Drumbeat: June 23, 2010

Posted by Leanan on June 23, 2010 - 10:16am

More oil gushing into Gulf after problem with cap

NEW ORLEANS -- The Coast Guard says BP has been forced to remove a cap that was containing some of the oil gushing into the Gulf of Mexico.Coast Guard Adm. Thad Allen says an underwater robot bumped into the venting system. That sent gas rising through vent that carries warm water down to prevent ice-like crystals from forming in the cap.

Thick pools of oil wash up along north Fla. coast

PENSACOLA BEACH, Fla. -- Thick pools of oil from the spill in the Gulf of Mexico washed up along miles of Pensacola Beach overnight.Dozens of workers used shovels Wednesday to scoop up the oil and orange-tinged sand. There were a few sunbathers at the beach, but no one was in the water.

NY pension fund to sue BP for investment loss

(Reuters) - New York state's pension fund plans to sue BP Plc to recover losses from the drop in the company's stock price following the worst oil spill in U.S. history, Comptroller Thomas DiNapoli said on Wednesday.

If the Gulf oil spill has taught us anything it should in the last 60 days, have awakened us to the fact that the "Peak Oil" concept is as deeply flawed as is Al Gore's "Global Warming" and Chicken Little's "The Sky is Falling"!

Is the smart grid a dumb idea?

Amid recent media reports of smart grid security concerns and meter angst, it's easy to wonder whether U.S. plans for an energy overhaul are really all that "smart." Ask the experts, however, and they'll assure you that we've chosen the right direction for energy production, transmission, distribution and usage. We just have to fine-tune how we're going to get there.

Belarus 'clears gas debt with Russia'

Belarus says it has fully paid off its debts to Gazprom for Russian gas.The announcement came shortly after Russia made a further cut in the gas supply to Belarus in a row over payments, reducing it by 60% in all.

Belarus transferred $187m to Gazprom's account on Wednesday "to clear the debt", Belarus First Deputy PM Vladimir Semashko said.

Mr Semashko said Belarus had borrowed $200m in order to pay off the debt to Gazprom.

A View From St. Petersburg: Russia Rebounds From Oil Collapse

In terms of Russia, itself, I find myself wondering more and more whether the extent of the late 2008 and 2009 collapse in gross domestic product has been a good thing in some respects. As one other forum delegate remarked, back in the summer of 2008, Russia was "drunk on oil prices." At that forum, I had been asked to present a 2020 BRIC (Brazil, Russia, India, China)-type presentation to suggest where Russia might be in the world. My presentation of average real GDP growth of below 4% was roundly regarded as deeply pessimistic and appeared to surprise many. My main reasons were simple: Oil prices won't rise forever, Russia has poor demographics, and its governance especially for business needs considerable improvement.

For Sale: BP's Non-Core Assets

If BP Plc’s (BP) $20 billion escrow account runs out, and the oil giant quickly burns through the $10 billion dollars in savings from its recently suspended dividend, the beleaguered company still has plenty of assets to sell before bankruptcy becomes a realistic option.

Far from Gulf, a cloudy picture for oil fund czar

NEW ORLEANS—Is a strip club that caters to oil-rig workers entitled to a piece of the $20 billion fund for victims of the Gulf of Mexico disaster? How about a souvenir stand on a nearly empty beach? Or a far-off restaurant that normally serves Gulf seafood?The farther the massive spill's effects spread, the harder it will get for President Barack Obama's new compensation czar to decide who deserves to be paid.

Oil spill ads: 4 tasteless spots

The Gulf oil spill doesn't exactly scream 'marketing opportunity,' but that didn't stop these four companies from rolling out ad campaigns tied to the tragedy.

BP Establishes New Gulf Coast Restoration Organization

BP provided further details about the previously-announced new organization that will manage the company's long-term response to the Deepwater Horizon incident and the MC252 oil and gas spill. Effective immediately, Bob Dudley has been appointed President and Chief Executive Officer of BP's Gulf Coast Restoration Organization. Mr. Dudley will report to Tony Hayward, BP's Group Chief Executive.

BP Is Burning Sea Turtles Alive, Gulf Captain Says

A boat captain working to rescue sea turtles in the Gulf of Mexico said he saw BP ships burning sea turtles and other wildlife alive, myFOXtampabay.com reported late Tuesday.

U.S. oil spill starts to affect Mexico: official

The oil spill disaster off U.S. Gulf Coast has already begun affecting Mexico, an official said on Tuesday."There has been a real impact in bird migration and fish food, which is a worrying fact that could worsen in coming months," said Salvador Trevino Garza, head of the Tamaulipas state's Environmental Agency for Sustainable Development. "We will continue monitoring this problem," he added.

A Dead Zone Was Already in the Gulf

The BP oil spill is making it even worse. But few people paid much attention to this 25-year-long environmental disaster.

We Need To Wean Ourselves From Our Dirty Oil Addiction

There other ways the U.S. can transition away from petroleum. The IEA outline for reducing American oil consumption by 29 percent between 2007 and 2030 includes increasing public transportation, shifting to hybrid and plug in hybrid vehicles, using more biofuels, increasing conservation in heating homes, and almost eliminating oil use in electricity generation.A phased-in oil tax that reached the equivalent of about $1.70 per gallon of gasoline by 2030 would reduce oil consumption by around 10 to 15 percent, says Ian Parry, senior fellow at Resources for the Future.

Socotra: The Other Galapagos Awaits Tourists

Yemen, which is dependent for up to 80% of its revenues on oil that is running out, is counting on tourism to provide a more sustainable income source. Indeed, the government, which had restricted entry to the 1,400 sq. mile island until 1991, now wants more people to visit. But you still have to go through the mainland in order to reach Socotra and eco-tourism is being held back by fears of al-Qaeda and the kidnapping of foreigners for ransom in the mainland. (And, in the not so distant past, Socotra has seen its share of trouble: the hulks of Soviet tanks stand rusting on its western shores.) So for now, Socotra's long white beaches and translucent turquoise waters remain lonely and unfamiliar.

Botswana’s short term energy options costly – World Bank

A World Bank report has revealed that the country’s short term energy options will be costly. The country is expected to spend around US$4 billion cumulatively, the Morupule B Generation and Transmission Project, project appraisal document has revealed.

Pakistan hasn't quit its 'insurgent habit'

WASHINGTON: Pakistan hasn't quit its habit of courting insurgents, and extremist networks with current or former ties to the government pose a significant risk to the United States and Pakistan's elected government itself, a new study concludes. A rising number of terrorist plots in the United States with roots in Pakistan stems in part from an unsuccessful strategy by the US-backed government in Pakistan to blunt the influence of militant groups in the country, the report by the RAND Corp said.

Extreme DIY: Building a homemade nuclear reactor in NYC

Many might be alarmed to learn of a homemade nuclear reactor being built next door. But what if this form of extreme DIY could help solve the world's energy crisis?

Uranium One Says Russian Owners No ‘Cowboys,’ Help Power U.S.

(Bloomberg) -- Uranium One Inc., which has slumped 7.3 percent in Toronto trading since agreeing to a takeover by Moscow-based Uranium Holding ARMZ, said shareholders have nothing to fear from Russian state control.

Huntsville bicycle parking law rolls closer to passage

Recommended by the city's bike safety task force, the ordinance would require new businesses and apartment complexes with 20 or more parking spaces to provide at least two dedicated bicycle parking spaces with racks.Malls and other places with huge parking lots could have to make room for up to 30 bicycles.

Helena residents speak up for community gardens

Helena currently has four community gardens, and two more in the planning stages. But with the city facing a $750,000 budget crunch, one of the items on the list to go is a water supply to those two gardens.

Towards a new economy and a new politics

Economic growth may be the world’s secular religion, but for much of the world it is a god that is failing—underperforming for most of the world’s people and, for those in affluent societies, now creating more problems than it is solving. The never-ending drive to grow the overall U.S. economy undermines communities and the environment. It fuels a ruthless international search for energy and other resources; it fails at generating the needed jobs; and it rests on a manufactured consumerism that is not meeting the deepest human needs. Americans are substituting growth and consumption for dealing with the real issues—for doing things that would truly make the country better off.

After people began to ransack fixtures from the vacant homes, Victorville town officials warned the bank owning the sixteen-home development that it would be on the hook for security and fire calls. The bank, which had inherited the mess from the defaulted developer, assessed the hemorrhaging local real estate market and decided to cut its losses. A work crew was dispatched to rip the houses down and get what they could—money, beer, whatever—for the remains.

Canada to impose new emission limits on coal power

(Reuters) - Canada will reduce greenhouse gas emissions by introducing new regulations for coal-fired electricity generation, Environment Minister Jim Prentice said on Wednesday.

There is no ‘peak oil.’ But there is supply and demand

The price of crude oil, in the money of the day, fell as low as 4 cents a barrel in early 1933 – or, expressed in equivalent 2009 terms, 66 cents (U.S.). It bounced back to 10 cents (2009: $1.64). Yet the decade of the Great Depression produced the greatest oil field discoveries in the history of the United States. Was this, as some Malthusian economists assert, mere predestination, documentary proof of the country’s upward thrust on a preordained Bell curve trajectory toward peak oil?No, says University of Calgary economist John R. Boyce, not so. The oil boom of the Dirty Thirties, he says, proved only that crude oil behaves as other finite commodities behave. Crude oil discoveries tracked price incentives in the Great Depression – and tracks them globally now.

With production quotas imposed in the Depression (mostly to assist Big Oil), Prof. Boyce notes, the price of crude abruptly increased tenfold to $1.18 a barrel (2009: $19.35). The subsequent increase of oil field discoveries, 1933 through 1940, was never subsequently matched in the continental U.S. Significant discoveries did occur again when crude prices hit $140 a barrel in 2007. In this instance, though, these discoveries followed a mere doubling of prices. Think what further discoveries would probably have occurred, Prof. Boyce suggests, were prices to rise by a Depression-equivalent factor of 10 – taking oil to $700 a barrel.

In a paper published last year, Prof. Boyce offers a devastating analysis of peak oil theory. Obviously, he wrote, any finite commodity can ultimately “peak,” assuming accumulative consumption exceeds accessible reserves and keeps rising. But crude oil itself has already peaked – at least five times since 1950, Prof. Boyce says – without beginning to approach the demise of oil anticipated by peak oil theory’s famous Bell curve. Indeed, crude oil reserves have doubled roughly every 15 years since 1850 and the world now has more proven reserves than it has ever had in the ensuing 150 years.

Crude Oil Falls a Second Day as Report Shows Increase in U.S. Stockpiles

Crude oil declined in New York for a second day amid evidence that demand is falling in the U.S., the world’s largest energy consumer.Crude inventories increased 3.69 million barrels last week for a second week, according to a report late yesterday from the industry-funded American Petroleum Institute. A U.S. government report on inventories today may show a drawdown. European equity markets declined.

“The API figures were very bad. They pushed the market lower,” Roland Stenzel, a crude and carbon trader at E&T Energie Handelsgesellschaft mbH, said from Vienna. “Equities could be negative for the market today.”

Oil Demand to Be Boosted by China, India, IEA Says

World oil demand will grow faster than earlier expected through 2015 due to stronger economic growth, particularly in developing countries like China and India, the International Energy Agency forecast forecast Wednesday.The IEA, which advises oil-consuming countries, said world oil demand will grow by an average of 1.4 percent annually through 2015. That compares with last year's forecast of average annual demand growth of 0.6 percent over the 2008-2014 period.

Demand would reach 92 million barrels a day by 2015, assuming annual economic growth of 4.5 percent from 2010.

The Paris-based agency said it expects a strong rise in oil demand in China, India and the Middle East, but weaker or flat growth elsewhere, particularly in Europe where the economy is fragile.

A Little-Read Report Reveals BP's Energy Outlook

BP's web site is filled with a wide range of Gulf-spill related updates. The energy giant is overwhelming visitors with frequent updates in a bid to show that it is taking matters quite seriously.Lost in all those updates, investors may have missed a fairly important annual document that has just been released called the "Statistical review of world energy." BP takes a fresh look at the global oil picture every June, and they've reached some interesting conclusions.

China plans to pump about 11 million barrels of state reserve crude oil into private storage tanks by year-end, according to reports as Beijing expands its strategic oil stockpiling beyond state oil giants.

Jeff Rubin: No global solutions at G20

The real imbalance in the global economy is that those countries that have room for further fiscal stimulus are precisely those whose economies don’t require it, while the economies that are in desperate need of it don’t have the budgets to pay for it.

Qatar consumer prices fall 0.1% in May

Annual deflation worsened to 3.6 percent in May, after staying at 3.0 percent in the previous two months, the data from Qatar Statistics Authority showed.

Treasury Bond contract bets on deflation, not inflation

While volume remains comparatively low, investors have been turning to the Ultra increasingly as deflation, not inflation, has become a bigger worry for the economy.

Qatar fund seen surging ahead, needs to diversify

(Reuters) - Whether it's snapping up glitzy buildings or stakes in luxury carmakers, Qatar's state fund has its hands everywhere -- and more high-profile deals are expected, fuelled by the Gulf state's natural gas riches.

Petrobras Delays $25 Billion Stock Offering Until September

Petroleo Brasileiro SA, Latin America’s biggest company by market value, delayed the sale of as much as $25 billion of stock until September because a price hasn’t been set in a related deal to buy oil reserves from the government.

Falkland Islands logistics firm boosted by oil drill

LONDON (Reuters) - British diversified logistics company Falkland Islands Holdings posted results ahead of expectations as the return of oil drilling to the disputed islands boosted its business.

Russia cuts Belarus gas again as energy feud escalates

MOSCOW (AFP) – Russia on Wednesday cut gas supplies to Belarus by 60 percent as a payment feud between the ex-Soviet neighbours that has raised fears for European consumers went into a third day.But despite threats from maverick Belarussian leader Alexander Lukashenko that he was shutting down transit of Russian gas to Europe, Russian state gas giant Gazprom said gas was flowing normally.

Belarus concedes contract gas price at $184 per 1,000 cu m

MOSCOW (Itar-Tass) - Belarus has conceded the contract price of gas in payments for Russian supplies in May. Beltransgaz paid for the supplies in May at the rate of 184 dollars per 1,000 cubic meters, PRIME-TASS reported.The payment amounted to 260,134 million dollars. Beltransgaz calculated the sum in accordance with the contract of gas supplies dated December 31, 2006.

Lithuania says Belarus reduced gas supplies

(Reuters) - Belarus, in dispute with Russia over debts for gas, has cut supplies of the fuel to Lithuania and the Russian region of Kaliningrad, Lithuania's gas company said on Wednesday.

Russia increases gas transit supplies through Ukraine by 40%

KIEV (Itar-Tass) -- Russian gas transit supplies through Ukraine increased by 40% since the beginning of the year against the same period in 2009, Ukrainian Minister of Fuel and Energy Yuri Boiko said at an enlarged government meeting on Wednesday involving President Viktor Yanukovich and parliament speaker Vladimir Litvin over 100 days of work of the government.

Colo. energy rules to get a second look

DENVER (AP) -- Democratic gubernatorial candidate John Hickenlooper and GOP opponent Scott McInnis vowed Tuesday to revamp tougher state oil and gas regulations that took effect last year.The Denver mayor told energy industry executives that some rules pushed by Democratic Gov. Bill Ritter and his administration and approved by the Legislature may not be necessary, including strict rules on pit liners and requirements to pump production water back into the ground instead of using it for agricultural purposes.

Hickenlooper, a former geologist, said the new rules were partially responsible for the decrease in drilling and loss of jobs over the past three years.

Each day, another way to define worst-case for oil spill

An enduring feature of the gulf oil spill is that, even when you think you've heard the worst-case scenario, there's always another that's even more dire.The base-line measures of the crisis have steadily worsened. The estimated flow rate keeps rising. The well is like something deranged, stronger than anyone anticipated. BP executives last month said they had a 60 to 70 percent chance of killing it with mud, but the well spit the mud out and kept blowing.

The net effect is that nothing about this well seems crazy anymore. Week by week, the truth of this disaster has drifted toward the stamping ground of the alarmists.

Big Oil closes ranks behind BP

LONDON - After weeks of suffering the ire of the White House over the Louisiana rig spill, the oil industry is fighting back.Rallying around beleaguered BP at a major oil conference Tuesday, industry leaders pressed President Barack Obama to lift the six-month ban on deepwater drilling he ordered after the Gulf oil spill. Deepwater drilling is expensive, risky and largely uncharted, but the industry argues it is necessary in a world where land and shallow-water oil supplies are running out.

US to issue new order on deepwater drilling freeze

WASHINGTON (AFP) – US Interior Secretary Ken Salazar has said he would issue a new order in the coming days to enforce a freeze on deepwater drilling in the Gulf of Mexico in the wake of the BP oil disaster.Salazar was responding to the decision of a district judge who blocked the six-month moratorium announced by President Barack Obama in May because of its effect on the livelihoods of those on the Gulf coast.

Oil Drillers Won't Rush Back to Gulf Deepwater After Judge Lifts Obama Ban

Oil companies and contractors with operations in the deep waters of the Gulf of Mexico won’t resume drilling until they see how a federal judge’s decision to lift a U.S. ban plays out, analysts said.

Oil Companies, Rig Owners Clash Over Idle Time Costs Amid Ban, WSJ Says

Oil rig owners and the companies who lease them are fighting over who should pay for the losses incurred during the enforced idleness triggered by U.S. President Barack Obama’s moratorium on deepwater drilling, the Wall Street Journal reported, citing industry officials.Although a federal judge overturned Obama’s ban, brought in after the April 20 Deepwater Horizon disaster in the Gulf of Mexico, major oil companies are unlikely to resume operations until appeals to higher courts are completed; some rigs are costing as much as $600,000 a day while not in use, the newspaper said.

In Gulf cleanup, toxic risks are uncertain

There are multiple possible human health effects of the Gulf of Mexico oil spill, experts told an Institute of Medicine workshop in New Orleans on Tuesday. The problem for now is that true danger levels aren't known."There is a threshold for these effects" based on the amount of toxins people are exposed to and for how long, says Peter Spencer, a neurology professor at the Oregon Health & Science University in Portland. "And we don't know if these thresholds will be reached in this spill."

Is the Oil Dispersant Helping? Official Says Yes

Early indications are that naturally occuring bacteria are doing their work on the spilled oil. Government scientists are measuring this indirectly by monitoring oxygen levels in the gulf. The bacteria consume oxygen as they eat oil, and oxygen levels are normal or slightly depressed, the official said.

Fierce Recycling Effort in Fighting Oil’s Spread

VENICE, La. — Pete Parker’s not-so-small frame radiates purpose. Striding around a dockside yard where his “decontamination unit” works, he keeps an eye on 11 workers who are stooped over drills, bolts and iron mallets to repair oil-containment booms damaged by waves and strong currents in the gulf.Like a cobbler in a town where no new shoes are to be had, Mr. Parker, 60, is helping the oil-spill containment effort get by with the boom it has. Many days, no new boom is delivered. The goal of his unit, which works for an emergency response company known as O’Brien’s Response Management, is to supply boom as soon as it can be made seaworthy again.

Jimmy Buffett's Gulf rescue mission: Saving marine life

Singer Jimmy Buffett and two friends are hoping their new rescue boats could help save birds and marine life under threat from the nation's worst oil spill.The boats are specially designed to traverse shallow marshlands, the breeding grounds for a wide variety of wildlife off the Gulf Coast.

Dark Ecosystems Nurtured by Oil

How much oil flows into the sea aside from the BP spill? That question arose as I researched a story about a fascinating group of sea creatures that live on the bottom of the Gulf of Mexico. Over the eons, the animals have evolved to thrive on oil and gas seeping up from the seabed.The answer to the flow question turns out to be a lot.

Regulators look for questionable oil spill claims

Regulators say they're on high alert for companies trying to take advantage of the Gulf of Mexico oil spill cleanup to mislead investors.The Securities and Exchange Commission on Tuesday suspended trading in Green Energy Resources for allegedly failing to provide accurate information about its role in the Gulf cleanup. The shares had traded on the Pink Sheets market and closed Monday at $0.002. The halt ends July 6, and no charges were made.

BP's Gulf Oil Spill Costs Accelerate as Cleanup Work Peaks

BP Plc’s expenses for stopping and cleaning up the worst oil spill in U.S. history have accelerated as it prepares to strengthen its capture system for the hurricane season.

As the Gulf of Mexico oil spill crisis enters a third month, the economic impact of this environmental nightmare is starting to become clearer. The truth is that the "oil volcano" spewing massive amounts of oil into the Gulf has absolutely decimated the seafood, tourism and real estate industries along the Gulf coast. Not only that, but energy industry insiders are now warning that the chilling effect that this crisis will have on offshore drilling could precipitate a new 1970s-style energy crisis. Considering the fact that the U.S. economy was already on incredibly shaky ground even before the oil leak, the last thing we needed was a disaster of this magnitude. But it has happened, and the reality is that the long-term effects of this crisis are potentially going to reverberate for decades.

Thousands of residents, businesses and organizations across the nation will unite under the banner of Hands Across the Sand on Saturday, June 26, to demonstrate their objection to dangerous offshore drilling and to call for a renewable energy policy at the state and federal levels.

BP oil spill was avoidable: IEA

PARIS - THE oil spill in the Gulf of Mexico is a catastrophy caused by human error which could have been avoided, the head of the International Energy Agency said here on Wednesday.

Michael T Klare: BP-style horrors coming your way

On June 15, in their testimony before the House Energy and Commerce Committee, the chief executives of America's leading oil companies argued that BP's Deepwater Horizon disaster in the Gulf of Mexico was an aberration - something that would not have occurred with proper corporate oversight and will not happen again once proper safeguards are put in place.This is fallacious, if not an outright lie. The Deepwater Horizon explosion was the inevitable result of a relentless effort to extract oil from ever deeper and more hazardous locations. In fact, as long as the industry continues its relentless, reckless pursuit of "extreme energy" - oil, natural gas, coal, and uranium obtained from geologically, environmentally, and politically unsafe areas - more such calamities are destined to occur.

The oil catastrophe in the Gulf of Mexico, as horrible as it has been, was yet another opportunity. In his address to the nation from the Oval Office last week, President Obama could have laid out a dramatic new energy policy for the U.S., calling on every American to do his or her part to help us escape the insidious, nonstop destruction that is the result of our obsessive reliance on fossil fuels.He chose not to.

Senate Democrats to Obama on energy bill: Help us

Washington – Senate Democrats are taking a fresh run at energy legislation this week, beginning with a bipartisan White House meeting on Wednesday and a Democratic caucus meeting on Thursday to find common ground.The hope that the Gulf oil spill disaster might break partisan deadlock as 9/11 did – leading to a flood of new legislation – has not come to pass. So far, it has only reinforced the partisan tensions.

Russian president seeks Silicon Valley help

After more than a decade of relative freedom, Russia's economy is still stuck in its dependence on energy, sending natural gas to Europe and petroleum to the world, and leading Medvedev to look for new industries.

Iraq's oil minister temporarily assigned control of electricity

Baghdad - Iraq's minister of oil was assigned control of the Electricity Minister until a new national government can be formed, the Iraqi government announced on Wednesday.

Frequent electricity outages upset Iraqis

People here commonly have only a couple hours of power a day for appliances such as fans and air conditioners. Those who can afford it rely on costly gas-powered generators to produce electricity.Last week, frequent electricity outages prompted thousands in the oil-rich southern province of Basra to take to the streets.

"Prison is more comfortable than our homes," signs carried by angry demonstrators said. A coffin on the roof of a van had the word Al-kahraba (electricity) written on it.

Fire McChrystal? A new test for Obama

WASHINGTON — Gen. Stanley McChrystal's forced return from Afghanistan Wednesday to explain embarrassing comments about President Obama and his top advisers could hardly come at a worse time.A spring offensive against the Taliban in southern Afghanistan is moving slower than expected. The promised effort to retake Kandahar, the country's second-largest city, will take longer than initially forecast. Attacks on U.S. and coalition troops are setting records each month, and June is on track to be one of the bloodiest months for Americans in the 9-year-old war.

There’s a huge renaissance going on,” said Paul Lorenzini, a former utility executive who now heads NuScale Power, an Oregon company developing small reactors. “You don’t have to build the whole plant all at once,” he said, promising a huge change from the way the nation’s 104 commercial nuclear reactors were built decades ago, each custom-designed and built, each one different from the next.But it’s not happening here in California. New plants using radioactive uranium to make steam to power electric generators are being planned elsewhere in the country, primarily the southeastern U.S., said Ted Quinn, the nuclear society’s former president.

Q.-and-A.: Woody Biomass, Pros and Cons

While emissions from burning wood are initially higher than from fossil fuels, regrowing forests sequesters carbon, a process that eventually can yield greenhouse gas levels lower than would have resulted from continued burning of fossil fuels.The key issue, and the focus of the Manomet study, is the timing and magnitude of these effects. Energy and environmental policymakers will need to carefully weigh these short- and long-term trade-offs of biomass energy development. All the headlines miss the details and therefore serve to misinform rather than inform the public. It’s unfortunate that the story can’t be reduced to simple sound bites, but these types of life cycle analyses inevitably are complicated.

Silva: 'Gringo' outsiders keep nose out of Amazon

BRASILIA, Brazil – Brazil's president has blasted "gringo" outsiders for protesting a planned hydroelectric dam to be built in the Amazon.President Luiz Inacio Lula da Silva says no "gringo should stick their nose in where it does not belong."

Where Thoreau Lived, Crusade Over Bottles

CONCORD, Mass. — Henry David Thoreau was jailed here 164 years ago for refusing to pay taxes while living at Walden Pond. Now the town has Jean Hill to contend with.Mrs. Hill, an octogenarian previously best known for her blueberry jam, proposed banning the sale of bottled water here at a town meeting this spring. Voters approved, with the intent of making Concord the first town in the nation to strip Aquafina, Poland Spring and the like from its stores.

Local experts advise on city’s financial future

SARATOGA SPRINGS — How locally based is the economy of Saratoga Springs? What effect does development in neighboring municipalities have on the city? Is the Spa City financially prepared for the future global economy?These are just a few of topics discussed Tuesday night at Skidmore’s Gannett Auditorium during a panel discussion titled “Making and Preserving a Resilient Local Economy.”

Justices Back Monsanto on Biotech Seed Planting

In its first-ever ruling on genetically modified crops, the Supreme Court on Monday overturned a lower court’s ban on the planting of alfalfa seeds engineered to resist Monsanto’s Roundup herbicide.The decision was a victory for Monsanto and others in the agricultural biotechnology industry, with potential implications for other cases, like one involving genetically engineered sugar beets.

On the high seas, the bluefin is being hunted into extinction. Will we ever be able to think about seafood the same way?

Bid to suspend California's global warming law qualifies for November ballot

The battle over the initiative, launched by Texas oil giants Valero and Tesoro, will pit that industry against environmentalists and the state's clean-tech businesses.

UN climate panel names authors for 5th report

GENEVA – The U.N. science body on climate change has released a list of 831 scientists who will write its fifth report on global warming.The Intergovernmental Panel on Climate Change received 3,000 nominations and the authors were drawn from fields including meteorology, physics, oceanography, statistics, engineering and economics, the Nobel Prize-winning body said.

Link up top: A Little-Read Report Reveals BP's Energy Outlook

Is that statement supported by the facts?

Do we have far more untapped oil than anyone could have imagined 10 years ago? Just where is the author of this article, David Sterman, getting this information? I am not aware of any such great discoveries in the last 10 years.

There has been Tupi, 5 to 8 billion barrels or two to four months world supply. Then in 2006 there was Jack 2 which has somewhere between 3 and 15 billion barrels, no one really knows at this point. But that is from 2 to 6 months worth. Then there are lots of much smaller discoveries. But in 10 years we will consume about 300 billion barrels of oil. We have discovered nowhere near 300 billion barrels in the last 10 years.

So what facts is Mr. Sterman privy to that we are not?

Ron P.

"Indeed, crude oil reserves have doubled roughly every 15 years since 1850 and the world now has more proven reserves than it has ever had in the ensuing 150 years."

This is a very supply-side sort of argument and ignore the fact that total proven reserves aren't as important as the ratio of total reserves to annual consumption. It matters little if we have all this petroleum lying around if we're exhausting it at a much faster rate than we did in the 19th century. He's basically arguing that "somehow", through the magic of the Invisible Hand, more resources will be discovered. I don't doubt that more resources will be discovered, but will enough resources be discovered to compensate for a rapidly accelerating rate of consumption? What does it matter if we have additional resources if they're both costly and inefficient to extract, as in the case of oil shales, or if they can't keep up with our rate of increased consumption?

He also ignore that old adage: past performance is no indication of future returns. The historical increase in reserves doesn't imply that as-yet-unknown reserves will somehow materialize. You can't consume a finite resource infinitely and, while you may find an alternative, often that alternative is more costly and more energy-intensive than what you had before and reliant on a higher price-point to be profitably extracted. "Wait and see" is not a viable energy policy.

Look, I'm all for free markets, but it ain't magic fairy dust that'll make your car run on innovation and rugged self-reliance.

Maybe I am seriously misreading The Oil Drum -- but I think "peak oil" is about, well, oil, and that world oil production is not, in fact increasing.

"Peak Oil Theory" doesn't really address mitigation strategies -- substitution of alternate fuels, conservation, increased energy efficiency or demand destruction through economic collapse. All that is occurring, but the the bottom line as I understand it is that oil production is not increasing.

Desperate times call for desperate measures -- change the goalposts, blur the picture, change the frame. BP is doing all of that and more -- they are, after all, the smartest guys in the room (after Enron).

I like your line of reasoning here. Because the question is related not to how much oil is down there, but to how much people imagined it to be. And that, to my mind, is a loaded line of reasoning. For example, suppose people "imagined" what their gas mileage would be. And it turned out to be better than what they imagined. And so the car company put out an ad that "this model gives higher gas mileage than you imagine." I mean, how sane an ad would that be? But that's what's being stated here....

Indeed, how can you measure "imagination"? And then compare it to reality? And base an argument on that?

Very good catch!

Hello Ron

I live in rural North Texas along the Red River with aging oil fields in all directions.Fortunes have been made here from oil in every decade since the 1920's.Now rumors of a massive oil drilling program are becoming evident locally.We are in Barnettt Shale country.Big rigs again roam the prairies in search of the gas and oil too.Some Shale gas wells come in at 5000 bpd oil others less but still massive amounts of oil.The origional rumor was for 2000 - 3000 deep wells along and south of the Red River from I-35 west 40 miles or so call it 1000 square miles of drillable surface.One neighbor of mine will probably get near $85,000 just to lease his 160 acre farm.He says they want to go 14,000 ft ,bypass the shale play and go for 600 bpd oil.EOG is the main player around here.

My point is are we all somewhat naive to the fact that this world is still awash in oil far greater than our imaginations?This deep oil around here could be the gravity pit for all loose oil that Can migrate thru various formations eventually getting deep and deeper who knows about deepest?

So we have Texas far from out,what about the jungles of South America,and Africa.Old fields in Russia.Then there is the 60% of the Earth's surface under salt water.Tremendous opportunities exist.

I have read this blog since it's inception,I am a doomer for many reasons but beware of that mindset,I have been waiting for doom here on the South Bank of the Red for near 40 years and look around The Sun Also Rises!

Howdy,, neighbor.

Do you realize that it will take 140,000 wells like the one you neighbor is talking about, to total the present daily liquids?

The problem of peak oil is that it jumps up and bites you, just after you feel so secure. Imagine that there are ants taking coffee from your coffee can, one ant takes one grain. Every day, the number of ants doubles. At first, it is just a few grains of coffee that the take, but next thing you know the coffee is half gone. At that time, how long will the rest of the coffee last?

Figure it out, and consider... it is our numbers, and the number of BPD that we are consuming that is the problem. We have used, in total, about half of the recoverable oil. How long will the rest last?

Oil consumption is rising, worldwide, especially in China and India. Corniucopeans believe that demand will stimulate supply; if oil supply is, indeed, infinite, there is no problem. If there is a limit, well, look out! Just about the time you see the largest 'supply' ever, you're almost to the end of the story. Unless, of course, people suddenly stop using oil [and other fossil fuels].

Like me, you are most likely only going to see 'the beginning of the end.' I have children and grandchildren who will have trouble understanding how we (that is you, me and the rest of us) could have let this happen. I don't have an answer. Frankly, I am ashamed.

Best wishes for 140,000 wells all at once - and, remember, they will be depleting fast ... 6% or more per year, so ya gotta be drilling about 10,000 + per year.

Craig

Well I don't think we are all that naive. I do not believe the world is anywhere near being awash in oil, regardless of the limits of my imagination. In fact I think we are using upwards of 3 percent of all recoverable oil each year. I think OPEC nations have nowhere near the reserves they claim. I think the use of superstraws, or horizontal MRC wells, are allowing the world to keep old wells producing at a near maximum rate right up until the water reaches the very crest of the reservoir.

Well no, tremendous opportunities for that 60%, (actually it is 70%), do not exist. Oil is found on only in sedimentary rock, never in basement basalt like the bottom of the ocean. Once you get off the continental shelf there is no possibility for oil to be found. I don't know what percentage of the ocean bottom is continental shelf but I would imagine it is somewhere around 10%.

So the continental shelf ocean bottom can be explored for oil, and virtually all the shallow continental has already been explored. Only the very deep continental shelf remains to be explored and we are quickly exploring that.

I know we doomers have been predicting the collapse for many years but the fact that it has not happened yet only increases the chances that it will happen soon. In the past I looked with anticipation for signs of the collapse. I am looking no more. I am only getting scared, damn scared that my earlier predictions may be coming true. I sure as hell wish it weren’t so.

Ron P.

For starters, you might want to follow my Catalog of Recent Oil Discoveries thread on peakoil.com:

http://peakoil.com/forums/catalog-of-recent-oil-discoveries-t35194-990.html

There is a lot more in Brazil than just Tupi. Since December 2005 I have cataloged at least 25.4 billion barrels of oil - and nearly all of that is a recoverable figure. In addition they've explored just a fraction of the Brazilian coast, so there is a lot more to come.

Then there's a tidy 1.8 trillion barrels of oil sands in Alberta, which is a larger estimate than they figured 10 years ago:

http://calgary.ctv.ca/servlet/an/local/CTVNews/20100605/CGY_ercb_report_...

Throw in a trillion barrels in the Orinoco heavy oil belt (another number that's gotten bigger in the past 10 years):

http://geology.com/usgs/venezuela-heavy-oil/

Another 3-4 billion barrels of recoverable oil in the US Bakken shale, new information as of 2008 . . .

http://www.usgs.gov/newsroom/article.asp?ID=1911

. . . And according to one guy who's drilled a ton of wells there, that number could actually be double.

There will be many more Bakkens. All over the world. Really! I can think of at least 3-4 others in the US of varying sizes, plus at least one in Australia. I'm dying to know how many of these things there must surely be in Russia! Ten years ago there was very little activity in these things, and little knowledge about how much oil they contained. Think about how much oil there is in porous conventional reservoirs . . . and then stop to think about how much oil there must still be in the source rocks for all those fields. That's what these shales are. Tens of trillions of barrels around the world in these rocks wouldn't surprise me. If there were, say, 50 trillion barrels left in the source rocks of the world, and we figured out how to extract just 1% of that, that's another 500 billion barrels we can add to future production that we currently have *just* started to extract.

Mr. Sterman is not privy to anything that anyone can't find out for themselves . . . if they were interested in looking for it.

Walking to the store tonight I passed by an older gentleman exiting from a gas station clutching a lottery ticket in his hand, waving it around as if it were a magic wand.

Gee, I wonder why I was reminded of that?

You're aware of the low flow rates of this stuff, why do you delude yourself thinking Peak Oil is far off in the future?

Because, Mr Abundance.Concept is a disciple of the cult of oil reserves, just like our friend, Mr Economist.

Even if we were to pretend for a moment that the figures you cite truly represent recoverable quantities of oil, which they do not! BTW, There is plenty of data and information on this very site that supports my statement. I'll leave it to you to do your own research since as you say, "anyone interested in looking, can find out things for themselves" So get to it!

To my point, even if we could physically recover all that oil and if we should burn it, we're simply FUBAR! We still have this annoying little issue with CO2 being added to the atmosphere...

http://www.realclimate.org/index.php/archives/2010/06/five-thousand-gulf...

We need to stop population growth and change our current ideas of economic growth, it's the only possible way forward and it is going to happen whether we like it or not. The sooner we accept this reality the better the likelihood that humans will still have some kind of a future worth having.

Define "recoverable figure". Can't put that in a 43 101.

-That's what these shales are. Tens of trillions of barrels around the world in these rocks wouldn't surprise me-

Well, there are tens of trillions of rocks. The amount of oil those rocks contain is a completely different issue. I doubt we can run a growing economy on what scant oil we can suck from rocks.

Oil extraction is going to slow regardless of the "amount" of oil in the shale or at the bottom of the ocean simply because it's harder to extract and refine. That means economy contraction and failure.

The result is the same, whether we follow your logic or ours.

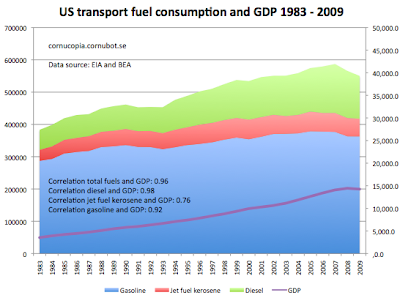

http://cornucopia.cornubot.se/2010/06/correlation-between-us-gdp-and-fossil.html

Correlation between US GDP and fossil transport fuels: 0.96

There is nothing controversial with the strong linkage between economic growth and the consumption of fossil fuels, at least for transports. I have earlier shown the high correlation between Swedish economic growth and the consumption of gasoline, diesel and jet fuel kerosene.

It is about time to do the same thing for the US.

The correlation between GDP and the sum of the consumption of fossil transport fuels is extremely high, 0.96. Like in Sweden, the correlation is even higher for diesel, 0.98, and lower for jet fuel kerosene.

A comparison between the two countries follows.

Correlation between GDP and all fossil transport fuel consumption

US: 0.96

Sweden: 0.95

Correlation between GDP and diesel consumption

US: 0.98

Sweden: 0.98

Correlation between GDP and gasoline consumptio

US: 0.92

Sweden: 0.87

Correlation between GDP and jet fuel kerosene consumption

US: 0.76

Sweden: 0.89

For some reason the correlation between economic growth and jet fuel kerosene is higher in Sweden than the US.

Let me present a solution to the problem with an economy strongly dependent of transports fueled by fossil fuels as in both the US and in Sweden. Send the economy into a more or less permanent recession in order to keep pace with declining oil production in the aftermath of global peak oil.

Maybe not what unrealistic cornucopians would like to see as a solution?

Eternal growth is not possible in a finite world.

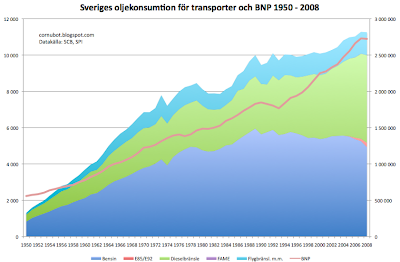

Sweden has had a green outlook on energy for decades. The move to efficient diesel engined cars has reduced gasoline demand sharply. The opening of a land bridge/tunnel to Denmark has enabled faster travel to central European area without resorting to short haul flights.

I remember in one year Sweden's largest single exporter was the pop group Abba. True, records are (were) made from oil !

Um. Fossil fuel use for transports in Sweden 1950-2008 below. Correlation with GDP is 0.95. Graph in swedish, sorry.

It is a myth that Sweden has moved away from fossil fuels. It only applies to industrial and heating use. We have seen a steady increase in fossil fuels for transports, especially diesel. Fixing heating and industry is easy, breaking the use of fossil fuels for transports is not even possible in Sweden.

Correlation of 0.95 on this graph doesn't mean much. With the naked eye it is easy to see there is correlation, both rise steeply to the right. Correlation is useful when it is difficult to graphically display the correlation but that isn't the case here.

I’ll be brave and try another comment. Maybe this one will show up in the right place.

Correlation by itself, no matter how strong, doesn’t prove cause and effect. In other words, the fact that transport energy use in Sweden correlates strongly with GDP is not proof that it must continue like that.

Cornucopian has already acknowledged that industrial and heating oil consumption has declined in comparison with GDP. A simple correlation between transport fuel use and GDP does not prove that transport fuel use cannot also be reduced without damaging GDP.

Not necessarily, but in this case it does. You are free to attempt to show otherwise; I think you will be unsuccessful.

The graph below (originally from Deutche Bank) is from Hirsch's Mitigation of Maximum World Oil Production:Shortage Scenarios, 2008.

I discuss that paper and several others in Estimating the Economic Impacts of Peak Oil.

Oil isn't just important to the economy or even critical to the economy.

Oil is the economy.

Link up top: There is no ‘peak oil.’ But there is supply and demand

The most astonishing statement you may ever read about peak oil:

He is saying that the term "finite" is illogical where incentives can cause more oil to appear.

However I found something that I did not know in this article. I foolishly thought that discoveries peaked in the 1960s. But noooooo...

The highest peak of all was in 2007 at 85 billion barrels. Anyway this may be where Mr. David Sterman got his information about the tremendous amounts of new reserves that have come on line in the last 10 years. (See my post above.)

Question: Are these guys just making up things, or is there some basis for their data? Why would they print such stupid things as saying that oil discovered peaked in 2007 at 85 billion barrels.

Ron P.

I'm reading Hall / Cleveland / Kaufmann's Energy Bible at the moment, and just finished the section that shows the strong correlation between energy and GDP, confirmed in the article with this quote:

In fact, all the so-called "technological" solutions turn out to be really energy solutions, especially the increases of productivity with falling prices that characterized the oil boom years.

It'd be nice if the author of the article put the discovery peaks in context by showing the diminishing returns of discovery over consumption rates.

Here's a link to Prof. Boyce's paper. Let the flames begin...

E. Swanson

Black Dog, why would anyone flame you for posting a link? Now flaming Professor Boyce, that is a different story. Nevertheless...

Anyway it all becomes clear now. Looking at Figure five from Boyce's link we finally understand what he is talking. (Sorry but I don't know how to copy and paste a chart from a PDF file.) But from this chart he is clearly implying that an increase in "proven reserves" means those reserves were added because of new discoveries. So much for Professor Boyce's knowledge about the oil industry.

The chart shows almost no discoveries during the mid 60s, when discoveries actually peaked. His "discoveries" merely reflect increases in "claimed" proven reserves. There was a spike around 1970 when the oil discovered in the 60 were likely added to proven reserves. Then the next spike was when OPEC added all those "proven reserves" during the mid 80s. Then the last spike was when some added Canada's tar sands to proven reserves.

Ron P.

Ron - If price of WTI were say an average of $150 a barrel in 2010 with projections of $200 based on demand don't you think that the world could ramp up production beyond previous records? At current prices a lot of oil is not economically recoverable. No?

Joe

Joe, of course we could ramp up production but I am not sure by how much. And they might just ramp up past the 2005 or 2008 peaks. That does not change the fact that we are have been on the peak plateau of C+C for about six years now, since mid 2004.

In fact the surge we are seeing right now, by non OPEC nations, is because of the very high price of oil. With such high prices we can afford to drill in ultra deep water and get the very hard to produce stuff.

Much of the current production however is due to infield drilling of very old fields. Russia, up until last year, was drilling from 5,000 to 6,000 new wells each year, most of them in their very old large reservoirs. That is what Saudi, Kuwait and the UAE have being also. They are drilling horizontal wells and sucking the very cream off the top of their old fields. Saudi says this has enabled them to get the decline rate of their existing fields down from 8% to almost 2%.

Saudi Arabia’s Strategic Energy Initiative: Safeguarding Against Supply Disruptions

Bottom line, most of the new production due to price incentive comes from superstraws that just suck the oil out a lot faster. They are producing now instead of later. This will mean that sooner or later they will hit the cliff and production will drop off much faster than the 8% they would be declining without these superstraws.

RonP.

Thanks Ron. That puts the meat on my thinking about Peak Oil = Affordable Oil. A decade ago Tar Sands and deep water drilling wasn't even on the map. No doubt a great deal of innovation has come into play due to higher prices but eventually I think even that will run out of rope. I guess that's when TSHTF.

Joe

I was thinking about flaming Professor Boyce, not me. The paper is rather long, but there are a few interesting points to consider. For starters, he uses these data, from footnote 10:

Looking at his Figure 5, as you mention, it would appear that there are 2 large spikes in claimed reserves, the first in the mid 1980's and the second after 2000.

I agree that the first blip upwards was probably from the re-statement of OPEC reserves, which have been a subject of considerable debate. As Matt Simmons and others have pointed out, these reserves may be an illusion, unsupported by facts on the ground. The claim is that OPEC members boosted their claimed reserves to allow higher production quotas. The fact that Saudi Arabia's stated reserves have not declined since leads one to the conclusion that these numbers are bogus.

And, the second blip might be the inclusion of estimates of economically recoverable oil from Canadian tar sands, which is not what one could call "conventional oil". Later, the caption for his Figure 10 points out the difference between "Alberta Conventional" and "Alberta Oil Sands" leases. So, Boyce is including tar sands, calling them "oil sands", which is not a proper description of the resource. The various authors who have written about Peak Oil usually are pointing to production of conventional oil, as I understand it.

In short, his analysis appears to be another example of "garbage in/garbage out". Of course, his use of lots of fancy math obscures any possible flaws in the data he uses. And, the fancy math gives an air of credibility to his analysis that would blind the typical reader to any questions regarding the original data.

E. Swanson

Ron, Is this the one?

That's the one. It doesn't have the properly backdated discovery profile that most people remember seeing.

The actual discovery peak is right around 1962 or so.

Indeed he is throwing in Canada's 176 bbo jump in 2003. None of that, you.

Also he says he's using Horn for discovery data, with markedly different results than Laherrère:

Jean uses Petroconsultants/IHS, IIRC. His graph doesn't incorporate East Texas, but here's another that does:

Contrast Boyce:

Must be reserve growth in action.

I really appreciate someone trying to do the math behind oil depletion, but I have to gloat over the delusional incompetance of John Boyce. He sticks in Nash equilibrium and Lagrangian multipliers without ever resorting to plain logic. The sad fact is that this looks like typical economics wankery, with all this deterministic crap that reflect the reality of a gerbil wheel.

Interesting to find out if this gets picked up elsewhere, as it certainly looks important enough.

Didn't the Tar sands get redefined as oil in that year?

Clearly he simply took the difference between the annual total reserve figures and added consumption.

Not an an depth analysis.

It's always nice to have visitors from Fantasy Island

It's a variation on the same theme, to-wit, that the sum of the output of discrete sources of oil (e.g., Texas & the North Sea), which show clearly defined peaks and subsequent declines, produces a near-infinite rate of increase in production. I suppose if one could add new production fast enough, this might even be technically true, i.e., if we had an infinitely expanding supply of equipment, personnel and prospective areas, I suppose that one could technically outpace declining production from existing sources, but back here in the real world, we tend to see production peaks like the 1972 Texas peak (blue) and the 1999 North Sea peak (black):

And once more, these two regions accounted for about 9% of global cumulative crude oil production through 2005, and they were developed by private companies, using the best available technology, with virtually no restrictions on drilling--and in both cases the initial declines corresponded to sharply rising oil prices.

And so far, the annual rate of change in global crude oil production, relative to the 2005 rate, has been zero (2008) or negative (2006, 2007, 2009 and 2010 to date), despite annual oil prices over the same time period so far exceeding the $57 annual price that we saw in 2005. This is in marked contrast to the 2002 to 2005 pattern, when we saw a large increase in crude oil production in response to rising oil prices. IMO, rising levels of unconventional production have so far only served to produce an annual crude oil production rate that has to date been at or below the 2005 rate.

I have often pondered this. The rate of extraction of any finite resource theoretically can follow one of two paths: if there is any change in the rate of extraction than at some point there must be a peak rate of extraction. The other option is for the extraction rate to be constant until one day when extraction ceases - the production profile is a flat straight line.

So is this theoretically possible? As a thought experiment suppose you had a near infinite supply of capital. Could (not would) the production profile be a horizontal line?

This ultimately gets at the definition of peak oil. Is it a geological argument - WHT's entropic dispersion? Is it an economic argument - we will always go after the most profitable resources first? Or is it a combination of the two?

You can never extarct the last barrel of oil. Because you could never build enough oil extracting infrastructure fast enough to get the last of the oil out of the ground as you approached the hardest to reach oil. The easy oil is almost always extracted first. No amount of (fiat) capital will do you any good, because all physical resources are finite, even steel for drilling rigs and pipelines. Once you reached peak net energy, you can only increase the resources for further oil extraction by removing them from other parts of the economy.

At the peak of production, you can skew the peak to the right into a shark's fin , but the inevitable result will be collapse of demand and therefore production as the economy implodes from relative under investment elsewhere and makes much of the remaining oil in the ground too expensive to extract.

So peak oil production is an economic event with an underlying geological cause.

What if we assume all other resources are infinite (again, just for the purpose of a thought experiment)? We have coal or some other energy source so net energy is irrelevant. The goal is simply to extract ALL of the resource, but at a constant rate. Would it be possible?

You have a bank account, but you don't know how much money is in it. You can extract at a constant rate only what you guess to be there, because you can't know what is there.

So to answer your question. NO.

We don't know what is there in the ground, we have good guesses, and some sorta okay guesses, but none that are spot on. So we can't pick a rate, and keep it totally level till all the resource is gone.

If you knew you had $1,000,000,000,000,000.00 in the bank, you could level out how much you needed and get a zero balance in a given amount of time.

I used the 1,000 Trillion figure so that all those people out there that don't know how much oil is in the ground, but figure it is oodles and oodles would have a fun day trying to spend a Quadrillion dollars.

Hope that helps your thinking a bit.

Charles,

BioWebScape designs for a better fed and housed world, one person at a time.

Hugs from Arkansas.

That makes sense to me. What is confounding to me is wondering when and if the U.S. will reach a critical mass; Obama has an opportunity and a mandate to shift the focus away from a fossil fuel based economy to an economy based on conservation and efficiency. We are so wasteful of energy in this country that we could easily reduce our consumption by half. It's time to change course!

Joe

In a free market, the time to change course is indicated by a rise in the price. And individual consumers each make their own course changes.

The question on the table for me is this: Given the volatility of price spikes in the 70s and 2008, can we depend on a slow steady rise in oil prices that will allow sufficient time for transitions in consumer behavior or will prices assume such volatility that they will simply be destructive and push the country into depression. If the first case is true, time and market forces will take care of the matter better than any government intervention. If the second case is true, forces outside the market should be enacted to minimize the damage that can be done.

Ron - People can't plan their lives around something as vital and unpredictable as oil prices. A phase-in of carbon taxes (not cap and trade) seems to be the most pragmatic course. I realize that there is a huge entrenched industry that will fight those changes every inch of the way but if we don't do it now...when?

Joe

Factor this into every concept..... http://dilbert.com/dyn/str_strip/000000000/00000000/0000000/000000/40000...

Human nature portens we ain't goin' anywhere but down. Agenda's range from self aggrandizement and power to monetary gains or even a reward in the next life.............it always gets back to "what's in it for me".

Better to assume volatility. If you wait for volatility to be true, there will be arguments that the subsequent future cannot guarantee the same volatility. A slow steady rise will just let the frog boil in the water. In the middle of the slow steady rise, how do you convince people the slow, steady rise is continuing.

Tell me what the price of gasoline will be down the road and I will make the appropriate decisions to prepared for the rise. Give me some hope that the recent rises are only temporary and I, or at least most people, will flounder.

People will change course when it is too late and then complain that they were not warned. And then they will ask of bailouts. Most people learned nothing from the last price rise.

Being a politician from Illinois, Obama is a long time friend of the coal industry and still believes in and heavily funds CCS as a clean coal alternative. There is nothing to suggest that he has made any kind of break with the coal industry, albeit the EPA is making some progress vis a vis mountain top removal and coal waist. I think he is conflicted and is not ready to announce that not only must be have oil independence must be must radically reduce our dependence on coal. Wasn't there a campaign slogan to the effect that we are the ones we are waiting for? Well, we are still waiting if the ones we were waiting for have arrived.

I believe that Obama is way better than Bush. But way better is not good enough.

The key limit is the number of prospective areas, especially the number of prospective areas with large oil fields. Peak Oil is basically the point at which the smaller fields that are being found can't offset the declines of the older, larger fields, which tend to be found early in the exploration/production cycle.

I debated this point with the Texas State Geologist in 2005. He asserted that Hubbert's methods produced plausible results on "geographically limited" areas (like Texas and the overall Lower 48), but the model broke down when applied globally. His underlying premise was apparently that the discrete areas like Texas and the overall Lower 48 had finite resources, but that the world didn't suffer from similar constraints. You really can't make this up. This guy had a PhD, in an official position with the State of Texas. But on the other hand, he was expressing the conventional wisdom. It's the nutcases who think that a finite world has finite fossil fuel resources.

Where to stick in my 2-cents, I'll think I'll post after Jeffrey because he can be funny sometimes and mine is also an anecdote to a second-hand case history.

During the 2007-2008 ramp up in oil prices where diesel fuel went up almost proportionately, I was working with a couple of copper mines in BC. We were looking at energy efficiency because they carry a hefty bill of about $10 million per year each for electricity and diesel fuel. These mines run the Cat 240's - the 240-ton ore hauling trucks with each tire worth a nice down payment on your house. Naturally, they were very concerned about the rising diesel fuel expenses.

And this is where I believe most academic analysis of economics versus the real world fall down. These mines have embedded costs in the diesel fueled truck infrastructure from the machinery, to the operators, and to the mechanics. As much as they would like to convert to some other energy or form of moving the ore, they simply cannot. Their cost of production is rising with the oil price and the reduces the capital available to invest in alternatives; and the cycle is reinforcing because lenders won't make more available because their production costs are too high. The Invisible Hand is quite visible actually and it isn't conjuring new mining methods and equipment out of mid-air.

At the time I recommended they seriously look into primary crushing (electrical) and conveyor systems to move the ore, and of which I was summarily ignored. Guess what they are putting in now? They have seen the writing on the wall and are trying to reduce their dependence on the 240's. Now they are up against the limits of their transmission line feeding the site, and they didn't like me very much when I told them they would face this soon also.

No wonder why I don't get invited to parties.

The point is the Peak Oil theory may seem self-negating as people and organizations look to reduction or reasonable alternatives, but that doesn't mean the central tenet of the theory is unsound. It only means that maybe we have a chance to move beyond put the crisis behind us. In the end, the world and its resources may seem infinite to a single person, but it seems very limited to 7 billion persons.

"In the end, the world and its resources may seem infinite to a single person, but it seems very limited to 7 billion persons."

Well said. I'm going to use that in my next talk. I hope you don't mind.

Don

At lot of things that are mandated by foolish human legal contracts work this way. Think retirement programs. As people retire they are granted the whole 100% promised benefits, until one day they money is gone. But you were more concerned with whether production can be maintained constant until we reach the last drop. I think that depends upon the difficulty of draining the reservoir. If it is a cookie jar, we have no problem eating them at a constant rate until the last one is consumed. With oil, the indidual wells are usually rate limted, and as some go out of production the rate from the aggregate collection of wells goes down. Of course you can have an intermediate case, feeding a bunch of kids from ten cookie jars. Each jar can only allow one cookie per minute. Some jars run out sooner than others, but perhaps the original demand was only five cookies per minute. So you can maintain this rate until the sixth jar runs out. Depending upon the initial distribution of cookies it could remain flat for a pretty long time, then rapidly decline to zero.

Actually rather than your flat until exhausted model, I think exponentially increasing production until the resource is gone is also possible. That is the ultimate "sharkfin" curve.

One place you see this to some extent is in natural gas production.

I will post the graph for Texas a bit later, but they bring on-line new sources to make up for the depleting ones.

This is not dispersed much because you have a deterministic, demand limited decision on how to select the production levels.

The dispersion happens when you start aggregating these "micro" cases over the "macro" sense.

So you are right, it is a combination of the two. Just like economics is a combination of microeconomics and macroeconomics, with a squishy boundary between the two.

I've seen that chart a number of times, but today was the first time I counted the number of years that the North Sea was on that undulating plateau. Six. Six Years.

So.. the black runny stuff peaked in 2005 then... (Okay, five and six... carry the one...) Oh sh*t! Oh sh*t! Oh sh*t! Oh sh*t!

A perfect example of curve- fitting.

At some point reserves become a form of belief. Now that Peak Oil (in the real world) has arrived (and is looking to kick some serious ass, right Mr. President?) all the protean- capitalist agonistes have started crawling out of the woodwork like cockroaches.

All that is needed is sufficient willpower (and the willfulness) by the entrepreneurial few and favored to smash the interfering untermensch; the Horatio Alger characters, the Ayn Rand objectivists, the Nietzschean Hitlerites, the Rockefeller monopolists, the Austrian economists of every stripe and flavor and the flamboyant charismatic necrophiliacs/fascists; Beck, Palin, Limbaugh.

If collective suspension of disbelief stops working it is imperative to try harder! C'mon people, tomorrow will be a great, new day!

Here is a stupid, little man being swept away by fate. In a year no one will remember him.

I sometimes wonder if Industrial society is now hamstrung by gutless politicians, nimbies, PR consultants, lawyers and the cult of the individual, that we will simply allow the economy to slide into total collapse because no one at all is prepared to stand up and force people to take action. "We are entitled to unlimited cheap energy. Therefore there will always be unlimited cheap energy. Ban offshore drilling. No more Nukes. Wind farms kill birds. Fracking is poisoning the water table. I will drive any F**king vehicle I want ".

I suspect the US could come to resemble Somalia in surprisingly short space of time.

But look at the bright side, IMO we are well on our way to becoming free of our dependence on foreign sources of oil. . .

Bravo WT!

Would that be the Cult of Oil Reserves? To make it clear how much this rests on "faith" - not "fact" - perhaps we need to identify some "rituals" connected to this cult. Rituals like "car races" and toys like "ski-doos" etc. etc. etc. These rituals feed the "cult" and depend upon it. How necessary are they really? Or what other fuel sources could be mandated for such superfluous activities? Transportation is one thing. Sport is another. IMVHO.

Cockroaches, and some gerbils running furiously in their wheels to little impact because that is all they know to do.

Brilliant! And the only exhaust is rainbows and marshmallows!

But where are you going to find enough virgins for the unicorns?

Possibly they use the same source as CERA does.

Isn't 85 billion barrels enough oil for the world for about 3 years or so? So if oil discovery has fallen to half that from 2007 to 2010...

It still amazes me that some economists are quite capable of believing that virtual commodities based on oil can affect the market (even produce oil if this guy is to be believed), yet amazingly the oil itself can't.

This is absolutely true. The problem is that real physical limitations mean that regardless of one's incentives there isn't any more to be found. It's not that people can't understand this idea, it's that they don't want to accept it and the follow on implications - so they don't.

Edit: Much easier to imagine that "because I want it, then it will be there"

Twilight, you quoted only part of the sentence, leaving out the most important part. That is called "quoting out of context!

That statement is absolutely not true!

Ron P.

Oh, here we go again. You had already quoted the whole sentence, quite clearly I was eliminating the end part - that was the entire point! The end part is where he goes off the deep end logically - he concludes that because people have incentive to find more that this means the supply must not be finite, ignoring the concept that they may fail to!

You quoted one sentence from a long article, which is fine because the link and a good bit of it are above. However, when I repeat a part of what has been stated in order to show the absurdity you freak out about "quoting out of context" again. How about we agree that we can never repeat any part of an article unless we print the whole thing, therefore ensuring it can never be out of context or alter the meaning in any way? Or might that be silly?

No, you are the one being silly right now. The point is quote enough so that you do not change the context or the true meaning and reason for the statement in the first place. That might be one sentence or several sentences or sometimes a whole paragraph. But it is seldom, if ever, half a sentence. Anyone who quotes only part of a single sentence and omits part of it is almost always quoting out of context.

I get your point but you paid too high a price to express it, quoting out of context. That is an unforgiveable sin for any journalist. You should have said something to the effect: "While it is true that as the price of commodities rise the incentive to find more is also generated, however...

Ron P.

If I had quoted it that way on some other venue absent several copies of the original, then certainly it would be out of context. How many times must it be repeated verbatim in the same thread? Clearly I believe it had been repeated enough that it was reasonable to pick it apart to show the absurdity, and to point out which parts made sense and which didn't, your lectures not withstanding. You may feel free to word things as you like - I certainly do.

I'm with Twilight on this one, as the statement has two distinct parts.

First Part:

Summary of First Part: If A then B

Second Part:

Summary of Second Part: If B then C

It is perfectly logically valid and journalistically fair to break up a two part statement into its component parts. It is only "out of context", if the second part of the statement invalidates, modifys or contradicts the first part. Nothing in the second part of the given quote fits this definition so it is fair to split up the statement. An valid example of taking something "out of context" from the same article would be to quote

but leave off the modifying statement (which in this case is signified by the modifying keyword "but"... "however" or "except" would be other examples)

The odd thing is that you two don't even really disagree. Twilight was making the point that even if the first part of the statement is true... if A then B... the incentive to find more oil does not mean that people will be suceessful at actually finding new oil. I don't believe that leaving off the last part of the sentance, with which both of you apparently disagree, affects the statement as strongly as you seem to believe. If B then C assumes the first part of the statement, and also assumes that there is a limitless supply of oil out there to find so that production can truely respond to price, which is exactly what Twilight was disputing.

And, just in the spirit of fun...

Finite declarations are illogical in regards to the price. Under peak oil, the supply curve for oil goes vertical, and there is no limit to where the price might go.

Quantity, however, is subject to that pesky confounding factor of whether or not mroe oil exists...

Regardless of a vertical supply curve there are strict limits as to how high oil prices can go: The limitation is ability of consumers to pay high and then very high prices. Note that high oil prices tend to drive real GDP down into recession or depression. Lower GDP means less demand for oil. Lowered demand for oil tends to drive prices down the vertical part of the supply curve. Note that at lower prices the price elasticity of supply increases: Only when production equals capacity does the supply curve go vertical.

That assumes something like the BAU scenario.

Break BAU and any price is possible. How much does 1000 barrels of whale oil cost today?

Once whale oil was a critical part of BAU.

While your scenario appears reasonable, one must consider that oil is a rather addictive commodity. People who are addicted to drugs often continue to abuse them all the way to the grave. Like the person who smokes, then has heart and/or lung problems, yet continues to smoke. Like the lady who had one lung removed because of damage from smoking, yet, on awakening from surgery, asked for a cigarette. We hear many stories of people addicted to "hard" drugs who abandon their children or throw themselves onto the street in search of the money to purchase more drugs for another short term high.

The car culture has become the foundation of the "American Way of Life", as Bush 41 called it. Driving a car is likely to be one of the last expenses which one will give up because of economic trouble. That's because mobility is so important for survival and in many cities of the US, there's few alternatives to driving. Out in the country, this situation is much more profound, as public transport is usually not an option. Not to mention the old saying: "You are what you drive", which is to say a person's self image is linked to his/her vehicle and is the reason Detroit's car makers are able to sell so many new cars each year.

E. Swanson