Peak Oil - Whom to Believe? Part One - "There's Plenty of Oil, CERAiously"

Posted by nate hagens on March 28, 2007 - 10:23am

If you're like me, you might have spent a moment or two in recent months pondering how billionaire oilman T. Boone Pickens, oil banker Matthew Simmons, and many others are suggesting that the world is reaching Peak Oil now, and at the same time, Cambridge Energy Research Associates (CERA) headed by Pulitzer Prize writer Daniel Yergin, and others such as Exxon Mobil, are not predicting a Peak in global oil production until circa 2040 followed by a slow gradual decline. How can such smart and successful people disagree by decades on a topic so vital?

Is it possible they use different data sources? Do they mean different things when they say "Peak Oil"? Do they get different secret handshakes from Saudi princes? Do they have different agendas? Are they using different boundaries of analysis? Is one of them kidding? This 3 part post will address how people can differ so much on something so important as a peak and subsequent decline in world oil availability, addressing both factual and psychological reasons. Does the world have plenty of oil? Maybe, but as I will discuss below the fold, this is not among the questions we should be asking.

|

|

Part One is a general background and history on why people can disagree so much on peak oil.

Part Two will explore the many factual areas that are confusing and lead to different conclusions.

Part Three will look at social and psychological reasons for disparate opinions on this critical topic.

BIG PICTURE

Humans like to eat and have sex (1). We also are designed to compete with each other and other species for resources (2)(3). This function of population times demand will continue to increase, ceteris paribus.

We live on a planet subject to natural laws. The procurement and use of oil, a finite resource critical to our globally interconnected society, follows the 2nd law of thermodynamics. As we transform carbon from low entropy into human use plus waste, an increase in the 'heat loss' will occur as we find, pull out and transform the more difficult fossil deposits. Technology is thus in a battle with depletion, and so far depletion is winning. What once returned over 100:1 on an energy investment is now below 20:1. (4&5) The ease of finding, harvesting, refining and distributing liquid fuels to society, will continue to decrease over time, ceteris paribus. Yet we continue to rely on abstract (fiat) accounting methods to measure our real resource base - furthermore, the debt and credit that allow the world economic system to grow are increasing exponentially, while at the same time the real economic driver, cheap availability of high flow rate liquid fuels, is becoming more scarce.

Peak oil, as will be discussed below, has many definitions. Simply put, it is about one important intersection of the above two trends. It represents the general time frame when human demand for the energy services derived from oil will permanently diverge from our capacity to provide them. In effect, though the resources exist, we will not be able to afford the prices necessary to procure them for a global democracy.

Modern human culture, capitalism, globalization, food production, and essentially all aspects of life as we know it (unless *we* are Amish, 3rd world, or off-the-gridders), centers around oil, electricity and natural gas. Peak Strawberries or Peak Snapple obviously wouldn't be as big of deal.

Peak Oil is not a theory. It is a fact. Only the timing, magnitude, and implications are open to interpretation. How we interpret them should be a top priority for us individually and collectively. This post addresses why there are so many disparate opinions on this subject - many are concerned - many are unconcerned - many flip/flop from being concerned to unconcerned, etc. Why?

PRE-AMBLE

There exists considerable rancor between increasingly polarized groups on this topic. Many names for the two camps have been used: cornucopians/doomers, optimists/pessimists, pollyannas/cassandras, etc. I prefer to group them as the 'relatively unconcerned' and 'relatively concerned', as it is the level of concern that will motivate near term actions and policies. So far, the 'unconcerned' group (which includes the 'unaware') comprises the vast majority of the population.

I obviously am in the 'concerned' camp. For people interested in my motives, here they are: - I am getting my Ph.D. in Natural Resources specializing in the energy/human nature side of the Peak Oil problem. Like my fellow Oil Drum contributors, I offer my time freely because I believe this issue needs to be urgently addressed, especially at the regional, local and community levels, due to the long time lag between policy change and meaningful response. Neither the mainstream media nor the scientific community have connected enough dots to communicate the urgency with which this problem needs to be addressed. My writing here is an attempt to get people in macro-policy and decision-making positions to think in ways that exposure to typical media and stimuli-laden schedules may not elicit. If my efforts result in a slight course change of current misguided energy and environmental policy or help citizens or communities better prepare, the effort will have been worthwhile (and, if I should randomly receive an email from a single, attractive off-the-grid farmer, I would view that as a positive externality (female only pls...)

AND NOW, A WORD FROM THE UNCONCERNED

CERA and Exxon are probably the most vocal oil optimists (not all oil companies are inherently optimistic, as evident by some Chevron and Shell ads). Here are three recent reports and interviews by CERA and Peter Jackson:

- Why the "Peak Oil" Theory Falls Down - Myths, Legends, and the Future of Oil Resources

- Peak Oil Theory Could Distort Energy Policy and Debate

- There is No Evidence of A Peak in the Next 10-15 Years

Some of the main points of these pieces include:

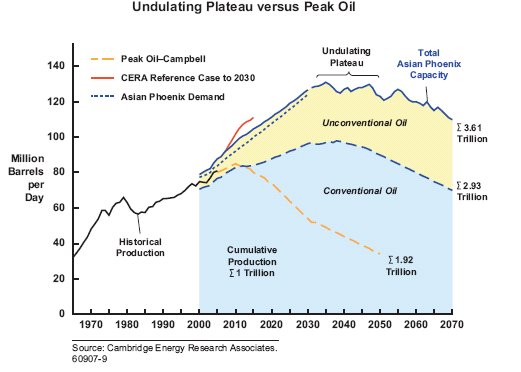

- Based on a detailed bottom-up approach, CERA sees no evidence of a peak before 2030. CERA believes that we will see an undulating plateau of global production starting sometime after 2030, which is likely to last for a number of decades. Towards the end of the plateau period, we envisage that global production will decline more gently compared to the very rapid production decline predicted by the peak oil lobby**.

- We hold that aboveground factors will play the major role in dictating the end of the age of oil.

- Despite his valuable contribution, M. King Hubbert’s methodology falls down because it does not consider likely resource growth, application of new technology, basic commercial factors, or the impact of geopolitics on production. His approach does not work in all cases—including on the United States itself—and cannot reliably model a global production outlook. For example, production in 2005 in the contiguous 48 states in the United States was 66% higher than Hubbert projected.

- The peak oil theory causes confusion and can lead to inappropriate actions and turn attention away from the real issues. Corporations, governments, and other groups, including nongovernmental organizations, need to have a coherent description of how and when the undulating plateau will evolve so that rational policy and investment choices can be made. It is likely that the situation will unfold in slow motion and that there will be a number of decades to prepare for the start of the undulating plateau.

**There is no such thing as a 'peak oil lobby'. A) we have no money and B) lobbying implies pursuit of special interests; educating society about Peak Oil is in the interest of the global commons.

A FEW WORDS ON WHY THE CORNUCOPIAN THEORY FALLS DOWN

Before I add my own thoughts to this debate, here are some recent rebuttals of CERAs claims, predictions and analysis:

- Dialoguing with Dr Peter Jackson - Is the Future of Oil Resources Secure?

- The Forecasting Record of CERA and other Commentators

- Does the Peak Oil "Myth" Just Fall Down? - Our Response to CERA

- An Open Letter to Peter Jackson of CERA

- Its CERA Week and Houston We Have a Problem

- Peddling Petro-Prozak - CERA Ignores 10 Warning Signposts of Peak Oil

- Does TheOilDrum Threaten CERAs Market Share?

Some of the main points of these posts include:

- CERA conflates reserves with resources

- CERA conflates productive capacity with productive flows

- CERA misprepresents what King Hubbert modeled, and how subsequent modelers use linearization methods.

- Approximately 50 countries have already peaked, more are peaking or about to peak (China, Mexico)

- So far the discovery forecast that CERA uses from the USGS is 77% too optimistic (see here)

- CERA's track record on individual countries is poor because its been too optimistic (see here)

- CERA needs to publish production intervals (i.e. a lower bound + a higher bound) not just production capacity.

- The Hubbert high forecast was spot on for the lower-48 (1% error on the 2005 cumulative production after 40 years!)

- Unconventional sources are slow sources of oil (low flow rates)

- Energy profit powers civilization. It is unlikely we can afford the substitutes to cheap oil in a timely fashion, a fact which will likely accelerate oil decline rates.

- The Super-giant fields with high flow rates are dying (Ghawar, Cantarell, Burgan etc.)

- Reserve growth remains unproven at the world level and is based on observed reserve growth for the US (Attanasi et al.) which is likely biased due to the inclusion of censored statistics

- CERA fails to acknowledge (or realize) that the long list of 'above ground factors' exist precisely because of increased geologic constraints on 'below ground resources'

- The best technology in the world and higher prices did little to change the production profile of the United States, which peaked in production in 1970.

- Ultimately its not about how much oil we extract or what year this level peaks, but what contribution energy makes to society. Our institutions and policies are based on inexpensively substituting human labor with fossil labor. If we have plenty of fuel but it costs 3X as much, this substitution breaks down

MAN ON THE STREET

As with my last article on discount rates, I thought I'd include an interview with one of my friends, who happens to be an energy broker at a middle-tier Wall Street firm. His name is John (not really).

Nate: Yo Johnny - how's it going?

John: Not lousy Nate. I'm sure your environmental friends are dancing a jig on this TXU deal but they are going to be singing a different tune in 2009-2010.

Nate: Why is that?

John: They defeated the construction of new coal plants. Texas needs that energy man - there are going to be blackouts in a few years and not just sporadic ones. Someone else will have to build those coal plants.

Nate: I didn't know that - perhaps we can talk more about that another time. I'm writing another Oil Drum piece. Did you ever read my last one on how we steeply value the present over the future?

John: Um, I actually started it then got called away - It looked real good. But maybe you should put the summary points up top so busy people can get the special sauce without spending 20 minutes trying to read everything - you are kind of wordy you know.

Nate: Thanks for that. So what do you know about CERA - I am thinking about writing a piece criticizing their criticism of Peak Oil. Are they respected? Do your clients talk about their research?

John: They are respected. Probably upper 25%. Real mensa types.

Nate: How can they realistically disregard net liquids and flow rates and instead focus only on productive capacity, which in the end is basically just an academic exercise?

John: Hey man - they are not policy wonks - they try and make money for their clients and thus themselves. CERA is a cash cow for IHS Energy. Their clients think the same way mine do - their long term strategy is to make short-term profits. So if they paint the oil picture a certain way thats advantageous to their clients, they make money. And it's all about money man. And what do you mean, net liquids?

Nate: Actually it's not all about money. But thats a different topic. Do your clients agree with the cornucopian rhetoric behind those recent peak oil denial reports from CERA?

John: Cornucopian rhetoric? Man have you turned into a philosopher or something? Like I said, my clients are looking at how to make money in the oil markets over the next 6 months. They realize Peak Oil probably is for real but still view it from an investment perspective, not a life perspective. My smartest clients think that CERA is using 2007 geology with 1970 cost structures and 2050 technology in their projections - but the story still sells. CERA has smart people but they're definitely drinking the kool-aid.

Nate: Do your clients understand net energy? That producing energy requires energy and this comes out of a shrinking pool as the quality resource depletes?

John: I think less than 5% of the street thinks of things that way, and most of those are the analysts. The ethanol debate started people thinking about net energy but most everyone still thinks in dollar terms.

Nate: But don't they realize that oil is finite and dollars are not, meaning this increase in oil prices is going to accelerate once we permanently cross peak in net oil available for purchase?

John: There is the beginning of such conversations. Obviously with $60 oil, the E&P sector should be printing money, but alot of companies' costs are going up more than their revenues. New finds of oil are really expensive, especially domestically. Chevron, with all the hoopla a few months back, has still not sanctioned Jack II. I'm guessing it's cost related.

Nate: But do you thi---(phone rings)

John: Nate buddy. I gotta hop. This is one of those clients whose long-term strategy is short-term profits. Later.

Nate: Bye

REASON #1 - THE PHRASE "PEAK OIL" MEANS DIFFERENT THINGS TO DIFFERENT PEOPLE

When someone says 'oil has already peaked' or 'peak isn't until 2020', what do they mean? Peak Oil can (and will) have many definitions. It would benefit policy debates and discussions if there were a universal, agreed-upon definition. The most common is the year in which global crude oil production reaches its maximum sustained level, followed by a permanent decline. Some (Ken Deffeyes) define Peak as the date when 50% of the world's oil has been used irrespective of the annual flow rate (presumably, we could have used 50%+ of our oil and still have rising production if technology is allowing us to borrow from what would have been a bell shaped curve.)

Other definitions differ in what is included as 'oil'. The most restrictive includes only oil graded as "Light Sweet". More common definitions include condensate and Natural Gas Plant Liquids (NGPL). Still broader definitions include the heavy oils, the Orinoco oil sands, and the Alberta tar sands. And the broadest measure of 'what is oil' might include corn and sugarcane turned to ethanol, palm nuts turned to biodiesel, and coal turned to diesel fuel. This is referred to as "All liquids" and is what is commonly reported as total oil production in the media.

Ultimately, we want oil for the energy services it provides. None of us should care about how much daily or annual gross oil production of this and that there is, other than these statistics being precursors to a more important statistic: the cost of net liquids available to the non-energy, non-governmental sectors of society. This is the oil that is able to 'do work' for the world economy. As I will discuss in Part Two, gross statistics are misleading on three counts: 1) NGPL and ethanol have lower BTU content than crude oil yet are counted the same 2) procuring energy requires energy - a low energy requirement product is counted the same as a high energy input product and 3) following best first principles, depletion eventually overtakes technology, until one day an energy break-even point is reached in the extraction of a resource, irrespective of price. Total costs (since it is difficult to parse all inputs into energy), will reach break-even well before energy break-even. Thus future projections that assume oil in 2040 has the same ability to do work for society, after its energy costs have been subtracted will prove to be wildly optimistic. But once peak production is passed, the decades away peak camp will rationalize it as something other than geology - (more on our psychological reactions to Peak Oil in Part III...)

References:

- Malthus, Thomas, "An Essay on the Principle of Population" 1798

- Williams, George "Adapatation and Natural Selection" 1968

- Lotka, Alfred J. "Contribution to the Energetics of Evolution" 1922

- Cleveland, CJ, "Energy Quality and Energy Surplus from the Extraction of Fossil Fuels in the US" Ecological Economics 1992:6 139-162

- Cleveland, CJ, ""Net Energy from the Extraction of Oil and Gas in the United States"(pdf)

Coming up next

PEAK OIL - WHY SMART FOLKS DISAGREE

and

Nice piece. Liked the bit with "John."

Curious:

Could "John" elaborate more on how CERA makes money for its clients?

Nate,

You are a gifted writer, that is a great piece! I am really looking forward to the next 2. Qualiy is WAY better than most news reporters, you should submit to a printrag!

(English Teacher Wannabe Mode) I was almost euphoric to see your use of the uncommon word "disparate". But then the euphoria evaporated when I saw you abuse "illicit", which you are no doubt DO'H!-ing right about now. (/English Teacher Wannabe Mode)

DOH

that was freudian. its been changed. thanks

especially when TOD is cutting into CERA's market share:

http://resourceinsights.blogspot.com/2006_11_01_archive.html

Re: The Recent Debate Regarding the HL Model

Deffeyes says that the world peak could be as late as 2008.

Robert says that the world peak could be as soon as 2009.

And the difference is?

Re: The Cornucopian Position

Regarding ExxonMobil and CERA, IMO they are motivated by two things: (1) They largely believe what they are saying and (2) They are trying to forestall punitive taxation, i.e., the major oil companies need all of their cash flow to put production on line from trillions of barrels of "resources."

The problem with the ExxonMobil/CERA position is that they are, in effect, encouraging Americans to continue borrowing money to maintain their SUV/Suburban lifestyle.

OGI announced yesterday that a 2 billion barrel (guestimated) field was discovered in Bohai Bay, China. There might be more oil in the South China Sea disputed areas.

Mexico is probably getting overconfident with its Ku- Maloob-Zaap nitrogen injection. Cantarell was a larger field and the nitrogen injection schema only boosted production a decade, the drop off in production in their largest field is of the steepest type. Mexico will need to tap into its onshore heavy oil resources. That takes time, it might take more expensive upgrading also.

North Ghawar was reported as watering out. I have read that there are many different parts of Ghawar and much is not published. The Saudis yet have on a website that there are 75 billion barrels of recoverable oil in Ghawar. I think that might closer to remaining oil in place, and that most of it may not be recovered with current technology. Ghawar was described as past peak. I recall OPEC had advertised a million barrels a day plus in production cuts, OPEC is something that might obscure peak forecasting.

National Oil Companies might need more money for E&P to replace declining production or temporarily boost it like Mexico did. National governments need to take more funds from NOIC's to fund growth.

I think Rex Tillerson's 4 year investment plan for XOM is a failed plan, even as defined by his own terms. He plans to spend 20B a year for 4 years to increase capacity by 1 Mb. That's not net, btw. That's gross. Not only am I unconvinced that he'll gross that amount, but, I also conjecture he'll be spending more than 20B a year the second two years.

It's a stupid plan fraught with exploration and cost escalation risk, especially when there are at least 10 E+P companies already trading on the exchanges that he could buy. Everyone from Suncor to OXY, to Devon, the CNQ, NXY, Anadarko, and so on.

But Rex Tillerson's need to believe in the traditional model is so strong, he can't consider the possiblity that his plan is higher risk and will spend the money to prove it, (dammit!).

Other interesting examples of stubborn belief include the public beleiving that Dan Yergin is "an oil expert", and/or that Rex Tillerson understands or even cares to understand the price of oil. Neither are true of course, and even Rex has tried to tell us in as many words. When he was first made CEO of XOM he was asked about the high price of oil and said "I have no idea why the price of oil is where it's at, and frankly I don't care. It's not what I do."

A very honest response for a man in his position, imo.

When Matt Simmons says he won't be investing in XOM, he too is being quite honest and knows exactly what he's saying.

Tillerson is now essentially running an Oil and Gas Trust. He trumps up the gross production capacity he wants to achieve, while carefully avoiding the net, and meanwhile he's really spending capital buying back XOM shares. And Yergin is really just a Front Man for CERA, a Hood Ornament--a kind of accidental expert--who is wise enough to never, ever say anything notable, that hasn't already been said by someone else.

Interesting world.

Gregor

If you are so inclined, this is just a reminder to upvote this at reddit, digg, stumbleupon, slashdot, and other linkfarms.

This is an important piece and we need to get Nate as many readers as possible.

Nate wrote:

Now we know why you retired your LastSasquatch moniker! Seems even aspiring peasant women have limits to their atavistic tastes. :-)

Nate,

Love your Socratic dialog with "John".

That so pegs it on how our Attention-Deficited Money-Directed (ADMD) culture operates.

We are each so programmed into thinking of everything in terms of money ($$$) and social prestige (mensa-types, ha ha) that we cannot begin to grok the world in any other way.

(P.S. Recently I was watching CNN's Anderson Cooper doing a story on cults, brain washing and more specifically the Heaven's Gate group that drank the Kool Aid as the Hale Bob comet came flying by because they thought that was their ride to the next dimension if only they free themselves of the mortal Shell. The funny part was that Anderson was wearing a pin stripe suit with tie, his expert was donned in suit and tie, and they were laughing at how the Hale Bob bobo's could ever allow themselves to be brain washed. Hello Anderson. You're wearing a rope around your neck! Don't you see it?)

thanks, i have more on that, but understanding the ADMD of the people we are trying to reach, i doubt anyone had 1-2 hours to read this post so broke it up. Cultural memes are strong forces. That currently is a curse but could turn out to be a blessing - we'll see.

Brainwashing is a very interesting subject. The vast majority of people do not realize their own predilection to brainwashing. Almost everyone on earth have been brainwashed into taking certain things on faith, though they may believe their beliefs are based on sound scientific evidence.

The talking heads on CNBC have been brainwashed into believing that Saudi Arabia and the rest of the Middle Eastern countries have vast amounts of oil and can increase production at any time. There is absolutely no scientific evidence to support this silly notion. But there is lots of propaganda to support it.

And I really hate to be a nitpicker Step Back, but it's "Hale-Bopp", not Hale Bob.

Ron Patterson

What is even more interesting than brainwashing -- which is after all as old as civilization itself -- are the tactics people adopt to try to avoid it.

One tactic is to fasten one's mind very tightly onto a handful of scientific first principles and then to attempt to organize the overwhelming complexity of the world through that lens.

I imagine that this has been done ever since Newton's time as science waxed and religion waned, at least among the cognitive elite. There's isn't much that isn't amenable to the Three Laws of Motion or some slightly approximate popular version thereof. For instance, even stating "What goes up must come down" can be highly informative and even reassuring if one is beleaguered by a priapism. But, of course, Newtons Laws apply to much more than one's private(s) life. They pretty much explain all things political and social or at least give a good approximation.

Of course, we have since gone on to apply quantum mechanics and relativity to equally good effect but on a disappointingly smaller audience.

I hereby posit the Laws of Usefulness of Scientific First Principles for the Avoidance of Brainwashing

(1) For a principle to be useful, the broader public must be convinced that they can have a vague clue about it.

(2) The scientifically minded layman, after reading a couple of popular works on the principle, must be capable of feeling he is one of the elite few who now understands it perfectly.

Asebius,

Best comment ever! That had me laughing! Written as only a true linguaphile can write!

For anyone who didn't get Asebius' very funny comment, look it up. It's worth it.

http://dictionary.reference.com/browse/priapism

(I guessed your enjoyment of words when you used 'revenant' in a previous comment, although I would have used 'atavism' or 'atavistic,' myself, since a Sasquatch is more of a throwback than a ghost. Not that I'm a cryptozoological expert!)

[atavistic is indeed better, i think i'll go change it ;-) ]

That's for sure - most people believe in something supernatural, whether religious or new age or paranormal, etc., despite the total lack of falsifiable and verifiable evidence. That scientific naturalism is so very rare in this so-called "modern" age is proof positive that most humans are basically just talking monkeys. James Randi will give anyone 1 million dollars who proves a single supernatural phenomenon (and the preliminary test set-up is actually very forgiving - yet no one ever makes it to the more scientifically rigorous test, because there is no such thing as magic - only fallible human minds).

Simple-but-false memes which reinforce what people want to hear will ALWAYS succeed over complex logical-reality-based memes which challenge misconceptions. This is true whether you are talking nutrition, religion, or whatever. Thus, only when the cultural zeitgeist has evolved to where people ARE PRIMED BY DIFFICULT CIRCUMSTANCES TO BELIEVE - only then will the simple logical facts surrounding peak oil penetrate the masses. There is probably a threshold that has to be reached, and it could probably happen damn quickly after energy descent gets undeniably viscious. Humans are meme machines not truth machines.

The free market meme easily triumphs over the peak oil meme precisely because there is no thinking (or documentation) required, whereas even the most wonderfully distilled peak oil meme is significantly more complex.

Actually, ALL of us are talking apes except for the few who can't talk.

New excuses are fabricated every time another animal is observed using tools or communicating with a species mate.

I like to think that our brains were not designed (by evolution!) to look objectively at facts and come to logical conclusions. They were designed to listen to our physical and emotional needs and define actions that will secure resolution of those needs. Learning and applying the scientific method is extraordinarily unnatural. It is so unnatural that humans that develop the ability to use it need to compartmentalize it in their brains so that they can lead a normal life among other humans.

That nicely explains engineers and astrophysicists that go to church and why men get married.

There must be some evolutionary advantage to religeous belief for it to be so prevalent and persistent over the millenia. Religeons provide the basic rules of community life and the mythologies around them describe our relationships with each other and with nature. It is a belief of my faith community that all things are spiritual and that there is no separation between science and true religeon. We are not biblical literalists and assert that nature is another way God reveals himself and his will for our lives. I believe religeous belief can be as self correcting as science claims to be as we do our best to promote communities of love, hope, faith, and peace. Belief that grace taught by Jesus of Nazareth is not rooted in magic but is an empowerment to keep trying to improve the quality of life of all people. The grace extended to us allows us to extend grace to those who have offended us and break the cycle of revenge which has left so many blind and toothless. Not all Christians believe these things. Some Jews, Muslims, Bhuddists, and others do.

The threats of peak oil and global warming calls the body of Christ to act as the savior of the world and to offer a voice of hope while doomers scream that all is hopeless.

"Learning and applying the scientific method is extraordinarily unnatural."

You couldn't have said it better.

I would only make one suggestion to this analysis:

Too much is focused on "our physical and emotional needs". This is implying that humans tend to act as individuals.

After observing the way kindergarden mothers adjust their views so quickly to compensate for each others' view (and all the unnecessary talk that goes along with it!!), I would place common opinion/belief much higher than any physical needs out there. Except, of course, in a dysfunctional/collapsed/broken society.

Groupthink is about a zillion times more prevailent than any scientific method...

---------

My grandfather pumped oil with an engine-house,

my father pumped oil with a 20 lb. electric motor,

can't I just pump it online?

Evolution does not "design" anything. Evolution is not some form of "intelligent controller" (intelligent designer) that lurks out there and forces things one way or another.

Our brains are the result of random scrambling. There was no "design". It just so happened that a bunch of random mutations (from among all other mutations that failed miserably) did not fail miserably and managed to squeak by with a D- instead of an F grade in the great school of hard knocks and competitive survival.

We humans do not choose to "compartmentalize" things in our brains. Instead, our brains are the messed up compartments.

You have a chicken/reptile compartment up there in the attic, as well as a herded sheep compartment, and finally some miniscule compartment that fools itself into thinking it engages in "rational" thought.

It is the herded sheep compartment that urges engineers towards going to church and towards huddling in Dilbert cubicles. Once inside the cubicles, they engage on rare occasions in some rational thought. (i.e., Let's see. I went through a graduate engineering program, busted my ass, all so that some business degree major can now control my life. That makes me "smart" and her "stupid".)

Can you say Mooh? How about Bah, Bah?

Can you say Bah Humbug? --See? That proves you are a sheeple and I'm a sheeple. Relax. I engage in religious activities also. It comforts the sheep compartments of my "designed" brain. :-)

One thing I would like to say is Peak Oil is a economic event it occurs when supply cannot meet demand and gets worse as supply decreases. So peak oil in the economic sense occurs when cheap oil peaks.

So even on a global scale this core issue is supply and demand

even if we had more oil and supply was not going to decrease for say 30 years we are in a peak oil economic model the moment demand is not reached.

Now drop down to the individual level this means that for each person they experience peak oil in two simple ways.

1.) They cannot afford the oil (Demand Destruction)

2.) They can afford it but supply constraints cause shortages.

Bill Gates will never experience peak oil in the first sense. But even he its not immune to the second case.

The point is regardless of how much money you have your oil

usage will decline as overall oil production decreases simply because its impossible to subsidize all the goods and services you use that depend on oil. So literally having all the money in the world does not help.

And more important the social impact as more people suffer demand destruction is huge.

Just like the theory of peak oil is based on the peaking of well then fields and regions the effects of peak oil occur as each individual gets less oil this month than last month.

And to be more specific its when the total EROI/price peaks and declines.

We can argue the date of geologic peak but its becoming clear that the chances for a lot of new production capable of offsetting current declines are slim. OPEC has signaled that they will not allow prices to drop even if we have the oil.

Next prices indicate that demand is strong even at higher price points and we are supply constrained. World events indicate that the poorer parts of the planet are suffering demand destruction now.

So as far as the social and economic consequences go we have already reached peak oil. The geologic peak and decline is simply going to determine the rate at which the oil economy falters then destructs if we do nothing.

I know I'll be shedding a sorrowful barrel of tears if Billy experiences any hardship.

Leave no billionaire behind!

`Investment Porn' Panned by DFA Funds Preaching Fama's Gospel

By Seth Lubove

http://www.bloomberg.com/apps/news?pid=20601109&sid=aX85KTTfho.M&refer=home

In light of the conversation with "John," I thought this was an interesting look at market types that wouldn't even bother to ask CERA.

I wrote my masters thesis under Gene Fama. I got an F on the midterm but an A+ on the term paper titled "Why the Millionth Monkey Lives in Vegas" about how sports gambling markets were similar in herd mentality to financial markets.

Without getting to far off topic, I dont believe in efficient markets - though MOST people would be better off just buying the indexes.

More relevant to this discussion is that the 'markets' are the ultimate resting ground of the wealth created from natural resource extraction. Even at 10:1 EROI there is a 1000% return on oil that gets circulated through the economy. But what is the minimum EROI that can keep the 'fixed' component of the system going - let alone have any 'marginal' energy gain left over for growth. We are not only fighting depletion, but population. This will sound heretical, but I expect the end of (global) economic growth within a decade.

Can you share a copy of your midterm paper? That sounds interesting. I used to work for a broker and did some analytical work on peoples decisions to buy or sell a position. My conclusion is that it is all a 'crap shoot'.

If we have peak oil this decade, it cannot possibly be otherwise. As our energy slavs start to disappear, industry will start to shrink. Energy drives the economy and liquid energy, fossil oil, is the most efficient driver of them all.

Energy Slaves:

http://transstudio.com/2006/01/energy-slave-equivalency.htm

Ron Patterson

Ron I agree.

But it could possbily be otherwise. Here are the reasons:

1) its possible (though highly unlikely) that high net energy sources like large scale wind will be scaled in time to meet up with the depletion of lower net energy fossil fuels. remember right now large scale wind has higher energy return than new oil - its just that we have alot of 'old oil' in the ground.

2) if we use wind and coal (still high EROI, but dirty) to transform transportation grid to 50% electric, we could still have economic growth

3) some event reduces human population by 1/4 to 1/3 then there could be economic growth after that

4) some miracle like nuclear fusion or some way to safely access methane hydrates, etc

5)regions, countries, locales, etc that bite the bullet now (at cost of current economic growth) to create future based less on fossil fuels and more on sustainable flows could have growth - or at least steady state, but not the world as a whole

but if we (collectively) continue on the present course, assuming technology and capital create wealth, then I agree with you.

Your comments above are one reason I am firmly in the doomer camp. Essentially all efforts are toward maintaining some version of the growth paradigm/status quo. Realy, what is needed is a new societal meme not wind turbines and light rail.

As Greer argues in his Tuesday essay on EB, the same thinking that got us into this mess is unlikely to get us out of it.

Why does everyone forget/ignore nuclear fission? We've covered it here over and over and the overwhelming conclusion is that nuclear power is certainly viable enough to meet our future energy needs for as long as we care to project.

That wasn't *my* overwhelming conclusion.

Anyone see Roger and Me, wherein the flailing town of Flint MI keeps trying to prime the pump with massive (and massively stupid) projects (a theme park, a luxury hotel) which fail spectacularly. They eventually build a large prison.

WRT Cool Hand Nuke, I think nuclear plants will be built, using a lot of public money, and a few people will make a lot of money. The plants will lose money, but will keep the power on in certain neighborhoods.

I expect the much the same of Clean Coal and Mighty Wind.

Collectively most of us set at the apex of a great pyramid or better ponzi scheme based on continued economic expansion and cheap energy. We are far close to the top than the bottom.

The problem is its generally impossible to conceive of the pyramids intrinsic structure failing by those inside it. Even the biggest doomers still think the overall status quo will be maintained i.e the wealthy will stay wealthy.

Events such as the Russian or French revolution are not considered even though structural failure increased the probability of dramatic changes taking place.

I think that the reason this occurs is pretty simple when your dealing with a system that is exhibiting exponential growth the event that causes it to unravel or collapse is generally small. Slight changes in resources or other inputs results in a sudden massive collapse of ponzi based systems.

I'm not being a doomer really just pointing out that the system seems unstable if its effected structurally.

I guess I'm not a very good doomer :-(

Some of the wealthy are awfully well-entrenched, and only a political revolution could dislodge them. Until then, some wealthy folk will find that their cash cows have run dry, and will be replaced by fast-thinking and merciless schemers, as in the FSU. AIUI, there is no shortage of very rich people in the FSU.

Speak for yourself Memmel, I do not believe that at all. You brought up the French and Russian revolutions. The wealthy, especially during the French revolution, were the ones who lost their heads. During the Russian revolution, they simply lost everything and were wealthy no more.

When things get really bad, anarchy will reign. People will look for someone to blame for their prediciment. The wealthy will make a juicy target for their rath. But in the end there will be no winners, only survivors and not too many of them.

For those who are truly curious as to why I am such a doomer you might try reading “Overshoot” by Catton or “The Spirit in the Gene” by Morrison. But if you only have about twenty minutes to devote to research into why civilization must collapse with the disappearance of fossil fuels, then you should read “Energy and Human Evolution” by David Price. It is available from at least a dozen places on the web including the Dieoff.Com.

http://dieoff.org/page137.htm

Ron Patterson

Well most people :)

The point is the economics is a three legged stool.

1.) Monetary Inflation

2.) Forced Production

3.) Cheap energy

Monetary inflation forces investment into production of real goods and services to maintain and increase wealth. Efficiency gains ensure the the poor get a little wealthier and cheap energy feeds the production engine. The mania of greed ensures the cycle continues.

You can't knock one leg out without collapsing the whole scheme. For example this says the dark ages had to follow the fall of the Roman Empire. Until you clear out the old system and if your based on renewable you give a chance for trees to regrow land lies fallow etc and finally you can return to growth the key is once you go downward you can't resume growth until cheap energy/land is available again.

I cannot see how any sort of soft power down can actually succeed unless it done with a radical change in the way the economy works. I would not call the middle ages a soft landing but in a sense the creation of the serf based economy once large tracts of land where abandoned and granted to the new rich had to happen before the slide could be arrested.

In short you have to go through this period of lawlessness

which allows power/land to be grabbed before you can rebuild.

Russia is case in point several times over.

How to avert it ?

I don't know the closest solution I can think of is for everyone to basically redistribute the wealth evenly to avert a collapse. This is just being proactive on what must happen anyway. And most of the remediation approach have this sort of selfless sharing as a key feature.

But I can't see this happening since you basically need to initiate the collapse and control it on purpose.

To some extent Europe and Brazil are trying this approach but even they are doing too little too late. Robin Hood does not work in real life. People are selfish and believe they will be the ones that will come on top once the dust settles. They know their will be new lords and they want a spot at the table. I must say that even I believe that since I think I understand whats going on I might be able to come out better then the average joe. Its intrinsic in human nature. In reality I could easily get hit by that stray bullet if trouble comes.

I've ready my Morrison (although my copy's lost, I wonder who liked it so much as not to return it?). I've read dieoff since 1997. Catton I've only skimmed, I'm ashamed to admit.

And still I couldn't be doomed.

Yes, probability for serious events is likely more than zero.

Yes, some of the causal chains look pretty grim and hard to avoid.

Still, things are systemic and to some extent, unpredictable.

We as observers are bounded by our rationality. Things will emerge (good and bad) that we never expected.

This doesn't mean that one needs to be a cornucopian or a simple-minded techno-utopian.

It's just that: we don't know. It's not possible to know. Nobody has a crystal ball.

As such, that best option is, imho, still to work for an improved situation while also preparing (at least mentally) for something not so optimal.

Preparing for the collapse of a society in all of it's levels is practically the same as working towards it.

There's no fate, but what we make ourselves.

Granted that we've been "making it" for the past 100 years or so with pretty constant single-minded obession :)

I'm afraid that I am not yet convinced of the long term (100+ Year) viability of nuclear.

Maybe it's just me, but I have this concern about jumping from the frying pan into another frying pan. Two years of reading TOD has left me skeptical about every resource.

There are compelling and irrefutable statistics about the abundance of uranium in the Earth's crust, but I have yet to see a high-quality, deeply-researched paper on actual uranium recovery that supports long term viability. I have read several credible reports that point in the opposite direction. (And I've read, and taken into account, the criticism of those negative reports.)

What I'd really like to see is a solid analysis of nuclear power, something of the quality of this doctoral thesis on oil fields.

I'm not posting this to argue -- I've changed my mind on many things since I started reading TOD. I'm honestly seeking information. I promise that I will read and consider papers and reports that support your position that you would care to reference.

If my meager math skills serve me it would take 1245.58 nuclear power plants to match the US current use of energy. I'm overwhelmed.

For those that believe that illegal beaner immigration will solve our gas problems.

Raymond James: Excluding Hurricane Rebound, 4Q2006 Gas Output Down 3.2%

from NGI's Daily Gas Price Index March 27, 2007

The last three months of 2006 resulted in a 6.3% upward move in U.S. natural gas production from publicly traded companies, mirroring the upward trend from 3Q2006, but essentially all of the output rise came from the rebound following the hurricane-related production deferrals in late 2005, Raymond James & Associates energy analysts reported

One factor which is not widely appreciated is that in most cases we do better to average the opinions of diverse experts than to rely on any one person's opinion. This paper begins:

http://faculty.fuqua.duke.edu/~clemen/bio/Published%20Papers/13.Combinin...

Applying this to the Peak Oil question, where there are a diversity of viewpoints, we could average the position of what you call "concerned" and "unconcerned" regarding such topics as (A) when oil production will peak and (B) at what level.

So based on your graph up top, along with recent discussions here, we could start with four predictions:

TOD "consensus": peak in 2006 at about 80 MBD

Campbell: peak in 2010 at a little higher, maybe 82

CERA: peak in 2030 at, what, 120?

Asian Phoenix: undulating plateau past 2030 at about 130

Averaging these gives a peak in 2020 at about 105 MBD. Not what a Peak Oil "true believer" wants to hear, but that's what you get when you average.

Actually you could consider me a peak oil 'true believer' and I would LOVE for peak oil to be 2020! Ill happily eat crow for 13 years if I can continue my lifestyle and society has that much longer to prepare.

But as youll see in part two, 105MBD of what? and how much of that would we get to use?

What do make of the idea that Peak Oil happened 30 years ago? (on a global capita basis as Al Bartlett has pointed out)

well, Im not sure to which you refer, here are two datapoints:

Richard Duncan, who writes about "Olduvai Theory" which I will have a post up on soon, points out that 'e' or energy per capita peaked in the 1970s, went down and is just now reaching its 1970 peak. Of course, we pump more oil than we did then, but there are almost twice as many people.

Broad indicators of progress (as opposed to narrow like GDP) such as the GPI (Genuine Progess Indicator) actually show a double peak in 1960 and 1980 and smooth decline since 1980.

As I will argue in Part II, the net energy available to society is more important than the gross energy per capita. Its possible that this peaked 30 years ago, on a per capita basis, but clearly not for wealthy countries. So one hypothesis is the decline in total net energy has been disproportionately allocated to rich countries away from poor - i dont have the data to support that claim but it makes sense.

I believe that Bartlett just divided MBpd by the global population and came up with a certain number of liters per day - which peaked in the 1970s and has been going down since then.

On a global per capita basis oil consumption has been "flat" at 4.45 (mean) barrels per person per year since 1982.

S.Dev. = 0.07 barrels

Range = 0.26 barrels

The peak was in '79 at 5.51 barrels per person

Data source: BP statistical review for oil, U.S. census dept. for global population

If different "experts" have distinct and mutually exclusive world views, would it make sense to average?

For example, evolutionary biology and geology say respectively:

Multicelluar life forms are hundreds of millions of years old and humans originated and evolved in Africa within the past few million years then dispersed out of Africa 10s of thousands of years ago. Overall, the Earth is 4.5 billion years old or so.

Creation "scientists" say:

God created the Earth and all its creatures several thousand years ago.

What's the average of these two points of view?

Perhaps my argument is silly, but I am not convinced that it is. I am baffled by the folks who believe technology will always solve our problems and infinite growth is possible. I would tend to ignor much of what they had to say.

JB, you took the words right out of my mouth:

"OH, is that right, Halfin? What's the average belief between creationism and evolution?"

The truth, most emphatically, does not lie between two extremes. Sometimes one side is just (dead) wrong.

In such cases Halfin progress would not be met if you were to average. I don't follow this logic at all. It assumes that the experts on the other side are correct and their view influences the outcome of the opposing side.

Lets take a real world example.

Flight and the Wright Brothers.

Lord Kelvin, the Royal Society, and all of science declared that flight was impossible. Only the "unclean" layman dared risk the ridicule, and the common logic of the day and risked their lives in the pursuit of their vision and question the authority. Kelvin declared that flight was not possible in his century, that flight might become available in the next. (I recall an explanation for his view of this and its very interesting, but thats another discussion).

The Experts invent things, this is a fallacy also. Flight is a perfect example, also take a look in this time frame. Who took the ball and ran with it and created the computer revolution in hardware and software. People with degrees, or was it kids, students, and people with a vision, not a degree that drove that industry.

The Royal Society and Lord Kelvin EVEN after the Wright bros had flown acted like it had not happened. Even claimed it was a fraud by many "experts" whose views and physics had suddenly tumbled from the high podium they had placed themselves.

There are no "experts" where innovation and unknown scientific inquiry happen, except by those that make such a cliam. A degree doesn't mean anything except you have followed someone else, paid them a fee, and they give you a piece of paper that says, you have a brain, just like the strawman in Wizard of Oz. Did you think that because of a degree it makes you smart.

I think Lord Kelvin said something about the "air" would change and then we could have flight around this time.

The Royal

Quid Clarius Astris

Ubi Bene ibi patria

I assume this means that Prisoner X has no degree

You would assume incorrectly.

And since it appears you judge people based on such factors,

Ohhh, and I have a utility patent,

and

I had an idea that lead to one one Academy Award nomination, and lets see A grammy,

I didn't say you didn't have to have a degree, I said you didn't have to have a degree to be smart.

I learned most of what I know in the real world, not in school. That is only a foundation that can be built upon.

IQ 139

Quid Clarius Astris

Ubi Bene ibi patria

I agree with you, PrisonerX, and of course to see the flaws in the reigning paradigm, it helps if you haven't been drinking the orthodoxy koolaid. There IS wisdom in crowds, if you know how to find it.

IQ 132

"The people have a right to the truth."

IIRC, from a TOD comment a few months ago, there is wisdom in crowds, but only when no one is listening to each other.

Like that each person forms an opinion, and you average it out to get a pretty good approximation.

If OTOH people are listening to each other, then those who sound the most credible drown out the rest (note I said sound, apparent authority is key here), and the wisdom of the crowd is lost.

The other spanner in that particular works is when members of the crowd have a vested interest in sharing 'their' truth. But that's another matter entirely.

IQ 135

David

I'd take you more seriously if you were presenting actual flaws in widely-held paradigms instead of posturing. Numbers count for more than words.

(I have multiple utility patents.)

PrisonerX for President! His IQ is 150% of Bush's!!!

"PrisonerX for President! His IQ is 150% of Bush's!!!"

You know what? That sounds about right. I would guess about 92. Any lower, he couldn't perform his duties even inadaquately. Any higher he wouldn't come across as such an idiot.

As far as creation vs evolution, if you averaged the opinion of all the experts on the subject you would find far more evolutionists than creationists, so the consensus would be for the evolutionary perspective.

Keep in mind that I was actually very generous to weight Peak Oil believers equally with the "unconcerned". A more objective analysis would recognize that Peak Oil beliefs (at least the more severe ones like Peak in 2006 or 2010) are very much in the minority, which would probably push the average out even farther. (If you don't recognize that pre-2010 peak oil belief is in the minority, you need to get out more!)

This whole concept of "balance" irritates me somewhat and this idea that there's a kind of golden middle-way waiting for resonable people to find.

I've seen lots of debates about climate change on televsion and invariably they have two "experts" discussing the issue. I've actually met a leading "sceptic" about the true level of "threat" posed by climate change. It was at a party and he drove me nuts after about thirty seconds. I think it must have been a chemical reaction! Anyway he's an incredibly influential guy, whose made a fantastic career out of being a sceptic, wealth and fame are his rewards.

Now, he's not actually an expert on climate at all. He isn't a climatologist, but a statistician. He turns everything into a question of what it's "worth" and "priorities" and where we should concentrate scarce resouces. However, he's always introduced in the media as a climate expert. He only rarely, and usually under intense cross-examination, mentions in passing that he isn't a climatologist. He's never had a paper published or peer reviewed about climate change, well, because he can't cut it amoung real climatologists. They tear their hair out everytime he's on the television.

Anyway the point is this idea of balance. He sits in the tv studio with a real climatologist and does his professional sceptic spin job, and then it's the climatologists turn for balance and everything is fine. Except it isn't. The very structure of the studio interview gives the false and ultimatley dangerous impression that there's a balance of opinion about climate change and implicitly a golden middle ground between the two positions. I've heard hosts talk about this middle position three times when my "friends" been on tv.

There is no "balance" the scales are rigged!

In reality there shouldn't be two people in the studio, there should be about a thousand. My famous friend on one side and 999 climatologists on the other side on his own. This is an accurate picture of where the debate on climate change stands today. But that isn't the impression the television gives at all.

Part of this, the main part, is because modern journalism really sucks. It's mainly "entertainment" disguised as news. They want cheap and fairly meaningless "confrontation" and sensationalism. There is no real contextualisation. One argument is apparently just as good as another and the guy with the best haircut and the best one-liners wins!

This structural problem in "news" doesn't just apply to the climate change debate, but to a whole host of other issues of importance. It's not only that modern mainstream journalists don't ask the right questions anymore, the poor souls don't really know how to ask the right questions anymore.

writerman,

You have no balance, nor any scientific skepticism about AGW.

On the one hand, you believe the "consensus opinion" on AGW, because the climatologists and the mainstream media tell you that you should.

On the other hand, you reject the "consensus opinion" that peak-oilers are alarmists, even though the "consensus" of scientists, oil companies and mainstream media say that your should.

Do you know that the US Government will spend $9bn on climate-related issues this year? Better than trying to get a grant for studying the life-cycle of the Ecuadorian snail, isn't it? Better house, better car, etc., etc. What would you choose to do, given how grant-based science funding is these days?

Re-read your post: there is nothing there which contains any evidence to support your opinion, other than appeal to emotion and rhetoric.

You criticize your acquaintence because he is a statistician, rather than a climatologist.

Do you know what computer models of future climate outcomes consist of? Do you know what their entire premise is based on?

Answer: Probabilities, with standard deviations (margins of error).

Do you know what probabilities are?

They are statistics.

Whether AGW is, or is not happening, your emotive and unsubstantiated support of it, coupled with your equally emotive dismissal of a statistician, is arrogant and ignorant.

[Sorry to all that this is my first post - this is an excellent website. The level of analysis in the posts is outstanding. We cannot do anything about the level of uncertainty regarding reserves/resources/productive capability/etc. without the "owners" being open about it, however that doesn't mean you stop thinking.

It's much easier to eat choc-coated CNN, than to exercise your critical mind.

Oh the infinite growth strawman again!

Technology will continue to solve our problems for the forseeable future, centuries are good enough for me.

Growth will continue for the forseeable future.

Neither of these are 'infinite growth.' The prophets of doom will eventually be right, the universe has to end someday. But they'll be wrong many, many more times before they're right.

"the universe will end someday"

o my you are a doomer aren't you LOL

Quid Clarius Astris

Ubi Bene ibi patria

"What's the average of these two points of view?"

I don't know why, but this reminds me of the old country saw that says half of a horse-chestnut (buckeye) is poison and half is not. One just has to watch the squirrel to see which half he eats to figure out which half is not poison.

Averaging point of view without any reference to the scientific validity would be an exercise in absurdity. That's why Halfin's ideas on market consensus simply don't hold any water as far as I'm concerned.

I agree, this is what I have been trying to do:

World oil production (EIA Monthly) for crude oil + NGL. The median forecast is calculated from 9 models that are predicting a peak before 2020 (Bakhiarti, Smith, Staniford, Loglets, Shock model, GBM, ASPO-[70,58,45])

Problem is you need a lot of independent experts in order to make your average meaningful.

It is a good methodology but by restricting yourself to models that predict a peak before 2020 I think you are selecting too small a subset of the available experts/models. The fact that your median predicts a peak TODAY (or in the past) means that at least half your models must be making that prediction. That is far from an accurate representative sample of all expert opinion available in the world today on the subject.

Hmmm, I wonder if the process you performed was what the author you quoted intended!

When doing the syncretic approach to something like Peak Oil the problem is not just that the answers (from various sources) are different, but the questions are too! Indeed, that is one of the points of this TOD entry.

There have been proposed over the years differing ideas on how to take various opinions (on any given subject) and try to come up with a combined answer that somehow would outperform simply averaging individual readings.

Human endeavors of this type are common: the courtroom jury, equity mutual funds, even elections can be like this.

The combined charts form Khebab is one approach to visualize the differences of opinions, which is helpful if one is trying to synchronize one's internal emotions/expectations to the plethora of data and hypotheses about peak oil. I am often tempted to look at them and let my heart throw a virtual dart at the chart, and see which curve it lands closest to.

Here's an example of how well simple averaging can do. It's from a blog comment I made last night, not totally apropos to the present case but it serves as a concrete example:

http://www.leggmason.com/funds/knowledge/mauboussin/ExplainingWisdom.pdf

I would love to see a prediction market for future oil production at Intrade or the Iowa Electronic Markets (IEM). To suggest a contract at Intrade you can e-mail them at markets@intrade.com. IEM is iem@uiowa.edu.

It is interesting to notice the behavior changes that occur when real money is on the line.

I'd like to see that too. In the mean time we do have a predictions market for future oil prices, of course, the Nymex commodity market. If we see the kind of short-term peak many here expect, and demand continues to rise and tries to outstrip supply, then we'd expect to see a price spike within the next few years. If traders believed this then we'd see oil for 2010 delivery at very high prices. But actually it's under $70/bbl, which doesn't really jibe with most Peak Oil predictions. This is one of the main reasons why I am still skeptical about at least the more severe shortage scenarios.

As I've pointed out, the Wall Street Journal itself looked at the oil futures market and concluded that it was a horrible predictor of future oil prices. The guesses at why varied but several of them centered around the poor quality of overall data that we have about the market coupled with the geopolitical power of oil as a lever. But regardless, the futures market is nothing but a betting game beyond about 6 months out.

Ghawar Is Dying

The greatest shortcoming of the human race is our inability to understand the exponential function. - Dr. Albert Bartlett

try 6 hours out...;)

Doesn't the futures market reflect the opinions of brokers like "John" in the above article. When the participating group has a biased world view, the resulting opinion will reflect that view. How many geologists participate in the oil futures process?

This does not help in the case of peak oil since the basis is different. Your jelly bean example assumes that everyone has the same facts and basically the same interpretation of the facts. Thus a consensus is possible. In the case of oil the data is in dispute much less the interpretation.

If the experts ever agreed on the facts then a consensus is important. Global Warming for example tends to be true because the facts overall seem to be agreed upon even if the experts differ somewhat on the effects. We have not even got a consensus on the facts inside the Peak Oil community much less

outside.

I agree that jelly beans in a jar is not exactly the same as Peak Oil. Still it is a useful example for people who are skeptical about the whole notion of averaging and consensus as a guide to truth. And while you suggest that everyone has the same data, in fact I'll bet that guesses were widely divergent.

I was at a trade show last months and one of the booths had a contest where you guessed how many yellow M&M candies were in a jar, to win a prize. I found it hard to convince myself that my guess was even within a factor of 10 of being reasonable!

I wouldn't be surprised in those experiments if there were a factor of 10 or more between the highest and lowest estimates, even though everyone in some sense has the same data. Yet the average was right to within a few percent.

And with Peak Oil we all basically have the same data, too. It's not like anyone here has secret inside knowledge and we're all just following him on faith. Everything that goes into the Peak Oil case is public data and public interpretation. Even so, as you say, everyone sees it differently. Beans in a jar may not be such a bad model after all.

I disagree a big part of CERA's credibility rest on the fact they control a private database. In general this insider information effect is the number one issue with peak oil today. If anything most of the controversy I've seen surrounds interpretation of data that is public. In the case of KSA for example the two extreme views i.e they have peaked and they will produce 15mbpd any day now and continue for 30 years have a real impact on any decision to address peak oil.

This should not since the argument of moving off of oil can be made without a near term peak but they do.

We should have moved off oil back in the 1970's when we the US lost control of its energy needs. Instead we have practically sold our souls to the devil so to speak.

If we had continued to move off fossil fuels then we would not be where we are today. Instead we are now involved in depending on a very volatile part of the world to run our economy. From my point of view the people arguing that we should move off oil then where right we should have and we should have done it then.

Just as a matter of interest, what might the average guess have been if:

a) The true answer wouldn't be revealed for some time (say at least 5 years).

b) 6 of the 73 respondents were objectively trying to guess the number of beans.

c) The remaining 67 respondents had vested financial and political interests in the answer being at least 1500 beans.

This is exactly what SS and Khebab have done. Most of their linearizations and logistics are a consensus of mathmatical opinion.

This may be more pertinent to a later segment of this, but I just want to note something along the lines of your "John" insert.

Here in Willits we have had many peak oil discussions, experts on climate change, promotion of the need to curtail consumption, develop more walkable communities and local economic systems, etc.

Since it is a small town, I know for a fact that every major stakeholder in government is aware of our message. I speak directly to most of them. We also have a Chamber of Commerce supporting a "local economy."

Even so, when it comes to making decisions regarding the allocation of public funds they appear to "stay the course." (There are a few wonderful exceptions to this). 10s of millions go towards massive freeway projects covering prime ag land, hundreds of thousands to expand ball fields, 10s of thousands for consultants to figure out ways to maintain growth in the face of water shortages...etc.

Meanwhile, I sit on an ad hoc committee with the city about climate change and energy use reduction. It was a political close call to get them to establish this, it has no funding, doesn't appear to be a priority with respect to the time of council people or city staff.

My sense is that there are established patterns of behavior and norms of conduct, precedents for spending which imply a set of valuations for what is important to be doing with public funds. If you convince one or two people that these things need to change, they are unlikely to do anything about it because they know they exist in a social environment and will be regarded as upseting the boat to suggest changing course.

Therefore, some critical mass or social threshold needs to be met before change occurs. Then a shift can happen rapidly.

The trouble for those of us who've been at this for years is that it gets old and tiresome. (I've been on energy forums for 6 years now, many have been on these for much longer). How do we keep at it when we don't see much progress for very long? Keep working, trying to get a "tipping point" before we get too cold and hungry? Give up and enjoy life while we can? Build "lifeboats" with the likeminded and hope for the best?

Nate, let's say John understands what you are talking about. What happens next? What does he do when that client who is looking for the short term fix calls?

Well hes a friend of mine. So hopefully he will have moved to Willits and someone else will answer the phone

"The trouble for those of us who've been at this for years is that it gets old and tiresome. (I've been on energy forums for 6 years now, many have been on these for much longer). How do we keep at it when we don't see much progress for very long? Keep working, trying to get a "tipping point" before we get too cold and hungry? Give up and enjoy life while we can? Build "lifeboats" with the likeminded and hope for the best?"

Look to your own. The hours late and any chance at mitigation is past. We just found out from Stuart and Fractional Flow that Saudi oil production is in the process of crashing(not the long slow decline that has almost been doctrine for so long) NOW. Collapsing, Gone, Kaput. That wonderful new oil producing technology turned a long slow decline into maximum production til it's gone followed by abrupt collapse. And how many other major fields have been using the same technology and for how long. Does 'in decline' for these fields actually mean 'verge of collapse'. Are they about to go bang, bang, bang, bang, bang, bang collapsing one after the other. To be followed by Banks doing the same thing. Perhaps Collin Campbell's "Long Slow Decline, Forever", is not the reality we face. Perhaps we ARE talking about the oil running out, rapidly, soon.

Hi Jason,

We're replicating most of your work up here in a North Seattle neighborhood, and our president just got the local Chamber of Commerce interested in energy issues. Our local Senator, Jeanne Kohl-Welles, is coming to speak to us in July.

One point, however small, to encourage you, is a consensus that fell out of our recent Board retreat: that in many ways, much of what we are doing is "holding space": building what we can while waiting patiently, sometimes crankily, for that critical mass/tipping point. Keeping faith would be another way of phrasing it.

The process is indeed tiresome.

I encourage everyone to take advantage of today's most popular media outlets - YouTube and MySpace. The educated need to get the uneducated up to speed as rapidly as possible. Spending 6 years in energy forums is enough... it's time to reach the masses.

www.myspace.com/ziontherapy

I feel it's best to focus on the preparation part. I don't think it takes much educating to get people to see that getting all the oil one wants from Iraq, Iran, Russia, Nigeria, Venezuela is not a sure thing. The part they don't see is what to do about it.

"The people have a right to the truth."

Here is a Pop-Culture response for preparation.

"Peak Oil - Who to Believe? Part One - "There's Plenty of Oil, CERAiously"

Man! What a conglomeration of odd and interesting disputes and assumptions, and helll, just for kicks even a few facts! :-)

I would love to have a crack at some of this weirdness, and probably will after my work duties are done around 1:00AM or so, but for now, I have to say one thing: It absolutely ASTOUNDS me that the "concerned" simply either cannot (and that does not seem possible to me) or WILL NOT (and that seems more likely, but for what reason I do not know) understand why the ones referred to as the "'unconcerned' group" do not toss away their belongings and follow the savior of the peak oil crowd, (insert fav' guru, Simmons, Deffeyes, Kunstler, Hienberg, Campbell, etc, etc,) off into the wilderness retreat....

So let me remind you....

1978-1982

READ ABOUT IT! LOOK IT UP, CHECK IT OUT, please.

Almost all the persons of any power in American management, banking, oil, government, policy, etc., is at least 45 years. They were in their formative years the last time the SCREAM of panic went up, and it was on much greater price increases, much greater production drops and much greater actual disruption at street level that the cries of "the oil age is OVER FOR GOOD, we will NEVER, EVER see low priced oil again, THE ECONOMY is in tailspin, we WILL GO TO ALTERNATIVES, all the same stuff we are seeing now, and what else did they see? They saw people who followed Cassandra's call lose big.

Lost investments, lost investment opportunity, for those who went into the "we will save America" with alternatives and conservation, some even lost the best years of their career.

So this time, they are much more leery, much less trusting of those who assert "Everyone else is wrong and I'm right." Sorry, that's just the way in is.

This time, the Cassandra call HAS GOT TO BE RIGHT, not only in principle (which I think almost everyone agrees on, the oil age can't last forever, and in fact should not), but in timing (a miss of a decade or more makes all the forecasting essentially more useless than no forecasting at all, because it sets us up for a "cry wolf" accussation, and everybody walks back into the theatre just as it actually is catching fire!)

Let's do some posts looking at news stories, energy stories, from the period of the 1970's-1980's. These are the formative years of the minds in the energy trade. It will tell us SO MUCH about why they think the way they do (Saudi Arabia still shows far, far more worry about a price collapse than a loss of production. How could they believe that? LOOK at the 1980's.

Roger Conner Jr.

Remember we are only one cubic mile from freedom

That's a great point, Roger. My dad worked his whole career for the Union Oil company. Here's an interesting history of the company which touches on its efforts in alternatives to oil:

http://www.answers.com/topic/unocal-corporation-1

A billion dollars was a lot of money for that company at that time. Everyone hoped that oil shale would be the salvation of the company. My dad was a VP at the time and from what he said I know it was a real headache. In the end it was a total write-off, an enormous waste.

Speaking of Cassandra, who started calling the "relatively concerned" Cassandra anyway? Was it meant ironically? I mean, after all, Cassandra was not just a prophet nobody listened to, she was a prophet nobody listened to who was always right. That was her curse. So it's either intentionally or unintentionally brilliant.

Good point.

Which is exactly why I titled my essay:

The Cassandra of Toledo

Has any country declared it's concern for peak oil and the ramifications? Seems like the discussion has been how to reduce CO2 and hopefully head off global warming. Could well be peak oil is the main concern, better under the guise of GW, let's not scare people, GW in 50 years vs peak oil today.

Don't know about other countries' published concerns about Peak Oil, but the Japanese national energy policy does indeed mention it. However, on the "Whom do they believe?" issue, the Japanese are believing the IEA (at least in public.)

As for GW versus Peak Oil for attention, in today's press conference by Democrat presidential dark horse Richardson:

http://www.breitbart.com/article.php?id=D8O5AHH00&show_article=1

oil does get a #2 mention as for concerns he would do if elected, one slot up from GW. Richardson appears to rank threats to the US in this order: nuclear proliferation, oil dependancy, and global warming.

Kind of an about face by Richarson as he either chose to ignore oil dependency or was clueless when he served as Secretary of Energy for Clinton. Probably why I could never support him as it demonstrates a total lack of insight that someone in charge of the countries energy policy could be so ignorant or careless about what was going on. Doesn't imbue confidence in his stategic vision capabilities about what was coming down the pike. I say that as both Gore and Clinton have professed as to have never heard about Peak Oil or its associated issues when in office and I would have expected that to have been Richardsons'accountablity.

Interesting about Richardson. On today's Drum Beat they mention that Matt Simmons has signed up with Republican Mitt Romney's campaign. I can't see anything about PO on Romney's web site, although he does call for cutting our dependence on foreign oil, more nukes, more domestic drilling, more ethanol and biodiesel, the standard Republican line.

Last year during the Massachusetts gubernatorial campaign to succeed Romney (Kerry Healey (R) vs. Deval Patrick (D)), Healey, who was the Lieutenant Governor at the time, came out in favor of suspending the state gas tax, which put her at odds with her boss:

Romney, Healey part ways on rollback of state gas tax

In general I think Romney's energy policy is a mixed bag but leans Republican. At one point last year, for example, he considered suspending environmental controls on power plants to allow them to produce more electricity. He was also against the Cape Wind wind farm project off Cape Cod, putting him on the same side as Ted Kennedy. Google Mitt Romney oil (or energy) for more of his positions.

Watch the Congressional Peak Oil Caucus news conference on Capitol Hill tomorrow at 11:30am if you're able to - http://www.energybulletin.net/27883.html.

http://www.myspace.com/ziontherapy

btu - the answer to your question is Sweden. Perhaps the only country on the globe with a realistic energy plan.

Here's why I don't understand a lot of the discussion of peak oil. Quoting from the original,