Electricity price differences between countries

Posted by Rembrandt on December 11, 2010 - 10:45am

In this post an overview is given of electricity prices in a large number of countries, mainly members of the OECD. This shows how prices vary between households and industry due to tax differences, and by analyzing the sources of electricity per country, it also leads to a better understanding how different energy sources affect the price of electricity.

The price differences show that industrial electricity users are not or only marginally taxed in nearly all countries, while household taxes on electricity usually range between 10% to 35%. The analysis of energy sources show that: 1) countries with a 35% or higher share of natural gas in the electricity mix have the highest industrial electricity prices, 2) Countries with a diversified electricity mix are in the mid-range of electricity prices, 3) No general price level was found for countries with a high share of nuclear, coal, or both in their electricity mix.

Comparisons between households and industrial electricity prices

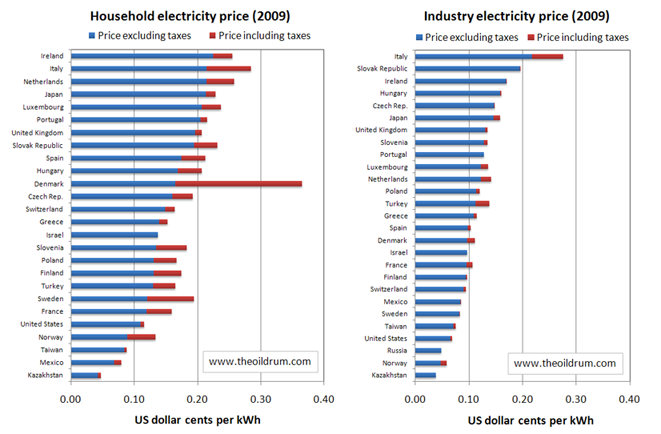

The quarterly Energy Prices & Taxes publication of the International Energy Agency is one of the best sources for energy price data. I took a dataset from it of 2009 household and industrial electricity prices including and excluding taxes for 26 countries, mainly member states of the OECD except Kazakhstan, Israel, and Slovenia. Taxes can include value transfer added (VAT), general excise taxes, and renewable energy taxes or feed-in tariffs. An overview of this data is shown in figure 1 and 2 below. Astute readers will notice that Germany is missing in the overview. The IEA does not include electricity price data in its Energy Prices & Taxes publication for Germany. The EU energy portal shows that Germany's electricity price including taxes is in the upper range in Europe, both for industry and households.

The following observations were made for this dataset:

1) The price of electricity for households and industry in this set differs by more than 50% on average. For the 26 countries the average household electricity price was 19 US dollar cents per kWh, while the industrial price was 12 cents per kWh. Many countries therefore have a clear industrial policy to try to keep their industries as competitive as possible, at least regarding energy inputs.

2) In general industry is only marginally taxed for energy ranging from a 0% up to 10% level, except in Italy (27% tax), Netherlands (15% tax), France (12% tax), Turkey (23% tax), and Norway (26% tax).

3) In most countries households have to pay a 10-35% tax rate on top of their energy bill. Exceptions on the upside include Denmark, which has an extremely high household tax on electricity (122%) to support its renewable energy feed-in system, Norway (50% tax), Sweden (60% tax). Exceptions on the downside include Israel (0% tax), Japan (7% tax), and the United States, Taiwan, the United Kingdom, and Portugal (all 5% tax).

4) Only two countries have lower household electricity prices than industry. Industrial electricity users in Mexico pay 8% more than households, and industrial electricity users in Costa Rica pay 1% more than households.

Figure 1 & 2 – Household & industry electricity prices including and excluding taxes in 2009 for a selected number of countries. Prices excluding taxes in blue and taxes added in red. Data obtained from IEA (2010). Click here for a large version.

How the electricity generation mix affects industrial user electricity prices

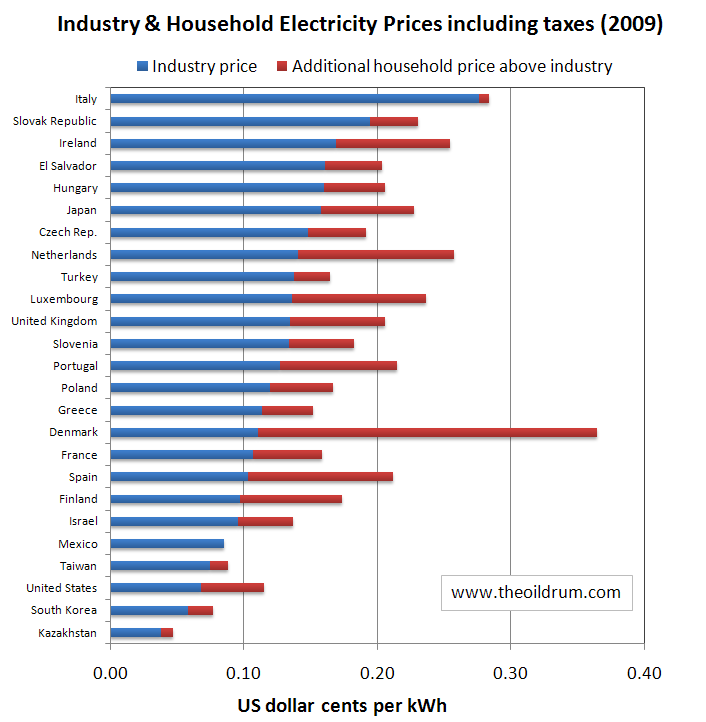

To look at effects of energy sources on electricity prices I took another dataset of 25 countries from the Energy Prices & Taxes publication, excluding countries which have large shares of hydro power. The countries are mainly member states of the OECD, except Israel, El Salvador, Kazakhstan, South Korea. An overview of the data can be found in figure 3 below.Although many other factors play a role in electricity price formation, include market structure, regulation, and interconnection between countries, I ignored these factors in this analysis due to time constraints. In such a manner only the cost differences between energy sources are analysed, but these already give interesting insights.

The following observations were made regarding industrial electricity prices including taxes:

1)The highest industrial electricity prices, above 13 US dollar cents per kWh, are found in countries that are more than 35% dependent on natural gas for electricity. For example, Italy has the highest industrial electricity costs in Europe and is 50% dependent on natural gas imports for its electricity. The country paid the highest price for natural gas pipeline imports in 2009 at 9.05 dollars per Million Btu and also the highest price for LNG imports in at 7.86 dollars per million Btu. Similar to Italy are Slovak Republic, Ireland, Japan, Turkey, Luxembourg, and Hungary. Doing slightly better are the United Kingdom, and the Netherlands as they are also producers of natural gas.

• El Salvador’s Electricity price is one of the highest in the dataset found because the country relies to a large extent on oil for electricity production. Last estimates found for the energy mix is a 45% oil share in electricity production in 2007.

2)Medium industrial electricity prices, between 9 and 13 US dollar cents per kWh, are found in countries that have a highly diversified energy mix including coal, natural gas, renewable energy and sometimes also nuclear (Portugal, Spain, Finland).

3)The lowest industrial electricity prices, below 9 US dollar cents per kWh, are found in countries that have a diversified mix including nuclear, natural gas, and coal, and are reliant on the North American market for natural gas and (Mexico, USA), and in case of Kazakhstan rely 90% on domestically produced coal and 10% on hydro power.

No pattern of industrial electricity prices, are found in countries dependent mainly on nuclear, coal, or a combination of both for electricity generation.

• High electricity prices, above 13 cents per kWh, are found in Slovenia (59% coal, 32% Nuclear), the Slovak Republic (39% Nuclear, 32% Coal), and Czech republic (59% Coal, 32 Nuclear).

• Medium electricity prices, between 9 and 13 cents per kWh, are found in Greece (52% coal), Poland (90% coal), Israel (63% Nuclear), Denmark (48% coal), and France (77% nuclear).

• Low electricity prices, below 9 cents per kWh, are found in Taiwan (49% coal, 22% nuclear), South Korea (34% nuclear, 38% coal), and Kazakhstan (90% coal).

Especially interesting is the difference in electricity prices of Poland and Kazakhstan (both 90% dependent on domestically produced Coal). Respectively these are 4 US dollar cents per kWh for Kazakhstan and 12 US dollar cents per kWh for Poland. Possible differences would be regulation, differences in quality of mined coal, and efficiency of coal thermal power plants.

Figure 3 – Household electricity prices including taxes in 2009 for a selected number of countries. Industry prices in blue and household prices in red shown as an added price above the industrial level. Data obtained from IEA (2010).

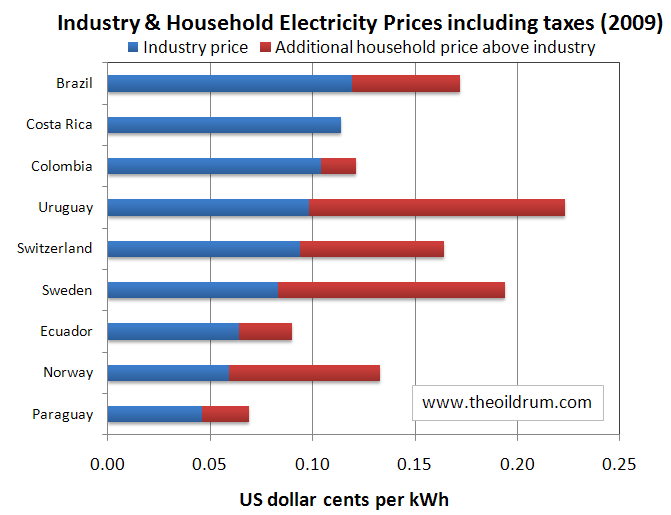

Overview of countries with a large share of hydropower in the electricity mix

The dataset on countries with large hydropower shares in electricity generation includes 9 countries. Costs ranged from a low of 5 to a high of 12 US dollar cents per kWh in respectively Paraguay and Brazil. Difference can probably be explained by difference in infrastructure costs to transport electricity. For example, Norway and Brazil depend nearly entirely on hydro power but prices differ at respectively 6 to 12 US dollar cents per kWh. Norway has a fairly simple electricity transport infrastructure, and Brazil a highly complex one, due to country size and population differences.

Figure 4 – Industry and household electricity prices including taxes in 2009 for countries with a large share of hydro power. Industry prices in blue and household prices in red shown as an added price above the industry level. Data obtained from IEA (2010).

Discussion question

How can differences in electricity price be explained between countries with a large share of coal, nuclear, or both in the energy mix?

References

IEA, 2010. Energy Prices and Taxes: Quarterly Statistics 3rd quarter 2010. IEA Publications: Paris.

There is a G7 nation that is a net exporter of oil mainly to the United States that seems to be absent from this list. May I ask why?

That country is also a big exporter of electricity to the United States, too.

Source: ASPO Canada http://aspocanada.ca/eia-country-analysis-briefs-canada.html

@Chrisale, @ Zadok_the_Priest

It is not included because electricity price figures for Canada are only included up to 2007 in:

IEA, 2010. Energy Prices and Taxes: Quarterly Statistics 3rd quarter 2010. IEA Publications: Paris.

Rembrandt

It is something of a gap since Canada is a major electricity exporter to the US. Much of the northeastern US, not to mention California, would have much higher electricity costs without Canadian imports.

I think you can take it as probable that Canadian electricity prices are at the low end of the scale, lower than the US. About 60% of Canada's electricity supply comes from massive hydroelectric projects, and much of the rest comes from low-cost coal and natural gas reserves.

Canada does have a bit of a problem in that its most populous province, Ontario, has run out of hydroelectric potential, has no significant coal or natural gas reserves, and has nuclear reactors that have reached or exceeded their "best before" date. Ontario's electricity prices will probably double in the next 20 years. Its three smallest provinces have similar problems.

However, the rest of Canada's bigger provinces have surpluses of hydro and/or coal and/or natural gas. The solution to the energy problems may be to just move people to where the energy is.

7 cents for my bill, however, we have just been told BC Hydro will receive 10 percent per hear increase for the next 3 years.

We do not need anymore people...there is a reason why high voltage lines exist. Mountains and rain we have, not much arable land. best to stay home.

Mountains and rain we have, not much arable land. best to stay home.

Just move across the mountains to sunny Alberta. You just have to get used to the brisk, invigorating winters. Not nearly as much rain, but we could clearcut all the northern forests, plow the soil, plant crops, and have more agricultural land than France. Greenpeace, of course, would be horrified.

Worth emphasising that electricity is provincial business.

Current rate in Manitoba is $0.065 for residential and $0.045 for small industrial, and $0.028 for large industrial, but it is subzero Fahrenheit as I write and and will get colder later tonight. It is pretty much all Hydro - far from being paid for. Manitoba is building hydro to sell to US.

Ontario just announced that they will keep going with nuclear, hence prices will go up, and together with FIT subsidies, most likely faster, 50% over next 5 years.

Quebec has all hydro it can use and some more, and several thousand Megawatts for pretty much free from one sided deal with Newfoundland. Their price is $0.40 per day + $0.05-$0.07 per kWh

I assume 1 USD = 1CAD, which is pretty close now.

Smallest provinces (Nova Scotia, New Brunswick and perhaps PEI) have just agreed to build underwater line from Labrador to Nova Scotia, just to bypass Quebec, so they will have their hydro, but cost of underwater line is going to be high.

So the only province in trouble is, as RMG said, Ontario

RMG, tongue in cheek, in Canada, the colder the province is, the cheaper electricity.

RMG, tongue in cheek, in Canada, the colder the province is, the cheaper electricity.

That's why I have a Hydro Parka, the perfect coat for temperatures lower than -40. I particularly like the wolf fur fringe on the hood (doesn't ice up like your eyebrows so you can see under severe conditions), and the handy slots for pencils on the left shoulder. People who don't have one probably don't have a clue what I am talking about.

Fur patch on forearm?

No, no fur patch on the forearm. No hair on the palms of my hands either.

Nova Scotia Power's residential rates are increasing 5.7 per cent on January 1st, roughly half of this increase being fuel related and the balance an increase in the energy efficiency surcharge.

Source: http://www.cbc.ca/canada/nova-scotia/story/2010/12/08/ns-power-rate-incr...

Currently, the residential rate is 11.612-cents per kWh and the energy efficiency surcharge is 0.193-cents which, combined, totals 11.805-cents; in the new year, that increases to 12.47-cents. High by Canadian standards although still quite reasonable compared to New England.

If my memory is correct, this is the eighth such increase in the past nine years and the upward pressure on rates will continue as we slowly wean ourselves off imported coal and oil. Over the past ten years provincial electricity rates have increased by a factor of 1.5 whereas fuel oil prices have effectively tripled and, in that context, electricity is holding up pretty well.

Cheers,

Paul

Hi HereInHalifax,

Is it true that Nova Scotia is currently experimenting with tidal power in the Bay of Fundy and that this is realy its "secret weapon" to get cheap electricity in the future?

JB

P.S: It is not likely to the $7 billion deal with Newfoundland for about a mere 800 MW of power through expensive underwater electrical lines (that might not even be technically feasible over such a long distance) that is going to reduce electricity costs in Halifax...

Hi JB,

I dare say there will be no such thing as cheap electricity in the future, certainly not tidal nor the LCF. However, as mentioned, we have to reduce our dependence upon imported coal and oil and, in fact, there will be no other alternative once our coal-fired plants reach retirement, which is not that far off actually. In addition, roughly 80 per cent of all homes in this province are heated by oil and that has to change; presumably, the bulk of this need will swing over to electricity.

To better protect myself from the coming price shocks (and I fully expect they will be painful), I've invested heavily in energy efficiency and I've already made the switch away from oil. As noted here before, the previous owners of this home consumed 5,700 litres of fuel oil and I believe some 14,600 kWh of electricity in the year prior to our purchase. I've effectively cut our fuel oil demand to near zero (roughly 120 litres a year for supplemental heating and DWH during extended power cuts and to help prevent the radiator pipes from freezing during extremely cold weather where routed through exterior walls) and with respect to electricity, our twelve month rolling average now stands at 10,475 kWh.

To put this into context, our home is a 42-year old, 235 m2 single detached Cape Cod and our local climate is colder than that of Buffalo, NY. Oil and electricity combined, our total household energy usage is just under 50 kWh per m2 and I believe the Passive House standard is 118 kWh/m2. With a little more air sealing and by replacing the older of our two ductless heat pumps with a high efficiency Fujitsu, my goal is to ultimately get that under 40 kWh per m2.

Anyone who hasn't already started to take steps to cut their energy use had better do so now because I fear time is quickly running out. Insulate, air seal and get off electric resistance and oil as fast as you can.

Cheers,

Paul

Thank you for your interesting response HereInHalifax.

May I suggest that you use a geothermal heat pump instead of the conventional ones. You will then get a much more efficient heating system, even less dependent on electricity and oil.

You are quite right. It is wise to be prepared for the unexpected in terms of energy supply.

How much is your overall annual heating/electricity bill?

Take care,

JB

P.S: Can you send me your e-mail so that we can exchange e-mails bilaterally. My e-mail is jonatan252000@yahoo.com

Hi JB,

Our fuel oil costs at 87.9-cents a litre are approximately $100.00 a year. I could likely cut that by half or more if I were to add antifreeze to the radiator lines but it's not a bad idea to exercise the boiler periodically to hopefully prevent things from seizing up. As it now stands, our 900-litre tank will be filled once every seven years; by comparison, during the winter months, my neighbour's tank is topped up about once every three weeks. When you add in the cost of electricity, including the meter charge, our total household expenditure is just under $1,500.00 per year or about $125.00 per month.

A GSHP is not a good fit for us because we're basically built on rock and the small amount of top soil that we do have is mostly clay which, as you can appreciate, is not a great thermal conductor. In any event, our two heat pumps consume, in total, roughly 4,000 kWh a year and I could get that down to perhaps 2,800 kWh if I were to replace the older of our two units with a Fujitsu 12RLS and, at that point, I can't imagine how a GSHP could do that much better.

Cheers,

Paul

Hi HereInHalifax,

$ 1500 per year including heating and all other electrical appliances is not expensive at all for a detached +200 square meter 42 year old house. You have done a very good insulation job and have installed an efficient heating system.

When does Nova Scotia plan to retire its coal power plants?

JB

Hi JB,

Trenton 5 was commissioned in 1970 and so it's fast approaching the end of its economic life. Point Tupper was placed in service in 1973 and it too will soon reach the end of its road. In a July 8, 2008 filing with the NSUARB, the "Probable Retirement Date for Depreciation Purposes" for Trenton 5 is shown as 2010 and for Point Tupper it's 2013. The next coal-fired plants theoretically in line for retirement are Lingan 1 and 2 in 2021 with Lingan 3 and 4 to follow in 2025.

Source: http://www.nspower.ca/site-nsp/media/nspower/IR-001toIR-126.pdf

Their decommissioning could occur sooner or later; I guess it depends upon how difficult/costly it will be for Nova Scotia Power to meet its emission requirements in the years to come.

Cheers,

Paul

Hi Paul,

Thank you for the interesting info.

What is your overall assessment of Nova Scotia's current and future energy situation?

JB

In a word, "bleak". Some 80 per cent of our electricity is currently generated through the burning of coal and oil, our transportation and housing sectors are likewise heavily dependent upon imported oil, and our off-shore oil and gas industries are in terminal decline. The SS Minnow is taking on water.

Cheers,

Paul

No wonder you decided to improve the heating facilities of your house...

What potential solutions to you see?

JB

I expect a growing portion of our energy needs will be met by electricity and this will involve imported hydro from the LCF as well as expanded wind, tidal and biomass. We need to get far more aggressive with respect to demand reduction, and the recent creation of Efficiency Nova Scotia is a small step in the right direction. It will be costly and no doubt painful endeavour, but the consequences of doing nothing are unimaginable.

Cheers,

Paul

Importing electricity from LCF is very likely a technical and economical pipedream...

How about tidal and wind power? Large off shore wind farms coupled with tidal power and individal geothermal heating/cooling units and a bit of unimaginable...

JB

I disagree. Both Newfoundland and Labrador and Nova Scotia are publicly committed to making this happen, as is Emera, the corporate parent of Nova Scotia Power. NSP needs this energy to meet the province's renewable energy standards -- 25 per cent by 2015 and, potentially, 40 per cent by 2020 (see: http://gov.ns.ca/energy/resources/EM/renewable/renewable-electricity-pla...). No question, it will be a costly and technically challenging undertaking, but it's a critical piece of the puzzle. At this point, tidal is mostly eye candy and wind and biomass can only take us so far.

Cheers,

Paul

Does Nova Scotia still have positive EROEI coal reserves that could be used?

JB

P.S: To be quite frank, if I were the Nova Scotia power authorities I would push for an energy mix that I can as much as possible control like local coal mines, local tidal power, local wind power... Trusting never tested undewater electrical transmission lines that run several hundred miles underwater and that cannot easily be repaired appears to be quite a gamble.

Coal mining in this province is officially dead, Westray being the final nail in that coffin, besides which our coal is extremely high in S, Hg and Cl, making it largely unfit for consumption. NSP won't touch it.

I don't know much about the technical ins and outs of submarine cables and their associated risks -- BC EE would be in a much better person to address this point. I do know that the NorNed cable that connects Norway and the Netherlands is nearly 600 km in length whereas the proposed link between Cape Ray, NL and Lingan, NS is 180 km (110 miles).

Cheers,

Paul

How much onshore wind resource is there?

I'm not sure, Nick; we're still in the exploratory stages, but I expect it would be substantial. In July of this year, Nova Scotia and Maine signed a memorandum of understanding to work together on this front.

See: http://www.maine.gov/tools/whatsnew/index.php?topic=Gov+News&id=110128&v...

Of course, if Cape Wind is any indicator, it won't come cheap.

Cheers,

Paul

Well, I was wondering about onshore resource, as that it would indeed be much cheaper.

Right you are... my mistake.

Pretty good actually, given our seabound coast.

See: http://www.nspower.ca/en/home/environment/renewableenergy/wind/map.aspx

We currently have 138 MW of installed capacity in place and that's expected to more than double within the next two years.

For a detailed assessment of our wind potential and the integration of wind resources within our power system, see: http://www.gov.ns.ca/energy/resources/EM/Wind/NS-Wind-Integration-Study-...

For planning purposes, NSP assumes a 40 per cent winter capacity factor and a 32 per cent annual capacity factor (as noted above, NSP is winter peaking).

Source: http://oasis.nspower.ca/site-nsp/media/Oasis/10%20Year%20System%20Outloo...

Cheers,

Paul

Paul, presumably you are running into the problem of wind power being wanted, but not where anyone lives, or can see it? Are there going to be turbines built within sight of all the American owned houses in Peggy's Cove, etc. After all, those owners bought their oceanfront hideaways to get away from that awful wind energy development in Nantucket Sound.

I am sure they will not appreciate having wind turbines on the horizon, much less the foreshore, to provide expensive power to their LEED certified holiday homes - they would much rather provide hazardous jobs to the hard working coal miners out of sight underground.

The whole purpose of having these environmentally friendly retreats that they fly to on weekends is to disconnect themselves from the busy, industrialised world that made it possible for them to own these retreats in the first place.

Hi Paul,

I can't say I've heard of any serious opposition but, then again, I haven't had my ear to the ground. There are two in-province opposition groups identified on the NS Wind website -- the Folly Lake-Wentworth Valley Environmental Preservation Society and something called Pugwash windfarm which appears to be a personal blog. You can find links to both at: http://www.nswind.ca/resources.htm

Personally, I would hate to see the province littered from one end to the other with industrial wind farms when I know we can use electricity far more wisely. Still, if we want to free ourselves from coal and oil, we need to step up to the plate.

Cheers,

Paul

I don't have a problem with the odd wind farm, but end to end would be a tragedy. Some scenic areas, should remain scenic areas, I'm sure the NS government will see to that.

I think the Lower Churchill is a better option, as of course, is efficiency

I fully agree, Paul; I would hate to see this province despoiled so that we can all frolic in our hot tubs. The LCF, although not without its own set of social and environmental consequences, seems like a more appropriate fit in many ways (after energy efficiency, of course!).

There's one small consolation perhaps: wind turbines can be decommissioned and the site physically restored to its original condition; twenty or thirty years later, the scares will have largely if not fully healed. Mountain top removal and large-scale hydro, on the other hand....

Cheers,

Paul

On the other hand, we could redefine wind turbines as a scenic attraction.

Think Holland...

Well, that's true, Nick, but I'm rather fond of things as they are.

The picture on the front cover of this report (oddly enough) was taken not far from our family property in St. Anns, or Baile Anna if you prefer to keep to its original Gaelic name.

See: http://www.gov.ns.ca/energy/resources/EM/renewable/renewable-electricity...

I'm a fiercely proud Canadian but my love for this province runs even more deep; for me, this place is pure magic and a large part of this is due to its unspoiled beauty (I'm sure anyone from Newfoundland and Labrador can relate). I don't ever want that to change.

Cheers,

Paul

Paul,

Very impressive stats - I hope you don't run into problems with "oil aging" in your tank.

Sounds like a good example for a magazine write up, sponsored by Fujitsu, of course.

Thanks, Paul. I've been thinking about this as well. The good news is that it's an inside tank and so the fuel is not subject to large temperature swings. The original tank which was 34-years old was replaced in 2002 shortly after we took possession and has a bottom outlet to minimize water accumulation -- that should help too. The filter was changed in May of 2008 when the boiler was last serviced, but we've only burned a couple hundred litres since then so it should still be in pretty good shape. I haven't added any fuel stabilizer or an anti-bacterial agent as yet, but that's on my to-do list.

I often speak of the Fujitsu 12RLS because it's such a fantastic product; with an HSPF of 12.0 it could theoretically supply 1.7 times more heat per kWh than our Friedrich. It's hard to justify a change out in purely economic terms, but shaving another 1,200 or so kWh from our power bill is rather appealing -- basically, that's enough electricity to satisfy our domestic hot water needs for eight or nine months of the year. And, of course, our current system has another eight or ten years of life left in it and so it won't be tossed into the dust bin; rather, it will be passed on to someone else who can put it to good use.

Cheers,

Paul

Have you had any experience with Daikin heat pumps? My local plumbing/heating outfit is a Daikin agent and can't get Fujitsu. They seem to be on the same level as LG etc.

I can;t believe so many houses out there heat with oil! There must be a huge opportunity for the heat pumps.

Personally I think the ductless are the best thing to come along in a while - something that can replace a lot of baseboards. The potential Quebec for that must be huge.

I have wondered if the conservation efforts by BC Hydro might be better focused on just heat pumps instead of everything but the kitchen sink. The 430 rebate for an old fridge is hardly going to make anyone buy a new one, or turn off the beer fridge in the garage. Certainly on a kW avoided basis, they must be cheaper than the new site C projects, and likely most other forms of new generation.

Not first hand, Paul. I understand they're a reputable player, but perhaps a bit pricey. If it's helpful, I can purchase a 12RLS with all of the miscellaneous do-dads for under $2,000.00.

With an HSPF of 12.0, the 12RLS supplies, on average, 3.5 kWh of heat for every kWh consumed -- the potential savings are thus enormous. Anyone who heats now with oil hot water or electric baseboard would be well served by one of these units. And you're absolutely right, utilities should be doing a lot more to promote this. The only one I know that's pursuing this with any vigour is the BPA and its member utilities. See: http://www.nwductless.com/

Cheers,

Paul

At what temperature difference does it reach a COP of 3.5?

The best COP I read of so far is 4.2 at 2C (cold) and 35C (hot) (and still a COP of 2.8 at -15C (cold) and 35C (hot)):

https://institute.ntb.ch/fileadmin/Institute/IES/pdf/Pr%C3%BCfResLW10101...

http://www.heliotherm.at/cms/en/waermepumpen/heliotherm-air-source-heat-...

(But I don't think that they are available for $2000).

The older of our two units has a nominal heating capacity of 14,000 BTU/hr or 4.1 kW at 47°F/8.3°C and at this temperature draws approximately 1,175-watts, which puts its COP a hair under 3.5. At one time you could download the service manuals for these products from the Friedrich website, but that's no longer the case so you'll have to take what I'm about to say at my word -- based on the performance curves as I've interpreted them, heat output falls roughly 400 BTU/0.12 kW for every degree Celsius downward; it's not perfectly linear as I recall, but certainly close enough.

The other thing to note is that this is a non-inverter (single speed) model and so its power consumption can be accurately measured at various temperature points (by contrast, the power draw of our Sanyo which is an inverter system is all over the map because its compressor ramps up and down according to load). So, for example, at 1°C this particular unit draws 1,125-watts; at -3°C, it's pulling 1,035-watts; and at -13°C, its down to 970-watts. Thus, if my numbers are more or less correct, at 1°C, its COP is running in the range of 2.9; at -3°C, it's closer to 2.6 or 2.7; and at -13°C when it pretty much calls it a day, we're down to perhaps 1.6 - 1.7. Knock off between 5 and 15 per cent for defrosting depending upon ambient air temperature and relative humidity (the biggest penalty occurs around the 0°C mark and falls off rather sharply as you move up or down from there).

Knowing its limitations, I use a couple tricks to help goose-up the numbers. For example, rather than have it maintain a set temperature, I'll run it flat out for several hours at a time, thus minimizing the standby losses that normally occur whenever the compressor cycles on and off. Secondly, during the swing seasons, I restrict its operation to the warmest times of the day as the spread between daytime and night time temperatures can be fairly significant; there's enough thermal mass in our home to help even things out and thereby maintain an acceptable level of comfort. As we move further into the heating season, I closely monitor the weather forecast and whenever temperatures are expected to fall, I'll bank as much heat as I can to coast through the cold snap; likewise, if it's expected to warm-up, I'll hold off turning it back on until the mercury starts to climb. Fortunately for us, with our maritime weather, temperatures bounce up and down all the time, e.g., right now, it's +12°C whereas this same time yesterday it was -1°C. I'm willing to trade off some personal comfort by letting indoor temperatures swing within a 5 to 10°C span as need be. This sort of "hands on" approach allows me to maximize operating efficiency and to displace the greatest amount of fuel oil possible.

This model has a HSPF of 7.2 in our climate zone, which translates to be a seasonal average COP of 2.1. Using a combination of the above techniques and depending upon the severity of our winter, I can generally bump that up to between 2.6 and 2.8, i.e., closer to a system with a HSPF of 9.0 or 9.5.

Lastly, a large part of the rationale for replacing this unit is that I can achieve significantly better results with a Fujitsu 12RLS without having to micro-manage its day-to-day and hour-by-hour operation. It's not a huge burden as such and I kinda enjoy the challenge, but there's something to be said about "set and forget" convenience and the added comfort of maintaining a more constant indoor temperature.

Cheers,

Paul

Thank you for your elaborate response.

Might I suggest passive solar. Cold climate low-e windows will get you half way there. Who can argue with free energy?

Hi apater,

I replaced all of our operable windows and doors with Pella Architectural series low-e/argon units back in 2002. The fixed units are either triple pane or are fitted with exterior wooden storms and two sets of 3M window kits (one on the inside and a second in between the window and storm). Now, if you could arrange for some winter sun, I'd be indebted to you. :-)

Cheers,

Paul

We added 12mm laminated glass to fixed double-pane windows, and 9mm lami to operable double-pane windows (older Pella).

We no longer need heat until outside temps are below about -5 degrees C: we run on lights and body heat.

Hi Nick,

You've got us beat hands down. We turned on our heat on October 10th which was a little earlier than usual. In the last 22 days of that month, the mean air temperature was 8.4°C and total heat supplied was an estimated 307 kWh. Our actual energy use according to our Kill-a-Watt power monitor was 85 kWh, so our COP for October was 3.6. In November, the ambient air temperature was 4.0°C and total heat supplied was pegged at 1060 kWh; our actual energy usage was 345 kWh, so the COP for this thirty day period would be in the range of 3.1.

I don't know how accurate this might be, but I've estimated our home's demand point at 13°C/55°F and our average heat loss at 0.175 kW per °C whenever temperatures fall below this point. So, for the month of October, this would suggest a space heating requirement of 425 kWh (1.38 above actual) and for November it would be 1,134 kWh (1.07 above actual).

Some of the difference is likely due to variations in solar and other internal heat gains and average wind speed. We also tend to bump up the thermostat a bit as the weather turns progressively colder. The other part of our problem is that our relative humidity is so high that if we don't keep the heat on we run the real risk of mould and mildew.

Cheers,

Paul

Paul/Nick,

Do you use a heat exchanger, in particular to ensure that you get some fresh oxygen into your houses?

JB

Additional layers of window glass don't reduce air infiltration.

I installed a Venmar HEPA 3000 heat recovery unit when we started to tighten things up. I believe a heat recovery ventilation system has been a code requirement for all new construction in this province for some twenty years now.

Cheers,

Paul

This house stores the summer sun in a tank and does not require any heating furnace:

http://www.jenni.ch/pdf/Mediendokumentation_Einweihung%20Solar-MFH%2031....

Obviously this house was designed with a big tank from the start, so an older house could not be renovated this way within reasonable costs, but even a smaller water tank could increase heating cycle periods and allow the evaporator of the heat-pump to run at higher average temperatures.

in Canada, the colder the province is, the cheaper electricity.

If you say strictly provinces then you may be right, but go north into the territories and it rapidly gets more expensive.

Though not always because of lack of potential.

The Mackenzie river, between Yellowknife and Inuvik (close to sea level) has enough hydro potential to produce more electricity than Alberta does today (about 12GW). Not quite so simple to harness it all, but that is the potential that is there.

Yukon has plenty of potential too, though not quite as much, but neither place can get it anywhere, and don't really have many options for turning the electricity into something else.

Hello Curious Canuck.

You have rightly said that: "So the only province in trouble is, as RMG said, Ontario."

A quick question: where do you think Ontario will find the + 10 000 MW (more than a third of its total capacity) that they will be losing when all their remaining rapidly aging nuclear power plants (18) go offline (at the latest by 2020 according to Atomic Energy Canada)?

Ontario has not yet started building any replacement nuclear plants and it takes 10 years to build a nuclear power plant... Ontario has rejected the latest bid from Atomic Energy Canada for new nuclear power plants saying it was too expensive and now the Canadian Feds want to sell Atomic Energy Canada!

JB

P.S: I would appreciate if you could provide me your e-mail so that we can further discuss this issue bilaterally. My e-mail is jonatan252000@yahoo.com

Hi Curious Canuck,

You have said that in Canada "electricity is a provincial business".

What are then you views about Newfoundland, Nova Scotia, New Brunswick and P.E.I asking the Canadian Feds for a nice fat subsidy to cover the cost of expensive underwater electrical transmission lines between Newfoundland and Nova Scotia within the framework of Danny "W" testament hydroelectric project?

Given the latest constitutional challenge of the Canadian Feds in the area of securities regulation, I would also be curious to know if you think that the Canadian Feds could invoke their constitutional authority to regulate interprovincial and international commerce to somehow get a hold in the regulation of the electricity business in Canada...

JB

In Canada everybody is asking federal government to subsidy everything. That's a tradition, on top of that 10 years ago Liberal gov't unloaded a lot of its deficit onto provinces and municipalities, so provinces genuinely have less money.

Underwater line: be my guest. Politics involving Quebec...I am not going there...

Federal government will not regulate anything except drivel and will not invoke anything. That's a Canadian political tradition. NEP? FLQ? Constitution? Charlottetown?

... the Canadian Feds could invoke their constitutional authority to regulate interprovincial and international commerce to somehow get a hold in the regulation of the electricity business in Canada...

The Canadian constitution precludes that. It specifically assigns regulation of electric power to the provinces. Any changes to that clause will be made over the dead bodies of the provincial politicians, or more likely, the provincial politicians will make sure that the federal politicians are casualties in the next election. Even if they are in the same party.

Hello RMG.

You have rightly said that: "Canada does have a bit of a problem in that its most populous province, Ontario, has run out of hydroelectric potential, has no significant coal or natural gas reserves, and has nuclear reactors that have reached or exceeded their "best before" date. Ontario's electricity prices will probably double in the next 20 years. Its three smallest provinces have similar problems."

A quick question: where do you think Ontario will find the + 10 000 MW (more than a third of its total capacity) that they will be losing when all their remaining rapidly aging nuclear power plants (18) go offline (at the latest by 2020 according to Atomic Energy Canada)?

Ontario has not yet started building any replacement nuclear plants and it takes 10 years to build a nuclear power plant... Ontario has rejected the latest bid from Atomic Energy Canada for new nuclear power plants saying it was too expensive and now the Canadian Feds want to sell Atomic Energy Canada!

JB

P.S: I would appreciate if you could provide me your e-mail so that we can further discuss this issue bilaterally. My e-mail is jonatan252000@yahoo.com

I have no idea where Ontario is going to find 10,000 MW of new electric capacity. They have been pursuing dead ends for the past few of decades, and their current strategy seems to be to pursue more dead ends.

Their best option was probably nuclear, but they should have started the process of replacing their reactors with more reliable ones two decades ago.

Regardless of what they do, it is going to cost them a lot more money than they are used to paying for electricity.

Hello RMG,

As you rightly indicate Ontario has a problem...

Here is how they might try to solve it:

1) By getting a nice fat Canadian Government subsidy through Atomic Energy Canada for buying new nuclear power plants at a very reduced rate compared to the initial bid that they have rejected. That "subsidy" would be provided to Ontarion after the Conservative Government gets a majority at the coming Spring election...

2) A new Canadian national energy program could also be set up by a Canadian Government having a safe majority. This program would spread the oil & gas revenues currently only collected by Alberta to all the other provinces, including for the major part Ontario which would then use that money to purchase an updated collection of nuclear power plants at market price...

JB

Here political situation is very simple:

1. There will be no fat subsidy from conservatives.

2. There will be no national energy policy.

As far as Alberta situation, here are two links that address a lot of issues and show that the Alberta picture is not exactly as rosy as people believehttp://www.nationalpost.com/todays-paper/Vices+revenues+Alberta/3449203/story.html

and

http://www.scienceforpeace.ca/the-alberta-tar-sands

CuriousCanuck,

You have a good analysis of the situation but do you seriously think that the Canadian Feds will let Ontario's economy implode without at least attempting something? After all, the Canadian Federal minister of Finance is Jim Flaherty...

JB

I think Ontario has already had its "get out of jail free" card from the Feds. There will be a revolt if the rest of the country has do it again - supporting Quebec all the time is hard enough, we can't afford to do Ontario at the same time.

Ontario will just have to take its lumps, it's not like they couldn't see it coming.

Its sorta funny to watch you guys kicking hopefully at Ontario when you apparently can't even read. Electricity availablilty is not going to be a problem for Ontario any time soon, as you'd know if you followed news. In fact the present strategy includes shutting down a further 4.5 GW of coal-fired generation over the next ten years. BTW, when might we expect Alberta to stop generating electricity with dirt-burners?.

Presently Ontario is exporting to the US about 2.5 GW continuous. In the next ten years, the plan is to a) refurbish all present reactors not yet done except perhaps two of the Pickering ones now mothballed. b) near the end of the term, construct 2 GW of new nuclear. c) add a bit more N Gas combined cycle. d) convert Niagra Falls from run-of-river to a storage peaker. e) add significant new wind generation to the 750 MW now installed. f) add whatever additional small hydro can still be economically developed, perticularly in the north g) implement a serious conservation program to improve GDP per unit energy.

Following is from Snapshot of the

Power Industry in Ontario - pp 4 - Association of Power Producers of Ontario

To be built or replaced by 2025: 22,000 megawatts

Currently underway: . . . . . .: 8,000 megawatts

BTW, wholesale costs here are about 80% of the average for New England states.

Now, if we could just get those stubid praire conservatives feds to not pull another Diefenstupid / Avro Arrow type move with AECL. Good luck on that though, eh?

Hi LenGould,

That Ontario snapshot brochure to which you are referring is dated September 2007... A lot of water has flowed down Niagara Falls since then!

Is it true that the cost of electricity in Ontario has been approved by regulatory authorities to go up by 50% during the next five years?

Have the Ontario authorities decided to take off line the province's dinosaur coal power plants yet?

When are the Canadian Feds going to announce the new owner of Atomic Energy Canada?

JB

Hi Len,

One of the first things I learned when I came to Canada is that the 2nd most popular sport is inter provincial nitpicking, and that is not always a bad thing.

If you think Ontario's electricity future is bright then I am happy for you. I'm sure the stranded debt will be paid off one day, maybe even in time to borrow a bunch more for the next gen of power plants, whatever they will be.

As for AECL/Avro arrow, do you mean you don;t want it shut down?

If so I'm the Feds would welcome a bid from Ontario. They might even offer to swap AECL for Ontario's stake in GM, though I'm not sure who comes out worse in that bargain.

With 8000MW underway, only another 16,000 to go. At ten years to build a nuke plant they had better not wait too long to start.

Not sure where you're getting the "10 years to build nukes". Most recent new ones by AECL were at Quinshan, 46 months from first concrete to first criticality in 2003. Of course the Cdn. Natural Gas industry feeds a lot of money into things like legal costs etc. for delaying in every possible way nuclear plant work (and hydro energy and LNG also), in particular google "Energy Probe", then "Tom Adams". Over the past 10 years he has concurrently "worked" as executive director of Energy Probe (a strong anti-nuclear lobby group) and at the same time under his own name, written several papers promoting the use on Natural Gas generation in Ontario. If you also google "Grain Sarsons" you'll find several examples of their fighting against hydro power.

Thanks guys. ;<[

Len,

You are forgetting about the time to complete the environmental studies and the public hearings and the licensing...

JB

Spoken like a true "environmentalist lawyer". ;<)

Len,

Are you saying that because a nuke can be built quickly and cheaply in a country that has hopelessly lax human safety and environmental protection rules, that it can be built in that timeframe here?

Do you really think if someone finally decides to build a CANDU tomorrow, in Ontario, that it will be producing megawatts in 46 months, let alone ten years?

Ontario has been arguing for at least 46 months about what to do next. It will probably take another 46 months to decide, and then take ten years to build the reactors. Unless, of course, they decide to buy BC and AB coal instead, then they can be up and running faster, and cheaper, than any CanCan't reactor .

So there are anti nuke people in Ontario - who knew? Come out to Vancouver and propose a nuke and see what happens - here you have to do an environment impact study to put in a wood fireplace!

Every industry has its opponents - if Ontario can't deal with the anti nukes, then it shouldn't be doing nukes. There are plenty of other options for Ontario to not get power from other than nukes.

Paul, I stated factually 46 months "from first concrete to first criticallity". If you think it is rational to a) continue arguing in courts about completion after the project has progressed to pouring concrete, and b) count all the time spent arguing about construction in advance as "construction time", then of course, you get to say anything you want.

Naturally I agree China's environmental standards are not as high as here, but as far as the design and construction of CANDU reactors goes, the difference has zero effect. One significant difference there to here also is that once the decision has been made to construct the reactor, then no further interference is allowed from minor external fanatics, which is clearly an advanced state compared to this.

BTW, when might we expect Alberta to stop generating electricity with dirt-burners?.

Given that Alberta has vast coal fields, Alberta's coal is considerably cleaner than the high-sulfur stuff that Ontario imports from the eastern US, and Alberta's power plants have more pollution controls than Ontario's, probably not very soon.

It would also be relatively easy to sequester the CO2 emissions in deep formations in Alberta. In fact they could use the CO2 from power plants in CO2 miscible flood projects to improve oil recovery in old oil fields. Ontario lacks deep formations suitable for CO2 sequestration.

So, Ontario lacks electricity, lacks uranium for its nuclear plants. lacks coal, lacks a good hockey team and even lacks places to store CO2? What, if anything do they have going for them?

So, as you post your messages using your RIM BlackBerry or via Nortel fiber optic switches, drive to work in your Lexus (the only such factory outside of Japan) or Toyota or Suzuki or GM or Ford or Chrysler, drink water from plastic bottles moulded in Husky moulds (largest plastic mould-maker in the world), trust your doctors to implement the results of three among the largest medical research centres in Canada, trust your next flight on an airbus A380 to the landing gear built here, trust the data centre in north TO to record all transactions for the largest bank in the world (Citibank), kick dirt at AECL which has constructed a significant proportion of all the world's nuclear reactors with entirely locally-developed technology and an unblemished safety record, go to your factory job to work alongside ATS automations world-class factory automation systems, etc. etc. etc. you must wonder to yourself "How the heck did Ontario ever become the most wealthy province for endless decades, carrying all the western farmers for decades through the tough times until the resource plays kicked in for a short time?"

I might also note that Ontario lacks fools who might make statements like yours, which is a good thing "going for them" ,<)

Ok, so Ontario does have some positives, though you wouldn't know it watching the Ont govt.

But as far as electricity goes, it does seem like there is some serious work to do.

My understanding of the bids for AECL is that the two parties were not interested in completing development of the next generation, but rather wanted to buy the"order book" for maintenance of existing stuff - that is not a vote of confidence.

Well, I suggest its more of an indication of their perceptions of the future of nuclear energy given the existence of rabid irrational opposition. One little-known added acpability of the CANDU, (which China is presently testing) is it's ability to "burn up" many of the nasties in spent fuel from light-water reactors. That capability alone should guarantee AECL a bright future one would think, but no, the irrational opposition to nuclear don;t really want a solution to the spent fuel issue, that would make their religion less saleable.

Given that the US has 104 light water reactors using once through fuel, you would think there would be more interest in the CANDU from the US. At the very least, there should be a never ending supply of fuel for Ontario from them - though I'm sure there will be the inevitable objections to that concept, if it isn't being done already.

One little-known added acpability of the CANDU, (which China is presently testing) is it's ability to "burn up" many of the nasties in spent fuel from light-water reactors.

A better known capability is its ability to generate weapons-grade plutonium, which of course India used to build its first atomic bomb. This causes the regulators to become nervous when some third-world country develops a sudden urge to buy CANDU reactors in preference to the light-water reactors that other countries are selling.

It saves them the cost and effort of constructing their own uranium enrichment plant. Just surreptitiously pull some fuel rods out of the reactor, extract the plutonium from them, and build a bomb.

How the heck did Ontario ever become the most wealthy province for endless decades...

Well, other than the fact it has major population centers directly across the Detroit River from Detroit, which made it an obvious location for US car manufacturers to set up branch plants to take advantage of lower wage rates, there is the fact that it has Niagara Falls, which gave it some of the lowest hydroelectricity rates in North America for quite a long period of time.

Unfortunately, there is only one Niagara Falls, and Ontario's population has exceeded the level where it can provide cheap electricity for all of them. Given their cost overruns and reliability problems, its CANDU reactors have not provided additional electricity at anything near the same low rate, and of course now they're falling apart. Other solutions have also worked out badly, so I guess at this point Ontario is screwed.

...carrying all the western farmers for decades through the tough times until the resource plays kicked in for a short time?

Well, I've talked to a large number of old western farmers, and they don't remember this particular period of time. What they actually remember is the Depression, the Dustbowl days, and the Ontario, Quebec, and Federal governments saying that they would never subsidize the western farmers, or bail out the Alberta government, after it went bankrupt and defaulted on its debts from 1936 through 1945.

It's something like Camelot and the era of King Arthur. It was a mythical time that never really happened, but the people of Ontario would like to believe it did. If it had really happened, they would probably have had a lot fewer problems with the West during the last few decades. The western farmers have long, long memories and are prone to holding grudges.

Of course, the Federal government did eventually subsidize the western farmers, but that came after 1947, when Leduc well #1 blew in and they discovered Alberta was sitting on hundreds of billions of dollars worth of oil. After that the Federal tax take from Alberta became truly astronomical, and the Feds found they could use all that Alberta oil money to subsidize the western farmers - and of course the eastern fishermen, the Quebec maple syrup manufacturers, and anybody else who wanted a handout.

I can go on in considerably more detail, but I'll only do it if you provoke me.

You may have talked to "old western farmers", I grew up with them and still have a brother who hobbys with 200 head cattle in Alberta after retiring and selling his 20,000 head feedlot. I know all the stories, how the price of barley in 2002 was exactly the same as it was in 1970, and that's Ontario's fault or something like that.

However I can also read, eg this interview by Canadian Business of Jim Peterson, Federal Minister of International Trade between 2003 and 2006, criticising OTHER nations high subsidies compared to the apparently LOW subsidies in Canada, a fair point.

Jim Peterson on crippling agricultural subsidies and Canada's trade policy

That's an acknowledged $3.7 billion of "support" to Canada's approx. 3% of population who are farmers. (246,923 farms, 729,405 persons, average $15,794 per farm). Agreed, not all of it comes from the Federal level (I presume) but of that which does, a large proportion of it comes from Ontario.

Agreed, I grant you that the east didn't provide much support for the west during the dirty thirties, and my father held that grudge all his life. But times were tough then in Ontario too. It would have been extremely difficult to have raised taxes in depression-hit Ontario at that time in order to provide subsidies to people trying to farm an apparent dust-bowl desert with no percieved future. Also, in those days the concept we now have of government's helping the needy out in the rough times simply didn't exist. And to listen to the present (western conservative) federal government, that is where they are taking us back to, the "good old days" of "individual responsibility and low taxes". You can't have it both ways. And the issue is completely unrelated to Alberta oil. Some reality might help.

At this point in time, Alberta is the most urbanized province in Canada, so a subsidy for rural farmers in not particularly a subsidy for Albertans.

The concept of subsidizing farmers is relatively new, and the grudges of western Canadian farmers predate predate WWII. Prior to that time, the farmers in Canada were subsidizing the industrialists through what was called the National Policy .

There is also the fact that during the Depression, when the Alberta government went bankrupt and 25% of the Alberta population was out of work, the federal government managed to extract more money in taxes in Alberta than it spent in the province.

And when grain markets improved in WWII, the Canadian government decided to support the British war effort by selling wheat to Britain at one-half its market value. However, they didn't subsidize exports to Britain, they just paid the farmers half the going market value for their grain.

Of course, as you say, they felt Alberta had no perceived future, so why bother supporting it. Particularly in Ontario, people thought the good times would roll forever.

However, after Alberta discovered its massive oil and gas fields after WWII, Albertans were not keen on subsidizing the rest of the country because they had never been subsidized themselves. The "days of individual responsibility" were the only kind of days they had experienced. The government had never done anything for them before, so they didn't expect it to do anything for them now.

This attitude still persists in Alberta and is in sharp contrast to attitudes in Eastern Canada, where government subsidies are considered an entitlement. The government has always subsidized them before, so people expect it to subsidize them forever.

If only...

Unfortunately Nortel is belly up, RIM is loosing market share, AECL is a lame duck, nobody buys Suzukis, Lexus is a small volume manufacturer, failing landing gears are Canadian specialty (OK this one is on Bombardier in Quebec...), AECL build just 12 reactors outside of Canada so far, some of them before 1974and the interest in CANDU is relatively mild.

so we are left with a mould maker, data and call centre, and two decent hospitals?.

Ontario was a most wealthy province, because of manufacturing driven by lower labour cost, public health care and cheap Canadian dollar for most of the time. Agricultural subsidies are political and economic issues, but the actual cost to the party paying subsidies is not that much (compared to other things)

Now it's not good, really. If something is made in Ontario, it is for US market, which is in (for all practical purposes) recession, and dollar at parity. So Ontario runs now a big trade deficit (something like $10B) Personal debt per capita in Canada is higher than in the USA (or as ratio to disposable income). I am sure Ontario with McHouses leads here.

You guys are hilarious. Sad, true, but still very funny. Face it, you'd snap up the opportunity to start a Lexus assembly plant in your home town in a second, if it were offered. But it won't be, because you don't have the miles and miles of high-skilled specialty machining companies, the sub-parts manufacturers, specialty casting and etc. etc. infrastructure required to make those operations viable. On my way to work each morning I drive through large areas entirely dedicated to high-tech machining facilities, heat-treating plants, casting plants, tooling fabricators, toolmakers, etc. etc. City block after city block, all competing, competitive, requiring an extremely high-skilled workforce.

But all you western conservative neo-cons can think of is cutting back on the educational system and providing tax breaks for home schooling. Don't complain to us over the results.

As soon as NAFTA passed, there were all the reasons to be be in Ontario was: cheaper labour, no health cost and weak dollar + NAFTA. But then Mexico had its NAFTA and the jobs (read whole factories were dismantled and shipped to Mexico to Maquiladoras). A few years later the whole thing went to China. US used to import 80% of Canadian exports And now Ontario's trade deficit is $10B - it would have been $300B for USA, adjusted for population.

I am not saying Ontario will go down the tubes, but the outlook is not very bright.

There are all these manufacturing companies but they simply do not make as much stuff as they used to. Google the following item: "manufacturing jobs losses ontario" and you will see the hemorrhage of jobs over last 10 years.

Finally, I am not a western neo-con, please...I moved West from Ottawa 3 months ago. I've been teaching at high school and college level and believe that in good context education vouchers would go far to fix our education systems. That's for a another discussion but not on TOD.

Is Canada suffering from the Dutch Disease, where strong oil exports raise the exchange rate, and make manufacturing unable to compete?

Hi Nick,

You rightly said that Canada looks like it is suffering from the so called "Dutch Disease". The "Loonie" is now trading at par with the $US and the net effect of this is to sink the comptetiveness of Ontario manufactured products which are mostly exported south.

As a result Ontario's economy is sinking ($Can 25 billion deficit this year), they do not have the money to replace their aging nuclear and coal power plants, electrical rates are shooting up to the roof (+50% during the coming 5 years) and within the coming decade Ontario industries are likely to be running for the exits, strangled by their electrical power bills, trying to find a place where they will be able to afford some long-term electrical supply contracts.

Meanwhile, the oil and gas producers in Canada are getting richer everyday with the rise in the world price of hydrocarbons and the absence of any NEP.

At some point in a not too far from now Ontario is likely to try to use its demographic and political muscle to convince the Canadian Feds to much further "spread the commodity whealth". Alberta has already said that if a new NEP was ever attempted by Ontario and the Canadian Feds, they would separate faster than Quebec ever thought that it would be possible to do... Meanwhile the US Feds are looking up at their northern border thinking that it would not be so bad if that was to happen. After all they do badly need the oil, the gas, the water and all the rest of resource basket that would become more readily available if the "Canadian dinosaur" was to unexpectedly succumb to a particularly bad episode of political fracking...

Since the adoption of NAFTA a considerable amount of economic change has taken place within North America and it comes to mind that a cross-border political "rationalization" might become necessary, essentially for the sake of efficiency and security, within a foreseable future. Particularly with the resource hungry Chinese dragon now rapidly rising...

JB

Get a grip on reality, eh? Sure it's been a bit tough adjusting to the loonie appreciating so rapidly as far as manufactured goods exports to US goes, but the suburb of TO where I live is still growing very rapidly, home prices have never stopped rising, residential construction has only slowed down a little (a good thing, it was too hot a couple years ago). Many exporting companies in Ontario no longer depend on the US market (eg. RIM is worldwide, Magna covers all EU, you wouldn't believe the number of small specialty experts dealing everywhere in the world.) Also, the appreciating loonie has helped a lot of importing companies such as the one my daughter is CFO of, imports Honda engine all eastern Canada, my neighbour, president of Panasonic Canada (and also a board member of parent), tons of others easily named.

Ontario is not only heavily dependent on exports, but on imports as well, so the appreciating loonie, though it takes some pain to adjust older contracts to, comes out about a wash overall. I'd be more concerned about areas of the country which are heavily dependent on tourism, such as BC, but I'm not willing to say they might now be hurting without specific knowledge.

Can't replace electric generation? You must be joking. You can see from the ISEO's website that the Import / Export balance has gone from approximately zero net in 2004 to net exports of 10.3 Twh in 2009 approx. 1,100 MW continuous, enough to shut down Lambton and part of Nanticoke coal stations, and convert Ft. Frances to bio-mass in 2010.

Reports of the demise of Ontario are greatly exagerated, essentially wishfull thinking by somewhat wierd westerners. Not at all surprising though, I've had Albertans tell me openly they "wish Toronto would fall into the lake" (and when I'm out there I DO know enough to never argue or debate with anyone I don't know VERY well, as it can be unhealthy). On inquiring I found that they had never visited Toronto, so I supposed they simply can't stand cultural diversity or something like that, an attitude which, though not held by a mojority of Albertans is still far too common, especially unexpressed.

What is Canada's overall balance of trade?

Have Canada's exports shifted from manufacturing to oil & gas?

Canada's balance of trade has been in a deficit situation for the last couple of years, primarily because of a decline in exports to the US. Prior to the US recession, Canada had a trade surplus. The biggest problem has been a decline in exports of automobiles and parts to the US.

Canada is one of the few developed countries that is a net exporter of energy, and that has been true for some time. Natural gas exports are declining, but oil exports are showing a strong increase due to new oil sands production coming on stream.

Let's hope all of the above is true. There is notpoint arguing in a he-said, he-said manner, so let's agree on one: Leafs and Sens .....

Face it, you'd snap up the opportunity to start a Lexus assembly plant in your home town in a second, if it were offered.

No, speaking as a member of the local Town Planning Commission, I would say probably not. I look on automobile manufacturing as a sunset industry. With the probable decline in global oil production coming in the next few decades, I would say we would not want to have an industry that is going to fade away.

But all you western conservative neo-cons can think of is cutting back on the educational system and providing tax breaks for home schooling.

You're getting eastern Canadian urban mythology confused with reality. In the recent Programme for International Assessment tests, at the state/province level, students in the province of Alberta scored second in the world in reading and science, and eighth in mathematics. In Canada, Alberta students ranked first in reading and science, and second in math.

However, students in the province of Shanghai, China, scored tops in the world in all three categories, so we may have to take a look at what they're doing.

1) The Canadian government wants to get out from having to subsidize Atomic Energy of Canada. They've spent billions of dollars on it, and it has gotten them nowhere. It seemed like a good idea at the time, but turned out badly. They would much rather foist the costs off on the provinces.

2) A new National Energy Program is unlikely after the disastrous experience with the old one. A new one would be much worse because it's not just Alberta any more - there are about 5 provinces with major oil and gas production now. The Feds probably don't feel the urge to get into a knock-down drag-out political fight with half of the provinces.

The net result is that the Canadian government is just going to allow Ontario to deal with its own problems.

The Feds wouldn't need to subsidize AECL if they'd simply rationalize that idiotic new (1998ish) Nuclear Regulator the Fed Liberal Party dreamed up solely to cause problems for the Ont. provincial Conservative government of the time. That one move alone cost ontario 3 yrs delay in a six-month-scheduled Pickering A project and caused (then Ont. Hydro) to spend nearly $2 billion to import replacement power from USA coal-burners. Just the same as that same stupid agency has been playing games with the medical isotope reactors, constantly changing their so-called minds on what the definition of "backup power" and "original design" are, to the point where finally the chairwoman had to be fired (thankfully).

You wanna play those games, it's gonna cost you. :<)

Thank you Rembrandt.

Hi,

Note that all prices in this article are in Canadian dollars but they are about the same as US$ (0.99$)

Electricity prices varies a lot between provinces because it's a province regulated domain in our federal system.

Here in Quebec, we do have many interconnexion with US. The exchange goes on both sides because we buy electricity when the tarif is low because of low demand (in the nights, when AC of heating is not needed). We usualy store it in our damms by closing generators as needed. It can be done in minutes really. We sell back the surplus production in high sport prices. There is probably fixed contract also.

Since the 70's Quebec as built many very large hydro electric complex. Those are not small feat, they are encompassing large geographical area, joining together rivers and creating gigantic lakes troughout our province. We are proud of them, really.

Currently, we are constructing an 8,7 TWh complex called Eastmain 1A

And La Romaine (french only) for 8 TWh. Scheduled to be built from 2009 to 2020.

There is more project and there is more project built or already owned by RioTinto Alcan, wich are deemed to cost from 0.02 to 0.03 CAD (Canadian $) per KWh.

It's said that until 2005 or so, new or old hydro project costed only 0,03-0,04 CAD$ per KWh.

New project would be costing about 0.05$ KWh

If I look at my electric bill for september-october 2010, the cost are listed like this :

Subscription fee for 55 days at 0.4064$ = 22.35$

Power consommation : 30 first kWh per day = 1 010 kWh at 0.0545 $ = 55.05

Subtotal 77.40

HST (normal Federal tax) 5 % = 3.87$

PST (normal provincial sale tax) 7.5% = 6.10$ This tax will go up a percent in january.

So for two month, a 4 1/2 pieces appart cost me only 87.37$

Did you know that many customers complains when there is an electricity rise here?

My sole an only heating means are electric heaters. We are not used to gas powered appliance : stoves, drying machine, water heaters, heaters. We mainly see them in movies...

I do think that 0.12$ kWh is paid for wind generator project and maybe a bit more when local municipalities are funding 50% or more of the project.

A 25 MW project (between 12-16 wind generator) is being projected in my county and they will be paid 0.125$/kWh. The project is said to be generating around 1 milion $ of local profit that will be distributed between the different cities and municipalities of the county.

Industrial tarif

Tarif G - General small user

Monthly fee : 12.33 $

Price of power over 50 kW : 15.54/kW

15 090 first kWh : 0.0882 $/kWh

after 15 090 kWh : 0.0485 $/kWh

Tarif M - Medium size user (between 100 kW - 5 000 kW) 13 000 contract for the province

Power fee : 13.44$/kW

210 000 first kWh : 0.0451$/kWh

after 210 000 kWh : 0.0319$/kWh

Tarif L - Large user over 5 000 kW 240 contract for the province

Power fee : 12.18 $ kW

110% overflow from the subscribed power in winter :

per day of overflow : 7.11 $/kW

monthly maximum : 21.33 $/kW

Power price : 0.0299 $/kWh

There are other tarif stated here for general business tarif but it is widely known that if your name is RioTintoAlcan or any aluminium producer, your price could be lower.

I think that it's as close as we can get to "too cheap to meter" electricity.

Ah, Quebec Hydro engineer invented the high voltage 750 000 volt transport cables. They run for thousands of miles from producing facilities to our cities.

@Wolfricus

That is an amazingly low price for industry, it shows how problematic energy price rises are for energy intensive industrial processes. For these to my knowledge at least 20%+ of operational costs are energy, sometimes up to 50%.

Impressive, makes me wonder if there is a lot of expansion potential for Hydro power in Canada (probably not).

Rembrandt

In Canada, in the 20's and 30's 80% of power production was going to paper mills and wood mills.

In 1936 or so, the first damm in Lake Saint-John was built to power an aluminium factory for Alcan. The lake level grew up some feet and because the relatively low lands were really good soil, many farms and property were permenently covered by the lake. We even has a village that was half drowned forever in St-Méthode and a some part of a street is still missing in Roberval.

Oh, did I mention that the villagers or owners were not really warned nor paid for lost land, houses, farms, income and moving expenses? And sometimes we dare to talk rough about other countries that dare to offert help and compensation for moving resident of future drowned area. Figures :)

Nevertheless, this project and many other paved the way for a rich aluminium production development in the Sagnenay-Lac-Saint-Jean région in Québec and in Côte-Nord. I guess Quebec account for a significant part of aluminium production in the world (about 10%).

As for planned expension, the 2 project that I talked about are the most significant. We are mainly running out of big rivers that are not protected or already dammed.

That's why I'm really keeping an eye at the KiteGen guys!

Pascal

There is a great deal of expansion potential for hydro in Canada, but it is in the far north, and most of the population is in the far south.

The main exception is Ontario, which has almost no hydro potential left, even in the north. It could bring in hydro power from undeveloped sites in northern Manitoba and Quebec, but the main industrial centres in Ontario are very far south - in fact the southern tip of Ontario is further south than the northern boundary of California.

The net result is that if Ontario wants to buy power from Quebec or Manitoba, it has to outbid buyers in the northeastern and midwestern US. The people in Ontario are not used to paying nearly that much for electricity.

Consumers in Quebec and Manitoba, though, can buy electricity from government-owned Hydro Quebec and Manitoba Hydro at cost, not at market value.

By law, customers in Quebec pay 2.79¢/kWh for the generation component of their electric bill (the price will be increased to 3.79¢/kWh by 2018). The average production cost of Hydro-Québec facilities was estimated at 2.0¢/kWh in the latest financial profile, for an healthy 28% margin. The cost structure reflects the high construction/low operating cost structure and the low interest rates.

It would be more accurate to state that Hydro-Québec wholesale price on the Quebec market is far below the marginal cost of new generation capacity.

I just can't let this pass without comment. Under a 1969 agreement signed between the Quebec and Newfoundland governments, Quebec agreed to buy 4,900 of the 5,200 MW Upper Churchill hydro development. The project lies in the Province of Newfoundland and Labrador. Those were innocent times in Newfoundland; the agreement contains no escalator for inflation and commits the government to sell to Hydro Quebec at the rate of 0.25425 cents per kWh until 2016, when the rate drops to 0.2 cents per kWh until 2041.

That's why Hydro Quebec is able to calculate such a low cost of generation.

You mean this contract right?

First and contrary to popular belief, the May 12, 1969 contract was not signed by the governmnet of Newfoundland, but between Hydro-Québec and Churchill Falls (Labrador) Corporation, a company owned by Brinco, in which the Quebec Crown corporation was a large investor (34.2%).

Yes, folks at HQ are guilty of driving a hard bargain. But any honest observer of the Quebec electric scene would also acknowledge that HQ also took significant risks in this venture. When it committed to CFLCo, HQ had to mothball active development of the Outardes 2, 3 and 4 complex and delayed decision on the James Bay project, incurring significant costs due to inflation and higher interest rates in the 70s.

The price was set at 2.5 mils/kWh for 40 years and 2.0 mils/kWh for an automatic 25 years extension. But the contract also involved substantial investments by HQ, including $100 M in bonds, loan guarantees for the general mortgage, an equity stake, a take-or-pay kind of agreement (30 TWh constituted one third of all electricity consumed in Quebec at the time) and the construction of a 3 X 700 miles long 735kV line, at HQ expense.

It's far from clear if Hydro would have invested in the $900 M scheme if the price had been much higher than 2.5 mils/kWh. You seem to forget that companies such as ConEd and Ontario Hydro broke talks with the promoters in the early 60s because the asking price 4.3 mils at the Quebec border was much as they were then willing to pay (transmission costs were estimated at the time at 1.5 mils).

So please, stop spouting Danny Williams' nonsense and misinformation.

Very nicely put...

Danny "W" has now come and gone by but Newfoundland and its partners are now asking the Canadian Feds for a big subsidy to pay for the cost of the expensive underwater electricity lines. Kind of an embarrasssing precedent that would infringe the north american commercial rules in electricity trading...

A few questions:

1) Is it technically possible to build such transmission lines between Newfoundland and Nova Scotia?

2) The project announced by now retired Danny "W" will cost close to $7 billion and is for less than 1000 MW... Is that economically realistic?

JB

P.S: I would appreciate if you could provide me your e-mail so that we can privately correspond. Mine is: jonatan252000@yahoo.com