The ASPO-USA Conference - First Afternoon

Posted by Heading Out on October 8, 2010 - 10:48am

One of the speakers commented, just at the beginning of the ASPO 2010 Peak Oil Conference, that we would be subject to enough information that it would seem that we were standing under a fire hose. Well the Conference has had its first day, or at least afternoon, our first fire alarm (we got to the top of the stairs before being told it had been dealt with) and our first reception is over, as is the evening keynote session. He was right.

I occasionally think that attending Conferences should be a biennial practice, since change in the papers is so slow – but so far that hasn’t been the case this year where the new information available is already evident, though some of the old lions are still roaring on the same topics. There were three concurrent sessions this afternoon, and so I can only report on one set – starting with the session on the Export Land Model (which just gets more worrisome); then the Oil Drum session (where I was a speaker) and then the session on Energy Alternatives (which mainly talked about EROI). This report is being written incrementally, and has been updated once, but I will add the evenings two sessions in a second post, given the length that this one has already.

Jeff Brown began the session on the outlook for exports. His Export Land Model is now well recognized within the community, and after paying a short tribute to the late Matt Simmons, always a friendly and helpful face at these meetings, he brought us more up to date on where the model predictions were being validated, and what they were showing. With lots of papers to cover I can only hit the very high points of the presentation, so this is a very short summary. After commenting on how production declines in major fields, he tied this in to the rising standards of the producing country, and showed that, in a base case a 5% decline post-peak production for a country’s oil, when matched with a 2.5% growth in that country’s consumption, driven by the oil, but continuing after it starts into decline, rapidly lowers exports. Simplistically within 3 years after peak the country will have exported half the oil it will export post-peak. He then compared this theoretical situation with the realities of Indonesia and the UK, where within 9 years for Indonesia, and 6 years for the UK, the countries stopped exports and became importers. Export declines in the final years were over 25% per year.

He pointed to the problems that Venezuela is seeing, and noted that consumption in Saudi Arabia is rising at 6.9% a year. He anticipates that Saudi Arabia, until recently the largest exporter (now behind Russia), will stop exporting before 2030. Looking at the top 5 exporting nations, who collectively supply 50% of the imported oil around the world, he anticipates that they will have shipped half of their remaining export volume in two years. There are now only 33 countries that produce more than 100,000 bd. And, for these, production is sensibly flat over the past five years, while consumption has risen from 16 to 17.5% of production.

While unconventional oil is supposed to be a positive contributor in the future, he noted that when Canada and Venezuela are combined, production is actually falling. The worrying factor is the combination of China and India, who have increased imports from 11.3% of the total in 2005, to 17.1% in 2009. If this continues they will consume 25% of global oil exports by 2015, which will significantly reduce the amount available to the rest of us.

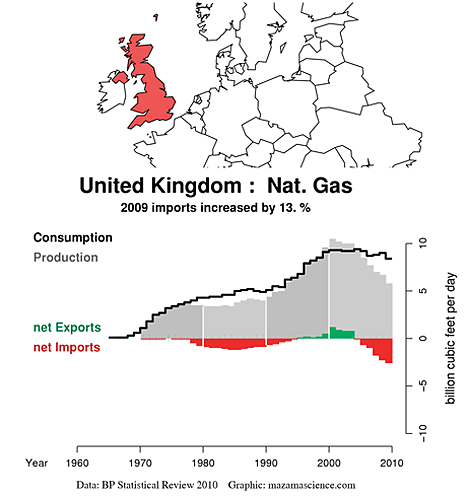

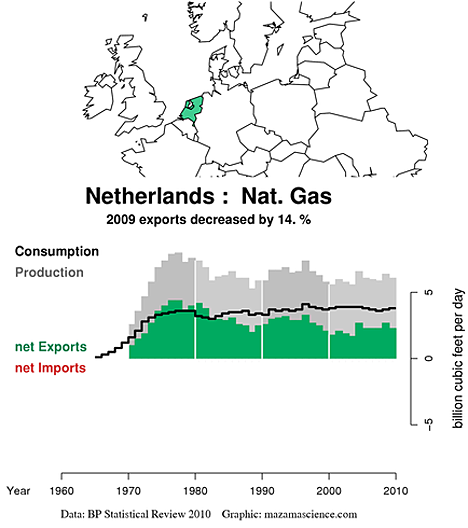

With the first speaker having raised the problem of oil, it was Jonathan Callaghan who shifted the topic over to Natural Gas. Jonathan runs the websites on energy that I use as a reference on occasion, where there are very useful plots of the energy consumption, production and import/export balances for the nations around the world. These provide patterns for the various fossil fuels, by nation, and Jonathan used representative plots from the series for his talk, beginning with the UK.

Noting that the UK used town gas (made from coal) until 1959, when the first LNG was imported from LA, gas in the UK was privatized in 1986 and reached peak production in 2000, becoming a net importer of natural gas in 2004. This last winter it was necessary, on three occasions for the National Grid to issue “Gas Balancing Alerts”, where industrial consumers should reduce use to protect domestic consumers. The situation is anticipated to get worse.

He contrasted this way of managing a resource with that of the Dutch, who have the large Groningen Gas field but which they have managed in a much more conservative way. With their different management philosophy they have retained a considerable margin for the future, over the same time interval.

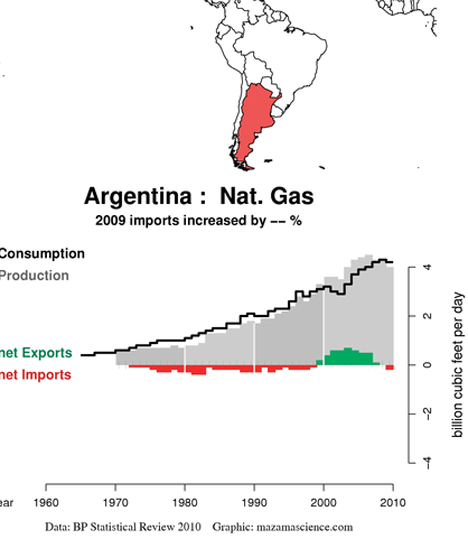

Presentation of the data in this way also allows judgments that are not otherwise immediately obvious. For example consider the data for Argentina:

Without looking at the export/import data it might be hard to decide whether it had peaked in production, but when that data is examined the conclusion is relatively obvious.

And thus he went through different countries showing how the analysis of the plots, with a little local knowledge, gives a global picture of what is going on. As South America moves to becoming an overall importer and China is adding compressors to the pipeline from Turkmenistan to increase the flow rates, the time before world production peaks may be considerably sooner than people realize, since most of the fields are being run on the British, rather than the Dutch model.

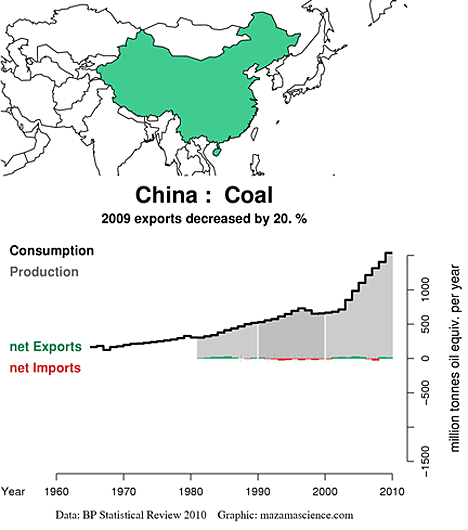

He then turned to coal, in what was really a second talk, looking at the amounts that are available (pressing the coal button on the website) allowed him to note how dominant China is becoming in coal consumption.

The problem, however, is while the condition of the industry is known in general, the behavior of China and India will likely govern overall future coal use in ways that we have yet to understand.

There was then a very short break, and the team from The Oil Drum took to the podium. Gail Tverberg began with introductory remarks explaining some of the factors, such as Geology, Technology, Economics and Timing that influence production and its impact on demand, and ability to respond to it. She noted the difficulty in justifying large investment for increasingly expensive reserves, and the problem in justifying the expense years in advance of production. Further when there are new crises, which could be created by one of several scenarios (including higher industry taxes) drops in production which can be relatively immediate cannot always be made up in that short a time interval. And sometimes those with the capacity might not be so inclined – particularly if the shortage drives up prices.

I spoke second and took as my theme that Technology, while it can come to the rescue on some occasions if needed (the horizontal well, slick fracture development of gas shales for example) requires considerable lead time and the solving of several technical problems if it is to succeed. Those solutions as has been stated in the Hirsch Report, can take 20-years to become a significant player. Thus while, for example, the “Green Hornet” flew with biofuel power this April, it used oil from camelina, which is not a popular agricultural product in the US. I then pointed out ( and I will expand this thought into a technical post, perhaps this Sunday) that those who anticipate Peak Coal in the next few years are likely going to be mistaken. The reason there has been no innovation in mining has not been because no one has thought of answers, rather that what is used today is too cheap to need replacing.

Dave Murphy then gave a discussion on the changes needed to move away from the classical economics theories toward recognition of other factors in societal health. He noted that national economies are tied to the consumption of oil (which is then tied to price) rather than to oil price itself. The variation between expansion (up 2%) and recession (down 2%) is not great, though it is the provision of cheap fuel that has funded international growth. Every recession since 1970 has been preceded by an oil price spike.

We are now in an era where small fluctuations in flow (on the order of 1 – 2 mbd) can have a significant impact on price and economic stability. We are entering a period where the cost of production of oil begins to reach the point at which a recession is started, but the drop in demand in a recession would not justify the oil supply. And so this conundrum illustrates the world into which we are rapidly entering.

As the production of energy requires complex drilling platforms that rent for $450,000 a day (of the Deepwater Horizon ilk) rather than the wooden platforms used to drill Spindletop, those costs will only continue to rise.

With so much uncertainty it is, perhaps time to change economic models, from the neoclassical to bio-environmental. He noted that studies have shown that emotional happiness increases only until a person earns $75,000 a year. Above that there is no increase, and so perhaps we should be content when we reach this level, and stop the perpetual growth cycle.

The session closed with a talk by Jeff Vail, who talked of the “Rescuing of Suburbia.” Much has been written about the trouble that those communities are in, but does it really need rescue? Of the 150 million Americans living in the 40 million homes in Suburbia, how many would have the money to relocate and where? There are 5 million homes at risk of, or in foreclosure. Those 5 million homes in foreclosure are a big problem already-how could one afford to abandon the 40 million homes in Suburbia?

Commuting costs are a real problem, but this is a low hanging fruit. But to save energy and cost, one must accept inconvenience. (The Admiral later in the evening talked of going to a child’s game and seeing all the neighbors there in there SUVs , all having driven separately an hour and forty-five minutes to get to the game, and the same back.) He talked of making other decisions, citing Brad Lancaster in Tucson who harvested rainwater to grow food to feed 50% of the needs for a family of four on what started as a barren lot. The open spaces also allow more effective installations of solar power.

The transition however must go beyond that, if we are to re-invent suburbia – and there are tools in development. For example, rapid prototyping equipment and early machines that can make 3-D objects from computer programs is in development. This will allow small-scale manufacturing and construction, and distributed manufacturing decentralizing the process and empowering suburbia. Suburbia, it must be remembered, has need the greatest egalitarian land ownership movement in history. Unfortunately the transition, without significant help, will not happen fast enough.

We then took the break in which I started this post. I'll write on what came next in a second post.

Thanks, Dave, for writing this amidst all of the activity.

I think we are seeing more government people here. Perhaps more industry folks as well. I had the opportunity to visit a little with an economist from Chesapeake Energy last night. They are concerned about peak oil, and would like to see more natural gas for vehicles.

So it is an interesting group. My introduction was trying to bridge the level to make our story understandable to a group who may never have read The Oil Drum.

Chesapeake and Pickens Plan

http://www.dallasnews.com/sharedcontent/dws/bus/stories/090908dntexpicke...

In the latest planning document of the New South Wales government (Australia) peak oil is mentioned in this sentence:

http://www.transport.nsw.gov.au/infrastructure-australia-submission-augu...

That sounds promising. But then the submission for funding contains new freeways and road tunnels (getting 2 ticks out of 3 for "reducing greenhouse emissions"), although a recently opened road tunnel in Brisbane, in the neigbouring State of Queensland, may not be able to pay back its debts after just one more year, due to lower than expected traffic volumes. I have documented this in my menu item

"I told you so"

http://www.crudeoilpeak.com/?page_id=1362

This demonstrates that peak oil awareness and CO2 reduction are only quoted for the purpose of appearing in the report for completeness. But in actual fact - when it comes to proposing concrete projects - reference to peak oil means nothing and it will not stop governments doing business as usual - until we get another oil price shock or the problem becomes physical.

Dave,

I agree that the flood of information is like a fire hose.

A couple of minor corrections. Consumption (C) as a percentage of production (P) for the top 33 net exporters in 2005 rose from 26.1% in 2005 to 29.1% in 2009 (top 33 are 99%+ of total net exports). Chindia's net imports as a percentage of top 33 net exports rose from 11.3% in 2005 to 17.1% in 2009.

We did two scenarios regarding the top 33 net exporters. Under both scenarios, we assumed a small production decline of 5% from 2005 to 2015 (0.5%/year), and we assumed that Chindi's 2005 to 2009 rate of increase in net imports continued out to 2015. The variable was consumption among the exporting countries. Scenario #1 held them flat out to 2015 at their 2009 consumption rate, while Scenario #2 has them increasing consumption out to 2015 at their 2005 to 2009 rate of increase.

Under scenario #1, global net exports drop by about 10% (46 mbpd to 41.6 mbpd), while Chindia's share of global net exports increases to 29%. The volume of net exports available to non-Chindia importers falls by 28% (40.8 mbpd to 29.5 mbpd).

Under scenario #2, global net exports drop by about 14% (46 mbpd to 39.5 mbpd), while Chindia's share of global net exports increases to 31%. The volume of net exports available to non-Chindia importers falls by 33% (40.8 mbpd to 27.4 mbpd).

Here is the key summary regarding Scenario #2:

Hi,

will you be making a copy of your presentation available at some point?

Regards, Nick.

I am working on the long postponed update to the top five paper that was posted in early 2008.

Thanks, Dave, for putting this together.

John Michael Greer, me and Dick Vodra had the job at the beginning of the conference to set the context for the attendees (at least for the people in our track). I spoke about the big picture and how we will likely contract, a bit on the role of debt and then some new material on discourses. That part in people are telling me was very useful because they now understand why this conversation is getting rejected by the network.

The session was very well attended in the main room of the hotel. I don't have the video yet but I've posted the slides and the transcript.

John Michael spoke about the history of investment and how, in a contracting world economy, on average all investments will lose money until we dramatically alter how we invest. The current system is a very temporary aberration in our history.

Dick gave a good review of the unknowns that we know about. In other words, aside from contraction, the future is very unknown.

http://www.postpeakliving.com/content/aspo-2010-talk

aangel: I've just looked at the PDF you provide at that link. thank you, well put together

Is Dick Vodra's material available? Sounds interesting.

(not to slight John Michael ... I've been following his blog quite a bit, and check his books out of the library, so his ideas are familiar to me)

-John

aangel: Ditto. I also just looked at the PDF you provide. Thank you! Job well done.

(Too bad though, that the conclusions of your talk couldn't point to a Cornucopian Happy Meals future.)

Yes, Andre', very well done. Super short but straight to the point and the discourse concept is very helpful. It can be really frustrating to feel something so strongly and yet face nothing but silence or denial.

Thanks everyone. It's my privilege.

Edit: I don't know if Dick is making his slide deck public. I'll ask tomorrow. Gotta go to bed now. Long conversation at the bar about all sorts of post peak topics...

Great PDF, aangel!

This musical gem by Roy Zimmerman might work as a soundtrack to the your presentation...

Via: scienceblogs.com/pharyngula

http://www.youtube.com/watch?v=qNi1sevKNd0&

"End of the Ship" by Roy Zimmerman

This is Dick Vodra. I'll try to post my slides on Monday. I don't have access to the computer they're stored on today.

"He anticipates that Saudi Arabia, until recently the largest exporter (now behind Russia), will stop exporting before 2030."

I think that is total nonsense. You can't eat oil; Saudi Arabia will have to export oil to pay for all huge number of products it consumes and will cut internal oil use so it can do this.

As to the other comment that happiness does not increase after $75,000/year in income--I doubt if more than 1% of the world's population are at this level.

To be more precise, I usually try to remember to say that Sam's projection is that Saudi Arabia will approach zero net oil exports between 2030 and 2036. I suspect that a lot of world trade will ultimately consist of net food exporters trading with net energy exporters.

That is a very cogent statement... one that we should consider carefully.

How do you see trans-oceanic trade proceeding in an era of limited energy resources?

Craig

Who will the net food exporters be? This will limit the amount of transoceanic trade.

Very few countries will still have a surplus of food to export if fuel and fertilizer shortages crimp production. Those which produce a large surplus of food relative to internal consumption -- Australia Canada and New Zealand are about the only ones I can think of -- may still be net food exporters.

Countries like the US which currently export only a small fraction of food production, but waste a lot of farm products by using them to produce ethanol and to fatten cattle may be able to maintain some exports.

But overall, if transoceanic trade is reduced to two-way trade of oil and coal in one direction and grain in the other, there will be only a fraction of today's trade.

> Countries like the US which currently export only a small fraction of food production ... may be able to maintain some exports.

I hope so! Otherwise, everyone else will starve. The USA comprises more than half the total export market for grain, based on these figures:

http://www.nationmaster.com/graph/agr_gra_coa_gra_exp-agriculture-grains...

Have I misunderstood this somewhere?

I must be drowsing off.. that statement is making me think of a PO-inspired retelling of 'The Gift of the Magi', where the US and SA are making a sweetheart's exchange of Tankers full of Grain and Crude.. and somewhere, out in the uncaring Atlantic, The ship full of grain has stalled out, with no more Bunker Oil, while the Other ship has lost control as a result of the crew starving towards insanity, and they drive right into the grain ship, sinking both..

That is really funny. :-)

+10

Pasttense, I don't think that is meant to be taken literally. If present trends continue then that would be the case. Obviously present trends will not continue until 2030. That is an impossibility because without oil exports the economies of all importing nations would collapse. That will happen and a lot sooner than 2030.

The current population of Saudi Arabia is 27,137,000 with 9,500,000 of those expatriates according to Wikipedia. That is a whopping 35 percent. Obviously as exports begin to decline many of those will be sent home. This will cut down on domestic consumption but it will also, though not immediately, cut production.

Any way you slice this pie, Saudi Arabia is in for hard times just like the rest of the world.

Ron P.

Have you factored into you thinking the fact that S. Arabia is a very large investor in agricultural land in Africa, esp. Somalia, and is responsible for that poor starving nation being a net food exporter of fresh vegetables etc? Buying out small poor landholders in the best rainfall areas and organizing large industrial-scale fresh food growers on which the former landowners have become poor wage labour?

I wonder if they use World Bank development funds for the purpose.

Before Saudi Arabia reaches zero crude oil exports, they will stop subsidizing the domestic price of gasoline causing domestic demand to plummet and their economy to enter recession. Westexas describes this interval as Phase 2 of ELM (Net Oil Exports and the "Iron Triangle" post 212833 July 13, 2007):

Did he supply a concise mathematical definition of the Export Land Model?

TOD recently had a post on verifying ELM, and no one could supply the definition. I offered up one or two based on translating the English language description but no one would commit.

The candidates are:

dPc/dt > dPe/dt (Internal consumption rate greater than export rate)

or

dPc/dt > 0 (Internal consumption rate will continue to rise after peak)

non sequitur from yesterday

For derivatives and associated theory, see The Swaps & Financial Derivatives Library: Products, Pricing, Applications and Risk Management, 3rd Edition Revised (Boxed Set) (Wiley Finance) [Hardcover]

Hardcover: 4700 pages

Shipping Weight: 14.6 pounds

Also Traders, Guns and Money: Knowns and unknowns in the dazzling world of derivatives Revised edition (Financial Times Series)

The first book is $355!

The second book:

ELM I fear suffers from some of the same problems as Black-Scholes, as no one really can pin down what it is supposed to tell us. Yet, at least B-S has an equation one can dissect.

Where is the equation for ELM? It is a model isn't it? From what I gather, it is a universal observation that can mean anything you want it to mean.

Given an ongoing production decline in an oil exporting country, unless consumption falls at the same rate as, or at a faster rate than, the rate of decline in production, we will see the following:

Regarding #3, a rough rule of thumb appears to be that about half of post-peak CNE (Cumulative Net Exports) are shipped about one-third of the way, time-wise, into the decline period.

Good.

#1 implies that dPc/dt > 0

#2 implies that d2Pe/dt2 < 0

The first one says the internal consumption curve is rising with time

The second one says that the export curve is an updown-shaped parabola (minimally).

The third qualitative statement implies that export is beyond peak on that parabola.

In other words dPe/dt < 0

So the ELM is this concisely:

dPc/dt > 0

dPe/dt < 0

I think it's this.

dP/dt > 0. Ok I think, all is great, production is up.

However, even given the above condition,

dPc/dt > 0 and dPc/dt > dP/dt. Therefore,

dPe/dt < 0 because P = C + E and C < P. Furthermore, once said country peaks,

|dPe/dt| > |dP/dt|.

That is definitely another inequality that holds.

I think of it more as a heuristic than a math model.

Without ELM, you'd be tempted to graph world production against world demand when thinking about prices.

ELM says - don't do that - instead, graph global exported oil against global demand*, to think about prices.

So prices reflect utility of oil - to non-producers - of oil leftover after producers' consumption.

Further, ELM reminds us that internal consumption can grow with less physical/political/economic constraints than exports.

* : actually, world sum of { each country's remaining demand after consuming self-produced oil }

The only thing unusual about an ELM view of world oil use / resources is that it values the consumption of residents of exporting nations only, a strange concept. Why are consumers in S. Arabia more important to competition (apparently in the USA) for the world market for oil than those in China? I've heard some propose export controls, but somewhat doubt that those SIGNIFICANTLY distort the world market. Others have proposed the significance of oil revenu accruing to residents of export land (??S. Arabia?? LOL), but am convinced that the money of Chinese consumers, not derived from oil exports, is no less valued by producers.

Bottom line is, it is the changing economic conditions of all competing consumers worldwide which affect the world market for oil, regardless of why those conditions of any particular group improved or reduced.

My response to similar previous comments:

Consider a recent example--Russia banning wheat exports. Let's assume, for the sake of argument, that Russia were the sole source of wheat for the world. Would you rather live within the national border of Russia or outside its borders?

But back to oil exports; we looked at 16 net exporters showing production declines. Their net export decline rates ranged from about 2%/year to over 20%/year. The median was about 7%/year (at 7%/year, the volume of net exports falls by half in 10 years). And I have yet to find an example of an oil exporting country where their production decline rate has exceeded their net export decline rate for an extended period of time.

If the ELM concept is wrong, find me some examples of net oil export decline rates being above production decline rates on a long term sustained basis. As WHT might say, show me some numbers.

Here is my complaint: I keep getting qualitative arguments against a quantitative model that is basically 100% supported by real life case histories.

From the point of view of oil importing country, the math is inescapable--almost certainly a long term accelerating rate of decline in global net exports. And then we have the "Chindia" factor.

Exactly, I dare say:

ELM puts the real world back into economic models of oil consumption. Any model that treats the whole world as one unit is flawed. (Side remark: this is also true for the original Limits to Growth model, which was a whole-world model)

One world models work better IMO because they have better statistics and it's easier to apply the maximum entropy principle because fewer constraints exist.

ELM actually didn't work in predicting global peak ahead of schedule because it appears that global peak occurred at the same time as export peak.

That brings up one of the interesting factors with export land. Assuming Russia has a bad crop and band exports what is the real harvest ?

If obvious food shortages or extreme price speculation become rampant or they start importing then you know it less than enough for Russia.

The problem is once you get into and export land situation its difficult to know what the total production level is because production vs internal consumption becomes ill defined. The larger the value the less well defined it is.

Peak oil is a total production concept but this split between producers providing for local consumption and for export makes it difficult to actually determine the total.

Underlying this of course is the simple fact that in general only the government has total production stats no one else has access to the overall data. Consider how the US manages unemployment numbers and a whole host of other statistics changing the methodology routinely. Most other countries don't even have the machinery in place to even collect the stats much less manipulate them.

This export land induced fuzziness is in my opinion and important issue.

As another example the middle east and OPEC in general has never been open with its reserves and even production levels. The data simply is not published. Compare the world with Norway for example.

Here we have the same problem as producers that do publish excellent data dwindle the error term gets larger and larger or more correctly the uncertainty.

Last but not least these uncertainties need not be isolated any nation can become politically motivated to accept and uncertain number from another country to adjust their own numbers to match. As and example not once have I read and article about some African fuel shortage where the official actually admitted that supplies where tight.

Its all ways some sort of operational/logistics problem. The point is that as long as uncertainty exists in the system it can be leveraged and propagated for political gain.

Indeed it seems uncertainty and unexpected results are the new normal. For me at least this is one of the most important factors which arise from export land. We can expect uncertainty to steadily increase over time.

In today's news, we find that:

http://online.wsj.com/article/SB1000142405274870465730457554025176588587...

If the Department of Agriculture, with its vast bureaucracy, has problems getting a grip on how much grain is produced in the US, one can imagine how much worse it is for Russia, Ukraine, and other central Asian countries.

I am fairly certain that no country will export food without taking care of its own first, unless it is somehow related to an export deal to get enough fertilizer, oil, etc. to produce the food. In fact, all available recent examples indicate that food exporting countries close down food exports while they still have an some excess of food available.

It is not hard to imagine oil exporters shutting down exports 'early' too. I like the exportland model as telling us where we are heading - that is will we (in the US) be able to import enough in the future? As I have said before, eventually we won't be worrying about the price of oil, but whether we even have enough oil as we want. Signals such as seeing an oil exporter closing down exports would be a very important signal - since oil exporters, such as most of OPEC, don't give us specific export totals.

Greed is enough for farmers and international corporations to shortchange the local citizens and sell to the highest bidder. Different countries have different attitudes. Anywhere there are exports of food with a starving population, your assertion is contradicted. Argentina comes to mind.

The ELM is intuitive, especially after your good work in 2007. In an oil exporting country, when production is declining and internal consumption is increasing, this can only lead to an even higher compounded rate of decrease in exports. It is great to refine the math on all of this but it may be better to just keep it simple when trying to communicate this concept. It is a simple, common sense idea.

It is the energy equivalent of "Feed our own country first" or more to the point "Feed your family first".

I just find it odd that this proverb or adage gets raised to the level of a "model".

Most people's eyes glaze over when you go much beyond that.

Rest assured that is not my audience.

Ha, I understand. Unfortunately, after years of talking about this stuff with people who should know better, my tally of glazed looks is awfully high.

A recent case in point was when an advisor (who has a masters degree in economics) to high level political candidate asked me if I was sure that oil could not be manufactured quickly by some other means vs having to wait hundreds of millions of years to produce it.

Or, I often get the comment that those 'enviros' are preventing us from pumping our own oil.

Hi Jim,

Overheard on the bus (a couple of years ago):

"Al Quaeda controls the oil."

This story does not surprise.

On the other hand, it does make one want to cry.

How can so many be so ignorant about the sciences and technologies that make our current and nonnegotiable way of life possible?

Well, as author Arthur C. Clarke is famed for having said: "A sufficiently advanced technology is indistinguishable from magic."

And for the overwhelming majority of people in our social network, everything happens by magic.

1. You turn on the computer thingy and ... wham ... there is the Internet chugging along at T1 speeds as usual.

2. You turn on the automobile thingy and ... wham ... it "goes" (so it goes).

3. You take a pill the doctor gave you and ... wham ... you are better.

So where does oil come from? It comes from the gas station at the street corner of course you silly silly. "They" see to it that it will always be there. "They" always have done so.

"The only thing unusual about an ELM view of world oil use / resources is that it values the consumption of residents of exporting nations only, a strange concept"

But this is exactly what happens. Plenty of producer regimes are incentivised to value their domestic populations over other peoples, even if they are hard-nosed capitalists, since the populace can back the coup. Look at Iran.

The general definition of ELM is that oil producers show a preference for selling their oil to domestic customers, more so than an equitable distribution would demand.

This is true because if you took the converse of this statement, i.e. if distribution was perfectly equitable and fair, you would never see ELM effects.

ELM essentially describes the trend toward isolationism and nationalism.

Ant-ELM describes free trade and globalism with respect to oil exporting policies.

Back in the days when minority guys had a really hard time getting a job, these two (minority opinion)guys Sam and Tex show up at a trucking company advertising for drivers.The secretary gives them ten page applications, explaining that they must be complete and no blanks, figuring they won't be back.

The next day, they are back, and letter perfect.

So the call for the drivers records and health reports is issued.

Perfect again.

Road test.Perfect again.

Tested on knowledge of all paperwork and regulations pertaining to common carriers-record high scores.

Redneck Boss in desperation thinks he simply must hire them, but in house lawyer wants a shot at glory, and Sam and Joe are informed that new hiring policy includes group interview with management.

So lawyer poses a question thus:

Sam, you have started down a long steep mountian when suddenly you find out you have no brakes;the truck starts speeding up;you're doing sixty, sixty five, seventy , seventy five;and all of a sudden a sign starts flashing reading rockslide, the next sign reads all lanes closed, the next one detour ten mph one mile, prepare to stop.By now you're doing ninety.

So what are you going to do?

Sam , hesitates, and the lawyer pounces, insisting on an instant answer, as this is an emergency situation, asnd Sam is driving a company truck worth a quarter of a million loaded with a couple of million dollars worth of merchandise

So Sam answers that he supposes he will wake up Tex, his codriver.

Lawyer pounces, asking what this will accomplish towards solving the problem, and he gets his answer.

"Nothing at all.But Tex has never seen a wreck like the one we're going to have."

The moral of this story is that Sam and Tex don't need a mathematically and statistically perfect model to understand thier problem.

I'm an Irish man and have actually seen old newspaper ads and so forth stating " No Irish need apply", so I hope any minorities reading this little story will appreciate that no slights or insults of any sort are intended and apologize in advance to those who might be offended.

Three clicks on the inappropriate button and it will be gone of course, but I hope it stays up.

OFM

Your analogy is spot on. I have found recently that it is becoming harder and harder to get people to consider (really thoughtfully contemplate) out of the box concepts and change. Instead they look for inconsistencies/problems in the new approach rather than grasping the basic concept and working to eliminate the inconsitencies through dialog or data gathering.

Meanwhile established models that have more and more data indicating they are flawed are vigorously defended (often by the same people) when the data clearly says soemthing is amiss.

I fear this increasingly entrenched dogmatic thinking process in the U.S. today more than I fear the changes forced by a debt crisis, peak oil and over population. A willing and open mind can solve many problems but a closed mind will starve to death rather than eating from a buffet of new knowledge.

#2 neglects what happens when dPc exceeds domestic oil supply. Eventually domestic consumption must equal domestic production plus imports - like it does in America today. When exports end, domestic consumption = domestic production; and, zero is a horizontal asymptote, at least in theory.

Craig

That is true. ELM is really a descriptive model of a narrow window of time.

Any model that can be expressed purely as inequalities can never become a quantitative model since it can by definition generate an infinite number of solutions. All it does is describe the situation where the data crosses the boundary into ELM territory.

Try this. What is the quantitatvie model for X> 0.

Well, X=1, X=9999, x=0.0000, x=55.87529, are all equally valid.

x=0.0000 is not in the domain of x>0. Otherwise, quite right.

x=0.00000001 would be, though.

Craig

"After commenting on how production declines in major fields, he tied this in to the rising standards of the producing country, and showed that, in a base case a 5% decline post-peak production for a country’s oil, when matched with a 2.5% growth in that country’s consumption, driven by the oil, but continuing after it starts into decline, rapidly lowers exports. Simplistically within 3 years after peak the country will have exported half the oil it will export post-peak. He then compared this theoretical situation with the realities of Indonesia and the UK, where within 9 years for Indonesia, and 6 years for the UK, the countries stopped exports and became importers. Export declines in the final years were over 25% per year."

Mexico is another good example of the ELM. After peaking in 2005 they are due to start importing next year. This doesnt bode well for countries with absolutly no oil production. They could literally have oil imports suddenly cut off with all the ensuing problems that will cause.

As David Shields predicted, Mexico's overall rate of decline in production has slowed, and his estimate, which appears to be more accurate than mine (approaching zero net exports by end of 2012), is that they will be approaching zero around 2015. But the remaining CNE (cumulative net exports) in the final third of the decline phase are pretty small. Typically, about half of post-peak CNE are shipped in the first third of the decline phase. So, Mexico probably shipped about 50% of post-2004 CNE by the end of 2007 to 2008.

OK, cheers for the update.

What is the level of attendance by members of the MSM so far?

I just checked the site search functions of both Washinton papers and that of the NYT as well.

Nothing at all about the conference, so far as I can see, made it into any of these three papers.

Obviously the truth is too scary to be broken to the children.

A google search-I admit I am not highly skilled in searching- returned the first mass media hit about fifty spots down-a television station in South Carolina has links on it's website.

Of course there are countless hits among various kinds of web sites devoted to the environment, economy, and so forth, but none I recognized as conventional mass media outlets..

Nearly 42 million Americans are on food stamps which represents almost 12% of the spending on food in the USA.

The MSM may not be reporting on Peak Oil, but the reality is growing every day.

I guess it is sort of like the question about, if a tree fell in the forest and no one was there, would it make any noise. If oil peaks and no one reports it, can we continue with BAU?

Craig

For a first pass at searching I plugged "ASPO" into Google News and get about 25 hits, and most of them were just picking up on the PR Newswire release. Out of the original reporting, AOL News and "Globe and Mail" were the only ones, the latter being Jeff Rubin's column.

As for BAU, I'd expect it to go on as long as the stores are stocked with food and people can scrape together enough cash/aid to purchase said food.

5 years and counting on conventional. Lets just say that it ain't so bad that a bunch of people with way too much time on their hands can't all fly/drive/train to Washington and do a $400 conference on the topic.

I actually don't think peak oil in and of itself is a real problem. The real problems are population and a financial system based on endless growth. Peak oil interacts badly with both issues. The financial side is steadily becoming obvious the population side is still not. Global warming is a symptom of all three.

Peak oil is not really on the radar.

I'm not convinced it has to be as its simply one of the factors which make BAU impossible. Perhaps a big factor but one of many. All require us to fundamentally change the way we do business.

On the resource front if it was not oil it would be agricultural land, water or any number of other resources vs population that eventually constrain and hobble growth. The only thing that makes it special is its central role in our current economy.

Its easy enough to consider a number of societies where peak oil would have practically no impact.

Many are offered as "obvious" solutions but the important thing is that they are different from ours.

Thus oil is simply one of many factors that will force us to change to some other society.

Yes, it could be any number of resources if they were a) as ubiquitous as oil b) as difficult to substitute for as oil, and c) had "peaked" as oil has.

For every oily carbon atom burnt there are two oxygen atoms also consumed, it's just that we haven't run out of oxygen yet :-)

Yes, there are many other resources that are also essential inputs to BAU that have become increasingly expensive as they become more costly to obtain because of competition through increasing industrialisation and population growth.

Total input cost for BAU is rising for a range of reasons and because BAU is based totally on continued economic growth, BAU is becoming problematic for a range of reasons...

If oil was still freely available at $10 a barrel instead of +$80 then maybe we'd be fretting about how to substitute for peak phosphorous or peak tin.

But oil is not freely available at $10 and a) it is ubiquitous b) it is difficult to substitute for, and c) it has peaked.

Somehow, it seems that the real problem is indicated where he says,

It is that pesky population factor that keeps getting in the way. It mitigates for the ELM, it mitigates against reduction of demand, and for peaking of - ((here fill in your favorite finite resource)).

And, it is the most difficult part of the equation. I can see no way that any government, even the most repressive, can effectively deal with that. China is trying to do that by establishing a quota of one child per couple. Perhaps they will succeed. I fear, though, that the increasing male/female ratio (as sex-determinative abortions increase) will become a real bugaboo in the future over there. My better half tells me that this ratio causes intense competition between the males, and in response the leaders of countries that see such a ratio are more likely to engage in warfare (or other activities, such as violent games, etc., that reduce the numbers of males).

The problems in the future are going to be difficult to predict, and some will be more difficult than that to resolve or even deal with (attribution to John Michael Greer I believe, but cannot locate right now).

I suppose it will be nice to have a great statistical model for ELM and for other aspects of PO, to go along with and fit into the ludicrous economic models we see (I say this b/c IMO they are based on mere assertion with no empirical basis, and utilize formulae borrowed from unrelated fields with no visible means of support. Also, they do not appear to be very predictive.) The real problem is that all of those theories and models don't have much discernible impact. We have seen them, and we (collectively, as a Nation and as a race) have not taken any action based on them. We just go along saying, "Yeah... that's what the models show," or, "Strange, the models don't predict that." No one in power and no one having the means and where-with-all to make a difference is interested. At best they obfuscate; at worst they distort reality.

Otherwise, I am an optimist, as all are aware.

And, the beat goes on...

Strange species, homo sapiens. Wonder if they'll be missed.

Craig

With our current population we are already hitting the wall on oil. We have been on the plateau with no increase in production since 2005, so even if population was frozen right where it is, BAU oil consumption + 300 million Chinese moving from low to higher oil consumption as scheduled over the next decade will keep pushing the oil price beyond the ~$80 figure causing the "permanent recession" some nations now find themselves facing.

So even without population growth we are right now faced with increasing oil consumption, increased oil access and production costs, together with a deficit of new fields available. Peak oil is peak oil is peak oil, regardless of how steep the downslope due to population growth might be.

I think there are individual people at the conference who will make more difference than the newspaper reporters.

For example, there is someone here from the International Monetary Fund who is doing work that would go into their forecasts. He has been asking several of us for input, links, etc.

Yes, he and I had a good talk about the difference between Jeff Rubin's view and Nicole Foss' view (Stoneleigh). He asserted that the equilibrium economists could include debt into their math and their thinking and that he was in fact doing that now back at his office. The biggest barrier however was the unwillingness of his fellow economists to move in that direction. Thus one didn't have to go wholesale to Keen's approach, he thought.

I am skeptical of the deep deflationary view. Have Stoneleigh and Ilargi ever explained why the Fed will hold back from doing big debt purchases? Or do they believe these purchases will fail to cause inflation?

As I see it the Fed could buy up most of the economy. It can generate as much money as it wants to. A deep deflation requires either:

- Motivation on the part of the Fed to hold back from buying debt when deflation kicks in strongly.

- Failure of the Fed's debt purchases to stop deflation.

One can argue that the Fed's debt purchases haven't caused inflation. But so far the Fed hasn't tried to cause inflation. As I see it the Fed has to be motivated to let deflation happen. Otherwise the Fed can prevent deflation from happening.

Live tweets at:

http://twitter.com/search?q=peakoil2010