Verifying the Export Land Model - A Different Approach

Posted by Gail the Actuary on October 1, 2010 - 9:27am

This is a guest post by George C. Lordos, of Nicosia, Cyprus, known as Lumina at The Oil Drum. He has degrees in Philosophy, Politics and Economics from Christ Church College at Oxford University and in Business Administration from the MIT Sloan School of Management, where he specialized on strategy, finance and system dynamics. George has business interests as a Principal/Chairman in food trading, energy efficiency, renewable energy and information technology. He also makes a hobby of blogging about sustainability, energy and finance. George's blog is at baobab2050.org.

The Export Land Model of forecasting future oil supplies available for sale to oil importing economies, which as far as I know was first presented at the 2007 ASPO-USA conference by its authors Sam Foucher and Jeffrey J. Brown, takes my “Cassandra Prize” for its importance and for the deafening silence with which stakeholders have been reacting to it, despite the mainstream media giving it some coverage.

In this post, I use a different way of grouping countries to confirm key insights of the Export Land Model.

Note: For all images, click on figure to view full size version.

In this analysis, a 30-year data set on oil production and consumption which is made publicly available by the U.S. Energy Information Administration is analysed in an effort to confirm the two key insights of the Export Land Model (ELM). These insights, as I understood them, were the following:

1. For oil exporting nations, the higher the level of their domestic oil consumption as a fraction of their production, the more the changes in production volume will amplify the resulting change in net exports.

2. The domestic oil consumption of oil exporting nations will, over long periods, tend to grow faster than the domestic oil consumption of oil importers because of the windfall effect of oil revenues, and will tend to continue to grow even past the production peak, especially whilst net exports remain positive.

In a country that is past its peak of oil production, the above dynamics operate together to cause the net export decline rate to be much higher than the production decline rate. If this effect appears simultaneously in many exporters, for instance due to global peak oil, the accelerated decline in net exports will disproportionately strike nations which are heavily dependent on imported oil.

The analysis, which follows below, confirms that both key insights of ELM are consistent with real-world global production, consumption and net export data from 1980 to date.

PART I: THE SUMMARIZED DATA

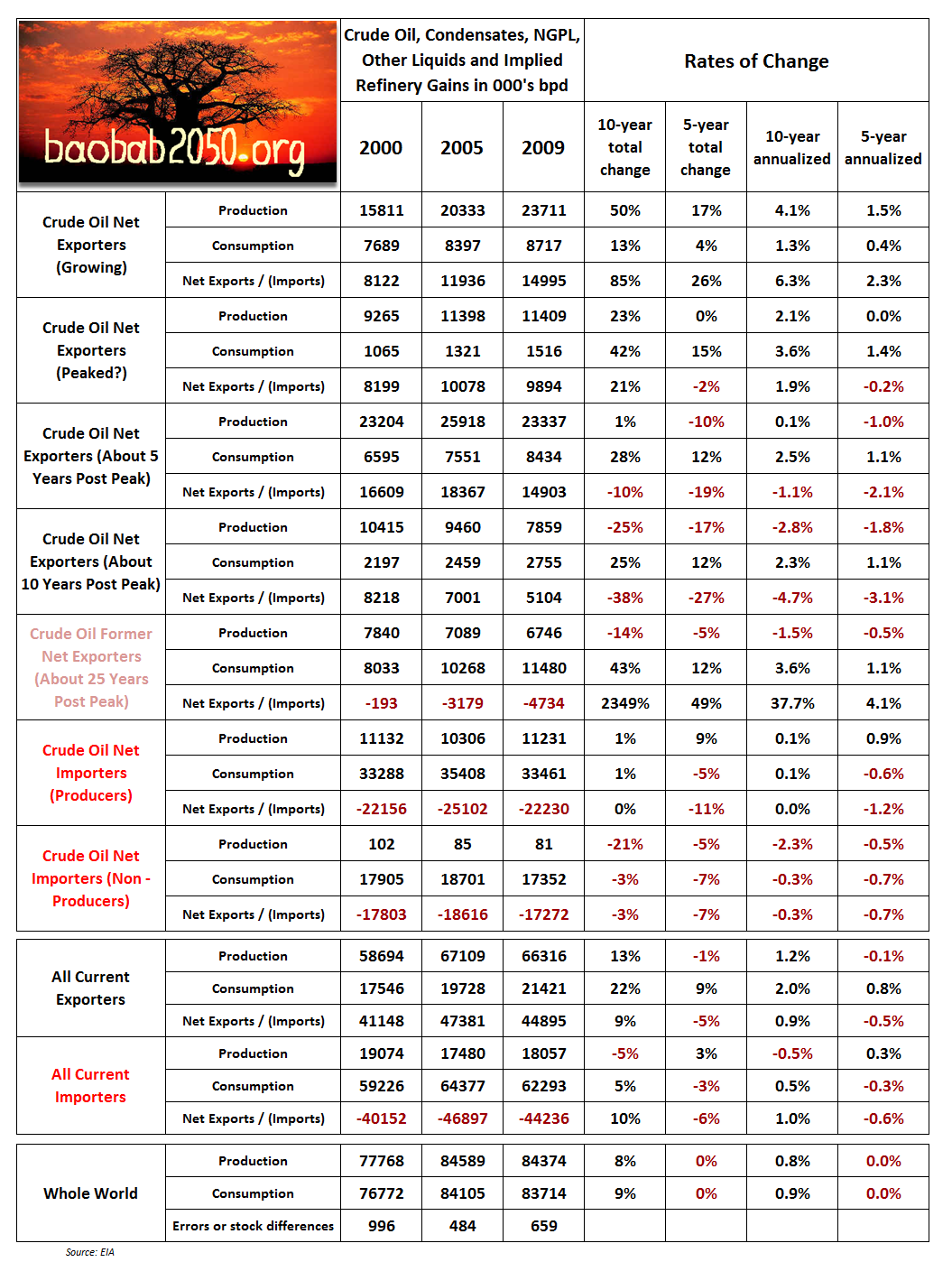

All of the figures in this post are drawn from a summarized data set, an extract of which is shown below:

Click here for a listing of the countries assigned to each grouping.

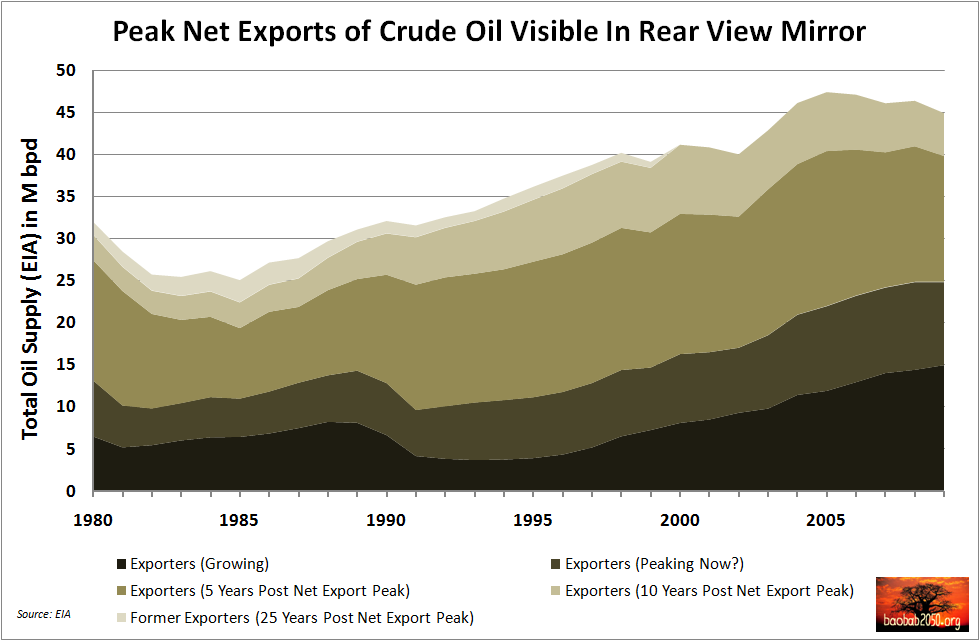

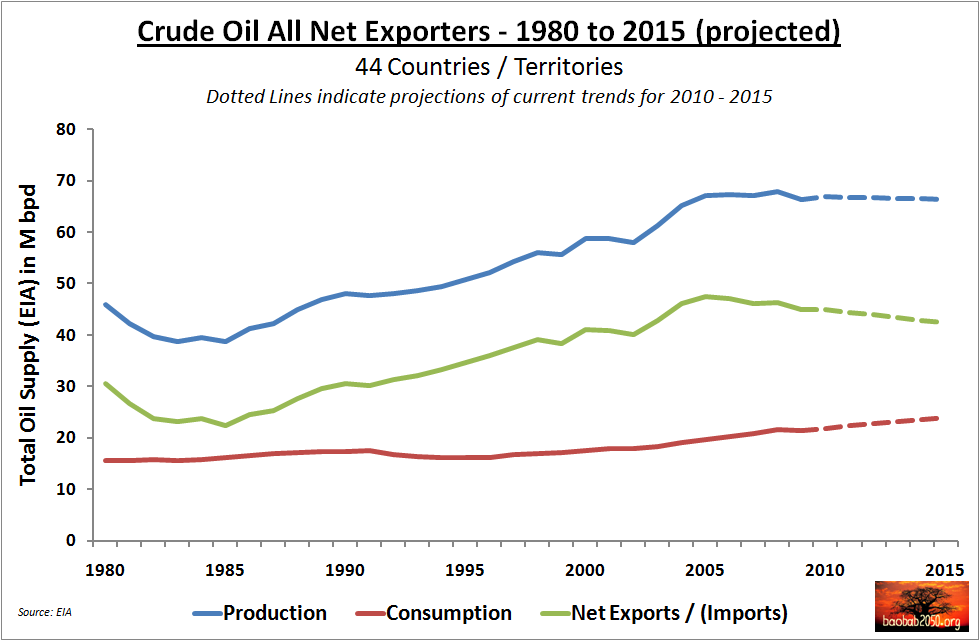

There are currently 44 countries / territories that are net exporters of crude oil, who therefore supply the requirement of 173 countries who are net importers – and only about a quarter of the latter have some production of their own. At least from the perspective of countries who are heavily dependent on net oil imports, the continued availability of oil on world markets at a reasonable price that their economy can bear is a key factor affecting long term economic and social stability. In Table 1 above, we note that net oil exports of all current exporters are down 5% from their 2005 peak volume.

PART II: CRUDE OIL NET EXPORT ANALYSIS, GROUPING EXPORTERS BY THEIR GROWTH RATE IN NET EXPORTS

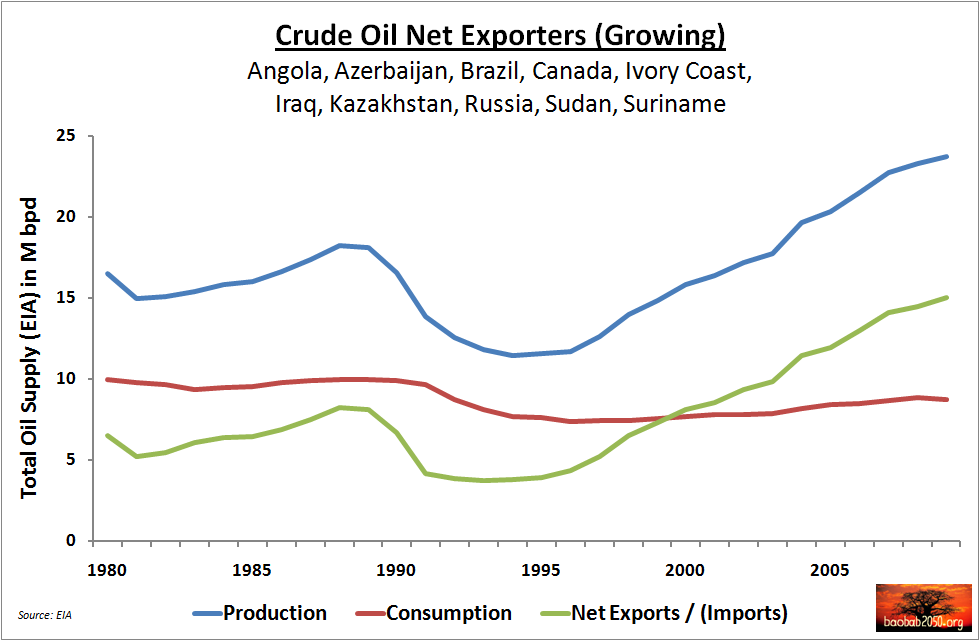

From studying the EIA data, I identified 10 countries which are still posting strong growth in their net exports, which is the green line in Figure 2 below. Together, these countries account for approximately one third of today’s global net exports. Note that this group includes Russia, which suffered a massive production and consumption collapse in the wake of the 1991 implosion of the former Soviet Union. Over the last 10 years (see Table 1 above) this group of countries posted a 50% increase in their crude oil production, a 13% increase in their domestic consumption, and an 85% increase in their net oil exports. This is consistent with both key insights of the ELM.

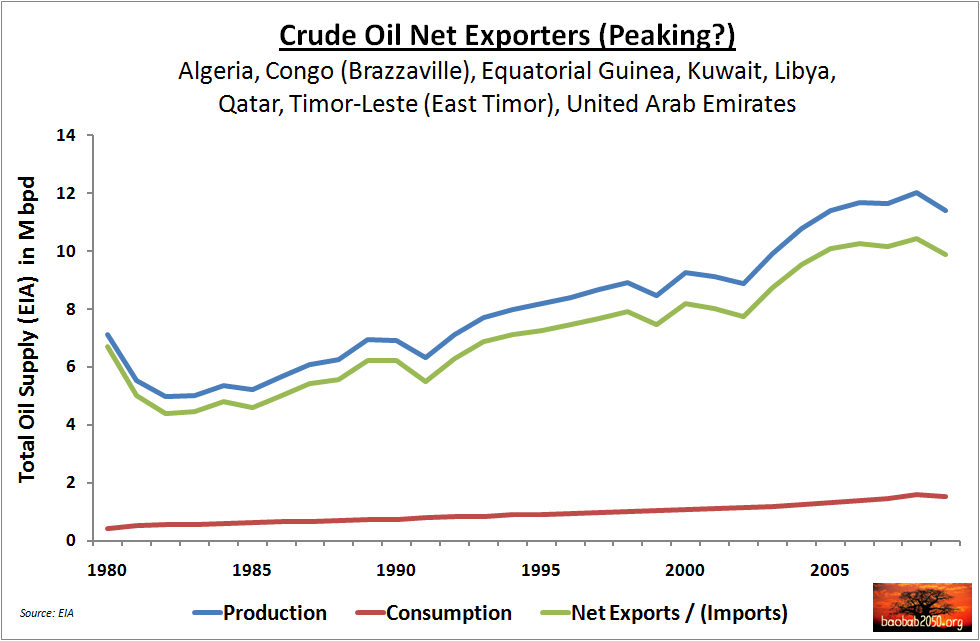

The next group consists of countries which up until recently had exhibited strong net export growth, but have since stalled. Their growth rate in consumption (42% over 10 years) in parallel with their past strong net export performance is consistent with the second ELM insight. The fact that their net export growth rate is neither amplified nor attenuated by the 10-year change in their production rate (they are roughly equal) might also be weakly consistent with the first ELM insight because right at the peak of net exports, the effect should logically change over from amplification to attenuation. I therefore tentatively labelled these exporters as “Peaking?” in Figure 3 below:

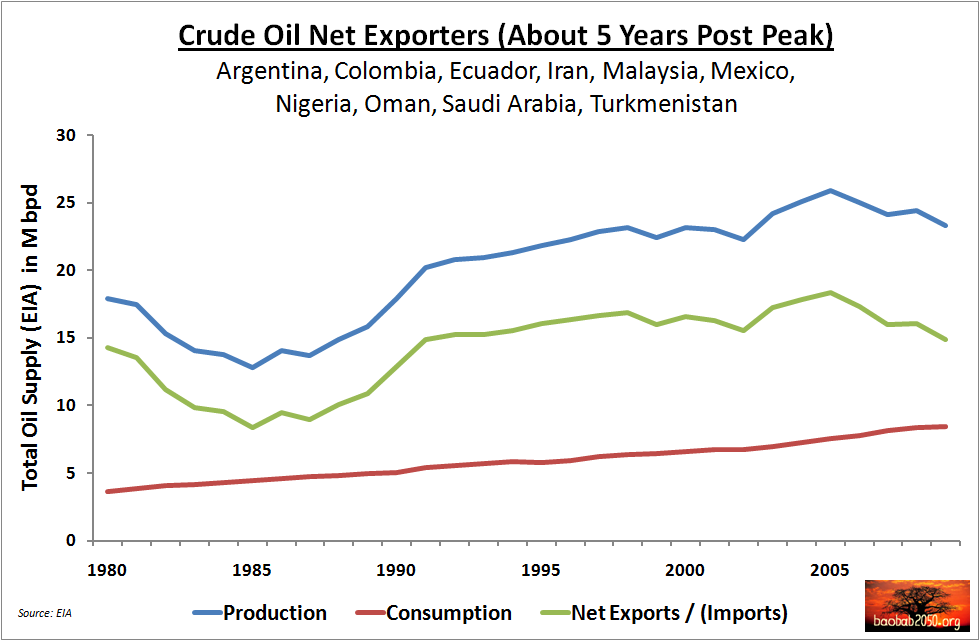

Then, going down the pecking order of net export growth rate, I grouped together the net exporters where I felt more certain about the peak in their net exports. This group experienced a fall in production of 10% over the last 5 years, and together with a 12% domestic consumption increase, they ended up posting a 19% decline in their net exports. This is consistent with both the key insights of ELM. Collectively, their net exports display a clearly visible peak about 5 years ago, as shown in Figure 4 below:

The next group in Figure 5, where net export declines collectively set in an average of 10 years ago, appears to be in terminal net export decline. These countries are in the twilight of their net oil exports. Over the last 10 years, their production has fallen by 25%, domestic consumption rose by 25%, and net exports are still positive but they are down by 38%. This is also consistent with both key insights of ELM.

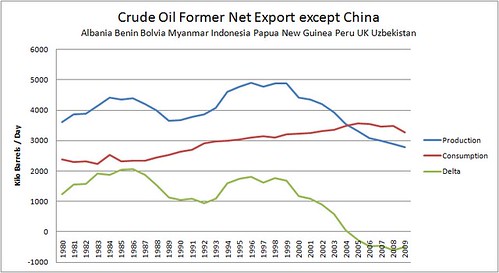

And finally, the destiny of every oil exporter – a destiny that ELM predicts will strike sooner than most people realize. In Figure 6 I show all the countries which were formerly net exporters, but have since collectively become net importers – with their collective net export peak occurring over 25 years ago. The zero net exports threshold was crossed in 2000, and since then, production has fallen by only 14%, but consumption has risen by 43% – largely thanks to China.

This last group of “former exporters” also confirms the key insights of ELM, but more importantly it amply demonstrates the main reason why ELM should be taken a lot more seriously: although it will take many decades for production from this group to approach zero, their net exports have already been less than zero for one decade. The rapid onset of net export decline is thus “baked into the structure of the global oil system” and all net importers, especially those who have no oil production of their own or few geopolitical chips to bargain with, can only ignore this at their peril.

The implications of ELM for the “health” of a world economy addicted to its daily dose of 85 million barrels of crude oil are serious, and they are mostly being ignored. To some, the two key insights of ELM might seem mathematically trivial and obvious, but out there in the real political economy it is important to confirm the trivial and obvious with real data. It is doubly important in the case of crude oil, because the focus of mainstream media is entirely misplaced: they don’t often go past discoveries, additions to reserves, or maybe production figures if we are lucky.

To sum up this section, and referring back to Figure 1 and Table 1 at the top of the post, apart from the 5% decline in total net exports relative to the 2005 peak we also note that the volume of net exports from the two groups of declining exporters is 20m bpd, which is currently more than the 15m bpd volume of net exports from the group of growing exporters. We also note that the 5-year annualized net export growth rate of the 15 million barrels of the growing group is 2.3%, but the weighted 5-year annualized net export decline rate of the two declining groups is 2.4%. The “peaked?” group, sitting in between the growing and declining groups, exports 10m bpd and their 5 year annualized net export decline rate is almost zero (-0.2%).

Of course these are snapshot comparisons and not fitted trend lines, but this volume and growth rate comparison between growing and declining exporters is nevertheless significant, as it implies that in our immediate future we will see a probably downhill-inclined plateau of net exports. Indeed, fitting a least squares trendline to the 2005 – 2009 production plateau which most people expect to continue, and a long term consumption growth trendline going back to 1996 when the FSU appears to have stopped collapsing, I got these results for a 2010 – 2015 projection of production, consumption and net exports (Figure 7):

Put in different words, any “plan” to grow total net exports will face the headwinds of (a) having to replace large volumes of declines from the 20m bpd declining group, (b) having to also replace increasing declines from the 10m bpd “peaking?” group, and (c) the growing group possibly speeding up their consumption growth rate to levels similar to those of all other current and former net exporters (see Figure 11 below). Considering that net exports are already 5% below their 2005 peak and that near-term trends are biased towards a downhill rather than an uphill plateau, it is more likely than not that global net exports have already peaked. Therefore, I am going out on a limb and calling 2005 as the peak year for net oil exports – barring any big surprises such as many net exporters suddenly deciding to start investing in cleantech in a big way!

PART III: THE OTHER SIDE OF THE COIN – NET IMPORTERS

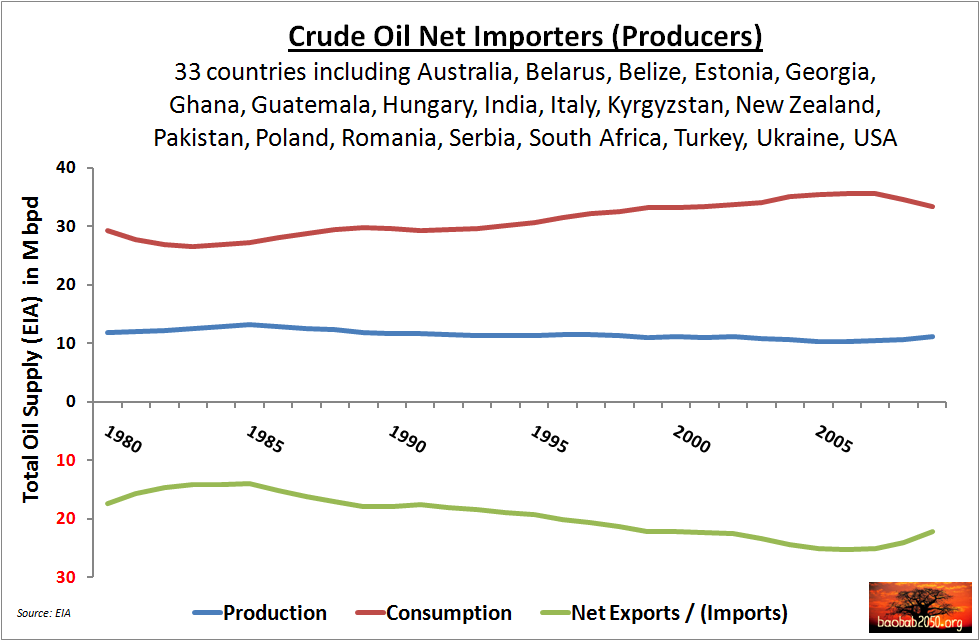

If the peak in net exports is behind us, what happens to net importers? Clearly, the groups of importers who have some production of their own, including all the countries in Figure 6 and some of the countries in Figure 8 below, will have more options available to them as the unavoidable efforts to reduce their economy’s dependence on oil only have to go as far as needed to support the demand with their own production.

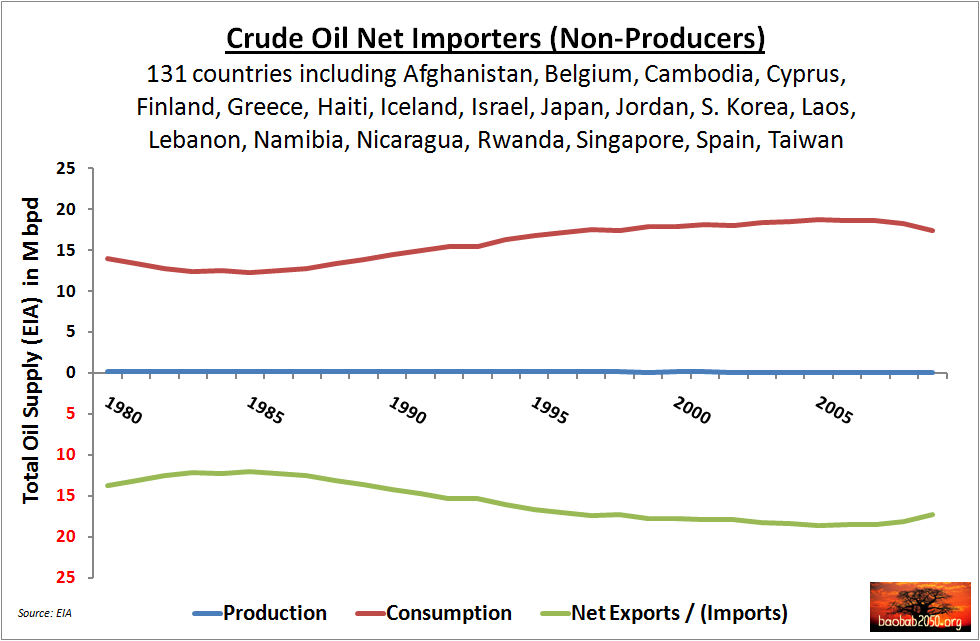

The situation of this group is at least a little more bearable than that of the much larger number of countries – including Japan, South Korea and many E.U. member states – who have no production of their own (Figure 9 below), some of whom will have to wean themselves off oil entirely if they lose access to the world oil markets as shortages of net exports develop.

The situation of most importer countries is made more complicated because it is very unlikely that large, powerful nations will “play nice” and scale back their own import requirement to allow a smoother adjustment for every importer. China has been busy sealing long-term resource purchase agreements in Eurasia and Africa using clever devices to lock in supplies such as pipelines from Siberia and joint venture refineries in the Middle East and Africa, and U.S. troops are all over the Middle East, particularly Iraq which is one of the few potential future growth stories left. It is hard (though not impossible) to model this, but the likely picture past the second decade of this century is that small or geopolitically weak importing countries will pay exorbitant spot prices for crude oil and be confronted with increasingly unstable oil supplies and wrenching emergency adjustment pressures.

PART IV: CONFIRMATION OF THE EXPORT LAND MODEL

The purpose of this post was to find empirical validation of the two key insights of the Export Land Model in real-world data. We analysed production, consumption and net export data for every country in the world from 1980 – 2009 and have found proof that both key insights of ELM are consistent with real-world data. Figures 10 and 11 speak for themselves.

PART V: METHODOLOGY AND REFERENCES

I obtained production and consumption data of “Crude Oil, NGPL, and Other Liquids” from the 1980 – 2009 International Energy Statistics supplied online by the EIA. I then adjusted the production data by a factor of 101.5% to 102.5% to incorporate the appropriate refinery processing gains for each calendar year, thus attributing the RPG’s back to the source of the crude oil. This adjustment is essential to remove noise and obtain a fair picture out of net export data, given that my definition of Net Exports is “Production – Consumption”. Then, using the first year of their independence as my benchmark, I back-casted and pro-rated the production and consumption of “former” countries (USSR, Yugoslavia, Czechoslovakia and Serbia & Montenegro) into the component countries, so as to have a 30 year data set for all of today’s countries. I also merged East and West Germany into “Germany”, and I merged UK and Dutch offshore production figures into the mother countries. I then calculated net exports for each country by simply subtracting consumption from production.

The grouping was accomplished by first calculating “cumulative production to cumulative consumption” ratios, one over the full 30 year period, and another over the last 3 years, and then by grouping countries in descending order of net export growth rate based on these ratios and on the actual 30 year net export history. Other people may group certain countries differently, because for some countries the data may show stagnation or even decline, but the potential to be in a faster-growing group might still be there (Venezuela and Libya come to mind). However, as there are so many unknown unknowns, I decided to stick with what the data has been saying, for better or for worse.

The Export Land Model (ELM) is explained in the following two posts by its original authors:

Declining net oil exports–a temporary decline or a long term trend? – by Jeffrey J. Brown and Samuel Foucher

A quantitative assessment of future net oil exports by the top five net oil exporters – by Jeffrey J. Brown and Samuel Foucher

Thank you Gail; I got a lot out of reading TOD over the last 4 years and I am happy to contribute something of my own in return!

Thanks, George for the post.

This is an interesting way of looking at things.

It seems like theoretically, there is also a group of countries for which things change going forward--say Iraq suddenly develops a lot of oil production, or Saudi Arabia, or Brazil, or Russia (perhaps near the North Pole). This is what keeps things interesting--and is why we can't just project the past forward.

There could also be changes of a negative sort. Say, Venezuela is not able to pay its bills, and its production drops greatly. Or Ghawar suddenly starts significantly declining in Saudi Arabia, and can't be replaced.

Gail is likely right on this.

Using Iraq as an example, you can disprove the hypothesis. I have the formal definition of what you want to prove a little down in the thread: http://www.theoildrum.com/node/7007#comment-727657

It is really this relation that needs to universally hold:

d(TOC)/dt - d(TOE)/dt > 0

This says that the rate of change of oil consumed by a country is greater than the rate of change of oil exported by a country. In the case of Iraq, by invading the country, the USA could force that country to increase the rate of exports so that d(TOE)/dt > d(TOC)/dt and thus pushing the above relation into negative territory.

Bottom-line is that geopolitical events can violate the model or just the rare statistical anomaly, as Gail points out. This makes it nothing more than a heuristic. Heuristics are not verifiable, but just reflect the empirical data collected. If the observations change significantly, it doesn't disprove the heuristic, you just need to find a different heuristic.

There were two reasons for my choice to group all exporter countries together. First, if I had tried to show each one individually, the info glut would have obscured the exposition of the argument. Second, by grouping countries in "peer groups" based on whether they were pre- or post- peaked (and by how much) with respect to net exports, it is possible to see the endogenously generated patterns in the data which "bring the ELM insights to life" without getting lost in the exogenous noise caused by individual events in individual countries such as wars, economic collapses, etc.

Say that at some point in the future, all Muslim countries decided to prohibit oil from going to any Western countries due to some dogmatic decisions of their rulers.

This would also verify the outcome of export model but not for the reasons that the original model intended. The point is that it is hard to separate out the noise from anything you are trying to verify when it comes to these events.

Gail, I thought about this for a long time while planning the article. In the end I concluded that "things also changed" in the 30 years since 1980, with various ups and downs for various individual countries, yet the big picture was still clearly visible in the data once you aggregate at least 10 or so countries together based on them being in similar stages of their "net exports lifecycle". It is probably the good old central limit theorem at work - the independent random variations in output or consumption of individual countries were mostly absorbed by the sum of the respective variables for a peer group which shares the basic characteristic being studied.

So, that was why I didn't pull out these countries to form a separate group. I thought about it, but I decided to go with the historic rate of change of net exports and ignore my knowledge of POTENTIAL future changes, "for better or for worse" as I said in part 5 of the article.

Nice summation, George.

Is there a mistake in figures 8 and 9?

I'm referring to the double listing of Ghana in both figures. Did you perhaps intend to list Germany in figure 9 with the "non-producer importers"?

Lumina,

Thank you and a question!

Of your professional peers, how many are peak oil aware?

Of course I realize that your answer can be no more than an educated guess.

If there are any MBA and Doctoral candidates in business and economics among the audience today, I am sure the members of this site are interested to hearing what is being said in the classrooms in respect to peak oil.

Oldfarmermac, I have one uncle who is aware, and that's about it. Last night I met someone who came close but he was not aware either. This is not a scientific poll of course ;)

Lumina,

Considering that you move in the rarefied circles of those educated at Oxford and MIT in business and economics,it appears that there is essentially no hope whatsoever of the bau establishment coming to grips with the coming energy crisis until after it breaks over us like a hurricane in the days before there were weather forecasts.

The only silver lining I can find in your comment is that it helps prove my arguments in respect to religion.

People who still believe in a God or various Gods are not any less intelligent than the rest of us; they are simply relying on what they have been told by people they trust and look up to as thier leaders-just like your peers who hold advanced degrees in business related fields and are trained to do research.

Trained they may be, but it seems rather obvious they can't see the forest because all the trees are blocking thier view!

I get a regular scolding from the faithful among those who worship in the church of science for pointing out that the high priests of the church are simply men and women who put on thier pants and dresses just like the rest of us, ignoring whatever it suits them to ignore while minutely documenting any arguments that favor thier agendas.

In respect to fossil fuels, the entire climate establishment more or less swallowed the cornucopians arguments in respect to ff reserves hook, line, and sinker, as it was politically expedient to do so at the time.

Joe Sixpack has heard so many doom and gloom warnings over the last few decades that he has learned to ignore them as nothing more than the pranks a the little boy in a white lab coat crying wolf.

When the wolf finally does make his appearance.........

I am not sure PO will "hit us like a hurricane". I am firmly in the camp that believes that PO occurred in the 2004-2008 timeframe (C+C -All liquids may be later) and one of the results is oils role in the GFC. Economists are now increasingly talking about a double dip recession. If the PO hypothesis is right, it won't be W shaped, but L shaped and we can expect the current situation to persist for a very long time. More unemployment, more businesses going bust and the establishment in continual denial. There will be statistical, timing and regional changes in recorded economic growth that will obscure the real underlying issue, but PO will never be acknowledged by the establishment. We can also expect a great number of social, economic and environmental trends to worsen and/or continue to worsen. All that we will see on a year to year basis will be small trend changes. JH Kunstler called it The Long Emergency. It is really The Long Grind Down. One way of measuring it would be to take a number of statistics and compare them on a decade by decade basis.

It could be like a slow motion train wreck, or it could be like OFM's hurricane when the markets realize what is happening and go through a panic dive. Don't forget the tipping point section of the German military think tank report, which supports the hurricane scenario;

• Banks lose their business base. Cannot pay interest on deposits, because they can not find creditworthy companies.

• Loss of confidence in currencies. The belief in the value-preserving function of money is lost. It only comes to hyper inflation and black markets, then to a barter economy organization at the local level.

• Collapse of value chains. Labor processes are based on the possibility of trade in precursors. The processing of the necessary transactions without money is extremely difficult.

• Unbound monetary collapse. If currencies lose their value in their country of origin, they are no longer exchangeable for foreign currency. International value chains collapse as well.

• Mass unemployment. Modern societies are organized labor and have throughout their history ever differentiated (specialized). Many professions have to deal only with the management of this high degree of complexity and nothing more with the direct production of consumer goods.

• State bankruptcies. In the situation described, state revenue is unable to cover expenditures. The possibilities of additional debt are extremely limited.

• Collapse of critical infrastructure. Neither the physical nor the financial resources now exist for the maintenance of adequate infrastructures. The problem is compounded by the high degree of interdependence between infrastructure subsystems.

• Famines. Ultimately, it will provide a challenge to produce and distribute food in sufficient quantity.

I agree. It could be quick, but it seems unlikely as of right now. "Slow motion train wreck" is a good metaphor. The slow motion won't in case be that slow. It will just appear slow. The establishment showed they could "manage" the GFC using stimulus. They can continue to do that but their options are much more limited. As it is we are seeing govt. contract in various US states and even quite large countries like the UK as well as smaller ones like Greece.

Agree it could go either way. My view however is it will descend in drop downs, just as the 08 collapse was a drop down. Oil goes up in price leading to collapse, followed by cheap oil, increasing economic activity (which is building slowly now), oil price rises and then another step down. I'm guessing the next step down will probably occur in 2011 or 2012.

Hi, OFM.

Am current third year undergrad (Econ and Politics). Not a single one of my ECON lecturers knew about, P.Oil, Expt.Lnd.Model, or the FIRE econ.!!!!! I asked. Shook heads slowly!

Brian P

What's the FIRE econ?

I believe it stands for "Finance, Insurance, Real Estate". It is an umbrella term for all the legalised Ponzi schemes that are out there :-)

I work in professional environment in a finance related field in Asia. I would guess that if you asked people if they have heard of peak 80-90% would say yes, although few would know much about it.

But an increasingly large number of governments and companies speak prominently about adapting to a future world with less energy, often in official publications.

I would expect that everyone working in resource related fields knows something about peak oil. I don't think this was true five years ago.

Good catch, I deleted Ghana from Fig 9. Sorry about that.

I don't understand the title of this post, especially the point about "verifying". Of course the general idea of export/imports is correct and it really doesn't need verification. It is not so much a model as a definition, and you needn't verify a definition.

So this is the definition:

TOC = Total Oil Consumed by Country

TOE = Total Oil Exported to other Countries

Total Oil Produced = TOC + TOE

So to get it in to something that you can verify, you have to postulate an assertion that you can try to falsify.

Perhaps this is the assertion that you would want to verify:

d(TOC)/dt > d(TOE)/dt

This says that the rate of change of oil consumed by a country is greater than the rate of change of oil exported by a country. By itself, this has an infinite number of solutions and is more of a heuristic more than anything else.

Another way to express this is the following:

d(TOC)/dt - d(TOE)/dt > 0

This says that the rate of change of (consumption - export) is always positive.

So to prove this, then you have to plot this on a graph and show that every slope of (consumption - export) for every country in the world is positive. If it doesn't hold everywhere, then the model can not be verified. But then again it doesn't really matter because it is just a heuristic anyway and a heuristic can change depending on what the observations are.

I guess my point is that to do a real verification, you have to formulate the definition into mathematical terms and then demonstrate that the result holds over all possibilities.

I am the one to blame for the title.

It seemed to me that with respect to consumption, what George is doing is calculating what happens in practice for exporters and for other groupings. So in that way, he is verifying that what is expected happens in practice.

In that case, OK, because I don't think the export land model heuristic would have ever been proposed unless it matched what the observations were. The reason to have heuristics is to provide convenient shorthands so people can describe what is happening without having to fundamentally prove anything. Its really a "rule-of-thumb"; people that have used that figure-of-speech before will know what this means.

For example, if it was really hot today, it will be hot tomorrow. That rule-of-thumb holds in the summer. The converse holds if it is in winter. No way to verify this for every case but it works reasonably well.

You know ... we are going to look back over this period and recall it as a 'Golden Era' of plentiful automobiles and parking spaces, cheap(er) hamburgers, 'Entertaining' Tea Party politics, 'Sparkling' reality (ahem) TV and 'Recovery'.

Johnny Heuristic sez we are recovering today therefore we will recover more, tomorrow. Is it winter or summer? Who cares!

Dealing with rates of change during golden eras is very hard to do. How to see where the rates actually change before they do so can be disconcerting. I don't think this export land biz is easy to predict.

Right now, the driver of the rates is the return in hard currency from exports is greater than the rates of return from development (which is driven by the rate of return from hard currency). Hard currency is gained by exporting fuel.

Fuel exporters import hard currency. What matters to fuel exporters is replacing currency imports, regardless of source.

An example of the effect of the change can be seen in Mexico, which has declining hard currency returns from fuel exports but increasing hard currency returns from non- fuel exports (excluding drugs?) mainly automobiles and parts.

Exporting autos/parts inevitably forces hard currency returns to Mexico (increase in fuel imports into USA raising real price). What would the feedback loop be? It's really hard to say at this point.

China is trying to export fuel in the form of solar panels and wind turbines (along with rare earth metals). China will as a consequence import more hard currency while exporting hard currency to purchase more petroleum for its expanding auto fleet. Which will expand faster?

I think a set of converging rate curves can be calculated as (fuel import rate/currency import rate) change in output as GDP - GDP2/time or some such to see if a country can make money selling marijuana fast enough to offset declines in fuel exports.

Of course, the world cannot run on marijuana but it can have fun in the interval ...

It was precisely the point, made in the post, that in the real political economy (the one where political actors distort scientific truths) even definitions need to be verified against data in order to drive home a point.

In addition, the post proves (fig 11) that all exporters grow their consumption faster than the control group of importers, which is an empirical postulate of ELM. Recall that my data set is comprehensive, and it includes every net exporter in the world.

So ELM is verified, and I use the word very carefully and deliberately. If anyone claims they can produce an argument and data which disprove ELM, please come forward with the goods?

Here is an interesting approach to "verification" that totally avoids the real political economy.

I will "prove" that an export land model reduces to EROEI, nothing more nothing less.

The premise is that we have a single oil field rig with a production P. For the purposes of argument, this field can either export to a consumer of that oil, call this Pe or it can use it internally to provide the energy for extraction, Pc.

Then

P = Pe + Pc

But the amount of oil used internally is dependent on the value for Energy Returned on Energy Invested (EROEI) = E.

so that

Pe = (E-1)*P/E which is the standard form for how much energy one can ship elsewhere

and

Pc = P/E

but the export model says this as an invariant

d(Pc)/dt > d(Pe)/dt

which means that the rate of change of oil consumed by a rig is greater than the rate of change of oil exported by that rig over time. This is nothing more than an expression of the law of diminishing returns, in that it gets progressively harder to extract oil from a declining well over time, and progressively more energy is fed into the rig itself.

So when we insert the EROEI factor in the above equation, we get

d((E-1)*P/E)/dt > d(P/E)/dt

which reduces to E > 1.

E=1 is the break even point for where a rig or field ceases to be productive. More energy needs to be invested into the field than can be extracted if E drops below 1.

So the export land model is provably equivalent to EROEI when applied to a single rig or field. Scale that up to where a country essentially "owns" the fields and rigs on its land, and then the rule still holds. The energy is used internally to feed its own country or some fraction is exported to be consumed by other countries. Only when geopolitical events conspire to allow the owners of the fields to become disconnected from their nations (such as in the case of war or global free-trade), will this rule fail to hold.

I think ELM is just a manifestation of EROEI whereby the reinvestment bucket shows arbitrary political boundaries. And the latter is the part that you generally have difficulty in verifying universally, as future events unwind.

Good analysis, but there's a snag: your Pc refers to the energy consumption of a single oil well: the export land model uses it to refer to the internal consumption of an entire country.

You scale up from the former to the latter, which is only legit if energy production is the country's sole activity.

A nation is more than just a collection of oil wells: one might imagine that, in the face of declining oil production, a country might reduce its internal use of energy for other purposes, softening the decline of exports. The export land model finds that this is not the case, but that behavioral tendency is more than just a simple consequence of EROEI limitations.

An exporting country may also invest in industries that are energy intensive and produce products for export. It would therefore capture more of the value chain. But it may still make the same amount of "embodied energy" available to the global economy.

Could you state this mathematically? ELM is supposed to be a mathematical model useful for prediction, but if we can't fit in the constituent factors that influence its behavior, I don't know how ELM can "find" anything.

I confess I'm not up to speed on the mathematics of the ELM, but to continue the formalism you've introduced:

When dealing with nations rather than individual wells, we should divide the national production P into *three* parts:

Pe = export production

Pi = production used internally for non-energy uses

Pr = energy reinvested into energy production

P = Pe + Pi + Pr

We can also redefine

Pc = Pi + Pr = Total national consumption

EROEI = E = P / Pr

The ELM asserts

d(Pc)/dt = d(Pi)/dt + d(Pr)/dt > d(Pe)/dt

You can continue the math in your post using this framework, but the basic issue is that EROEI places no constraints on the Pi term: the ELM is making specific assertions about how this non-reinvested internal consumption changes which go beyond EROEI ideas.

excellent.

Remember, that I originally framed this from the perspective of a single oil rig or oil field. The operator of that rig has no use for that oil unless he can (1) sell it to others or (2) conceptually use it to make more money.

So we jump from a single oil field to a nation of oil fields.

In a global free-trade economy, the collective of oil operators still has no use for the oil for the same reasons. They will ship it to whoever offers the most money. So the Pi term you added simply apportions this according to some efficiency of markets argument. We have to use the full matrix to describe the fractions allocated to various countries based on their ability to pay. The grouping Pi+Pe still holds from the perspective of the aggregated oil fields and we are left with a diminishing returns result.

In a totally nationalistic economy, Pe becomes zero and the Pi term apportions to the "haves" and "have nots" comprising the national economic base. We no longer worry about doing a global matrix (unless we want to know what we are importing). But the math remains the same, replacing Pi+Pe with just Pi, and you still get a diminishing return result.

Anything in between these extremes, which amounts to a mix of free-market and nationalistic economies, I would assert we would see the same result, i.e. diminishing returns.

So no big deal, we would see the same diminishing return result whether or not the economies are free-trade. We are just picking the "haves" and "have-nots" or the winners and losers. The losers just move to the local economy when the economy goes away from free-trade.

--- duplicate post ---

To me, the value of ELM is that it relates to the real world. A mathematical statement of ELM can be useful, but to state the relationship between ELM and the real world mathematically would require a mathematical model of the real world. And not just any model would do. It has to be one that you (and I and everyone else here) understand and accept. Otherwise what is the point? If your argument is not understood by your audience ... why argue?

Yet they want to get quantitative numbers out of the model.

You can't get a quantity unless you do some math. Even a linear extrapolation off of some graph is math.

Anyways your question is completely moot. Goodmanj provided a potential math model that looks intriguing and that we can work with. He apparently did what you thought impossible.

WHT,

What I had in mind when I spoke of a mathematical model is a system of set theoretic objects that supports a logic that is capable of proving the correctness of the system. This is fairly hard to do in pure mathematics without any reference to the real world. It was in the context of you asking someone for a proof of the correctness of statement. Using arithmetic in working out numerical values in a model doesn't make the model 'mathematical' in the sense that it properly supports the concept proof.

And if there were such a model, very few people would understand it. For example, the computer code that is used to model climate effects of atmospheric CO2, is a computational model, not a mathematical model. Running these climate models does not prove anything. Mathematical proofs are hard and, IMHO, seldom worth the effort for a real world problem.

Peace.

Your interpretation is way, way out there as far as I am concerned. It wasn't me that was saying that something was verified; I would know enough not to do this.

Take the case of the multi-body or N-body problem in celestial mechanics. This shows the gravitational pull between N unique objects. You can solve it analytically for two bodies, but you can only compute it for higher values of N, yet no one has any qualms over using a computational model instead of wasting time trying to prove it analytically. So the astrophysicists can do celestial orbits quite fine thank you.

About the climate model for CO2 and its persistence level, it is actually quite straightforward to demonstrate in terms of a probability model.

http://mobjectivist.blogspot.com/2010/04/fat-tail-in-co2-persistence.html

http://mobjectivist.blogspot.com/2010/05/how-shock-model-analysis-relate...

Now what exactly are you saying about the failings of a mathematical model?

WHT, I think you and geek7 are talking past each other, and I think I can help clear up the misunterstanding.

The snag here is that logic has a concept of "model" that is rather different from the common empirical science one:

Model Theory (wikipedia)

IOW, a "theory" is pure syntax; a model is where a theory gets its semantics.

I'm not completely on board with the wiki article; I'd say that in a broad sense, a model could be virtually anything. Two extremes would be: the theory itself; and the real world.

The point would be that while the rl wrld could be a model of the theory, unless our model is formal it is "hard" to prove that our theory is indeed true in it.

The discussion between WHT and Lumina is quite animated, and I'd like to offer an analogy with tongue in cheek:

What happened to Newton when he got banged by an apple?

Physicist: The force acting on apple is GMm/r2, F=ma and then we can figure out the rest using simple (grade 12) math. When there are very many apples, probabilities of apples falling of a tree start playing a role, but each apple follows GMm/r2 and we can figure out more using more difficult math (3rd year uni physics let's say). BTW, those descriptions with probabilities apply to more things, including oil depletion and this is what WHT does.

Scientifically minded individual: Based on observations, we can derive a model that gives us velocity and distance of apple as a function of time and it seems to hold well for all apples and many other objects we've seen so far. The models is conceptually simple and gives us a lot of insight into the problem we are dealing with including some predictive powers. And this is what Lumina does.

That's about right. The latter is a good description of a heuristic.

I go the first route because I have seen how deniers and skeptic completely decimate heuristic arguments. Look at the entire global climate change debate. Scientists working the heuristics side have had limited success in defending their positions.

There is another important element that I add to the mix, the concept of disorder. So rewriting

Scientifically minded individual: Based on observations, we can derive a model that gives us a probability distribution of velocities and distances of apple as a function of time and it seems to hold well for all apples and many other objects we've seen so far. The models is conceptually simple and gives us a lot of insight into the problem we are dealing with including some predictive powers. And this is not what Lumina does.

There is not just one trajectory for oil discovery and production, but a whole set of these based on real world dispersion of behaviors.

Model is a much-used term. From Systems Engineering, which utilizes a great many models of all sorts, a good definition is:

Usually the point of having a model is to answer a question, or sometimes to simply aid description.

Ones uses a model, because, well, it is useful. "Model are to be used, not believed." - George Box

A model, strictly speaking, is rarely "right", "truthful", or even "accurate". It is generally either "effective" or "ineffective" for the use intended.

Therefore, the argument shouldn't be about whether ELM is indeed a model, but whether it is indeed effective for a given purpose. Certainly one could discuss ways to make any model better, but that is as much a tradeoff in terms of effort vs efficacy, as it is of any technical considerations. Determining the effectiveness of models is a professional discipline all its own, and this is not an uncommon area of argument.

ELM is what it is. If it is unsuitable for a need, then a better model may be needed. Or we can just wait and see. In any case, a few moderate examples that fall contrary to the model do not necessarily invalidate the model itself or its usefulness, if an "average" behavior is sufficient and effectively modeled.

Personally, I think it would be interesting to make ELM into a simulation (a model operating over time) based on economic theory and behavior theory ("game theory" is one such subdiscipline). I think human nature tends to be on the side of ELM, but such intuition can often be miscalibrated.

Thanks for that. My last word in a discussion that went on too long: the original Export Land Model with the stylized straight lines for production, consumption and exports (see the first reference link at the bottom of Part 5 of the article) is indeed a model. Although it is a simple model with an equation my 9 year old son would easily understand, the insights evoked by it are of grave importance.

When I think of all the posts in this thread which were about the definitions of words in the title, and the time invested in those, I am reminded of the funny scene in Lord of the Rings: The Two Towers where

I would also add, to cap another discussion on semantics that was also too long, any comparison of model output with real world data which shows that the model is consistent with the data amounts to verification (or validation, or confirmation) of that model. This article confirmed that the insights evoked by watching Export Land Model's stylized straight lines can also be evoked against the entire real world data set. Whereas most models are verified against a sample of the data.

Not all models are built for the purpose of express quantitative prediction, because chaos theory makes certain predictions impossible beyond the short term. If one purpose of ELM is to instill, via the transmission of these insights I talked about above, a sense of urgency in oil importing countries that they must decisively kick the fossil fuel habit, then the model is potentially useful for something other than quantitative prediction - which in any case is very hard to do. Hopefully this verification of the model against real world data has helped in that regard.

I am glad that you straightened that out.

I created a post on my blog earlier today where I analyzed a complete set of real world data against a model that I put together in the last couple of years. The data set is the area distribution of fresh water lakes in various parts of the world. The model does not incorporate chaos, just ordinary disorder and variability in the collection rate and basin collection area, according to the maximum entropy principle. The final form is a single parameter equation describing the distribution. The single parameter does double duty as it also generates the median lake area.

Notice that the fit is perfect. I would say that the fit is so perfect and parsimonious (a one parameter fit that matches the median exactly, so it is essentially a zero parameter fit) that I have VERIFIED that the model explains real world behavior. Look at the scale: it matches over 4 orders of magnitude in one dimension and 5 orders of magnitude in the other dimension. As far as I can tell, no one has ever done this before so it is a novel approach as well. No one can possibly come up with a better model, because it would have to be more complex, and that would violate Occam's Razor.

Devil's Advocate:

Hold on. Its not that easy. You may have missed something in the verification process. You also have to have everyone else agree that what you have done passes all the other sanity checks. That's the tough part, the validation part, and you will realize that your work has only started. Somebody like garyp will come along and completely trash it, saying it doesn't demonstrate complex adaptive systems behavior.

That's OK and that's why this business is fun.

I get the feeling from that last bit that someone is getting niggled.

My actual question would be rather different: so what?

So you have a dispersive model that predicts Amazonian lake sizes. So what? Maybe it might predict oil reservoir sizes. So what?

The exam question here is the availability of oil. ELM provides a simple descriptor connected to oil exports, and therefore the exam question. It won't be exactly right to n orders of magnitude, but it does describe one of the key patterns associated with the availability of oil at the moment. It's prediction forms an attractor (sorry, but it is) around which other factors play out over time, and which is subject to the force of other attactors.

In scientific terms, it produces a testable prediction - which can be shown to be correct(ish) relatively often.

In engineering terms, its useful and answers the 'so what' question.

Maybe you'd like to take your entropic/dispersive model of ... oil reservoirs? ... oil exports? ... whatever it is ... and make a testable prediction that hasn't already been covered. Because at the moment the best I'm seeing is a way to define the maximum possible reserves globally via the previous incidence of field size - something I've seen before and doesn't seem to cover how exploitable it might be.

I'm not getting a eureka moment I'm afraid.

My comment is not necessarily about practicality but about the arc of scientific discovery.

If you know something about probability density functions, you will realize that a PDF can only describe an intrinsic quality. Like knowing the density of a material doesn't allow one to know the actual mass of a specific object, knowing the field size distribution won't allow you to estimate "maximum possible reserves globally". If you said you have seen this before, it was likely in a very misguided context (some USGS report probably). Yet, there are other interesting questions that this finding raises. The reservoir size distribution shows that the mean size diverges to infinity. It may be a weak divergence, but this does tell us about the possibility of other super-giants, and together with dispersive discovery can guide us in generating estimates of how likely that a significant new field would occur.

The arc of scientific discovery really only begins when we start understanding a concept somebody sets forward. My example happens to be grounded in simple models of geology and guided by fundamental concepts of entropy. In contrast, the ELM model seems grounded in socio-economics and vague predictions in human behavior, and only guided by linear extrapolations. Yet, I realize that it will take a lot more than an assertion or two that I write up to make it acceptable to other scientists or analysts. I don't sense that the ELM proponents have that same outlook, as they have seemingly verified and validated the concept all on their own.

So what is the prediction? They can't even write it in precise mathematical terms. In this thread, I offered up the suggestion that the testable prediction is this relation:

dPc/dt - dPe/dt > 0

But all I hear is crickets that this is the correct formulation.

The most amazing part of engineering (and what most people don't realize) is that many of the brilliant innovations come from the engineers that are able to take obscure and cryptic scientific work and turn it into something useful. So where is the meat of the science that makes this anymore than a yawner for any engineer to develop further? I tried to both do the science for these ELM guys and get out some equations that might prove usable, but have only gotten some pushback that what I am doing is somewhat out-of-bounds.

Unless you are talking about social engineering?

You state:

Even for the case of exports=national consumption (a special case), the heart of exportland is that dPe/dt ≠ dPc/dt. Rather dPc/dt continues to be positive whilst dPe/dt is increasingly negative.

Thus when dP/dt = 0 (eg peak):

dPe/dt = -dPc/dt

and since dPc/dt is positive (country is growing because of the oil earnings), dPe/dt has to be negative. In other words its already past peak. QED

By the way, I note you haven't come out with anything that answers the 'so what' question, other than being able to put a handle on the total size of reserves from discovery data. I'm not seeing this as surprising, since the reality of oil exploitation is 'complex', and therefore NOT a case of maximum entropy. That's kind of the point.

If you want to take it in a direction to answer the 'so what' question, may I suggest something else I remember seeing. The size of terrorist incidents worldwide follows a similar smooth curve, allowing you to predict the probability of any size of terrorist incident within a time period - eg it CAN predict social factors, provided there are enough actors and its simple enough.

My guess is you can do something similar to predict the actions of individuals relative to a supply constrained world - taking as the data set basis the actions of the populations of countries where the oil price has already risen above the affordable level. There is a point of strain where things break and civil discord results - and I'm guessing that it is roughly at the same relative point on the 'strain' graph for each country. Predict the strain over time and fold-in the expected fall off in available fuels in each country and you can put a finger on when it all goes to hell. As far as I can see, that would be using an entropy based technique for an area it's good at.

Not if it is a strong production growth situation!

I already did the case elsewhere in this thread if you would care to look around.

P = Pe*(1+f(t)) + Pc*(1-f(t))

(Production exports go up as a perturbation described by f(t))

dP/dt = dPe/dt + Pe*df/dt + dPc/dt - Pc*df/dt

(expanding using the chain rule)

but Pe=Pc and dPe/dt = dPc/dt

(equal amounts go to consumption and export as a first-order approximation which agrees with Figure 1)

so making the substitution

dP/dt = 2*dPe/dt + (Pe-Pc)*df/dt

but since Pe=Pc the second term disappears and you get the same thing as before

If Pe>Pc and df/dt>0 then dPe/dt has to be negative at the peak, which does imply that the export peak occurred earlier, yet df/dt could just as easily been negative for awhile and then the export peak would have occurred later.

In any case, these are all second order effects and the fact that Figure 1 shows the export peak coinciding with the global production peak indicates that these effects are inconsequential. The utility of this as a leading indicator is marginal at best.

You really don't know the diversity of work that I have put into this effort.

You been reading to much of the crazies at the Army War College or something. Read my blog instead and you can get an indication of the stuff I am interested in. It certainly isn't this NSA wankery.

Sorry, but I have to conclude you are trolling.

You go round the houses with some blatantly dodgy steps (dPe/dt = dPc/dt only when at production peak and 50:50 distribution, therefore dP/dt=0, f(t) isn't common except at dP/dt, momentarily), when a simple formulation is all that's needed - in what looks like an attempt to hide your slight of hand.

Couple that with your offhand dismissal of complexity and other dodgy statements and I'm sorry, but I have to conclude you are a green pen merchant.

Oh well.

You can't explain why global peak export happens to line up with global peak production. I wrote an analysis that shows how this can happen and served it up to you on a silver platter.

You have to be able to explain why dP/dt=dPe/dt=0 happened around 2005.

dP/dt=0 in 2005

dPe/dt=0 in 2005

yes look at Figure 1 and any global production graph.

You know which analysis doesn't work?

=> yours

---

And another thing it is at about the 50% situation if you care to look!

I am putting the question (to WHT) here, because I really do not know where it belongs. Aand how much sense it makes, whether it's been answered here on in your blog. There are no stupid questions they tell us...

Here it goes. Tossing coins with 50/50 outcomes leads to binomial distribution. We could say that the process is "driven" by individual probabilities and extends to stating that binomial distribution turns to be an "inherent property" of such observable. It is more than just description, or fit to results.

Is it the same that the processes you are studying (lakes, oil, crystals etc) are really driven by entropy and if we knew values of any additional "parameters" existing in the model, it would imply some other PDF?

In this regards is it the entropy that drives the process?. E.g. in your CO2 persistence blogs you compare results with kinetic models having 5 kinetically limited processes. But is this chemical kinetics "expression" of the process driven by entropy? Or is it situation where the amount of various deterministically and probability driven processes is so complicated that we are unable to extract the components? Which is another way of saying that "it is such a mess" that only looking outside-in via some extensive property

is a better or at least easier way of doing things?

Very astute questions.

Maximum entropy modeling is neat (IMO) in the fact that you can only model based on observable measurements you can make. These generate the constraints for the probability distributions. Any other information you want to include is a no-no as it leads to unwarranted assumptions. So MaxEnt is a way of dealing with limited information.

So if we did have more information, then we would get different results. One of the best examples of a "failed" maximum entropy PDF is the case of mapping out the dispersion in marathon finishing times. Humans show a huge variation in athletic abilities and you should see this in the distribution. There are fairly hard constraints in the maximum speed of a runner but not in the minimal speed of a runner. But then you add in other constraints such as the artificial cut-off time in a specific race, and it screws up the finishing time distribution in the tails. All the people that could race at the slower speeds won't enter the race because they know that they won't make the cut-off time. There is also a bulge in the top runners that gets affected by the lure of prize money. This only affects a few but you can see the bulge. The point is that you can "know" about these things and thus adjust your model and get different results.

When you start piling up the constraints and information it gets harder and harder to model entropy this way, unless the combination of constraints also starts to become random. Then you are back in business and you can reason about this. The best example of this is the distribution of human travel times that I have posted about. The maximum entropy principle applied to this problem gives just about perfect agreement.

Is it the same that the processes you are studying (lakes, oil, crystals etc) are really driven by entropy and if we knew values of any additional "parameters" existing in the model, it would imply some other PDF? Yes indeed, you can look at e.g. other aggregation of lakes within the data set and you can see other PDFs emerge based on the additional knowledge you have.

In this regards is it the entropy that drives the process? Entropy drives the process in that more and more variability is added to the mix when you make your problem more and more and more "global". This is the same as saying that entropy describes the march to filling up the state space.

But is this chemical kinetics "expression" of the process driven by entropy? The 5 processes is someone's attempt at describing the constraints. I simply assumed a lot less knowledge but some fixed constraints (i.e. a diffusion-limited rate) and went from there. Entropy dries it because the assumption that there could be a lot of rate pathways and distance pathways which will fill up state space.

Or is it situation where the amount of various deterministically and probability driven processes is so complicated that we are unable to extract the components? That happens all the time. Most of these "scale-free" probability distributions occur because the dimensionality disappears. So a short time could be caused by a slow rate operating over a short distance and or by a very fast rate operating over a larger distance. Everything gets mixed up so much that you may not be able to extract the essential components or their behaviors.

Which is another way of saying that "it is such a mess" that only looking outside-in via some extensive property is a better or at least easier way of doing things? Yes.

Thanks,

There is a lot of elegance in your method(s); lots to read in your blog, and I am enjoying reading it immensely.

One significant shortcoming of the original ELM is that it contained no obvious way to evaluate how well it fit data from the real world. (at least in my opinion)

Lumina assumes (correctly IMHO) that each individual export land is a microcosm of the whole world.

Subsetting the data according to country or other political subdivision and then grouping according to time after their individual production peaks gives a way to assess the variation the decline after peak. I would expect to find that the post-peak development of each country to be different, and that they would share similarities. But what similarities? and what differences? He is seeing patterns that could only be guessed at and arm-waved without this work.

Bravo, Lumina!

Thank you geek7.

The presumption is that each political unit (country) is on its own in the jungle of the international society. At the risk of oversimplifying, if they produce oil, they will export any surplus to their need. If they don't have a surplus, they will burn their own stuff before importing anything. If they don't produce enough (or any), and they don't have geopolitical muscle to secure their full requirement out of declining available imports, their adjustment period to 90% reductions in oil consumption will be much shorter than they thought. That will be partly because those importers who can foresee the endgame and who have the geopolitical muscle to secure their full oil import requirement are unlikely to play nice, further accelerating the shrinkage of the pie for everyone else. Think of a gun-toting gang taking all the sacks of rice from the UN food aid truck and leaving nothing for the unarmed hungry crowd, which could have been fed had everyone stuck with 1 sack of rice per family.

The traditional focus on just doing production forecasting carries with it the implicit but mistaken assumption that the burden of the future declines will be shared equally. Statements by TPTB such as "at current production rates, oil reserves are sufficient for 50 years" lull stakeholders into a dangerous stupor. Nothing could be further from the truth than the hidden assumption that production declines will be shared equally, and the consequences are very destabilising for a very large number of countries who depend on imports, small and large, developed and developing.

"So ELM is verified, and I use the word very carefully"

"Verified" is OK, but "validated" is a better word for what you have done, IMHO. It makes more clear the connection to the real world.

The connection to the real world is exactly what I set out to find. "Validated" works too, but I am just as comfortable with "verified" or "consistent with" or "confirmed". The main thing is for this connection of ELM to the real world to become visible and believable: that was the point of the exercise.

It was very well presented and clear enough, without a more in depth analysis. But it is fascinating the need by some to squeeze the information in a much more detailed manner to feel some control over or comfort with the conclusion. I suppose the center of a target has its center too, and with enough scrutiny it can be targeted.

I think I understand what you are implying. Most top-notch design firms have a few people designated as "devil's advocates" that appear at review meetings. Ignore what these guys say at your own peril; they are there to keep you from embarrassing yourself later on when something flops.

At later stages, it's also known as peer review, thesis defense, etc and it goes with the territory.

Unfortunately, the internet doesn't have much by the way of quality control so the devil's advocates can often turn into "concern trolls".

Verification & Validation have very specific definitions in engineering circles.

Verification is an objective evaluation of a model or some product that meets some requirements.

Validation is a subjective evaluation of the same thing.

If you were to make a model and give it to some customer, you would do the verification and he would do the validation. It wouldn't matter if the model was correct or not; if he didn't like something about it, he would declare it invalid for its intended purpose and you would have to go for a retry.

AFAIAC, this model is not fit for my purposes and I would not use it. Therefore it is invalid in my view. So it really misses on both accounts.

George,

Thanks for this very careful review of the Export Land Model. I especially appreciate the details of your methodology and will be sure to try out your refinery processing gains adjustment when I start working with the EIA oil data.

While agreeing with WebHubbleTelescope that ELM is an entirely heuristic approach, it is important to recognize that this approach is extremely useful heuristic approach when it comes to explaining what is going on or making predictions. It is easy to understand and, as you have pointed out,

largelyentirely validated by the data. As an explanatory and predictive tool it is far superior to the "multicyclic hubbert analysis" we have seen in a few peer reviewed papers lately.Kudos!

Jon

As you are likely aware, I have some fundamental problems with the export land formulation because it has many of the aspects of a zero-sum game to it.

For example, suppose that the world was composed of a single country. What fundamental rules from ELM can you apply to allow anyone to explain or predict what would happen with declining production? I know exactly what would happen. You would set up a model of the "haves" and "have nots" in the society and they would get busy dividing up the pieces of the pie.

The fact that you have rather artificial political boundaries does not make it any more fundamentally correct or easier to reason about than any other socio-economic model.

Now if you want to do this correctly and account for where the oil is going to, assuming nation boundaries, you have to create a matrix of all the countries that can import and export oil and guess generally what the individual agents will do.

The full Production->Consumption model needed to keep track of all country interactions is set up like the following:

C = [E] P

P is a vector of size N giving the gross Production outputs of N countries.

C is a corresponding vector of the Consumption inputs of N countries.

(ignore the refinery bits where a country will import and then export)

[E] is a matrix of size NxN which describes the relative amounts of oil exported from one country to another. The invariant is that the sum of the elements in a row has to equal unity if an individual element in P gives the gross production. This will also result in the fact that summed Consumption equals summed Production. That is the Export matrix and it can have 900 elements if say N=30 countries.

Inverting that equation and you will find the corresponding import matrix [I] is just [E]-1. They have a built-in relationship so that if you know one, you can get the other.

There are two limiting cases. One case is trivial. It is where each exporting country becomes very nationalistic and only sends exports to itself. If every country did this then [E] will turn into the identity matrix with elements only along the diagonal. You might as well calculate individual production profiles for each country and keeping track of exports is trivial, as there are none.

The other limiting cases is a fairly balanced matrix. Each country sends its exports to other countries depending on its "demand", which further depends on its population among other things. In this case, things rise and lower in unison and export/import bookkeeping is pointless.

The difficult case is anything in between these extremes. The elements of [E] have to stay consistent and also match the consumption demands of all the countries involved. If you don't do this correctly it becomes a GIGO equation and if it only reflects current reality it doesn't tell you much. That is the zero-sum aspect of it.

So who can manage the model while understanding all the complex interactions among all the countries?

You can try to take a shortcut and have it move towards a more balanced approach, which in fact is the highest entropy model. This high entropy is associated with trend toward free-market disorder or to free-market chaos. This explains why peak export lies pretty much on top of the global production peak, give or take. (If you don't believe me look at Figure 1). So ELM doesn't really explain this, it only reflects the underlying production model, i.e zero-sum or you are back to where you started, as ELM is a model of very weak predictive power. It is only second-order in terms of the underlying global production.

Its so much easier to have the agents apply a greedy algorithm and find and extract the oil as fast as possible, which becomes a model of global oil production. Yet no one seems to want to do this except for me, preferring to analyze a second-order effect which is obviously only applicable if you have the first-order effect figured out. I repeat: Import/export=2nd order and oil production=1st order, with the import/export bordering on a zero-sum game, with little predictive strength if game theory elements (war, corporate strategy, etc) come into play.

And this explains why I am not that interested in pursuing a complete ELM. Its nasty in the bookkeeping, hard to explain, and really holds little value in predictive power.

That's the issue which was bothering me throughout reading the article. ELM contends that there is huge significance in the graph line of a)(production - local consumption) as opposed to simply the graph of b)(production), yet in the samples presented such significance simply doesn't show. What policy decisions would a "mover / shaker" make differently given the b) graph data above versus the a) graph? Both are pretty much entirely controlled by the (production) data.

Len,

You got that right.

The only reason I am working the math angle is to figure out exactly what I am missing in my interpretation. Ultimately, if I was deeply convinced that ELM could tell the whole story, I would have dropped the modeling I was doing elsewhere, and would have pursued the ELM approach exclusively. Yet quite clearly to me, the fact that the export peak lines up with the production peak means there is something else to the story. It has been a second-order effect up to now or we would have seen a significant shift in the export peak with some huge associated change in global free-trade policies.

Is it because ELM tells the whole story post-peak? I kind of doubt that too as political boundaries and alliances will change. Then it becomes at best a qualitative model of the restructuring of export/import pathways. And in that case, I would think that we would want to use the matrix formulation I presented in my comment above.

WHT, From what I see, you prefer analytical solutions over "heuristics" of one kind or another.

But what about exploring the area by Monte Carlo approach? Sample over countries, production curves and consumption curves, etc. and see what happens? I know, major heuristics would be involved in assigning probability distributions. But such an experiment could show possible pathways to successful outcomes, and these could be examined further by adding/considering economics/policy?

As we see it now, positive outcomes need miracles.

Monte Carlo techniques are typically either based on sampling from a model, or resampling from a set of data. The former allows you to compute a potentially intractable expression and the latter allows one to determine statistical properties of a limited set of observables.

I can just as easily solve my analytical models using Monte Carlo, which I demonstrate here:

http://mobjectivist.blogspot.com/2009/12/monte-carlo-of-dispersive-disco...

About the only thing it helps with is getting a sense of the statistical noise you would get with a finite number of discoveries. Otherwise you get the same result. The fact is that if you can get an analytical result, it becomes much easier for other people to check your work. OTOH, if you leave it in a computational state, you leave doubt that no one else will be able to reproduce your results. Thus, my preference for analysis whenever possible.

With that as a premise, I think I understand the context of your idea. If I was trying to infer the coefficients of a grand scale export/import matrix, there are ways of learning the coefficients from techniques other than Monte Carlo. For one you might be able to look many of them up, from a country's import/export records. The missing pieces you might be able to piece together from the constraints and a few smart guesses.

Thanks for explanation.

Len, thank you for your thoughts.

One reason why policymakers should look at net exports instead of production is graphically demonstrated by Figure 6 ("Former Exporters") in terms that a layman can understand.

These countries, the Former Exporters, used to export 2 Mbpd back in 1985. Their production and consumption both grew after that, but consumption grew faster, until around 2000 - shortly after what proved to have been their ultimate production peak - their net exports dropped to zero. So we had a 100% drop in net exports over 15 years, from 2mbpd to zero, but over the same period production for this group had actually increased.

Of course Fig 6 is just a group of countries amounting to less than 10% of global production. However, my analysis covers all global production, and the endogenous ELM behaviour is evident in each group of net exporters, including those who are still growing. So simply take the all exporters graph (fig 7) and put the clock forward 10-20 years, by which time global production will surely be declining, and you will have a graph of net exports for all the world's exporters that will increasingly start resembling that of the former exporters in its early days when net exports were in decline, but before the net exports fell below zero.

Then ask yourself: if I was President, should I be looking at the production curve or net export curve? Again, if the early stages of figure 6 resemble a future chart for the whole world, and right now we were sitting at 1990 looking back at just the production data of 1980, 1985, we would be feeling great. But how can things be just great, if global net exports will hit zero in just a decade (2000) and 131 countries would suffer a forced reduction of 100% in their oil consumption? Something has to give, and that would be the fallacy that the most important curve to watch is the production curve.

The value of thinking in ELM terms may be elusive to some, but I suspect that it is not lost to the Chinese. Their overtly manifested policy of locking up future resource extraction streams using joint ventures in refining, mining, etc. puts them far ahead of the curve...

I call that by the well understood names of "isolationism" and "nationalism".

No brainer, the production curve. First-order models always come first. The net export curve is second-order and doesn't come with a fundamental first-order model.

Hmm.

Net Exports = Production - Consumption, for an oil exporting country

Net Income = Revenues - Expenses, for my businesses

Should I call in my business partners and closest associates on Monday at 8am and start evangelizing about the need to maximise Revenue and "stop obsessing with net income which is merely a second order function and does not come with a fundamental first-order model"?

But you have no basis for absolute values of Revenues|Production and Expenses|Consumption.

Those numbers are just floating out there, not grounded to any fundamental model.

I have a global model of cumulative oil discovered over time called Dispersive Discovery. This becomes input to another model called the Oil Shock Model, which generates an estimate for global oil production over time. You need this global production model to reason about the numbers because oil is a finite resource that doesn't just magically appear from some checking account balance.

My problem, and perhaps my advantage, is that I don't think like an economist or a financier.

If I continue to see people ignoring the fundamental fact that finite resources can be absolutely counted, and not treated as some tenuous derivative or price, I will say the same thing -- we need a first-order model before you need the ELM. This is not some business problem that you need solved to maximize profit, it is a model that is closest to reflecting reality.

You don't need a first order model of planetary orbits to state that the sun will rise tomorrow. Even when everyone thought the earth was flat, they still knew that the sun would rise the next morning, set the next evening, and shine for longer in the summer than in the winter. Heuristics are not all bad (unless there is a Black Swan).

For example, suppose that the world was composed of a single country.

I really like the principle you're pursuing here, of ignoring national boundaries and considering the world as a closed system. However, the sad fact is that national boundaries *do* matter: the first figure of the article demonstrates that point, that a nation's production history is a strong determiner of its current consumption trend.

A key assertion of the ELM seems to be that consumers make decisions based on production/export statistics internal to their nation: they don't look at the global energy situation.

Borders are inconvenient and annoyingly variable and contingent, but they can't be ignored.

Yes, and that is precisely why I put it in terms of a matrix formulation above where you keep track of all possible paths between oil exporters and importers. That defines the borders of a closed system (we are not sending oil to Mars yet). The ELM folks don't do this as far as I can tell, preferring to look at in terms of isolated or loosely-coupled systems.

You mean that the USA hasn't looked at the global energy situation since they became a net importer in 1949?

Note that the table I posted in the article is just a summary. In my database, I have three large matrices of 218 rows by 30 columns each, one each for production, consumption and net exports by country. My database is thus a closed system, and it allows all possible paths between exporters and importers implicitly. If one then starts earmarking certain exporters for certain importers only, the impact of that on everyone else is exactly like the dynamics of ELM: the pie shrinks faster than you'd think it would.

Now you understand why I ask the questions. For anyone to have any chance of reproducing what you have done (the hallmark of science, BTW) you need to explicitly lay out your calculations.

So you have 218 oil consumers/producers and 30 oil producers?

There are about 195 countries in the world so the value of 218 almost makes sense. But only about 75 oil producers exist, so you may be a little short on that, unless you count just the significant ones.

So you have 218x30=6540 matrix coefficients in your database?

Is this getting close to what you are doing?

The fundamental problem is that without the first order model of overall production, what exactly are you comparing it against? So it shrinks faster than you think it would ... compared to exactly what? That is my contention of ELM being a second order model.