Drumbeat: September 15, 2010

Posted by Leanan on September 15, 2010 - 10:00am

Exxon: Curbing US Tax Breaks On Oil Cos Would Hurt Competitiveness

MONTREAL -(Dow Jones)- Proposals to repeal U.S. tax breaks for oil companies are fostering unnecessary uncertainty as the world tries to emerge from crisis and could damage U.S. oil companies' global competitiveness if they succeed, Exxon Mobil Corp. Senior Vice President Andrew Swiger said Wednesday."There is a huge amount of uncertainty out there now," Swiger said in an interview with Dow Jones Newswires on the sidelines of the World Energy Congress here. "Coming out of the deep recession, it's the last point in time when you want to create uncertainty."

Summer sizzle: Earth's land areas had warmest summer on record

The Earth's land areas sizzled to their warmest summer ever recorded, according to a report released Wednesday by the National Climatic Data Center.The summer of 2010 surpassed the previous warmest summer on record for the Earth's land areas, which was 1998.

For the year-to-date period (January-August), the Earth is enduring its warmest year since records began.

Prop 23 Undermines Plans to Shock-Proof California

ack in 2008 Californians saw the price of oil soar to record levels, topping out here in Monterey at $4.50 a gallon for the lowest grade of gasoline. This wasn't anything new; gas prices had steadily been rising for about 5 years, breaking $3/gal in 2006 and bursting the housing bubble as a result.The underlying cause was the impact of peak oil, which depending on who you talk to has already arrived or is just around the corner. As oil field production tops out and new discoveries tail off, combined with increased global demand, the price of oil will steadily increase. That's what happened from 2003 to 2008. The gas price spike of 2008 wasn't a random event that is past - it was a first glimpse of our future.

Why Oil Will Sink to $20-$40 Per Barrel

Anything can be overvalued and anything can be undervalued. It's usually pretty apparent why you would want to own the most desirable assets in the world like beach front property, but investing isn't just about owning the best assets in the world, it's about owning them at the right price. Often times the most desirable assets and the "obvious" trades get crowded and have bull arguments that people can't or won't argue with. In the case of oil, the followers have developed a religion.

Brazil to Control 8 Billion-Barrel Find as State Tightens Grip on Reserves

Brazil’s government plans to keep control of one of the Americas’ two biggest crude discoveries in three decades as the South American nation tightens its grip on its reserves, an official at the oil regulator said.

Pennsylvania Families Sue Southwestern Energy on Alleged Shale Pollution

Thirteen families in northeastern Pennsylvania filed a lawsuit against Southwestern Energy Co. alleging that the company’s drilling for natural gas has contaminated drinking water.

Interior: Abandoned wells in Gulf must be plugged

WASHINGTON — The Obama administration says it will require oil and gas companies operating in the Gulf of Mexico to plug nearly 3,500 nonproducing wells and dismantle about 650 production platforms that are no longer used.Interior Secretary Ken Salazar said a formal notice issued Wednesday would make energy production in the Gulf safer and prevent potentially catastrophic leaks at wells that in some cases have been abandoned for decades.

Gov't: BP Well to Be Sealed - for Good - Sunday

(AP) The U.S. government's point person on the Gulf of Mexico oil spill says the well that blew out is expected to be permanently sealed and declared dead by Sunday, nearly five months after a rig explosion set off the disaster.

Russia may let more firms tap offshore oil and gas fields

MURMANSK, Russia (Reuters) - Russian Natural Resources Minister Yuri Trutnev said on Wednesday that his ministry has proposed to expand the list of companies that have the right to develop offshore oil and gas fields.

Pemex Plans to Raise as Much as $12 Billion of Debt to Fund Exploration

Petroleos Mexicanos, Mexico’s state-owned oil company, plans to raise $10 billion to $12 billion this year, Arturo Delpech, associate managing director of finance, said in Beijing.The funds may be raised through various means, including selling bonds and bank loans in domestic and international markets, Delpech told reporters at the LatinFinance Investors Forum in the Chinese capital today.

Total Plans to Step Up Energy Exploration Rather Than Making Acquisitions

Total SA, Europe’s third-biggest oil company, pledged to explore more aggressively in frontier regions, saying it prefers to boost production of oil and natural gas by making discoveries rather than acquisitions.“We need to be a little bit more aggressive and take a little bit more risk which means being in more frontier areas rather than traditional ones,” Chief Executive Officer Christophe de Margerie told investors at a presentation in London today.

In the past Total hasn’t been aggressive enough in exploration, preferring to venture into known areas using in- house engineering skills, he said. “We could have taken more risk in Brazil -- we didn’t. We made a mistake.”

Solar-Panel Prices May Decline Less Than Expected

Prices for photovoltaic panels that convert sunlight into electricity may fall about 10 percent next year, less than analysts forecast, as European demand increases.

Studies: Green offices improve workers' health

Workers who moved from conventional office buildings to eco-friendly ones report less absenteeism and greater productivity, according to two studies by researchers at Michigan State University.

Poland At Full Steam Toward National Electricity Group

The Polish government is pushing ahead with its plan of creating a dominant electric energy group, ignoring objections by Poland’s antitrust regulator. In its strategy of building large domestic-owned groups, the government is not afraid to appear like it is re-nationalizing by bidding for previously state-owned firms or “privatizing” by selling its assets to companies it already controls.

Russia, Norway sign border deal for Arctic energy

(Reuters) - Russia and Norway ended a 40-year dispute in signing an Arctic border treaty on Wednesday which opens the door to offshore oil and gas exploration.President Dmitry Medvedev and Norway's Prime Minister Jens Stoltenberg presided over the signing in Murmansk, a Barents Sea port city near the Norwegian border north of the Arctic Circle.

Venezuelan Oil Minister Rafael Ramirez said $100 per barrel is a fair price for crude oil on the global market, according to local media reports.His comments echoed the position of Libya, which said last week that Opec needed prices to rise to $100 because the higher costs of imports like food had eroded the income of member nations.

"One hundred dollars per barrel is a fair price because it would reward the value of our natural resources and sustain the important investments that all oil producing countries make in order to maintain our production capabilities," Reuters quoted Ramirez saying.

Trio of storms swirls over Atlantic Ocean

MIAMI (Reuters) - A trio of potentially dangerous storms swirled over the Atlantic Ocean on Tuesday as Tropical Storm Karl formed in the Caribbean on a path that could take it over oil-production facilities in Mexico's Bay of Campeche.

Anadarko states force majeure on Diamond rig

Anadarko Petroleum has moved to cancel a contract to use a rig owned by Diamond Offshore Drilling, citing the US suspension of drilling in the Gulf of Mexico, Diamond Offshore said today.

FACTBOX - Refineries affected by Enbridge's pipeline outage

NEW YORK (Reuters) - Some refineries in the Midwest are using crude in storage or seeking alternative supplies following the shutdown of Enbridge's (ENB.TO) 6A pipeline outage due to a leak on Sept. 9.Others have been less impacted as they were taking units down for planned seasonal maintenance.

Shell Starts Expansion of Athabasca Oil Sands Project

Shell, as operator of the Athabasca Oil Sands Project (AOSP), announced the successful start of production of a 100,000 barrels per day expansion of its oil sands operations in Canada. The new Jackpine Mine will combine with existing production from the Muskeg River Mine to feed the Scotford Upgrader, which processes the oil sands bitumen – heavy oil – for refined oil products. Construction for an expansion of the Scotford Upgrader is underway, and will come on-stream in 2011.

Utilities circle Exxon, Shell gas storage sites-sources

(Reuters) - At least two utilities are eyeing the German gas storage assets of Exxon Mobil Corp (XOM.N) and Royal Dutch Shell Plc, valued at up to 1 billion euros ($1.30 billion), people familiar with the matter said Wednesday.

Power-Coal Demand in China May Drop on Use Curbs, Hydro Output, Daiwa Says

Demand for power-plant coal may slow in China, the world’s biggest energy consumer, as electricity generation continues to be “depressed,” Daiwa Capital Markets Ltd. said in a note.“Given that the third quarter is a peak season for hydropower generation, which has guaranteed dispatch, we expect weakness in thermal-power output in September given the double- whammy impact,” Dave Dai, a Hong-Kong based analyst for Daiwa, said in the note today.

U.S. says Iran intimidating UN nuclear inspectors

The United States accused Iran on Wednesday of intimidating UN inspectors investigating its nuclear program in an effort to influence their findings — a move an American diplomat suggested allowed the International Atomic Energy Agency to consider “appropriate action.”

Four Factors for Energy's Future

Fatih Birol, chief economist with the International Energy Agency, laid out four major factors that will include the future of energy. He made his statement at the World Energy Congress, which is underway this week in Montreal, Quebec.Dr. Birol said the world energy sector faces unprecedented uncertainty. This is due in part to questions regarding the pace and pattern of economic recovery following the recession. A big part of the recovery is due to non-OECD countries rebounding. Uncertainty remains over whether or not those economies will remain relatively insulated from weaknesses still evident in developed econonies in the U.S. and western Europe.

China rejects US trade complaint over clean energy

BEIJING (AP) -- China rejected a U.S. union's trade complaint over Beijing's support for clean energy industries and said Wednesday such criticism is hypocritical at a time when China is under pressure to cut greenhouse gas emissions.

Toyota announces 6 new hybrids, electric cars

NEW YORK (CNNMoney.com) -- Toyota Motor Co. will put out six all-new hybrid vehicles worldwide by 2012, a Toyota spokesman confirmed.The vehicles will all be new models, not updated versions of current models like the Prius, Toyota spokesman John Hanson said.

The Long and the Short of It: Existential Comfort in the Age of Hopkins and Greer, Part III

On first consideration, even second, Greer seems to be telling a story of tragic necessity. As players in this drama it would be possible to imagine that we would feel compelled to tear out our eyes or fall on our daggers. But this is not the mood of Greer’s book which, though not exactly hopeful, does not present a feeling of desperation. Why? Because, it turns out, we are not actually players in this drama. Instead, we are, for the most part, spectators sitting knowingly beyond, even, the chorus. It is here, perhaps, where Hopkins and Greer are furthest apart.

Current farming practices unsustainable, expert says

At the current rate of consumption, mankind will quickly consume the Earth’s limited resources, sustainable agriculture expert Fred Kirschenmann said Tuesday afternoon.Kirschenmann spoke about the future of food production and energy use before an audience of about 30 at a Master’s Tea in Saybrook College. Without new methods of farming, he said, the world’s food supply could become increasingly unstable.

X Prize Calls for Clean-burning Cookstoves

The X PRIZE Foundation is teaming up with Indian’s Ministry of New and Renewable Energy and the Indian Institute of Technology Delhi to host a global competition to develop and deploy clean, efficient cookstoves.The competition seeks to combat indoor air pollution and decrease the role of inefficient cookstoves in contributing to climate change.

An inconvenient truth about OPEC

OPEC will not be able to meet the world's energy needs.The three major organisations that forecast long-term oil demand and supply – the International Energy Agency (IEA), the Organisation of Petroleum Exporting Countries (OPEC), and the United States Energy Information Administration (EIA) – along with oil companies and consulting firms, believe that OPEC will reconcile predicted global demand and non-OPEC supply. But they are wrong: OPEC output will not meet such projections, because they are based on flawed and outdated forecasting models.

Oil Falls For Second Day as Inventories Rise, Enbridge Begins Pipe Repairs

Oil fell for a second day as traders bet U.S. crude inventories dropped less than initially forecast and Enbridge Energy Partners LP got permission to restart a ruptured pipeline supplying the U.S. Midwest.Crude inventories are at their highest level for this time of year in a decade, according to data yesterday from the American Petroleum Institute. The Energy Department is forecast to report an inventory decline later today. OPEC doesn’t plan to change output quotas at its next meeting amid the recovery of world oil demand, the group’s president said.

“The market is taking a breather before the Energy Department numbers,” said Andrey Kryuchenkov, an analyst with VTB Capital in London. “Inventories are still plentiful. We’ll probably have to wait for seasonal demand to improve.”

Enbridge Allowed to Start Midwest Oil Pipeline by End of Week, U.S. Says

Enbridge Energy Partners LP will be allowed to restart a key oil pipeline supplying the U.S. Midwest by the end of the week, following the repair of a rupture, a federal official said.Enbridge has already submitted a restart plan, said Carl Griffis, Chicago-area senior engineer from the Pipeline and Hazardous Materials Safety Administration, who was on the scene of the leak in Romeoville, Illinois. The government doesn’t see any “systemic problems” with the pipeline, Griffis said in an interview late yesterday.

Gasoline Shipments to U.S. Slide as Profit Margin Vanishes

Bookings of tankers to ship European gasoline across the Atlantic fell in August as the profit margin from the trade slid to the lowest level in a year.

OPEC Won't Change Output Quotas Even as Demand Recovers, Pastor Says

The Organization of Petroleum Exporting Countries doesn’t plan to change output quotas at its next meeting amid the recovery of world oil demand after the recession, OPEC President Wilson Pastor said.

Tropical Storm Threatens Yucatan Resorts, Oil Wells

Tropical Storm Karl is set to hit Mexico’s Yucatan Peninsula today and may threaten oil wells and rigs in the western Gulf of Mexico in the next day, while in the Atlantic, Hurricane Igor continued on a course toward Bermuda.Karl was 45 miles (75 kilometers) east of Chetumal nearing landfall on Yucatan’s east coast, the National Hurricane Center said in a statement at about 6:50 a.m. Cancun time. Karl was forecast to cross land before entering the Bay of Campeche, where state-owned oil company Petroleos Mexicanos has wells.

Is Oil Heading For $150 A Barrel?

Some people still maintain that it was oil at $147 a barrel that sparked the credit crunch. When US motorists saw how much they were paying for a gallon of gasoline, they stopped spending, the argument goes. The rest is history.I don't fully buy that argument, there were a lot of other things going on in the summer of 2008, but I can see how the oil price surge helped to accelerate the looming crisis.

Cnooc Interest in Brazil Assets Driven by China Need for Energy, Chemicals

Cnooc Ltd., China’s biggest explorer for offshore oil and gas, may add to the nation’s fivefold increase in direct investment in Brazil this year as demand for raw materials increases.

`Appalled' Pa. gov. shuts down reports on protests

HARRISBURG, Pa. – Information about an anti-BP candlelight vigil, a gay and lesbian festival and other peaceful gatherings became the subject of anti-terrorism bulletins being distributed by Pennsylvania's homeland security office, an apologetic Gov. Ed Rendell admitted.Rendell, who claimed he'd just learned about the practice, said Tuesday that the information was useless to law enforcement agencies and that distributing it was tantamount to trampling on constitutional rights. In recent weeks, several acts of vandalism at drilling sites spurred the inclusion of events likely to be attended by environmentalists and the bulletins began going to representatives of Pennsylvania's booming natural gas industry.

BP cited for North Sea safety failures: report

LONDON (AFP) – BP failed to comply with emergency regulations on oil spills at four out of five of its North Sea installations which were inspected last year, a report said Wednesday, citing official records.

San Bruno wasn't riskiest PG&E pipeline

The pipeline that exploded in last week's disastrous San Bruno fire wasn't ranked as the riskiest in the region in a report prepared last year when Pacific Gas & Electric Co. was seeking to raise rates.The Bay Area News Group reported that lines in Fremont and Livermore were rated at the top of the risk analysis when PG&E told state regulators that they needed to raise rates to help pay to replace the lines.

Amish population growing, heading west

Amish communities are now in 28 states, and the continent's population will double by 2024 if the annual growth rate of around 5% continues, the survey says. The highest rates of growth over the past year were recorded in New York (19%), Minnesota (9%), Missouri (8%), Wisconsin (7%) and Illinois (7%). The survey attributes the population boom to Amish families tending to be large, with five children or more on average.

Grow your satisfaction – not the GDP

The common prescription for our woes, as defined by the current economic model, is to get more stuff and find satisfaction through material possessions. However, we know that this economic model, based on an infinite growth of gross domestic product over time, is destined to fail in providing both satisfaction and sustainability. We are seeing the coming end of this model, with too few resources to feed infinite growth. Oil production has peaked and the effects of climate change continue to show themselves, both the result of our overconsumption of natural resources.Another model must come into being if we are to transition smoothly and happily into a post-oil economy. Several models have been presented, including a no-growth or steady-state model. I’ve just come across another model called plenitude, which is a much more optimistic look at economics. Rather than looking for a no-growth economy, something that often sounds scary and dismal, economist Juliet Schor looks to diversification of time resources.

Hong Kong to replace coal with nuclear

A consultation put to the people of Hong Kong suggests an increase in nuclear capacity to supply half of electricity as a major plank of its climate change strategy.

Thousands of green jobs could drive growth, says Huhne

"Green jobs" could ease the impact of spending cuts and drive the recovery, Energy Secretary Chris Huhne has said.He told MPs thousands of new jobs could be created and the insulation industry "enormously" increased as part of the coalition government's "green deal".

Seed Warriors target global hunger

As food riots return to Africa, a Swiss documentary asks how the world will be fed in just a few decades when global warming causes major losses in food production.

Climate change talks in US next week

Representatives from the 17 nations responsible for 80 per cent of the emissions thought to be the cause of global warming, including Australia, will meet in New York next week.US special envoy for climate change Todd Stern said on Tuesday the meeting will take place on September 20 and 21, as part of ongoing global talks on reducing harmful emissions that cause climate change.

Oil Industry Targets Schwarzenegger

LOS ANGELES – The oil industry is going after Gov. Arnold Schwarzenegger, the California Republican.The issue is Mr. Schwarzenegger’s strong opposition to a proposition on the ballot this November that would suspend a landmark greenhouse gas bill passed by the Legislature in 2006 mandating that carbon emissions be rolled back to 1990 levels by 2020. The oil industry has invested millions of dollars in getting the initiative on the ballot and has made clear it was ready to spend millions more to get it passed, arguing that the bill would cost the state jobs and raise energy prices.

Oil companies split on bid to suspend global warming law

Three are bankrolling Proposition 23, but one opposes it and others are neutral or on the sidelines. A national industry group issues an appeal for money to back the initiative.

States are climate battlegrounds

The nation’s premier state-led climate programs are under attack by a growing coalition of industry, tea party and conservative activists.

Kazakhstan set to sell its greenhouse gas emission quotas

Kazakhstan plans to sign an agreement with the Chicago Climate Exchange this year to sell its greenhouse gas emission quotas, the country's deputy environment minister said on Wednesday.

Women Agree with Science on Global Warming More Than Men Do

Women are the more scientific sex regarding climate change, a new survey suggests.Women are more likely than men to support the scientific consensus on the reality of global warming caused by humans, according to sociologist Aaron McCright, an associate professor at Michigan State University. He analyzed eight years of Gallup Poll data to perform one of the first in-depth studies on how men and women think about climate change.

Arctic: MEPs and MPs debate retreating ice, governance needs and seal product import ban

Retreating Arctic ice that could open up new oil and gas reserves and fisheries and hence require stronger international governance, Arctic wildlife management, and the impact of the 19 August European Court of Justice preliminary ruling suspending the EU ban on seal product imports, took centre stage at a meeting of MEPs and MPs in Brussels on 13-15 September.

Arctic species under threat, report warns

London, England (CNN) -- Polar bears clinging to melting ice sheets have become one of the most frequently used images to portray the perils of climate change.But a new report by the U.S. Center for Biological Diversity (CBD) and UK-based Care for the Wild International (CWI) is bringing attention to the predicament of other equally endangered Arctic species.

Arctic Sea Ice Continues Its Summer Slide

The ice this summer did not pull back as much as it did in 2007, when an unusual conjunction of winds, atmospheric pressure and temperatures caused the biggest ice retreat since satellites began tracking conditions in 1979. But it’s clear that a downward trend, which many Arctic specialists are convinced will lead to open-water summers around the North Pole later in the century, has not abated.

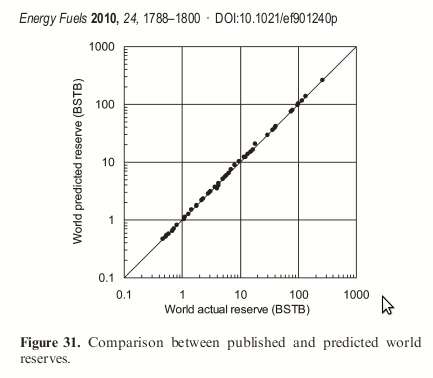

Has anyone else seen this published graph out of Kuwait U?

I think there is something seriously wrong with this analysis. It may be essentially plotting X=X.

At one point someone makes a prediction of current reserves (which is an estimate). At the next moment some estimate gets published (which is a reasonably close approximation to what someone thought it was at the previous moment).

This either shows that :

(1) just because something gets published doesn't make it any better an estimate,

(2) the early estimates are actually very close to the actual value,

(3) or that they have no idea of what they are doing.

If it is indeed #2, the world's reserve curve over time should be made available and it will be an additional curve to fit in between the discovery curve and the production curve. Reserve is the difference between the cumulative discovery estimate and the cumulative production estimate and it will be an additional set of data to strengthen production and discovery data.

You think? ;-)

Essentially what they are saying, if I am reading it correctly, is that "the reserve data OPEC publishes, by some strange coincidence, equals what the actual reserves really are". Of course they include the whole world, not just OPEC. But only OPEC reserve estimates have been called into question. And they are saying, "Nope, we checked and the data published equals actual reserves"

Of course the question that immediately comes to mind is: Where did they get the data of actual reserves? Why from the OPEC nations of course, they told them what their proven reserves were.

Ron P.

An enigma! A conundrum!

But I disagree with this definition if only because reserves have components that this particular definition doesn't cover... "Reserve is the difference between the cumulative discovery estimate and the cumulative production estimate and it will be an additional set of data to strengthen production and discovery data.".

Having two definitions for something is not a good thing.

I suppose you can say Reserves = ObtainableReserves + UnobtainableReserves. But then you would state

ObtainableReserves + UnobtainableReserves = CumulativeDiscovery - CumulativeProduction

regrouping

ObtainableReserves = (CumulativeDiscovery - UnobtainableReserves) - CumulativeProduction

Then you redefine RecoverableCumulativeDiscovery = CumulativeDiscovery - UnobtainableReserves

and you get

ObtainableReserves = RecoverableCumulativeDiscovery - CumulativeProduction

So you basically fix that problem in interpretation.

Cute. But reserves operate perfectly probabilistically and you making up definitions as you go along certainly doesn't help out the usual confusion on the topic.

The Law of Large Numbers says that there is always an expected value for these parameters.

I am of course just trying to help clear things up due to the years of complacency and layers of confusion that have built up on this topic.

What ARE the "standard" definitions? I've heard proven, theoretical, recoverable, and many other reserve terms mentioned. Maybe we need a definitions page.

Anyway, nothing changes the fact that OPEC reserves are (1) made up by them and not independently verified, and (2) suspiciously consistent when warranted, and suspiciously subject to step function changes when warranted.

Anyway, nothing changes the fact that OPEC reserves are (1) made up by them and not independently verified, and (2) suspiciously consistent when warranted, and suspiciously subject to step function changes when warranted.

There are facts, and then there are facts. Your presume that the Saudi's lie, I do not, but admittedly the only information I have comes from ex Saudi technical experts who did their reservoir engineering. What might your source be to call them liars? Certainly their technical management of Ghawar alone is testament to their technical capabilities, at least when compared to the likes of accountants who once pretended to dabble in the real oilfield.

As far as step function changes, they are quite popular and happen all the time in states like, say, California in the Kern River oilfield, the South Belridge field, etc etc. Is there any reason why those step functions are perfectly acceptable, but the Saudi's doing the exact same thing is a conspiracy?

I don't see any massive step changes on the graph from KuwaitU that I posted.

So whatever the Saudis said they have, back when they made that original estimate for their reserves, will be what they will have in the future. According to the authors there will be NO reserve growth. Why else would they publish that graph unless to press the point that they are expert predictors of reserves?

WHT, Is that possibly a deliberate use of a log plot of the data on logarithmic graph paper to hide the curve and represent it as a straight line?

Fred, The log-log scales just compress the data. If it was on a linear-linear plot it would look like the same straight line, but with more noise.

But you are right that it may expose more structure in the data. Plotting stuff with a wide dynamic range is tricky.

A classic case of GIGO (garbage in -> garbage out).

The caption states it is a graph comparing "published and predicted" reserves, but the X axis is labeled "actual reserve". Since nobody knows the size of the ACTUAL reserve, it's basically a plot of pairs of equal numbers, as WHT proposes.

The ethanol market anticipates EPA approval of E15 for newer cars helping to drive up corn prices.

If E15 is not approved, increasing ethanol consumption will be difficult since blending to make E10 is the main use, few E85 stations exist and getting flex fuel cars on the road is difficult. When the blend rate is held down, cellulosic ethanol and sugar cane ethanol are also punished along with corn ethanol.

Efficiency gains, conservation and economic recession that depress gasoline consumption also reduce demand for ethanol at a fixed blend rate of 10%.

It appears that this reality is beginning to dawn on the EPA and the administration. Ethanol opponents with their fallacious EROEI, Indirect Land Use Change, and corn ethanol pollution arguments may be in for disappointment.

But who knows. The world has gone mad, especially the world of politics. If politics triumphs over reason it will be no surprise.

Lisa Jackson seems to be getting her act together:

It’s about time.

I see tons of "Flex Fuel" trucks on the road. Surely they buy E85 where it's available (it is here, in some locations, and this is fossil-fuel country)?

Or, is the 20% lower price offset by lower mileage or power? The "100% gas" stations here certainly have a loyal following.

By promoting conversion of food to driving, and thereby accelerating the schedule for food shortages and bring population issues to the political foreground, I guess E85 does have some value.

EIA-Alternative Transportation Fuels says 450,327 E85 vehicles for 2008, .18% of 247 million total. Note their big caveat, however:

Which is quite lame - CA had an E85 fleet that was discovered to run almost entirely on gasoline, owing to lack of E85 availability. That situation has likely changed by now. But I don't think anyone builds an E85-only vehicle. 7.1 million is 2.8% of 247 million, a proportion of fleet penetration closer to that of hybrids.

I don't know how you utilize an EV or CNG vehicle as anything other than an EV, so the statistics for those other fuel types are likely more useful.

The E85 alowed the auto companies to skirt CAFE rules. The objective wasn't to expand the use of ethanol, the objective was to allow more low milage trucks and SUVs to be sold.

I agree that the world has gone mad and the ethanol proponents are the Mad Hatter at the tea party.

"few E85 stations exist"

If by few you mean 2,384 then I agree. But the problem is that even with increasing stations and increasing vehicles on the road, E85 sales in the Midwest are dismal and falling. That's why they are pushing the E15 mandate, but if you could sell E85 in your backyard it wouldn't be an issue.

Link up top: An inconvenient truth about OPEC

Exactly! And deeper into the piece the author talks about the "Call on OPEC" model. That is what the EIA, the IEA and everyone else is counting on. All we must do is call on OPEC and OPEC will come rushing to the rescue. We are counting on the villain of high oil prices to save the world from high oil prices. That seems rather strange.

Anyway a good example of this flawed forecasting model just came out a few minutes ago:

Why Oil Will Sink to $20-$40 Per Barrel

The author of this "Seeking Alpha" piece quotes the massive spare capacity of over 5 million barrels per day as one reason oil will go to to $20 to $40 a barrel. He also states:

The author has done his due diligence and checked with the EIA. The EIA says OPEC has over five million barrels per day of spare capacity and only a "Call on OPEC" is needed for them to produce it. And the author gives links to the EIA's estimate of world oil reserves. And the EIA says world oil reserves stand at 1,342,207,000,000 barrels and they have gone up every year for the last 10 years. In fact they went up 10 billion barrels from 08 to 09. This was because Venezuela took a pencil and added 12.83 billion barrels to their reserves in 2009.

That is how Venezuela did it and that is how OPEC came up with the over 1 trillion barrels of reserves they claim. That is the flawed model! That is the "Call on OPEC" that the world is counting on. If they only knew that about OPEC spare capacity is overestimated by about 4 million barrels per day. If they only knew that OPEC has nowhere near 1 trillion barrels of proven reserves.

If they had only done their due diligence they would know these things.

Ron P.

And then there is our net export model, which differs "slightly" from the conventional wisdom.

Yes, this is the paradox: you can have claimed oil reserves growing (and what type of oil) but oil production is peaking.

11/6/2010

BP Statistical Review June 2010: Oil reserves and production don't match

http://www.crudeoilpeak.com/?p=1591

Hey, in 2007 these guys predicted 4.5 mb/d spare capacity for 2010. Good call. [/sarcasm]

Re: An inconvenient truth about OPEC.

There are many articles and books on this subject since OPEC's reserves are shrouded in mystery. In my opinion, it is not helpful when OPEC members making outrageous statements about their reserves as done on 13 Sept 2010 in Vienna:

El Badri, the OPEC Secretary General said in an interview with the German Handelsblatt that OPEC has 6 Million b/d spare capacity. He also said that enormous OPEC reserves exist and one only has to find them. Children say the same about Santa Claus.

but readin throught the article

"Let's check the math: at a 3% rate of decline, OPEC needs to add an additional 17 mb/d by 2035 just to maintain 2010 levels of production. If the EIA forecasts OPEC production to increase by about 11 mb/d, OPEC needs to add about 28 mb/d in the next 25 years, a feat that it has never accomplished – indeed, current production capacity is similar to that of the mid-1970s."

Ok I'll go with that - " a feat that it has never accomplished" on getting OPEC to increase supply

"Rising domestic oil consumption – and thus lower oil exports – by OPEC countries;"

ELM - West texas sorry you're not aknowledge :)

and

"It is nearly impossible for OPEC members to produce the difference between estimated world demand and non-OPEC supply"

and thats just DEMAND! what about actual supply ?

real - not estimated

Is any one in Goverment reading this stuff ??

Forbin.

PS: Ofcourse looking at the ecenomic news - theres not going to be much of demand - although the USA is using more diesel...

Net exports is the only thing that matters for importing nations. Net exports from OPEC have been on a plateau or declining since 2005. It would take an unexpected miracle of enhanced recovery to boost exports.

And why is consumption going up in those nations? It's partly increasing standards of living and partly raw population. OPEC nations combined have a higher population than the US and Canada combined and are currently growing at 2% per year. Existing population and consumption trends are unlikely to do an about face in the near future.

(population chart from the Gas Trends databrowser)

Jon

Canadian Net Oil Exports to the Rescue

Some interesting numbers that I looked up (EIA):

If you look at the 12 year rate of increase in Canadian net oil exports--about 37,000 bpd per year--versus the 12 year rate of increase in Saudi consumption--about 88,000 bpd per year-- we would need the incremental increase in net exports from more than two Canadas, just to match the increase in domestic Saudi consumption.

Summary of Weekly Petroleum Data for the Week Ending September 10, 2010 [PDF]

As indicated in some articles up top, energy analysts remain generally upbeat about the adequacy of oil and gasoline supplies – despite multiple oil pipeline breaks, weather related disruptions caused by the peak of hurricane season, and less noticed – major operations and shipment problems in Venezuela and from their port in Bonaire.

Granted general US inventory levels remain ‘high’ as compared to recent years, that is if you think an extra day’s worth of oil supplies is excessive. Also in the optimist favor this week is the fact that gasoline demand appears to have slipped a bit these last few weeks.

On the other hand, demand for distillates (diesel) continues to race ahead at higher than an 11% rate – it has been gaining at about an 8% rate or higher since June. This appears to be related to business restocking inventories – especially of imported goods. Some say that this is a short term trend until inventories recover to normal levels, but this trend has now continued for four months.

In sum, this week’s report is not particularly surprising. Going forward the level of oil imports will determine if oil supplies remain ‘excessive’. The biggest limitation to oil imports this week is the multiple Enbridge pipeline breaks. While some government officials have said that the closed Enbridge 6A pipeline will reopen by this weekend, other officials indicate that the reopening will be a slow and deliberate process. The same has already been said about the 6B pipeline. So it remains to be seen just how long inventories will remain ‘comfortable’ in the face of slowing oil imports from Canada and also Venezuela. If structural problems can be resolved in a few weeks, then supplies will be adequate for the start of the winter season.

This afternoon, Venezuela said it was resuming operations at a major refinery, although the Bonaire storage facility and loading terminal - mostly used for oil exports to the US and China - remains closed.

http://english.eluniversal.com/2010/09/15/en_eco_art_docks-of-venezuelan...

Perhaps reduced exports is the reason why Venezuela now wants $100 per barrel for oil, but will apparently accept a price as low as $70:

http://english.eluniversal.com/2010/09/15/en_eco_esp_venezuelan-oil-mini...

I don't think OPEC ever said it could replace a 3% continuous depletion rate for all the world's oil fields.

OPEC produces 29 mbpd(2009) or 40% of world oil production.

If all oil production is reduced by 3% per year for 25 years, that means world output in 2035 will be 35 mbpd.

It appears that OPEC is really pledging to hold output constant at 28 mbpd for the next 25 years;

28 = 29 mbpd x (1-.97^25) + 11 mbpd (pledged?) or 10 Gb/yr by 2035.

This is what OPEC historically has done.

http://europe.theoildrum.com/node/6859

The whole world increased its oil production by 6 Gb/yr between 1980 and 2005. However, the oil industry is a lot more efficient than it was in 1980.

If OPEC allows the IOCs into their reserves(+80% of remaining reserves) I think they could conceivably produce 28 mbpd and meet their pledge.

The problem is, he rest of the world will need to add 24 mbpd to keep up its end if 3% is correct which means it's going to have to be twice as busy as OPEC in increasing production for output to remain steady.

Bankrupt, USA: Why our cities aren't too big to fail

The big question: will there be a federal bailout?

Bloomberg points out that Harrisburg was sued by two parties: some Bermuda based bond monster, and Dauphin county - Harrisburg's home county. Where does a municipality go into receivership, anyway? Could part of that entail seizure of assets? Will people wind up drinking Berkshire Hathaway brand water?

Also in bond news: Pimco Makes $8.1 Billion Bet Against `Lost Decade' of Deflation - Bloomberg. Thank you, Bill Gross.

America's cities and infrastructure have been softened up by the Great Recession, and we better hope there isn't another hard blow in the near term. To use an analogy, boxers that get softened up, often fall later from a hard blow. Could that be our fate via the coming oil supply crunch? Could city budgests and infrastructure then simply begin to fail en masse?

Speaking of which, I recently heard that NY needs to replace the bridges connected to Manhattan. Now that's gonna cost a pretty penny they don't have.

Hmmm, a federal bailout for the bankrupt cities and states?

You DO realize the total insanity of that concept, right?

That somehow, taxpayers can afford at the federal level what they cannot afford at lower levels.

Perhaps this worked once upon a time in a universe far, far away.........

Well, that's the very basis of taxation, is it not? It's meant to redistribute wealth, not create it.

The simple reason that this may happen is that the Fed Gov't has no hard bounds on debt, and has currency options that states and cities do not. That said, bailouts for cities will have the same net effect as bailouts for banks did -- it increases moral hazard for the poor fiscal behavior and punishes the taxpayer while preserving the lender.

The US has evolved to a very predatory lending situation, where the risk appears to be carried only by the borrower.

X Prize Calls for Clean-burning Cookstoves is, I think, going after the wrong thing. Stoves and equipment is not what is needed, but rather a readily available fuel that can be (somewhat) easily created and managed by the local families or village.

Michael Yon had posted a great write-up on small, methane gas generators that are prevalent in Nepal that he learned about from some of the Gurkha troops he worked with in Afghanistan:

Gobar Gas II

I vote for both items on concerning cookstoves. Some of the pics I've seen of these homes, a non-clean burning cookstove would generate and (the house) contain enough Monoxide to knock over a mule...

Attention Exxon (et al.):

Concerning your recent request for "tax breaks"...

Please observe the motions of my fingertips as they play the Worlds Smallest Violin in a rendition of "My Heart Bleeds for You"...