North American Natural Gas Production and EROI Decline

Posted by nate hagens on February 27, 2008 - 9:40pm

This is a guest post by TOD reader Jon Friese. Jon is a software engineer living in Minneapolis and a volunteer with the Twin Cities Energy Transition working group, seeking a path to a low carbon future. Under his own initiative Jon tracked down literature on EROI methodology, contacted the Canadian Government and an energy consulting company for data, and came up with the following analysis on declining energy return on Canadian Gas. This draft analysis is provocative (backing into an EROI estimate using $/GJ suggesting possible energy break even for natural gas within a decade). However, in addition to the new info, I was inspired that a smart, engaged citizen chose to volunteer his time on the pressing issue of fossil fuel decline, and then shared it with others in the TOD forum for feedback. Thanks for your initiative here Jon.) (Editors Note: Jon is working on an update to this analysis incorporating feedback from the TOD community -please treat the information in this post as a work in progress.)

Figure 1 Canadian Natural Gas Energy Return on Investment, actual + trend line (Click to enlarge)

EROI at Theoildrum.com

Biophysical analysis is important in a world of finite resources. We write often about net energy and EROI on this site, as it gives insights that might not be immediately seen by conventional dollar analysis. In the coming weeks, Charles Hall (referenced in Johns report below) will be running a series of EROI articles on TOD, starting with "Why EROI is Important". Here are some selected historical posts on the topic:

At $100 Oil, What Can the Scientist Say to the Investor?

The Energy Return on Time

Peak Oil - Why Smart Folks Disagree - Part II

Ten Fundamental Truths about Net Energy

The North American Red Queen - Our Natural Gas Treadmill

Energy From Wind - A Discussion of the EROI Research

A Net Energy Parable - Why is EROI Important?

Natural Gas and Complacency

And the following is Johns analysis on:

North American Natural Gas Production & EROI

Abstract

Creating an Energy Transition Plan away from natural gas requires at least a rough forecast of future production. Two very different forecasts for North American natural gas exist. The official “consensus” view published by Natural Resources Canada [NRC 2006] argues that 2,200 Tcf (trillion cubic feet) remain and that less than 50% of the total natural gas has been produced. Jean Laherrere has posted a forecast which shows only 600 Tcf (trillion cubic feet) remaining with about 70% already produced of the total supply of 1900 Tcf.

Energy Return on energy Invested (EROI) was explored as a method for choosing between the two forecasts. Examining a historical study of Louisiana natural gas production shows that EROI declined rapidly post peak production and that peak production occurred at about 70% of URR.

The EROI of Canadian natural gas production was found to be falling quickly. If current drilling rates are maintained, Canada could see energy break even occur as soon as 2014.

The EROI analysis was extended to the US by comparing data on Yield-per-foot drilled and Yield-per-well drilled between the two countries. It was found that the US is rapidly approaching the same low EROI as Canada.

Taken together this evidence supports Laherrere’s position that North America is past peak production and that as little as 30% of our natural gas endowment remains to be produced.

Two Forecasts

Coping with global warming or peak oil requires a reliable forecast for natural gas. Natural gas is a clean burning substitute for coal and oil. Natural gas is essential to ethanol and tar sands production. Much like world oil supply, the official forecast is that natural gas supply will be abundant for nearly a century. This view suffered a serious setback in 2001 when the US production peaked and again in 2003 when Canadian production peaked. The ASPO has put forward a more conservative forecast. These two forecasts are examined in more detail below.

The Official View

The official “consensus” forecast (an average of several government agencies) is that there will be an abundant supply of domestic natural gas at relatively low prices for many years to come. Here is a good summery of the official position:

“The total remaining US natural gas resource base, including proved reserves is 1,620Tcf. At 2004 levels of domestic production, the US has about an 86-year supply of natural gas.” [NRC 2006, pg 23]

The reason for this optimistic forecast is clear when looking at the reserves and resources map below. 100+ years of extraction have not even consumed half of the natural gas that is expected to be produced.

Figure 2 Official "Consensus" Resources and Reserves Forecast [NRC 2006, pg 22] (Click to enlarge)

Yet this position does not explain why natural gas production in both Canada and the US has peaked. Nor does it explain why large scale drilling campaigns have tripled prices while not bringing further production on line. If less than half the natural gas has been produced, then why cannot production rise?

The Alternate View

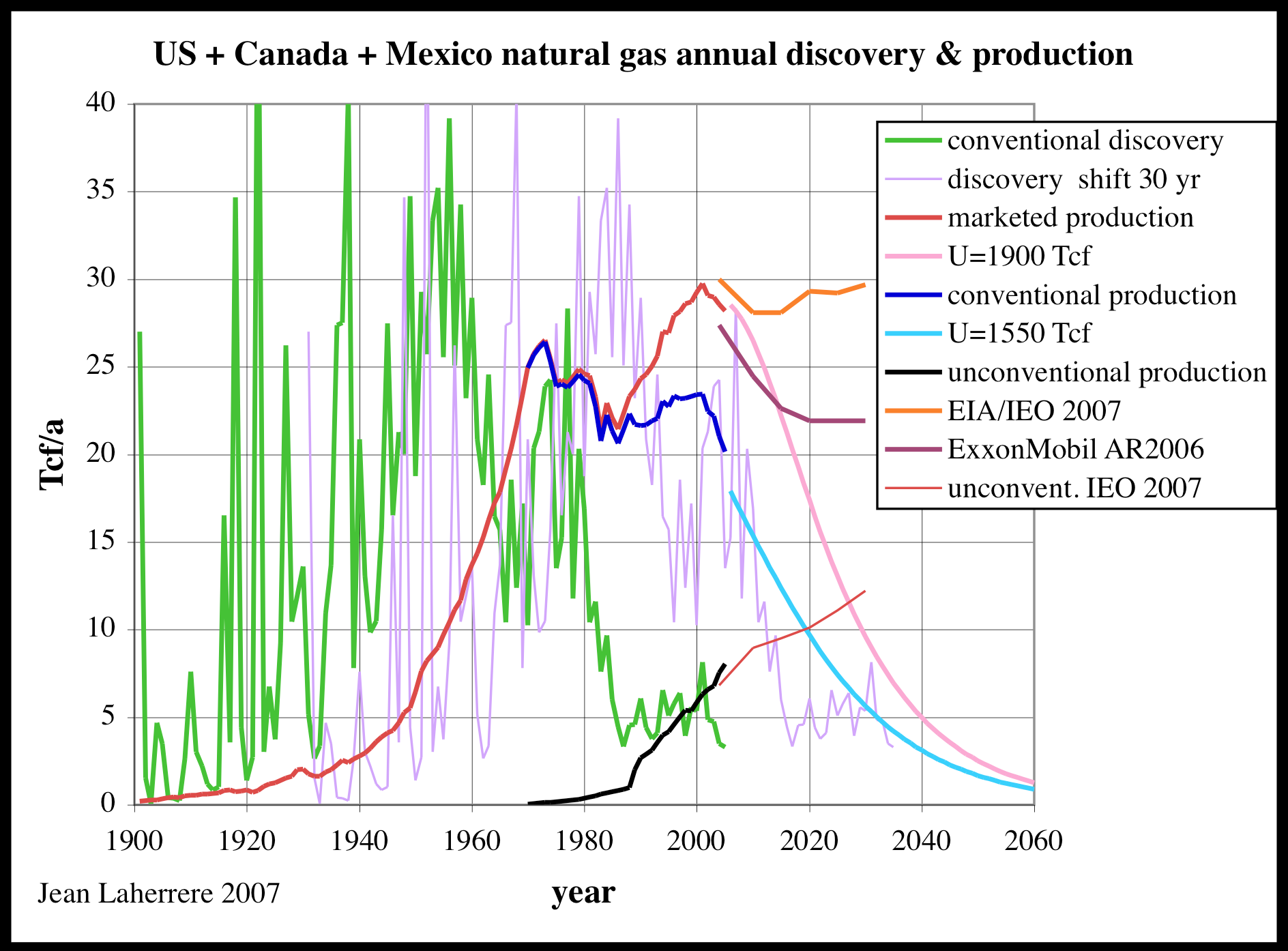

ASPO member Jean Laherrere is an internationally renowned expert in oil and gas exploration. He was in charge of Total Canada’s exploration from 1966 to 1971. He has recently published a forecast for North American Natural Gas production [Laherrere 2007]. Here is his summary graph:

Figure 3 Laherrere's alternate forecast (Click to enlarge)

The first line to look for is the pink line that describes overall natural gas production (U=1900Tcf) and the second line to look for is the pale blue line that describes conventional natural gas production (U=1550). He has no difficulty explaining why production cannot be raised. It cannot be raised because North America has already produced 70% of the total natural gas that will ever be produced. Production has peaked and will now decline during the final 30%. In his forecast there will not be 86 years of production at current rates. Instead, in less than 50 years production will be a tiny fraction of current levels.

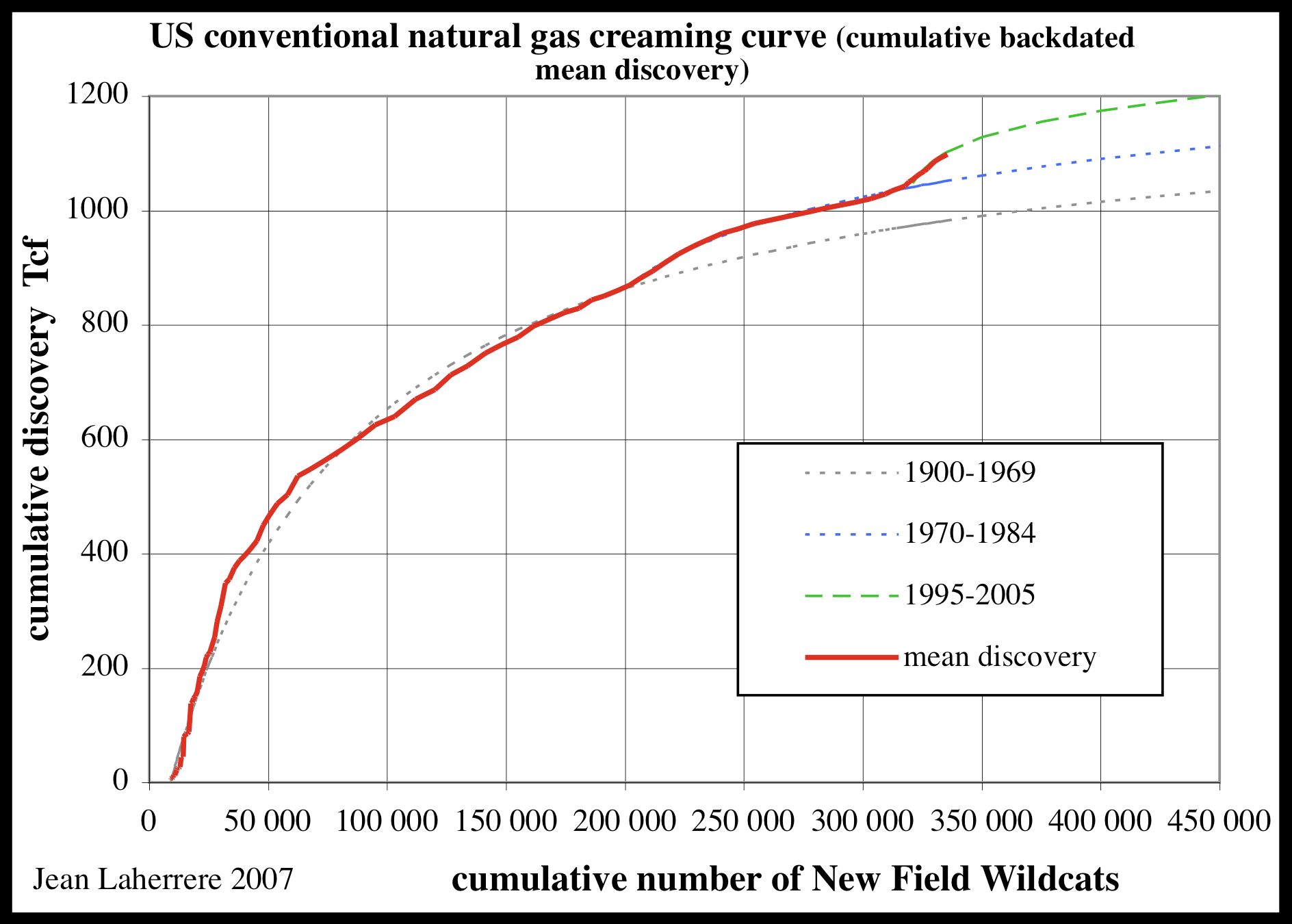

One of the many ways he supports his forecast is by plotting backdated discovery data against the number of exploratory wells to form what he calls a “creaming curve”.

Figure 4 Creaming curve evidence (Source Jean LaHerrere) (Click to enlarge)

In a new region the first few exploration wells discovery a large amount of natural gas resulting in a steep upward curve. As most of the discoveries are made, each new exploration well discovers less gas, bending the curve downward until it points to the Ultimate along the right hand side. Looking at this creaming curve for the US it is hard to imagine that the curve could accommodate another 800 Tcf of new discovery that the official forecast predicts. A huge number of exploratory wells have already been drilled. The curve is already close to flat.

Economic Reserves and Energy Return

How is it possible that two forecasts made with similar data could reach such a different result? One reason hinges on the definition of “Economic Reserve”. There are vast quantities of non-conventional natural gas. But it is expensive to produce. At what drilling and operating cost do you draw the line between reserves that can be produced at a profit and non economic resources that never will be produced? Opinions can and do differ and this leads to very different forecasts. However, fuel sources have a clear boundary between the economic and non economic reserves. A fuel source must be produced with a positive Energy Return on energy Invested (EROI). An economy cannot spend more energy drilling for natural gas than the economy gets from the natural gas itself. At energy break even, fuel production will stop (unless it is subsidized by a lower quality fuel)

Calculating the EROI of current natural gas production would give another line of evidence. If EROI is steady or rising than the official forecast is likely correct and natural gas will be abundant. If the EROI is falling then we can assume that much of the official resources will never be economical and that production will continue to fall.

Louisiana Natural Gas

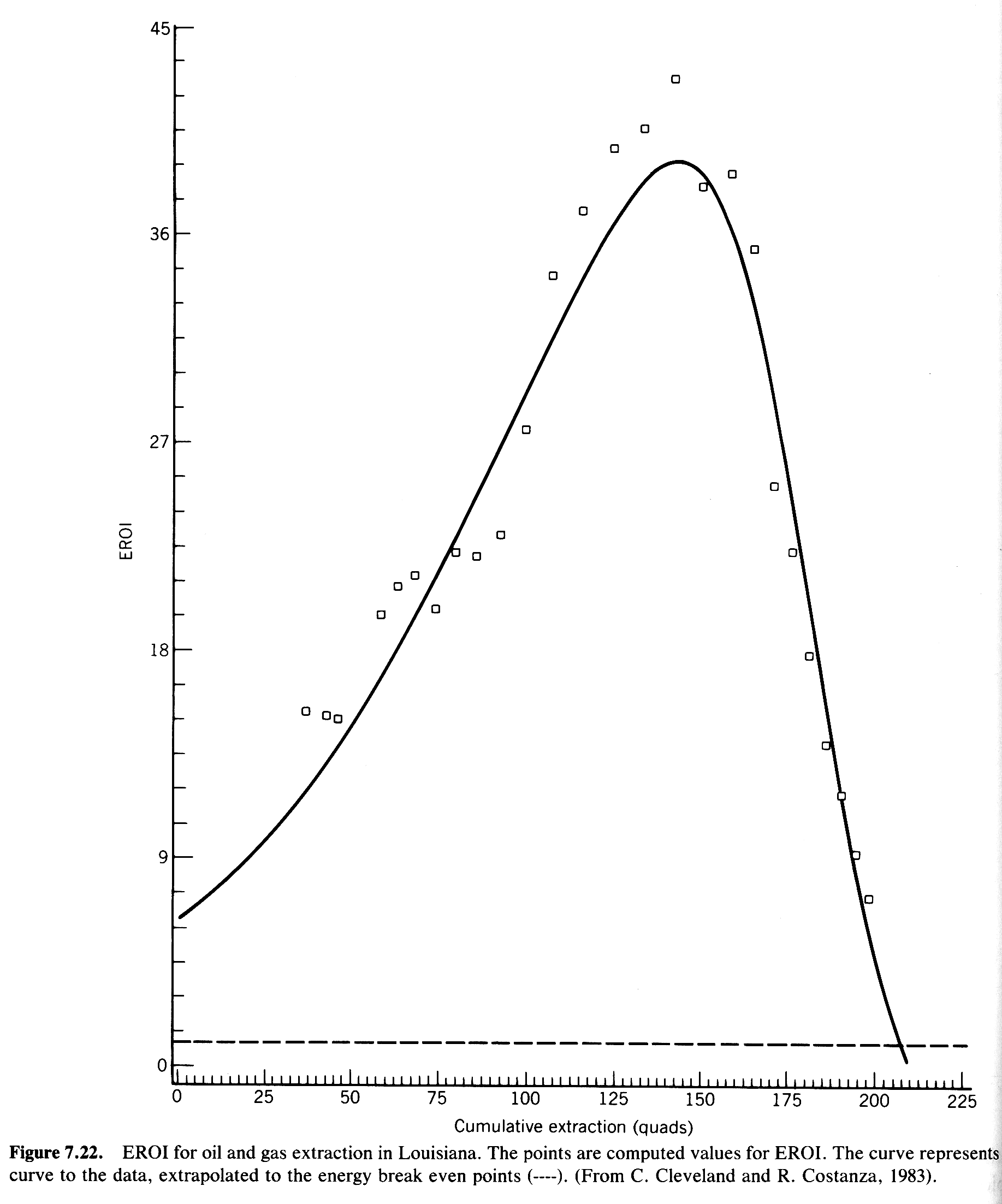

Cutler Cleveland and Robert Costanza did an EROI study of natural gas production in Louisiana [reported in Hall 1992]. That study calculated the EROI from early production, through peak, and into decline.

It is useful to stop and examine this historical production cycle and try to discern some patterns.

Figure 5 Louisiana Natural Gas production in Quads per year(Click to enlarge)

Cleveland and Costanza calculated the Energy Return on energy Invested (EROI) over the whole production cycle. The year that production fell off “plateau” was 1972 with a cumulative extraction of 150 Quads. 150 Quads corresponds to the first downward EROI point after the sharp rise. The next point over actually has a slight increase in EROI.

[Note: One can imagine an intensive drilling program to try to keep production on the plateau. When drilling finally slowed and yielded to the inevitable, EROI had a small uptick but production dropped. I cannot prove this conjecture because I do not have the well drilling data. But we will see similar bounces later in the current production data.]

Figure 6 Louisiana Natural Gas EROI(Click to enlarge)

Please note the following: First is that the maximum EROI is in the 40 to 1 range (which will be important later).

Second is that the EROI decline rate is quite steep and it is very linear. The EROI plunges from maximum to minimum in only 25% of the quads extracted.

Third is that energy break even (where EROI = 1:1) happens far before a 300 quad URR. It is normally assumed that peak happens at 50% URR, but in this case, the energy return would end up skewing the graph so that peak appeared at 150/210 = 70%. (Sound familiar?)

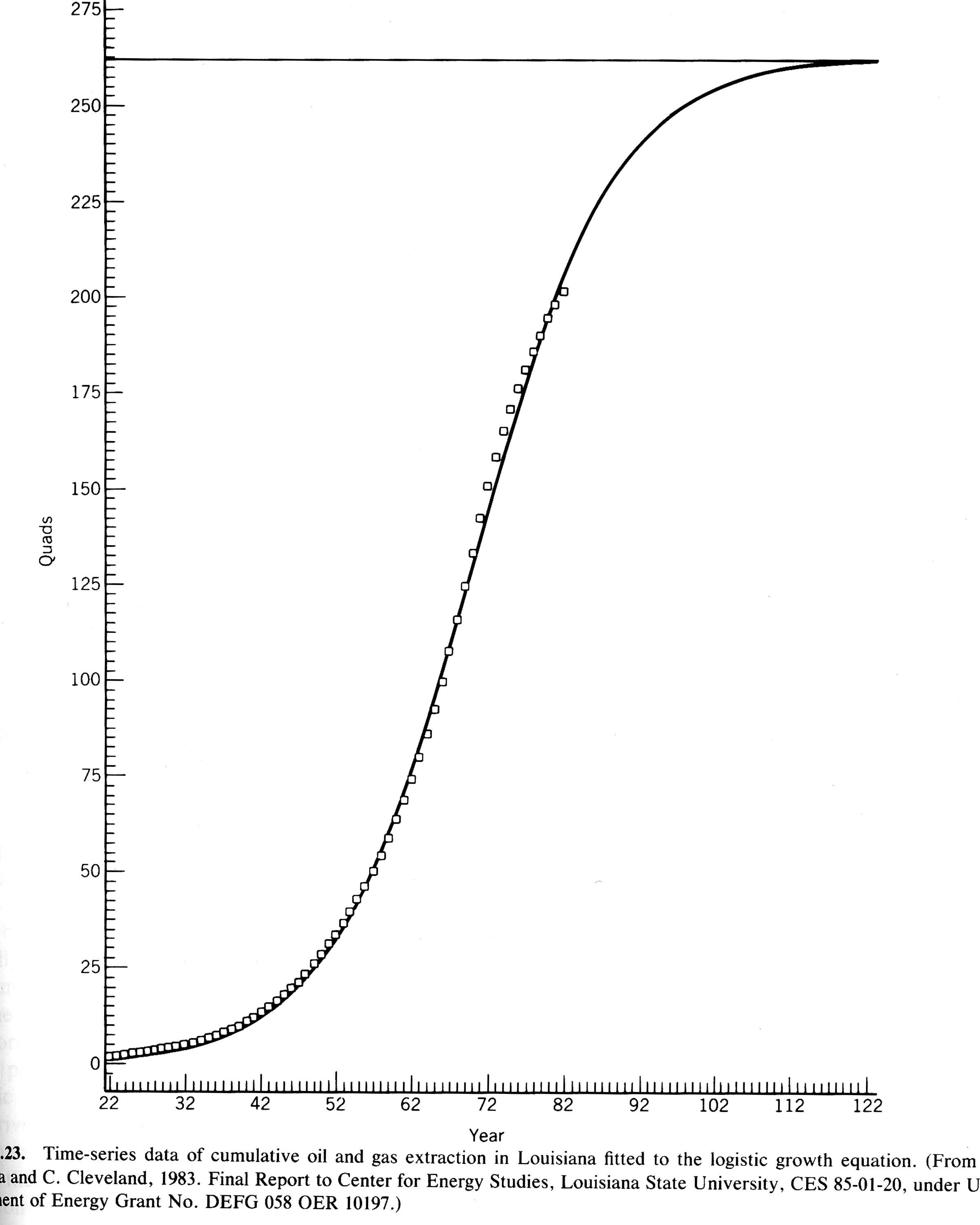

Figure 7 Cumulative quads versus year(Click to enlarge)

This final graph plots cumulative quads against years. It follows the classic Logistic shape. The logistic is pointing to a URR of ~260, but the EROI graph is saying there will not be a positive energy return past ~210. This graph can be used to convert from years to quads for matching up data points on the two prior graphs.

Summarizing this historical example:

1. EROI peaked around 40:1

2. Production peaks at about 70% of total extraction.

3. EROI declines sharply past peak.

4. The steep EROI decline indicates extraction is in the final 25%.

Canadian Natural Gas EROI

There are several techniques for calculating Energy Return on energy Invested when you only have cost data in dollars. Charles Hall describes one technique [Hall 1979] where the energy content of each dollar is calculated in the following manner:

Energy content per $ = National Energy Use / GDP.

The EROI of natural gas production can then be calculated by

EROI = Energy output of total NG / ($ cost of NG production * Energy associated with spending of a $)

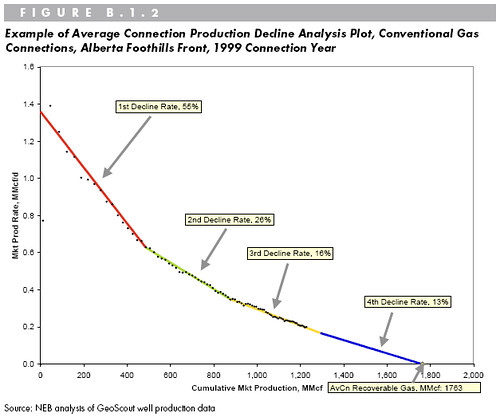

The Canadian National Energy Board (NEB) publishes the “Short-term Canadian Natural Gas Deliverability” report. In the 2007-2009 edition they provide data on how many Canadian $ are required to produce 1 Giga Joule of natural gas. [NEB 2007] The Canadian NEB calculated $/Gj in a special way that only includes new gas produced. What they did was use decline models of each type of well in each region. And then they totaled up the number of new wells in a year of each type. They used the decline model to predict exactly how much gas would be produced from those new wells (long term).

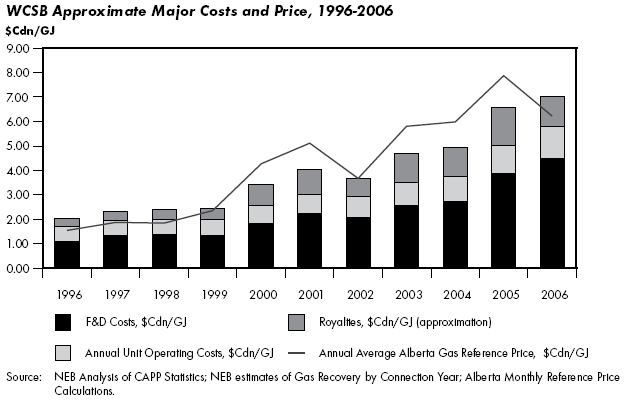

Figure 8 National Energy Board cost per Gigajoule (Click to enlarge)

There are several features of this graph worth noticing. The first is that drilling costs have overshot prices, despite a 3x increase in price. The second is that Finding and Discovery (F&D) costs show the largest increase. It is getting harder and harder to find natural gas. These are both certain signs of falling EROI. Royalties are not counted in the following EROI calculations.

Using the NEB data simplifies our EROI formula:

EROI = 1 Gj / ($ drilling cost * Gj/dollar)

As the NRB data provides the “$ drilling cost” term, the next step is to calculate the energy value of each Canadian $. That value is estimated by taking the Canadian GDP for each year and dividing by the total energy used by Canada in that year. The GDP data was taken from the Canadian Government web site Statistics Canada. The data for GDP Expenditures in Current $ was selected (mostly because I know of no reason to prefer one data series to another for this type of calculation). [Can Stats 2007] The total energy use data was taken from the 2007 BP Statistical Review of World Energy [BP 2007]. The review provides a “Primary Energy per annum” that sums all energy sources. The resulting sum is in Mtoe (Millions of tons of oil equivalent).

Here are the values from 2006 to help understand the calculation:

GDP = $1.44e12

Primary Energy = 322e6 Mtoe

Gj/$ = 9.4e-3

EROI = 1 Gj/(5.79*9.4e-3) = 18

EROI Results

Figure 9 Canadian Natural Gas EROI 1996-2006(Click to enlarge)

The results are quite dramatic. EROI is dropping very quickly. If high drilling rates are maintained, costs will rocket upwards and EROI could hit break even by 2014. If drilling rates fall, then production will fall. Either way Canadian production will come off plateau and go into decline.

The Louisiana historical example offers some guidance. The EROI peaks are roughly the same 40:1. The decline in EROI is rapid and linear. It is safe to conclude that Canadian production is in the final 25%. This lends support to Laherrere’s forecast.

Extending the Analysis to the US

The same analysis cannot be done for the US because the EIA does not provide an estimate of the underlying decline rate or the $ per GJ production cost. It is possible to make a rough approximation but this part of the post is more speculative. (Editors note - I am attempting to get some of this type of data form the API (American Petroleum Institute) - I am told it is quite expensive but am still trying - such data may be able to replicate and advance Johns Canadian analysis)

Production per Well Foot Drilled

Most of the production cost is drilling related and there are drilling statistics for both countries [EIA Foot][Capp 2007]. Figure 10 shows the yearly production divided by the number of feet drilled that year. This is only a rough approximation of Yield per Effort because production is mostly from prior years drilling. A clear trend down is visible in both the US and Canada. More and more drilling is yielding less and less production. This is a sure sign of dropping EROI.

Figure 10 US & Canadian Production per well foot drilled (Click to enlarge)

Canadian Yield-per-foot drilled is lower than the US. However in the last few years the US has fallen into the Canadian area and the slope is very steep. That steep slope will soon cross the Canadian trend lines. It is safe to assume the US EROI values are falling as fast or close behind the Canadian EROI. There are two regressions for the Canadian data. The yellow regression discards the first two years as outliers to get a better fit. The yellow regression shows a steeper slope that would cross the zero point at approximately the same location as the Canadian EROI graph hits break even.

Production per Well Drilled

Another way to look at Yield per Effort is to examine Yield-per-well instead of Yield-per-foot drilled [EIA Well][Capp 2007]. In Figure 11 Canadian production is divided by the number of wells drilled. The trend is downward as expected, but the fit is poor. The trend line begins to approach zero production per well around 2016.

Figure 11 Canadian Production per well (Click to enlarge)

Figure 12 shows that US production per well begins much higher (which is why the data is plotted separately). The trend is downward and at a steeper rate than the Canadian trend. The US data in 2006 is just entering the region where the Canadian production was in the late 1990’s.

Figure 12 US Production per well(Click to enlarge)

US Notes

Overall the US seems to be entering the same steep EROI decline Canada is facing. The US seems to be slightly behind Canada in EROI decline, however the US has a huge number of producing wells and this may be skewing the productivity results. We do know that the US peaked prior to Canada.

Conclusion

The natural gas industry has clearly been mounting a heroic effort to keep natural gas production on plateau in North America. This effort has raised costs dramatically. The EROI of Canadian production shows a rapid decline. Drilling statistics suggest a similar EROI decline is happening in the US. The falling EROI makes it impossible for natural gas production to maintain both low costs and current levels of production. It is clear that most of the reserves in the official forecast will never be developed. Jean Laherrere’s predictions are more likely to be correct. And if EROI continues to fall at the current rapid rate, he will be remembered as an optimist.

References

[NRC 2006] “Canadian Natural Gas; Review of 2004 & Outlook to 2020”, Natural Resources Canada, January 2006. pg 22.

http://www2.nrcan.gc.ca/es/erb/CMFiles/CANADA_GAS_REVIEW_&_OUTLOOK_ENGLI...

[NEB] Link to Appendix of National Energy Board Calculations and Methodology used in this analysis

http://www.neb.gc.ca/clf-nsi/rnrgynfmtn/nrgyrprt/ntrlgs/ntrlgsdlvrblty20... (pdf)

[Laherrere 2007] “North American natural gas discovery & production”, Jean Laherrere, August 2007, ASPO France, pg 15.

http://aspofrance.viabloga.com/files/JL_NAm-NG07.pdf

[Hall 1979] C. Hall, M. Lavine, "Efficiency of Energy Delivery Systems:1. An Economic and Energy Analysis", Environmental Management, vol 3, no 6, pp 493-504, 1979 (First part of a 3 part article).

[Hall 1992] “Energy & Resource Quality: The ecology of the economic process”, C. Hall, C Cleveland, R. Kaufmann, 1992, University Press of Colorado, pg 184-188.

[NEB 2007] “Short-term Canadian Natural Gas Deliverability 2007-2009”, National Energy Board, 2007, pg 8-9.

http://www.neb.gc.ca/clf-nsi/rnrgynfmtn/nrgyrprt/ntrlgs/ntrlgsdlvrblty20...

[Can Stat 2007] Statistics Canada

http://cansim2.statcan.ca/cgi-win/cnsmcgi.exe?Lang=E&C2Fmt=HTML2D&CIITpl...

[BP 2007] BP Statistical Review of World Energy 2007

http://www.bp.com/liveassets/bp_internet/globalbp/globalbp_uk_english/re...

[EIA Feet] Energy Information Agency. Feet drilled in natural gas wells.

http://tonto.eia.doe.gov/dnav/ng/ng_enr_wellfoot_s1_a.htm

[EIA Wells] Energy Information Agency. Natural gas wells drilled.

http://tonto.eia.doe.gov/dnav/ng/ng_enr_wellend_s1_m.htm

[Capp 2007] Canadian Association of Petroleum Producers. “Wells and Meters Drilled in Canada 1981-2006”

http://www.capp.ca/default.asp?V_DOC_ID=1072&SectionID=1&SortString=TableNo

John Friese can be reached at grandpa.trout@gmail.com

I figure that the price of natural gas will double in the next 5-6 years. At that time biomass gasification and synthesis of methane will be affordable and profitable. We can then get to a more CO2 neutral form of hydrocarbon that we can put in the pipelines.

Ten fundamentals of net energy. Required reading for newbies and veterans and all in between

http://www.eoearth.org/article/Ten_fundamental_principles_of_net_energy

Thats one of the articles I linked to at the top of this post. But you are right - lots of work done on net energy analysis in 70s and early 80s when the front energy burner seemed hot. (Odum, Berndt, Hall, Cleveland, Costanza, Herendeen, etc.) This work transitioned more broadly into Life Cycle Analysis, which isn't necessarily about energy, and now 25 years later far fewer papers on biophysical principles / net energy analysis are being published, though Cutler and Charlie and some others are still banging the drum. It seems the conventional economists have won the battle, but will lose the war. 70s energy crisis was dress rehearsal for what we are now facing.

Here is a piece on Encyclopedia of Earth that is a bit more academic but very detailed and informative on net energy analysis.

I think EROEI will match the ELM.

*Nate, you got the entire article in the preview box, so it shows on the frontpage.

And... wow. The US halved its production per well in a scant 4 years. This really, really isn't good. Is LNG the only thing between gas-heated furnace homeowners and panic?

What currently constitutes "unconventional" NG?

And from a physical/geological standpoint, what's the point at which the production ROI hits 1 while the reserves still remain at 70% depleted? Does that mean that the existing wells have been plugged by sediment/water? I can understand this much easier in an oil or water aquifer, but a contiguous body of a light, nonviscous fluid/gas?

Firstly I would like to say a very big thank you to Nat, for it is on the shoulders of such giants as nat and Colin and the contributors to sites such as the Oildrum that I stand.

Forget LNG, I was at the Energy Institute's International Petroleum Week in London last week. I asked Dr Fereidun Fesharaki the last question on the last day regarding natural gas production from north and south pars fields.

His answer shocked the audience. He basicly said do not expect much higher production from those field and that LNG tankers expecting to move this extra LNG would be redundant.

If you add in the infrastructure issues with Russian gas you can forget about LNG coming to the rescue.

"However, there's no time to be lost, because the forecasts predict an energy crisis. Capital assets deterioration is now 60% in the oil extraction sector, 80% in the oil refine sector, 55% in the power industry. The coal industry is in permanent crisis. Gas companies have to reduce gas recovery because the most profitable fields are running low. Your readers are well aware of the fact that the pipeline transport, too, has enough problems: One fourth of the total length of trunk pipelines has been operating for over 30 years, yet another one third has been operating for over 20 years. It is widely understood that FPC urgently needs large (up to $30 billion a year) investments." head of the specialized Committee for energy, transport and communications of the State Duma Vladimir S. Katrenko

Read Harold York's Limited Availability for 'Cheap' LNG to the U.S. for more info on why NA is effectively stranded for NG. For one thing the heat content of much foreign NG is wrong for our system. Also check out Dave Cohen's excellent TOD piece Empire On the Edge--Betting On LNG, which references York's paper. I've read all the articles on NG I can find, shortages for NA are a much more tangible threat than oil, which remains largely a question mark due to the lack of data.

Jeez - I had never read that piece and was unaware of the heat content issue:

It seems a good deal of the natural gas from overseas is higher than that range (anything above the yellow band). How hard is that infrastructure to change?

OK, Amazing.

It's rare to hear about too *much* energy here :-)

I always assumed that the warmed LNG had added nitrogen or CO2 or something inert added to it.

OK -- stabilization

Coal availability for the rest of the world may be in crisis but the facts - for US domestic coal - do not bear that out

Arch Coal for example was selling Low Sulfur Steam Coal for $10.71 per tonne in Q4-07 and was able to get $10.82 in 2006. (Source Arch Coal Annual Report 2007

http://news.archcoal.com/ReleaseDetail.cfm?ReleaseID=291232 )

That is 1000 kg, or 2200 lbs and will put 8800 lbs of Carbon Dioxide in the Air.

To put the numbers in perspective US Taxpayer (the few percent that still pay income taxes to the Federal Government) expenditures to Victims of Hurricane Katrina are $200 billion or higher. For those who do not know - Katrina was a storm with a lot of rain and wind that caused several 100 ft of a mud dike to break and caused flooding that resulted in mold in poorly ventilated houses built out of organic matter (wood). Also for comparison, 2 category 5 hurricanes hit the Yucatan peninsula last year but those residents were unable to tap the largess of the US Treasury. Hence their rebuilding expenses were a couple of million - if that - Hurricane Katrina expenses continue (rebuilding, clean-up, housing, food, spending money for Victims).

http://www.sourcewatch.org/index.php?title=U.S._budget_deficit

"What currently constitutes "unconventional" NG?"

From what I understand, unconventional gas, for the most part, now, refers to gas from shale deposits. I don't think we have substantial XTG (agricultural methane, biomass etc...) resources available at the moment for electricity generation. Most of those feedstocks are now going to liquid fuels -- ethanol and biodiesel.

Wow. I mean, WOW.

What do the words "deep shit" mean?

Hmmm. And whatever happened to all this talk of NG as the bridge fuel supply a few years ago? Poof! Gone.

We need to become very serious about real renewables -- solar, wind, OTEC, and non-food biofuels. Yesterday.

Yester-couple-of-decades-ago, you mean.

Mr. Hans Blix's above reaction to the situation, while appropriate, was if anything an understatement.

*Whistles while walking past graveyard.*

The problem is one of technology. Canada has reserves of unconventional natural gas equal to 3 times the World's reserves of conventional NG. The technology to exploit them is in it's infancy. Soon methane hydrates will be exploited. Race against time?

"Race against time?"

I think so. Maybe even running just to stand still. But that's better than running to fall behind.

We are already behind. We failed to respond when we had clear opportunity and we threw Jimmy Carter's call to energy conservation to the wolves of infinite consumption. When we learn to accept that we will have learned an important lesson. And after we've learned that lesson, we may finally begin to think about applying triage to our global civilization in an effort to save some of it. Because quite frankly, we are not going to save all of it.

All the oil and gas guys want to do is find and sell more oil and gas. But that's a path to all sorts of trouble. I think we need a serious shift to renewables. As I said before -- Yesterday.

That's Business As Usual (BAU). BAU is simply bad. The only rational road that I can see out of this cul-de-sac is electrical. Conversion of transportation and everything else to an electrical base coupled with creation of electricity from whatever sources turn out to be best for us. That looks (to me) to be solar, wind, and nuclear, at least for the near term. I don't like nuclear because of safety, security, and proliferation issues but the alternative is literally social collapse somewhere down the road. I'd prefer renewables over nuclear to the greatest extent possible but it's not yet clear if we can ramp up renewables fast enough to matter. In any case though, if we continue down the BAU path, we are making the situation worse, not better.

you forgot coal :)

This portends very bad things for N American electricity generation doesn't it?

Your right, assuming home heating gets priority, the grid will be hit first:

If people want to help out, they could gather up some links on how much grid capacity is generated by nat gas for each region.

And find some maps of long range electrical transmission links. Are they going mostly east west (meaning all cold states are linked together) or going north south (meaning a warmer south can power a colder north)?

Living in CA, where NG generated electricity is very important, this was one of my first thoughts.

We were able to convince our city officials to install a large photovoltaic system at our water treatment center (pumps and cleans water for the city supply), but they have a total grid-tie system and didn't consider it important to engineer it to run on direct PV output! Our appeals that "We can't rely on the stability of the electric grid" were considered hysterical and naive because of course governments and corporations wouldn't let things get that bad.

I am hoping some retrofit can be worked out when the grid gets iffy within the next several years.

Sorry for a blatant plug but I am invested in World Water and Solar Power. WWAT.OB They have patents on large horsepower pumps tied directly to solar systems and have set up systems which directly address the concerns you mentioned. They cut their teeth in developing solar water pumping systems for poor people without easy access to clean water - still do this recently supplying solar water pumping units to Darfur and Iraq. (also donated this technology after Katrina where it was put to good use) Have gradually been winning larger and larger contracts (multimegawatt Airport solar systems) Currently have some letters of intent (nothing signed) for large multi-megawatt solar farms in Spain and Italy. Recently merged with Entech, a supplier of concentrating solar photovoltaics to NASA for many years and are building their first 50 MW plant.

Sorry - but they did do for some water utilities exactly what you recommended. I'll say no more.

Yes it does.

Anyone got any guestimates on where we are on a similar curve for world NG supplies?

Euan Mearns has done several articles on European NatGas. Jean Laherrere's latest predictions for LNG exports are posted over at ASPO France. The paper is in French but the graphs are in english. He does an ELM study as well (Westexas, you get around). The numbers are not very happy. And they totally depend on Qatar. If the North Field is over estimated.... Well it will be very cold in Europe.

Matthew Simmons spoke here in Minnesota before the Legislature. While answering questions at the end he said he was really worried about Gas reserves because most of those reserves were just estimates that had never been proven by drilling.

Matthew Simmons has been talking about nat gas for a long time. It tends to take a back seat to oil talk, but Simmons seems to believe that when the declines hit, they'll hit hard.

Dave - Luis and I will have a post on Olduvai, hopefully Thursday, providing a global view of oil, gas and coal. Best have a fine bottle of Scotch available to see you through that one.

Here's my current view on European gas:

Most of our gas is off shore. So we cannot really drill the shit out of poor quality reserves like you do on shore - the poor cost benefit ratio (proxy for energy return) I believe is more obvious in the offshore environment.

If Norwegian gas production peaks around 2009 as forecast by Rune Likvern then this will be the first stage of a full blown energy crisis for Europe and the world.

In my book, that means full scale bidding war for nat gas (if infrastructure for LNG is in place). Barring that a full scale real war.

We need to scale non fossil fuel power sources (that have good energy returns) as fast as possible. We cannot afford to wait for all the pundits to recognize there is a cliff ahead. See Murrays post below.

Nate - as I pointed out in this post here Daddy why can you not afford to buy me a Christmas present, there is plenty LNG import infrastructure in place - twice as much import infrastructure than export infrastructure in fact. These are pipelines that lead no where - it is so f****ing incredibly stupid it makes you want to cry.

It is well worth noting that West Europe has had a mild winter - not like N America and E Asia where it has been cold. UK nat gas spot prices have been running about double this year compared to last - so I think there are signs that we already have the makings of a global gas market.

Whilst we do not use much LNG yet - we are dependent upon it - and so need to pay whatever it takes to secure supplies.

Prices are set at the margins, I believe, and presumably LNG is the margin. At what point will the price of LNG determine the spot price of pipeline gas?

Given:

Presumably the price of LNG is going to the moon.

Peter.

Olduvai? Do you mean on another forum? or that that's where we're headed?

Peter.

Its going to be a post here on Duncan's Olduvai theory that Luis has been working on for months. It will explain why your TOD handle may or may not be an accurate description in a decade or so....;-)

Oh dear,

Peter.

Cheers Euan - I think!

I had a bit of a wander round the ASPO site as I am fluent in Franglais, but didn't spot the link referred to, so I think I will hang on for the bad news.

The Russian and Middle Eastern figures should be 'interesting'

Alan from the Big Easy has even got me convinced we are going to have to shell out the suicidal price of the off-shore wind proposals for the UK, things are so bad.

Good job our politicians are on top of the issues, or we would really be in a mess!

Hi Dave, Here you go:

World Nat Gas + Exports by Laherrere

Thanks Jon - again, I think!

And BTW, thanks for an excellent and informative article - shame we can't get it into the powers that be to read.

I agree entirely Dave - in Scotland the top priority right now is to secure a new golf course - that will save us. The eroie of a round of golf is about 0.0000000000001. So I guess if you attract 10 million golfers and each play 10 rounds that will save us, eh? Especially if they fly in on Virgin Vandal's nutty airline.

Humor, a stiff upper lip and gallons of booze is the answer my friend.

No, No! Donald Trump said: "I want to build some bunkers right next to your oil-fields" and someone thought he meant a golf-course :-)

http://news.bbc.co.uk/1/hi/scotland/4862982.stm

No worries, our politicians here in the states are focusing on critically important issues:

This is a preview from my UK gas post that I have been working on for months.

yellow = imports (hahahahhahaha)

The Uk has a major advantage over the rest of the world in that unlike everywhere else, our economy is fundamentally strong. Thus, even though we make nothing, apart from weapons, we will win the bidding war for energy.

Apparently, your month off the sauce has ended...

And why not? Given the alternatives.

As a UK resident that chart is the scariest thing I have seen in a long time :(

I agree just as long as we can persuade our friendly heavily armed European neighbours to continue "donating" all that oil and gas in European north sea waters that we are using :)

Look on the Bright Side Euan, the UK has an abundant sheep population, and the world is going to need a lot more sweaters!

That is another really scary chart. At least the remaining supplies are close to Europe. Ah, this has stopped being fun. Can we play a different game?

Rumor has it that the Ozzies have invented a way of using sheep to generate heat without having to turn em into sweaters - I'll see if Gav can dig something up on that.

And yes, Nigeria and Qatar are right on Europe's door step. N America always has Trinidad to fall back on of course.

Exactly ... evidence? ... our finances are so strong we can afford, at an unplanned moment's notice, to spend £100,000,000,000 buying bankrupt banks!

IMO the overall UK energy situation is a serious concern and the politicians/civil servants won't even talk about making contingency plans in case the public get to hear about them and panic - I am totally apalled by the complacency and blank stares in Whitehall.

Sadly, I don't think the people that do understand can see a viable way out of the mid-term situation but will try and grow the economy until it doesn't. They have 'market will fix it' faith! ... if the invisible hand doesn't fix it there will be panic.

I got an e-mail from an actuarial search firm this afternoon telling me how wonderful it would be to move to London. I'm sure if people in London can sell a few more insurance policies, everything will be all right.

Hello Euan and fellow TODers,

Your Quote:

"Dave - Luis and I will have a post on Olduvai, hopefully Thursday, providing a global view of oil, gas and coal. Best have a fine bottle of Scotch available to see you through that one."

I hope all readers will join me in shouting out 'Peakoil' everytime the glass of your favorite yeasty beverage reaches half-empty!

I have long been trying to promote this as a new cultural tradition to help leverage Peak Outreach.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

PEAK OIL!!

Does anyone have any information on net natural gas (NG) exports from Canada? I thought it would be interesting to plot Net Oil + NG Exports from Canada on a BOE basis. And of course, this whole analysis--which is very good--has unpleasant implications for the tar sands operations.

BTW, Clinton and Obama were debating withdrawing from NAFTA, if it is not renegotiated. I wonder if Canada might be more than willing to scrap NAFTA.

Hans Blix's "deep shit" comment is right on the mark.

There probably isn't enough LNG to allow a sufficient quantity of imports to substitute for falling supplies and rising demand --and North America's not building much in the way of new LNG ports anyway.

Is there any way we can avoid the cruel choice of no winter time heat or no electricity within the next five or ten years. There are many people more knowledgeable than myself but if I interpret this correctly, we are a few short years away from a huge disaster we will not be able to recover from.

Am I missing something or is that the implication of this study?

Another factor to consider is where you are on the distribution system. On a global basis, two regions that are not in good shape--at the end of distribution systems--are California and the UK. One might expect to see a migration of people and companies into energy producing areas.

This is already happening with the relocation of amonia/fertilizer, and oil/natural gas products plants to the middle east along with the migration of skilled labour from mature areas such as the north sea.

Your analysis is correct. Add in the off shored amonia/fertilizer plants and you are looking at the end of the obesity problem.

We are probably 5-10 years from shortages and a much more massive coal burn, and hang GW.

Underground gassification is just being researched now, and will no way be ready in the right time-frame.

It will take 20 years to ramp nuclear up to a large figure, although actually it is hopeful that we will be able to get around 50% more out of present reactors through the use of annular fuel:

http://mit.edu/canes/publications/abstracts/nfc/nfc-095.html

Abstract: Feasibility & Economics of Existing PWR Transition to a Higher Power Core Using Annular Fuel

However a lot of reactors are approaching the end of their lives.

Wind energy can be built quickly and is a relatively good resource in the States - the costs in Europe are horrific - but the transmission system will no way be able to shunt all that extra power around, and costs are still high.

Transmission is also a problem with coal, but to a lesser extent as you can burn it where you want, unlike wind which is fixed in it's location for the best resources.

Solar power is in it's infancy, and realistically needs to be introduced initially where it is most cost effective, for peak power in the South West where it is abundant.

PV in the north gives you very little power when you most need it in the mid-winter.

Residential solar thermal is a very good technology, and could help a lot, as will air heat pumps, which can now deal with cold climates - but you would still hit grid limits in switching to electric heating from gas.

About the only white knight riding to the rescue I can see is aerogel, which provides massive insulation - it is currently at around $5 square foot, far too expensive for normal insulation, but I have no idea what potential it might have for rapid price reduction - anyone got any idea?

It would take massive amounts of time and money to upgrade the insulation of the housing stock by normal means - something like compressed paper or straw will probably be fadged up, and darn how it looks and maybe darn fire risk.

Bussard fusion and high-altitude wind are Hail Mary plays.

So the situation is certainly extremely serious, and worryingly entirely unaddressed in the current political debate.

More cheery thoughts - it seems likely to me that nuclear plants will be run well past their safe close-by dates, and coal will return to the homes of American people, air pollution and all - one of the few ways of not having to put power through the grid.

Only a touch more positively coal can be turned into syngas, but you would need a lot of infrastructure which would take years to build.

I suppose if you can't warm your house, you can at least warm the world.

It ought to be cheaper to build and run coal gasification plants that feed syngas or methane into the natural gas distribution network then retrofit coal "boilers" into hundreds of thousands of houses and do the logistics.

In an emergency quite a lot of people would probably just stick in some kind of chimney and have a good, old fashioned, polluting and inefficient coal fire, and heat one room.

Amazing what you do when the kids start crying.

Expect wood to be burnt rapidly in the states - in the UK there is not enough to make a difference.

Going from gas from coal to natural gas in the UK took around 10-15 years I think, going back will not be cheap, quick or easy.

With coal supplies limited in lots of places nuclear or wind where available and heat pumps with a strengthened grid are likely to help more, but I fully expect out politicians to run in all directions simultaneously.

Expect anti-nuclear protesters to be hanging from lamp-posts, even if as seems likely the politicians cut every corner in the book, cut safety precautions, use poorly trained staff and so on.

Then if something goes wrong the nuclear industry will take the blame, not incompetent regulation.

The standards are so over built now compared any other generation source that likely the worst that could happen is that that standards enter the reasonable area.

I doubt that anyone would actually die, too, but can see a potential for cocking things up enough so that you get the occasional scare.

Windscale's release of radioactivity didn't kill anyone, and was blamed on the technicians, but in fact happened because they were ordered by the politicians to over-ride safety so as not to interrupt supplies for the weapons industry.

I like to realy see the problems solved and thus I search for business ideas that makes the maximum use of available resources. Centralized large scale investments makes more sense then manny, manny local coal burners that also would be terrible for the air quality and so on.

Sure it would be more efficient, although perhaps not than a really good home boiler.

We are however talking about a grid which would certainly not be able to transmit the extra energy required to take over the heating duties of NG, although that problem may be minimised if we haven't got enough for our electricity either, and we are talking about very hard times when you can't just pop out and buy a boiler, either because you haven't got the cash or they are in short supply.

Sub-optimal but low capital solutions then come to the fore.

I as refering to feeding the coal thru the natural gas pipeline system as mixed in H + CO or syntehtisized methane.

But large CHP plants feeding city sized district heating and district cooling networks and via the electrical grid powering heat pumps would of course be even better. Make that nuclear CHP if you care about global warming.

What you might find is that coal gasification is usually done like the IGCC idea. They just put the CO+H2 synthesis gas into the turbine of a combined cycle power plant. The synthesis gas is lower BTU per cubic foot than natural gas and to bring it up to pipeline methane levels is not cost effective at current natural gas prices. It is more profitable to make electricity out of it.

Current natural gas prices are not especially relevant if this threads scenario happens.

That could be the case. Coal is mostly carbon so getting to CH4 methane might take an extra supply of H2 to get the yield up. This is not all that big a deal to make happen. I prefer biomass to methane, because it is more renewable and CO2 neutral, but coal may turn out to be more popular.

Gasification of coal with steam produces the needed H2 (via C + H2O ==> CO +H2). GreatPoint Energy is developing a catalytic coal methanation process which they claim will produce approximately one mole of CO2 (sequestration ready of course) for each mole of CH4. This process is not done in situ but rather uses mined coal. They claim (You will have to judge for yourself how seriously to take this claim) that they will be able to produce methane from coal for less than U.S. $4/MBTU. From a global warming perspective this is not a great strategy (Who knows if the excess CO2 will really get sequestered when the economic chips are down?), but since in fact no strategy whatsoever exists with respect to fossil fuel depletion a coal to methane process will probably be pursued.

Coal gasification to natural gas via methanation

gives you around 10000 scf of synthetic natural gas(1000 btu per scf) per ton of coal with current technology. The US uses 23 trillion cubic feet of natural gas; to make that much synthetic natural gas would require 2.3 billion tons of coal per year, the US currently mines 1 billion tons of coal per year.

There's no way to replace natural gas.

You could suppliment natural gas by adding electrolyzed hydrogen from windfarms to natural gas. You can run 20% hydrogen by volume along with natural gas in existing gas pipelines. The mixture burns

like natural gas. Something like (700 GWh) could generate that amount of hydrogen.

http://www.hythane.com/

It may be a good idea to add hydrogen made from renewable sources to gasified biomass and coal to methane. You usually end up with more carbon than hydrogen when making CH4 from biomass, so adding hydrogen from wind electric electrolysis may make sense. It is one way of transporting the fuel via existing NG pipes.

There is a fairly extensive study on this idea:

http://www.pnas.org/cgi/content/abstract/104/12/4828

For biomass, they estimate that 100% of transportation can be covered through this method. My thinking is to go a step further and eliminate the biomass, taking carbon from the atmosphere directly which reduces the land area needed to produce fuels even more.

http://mdsolar.blogspot.com/2007/12/jet-fuel.html

Chris

There was an article on Green Car Congress about a national lab taking CO2 from the atmosphere. I would guess that we have enough sources of CO2, like power plants to provide enough to make NG from renewable hydrogen. Using the CO2 twice could be a good way to reduce emissions.

I agree that that is a good way to start. Cement manufacturing can give CO2 with a low N2 content pretty easily. The energy requirements for getting CO2 from the atmosphere don't look too tough though and as we phase out coal we'll likely want to go that route eventually. One thing is that you can get the CO2 where you need heat and don't have to ship it if you take it directly.

Chris

"Then if something goes wrong the nuclear industry will take the blame, not incompetent regulation."

Almost all of the complexity in nuclear regulation comes from the need to be 'safe' in spite of the fact that almost none of the workmen actually understand nuclear physics. I think an unregulated burst of nuclear power construction will be rapidly self limiting as catastrophic accidents happen. Who gets blamed is really a minor issue. They will probably be dead from an accidental release of radioactive material.

And in a race to build power plants, only idiots will choose nuclear over coal.

Huh? Obviously you don't believe in GW. Don't confuse the regulatory regime with the basic technology, which is incredibly safe.

Coal kills thousands every year anyway, so I doubt that you could do worse.

I do hope we get on and start a build of clean. safe nuclear power plants now though, so we can do things at the right pace.

A combination of them, conservation and renewables is surely the best bet, and use coal after NG runs out for plastics and so on

Well its not obvious to me that I don't believe in global warming. I think I believe in it very much. But it will take effect on a much longer time scale than the collapse of NG supply according to this study. As to your 'best bet', IMO it will fail. It requires too much reasoned debate to succeed with real human beings. And yes, the safety of nuclear power is incredible. I prefer credible safety.

So your solution to GW is to carry on burning coal? Wonderful.

Rational assessment of risk is what is needed - and opposition to nuclear power over the last 30 years has already killed people from coal emissions in their thousands and greatly increased greenhouse gasses, which could kill millions.

However, I don't really want to continue the discussion in this thread, I would just note that many of us who are pro nuclear take safety very seriously, even to the point of trying to draw attention to the fact when the political imperative might be to ignore it.

I think you are perhaps naive to think that there will be much left of the anti-nuclear movement when the first shortages bite, but I always been contrarian, supporting nuclear when it was not fashionable and possibly in the future urging greater caution long after the fashionable have moved on.

Davemart : The problem with coal to gas is the need for hydrogen. Hydrogen requires extensive amounts of electricity to extract from water, and the use of Gas would of course be impossible. The idea is unfeasible.

Well, I dunno what they did when I was a kid then - we used to call it town gas, and it was piped to most homes, and was kept in the old gas-works, which stunk like hell, and it was certainly made from coal.

Looks like Coal Gas has CO in it which is something of a showstopper.

At least for now.

In any case it can be made with coal, water and air (it seems the H comes from H2O dissociating). So no technical problem. But one might say it has many unaccounted-for externalized costs.

It's a fascinating story how it was used and discarded. I hope we can do better this time, re: GHG and cleverness. But we'll see.

Best,

NR

I was an awful energy source, mainly used for cooking.

But I have little doubt that in the situation of severe shortages we are hypothesising here it would make a come-back - a poor energy source is so much better than no energy.

Synthesis gas can be made into synthetic methane through thermo chemical processing. Coal or biomass can be made into Substitute Natural Gas to be put into the pipelines. Once you have synthesis gas, you can make liquid synthetic fuels through the FT process as well.

1. Switch back to coal for domestic heating would be very difficult. Consider the transportation costs in a post peak oil world, and the amount of money would be required to retrofit existing homes and business. In addition large office and apartment buildings lack the storage to store vast quantities of coal. I doubt any Natural gas heating systems can be retro fitted to support coal. They'll need to replace them new coal fired boilers. Consider the amount of sulphur and ash that will desposit on the boiler tubes that were originally designed to operate on clean natural gas. The materials used and boiler design for natural gas are completely inappropriate for use with coal.

2. To replace NG would require a massive amount of Coal gasification infrustructure, which will require constant maintaince because of the corrosive nature of most coals, ans well has the harsh operating temperatures and the complexity of the equipment required (ie oxygen seperation from nitrogen, Slag removal, etc). Much of the rail lines have been downsized as Cars and trucks replaced rail as the primary transportation method. Today, Most coal fire plants run coal supply deficits during the summer. They use the winter months to stockpile coal at the power plants because there is insufficient rail. During the summer the rail lines because fully saturated, deliveing coal to existing plants. While we certainly can increase rail, its going to be extremely costly during a severe energy crisis, as the costs for construction materials will be significantly higher. There is also considerable demand for water in coal gasification. The water is required to distribute coal to individual burners, as well as part of the gasification chemical process.

I suspect that when we hit the NG wall, we will turn to in-ground coal gasification as an emergency measure. It will be extremely inefficent (probably under 10% efficiency because it will be done very hastily), but we'll do it anyway just to keep the party going for a wee-bit longer. Much like we did with the creation of the housing bubble to avoid a severe recession after the dot com bust. We will continue to sacrific remaining resources until the system collapses.

Consider the dozen of other problems that are headed because of resource depletion and the credit crunch. We are not only facing a energy crisis, we are also facing a financial crisis. Even more problems are on the way such as boomer retirement and the massive unfunded entitlements promised to them. Unemployment will soar caused but the massive debt load, and soaring cost of basic commodities such as food and energy (already underway). These problems further undermind the availablity of resources to migate energy depletion. The US, Europe and other industrialized nations now much compete for declining resources with Asia and China. Much of the goods sold to energy exports now come from China and India. Its likely that in the future, China and India will be given more favorable access to energy than the West currently enjoys.

I suspect that as the recession gains momentium more capital resources will go toward the unemployed and to address the credit crisis we are currently in (e.g banking bailouts). The focus from enery migitation will remain off the table until it hits like a runaway train. When the energy crisis hits, I expect remaining resources we be used to continue to support the existing infrastructure. such as subsidised heating fuel, electricity and food. Politicians will hand out food and energy subsidies to buy votes. These will suck all available resources to maintain the existing infrastructure instead of freeing up resources to replace it.

Another critical issue is the replacement of approximate 25% of gas fired power plants. Before the NG gas runs out, its going to get a lot more expensive. this will drive up electrical costs. Its unlikely that existing Gas fired turbines can relably run on syngas, unless it is incrediably clean (rapid corrosion of turbine equipment from sulphur and other containments). While new coal or nuclear plants could be build to replace NG fired plants, its going to take considerable time. Coal and Nuclear plants have a much bigger water foot print than natural gas. Coal plants need to be construct by nearby coal seams, or by rail. Both Coal andNuclear have a NIMBY problem.

Its likely that the high cost of NG will drive some electricity producers out of business leading to frequent blackouts. This largly depends on how fast the price of NG rises. A sharp run up will lead to bankrupcies as NG fired operators can not raise prices to energy consumers fast enough (ie customers with locked in rates, and state price regulation). Many of the NG power companies are already loaded up with debt, and are near bankruptcy.

As I've discussed on numerious times, Wind and solar cannot not directly replace base load NG, Coal and Nuclear plants. They need to be backed up with expensive energy storage systems, and the for every watt of baseload demand required about 5 watts of solar or wind power because the sun doesn't shine and the wind doesn't blow 24/7/365. To replace a single 700 Megawatt NG fired plant will required approximately 3,500 Megawatts of solar or wind power plus a substantional energy storage system capable of storing at least a full days worth of power (in the case of solar, extended overcast weather, or extended periods of no wind) The cost of a single 700 Megawatt gas fire power plant is between $300 and $500 million. The cost to replace it with wind or solar would probably be approximate $20 to $25 billion (probably much higher during an energy crisis).

Wow! That makes me an optimist about renewables!

I estimated the cost of a wind-powered build for the UK at 'only' $13bn or so a GW, but did not really cost for back-up or fully for connection.

On one thing though I think problems are likely to be mitigated - I really can't see the NIMBY problem or anti-nuclear movement surviving - everyone will want the power plants as close to them as they can possibly manage, which incidentally gives you new possibilities in underground nuclear plants in city centres piping hot water to the inhabitants.

One cold winter with short natural gas and it will be the most popular power source.

This would be cheap heat an power even in a post-peak world, although for the countries without the piping like Britain and America the infrastructure will take some making.

Continental Europe and China are much better placed, as is Japan.

I would be interested in pointers to your relevant fuller discussions of your calculations for renewables as baseload.

With thanks,

Techguy you have given us the big picture perspective. There are so many excellent contributors to this site and most tend to look at trees and however brilliant their analysis, it's nice to read someone who looks at forests. Thank you.

Dave…

Do you have a link for purchasing aerogel in “insulation quantities” at your quoted price?

Google only comes up with samples at $25 for a 2.5 cm disk. Or $30 or $125 from United Nuclear.

I also recall someone (you???) recently linking to a newspaper story of a person in UK who had insulated his house with aerogel; so it obviously is available.

I’m presently visiting family in UK and would like to see/sample the product, having been aware of its existence for several years now.

Thanks

PS coincidentally, I’m heading to the Eco-home conference/exhibition at Earls Court, London tomorrow

Darned if I know where I spotted the $5 sq ft, so I may be in error, but these are the suppliers I was talking about:

http://www.aerogel.com/products/overview.html

ASPEN AEROGELS | PRODUCTS OVERVIEW

I also know someone who insulated his shed roof with it, and it cost £250 for the roll, so the cost seems in the right ball-park.

If you are going to ideal home, you might be interested in this link to the new design for a reasonably priced carbon neutral home:

http://www.independent.co.uk/environment/green-living/on-the-market-the-...

I have a couple of reservations about the design - the plumbing and porches and so on eat up a lot of the floor space, it is unclear whether it is carbon neutral only in the sense that you are feeding excess power back into the grid when it is not needed in the summer, while drawing it in the winter when it is, and I am none too keen on wood stoves.

Still, it is a start - would that all y=our houses had so many 'problems'!

I've used a new nanotech coating called Nansulate that is a water based paint,use the clear coat home protect it has twice the insulating as the tintable.18 months ago replaced the hvac system and got a 50% savings since that time I've painted approx.60% of the interior and have reduced our bill 30% and that's heating/cooling the upstairs we normally don't heat extra 450 sq ft.But on the main floor the two bedrooms across the hall from each other the one on the north has always been 5-8 degrees cooler than the south now you can't tell the difference.The back of the house is now warmer than the front where the theromstat is I'm getting ready to do the front and it will be interesting to see if next winter it flips back to cooler in the back.Also I need to have the hvac unit reset on fan speeds designed to run more than it does now.

Dave, you might be interested in this:

http://www.rparts.com/Catalog/Box_Building/insulation/insulation.asp

(VIP or Vacuum Insulation Panels). They are intented for freezers and refrigerators. Its still expensive, but cheaper than aerogel.

I think the more cost effective solutions are:

1. New home construction using 2x10 or2x12 framing (you use a pair of 2x4 with a gap in the middle). Then the entire gap is filled with insulation. I recommend blow-in fiber glass or sprayed on poly-euthane foam. I like the fiber glass because won't generate toxic fumes in a fire, and its easier to fix pipes and electrical. the Eurthane foam sticks to everything. The other choices are blow-in cellose (I don't like it because it settles over time, and the fine cellose particles can leak into your living space).

2. Retrofit. Ridge foam panels on the outside (you remove the exterior, put up the rigid foam panels and put back the exterior, such as vinyl siding which doesn't require period painting and provides some thermal resistance). On the Inside you can add a second 2x4 frame with an airgap (or not) for all the exterior walls, that is filled with an extra layer of insulation.

In both cases its important to calk and seal every crack in crevious before you add the insulation and add dry wall Holes for electrical and pipes should also be calked. Pipes should be wrapped. Its also a good idea to add a vapor barrier to the exterior plywood. this helps prevent moisture from collecting in your walls.

Thanks for the link.

I would be pretty worried about condensation if I installed these or Nansular on the inside of a house - any idea how they pan out in this respect?

Here is contact info for you on advice and UK supplies:

http://www.greenbuildingforum.co.uk/newforum/comments.php?DiscussionID=4...

More chat about aerogel:

http://www.greenbuildingforum.co.uk/newforum/comments.php?DiscussionID=9

And their website:

http://www.proctorgroup.com/index.asp

Proctor Group - Home

Cheers!

I'd like to see a Hubbert's curve projection on north american natural gas.

If it drops quickly, the US could gasifiy lignite coal to natural gas as we are doing now at Beulah, ND. Much of the resulting CO2 ends up sequestered in the Weyburn Oil field in Canada for EOR. Something like 0.5% of US natural gas is syngas from Beulah.

But obviously this would only be a band aid given a large rapid decline of NA natural gas.

How rapidly could NA gas decline?

Here's an interesting 2006 article on Hubbert linearization of gas productions with declines rates for the Siberian Urengoy field.

http://www.mees.com/postedarticles/oped/v49n11-5OD01.htm

Is there something recent for north america?

I don't think a Hubbert curve is going to help here. Peak is skewed for natural gas. At least it is skewed in the only example we have. And it seems to be skewed in North America. On the other hand, the historical model follows a logistic perfectly.

Follow the link to Laherrere's paper. He covers how he created his curves in more detail.

The other factor is the double peak in the US. You would need to separate out solution gas (from oil production) from non-associated gas. But because they overlap, you would still end up with a non-logistic (that is me guessing, you would have to look at the data to be certain).

As I have noted several times, the 2004 End of Suburbia (EOS) DVD, which was basically built around an extended interview with Jim Kunstler (JHK), has been uncannily accurate in predicting recent trends: deflationary trends in the auto, housing and finance sectors and inflationary trends in food and energy prices.

I am in early chapters of JHK's new post-peak novel, "World made by hand." Everything is local. The grid is functioning only sporadically at best, and the central government is pretty much irrelevant. Note that a severe flu pandemic caused significant deaths. However, the bottom line is that the people in upstate New York were adjusting (what choice did they have?) and surviving. In an e-mail communication, Jim said that he thought that a lot of Doomers would think that his novel is too optimistic.

Please please withdrawl from NAFTA. Our spinless mob would never dare. However they only want to re-negotiate the parts that are bad for the Empire, not the parts that screw Canada. I will be using this NG analysis a lot in the next week or two. Thank you very much!

http://www.rrc.state.tx.us/divisions/og/statistics/production/ogisgpwc.html

Texas NG production is interesting. We have shown two years of increasing production, because of the Barnett Shale Play, to 5 TCF or more per year NG production. However, note that the number of gas wells needed to produce 5 TCF is twice the number needed the last time we produced 5 TCF per year (in the early Eighties), so it's a pretty reasonable assumption that the net energy from 5 TCF today is not the same net energy as 5 TCF in the early Eighties.

The following website is pretty interesting, with tons of energy statistics by state. I'm not sure how current the data set is. In any case, Texas is a net oil importer and probably a net NG exporter, but on a net energy basis Texas is probably a net importer. Note that Texas is the #1 largest oil consumer and #1 largest NG consumer.

http://www.statemaster.com/graph/ene_nat_gas_con-energy-natural-gas-cons...

So about 23,000 wells to produce 7 Tcf and now 83,000 wells to produce 5 Tcf. If we had a bit of pricing data we could make a rough calculation.

Florida has 18 million people. Texas has 23 million but has an order of magnitude more NG use. It looks like the states with a lot of oil refining are using the natural gas? That does not bode well for future domestic oil refining.

Oil refining is one of the most electricity intensive industries in existence. Figure out the consequences from there. A full scale refinery uses electricity like football fans downing beer.

This is the analysis that needs doing, either here or an academic journal: "What are the Implications of declining natural gas production in North America for N.A Oil Production"? As I noted below, over 70% of the energy input into petroleum extraction is natural gas. I know nat gas is huge user in the refining sector. Just how much of our annual natural gas use IS used in the petroleum finding/harvesting/refining/distribution chain? I don't have time to do it but I think it would be important if someone else could....

My gut tells me that relying on coal, nat gas and oil is kind of like having a portfolio of Microsoft, Intel and General Electric. They are all bluechips but there is some nasty autocorrelation and systematic risk hiding betwixt the three...

Not in per capita terms. NG consumption: Alaska is of course first, and by a long shot, more than triple the NG consumption of Texas. Louisiana and Wyoming also far outstrip Texas. (all per capita.) The picture for oil consumption is comparable.

As far as oil production per capita goes, the largest is, of course, Alaska, and Texas is only in 8th rank (after Wyoming, Louisiana, and others.)

Those who produce, consume. And Alaska is cold.

http://www.statemaster.com/index.php - go to energy stats.

I was of course looking at the energy export/import balance. While per capita is meaningful, the fact remains that Texas uses more than 10 times as much natural gas as Alaska.

Here is per capita graph of oil and gas used for home heating:

US per capita direct fossil fuel use for heating Click to enlarge.

Here is per state total use of oil and gas for home heating:

US direct fossil fuel use for heating Click to enlarge.

Details in this post, Home Heating with Fossil Fuels compared to Wood

This is a table of the sources of electricity generation by state.

OR,ID,WA and VT and a few others look in good shape (relatively). However the Vermont stat is misleading as their nuclear contract runs out soon.

There is also the issue of sharing power across state lines. My chart is of what is generated in the state. I don't know how one would determine the distribution of the source of the electricity actually used in the state. In the Northeast, I would expect there to be quite a bit of sharing across state lines, so that natural gas would have a more widespread impact than just the states that are shown to have high percentages.

From my inspection of that table: DC--District of Columbia?-- is 100% petroleum powered-- do they have their own local grid? Does that mean the rest of the US could be blacked out but they are still warm, toasty, and illuminated if they can get a single VLCC tanker to supply them? WTF?

More like the only generation they do is diesel, probably for backup, and are dependent on juice from the outside. Think about it, you don't see many cooling towers in Georgetown!

Wonder how much those White House solar panels contributed? Seem to remember someone describing that story in great detail here, and it probably only qualified as a single residence, albeit a pretty big one.

yes i understand westexas but i am always beating that drum eg. protesting comparing the accused, accursed, energy-hogging US to the sweet and egalitarian Dutch, with their postcard windmills, trains, bikes, walkers, modest cheese eaters, xmas cookies, in absolute terms, or in terms that somehow sneakily pull totals in, burying all other comparisons.

As I have pointed out many times, EROI analysis is only valid if one is comparing apples and apples. It must be natural gas in and natural gas out. If oil or, heaven forbid ethanol, were used to drill gas wells, EROI is meaningless. And price can not be left out of the equation. A critical factor in any equation can not be left out just because it suits the point of view of the analysis and skews the result in a preferred direction. It is the functions of the equation that left out that invalidate the analysis.

Suppose that because of shortage the natural gas price spikes. Now suppose that drilling equipment operates mostly on diesel. Then suppose diesel prices are held in check by bio diesel. Drilling could go one for some time with a negative EROI. Some would depute that this could occur, but it may because of the infrastructure that is set up to demand natural gas for electricity and home heating which is not easily changed.

In theory, true, in practise in this case, misleading.

You are not talking about small differences, but of the order of three times the drilling.

I don't really like EROI calculations myself - the simple way of looking at it is it is getting more and more expensive to find less and less gas- that is why the big companies are not drilling even more.

My understanding of purpose of this analysis was to decide between the question of do we have a lot of reserves or not using EROI as an indicator. I don't think the implication was that it would mean the end of production or that expensive production would not continue. It seems to support the low URR analysis.

And in true oil drum fashion, the trend is extrapolated far beyond what is warranted.

It's true there is no prima facie reason for the points to continually linearly to the X axis -they could slow down and maintain moderate EROI for decades. But this analysis showed the current trend and suggested what could happen if it continues. In my opinion the onus is on the natural gas optimists to show why this will not be the case. And as an aside to your comment, would you generally rather err on the optimistic side or pessimistic side, if you are making long term plans?

Hmmm, an infinite rate of increase in energy production (extraction), or energy production peaks and then declines. In a finite world, which scenario is more likely? Anyone? Anyone?

My favorite extrapolation is the Economist Magazine's assertion that Saudi Arabia could produce at their 2005 rate (about 11 mbpd, total liquids) for 70 years without ever finding another drop of oil. So, in 2075 they would be producing 11 mbpd. If we extrapolate their consumption at their 2006 rate of increase, they would be consuming 108 mbpd in 2075.

Removing the extrapolation and looking solely at fit, the trend is impressive. Given this data, a sudden upswing would be a much less likely scenario.

There are 10 years of data and the extrapolation is 6 years. Unless drilling slows (and production falls) EROI will keep falling.

Interesting analysis regardless of whether the analysis is apples and apples or not. Many people think that NG production is relatively inexpensive, as its just like collecting gas out of a balloon ... ain't it?

That is largely true of conventional reserves, but of course as the fields get smaller, more wells are required to keep the production up, but nonconventional reserves have some pretty high ongoing operating costs.

For example, coal bed methane (CBM) wells generally need to be de-watered, by pumping water out, for quite a while.

And Barnett Shale wells generally need additional frac jobs with time.

I did a rough calculation for CBM based on Canadian initial flow data and ultimate recovery. CBM looks to be about 1 or 2 orders of magnitude less gas per well than 1996 era conventional gas. That puts CBM at about 5:1 to 2:1. And I think that reliance on these non-conventional sources is why the EROI graph is falling so quickly.

PDF With well flow data

The Canadian data does not break out shale gas or tight gas, so we cannot estimate the EROI.

If you look at EIA data you see a downturn in production for the early 80s recession, for a purely economic indicator. Doubt it was mysteriously warmer then. In a severe downturn expect many operators to just hang up their hat, unless we decide to subsidize them - which wouldn't be surprising.

Barnett Shale also has the onus of being underneath Fort Worth. Kind of the opposite of Stranded Gas!

What in blue blazes are you talking about?

If you use a windmill to produce the gas it is still stupid if it takes more energy to manufacture, erect and maintain, than the amount of energy which it can produce. You would simply sell the energy the windmill produces, why bother extracting gas with it.

Your apples and oranges analogy seems absurd.

Price can be ignored every time. If it takes 51 oranges to produce 50 apples then burning the oranges is better. Why produce the apples when you could sell the oranges for the same or more? In the end, they both represent energy.

If gas was food and if the amount of gas being extracted could not adequately feed the person extracting it, then that person starves, the same is for the economics of production.

I think all investors, would appreciate being made aware about a process which uses more energy of any description to produce energy. Though I seriously doubt investors would need to be "made aware".

Supposing about spikes and costs as you suggest is meaningless, the differential could never last long. The world would be certifiably mad if it did.

Maybe you have an example where your supposition has occurred and for how long.

Sometimes the EROEI arguments can become pretty amazingly absurd. Of course a wind mill produces more energy than it takes to build and maintain. If you listen to the EROEI high priests you'd never build anything but oil, gas, and coal plants. Of course, at a certain point those too will take more energy to build than they'll ever give in return once we get into the hard to find oil, gas, coal.

Ridiculous!

Do a little research and you will find that a in a 1 MW Windmill:

"The energy invested in manufacturing, operating, and recycling a windmill that lasts 20 years is paid back in 3 months, a 1:80 ratio. Nothing else comes close."

With Wind Mills you have amazing EROEI. Better than oil and gas by far. Gas is around 1:10.

Even the Oil Drum has favorable data regarding wind energy:

http://www.theoildrum.com/story/2006/10/17/18478/085

But this study doesn't even look at higher scaled options like 1 MW, 1.5 MW, or even the 3.6 MW recently being produced by GE, which have much more favorable EROEI.

For many, the data on renewable energy has been NEGATIVELY padded. Not positively padded. In no small part is our current economic crisis in the US due to our energy inefficiency and heavy reliance on oil and gas. Is it any wonder the Euro is gaining even as the dollar slides with Europe so much more efficient than we are?

Where did I say anything about the EROEI of a windmill.

I gave an example of a comparison for energy production that a simpleton could understand. obviously it flew way over your head

"If you use a windmill to produce the gas it is still stupid if it takes more energy to manufacture, erect and maintain, than the amount of energy which it can produce. You would simply sell the energy the windmill produces, why bother extracting gas with it."

My response was to the above statement.

I'll break it down a little more:

1. One of the primary issues with wind has been intermittency and storage of generated energy for later use.

2. Throughout Oil Drum Discussion, a number of potential solutions have been raised including storing the electrical wind energy in various alternate forms.

3. One mentioned above was using wind energy/electrolysis to convert to methane at a high efficiency.

4. With wind EROEI being so high, and with electrolysis efficiencies at 85%, the loss in conversion would likely be very low.