Lloyd's 'Sustainable Energy Security' White Paper - Some hits; some misses

Posted by Gail the Actuary on July 19, 2010 - 10:37am

Lloyd's hired Chatham House to prepare a white paper on the risks of peak oil called Sustainable Energy Security: Strategic risks and opportunities for business. It seems to me that this new report gets quite a few things right, but it misleads in the direction of thinking things are better than they really are, when it comes to timing and alternatives.

First, what does it get right? The big thing it gets right is what it lists as Conclusion 2:

2. Traditional fossil fuel resources face serious supply constraints and an oil supply crunch is likely in the short-to-medium term with profound consequences for the way in which business functions today.

Some other things it seems to get right include these points, listed as "Conclusions" to the report:

1. Energy security is now inseparable from the transition to a low-carbon economy and businesses plans should prepare for this new reality.

5. Increasing energy costs as a result of reduced availability, higher global demand and carbon pricing are best tackled in the short term by changes in practices or via the use of technology to reduce energy consumption.

6. The sooner that businesses reassess global supply chains and just-in-time models, and increase the resilience of their logistics against energy supply disruptions, the better.

7. While the vast majority of investment in the energy transition will come from the private sector, governments have an important role in delivering policies and measures that create the necessary investment conditions and incentives.

There are quite a lot of other things the report mentions that makes sense as well. For example, it mentions the potential problem with rare raw materials, if we attempt to ramp up production of new high tech devices, such as electric automobiles. It talks about the possibility of new environmental risks from carbon capture and storage. It also talks about water shortages potentially being an issue for electric power plants, especially if climate change causes areas to be hotter and drier. And, as indicated in the conclusions, it talks about supply chain risks, and the possibility of disruption to electric supply, for example, if suitable fuel is not available.

Where the Report Misleads

High Tech Alternatives

One of the problems I have with the report is the assumption that the world should be planning to transition to high tech alternatives. Furthermore, the report seems to say that there is lots of money to be made during the transition by those who plan right.

The report starts out with the following quote:

“In some cases, the surprise element is only a matter of timing: an energy transition, for example is inevitable; the only questions are when and how abruptly or smoothly such a transition occurs. An energy transition from one type of fuel (fossil fuels) to another (alternative) is an event that historically has only happened once a century at most with momentous consequences.” (US National Intelligence Council 2008")

I very much agree with the basic statement, that energy transitions take place at most once a century, with momentous consequences. We know we are reaching limits on oil, and that in not too long we will have to transition away from fossil fuels all together. The big question in my mind is what we transition to. This quote says alternative, and I expect it intends that we read into this quote to mean something like high-tech wind, solar PV, second generation biofuels, hydrogen, fusion, or something else that will allow us to maintain business as usual, since the rest of the paper talks about options such as these.

But at this point, we really don't have any alternatives that can be constructed and maintained in a system without fossil fuels, except some pretty simple things that were used in the time period around 1500-1800 AD --water power, sail boats, low tech wind turbines, animal power, wood, and human energy, for the most part--but these aren't the kinds of alternatives being discussed in the report.

Transitions take such a long time (at least 40 years, according to Vaclav Smil in History, Requirements, Prospects) that we need to make plans so that at the end point, we truly have a sustainable system. There is not really time for two transitions--one to extend fossil fuels a bit with high-tech add-ons, and a second transition away from fossil fuels all together. So we really need to figure out what we can maintain for the long term, and transition there, it seems to me.

The Main Impact of Oil Shortages will be High Prices

The report seems to assume throughout the standard belief that oil shortages will cause high prices. There is an assumption, too, that this is all still in the future.

It seems to me that the biggest impact of oil shortages is recession--something that is not even mentioned in the report, and something that companies would do well to learn to adapt to. This means companies would probably do best to concentrate on basics, since people are likely to be buying fewer and fewer discretionary items.

What tends to happen if oil prices rise is that people will find the price of essentials (food, gasoline for transportation to work, and perhaps home heating costs) rising. With these prices higher, consumers will cut back on discretionary spending--vacation trips, new higher-priced homes, new cars, and going out to eat for example. These cutbacks will have a recessionary impact, and will tend to bring down the price of oil (as well as raise unemployment). Many people will find it harder to find the funds to repay loans (either because of the higher price of oil, or because they have been laid off from work, in the recessionary aftermath), so debt defaults will rise greatly as well.

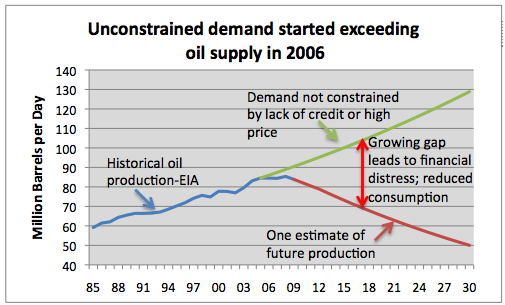

While the report seems to indicate this is all in the future, it is really something that we are already experiencing, starting not long after world oil production hit a plateau in 2005.

We have already begun seeing recessionary impacts and problems with the credit system. We have seen very high oil prices, and a drop back in these high prices to prices which are lower, but still high by pre-2005 standards. In the years ahead, recessionary impacts and credit problems are likely to get worse. It is unclear to what extent oil prices will really rise and stay at extremely high levels. The $200 barrel level mentioned in the white paper seems very speculative.

Insurance companies are likely to be hit particularly hard by loan defaults, because many of their assets are bonds. For example, there are many municipalities that are having difficulties maintaining tax revenues, and may have difficulty repaying their debt. This would seem to be an area which the report fails to warn about.

Natural Gas as Transition Fuel

The other area where the report misleads is in giving more hope to natural gas as a transition fuel than would seem to be warranted. For example, it quotes from CERA:

“A major new factor – unconventional natural gas – is moving to the fore in the US energy scene…it ranks as the most significant energy innovation so far this century. It has the potential, at least, to cause a paradigm shift in the fuelling of North America’s energy future.” IHS-CERA 2010: Fueling North America's Energy Future, the Unconventional Natural Gas Revolution and the Carbon Agenda

It then goes on to say:

Unanticipated technological developments dramatically increased the availability of non-conventional (mostly shale) gas in the US last year. In 2000, non-conventional gas provided just 1% of total gas supply, but by 2009 it had reached 20%. Forecasts suggest this will reach 50% by 2035. As natural gas prices fell in the US, demand for LNG fell internationally and volumes destined for US import were redirected to other (mainly Asian) markets. But the full impact is highly uncertain. Production from shale gas wells seems to peak much faster than conventional gas, and data is limited. Assessments of the Barnett wells in the US using horizontal drilling showed that most of the recoverable gas is extracted in the first few years. (International Energy Agency: World Energy Outlook 2009).

Is the US experience set to become a global phenomenon? Some suggest that resources in OECD Europe are large enough to displace 40 years of imports of gas at the current level, assuming recovery rates in line with those in North America. Exploration is already under way in Europe (including in France, Germany, Poland and the UK) to assess this potential. (Eurostat 2009: Energy Statistics to Support EU Policies and Solutions)

There may be some potential for a small ramp up in natural gas production, but we need to remember that a major change in infrastructure to accommodate a much larger natural gas supply will take many years and significant fossil fuel resources. A big reason natural gas prices in North America dropped once production rose is because insufficient new infrastructure to use this new supply was in place (for example, new cars or trucks using natural gas as fuel and new stations for such vehicles to refuel). Adding new infrastructure takes time. People don't lower the temperature in their homes (so as to use more gas for electricity for cooling) or ramp up industrial production of fertilizer (so as to use more natural gas), just because more natural gas is available--especially if the new natural gas is at a high price.

But it is not clear there is really all that much more natural gas. First, the amount of natural gas used today is less than that of oil, so expanding natural gas to replace oil is not something that can really be considered. But even raising the current amount by say, 30%, is likely to be difficult. One of the issues is how much can be produced at affordable prices. If the prices are much higher than today, there may be some of the same issues with recession and cutback in demand as with high priced oil. And there are concerns that a huge expansion of natural gas will require drilling in populated areas, with possible environmental issues associated with fracking. A transition to natural gas as a primary fuel source--assuming we really do have enough--would likely take 40 years as Smil indicates, and by that time what natural gas we have would likely be gone.

The report seems to suggest natural gas might be used as a transition fuel, but if high tech alternatives that don't rely on fossil fuels really are lacking, it is doubtful that there will really be a new fuel supply to transition to--especially one that will permit business as usual.

The report is valuable for pointing out the peak oil issue. The major problem of this report is that it attempts to sugar-coat what peak oil will look like. Or perhaps, the authors are confused about peak oil implications themselves.

Excellent summary and thank you for posting it. Great points.

"And there are concerns that a huge expansion of natural gas will require drilling in populated areas, with possible environmental issues associated with fracking."

There will be a point where property owners will say "not on my land". Sure, the companies will flex and stall court proceedings with bought politicians/judges and armies of lawyers, but can that go on forever?

If my land/water was buggered up by fracking, I would certainly be angry and get satisfaction. I don't advocate violence and vandalism, but sometimes that's what it takes. ....Or roadblocks, etc. I wouldn't stand still for it and I don't know anyone who would stand for it, either.

How many would simply allow their lives to be destroyed for profits and continued traffic nonsense, or as JHK calls it "happy motoring"? I understand that many in US southeast want to see deep water drilling continue right now, but lets wait and see? Why not put out a referendum in the November elections? This isn't NIMBY, this is allowing people who live in an area have input into what happens in an area.

There will be a day of reckoning for the folks at Fort Chip as the tar sands development continues. Maybe Lloyds will pay for it.

I can't see that increased gas supplies will allow BAU.

Excellent indeed, and enough food for thought to last for a while!

I may be wandering a bit here but one subject that has not been much discussed on TOD is what can and will be done in the face of day to day reality once we go from complacency mode to panic mode, in terms of doing something about the energy crisis which surely MUST BE dealt with in the next few years at the longest.

Setting aside the issue of readiness and what should have been done years ago in getting ready for a deep water blowout, any reasonable person must admit that a truly remarkable , indeed stunning , amount of ground breaking work has been accompolished in less than three months , apparently mostly by BP and BP contractors , in getting the leak stopped.

If this problem were hypothetically on the agenda for action according to the usual ways of big govt/big biz/big environmentalism/big inertia in general,it would take a couple of years at least to get thru the initial studies and reports, then a year or two to build coalitions to get legislation passed, another year or two to get things budgeted and contracted-in short-nearly forever, in terms of emergency response.

I spent an hour or two yesterday thinking about things and the way they used to be, and and how they could be again, and how quickly, in terms of transportation , home energy use, commercial energy use, and so forth, in a real emergency.

Military vehicles were designed and put into production with slide rules in WWII in less than a year.

I believe it would be no problem, technically, to put a hundred mile per gallon commuter car that would sell for five thousand bucks in the hands of consumers in twelve months. Basicaly all such a vehicle needs to be is a small well streamlined motorcycle with a couple of wheels added and something to keep the weather off, powered by a ten horsepower high efficiency diesel engine.

It most emphatically does not have to have carpets, power accessories such as ac, ps, pb, pw,stereo music, a big trunk,or a flashy paint job-and if it will get up to fifty five in thirty seconds that will get the job done.It could even be easily started with a hand crank or foot pedal, saving another forty pounds or so very easily, given modern designs;no starter would be needed and a tiny battery would suffice.

The" luxuries " could easily be limited to a heater if specified, wipers, and lights.

Absolutely no new technology would be required, and a lot of existing tech could be done away with;the clean air emission rules could be relaxed considerably and the amount of pollution emitted would still decline due to less traffic.

Anybody who is in doubt should take a look at what six thousand bucks will buy in terms of a commercial duty lawn mower.Of course such a car car would have to be totally standardized and sold Walmart style to make the price goal.

But it would get the commuters living in far flung suburbs to work affordably.It would mean that the suburbs would not have to be abandoned.

A dentist could be allowed to move his practice into his house, and serve the people within walking or bicycling distance, rather than practicing out of a "medical park".

If all the money being poured into say fusion research,aircraft design, highway construction, cutting edge bailout schemes for bankers, and so forth were to be diverted into energy efficiency initiatives such as manufacturing insulation, triple glazed windows,low energy appliances, and so forth, we might be amazed at just how fast we can cut our energy use without suffering a paralzying collapse..

I do not contend that I have thought this thru at all carefully;I simply hope these remarks will lead TOD community to pick up the ball and run with it.

What can be done once we hit the panic button, and how fast?

Your motorcycle based commuter car wouldn't meet safety requirements.

What would happen if an SUV ran into it?

Actually there are cars available internationally which are very cheap and very fuel efficient:

http://en.wikipedia.org/wiki/Tata_Nano

What would happen if an SUV ran into it?

I read your comment as "Business As Useual". Why do SUV owners have a right to question others saftey at all? Why keep any 6000 pound SUV killers on the road in the first place? Why are vehicles designed to travel faster than the speed limit? Why should others have to protect themselfs from SUV's? Why isn't the speed limit set lower for safety and effeciency? Why couldn't motorcycle based commuter car be designed to meet safety requirments?

Either one changes on their own terms or change is forced on one. One either leads or follows. The game is not going to stay the same.

I'd take it a step further (in terms of "business as usual"): why do we assume such safety standards are necessary or possible in a post-oil world. Like everything else that has to change, presumptions of risk and cost-benefit also have to be completely on the table with no sacred cows. To do otherwise is simply blindness for the sake of political correctness which is exactly what got us into this situation in the first place!

"why do we assume such safety standards are necessary or possible in a post-oil world."

Because it's not a post litigious US we live in.

"The first thing we do, is shoot all the lawyers" paraphrased from Shapespeare I believe, in reference to the coming of the revolution.

The lawyers have not stopped things from happening pretty damned fast in the gulf on Mexico , have they?

We hear all about the buearacratic woodpiles on the railroad tracks, but the real action at the well itself( and or in the offices/shops where analysis/decisions/design were being performed) and has been more or less continious and flat out, and under the supervision and control of engineering/scientific types.The lawyers are fetching the coffee.

In an emergency vehicle safety requirements can be and probably will be waived or at least considerably loosened , and not very many suvs will stay on the road once fuel is either draconically rationed or stratospherically expensive.

You are probably aware just how effective drunk driving laws have become in recent times;in my state a conviction is the end of the road for all practical purposes, and the laws are very well enforced;I know a ton of drunks with drivers liscenses, but only one that drinks and drives;he will be walking within a year in my opinion.Fifteen years ago any one of them would drive himself home or all over town after having a half a dozen drinks.

I believe these laws and the emphasis on thier enforcement have mostly come about as the result of political pressure from an enraged non drinking public, spearheaded by groups such as MADD.

If we find it necessary to commute in minicars such as the ones I envision, public pressure will put the skids under the last of the suv maniacs in a hurry, if rationing and prices don't get the job done sooner.

A driver who is reasonably alert and conservative in such a vehicle might actually be safer than he is today making the same commute, due to lower speeds and lighter traffic under existing fyuture conditions.Certainly he would be safer than he would on a bicycle or odrinary motorcycle in terms of accidental collision with a larger vehicle.

Another idea that just occured to me is that an ordinary suv or van could be equipped with fast operating multiple bike racks, maybe three or four of them;this might make otherwise impossible carpooling arrangements possible;a biker could do the first mile or two on his bike in the morning to meet his ride, and the last mile or two after being dropped off in the evening on hs way home.This wouls peeded things up for the suburban based driver enormously while still keeping the biker out of the rain most of the time;the driver could drop him at his door on rotten days.

Of course the insurance and taxi laws would need changes for this scheme to work really well.

Race cars are extremely light wieght and spartan ; the builders use only a few pounds of high strength pipe to build a safety cage around the driver, plus a safety seat, and a sophisticated seat belt arrangement.These things would be dirt cheap if mass produced.

Tune into a short track Nascar race someday ,you will see what I mean;short track speeds are typically well above eighty mph on up to a hundred twenty to a hundred and eighty or so;accidents are quite frequent, sometimes as many as a dozen in a single race, but serious injuries are very very few, in relation to the speeds involved.

At seventy five mph, a race car driver that doesn't hit an immovable object straight on usually walks away cussing his luck and is at work again the next day.

Race cars don't crush much and they don't use air bags or antilock brakes as a general thing .

And for what it's worth, it seems that OVERALL a bicyclist is safer than a motorist, in terms of health and life expectancy;the exercise benefits his health to a greater extent that the reckless automobile driver endangers it.

Well, with a little computer-aided design, you could design your commuter car with a profile such that, if an SUV ran into it head on at high speed, it would toss the SUV into an overhead back flip, and the SUV would fall onto the road upside-down, killing all the occupants.

However, that somewhat misses the point of vehicle safety design. You should design vehicles so that everyone is safe, including occupants of the other vehicles.

SUVs are not safe because of the rollover problem. Most people killed in SUVs are killed in rollovers.

Modern passenger cars, particularly non-American ones, do not roll over very readily - you can spin them end-for-end on the highway at high speeds, and they will almost never roll. If you spin an American-designed SUV end-for-end after hitting a patch of ice on the highway, you're almost certain to roll it.

And if you hit something solid, like a concrete barrier, there will be parts of the SUV scattered all over the highway because they don't have a lot of structural cohesion. Despite their high weight, they don't meet passenger car collision standards. Clever of the car makers to convince people they are safe, isn't it?

Why get that POS, when you can get a 64 MPG Ford Focus? It's a diesel available this year in Europe. Of course, not available in the US.

Please don't forget that diesel has more energy per gallon as well as there being other factors such as more energy to produce low sulfur diesel. The Union of Concerned Scientists recommends adjusting the MPG for diesel downwards 20% to get a fair comparison. I can't find link right now, this says 25%. So that Ford Focus is really about 51 MPG gas.

The WW II conversion of industry happened due to two things. There was unused industrial capacity just sitting there due to the 1930s depression. The other was a prohibition on the manufacture of consumer goods most prominently automobiles and new housing. This reduced the price pressure on commodities due to lack of competition for war materials. Rationing was imposed on fuels, food, and many other goods.

The situation in America at least is there isn't that much unused industrial capacity left due to the exporting of manufacturing jobs over the last 30 years. Jimmy Carter told us that the energy challenge was the moral equivalent of war which was opposed vehemently by the GOP. A large percentage of voters are anti-government to a very irrational and at times psychotic extent. What you suggest are things I support but it just isn't going to happen until conditions get very bad and even then a vocal minority will still claim that the free market would fix everything if government got out of the way. That's like saying the Mafia would solve our crime problem if we just fired all the cops.

What your say about industrial capacity being available during World War II and commodity prices being low makes sense. Building up, it the capacity isn't there, is terribly expensive and time consuming.

Where we are now, it is hard to see that we have much capacity for ramp up.

And you are right about the love for small government. The primary election where I live is tomorrow, and the phone keeps ringing with candidates wanting to tell me how low they will keep taxes.

Building up (rebuilding) an industrial base, or transitioning to alternatives (including natgas infrastucture) will require large amounts of liquid fuels as well which, hypothetically, will be in short supply (as this is the reason for the transition to begin with). The ol' "Tverberg Paradox", if you will.

We shoulda started this decades ago,,,,,,,,,,,,oh yeah, Carter tried that. Silly me!

It seems to me we'll likely be busy trying to make our own shoes and underwear again.

We have plenty of automobile manufacturing capacity;all that is required is a new set of drawings.

We also have plenty of most of what is needed to manufacture first class windows-empty buildings located on rail or highway with water , electricity, and sewer in place-the machinery is not all that sophisticated, and the materials used-glass, plastic, aluminum , etc, can be ramped up fast or capacity diverted from other industries such as the manufacture of big cars,oversize pickup trucks, soda pop cans.....

We will also have an AMPLE SUPPLY of cheap skilled labor.

Of course such a plan would not work if the crisis hits so hard and so fast that we suffer a sudden death collapse comparable to a bad heart attack;but my guess, for what it is worth, is that we will have at least a couple of years to implement emergency measures while still strong enough to do so.

We are more self sufficient by far than most people, but every week I throw out significant quantities of plastic wrap and bags, glass and plastic bottles, metal cans, newspapers, and other recyclable trash-almmost none of it except aluminum cans is actually reused.

A shortage of material inputs may cause a lot of problems, but I don't see them as being insurmountable.

The drywall or sheet rock industry to make one example would be very short of new construction customers, but when labor is paid out of a welfare type program such as the Depression era WPA,it would be feasible to rip out lots of old houses and stuff the walls with cellulose based insulation made mostly from recycled paper-or the trees that would have went into new houses;the new sheet rock would be needed to replace whatever is ripped out.

The guys who have been busy digging new septic systems could be put to digging the ditches for ground source heat pumps.

Landscapers could be redirected from planting ornamentals ans sculpting slick paper magazine picture yards to building raised bed gardens and planting properly located shade trees and windbreaks.

If construction people must be supported on some sort of welfare, we might as well get some return on the money;and such work involves mostly money for wages rather than for materials.

Now a lot of folks will argue that we won't be able to pay for such programs , but we WILL PAY the living expenses NO MATTER WHAT of all these out of work people right up until the day things go totally to hell-the day we stop paying the necessary welfare is the day before things go mad max.

As Alan from Big Easy often says, the surest way to fail is to fail to try.

I am not saying that such down and dirty measures will save us from the many worst case scenarios we can think of but it is possible that they might.

Well old farmer, good luck on all that. I been singing the same song for decades and have nothing but hermitdom for my reward. I go a little farther, tho. What I say is:

1) Jobs? we have tons and tons of jobs, never ANY lack of jobs. Just like me here, my fridge is loaded with jobs, and the faster I do them, the faster more get tacked up. In my town, everybody needing something to do other than eat and sleep could be out putting skins of insulation on every house here. As you say, they are gonna eat and sleep anyhow, so might as well be doing something good.

Ditto with energy. I know plenty of guys, mostly with bad grammar and drinking habits, who could EASILY convert any old IC engine to run on booze, which they know how to make, not to mention wood gas, like in the war. Windmills work, and do not need to be anything like complex. I made a pretty good one out of the rotor from a big industrial blower I found in the junk yard. I used it to stir water for heating my shop. It blew down in a famous windstorm and punched a small hole in the wall, making my wife mad.

And then, to really get the kettle boiling, I recommend a national emergency to switch off carbon fuels, paid for by quitting all the worthless things we do and spend tons of money doing right now. I would start with soft drinks, go on to no more than one type of peanut butter, no bananas or any other fruit needing a boat to get here, almost all clothing, silly cars ( that is, any more complex than a model A) and all toys from China. And of course, all stockbrokers and other thieves, who take much for nothing, and you can add the rest-- a very very long list of things we don't need and should not be doing.

And put all that time, energy, management etc etc into getting on to solar for good. Paradise! then have a beer party.

PS, this could make me really rich, but not to worry, I never had any desire for more money than what I needed for firecrackers and, of course, the right kind of peanut butter.

"We will also have an AMPLE SUPPLY of cheap skilled labor."

I have to take issue with your comment that we have an ample supply of cheap skilled labor. 1) US labor is not cheap and 2) US industry has had and is still having problems finding skilled labor in the US. For example, during my days at the Defense Department, I worked as a military industries analyst and as a result visited many US industrial facilities of all types, defense and civilian production. One of the most common complaints voiced by the VPs of the factories we visited is the cost and effort that goes into remedial eduction of US workers. Our educational system is a failure and industry has to educate their employees to do what they need.

"We have plenty of automobile manufacturing capacity;all that is required is a new set of drawings."

This comment is also fallacious. There is a lot more involved in changing a production line from making SUVs to making mini-commuter cars. Such a change require new tooling, jigs and fixtures for production of car bodies and the parts necessary to put them together. This is not something that just happens over night. It takes some real effort. I spent many years watching Russian defense industries try just that, re-tooling for civilian production and watched them mostly fail at it. New drawings are the least of your problems.

Also, concerning the state of the US industrial base, most of the aero-space industry has out sourced its machine shop work, in some cases shipping entire factories overseas. In the late 1990s I walked though a huge machine hall in Denver, CO and five years later walked through the same hall and all the machining centers were GONE! Mostly sold for scrap at the end of the Titan program (SLV conversion from ICBM.) Today that production capacity to re-tool to something civilian is gone and all the remains is an empty building. I saw far too much of that over the years as factory after factory shut down and shipped the equipment overseas. It will take years and lots of credit to reestablish the industrial base that is now gone.

Hi, Astro,

While we aren't as well trained as the Germans or the Swiss or maybe even the French , we have lots of highly skilled labor, and tons of engineers and programmers and so forth.

And when tshtf, one hell of a lot of them are going to be looking for work.All the ones working on the next generation of the full size luxury cars and and pickup trucks for instance.

When "tshtf", which if you will remember , is the initial premise,and the question is" what can we do in a hurry " then one must reasonably assume that lots and lots of skilled labor can be diverted to new emergency production.

I am not an engineer but I strongly disagree about how hard is is to build a simplified bare bones mini car-I suspect you are picturing a mini sized new model Civic or something-I could throw together the complete drive train for such a car in a month myself, an entirely practical and workable drive train, without using a single new part not available off the shelf out of catalogs;it would not satisfy THE PAPER PUSHERS WHO DEPEND ON PUSHUNG THE PAPER FOR A YEAR OR TWO OF COURSE, but it would be cheap, reliable, and very economical to operate.

It would not be OPTIMIZED as to getting the last few drops of performance or economy of course but it would run , and be far far cheaper than anything mass produced today.

Take wheels for instance-the wheels used on the larger off road vehicles known as "fourwheelers " would need only very minor modifications , or none, to be fitted with passenger car tires.

Take a look at a Honda fourwheeler and see just how simple it is in terms of chassis;stretch it a bit, widen it a bit,get the driver seated lower, and put an aerodynamically shaped trash can over the top with a windshield and you are basically THERE.

I ride mine almost every day doing chores and I seldom put over a couple of gallons of gas in it in a MONTH;and it will would do fifty five easily if geared a little taller.Of course it is too tall short and narrow to be safe at such speeds.

Just how many engineers employing a battery of computers do you think it would take to design a go cart or slightly larger sized unibody for an automobile?The manufacturers have designed, built, and discarded hundreds of different body shells over the years, and we are talking an elementary school exercise here.One where the effing stylists and marketing people are relegated to fetching the coffee,and the paint buyer is told to stock up on about four different colors-none of them sparkly or clearcoat.All the little stuff is already mass produced and standardized, such as electrical wire, switches, fasteners, terminals,nuts bolts, springs, radiators, hoses,brake drums and rotors, etc.

A fender is made by unrolling a coil of sheet metal into a press that goes KACHOMP! KA BLAMM!!! AND A FENDER GOES DOWN THE BELT.The top and bottom of the die are of course necessarily more of less hand made by very skilled machinists or tool and die makers, but hundreds of such dies are not necessary-a couple of dozen could be more than enough to get a plant up and rolling building the body shell.

I can build and have built many welding fixtures myself;I couldn't build one to 2010 appearance and fit tolerances, but any machinist could, in a few weeks.

We won't be selling such a car in a highly competive environment, we won't be paying UAW wages, and engineers will be as cheap as farm laborers;an assembly line worker may very well be glad to take a job adequate to buy groceries and pay his greatly reduced rent, as folks double up and landlords start having rent fire sales.

I don't think you have grasped the idea that we are talking EMERGENCY and COLLAPSE.

BAU will necessarily be TRASHCANNED, except for politics.

Hi OFM,

I have been intrigued by some of the criticism of the Lloyds report.

On the subject of "what the governments know compared with what the people on this site know", I think the readers of TOD would be amazed if they knew how much the US Government did indeed know.

You cannot have eight presidents in a row spouting about the need for energy security on the one hand and for the government to be doing nothing on the other.

The argument between people who believed in the logic of peak oil theory on the one hand and those who did not, on the other, has always been a side show for me. The practical limitation of fossil fuels was proven 35 years ago. Semantics and vested interests have only smudged the issue.

There are numerous and often uncoordinated stealth developments happening in the USA, which if they work out could change the way we view our post peak future. The involvement of Dr Chu and the way he pops up in interesting locations with knowledge of ambitious projects has always intrigued me. The way that the US government has backed seeming losers as well as smart grid and lithium-ion and sodium sulphur energy storage developments as well as the renewable alternatives has suggested to me that they know more about what is coming down the track than anonymous posters to Peakoil.com and TOD.

Just look at who is on the President's steering committees. The heads of those enterprises that are doing or funding stealth work pop up.

I know, it will take several years to slow the pace of demand for oil and that may be time we don't have. But let's not ignore the fact that that the one major breakthrough we need to wean us off oil could be just around the corner. I know of two, but I don't know progress.

Despite the internet, we don't know everything that is visible to governments. So my attitude is to keep an open mind and just hope I will have a slice of the action when the winner cuts loose :-).

Good ideas, OFM!

I think one of the biggest hurdles to using NG as a bridge fuel is that it locks countries like the US into using a fuel that, even if it were plentiful, still emits far too much CO2. Consider the infrastructure aspect of converting a sizable portion of the US vehicle fleet to NG, a point Gail mentions. This will take years, possibly decades, and yet it will yield only a 25% reduction in CO2/mile compared to a comparably sized gasoline vehicle. The result is a long, expensive conversion to a different fuel that has to be abandoned as soon as (or even before) it's fully adopted simply because it's too carbon intensive.

NG has a reputation here in the US (and in other countries, I'd guess) of being an extremely clean fuel. No filthy black rocks and dust, no slimy oil spills, just clean, invisible gas. As a result, there's a lot of greenwashing going on as companies add NG vehicles to their fleets and issue glowing press releases that brag about how they're using a dramatically cleaner fuel. (NG is vastly cleaner for some emissions, like particulate matter, but it offers only a slight improvement regarding the one pollutant that's holding a gun to our head, CO2.)

This problem can be solved by putting a reasonable price on carbon emissions, via whatever mechanism politicians and voters will accept. I'm not optimistic we'll see that happen in the US in the near future, though.

Yeah but only propagandized globalist stooges and delusional fools actually believe that CO2 is an issue. Maybe in a perfect utopia, we might need to worry about the marginal effects of greenhouse gases over long periods of time. But here on the Real Planet Earth, there are far more pressing concerns. I'd be more concerned with rioting on the streets. Just imagine thousands of tires burning... all our water sources are just "one dumb moment" away from being toxic sludge pits. And that is exactly what's going to happen if people continue to allow themselves to be misled by the Carbon Profiteers.

"Rare" earth elements are used in the construction of Ni-Cad batteries, however, current electric vehicles use lithium batteries, and lithium is not a rare raw material. In fact, conventional automobiles use "rare" raw materials, mainly platinum, which is found in the catalytic converter. Rare raw materials for electric vehicles is a red herring.

Oil prices might rise and fall, as you state. However, each peak price will be higher than previous peak, and each trough price will also be higher than the previous low. Over time, the average price of oil will continue to rise, regardless of any cyclical impact of recession. Our current, "recessionary" price for oil is double to triple the average price of oil in the not so distant past. Overall, oil will continue to get more and more expensive, regardless of what happens with the economy.

To expect oil to continue to undulate within any particular price band is misguided. Expect and plan for the average price of oil to double, then double again and continue to go up from there, assuming that it will even be available for purchase to you as an average consumer. As supply gets more and more constricted, who do you think will have first dibs on oil... governments, military, police, long-haul truckers, farmers, or Joe Consumer? Looking at very long time horizons, Joe Consumer might be able to get some future oil/gas on the black market from one of the other potential sources... but do you really expect that oil/gas to only cost $4 or $5 a gallon at that point?

If enough people are out of work, even a medium price might be unaffordable for a large share of the population.

I think too that there is a distinct possibility that there will be price caps (perhaps locally mandated). If so, these will tend to result in gaps in supplies. For example, in the Atlanta area we have had shortages after hurricanes affected pipeline supplies of oil. Local officials made it very clear that oil companies were not allowed to charge higher amounts to compensate for the supply shortfall --to do so would be considered "price gouging". The result was long lines, and many people who stayed home for a few days, because there was not enough gasoline to go around.

Or governments could try subsidies for gasoline prices, as oil prices rise (the opposite of the carbon tax being suggested)! This too, could result in gaps in available supplies.

Oil and its products is a global market. So even if there is a cut in demand in the United States because of the recession, Americans are still going to have to pay the global price. And there is a massive increase in demand in the third world (the Chinese and Indians wanting to have cars of their own...--and note they only use a very small fraction of U.S. usage per capita). So major energy price increases are inevitable.

I think that maximum oil price really has to do with Energy Return on Energy Invested (EROEI) - and the level of net energy needed for society to function.

Many years ago, EROEI was very high, as much as 100:1, so the price of oil could be very low--quite a bit under $10 barrel. As the amount of energy (and cost) going into extracting a barrel of oil increases, so does the required price in order for extraction of that barrel of oil to be profitable for the operator. For example, for oil from the oil sands, the EROEI is something around 4:1, and the needed price for profitability seems to be about $75 barrel.

But an EROEI of 4:1 is pretty low--probably down in the range of the minimum needed to keep society operating at the level it is today. I know Charlie Hall, Stephen Balough, and Dave Murphy have published a paper called What is the Minimum EROI that a Sustainable Society Must Have?. The paper concludes that the minimum is at least 3:1. The EROEI needed to maintain the current US society is probably more than 3:1. So were are already probably in the range of minimum EROEI, with oil from the oil sands, and with some other high priced oil (very deep water, for example).

Bidding up the price only "works" if the fuel provides enough output that society earns enough to pay a high price to pay for the oil. Clearly, if it took 2 barrels of oil to produce one barrel of oil, the equation wouldn't work, but even if the inputs are different (say water, labor, and capital, besides oil) at some price oil it becomes too expensive to drill for, given the likely return. If price really could be bid up to, say, $500 barrel, our peak oil problems would pretty much be solved, for a very long time, since then we could afford develop very low EROEI oil, perhaps even less than 1:1.

Gail, you say

Unfortunately not the way it works. Money has no connection to energy in any way whatsoever, (in fact money has only a tenuous connection to this planet and that by way of human belief, the most maleable of paradigms), energy obeys the laws of physics and in particular the laws of thermodynamics, in none of these laws do we see a $$/yen/rouble/etc sign. Money has no connection to the laws that govern our existence yet we (as a species) use it as the basis for all our decisions, this is why we find ourselves on the edge of the abyss.

As far as suggesting our peak oil problems would be solved with $500/bbl oil misses the whole gist of EROI. EROI is a physical measure, $$ cost is immaterial, energy cost and energy return is what is measured. NO matter what $$ price a barrel of oil if it takes more energy to extract it than we gain from it (ie EROI <1) then it is an energy sink not a source. The only way we will ever be getting oil out of the ground when its eroi<1 is if we have other available energy sources and the oil is required for purposes other than energy production.

So are you saying that if we hadn't discovered fossil fuels we would have just as much money in the world as we do now?

I believe you are failing to see the connection between energy and money, a very common blind spot.

aangel,

money creation has been enabled by energy availability, energy availability is a necessary prerequisite for physical growth in any system. At times in the past money did approximately reflect some physical "value" but today the neoliberal economic system is completely divorced from the world we live in. Money availability has no effect on energy availability, resources do not respond to money they respond to other resources and in particular energy. Money is belief, the greatest con since the other less successful religions.

Are we ruled by the laws of the physical world (physics, bio, chem) or not?

We are. But if you live in a world where you can change the definition of the thing at will, is it a surprise that energy and economics can be confused, particularly if that is a concept you already believe in? Rationalization is a powerful force.

Of course we are ruled by the laws of the physical world.

But so too are we ruled by the laws made and enforced by us. Just go try to murder someone and you'll see that those laws can dictate your future just as much as some of the physical laws we must abide by.

The money system guides a great deal of our activity on this planet. So I think your comment that money availability has no effect on energy availability is fundamentally inaccurate.

aangel,

please show me one physical law (you know the F=ma type) that has a $ sign in it.

As I mention in my response to reservegrowth below, this isn't a very useful conversation since it has no practical use to me. So I'm going to stop participating in it. In another situation, perhaps over a beer at a local pub, I would enjoy hashing this point out further with you.

Oh...I think Mastodon see's the connection between energy and money very, very well.

Using an energy measure for success/failure in an economic system is nothing short of ridiculous, and Mastodon pins down exactly why such a statement is correct.

You appear to have missed his point.

No I understand his point entirely. It just isn't correct.

There is a very definite link between energy and money even if the link is invented and enforced by us. Saying 'Money has no connection to energy in any way whatsoever' is clearly a false statement.

Now, if he were to say: 'Money has no material connection to energy in any way whatsoever" then he would be correct. Or he could say, "Mankind has created the link between money and resources which means that he could, by a consensus decision, break that link." That would be correct.

But there very definitely is a link that exists right now. Further, raising the philosophical point that it could be broken just isn't a very useful conversation to have, in my view. That link is going to manage the futures of most of the 6.8 billion people on this planet for the foreseeable future.

Some people may drop out of the money economy (maybe even many people) but the link will still exist for great swaths of our civilization.

aangel,

this link, the monetary system you think will continue to exist for "great swathes of our civilisation" how do you think this link will survive continuous contraction?

Surely if we were to be truly concerned about what we can actually achieve on this planet (for the 6.8 and counting billion) we should firstly make certain the control system we are using has some relation to it? Money does not, so using it as a control system would seem a little foolish perhaps. I see very few "solutions" suggested from within our current framework (neoliberal economics)that have any chance of even partially mitigating the coming collapse, in fact most of them will exacerbate the problem. In a bigger picture mind you this could well be a good thing, after all the sooner and the harder we (the human experiment) hits the wall the better for all other spp on this rock and for those that survive.

Well, based on how I read it, he is most certainly correct. Energy is energy, and the laws which we understand to govern it doesn't have anything to do with $'s.

Now, humans can make up a link if they'd like, as you have mentioned, but at that point you don't get to just assume that the same laws which you think work with energy transfer over to the economic system you've just dumped them into.

Our financial system is pretty messed up. But the idea is that regardless of how you measure it, if you have to put more in than you get out as an end product, the system isn't going to work very long.

You may remember Charlie Hall's cheese slicer model. The amount of energy we get out of the system eventually gets smaller and smaller, so we have less left to put back in the model.

On a different kind of model, actuaries look at Social Security being a way of allocation a portion of the goods and service that are produced in a given year to retired people. What really matters is how many goods and services are produced in a given year and how many retirees there are in comparison to the number of workers. The planned benefit level for workers makes a difference, too. But no matter what happens to the money supply, there is no way you can give away more than the goods and services actually produced.

I agree that our financial system has pretty much detached itself from underlying assets. That is why $500 this year is quite different from $500 ten years ago, and likely from 10 years in the future. My point is that now, if $75 corresponds to an EROEI of 4, than $500 corresponds to much lower EROI. Ten years from now, the numbers will likely have changed.

Gail,

I agree with the thrust of your comment, however your initial comment suggested that $500/bbl oil was a cure for peak oil, it aint. No matter what the $$ cost if the eroi<1 then it is an energy sink not a source. Yes sure we may find some way to justify the extraction at that price but it will not be as an energy source.

I have known Charlie Hall for yrs and would highly recommend to all getting a copy of "Energy and Resource Quality" which he wrote with Cutler Cleveland and Robert Kauffman back in the '80s. 600 pgs of eroi discussion and data that really makes our current predicament obvious.

Tainter when discussing complex systems has a great expression that (perhaps unknowingly) defines the eroi slope, "benefits decrease as costs increase", basically same as your takeout from the above cheese slicer model

Gail, I too live in the Altanta area and know of what you speak. I acknowledge your superior understanding of peak oil, having read many,many of your articles and posts, but I don't think the anti-gouging law, had much impact on the price and availability of gasoline in metro Atlanta.

Despite the law, several stations did in fact double their prices, and were eventually brought to the attention of law enforcement. Most stations were out of gas because of the pipeline problems, including the fires at the pumping stations in Texas as I recall. Most of the problems were caused by people filling up their tanks or "topping off" before they reached anywhere near empty.

I do agree that one of the major components of our current economic depression is peak oil, a point that seems to be deliberately obfuscated by the corporate media. I think its a 10 to 20 year depression because of the technical problems of replacing energy sources, the aging demographic of the American population (old folks spend less) and the corruption and fraud of the financial system and its endemic destruction of real growth by parasitic substitution of "financial growth" which is merely casino like speculation that destroys real working capital for businesses and governments.

As Japan has endured a 20 plus year deflation, so too America and most of the 1st world will follow this path. In some respects this will be problematic as it will obscure the issue of peak oil as weakened demand will mask the magnitude of the deficiency, and the primary focus of many will be "economic growth" rather than the underlying reasons for the failure of "economic growth".

I am curious why venture capitalist have not embraced Thorium reactor development, as this seems to be the fastest and easiest way to produce more energy over a very long time line. I hope it won't take a worldwide collapse of heavily indebted governments to make the governments who should be financing these developments. to wake up, but I fear the political class understand nothing outside their insulated bubble and until it collapses they will not see the world drifting into the end of prosperity with the loss of cheap oil and its inherent economic model.

black_gold,one of the main reasons why venture capitalists have not embraced Thorium or any other fission power source is the irrational prejudice against nuclear power in many Western countries.Even if a nuclear program can be got off the ground in spite of the squalling of anti-nuclear groups the industry will face a plethora of delaying tactics and time consuming unnecessary regulation.

No businessman is going to risk their own money under these circumstances.It is instructive to look at nations which have a high rate of nuclear power generation,or are building it,and see what the attitudes are of government and the populace.

France is big on nuclear power. The saying goes...

No oil,

No coal,

No choice.

Wind power and solar can not replace oil and coal. We will have to go nuclear or give up.

as for fusion. Vermont is belly acing about some pico curries of tritium leaking from their reactor while a fusion reactor, would be filled with massive amounts of tritium that is being held together with a magnetic blanket, that is trying to blow its self apart.

I was ready to buy up a truck load of brand new generators and other such equipment and haul it to a hurricane struck community and sell out fast to make a few bucks once but my lawyer convinced me I would get locked up for my troubles.

But if I had made say two hundred bucks on a generator and that enabled a guy to get out of a hotel and back into his house a couple of days faster, it would have been a truly great deal for my customer.

Needless to say, twenty five or so homeowners did not get back into thier houses a couple of days or even a week sooner.By the time the retailers got restocked, the critical need had passed.

Since your local retailers would have had to pay extra to getr gasoline delivered an extra long distance by truck rather than by pipeline,and thereby lost money on every gallon, they simply took the easier path and sold out what they had and then thier customers did without.

At the same time we had price spikes here near nw North Carolina due to pipeline capacity difficulties but no real shortages because every tanker available went on double duty and ran some extra trips all the way to the coast where gasoline was plentiful.Gas went up thirty cents or so for a few weeks but hardly any store ran shoret..After that the pipelines caught up again after the storm passed and things went back to normal.

I think you're right to hammer the economics of all this, Gail.

This seems to be the perennial blind spot in these analyses. The energy program that aired on the Discovery channel over the weekend also ignored the financial/economic aspects of the energy predicament.

The nub of the dilemma just doesn't seem to be getting through. It's not about energy per say, but about how to make available enormous amounts of cheap energy. There seems to be an underlying assumption that if only enough energy can be harnessed/generated, then cost will be no object.

This seems to be an obviously faulty assumption.

I figure that there are going to be quite a few insurance people looking up the Lloyd's white paper on the Internet. Someone needs to have a fairly simple report pointing out some of the problems with it, since most of these people are not regular Oil Drum readers. Oil Drum posts generally come up fairly high on Google searches, so I am hoping that by putting up a paper on TOD that includes the name "Sustainable Energy Security", I may be able to reach a wider audience.

For regular readers, sorry about the repetition!

Thin film photovoltaic panel manufacturer First Solar delivers MW-size installations for about $2.50/Watt(peak) installed. This is close to what a new natural gas power plant costs to build and install. Fuel comes extra for the NG plant, it is free for the PV plant. For very sunny areas, thin film PV is already cost competitive with all forms of new power. Of course the cheapest power comes from a 40-year old coal power plant that does not pay any extra for sulphur, NOx, particulate capture, dumps its ash on-site and otherwise gets its cooling water for free. But is the yardstick we should be using? I think not. This point appears to be missed by just about everyone who whines about the cost of PV or wind. These are in fact cheap compared to a new coal power plant, which can be as high as $4.50/Watt installed, and the coal costs are extra. And that does not pay for mercury emissions, cooling water or ash disposal.

Next year at least 12 electric or plug-in hybrid cars will come to market. These will use less than 30% (or BETTER) of the energy of a 25 MPG auto. They won´t be cheap but the richest 30% of the population will be able to afford them. It is a start and 5 years from now, 50% of the population will be able to afford them, and there will likely be 25 models to choose from.

Honestly, the solutions to Peak Oil are so painfully simple and affordable I wonder what sort of doomsday funk has come over this crowd.

"5 years from now, 50% of the population will be able to afford them,...."

Geez, Todd, perhaps you need to visit the little people in the US more often. I'll be surprized if, 5 years from now, 50% of the population will be able to afford a new battery or tires for their old ICE vehicle, or insurance, or taxes, or........hell, many folks are there now, and I see no sign that it's getting better. There's your "painfully simple doomsday funk" for ya.

It would be fun to see who is and who isn't fully employed or nicely retired and compare the tone of their comments.

Also, figure out what fossil fuels go into making the new electric vehicles and transporting the to the location where they are sold. There is no way that there is a sustainable system for electric vehicles, without fossil fuels.

Todd, call back when photovoltaic (any and all forms) provides one percent of world electricity. One percent. Not even a useful amount.

I'll expect to hear from you in about 20... no, 45 years. Or perhaps never.

If you're focusing on what is technically possible, you're looking at a non-problem. The problems are, and always have been, political and social.

Don't be surprised by an underwhelming take-up of electric or hybrid vehicles. How long do they last? How much do they really cost to run? How good is the battery gauge? -- the ones on laptops and cellphones are hopeless. How much do repairs cost? What's the re-sale value going to be? How does buying an EV affect my insurance? Can I drive to Yellowstone National Park, or go duck-hunting in it? Tow my boat, which I don't have?(Whether or not I actually do any of these, closing off the possibility is a negative. People are not rational.) Will my dog like it? What about the neighbors -- will they laugh?

There is a heap of uncertainty. That tends to put people off. If the first few EVs are over-hyped, like the Volt, that is going to put people off even more.

Hi gregvp,

Global growth in PV in 2009 was 98% over 2008. About 12-14 GW (nameplate or peak power) are predicted installed globally in 2010. You will get to 1% of global electric production soon enough, and if the annual growth rate slows to a steady 50%, it will pass up coal in about 12-15 years. What was the market penetration of personal PC´s in 1980? How many people had cell phones in 1985? Less than 1%. How many have these today? Remember how expensive these products were to begin with? How expensive are they today? OK there are limits to how cheap PV can get. But we are not there yet, and at some point it will be so much more cost effective than everything else that they will putting thin film PV on every roof instead of composite shingles and man will you see an improvement in the mood around here.

As for the market penetration of hybrids, they are already close to 3% I believe, and climbing fast. If you need a vehicle with hauling capacity and high efficiency, clean diesel is the answer. We have these in Europe and I hope you will get them soon in the US. My clean diesel gets 40 MPG and has 240 Newton-meters torque.

Clean for the EU might not be clean enough for California. As I understand it, clean diesel tech that's good enough for California's standards, isn't yet reliable enough.

BTW, I hope that's 40 MPG imperial. We're getting at least 2 gasoline powered non hybrid cars this Fall in America that will get 40 MPG (US).

Hi 1smartass, no I meant 40 MPG US gallons. And someone else commented that it is misleading to compare diesel MPG with gasoline. Diesel has only about 3% higher energy content volumetric compared to gasoline, so I do not have a problem with this comparison. Here in EU there will be no fewer than 8 clean diesel models from different manufacturers that will get better than 60 MPG US this year. Fiat will produce a 2-cylinder gasoline powered Fiat 500 that will get about 55-60 MPG (US) coming late 2009-early 2010. This "tweaking" will propagate throughout model lines and it will definitely help in the short-medium term. But beyond that (after 2017) I do not see anything competing with electric and plug-in hybrids. And by the way, here in Norway gasoline is about $7/US gallon, and the excise tax on cars is on average 100%. People still buy new cars and fill them with fuel, and an amazing number of them do not choose the highest MPG car they can buy. I expect they will be doing so soon.

ToddInNorway, I believe your assumptions about the future are not supportable by history.

If that were to occur (50% growth rate for the next 12-15 years), that would greatly exceed the fastest energy transition we have yet gone through, which was onto oil and averaged 7% for the last 100 years or so. (From the forthcoming paper Growth rates of global energy systems and future outlooks by the Uppsala Global Energy Systems Group.) In that paper, they show that the fastest the oil transition reached in the last century was in the 1950's at 9.9 percent growth annually. The fastest it reached in the previous century (the 19th) was 20-30%.

It is a completely unsupportable assumption to predict that the growth rate of PV will stay at 50%. A doubling of the industry every two years can be accomplished only when an industry is small. As it gets larger growth rates decrease to single digits or, at best, the low teens. However, in a future with a contracting economy, the growth rate of all renewables is likely to decrease rather than increase. If in a few years the industry doesn't experience a full stop due to tight credit and a product that is still more expensive per unit in most (but not all) cases, I'm expecting the torrid growth rates of the past to slow to low single digits, at best.

As for hybrids, here in the U.S. converting half the vehicle fleet to hybrids (halving their annual fuel usage) would save about 5mb/d or just a few years of oil's decline assuming a conservative decline rate of just 2-4%. If we experience 4-8% decline rates as proposed in the IEA 2008 study, hybrids barely buy us any time at all.

For fuel usage numbers see:

http://www.infoplease.com/ipa/A0004727.html

And, again, in a contracting economy, the rate of technology penetration decreases because credit becomes difficult to get so more expensive hybrids are unlikely to continue selling a the current rate, especially since all vehicle sales will plummet. They did this already when oil got expensive. Sales decreased from 16 million cars per year (2006) down to 10 (2009) and have recently crept back up to 11 million cars per year or so, giving us a vehicle turnover rate of about 22 years (240 million cars and truck / 11 million cars per year).

I don't expect electric vehicles to make much of a difference in the next ten years so I leave them out of the analysis. If you'd like, remove another 0.5mb/d for them, although I think that's not a supportable assumption since their production quantities are so small (in 2010, 10,000 per year for the Chevy Volt, 25,000 for the Nissan Leaf, etc. perhaps 150,000 vehicles per year by 2014 or so). Deutche Bank sees US sales of EVs to reach 400,000 per year by 2020 (http://web.mit.edu/sloan-auto-lab/research/beforeh2/files/Cunningham_BS_...), a projection that does not adequately take into account the various oil shocks that we are about to experience this decade (the finding of Lloyd's and the reason for this post).

Even 5 million all electric cars represents only 554 gal/year x 5,000,000 / 42 gal per barrel / 365 days per year = ~181,000 barrels per day

Now you might see why many of us believe contraction is inevitable. We are entering Energy Descent largely with the infrastructure and vehicle fleet we have now and their composition will not change much in the contracting economy that is in our future.

I recently bought a used Prius with almost 100,000 miles and it wasn't cheap. The market value of these hybrid cars is certainly holding up rather well.

How heavy is your imaginary boat? I've put a tow hitch (bought from Amazon) on that Prius and routinely tow with it. There is a yahoo chat group called Prius Trailers, so I'm not alone. I wouldn't tow more than 1500 pounds or so, but I don't think I'd have any problems with that.

Sure, the neighbors may laugh now that we have two Prii in the driveway and I treat one like a truck, but I'm the one smiling at my low cost fillups at the pump.

You are a self-fulfilling prophet, Gail and you are too gloomy.

But we could even transition to mainly natural gas with not too much difficulty.

The US uses ~23 quads of natural gas, 37 quads of oil,

9 quads of nuclear, 23 quads of coal and 7 quads of renewables to make 14 quads of electricity, 18 quads of heat, 6 quads of non-fuel products and 28 quads of transportation fuels.

Our use of fuel is demand driven. In general you don't believe much that we are capable of reducing demand without collapsing the economy, though if we can't at some point the economy will collapse anyways.

The easiest thing we can do is to replace cars and light trucks for personal transport with hybrid(or EV) cutting fuel demand for that by 50% to 20 quads and oil use to 28 quads. I would guess that the 6 quads of fossil fuels we use for non-fuel products would stay the same.

A car lasts ~20 years so the entire fleet could be replaced with hybrids by 2050. There would be shortages of cars so increases in mass transit would be necessary. Of course a hybrid natural gas car could be manufactured tomorrow and some people would opt for EVs.

US building stock are notoriously inefficient but retrofiting those buildings with insulation and building new with superinsulation could cut the energy use for heating by half from 18 quads to 9 quads.

Finally there is the electricity market which uses

42 quads of energy input to produce 14 quads of electricity.

If all coal plants 36% efficient were replaced by 55%

efficient CCGT plants and all the inefficient gas turbines were replaced the amount of input energy required for electricity would go from 42 quads to 32 quads.

Totaling it up we would need 20 quads NG for transport

plus 9 quads NG for heating plus 20 quads NG for fossil electricity--49 quads. We would still need 6 quads oil for non-fuel products and 8 quads oil for other transport--16 quads(8 mbpd).

We would also have 9 quads for nuclear and 7 quads for all renewable.

Total fuel 81 quads down from 100 quads.

Total fossil fuel 65 quads from 83 quads.

Total CO2 emissions down to 3.5 billion tons from 6 billion tons(42% reduction).

If we linearly ramped up from 23 to 49 quads per year of NG over the next 40 years that would amount to

1440 Tcf of natural gas which is about the size of the size of the unconventional NG resources of the US.

We would also save 22 billion tons of coal.

We can convert coal to natural gas with CCS, a process that is 40% efficient, so 250 billion tons of coal reserves converted is equivalent to 4000 Tcf of natural gas.

Converting coal to synthetic natural gas is largely old school technology but if we don't bury the CO2 we'll fry the planet.

If coal-to-gas with CCS doesn't happen we'll quickly run out of NG for your mitigated BAU.

Between the two of them totalling 5440 Tcf there is over 100 years of a NG mitigated economy based on current consumption. The reduced oil use of 16 quads per year for 100 years or 320 billion barrels could be handled by the Alberta Tar Sands or Colorado Oil Shales.

If we can't figure out renewables or fusion by 100 years from now, I agree, we're finished regardless.

Current consumption when the population is doubling every 20 years is very misleading.

majorian:

Poor people don't have any money/credit to make major investments in energy saving technology such as hybrid cars or well-insulated houses (and the way the economy is going this is a rapidly growing part of the population). And the government, with its massive increasing deficits won't have the money to do it for them.

Yes, this is the major blind spot of the business people and technologists, in my view. They fail to incorporate limited or no credit into their model of how the world will unfold. It's usually all just a conversation about the technology as though current economic conditions — or those sufficiently similar to them — will continue and thus permit this pie-in-the-sky transition to occur.

Some people who really don't understand go so far as to say the move off of oil will speed up as the contraction sets in because "there will be more incentive to do so."

Sure there will be more incentive but you can't pay the hybrid car manufacturer with incentive. Last time I checked they accepted credit or hard cash.

Of course this giant fiat credit bubble is going to burst, likely in an orgy of asset sell-off as people scramble to raise capital to pay their creditors.

Click for larger view

Can it be any other way as energy declines?

Click for larger view

I really like the Greer's Stages chart. Even if I don't like what it implies about the future :-O

That credit contraction chart sure puts things into perspective, now doesn't it...

You always seem to have something interesting to post aangel!

Thanks, delawaresooner. I try to post these sort of charts often enough because there are always new people coming to TOD and the adage about pictures vs. words I think is very true.

Still, words can provide a sort of detail a graph can't often portray. Here is where Greer fleshes out his theory of catabolic collapse:

http://thearchdruidreport.blogspot.com/2006/05/on-catabolic-collapse.html

The graph above is more a view of his thinking of Civilization and Succession:

http://thearchdruidreport.blogspot.com/2007/09/civilization-and-successi...

Toward an Ecotechnic Society

http://thearchdruidreport.blogspot.com/2007/10/toward-ecotechnic-society...

Climbing Down the Ladder

http://thearchdruidreport.blogspot.com/2007/10/climbing-down-ladder.html

The Age of Scarcity Industrialism

http://thearchdruidreport.blogspot.com/2007/10/age-of-scarcity-industria...

The Age of Salvage Societies

http://thearchdruidreport.blogspot.com/2007/10/age-of-salvage-societies....

Of course all this is nicely bundled up in his book The Ecotechnic Future, which I recommend highly.

Aangel,

I have nothing but th greatest of respect for your analysis of the overall situation and your understanding of the nuances and the details of the big energy picture;I will even go so far as to say you have probably forgotten more than I know, or ever will about the subject.Seriously.

But I am not so sure that you or anybody else has a secure grip on the issue of debt and finance;all the commentary and articles I see seem to indicate that the authors think either (a) that the debts will be defaulted, or (b) that the citizenry will be criushed by having to pay them , or both a and b , never mind the possible logical contradiction..

I have no training in finance, and only some ancient undergrad courses in economics.

But I'm a professionally educated ag guy, which means my thinking is based on and guided in the last analysis by the physical sciences in general and biology in particular.I read omnivorously and I devour history, especially military and technical history.

I can't put my finger on it specifically, but there is something not quite kosher about monetary theory-things can happen, and have happened, without money playing much of a role, such as the building of the pyramids.

What I'm struggling to say clearly is that there is a larger envelope or box not generally considered by those trained in finance and business;they can see the trees with great clarity, and can concieve of drought , fire, and storm,but as financial foresters they don't seem to recognize that a forest can be replaced with another kind of biological community.economists of the mainstrean type have not proven, so far as I can see, that debt, credit, and growth are REQUIRED by some sort of immutable natural laws to be siamese triplets.

When a nation or empire loses a war , the money and financial institutions of that nation may be and often are simply rubbed out of existence.

The new people in charge may or may not assume responsibility for some part of the property and savings of thier victims, and the debts owed by those victims.

A war need not be total;and one conducted under the name of "revolution" need not even involve outsiders.

We tend to think it can't happen anymore but many a former head of state has ended up with his head on a stake, literally or figuratively. In ten or fifteen years we might be living under a govt that severely limits the consumption of goods and energy by draconian law by everybody body except (of course!) those way up near the top of the power structure.We could all be laughing at former investment bankers chained to a grist meal, or patching potholes in residential streets while dressed in snappy orange coveralls, or taking our grandchildren to see thier remains hanging in chains from a new monument on the Washington Mall commending the Second American Revolution......

I'm not saying it's going to happen;but we could wind up with a govt-concievably one that is actually more or less representative of the people-that simply decrees that most of what exists as debt and investment is dissolved into a new economic commons.

I don't like to use the nazi example but they managed to solve the financial crisis that had as much or more than anything else to do with thier coming into power in very short order, and they built up a formibable war machine in a very few years;and they did it in spite of being short of a lot of critical resources.

If they had expended the effort on for instance creating a renewables energy industry they expended on making war,and the technology had been available then that is available now, they would not have needed to go to war for food , energy, iron ore or anything else-excepting the ego trip of power and status of course.

Now considering that we are already seated at the game table and our money and security is in the pot, so to speak , I can't see any viable way , politically, for us to shut down our empire and send the people working in the military industrial complex to the unemployment office.

But this is not to say that circumstances will not change in unforeseen ways and that an opportunity to do so in relative safety might not arise sometime within the forseeable future.

For those who might criticize me for jumping all over the future map from one week to the next, I can only say that a foolish consistency is the mark of a small mind. ;)

None of us knows what is going to happen, except perhaps in a very general way, and even then random chance can and likely will throw a monkey wrench or two or three of them into the gears of out prognostications.

Hi, ofm. Thanks for the kind words.

It's true that no one knows the future and we could go back and forth on whether the world's outstanding debtors will default massively or the governments will attempt to inflate it away. My bet is with the first option but intelligent people can disagree on this.