EROI on the Web part 2 of 6, (Provisional Results Summary, Imported Oil, Natural Gas)

Posted by nate hagens on April 8, 2008 - 10:30am

This is the second of a six part series on net energy research resulting from Professor Charles Hall of the SUNY College of Environmental Science and Forestry and his students during last semesters "EROI Sweatshop". While it is still in draft form, it is hoped (with some help from TOD readers) to be refined and directed into the formal peer review literature. But Professor Hall (and I) believe this type of thinking also needs to be considered outside the academy, and increasing the level of energy discourse in our nation is one reason for him choosing to display his draft essays on theoildrum.com.

This installment highlights 3 individual sections of the larger compilation: 1) a provisional summary table of updated (or as updated as we have) EROI figures for various fuels, 2) an insightful (but counterintuitive - I had to read it twice) analysis on the EROI of imported oil from the perspective of the importing country (USA), and 3) an analysis on the EROI of natural gas. If you would like to 'improve on the silence' in the comment section to help Dr. Hall and his students advance the biophysical Rubik's cube that is EROEI analysis, please share your wisdom /expertise/ links, etc. Next Tuesday will be the Appendix on the EROI of Nuclear.

Previous articles/commentary from this series:

At $100 Oil, What Can the Scientist Say to the Investor?

Why EROI Matters

EROI Post -A Response from Charlie Hall

PROVISIONAL RESULTS FROM EROI ASSESSMENTS

Charles A.S. Hall and the “EROI study team”

State University of New York

College of Environmental Science and Forestry

Syracuse, New York

Introduction

Energy return on investment, sometimes called EROI and sometimes called EROEI, is thought by many, including myself, to be a critical issue for determining the past, present and future status of human society. It is usually considered in terms of energy return on energy investment, but it can also be considered in terms of energy return on monetary investment. While much of human progress has been attributed, rightfully, to technology, much of that technology has been a means of using more energy for human ends. This is true for fire, knife blades and spear points (energy concentrating devices), the development of agriculture and the increase in its productivity and, essentially all aspects of the industrial revolution.

EROI is simply the energy delivered by an energy-obtaining activity compared to the energy required to get it. If the numerator and denominator are expressed in the same units (barrels per barrel, MegaJoules per MegaJoule) the result is a dimensionless ratio, i.e. 100:1 or 10:1). Obviously a higher ratio implies a more desirable fuel than a lower one, other things being equal (which is rarely the case). The concept is extremely simple in theory but often very difficult in execution, mostly because society generally maintains its records in monetary rather than energy terms. Another problem is that the U.S. Government has not supported such studies in a consistent fashion and it is my perception that the quality of some energy records as are kept by e.g. the U.S. Departments of Energy and of Commerce appear to be deteriorating in recent years. Thus deriving the energy cost of getting energy (or most other things) is generally somewhat, and oftentimes exceedingly, difficult. A second problem is that the usual measure of the quantity of a fuel, its heat value, often does not give a full assessment of that fuel’s ability to do economic or other work. Most simply electricity and thermal heat from e.g. coal or oil have a great difference in their ability to do work, such as we are willing to trade three or four heat units of coal or oil in a thermal plant for one thermal unit of higher quality electricity. Thus if the input and output fuels are of different quality then it is often thought desirable to weight in some way the inputs and the outputs. A third problem is that it is important to consider boundaries: how large should we draw the boundaries of the energy analysis for the inputs? We will consider these issues in far more detail in later publications but there are many reasons why it is important to make summaries of EROI available at this time even though many uncertainties exist in the numbers that we present here, and indeed with any numbers that might be possible to generate.

At this time humans are especially dependent upon oil and natural gas, collectively called petroleum, for they supply about two thirds of the industrial energy both in the US and in the world. Petroleum is an especially advantageous fuel for human society because of its abundance, energy density and, at least in the past, high EROI. The concern at this time is twofold: there are many arguments and more than a little data that we may be approaching “peak oil” for the world, as has already happened, often long ago, for the United States and some 50 other oil producing nations. A related issue is that the EROI for oil and gas nationally and globally appears to be declining fairly substantially. For example, in the US in 1930 the EROI for oil was at least 100 barrels returned for each barrel invested (i.e. EROI = >100:1), but declined to about 30:1 in 1970 to from 11 to 18: 1 in 2000 (Cleveland et al. 1984, Hall et al. 1986, Cleveland 2004). Similarly, Gagnon et al. (in preparation) have estimated that the EROI for global petroleum has been declining steadily in recent years. Were these trends to continue, and there is little to indicate that they would not, then oil and somewhat later natural gas would be not only less available due to peaking but also much more expensive in terms of society’s resources, including energy, required to obtain them. Consequently there is considerable interest, at least amongst those relatively few who think about it, about what might be the EROI and scalability of alternative fuels.

At the present time the most available (and promoted) alternative to oil as a transportation fuel is ethanol made from corn. EROI has been an important part of the debate about the desirability, or lack thereof, of this fuel (See e.g. Farrell et al. 2006 as well as the many responses to that article, including our own, in Science, June 23 2006). Different estimates of the EROI for corn-based ethanol range from 0.8:1 to 1.6:1. The debate has usually focused on whether the EROI is greater or less than one for one, as obviously it would not make sense to invest one Joule of existing oil or gas to generate less than one Joule of alcohol. (Some arguments have been made that if we would invest one Joule of lower quality fuel such as coal to make one Joule (or less) of liquid fuel it would make sense). We will argue in later papers that if proper boundaries are drawn the minimum EROI needed for a fuel to make a real contribution to society, and not be subsidized by petroleum, is not 1.1:1 but closer to 5:1. However it is not the issue of this paper to make such arguments but to simply examine what might be the EROIs of various energy sources “out there”, as well as consider the potential magnitude and environmental aspects of various fuels.

An additional critical component of the value of a fuel is its magnitude, both in actuality as well as potential. A fuel may have a very high EROI but be limited in magnitude to less than one percent of e.g. the energy use of the U.S., as is the case for wind energy now in the U.S. In addition there are many other criteria that might be used, including, as noted above, magnitude and environmental issues. Additional considerations might include labor, financial, land use and many other issues. Some of these can be quantified. A comprehensive, although controversial approach to quantification is emergy analysis (e.g. Odum 1998) whereas all environmental as well as industrial energies are considered. Nevertheless it seems obvious that not all issues can be easily quantified, and some important aspects can only be listed. In the meantime it is important to quantify what we can. Such quantification can help us to judge various alternatives, eliminate some obvious bad choices and understand how the future may be very different as we continue to exploit and deplete our highest quality fuels.

Methods

Unfortunately there does not exist at this time a large and sophisticated literature on this important problem, primarily because most records kept on energy analysis are monetary-based rather than energy-based, reflecting the obvious and understandable focus of business on the monetary end of things and the basic way that information on our economy is maintained in the US (and the rest of the world). In addition there is not yet any explicit publication or protocol by which we could agree to undertake EROI analyses, and different analysts use different methods, procedures and, most importantly, boundaries to do their particular analysis. Finally a given technology may have inherently different EROIs depending upon the location where the analysis is applied. For example, different dam sites can give enormously different EROIs, and corn grows much more efficiently in Iowa than Maine or New Mexico. While we await a more explicit protocol (which we are working on) the approach used here can only be described as “hammer and tong”, that is, using anything that can be possibly brought to bear on the problem. Our preference is for an explicit “meta analysis” using a sophisticated assessment of extensive data reported in reviewed literature. Unfortunately these conditions are rarely met, so we used whatever information we could find with some comments about the quality of the literature we found. In addition we have developed new analyses for several fuels.

Some alternative approaches that can be used to calculate EROI include:

1) Top down (National aggregate) approach:

1a) National energy/GDP ratio. The crudest approach is simply to examine the amount of energy used by the entire economy per unit of economic production to give an average amount of energy used per dollar of economic production. This is obtained easily by dividing the total GDP of the economy in question by the total energy used by that economy. For example in 2005 the GDP for the United States was 12.456 trillion dollars, and the energy used was 100 quadrillion BTU’s (English units), equal to 105.5 ExaJoules in Metric units). The quotient is 8.47 ExaJoules per trillion dollars or, in more useful terms, 8.47 MJoules used per dollar of production. This of course is not especially useful for most applications because different economic activities have different energy intensities. For example Herendeen (personal communication) estimated that in 2005 heavy construction requires about 13 MJoules per dollar of activity, and very heavy industry needs more. Nevertheless, earlier work by Hannon, Bullard and Herendeen at the University of Illinois showed that because of the extreme interdependency of our economy (i.e. different sectors purchase considerably from each other) and the concept that, perhaps, energy is in some sense the ultimate raw material for economic production (Costanza 1980) the difference was not enormous for most final demand except fuel itself.

1b) Direct energy: The approach that had been used most commonly in the past was to divide the energy generated by a resource by the energy used to obtain that resource as indicated by national assessments of the total energy used by that sector of the economy (See e.g. Cleveland et al. 1984; Hall et al. 2006). These are derived in turn by questionnaires sent out every five years by the Department of Commerce to many players in each sector and scaling up the results to the entire industry. This is sometimes called a “top down” approach because it derives the analysis for the entire industry from aggregate data collected on key players in the industry. Unfortunately this approach cannot be used for many of the alternatives to principal fuels because they are not important enough quantitatively for the Department of Commerce to maintain such data. This is a very sound way to get minimal estimates of energy used to get energy, although I and others have felt that there has been a degradation in the quality of the data maintained in recent years.

1b+) Indirect energy: In addition to the direct energy used to produce a fuel, energy is used off site (i.e. indirectly) to generate the materials used by that industry. These can be derived in various ways, most accurately by using the “Leontief I-O” approach adjusted from money flows to energy flows (e.g. Bullard et al. 1975, Bullard et al. 1978, Hannon 1981). The direct and indirect flows are added to provide a more complete assessment of energy used. An analysis using much larger boundaries and including the energy used by nature is the emergy approach (e.g. Odum 1996). While this method is controversial it is useful in generating an upper bounds for an analysis.

2) Summarizing existing literature.

Ideally this would be based on peer reviewed literature published in reputable scientific or economic journals. This is an important criterion as many such analyses as are “out there” are clearly advocacy pieces for or against one fuel or another. When such analyses are done well and include many studies as well as a consideration of the quality of the methods and results it is often called a “meta analysis”. Unfortunately such quality control is rarely possible. Thus we rank the analyses presented below as “literature summaries” and “meta analyses” based on the above criteria.

3) A “bottom up” approach

This approach scales up information for some hopefully representative part of the industry to the industry as a whole. In this case an inventory is made of the energy and materials used for an activity and all are converted to energy units (see energy intensities).

4) Other approaches

Their use is too rare and too diffuse to summarize.

All of these methods are incomplete for many reasons, because they do not include all of the energies used to create the product or all of the energy loses due to the products’ production or use. These include, but are not limited to, the energies required to overcome environmental impacts, to support the labor used and to construct the machines and infrastructure necessary to use the energy. In addition for non-renewable energies they do not include the energy used to make or replace the energy itself, but rather only that energy used for exploitation. The inclusion of these additional energies are controversial and complex, and are not used here. Hence EROI values given (that are current) are probably maximums, in some cases substantially so.

The information summarized below was obtained by an intense month-long “EROI sweatshop” where about a dozen dedicated and carefully-selected graduate and undergraduate students were directed by Charles Hall to seek whatever information might be available on the magnitude, EROI and environmental impacts of various energy sources.

Disclaimer: The results given here are preliminary, sometimes perhaps quite crude and subject to revision. Almost always we did not find enough obviously reliable information such that we could feel really certain about our conclusions. On the other hand it is our general sense that for most of the analyses presented our numbers are well within the ballpark and are unlikely to change substantially in the future, but we could be wrong about that too. Subjectively we are least certain about nuclear energy (because most of the analyses were old, although reinforced by several modern ones), coal (because the analyses are very incomplete), hydropower (because the results are so site-specific) photovoltaics (because the technologies are changing so rapidly and the materials supply for major expansion so uncertain). It is also important to remember that our results are based on existing operating technologies and not on some future perceived improvement. We welcome any additional objective and reliable information that we have overlooked.

Provisional Results Summary - TD= top down, EI= Energy intensities times dollars, LS = Literature summary, MA = MetaAnalysis, BU= Bottom up, LR = literature review, O = other. (Some are mixed)

RESULTS

We have four main results:

1) First there will be almost certainly a continued decline in the EROI of most major fuels, including especially liquid fuels, used in the U.S. economy. This problem is likely to be as much due to an intensification of effort as to the decline of the resource base itself (see 3). The probable decline in EROI includes domestic and especially imported oil and probably natural gas as well.

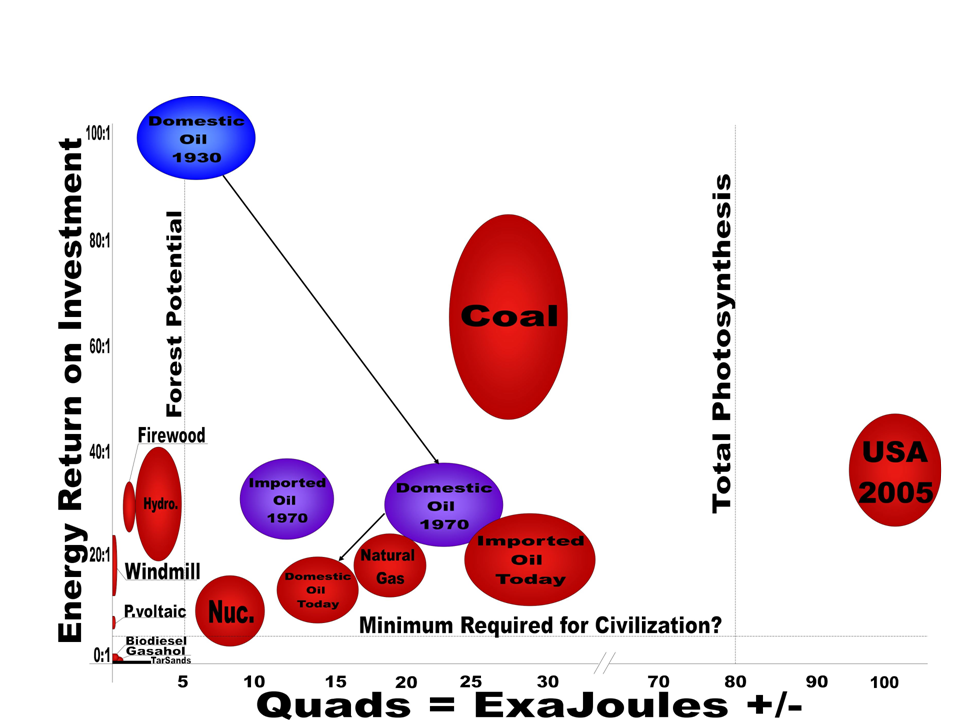

Figure 1. “Balloon graph” representing quality (y axis) and quantity (x axis) of the United States economy for various fuels at various times. Arrows connect fuels from various times (i.e. domestic oil in 1930, 1970, 2005), and the size of the “balloon” represents part of the uncertainty associated with EROI estimates. Click to Enlarge.

2) Few of the energy sources put forth as alternatives to oil and gas have anything like the quality (e.g. EROI) or quantity (total resource available at a national level) necessary to in any meaningful way act as replacement fuels for oil and gas. This is especially true for liquid fuels (Table 1 and Figure 1, See also Hall et al. submitted). Greater details are given in Appendices A-G, Hall et al. (submitted) and also other work in progress. Solar, especially photovoltaics, and perhaps nuclear, do have very large potentials but their costs at this time are very high, storage is a huge problem and material costs appear to be escalating rapidly. It is unclear for nuclear whether there is enough high grade uranium ore for conventional reactors, what the possibility of thorium is, and terrorism may present some additional problems. Now designs based on e.g. thorium might offer solutions but are only on the drawing boards.

3) The EROI benchmark required for any really useful fuel for modern infrastructure has to be substantially higher than unity, 5:1 at a guess.

4) Intensification of effort is often counter productive, leading to little or no more resource but an increase in energy used to get the fuel. Thus market incentives may have a counter productive effect (e.g. figure 2).

Figure 2. Annual rates of total drilling for, and production of, oil and gas in the US, 1949-2005 (R2 of the two = 0.005; source: U.S. EIA and N. D. Gagnon).

Literature cited

Bullard, C. W. and R. A. Herendeen 1975. Energy costs of goods and services. Energy policy 3: 263-278.

Bullard, C. W. , P.S. Penner and D. A. Pilati. 1978. Net energy analysis handbook for combining process and input-output analysis. Resources and Energy, 1: 267-313.

Campbell, C. and J. Laherrere. 1998. The end of cheap oil.. Scientific American March: 78-83.

Cleveland, C. 2005. Net energy obtained from extracting oil and gas in the United States. Energy 30:769-782.

Cleveland, C. J., R. Constanza, C. A. S. Hall, and R. Kaufmann. 1984. Energy and the U.S. Economy: A Biophysical Perspective. Science 225:890-897.

Deffeyes, K. J. 2005. Beyond Oil: The View from Hubbert's Peak. Hill and Wang, New York, NY.

Farrell, A. E., R. J. Plevin, B. T. Turner, A D. Jones, M. Ortare, D. M. Kammen. 2006. Ethanol can contribute to energy and environmental goals.

Science, 31 (5760): 506508.

Hall, C.A.S. 1972. Migration and metabolism in a temperate stream ecosystem. Ecology 53 (4): 585-604

Hall, C.A.S., R. Howarth, B. Moore, and C. Vorosmarty. 1978. Environmental impacts of industrial energy systems in the coastal zone. Annual Rev. of Energy 3: 395-475.

Hall, C. A. S., C. J. Cleveland, and R. Kauffmann. 1986. Energy and Resource Quality: The Ecology of the Economic Process. Wiley Interscience, NY.

Hall, C.A.S., C.J. Cleveland and R. Kaufmann. 1986. Energy and Resource Quality: The ecology of the economic process. Wiley Interscience, NY. 577 pp. (Second Edition. University Press of Colorado).

Hall, C.A.S., T. A. Volk, J. Townsend, M. Serapiglia, D. Murphy, G. Ofezu, B. Powers and A. Quaye (submitted). Energy return on investment (EROI) of current and alternative liquid fuel sources and their implications for wildlife science. Journal of Wildlife Science.

Hannon, B. 1981. Energy cost of energy. In Energy economics and the environment. Westview Press, Boulder, Co.

Odum, H.T. 1996. Environmental Accounting, emergy and decision making. John Wiley, New York

APPENDIX A.

EROI FOR GLOBAL OIL AND GAS

The EROI for oil and gas globally, and it's slope, are obviously of great concern. The problem, as usual, is in the data available: while it is straightforward to convert global oil and gas production figures (from EIA, BP and so on) into energy units, most of the cost data is in monetary units, and even that data is limited. Fortunately we have been able to work closely with personnel at John S. Herold Inc. which is a repository for financial data on “upstream” (i.e. pre sales) of oil and gas for publicly traded companies. We have derived energy intensities (i.e. energy used per dollar spent) for a number of countries and used this to convert the dollar-based Herold data into EROI estimates. The details are in a separate paper by Nate Gagnon and Charles Hall which is being prepared for submission to a journal and which is not publicly available at this time. Our preliminary estimates are that the EROI for global oil and gas has declined steadily from roughly 35:1 in 1999. Details will be available when the paper is in press, which we hope is soon.

APPENDIX B.

CRUDE AND REFINED OIL IMPORTED TO THE UNITED STATES

Palcher, Sarah, Mike C. Herweyer and Charles Hall

Definition

The Energy Information Administration defines crude oil as “a mixture of hydrocarbons that exist in liquid phase in natural underground reservoirs and remains liquid at atmospheric pressure after passing through surface separating facilities.” They define imported crude oil as “Receipts of crude oil into the 50 states and the District of Columbia from foreign countries, Puerto Rico, the Virgin Islands and other US possessions and territories.” The definition is probably increasingly inadequate because the United States imports an increasing proportion of refined oil and the total imported oil, both crude and refined, is normally what is considered. This oil can come from many parts of the world but Canada, Mexico, Venezuela, the Middle East and North and West Africa have been traditionally the major suppliers. The term “imported oil” thus refers to all oil no matter where it came from or no matter the precise form.

History

Before World War I the demand for oil was reasonably constant and few or no shortages occurred within the U.S. During World War I, however, the importance of oil for military operations and of controlling domestic oil demand came to be realized. It was the first realization that humanity was becoming dependent on oil resources, although after the war that concept was rapidly forgotten.

In the 1950s the various oil exporting countries realized that oil production could be regulated in order to regulate prices throughout the world. In 1960 OPEC (The Organization of Petroleum Exporting Countries) was formed with originally five founding members, Iran, Iraq, Kuwait, Saudi Arabia, and Venezuela. By the end of 1971 Qatar, Indonesia, Libya, United Arab Emirates, Algeria, and Nigeria had joined the organization (WTRG economics, 2006). OPEC was a very important actor in the “energy crisis” of the 1970s. Most people today view the two oil crises as one, but there were actually two separate “crises” with at least two separate causes. The first real “oil crisis” was in 1973 and was caused by the Yom Kippur War. On October 6th 1973 – on the Jewish holiday “Yom Kippur” - Egypt and Syrian troops invaded Israel following long standing altercations amongst the participants. The troops of Egypt and Syria were supported by the Arabic world, and those of Israel were supported by the US. In response to the support of Israel the OAPEC (the Arabic part of OPEC) declared an oil embargo at October 20th against the US, the Netherlands and other states helping Israel. This was the beginning of the 1973 energy crisis when the oil prices tripled. The issue was exacerbated by a main pipeline in the Middle East being ruptured by a bulldozer. The second oil crisis occurred in 1979 when the Iranian Revolution started as Iranians rebelled against the Shaw of Iran (who had been installed by US intervention some decades earlier). During this period the oil prices (corrected for inflation) rose to the highest levels ever seen in the U.S. The total increase over 7 years was a factor of ten, from $3.50 a barrel to $35.

Figure 1: history of crude oil prices, in 2006 US dollars, with some main influences from political events (source: WTRG Economics). The price has increased subsequently to as much as $100 a barrel.

The US had imported small amounts of oil since the beginning of the 20th century, but after a peak in the domestic oil production in the beginning of the 70s, imports increased rapidly. The dependency on ever more expensive imported crude oil resources was a very new phenomenon for Americans and was evidenced by economic stagnation, inflation, long lines to purchase gasoline and a reduction in National confidence. But in time the US started to import less oil even though domestic production continued to decline. This was due mainly to a reduction in demand and hence price as companies and municipalities had made large investments into making plants, buildings, and equipment more energy efficient, and also the shift in electricity production from oil more towards coal and gas. Around 1986, the price of oil dropped sharply. A surplus in supply relative to demand occurred and continued until about 2000. The effects of these and other events can be seen in Figure 1. From the mid 1980s until the end of 2001 the oil supplies became more secure, the US oil demand grew steadily, but the domestic crude oil production continued to decline. In reaction the US started to again import more and more crude oil to satisfy the demand, and in 2005 about 60 percent of the US crude oil supply was imported. These oil imports cost as of 2007 was about 250 billion dollars a year, much of it paid for through debt, so that with interest the cost will in the future be larger. Figure 2 shows the historical pattern of imports of crude oil to the US.

Figure 2. US dependence on imported petroleum, 1960-2005 (Source: EIA, monthly energy review, Sept 2006)

According to the EIA (The US Energy Information Agency, Annual energy review 2005)) about 52% of the total US petroleum consumption in 1950 was in the transport sector. In 2005 it was 68%. Thus today more than two thirds of the total petroleum products consumed in the US is used by the transport industry. Since there is no ready substitute for this petroleum on the scale required this is the most vulnerable aspect of the US energy situation.

Resource base

The crude oil resources which can be found outside the US are still large, although “large” depends on the definition and who is doing the analysis. The world has consumed about one trillion barrels as of 2006, which can serve as a benchmark. There are probably at least 3 to 5 trillion barrels left in the ground, but the trick is, what proportion of that can be extracted? The usual proportion that can be extracted is given as about 35 percent, but there is a huge variation depending upon the specifics of the field (Deffeyes 2005). The US Geological Survey undertook a very exhaustive survey in 2000 (USGS 2000). They gave a 95 percent confidence (i.e. very high probability of that much oil being ultimately produced) of 1.9 trillion barrels, a median (50 percent probability) value of 2.9 trillion barrels, and a high (5 percent probability) value of 4.0 trillion barrels. These numbers imply that the world has extracted and consumed from about a quarter to about one half of all of the oil it will ever extract. Much of the variability in those numbers depends upon what proportion of the oil in place can be extracted. Obviously increasing the proportion extracted usually increases the energy cost of that barrel, but it might make the reserve estimates substantially larger.

According to the Oil and Gas Journal (Dec 19th, 2005) the world’s proven reserves of oil (crude oil, natural gas liquids, condensates and non-conventional oil) amounted to 1.293 trillion barrels. About 62% of these reserves are located in the Middle East and North Africa. Figure 3 shows the top twenty countries with proven oil reserves. There are two caveats that go with this figure: the first is that there is considerable controversy about the actual size of the reserves of most OPEC nations as there was a suspiciously large jump in reserves of these nations following the 1986 agreement to allow pumpage in proportion to reserves. Thus as much as a half of the reserves of some nations might be “political” vs “geological” reserves. The second is that the majority of the reserves for Canada are “unconventional” crude oil resources (mainly oil sands). While these reserves are large their rate of exploitation is likely to be restricted by the needs for water, natural gas or environmental or social issues.

Given that the United States is the world’s largest consumer its need to import is obvious. These estimates represent values with, at least in theory, a very high probability of actually being extracted. In addition it is likely that an unknown quantity of other oil resources will be found and added to these reserves. If that number is small and Canada’s unconventional oil sands are not included then this assessment would not be too different from the USGS (2000) low value. Thus if the USGS median or high quantities of conventional oil are to be realized a great deal of additional oil must be found, which would require a large change in the finding patterns we have witnessed since about 1970.

Figure 3, Top twenty countries proven oil reserves (at the end of 2005). Note that Canada includes non-conventional proven reserves. (Source: Oil and Gas Journal, December 19th, 2005). The reserves to production ratio indicates the number of years of production at present rates that would exhaust known reserves.

EROI

Methodology

The EROI of imported oil for the US (from the perspective of the US), must be calculated differently from how it is done for most other fuels. The EROI for actually getting the oil to the surface (i.e. the oil produced divided by the energy required to get it) is covered in a forthcoming publication on global oil and gas (Gagnon and Hall,Appendix A) and was roughly 35:1 and declining as of 1999. But the actual energy cost to the importing nation is not simply the energy cost of recovering the oil from the ground and shipping it across the ocean but rather is the energy that must be used to generate the goods and services that in (a net sense) must be traded for that oil, and this depends on the price of a barrel of oil relative to the prices of the goods and services exported to get foreign exchange (Hall, Cleveland and Kaufmann 1986, chapter 8, originally authored by Robert Kaufmann). This methodology can be applied only to an individual country and has little to do with the fundamental EROI of global oil and gas. In a sense the money we spend to provide our imported oil supports export nation’s government subsidies (both as dollars and the energy associated with those expenditures) to the burgeoning populations and the often opulent life-styles of their leaders. These supplier nations, of course, gain enormous financial leverage because of the US’s and the world’s increased addiction to a resource that most countries can no longer fully supply for themselves, and for which there are no, or certainly no easy, substitutes. In addition, since almost all US economic transactions are done in terms of dollars and not energy, we are forced to, again, translate economic transactions done in terms of dollars to energy values using energy intensities of economic activities. (If you are unhappy with this use of energy intensities of economic activity then you must ask the government (or someone) to keep a separate set of books based on Joules!) The EROI for an imported fuel can change dramatically as the price of oil relative to our exported goods and services increases and decreases due to economic, political, meteorological, psychological and other factors, and the cost to the U.S. recently is far above production costs (in both dollars and energy) due, I suppose, mostly to the geography of supply and demand. As imported oil gets more expensive and diverts more of the total economic activity of importing nations, then, as suggested in our first post, the discretionary money and energy available to the population becomes less. We have examined these issues in some detail for Costa Rica and other countries, where they may have an even larger impact than in e.g. the U.S.

We exclude from this analysis the interest on the debt with which we increasingly pay for oil—but that would increase the energy cost of the oil assuming the debt is eventually paid. We derive the EROI in a way similar to other EROI calculations in that we divide the energy of the delivered crude oil by the energy required to obtain it. However in this case it is the energy used in the general economy to generate enough exported goods and services to pay for that oil. More specifically, the energy delivered is determined by the energy content of one barrel of imported oil, about 6,164 MegaJoules/barrel, by the energy required to generate the dollar cost of an imported barrel, that is by multiplying the international price of a barrel of oil (i.e. in nominal dollars) by the average energy intensity of the US economy (in MJ/nominal dollar) for that specific year (equation 2). In other words to get the foreign exchange to buy one barrel of crude oil the U.S. needs to generate enough goods and services to be sold abroad to generate the necessary money to buy it. This methodology calculates the energy cost to the U.S. economy to import the energy contained in crude oil, using monetary values as a transitional stage. For an example, a farmer has to earn money to buy one gallon of gas so he has to sell some of his or her crop, much of which goes overseas. To produce the crop he has to do economic work, which is by definition an energy-intensive procedure, usually requiring oil or some other energy source. So to earn the money to buy his or her fuel he has to invest a certain amount of energy in growing and harvesting the crop. While the farmer does not pay the supplier in Mexico or Saudi Arabia directly the oil importer must, using in part that farmer’s purchases. How much energy we as a nation must invest on average to get the energy embodied in one barrel of crude oil is calculated in formula 1.

Where: Eboe = Energy content of one barrel of oil equivalent (6164 MJ/boe)

Eintensity,y = Energy intensity of the total US economy in year: (MJ/USD/y)

Pboe = Price of one barrel of oil equivalent in year: (USD/boe/y)

Econs = Total energy consumed in the US in year: (MJ/y)

GDP = Gross Domestic Product in year: (USD/y)

This study is based on Kaufmann’s (1986) analysis of EROI of imported oil. Kaufmann calculated the EROI of imported liquid petroleum by calculating the energy needed for sector-specific exports. However we could not follow the original methodology because much of the data needed is no longer collected by the US government. Thus we use the average value for the US national economy. The results of Kaufmann’s study, however, can be used to validate our results.

Results

Our estimated EROI values for crude oil imported to the US from 1968 until 2005 varies from about 45 to about 5 barrels of oil obtained per barrel invested in the general economy to make goods and services for export. These values are plotted as a time series in figure 4 along with the price of a barrel of oil in international markets. The effects of the first and second oil crisis can be seen clearly. In 1973 - after the first oil crisis started - the imported EROI for oil dropped from 26:1 to 9:1 as the price of a barrel of oil increased relative to the price of our exported goods – assuming that the goods and services we exported were as energy-intensive on average as the society in general. It cost the US society almost three times more energy (embodied in money and in the goods and services exported to pay for the oil imported) to gain the imported energy embodied in a barrel of crude oil than it cost to get domestic oil. Money lost its (energetic as well as monetary) value in terms of buying a barrel of oil. A second drop in the EROI to about 5:1 can be seen in the beginning of the 1980s. From 1986 until 2001 the price of a barrel of oil dropped and remained relatively low, while inflation had increased the dollar value of exported goods and services so that the EROI increased to as much as 55:1. But starting in about 1998 the price of oil gradually increased again (and more rapidly than the inflation of goods and services) and the EROI declined, a trend that appears to be continuing. The EROI for oil imported to the US declined during this period from 27:1 in 2001 to 15:1 in 2005. Given that as of September 2007 the price of a barrel of oil has increased to nearly $80 dollars a barrel with (thus far) a relatively small increase in general price levels (about 10 percent) we might assume that the EROI has continued to decline to perhaps 10 to 12 to one (and to much less by 2008). If the price of oil continues to increase rapidly compared to the price of exported goods and services then an increasing and very large proportion of the total output of the U.S. economy will be required to gain imported oil.

Figure 4: EROI Imported Crude Oil into the US plotted with the crude oil price from 1968 until 2005, and validated against Kaufmann’s EROI (1986) for liquid petroleum . (Data from U.S. BEA, 2007; EIA, 2007).

When the EROI is examined against the total imported crude oil, a clear trend can be seen (Figure 5). In 1973 the EROI declined, but the amount of oil imported still increased (because of the decline in domestic US production, and the slow reaction in crude oil demand). In 1979 the quantity of imported crude oil stabilized and declined until 1985, because of slowed economic growth, some efficiency improvements, conservation, and especially an increase in the use of other energy sources (coal, gas, and nuclear energy). The inflation caused by increased oil prices takes a while to work through the economy but eventually makes exported goods more expensive so that in 1986 the EROI went back up to 24:1. The EROI remained relatively constant until 2001 but began to decline again. From 1986 until 2004 the amount of crude oil imported rose steadily even as its relative price increased.

The trend from 2001 until 2005 is similar to what occurred in 1973/74. In 1973 the oil embargo happened abruptly and the US government was not well prepared. The EROI decline happened quickly and steeply. Following 2001 a less steep decline in the EROI occurred. Currently the US is faced with an increased dependence on imported oil, the same trend as in 1970s, except that now the global peak is on the horizon, so a large increase in imports might not be possible. With this knowledge we can assume that the EROI (from the perpective of the US as importer) will decline in the near future, and after a little increase in the price of crude oil imports they may decline as well.

Figure 5: EROI plotted against total energy content in imported crude oil from 1968 until 2005. (Used data: BEA, 2007; EIA, 2007)

Validation

We compared our results with Kaufmann’s (1986) analysis which we read off his graphical output (Figure 4). Kaufmann’s EROI’s tend to have a very similar pattern to ours but are somewhat lower by from about 5 to 30 percent. The lower values perhaps can be explained by the differences in research boundaries or by the possible fact that exported goods and services are more energy-intensive than is the case for the general economy. The United States used to maintain much better energy (and other) statistics. Thus Kaufmann was able to derive sector-specific energy intensities, and multiply these by the weighted value of exported goods and services. Our values are more aggregated but show very similar trends, although at about a 5-30 percent smaller energy intensity than Kaufmann’s. Thus we can say that our aggregated estimates are reasonably but not perfectly validated by an earlier more detailed study. There is little we can do to improve on this until if or when the United States decides again to again maintain more comprehensive energy statistics. In the meantime it is probably safe to say that our analyses are conservative, that is represent a high estimate of the EROI for imported oil.

Environmental impacts

The environmental and social impacts for imported oil to the US include both spillage and routine releases of transported oil (e.g. Hall et al. 1978) but also all of the general impacts associated with the entire US economy, for it is the results of that economic activity that pays for the imports.

Literature Cited

Deffeyes, Kenneth S.. 2001. Hubbert's Peak: The Impending World Oil Shortage. Princeton University Press. Princeton, N.J.

Bureau of Economic Administration, 2007

EIA (U.S. Energy Information Agency), 2007 (Accesed May 2007)

Gagnon, N. and C.A.S. Hall, Appendix A

Hall, C. A. S., R. Howarth, C. Vorosmarty and B. Moore. 1978. The environmental impact of energy use in the in the coastal zone. Annual Review of Energy 3: 395-475.

International Energy Agency, World energy outlook 2006, Paris, 2006. (www.iea.org 5-23-2007)

Energy Information Administration, 2007, definitions, sources and Explanatory notes, Website: www.eia.doe.gov , (6-29-2007)

Kaufmann, Robert. 1986. Imported Petroleum. Chapter 8 in Hall, C.A.S., C. Cleveland and R. Kaufmann. Energy and Resource Quality. Wiley Interscience, New York.

Oil and Gas Journal (Dec 19th, 2005)

US Geological Survey 2000.

WTRG Economics, 2006 (An on line oil information company).

APPENDIX C NATURAL GAS

NATURAL GAS: POTENTIAL, EROI AND SOCIAL AND ENVIRONMENTAL IMPACTS.

Sara Button, SUNY-ESF, Syracuse NY.

Bryan Sell, Department of Geology, Syracuse University

INTRODUCTION

Definition: “A mixture of hydrocarbon compounds and small quantities of various nonhydrocarbons, widely used as a fuel throughout the industrialized world; it exists in the gaseous phase or in solution with crude oil in natural underground reservoirs” (Cleveland 2006).

History Time line of Natural Gas (naturalgas.org)

TECHNIQUES

Natural gas is often found along with oil and hence can be found by the same geological procedures as oil is found: surface geological features (including seeps), subsurface geology (using seismic processes etc), and geophysics. As a well is drilled the substrate removed by the hollow drilling device emerges at the surface and can be analyzed for its geological, paleontological and petrochemical properties. As more and more wells have been drilled geologists have been able to construct regional maps of the underground substrate so that we have very detailed information for many oil and gas producing regions. In some regions, such as Indiana County Pennsylvania, many thousands of wells have been drilled to extract gas from relatively low yielding but very extensive fields. The spacing of wells depends on highly variable subsurface geology, although tight gas wells are more closely spaced at less than 1,000 feet. New drilling is limited by transmission pipeline availability. All sedimentary basins that have gas potential have been identified. Size and geometry of these basins are established by plate tectonic setting.

The process of drilling a gas well on land is usually more or less as follows unless the terrain is unusually difficult (such as on marshland or on permafrost). First the drilling site, chosen by seismic or other means is prepared by constructing a road, clearing the site itself (usually less than a hectare), moving drilling and gas handling machinery onto the site and then stockpiling the materials required. Once the drilling rig is assembled the drilling begins, normally using incrementally larger drill bits with the smaller cheaper holes furthest into the Earth and larger holes (usually up to 9 inches in diameter) nearer the surface. Next, casing (a kind of pipe) is inserted into the hole for it’s entire length. Once the hole and casing are finished cement is poured down the outside of the casing. At all stages the characteristics of the substrate are assessed using “wireline logging” techniques where various instruments are lowered into the bore hole. Then the portion of the pipe that is thought to be in gas-holding strata is “shot” with a series of projectiles similar to rifle bullets. The slugs go through the pipe and into the substrate, and their shock waves help to open up the substrate for some hundreds of meters. Acid is typically poured down the pipe and into the substrate to further open up the substrate. Gas then flows under its own pressure through the substrates and the holes in the pipes and to the surface, where it is collected, merged with other wells’ gas in trunk lines, separated into various fractions in holding tanks (e.g. removing brine) and shipped through pipelines to consumers. Production from mature natural gas field production tends to fall off much more rapidly than that from oil fields.

TYPES OF GAS FIELDS

In general natural gas is the end result of the “cracking” (i.e. breaking up”) of the original long chain molecules of petroleum that had once been various biological materials into shorter and shorter pieces as a result of the application of heat and pressure from the thousands of meters of sediments overlying the organic material. The type of gas depends upon how many atoms of carbon remain linked together. Methane (CH4) for one, ethane (C2H6) for two, Propane(C3H8) and butane (C4H10) are all useful gaseous forms familiar to use in routine economic activity.

Natural gas is usually divided into “conventional” (meaning from oil and gas or gas “fields” of usually limited spatial extent and specific form, vs. “unconventional” which are from more diffuse fields as indicated below). Another categorization is as “associated” (with oil—usually conventional), and “non associated” fields. The various unconventional fields include:

Coal Bed Methane (CBM) -- “An unconventional form of natural gas formed in the coalification process and found on the internal surfaces of the coal. To commercially extract the gas, its partial pressure must be reduced by removing water from the coal bed. The large quantities of water, sometimes saline produced from coal bed methane wells pose an environmental risk if not disposed of properly” (Cleveland et al. 2006)

Marginal Wells, defined as wells that produce less than 60 Mcf per day (Interstate Oil and Gas Compact Commission, 2006). Marginal currently comprise about 9% of total U.S. gas production (Sell 2007).

Tight Gas defined as “A category of unconventional natural gas that is trapped underground in extremely hard rock, or in unusually impermeable sandstone or limestone formation; tight gas requires much greater extraction efforts for acceptable rates of gas flow” (Cleveland et al. 2006).

Off Shore defined as “A general turn for oil and gas industry operations taking place along a coastline (e.g., in Louisiana) or in open ocean water (e.g., the North Sea field). Thus, offshore drilling, offshore lease, and so on” (Cleveland et al 2006).

Methane Hydrate defined as “the most recent form of unconventional natural gas to be discovered and researched. These interesting formations are made up of a lattice of frozen water, which forms a sort of 'cage' around molecules of methane. These hydrates look like melting snow and were first discovered in permafrost regions of the Arctic” (NaturalGas.org 2004).

RESOURCE BASE

Overview: The current official reserves for the United States for 2005 are 608 trillion cubic feet, compared to use of about 24 trillion cubic feet a year. Thus current reserves would last some 24 years as the simple quotient of the two, although this neglects the probably more important issue that the gas appears to have peaked in 1973 and then secondarily in 2001, that the current production appears to be falling, and that many or most major conventional fields appear to be approaching depletion. Thus it is becoming an issue of flow rate versus reserves. Production has shifted increasingly from large fields in Louisiana, the traditionally largest producer state, to often unconventional fields in the Rocky Mountain States. If one examines the rate at which gas has been found (shifted forward for 23 years) vs. produced for conventional gas there is a very close overlap and a strong indication that production , at least for conventional gas, is likely to take a strong downward course in the near future (Figure 1). Unconventional production has been flat for a decade at about one quarter the rate of conventional gas, but has recently started to increase. Some observers believe that U.S. and North American production is likely to decline sharply in the near future (i.e. Darley 2000). Natural gas is abundant, for the time being, in Russia, Qatar, Iran and some other places, but it very difficult to ship overseas. One solution to that is LNG, the liquefying of the gas (requiring roughly 10 percent of the energy liquefied) and shipping it overseas in a special “LNG” tanker. Port facilities for this in the U.S. are expensive and rare, but could be increased.

More specifically the reserves or resources of natural gas are very uncertain and depend upon the quality of the resource one might want to exploit and our ability to mobilize technology to exploit currently unexploitable resources. According to the EIA (2005) the “Technically Recoverable Natural Gas Resource Estimates for the U.S. in 2004 (EIA2, 2005) include:

Undiscovered Conventional Reservoired Fields 682 Trillion Cubic Feet

Discovered Conventionally Reservoired Fields 390 Trillion Cubic Feet

Total Conventional Reservoired Fields 1,072 Trillion Cubic Feet

Undiscovered Unconventionally Reservoired Fields 359 Trillion Cubic Feet

IMPORTED GAS

Currently the U.S. cannot meet all of its gas demand with domestic production and hence imports about 18 percent of its gas from Canada, although there are arguments that this gas will be needed to develop the Alberta tar sands. If additional gas is to be imported it will have to be done so using LNG technology, where the gas is liquefied and sent long distances in specially-designed ships. Major conventional gas resources are found in Russia, Iran and Qatar. The dollar costs for this fuel depend upon volatile international pricing and may follow oil prices. In 2006 high gas prices drove many gas-intensive U.S. manufacturing firms overseas or to close shop. The energy cost to the US depends upon the relative prices of gas and what we export as we have discussed for oil.

EROI

The problem: There appears to be little or no information that would allow us to derive the EROI from explicit national- or regional-level data about the gas industry because 1) oil and gas data, when available, tend to be combined and 2) the data maintained at the Federal level on energy costs of various industries appears less reliable than in the past. Therefore we can either give up or start “from the bottom up” to derive EROI for specific plays/regions, which is what we have chosen to do. Therefore we must make the following disclaimer: “There is no readily available literature either on, or by which, one might derive the Energy Return on Investment (EROI) of Natural Gas. Published summaries of natural gas reservoir studies and general overviews of drilling practices are sparse. Even with such a broad study, it would be difficult to assess natural gas production generally because each kind of operation is very field- specific".

However we undertook an analysis with Bryan Sell, a geology graduate student of Syracuse University who had previously worked for three years as a field driller, to calculate the EROI of a random sample of 100 wells in Indiana County, Pennsylvania. Due to the maturity of this field it may be representative of many gas operations in the U.S. This county was chosen because it is made up of a mature dry gas field composed of marginal wells (< 60 Mcf/day) and the necessary data was fairly easily accessible because of Brian’s contacts. With the completion of this specific EROI analysis a general research protocol is established that could be applied elsewhere. Most data was obtained from Pennsylvania state completion reports and electronic data of the Pennsylvania Department of Conservation and Natural Resources. Fuel consumption data was obtained from surveying industry contacts. This study explores the minimum requirements for natural gas drilling and establish a baseline for natural gas EROI studies. We used wells in Indiana County because they are relatively simple, but the drilling practices are very similar to other producing fields in the onshore United States. We extended the results by applying the energy consumption per foot of drilling in Indiana County to EIA data for national-level drilling and production data, to generate a crude estimate of the EROI of the United States (Figure 1).

We calculated the EROI for conventional dry gas wells in Indiana County, Pennsylvania. This started by assessing the amount of energy needed to drill and complete a well, which was adjusted to the energy cost per foot (about 0.35 GJ per foot, including secondary operations such as cementing). For our methods we calculated the direct energy (diesel fuel) that is principally used by the machinery drilling the wells and the indirect energy is for the materials (steel, cement, sand, water) consumed in drilling the wells. Acids and other chemicals are not yet included. Energy for cement production was obtained from Worrell and Galitsky, 2004, steel from Worrell et al. 1999, and sand from Department of Energy Report 2002. The largest indirect energy cost (approximately 60%) of drilling is from steel, principally used in the cladding.

We also calculated the indirect energy includes the energy used to produce the materials consumed (e.g.cement) during the plugging and abandonment of wells, and the energy used to generate dry holes, which have gone from 80 percent to about 50 percent of all wells, therefore the actual EROI is about one fifth to one half as much as for one successful well when they are included in the analysis. Pipelines contribute a minor energy cost and are assumed to be negligible. Operational energy costs are not yet included. The EROI value of marginal gas fields in Indiana County would decrease with a more inclusive analysis that included e.g. the energy cost of pipelines, acid, field vehicles and so on.

PRELIMINARY RESULTS

The EROI for a producing well was calculated to be about 29:1 in the early 2000’s, or somewhat less than half that if the cost of dry holes are figured in. Coalbed methane wells were calculated similarly to be 15:1. Thus as of 2005 the EROI for gas fields in the U.S. is an estimate 10:1.

Figure 1. EROI time series for Indiana County, Pennsylvania, plotted against a production curve for the U.S. (Sell 2007).

ENVIRONMENTAL IMPACTS

The environmental impacts from burning natural gas are relatively low compared to oil and especially coal because the gas is essentially pure methane with relatively few impurities. It’s CO2 emissions are about half that of coal and about two thirds that of oil. Carbon Dioxide Emissions in U.S. from Natural Gas in 2005 (DOE 2006) was 261.7 Million Metric Tons of CO2 from residential sources and 166.3 Million Metric Tons of CO2 from industrial sources. There are virtually no emissions from sulfur dioxide and there were 80% less emissions of nitrogen oxides than from the combustion of coal. The water produced as a by-product of Coal Bed Methane (Keith et al. 2003) can be a problem when discharged or impounded as it impacts salt sensitive plants (including agricultural plants) and animals. Although discharging this water (or brine) is not allowed for new wells, it still occurs through past “grandfathered” systems. The drilling technique called “hydraulic fracturing,” is a potential polluter of underground drinking water is exempt from the Safe Drinking Water Act. These pollutions occur in part because natural gas companies are exempt from the Federal Water Pollution Control Act for their construction activities surrounding gas drilling. The density of wells in many gas producing regions of Eastern and Western United States has interrupted once-continuous ecosystems and destroyed any sense of wilderness in these areas.

SOCIAL IMPLICATIONS

• Land Rights

o Companies can buy mineral rights to coal found under private lands. With the mineral rights to the coal they are legally allowed to drill coal bed methane wells on private property (Hopey 2007). However, overall the area taken up by a gas operation, while destroying the continuous nature of the environment, is not a large proportion of even intensely developed regions and hence in most cases interferes little with agriculture and forestry. It does interfere with the “wilderness” sense of the region.

ECONOMICS

• The U.S. may have reached a peak or plateau in natural gas production. “Production decreased by 2.7 percent in 2005, declining below the 2000 level, and reaching the lowest production level since 1993” (EIA 2006). “The number of producing gas wells has increased each year since 2000, rising from almost 342,000 wells in 2000 to more than 405,000 wells in 2004. However, production has not increased proportionally” (EIA1 2006). Thus it has not been possible to increase production simply by drilling more. This is the case despite the subsidies $1.035 billion and regulatory rollbacks in the energy bill of 2005 (Public Citizen 2005):

Annotated Bibliography

:

Cleveland, Cutler J. Energy Encyclopedia. Elsevier Science, 2004.

Cleveland, Cutler J. and Christopher Morris. Dictionary of Energy. Oxford: Elsevier, 2006. pg. 82, 292, 308, 450.

Darley, Julian. 2004. High noon for natural gas.: The New Energy Crisis. Chelsea Green Publishing.

Cutler J. Cleveland, Jr. and Robert Costanza. 1984. Net energy analysis of geopressured gas resources in the U.S. Gulf Coast Region Energy 9: 35-51.

Energy and Environmental Profile of the U.S. Mining Industry. Prepared by BCS, Incorporated for the U.S. Department of Energy, Office of Energy Efficiency and Renewable Energy, 2002. Chapter 9, Limestone and Crushed Rock, pages 9-1 through 9-12

Mark Gately 2007. The EROI of U.S. offshore energy extraction: A net energy analysis of the Gulf of Mexico Ecological Economics 63: 355-364

Hopey, Don. Why gas bonanza is no boon to landowners. Pittsburgh Post-Gazette. 29 April 2007.

Keith, Kristin and Jim Bauder. Frequently Asked Questions Coal Bed Methane (CBM). Montana State University-Bozeman. 2003.

Interstate Oil and Gas Compact Commission. Marginal Wells: Fuel for Economic Growth. 2006. http://www.iogcc.state.ok.us/PDFS/2006-Full-Marginal-Well-Report.pdf

Naturalgas.org. Unconventional Natural Gas Resources. 2004. http://www.naturalgas.org/overview/unconvent_ng_resource.asp

Public Citizen. Public Citizen’s Analysis of the Domenici-Barton Energy Policy Act of 2005.

Sell, Bryan. Natural Gas. Personal Communication. June 2007.

Swindell, S. Gary. Texas production data show rapid gas depletion. Oil and Gas Journal. 21 June 1999.

United States. Department of Energy (DOE). Energy-Related Carbon Dioxide Emissions from the Residential and Commercial Sectors, by Fuel Type, 1949-2005. 20 Nov. 2006.

United States. Energy Information Administration (EIA). Residential Natural Gas Prices:

What Consumers Should Know. Nov. 2006.

United States. Energy Information Administration (EIA). Annual Energy Review. 2005.

Worrell, Ernst and Christina Galitsky. Energy Efficiency Improvement Opportunities for Cement Making: An ENERGY STAR Guide for Energy and Plant Managers. Lawrence Berkeley National Laboratory, 2004. LBNL-54036.

Worrell, Ernst, Nathan Martin, and Lynn Price. Energy Efficiency and Carbon Dioxide

Emissions Reduction Opportunities in the U.S. Iron and Steel Sector. Ernest Orlando Lawrence Berkeley National Laboratory, 1999. LBNL-41724.

**Acknowledgements: I thank the Santa Barbara Family Foundation, the Interfaith Center on Corporate Responsibility, The Tamarind Foundation, Boston Common Asset Management, and ASPO USA for financial support for this research.

Previous guest posts from Professor Hall on theoildrum.com:

At $100 Oil, What Can the Scientist Say to the Investor?

Why EROI Matters

EROI Post -A Response from Charlie Hall

Additional theoildrum.com articles related to net energy analysis and EROI:

An EROEI Review

North American Natural Gas Production and EROI Decline

The Energy Return on Time

Peak Oil - Why Smart Folks Disagree - Part II

Ten Fundamental Truths about Net Energy

The North American Red Queen - Our Natural Gas Treadmill

Energy From Wind - A Discussion of the EROI Research

A Net Energy Parable - Why is EROI Important?

Is there a PDF available of this posting?

EDIT: Never mind. I just printed the posting (23 pages) and it came out very well.

Thank-you very, very much, Professor Hall (and Nate). Looks like some great reading as my hound drags me around on our mid-day outing.

Prof. Hall-

Thank you for tackling this very important topic! There is one aspect of the EROEI debate that I would like to raise--I don't know if you plan to address it, or if you are even aware of a methodology for addressing it, but I think it is very important. That is what I call "bootstrap-EROEI" (if there's a more accepted term, please let me know).

By "bootstrap-EROEI," I am refering to the distortion in existing EROEI calculations created by the fact that the infrastructure used to produce energy today was built at some point in the past using a higher-EROEI energy for its creation. For example, coal being mined today may use equipment assembled from machine parts that were transported and manufactured using 40:1 EROEI oil from 1998, whereas to replace that same machinery today would use oil with today's average EROEI of about 20:1. This seems to distort the EROEI calculation of coal (in this example), and would apply to all the renewables that effectively transform some "primary energy source" such as coal, oil, or natural gas into a source for renewable energy production. As another example, consider the energy required to mine ore, smelt metals, transport metals, etc. for wind turbines.

My question is whether you have A) a methodology to estimate EROEI after this distortion is eliminated, B) the shape and length of the time-lag curve, and/or C) a reason why this distortion either doesn't exist or isn't significant.

It seems that, especially when looking to a wide-boundary EROEI analysis where direct and indirect energy are accounted for, this distortion would be very significant. Present economic activity is largely dependent on the *past* expenditure of energy, whether that's the ore, refining, and manufacturing of raw materials into capital goods, the construction of our transportation infrastructure, etc.

Jeff,

Your comments and questions lead me to posit something I call "energy banking." Here is a hypothetical example: Suppose PV currently has an EROEI of 1:1 and has a 50 useful lifespan. In other words, the PV output over its lifetime will equal the input energy from when it is first put into service. It is likely that the EROEI of the materials used to build the system will drop over the years. Therefore, the EROEI of the PV system will increase with passing time and provide "interest" on the initially invested energy.

I'm beginning to feel that maybe we should discount EROEI to some extent for sustainable energy systems with long lifetimes.

Todd

I agree. There is a difference between fixed and marginal EROI and also the timing of the flows. For wind power, high EROI would tend to favor the PURCHASERS of the wind, because it has a long duration, for biofuels, any positive EROI (we know its not high) will go to the seller, especially dueto subsidies, because the payback is on a much shorter time frame, etc. As energy prices go up, those who have invested in long duration renewable flows will be better off. In any case, my opinion is EROI is the second step. It will be best used only after we figure out sustainable scale. Ends before means.

Todd-

I think that applying banking and finance principles to energy accounting is a good idea--provided that EROEI in general is sufficiently greater than 1. As oil, coal, natural gas, etc. begin to decline in EROEI, the comparative return on existing renewable (wind, PV, etc.) infrastructure will improve. My concern (as I wrote about here) is that a certain amount of surplus energy is needed to build-out a renewable energy infrastructure. Energy for PV and wind, for example, must be expended up front before any energy is returned (same true of oil & gas, but to a different extent). I think that it takes a huge (and unacceptable) leap of faith to assume that, after we've burned off the high-EROEI fossil fuel, there will be either A) sufficient energy to build out a fully renewable energy infrastructure with lower-EROEI fossil or renewable sources, or B) that the actual EROEI of renewables like PV and wind, after accounting for the energy required to produce their full supporting infrastructure, will actually be greater than 1.

Declining production and EROEI of "primary energy sources" like coal, oil, and gas, will decrease the amount of surplus energy available to build out new renewables while simultaneously maintaining the energy required by the existing economy. Will this surplus be large enough to build out enough renewable generation capacity to make up for declines in fossil fuels, once they set in? I just don't think we have enough information, or a sufficient methodology, to answer this question at the moment. But, ultimately, I think it is the question that all EROEI analysis leads to...

Nate or Dr. Hall can correct me here, but I think this issue is where the power of Input-Output table analysis would come in. As the energy required to mine for coal increased, that would show up as increasing energy intensity in that sector of the economy. Other sectors that used coal would likewise see a boost in energy intensity per $ of steel and other sectors.

The question in my mind (you may be saying this as well, not sure) is predicting how large the repercussions will be in the future. I think we have adequate (?) theory to account for a present increase in the energy input in a given sector, but no theory to help us understand to what degree present increases in the one part of the IO table will impact another part of the table, and how long the time-lag will be. By way of example, think of our highway infrastructure, which was constructed largely on oil and coal energy that has experienced significant EROEI declines over recent years. We can't just input the new intensity of coal and oil because that highway infrastructure will last for many years--how, and over what period do we amortize the energy for that replacement? It seems workable if all we had to do was amortize over a known replacement period for the infrastructure, but because we're trying to continually incorporate a moving target (the EROEI of oil & coal) that is moving in an unknown way in the future, I don't know how to proceed...

See the response to my post below.

http://www.theoildrum.com/node/3810#comment-328100

I don't know if my numbers are right or not. But using my weird methods I also came up with 5:1 as probably the real lower bound EROI. This is mentioned in the key post.

Also in my post I think our current EROI is actually 10:1 not 20:1 my justification is simple. We where at 20:1 about 2002 and prices have increased five fold so that suggests a real EROI of 20/4 == 5:1 right now. Taking into account growth etc 10:1 makes more sense as a high estimate.

If you somewhat agree with that argument then EROI has dropped by 50% in five years with steady oil production. It makes sense that real EROI will probably drop faster once production begins to decline so instead of being at 5:1 if we are not there now in five years we probably will be less.

Of course we are not going to make the massive investments needed to keep net energy levels up so the net energy levels should be and probably are already dropping probably in line with the EROI drop. This would mean that say if EROI goes from 10:1 to 5:1 and absolute production drops by 50% then net return would be say 25% or a 75% drop.

My gut feeling has always been that if we where going to make a smooth transition from oil to alternative energy we would have had to start in the 1970's. Even if my numbers are off I don't think they are off by orders of magnitude. So I simply don't think its possible to make a smooth transition.

Considering we need to invest a significant amount of excess energy into alternatives to speed the transition say 10-25% of todays excess. You can see that when we reach the point of having only 25% of todays excess energy the rate we could make the change drops dramatically. Also of course as current energy extraction process begin to take up more and more of our economic activity they are in direct competition with alternatives. Both are chasing the same shrinking pie. I'd hazard that current approaches would generally win.

Now I'm not saying we can't make such a transition just that from what I can tell it would already be extremely painful if we made it a top priority right now and it becomes increasingly more painful as we wait. And probably worse it seems the time it takes to deploy the amount of alternatives to bring us back to our current free energy levels quickly stretches out to centuries as the ability to expand alternative energy sources contracts to a small percentage of a lot lower net energy level.

Finally as far as our current infrastructure goes very little of it is terribly useful for building out alternatives. Roads and oil based transport are not all that useful over the longer term. Rail would be but in many places it would itself need to be built out. The highway infrastructure in the US is actually in horrible shape and close to collapse and our secondary roads basically need to be rebuilt completely every 10-20 years. We have been abusing this oil investment for a very long time. Given the huge amount of deferred maintenance in roads at best they offer no total support at worst they are and additional place we must invest to simply get our rail expanded. Cars/Trucks etc also have limited lifespans generally less than 20 years again its dubious how much of this can be treated as a stable investment and how much of it would be lost in even 20 years.

Overall after all the money we have spent in my opinion our current infrastructure is only useful for about 20 years of support for investment into alternatives at best. After that we have to have new rail infrastructure in plain to continue development.

In any case pain or not we need to start transitioning off oil yesterday. If we wait to long considering the way EROI seems to work only a tiny fraction of todays population will be able to create high tech sustainable lifestyles and the rate they can expand will be painfully slow.

I happen to think we will end up with these islands of technology in a sea of misery but I'm not the most optimistic guy on the planet.

Ok, now I see what you are doing. The energy needed to refine silicon (say) does not change. But the energy to create the energy to refine the silicon goes up. And this should work for all materials.

What is the damage to society from this change? Hmmm. First pass, I would try to bound the problem to see how much trouble it could cause. So take an extreme example and push the drop from 100:1 to 10:1.

So suppose I have a 100:1 energy source powering my society. I calculate the EROI of some alternative source and it comes out 10:1 (Estimate A). My wonderful power source now declines to 10:1. What will the EROI of my alternative power source decline to? (Estimate B).

Here is my approximation. I am going to change the coding slightly to make it clearer (I would appreciate others to check the math). Society starts with a 100:1 power source that declines to 100:10 (recoded 10:1).

We want to know the impact on another EROI calculation that also has a 100:10 ratio. Ok. Estimate A would include a tiny 1% hidden cost that is the energy cost to get the power which = 10*0.01= .1 units energy. For Estimate B that would increase by 10 times. 10*0.1 = 1

So for Estimate B our alternative energy source would really end up being 100:11. That is not much change. But dropping below 10 would start to get painful. It should be possible to calculate directly this way, and put in a corrective factor. Anyone have a different view?

I wonder if this isn't addressed better as a time component of Net Energy. We need a "velocity" of energy as it moves through our economy. Energy that has become embedded in long life items is still flowing through the economy, just slower than fuels. An Embodied Net Energy concept.

Jeff,

I read your current post on your site (I disagree about the recession part) and it sounds like we sort of agree. We do have surplus energy now. As a surrogate, I would point to where it takes 10cal of input energy for 1cal of output/body energy.

Retuning to my "banking" of energy: I am unaware of any part of society that cares about EROEI. I was a process development and plant manager in the chemical industry and we didn't care about energy use as long as the cost could be passed on to other manufacturers using our products. My group developed several innovative ways to reduce reaction times...in one case from 1 1/2 hours to 45 minute and another from 30+ hours to 8 hours. The irony is that I, as the chief honcho, seemed to be the only one who could do this stuff. I want to put this in context - I was never a chemical reactor operator, heck I started as a research chemist and moved into chem engineering. I would go out to my facility or the production plant in my coat and tie (naturally with hard hat and safety goggles), tell them to keep dumping in catalyst until the pressure began to surge, tell them to put on full cooling and go back to my office. Did anything come of this? Nope. I was the only person out of several hundred employees who could do it. And, I'm not kidding here - production turned it all down cold because "it took too much attention."

My point is that, today, energy only matters in a financial/profit context. There is lots of "surplus" energy that can be captured. And, I return to arguing that it makes more sense to invest this energy/money in energy that has a currently slightly negative or break even EROEI but is sustainable in the long term - with an ultimate positive return.

Todd

Todd

Alan and I talked about something along these lines a long time ago. Basically, if the oil was going to be used up anyway (Jevons's paradox) then how can we use it in a way that pays back for centuries?

I said road beds (Roman road beds have been in use "forever") and he said rail tunnels. Rail tunnels are expensive to cut, but then the trains don't have to climb or divert so they pay back handsomely.

EROEI over time is a great point. Which leads me to another thing I noticed in the article:

The EROEI numbers for CSP are ancient -- 1986??? Can't you find newer numbers? In 1986 CSP plants were fairly new and EROEI over time has been on the increase for CSP, thermal and solar towers.

I'm looking for more recent CSP numbers but I found the numbers on the ASPO site to be, in some cases, more favorable for renewables than the ones posted in the above.

Hydropower 11.2 (33.6)

Nuclear (light-water reactor) 4.0 (12.0)

Solar

Power satellite 2.0 (6.0)

Power tower 4.2 (12.6)

Photovoltaics 1.7 (5.1) to 10.0 (30.0)

Photovoltaics Thin-Film 7 (21) to 40 (120)

Solar Thermal to find

Wind 80 (240)

Geothermal

Liquid dominated 4.0 (12.0)

Hot dry rock 1.9 (5.7) to 13.0 (39.0)

Table Notes: Estimates of energy return on investment (EROI) ratios for some existing and proposed fuel supply technologies. Numbers in parentheses for electricity generation include a quality factor based on a heat rate of 2,646 kcal/kWh (10,493 BTUs/kWh) (source: http://energycrisis.com/aspo-usa/2005/).

A solar tower is a kind of CSP and here it is listed as a 4.2 EROI. It also adds a break out for thin film photovoltaics which the original post has failed to mention.

One thing I did find is that the energy payback time for CSP is 5 months to one year depending on the system:

"The energy balance is outstanding: the payback period for the energy expended in production of the components is 5 months. The materials used (concrete, steel, glass) can be recycled. The specific land use is quite low at 2 hectacres per MWel. The property needed has a very low value. There is no social or ecological problems associated with its use. There are no hidden social costs in the form of environmental pollution, additional social services, or resulting economic effects. Solar thermal plants use materials that are available and affordable worldwide. For the most part they can be constructed and operated by local labor."

http://www.schott.com/solar/english/download/schott_memorandum_e.pdf

If the energy payback time is five months then to state that the EROEI on a system that will last 25 to 50 years is 1.8:1 is ludicrous.

If you want to be taken seriously, you need to take a hard look at your data and determine if it's telling the truth as it stands today and is an accurate representation of FACTS or if it's simply a long chain of inaccurate, outdated, and issue-slanted statistics.