prices of fodder did increase a year and a half ago, due to the global financial crisis and the increasing amounts of land being used for crops to produce ethanol for fuel.

Urban farms herald green city 'revolution'

London, England (CNN) -- As the world's urban population continues to grow at a rapid rate, communities around the world are increasingly turning to "city agriculture" to produce cheap, locally grown fruit and vegetables.Among skyscrapers and housing estates, previously vacant lots are being used to produce millions of tons of organically grown food that experts say are "greener" and cheaper than commercially grown produce.

Smoke And Mirrors From The U.S. Chamber Of Commerce

Harbert wants to wave this 8-year renewable energy tax credit extension flag, complete with a phase out plan over four years. Well where the hell is the phase out for oil, coal, and natural gas?When the Chamber decides to support phasing out all subsidies for fossil fuels over a four-year period, you let me know.

From chip oil to sunshine, we recall the green engines that never quite ignited

Remember when vegetable-oil cars were mooted to save the world? Diesel engines converted to run on used cooking oil from restaurants were lauded as the answer to the energy crisis.Alas, not even the Yanks ate enough chips to make the motors meaningful. And the cost of conversion and mess of straining the oil also put people off.

Rare Earth Materials in the Defense Supply Chain [PDF]

While rare earth ore deposits are geographically diverse, current capabilities to process rare earth metals into finished materials are limited mostly to Chinese sources.The United States previously performed all stages of the rare earth material supply chain, but now most rare earth material processing (97%) is performed in China, giving it a dominant position that could affect worldwide supply and prices.

Based on industry estimates, rebuilding a U.S. rare earth supply chain may take up to 15 years and is dependent on several factors, including securing capital investments in processing infrastructure, developing new technologies, and acquiring patents, which are currently held by international companies.

Australian LNG Exports May Increase Fivefold to A$50 Billion

(Bloomberg) -- Australian liquefied natural gas exports may increase fivefold to A$50 billion ($47 billion) by 2016 from 2009 levels as countries seek cleaner-burning fuels, the nation’s energy minister said.The value of shipments of LNG may jump to the estimated figure should projects operated by Royal Dutch Shell Plc, Woodside Petroleum Ltd., Inpex Corp, Chevron Corp. and Santos Ltd. proceed by the middle of the decade, Martin Ferguson said in Sydney today.

Gazprom Says ‘Abnormal’ Price Gap Threatens Spending

(Bloomberg) -- OAO Gazprom, the world’s biggest natural-gas producer, said an “abnormal” gap between spot fuel prices and long-term contracts is threatening investments in new fields and pipelines.Spot gas prices slumped last year as the recession slowed consumption, while U.S. success extracting the fuel from shale rock added to supply. The output increase in the U.S. diverted some liquefied natural gas cargoes to Europe and led Gazprom’s traditional customers to demand contract prices be cut.

“The gap between gas prices is a destabilizing factor that puts long-term investments at risk,” Gazprom Deputy Chief Executive Officer Alexander Medvedev said in an interview near Vyborg, Russia. “It’s an abnormal situation.”

Shmatko Says Gas Exporters ‘Concerned’ About Europe Spot Market

(Bloomberg) -- Russian Energy Minister Sergei Shmatko said gas exporting nations are “very concerned” about the European spot market and will discuss the issue at a forum in Algeria next week.

Gazprom cuts imports of Turkmen gas for 2010

ASTANA (Reuters) - Russian energy giant Gazprom looks to import only 10.5 billion cubic metres (bcm) of Turkmen gas this year -- a third of the agreed maximum volumes -- as poor demand and other fuels' usage eat into consumption.

Russia agrees gas deal on Ukraine's terms - agencies

MOSCOW (Reuters) - Moscow and Kiev have agreed a new deal on Russian gas supplies to Ukraine based on proposals made by Ukrainian President Viktor Yanukovich, Russian news agencies reported on Friday.

Schlumberger Starts Hiring Labor for Iraq Oil Services, WSJ Says

(Bloomberg) -- Schlumberger Ltd., the world’s largest oil industry services provider, is hiring labor for its Iraqi business, betting that the security situation will improve to allow them to provide support for oil companies, the Wall Street Journal reported, citing an interview with Chief Executive Officer Andrew Gould.

Nigeria Will Discuss Oil Law Concerns With Majors

(Bloomberg) -- Nigeria will hold talks with international energy companies to address their concerns over a proposed oil law, said Shehu Ladan, head of state-owned National Petroleum Corp.“The door is not yet closed,” Ladan told reporters today in Lagos. “In the next couple of days we’ll be able to sit down with all major oil companies and iron out finally those aspects of the bill that they have problems with.”

Pemex board rejects business plan

A committee of the board of directors of Mexico's state oil company Pemex has refused to approve a draft business plan for the company, saying it was not sufficiently detailed, a board member said today....A new government regulator created under the 2008 reforms sharply criticised Pemex's flagship Chicontepec oil project last week, warning poor planning and execution meant the venture was running the risk of not being profitable.

Pemex has poured more than $4.5 billion into Chicontepec in an effort to ramp up production from the area to replace dwindling output at other fields, but efforts have so far shown little promise.

Qatari Diar Acquires 5% Stake in Veolia, Gets Seat on Board

(Bloomberg) -- Qatari Diar, a unit of the country’s sovereign wealth fund, acquired a 5 percent stake in Veolia Environnement SA to work on joint projects.The purchase “reflects the two groups’ mutual ambition to work together on infrastructure and utilities projects in the Middle East and North Africa,” Veolia, the world’s biggest water company, said in an e-mailed statement today.

The Best Peak Oil Investments, Part VII: Peak Substitutes?

Increasing demand and constrained supply of oil is fueling the search for oil substitutes to use in its place. Unfortunately, almost all of these potential substitutes also have limited supply. This article looks at the factors that limit the supply of (or demand for) potential substitutes.

Letter threatens new pipeline bombings

After months of silence, another threatening letter linked to a series of six bomb attacks on sour-gas wells and pipelines in northeastern British Columbia has been delivered to a local newspaper.

In Vermont, nuke power faces a test

VERNON, Vt. — The pro-nuclear governor here has gotten a cream pie in the face. Compost has been thrown on a nuclear power plant manager. Protesters, including several grandmothers, have been arrested for trespassing at the plant gate.This was not what President Obama, who hopes to spark a renaissance in nuclear power, had in mind this year when he urged an end to "the same old stale debates between the left and the right, between environmentalists and entrepreneurs." In Vermont, the same old debate rages on. As an embattled nuclear plant seeks to extend its operating life — and become a symbol of the conflict over whether to expand nuclear power — it's "no nukes" vs. "pro nukes," and not much in between.

BP pledges not to use open-pit mining at Canadian oil sands sites

Tony Hayward, BP's chief executive, has attempted to dampen growing investor anger over its oil sands activities by publicly pledging for the first time not to use mining techniques that devastate the landscape.But the pledge was not enough to head off a significant rebellion from a growing group of increasingly environmentally aware investors at its annual general meeting today.

California Climate Fight May Break Campaign Spending Record

(Bloomberg) -- A dispute between environmental groups and refiners Tesoro Corp. and Valero Energy Corp. over global warming laws in California may flare into a political campaign with a price tag exceeding $150 million.The Texas-based companies want California voters to decide in November whether the state’s program for cutting greenhouse gases should be delayed until the economy dramatically improves. Environmental groups say the pollution controls will create jobs and should start in 2012 as planned.

Solar Growth Slows, With Homes a Glaring Exception

A new report from a solar industry group found that the pace of solar installations slowed last year amid the economic downturn.Total capacity installed for all types of solar energy grew by 5.2 percent in 2009, compared with 9.6 percent the previous year. But Rhone Resch, the chief executive of the Solar Energy Industries Association, which released the report Thursday, said that the overall number hid tremendous variation within the industry.

Transition Town: Launch date is in sight...

NEXT month, the Hebden Bridge Transition Town group is staging the grand launch of its ideas to coincide with the Big Green Weekend.This will be the moment when we formally set off on our course towards making Hebden Bridge a low carbon community.

GAO Report: OIL AND GAS MANAGEMENT [PDF]

Interior’s measurement regulations and policies do not provide reasonable assurance that oil and gas are accurately measured. Interior’s varied approaches for developing and revising its measurement regulations are both ineffective and inefficient—Interior’s onshore measurement regulations have not been updated in 20 years and do not address current measurement technologies.Report highlights [PDF]Additionally, Interior’s decentralized process for granting waivers from current regulations and approval of alternative measurement technologies allows officials to make key decisions affecting measurement with little oversight, increasing the risk of approvals of inaccurate measurement technologies. Further, Interior has failed to determine the extent of its jurisdictional authority over key elements of oil and gas infrastructure, including gas plants and pipelines, limiting its ability to inspect these elements to assess the accuracy of their measurement.

Oil Falls Below $85 on Slow U.S. Recovery; Dollar Damps Demand

(Bloomberg) -- Oil declined for a second day on speculation that economic recovery may be stalling in the U.S., the world’s largest energy consumer.Oil slipped below $85 a barrel in New York as the U.S. currency strengthened against the euro amid speculation Greece will struggle to curb its budget deficit. U.S. weekly jobless claims unexpectedly climbed to a two-month high and industrial output in March rose 0.1 percent, less than analysts forecast.

Oil May Rise as U.S. Supplies Drop, Equities Gain, Survey Shows

(Bloomberg) -- Crude oil may rise next week reflecting a decline in U.S. inventories and predictions U.S. equities will advance, a Bloomberg News survey showed.Sixteen of 36 analysts, or 44 percent, forecast oil will climb through April 23. Fifteen respondents, or 42 percent, predicted that futures will decrease and five said the contract will be little changed. Last week, 50 percent of analysts said there would be a decrease in prices.

Peak Oil: the end to globalization?

Jeff Rubin in his recent book Why Your World Is About to Get a Lot Smaller and in his many public appearances has made a very passionate and compelling case for the concept of "peak oil."The thesis he and others expound is quite straightforward and is based on the simple laws of supply and demand. In short, the rising demand for oil from the many emerging economies cannot be met from the existing known reserves nor is there any likelihood of major new discoveries to meet the shortfall.

Oil crunch by 2012, say military experts

RISING oil prices pose a grave threat to global economic recovery, according to some economists.Thus it was sobering this week to read that the US military has warned the world faces a "severe energy crunch" and looming oil shortages.

According to a Joint Operating Environment report from the US Joint Forces Command, "a severe energy crunch is inevitable without a massive expansion of production and refining capacity".

Alex Jones reacts to news of potential oil shortages

“We see hype coming out of government in the west claiming that we have peak oil and there isn’t enough oil in the ground, but I live in Texas; you can find oil just about anywhere. The world is awash in petroleum, but there is a shortage in refining capacity, especially in the west,” said radio host Alex Jones. “This is really just propaganda and just an excuse to invade more countries.”"This is a larger geopolitical battle taking place here," said Jones. "Really, it’s like deBeers and the diamond monopoly. We’re not running out of oil, but we haven’t built a new refinery in more than 25 years. They have created an artificial scarcity and just basically rob people."

Statoil resumes helicopter filghts in Norwegian Sea

OSLO (Reuters) - Statoil said it has resumed some helicopter flights to offshore platforms in the Norwegian Sea on Friday, a day after choppers were grounded due to volcanic ash spewed from Iceland.

Palin Urges Canada to Boost Oil Production at Ontario Speech

(Bloomberg) -- Canada should boost oil production from the tar sands in Alberta to create more jobs and greater energy independence for North America, former Alaska Governor Sarah Palin said.“Ramp up development,” she told an audience in Hamilton, Ontario. “There’s an inherent link between energy and security.”

Ivory Coast Strike Enters Fifth Day, Affects Cocoa

(Bloomberg) -- A strike by Ivory Coast transport workers that has slowed cocoa deliveries to ports entered its fifth day after talks with the government failed to resolve a dispute over gasoline prices.

Repsol to Start Idled Crude Unit at Bilbao Refinery

(Bloomberg) -- Repsol YPF SA plans to start a crude unit at its largest refinery in Spain, after it shut seven months ago because of declining demand for fuels such as gasoline and diesel.

Exxon’s Oozing Texas Oil Pits Haunt Residents as XTO Deal Nears

Exxon, the biggest U.S. oil producer, has neglected this stretch of Texas since its oil fields began drying up in the 1970s, said Jerry Patterson, the state’s General Land Office Commissioner. Now Patterson and other state officials are urging Texas lawmakers to follow the examples of California and Pennsylvania in cracking down on oilfield practices that have left leaking pipelines, wells and storage tanks.Oozing chemical pits and Vavrusa’s scarred skin are emblematic of a legacy Exxon has sought to keep buried in court, even as it gears up for a return to active exploration within miles of the ranch through its pending $29.3 billion acquisition of Fort Worth, Texas-based XTO Energy Inc.

A 2nd garbage patch: Plastic soup seen in Atlantic

(AP) -- Researchers are warning of a new blight at sea: a swirl of confetti-like plastic debris stretching over a remote expanse of the Atlantic Ocean.The floating garbage - hard to spot from the surface and spun together by a vortex of currents - was documented by two groups of scientists who trawled the sea between scenic Bermuda and Portugal's mid-Atlantic Azores islands.

Peak P? Phosphorus, food supply spurs Southwest initiative

The mineral phosphorus (P) is critical to the creation of bones, teeth and DNA. "P" is also a key component of the fertilizers used to produce our food, as critical to agriculture as water. But is P, like oil, peaking? Natural and social scientists in Europe, Australia, the United States and elsewhere see growing evidence that the answer is yes. But when? That is the question.Predictions of P scarcity run the gamut, starting as early as 2034 to as late as 2070 or beyond. According to ecologist James Elser of Arizona State University (ASU), most people don't realize that phosphorus is mined and that these mines are a limiting resource.

"Our current use of phosphorus is not sustainable," Elser asserts.

Ruling stalls Amazon dam, but construction likely

SAO PAULO – As environmentalists cheer a judge's roadblock to a huge Amazon dam, its supporters, including Brazil's president, insist the hydroelectric project is needed and will be built.

Tax Cuts, Renewable Energy Grants Attract Unlikely Allies

They might seem like strange traveling companions, but solar power companies and chemical manufacturers are riding the same bandwagon to urge Congress and the Obama administration to expand tax cuts and grants for clean energy.

Using Tax Incentives to Drive the Green Job Economy

Our overreliance on fossil fuels, which harm human health, our billion-dollars-a-day addiction to imported oil, the economic threat posed by peak oil, our declining international competitiveness in energy technologies we invented, and the threat of human-caused climate change present a grave danger to our economy, our national security, and our children’s health and well-being. They are caused in large part by our out-of-date, uncoordinated, and counterproductive energy tax policy framework.

Governor urges climate consensus

At a Eugene lecture on climate change on Wednesday, Gov. Ted Kulongoski sought to sidestep skeptics by framing the discussion around energy independence and social equity.If there’s consensus on anything, the governor said, it’s that ending the country’s reliance on foreign sources of fossil fuels is good for the economy and the environment.

Senate climate bill to be unveiled April 26

WASHINGTON (Reuters) – A long-awaited compromise bill to reduce U.S. emissions of carbon dioxide and other gases blamed for global warming will be unveiled by a group of senators on April 26, sources said on Thursday.The legislative language to be sketched out in 11 days, according to government and environmental sources, is being drafted by Democratic Senator John Kerry, Republican Senator Lindsey Graham and independent Senator Joseph Lieberman.

China to Fight ‘World War’ Scale Climate Destruction

(Bloomberg) -- China, the biggest producer of greenhouse gases, vowed to “vigorously” develop a cleaner economy by using energy more efficiently and investing in research and development projects to cut carbon emissions.Climate change represents a threat to Chinese economic development, and laws should be strengthened to meet climate targets, the Chinese president’s special envoy Xie Zhenhua wrote in the China Economic Herald.

“The scale of economic destruction would be equivalent to that of the two world wars and the Great Depression combined” if global temperatures rise by 3 degrees (5.4 Fahrenheit) to 4 degrees Celsius, Xie said. “Human beings and the Earth cannot afford such disasters.”

And the heat goes on: warmest March on record

(AP) -- And the heat goes on. Last month was the warmest March on record worldwide, based on records back to 1880, scientists reported Thursday.

The Difficulty of Balancing Earth's 'Energy Budget'

Greenhouse gases emitted by human activities help trap more heat in the Earth's atmosphere, warming the planet. But a new analysis warns that scientists don't fully understand where all that heat is going.They can't explain where about half the heat that has built up on Earth in recent years has gone, warn Kevin Trenberth and John Fasullo, researchers at the National Center for Atmospheric Research.

That inability to balance the Earth's "energy budget" will make it harder to weigh the merits of policies to fight climate change and determine which natural events are driven by warming, the pair say in a "Perspectives" essay published in the latest issue of the journal Science.

Apparently the University of East Anglia commissioned a study led by Lord Oxburgh (formr chairman of Shell) on current climate change research. A member of that panel Royal Statistical Society president David Hand made an interesting claim:

“basically all statistics”

Statistical fluctuations do make a difference when analyzing data of limited sample size. That is one issue that oil depletion analysts are familiar with. We see variations in data all the time and have to deal with it constantly to make any sense of trends.

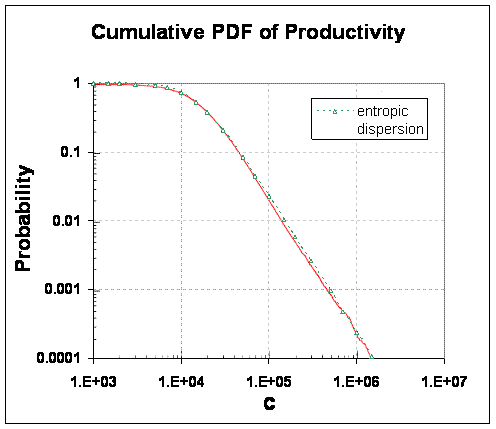

As a counterpoint, I wanted to point out an example of a set of data dealing with labor productivity (C) collected by Japaneses researchers. I am currently modeling this because the math model that describes productivity turns out to be very similar to that I use to model oil exploration. This particular data set consisted of over 1 million firms and 15 million workers. The number of points is so large that virtually all noise from the statistical mechanics of the econophysics has disappeared.

Here is the data histogram (red line) and an econophysics model fit (blue line) over a linear regime:

Over a much larger log scale, if we plot the cumulative it looks like the following:

The only spot on the whole curve that fluctuations play any kind of role is in the range of very large C. These values turn out to be more rare (i.e. cumulative probabilities of one hundredth of a percent) so that statistical noise is only really apparent here, and then only barely. The cumulative helps to smooth out the variation as well.

This is just an example of a experimental situation where "counting statistics" plays almost no role whatsoever and the econophysics (the statistical mechanics of the actual behavior) is completely clear. All that one needs to argue is the validity of the model itself. Were it that easy for climate change and oil depletion.

One potential brightspot is that labor productivity as I analyzed it may make an excellent proxy for monitoring energy use trends in the future. Since, as Steve Ludlum has pointed out, labor productivity leverages energy, especially in efficient business cultures such as Japan, then we may be able to use this data as a more "noise-free" window into oil depletion and energy usage patterns than we can from more direct measures.

A Green New Deal for Europe? What do you think? Is this a viable policy?

I've just heard something interesting on the BBC radio (can't find an article on the website). Apparently the flight shutdown over Britain and some parts of Northern Europe due to the ash in the atmosphere is leading to some problems with, eg, aircraft full of green beans that have been loaded ready for shipping somewhere in africa to be flown into the UK, and that if they don't get shipped within the next day they're going to have "gone off" beyond what the buyer will tolerate. It'd be interesting if this makes it into the TV MSM to highlight just how much oil dependent transport of food happens, but I suspect they'll just go with people complaining about their holiday plans being disrupted.

Our whole networked system is so complicated that it is hard to see where the ash problems will lead. The WSJ has an article Airlines Are Grounded as Ash Clouds Spread Across Europe.

The things the article mentions are

1. Loss of revenue for airlines, especially from first class passengers, not likely to rebook.

2. Rental-car firms, ferries, trains and hotels would benefit from the disruptions to air travel.

3. Disruptions to cargo, especially between Europe and Asia. (As you mentioned, if the travel disrupted is of perishable things, these may perish).

4. Lower demand for jet fuel, affecting prices.

The eruption was still going strong, as of Thursday.

With the economies everywhere still fragile, it would seem like, for example, the bankruptcies of several major airlines, if this keeps on, could be a major force affecting world economies.

Those airlines are going to go bankrupt sooner or later anyway. If not this, then something else would eventually do them in.

Something that people haven't really faced up to: volcanoes sometimes go on, not for hours, but for MONTHS or even YEARS like this. Has anyone even dared to consider what a Europe with all flights grounded FOR YEARS might imply?!?!?

And lest we feel smug over on this side of the pond, the same thing could happen to us any day now.

Apparently, while eruptions are common and volcanoes can go on smoking the big cigar for months, the problem this time is due to the path the jet stream is temporarily following.

Seemingly part of the problem is steam created from the melting ice which is allowing the dust to disperse to a wider area. Once the ice and steam is gone the eruption should become a more local affair. Until Katla blows that is, then we may be in for some serious trouble.

Speaking of melting ice and Katla I just found this tidbit on wikipedia (of course).

No references to any specifics of that estimation but there was some support for the average discharge of those rivers.

I then learned that these events occur often enough in Iceland that it has a name - Jökulhlaup (meaning glacier burst).

Reading thru that wiki page there was mention that some large surges of freshwater into the North Atlantic Ocean may have "triggered the reduction in thermohaline circulation and the short-lived Northern Hemisphere Intra-Allerød cold period." In other words "The Day After Tomorrow Scenario" minus the bad acting and dramatic effects. So now I'm left wondering, just how much glacier is up on that mountain? Is it enough to slow the NAC?

I'm no climatologist or volcanologist but it struck me as plausible right off and I have yet to see any mention of this affect. Any experts out there?

It is my understanding that it would take one sverdrup (1 million cubic meters/second) to stop the NAC. I don't know how much less would slow it to some degree.

I think going on for years at this level is highly unlikely. Not that the earth doesn't occasionally have some pretty wild volcanic episodes, the major floof basalt episodes, which sizes of millions of cubic kilometers are pretty awsome (but typicall take tens of thousands of year), and only happen a few times in a hundred million years.

I was fascinated reading the comment thread on eruptions, where the scientists monitoring the instruments were posting comments/theories etc. They did thing this baby was just getting going. But also the explosiveness is due to the large volumes of meltwater. That source won't last for more than a few more days.

what is the iridium content of the ash ?

"The eruption was still going strong, as of Thursday... With the economies everywhere still fragile"

Wouldn't it be something if this one little eruption ended up being "The Little Black Swan" that catalyzes the dreaded super-doomer a 'fast' collapse.

Maybe Obama should call a summit to decide what deck chairs need to be moved this weekend.

Yes - since Dubai & Greece didn't do it, doomers will have to "hope" this is it ;-)

Since the last eruption lasted for about 2 years, this thing could have some very unexpected consequences.

Return of the Transatlantic Cruise ships?

The potential exists for the cloud to wrap around the whole planet. It would be kind of funny if we had to return to using cruise ships to cross the Atlantic. I think they only handle about 3000 people.

Although the short term effect will be a destruction of the airline industry, the long term affect will be on crops and agriculture. Past eruptions have caused famine in Europe and the USA.

When Mount Tambora erupted in 1815 it blanket the earth with so much ash climate was disrupted worldwide. Causing crops to fail from frost and snow in the summer of 1816. (Don't worry, this is no Mount Tambora)

Current situation and 24 hour forecast

http://metoffice.com/aviation/vaac/data/VAG_1271417376.png

http://metoffice.com/aviation/vaac/index.html

The London meteorological office is official volcano ash prediction center.

http://edition.cnn.com/2010/WORLD/europe/04/16/volcano.weather/

Effects of past eruptions:

http://www.guardian.co.uk/world/2010/apr/15/iceland-volcano-weather-fren...

http://en.wikipedia.org/wiki/Year_Without_a_Summer

What is a bit confusing to me is that we have had large volcanic eruptions in recent history without it affecting that much air travel. Surely those past clouds spread out to cover large areas as well? Is it just the weather keeping the clouds together and the location of the clouds in the frequently travelled air routes that are causing such problems this time?

Another question is at what ash particle concentration is it safe to fly airplanes with jet engines? Perhaps, we need to deploy older technology and bring back some prop planes or would they be affected by the ash as well?

We use a "prop" plane for skydiving activities. The propeller is driven by a turbine which will have the same problems as a jet engine with ash. So, no skydiving for me this weekend.

There were reports on radio that if this continues for some time we could expect shortages of certain food items that are flown in.

First the Icelanders screw us with their banks and now with their volcanoes.

According to some wag: "We said 'Send CASH', not 'Send ASH'!"

..... So then, if you stop asking for all that cash, maybe they'll stop sending you all that ash?

No, everyone else screwed them with the banks...The eruption is - payback

Dragonfly41:

It is all about location and type. Not all volcanoes are the same, nor do they all erupt in the same way:

http://vulcan.wr.usgs.gov/Glossary/VolcanoTypes/volcano_types_quick_refe...

http://www.geology.sdsu.edu/how_volcanoes_work/Volcano_types.html

Europe just got "lucky" with this one.

The BBC showed some scientists in a prop plane sampling the edges of the plume. They said prop planes are less sesitive. But, also that they were afraid to venture into the higher concentrations.

Imagine a volcano that goes on for years and years, grounding the airlines to the point where they all go out of business and flying becomes but a memory.

Would the first day or two look any different than it does right now?

We have to take this seriously. After Vesuvius went off, there were no flights into or out of of Italy for 2000 years.

Seen in comments elsewhere :-)

Volcanoes and their effects on civilization is a fascinating, under-discussed topic. I highly recommend “Catastrophe: An Investigation into the Origins of Modern Civilization” by David Keys, which theorizes that the ancient world was reset globally by a huge volcanic eruption in 535/536 (see http://en.wikipedia.org/wiki/Extreme_weather_events_of_535%E2%80%93536) . The Santorini eruption which devastated the Minoans, and which some think is the basis for the Atlantis myth, is another great case in point. Interesting to imagine something like this happening in our time!

Thats so funny and exciting.

I hope Frankfurt has to close down the next 2 years.

Just watch and see what happens...

There is no real need for air travel anyways. We can always built Zeppelins again.

Here's an article on what happened to Finnish F-18s flying in this volcanic ash cloud.

Hornet engines ashes (Google translated)

Yep. Basically volcanic ash is quite abrasive. Like sending sandpaper through an engine. Not good.

Alex Jones is sooo last year.

http://tonto.eia.doe.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WPULEUS3...

Oh I think he is really good. Well, good for a good laugh anyway. According to him Peak Oil is one giant conspiracy, and he hints that the Bilderberg Group is behind it. He knows because he says he has researched this in great depth. He lives in Texas he says, and in Texas you can drill almost anywhere and find oil and gas. He says the Gulf of Mexico has massive reserves, so has Russia and the North Sea. He says the world is awash in petroleum.

Well there you have it. Peak Oil is a conspiracy by governments in the West, the Pentagon as well as the top ten oil companies in the US and England. He says Bilderberg plans to run prices up to above $100 a barrel in the next year and they plan on blaming it on a lack of refining capacity.

I love it, these conspiracy theorists are a riot.

Ron P.

Ron,

I know you track US oil production closely. What do you make of the EIA's very recent revision to November 2009 production? That's more than half a million barrels per day of reported production which apparently wasn't actually there.

http://tonto.eia.doe.gov/dnav/pet/pet_crd_crpdn_adc_mbblpd_m.htm

Undertow, I am shocked. Nothing happened in November to cause such a one month drop in US oil production. Most of it is "adjustments" to Padd 3. This makes no sense but apparntly it is just to make up for posting too much production in the past. It will be interesting to see if they revise the International Petroleum Monthly report next month or the Monthly Energy Review which comes out the last week of this month.

Ron P.

As I notred previously, there is a bit of a disconnect between what the MMS reports as Federal Offshore production and what EIA has posted. Usually, the numbers track quite closely (sometimes identical, certainly within a few thousand barrels per day).

Beginning in 2009 the disconnect between the two reported values got pretty out of whack and the EIA has posted ~120 million barrrels MORE production than has been posted by the MMS (the GAO report not withstanding).

Eventually, it would seem like that would catch up to you. And apparently it has. Don't be surprised if there are more fairly large "adjustments" in the future.

Is there a summary report of the MMS data available or a user friendly web interface like the EIAs? I did find the public raw data tables available for download when I had a quick look but it wasn't immediately obvious to me what was what.

Yes, here is the link:

http://www.gomr.mms.gov/homepg/fastfacts/pbpa/pbpamaster.asp

Simply type in the date range and it will give you summary data. Although not as detailed as some of the other datasets, it will give you the basic information I referenced.

Interesting. MMS reported GOM Natural Gas production has fallen from 7.1 bcf/day in July to 5.6 bcf/day in January.

As I outlined on the offshore drilling thread, my source told me in October, 2009 that the Thunder Horse Field was showing rising water cuts, due to very high vertical permeability. And someone posted MMS data showing a drop in GOM production of about 250,000 bpd from 9/09 to 12/09.

Has anyone been able to identify what fields contributed to the decline?

Usually, the water production data is included in the MMS data though none is shown for Thunderhorse.

Here is the most recent data for Thunderhorse since it came on line this past summer (in barrels).

06/09.......223,579

07/09.......1,016,422

08/09.......1,003,180

09/09.......976,484

10/09.......978,821

11/09.......720,602

12/09.......857,311

01/10.......905,199

Note the oil to gas ratio has changed pretty dramatically since startup, but 8 months of data is probably not enough to really see a trend here. You will the data for Thunderhorse under the Mississippi Canyon, Lease G09868.

I have not strayed too far into the data to see what fields contributed to the largest declines. It looks like the production was throttled back pretty broadly in November (just looking at wells producing 100,000 to 10,000,000 BPM as the database filter). Taxes took precedence.

Maybe this weekend I play with the data a bit.

Half of the 9/09 to 12/09 decline was due to Thunder Horse. The July peak rate was 327,000 bpd, while the average for the last three months of data was 275,000 bpd, with a recent low of 240,000 bpd in November.

Note that production started in 2008, according to the following Rig Zone article:

http://www.rigzone.com/news/article.asp?a_id=70866

Note the June, 2009 number: 74,000 bpd. This is consistent with what my source told me in early October--that Thunder Hose was down to about about 60,000 bpd (he only had data through June apparently). I would assume that the bulk of this decline was voluntary (perhaps as they tried to address rising water cuts).

In any case, the bottom line is that the producing wells reportedly start making water very early, in the first few months of production. This is the same problem that apparently caused Neptune Field production to crash:

http://www.upstreamonline.com/hardcopy/news/article185261.ece

Marathon feeling heat at Neptune August, 2009

Marathon of the US has written down the value of its share of the BHP Billiton-operated Neptune field in the deep-water Gulf of Mexico in the wake of flagging production one year after coming on stream.

Hang on. Are you saying that Thunderhorse is recorded as producing less than 1 million barrels per month?

I assumed that the data table actually showed 1,000's of barrels per month.

Still not getting it. That would mean Thunderhorse was producing a Billion barrels per month.

Just quickly totalled all the data for 2009 and that field does seem to be barrels. Either this is not Thunderhorse, is only partial Thunderhorse or Thunderhorse is struggling to stay above 30kbd.

You're right. That's the hazard of trying to multitask.

So, as you said, either the actual production data are far worse than what my source told me, or we aren't looking at anything related to Thunder Horse.

My source says that it appears that Thunder Horse is still experiencing rising water cuts. Still trying to get an exact current production number.

It's possible that the production data above are from Thunder Horse, North. The mid-2009 start up date would make sense:

http://www.offshore-technology.com/projects/crazy_horse/

30k bopd, but weren't they talking about 250k boepd ? gas production of 1.1 bcfd ? someone mentioned gas production data but i cant find that just now. anyone have gas production for th ?

Converting that to "barrels per day" it comes to:

Wow! I really thought Thunder Horse was producing a lot more oil than that. What happened to the 250,000 bp/d it was supposed to be producing/

Ron P.

Even that is going down. Maybe that 250,000 was only BOE in natural gas? In any case, it seems pretty clear that the return on investment here is 'disappointing' to put it mildly.

http://www.businessweek.com/news/2010-04-10/bp-thunder-horse-maintenance...

Using your link and doing the math: ...will lower 2010 production by about 10,000 barrels of oil a day,

BP will start to close about half of the wells feeding Thunder Horse this week for about 60 days

60 days is approximately one sixth of one year. That means that about 60,000 barrels per day will be lost for 60 days. If that is one half of the output of Thunder Horse then they are currently producing about 120,000 barrels per day.

Also: ...The lost production is equivalent to about 0.25 percent of the company’s overall output...

The company raised total output to 4 million barrels a day last year...

.25 percent of 4 million also comes to 10,000 barrels per day. So there we have it twice. Thunder horse is producing, according to this article, 120,000 barrels per day but will only be producing about 60,000 barrels per day for about 60 days. In other words they are producing about half of what they originally predicted.

Ron P.

I suspect that these data points are for Thunder Horse, North.

Has anyone been able to track down the actual Thunder Horse production data?

I've got the data loaded up into an Access database and with enough time I think I can figure out all the lease numbers which might apply other than G09868. Starship Trooper any other codes?

There are public lease descriptions at http://www.gomr.mms.gov/homepg/pubinfo/pdfindex.html

If someone can identify if there are any more for Thunderhorse from this that would be great. Otherwise I'll try and figure more out as and when time permits.

[Edited to remove partial Thundehorse data. See corrected info and discussion in Drumbeat 17th April]

I think I missed the memo. I thought we were the conspiracy theorists and hiding of the decline in Saudi Arabian oil production was the conspiracy. ;-P

one side hates us, and the other side hates us too.

charles

back in 2002 or 03 rush limbaugh was spouting on and on about oil shale and the trillions of barrels there ripe for the picking. Alex Jones is more loud in the radical sections of the people than even rush is.

typos are due to laptop, argh.

charles

Jones may be wrong most of the time, but even a broken clock is right twice a day.

I need to track this guy down Ron. I have a few thousand locations in Texas ready to drill. I'm sure with his confidence level he's more then ready to put some money behind his mouth.

I think he is wrong about the Bilderberg Group being behind it. If they were then it would be covered by the MSM just like Global Warming.

So we have been on the bumpy plateau 73 MBD for about six years now - since 2004.

Any predictions for when we fall off?

Personally, I didn't think the plateau would last this long

I get all my exercise jumping to conclusions

I don't have any predictions since the length of the plateau is in some way controllable via market forces. Thinking logically about it, cranking up the extraction rate in the face of dwindling reserves can enable a system to maintain a plateau. I described this a few years ago in the context of the Oil Shock model (http://mobjectivist.blogspot.com/2005/12/top-overshoot-point.html)

Here is a hypothetical situation where some arbitrary parameters were assumed:

The classic curve assumes a constant extraction rate while the plateau curve uses an accelerating extraction rate kicking in near the initial peak. The form looks like this:

Interesting that in the event of the expected scant future discoveries no amount of acceleration can stop the decline and the plateau will eventually drop off. This is an econophysics model by the way.

Nice work on the graphs Web. I didn't put together graphs, but have thought that the longer the plateau was maintained by way of added super straws to the biggest existing fields, the harder the drop from plateau would be once it initiated.

Yeah, the big question still remains, when will it drop off? I suppose that partly depends like you say on rate of extraction. It would be interesting if TOD took a poll on expected quarterly periods as to when posters think the drop off will occur. I'd pick the first quarter of 2012.

I think the DOE has it right - 2012ish.

The "unidentified (flying) projects" they hope for will not materialize and the Global Village begins THE Crash Diet.

But, it's possible the global financial games fail to keep Frankenstein Humpty Dumpty together much longer and the global economy collapses again like 2008/9.

In which case production declines might arrive earlier than expected.

Yes, 2012 or within six months either way. Non-OPEC production will stay high until July or August. Then it will start to decline, slowly at first but start to drop much faster in the second half of 2011. OPEC will be able to increase production to keep pace with non-OPEC decline until about mid 2012.

By late 2012 even Alex Jones will know we are on the downside of the peak. Of course he will still blame it on the Pentagon, the oil companies and the Bilderberg group.

Ron P.

Alex Jones + Bilderbergbumblingdorks + Beck + Palin + Rush + teabaggers + Obama = deafening cacaphony of confusion just before the bottom falls out.

Let's hope we make it to 2012.

OK, that would be some freaky stuff if the Mayans pegged the year of great worldly transition.

I like the idea above of the little black swan. As Greer would say "a minor event causing great effects." Maybe we are looking at another little swan in the financial market with the SEC going after gold-in-sacks.

I think 12/21/12 is a good time to die.

Mayans didn't think of 2012 as a finalistic death, but a death of one age and the birth of another. Sounds about right.

Yes, thats been my thinking all along. Non instantaneous changes that take a few years to work out. No precise date to draw the line at. Might as well pich Mayan epochal date, as that will probably be not to far from the period of most rapid change. Both human affairs -economic system, and geological, global warming, and other human assaults on the biosphere ushering the anthropocence geologic era.

Demand will exceed supply in two months, not in two years, although the imbalance at first may be only temporary.

In reality, demand can only exceed supplies for short periods where surplus inventories have been built up. Keep in mind that the US only minimally tapped the Strategic Petroleum Reserve when pruices passed $140, so most national strategic supplies will be saved for more dire emergencies - such as hurricanes, volcanic activity, blockades, outright war, etc.. The recent hijacking of two US bound oil tankers did not bring much if any response from the Department of Energy.

However OPEC does have some limited ability to step up production, which if I understand some recent statements made by OPEC members correctly, they might kick it up at about $100 oil.

No doubt though, the production plateau phase is coming to an end, and it will be all downhill from there within a year or two.

My guess is that the amount that was potentially in the ground was a bit more along the lines of what some optimists were saying. However, they seem to have failed to realize that just because it is in the ground doesn't mean that it is necessarilly going to come out - it has to be gotten out. That takes investments in megaprojects - investments that were not and are not being made in anywhere near the level required to push things up above that 73 mbpd benchmark. So, there we have been setting. The investment capital is still not forthcoming - how can it be, given the state of the global financial system? Thus, 73 mbpd is effectively the peak, not necessarilly because that is the maximum it possibly could have been, but because that is what we've ended up with given limited megaproject investments. The good news, if this is anywhere close to the truth, is that if we have indeed "undershot" the maximum theoretical peak, then that leaves open the possibilty of a decline slope on the backside of the curve being a little less steep and catastrophic than it could have been. This means we might stay on the plateau a bit longer, and the slide off it might be very gentle for quite a while afterwards.

I could be wrong about this, of course - as could just about everyone else.

On the net export side, Sam's most optimistic scenario is that the post-2005 CNOE (Cumulative Net Oil Exports) from the (2005) top five net oil exporters will be about 132 Gb. I estimate that by the end of 2010, the (2005) top five will have shipped about 30% of their post-2005 CNOE. Sam shows the net export decline rate accelerating after 2010, which is only to be expected. The model and multiple case histories show that net export decline rates tend to accelerate with time.

This is perhaps the most insidious characteristic of net export declines--the initial net export decline rates tend to be low, but the flip side of that is that the initial net export depletion rate is quite high. The Indonesia, UK, Egypt (IUKE) case history is a prime example. Their 1996-1999 combined net export decline rate was only about 3%/year, but their combined post-1996 CNOE depletion rate was about 25%/year from 1996-1999. In other words, over the initial decline period, they were depleting their post-1996 CNOE at eight times the rate that the volume of their net exports was falling.

For the (2005) top five, Sam's best case scenario, over the 2005-2013 time frame, is that they are depleting their post-2005 CNOE at about 5.4 times the rate that the volume of their net exports is falling. Of course, then we have the ELM 2.0 (Chindia, et al) factors.

I'm going to chime in with my prediction, based on eyeballing the graphs WT shows on the peak and decline of the UK north sea, and also the US lower 48. If you squint at these two graphs plateaus and average them, the average time at the peak plateau seems to be about 6 years.

these two represent a wide variety of different fields, which could be taken as a proxy for the whole world

so Im going to say 2011 we will see a fall off the cliff.

Matt Simmons was right - but his prediction of 2010 was a year early

Remember that our historical models are virtually 100% conventional, while current global production is conventional + unconventional.

Well it has to happen before Dec 22, 2012.

And if it does happen in 2012, you can bet the likes of Rush Limbaugh and Glenn Beck will be the first to scream "The Mayans did it!" and agitate for taller fences and more yahoos with guns.

OIL CRUNCH by 2012 - what does that really mean?

Higher prices, shortages, power outages, economic depression, all of the above???

The WSJ is now reporting SEC Charges Goldman With Fraud

It is hard to believe the Goldman would be charged with anything, it has such ties to the US government. Maybe it went too far this time.

I was thinking that, too. Goldman Sachs pwns the US government. Or is it the other way around?

Here's the SEC complaint (courtesy of Denninger).

MA senate election.

That taught Obama that he needs to do something about the Wall St.

The covered wagons closing in a circle:

http://www.youtube.com/watch?v=_AWktx-tCZg

Jim Cramer slammed on CNBC

Actually, Obama pushed harder for healthcare passage once MA voters replaced Kennedy's position. He saw the writing on the wall, come november 2010, dems would be out of power. And here we are, obamacare.

Alex Jones, I happen to enjoy his message, and he has been consistent with his message. The govt is corrupt, more than ever before. The new world order is real. War really is a racket, as mentioned by Smedley Butler, in the 1930's, the most decorated U.S. Marine in US history.

Wall street owns and runs the govt.

The politicians and the prez may slam wall street, but when the cameras are off, it's back to business as usual. Screw the people and tax them more.

Standback and look at the big picture over the years, we are being played by an elite group of career politicians (the second oldest profession). they aren't leaders, they are nothing more than politicians. The first objective of politics is to hide/distort the truth. plain and simple.

Youtube: "policestate 4", open your eyes.

I don't know why you wouldn't expect them to be prosecuted if there is clear evidence of law breaking. Surely there is something in the Constitution calling for equality before the law for all financial speculators.

Bad jokes aside, it will be interesting to see how any punishment, assuming guilt is determined in court, stacks up against that meted out to the average non-rich youth caught threatening the moral fibre of the nation by dealing pot.

I hope people take the time to read Paul Krugman's column today. A look a Republican duplicity in the matter of financial reform. http://www.nytimes.com/2010/04/16/opinion/16krugman.html?hp

I was a bit surprised it was the government, not the suckers who bought the built-to-delierately fail" products bring the suit. It is a civil suit, so can't directly lead to criminal charges. But, what happens if it exposes true criminal activity. Do they get off because of double jeopardy, or some other ridiculous technicality? Or do they have enough money to buy any judge and jury!

OK, why is the SEC suddenly growing a pair and biting the hand that feeds it? I don't trust this development at face value.

Assume that it happened when Obama's new SEC chair took over. It takes time for the word to come down that the new boss is serious about enforcement. Staff reports that they have what appears to be illegal behavior and is told to pursue it. The investigations for this type of crime take large amounts of time, to dot the i's and cross the t's. When did what things happen? Can we prove that so-and-so authorized particular actions? Or at least that they knew such actions were going down and did nothing to stop them? Progressing through the documents, taking depositions, etc. It is not uncommon for charges to be filed years after the events in question. Compared to the usual pace, the SEC appears to be moving at breakneck speed.

If I were trying to anticipate a conspiracy or political stratagem -- not necessarily mutually exclusive concepts -- I would look for Geithner to resign and Bair from the FDIC nominated for Treasury. Then a series of announcements like this one, and after each the Congressional Dems make the financial reform bill tougher. Final votes on the bill shortly before the summer recess starts, a clear challenge to Republicans to vote against the bill just before they have to go home to do their heavy campaigning.

Love Obama or hate him, it seems worth noting that during his successful campaign, he generally looked smarter a few months after things happened than he did while they were going on.

The SEC took its time because you do not press criminal charges against a vice president of Goldman Sachs, a man who can afford the best possible defense legal representation, without all of your case prepared to perfection. Otherwise you lose, the prohibition on double jeopardy kicks in, and you wind up looking like a jerk.

Oil under $83 as stocks slump on Goldman news

Good old Goldman.....LOL They are wrecking the finances again, and again, and again. It is now clear that the Treasury, the Federal Reserve and Wall Street all played together and caused this mess that we are now suffering. The SEC is trying to win public friends by pointing the finger at GS, but they should have done something 5 years ago, now it is too late.

How Bubble Barons Protected Their Influence While the Economy Tanked

AlterNet citizen journalists investigated bubble barons who got rich as the rest of the economy tanked. The project shed light on the barons' power delusions and toll on society.

http://www.alternet.org/investigations/146462/how_bubble_barons_protecte...

Research Groups

Research groups allow LittleSis analysts to work together on research projects. Currently groups can only be created by LittleSis staff, but soon any analyst will be able to create them. In the meantime, if you want to create a group to help you organize a project on LittleSis, please contact us.

Maybe in light of the doomerish coments on the oil production cliff awaiting us all, the US govt recognizes that GS will not be big and powerful for much longer so the might as well go after some money now while it is still there.

It can be read as a kind of fissure that develops as a huge untenable slab of power cracks on its way to breaking up.

Let`s HOPE!!!

Oil and stocks down, gold and silver as well as other commodities are off. But the weather here is great. Time to plant!

Let me guess, Goldman shorted oil and they are that unscrupulous to throw themselves under the bus?

Or, it will be show trial, smoke and mirrors to give the appearance of justice. 10 will get you 20 that any VP's offered up are within 12 months of retirement.

It sucks to be this cynical.

I do not expect criminal charges against individuals at GS, just fines.

Charges will instead be levied against Paulson and Co. (no relation to Hank Paulson, the former treasury secretary). If anyone at GS is charged, it will be low level people. GS will otherwise simply pay a fine, probably not even a large fine relative to GS's profitability.

This is how the game is played.

I suspect loss of confidence in their customers will hurt far more than any fines and restitution they may have to pay. Would you want to buy a security from guys who deliberately concocted guaranteed to fail toxic crap so they could benefit from their customers taking it in the shorts.

1. The types fines levied by the SEC in the recent past, if applied to GS today, would be next to nothing, even less than a slap on the wrist.

2. GS was informed in advance of the charges against them and shorted themselves, then led the stampede today to the downside, thereby guaranteeing a large profit day for themselves while they fleeced those who had been fooled back into the stock game yet again.

3. Today's stock movement coupled with GS's own short play on itself will pay the probable fines and still make a profit. The SEC wins by being able to claim "enforcement". GS wins on profits and by getting to play publicly contrite. And Obama wins by being able to ensure future campaign contributions from his largest donor during the 2008 campaign - Goldman Sachs.

P.S. Oil price is not behaving like a commodity in short supply. It is behaving like a commodity in a bubble.

Well it's become very easy this last year or so to throw around the word 'bubble', but what exactly does that mean? Usually here at TOD and elsewhere the word bubble is used everytime some thinks the price of something is too high, mostly because of perceived speculative buying.

There are very low supplies of oil floating offshore, unless you count Iran - which is the subject of US inspired sanctions. Even there 20 million barrels of oil is not going to have a great influence on prices. US gasoline demand in March was very strong, as I posted further below. Altogether, worldwide demand appears it will overtake supply by mid-year.

It can be argued that the price is too high to facilitate economic growth in the US, but I ask - where is the evidence of a bubble?

4. Even if specific individuals are sent to prison, they can get pardoned or charges retroactively dismissed, either by the outgoing current administration, or the incoming one.

Kind of what I have in my mind as an example, doesn't directly apply to oil, but seems relevant:

"North was charged with several felonies and convicted of three, but the convictions were later vacated, and the underlying charges dismissed due to the limited immunity agreement granted for his pre-trial public Congressional testimony about the affair."

http://en.wikipedia.org/wiki/Oliver_North

Nonsense! Here is a CNBC video that I posted a few days ago.

Clayton Williams, CEO of Clayton Williams Energy

Mr. Williams is an oil driller and crude oil producer.

The point is David, that if oil were much lower then it is today, there would be a lot less oil produced. That is not the definition of a bubble. That is the definition of supply and demand.

Ron P.

Clayton Williams is not a major player in the US oil market. As their 2009 Financial Results clearly demonstrate, Clayton Williams "total estimated proved oil and gas reserves as of December 31, 2009 were 33.6 million barrels of oil equivalent (MMBOE), consisting of 21 million barrels of oil and NGL and 76.1 Bcf of natural gas. Proved developed reserves were 28.6 MMBOE, or 85% of total proved reserves. The present value of estimated future net cash flows from total proved reserves, before deductions for estimated future income taxes and asset retirement obligations, discounted at 10%, (referred to as "PV-10") totaled $460.4 million." Extrapolating from a company whose entire reserves are less than 1.5 days of US consumption to the entire world is not a valid comparison.

On the other hand, the response of oil to the run up in the stock market is quite remarkable. And the market has clearly been run up by the after hours trading desks of the largest financial firms. In fact from the market low of March 2009 through the end of October 2009, the daily market moves amounted to almost no change. It was only the after hours trading that moved the market significantly off its March 2009 lows, and at the same time, we saw oil move as well. Then today as the market takes a beating, oil dropped dramatically. If supply and demand were the only considerations, Ron, oil would not have fallen by over $3 per barrel from Thursday to Friday, a nearly 5% price drop solely on market news, not supply and demand.

I am a believer in peak oil, Ron, but I am not so foolish as to believe that every move in the price of oil is solely determined by supply and demand considerations. You are free to disagree but your evidence thus far is hardly compelling.

What does "being a major player" have to do with anything? He said they are spending a lot more money to find a lot less oil. That is true whether you are a major player or a minor player. He said he would be shut down, as far as new drilling goes, if oil dropped below %60 a barrel. That would be true whether you are a major player or a minor player. It cost him just as much to drill a well as it does Exxon.

That is the reason this is not a bubble David. It is costing a lot more to explore for oil these days, the oil being so much further down, and in some cases below thousands of feet and possibly under over a mile of salt. That is the reason oil prices are so high.

It is simply foolish to claim that oil prices are in a bubble.

Ron P.

For more than a year the price of crude oil has been behaving like it is controlled by the OPEC cartel acting as a swing producer restricting production to force the price up.

I will be visiting New York state this coming week as part of a series of talks on energy and finance. I thought some readers here might possibly be interested. For the more recent readership who may not recognize my name, I used to be editor of The Oil Drum Canada until two years ago. I am now co-editor of The Automatic Earth, a site devoted primarily to discussing energy and finance.

I will be doing either two or three talks. The first is on April 20th at Hartwick College in Oneonta at 7pm in the Anderson Theatre. The second is in Rhinebeck on April 21st (please contact TOD commenter George in Vermont at gfcomms@gmail.com for details). I also have a tentative arrangement to visit NYC on either the 22nd or 23rd (no specific details yet).

In May I will be speaking at the Tamworth Library in New Hampshire, and possibly in Texas (either Austin, San Antonio or both). In June and July I will be doing talks across Europe, and in August and September I will be touring the US midwest. I am happy to speak in other locations as well, time permitting.

Talks need not be formal academic affairs. I am happy to speak at colleges, but also to address small community groups.

I can be contacted at StoneleighTravels(at)gmail(dot)com

Hi Stoneleigh,

I've found your writings on the Automatic Earth and TOD to be most educational. Have you considered making a video of one of your talks, so the rest of us who are too far away to catch your presentation live might also view one? Or, how about doing a YouTube version??

E. Swanson

+1

Hi, Stoneleigh. I wish I could attend...a little across the country for me :-(.

Stoneleigh, Nice to see you back, I always enjoyed your talk of gardening and such, I wish I were able to travel, So I'll have to add to the list of folks wanting a video of your talk, I'd be willing to supply funds for it, in a limited way, prayers for a safe set of trips.

Charles,

Biowebscape designs for a better fed future.

Thanks All,

I will be doing a lot of traveling this year, so I may be able to get to where some of you are. So far my travel plans in the US include NY, NH, Texas, Ohio, Wisconsin, Minnesota, Iowa, Kansas, and Missouri, and I have requests for California, Florida, Montana and Wyoming. Elsewhere I have plans for the UK, the Netherlands, Belgium, France and Italy, with additional requests for Germany, the Czech Republic, Switzerland and Finland. I am working on turning all of this into some kind of sensible itinerary.

If people would like me to come somewhere, I will if I possibly can. In the meantime, I may be able to arrange a video. We have a recording of a talk I did in Vancouver, matched with slide-deck. Hopefully that will be up on TAE in the not too distant future.

When will you be in MN? Or can you point us to a link with an itinerary?

Here's a staggering statistic I just heard on BBC news: By value, the UK imports 25% of all our imports by air. Amazing.

Also the grounding of the airplanes will cost the UK economy at least 100 million pounds per day. Amazing. So volcanoes aside just realize how much of our economic activity is reliant on the airplanes.

A "preview" of what it will be like in 5 years, when planes are not affordable due to high fuel costs. The cost of all imports will continue to rise sharply. International air travel will become a luxury. Nuclear powered ships will become much more widely used.

If only we could harness volcanic energy in an easier way!

That is going to take a while. First, someone would have to provide government approval for the idea (even considering the security aspects of nuclear fuel). Then someone would have to design the ships and build them (or retrofit existing ships with new nuclear powered engines). I bet we are talking at least 15 or 20 years, even if military technology is applied.

Cool one -

I have serious doubts as to whether we will see a widespread use of nuclear powered commercial ships.