Drumbeat: May 14, 2010

Posted by Leanan on May 14, 2010 - 10:13am

Wind power growth in China's deserts ignored financial risks

Across the country, seven wind-power zones, each with a capacity of 10 gigawatts, have been approved. In the space of just a few years, this previously overlooked source of energy has undergone a massive expansion, led by China's "big five" power firms. Han Mingwen, the deputy chair of Guazhou's reform and development committee, has said his region is leading the way: "We are pioneers," he said on July 16, 2009. "A lot of management and technical issues will be solved here and large-scale projects in other provinces will be able to learn from that experience."At the same time, concerns about a national wind bubble are mounting. The losses visible in financial reports from Jiuquan's emerging wind-power network prove that, without state assistance or more preferential policies, limitless winds do not translate into limitless profits.

Lisa Margonelli: 7 Ideas for Armchair Oil Spill Regulators

Drill here often? Then register your ship here, too--and pay some taxes.I noted yesterday that though Transocean was in fact a company largely formed in Houston, it registered itself in the Cayman Islands so it didn't pay U.S. taxes. In 2008, company brass moved to Switzerland, avoiding U.S. income taxes as well. Even more problematic, their drilling ships are registered in the Republic of the Marshall Islands, which is officially responsible for inspections but actually leaves the work up to a classification society. Under the Jones Act, only U.S.-owned ships can do coastal shipping. Do we want to allow "non-U.S. rigs" from "non-U.S. companies" to drill off our coasts?

Barack Obama: No more cosying up to oil industry

US President Barack Obama has vowed to end the "cosy relationship" between oil companies and US regulators in the light of the Gulf of Mexico disaster.Promising "relentless" efforts to stop the oil leak, he rebuked oil industry executives for seeking to pass on blame for the disaster in Congress.

Proposed spill penalty: A year of profits

NEW YORK (CNNMoney.com) -- Companies responsible for oil spills could be forced to give up a year's worth of profits under a bill introduced in the Senate on Thursday.The Oil Spill Response and Assistance Act was proposed in response to BP's Gulf of Mexico oil spill. The bill would double the current $75 million cap on economic damages to $150 million or expose a company to damages equal to the last four quarters of its profits, whichever is greater.

Environmental analysis: Oil spill disaster 'could lead to oil crisis'

The oil industry is likely to suffer as awareness of the risks of drilling grows among environmentalists, an oil and energy group has said.BP's recent oil spill off the Gulf of Mexico may cost the company more in the long-term as major organisations could join the lobby against the oil industry for its harmful effect on the environment, according to the UK Industry Task-Force on Peak Oil and Energy Security.

Spokesman John Miles said: "There is likely to be a massive outcry against the environmental risk of drilling in extreme locations and operations may get suspended."

Disastrous oil spill further greases the energy crisis

Americans act as if gasoline comes from a pump and electricity from a switch. But a recent string of environmental and human disasters reminds us that there are consequences to our cravings for cheap energy.

2 oyster areas reopen in Gulf ahead of oil slick

NEW ORLEANS, La. — Louisiana health officials reopened two prime oyster areas Friday to give harvesters a chance to gather as many oysters as they can ahead of a Gulf of Mexico oil slick that has been spreading west from the Deepwater Horizon disaster."It'll keep the wolf away from the door for a number of people," Al Sunseri, co-owner of P&J Oyster Co. in the French Quarter, said of the move by the Department of Health and Hospitals. He said he had been close to running out of oysters to shuck for restaurants in New Orleans and along the Gulf Coast.

US Coast Guard treating oil spill as "catastrophic"

DAUPHIN ISLAND, Ala. (Reuters) - The spreading oil slick in the Gulf of Mexico has the potential to be "catastrophic", and the U.S. response is already treating it as such, Coast Guard Commandant Thad Allen said on Friday.

US Coast Guard sees less threat of huge oil landfall

DAUPHIN ISLAND, Ala. (Reuters) - The oil slick from the huge uncontrolled spill in the Gulf of Mexico has broken into smaller parts, and while potentially catastrophic, may pose less threat of a massive landfall, U.S. Coast Guard Commandant Admiral Thad Allen said on Friday."The character of the slick has changed somewhat, it is disaggregated into smaller patches of oil," said Allen, who is leading the response to contain what could be the worst oil spill in U.S. history.

"It's not a monolithic spill, we're dealing with oil where it's at," Allen added.

Indonesian energy - a black future?

Indonesia is mixed up about the energy mix, and the underlying problem is the shortage of energy. Latest long range projections from the Ministry of Mines and Energy show growing dependence on coal, rising from 36.5 percent now, to 52 percent in 2025 and 86 percent by 2050.Although government and people seek a green future, the future will be black, or coal will have to be greened. What has happened to all this renewable energy we are supposed to develop? To paraphrase Humphrey Bogart in the famous movie Casablanca "It doesn't seem to amount to a can of beans".

Airlines come out for regulation -- of the derivatives market

(Fortune) -- Airlines and banks tend to be on the same page when it comes to regulation of business -- they don't want it.Now, the airline industry has decided some regulation isn't so bad. Carriers have become big champions of limitations in the financial sector, especially around reforms related to derivatives trading.

So, why the change of heart? It comes down to oil. Airlines are blaming the unchecked derivatives trading market for severe price swings that have made it impossible for them to control their fuel costs. In a note to employees on April 23, Delta Air Lines (DAL, Fortune 500) CEO Richard Anderson summed up the issue for his company: "Prices are artificially inflated and volatility is created as a consequence of excessive speculation and trading by parties with no tangible need for the commodities."

In other words, hedge funds and other investors with no intention of taking delivery are betting on oil futures, and it's making fuel hedging harder and more expensive for the parties that actually burn the jet fuel-the airline carriers.

Nigeria's oil region ex-governor freed on bail

ABUJA, Nigeria (Map, News) - A spokesman for the former governor of Nigeria's oil-rich Delta state says he was freed on bail after being arrested in Dubai for corruption charges.

BP May Bid for Colombian Reserves as Production Slips

(Bloomberg) -- BP Plc, Europe’s second-largest oil and gas company, said it may bid for new reserves in Colombia as it seeks to stem a decline in production in the country.

Is there a quick fix for KSA’s refining sector?

Saudi Arabian refining has suffered a lot since the beginning of this year. Three major development projects face an unclear future that may lead the government to review its generous subsidies for the sector.

Brazil May Top Second Biggest Pre-Salt Find at Well

(Bloomberg) -- A second oil well Brazil’s drilling as part of a plan to swap reserves for stock in state-run Petroleo Brasileiro SA may hold more than the 4.5 billion-barrel estimate of the recent Franco discovery, an official said.The new prospect, named Libra, may be larger than Franco based on seismic data obtained from the well, Magda Chambriard, a director of oil regulator ANP, told reporters today in Rio de Janeiro. Franco is Brazil’s largest discovery since the 8- billion barrel Tupi find in the offshore Santos basin in 2007.

Economic Woes Threaten Chavez's Socialist Vision

Venezuela's economy is in trouble despite the country's huge oil reserves. Blackouts plague major cities. Its inflation rate is among the world's highest. Private enterprise has been so hammered, the World Bank says, that Venezuela is forced to import almost everything it needs.The situation is creating a serious challenge to President Hugo Chavez's efforts to transform his country into a socialist state.

Semisub Had Taken on Water Before - Reports

The Aban Pearl semisubmersible rig that sank off the Venezuelan coast early Thursday had a history of listing problems, according to August 2009 reports from two Trinidad and Tobago newspapers.

Venezuela rig disaster further dents PDVSA image

(Reuters) - The reputation of Venezuela's state oil company PDVSA has taken another hit with the sinking of an offshore gas exploration platform it was leasing in the Caribbean Sea, raising doubts about its ability to develop potentially huge undersea reserves.

China coal imports may hit 170 mln T in 2010

LONDON (Reuters) - Net coal imports to China, the world's biggest coal producer, could soar by 70-100 pct to 170 million tonnes or more in 2010, boosting coal prices globally, if China's power use boom continues, according to exporters and analysts including the International Energy Agency.Despite domestic coal output of over 3 billion tonnes a year, China's 2009 net imports soared to 100 million tonnes, having been forecast at 50 million at the start of the year.

Iran’s Nuclear Determination May Doom Fuel Swap, IAEA Head Says

(Bloomberg) -- The prospects of a nuclear-fuel swap with Iran are fading because the Iranian government refuses to heed calls to curb its uranium-enrichment program, International Atomic Energy Agency Director General Yukiya Amano said.More than six months after the United Nations-brokered offer to exchange nuclear fuel for low-enriched uranium, the deal has stalled and chances of reviving it look bleak, Amano said. In the meantime, some nations are losing interest in pursuing the agreement, he said, without naming the countries.

UN warns rare metal shortage could derail clean tech boom

The UN yesterday issued a stark warning that the adoption of low carbon technologies such as solar panels, electric cars and energy efficient lights could stall unless the recycling rates for "speciality metals" used by the electronics industry drastically increases.Metals such as lithium, neodymium and gallium all play crucial roles in the development of many clean technologies. But according to a new preliminary report from the UN's International Panel for Sustainable Resource Management, recycling rates for these metals currently stand at around one per cent.

Regulators OK Ameren's 'Methane to Megawatts' project

Missouri regulators said Thursday they approved AmerenUE’s plans to build electricity-generating turbines that burn methane gas captured from Fred Weber’s landfill in Maryland Heights.

Nature loss 'to damage economies'

The Earth's ongoing nature losses may soon begin to hit national economies, a major UN report has warned.The third Global Biodiversity Outlook (GBO-3) says that some ecosystems may soon reach "tipping points" where they rapidly become less useful to humanity.

Such tipping points could include rapid dieback of forest, algal takeover of watercourses and mass coral reef death.

Wild Fishing Industries Catch On to Locavore Craze

Ask any fisherman: It's not an easy way to make a living.Still, from Alaskan wild king salmon to lobsters plucked from the chilly waters off Maine, the industries have for the most part survived, many benefiting from the newfound appreciation for local, sustainable food sources.

Iceland's volanco revealed the deep ignorance of jet-setters

Why, asks Molly Scott Cato, did it take a volcanic eruption to demonstrate to us the hugely fragile links that hold our modern lives and economy together?

Degrowth - Voices from 1st North American Conference

Pretty well everyone senses a collapse is inevitable, as natural reality, and the laws of physics, interrupt our endless expansion of population and consumption. The only question is: will we drain Earth until it dies, or will we at least try to plan something else?There is an alternative. It is called "Degrowth". A planned and willing movement to end the mad economic system of endless growth, based on endless consumption and pollution. An admission that really, to survive, humanity needs to shrink out demands upon the planet. To plan out a smaller economy, and lower personal ecological footprints.

Sustainable business: sea change or meaningless buzzword?

It may seem a misnomer as big businesses by their nature are money-making machines first and foremost, but there are ways they can reduce their impact on the environment, either through technology and more government intervention.

Bill McKibben's Nonfiction Picks

MJ: Which science-fiction book do you think is most interesting in the way it grapples with the future of our planet?

BM: The Mars Trilogy by Kim Stanley Robinson, which is really a very long book about how to make communities work (or not).MJ: Which book (past or present) has given you the most hope?

BM: The Monkey Wrench Gang by Edward Abbey.

Response to “Who’s to Blame for the Population Crisis?” in Mother Jones

The author states, incorrectly, that “Two hundred million women have no access whatsoever to contraception…” This is false and represents a common misunderstanding of the primary driver of the population problem. Many people think that the term “unmet need,” which is used to describe the estimated 215 million women who don’t want to be pregnant and are not using contraception is actually the phenomenon of unmet demand for contraception. It is not.In fact, most of these women don’t want or intend to use family planning because: 1. they have heard it is dangerous, 2. their male partners are opposed, 3. their religion is opposed, or 4. they don’t think it will work because they think God determines how many children they will have. Many people in the population/family planning field do not know this information, let alone journalists.

Q. and A.: The Population Guru

Paul Ehrlich, the biologist and professor of population studies at Stanford University, is best known for his 1968 book “The Population Bomb.”The book gained him as many fans as critics with its stern warnings about the impact of population growth, and Dr. Ehrlich continues to explore this subject in his teaching and writing, often collaborating with his wife, Anne Ehrlich.

Recently, they have become involved in the Millennium Assessment of Human Behavior, or MAHB (aptly pronounced “mob”), an international effort to engage academics and the general public on the ethical and behavioral challenges involved in creating a more environmentally aware society.

Nigeria and China sign $23bn deal for three refineries

Nigeria's state-run oil firm NNPC and China State Construction Engineering Corporation (CSCEC) have signed a $23bn (£16bn; 18bn euros) deal.The two will jointly seek financing and credits from Chinese authorities and banks to build three refineries and a fuel complex in Nigeria.

The project would add 750,000 barrels per day of extra refining capacity.

NNPC hopes the construction of new refineries will stem the flood of imported refined products into Nigeria.

Ukraine president resists Russian gas takeover

Ukraine's President Viktor Yanukovych has told the BBC he will not let Russia's state gas monopoly Gazprom take control of his country's gas pipeline network.He was reacting to an offer by Russian Prime Minister Vladimir Putin to merge Gazprom with Ukraine's main energy firm Naftogaz. Ukraine's network carries almost all of Russia's gas exports to Europe.

Moscow's surprise offer was another indication of how close relations between Russia and Ukraine have become since Mr Yanukovych was elected president in February.

Shell faces final hurdles for 2010 Arctic drilling

ANCHORAGE, Alaska (AP) -- Shell Oil won a court victory in its quest to drill exploratory wells in Arctic waters this summer but still faces several regulatory hurdles, a company spokesman said.Curtis Smith said Thursday the company awaits appeals of required federal air permits before it can send its drilling ship north to the Chukchi and Beaufort seas off Alaska's northwest and north coast. The company also needs a final Interior Department blessing and authorizations on several wildlife issues.

Talisman, Repsol Win Drilling Rights in Indonesia

(Bloomberg) -- Talisman Energy Inc., PTT Exploration & Production Pcl and a unit of Repsol YPF SA were among companies awarded rights to drill in Indonesia as Southeast Asia’s biggest crude producer seeks to replace aging fields.The government awarded rights in 14 oil and natural gas areas with planned total exploration investments of $146 million, said Edy Hermantoro, upstream director at the Ministry of Energy and Mineral Resources.

Yesterday, crude oil futures settled below $75 per barrel, hitting a three month low. Although the U.S. Energy Information Administration (EIA) recently raised its forecasts on oil prices, supply and demand forces suggest otherwise and point to the likelihood that these price levels will remain intact, if not witness a further decline.

Oil Leak Stop At Least a Week Away, BP Exec Says

(CBS/ AP) A top executive for British Petroleum said Friday that the best-case estimate for putting an end to a devastating oil spill in the Gulf of Mexico was still a week away."We'll keep trying until we bring this thing to a close," Doug Suttles, BP's Chief Operating Officer, told CBS' "The Early Show", adding that the current techniques the company is using now "won't stop" the leak caused by an oil rig that exploded April 20.

Congressman to launch inquiry on how much oil is gushing into Gulf

(CNN) -- A U.S. congressman said he will launch a formal inquiry Friday into how much oil is gushing into the Gulf of Mexico after learning of independent estimates that are significantly higher than the amount BP officials have provided.Rep. Edward Markey, a Democrat from Massachusetts, said he will send a letter to BP and ask for more details from federal agencies about the methods they are using to analyze the oil leak. Markey, who chairs a congressional subcommittee on energy and the environment, said miscalculating the spill's volume may be hampering efforts to stop it.

Sunbathing, and Keeping an Eye Out for Tar Balls

DAUPHIN ISLAND, Ala. — When David and Darla Lindsey arrived for a day at the beach with their paperbacks and crab nets and towels, they found a mysterious line of hay bales stretching along the water, taking a heavy beating from the waves.A couple of hours later, they watched in bemusement as a small army of workers in Tyvek pants, work boots and life vests came along and moved the entire line a few feet back from the surf.

Life on the prized white sands of Dauphin Island, a barrier island guarding the mouth of Mobile Bay, is proceeding on two tracks right now. While National Guard troops and scores of laborers in hazmat gear and gloves fortify the island for the coming war on oil (the hay, it turns out, is meant to absorb encroaching sheen), vacationers kite-surf and loll about barefoot, peering at the heavy helicopter traffic through their bird-watching binoculars.

Nuke the Gulf Oil Gusher, Russians Suggest

Using a nuclear explosion to try to plug the gushing oil well in the Gulf of Mexico might sound like overkill, but a Russian newspaper has suggested just that based on past Soviet successes. Even so, there are crucial differences between the lessons of the past and the current disaster unfolding.

For U.S. government and BP, no choice but to work together

Within hours of the massive April 20 explosion on Deepwater Horizon, the U.S. government launched an urgent and carefully managed response to demonstrate its control of the emerging disaster, sending Coast Guard ships to the site, keeping the president informed and posting projections of how an oil spill might affect travel.What the Obama administration did not realize was how the arcane world of offshore drilling would collide with official Washington as politicians began kibitzing about rig mechanisms on Sunday talk shows and oil executives gave daily briefings about their disaster-management skills. The administration probably had no idea that it would find itself in many ways dependent on a foreign oil company -- both foe and needed friend in the response.

Africa’s Biggest Fund Manager Invests to Help Eskom

(Bloomberg) -- Public Investment Corp., Africa’s biggest money manager, plans to invest as much as $1.2 billion in the expansion of South Africa’s power utility that is needed to keep pace with economic growth.

Peak Oil Investments I'm Putting My Money On: Part X, Improving Vehicle Efficiency

Dr. Daniel Sperling knows about as much as anyone about what policymakers can do to reduce the use of oil. He is the Director of the Institute of Transport studies as the University of California Davis, and a long time member of the California Air Resources Board [CARB], so he understands transportation from both the academic and policy perspectives. He also recently co-authored a book Two Billion Cars: Driving Towards Sustainability, so he understands the magnitude of the problem as well.

Huhne outlines coalition deal over nuclear power plants

A new generation of nuclear power plants will still be built - provided no public money is spent on them, Energy Secretary Chris Huhne has said.

Huhne attacks 'scandalous' UK wind power waste

Huhne told the BBC that he thought "the most scandalous legacy" of the past 13 years of government by the centre-left Labour Party was "the fact that here we are sitting on the part of Europe that has the most potential for wind power. For tidal power, for wave power."We literally have an abundance of potential renewable energy and yet we have one of the worst records of any country in the European Union for generating electricity from renewables".

IEA to present roadmap for CSP at industry summit this June

This June at a meeting of over 650 Concentrated Solar Power professionals the International Energy Agency (IEA) will present their roadmap for CSP. The Roadmap which was announced last week in Valencia during the Mediterranean Solar Plan Conference hosted by the Spanish presidency of the EU, emphasises that solar energy could represent 20-25 per cent of global electricity production and reduce carbon dioxide emissions by 6bnta by 2050. The roadmaps detail the technology milestones that would make this possible.

U.S. Clears a Test of Bioengineered Trees

Federal regulators gave clearance Wednesday for a large and controversial field test of genetically engineered trees planned for seven states stretching from Florida to Texas.The test is meant to see if the trees, eucalyptuses with a foreign gene meant to help them withstand cold weather, can become a new source of wood for pulp and paper, and for biofuels, in the Southern timber belt. Eucalyptus trees generally cannot now be grown north of Florida because of occasional freezing spells.

EU biofuel policy has ‘negative’ climate impact

The new study conducted by Mareike Lange and Dominique Bruhn of the institute says that current EU regulations have seen biofuel production displace food production on cultivated land. In turn this has, in some cases, resulted in new land being cleared for the purpose of producing food and in extreme cases, the new land cleared is in tropical forests. This situation leads to a rise of greenhouse gas emissions as a result of the indirect affects of biofuel production. Equally if biofuels use of previously uncultivated land, e.g. forests, savannas, and grasslands (i.e., a direct change in land use), it emits considerable amounts of GHGs and results in a loss of biodiversity and habitats as well. In this situation, the contribution that biofuels have in reducing emissions is virtually nil.

Leading Evangelical Group Expresses Grave Concern Regarding New Restrictive Energy Policies

WASHINGTON /Christian Newswire/ -- Dr. E. Calvin Beisner, national spokesman for the Cornwall Alliance for the Stewardship of Creation, made the following statement today:"Despite the fact that the scientific case for dangerous, manmade global warming is crumbling in the wake of Climategate and other revelations of scientific malpractice by leading alarmists and the Intergovernmental Panel on Climate Change, supporters of policies to fight global warming are still pushing for restrictive energy policies.

"But those policies will hurt working families and the poor by driving up energy prices. And since energy goes into everything we consume, these rising energy prices will make everything more expensive--especially the most basic things like food and clothing and shelter.

"American evangelicals strongly support greater energy freedom, not restriction."

'Climate dice' now dangerously loaded, leading scientist insists

Evidence for global warming has mounted but public awareness of the threat has shrunk, due to a cold northern winter and finger-pointing at the UN's climate experts, a top scientist warned.James Hansen, a leading Nasa scientist whose testimony to the US Congress in 1988 was a landmark in the history of climate change, said he was worried by "the large gap" in knowledge between specialists and the public, including politicians.

"That gap has increased substantially in the last year," Dr Hansen said.

Study: Climate change puts world's lizards at risk

Hundreds of species of lizards in nearly all parts of the world are at risk of extinction because of climate change, according to research reported in the journal Science.In fact, because of rising global temperatures from carbon dioxide emissions, about 1,000 of the world's 5,000 lizard species could be extinct by 2080, the researchers say.

Ambani Says Refiners Must Prepare for $100 Oil as New Norm

(Bloomberg) -- Refiners must be ready for oil prices to rebound to more than $100 a barrel on growing consumption in Asia, said Mukesh Ambani, Asia’s richest man.“We have to again be actively prepared to see a three-digit oil price” amid sluggish refining growth and higher marginal cost of production at new fields, Ambani, chairman of Reliance Industries Ltd., said in a speech at a conference in Mumbai today.

Oil falls near $73 amid signs demand may slacken

SINGAPORE – Oil prices fell to near $73 a barrel Friday in Asia amid expectations a slower economic recovery in debt-saddled Europe will weigh on crude demand.

WTI at 15-Month Low to Mars on Cushing Supply: Energy Markets

(Bloomberg) -- U.S. benchmark West Texas Intermediate oil is trading at the widest discount in 15 months to traditionally less expensive grades as supplies in Cushing, Oklahoma, the delivery point for New York-traded futures, swelled to a record.

Salazar names 2 to oversee agency restructuring

WASHINGTON – Interior Secretary Ken Salazar said Thursday he has named two high-level officials to oversee a restructuring of an agency that oversees offshore drilling.Salazar previously said he wants to split the Minerals Management Service in two. One agency would be charged with inspecting oil rigs, investigating oil companies and enforcing safety regulations, while the other would oversee leases for drilling and collection of billions of dollars in royalties.

Saras Says Refining Margins Will Recover on Stronger Economy

(Bloomberg) -- Saras SpA, owner of the largest oil refinery in the Mediterranean, swung to a loss in the first quarter and said refining margins are likely to improve as the economy picks up.

India Acquires Russian Oil Company

NEW DELHI - India has acquired a Russian oil company and bought equity stake in an oil field project in Venezuela through consortium route, the Rajya Sabha was informed on May 4.Minister of State for Petroleum and Natural Gas Jitin Prasada said, “we have recently acquired a Russian oil company named Imperial Energy through ONGC Videsh. Apart from this we have acquired 18 per cent equity share in a Venezuelan field project through consortium mode.”

Aban Offshore Falls Most in 18 Years After Rig Sinks

(Bloomberg) -- Aban Offshore Ltd., India’s largest oil rig company, fell the most in almost 18 years as Venezuela started investigating the sinking of a natural-gas platform leased by a unit to state-owned Petroleos de Venezuela SA.Aban shares fell 18 percent to 832.25 rupees at the close in Mumbai, the biggest decline since July 17, 1992. The stock has dropped 35 percent this year compared with a 3 percent fall in the benchmark Sensitive Index.

Obama eyes 'next steps' in oil spill

NEW ORLEANS, Louisiana (AFP) – US President Barack Obama meets with top advisers Friday to determine the "next steps" in trying to stem a sea of oil lapping the fragile Gulf Coast as BP readies its latest containment bid.Obama, who the White House said was "deeply frustrated" that the leak has not been plugged three weeks since a spectacular explosion rocked an offshore drilling platform, has increased pressure on rig-operator BP as experts raised questions over exactly how much oil is spilling into the Gulf of Mexico.

Experts said the spill may actually be at least 10 times worse than the US Coast Guard's official estimate that 5,000 barrels (210,000 gallons) of crude were gushing from a ruptured well each day.

Pressure mounts on BP as Obama eyes 'next steps'

PORT FOURCHON, La. (Reuters) – Political pressure mounted on Friday for BP to show progress plugging a massive oil leak while residents of coastal Florida, Mississippi and Alabama learned the growing pool of oil from the leak would not strike their beaches before late on Saturday.The drifting sea of oil could still spell disaster for coastlines all around the Gulf of Mexico while crippling attempts in Washington to overhaul U.S. energy policy.

Obama Sends Bomb Inventor, Mars Expert to Fix BP Oil Spill

(Bloomberg) -- U.S. Energy Secretary Steven Chu signaled his lack of confidence in the industry experts trying to control BP Plc’s leaking oil well by hand-picking a team of scientists with reputations for creative problem solving.

BP hopes tube will siphon Gulf oil to tanker

Undersea robots tried to thread a small tube into the jagged pipe that is pouring oil into the Gulf of Mexico early Friday in BP's latest attempt to cut down on the spill from a blown-out well that has pumped out more than 4 million gallons of crude.The company was trying to move the 6-inch tube into the leaking 21-inch pipe, known as the riser. The smaller tube will be surrounded by a stopper to keep oil from leaking into the sea, which could be in place later Friday, BP said. The plan is for the tube to siphon the oil to a tanker at the surface.

Spill’s ‘Slow-Moving Hurricane’ Leaves Coast Waiting

(Bloomberg) -- For Tammy Wolfer of Louisiana, the worst part about the oil slick looming off the Gulf of Mexico coast isn’t that it cut her income from working at a marina and ruined plans to buy a house this year. The worst part is waiting to see where and when the oil will arrive on shore.“The not knowing is what is driving everyone crazy,” Wolfer, 42, who lives in Empire on Louisiana’s eastern coast, said this week. “At least if the oil started coming ashore, we could start cleaning it up and know where we are.”

Gulf Oil Leaks Could Gush for Years

If efforts fail to cap the leaking Deepwater Horizon wellhead in the Gulf of Mexico (map), oil could gush for years—poisoning coastal habitats for decades, experts say.

Where's the oil? Much has evaporated, underwater

NEW ORLEANS (AP) - For a spill now nearly half the size of Exxon Valdez, it's hard to pin down where the oil from the Deepwater Horizon disaster has gone.Although the government has been slow to say what's happened to it, a picture can be drawn from a publicly available model called the Automated Data Inquiry for Oil Spills.

BP chief executive Tony Hayward admits his job is under threat over oil spill

Tony Hayward, chief executive of BP, has signalled for the first time that his job could be under threat if the company is unable to swiftly resolve the oil slick crisis in the Gulf of Mexico.Mr Hayward admitted that, while he felt under no immediate pressure to step down, his career was likely to hinge on the company’s ability to end the crisis.

BP’s suggestion box is spilling over

Some 5,000 suggestions have been submitted through an online suggestion box set up by the oil giant and the Coast Guard, and thousands more are circulating through Youtube videos, in Internet chat rooms and in e-mails sent to media organizations.“It is just unbelievable,” said BP spokesman Mark Proegler. “People are not only offering products, we are getting a lot of calls — even here in the media center — from people with ideas on how to fix it. Anything ranging from crazy ideas to ones that actually sound sensible.”

The Risky Hunt For The Last Oil Reserves - Does Deep Sea Drilling Have A Future?

The oil catastrophe afflicting the Gulf of Mexico underscores just how dangerous offshore oil exploration can be. Oil companies are seeking to extract the planet's last remaining barrels by drilling from ever-deeper sites on the ocean floor that wouldn't even have been considered not too many years ago.The oil now coating the Gulf of Mexico in reddish brown streaks has a long journey behind it. Tracing that journey would require diving 1,500 meters (5,000 feet) into the ocean, passing through a massive layer of mud and finally pounding through hard salt.

Don’t drill: Recent destruction digs a deeper hole of despair

As we enter the third week of the Gulf Coast oil spill, various strategies have tried and failed to stop the flow of 210,000 gallons of oil per day. These include, but are not limited to, roping off the area, a failed cap system, untested chemical dispersants and even stuffing the hole with shredded tires.Those 210,000 gallons have translated into roughly $350 million in costs — at this point. While the news is abuzz with stopping the flow, we should be more concerned with stopping the flow of oil, for good.

It's now time that we stop paying for gasoline, along with its "mistakes," in the form of catastrophic oil spills and begin paying for environmentally-friendly alternatives.

Doug Casey on The Return of the Crisis Creature

Oil. As currencies go down, oil will have to go up. But there's a lot to be said for Hubbert's Peak Oil theory. And the increasing possibility of a serious war could send it to the moon. In any event, demand from developing economies will continue growing. The need for it isn't going away anytime soon. At least not until we're well into the Nanotech Era.

Matthew Simmons sees peak oil as the end of energy supplies as we know them.(Transcript of audio interview previously posted.)The following is a transcript of the conversation I had with Matthew Simmons on the April 27 episode of Turning Hard Times into Good Times and with Paul Michael Wihbey on the May 4 episode of my radio show. Simmons presented his continuing thesis that the lights on western civilization are about to go out. Contrasting that notion is Paul Michael Wihbey, who provides a much more optimistic view of prospects for keeping the lights on, not from foreign imported oil, but from abundant sources right here in North America.

Updating the Oil "Head-Fake" Scenario

The terrible irony of the head-fake, of course, is that the exporters' mad efforts to pump more oil merely exacerbates the oversupply, further depressing prices, which are set on the margin. As exporters receive fewer dollars for their production, they attempt to compensate by pumping even more oil. Perniciously, this suppresses prices even more, setting up a positive feedback loop which pushed prices into full-blown collapse.At the same time, the majority of exporting nations will continue under-investing in their oil production and exploration infrastructures, essentially dooming them to future depletion and potentially even collapse of production.

For energy, the manifesto talks about revising the fiscal terms to stimulate activity in the sector, the priority use of gas resources and renewable energy agenda. What is interesting is that the Government’s focus will be on small, mature fields, tail-end production and encouraging new investment (where?) while allowing production levels to be sustained.Its priorities for gas development refer to allocating gas to downstream plants. There is not a word in the manifesto on the precarious situation which we have been brought to by successive governments - past Peak Oil in which the production of oil is steadily decreasing and our risked reserves of gas is at 18.67 tcf which, with current use (not including the new plants), will last for 12 years. But moreso, wherein we have become a gas economy in which LNG is the major consumer of our gas production, the international gas supply situation is in glut and the medium term prospect is that its prices will remain low, restricting the Government’s ability to get the Heritage and Stabilisation Fund to TT$30 billion.

Vermont: Independent Congress candidate finally gets his say

"I don't see any alternative (to secession)," he said. "The system is broken and unfixable, but Vermont is small."Secession, Steele said, would free this progressive enclave from the moral stain of illegal wars and financial calamity of Wall Street bailouts. Vermont could harness an agrarian ethic, according to Steele, that would save the Vermont from peak oil and looming environmental disasters.

"For my children to be able to have a future in this state and live here and work here, I believe an agrarian agriculture-based society is the only way that can happen," Steele said.

EVs Will Fail in the Marketplace, Says a Battery Insider

He’s particularly negative about the viability of EV batteries, expressing doubt that costs will come down below $400 a kilowatt hour anytime soon. In an interview Monday, Anderman compared the fuel savings of the forthcoming Nissan Leaf with an off-the-shelf Toyota Prius and found the plug-in car wanting.The Leaf’s battery, he said, will cost $16,000 to $20,000. Even if the Leaf is produced in volumes of 200,000 or more, Anderman concludes, the battery will still cost $9,000. All this, he said, to produce a car that, when the different power sources are compared, only saves $400 in fuel costs annually over the Prius. “In five years, you save $1,500, which isn’t even enough to pay for the charger, let alone the $20,000 battery,” he said.

GE, Vestas Fall Behind in China’s ‘Tough’ Wind Market

(Bloomberg) -- Western wind turbine manufacturers are losing ground in China, the world’s fastest-growing green energy market.The combined market share for companies such as General Electric Co. and its European rivals Vestas Wind Systems A/S and Siemens AG fell to 14 percent last year from 71 percent in 2005, according to Bloomberg New Energy Finance. Sales are being eroded by local companies including Sinovel Wind Co. Ltd. and Xinjiang Goldwind Science & Technology Co. Ltd.

UN science chief defends work, welcomes review

AMSTERDAM – The head of the U.N. scientific body on climate change defended Friday the work of the thousands of scientists who contribute to its reports, even as he welcomed a review of procedures that produced errors undermining the panel's public credibility.

The E.P.A. Announces a New Rule on Polluters

The Environmental Protection Agency unveiled a final rule on Thursday for regulating major emitters of greenhouse gases, like coal-fired power plants, under the Clean Air Act.Starting in July 2011, new sources of at least 100,000 tons of greenhouse gases a year and any existing plants that increase emissions by 75,000 tons will have to seek permits, the agency said.

Amorphous silicon is a workhouse of the photovoltaic industry. I updated some novel ideas on how to charactetize the material here:

http://mobjectivist.blogspot.com/2010/05/characterizing-mobility-in-diso...

Many people consider this behavior "anomalous" yet I think it is perfectly predictable.

I also put together an analysis of wind energy statistics here:

http://mobjectivist.blogspot.com/2010/05/wind-energy-dispersion-analysis...

Again, people complain about the unpredictability of wind, but it is perfectly predictable in terms of its unpredictability.

BTW, This came from data that LenGould dumped to TOD from a few days ago.

Best hopes for a PV and wind future.

I am not at all hopeful; for a PV future - with the ridiculous subsidies being paid out, we will be bankrupt before we get enough power to do anything useful.

A very interesting analysis of German PV electricity production, and subsidies here;

http://uvdiv.blogspot.com/2010/04/how-much-subsidy-for-german-solar-powe...

Most interesting statistic is the capacity factor at just 11%!

They pay an average subsidy of $0.50/kWh produced, for 20 yrs. The german gov is now on the hook for about $3bn a year for 20 yrs, and for this, they get the power output equivalent to a 900MW plant, but with less controllability.

That is a LOT of money for very LITTLE output. It could have bought so much more in energy efficiency, or even improving efficiency of existing generation, or transmission, or virtually anything else.

Solar PV seems to be the most expensive way, by a long margin, to make electricity, and we haven;t got the money to waste right now.

I am not placing any value judgments (excuse me for borrowing Allan from NO's tag-line) apart from the fact that we will all need to learn to deal with entropic non-concentrated sources of energy. We got sent off-track by having a source of concentrated on-demand energy for so long.

We just have to learn how to deal with energy from sporadic sources. Isn't farming based on sporadic sources of rain? The wind dispersion analysis is just a step down that path. Same with PV, we are making incremental steps and I am just trying to add some insight.

Ummm... yeah, assuming "capacity factor" denotes real-world average generation divided by nameplate capacity, as it usually seems to for wind, it seems reasonable.

On that basis, the most you can ever get out of a fixed-orientation flat plate is a bit under 30% on average since it's dark about 50% of the time, and even when the sun is up, it's off-axis most of the time. Clouds - abundant in Germany - and haze reduce that 30% drastically, with average global cloud cover around 60%. All this is what makes solar expensive, it's only available a very small fraction of the time. (Fueled generating facilities, on the other hand, can be available 90% of the time since weather and daylight do not pose significant limitations.)

One commenter claims 70% ultimate capacity factor for solar thermal, so quite obviously he must be using a different denominator, one that must subsume the effect of darkness and maybe clouds - or he must be counting only the heat engine itself and not the expensive, complicated movable mirrors nor the thermal storage needed to keep the heat engine busy 70% of the time. (Nowhere in the world does the sun shine 70% of the time on a year-round basis.) If we used his denominator, whatever it is, for photovoltaic, it surely would look a lot better than 0.11. But irrespective of that sort of fiddling, if you want 1kW average, you'll need to order and pay for roughly 9kW of panels. (And in Germany you'll need massive seasonal storage or massive standby power, since you'll be getting about zip in January.)

OTOH efficiency, important as it is, is only a partial solution since it is not indefinitely scalable. Even a future near-100% efficient LED light bulb would still require an actual power source. So in the end one does need also to look at actual generation, and we do need to get started on it.

As to the money, well, even with the recession, there are vast gouts of frivolous public spending in the OECD. For example, in the USA there still seem to be limitless public billions available for palaces of moronic entertainment. And everywhere, frivolous energy-guzzling tourism garners gargantuan subsidies, now even, apparently, to the point of government-paid trips to the beach on already massively-subsidized trains and highways. Surely there's plenty of similar frivolity in Germany. So even if it turns out that the 60 billion could have been spent better, a quibble we can't possibly settle right now, in the big picture, inasmuch as it's over 20 years, it's lost in the noise.

(And in Germany you'll need massive seasonal storage or massive standby power, since you'll be getting about zip in January.)

Besides that most household energy is heat energy and seasonal heat storage is inexpensive and does already exist now,

http://www.jenni.ch/pdf/Mediendokumentation_Einweihung%20Solar-MFH%2031....

German wind farms actually produce much more electricity during winter than during summer.

PaulS:

You can legitimately claim such high capacity factors for solar thermal, if they include storage. But what you're trading off is peak power, by downrating the generating capacity.

Say a plant is picking up 300 MW of heat in midday; converted on the fly it could generate 100 MW of electricity. If it only has a 50 MW generator, with provision for storing the rest of the heat for later generation, its capacity factor will be quite high, because the denominator is the capacity of the generator, not the collector. The plant will generate the same number of MW·h but spread over more hours: 50 MW × 10 hours instead of 100 MW × 5 hours.

A very interesting analysis of German PV electricity production, and subsidies here;

Fact is the PV farms in Germany PAY TAXES and don't get subsidies. They indirectly receive feed-in tariffs which still make a miniscule amount of the German electricity price:

And according to the facts the feed-in tariffs mostly thanks to wind power lower the electricity prices more than what the consumers pay for them:

http://www.tagesspiegel.de/wirtschaft/art271,2147183

The german gov is now on the hook for about $3bn a year for 20 yrs, and for this, they get the power output equivalent to a 900MW plant, but with less controllability.

Again you are a blatant liar or you are simply proud to be that ignorant. The German gov does not pay a single cent. For the one-hundreds-time: Feed-in tariffs are paid for by electricity consumers and NOT the tax payer! And this is besides the fact that feed-in tariffs actually lower the electricity prices more than what the electricity consumer pays for the instrument:

http://www.ewea.org/fileadmin/ewea_documents/documents/publications/repo...

And if the electricity consumers still do not want to pay those extra 5% they can either free themselves from paying for that instrument (if they are a large industrial electricity consumer) or simply invest in efficiency measures.

The photovoltaic industry in Germany pays more taxes than what they indirectly receive in feed-in tariffs - not to mention that they reduced the German costly unemployment rate:

http://lohnsteuer-kompakt.de/redaktion/steuereinnahmen-der-solarindustri...

Of course Germany gets more energy for those $100 bn a year it pays for oil and gas imports, but then again those oil sheiks don't generate German jobs and don't warrant that they will still deliver cheap oil and gas in 20 years from now and neither will you.

we haven;t got the money to waste right now.

So you're basically saying that you don't have $3 bn including jobs for PV because you already wasted $11,900 bn on banks without any jobs and any return on investment at all... http://www.digitaljournal.com/article/277282

Anyone,

if the PV farms only "indirectly" receive feed in tariffs, then who *directly" receives them?

I stand corrected if you want to say the consumer pays, not the taxpayer, though, really, something that is mandated by government to be paid by someone, qualifies as a tax in my book. You can call it other names, like a feed in tariff, but if required by law, it;s basically a tax.

I would be very interested to see your comparison of the annual tax paid by PV farms compared to the subsidies they get. With poweer prices average 10c/kWh, and the solar subsdiies at 40c on top of that, that is one hell of a lot of tax to be paid to make it back. And if so, then why bother with the feed in tariff ion the first place?

Yes, the spot prices have come down, because the PV and wind farms get paid a direct subsidy (the feed in tariff) and then sell in the spot market. It's very easy to sell a kWh for zero when you are getting paid 40c to produce it.

You can compare the money wastage to banks, and in both cases the result is the same - money is wasted. Two wrongs don;t make a right.

If we are to have any hope of getting through peak oil, and transitioning away from fossil fuels in general, we should spend our limited capital where it creates the most benefit. The feed i subsidy of 40c/kWh for solar is way above the level needed to justify almost any conservation project.

With the capacity factor of 0.11, a 1kW panel will produce 963kWh/yr, or 19,260 over its 20yr life. at 40c/kWh subsidy, that panel has cost the consumer $7700, over and above the real value of the electricity produced. It represents a government mandated transfer of wealth from the consumers at large, to the owners of PV farms.

What should happen instead, is let consumers have the option of paying extra for electricity, if they want to pay the extra 40c, and feel good about solar, then have at 'er.

But as a business model it is futile. If it was to be scaled up to be, say 20% of all electricity, the cost of that 20%, with the feed in tariffs, would equal that of the remaining 80%. Surely then it becomes obvious a better way to go is to save 20%, or generate that 20% by other means.

A successful economy creates real value. Having government pay you a subsidy of 4x the actual value for a commodity is not creating real value, it is destroying it.

I would be very interested to see your comparison of the annual tax paid by PV farms compared to the subsidies they get.

Again that is a blatant lie. They PAY TAXES and don't get subsidies! But you obviously don't get it:

Private investors paid for their PV roof and thus the PV industry and its employees paid taxes NOW and these private investors won't get their big investment back with feed-in tariffs before 15 years from now, that is if their PV-roof produces the actual kWhs.

Yes, the spot prices have come down, because the PV and wind farms get paid a direct subsidy (the feed in tariff) and then sell in the spot market.

Again besides that it is not being sold in the spot market FACT is that the feed in tariffs lowered the electricity prices more than what the consumers pay for them, because most feed-in tariff electricity is produced with inexpensive wind, which is cheaper than the power produced with gas power plants but when operating dictate the electricity price for the entire country:

http://www.tagesspiegel.de/wirtschaft/art271,2147183

http://www.ewea.org/index.php?id=178

You can compare the money wastage to banks, and in both cases the result is the same - money is wasted. Two wrongs don;t make a right.

Wrong. Fact is that the PV industry reduced the unemployment rate and paid more taxes than what they indirectly received in feed-in tariffs.

http://lohnsteuer-kompakt.de/redaktion/steuereinnahmen-der-solarindustri...

The banks didn't do anything: No jobs, no electricity, no taxes - absolutely nothing!

we should spend our limited capital where it creates the most benefit.

You mean that's why it is sensible to spend $800 billion per year on your military and less than $1 billion on renewables?

Wind and PV have the highest potential of all renewables. It does make sense to invest in those 2 technologies among other renewable options.

First Solar would have never reached production costs of $850 per kW if it wasn't for feed-in tariffs allowing them to develop their thinfilm PV process and scale up production.

if they want to pay the extra 40c, and feel good about solar, then have at 'er.

Again nobody paid extra: According to the facts the feed-in tariffs lowered the electricity prices more than what they cost:

http://www.tagesspiegel.de/wirtschaft/art271,2147183 (PV plays a minor role)

But as a business model it is futile. If it was to be scaled up to be, say 20% of all electricity, the cost of that 20%, with the feed in tariffs, would equal that of the remaining 80%. Surely then it becomes obvious a better way to go is to save 20%, or generate that 20% by other means.

It is actually a very smart business model, because feed-in tariffs are lowered continuously especially in the PV sector to prevent high costs once PV has a higher share.

Germany will need more electricity as the entire heating, hot water sector will eventually be electrified.

If Germany would build gas power plants with low capital costs and increase its dependence on gas imports without reducing the German unemployment rate it will end up paying much more.

if the PV farms only "indirectly" receive feed in tariffs, then who *directly" receives them?

It should obviously have said: the taxes the PV industry pays.

Having government pay you a subsidy of 4x the actual value.

That's a blatant lie. The gov does not pay a single cent and the feed in tariffs lower the electricity price more than what the feed-in tariffs cost. http://www.ewea.org/fileadmin/ewea_documents/documents/publications/repo...

anyone, You shouldn't call someone a blatant liar and then make an argument that doesn't stand up to scrutiny.

1) Are there any taxpayers who aren't electricity buyers? Or any electricity buyers who aren't taxpayers? The feed-in tariff is effectively a tax on electric power. A tax on electric power raises prices overall.

2) Solar power companies of course employ people. But how you can know these companies increase net employment? If people didn't have to spend more on electric power as a result of the solar feed-in tariff they'd spend more on other goods and services which would also create jobs.

3) Putting expensive PV so far north with such low insolation levels is a really really expensive way to generate electricity. It would be more cost effective to spend the money on co-generation, wind, insulation, more efficient appliances, and other measures. Solar barely makes sense in SoCal, let alone Germany.

You should simply read what I wrote instead of repeating the same old lies.

The feed-in tariff is effectively a tax on electric power. A tax on electric power raises prices overall.

Wrong. Fact is that the feed in tariffs lowered the electricity prices more than what the consumers pay for them, because most feed-in tariff electricity is produced with inexpensive wind, which is cheaper than the power produced with gas power plants, which - when operating - dictate the electricity price for the entire country and the electricity costs for an entire country:

http://www.tagesspiegel.de/wirtschaft/art271,2147183

The feed-in tariff is effectively a tax on electric power. A tax on electric power raises prices overall.

And wrong. Fact is that feed-in tariff go directly to those who paid for and own the renewable power plants and only when they actually do produce electricity and not to the government and is therefore not a tax. And more importantly fact is that not just the wind industry but also the PV industry paid more taxes than what they indirectly received in feed-in tariffs.

http://lohnsteuer-kompakt.de/redaktion/steuereinnahmen-der-solarindustri...

So thanks to the feed-in tariffs, people actually do have more money. And this is besides the fact that the German wind, PV and biomass-waste industry generated over 200'000 jobs and reduced the very costly unemployment rate - making sure that people have even more money.

It would be more cost effective to spend the money on co-generation, wind, insulation, more efficient appliances, and other measures.

Wind and PV have the highest potential of all renewables and there's more wind during winter and more PV during summer. It does make sense to invest in those 2 technologies among other renewable options in order to reduce their production costs (especially what PV is concerned).

First Solar would have never reached production costs of $850 per kW if it wasn't for feed-in tariffs allowing them to develop their thinfilm PV process and scale up production. We cannot afford to wait a few decades until fossil fuel prices explode and then hope or pray for someone to develop cheap PV and ramp up production in a couple of months for nothing.

While Googling the peak oil news this morning I came across this jewel: Oil Panic and the Global Crisis Predictions and Myths by Steven M. Gorelickv. Wiley-Blackwell, Oxford, 2010. 255 pp., illus. $54.95, £32.50.

The rest of the article is behind a pay wall but I looked the book up at Amazon.com and searched of several key words and found out why the author is so optimistic. On page 30, figure 2.7 is a pie chart that shows the total world endowment of crude oil. Total world endowment of crude oil, according to the author’s source, the EIA and USGS, is 3142 billion barrels. (The author reminds us that this does not include 324 billion barrels of natural gas liquids.)

The pie chart shows that of this 3142 billion barrels, 1095 billion barrels have already been produced. Remaining known reserves are 1342 billion barrels plus another 759 billion barrels of reserve growth and undiscovered reserves.

The author also cites The Oil and Gas Journal as another of his sources. Anyway there appears to be nothing new here. The author seems to accept, without question, the reserve numbers claimed by the OPEC national oil companies and repeated by the EIA, USGS and The Oil and Gas Journal. And of course those reserve growth and undiscovered reserve numbers come primarily from the EIA.

Ron P.

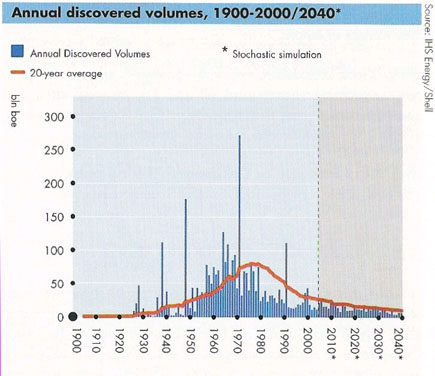

Based on conservative estimates on the discovery trends, I had 2800 billion barrels a couple of years ago:

http://www.theoildrum.com/node/3287

that gave a rounded peak centered around 2008. (this was the dispersive discovery model convolved with the oil shock model)

2800 is closer to 3142 than it is to 2000 or some of the other low-ball estimates. Unfortunately, in the greater scheme of things, it won't matter much unless we can get some conservation measures in place.

WHT, you did not mention "OPEC" or "Middle East" a single time in your article. And since almost every optimistic cornucopian bases their opinions concerning peak oil on those massive reserve estimates, why the omission from your article.

The world, outside a few peak oil aware folks, believe those numbers WHT. When most in the MSM becomes aware that the numbers are larely bogus, it will be the shock felt around the world. I expect that to happen about two years from now.

Ron P.

I only use ideas from the world of physics and probability and statistics. So I couldn't figure out how to include the concept or the role of political boundaries. The oil doesn't know that OPEC sits on top of it, and I am a fan of Occam.

Also, the laws of probability improve based on the larger sample space. It run counter to the notion of the central limit theorem and law of large numbers to use a subset of the data (i.e OPEC) when the superset will work better. No sane statistician will take the smaller data set when the larger one is available.

What say you about these basic premises?

The oil doesn't know that OPEC sits on it, but OPEC knows that they don't sit on nearly as much oil as they claim.

I'm sure your statistical calculations are fine, but Darwinian's point remains - if you are trusting that the OPEC data is accurate, it doesn't matter how sound your physics and statistics may be.

The OPEC numbers are highly suspect. Garbage in, garbage out.

I would argue that GIGO is not the operative term.

Replace this with Bayesian inferencing and improving on estimates with all available information. Under Bayesian inferencing you can include bad additions to your data set but it will work out eventually. Ultimately, it is the best way we have to quantifying people's uncertainty in numbers.

Perhaps what we are forgetting is that many of the discovery estimates occurred years ago and they have become a matter of historical record. A model based on maximum entropy essentially does a continuous Bayesian update over all the past history of discovery updates. Any new outlier updates become hiccups in the overall trend.

And then you have to consider this. So what if the OPEC numbers are exaggerated? At worst it becomes an unbiased (from statistical considerations) conservative estimate at how much is left. I figure it is better to argue from a quantitative POV rather than hand-wave.

So Saudi Arabia is what, around 20% of total estimated reserves? And that is just reserves, not what has been produced thus far.

I see what you are getting at but saying something is GIGO seems to be a pure excuse for ignoring what you can do with the numbers you have. I appreciate these kinds of arguments because incorporating these considerations makes the defense of the model more solid.

Would you argue that the amount of garbage in does not matter? Would you argue that the size of the error simply does not matter? I would argue that you are dead wrong here WHT. Very large amounts of bad data can obviously skew your results. And the OPEC reserve numbers are exaggerated by at least 50 percent.

Are you jus pulling our leg WHT? You are joking right? Both unbiased and conservative? I would argue that the OPEC estimates of their reserves are both extremely biased and the furthest thing from conservative. They are unbelievably liberal estimates.

I realize you are saying "unbiased from statistical considerations" but they are very biased from statistical considerations. Just like garbage in, garbage out, if you have biased data in then your output will be equally biased.

Ron P.

What someone means by "conservative" depends on what perspective you are coming from.

If you are being a pessimist in regards to oil depletion, a conservative estimate would include information that may not go your way. You are essentially remaining unbiased toward data that may make any projections more optimistic.

In contrast, if you are being an optimist in regards to oil depletion, a conservative estimate would include information that would low-ball your estimates.

The roles are reversed if you are being liberal.

So I am obviously a pessimist, so I include the conservative estimates of the first kind.

That makes perfect sense to me, yet I can understand how someone can get confused by this.

You claim you are being unbiased when you knowingly use deeply biased data. I fail to understand that logic at all.

Almost every peak oiler, and you are talking to peak oilers on this list, knows that the OPEC numbers are extremely optimistic, or overly liberal estimates. But because you claim to be a pessimist then the numbers become conservative. That makes even less sense.

That is not so obvious to me. You say the world endowment of oil was originally 2800 billion barrels while we have used less than 1100 billion of those barrels. This means we have used less than 36 percent of the oil available. And you call that pessimistic? I would say you are wildly optimistic, a cornucopian as far as peak oil goes.

Just curious, are there anyone else on this list who believes we have used only slightly over one third of our original oil endowment, as does WHT? Do we have any other wildly optimistic cornucopians on this list? ;-)

Ron P.

Ron,

The essential problem is that people do not have an appreciation for the effect of a fat-tail in a discovery profile. I did not assume an exponential growth in this model (which would have generated a Logistic and something closer to a URR of 2000), but instead assumed a power law growth which I think matches reality a bit better.

Just the term "fat-tail" implies that there is a lot of "meat" in the tail of a model. The URR is the integral of the whole curve so that is where the higher number comes from. The bottom line is that it doesn't shift the peak too much. In the link I provided, the peak shifts to the year 2008. Hmmm, wan't that two years ago?

So how am I wildly optimistic cornucopian?

This is the original plot with text from late 2007 that I posted on TOD:

And notice the extraction rate of around 3.8%. Isn't that in line with what everyone is saying?

This is actually pretty interesting math and I have applied it to all sorts of other applications, so don't mind if people get worked up over it. It is perhaps counter-intuitive but that's often what happens when you put pen to paper and actually do the math.

I take it all back. You are a person who believed that world oil production peaked after consuming about 33 percent of production. Hubbert said it would peak at 50 percent. I think it peaked at about 50 percent as well but stayed on that plateau until over 60 percent was consumed.

But you think oil production peaked after only one third of the recoverable oil was consumed. I have no idea what one would call a person who believed such a thing. I would not even venture a guess. Perhaps someone else can give me a hint.

Ron P.

Venture a guess?

Guess what the cumulative production is under this production profile:

The peak occurs at Time=0 yet the URR is infinite. The integral under the curve defines the URR and if the decline occurs in a certain way, you can get the odd infinite URR. That said, there is an awful lot of wiggle room between 1/2 URR and infinity. Put in those terms 2/3*URR on one side does not seem bad.

Chalk it up to the way fat-tails and causality works. People have been intellectually poisoned by classical statisticians who only believed in the power of the normal where everything is supposed to be symmetric.

There must be a lot of people that are confusing URR with OOIP. If all the stranded oil that could be recovered with CO2-EOR, etc is counted, one third recovered could be a good guess.

I haven't seen a proof of a symmetric peak oil curve and I can easily come up with an asymmetric curve.

Let's think of it like this. If I was a bad guy the good guys would think of me as a bad guy but my friends who are also bad guys might think of me as a good guy.

What WHT is saying is that even when he uses "conservative" estimates we are still screwed. You can insert "liberal" in the place of "conservative" if you didn't understand the good guy/ bad buy stuff above. If he used "liberal" estimates we would be even more screwed. Again if the good guy/ bad guy stuff is too complicated for you replace "liberal" with "conservative".

And to top it off, the author Gorelick of that book that Ron references shows the same 2 trillion and 3 trillion URR that Hubbert used in 1969. His peak also showed less than a 10 year shift in position after adding the extra trillion barrels.

So why aren't we attacking Hubbert as well?

I primarily want to put the analysis on a firm physical foundation. The logistic clearly doesn't explain anything and only gives the occasional close agreement due to happenstance.

The problem with using heuristics is that they have no defendable basis, since they are by definition aligned with the data. So when the data changes, everyone clinging to the original heuristic starts making crap up to rationalize their commitment to the new "standard" logistic. This is all so predictable and it does not happen with a real physics-based model, since the model can become invalid if it doesn't work in the face of new data. Yet, with these heuristics, people twist themselves into pretzels to justify their sunk costs and they always get away with it because it isn't science, just curve fitting. I guess that is why we can't fault Hubbert for his two estimates. Its also why all these estimates have chased their own tail over the years -- the old heuristics simply get updated with the new heuristic. No concept of Bayesian updating, entropic dispersion considerations, search rates, none of that stuff, just some "knobs" to tune (to put it into Gorelick's terminology).

I would argue that GIGO absolutely IS the operative term. GIGO is not a "pure excuse for ignoring what you can do".

It is a recognition that your calculations, though hewing to all the niceties of statistical analysis, are not going to be much use if you plug in bogus numbers.

You say "At worst it becomes an unbiased (from statistical considerations) conservative estimate at how much is left."

Unbiased? It is totally biased, statistically. This is not about "uncertainty in numbers", some random noise. These are systematically falsified data points, well to the upside. Conservative? Wildly optimistic is what it is.

You sure can sling the lingo, but I don't think I'm engaging in "hand waving". It is political and economic reality. You run your numbers, because it's what you can do, and you're good at it. But the reported OPEC numbers reflect what they need to do politically, and to bump up their allowed quotas. This means significant over-reporting of their reserves.

I am not sure what "bogus numbers" I am plugging in. I simply used Laherrere's discovery data that had his estimate of 2000 MB, and supplied the fat tails that were missing from his analysis.

I am not sure what the sticking point is. It seems to me that everyone is OK about including fat-tails when predicting financial calamity on Wall Street, yet here I am doing a bit of fat-tail analysis that may prolong peak a tiny bit and this is called GIGO.

Like I said above, I never intentionally included anything special about OPEC. Ron accused me of ignoring OPEC. I simply took the original Laherrere data and generated the fat-tails. There may be 800 MB left in there. Did Laherrere or Campbell approach it this way? I kind of doubt it.

WHT,

I hate to admit my ignorance of statistics,but I am sure I am not the only regular here who cannot follow your arguments-especially as you seem to have a personal brand of statistics.

Have you posted free on line a beginner's intro to your work accessible to a well educated layman who has only encountered statistics at the level of a typical undergrad majoring in a field other than math or some field heavily dependent on statistics?

If so , please state PRECISELY how to find it.

Thanks in advance!

It's not statistics precisely but more about probability. The book I would recommend is by E.T. Jaynes, "Probability Theory: The Logic of Science".

Jaynes was one of the first people to apply entropy arguments across disciplines.

If you understand that book, everything falls into place. Its also unique in that it remained unfinished on his death. So there are many freely available versions on the net and one commercially available where a co-author tried to tie up the loose ends by providing exercises for the reader.

http://omega.albany.edu:8008/JaynesBook.html

Also interesting about the book is that Jaynes provides a running commentary wherein he criticizes the conventional statisticians. You can just read this independent of the math and get a good feeling for what is going on.

If you can get through that, most of my applications are pretty trivial.

Okay, you say that the world's oil endowment is 2800 billion barrels. Of that 1095 billion barrels have already been produced. That leaves 1705 billion barrels still in the ground. That means we have produced less than 36% of the world's oil. If that be the case then we are nowhere near the peak!

Of course that was not your question. From what I can understand by your article, you are using discoveries, the rate of discovery and the size of discovery and some very complicated math to figure out how much discovered and undiscovered oil is left. I just ain't buying it no matter what the size of your sample.

I use a different method.

I have argued for years on this list that the more oil a country, a company, or the world, has to produce the more oil it does produce. The vast majority of the time they produce every barrel they possibly can but on rare occasions they may produce a little less.

I also believe that while most secondary and tertiary recovery methods may allow a field to produce a little more oil but mostly they just enable the oil to be pulled out a lot faster and delay heavy water cuts until a much later period in the life of the field. That is because they pull the oil from the very top of the reservoir instead of all the way down like the old vertical wells once did.

For these reasons I believe that a chart of the world's oil production will eventually look far more like a shark fin than a bell curve. We reached the peak in 2005 and have remained on that peak plateau every since. We are currently using from 3 to 3.5 percent of the world's remaining reserves each month. The numbers I list below are of course approximate. In billions of barrels.

What say you about these basic premises?

Ron P.

You mean 3 to 3.5% per year, right?

Thanks Fuser. Yes I meant 3 to 3.5% per year. I was shocked to realize that I wrote "per month". I often screw up when writing but seldom that bad.

Ron P.

I don't know where Dr. Mills got that graph. He includes it on his peak oil primer page:

http://www.drmillslmu.com/peakoil.htm

I go with Dr. Campbell's assessment until I see one I think is better (haven't yet). That's 2 trillion barrels with a margin of error of a few hundred billion barrels either direction.

I'll also concur with Gail and Ron on the net impact of decreasing capital shaping the other side of the curve into more of a shark fin. Oil production will, in my view, look more like this:

The capital to get the most expensive oil will become scarce and thus that oil will remain underground forever. The Deepwater Horizon rig was $1 billion alone. Simmons points out that the infrastructure delivering oil today needs trillions of $'s to be replaced as it continues to rust away. The competition for capital will be fierce and I see nothing but the shrinking of the petroleum industry over a relatively short period of time (like decades, not a century).

It's for that reason that I don't worry too much about CO2 coming from coal to liquids plants, unlike my friends in the climate change community. According to the coal to liquids industry association website, it costs approx. $6.5 billion for a plant that would make just 80,000 barrels per day.

We're just not going to build that many of those plants (same with nuclear power plants as they are retired).

Decreasing capital availability has far reaching impacts.

At 10% interest, that would be $650 million/year for about 30 million barrels/year, or about $22/barrel. That's more than loose pocket change, but it doesn't seem even to begin to rule it out.

Yes, however, that cost estimate was made in a low oil price environment. We saw during the last price spike two things:

a) cost estimates for plant construction skyrocket

b) then they often get cancelled when costs exceed the amount investors are willing to put in

Here is a list of oil projects that were cancelled or delayed when credit got tight:

http://www.reuters.com/article/marketsNews/idUSN0441115020081204

People routinely fail to consider that the economics of energy infrastructure projects are heavily impacted by the price of oil.

We just won't muster all the capital needed to make more than a small dent using CTL, in my view.

Do you think they can't / won't do it China ? Think again. Not only do they have enormous amounts of money - they have cheap labor that makes plant building cheaper.

evnov, I read China is reconsidering it, not in the last place because of the huge amounts of water needed in the process.

I think it is pretty obvious why it stuck to around 2000 billion barrels since around 1965.

Peak discovery occurred just a few years before this and according to Hubbert, there will be one curve that is both (a) symmetric and (b) the cumulative has to be double the amount observed at the peak.

If you use the Logistic curve, you will always get 2000 NB. Yet if you use some other curve that has a fatter-tail or includes the factor of reserve growth, then this number will go up.

Also you notice that no estimates go much below 2000 but several go much higher. The logistic generates that lower-level clamp and only a few people have had the nerve to predict anything higher than this.

So pretty obviously the number has to be 2000 or greater, just how much greater is the issue.

I noticed the last one on the graph is around 3000.

That might be this estimate from Shell, which also has a fat-tail if youu look closely.

So I notice that the upper range is around 3000. So what exactly is wrong with taking 2800 and providing a kind of safer upper-bound to the predictions? It still only moves the peak from around the Year 2004 to Year 2008.

This math is nowhere near as complicated as you seem to think.

It is essentially a fat-tail analysis that one can use to estimate how much oil remains undiscovered based on the premise of previous discovery data.

I don't think the Original Endowment of 1900 is a premise. That looks more like an assertion. So how exactly did you come up with 1900?

Oh you are just being modest. You know very well that one needs a degree in math to understand the some of the formulas in that article. But your math is only half the problem: