Tech Talk: OGPSS - Some limits to oil fungibility

Posted by Heading Out on December 12, 2010 - 11:05am

This is the second in a series I am just starting on oil production and consumption around the world. While it is going to focus more on individual nations and oil fields, over time, there are some general remarks that I want to use to preface the series and this is one of those. (OGPSS – Oil and Gas Production Sunday Series).

One of the first things that I was told when I started looking into whether there was a coming crisis in oil supply was that oil is fungible. What that meant was that if, for the sake of discussion, the Saudi Arabian government cut off oil supply to the West, then the West could turn around and buy an equivalent amount from somewhere else (it turned out to be the North Slope and the North Sea) and the world could continue on its merry way. In fact if you go to Merriam Webster oil is cited as an example of a fungible commodity.

being of such a nature that one part or quantity may be replaced by another equal part or quantity in the satisfaction of an obligation:- oil, wheat and lumber are fungible commodities.

But that assumption is not totally true, and in the world where matching production to demand is becoming a somewhat more difficult and expensive operation the limits to the fungibility of oil may soon become more evident.

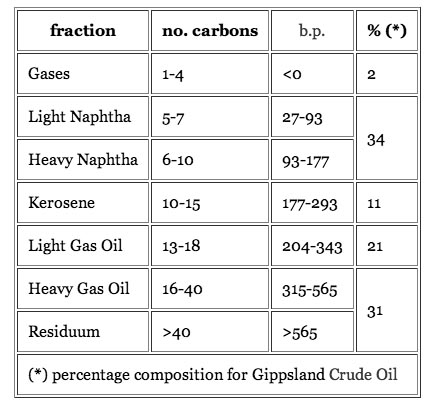

One of the reasons for this is that, with some increasingly rare exceptions, one cannot drive up to an oilwell and fill the tank with the flow out of the ground, and then drive happily off. Crude oil is a mixture of different hydrocarbons. (Morgan Downey explains this is more detail in “Oil 101”, and I will refer to that book a number of times as this series progresses, it sits on my desk.) Hydrocarbons are a combination of hydrogen and carbon atoms in different combinations, but with very approximately, twice as many hydrogen atoms as carbon. As the number of carbon atoms increases one moves from the simple light compounds such as methane (CH4) to the more complex heavier fluids that get down to residual oils ( 29 to 70 carbons) and bitumens (above 70). Because the different components of the oil have different uses, the different fractions of the oil are separated out for individual use at a refinery. The quality of the crude is generally expressed by the API gravity, of which more in a later post.

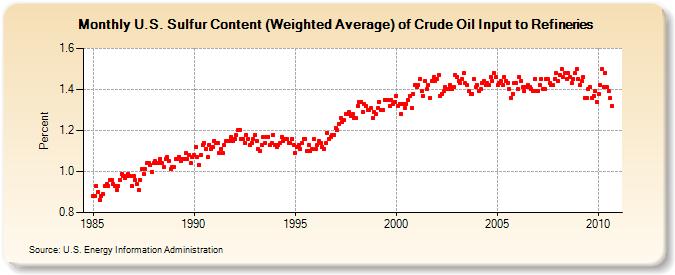

Because the different oilfields of the world produce oil with different combinations of hydrocarbon compounds, and with varying levels of other contaminants, such as, for example, sulfur, it is not always easy to switch the oil supply coming into a refinery from one field to that from another. The EIA has plotted the increase in sulfur content coming into US refineries. As the crude becomes heavier and contains higher sulfur content, so the refining process becomes more complex and expensive.

For many years, for example, the heavy, high sulfur, crudes produced in Venezuela were shipped to refineries in the United States that were designed to refine the oil to the desired products. Other refineries, geared to refining lighter sweeter (i.e. lower sulfur) crudes cannot accept very much of the Venezuelan oil and blend it into their process streams, since even to get to an intermediate crude they would need to include a higher quality (and more expensive) lighter crude in the blend. Thus when there was a strike in Venezuela in 2002, and the world lost 3 mbd of oil production, there was only a limited flexibility in the way that the affected refineries in the United States were able to resolve their supply shortfall. (And in those days it was possible to increase Mexican supply to help out).

Venezuela is one of two countries (Canada being the other) with a significant production of synthetic crude from the heavy oil sands in that country. These are a more extreme case of the need for special refineries, since in both the Canadian and Venezuelan case the heavy oil must first be treated at the site to upgrade it to the quality of a conventional crude, before it can be sent to a conventional refinery. (I briefly discusses that refining in an earlier Tech Talk). This established a secondary limit on how much oil can be produced from those deposits at one time. Some time ago I visited the Oil Sand operations in Alberta, and was there on the day that the new Upgrader facility was shut down because of the escape of some of the gases from the process. I could smell a faint odor of “cat pee”, but nothing near the smells from many other processing plants of varying nature that I have visited over the decades. Nevertheless the new section of the plant was shut down for months until the problem was solved, removing over 100,000 bd from the market.

More recently the difference in price between heavy crude and light has reduced, to the point that the Canadians are no longer going to increase the size of the upgraders in the Fort McMurray area, but will instead be shipping the bitumen to eager customers. This does require some additional technology:

Under the new timeline, which was disclosed yesterday, Syncrude will lift production to 425,000 barrels through debottlenecking, and add a further 115,000 per day of bitumen production. Both expansions are expected by 2020.

(With additions to its mining operations, Syncrude actually plans to extract 600,000 barrels a day of bitumen by 2020, but barrels that go through its upgrading process actually shrink in size, resulting in a total output of 540,000.) Bitumen on its own is too thick to flow through a pipeline: at room temperature, it has the consistency of old molasses. But Syncrude plans to employ a new system that uses a solvent to remove what Ms. Fisekci called the "nasty" part of the bitumen. That system, which Syncrude operator Imperial Oil also intends to use at its Kearl oil sands mine, will allow the bitumen to flow without needing to be upgraded.

This will reduce the current bottleneck in production, which lies with the upgrader capacity, since it is only after the crude has passed through them, that it is able to flow easily through the pipelines to the conventional refineries. That change is not yet being considered in Venezuela, where the syncrude is now counted, by the EIA at least, as part of overall production.

.png)

The graph from the EIA highlights another consideration as I move to discuss the global trade in oil. That is the rising consumption within the country, a phenomenon that Jeffrey Brown (Westexas) introduced us to as the Export Land Model back in January 2006, since, with declining production it accelerates the reduction in net exports, as the Venezuelan case now illustrates.

I’ll close today with one last point on the limits of fungibility. There are certain oilfields where the contamination of the crude is such that special refineries are needed to process the oil. The most outstanding of these is the oilfield at Manifa in Saudi Arabia, a subject I have been writing about for over five years. The problem with that production, which was initially slated to be in production next year comes from the need for special refineries to process the oil (an extreme case of the earlier condition I described). The plan was that two refineries would be built in Saudi Arabia to handle the initially 1 mbd of planned production, which by last March had dropped to 900,000 bd. One of these is being built by Total at Jubail, though it is interesting to note that the refinery is now scheduled – in its 400,000 bd capacity – to also receive oil from the more conventional field at Safaniya. It is now anticipated to open in 2013. A second refinery at Yanbu will also take 400,000 bd. Aramco will then build a new refinery at Jazan, with a capacity of 400,000 bd starting in 2013. But until those refineries come on line, unless the Saudi’s and Chinese work out a deal (not beyond the bounds of possibility) that oil will stay in the ground.

The above is intended to show is that there are constraints outside of just having oil in the ground, and a ready customer, that preclude immediate sales and satisfaction. As this series develops I will be highlighting some others.

I have a naive question: Where does the sulfur come from? I've assumed that it is somehow solublized from the source rock rather than high sulfur plant/animal material that becomes the oil. Is this right? If so, how is released from the rock and go into solution in the oil?

Todd

No, plants and animals produce sulfur compounds. You can experience this yourself if you eat a large meal of black bean burritos.

Depending on the mix of bacteria in your gut, it can be a mildly (mostly methane) to highly (lots of hydrogen sulfide) odoriferous experience. If you have a lot of methane-producing bacteria it won't be too bad, but if you have a lot of sulfur eating bacteria in your intestines, it will be a truly bad experience for your intimate relatives and close personal friends.

Oil fields are similar.

Thanks.

We don't "make" sulfur, we merely process it. Sulfur is ingested and our body (or another organism for that matter) makes it into a compound.

Sulfur is absorbed from the soil by plants as ions, and it is critical to life as we know it. it is one of the essential elements.

Rgds

WeekendPeak

Lets see if I can nail the 6 vital elements from the top of my head.

Carbon. Oxygen. Hydrogen. Sulfur. Fosfor (Arsenic in a newly discovered rare exception).

What is the last one? Nitrogen?

about 0.2% sulfur by weight in the average human.

Of the 20 natural amino acids, which make up the proteins in your body, cysteine and methionine both have a single sulfur atom in them.

Some sugars like heparin have sulfate groups on them (these sugars are critical to your immune system function and your joint materials).

Ever been to a hair dresser and smelled a sulfurous odor? They are using thiol compound to break sulfur-sulfur bonds in peoples hair and reforming them to either add or remove curls from hair.

In any case, sulfur is a very essential atom in life -- especially for turning glucose into energy-- electrons taken from sugar are carried along iron-sulfur clusters ultimately to join with oxygen to make water during respiration.

In plants, sulfur is also used to capture solar energy and fix carbon from CO2 to make sugars.

With the reduction in sulfur emissions required by anti-pollution laws, growers of crops like sugar beets, cabbages, and canola that have high sulfur requirements have to watch sulfur levels and augment with sulfer-containing fertilizers.

A dairy in CA tried to make biogas from digesters to produce electric to power its dairy, and then they were cited for releasing too much SOx and had to retrofit a scrubber.

They were operating in a valley with a lot of low lying smog.

In any case you are right biologicals have sulfur in them unless they are purified away initially.

Fungibility a subject not scrutinized as much as one would expect.

That's a very good summary of the world's problems with the crude oil supply, which is becoming increasingly heavy (more asphalt than gasoline) and sour (high in sulfur) as the existing supergiant oil fields deplete and the producers fill the gap by bringing their more problematic oil fields on stream. And a lot of the oil fields are really, really problematic.

A few decades ago, nobody would touch oil of the quality that is now being traded, but in the modern world the refineries have no choice. They have to process heavy, sour crude with heavy metal contamination, or go out of business. This is particularly true of US oil refineries - West Texas Intermediate may be a benchmark quality of crude oil, but there is very little of it available any more. The refineries have a choice between Venezuelan extra-heavy crude or Canadian bitumen, and even the Venezuelan extra-heavy is getting scarce because of Venezuela's political problems.

The declining quality of crude oil contributed to the oil price spike of 2008. The Saudis complained that there couldn't possibly be a supply shortage of supply because they couldn't sell a lot of their oil. The reality was that the additional oil they tried to put on the market was not the sweet, light Arabian crude that everybody wants. It was truly dreadful crap that very few refineries could process. That was all they had left.

One of the reason I seriously question Saudi Arabia's claim about being able to control prices. Its light sweet crude thats the market maker. Even if they do have spare capacity how much of it is light much less relatively sweet. My understanding is that Saudi crude even Arab Light is relatively sour.

As far as prices are concerned the availability of the lighter sweeter grades are probably all that matter.

SAUDI ARABIA - The Main Fields Producing Heavier Crudes.

http://www.thefreelibrary.com/SAUDI+ARABIA+-+The+Main+Fields+Producing+H...

Fungibility is a very important concept. We have long understood oil is a fungible commodity like dollars. But Heading Out rightly demonstrates this is not always the case due to infrastructure constraints.

There are some who believe energy is fungible. That is, one BTU of a form of energy is the same as another of a different form. This is the basis of the EROEI concept.

I have ranted on this subject to no end. The latest outrage is the EPA giving mpg ratings to electric cars. Implicit is that gasoline and electricity are fungible energy forms and that a BTU of one can be easily exchanged for a BTU of the other.

This despite that electricity is seldom generated from gasoline except in back up generators and auto alternators. Generally electricity is produced from other forms of energy than gasoline.

Of course my main gripe is when gasoline and ethanol are treated as though they are fungible. True there is an element of fungibility in that they are both used in gasoline engines, but there are infrastructure, EPA limits and mileage/price issues. Ethanol and gasoline are different. They are not fungible even though they are used in the same way. Each has its own standard and the standard for one can not be applied to the other.

Heading Out mentions wheat as a fungible commodity, which is generally true. However there are different kinds of wheat that are used differently. Not only that but even one kind of wheat may become non fungible with the rest because of qualtiy as in the case of what is happening now in Australia.

After several years of drought Australian farmers had a good wheat crop fit for human consumption. But lately excessive rain has damaged the crop standing in the fields to the extent that it has been downgraded to animal feed which is of much lower value.

This lower quality wheat is not fungible with the better quality wheat since millers will not buy it. This means the supply of wheat for human consumption has been reduced and that is behind the recent run up in wheat prices.

Fungibility matters. Some things like dollars are nearly always fungible. Other things are fungible in principle but not in practice due to infrastructure, market and quality constraints.

Heading Out has made a good point.

"Fungibility is a very important concept. We have long understood oil is a fungible commodity like dollars. But Heading Out rightly demonstrates this is not always the case due to infrastructure constraints."

That is an interesting thought. Coming from a background in mining, I have seen that each mill is set up to process the particular orebody, and they are all different. Oh the unit processes are much the same from place to place, but the details of implementation are highly customized. And they even change over the life of the mine, as the mineralization changes as you go deeper, or even as you move laterally.

So now oil appears to be going the same way. The basic refinery structure will sprout extra steps and side streams to process the local sort-of-oil, which is going at odds with the smaller average oil field sizes coming on line now. This is gong to raise capital costs more than a bit.

The basic refinery structure will sprout extra steps and side streams to process the local sort-of-oil, which is going at odds with the smaller average oil field sizes coming on line now.

The problem is that refineries are relying on much lower quality oil, coming from smaller fields, which are much farther away . There are generally no local sort-of-oil fields (except possibly California's Kern River heavy oil deposits - and even there you have to worry about the NIMBY crowd).

So, in general, refineries are having to accept lower quality oil, produced in smaller oil fields with higher production costs, and pay much higher transportation costs. It's something of a lose, lose, lose situation.

Yes, fungibility matters, and it's often a matter of degree. In a functional sense, ethanol is partially fungible as a fuel, or we could call that fungible at the margin. This makes it feasible to put it into cars, up to a point. If it were completely non-fungible ("different"), we would not have folks growing feedstock for ethanol to be used in car fuel...

So you have a gripe in that you don't think they are fungible.

Then you admit in the very next statement that there is a degree of fungibility. This means that you can compare them, and you just did in saying that gasoline and ethanl can both be used in gasoline engines. You have now been cured of your confusion.

Canada & Venezuela

"Net Export" Math

Regarding Canada & Venezuela, I have a "Canadian Oil to the Rescue" slide which shows Canadian and Venezuelan net oil exports from 1998 to 2009, along with their combined net exports (BP). Canada's net exports over this time frame increased by about 250,000 bpd, while Venezuela has been declining since 1998. Chavez has, shall we say, not been helpful, but I believe that Venezuelan production started declining even prior to him becoming president. In any case, their combined net oil exports fell by about one mbpd from 1998 to 2009.

Regarding Net Export Math, note that even flat consumption in an oil exporting country showing a production decline results in an accelerating net export decline rate. The "Export Land" stipulations were a C/P (Consumption/Production) ratio of 50% at final production peak, a production decline rate of 5%/year and a consumption rate of increase of 2.5%/year; this resulted in net exports going to zero in 9 years, with a net export decline rate of close to 30%/year at the end of the net export decline period (versus a 5%/year production decline rate). If we use the same C/P and production stipulations, but assume no increase in consumption, net exports would go to zero in 14 years, with a net export decline rate of about 23%/year at the end of the net export decline (versus a 5%/year production decline rate).

Given a production decline in a (net) oil exporting country, unless the exporting country cuts consumption at the same rate as, or at a rate faster than, the rate of decline in production, then the net export decline rate will exceed the production decline rate, and the net export decline rate will accelerate with time. One of the really dangerous aspects of net export declines is that they tend to be "front end" loaded with the bulk of post-peak CNE (Cumulative Net Exports) being shipped early in the decline phase. A rough rule of thumb is that post-peak CNE tend to be about 50% depleted about one-third of the way into a net export decline. Sam Foucher's most optimistic projection is that Saudi Arabia, Russia, Norway, Iran and the UAE will have shipped about half of their combined post-2005 CNE by the end of 2013--50% depleted in eight years.

What I find interesting to ask is: How much oil could be recovered from the Venezuela heavy oil deposits, given an oil price of ~ $150/bbl and given that Mr. Chavez and his cronies are out of the picture and Venezuela invites robust participation and competition by/from the World's oil companies and oil service companies?

Would it be smart for such a Venezuela of the future to invite the World to help it invest in building plenty of its own heavy oil refineries so that it could sell the petroleum products at a premium vice selling the crude oil?

How useful and profitable would the Vanadium and other contaminant by-products be?

How much oil could be recovered from the Venezuela heavy oil deposits, given an oil price of ~ $150/bbl and given that Mr. Chavez and his cronies are out of the picture and Venezuela invites robust participation and competition by/from the World's oil companies and oil service companies?

Oh, about 500 billion barrels, or what the USGS assigns to Venezuela. Considerably more than Saudi Arabia has. About the same as Canada (if you include the Canadian resources that are there but not many people know about).

It could happen in some alternate universe but probably not in this one under current conditions. It may happen in this universe at some future point in time, but not soon enough save us from declining global production until we're a long, long way down the decline curve.

Would it be smart for such a Venezuela of the future to invite the World to help it invest in building plenty of its own heavy oil refineries so that it could sell the petroleum products at a premium vice selling the crude oil?

Yes, it would be smart. That is why I do not expect it to happen. Chavez is not smart. His future replacement may be much smarter, but the odds are against it.

How useful and profitable would the Vanadium and other contaminant by-products be?

In general, not very useful or profitable. Sulfur is something of an exception since there is a lot of it in the new oil production, and it does have value in fertilizer and chemicals.

If tar sands and bitumen are more expensive to extract for use as fuels, we can expect more of them to still be around after other sources of crude oil for petrochemical feedstocks have all been burned.

What are the pros and cons of using tar sands and bitumen as the starting point for petrochemical plants?

What are the pros and cons of using tar sands and bitumen as the starting point for petrochemical plants?

Bitumen and extra-heavy oil would work as a petrochemical feedstock, but it would not be my first choice of feedstocks. The heavy components in it would not be that easy to work with. In general you would be better off starting with lighter products such as natural gas liquids. Bitumen is only a good feedstock if you are trying to make asphalt.

RMG,

Thank you for your insights.

That is a teaser...are you referring to deposits other than the Athabasca tar sands?

Also, I thought that Vanadium was a contaminant in Venezuelan heavy oil.

If so, is Vanadium not very useful? I thought it was used in certain steel alloys.

Also, would it have a market for use in Vanadium redox/flow batteries for use in stabilizing an upgraded electric grid which incorporates substantial amounts of intermittent renewable energy-generated electricity??

http://en.wikipedia.org/wiki/Vanadium_redox_battery

The article also mentions that sulfuric acid would be used in such batteries.

Here is where I am going with this: The U.S. stops playing Imperial overlord in the M.E., inviting blow-back from peoples with whom we share little common cultural ground. Let China, India, and Europe have fun playing in the sandbox, let them deal with the potential blow-back.

The U.S concentrates on cozying up to the Venezuelans and enter into a productive supplier-customer relationship...the ROW is invited to stay out, a la the Monroe Doctrine. The U.S. has a metric boat-load more people who can speak Spanish than we have who can speak Arabic...we and the Venezuelans share a closer cultural background...the oil shipments would be much shorter, using less bunker fuel and would be much easier to guard with our naval and other military forces.

500B of oil divided by a production of 15M bbls per year (~10 for the U.S. and 5 for the ROW) would last ~ 75 years, no?

Watch your units; the USA imports over 10 million bbl/day, not per year.

It's also not likely that the Venezuelans would accept small shares of the selling price; depose Chavez and he'd be succeeded by someone with a similar set of campaign promises and policies.

...are you referring to deposits other than the Athabasca tar sands?

Well, there is a group of related deposits known as the "carbonate trend" - bitumen trapped in carbonate rock rather than sand. It is actually bigger than the oil sands. The three major oil sands deposits in Alberta (Athabasca, Peace River, and Cold Lake) have a total of about 1.7 trillion barrels of crude bitumen in place. The carbonate trend probably has closer to 2 trillion barrels of bitumen in place.

Oil companies have been ignoring the carbonate trend because it is technically more difficult than the oil sands, and most people thought the oil sands were more than adequately difficult. However, companies such as Athabasca Oil Sands Corp and Osum Oil Sands Corp, are starting to build thermal recovery projects and book reserves on leases in the carbonate trend, so I guess they're making progress on it.

It's all rather speculative, and they refer to them as "contingent resources" rather than reserves, but the numbers are very, very large, and PetroChina and Korea Investment Corp are backing them with some serious money.

AOSC (Joint Venture with PetroChina)

Osum (Joint Venture with KIC - BTW, Osum is a private company and does not trade on any stock exchange)

It's a game for investors with lots and lots of money, high risk tolerance, and long planning horizons, which the Chinese and Koreans are. But the payoffs are potentially enormous.

A very poignant observation

... and probably implausible/impossible for most Western economies obsessed with "quarterly earnings" and 3-4 year re-election cycles

When Alberta runs out of natural gas to boil its tar sands or its "carbonate trend", it will not make a big dfference. The whole show will just stop...

There is only a 10 year proven gas reserve left and there are lots of people in Alberta, in the rest of Canada and in the US that heat their houses using gas. When the stuff starts getting rare, one will see how politicians react to a crowd that has no more heating in their houses in winter...

One can blow numbers all around about shale gas but its EROEI is way down from the conventional stuff and to suck it out it takes huge amounts of water along with a collection of toxic chemicals.

JB

P.S: If the industry is considering using nuclear plants to replace gas they better start building now because it takes 10 years to get a plan built, including the environmental studies, public hearings and licensing...

There is only a 10 year proven gas reserve left

Not true. There is a reserves-to-production ratio of 10. Ten years from now, there will probably still be a reserves-to-production ratio of 10. They will just convert "resources" (gas in the gas formations they know are there but haven't drilled into yet) to "reserves" (gas in the gas formations they know are there and have drilled into). The problem arises when they run out of resources to convert into reserves, and western Canada is a long way away from that point with the recent advances in shale gas and coal bed methane technology.

When Alberta runs out of natural gas to boil its tar sands or its "carbonate trend", it will not make a big dfference. The whole show will just stop...

No it won't. They'll just switch to syngas produced by bitumen gasification, or nuclear reactors, or coal. Whatever works. All you need is a source of process heat, and the oil sands region has a wide variety of fuels available (natural gas, uranium, coal, and the oil sands themselves). The reason they use natural gas is that it is locally available and convenient. There are natural gas fields underneath the oil sands.

As a metal worker I come in contact with vanadium/crome alloyed steels all the time. Used commonly as means of strengthening steel. I use to think about iron as soft, but CV-alloyed steel is vary hard.

According to wikipedia, vanadium is also used in nuklear reaktors and as a katalyst for some chemical reaktors. There are also some interesting ideas for bateries based on vanadium.

Just a dozen km or so away from where I grew up there was a place they used to day-mine for vanadium. So it obviously have some comercial value.

Yew mispelled kemical.

Feh. These nations increased net exports 2000-2008 by an average of 747.14 kb/d:

Kuwait

Azerbaijan

Kazakhstan

Saudi Arabia

Russian Federation

A while ago a name for these top dogs popped into my head: "Yerginstan." ;)

Ack, here's the inverse, or rather: "Savinarberg":

China

United Kingdom

US

Venezuela

India

-745.31 kb/d this time. Hey, a razor thin margin, waddya know. And for the whole set of net importers I extracted from BP data it was -1143.64 vs 1041.57. How does that work? Could do a much more thorough job with EIA numbers and of course a real statistician could vary the start and end dates in a series, etc. Something's up with hurricanes and recessions too as US gained 1,151 kb/d for 2008, which obviously isn't part of the underlying trend. But I lack the chops to do much more with these numbers. Still, you see some very interesting things with even rudimentary diffs and averages.

This article has some post-2005 total net export numbers:

http://www.energybulletin.net/stories/2010-10-18/peak-oil-versus-peak-ex...

omitistan ?

http://www.eia.doe.gov/country/country_energy_data.cfm?fips=AO

+1231 kbpd.

But except in the cases of short-term disruptions because natural disasters (hurricanes...), changes in the mix should be relatively slow (field declining at 6% a year because it is a mature field...). So I don't see the problem in re-engineering refineries to deal with a slow-changing mix.

H.O. - This is a very good description of the limits of oil's use by various consumers. The "drill here, drill there" crowd has no idea of the difficulty in refining lessor grades of crude, which is being produced more as lighter, premium grades are depleated.

My main comment is concerning the refining of bitumen from tar sands of Canada and extra heavy oil from Orinoco Basin of Venezuela. This oil takes more energy to extract (like Steam Assist Gravity Drainage, SAGG) in Alberta, but also takes more energy to even move it. That solvent that must be employed to get the Bitumen to flow must have a cost and energy content that reduces EROEI of Tar Sands oil. Thus net energy from Tar Sands is lower, perhaps 4 or even less considering the nat. gas used in refining that goo to short chains HC's that are needed for gasoline. SAGG also uses huge amounts of nat. gas.

Tar Sands were projected in ten years to ramp up to 4 or 5 million B/D according to reports I read a couple years ago. The THAI process (Toe to Heel Air Injection) was supposed to be the cure all (reduce cost but produce less percentage of usable HC's) to ramping up to that level. Reports of huge releases of NOX and CO/CO2 from the process may have curtailed that effort. Very large amounts of nat. gas must be burned to convert NOX compounds to H2O and N2, thus again using more energy to extract Tar Sands. EROEI then goes even lower, while CO2 emmissions grow evern higher per barrel of bitumen produced.

I'm not finding any mentions of NOx for THAI except in TOD threads, and the extreme fuel-rich combustion conditions and relatively low temperatures disfavor significant production. Do you have a reference?

I can's find the article that referenced the emissions from the THAI process, but it was listed in a Drumbeat thread a year ago or so. The article mentioned that the NOX and CO/CO2 levels from the combustion (comes out with the liquified bitumen) were much higher than expected.

Oxides of nitrogen are formed from a combination of heat and pressure where oxygen is present with nitrogen. This is true for automobile engines and that is why the compression ratios of gas engine cars today are on the order of 8:1 versus 10:1 or greater from 40 years ago. The THAI process produces oil at 400 deg. C ahead of the flame front which is burning the heavier fractions of the HC's, so the combustion region is likely much higher than this. I don't know the pressure, but if it is on the order of 200 psi, NOX is likely to be formed, IIRC from my studies of automotive engineering 30 years ago.

References I can find say NOx doesn't form in significant quantities until flame temperatures hit 2800°F. Any issues would have to be due to fuel-bound nitrogen. I can't find anything on Athabasca bitumen, but Uinta basin bitumen (Utah) is as much as 1.8% nitrogen by weight. Wow!

NOx is reduced easily in rich, low-temperature flames, so staged combustion of the CO-rich off gas would probably suffice to control it.

Compression ratios of gasoline engines went down to accomodate 87-octane unleaded fuel, but they're headed back up again with direct-injection engines.

A very interesting posting.

But how about a global picture of where we are collectively heading in terms of oil supply that takes into account true depletion rate, fungibility amd EROEI issues?

JB

This is the start of the series, and I only write in about thousand word chunks - be patient we'll get there.

HO only know so much. If he produces more words than he have knowledge for, he will reach Peak Words too soon. Then he will have to start using lower quality words (by making stuff up) to mantain the production plateau, and we don't want that.

Note also, there is question of what you want to get out of the oil.

In the US, for domestic vehicles, you're looking for gasoline. Very few diesel vehicles, and most of those trucks shipping goods around. In Europe, in contrast, there is a large market in domestic diesel vehicles, as well as trucks.

Different supplies can produce different percentages of each fraction, and there is a limit to how much you can veer and haul between %ages of each fraction.

Thus, currently, there is a market is shipping finished gasoline from Europe to the US (as essentially a waste) and diesel in return.

As the percentages of usage of each fraction change, you can get emergent price differentials as type availabilities become 'tight'. This becomes even more key as we move into a supply constrained rationing scenario. Diesel is key to important usages such as trucking and farming - and is likely to be rationed for those purposes. However gasoline will go in police cars etc.

Which will run out first, for the domestic user?

This also beautifully demonstrates the issue of the substitution spiral; whereby we replace a declining resource with other resources that may have the same utility but which are more complex and expensive to provide.

Adding units to refineries is very expensive and (as noted above) very specific to the feedstock available to that refinery. So not only are refineries becoming more feedstock-specific but will require ever higher technical and mechanical resources to make them work. And if a particular feedstock goes off line the refinery's capacity is lost.

The comment about the Saudi having oil to sell but it wasn't oil anybody wanted to buy because it was unable to be processed in any buyer's refinery is telling.

All adds to the worsening EROEI and further hastens the convergence of the supply and demand curves.

A question for the resident experts:

One can imagine that a particular oil field would over millennia have segregated the oil reserve into strata based on specific gravity. Thus the topmost oil would be the lightest (and probably easiest to process) while as the field is depleted - the remaining oil eventually floating on top of water pumped in - the oil fraction recovered will get progressively heavier and harder to process.

Thus in any field, and in total globally the oil yet to be recovered is increasingly like the Saudi crude: "...truly dreadful crap that very few refineries could process" (to quote RockyMtnGuy)

So not only are the newer-found resources of progressively lower grade oil, but the quality and refine-ability of the oil from existing fields is declining also. So the usable fraction of global at the well-head production is declining at far faster rates than any of the IEA's or even the grimmer EROEI decline curves suggest.

Is that correct?

Thanks

Nigel

One can imagine that a particular oil field would over millennia have segregated the oil reserve into strata based on specific gravity. Thus the topmost oil would be the lightest (and probably easiest to process) while as the field is depleted - the remaining oil eventually floating on top of water pumped in - the oil fraction recovered will get progressively heavier and harder to process.

No, that doesn't happen. In general all the oil in any oil field will be of the same quality. Since oil is soluble in other oil, it will all end up being of the same quality.

That's not 100% true, but it is 99% true, so you don't generally worry about the oil quality declining as the field is produced. What you do worry about is the water cut rising as the oil layer gets thinner and water starts creeping into the oil layer.

The problem with declining oil quality is that companies will produce their best oil fields first, because they are cheaper to operate and the oil commands the best price. As the good oil fields are depleted, they will produce more and more oil from their poorer fields, until at the end of it all, the only oil that is left is in oil fields containing oil that nobody wants.

Thanks for clearing that up Rocky!

I note that there are about 750 refineries in the world, roughly. It would be an interesting Google Earth overlay to show what crude these can each handle, and watch the lights go out in the control rooms as the feedstock quality declines.

Thanks

Nigel

It would be an interesting Google Earth overlay to show what crude these can each handle, and watch the lights go out in the control rooms as the feedstock quality declines.

This decline in quality does not come as a total surprise to the refinery owners, and what will actually happen is that they will close some of the refineries and rebuild many of the rest to handle lower quality feedstock. All it takes is money, large amounts of it.

This has already happened in many places in the US. With declining supplies of sweet light Texas crude oil, the Midwestern refineries have been modified to handle Canadian bitumen, and the Texas Gulf Coast refineries have been modified to handle Mexican and Venezuelan heavy and extra-heavy oil.

The problem there is that Mexican and Venezuelan oil production has been declining, so the Texas Gulf Coast refineries are wondering, "Can we somehow get Canadian bitumen delivered here?" Yes they can, by reversing the pipelines that lead from Texas to the Midwest, but it's not a simple process - bitumen doesn't pipeline all that well.

reservoir oil quality can degrade with time if the oil is 'volatile' and the field is allowed to deplete, pressurewise. if the reservoir is at a high temperature, intermediate components that were initially captured in the stock tank will be boiled off at lower pressure (in the reservoir). gas being of lower viscosity will speed ahead of the oil and ultimately be sold as ng. what is left behind is a lower gravity oil.

varrying stock tank oil gravity is a tip off that an oil is volatile(as opposed to a 'black oil'). stock tank oil gravity and gas/oil ratio will increase over time. if the reservoir is depleted to a low enough pressure, most of the intermediate components will be gone and stock tank oil gravity will then decrease.

a 'black oil' has physical properties(density,viscosity and solution gas/oil ratio) that are a function of pressure alone.

Well, as I said, it is 99% true that the oil quality will not decline as the field ages. However, if the pressure declines and viscosity increases, it is probably a good idea to put the field on a pressure maintenance program and reinject the produced gas. Or whatever the reservoir engineers think is best.

it would seem so. how 'bout the bakken though ? the nd industrial commission's solution is 'flare baby flare', maximize pv at any cost.

a huff'n'puff co2 experiment in the parshall field was a failure due to almost immediate breakthrough in an offset well.

how 'bout the bakken though ? the nd industrial commission's solution is 'flare baby flare', maximize pv at any cost.

The Bakken play is basically an exercise in squeezing a few dribbles of oil out of an extremely tight reservoir. It's sort of okay, but more about cost control than anything else. Do you realize the Bakken extends under Saskatchewan, and it's far from being even the best play in Saskatchewan? It's only exciting if you have nothing else going for you (I'm looking pointedly at American oil men, here)

As for "flare baby flare", if you foolishly said that where the Alberta Energy Resources Conservation Board could hear you, they would suggest you take your business to North Dakota because they don't want to see you in Alberta.

a huff'n'puff co2 experiment in the parshall field was a failure due to almost immediate breakthrough in an offset well.

For a truly spectacular breakthrough experience, you should try one in a fireflood project. There's nothing like seeing a well tubing string blown 100 feet into the air to liven up your morning. CO2 projects are for old oil men whose doctors have told them their blood pressure is too high to handle much more stress.

Fungibility = interchangibility?

fungible:

–adjective Law .

(esp. of goods) being of such nature or kind as to be freely exchangeable or replaceable, in whole or in part, for another of like nature or kind.