Applying Time to Energy Analysis

Posted by nate hagens on December 13, 2010 - 10:06am

Is a BTU today worth more or less than a BTU ten years from now? It's seemingly an easy question. A BTU will heat one pound of water one degree whether its 2010, 2020, or 2100. And, in a world of entropy where the easiest and best quality energy sources (generally) get used up first, one unit of energy should increase in value over time, as its ability to accomplish work becomes more valuable to society as time progresses. However this is solely a physical perspective, one that ignores biology of time preference. Once humans with finite lifespans and cultures with sunk costs enter the picture, a BTU today, behaviorally, becomes worth more than one in the future. This fact has pretty big implications for biophysical analysis of energy alternatives, which will be explored below.

This post is an adaptation (first a shrinking, then an expansion) of Chapter 5 of my dissertation, which was co-authored with my colleague Hannes Kunz.

Executive Summary

Biological organisms, including human societies both with and without market systems, discount distant outputs over those available at the present time based on risks associated with an uncertain future. As the timing of inputs and outputs varies greatly depending on the type of energy, there is a strong case to incorporate time when assessing energy alternatives. For example, the energy output from solar panels or wind power engines, where most investment happens before they begin producing, may need to be assessed differently when compared to most fossil fuel extraction technologies, where a large portion of the energy output comes much sooner, and a larger (relative) portion of inputs is applied during the extraction process, and not upfront. Thus fossil fuels, particularly oil and natural gas, in addition to having energy quality advantages (cost, storability, transportability, etc.) over many renewable technologies, also have a 'temporal advantage' after accounting for human behavioral preference for current consumption/return.

ENERGY GAIN

The concept of 'energy gain' - how much energy remains for an organism or process after the energy to procure it has been accounted for - has been a popular topic on this website for many years. Here is a short list of essays/analyses previously on TOD explaining that biophysical concept:

A Net Energy Parable - Why EROI Is Important?

Ten Fundamental Principles of Net Energy Analysis

At $100 Oil What Can the Scientist Say to the Investor?

The Energy Efficiency of Energy Procurement Systems

The True Value of Energy is the Net Energy

Basically, over time, natural selection has optimized towards the most efficient methods for energy capture, transformation, and consumption. In order to survive, each organism needs to procure at least as much energy as it consumes (Lotka 1922pdf, Odum 1973). For example, lions that expend more energy chasing a gazelle than they receive from eating it will not survive. In order for body maintenance and repair, reproduction, and the raising of offspring, a lion needs to obtain significantly more calories from its prey than it expends chasing it. This amount of energy left over after the calories used to locate, harvest (kill), refine and utilize the original energy are accounted for is termed ‘net energy’. In the human sphere, this same concept applies. Irrespective of dollar costs, which are often distorted due to inflation, subsidies, debt induced affordability, and myriad other economic distortions, energy sources need to return more energy than is used in their retrieval. And in order to secure an average modern human lifestyle including shelter, amenities, leisure activities and many more benefits beyond the bare necessities, this energy surplus needs to be significant.

Human history consists of transitions in energy quantity and quality. Generally, the value of any energy transformation process to society is proportional to the amount of surplus energy it can produce beyond what it needs for self-replication. (Hannon) Over time, our trajectory from using sources like biomass and draft animals, to wind and water power, to fossil fuels and electricity has enabled large increases in per capita output because of increases in the quantity of fuel available to produce non-energy goods. This transition to higher energy gain fuels also enabled social and economic diversification as less of our available energy was needed for the energy securing process, thereby diverting more energy towards non-extractive activities. (Cleveland).

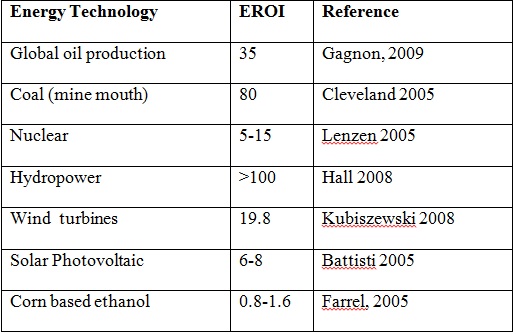

Examples of EROI Values/Studies -Table from Murphy (2010)

Figure 1 - Net Energy Cliff (based on Hagens, Mearns, Balogh etc. based on work of many before)

As fossil fuels become more difficult to extract and thus are more expensive, a move from higher to lower energy gain fuels may have important implications for both how our societies are powered, and structured. As illustrated in Figure 1, declines in aggregate EROI either mean more energy is required by the energy sector (light blue) leaving less energy available for other areas of an economy (the dark blue), or that energy is less affordable for aggregate society in general. Declines in amounts of surplus energy have been linked to collapses of animal societies and historical human civilizations. (Tainter)

ENERGY AND TIME

Energy gain, though prominent, is but one of several factors that defines the value of energy to an organism or utility of an energy system. Consider time for instance. Energy output occuring after the energy input can be disadvantageous to an organism. If the lion in the above example can't access the calories from the gazelle until 1 week after the kill, this would pose a problem. Similarly, energy that is accessed beyond ones lifetime wouldn't be benefial to an individual. Thus time beoomes an integral variable in the energy gain calculus. At the intersection of time and energy is power. In physics, power is defined as the rate at which energy is converted into work. Some have suggested that power (or energy transformed per unit time) has been a primary driver of both human and nonhuman biological systems (Hall, Lotka). This “Maximum Power Principle” which was referred to as the Fourth Law of Thermodynamics by H.T. Odum states:

“…that systems which maximize their flow rate of energy survive in competition. In other words, rather than merely accepting the fact that more energy per unit of time is transformed in a process which operates at maximum power, this principle says that systems organize and structure themselves naturally to maximize power. Over time, the systems which maximize power are selected for whereas those that do not are selected against and eventually eliminated. ... Odum argues ... that the free market mechanisms of the economy effectively do the same thing for human systems and that our economic evolution to date is a product of that selection process.” (Gilliland)

As explained here, there is a tradeoff between the energy return on energy invested, and the energy return on time invested. We see this tradeoff between energy and time in many areas. Airplanes get us to our destination much faster than cars or trains, but are less energy efficient per unit distance travelled per passenger. Similarly, people speed at 70 mph so as to arrive faster while driving 55mph would use less energy. In an economic sense, 'power' is maximized in our current culture via digital wealth, as the instantaneous survival/status benefits of burning/using energy have physical limits whereas digital markers do not.

Figure 2 - Maximum Power schematic (source)

The above graphic depicts the Maximum Power Principle. At zero efficiency power is also zero because no work is being done. Also, at maximum efficiency, power again is zero because to achieve maximum efficiency one would have to run processes reversibly, which for thermodynamic systems means infinitely slowly. Therefore the rate of doing work goes to zero. It is at some intermediate efficiency (where one is “wasting” a large percentage of the energy) that power is maximized. (The implication that 'waste' has been evolutionarily selected for, is also referenced in the field of biology (Zhahavi)).

Discount Rates and Time

(For a colorful overview on the evolutionary origins of steep discount rates, see Climate Change, Sabre Tooth Tooth Tigers, and Devaluing the Future)

Humans prefer present over future consumption in most situations (Frederick). The extent of this preference is measured using a discount rate - the rate at which an individual or society as a whole is willing to trade off present for future benefits. The behavior of discounting future returns has an evolutionary background (Robson). Most organisms in nature do not live as long as their biological potential. Thus in most animals, emotions and instincts drive behaviors with short-term goals, such as eating, drinking, resource acquisition and mating. These automatic behaviors, rooted in older brain regions like the limbic system, are inherently myopic - e.g. while they are active the future carries little weight (Berns]. Essentially, all biological research finds positive preference for current versus future returns, and if returns are equal, most experiments show a large preference for immediate reward, (other than for situations when the immediate needs of the test subjects have just been satisfied) (Bateson). However, humans differ from other animals in that we can worry about and/or experience immediate pleasure from considering delayed consequences. As such, our emotional systems also have the potential to motivate behaviors with long-term positive trade-offs. Thus it is the extent to which we prefer the present over the future that is at issue, not whether or not this preference exists.

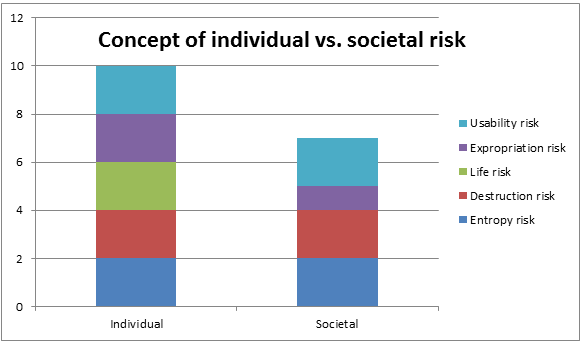

The reality of temporal risk is present in many forms for both animals and humans, including but not limited to: entropy risk, risk of destruction, risk of non-survival (e.g. a healthy 30 year old male in the U.S. has a 7.96% chance of not experiencing his 50th birthday), risk of limited access or government expropriation, risk of obsolescence, etc. These and other risks underlie the logic for favoring current returns over delayed future returns or, stated differently, require sufficient excess returns to justify the risks of waiting for the arrival of future benefits.

Decades of research in multiple disciplines have indicated that discounting of the future is also prevalent in human societies. In meta-analyses on individual discount rates, it seems that a relatively constant non-financial discount rate is applied after a certain period of several months, which seems to range between 5% and 50% for individual decisions, with an average near 20% (Frederick). Research on long term discount rates associated with durable goods purchases and energy saving devices show extremely high discounting (>100% annualized) (Hausman, Ruderman). Though some degree of time preference is present in all of us, certain cultures and demographics exhibit even steeper discount rates than others. Studies on young people, gender differences, alcohol drinkers, drug users, gamblers, smokers, risk takers, low IQ individuals, individuals with full cognitive load, etc. all exhibit a stronger preference for immediate over delayed consumption with variations across these life-style and genetic differences (Chabris). Unsurprisingly, people under stress exhibit higher preference for immediate versus delayed consumption. (Takahashi).

Figure 3 - Conceptual graphic of societal vs. individual risks

It is clear that human decision-making cannot be accurately predicted without reference to social context. Moreover, many decisions, particularly pertaining to energy and related infrastructure are made by groups as opposed to individuals. The social rate of time preference is the rate at which society is willing to substitute present for future consumption of natural resources. Overall, due to less risk of appropriation, longer life spans, etc., society-level discount rates should be lower than personal discount rates, but perhaps not significantly so. In fact, there is considerable debate on what level of discount rate to use in policy decisions. The arguments center around what rates should be used (prescriptive) versus what rates people and societies actually use in real decisions (descriptive). Many environmentalists assert that social discount rates should be less than 3% to properly weight future generations and the environmental costs they may face. In fact, in the Stern Review on climate change, the authors propose using a range between zero and 1.4% (Stern). However, some advocate using higher discount rates in policy so that enough infrastructure and investment takes place in the near term so as to build a bridge to the future. A meta-analysis of social discount rates from countries around the world showed a range between 3% and 12%, the higher numbers not surprisingly from countries of the global south (Zhuang). The United States Office of Management and Budget has applied a 7% discount rate towards civic projects in each year since 1992. This post does not weigh in on the prescriptive versus descriptive debate on discount rates other than to accept that some non-zero preference for immediate over future consumption exists for both individuals and societies.

Time and Financial Risk

Because a dollar received today is considered more valuable than one received in the future, time is also an important factor in financial and economic decisions. First, in a modern (and historical) leveraged banking systems where money supply increases over time without regard to underlying physical assets, positive rates of inflation diminish the purchasing power of dollars as time passes. Also, since dollars can be invested today and earn a positive rate of return, this creates an opportunity cost for both monetary and scarce resource investments. Finally, there is uncertainty surrounding the ability to obtain promised future income which creates risk that a future benefit might never materialize. For all these reasons, the financial world simply copies the principles of nature, as detailed above. In economics and finance, discount rates are used to compress a stream of future benefits and costs into a single present value amount. The net present value is the value today of a stream of payments, receipts, or costs occurring over time, as discounted through the use of some interest rate.

Time Value of Energy

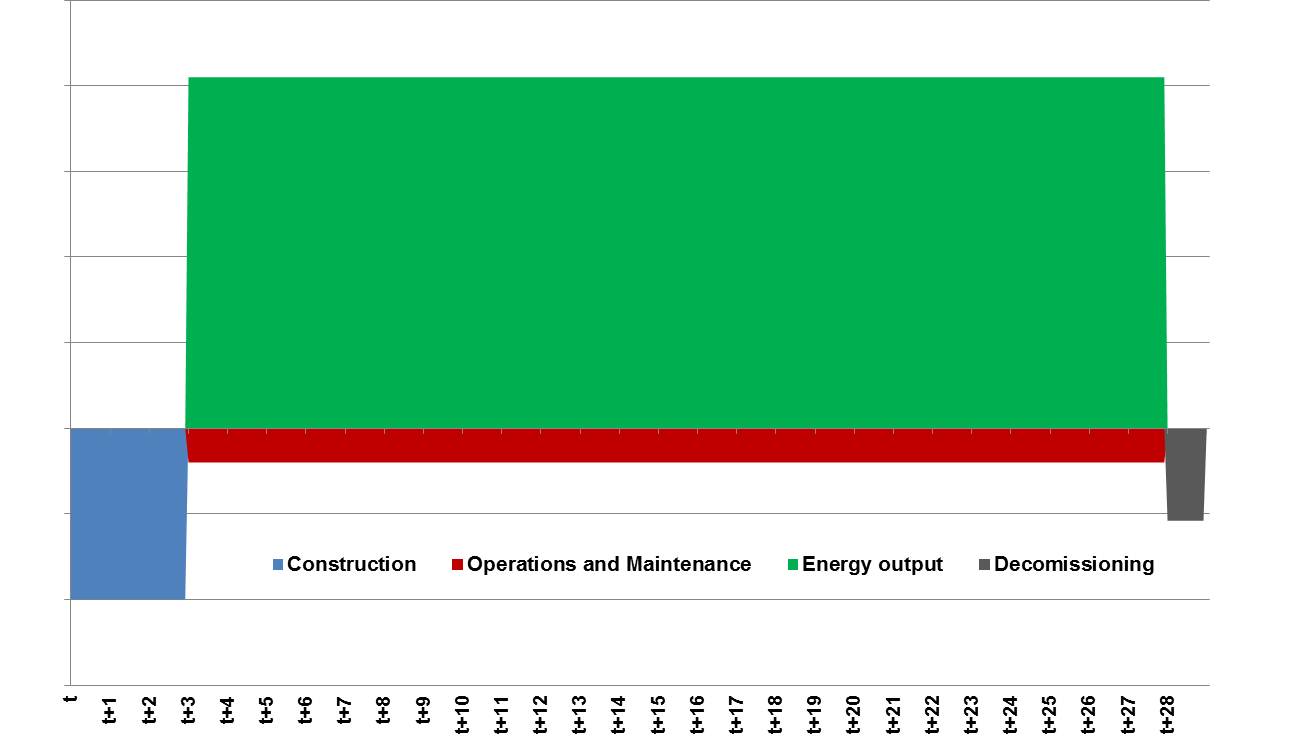

Figure 4 - Sample Input/Output Timeline for an Energy Technology

EROI is represented as a static integer representing the ratio of energy output to energy expense for the life of an energy technology, simply Eout/Ein. This can be represented graphically using an energy flow diagram such as in Figure 4. The green shaded region represents the energy output beginning at time t+c (where c is the period required for construction of facilities) and ending at time t+e (where e is the total number of years with energy gains). The blue section is the initial energy investment needed from the beginning of an energy gathering project. The red section represents ongoing inputs in energy terms through time t+e. Depending on the boundaries, there may also be another energy expense at time T+n dealing with decommissioning and waste removal (the grey).

In traditional net energy analysis, an energy input or output is treated the same regardless of where it occurs temporally in the life cycle of the energy technology. However, human preferences across time periods have considerable influence on our energy use and our energy planning decisions. Even though a barrel of crude oil extracted today will have the same BTU content as one produced 10 years hence, its usefulness to society at any given moment will change as a function of economic, institutional, and technological factors. In this equation, time becomes an important variable.

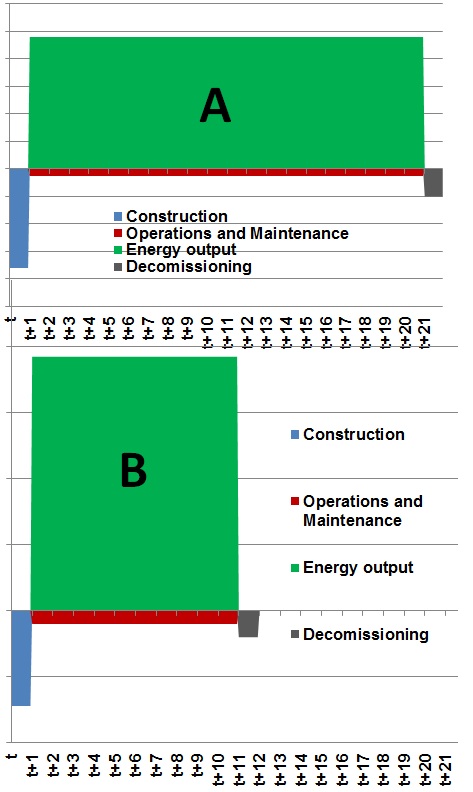

Figure 5 - Equivalent EROI over 10 years or 20 years

A comparison of two graphs for energy extraction might show the relevance of time. Both depictions in Figure 5 represent technologies that offer exactly the same energy return (EROI), but the first returns the energy over 20 years and the second returns the energy within 10 years. The energy costs are identical at the start and during the life of the asset. Provided the quality of the energy is comparable, it is quite obvious that societies prefer the technology that delivers more faster (the graph on the bottom), though standard EROI analyses treats them the same.

Net energy statistics and Time

The following section applies the above theoretical framework to several real energy examples including wind turbines, corn based ethanol and oil and gas production. Since specific year by year energy data was largely unavailable in each case, the analysis assumed energy was expended at roughly the same time and in same proportion as dollars were expended.

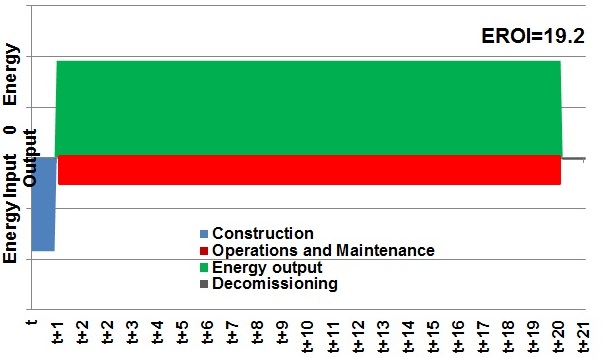

Figure 6 - Wind turbine energy input/output timeline - undiscounted

When introducing net present value to net energy gain or EROI calculations, both inputs and outputs are discounted more depending on how far in the future they occur. Figure 6 highlights an example based on available EROI data for wind-power generation with an EROI of 19.2 (e.g. a net energy gain of 18.2) and relatively high initial investments, steady inputs and outputs for 20 years and comparably small ongoing cost or operations and maintenance, and a small cost of decommissioning. (**The average EROI in a recent meta-analysis for operational turbines was 19.8:1 (Kubiszewski)(pdf). One of the wind farms studied was representative of age, size and EROI (19.2:1) from the meta-analysis, and we allocated energy inputs to the various times of dollar investment (construction, operations and maintenance, and disposal) and graphed these relative to the 19.2:1 energy return occurring over 20 years.)

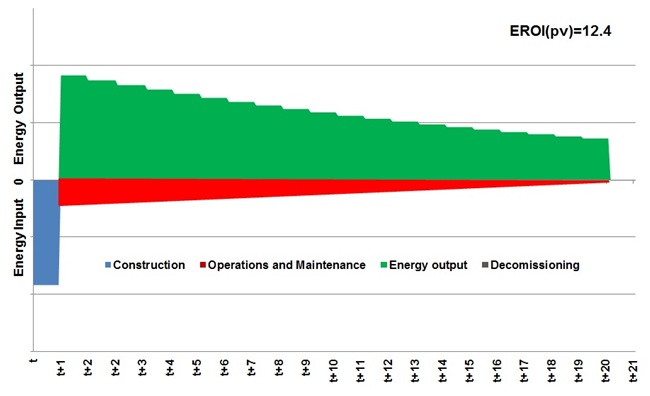

Figure 7 -Wind EROI discounted at 5%

When introducing a discount rate of 5%, which can be considered very low both in non-financial and in financial realms, and represents societies with high expectations for long-term stability (such as most OECD countries), the EROI of 19.2 of this particular temporal shape of future inputs and outputs is reduced to and 'effective' EROI of 12.4 after discounting.

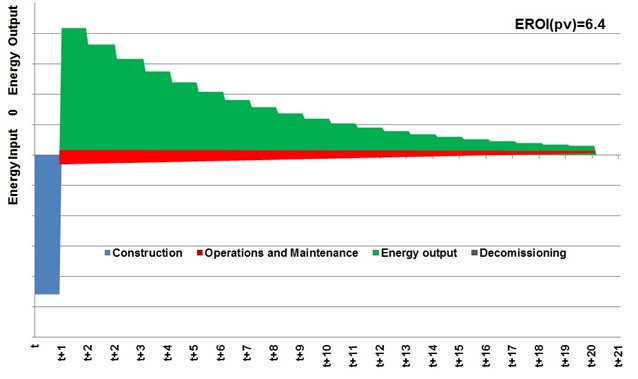

Figure 8 - Wind discounted at 15%

But discount rates are not the same in all situations and societal circumstances. Investing into the same wind power plant in a relatively unstable environment, for example in an emerging economy, where discount rates of 15% are more likely, total EROI for this technology is reduced to a very low value of 6.4, nearly 1/3 of the original non-discounted value.

The graphical depiction shown in figures 6-8 is representative of most renewable energy systems with significant upfront investments followed by linear returns thereafter. Other energy technologies often see a larger proportion of the inputs at the time of output generation, and a comparatively smaller amount of upfront investment. This pattern more closely resembles traditional fossil fuel extraction projects, like the exploration of an oil field or a coal mine, although this is changing for many fossil sources as prospecting costs are rapidly increasing.

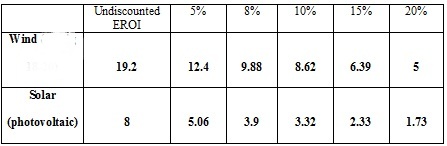

Figure 9 -Wind and Solar nominal EROI discounted at various rates

The above table shows the impact of discounting for typical wind and solar photovoltaic net energy. As most of the energy input required for wind turbines and solar panels is in the pre-production phase, the future (non-discounted) flow rates present an almost flat production profile as the ‘average’ energy return is modeled as a pro-forma. With such an energy input/output schematic, the future energy gain associated with the turbines has decreasing value to users when either a) the expected lifetime increases /or b) the effective discount rate increases. As can be seen above, an assumption of an 8% discount rate cuts the wind EROI essentially in half - from 19 to 9. A discount rate of 15%, common in emerging markets, brings the time-adjusted effective EROI from 19.2:1 down to 6:1.

Fossil fuels are quite different than renewable energy technologies both because of the timing of energy inputs and the shape of the energy outputs. Though there are large upfront costs, a larger percentage of energy input occurs after energy starts to be produced (contrary to wind, solar etc.). Also, the energy production trajectory, though sometimes lasting for decades, typically reaches its maximum within several years of first production. For example, a typical onshore gas well in North America produces 45-50% of its total energy output within 3 years. Most shale gas wells are 90% depleted within 18 months (Wolff). Even unexplored regions containing oil, like the Arctic National Wildlife Reserve, are projected to attain peak production within 3-4 years and only maintain it for a few years before entering terminal production decline (IEA 2008).

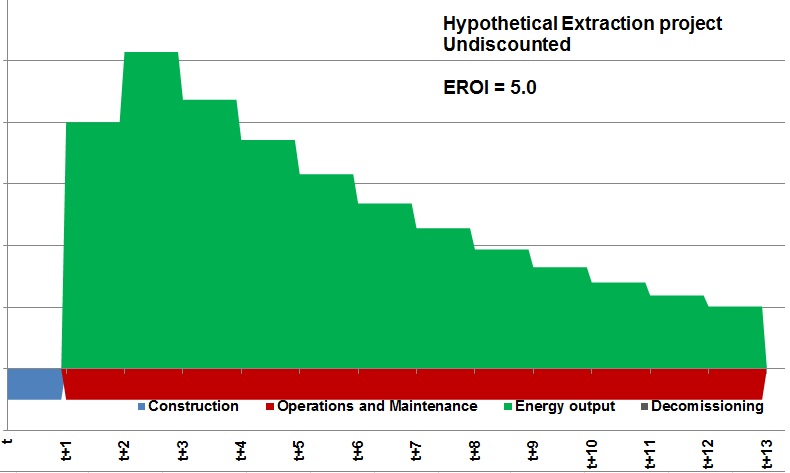

Figure 10a - Extraction technology - undiscounted

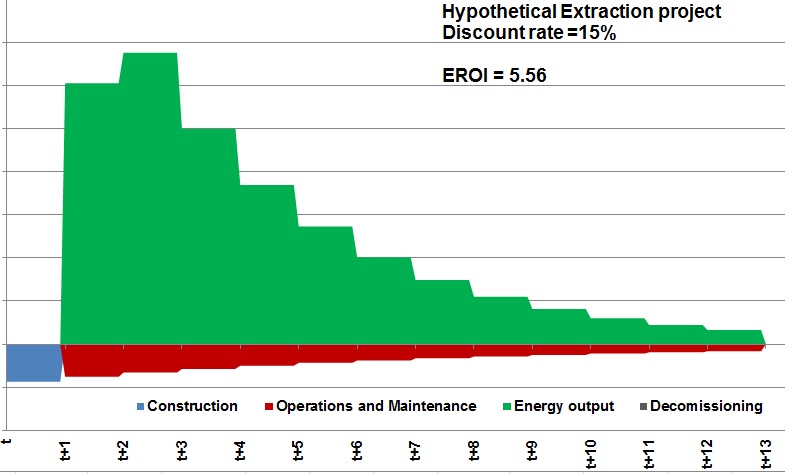

Figure 10b - Extraction technology - discounted at 15%

Figure 10a shows a hypothetical undiscounted flow diagram for the typical pattern of extraction related projects, a relatively steady (or even growing) effort yielding lower and lower returns over time after an early peak. When a discount rate is applied (10b -lower half of graph), the discounted EROI is actually slightly higher than undiscounted EROI.

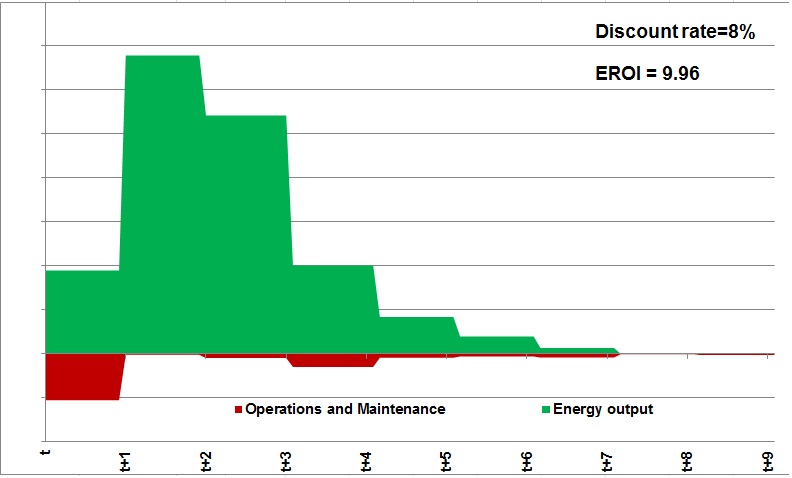

Figure 11a - Leon Herbert Field energy input/output - undiscounted

Figure 11b - Leon Herbert Field energy input/output - discounted at 8%

Figures 11a and 11b were modeled using an actual oil and gas field (Leon Herbert) in Louisiana which had completed its (seven year) production life cycle. We assumed it had an EROI of 10 which is the natural gas average based on the literature (Source. We took real dollar expenditures for the drilling, completion, work-over (in year 3), production/maintenance and all other costs including plugging and abandoning the wells and (as in the wind example above) allocated their percentages based on the time horizon they were expended (Denbury Resources 2010 - personal communications). We then discounted both the inputs (energy) and outputs (barrels of oil/mmbtu gas in dollar terms) to arrive at the temporal input/output diagrams shown. This field (comprised of several wells), produced 3.37 million barrels of oil equivalent during its 7 years of production. 38% of production was in the first 2 years and 85% in the first 4 years. Applying a discount rate to the energy flows changed the NPV only slightly (10 down to 9.96).

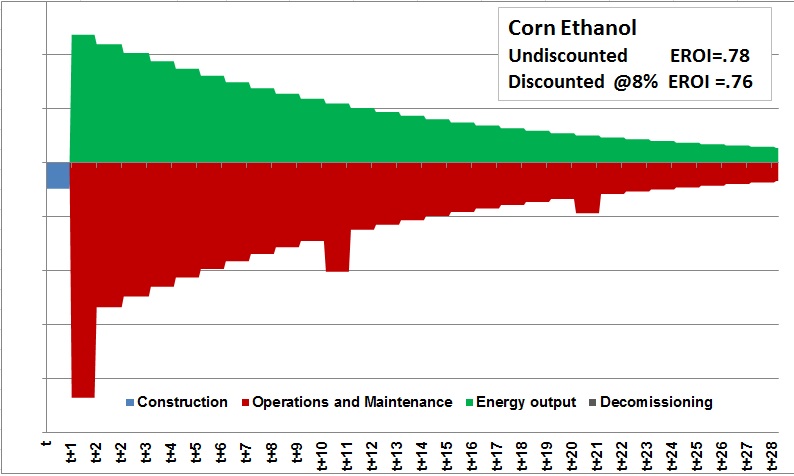

Figure 12 - Corn Ethanol energy input/output timeline

Similar to the wind and oil calculations, we used real data on corn production and ethanol processing to establish time horizons for energy inputs for each component in percentage terms of the total (Patzek, Pimentel). Since corn is grown and processed each year, most of the energy inputs, other than the capital equipment, (which we assumed needed replacement every 10 years), occur at roughly the same time as the energy output (the ethanol). Out of the many corn ethanol energy balance studies, the Patzek model showing sub-unity EROI was chosen because it had the widest boundaries. The above dynamic - that discounting doesn't really impact corn ethanol returns, is robust irrespective of the nominal EROI figure used.

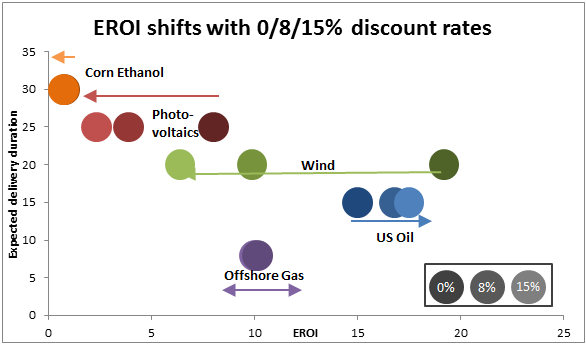

Figure 13 - EROI Time shifts after discounting

Figure 13 provides a clear indication that time discounting implies significant changes in present values of various energy technologies. The x-axis represents EROI. The y-axis represents expected lifetime of an energy technology. The darkest circles of each color represent nominal (non-discounted) EROIs from the literature for each energy source. The light circles represent the same energy output and input discounted at 15% and the intermediate shaded circles represent discounting energy flows at 8%. Particularly for renewable generation methods such as solar and wind, the implications of discounting change their position, even at relatively low discount rates. The impact of applying discount rates to corn ethanol and offshore gas is negligible on EROI. Based on the typical timing of oil flows (a near term peak followed by long tail), discounting actually slightly increases the nominal EROI for oil.

Conclusion

In summary, this analysis has shown that regardless of financial incentives, people discount the future to varying degrees. The timing of energy inputs and outputs has an important impact on their ‘time-adjusted EROI’ - in effect a combination of future energy flows and human time preference. Energy technologies with a high upfront investment typically show significantly lower EROIs after discounting, whereas those with a relatively low upfront investment and comparatively high cost during extraction are less affected by discounting. The same pattern applies for energy conversion technologies, for example in electricity generation. This may partially explain why many renewable energy technologies show a very slow adoption rate in situations that do not include subsidies.

In social circumstances where lower discount rates prevail, such as under government mandates and/or in generally more stable societies, longer term energy output becomes more valuable. Less stable societies with higher discount rates will likely handicap longer energy duration investments, as the cost of time will outweigh the value of delayed energy gains. It is interesting to note that the initial government/central bank response to the financial crisis - buying/guaranteeing sovereign debt has depressed what would normally have been an increase in interest rates - these artificially low rates make long duration energy assets (wind and solar) look better than fossil fuel generation options - something that would quickly reverse if rates went to market clearing levels sans government support.

Also in the context of general limits to growth, it is worth noting the evidence that stressed individuals exhibit higher discount rates. Thus, the discount rate may be viewed as the rate at which societies implicitly signal their desire to turn a present energy surplus into an energy transformation process so that greater energy services can be consumed in the future, in lieu of their immediate consumption. There is a tradeoff between energy costs and time costs that depending on the context will alter energy investments. Decisions made by energy modelers and policymakers are quite sensitive to the discount rate used. A big question is whether the social discount rate should be the same as the market return required by private investors. Given energy’s primary role in the production (and survival) function, one can infer that energy producing projects may use lower discount rates than other competing projects.

Final thoughts

Is a BTU today worth more or less than a BTU ten years from now?

The answer depends - on if you're a robot, or a human. As much as we'd like a biophysical statistic as an alternative to distortions in monetary analysis, it is clear that nominal EROI is not a strictly physical measure and its meaning changes when we introduce the biology of decisionmaking.

The above essay does not attempt to answer the longstanding debate on what discount rate is appropriate for energy projects and comparisons, but rather shows that some positive discount rate is inherently present in biological organisms, and therefore the net energy from human plans and projects will be affected, for better or worse, by the timing of the inputs and outputs. Like many aspects of sustainability /new paradigm discussions, there exists a dichotomy between the prescriptive and the normative - what should be versus what is. Ultimately, discount rates for future energy deliverables may differ between individuals or entire societies, but it seems important that the timing of energy flows is a variable that needs considering. As society potentially moves away from the maximization of money, the timing of energy flows may matter a great deal.

Selected References

Bateson, M. (2002). Recent advances in our understanding of risk sensitive foraging, Proceedings of the Nutrition Society, 61, 1–8.

Berns, G., Laibson, D., & Loewenstein, G. (2010). Intertemporal choice – toward an integrative framework. TRENDS in Cognitive Sciences 11(11) 482-488.

Chabris C., Laibson, D., Morris, C., Schuldt, J.,& Taubinsky, D. (2009).The allocation of time on decisionmaking, J Eur Econ Assoc., 7(2), 628–637.

Cleveland, C. J. , (1992). Energy surplus and energy quality in the extraction of fossil fuels in the U.S. Ecological Economics, 6 , 139-162.

Frederick, S., Loewenstein, G., & O'Donahue, T. (2009). Time discounting and time preferences: a critical review. Journal of Economic Literature, Vol. 40, No. 2. (Jun., 2002), pp. 351-401.

Hall, C.A. (2004). The continuing importance of maximum power. Ecological modelling, 178(1-2, 15), 107-113.

Hannon, B. (1982). Energy discounting. Technological forecasting and social change, 21, 281-300.

Hausman, J. (1979). Individual discount rates and the purchase of energy-using durables. Bell Journal of Economics, 10(1), 33-54.

Kubiszewski, I., Cleveland, C.J., & Endres, P.K. (2010). Meta-analysis of net energy return for wind power systems. Renewable energy, 35(1), 218-225.

Patzek, T., ‘Thermodynamics of the Corn Ethanol Cycle”, Critical Reviews in Plant Sciences, 23(6):519-567 (2004)

Pimentel, D. and T.W. Patzek, Ethanol production using corn, switchgrass, and wood; biodiesel production using soybean and sunflower. Natural Resources Research, 2005. 14(1): p. 65-76.,133

Robson, A. (2002). Evolution and human nature, The journal of economic perspectives, 16(2), 89-106.

Ruderman, H., Levine, M.D., & McMahon, J.E. (1987). The behavior of the market for energy efficiency in residential appliances including heating and cooling equipment. Energy Journal, 8(1), 101-124

Stern, N. (2007). The economics of climate change – the Stern review. Cambridge, England: Cambridge University Press.

Takahashi, T., (2004). Cortisol levels and time discounting of monetary gains in humans. Neuroreport, 15(13), 2145-2147.

Wolff, J. (2008). Marginal cost for North American natural gas production. Credit Suisse Equity Research.

Zhuang, J., Liang, Z., Lin, T., & de Guzman, F. (2007). Theory and practice in the choice of social discount rate for cost-benefit analysis: a survey. Asian Development Bank, Manila, Phillipines.

(Full reference list available on request)

From an article addressing the discount rate by Stoneleigh a little while ago;

"The fortunate in the developed world have lived through an unprecedented period of wealth and relative peace, hence longer term concerns have made it on to the political agenda. Concern for the environment and for other species always peaks in times of plenty, as the discount rate falls and people take on broader and longer term concerns. Unfortunately, this state is unlikely to last, meaning that the environment is not likely to retain its current level of protection, and that level is already insufficient to prevent continued degradation of our natural capital."

http://theautomaticearth.blogspot.com/2010/12/december-2-2010-future-dis...

Call me a pedant but

is not necessarily correct unless one assumes constant atmospheric pressure! One BTU at sea level will heat one pound of water by a different number of degrees than the same BTU at the top of Everest.

Will climate change change the atmospheric pressure significantly by 2100? mmmm...

;)

pedant.

;-)

Certainly atmospheric pressure affects boiling point, but small changes in pressure will be at most a second order effect on the specific heat capacity of water. At altitude, more heat will be lost through evaporation as the water approaches the lower boiling point.

All the more reason to use SI units, which are defined to take out as many as possible of these annoying little details.

There are about eight different values for the BTU which vary depending on assumptions about standard atmospheric pressure and temperature, etc. The various standards bodies never could get together on the same definition.

SI units - joules (J), kilojoule (kJ), megajoules (MJ), gigajoules (GJ) - would be more consistent. The conversion to and from kilowatt-hours is certainly easier (1 kWh = 3.6 MJ, exactly)

Natural gas in Canada is sold in gigajoules (GJ), which is convenient because 1 thousand cubic feet of gas (Mcf) has approximately 1 GJ of heat content. The exact conversion depends on the composition of the gas, and also the definition of Mcf, which again involves assumptions about standard atmospheric pressure and temperature, because gas is compressible.

Reasonable departures from one atmosphere will have negligible effect. It's an old (and obsolescent) engineering unit, so not to worry about the specific heat of water in the depths of Jupiter or something like that. Various definitions range from about 1054 to about 1060 joules. This is devoid of importance in the context of the keypost.

True, and an excellent keypost it is.

Of course, on Jupiter a pound of water has a lot fewer molecules in it.

That depends on one's definition of pound. If one takes it to be the usual 0.454 kilograms, that defines it is a unit of mass, and the number of molecules is the same. If it's pound-force, then owing to the stronger gravity, there would be fewer molecules. Or maybe it was supposed to be a poundal. :=O

As of this posting, a pound is 1.5864 US dollars. Or a way to prepare poi, or a place to send stray dogs. It's also the weight of .454 kilos at some locations on earth, but it ain't mass.

So few of Nate's posts deal usefully with gravity as a variable.

If people haven't looked closely at the post, I would suggest looking at Figure 13.

It says that taking into account discounting, the EROI of oil tends to get higher (that is better), while the EROIs of wind, solar, and corn ethanol tends to get worse. To me, this is the main take-away of the post.

I would note too, that this analysis assumes that we can use all of this new equipment (wind, solar, corn ethanol plants) for the full lifetime of the equipment. If in fact we cannot, because of indirect impacts of lesser oil supply (perhaps leading to less growing of corn, or more difficulty in servicing wind equipment), then the discounted EROI drops even further.

Yes, but aside from putting ethanol wind and solar in the same basket, which to me makes little practical sense, unless I misunderstand what Nate is saying, I draw a different conclusion.

So while to me sitting here today, the future energy gains associated with the turbines may have decreasing value because the turbines will be producing electricity for longer than originally expected and the EROI is brought down to 6:1, the way I see it this is a good thing since the current paradigm of an oil based growth economy isn't sustainable and I'd much rather have that lower EROI energy produced for longer in the context of a sustainable economy. In other words I see this as a good thing and in comparison the increasing EROI of fossil fuels as being bad, especially in a post peak oil world.

The effect of discounting would actually be to decrease rather than increase the influence of this "lost" or abandoned capital on ultimate EROI - since, presumably, if the SHTF/EOTWAWKI scenario does arrive, it will be at some point in the future rather than the immediate present. This actually makes sense in thinking about why discounting is helpful in general, i.e. it reflects the risk or uncertainty inherent in any attempt to predict the future, including (as in Nate's examples) future energy returns or income from capital investments.

FWIW, I happen to think the discounting as a concept makes sense, but the much more difficult problem is figuring out what discount rates are appropriate. Hydropower is a helpful example - facilities built today should still be operational 50+ years from now, but the electricity and other services they will provide are valued at zero under standard discounting. However, those BTU's will still be worth about the same as a BTU today to people living 50+ years from today, and especially if (as Nate suggested early on) a BTU at some indeterminate point in the future may actually be worth more than a BTU today thanks to mineral depletion. Our grandkids may appreciate our having the foresight to invest appropriately in such long-term projects, but only if we make correct assumptions about the value of energy at that time. Since the question of how we discount future returns (esp. compared to up-front costs) is at its heart psychological in nature, it is impossible to assess the proper role of discounting unless we understand how many social and cultural norms regarding energy and resources are likely to change over time.

I agree that discounting would decrease the impact of abandoned capital, but the issue is that current calculations (undiscounted and discounted) don't even consider the possibility of abandoning capital investment before the end of its planned lifespan. So, to me, most EROIs (especially those of renewables, which require considerable front-end investment) seem overstated.

I suppose that the rationale is that the assumed lifetime is an average lifetime, and we don't know how that varies, or how other limits will affect it. But if the average lifetime is under a BAU scenario, it would seem reasonable to me to reduce it for changed conditions, both in the undiscounted and discounted approach.

Adjusting for this impact could be done with or without discounting. I agree that the impact would be bigger without discounting.

Ethanol plants are questionable from the get-go owing to marginal or conceivably sub-unity EROEI. But beyond that I'm wondering how far we need to overthink the analysis. If things are allowed to go so utterly pear-shaped that serviceable wind turbines or solar arrays must be abandoned on a scale that matters, for sheer lack of maintenance, won't the starving survivors be far too busy poking for grubs to eat to care a whit about the analysis?

Gail,

There is one dimension that this article fails to address, and that is the relationship of the energy producer to the energy consumer. This article sees energy as a traded commodity, which for most forms of energy (particularly oil) this is the most probable form. However there are a small group on energies where the primary resource is free solar energy where the energy end user can also be the energy producer. Where this is possible the energy end user has very significant cost advantages. In the energy producer to energy user relationship the energy product is only available to the end user at a retail price, therefore the cost benefit to an end user to become a producer is significantly different to that of a mass energy production enterprise .

This scenario applies to a small group of energies including biofuels such as palm oil, cellulosic ethanol, as well as solar photovoltaic and solar thermal energies. It is a mistake for governments and energy producers to misunderstand the scaleability of these energy possibilities and their potential impact on the final new world energy mix.

Can you come up with a discounted EROEI diagram for nuclear? The large decommissioning costs (in energy terms) comes at the end of about 40 years of operation. That must massively affect the figure.

Is it realistic to discount energy costs at the same rate as energy gains? It will take the same number of physical BTUs to decommission the plant, and once operating, that expense becomes inevitable (in a BAU world).

Of course, in a non-BAU world we can discount 100% of those costs....

Oil companies do not decommission all their rigs in the gulf of Mexico for example. They sink them and leave them behind without concern for the waters they leave them in. I guess that helps their EROEI bottom line as well.

But more importantly, why not look at the historical use of wind and water mills in agriculture?

How long did those structures last and how much economic production did they achieve?

To me at least, guessing the depreciation % of wind, solar and water is kind of difficult without physical datasets.

Go with actual historical data on wind and start there.

Finally, not including the declining EROEI in oil production as we shift from conventional on-land crude to offshore or freezing arctic or oil sands is kind of like tricky accounting is it not?

Historically, decommisioning did not happen, the old infrastructure was re-used and adapted to new functions, or left to rot. Decommisioning is part of the health and safety and environmentalist cultures. These are luxuries of an expanding energy society, and will not persist.

Windmills (or at least locations with windmills) lasted for centuries. As parts broke or wore out, they were replaced. As new technology developped, it was patched and botched up into the existing designs.

Did we decommision anything before 1919 ? (first world war munitions)

I find it absolutely amazing that a wind mill today is so maligned when they were so versatile and useful in the past.

Why would windpower generation which requires no fuel be uneconomic in the future?

There is a difference between using a windmill to do an activity that can be done intermittently (like pumping water) and using it to generate electricity, which is normally needed as a continuous flow, in a regulated amount. Wind does very well at intermittent activity, but it doesn't produce the dispatchable electricity that is greatly in demand.

If the same power generation outfit decided to couple a natural gas peaking plant and/or a power storage plant with a series of windpower plants using good transmission and computer controls, then as a unit, the intermittent issue could be effectively resolved.

As for the cost, I do not know, but has this sort of option been considered?

These are complex systems but they seem to have technically achievable solutions.

Maybe that dispatchable energy is in demand now, but if we're facing a likely energy crisis, isn't it reasonable to look to scenarios where we will highly value ANY energy source as basic as wind, and will find ways to use it when it's there? Maybe 'demand' will have to start being described as 'preferred'.. I think 24/7 energy supply might start costing a serious premium, while most customers become used to the idea that there are times of the day/week when power is there, but the price makes it simply a luxury to consider using it.

Just because Wind Turbines were built to feed the grid today doesn't mean they can't be repurposed to preheat a bunch of homes, charge up the refrigerator tanks and feed a couple factories right next to them, which are designed to use energy when it's present.

Unlike a hundred or five-hundred years ago, we now have enough ability with electronic controls to allow many processes to commence at 1am if necessary, without having to assemble an entire workforce first.. heating up batches of tin or glass smelting pots, stamping out a few thousand sheetmetal components, baking a few hundred loaves of bread or preheating materials that will fire up the ovens at 3am.. If you can produce your product with a flex schedule to meet energy availability, you then have a level of resilience and hence value that competitors may not.

Of course, that is all only if we're facing a potential destabilizing of either Grid Availability, or even just wild price swings in grid power. What are the odds?

"we now have enough ability with electronic controls to allow many processes to commence at 1am if necessary..."

Electronic controls help but are not sufficient. That scenario only works out OK if you have enough energy storage or foreknowledge to guarantee or very nearly guarantee that the power will stay on long enough to finish the process step once you start it. Otherwise you end up with ruined materials and possibly, with some processes, wrecked equipment. Given the vagaries of the wind, it might be impracticably hard to know when, if ever, to start up - or occasions when sufficient certainty can be had might prove too infrequent to support having the equipment in the first place.

Well that would be why I said "Many" processes, and not All, for starters.. and clearly it requires a design approach that understands this point from the start.

If it's simply preheating a thermal mass, of course this isn't a problem at all, since you are simply feeding a storage medium, and if a given process is specifically depending on it, then (clearly) you have to set it up with triggers that proceed with the process when 'enough' heat has been gathered. Beyond that, there can be processes that would simply function at varying speeds, depending on the energy available, or would have certain backup supplies of fuel to offer follow-through, or would function within a fairly short 'burst cycle', and the control systems would be gauging just how many cycles ahead they are 'charged' for.. with expected forms of 'follow through' storage such as flywheels or capacitor banks, etc..

Beyond all that, there are wind patterns that come fairly consistently, and so these vagaries aren't quite as mysterious as they're often painted to be.

The point remains, a manufacturer or energy customer who can find ways to take advantage of intermittent energy has a clear advantage over those who are stuck relying on an unvarying supply that is delivered at varying rates.

One also has to remember that many of those processes were designed around abundant, cheap energy. So what if the oven doors leaked heat. So what if the walls were way too hot to touch. Hours to warm up, no problem. It is not just homes that have to address using energy efficiently. With many existing plants a night time pre-heat would be lost by the morning. With efficient insulating that would change. As well as using cheap, overnight power they would use less, a double benefit.

NAOM

I often worry that the US has chosen a bad policy path with regard to our system for generating and delivering electricity to the end users. The US has adopted policy that emphasizes the use of minimally-regulated markets. Dispatchable power becomes more valuable in a that situation as the time between order and delivery increases. A wind farm can make reasonable promises about the power that can be delivered in the next hour; still somewhat reasonable for power for a particular hour the next day; but it's a pretty random guess as to the amount of power that can be delivered in a particular hour next month.

Other countries have adopted priority dispatch rules for wind power. That is, subject to grid congestion problems, over short time periods available wind power is dispatched first and other power sources are forced to throttle back. In November 2009, this type of rule made it possible for Spain to use wind power to meet just over 50% of the total power demand during some overnight hours. In addition, almost all the wind power generated in Spain gets dispatched (less than 1% does not, IIRC).

Theoretically, the US market approach could get results similar to Spain's if all power were purchased in short-term markets (eg, only an hour ahead). However, analysis of California's debacle in the early 2000s suggests that if all power is purchased in a short-term market, you get extreme volatility in prices unless there is substantial excess generating capacity. One of the fundamental things enabling the kinds of misbehavior that occurred in California was a drought in the Pacific Northwest that took large amounts of generating capacity out of the California market. The Cato Institute, as pro-market an organization as you're likely to find, has concluded that the overhead costs associated with making short-term power markets work make the market solution no better, and quite possibly worse, than regulated vertically-integrated utilities.

Perhaps the abandonment and sinking of oil rigs has become or soon will be a thing of the past-scrap steel in large quantities is worth megabucks today-and it seems to me that it would be quite profitable to tow such otherwise useless old rigs to a scrap yard-copper is now around three bucks a pound,and there must be a lot of copper wiring, motor windings, etc, there to be salvaged.

I know. I thought that too. Why don't they collect all that steel? Seems like a waste to me. Some say it makes artificial reefs for the fish.

I've always dreamt ob buying my own decomissioned oil rig and build a sea side castele for me and my friends on it. With a heli-platform! Would be ultra cool. How much do you think you would have to pay up to get one of those who would have been sunk otherways?

A new meaning for "sunk cost" eh?

You could even start your very own micronation and declare yourself king.

http://en.wikipedia.org/wiki/Principality_of_Sealand

@oldfarmer, I personally toured a company in Louisiana that built and decommissioned offshore rigs. Unfortunately because of the psychotic way the EPA does things, a rig that was built on land, towed out to sea and comes back is now treated as if it contains hazardous nuclear waste. If they repair something and send it back out, that's one thing, but if they try to cut it up for scrap, it is now in a totally different category, and the EPA ensures that there is NO ECONOMIC WAY to do so. Whether they do this out of malice or misbegotten concern for our welfare I'll never know, but I have my suspicions. Companies aren't stupid, but government regulations and bunglecrats often are. There's your reason they sink them offshore instead of properly salvaging them.

Well, it's that 'misbegotten concern for our welfare' that makes this unfortunate blossoming of bureaucracy such a complicated mess. There is real reason for concern, of course. We've been suffering from the byproducts of casual treatment of industrial waste for a long time. Unfortunately, the overreaction is not just built on pure imagination. BP, Valdez, Bhopal, Love Canal..

There are a couple projects here in Maine that have shown some hopeful signs of Gov't, Business and Nonprofits working together at the table to find a middle-path. (This is the one I'm involved with, ATM.. www.penobscotriver.org , power company, Penobscot Nation, Enviro. Groups, Commercial Fishing Community and State Agencies.. )

Here's hoping for reasonable people meeting somewhere in between!

Bob

Ok Bob, I'll bite. At what time does a ship become industrial waste: When built, when floated or when decommissioned?

The EPA is not helping us when they turn these ships into sunken waste heaps. Which is worse, dealing with the metals on land or under thousands of feet of water? Do the fish enjoy higher iron concentrations? What makes the EPA act as if it is so hazardous now? Bhopal on your list above is specious, obviously that is in India so EPA has no authority. Nor were they involved with any of the other problems until AFTERWARD. Did they contribute ANYTHING WHATSOEVER to the solution? I leave that for the intrepid reader to decide for him/her self.

I do not claim to be an expert on this, so consider my recollections as iffy. We are sinking these derelict rigs in order to create marine habitat for critters that live where it is done. Like a coral reef, the sunken rigs, and ships I suppose, will be colonized. We could be seen as making amends to the denizens of the deep by replacing some of the reefs we have destroyed.

http://www.takepart.com/news/2010/09/23/can-abandoned-offshore-oil-rigs-...

http://www.msnbc.msn.com/id/12836731/ns/us_news-environment/

At one time, the Earth's oceans contained much iron... which combined with free oxygen to form rust, and which precipitated out onto the sea floor and formed iron deposits that we mine today. So, I don't think the iron will have any enormously harmful impact, and that the benefits outweigh the possible negatives.

http://www.windows2universe.org/earth/past/iron_ore_deposits.html

Craig

I live in Hollywood Florida and the Tenneco Towers are oil rigs that were sunk for the purpose of making artificial reefs and are just a few miles from where I live. I have dove them, a really nice dive if I do say so myself.

http://www.youtube.com/watch?v=5yU5rAHf5uI

Widelyred;

I mention the 'celebrity' industrial waste stories because they have all added to the public and government knowledge of the dangers that have been exploited by the energy and chemical industries.. here and there. EPA might be stuck in its narrow jurisdiction, but noone is fooled to believe that stops Union Carbide from doing what it did with impunity on distant shores, leaving us all to wonder what other transnational firms (BP) will get away with here. so it's not specious, I'd say.

Honestly, I don't disagree that the bureaucratic response to this familiar predicament will frequently be ineffective or even counterproductive.. but in part these regulators are stuck with 'putting good money after bad', trying to clean up our messes after we've had a century of spilling industrial wastes that we until recently trusted the earth to just 'take away' for us.

As we are seeing with BP right now, or Massey Energy and Entergy at Vermont Yankee a few months back, there are clear and repeated instances of hiding the messes, of ignoring warnings or denying complaints that are feeding into this hostile environment against accountability and public trust. It's a vicious circle in so many places, which is why I've pointed to situations where once opposing groups may be all swallowing some pride, and are sitting down together to start the difficult business of finding a series of compromises, instead of an endless stream of Tit for Tats.

It's easy to blame 'the other guy' .. I see our kids doing it all the time. As OCT was saying earlier.. 'we need the grownups to start leading the discussions again.' and we need to BE the grownups we want to see in the world.

There must be some de-regulated nation some place with no standard what so ever to have them scrapped. They can do so to operate ships that are to old. Why not to scrap rigs?

Both India and Bangladesh do a lot of work scrapping old ships. I do not see any reason why they could not do the same for old oil rigs. Of course the workers are on starvation wages, and there is no EPA, so this enterprise could be quite profitable.

And they work with hand tools like sledge hammers. And when they die (in hundreds every year) the workers families get no compensation. There must be loads of money in scrapping the rigs there.

Well too bad we throw stuff away the way we do. I'd bet the higher value items are stripped from the rig and reused by the company.

The remaining steel, if it is toxic, which is hard to believe, but I have to believe your word or the EPAs classification, should be processed and used again on other such rigs. But I am not a "bunglecrat" I guess. ;-)

Interesting and relevant comments all on scrapping old rigs and other infrastructure-one more way of looking at this is that our regulatory apparatus-meaning the govt in general- has gotten so big and so disconnected from reality that not only does it enact policies that result in waste and likely MORE environmental degradation occasionally, but that the various regulatory authorities enact incredibly short sighted and contradictory policies, the left and the right hands each being totally ignorant or callous as to the stated mission of the other.

Perhaps they should all be locked up together every year os so and not allowed any food opr drink or bathroom privileges until such time as they send out an outline of thier proposed new unified regulatory rules that meet with the approval of a select committee of us Oil Drummers.

But we shouldn't be surprised -after all, lots of environmentalists with their hearts in the right place but their heads in cuckoo land are unable to recognize that we can't deal in absolutes.

Sometimes we must simply accept that a wind turbine will kill some birds, and get over it, given that the alternative, as a practical matter, is to continue bau and kill many more birds, as well as other creatures, someplace else.

The first order of business , in any organization, or at the individual level , is to preserver, protect , and if possible, to grow-either the organization or the career.

So on the last big welding job I worked on, the foreman wanted me to move a considerable quantity of very heavy scaffolding by hand a hundred yards across a parking lot in hundred degree heat and high humidity, and then up four flights of stairs, by hand , to work a half an hour over an opening in the floor-this would have taken a day at least,probably longer, but cost was not considered-going by the book was the only consideration on the foreman's mind.

Fortunately I knew the job superintendent well, and he was more than willing to listen to my analysis of the job-which was to use a ladder and a safety harness, which we did daily, fifty or sixty feet up or higher-a fall was just about certain to be fatal from that height.

So he "held me over" for an hour after everybody else was gone, and pulled my fire watch for me.Of course nobody said anything when they saw that the super signed off this work order personally.

Fortunately, this engineer was smart enough to realize that the chance of me dying from a stroke or heart attack,or suffering a serious injury, such as heat stroke, moving all that scaffolding, was many times greater than the chance of me falling off a ladder , when properly harnessed and tied off.

I have been high pressured to drive to work by a supervisor who needed me badly at a time when the roads were so bad that the chances of actually getting there were vanishingly small-but the chances of having a bad accident were extremely high.This same super was in the habit of writing up every chickenshit safety violation on the job, but perfectly ready, even eager, to get me killed on my own time, and at my own expense, on the way to work .

Such is humanity.

Hi OFM, great story! May critical thinkers win the battle with mindless rule followers as often as possible.

Been there a few times myself.

In a National Lab, like Argonne National Lab, you need to take a training course to certify your ability to climb a stepladder. I have a someone working at Lawrence Livermore National Lab and he needed to get a full body scan to get into that place ;-) They don't let you onto the premises until you have a detailed background check.

I am right there with you guys. The rules are too steep in some cases or they are not coordinating objectives. Save the resources in a responsible way.

There may be some controls or other chemicals that are used in the oil rig that have a little radio-isotope in them. Smoke detectors have Americium for example. This government does panic over the isotope issue. We are not talking about nuclear fallout or anything. It should be that those bits can be checked for radiation levels and dismantled to allow the good steel to be recovered. The geiger counter would be a great tool in this instance.

Good news:

Texas Company Will Recycle Offshore Oil Platforms for Wind Turbines

http://cleantechnica.com/2008/04/30/texas-company-will-recycle-offshore-...

Wind Energy Systems Technology (WEST) will use old oil platforms to support new wind turbines. Herman Schellstede, CEO of WEST, holds sixty-seven U.S. patents and ten international patents, and is a naval architect and marine engineer. His partner, Harold Schoeffler, is a longtime Louisiana environmentalist, having co-founded Save Our Coast. The company is presently engaging in wind monitoring activities, shown in the picture at left. Still, I haven’t seen any announcement of any turbines actually being built on these recycled oil platforms. Wired has a nice story with great visuals dating from Feb. 2007. If anyone has more recent news, please comment below. Remaking old oil platforms into clean energy sources is a beguiling idea, but it would be even more charming to actually see wind turbines producing wind off the coast of Texas.

AND there are a lot to recycle. Look at this map.

http://dotearth.blogs.nytimes.com/2010/09/19/reduce-reuse-recycle-oil-rigs/

Maybe there is a little hope on the oil rig recycling front.

This company says things are booming:

http://www.americanrecycler.com/1210/643ship.shtml

I've seen those radioactive sensors ontop of boiler towers at paper mills. But what I can't see is what is the problem? Send in trained technicians to remove them upon decomission, then just scrap the plant/rig once they are properly removed.

All things mined have low level radioactivity which accumulates in sludge and in scale deposits on the rigs. Just like coal ash.

So that is one of the problems with radioactivity I understand in these oil rigs.

@all, I wasn't addressing radioactivity per se, just that the onerous regulations in place for salvaging metal made it SEEM like radioactive waste. Note that the vast majority of steel from the World Trade Centers was shipped all the way to China so we could buy it back in consumer goods. No one can tell me it was more economical to collect and ship all the way there than to Pittsburgh, but add in expensive regulations and that is easily possible. Now we just have to MINE the steel all over again, and at what environmental impact? Anyone remember the old Bureau of Mines? They were shut down during the Reagan administration when it was discovered that 1/4 of their budget was consumed in lawsuits with the EPA. From an economics viewpoint, the wrong agency was closed down.

Oldfarmer hit it right on the head. The bunglecrats are operating in silos and are incapable or unwilling to look at the big picture. Even where I live, which is flyover country hundreds of miles from any port, our community has an excellent recycling program for collecting aluminum etc. Unfortunately, when I dug into why the system was so costly even though scrap is at record highs, I discovered that WE ship scrap all the way to China, because no one can profitably PROCESS the scrap in this area. Therefore the value to the scrap is say, 70 cents a pound for aluminum MINUS shipping costs to get it to the coast and then on to China or wherever. Unfortunately.

Those who have read my posts on this site know that I have pet peeves against the EPA. I live 70 miles away from an EPA superfund site that they have NEVER DEALT WITH AT ALL, but they've spent $10's of billions along the way. They destroyed numerous employers, destroyed thousands of jobs and haven't moved a single shovel full of dirt. What the hell good are they? Their budget is too large, their accountability too low, they are reactive and constantly seek more power and budget. They are literally drooling at the prospect of "regulating" carbon, that gets them EVERYWHERE, in everyone's business and I heard a talk by their second in command bragging about the 100's of thousands of new employees they were going to need. The big picture view says they will sink our economy, but their myopic view says they will be the largest federal agency before they are done, therefore the most powerful federal agency. Too bad their lawyers won't help us when the shooting starts.

One could look at the skies over Chinese cities and contemplate a trick that they are employing in China: reduce or eliminate pollution controls to gain near-term edge in production.

No one can beat China with its cheap/younger labor force and minimalist pollution control standards.

Hard to think what we could/should do about it.

We could have the EPA relax the clean-up standard on these waste sites including oil rigs and nuclear (low level contaminated) metals. That would be smart but of course limited by the BAU government model we have.

Another way to help these things along, I try to buy products made from recycled products here in the USA to make sure that our manufacturing objectives are supported. One company is using polypro #5 plastic to make pretty nice plastic ware which my wife likes.

http://www.preserveproducts.com/products/kitchen.html

My kids play with some toys made from old milk jugs from a US company also.

A drop in the bucket but worth considering.

But regrettably these recycled things tend to all make their way to China. I expect with rising fuel prices mean scrap may remains nearby but that is based on declining steel imports only.

Nate

Great post, as ever.

But I think we need to look again at assumptions in relation to discount rates.

The fact is that there are literally trillions of $ quite prepared to accept at or near zero interest 'risk free' rates which, with inflation, actually give rise to negative real returns. If Japan is any guide - and I think it is - there will be no exit from zero rates within 20 years if ever.

As the Scottish Futures Trust (a non-toxic quasi public investment bank) puts it, there is a difference between financing of new productive assets, which is short term and high risk; and funding of productive assets once complete, which is long term and low risk.

If assets are publicly owned and used then the long term - virtually 'risk free' - real return from funding such assets these days is undoubtedly 1.0% or less. eg UK's Wessex Water utility a couple of years ago raised a 50 year loan at 1.49% index-linked, and they have (some) political risk.

The return from development financing productive assets will typically be higher, of course, but the problem is that historically the bank credit used for the purpose is 'hybrid' in use with the same rate applying through both the periods of development and operation. This has clouded the true risks and given rise to unrealistic expectations on the part of investors.

I believe that it is now straightforwardly possible to 'fund' completed energy assets simply by creating and selling to investors Units redeemable in payment for energy. There are many $ billions invested in energy markets through ETF and ETC funds which receive no return - and are being pillaged by the currently entirely dysfunctional energy markets, both physical and derivatives - who would be only too pleased to invest directly in energy production in this way.

Unlike 'unitised' renewable energy or energy saving projects, a conventional non-renewable carbon fuelled plant would have to enter into risk sharing 'tolling'/partnership agreements in order to fund themselves by 'unitising' energy in this way, eg with fuel suppliers, managers and other costs. It would also be necessary to cover maintenance/depreciation costs, and decommissioning costs.

There was an interesting historical perspective - A Farewell to Alms - a couple of years ago from Gregory Clark. In his economic history he demonstrated that the(real) return on 'risk free' capital had fallen from 25% pa in Babylonian times; through 10% pa in medieval times and 5% pa at the dawn of the Industrial revolution and has kept on falling since through 2.5% in 1900 or so.

The world is now awash in financial claims over productive assets (aka dollars) to the extent that the risk free global market rate of return may even be less than 0.25%. It follows that this would be the discount rate that should be applied to long term 'funding' of energy assets, as I see it. If investors require a higher rate of return , then they must take development risk by financing new assets.

That is a brilliant analysis, Chris. Thank you. I've long suspected that "investment capital ain't worth what it used to be", mainly because there is now so much more of it chasing fixed opportunities, even after factoring out inflation and all risks. That concept needs to be taken home to owners of capital.

What is the key difference between this analysis and engineering economics?

It seems like a recapitulation of the same math using energy units instead of monetary units.

One of the economic factors that doesn't seem to be taken into account is the scarcity value of a consumable resource. For example, once a particular vintage of a grand cru has aged several years and established its reputation for greatness, the owners of that vintage can anticipate a rise in the price / bottle over time. While some of the appreciation may be due to further improvements in quality with age, much of the appreciation will be due to its increasing scarcity as bottles are consumed. The price would also be affected by externalities, such as the number of people weathly enough to want wine at the going prices.

I think you mean the scarcity rent, based on the scarcity value (which is one sort of resource rents), right?

In fact your example of an old wine follows the special rule of a veblen good (i.e. people want more of it *because* it gets more expensive) - unlike normal goods which follow the law of demand" (i.e. people buy more if things get cheaper).

Generally, the veblen goods can only be "luxury" goods that people don't really need and not basic goods, which people do need (like fuels, basic food, water). This is interesting, because for example the price of oil, which is now a primary good, cannot rise above a level that the world's consumers can afford. Only when oil eventually has been substituted by other resources, and thus has become a true "luxury" good there will be no limit for the price of oil.

Yes "rent" would be more correct. If one owns an oil field where a barrel of oil can be produced at a cost of $40 and sold for $75, the difference of $35 is technically a "rent".

Oil would not be a veblen good (except maybe in the case of owners of very large motor yachts, where the cost of fuel certainly helps keep out the riff-raff). However, it is an input to a highly diverse set of sub-markets such that the rising cost of oil as it becomes more scarce will mean the collapse of volumes in particular sub-markets. For example, power boating and recreational vehicle fuel usage is much more price elastic than railroads.

Nate,

Thank you for your economic analysis. In purely physical terms, the energy required for transportation is dependent on process reversibility, which is also a measure of friction. One may travel faster while with less power by making a smarter vehicle choice. Aircraft and oil tankers are far more thermodynamically optimized than our automobile fleet. Most oil is moved very efficiently, only to be squandered at the point of use in an oversized personal vehicle. I especially liked your reference to Zhahavi, which seems to explain the SUV craze.

This is quite an assertion, Nate! To me it seems to embody the very question we are supposed to be thinking about. It quite obviously holds true for some people at some times, but I don't think there is any underlying, broadly applicable fact that can form the basis of any kind of a thesis. Many people live more for their children as part of a continuum than as hedonistic engines of present-day consumption.

I agree that as choices are removed and basic needs are put in jeapardy, that the focus on the future as a continuum is overcome by the present. I've worked in refugee camps where hundreds of thousands of people are thinking of nothing except finding somehting to eat, and obviously the same would hold true a heat source. A BTU now means I live for another few minutes. A BTU in a few minutes means I'm already dead...I get that.

But I don't think placing the debate in a context where no real choices remain is very useful - only where some range of choice remains available will discussing behavioral patterns have any use at all, and hence I don't think the idea that humans are "present-centric" to the point of systematically "wanting" to burn their children's inheritence is a useful or even a justifiable starting point.

Interesting post.

Intuitively it seems to make sense that energy has a time value component. The direction of the value of that time value component has several underlying forces.

On the individual level discounting (even energy) makes sense because there is a greater than zero possibility that there will be no tomorrow. Collectively however one can make the case that future energy consumption has more value than presently because of increased efficiencies, technologies etc and therefore one should apply a negative discount rate.

I noticed that the energy extraction technologies with heavily frontloaded expense structures behave differently from technologies with more ongoing expenses. Is that a function of NPV netting (between expense and revenue)?

Rgds

WeekendPeak

Yes.

One can and many do make that argument (e.g. Stern - Climate Change report). Part of the point of my post is it there is a difference between what we 'should' and actually do. And I expect that difference will widen not narrow, if economies/societies become more stressed.

Exellent article, Nate. But I find there are quite a few points to be discussed:

This would suggest that evolution leads to species that are consuming more and more energy - increasingly turning the biosphere into a hot pot of popcorn, whereas all "slow" species die out. But this is not the fact: There is still a huge amount of niches left for sloths, reptiles etc. In fact our planet stays a "biotope" for all sorts of life speeds.

All in all, in nature overall efficiency counts - and what is most efficient depends on the specific niche.

The same applies for the human example:

This would mean that people movement increasingly change from walking --> cycling --> driving --> flying. This was indeed happening all over the world until recently. However, since a few years at least in many places of Europe there is a backwards trend: People drive less and go more by biclycle. For example some of them have learnt that under the bottom line cycling is more economically efficient for them, as the cost for driving is much higher than the value of the few minutes of daily time saved.

Sure. But the background is not only evolutionary or psychological, but also plain rational: In economics, discounting is an important element for determining the present value of an investment, which depends e.g. on the comparision with alternative investments (opportunity cost) (see e.g. Wikipedia at Time value of money

Yes, I fear that individual lifetime is a problem, that poses a limit to our foresight and planning for a sustainable world. For example studies show that according to the rules of investment planning (see above) most homeowners in Germany should add a thermal insulation when renovating their house's facade. But in fact only few do. According to a homeowner association this is why many homeowners are already quite old and don't like to invest into something that doesn't amortize during their lifetime. This means: They don't care about the long-term economy that would pay off for their children (if their heir the house) or of those who would buy it - let alone other sustainability effects, e.g. the effect on global warming.

Interestingly, even enterprises, which are supposed to know about the investment calculations mentioned above, are reluctant to invest in thermal insulation although it would pay off on the long term. Instead they only look at the payback period - which shouldn't be longer than a few years. According to scientists this method is rather appropriate for a risk-based approach - which is appropriate for investments in a very uncertain environment (e.g. "I don't know how long my enterprise can survive here - so I should get my money back as soon as possible"). This sounds like a sad hidden message from our industry.

The sloth example had also occurred to me. The actual tendency is for species to multiply and become optimized for smaller and smaller ecological niches so long as the environment and resources are more or less in a steady state. This continues until some environmental change or extrinsic event reorganizes the ecological system back to lower complexity.

Here are few more comments:

Discounting is a topic being discussed among scientists in many topics of sustainability. For example this year a big report has been issued about the monetary value of biodiversity (The Economics of Ecosystems and Biodiversity - TEEB). Surprisingly to me, many scientists think that the monetary value of a deteriorated natural environment can be discounted with time: they expect that in future mankind will find technical innovations to deal with the challenge of dealing with the deterioration. However I think that also a "negative" discount rate should be considered: Our environment can become so stressed leading to increasing shortages of energy, arable land, water, food etc. that the value of the remaining resources will increase - including the value of a healthy environment. Sadly, still few of the experts involved seem to have the broad view to see the challenge...

As for the Time Value of Energy I think we shouldn't forget a speculative aspect:

The future value of an energy resource (or an energy facility investment) depends very much on the question if the supply of a resource is (almost) unlimited (e.g. renewables or fossil fuels from a cornucopian's view) or if it is limited (e.g. fossil fuels from a peakist's view). In a limitless world the investment rules mentioned above, which apply a (steep) discount rate apply - this is for example how the UK plundered its natural gas resources during the past few years. However in a world of limited resources a different rule applies: Hotelling's rule, which determines the maximum rent that can be obtained while emptying the stock resource. It shows that in an efficient exploitation of a non-renewable and non-augmentable resource, the percentage change in net-price per unit of time should equal the discount rate in order to maximise the present value of the resource capital over the extraction period.

This also means that it may be worthwhile to stretch the resource extraction as the price paid per resource unit may increase with time. This is for example how the Netherlands manages its natural gas resource extraction - and perhaps also Saudi Arabia its oil wealth.