"Peak Oil" - Why Smart Folks Disagree - Part II

Posted by nate hagens on April 2, 2007 - 11:35am

There continues to be considerable disagreement on both the timing and the magnitude of Peak Oil, though last week's GAO report(pdf) should be helpful in shrinking that gap. Part I of this 3 part series summarized some of the recent discussion of why some are very concerned about Peak Oil and others are relatively unconcerned. We also discussed why there needs to be a clear definition of Peak Oil so that policymakers discuss 'apples and apples'. This post will continue to examine areas of disagreement between the two camps, and will particularly focus on what I perceive to be the largest disconnect in energy, financial and government circles - that of the difference between gross and net production of finite resources.

Decline in Net Energy on US Oil Production

A Hypothetical Sensitivity Analysis on EIA Projections (mbpd)(click to enlarge)

If you ask 100 people about Peak Oil, you will get a few shrugs of disdain, a few vehement diatribes and about 90 blank stares. Its not a subject easily talked about, easily understood, or easily internalized. This post points out some major areas of why people either disagree about or don't comprehend the magnitude of this human problem. These issues have been thoroughly discussed on this site for the past 2 years, but for new readers I will attempt to briefly summarize some of these major areas of disagreement - for old readers (err..seasoned readers), please jump down to Reason #6, where begins some new analysis. This post will be followed by Part III, which will discuss the more interesting and controversial social and psychological reasons why there exists such a polarization of opinion on this important topic.

REASON #1 THERE IS VERY LITTLE RELIABLE DATA ON OIL, GAS (AND COAL)

"Dear, shouldnt we stop for gas soon?" "Nah- the gauge is broken - theres plenty left. Go back to sleep"

Neither the concerned nor the unconcerned camp can have any great confidence in reserve or future production data due to the fact that 85-90% of the worlds oil is owned or controlled by nations or national oil companies. Furthermore, estimates on the dollar and energy costs to produce this oil are all but nonexistent. The unconcerned camp leans heavily on forecasts from the USGS and EIA, both of which have in recent years been overly optimistic. (The US government Energy Information Agency has a $60 median forecast for oil for 2030!!(1) While there is a (very slight) chance they could be right, the prediction is based on not only a paucity of data, but (at least historically) has been comprised of economic as opposed to scientific analysis:

"..These adjustments to the USGS and MMS estimates are based on non-technical considerations that support domestic supply growth to the levels necessary to meet projected demand levels."(2)

In other words, the figures were rearranged to show that we will always have enough. Yet these pronouncements and predictions are received by corporate America as carrying the weight of certainty (more on this in part III).

The concerned camp at least uses the data that we DO have - that of past and current production. 50 countries have already peaked in production and many more could peak in the very near future based on logistical and hubbert linearization methods discussed on this website. While its possible these countries could rebound and see new peaks, that has not been the pattern. The USA peaked in production in 1970 and has since been in terminal decline with the exception of the blip up from the North Slope in Alaska. Yet the EIA ccurrently continues to forecast increased US production from now until 2016 in their latest report.

The basic point here is: we don't know, so isn't it better to use the precautionary principle than keep driving and hoping we're not on fumes?

REASON #2 -ACTUAL PRODUCTION FLOWS DO NOT EQUAL "PRODUCTIVE CAPACITY"

|

|

| The first half of oil | The second half of oil |

|

|

| The first half of oil | The second half of oil |

The second half of oil(or even 3/4 according to CERA) will follow vastly different rules than the first half. Deeper wells in more remote, sensitive locations, heavier, sourer oil, growing populations and internal consumption in exporting countries, lack of skilled oil personnel and geologists, geopolitical conflict, hurricanes in new exploration areas, expensive rigs, environmental limitations, first nation disputes, lack of upstream capital expenditures, etc will all contribute to actual production being unlikely to match 'productive capacity'. Again, maybe it will. But maybe it won't. And the flow rate of liquid fuels is what makes the world economy run, not how much is conceivably underground.

A prime example of the risk of these type of projections was pointed out by our resident water cut sleuth" last week. Cambridge Energy (CERA) expects Saudi Arabia to grow to 14.3 million barrels a day in 2015 from 12.7 mbpd in 2005 (actual production in 2005 was under 9.5 mbpd). So, sometimes productive capacity is even higher than actual production in the past.

REASON #3 - THE TIMING OF PEAK OIL IS SO IMPORTANT BECAUSE OF THE TIME LAGS REQUIRED FOR MITIGATION

|

|

The worlds transportation (and therefore food) system is utterly dependent on oil. In the DOE funded Hirsch Report, the economist authors made it very clear that the Peaking of global oil production was a monumental task and would require 20 years! lead time to effectively mitigate (noticeably absent from the report were environmental consequences of the choices of mitigation). Even at 10 year lead time they predicted liquid fuel shortfalls. In other words, this is not a problem that we can solve overnight.

Last weeks release of the much anticipated GAO Report on Peak Oil echoes the urgency with which to change policy due to long lead times and the pervasivness of oil services in our society.

REASON #4 - THE MARKET WILL SOLVE IT, RIGHT?

In Part III of this article I will discuss our penchant for believing confident authority figures. For now lets address the most embedded theme among the unconcerned - that the market will automatically solve the energy problem via advanced price signals that will lead to new energy technology that replaces fossil fuels.

Neoclassical economic theory has as a core assumption perfect information. But, as we have seen above, we actually have very little good information on future oil supplies and flows. The worlds major oil exporters mostly have below investment grade sovereign credit ratings, and the market is priced at the marginal barrel. As long as the market is reasonably supplied over the short term, and the major media focus on the government forecast for oil prices to remain constant for the next 25 years (the EIA has two forecasts a high of $90 in 2030 and a low of $28), the classic Hotelling model of resource extraction, where resource owners charge increasing rents and withhold production to maximize rents, has not yet started to kick in. From the above referenced TOD post:

The authors (Gowdy et al) conclude that temporary incremental production gains are offset by later steeper decline rates in the tail end of production without increasing the overall URR. Their main conclusions are essentially that 1) oil is not being treated as a finite resource as oil field analyses predict and 2) temporary production gains mask real scarcity and result in misleading low oil prices.

This is consistent with the thesis that parts of Ghawar are mostly watered out and there will not be a gradual decline when they quit but more of an abrupt crash. How many of the worlds productive fields will show this pattern due to horizontal drilling and advanced techniques getting out as much as possible as soon as possible? As 'John' said in the introductory interview, people may believe in the concept of peak oil, but they are trying to make money and live for today - the market probably wont give us a strong signal until we are well past peak oil - and that may even be masked by demand destruction due to recession/depression. Following the precautionary principle is not a strong suit of a market based economy. Without good information on 90% of the worlds oil, and decades needed to properly adapt, it is likely the market will be in for some surprises that don't have easy invisible hand fixes.

Briefly regarding alternative energy, we a)have to replace the total liquid fuels lost by a source or sources that give us the same or higher energy gain and can scale/grow at the same or higher rate than oil and gas deplete and b) do so without running into limitations of other finite resources such as water, land, soil, etc.(3) A colleague and I have just completed a paper showing that global bio-energy growth will be severely limited by water constraints by 2025, as one example.

REASON #5 - ITS NOT ABOUT RUNNING OUT OF OIL, BUT RUNNING OUT OF THE PERCEPTION OF GROWTH

There will still be oil in the ground 100 years from now, and even 1 million years from now. Peak oil has never been about it 'running out'. But society has become accustomed to growth. The embodied energy in fossil fuels generates this growth (aided and leveraged by human labor and ingenuity, but the vast majority due to the energy capacity of oil to do work). Remember one barrel of oil has the amount of BTUs it would take an average man 12.5 years of 40 hours a week of labor to produce.

Our debt based capitalist society is based on the ability of everyone to climb the ladder. If it becomes apparent that there is a ceiling, all the rules of the system breakdown. Growth is based on the ability of people to get loans, grow businesses and repay the loans with interest. If there is less and less energy available each year thats one thing - it might just show up as recession/belt-tightening. However, if peoples PERCEPTION is that less and less energy will be available then why would banks give out loans, why would people go to work, etc? The economy can only grow if the Energy Return on Investment from oil is replaced with something as high or higher. (more on that below)

Largely because oil is finite and dollars are not, King Hubbert concluded we would have either a zero interest rate, or (very high) inflation(5).

REASON #6 - THERE IS AN INCREASING GAP BETWEEN REPORTED BTU CONTENT AND USABLE ENERGY

Most oil analysts focus on the gross amount of oil produced. This will be increasingly misleading, for many reasons. First of all, the different liquids called 'oil' in the EIA and CERA forecasts differ in their BTU content.

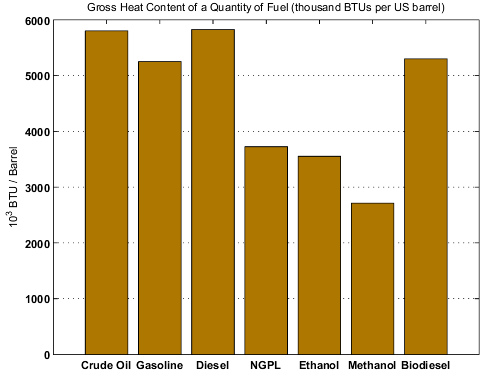

Gross Heat Content of 42 Gallons (1 US Barrel) of different fuels (Source EIA -ConversionFactors and Gross Heat Contents and the DEO (BiomassEnergy Book, Appendix A).

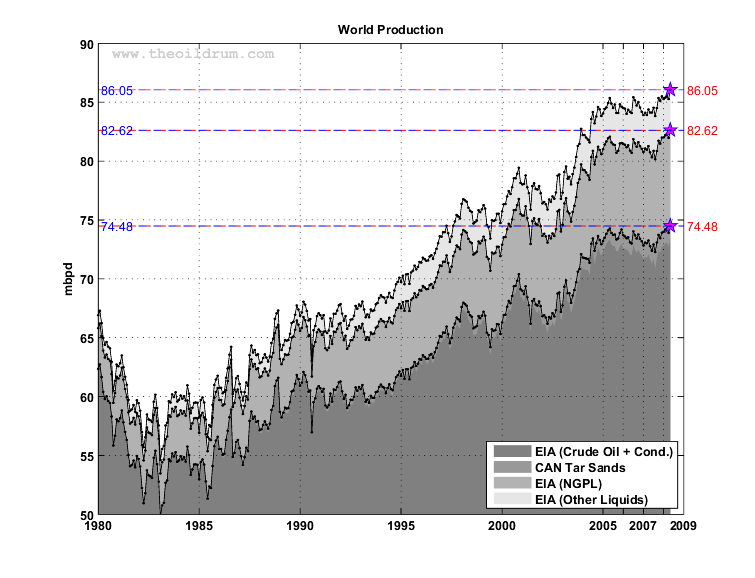

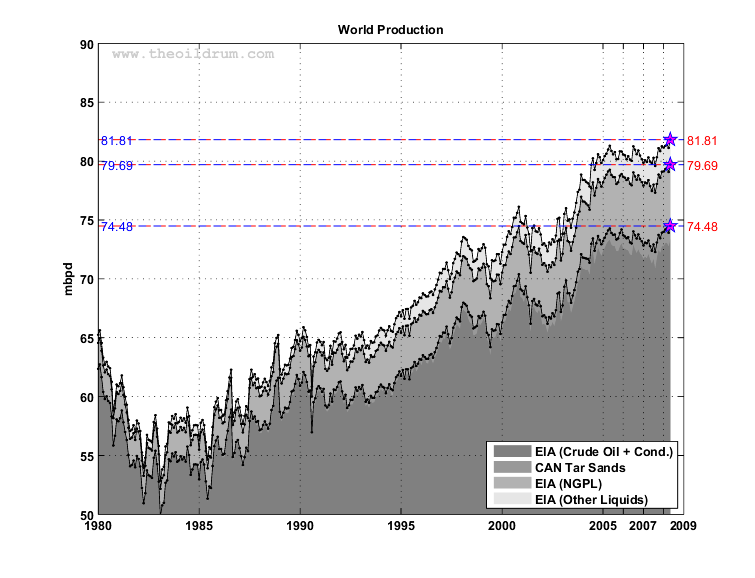

Gross World Oil Production (mbpd) and Gross World Oil Production Adjusted For BTU Content (Click to Enlarge)

Natural Gas Plant Liquids(NGPL) and "Other Liquids" (primarily ethanol) are taking up a larger share of world production (the relative width of the two lighter gray areas is growing on left graph). These liquids have much less BTU content than crude oil and we need more of these products to accomplish the same amount of work as with straight crude oil. 42 gallons of Ethanol equals 0.61 barrel of crude oil. One barrel of NGPL only equates to 0.64 barrel of crude oil. The graph on the top is what is reported by the EIA as 'total oil production'. The graph on the bottom is adjusted for the lower BTU content of NGPL and ethanol. As you can see - there is about a 5mpbd drop in BTU content available to do economic work.

We need oil for the energy services it provides. Though we notionally have 85mbpd, we only get to use 80mbpd of 'oil' BTU content. So other than convenience, using gross figures in projecting supply, especially when an increasing % of the liquids will be coming from lower BTU sources is overly optimistic.

US ONLY

| EIA Forecast US Production (gross)in mbpd | EIA BTU Adjusted US Production in mbpd |

Above are the EIA oil production forecasts through 2030 for domestic US production. As can be seen the lower BTU content in NGPL and ethanol cause our governments gross production to be about 12% too high by BTU content.

But wait. It gets worse. Potentially much worse.

REASON #7 NET ENERGY MATTERS FAR MORE THAN GROSS ENERGY

Net energy analysis is little used and much misunderstood. Essentially, the economy is 100% dependent on energy to do work. The first law of thermodynamics states there is a finite amount of energy in a closed system - that capital, labor and technology cannot create more energy. Available energy must be used to transform existing resources (e.g., oil), or to divert existing energy flows (e.g., wind or solar) into more available energy.

The second law of thermodynamics posits that there is an energy loss at every step in the economic process. (for example - about 30% of the BTUs in internal combustion engines are 'utilized' the rest is dissipated as heat loss). An energy resource has to produce more energy than it uses, otherwise it becomes an energy sink. It takes about 735 joules of energy to lift 15 kg of oil 5 meters out of the ground just to overcome gravity -imagine how much energy is required to lift oil from 27,000 feet beneath the ocean (Jack II). The most concentrated and easiest accessible oil is produced as soon as technology and scale can access it; thereafter, more and more energy is required to locate, harvest, refine and and distribute oil. At some unknown point in the future, more energy will be required to find and procure oil than the energy recovered in the oil-- and the "resource" will become a "sink", irrespective of oil prices. I wrote a specific example of how declines in net energy would take away from productive sectors of society here.

This is theoretically illustrated in the below graphic from an upcoming paper in AMBIO.

Graphic from Energy Return on Investment - Towards a Consistent Framework Mulder, K. and Hagens, N. forthcoming (Click to Enlarge)

The total 'resource' in the above graphic is the area A+B+C+D. It directly requires D energy to extract A+B+C+D energy. Extraction and distribution also requires indirect costs (like employees driving to work, health insurance, steel for the drillpipes, sandwich meat, etc.) This is energy cost C. As the scale of resource extraction increases, the ratio of A/(C+D) declines. Though conventional economics might not have done so, we also included cost B, which is the environmental externality costs of increased extraction. Once the scale of extraction reaches the point between A and B on the X axis, it takes more energy to produce the marginal unit than the marginal unit is worth. The 'resource' is still in the ground but is energetically unprofitable to produce. If at this point, (assuming one values the environmental tier B), an energy company uses its own stocks of energy to continue production, they do so at an energy loss, and would be better of selling or using their stored energy for other purposes.

As Richard Heinberg recently wrote about, an upcoming report from Energy Watch Group called “Coal: Resources and Future Production,” notes that:

Each coal class has a different energy content:

anthracite 30 MJ/kg

bituminous coal 18.8–29.3 MJ/kg

sub-bitiminous coal 8.3–25 MJ/kg

lignite 5.5–14.3 MJ/kg

and

"the authors of the report conclude that growth in total volumes (in USA) can continue for 10 to 15 years. However, in terms of energy content U.S. coal production peaked in 1998 at 598 million tons of oil equivalents (Mtoe); by 2005 this had fallen to 576 Mtoe."

In other words, we can continue to grow the gross amount of resource, but the amount of BTUs available to do work has declined since 1998. (Ive not yet seen this report so dont know what to make of it, but illustrate the concept here so as to make declining net energy on oil and gas more easy to grasp.

WE NEED THE SAME TYPE OF ANALYSIS ON OIL AND GAS

Where does the oil 'resource' fall on this scale? It is difficult to say for certain. Analysis by Cutler Cleveland suggests that the net energy of oil (EROI-1) was over 100:1 in the 1930s when discovery peaked in the US. It dropped to 30:1 in the 1970s and has since fallen to 10-15:1. Once you account for refining the EROI declines to 5-10:1 Why does this matter? Well lets put it in its simplest terms. Lets for the moment assume that the energy inputs in oil extraction are completely oil and gas. This is actually not far from the truth:

Source Cutler ClevelandClick to Enlarge

In this example, if the world oil and gas industry is averaging a 10:1 energy gain, that means 10% of the worlds oil and gas is needed to procure the rest. If the net energy drops to 4:1, then 20% of the worlds oil and gas is needed to procure the other 80%. If the net energy drops to 3:1, which it eventually could, 25% of the worlds oil and gas will be needed to get the other 75% used by society. So clearly 85 million barrels a day doesn't tell us the whole picture. Perhaps 50 million bpd at 20:1 net energy generates more 'wealth' for the world than 120mbpd of 5:1 oil - because an increasing part of the 'gross resource' will be required by oil companies before non-energy society ever sees it.

Most people think of net energy as some esoteric topic that has fleeting relevance to our energy predicament. However, as Joseph Tainter outlined, energy gain (or lack thereof) is critical to the functioning and expansion of society.(3) Many in the investment community are confused as to why energy prices are so high, yet many energy companies (particularly exploration) are struggling to show profits. One reason is their own higher energy use coupled with higher prices for everything in the last few years.

I dont have accurate net energy figures for current oil and gas exploration. (No one does, but it is sorely needed). If we use Professor Clevelands' net energy figures for US exploration and production and linearly extrapolate the average EROI decline over the last 3 decades forward in time and then overlay it with the EIA forecast for US production, you'd get a graph that would look something like this!:

Total domestic oil projection (EIA)(1) in mbpd with sensitivity on net available to society (green)

The total area of black and green is total US liquids EIA production forecast whereas the green is what is left over for non-energy company society under a linear declining net energy assumptions above. As can be seen, an energy break even point is reached within 20 years - at which point it makes no sense to drill/extract any more resource because it takes as much energy to do so as you get out. The resource has become a sink. Of important note, is WELL before that date, a significant amount of energy is removed from productive society and allocated towards energy production. This graph is probably unrealistic as new technology and demand/credit issues will impact extraction in next decade or so, making the net closer to the gross than the graph shows. But as a hypothetical exercise, it calls attention to a critical issue. At some point, declining net energy will mean the end of economic growth, unless it's replaced with equally high or higher energy gain systems. (*cautionary note - an energy source that DOES replace the energy gain from fossil fuels will still contribute to planetary waste absorption limits)

As natural gas prices increase, the costs of petroleum extraction will also increase (which at least partially explains the higher cost numbers from E&P last year). If North America doesn't get off the natural gas treadmill, there will start to be a strong positive feedback loop as natural gas is the largest energy input into petroleum extraction. More and more gas will be needed for exploration and production leaving less for plastic bags, fertilizers, and furnaces.

INDIRECT COSTS

Another aspect of net energy that is missed by most wall street analysts (in my opinion) is indirect costs. In addition to the direct electricity, natural gas, etc needed for E&P, there are also pipes, machinery, cement, lumber, steel, wires, tools, etc. As much energy that is used directly in the discovery and harvesting process, the indirect energy is even greater:

Source: Cleveland, CJ, "Net Energy from the Extraction of Oil and Gas in the United States"

There are even wider boundary costs not included here but are part of the global closed economy. Part of the 85 million bpd goes to highways, insurance, wheels for employees cars, schools, medicine, dogfood, etc. A wide boundary energy analysis such as this, as you might imagine, is difficult to accurately model in a world of dollar data. Yet its important - because this is how our interconnected world really works.

What does this all mean? It has two important implications. First, it suggests that the 'total resource' that gives CERA its confidence to delay the timing of Peak Oil, is not an apples and apples comparison of energy-many of the resources that make up their 'stacked resource' are not equivalent in terms of how much energy is left over for society. Second, and more worrisome, is the fact that as net energy of each fossil resource declines, a greater and greater % of its productive flows, will have to be used by the oil and gas companies themselves. This at a minimum robs economic growth and energy services from the rest of society and at a maximum, robs from both the economy and the environment, as energy companies seek out resources that have not yet become sinks (think Florida coast, ANWAR, etc)

SOME REAL LIFE DATA

There is some compelling and concerning pieces of evidence that tie together the last several paragraphs. Much of the expected growth in 'oil' in the coming decades comes from unconventional sources. The net energy of shale oil, tar sands, ethanol, etc is a fraction of that of historical crude production. Though a credible net energy study has yet to be done on tar sands, equity research on SUNCOR from John S Herold suggests it costs $30 a barrel to upgrade bitumen to oil. This presumably covers direct costs of the easier mining of bitumen as opposed to the in-situ production. If oil goes to $150 per barrel, will it still cost $30 to produce? Or do costs keep up with or outpace the commodity price? What happens if there is a cost blowout in Fort McMurray for housing, helicopters, services, raw materials, transportation, water, etc?

Before you look at the next graph, imagine how the above net energy information might translate into dollars, as net energy declines. As depleted regions require more energy to be productive, the costs should increase, and if we are approaching energy break even they should increase more than the commodity itself.

Finding and Development Costs per Barrel Oil Equivalent - Source - John S. Herold, IncClick to Enlarge

Though this is only a two year sample and comprises about half of the industry, the implications of extreme increases in finding and development costs in a country like the US which peaked 37 years ago, suggests that energy break even may not be science fiction. First of all, the % increase in costs from 2005 to 2006 far outpaces the % increase in oil prices for both US and Worldwide projects. Furthermore, consistent with the 'best-first' principle, costs of development went up much higher in the US, which relative to the rest of the world as a whole, is more fully depleted.

A FEW CLOSING WORDS ON NET ENERGY

Net energy analysis is not a purely physical principle, as the economy dictates how much energy it takes to make and deliver products that are used to procure energy. More efficient methods will result in higher net energy and vice versa. If the markets were perfectly functioning, devoid of subsidies and inclusive of environmental externalities, then in theory energy return would equate to financial return. But since the market is focused on the marginal barrel, if enough dollars exist to pay for production at a profit then those dollars will be printed. Net energy analysis holds moving pieces more constant than financial analysis (though the two can never totally be separated)

In sum, net energy analysis is important not only for comparing alternative energy technologies, but for determining how much energy out of our fixed pie is used by the energy sector. Since its the 'net' that we care about, it's important that the energy data agencies move towards 'net liquid fuel available to non-energy producing sectors' as a measure of Peak Oil. Oil production and cost to society will increasingly be obfuscated as debt and credit become more significant drivers of growth. As such, we are highly likely to grow gross production, while net energy declines. The unawares will be focused on the gross, as usual.

As an important future exercise, I would like to analyze how much of the worlds 85 million barrels per day of oil (which we now know has a BTU content equal to 80 million) is used by the energy and utility companies finding and delivering the energy services to the rest of society. Is it 20%, 25%? Whatever % this is, I expect it to increase. If it increases, some other economic sectors use will decrease - hospitals? shopping centers? individual drivers? airplanes? Disneyland?

CONCLUSIONS

In the era of fossil fuel use and depletion, much uncertainty and confusion still exists in policy circles and the general public as to the urgency of the situation. CERA, historically respected in oil supply analysis, is in my opinion providing detailed maps to the wrong destinations. In the only category that really matters in the Peak Oil debate, net liquid fuel availability and cost to non-energy producing society, there is ample evidence suggesting that the peak in cheap oil, which society and institutions are built around, is already behind us. This is not a binomial equation. An imminent peak or a peak of affordable oil in 2040 (CERAs projection) have dramatically different risk profiles for society. The best case scenario brewed by conflating reserves with resources, net energy with gross energy, capacity with flow-rates and ignoring the environment makes for a sweet tasting drink. But should we be drinking it?

(**I admit the possibility that although I am looking 2 steps ahead CERA might be looking 3 steps ahead, meaning they are part of an intentional effort to make the 2040 peak message take hold, so that societal uncertainty and pell-mell policy doesn't disrupt needed upstream investment. But I think it more likely they, and others, are just too narrowly focused in the boundaries of their analysis.)

Actual production can and will differ dramatically from productive capacity. To base decade lag time decisions (like changing transportation infrastructure to more electric, and relocalizing certain basic goods manufacturing) on best case scenarios is foolhardy. What is the risk reward scenario of such decisions? If CERA is right and we get to some 120 mbpd (net)of oil, all the better to use it for an early transition. If they are wrong or potentially WAY wrong, then the complacency in corporate circles from CERA and EIA optimism will mean we have missed our chance to prepare. To focus on a particular productive capacity or even flow rate are the wrong goals, because at 120 mpbd of lower quality/much more expensive oil, we will be stealing from both the environment and the economy. Using dollars to forecast costs is using a moving target. If tar sands are profitable at $32 with oil at $55, will the cost be $132 when oil is $155? Or even higher given wide boundary costs? Money, research and effort needs to go towards a better accounting and estimation of the energy costs of extracting our remaining fossil fuels.

This is the most important issue facing the 3 generations sharing the planet today. We are at a critical time for our nation and our world. Whether we make no changes, small changes or huge paradigm shifts in the direction of our policies and priorities is an open question, but one that will affect not only the environment and our children, but us as well.

THE BOTTOM LINE

1. Flow rates of liquid fuels available to non-energy society matter. Productive capacity means little.

2. Better technology is in a race with depletion, and so far is losing (declining net energy).

3. Focusing on energy return (gross minus energy cost) bypasses many of the moving pieces in project decision criteria inherent in financial analysis which increasingly includes debt/credit.

4. Modern society has been built around high energy density infrastructure. Declines in net energy, if not replaced, will have serious economic implications.

5. Declines in net energy, if replaced, must adhere to increasing limitations on other resources, particularly water, food, and waste absorption.

6. During the last 150 years, the market treated oil as a 'near infinite resource'. Increasing awareness of many of the issues raised above means classic Hotelling analysis of resource owners acting to maximize rents may soon become a reality (e.g. Opec permanently restraining production, knowing they will get higher prices in the future)

7. The window to address these issues at a societal level is before net energy declines so much that half of us are working for Exxon. Oil at $80, $100, $120, etc. will increasingly price out sectors of the global economy, and eventually population.

To conclude, here is a hypothetical conversation between the head of an oil analysis company and the president of the United States circa 2020. It is one of many such possible conversations for a decade hence. As a citizen of the US or of the planet, how would you want to change it?

Epilogue

P: Come on in Mr Zergin

Z: Thanks Mr President - you may call me Dan.

P: I understand your shop is one of the most respected in energy analysis, a lot of mensas on your staff.

Z: Yes. Thank you sir. We have long believed that there is plenty of oil in the ground and that above ground factors will be much more important than the amount of below ground resource. The world has supposedly been about to run out of oil 5 times in the past and obviously it never happened. Could I have some of that crumbcake?

P: Please. Thats good to know, but how come oil is $200 a barrel and we are on the verge of a depression and my approval ratings are plummeting? And were there 7 billion of us the last time we were supposed to run out of oil?

Z: This is a natural cycle sir. These high prices will bring about much needed investment in the oil industry. At $200 even corn ethanol will probably be profitable this year.

P: What is the time lag for this 'much needed investment'? Our importing ability has been drastically reduced due to the slow development of tar sands, first nation disputes, fighting in the middle east, militia in Nigeria, growing populations in the countries that still sell us oil, etc. Furthermore, Im sure youre aware of the statute I just passed disallowing home heating above 40 degree local weather, as we need the natural gas for exploration and corn fertilizer.

Z: Technology is getting better and eventually the benefits from more efficient extraction methods will overcome the effect of depletion of the giant fields you hear about.

P: Im curious. How much energy does the whole energy sector use in order to provide energy to the rest of us?

Z: Well, economically sir, thats not a relevant question. The incentive to procure more oil from older fields is now here. I always say 'Oil producers long term strategy is short term profits'! HA! And at $200 oil, you should be worried about the backlash from obscene profits from Microsoft-Mobil.

P: What if youre wrong?

Z: Well, our field by field analysis is among the most detailed in the business, so I really doubt we are wrong on how much oil there is. But above ground factors will continue to dictate the end of the age of oil. If Im wrong we can begin intense conservation and do odd/even driving days and such -theres lots of cool things as President you could implement. But Im not wrong - theres a whole world of affordable oil. We're yet to even pump half of it. The productive capacity today is well over 100 million barrels a day. And costs are not important. Gross production is!

P: Well the productive capacity of the First Lady when I met her was 15-16 children but we had only 3. Mr Zergin - Thank you for your time. On your way out please ask Vice President Schwarzenegger to send in my science team - and have him bring wheat grass shots for the lot.

A SNEAK PEEK AT PART III - THE SOCIAL AND PSYCHOLOGICAL REASONS WHY PEOPLE DISAGREE ON PEAK OIL

"I have it from high authority that there is plenty of Oil Resource"

SOURCES

(1) EIA Annual Energy Outlook 2007

(2) US Department of Energy: Annual Energy Outlook, 1998 pg. 217

(3) Tainter, Joseph Resource Transitions and Energy Gain: Contexts of Organization Ecology and Society 2003

(4) Cleveland, CJ, "Net Energy from the Extraction of Oil and Gas in the United States

(5) Hubbert, M King. "On the Nature of Growth - Testimony on Hearing for National Energy Conservation Policy Act 1974" June 6, 1974

remember to hit those buttons a la Professor Goose!

thanks for beating me to it Philip. :)

let's get Nate as many new eyes today as we can, eh? I can tell you he spent the entire weekend working on this...in fact, you wouldn't believe the amount of work the contributors put into their work to make it the best it can be.

Dear Nate,

Thanks for your lucid and informative presentations. I alwasy look forwrard to reading your pieces.

Here are just a couple of general points that occured to me.

You mentioned some of the indirect costs relating to oil production. One really big one that currently costs billions and is rising almost exponentially, is, the military costs of ensuring US access to the world's remaining oil reserves. If one factors in these "indirect costs" one could easily argue that oil already, roughly, costs over a hundred dollars a barrel! However, this is a pretty radical way of looking at the situation and controversial.

I operate with something I call "internal" and "external" costs. The internal is the "price" the oil/energy costs to produce and what "we" pay for it directly. The external costs are everything else! That is, the "price we pay" that we don't see or choose to recognise. It's the price society pays collectively, but which somehow doesn't figure in the everyday price we pay for a product. Capitalism has a tendancy to "hide" the true costs of a product, transfering the real "price" from the individual producer to society, often with a substantial time-lag which means that most of us don't even register that it's happening.

Two examples of this are atomic power, which has enormous "hidden" costs; the massive outlay for de-commisioning reactors and the problem of waste-management.

The second, an more controversial, is the gigantic cost of health care for the thousands of wounded, maimed and injured US soldiers coming home from Iraq. Over a fify years period were talking about several trillion dollars.

Leaving that aside, is "growth", with all that concept implies, part of the solution or part of the problem? Aren't we set for some collosal political problems is growth begins to slows down? Yes, we are! If the cake isn't getting bigger and bigger all the time, will we be satisfied with the size of our slice in relation to other social groups?

Looking at the twin problems of Peak Oil and Climate Change, it would appear that in the future "economic growth" will/should occur in the developing world and Not in ours. How will we grow then? I would contend that all our "growth" should/must come not from increased consumption of energy, but from a massive, root and branch, fundamental, re-configuration of how we use energy. Put simply, we have to stop wasting energy on crap and save energy to use on what's really essential for our society. Now, this is easy to write and understand in theory, but far more difficult to figure out how it could actually be implimented in practice.

It means, as far as I can see, that we have to start asking fundamental and rather scary questions about the structure and nature of our society and how and why and who makes the choices. Do we let the "market" choose for us or do we take control?

If we are living in a "market democracy" do we change that system? Is a "market democracy" in fact "democratic"? If it isn't how and what do we replace/modify it with?

Sorry there are so many questions and no real answers. I'm still working on them!

Why do smart people disagree on peak oil- from what I've seen they're not even arguing about the right things.

I would venture to guess that 90% of today's oil production stream is subject to a displacement process- principally water either natural or artificial.

The science is to focus on what is going in (water) and not what is coming out (oil) -- and the action is what is happening in between (under the ground). By the time the outlet gives you useful info, it is too late.

Stuart's "water in the gas tank"- is the seminal work on what is actually important... and the fundamental physics are applicable to all crude oil being displaced.

The geologists including but not limited to- West Texas, Colin Campbell, Pickens, Deffeyes have done a marvelous job of bringing this issue to light. Their focus should be on what is yet to discover.

The petroleum engineering community has done a lousy job of steering this discussion in the right area. That the right questions are being asked, pressuring Aramco for the right data. Their focus should be on what is on production.

Daniel Yergin has no more idea about what makes a barrel of oil come out of the ground than my kindergarten son... but he is not supposed to.

It is a shame that the engineering community has been so silent- only once in history will your knowledge play such a critical role in society.

In terms of leading, following, or getting out of the way, I would say the petroleum engineering profession has chosen the latter.

I don't want to get into a 30 post thread about why this is the case.... it just appears to be this way to me.

Fractional_flow - do you have any estimations of how energy intensive your area of industry is now vs 5-10 years ago, given that '90% of today's oil production stream is subject to a displacement process"? Thanks for your comments- I agree with you about engineers - engineers dont like politics, and this looks like a political rats nest.

They have to pipe seawater hundreds of miles and then pump it up to several thousand psi. Pretty power intensive.

Thanks, Nate for your excellent article!

Your Zergin epilogue was very good and funny!!!

"The age of easy oil is over" says Schlumberger chief executive Andrew Gould. How much longer do we have to wait until Zergin and Zillerson make similar statements?

http://www.upstreamonline.com/live/article130537.ece

The discussions here at TOD -- and this one is a great example -- show technical folks taking the public dialogue where it needs to go!

I doubt that we'll bring about a utopian outcome, but policy formed on such discussion will be better policy.

We face tough conflicts. Some "solutions" for climate change may mess with mitigation plans for peak oil, just as some "solutions" for peak oil will mess with mitigation plans for climate change.

I do not think we ought to focus our technical prowess on evaluating too much more about "how much is left" but rather need to focus entirely on transforming patterns of human settlement to be sustainable without heavy inputs from fossil fuels.

I think we have passed the stage where we can pour too much of our remaining limited resources into finding and extrcting more oil.

I think we need to focus on the radical changes needed to cut fossil fuel use and emmissions by 90% in 20 or 30 years -- no matter what resources are still in the ground.

Is that "radical change in patterns of human settelment" a good focus for engineers and technical folks?

I know that petroleum engineers will be working on the problem of what is left and where and "how to extract" to some degree, but I think we need to refocus on changing "us" very quickly and very radically.

Did I just get into the political morass now.....?

I think what's needed is one picture, immediately understandable by the non-expert, that brings everything together in one place.

It needs to include:

One image, preferably not just a graph. Concentration would probably be on the 'gap' between demand and supply - not absolute barrels of oil.

There is relatively little chance that most people will read complex arguments or seriously consider what will happen in 5 years time - unless they grasp it implicitly from the beginning. That goes double for engineers in the thick of it - they have a track record of not being able to see the wood for the trees.

My Oil Quiz is intended to be a step in this direction.

I posted this a week or so ago, so quite a few have already seen this.

FF: "Their focus should be on what is yet to discover."

Does anyone have a feel for how well the earth has been explored for oil? I've read various viewpoints that hit the extreme ends of the spectrum; from we've plotted every inch of the earth with 3D/4D all the way to we have vast areas left to explore.

Since I know zippo about the exploration process, it is hard to even imagine where the truth really lies. But if big oil companies are having a hard time replacing depleted reserves every year, it does seem obvious that significant finds are getting scarcer and further apart in time.

ckaupp,

Yours is actually a very good question, and I am in agreement with you, that one hears estimates all over the place. And, as you described yourself, I too know little about exploration. Some themes seem to be recurrent however:

--The independent oil companies of the West have less and less area that they are allowed to explore firsthand, due to the energy nationalism of various state controlled oil companies, and other prohibitions. They are trying to look for more and more oil in a smaller and smaller area of the planet. This is most pronounced in the OPEC/Persian Gulf region, and in Russia, places that the oil companies had hoped in years gone by to be included, but are now being excluded. One can presume a similiar fate in Latin America for many of the Western oil companies, as these nations become more and more nationalistic

---There are areas in which the oil companies have done no real exploration for a very long time, because they have not been allowed to drill, and if they found oil there, they would not be allowed to harvest. Various areas in the U.S. West and the OCS (Outer Continental Shelf) of the U.S. come to mind. Again, the estimates of how much oil is there are widely varied, from barely a couple of years worth of production up to the hopes for a new North Sea. No one really knows, and only drilling at least in selected spots can tell.

---Of great interest are (a) Offshore Africa and (b) Arctic. Efforts now seem underway, but there are large areas in each region that have had little real exploration. Why?

It is easy to forget that after 1982, and for a subsequent 20 years or so, no one spent money in the oil business doing much exploration, because they were too busy fighting for their financial lives. This was the period of the greatest price collapse in oil from it's prior top in history, and most effort was expended on mergers in the oil business, as the remaining oil companies in the U.S. tried to survive. People now seem absolutely astounded that exploration and discovery dropped off! With cheap oil flowing from the Persian Gulf and the North Sea, who was willing to pull money off the table to explore oil that would then be sold at a givaway price? Would you have endorsed exploration in that environment as an oil company shareholder?

I do want to mention one more thing: Many have mentioned the move by the oil companies into very deep offshore ocean drilling as proof that they simply cannot find oil onshore. There may well be some truth in that, but it is not the whole story. The private oil companies are being driven offshore by lack of anywhere to even look onshore. Once you take out the areas forbidden to drill for environmental reasons (and I am not faulting that, but it is simply a fact of life for them) and take out the areas onshore controlled by nationalist or hostile parties, you see a smaller and smaller piece of the Earth available onshore for the oil companies to drill. There is some debate as to whether the major private oil companies of the West can survive into the future given the situation as it is, and it will surely become more difficult for them with each passing year. Going out to deep water is becoming the only game in town.

What the above situation means to the world is that it is becoming more and more dependent on the willingness and the competence of the state owned oil companies to explore for oil and gas, and find it if it is there.

But, do we know how much is left to be discovered? No. We certainly do not.

Roger Conner Jr.

Remember, we are only one cubic mile from freedom, and that cubic mile could be hiding just about anywhere!

you seem to suggest that nationalized oil reserves are not being exploited. take saudi aramco as an example. imo they are and have done an excellent job of extracting oil.

Fractional_flow - let me phrase the question directly:

Oil extraction uses Ein energy to get out Eout oil.

What is the relationship on the fields you are familiar with between the following variables?

%W+%G+%O=1

Eout-Ein=Esociety

As %W increases what happens to Esociety?

you pose an impossible question. the Ein would depend mainly on the depth of the oil. hypothetical examples could be examined.

i know of one field (natural water drive with produced water reinjection) producing about 97% water from a depth of 4800 ft that is making a fair profit. i dont see how that field is an energy sink, although i havent actually made a calculation.

another waterflood at 10000 ft is producing 70% water, which is making a profit on a monthly basis but has not paid out the initial investment in 2 1/2 yrs(and doesnt seen likely to in the immediate future). the operator keeps spending money on one problem well.

you make some very good points about the energy needed to produce oil from ever increasing depths. for many fields, 10000 feet is the practical limit for rod pumping and the practical limit for electrical submersibles as well (these wells were developed with relatively small 5 1/2 inch casing).

"..has not paid out the initial investment in 2 1/2 yrs"

Well, I don't know how to calculate for such a deep well, but how fast should it pay itself off? How does it work that it won't pay itself off in the near future but is profitable per month??

Like I wrote below, if it doesn't pay itself off in two years then it never will - or was our production curve so much different?

-----------

My grandfather pumped oil with an engine-house,

my father pumped oil with a 20 lb. electric motor,

can't I just pump it online?

the investment i am talking about was conversion to waterflood for which the estimated cost (100%) was $600k, actual cost $ 1,200k the wells in the unit have averaged just about $ 40k net after taxes royalties and operating expenses so they are profitable on a monthly operating basis but payout has not occured. the cumulative net revenue revenue is just under the $1,200k and now an afe has been issued for another $ 188k . incidentally the oil price for this unit was $ 36.22 for january.

i read your post "down below" and yes the answer is apparently that the production curve must be very different. give me a two year payout on long lived reserves and i will buy as much of it as i can afford. the going rate for existing oil and gas acquisition is about 36 months current revenue for working interests and 48 months for royalties. although if you follow the auctions on www/energynet.com, there is sometimes a pissing match between two or more rams in rut and the price can go way up.

Wow. Outstanding work Nate! I had never thought about the differing energy densities inherent in the "all liquids" category. Seems that things are, indeed, more dire than I had thought.

Maybe this is why the USA's political leadership is so unbendingly focused on resource war?

"Did I just get into the political morass now.....?"

No, but you obviously want to.

Even a troll can usually reply to the correct post...drunk on that ethanol you love so much?

What an undulating plateau means

Nate hits the nail on the head with this post - there's so much language out there that you need a magic decoder ring to figure out what people are saying. Myself, I have finally figured out the CERA "undulating plateau:"

US natural gas reserves:

1995 - 165 Tcf

2000 - 177 Tcf

2005 - 204 Tcf

All's right with the world, look at how much our reserves are rising. Oh, wait a minute...

US natural gas production:

1995 - 18.6 Tcf

2000 - 19.2 Tcf

2005 - 18.5 Tcf

No worries, though, we're on the undulating plateau. But what exactly does that mean?

US natural gas wells drilled:

1995 - 8454

2000 - 16242

2005 - 27397

Cost per well (2005 dollars):

1995 - $535,000

2000 - $750,000

2005 - $1,534,000

Putting the above together, the real outlay for natural gas wells in this country has gone from roughly $4 billion in 1995 to $40 billion in 2005, with no gain in production (but reserves have gone up!!!). One might think that the next factor of 10 might start to hurt the economy at some point. At any rate, the magic decoder ring says: Undulating plateau = factor of 10 price increase each decade. Of course, until Nate's net energy kills us...

My own net energy wouldnt likely kill anyone - I take naps every afternoon.

As to net energy analysis, Ive just updated the dot-connecting of many who have worked on this decades ago, starting with Howard Odum in 1974 who pointed out that stripper oil wells were mathematically energy sinks and not sources. Net energy analysis was very popular in the 1970s and even got passed into law at one point.

With the bull market of the 1980s and increased imports and overcapacity in energy sector, net energy analysis largely fell by the wayside - Cutler Clevelands ecological economic group has always worked in this area. The past decade or so, this concept has (kind of) been subsumed into LCA (Life Cycle Analysis), though that is more a project by project basis and not a global macro pie-sharing exercise.

I know Cutler and a group at Boston U, Syracuse, etc are working on a global energy systems modeling project that addresses some of these issues - but their monetary and academic support list is not long.

I know that two of my own papers on this topic have been rejected (but since accepted) due to 'not enough attention to economic factors'. I am becoming increasingly wary that academia is slowly being eaten by the giant economic growth machine...

thanks for your natural gas analysis and comments- its clear that this theme is starting to happen. Nat gas companies are saying they wont drill new gas unless the commodity is over $7.25 per mcf in order to attain their 20% IRR - this implies a cost of at least $5. Tells me higher nat gas and lower economic growth will be a core theme ahead.

One problem I have with EROI estimates is that a lot of infrastructure is long lived. A good way to look at it is that replacement costs for roads and bridges built in the 1970's are much higher today. So I think EROI is a decreasing quantity and capitol costs are increased via construction of new infrastructure using low EROI energy sources. So we should see a delay between when EROI starts decreasing and EROI effects begin. The same problems are effecting all oil extraction technologies we at least until recently where able to leverage pipelines drilling rigs ships etc built with cheap oil. But depending on replacement schedules all this infrastructure will face significant cost increases as new infrastructure is built with expensive inputs.

This would show as a rapid escalation in the cost for oil production for one. Also it would show as corn/ethanol rapidly becoming unprofitable and more corn/ethanol as used as input for production. In general a lot of fixed equipment has a replacement time at around 10-15 years so one would expect EROI increases to start having and effect 10 years after peak EROI. Which is right about now.

There are cornucopian economists, but economices is not fundamentally a cornucopian discipline.

In the 6th edition of Samuelson's textbook, the introductory chapter subheadings include, "The Law of Scarcity," "The Law of Diminishing Returns," and "The Malthus Theory of Population." Although this text, written in 1964, was pretty optimistic, it still phrased the fundamental economic question as how to allocate scarce resources among a population with unlimited desires.

Not a economist but its seems fairly obvious that capitol will concentrate to attempt to relieve the scarcity at least initially. The problem with oil is that it is a major input into the production of producing equipment. To me it looks like a strange attractor problem.

http://en.wikipedia.org/wiki/Attractor

So your faced with a declining EROI scenario. So for example corn/ethanol may be positive now because of both low NG prices and use of equipment and infrastructure developed with cheap oil but as more capitol goods are developed using ethanol you get in this vicious feedback loop that must decline. So it is impossible to grow a economy when you move down the EROI slope it must contract and in fact its contraction is self reinforcing.

So the only import point is EROI is decreasing that actual rate of decrease is determined by the details but the outcome is certain once you move negative on the energy production side.

Great article Nate - net energy is a crucial part of how peak oil will play out and you explain it really well here.

Excellent.

Another way of putting one of your main points: there is a pyramid of capital intensity. Energy exploration, development, distribution etc is near the apex. But this pyramid is bound to become much narrower and steeper. At some point the narrow base can no longer carry the apex.

One point in regard to Part III: we live in an exceptional time, the age of oil, and an exceptional place, the middle class of a first world (I'm not going to muddy the waters with adjectives like 'imperialist') country. Most of us have no idea of history, no idea of how exceptional these conditions are, and therefore no idea that it might be coming to an end. I am working real hard on adjusting MY head to it. In other words, the key lies in Egypt: denial.

Go ahead and clear the waters: we are imperialists, and our underlings pay us tribute in the form of cheap resources, cheap labor, and cannon fodder.

More alternative fruit. If it can work then it should count. It is a matter of scaling up net highly positive energy approaches. Some recent tech.

Plasma burning of garbage generates 6 times the energy consumed. There's enough energy in U.S. municipal and other waste to replace as much as a quarter of the gasoline the country uses, says Daniel Cohn, cofounder of IET and senior research scientist at the MIT center.

http://www.technologyreview.com/Energy/18328/

http://www.technologyreview.com/player/07/03/MagForward/1.aspx

Waste water fuel cell produce 18 watts per 260 gallons of water and achieved a charge efficiency of more than 70 percent.

http://www.eurekalert.org/pub_releases/2007-03/ps-baa032107.php

Lesser developed countries discharge approximately (the equivalent of) 100 trillion gallons (380×109 m³) of untreated sewage per annum. This could potentially generate 7 Terawatts of power for them and clean up their waste water.

These kinds of approaches plus a lot more nuclear power and shifting to more electrical transportation (hybrids and all electric.)

http://advancednano.blogspot.com

advanced,

Definitely cool technology, but it's only going to help at the margin. The efficiencies, EROI, and potential amounts of energy from these technologies are far lower than what their advocates claim. The main benefits are the combination of disposing of waste and generating some energy.

But if you start adding up all the potential renewable energy sources along with a revival of nuclear, we might really have something.

And many municipalities are *paying* to have their garbage hauled away -- they'll end up buying back the energy later. This is just precious.

Nate,

I question how you can count "employees driving to work, health insurance, steel for the drillpipes, sandwich meat, etc." as an indirect extraction cost, and still require a net energy yield. Ultimately, we could transition to an energy extraction economy, where everyone is directly or indirectly employed in the oil patch. No Hollywood, latte, personal trainers, ..everyone would have a "real job", kind of like Alberta. In that scenario, "region A" on your graphic would disappear, yet we still have an economy.

Of course, the oil would continue to deplete, and then everyone is caught offside. I think a better metric than dollars would be to look at employment by sector, or post-secondary education-years by sector, to get an idea of how over-committed we are to oil, and how quickly a transition can be made to alternatives.

the point of the indirect costs is that without those things, no one could get to work to produce oil. If the entire economy was directly or indirectly employed in the oilpatch, how many industries would disappear? certainly nascars disappearance wouldnt hurt oil production, but prozacs disappearance might.

Ultimately it gets down to as the net high quality resources deplete faster, extraneous and luxury sectors of economy (arts, gee-gaws, entertainment, financial services) will at the margin be replaced by more and more basic goods (energy, food and necessities)

"No Hollywood, latte, personal trainers, ..everyone would have a "real job", kind of like Alberta. In that scenario, "region A" on your graphic would disappear, yet we still have an economy."

Try again.

There are about 2 million people in Alberta's labour force. About 125,000 are directly employed in the energy industry. Using multipliers, about 18% of Albertans can attribute their jobs directly and indirectly to the energy industry. Indirectly includes people selling lattes and personal training.

I think the personal trainer issue depends on the disposable income generated by the oil industry and of course its concentration or distribution. I'd say that the oil patch workers would see their real purchasing power decline while the owners see their purchasing power increase. So when your in a decline situation the net effect is to increase the transfer of wealth to the top where it can be invested in further energy production. So the economy should naturally favor wealth concentration over distribution as core resources become scarce. So you would see a increase in personal trainers and a decrease in health clubs for the average citizen. At some point the faltering economy would cause labor costs to decrease and probably force the energy producers to take on a more vertical business model as profits are squeezed out of the system.

Although the wealthiest look flashy they actually spend a much smaller percentage of their overall wealth on luxury items than the average consumer. So concentration of wealth leads to natural economic contraction.

OK.. so even Alberta is not yet an example of a totally committed energy economy. There are still people to staff all the planned expansion.

In 1905, 50% of the NA workforce was direct farm labour. The development of the tractor and fertilizers made many of these people redundant (one of the causes of the depression), and they eventually went into manufacturing, aided by demand for WWII. In 1948, 40% of the workforce were in manufacturing. The trend since then has been one of increasing diversification into the service sector, and only 4% of workers are now farmers.

My point was that the economy shifts (albeit painfully) to where the lowest efficiency lies, and there improves that efficiency. We are entering the era of the energy economy, and the best way to track this will be to follow where the people and skills are going, not $

I don't think so since its the amount of disposable income generated that allows a economy to grow either via the purchase of additional goods or investment for economic expansion. These capitol flows are what keeps our economy growing. If it stops growing we are basically toast.

To put it bluntly where the rats congregate on the sinking ship does not change the fact the ship is sinking.

The social effects of a shrinking economy will likely overwhelm the base economic effect.

I dont think an economy much like todays require growth but it must have change. Growing somewhere and shrinking elsewhere or going thru overall boom and bust cycles. Withouth such we will have litte technological change and it will become very hard for young generations to establish themsleves and for people to change their field of work and way of living.

Thats basically the style of economy we had for thousands of years slow technical advances with the rise and fall of empires as they overreached the local resources.

On big difference today is that in the past we always had access to lands controlled by barbarians which were basically fallow. Or you could invade the neighboring empire.

With even the hand weapons we have today this sort of economic warfare is tough to win. I think your mixing local economics with the macro economics. Its overall growth or decline on the macro level that has always been important. Rome took four hundred years to fall I'm sure that many regions experienced growth during this time.

That does not change the fact that Rome was on a long fatal downward spiral. It could well be hundreds of years before we know if we have a sustainable high tech civilization or if we end with some sort of ruined post tech world.

One reason It makes sense to start looking past trying to duct tape todays society and thinking about how if possible we can build a sustainable high tech civilization.

It may well prove impossible in the long run. I'm convinced it will require a basic changes in human society.

I think it means moving to a society where information is the corner stone for wealth not material goods. This would mean wealth would be focused on high tech items such as smart homes and electronics and a more electronic lifestyle over material goods. It would probably also include more interest in plans to create goods via automated synthesizers over the central manufacture of these goods. Hand made would be both hight quality and durable goods a art form. Synthetic goods would be designed for easy recycling and low production costs so the starting materials could be used for new goods. Obviously population control would be built into the society this is probably the biggest difference from today although it seems our wealthy countries seem to adopt population control naturally.

As far as growth goes the only place to go now is into space or the ocean so you would have to guess the society would eventually expand for real past the earth.

I was thinking about shorter boom and bust cycles then hundreds of years.

Making information the corner stone for wealth has the problem with information being easy and cheap to copy. Its not realy a problem since information both need to be widely distributed and interpreted. It would be good if information handling ability gave status. Hackers, teachers, librarians, moviemakers, etc.

Valuing quality over quantity and being happy with having smaller well though out homes, fewer long lasting toys, well made and repairable bikes, cars, computers, fridges, etc would be extremely good.

I dont see such changes as moving to another society. If they get trendy over 20-30 years it would be a smooth change that would save what is good with the culture I live in and its old traditions. People would not even have to feel poor. Its like a smooth urbanization and changing to bicycling, train riding and occasional care use. Everything essential can continue, its only a little different in how it is done.

There is a bit more to it. The change is not to accept this but to reject the throw away society of today. And long term I think there is a lot to it culturally. And of course the whole idea hinges on keeping populations low. Your right living within your means is not a completely foreign concept thank god.

As far as data wanting to be free I honestly don't know. I am a open source developer so I think about this. Right now our computer software is so incredibly primitive that I think its hard to grasp what a real computer based society would look like. Microsoft is certainly a culprit here but in general the vast majority of people cannot value software correctly much less support advances. Only the youngest children are growing up surrounded by reasonably usable software. Assuming at some point the monopolies holding back advances are broken imagine what software will be like in 50-100 years. I'm working on some fairly advanced concepts that fully integrate compiler theory into the final product.

We have never had self compiling adaptable software before so who knows what it can do. Sounds cool but this is a very basic concept and gives you some idea how primitive todays software is and its just the tip of the iceberg of things that don't tend happen when you have monopolies.

Since we have barely begun to build out the infrastructure for evolvable software that should be free so we have no idea what happens next. Right now its a matter of figuring out evolution then we can worry about revolution.

I dont think data wants anything. Its usually more usefull and influential on the future if spread around giving benefits to those who share data.

I agree that there are lots and lots left to do within the software field. I think this can help with making some and perhaps a lot of people happier and it can aid technological breakthrus but I can not count on such happening.

I'd like to repeat a comment I made on the drumbeat starting with

Why Cry Wolf ?

If you consider Nates post and WT bidding war model we are approaching a time when the remaining oil production will be bid on by the countries with advanced economies as they struggle to keep their economies functioning and hopefully growing.

This lead me to consider what if anything on earth is worth more than oil ?

The answer to this question turns out to be nuclear weapons and advanced conventional weapons system. It seems reasonable to assume that at some point nations will consider providing both nuclear and advanced conventional weapons to the oil producing nations in exchange for exclusive contracts.

This type of exchange makes sense because it accomplishes few things.

1.) It gives the country that makes the exchange more oil than its competitors.

2.) The competition's economies may fail soon ala demand destruction leaving more oil for the survivors. Esp since oil would not be equably distributed as would happen in a open market.

3.) The Oil producing economy is now armed against a attack by one of the other advanced economies or neighbors so they greatly increased security in this arrangement.

So a resurrection of the threat of nuclear war this time at least starting as a regional war or as warheads smuggled into countries threatening a oil producer is very high.

All out war or MAD is less likely at least initially in a sense this would be nuclear war by proxy.

So consider this possibility as we move into a time of constrained oil and high prices we will face our old enemy nuclear war again.

I think its much more reasonable to assume that nuclear-armed countries would be loathe to spread such technology around without remaining completely in control of it. If, for example, an oil-producing nation is "provided" nuclear technology for "exclusive contract" rights, what's to stop that country from reneging on the deal, and then daring the sucker of a country who provided it to do something about it?

No, I think the predictable response will be to dig out the old colonialism playbook -- as in Iraq -- where either an oil-producing nation will be outright invaded and controlled, or enough military advisers and troops are stationed in said country "for their own safety," to assure the same result. That being: the only way that another competitor can gain access to the oil is by militarily challenging the oil-producing nations nuclear-armed "patron."

The nuclear proxy option effectively checkmates the colonial approach. To give a concrete example if China strikes a deal with Iran to give them nuclear weapons in exchange for exclusive access to their oil it effectively stops the US from using the colonial gambit. If you want to take the traditional colonial approach its important to move fast and get your troops in place before someone changes the game.

For the western nations that are adverse to the cost and losses associated with a colonial style approach given that the other side will almost certainly receive high tech arms from other interested parties nuclear weapons are a great way to gain cost effective control of oil resources.

The US could take say the same approach with KSA. If we arm them first then Iran even if they obtained nuclear weapons would be effectively at a stalemate for some time.

Its easy enough to reject this today but I don't think it will be rejected forever. Maintain a traditional fighting force is horribly expensive a few well placed nukes are a lot cheaper and nuclear war via proxy makes a lot more sense than the old cold war. Its even technically winnable. One big reason we never had a nuclear war is it was tough to figure out a way to fight one and win. Not that anyone had any qualms on using nuclear weapons. With peak oil we get both the chance to use nuclear arms and a reason to use them.

As long as a limited exchange does not damage the oil fields it helps a lot in destroying demand in the producing countries.

Basically tactical nuclear weapons are the number one choice for causing needed demand destruction they can really make a difference if used in a semi-controlled manner.

In total your talking about killing less than a 100 million people we might lose a few American cities to smuggled weapons but this demand destruction will really help the rest of us since its a easy way to create a lot of very poor Americans that won't be using oil.

We get to keep our SUV's and more important its the cheapest why to power down and keep our oil based economy rolling.

You just don't want to many nukes getting into circulation.

There has been exactly one nuclear war. Two weapons were used and the other side surrendered. There were clear winners and losers in that war. It was called WWII.

Ghawar Is Dying

The greatest shortcoming of the human race is our inability to understand the exponential function. - Dr. Albert Bartlett

I'd assume if a nuclear resource wars occurred you would have more weapons used but of lower yield. I think you would be almost certain to have some collateral damage from smuggled weapons but you have to take demand destruction where you get it. As long as we can keep it to low yield weapons most of the demand destruction will be caused by the associated famine and conventional war not from the direct effects of the nuclear weapons. They just make a ideal way to initiate demand destruction and make it a lot easier to engage in aggressive occupation methods to control the oil resources.

I could easily see the US if it withdraws from Iraq giving a few low yield weapons to the Sunni faction to bomb Iran and key Shiite populations inside Iraq. And I'd say we would try to keep the score even. This would allow us to reenter with a more international force and be in a better position to control the country. I would think we would be able to fake the technology so it looks Russian or Chinese if we don't have low yield Russian or Chinese weapons. Russia or China could even be the culprits the beauty of a proxy nuclear war with low yield weapons is its almost impossible to place the blame.

This is just one scenario you can come up with when Pandora's box is opened hundreds are possible.

If its any consolation I don't think we will attempt to use biological weapons unless we can get a lot better at controlling them and normal famine is more than enough to accomplish the demand destruction we need to maintain the non-negotiable American lifestyle.

Lower yield? My gosh, man! The weapons used on Japan are considered tactical today! We're talking a 15KT and a 20KT nuclear warhead each for Japan. Tactical warheads vary in size from about 1KT to about 50KT (though a few can go higher still). Classic sizes are in the 5-20KT range. Strategic warheads are the ones in the hundreds of KT to MT range.

Exactly how much lower do you think they will go? 0.3KT? At what point is it even useful to use a nuke then? You DO understand how nuclear weapons work, right? You've read Glasstone and understand the basics? Once upon a time in another life I worked on nuclear weapons, both directly (handling/assembly) and indirectly (programming simulations).

The weapon of choice in the Middle East will be the B61 bunker buster for a huge variety of reasons. It comes in dialable yields from 0.3, 1.5, 5, 10, 60, 80, or 170 KT. I am expecting any B61 usage against Iran to be in the 5 and 10 KT range though they might try 1.5. I don't see the 0.3 yield as doing the damage needed for the targets currently under consideration, and frankly, given the hardened nature of the targets, I am not sure I'd trust a 1.5 to do the trick either.

And if you move beyond Iran to general usage, you want larger yields but you want air burst weapons instead of surface or sub-surface bursts. The way to take out refineries is via air burst, but for that you'd take the 10 or even the 60 KT choices (or maybe even the 170 KT choice). Against "soft" targets like a refinery, you want blast and overpressure and for that you want air burst.

P.S. You cannot fake a weapon unless you can get material from specific reactors. Each reactor has a signature that makes it unique and the weapons material for each major nation comes from a handful of reactors so you can tell who made it. The only way to keep your hands completely clean is to build a separate weapon in your black budget that is specifically to be used for this purpose and this purpose alone and which gets its material from a reactor that is not tracked or even acknowledged in any way, shape or form.

Ghawar Is Dying

The greatest shortcoming of the human race is our inability to understand the exponential function. - Dr. Albert Bartlett

Its my understanding that the US helped Russia dispose of some of its plutonium. I'd think that Russian plutonium would make the best choice for deniable nuclear weapons. Also I'd have to think the US if it wished and needed to could acquire Russian plutonium if it wished potentially posing as third world dealers. I'd assume China could do the same. Russia makes a handy source of deniable nuclear material.

Its not so important but even the use of misdirection is I believe possible. As far as air burst goes a simple airplane or helicopter could be used to hold the weapon so you don't need a sophisticated delivery. Simply dirty bombs also accomplish the same purpose.

I'm not trying to create strange scenarios on purpose just posing some ways you could create conditions that allow you to engage in limited nuclear war via proxies.

I would think that misdirection and plausible denials are important for waging nuclear war via proxy. Once you get past the first bombing its a lot easier to use mutual escalation as a reason to disperse more weapons and deterrents. If a few are used too bad.

If the US and China and other economies are facing the economic problems that may occur after peak oil I don't see that nuclear war by proxy is impossible.

I know they can detect a weapons plutonium source but is it also possible to determine the exact nature of the weapon from its explosion i.e can you distinguish if its one of these B61's ?

"Against "soft" targets like a refinery, you want blast and overpressure and for that you want air burst."

Actually you would want to go with non-nuclear fuel-air ordinance for these targets. You want to get back in there, right?

Right I can't see nuclear being that useful for these targets.

Outside of shear spite. Basically outside of using nuclear weapons for heavily fortified sites they are pretty usless as pure military weapons. We have better conventional arms.

Although seem to be very useful for balance of power games post peak via the proxy war scenario. This is of course simply using them as sanctioned weapons of terror.

I can walk back into an air bursted target in days and have near zero radiation issues. Only the people who were there during the burst are directly affected. About 2 weeks max and its more than clean enough to begin decontamination operations. Witness Hiroshima and Nagasaki. Our teams were in there within a few weeks. There was minimal fallout. Most of the radiation damage came from initial burst effects, not fallout. Fallout is only a significant problem in surface or sub-surface bursts.

Ghawar Is Dying

The greatest shortcoming of the human race is our inability to understand the exponential function. - Dr. Albert Bartlett

Ouch so Nuclear is more versatile than I give it credit.

This just makes the argument to use them in in a resource grab all the stronger.