Why EROI Matters (Part 1 of 6)

Posted by nate hagens on April 1, 2008 - 11:04am

This is the first of a six part series of guest posts by Professor Charles Hall of the SUNY College of Environmental Science and Forestry and his students and collaborative researchers. Professor Hall previously posted on TOD, "At $100 Oil, What Can the Scientist Say to the Investor?"Professor Hall has endeavored to update and improve the state of net energy analysis as he believes (as do I), that future energy policy decisions should at least be guided, if not directly steered using biophysical principles. The opinions on the importance of net energy analysis as a tool for addressing our looming energy crisis are quite disparate, but without some science grounded in physical principles, we are left to rely on the market. The unfolding international credit crisis highlights the dangers of relying on strictly fiat monetary measures for biophysical planning – credit and debt can be created with no underlying physical foundation.

This first post is composed of 2 pieces. First is an introduction and an explanation by Dr Hall why EROI analysis is important. The second part lays out a request to theoildrum.com readership for helping contribute to this net energy data effort. This post will be followed every Tuesday in April with Dr. Halls students preliminary analysis on four energy sectors: 1)conventional fossil fuels, 2) Nuclear fuels 3) solar fuels and 4)geologic sources. Please try and help Dr. Hall with this meta-analysis with suggestions, criticism, and sourced comments. This first post has no data, so there will be an opportunity for readers to discuss any theoretical issues regarding EROI and net energy analysis before starting into the actual numbers next week.

Why EROI matters

By Charles Hall

State University of New York

College of Environmental Science and Forestry

Syracuse New York

Making investment decisions

Society usually makes its economic decisions, at least those not predicated by personal greed at the expense of others or strictly political considerations, on economic analysis and most explicitly via either non government market decisions or governmentally-administered cost-benefit analysis. Probably most decisions are made by people in the financial markets who seek to gain the best economic return on their economic investment. Probably most of these people believe that their own best judgments, while of course subject to the vagaries of the market, are the best way that we can prepare for the future. There is an implicit assumption, probably believed by most market analysts, that if they (collectively) make good financial decisions, based on market information, market projections and good hunches, then we collectively (i.e. society) will make the best investments possible. Although there are certainly good rationales that such analyses make considerable sense, in many cases it is not so clear to me that they are an effective guide to the future of energy supplies. This is because 1) few understand the degree to which most technologies today are principally a means of subsidizing whatever it is we do with still-cheap petroleum 2) today’s price signals are unlikely to be especially influenced by future conditions when today’s most abundant and cheapest fuels are likely to be much less available, for either geological (depletion) or political reasons 3) current prices of energy in the U.S. are greatly influenced by various subsidies 4) there is painfully little transfer of information from the (rather limited) scientific community that has examined the large picture of energy to the financial communities. We propose to improve the information flow on these issues from the scientific community to the general financial community as well as to the policy world more generally.

Why peak oil matters

Our society is overwhelmingly dependent upon oil, which supplied about 40 percent of US energy use in 2007, and natural gas, which supplied another 25 or so percent. Global values are similar. It has also been dependent upon their growth in supply to support additional economic growth, even with some efficiency improvements. As of this writing there is considerable concern about whether “peak oil” (meaning the point for a region, a nation or the world at which oil production no longer increases year by year but enters a plateau or decline) has occurred for the world or might soon. If this is true then the “end of cheap oil” might be, or might soon be, upon us. Natural gas might not be too far behind, especially in North America. Because of the critical importance of this petroleum for essentially everything we do economically there are major concerns as to what the financial implications might be. A thoughtful although possibly extreme view of the implications of peak oil on the American Economy has been presented by Gail Tverberg at: http://www.theoildrum.com/node/3382#more . An assumption of some who examine this issue is that since all that we do economically in the US is based on cheap oil and gas then the absence of that cheap oil and gas will have enormous economic implications. Do conventional economics and conventional economic models and tools work only when it was possible to readily expand the petroleum supply? There is a strong view held by myself and others (see references at end) that because our main economic concepts were derived during a period of our expanding ability to do everything – i.e. that more or less regardless of policy we were able to pump more oil out of the ground readily to implement whatever we were trying to do, that conventional economic approaches may have much less relevance during times of contracting supplies. In other words, are finances beholden to the laws of physics? I think yes. Thus the question becomes: can we supplement or improve upon our ability to do economics and financial analysis by using procedures that focus more on the energy available (or not) to undertake the activity in question? I next attempt to make that case.

Predicting energy supplies and the importance of EROI

There are many, notably those associated with TheOilDrum and the Association for the Study of Peak Oil (ASPO), who believe that they can predict the amount of oil and gas that will be available in the future. This can be readily gleaned from their web sites. The news is not good, especially over the next few decades. Other, different views are available of course, both from the US Energy Information Agency and Cambridge Energy Research Associates, but even their probably inflated estimates would only extend the time until peak, not cause it to disappear. In addition their predictions seem to have lost a lot of credibility due to the recent analysis of Morton, who showed that all of their price predictions in the past 8 years have failed miserably.

Most economists are not too concerned about peak oil (if they think about it at all) because they believe that markets will generate substitutes from which markets will choose. But today’s markets often give very misleading signals about the potential of various fuels. The boom and bust of ethanol is an obvious example. I have been working on this issue for 40 years and have no idea what might be an adequate qualitative and quantitative substitute for petroleum except possibly and with enormous difficulty something based on electricity.

One potentially useful alternative or supplement to conventional economic analysis is net energy analysis, which is the analysis of how much energy is required to make a unit of the energy in question. Net energy is sometimes called energy surplus, energy balance, or, as I prefer, energy return on investment (EROI) (Hall 1972, Hall and Cleveland 1981, Cleveland et al.1985, Hall, Cleveland and Kaufmann 1986). Its advocates, including me, believe that net energy analysis offers the possibility of a very useful approach for looking at the advantages and disadvantages of a given fuel and offers the possibility of looking into the future in a way that markets seem unable to do. Its advocates also believe that in time real market prices must approximately reflect comprehensive EROIs, at least if corrections for quality are made and subsidies removed. Thus can we make market decisions based on biophysical, rather than market, economic analysis? At a minimum I believe that biophysical analysis can add a great deal of insight to traditional market analysis.

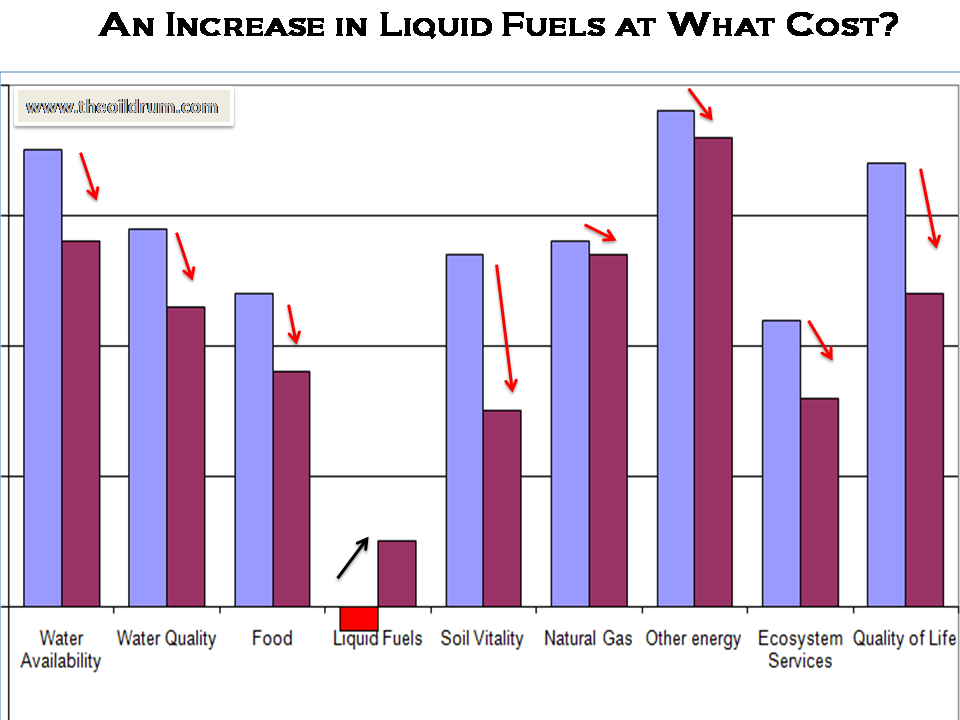

The current literature on net energy analysis, such as it is, tends to be mostly about whether a given project is or is not a net surplus, that is whether there is a gain or a loss in energy from e.g. making ethanol from corn (see June 23, 2006 issue of Science Magazine for a fairly thorough discussion of this issue). The general criteria used by much of the current debate is focused on the “energy break even” issue, that is whether the energy returned as fuel is greater than the energy invested in growing or otherwise obtaining it. If so then the general argument seems to be that the fuel or project “should be done”, and if not then it should not. Obviously this issue is clearest when one might be discussing whether the fuel requires more energy for its production than is delivered in the product, a claim held by several of the participants (most notably Pimentel and Patzek 2005 discussed in the above issue of Science) in the current debate about corn-derived ethanol. Others (summarized in e.g. Farrell et al., 2006) argue that ethanol from corn has a clear energy surplus, with from 1.2 to 1.6 units of energy delivered for each unit invested. Further aspects of this argument center around whether one should include co-products (such as residual animal feed), the quality of the fuels used and produced (liquid – presumably more valuable -- vs. solid and gaseous, for example) and whether or not to consider the energy required to compensate for environmental impacts in the future e.g. for the significant soil erosion occasioned by corn production. Such arguments are likely to be much more important in the future as other relatively low quality fuels are increasingly considered or developed to replace oil and gas, both of which are likely to be more expensive and probably less available in the not so distant future. If, of course, the alternatives require much oil and or gas for their production, which is usually the case, then an increase in the price of petroleum will not necessarily make the alternatives cheap and more available as a fuel. And, as we have seen, the use of biomass fuels an have enormous and generally adverse ripple effects though the world’s food and environmental systems that were completely unpredicted by narrow market analysis.

Why EROI matters—what information can it give about the future

I believe that EROI can give the investor or the publics a great deal of information that markets cannot. These are summarized below:

1) Markets can give you information only about the cost of exploiting a fuel, which usually today has nothing to do with making or even necessarily finding it in the future. Case in point is petroleum: today globally we find only one barrel for each 4 or 5 that we extract, so that we are basically pumping out known reservoirs. Hence we are not paying, assuming that we could, the cost of finding the replacement or of making some substitute. We are just emptying our tanks. Time trends and predictions of EROI can give you a much better insight into what the costs relative to the gains are likely to be in the future.

2) Nevertheless energy investments on the whole probably cannot fail to give the investor a profit. If costs go up, so will prices. If depletion of high quality fuels occurs whatever energy is left is likely to be worth more. Society as it has existed for 100 years simply cannot operate without energy, probably more or less as much as it can get. But while the investor might be satisfied the general economy will suffer, and indeed that is beginning to happen. I believe that even the sub-prime mess is about increasing oil prices increasingly removing once-discretionary income that had allowed the speculation.

3) Essentially all information that we have indicates that the EROI for our major fuels (solar may be an exception) are declining over time, so that in the future society will be having to invest much more money and energy into getting the necessary fuel to run the economy than we do now (e.g. Hall et al. in press). Thus we can tell investors that this is not a good time to invest in additional Caribbean hotels, new restaurants and so on. Both society and individual people will be spending far more of their income on just getting the energy to make the economy work, , resulting in a serious diminution of discretionary income and everything dependent upon it (e.g. Hall et al. in press, http://www.theoildrum.com/node/3412 )

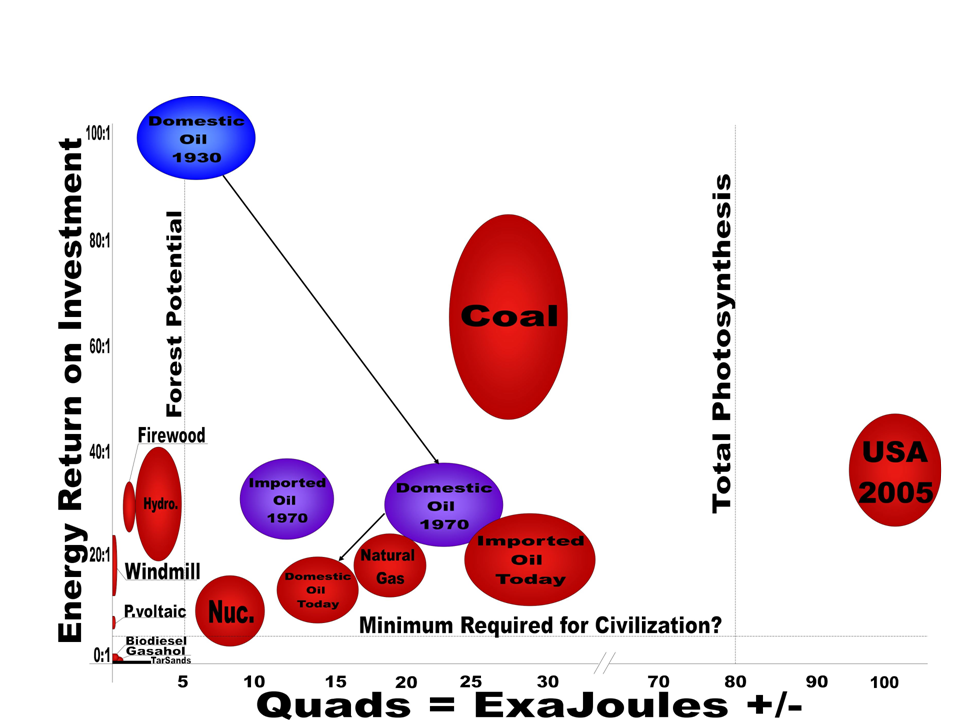

4) EROI can be used to help evaluate which alternative fuels are likely to be the most viable economically in the future (See the “balloon” graph in the above post)). Those investors who had used EROI information to guide investments in the last few years avoided being burned in the corn-based ethanol boom and bust. Similarly, science can tell you now that we have not yet broken down cellulose on a commercial scale, and that to maintain the conditions where this has been done in the laboratory on a large scale is extremely difficult. So much for the present-day advocates of switchgrass and other cellulosic alcohol. Maybe we can do it, but should we bet the house on a maybe?

5) EROI can be combined with estimates of the total magnitude of resources to indicate which fuels are likely to be able to make significant additions to US energy resources. For example, rapeseed is an attractive potential for biodiesel but the entire area in which rapeseed can be grown with a significant net energy gain probably is not enough to make a substantial contribution to the US liquid fuels budget.

6) Environmental issues can be included in EROI analyses, allowing a more comprehensive analysis of EROI. For example if growing a biofuel causes soil erosion the energy cost of making fertilizer to restore the fertilizer can be readily factored in.

Thus there are many reasons that good energy and EROI analysis can help guide the policymakers, investors and interested members of the public.

Part II

REQUEST FOR HELP TO READERS OF THE OIL DRUM

I have been involved in attempting to examine the relation of energy costs and gains of various living creatures (e.g. migrating fish, trees growing at different places on a mountain) and of energy used by humans (e.g. petroleum, coal, nuclear, biomass) for most of my professional career, that is since 1968. Various publications on this issue are available at my website (http://www.esf.edu/efb/faculty/hall.htm). It is my opinion that such energy return on investment (EROI) analyses are critical for how we understand our future energy possibilities and also about how we should make investment decisions about energy now. For example, from the perspective of society (but not necessarily the individual investor) it might appear to make a lot of sense to invest in oil at the present time, when substantial amounts of oil might be forthcoming and prices are good, but if in fact what we are doing is simply accelerating the depletion of existing reserves, rather than finding new reserves, then the net effect is simply robbing tomorrow’s Paul to pay for today’s Peter. i.e. accelerating the negative effects of oil depletion at some future time. What we really need to do is to decide what might be optimum investments based on (for our purposes) the EROI for the present and as projected to the future.

EROI is of course not by itself a sufficient criterion to make decisions about which energy resources should or should not be developed, encouraged, subsidized or whatever, but it is an important criterion. Obviously if an energy resource requires more fuel, or nearly the same amount of fuel of a higher quality, to create as is gained from its development then that is probably by itself sufficient reason to recommend against its production. In addition, other things being equal, it makes sense to develop that fuel which has the highest EROI. Of course it is rare that other things are equal. The most important additional criteria is the potential magnitude of the resource. In the United States, for example, really high quality geothermal sites (such as the Geysers in California) are rare, although low quality sites, with much lower or essentially negative EROIs, are abundant. The second most important additional issue is probably environmental issues, and our analyses attempt to assess each of these. Other issues that might also need to be addressed include: availability of, and impact upon, labor, land requirements, financial issues and so on.

“Balloon graph” representing quality (y graph) and quantity (x graph) of the United States economy for various fuels at various times. Arrows connect fuels from various times (i.e. domestic oil in 1930, 1970, 2005), and the size of the “balloon” represents part of the uncertainty associated with EROI estimates.

(Source: US EIA, Cutler Cleveland and C. Hall’s own EROI work in preparation)Click to Enlarge.

The results of our long term and recent analyses have been published recently on TOD (http://www.theoildrum.com/node/3412) as “The balloon graph”, a graph indicating the quantity (amount used in the U.S. per year for various years) and quality (EROI) of the main and possible fuels used in the U.S. What we want to do next is to utilize the considerable experience of the readers of the oil drum to criticize and, especially, expand upon our recent efforts to summarize what is known about the EROI, potential magnitude and environmental impact of various fuels. If you are interested I have prepared a preliminary summary of what we were able to summarize about existing studies of these issues for many different fuels. This summary was prepared by a month long study of about a dozen Graduate and undergraduate students at my College (The College of Environmental Science and Forestry of The State University of New York –i.e. SUNY ESF) in May and June of 2007. While I felt that the study was fairly exhaustive our preliminary results have been criticized in various ways, especially from the perspective that “There must be more studies than you have found”. I agree, and seek your help in this endeavor. So we will present in TOD our summary in four sections in four successive postings of TOD and we seek your input. The rules of engagement are simple: if you know of additional studies that would reinforce or refute (or anything else) our basic analyses then post them to TOD. We seek especially objective results that are published in peer reviewed journals (the normal gold standard of science) and we seek to avoid self aggrandizing reports by interested parties –i.e. someone with something to sell -- or the opposite. We are also seeking actual measured analyses vs. hypothetical assessments of where the technology might be headed. We also would welcome the responder’s opinion of the piece put forth.

We are also attempting to develop at this time, independently, a more explicit protocol for deriving EROI and associated criteria. We recognize that a lot of the difference amongst different estimates for the same fuels at this time are definitional and especially relate to the boundaries used, an issue that we are attempting to deal with independently. An example of the confusion we face relates to the messages that came in to the earlier posting on TOD of our “balloon graph” where as one responder (mkwin) states that there was a new study indicating that the EROI of the Forsmark nuclear power in Europe was some 93 returned for one invested. But the next responder (Chris) stated that since the enriched fuel had been provided by France, where some 3 of 21 or so nuclear plants were required to enrich the fuel used by the 21 plants then the maximum EROI would be about 7 to 1, something, more in line with our own earlier conclusions. Or is it? So we will see how this goes, filter the responses and try to get a more substantive basis for our various EROI estimates from the results. So if you are interested in this issue read on.

The four sections that will be posted are: 1) conventional fossil fuels 2) Nuclear fuels 3) geological sources and 4) biomass fuels.

Literature

Campbell, C. and J. Laherrere.1998. The end of cheap oil. Scientific American (March): 78-83.

Cleveland, C. J. 2005. Net Energy from the Extraction of Oil and Gas in the United States. Energy: The International Journal 30(5): 769-782.

Cleveland C.J., Costanza, R., Hall C.A.S. & Kaufmann R.K. 1984. Energy and the US economy: A biophysical perspective. Science 225: 890 897.

Hall, C.A.S. 1972. Migration and metabolism in a temperate stream ecosystem. Ecology 53: 585-604.

Hall, C.A.S. and C.J. Cleveland. 1981. Petroleum drilling and production in the United States: Yield per effort and net energy analysis. Science 211: 576-579.

Hall C.A.S., Cleveland C.J., & Kaufmann R.K. 1986. Energy and Resource Quality: The Ecology of the Economic Process. New York: Wiley Interscience. (Reprinted 1992. Boulder: University Press of Colorado.)

Hall C.A.S. 1992. Economic development or developing economics? Pages 101 126 in Wali M, ed. Ecosystem Rehabilitation in Theory and Practice, Vol I. Policy Issues. The Hague, Netherlands: SPB Publishing.

Hall C.A.S. ed. 2000. Quantifying Sustainable Development: The Future of Tropical Economies. San Diego: Academic Press.

Hall, C.A.S. and J.Y. Ko. (2006). The myth of efficiency through market economics: A biophysical analysis of tropical economies, especially with respect to energy, forests and water. In LeClerc, G. and C. A. S. Hall. Making world development work: Scientific alternatives to neoclassical economic theory. University of New Mexico Press, Albuquerque

Hall, C.A.S., R. Powers and W. Schoenberg. (in press). Peak oil, EROI, investments and the economy in an uncertain future. Pp. xxx-xxx in Pimentel,

David. (ed). Renewable Energy Systems: Environmental and Energetic Issues

**Acknowledgements: I thank the Santa Barbara Family Foundation, the Interfaith Center on Corporate Responsibility, The Tamarind Foundation, Boston Common Asset Management, and ASPO USA for financial support for this research.

Your reddit link to upmod this story can be found here: http://reddit.com/info/6e6mx/comments/

Thanks for your support.

The latest centrifuge for enriching uranium is 20 times more efficient as previous models

http://www.popularmechanics.com/science/extreme_machines/4257042.html?se...

Hum... The previous model was gaseous diffusion.

http://www.usec.com/Downloads/AmericanCentrifuge/KNS_02172008_SpinMaster...

Usually centifuges are expected to use 40 times less energy than diffusion and Paducah is kind of old so, aside from increased volume, this sounds like a step backwards. Time to ditch those shares maybe?

Chris

I do wonder. The generally proposed solution to all these problems here on TOD is to switchover the whole economy to zero EROI. See all the links to "limits to growth" etc.

So I wonder how one can think about this

1) clearly, we should not complain about "low" EROI if our solution involves (maximum) zero EROI or even negative EROI. Zero or negative EROI is obviously not a solution for "low or negative EROI" problems (ie. peak oil).

2) using as an assumption that there aren't any (reasonable) limits to growth (or at least none that will prevent the human race from advancing) *ever*

Personally I think I like option 2.

Huh?

No growth does not equal zero EROI. The latter would mean death. Even a 1:1 EROI (no net gain) would not support a steady-state economy. On the other hand, no finite energy source, even with 100:1 EROI, can support endless growth.

I see it here all the time: some people cannot disconnect the concepts of exponential growth and merely being alive. All biological organisms use energy, and thus require energy sources with EROI>1, and they all grow for a while as young individuals, and their populations fluctuate, but they all have zero long-term growth in any given finite environment. Like it or not, the planet it finite and our "economy" is a subsidiary of "the environment".

Maybe a helpful concept here is entropy. (Or maybe not...) basically, to maintain our current state of order, we need a net energy input, so EROI has to be greater than 1. Same goes for any biological system. Many people also seem to forget that that net energy input that allows us to exist and defy the second law of thermodynamics comes from one place only: the sun.

You're correct, except that we don't "defy" the 2nd Law. We extract free energy from sunlight down its gradient thru glucose to CO2, H2O & heat, according to the 2nd Law. All these proponents of EROEI analysis seem bound & determined to ignore the sun. Thank you for reminding them where the energy comes from.

for all practical purposes that lead to real or perceived darwinian fitness, energy comes from the ground (in concentrated ancient sunlight form), the biomass (somewhat concentrated old sunlight) and of course current sunlight. Under the Maximum Power Principle as evolved organisms we will grab as much power as we can (collectively). If the current sunlight isn't enough - no problem use the concentrated stuff. On human time scales, that stuff is all FREE (after subtracting energy and resources costs to get it)

Circa 1973 there were several articles in the business and scientific press on the hydrogen economy. One was in Scientific American titled The Hydrogen Economy. I believe that it was the January issue. If memory serves a major theme was that hydrogen could be produced using nuclear or solar energy and used for transportation. There were of course major problems which were discussed. I was more interested in a minor theme, the epithermal concentration of minerals. As I recall it was postulated that the earth was heated primarily by gravitational collapse with an additional input from radioactive sources. As the earth cooled minerals were concentrated by epithermal deposition as they precipitated under various degrees of heat and pressure. The resulting concentration of copper, silver etc. was essentially an enormous gift of low entropy. How does one account for this gift?

This debate that keeps coming up on the earth as a closed vs open system as it relates to net energy has its merits. We're certainly not going to be importing fuel from Mars, but the sun exports massive amounts of free energy to us every day, nearly all of which we waste. If we had electrical lines running from umpteen billion acres of solar panels running all our drilling rigs and electric cars, net energy would be a moot point. A similar argument is made by Huber and Mills in their thought provoking book "The Bottomless Well: The Twilight Of Fuel, The Virtue of Waste, And Why We Will Never Run Out Of Energy". Here they point out that energy does not get used up - it merely changes forms. We just need to get more chemically clever about capturing energy as it changes forms. This cleverness ultimately would be limited only by the 2nd Law of the earth's closed system, and not even by that if you consider the sun.

But it's also true that for all practical purposes, energy comes from the ground. We don't have umpteen billion acres of solar or the chemical cleverness Huber and Mills envision and won't anytime soon. But we certainly will be running up against all the net energy problems very soon.

Thomas Edison seemed to have a handle on all this way back in 1931. He said in a conversation with Henry Ford on the rush into oil:

My own impression is that the Solar Source of Earth's energy is mentioned with extreme frequency. Where have you been keeping yourself?

Nate, thanks for initiating this. Very important work. And as Alan might say, best hopes that this will help folks recognize that there are very real limits to growth and that we are bumping up against them. Perhaps you would post your very fine graph showing the net energy curve, and Euan's version of the net energy cliff as visual aids.

Thank you Charles for sharing your work.

I have a suggestion for your balloon graph to make it more understandable to a person not quite familiar with all the concepts and assertions. Create an "interactive" version in which the text either:

1) hyperlinks to additional pages that explain what each bubble represents (like for "Coal" it could tell if it is just US or worldwide data, tell if it it includes things like transportation and conversion to electricity, and perhaps include graphs showing how EROI has trended over time

or

2) pops up "mouseover" text that gives a very short summary of what the bubble represents

Personally I like #1, especially since you already allude to some changes in EROI over time and the auxiliary pages would be a good place to show that for all the energy bubbles.

The bubble graph is a powerful tool. Anything you can do to make it more easily understandable and user-friendly will go along way towards helping people get the message you are trying to communicate.

Greg in MO

I appreciate all of the research you have been doing in this area!

One question that bothers me is the vastly different price per Btu that different fossil fuels command. This is a graph, based on data from the 2008 Annual Energy Outlook (Early Release) of a history of prices, in 2006 dollars.

To maintain these differentials, it seems like we need to have very high EROI for coal and natural gas, relative to oil. Otherwise, the energy used for these sources must come from like sources (coal from coal, natural gas from natural gas).

I think that the fact that we are past "trough fossil fuel energy price" in 2006 dollars is important also. This would seem to say that the growing efficiencies of producing the fossil fuels have been cancelled out by other factors, like lower EROI. Electricity follows a similar pattern, with a smaller dip, since it is more a function of coal and nuclear.

These things are probably outside of what you plan to discuss, but if you have any insights, I would be interested in hearing them.

Perhaps the price discrepency can be summed up by the words 'immediate utility' and 'demand'.

If we started to turn coal into Petroleum I would expect the yellow line to rise up just as we have seen the price of corn rise...

Nick.

The combination of that price per BTU chart and the EROI bubble map above shows how desirable coal is as a major problem solver in peak oil. The coal circle stands apart from the other circles as a solution. It's really tragic that coal suffers the greenhouse problem so much more than the other solutions and points out the urgency of clean coal technology development.

If you look at how to guage the effect of declining EROI over the history of global oil production, you can get a sort of "EROI adjusted" Hubbert's peak. It does make a difference from the first half of production to the second half. And then we are adding all the oil substitutes, so many of which are of worthless or minimal net energy levels. If you lump them into the declining EROI for conventional oil, you get a diagram I posted here about a week ago. Many of the things we are putting into that zone between conventional oil and total liquids are contributing to the net energy curve, but far too many of them aren't pushing the curve out much at all.

Considering the net energy cliff implications we are coming up against in a few short years, it's imperative that we get this oil/EROI thing figured out soon.

As a first question, Gail, is the price of coal/btu shown here, the price of thermal coal delivered to the electrical generating plant, or the price of coal delivered to my yard from where I can haul it and dump it down a chute, from where to refill my furnace I can shovel it every few hours once I've gotten the fire going?

I wonder if the price per btu of natural gas includes the effort of programming my thermostat and arranging for pre-approved payments at my bank?

I'm afraid it is whatever EIA says it is. I haven't investigated the details. Given the low cost for coal, I would think that the costs are before delivery costs are added. Delivery costs would be high for coal, because it needs to be transported by rail / barge / truck. This may explain some of the difference between it and the other fossil fuels.

I looked at Jon Friese's graph down thread. The NG prices from the EIA are definitely the wellhead prices. If, as Jon says, delivery costs approximately double the NG cost, that may explain a big piece of the difference. It would be much better to use data including delivery costs. Delivery costs would also add something to oil, but not as much.

Not to mention that, with respect to transportation, the coal is not useful until it is converted into electricity or liquid and then actually inserted in the gas tank or used to recharge the batteries. The true cost of coal is a function of the ultimate use and the price per btu as an end product is much higher than the raw cost of coal, say, delivered to a coal fired electric plant.

I would've thot that Black Mesa coal I see people selling by the sack or pickup load along the roadsides around here would be pretty useful in the stove. Guess I'll just stick with wood, then...

if it takes 5 btus of coal or natgas or nuclear to make one BTU of transportation fuel on a wholesale basis, the wholesale price of each should be the basis of comparison. the cost of a barrel of crude from tar sands is the same as th cost of a barrel of oil from the north sea. the eroi of the latter might be very high vs. the former, while the absolute returns of the former are much higher due to cost inputs.

the price per BTU at the point where one energy is converted to another the only relevant price. so we should consider the price to suncor of natgas and coal delivered to their tar sands projects in ft. mcmurry -- low EROI but very strong ROI.

seems to me EROI analysis is ignoring the utility function expressed int he wholesale BTU price.

These price differences underline the issue of "energy quality" which must be addressed to get EROI straight. Per-BTU is not the most useful measure. E.g., electricity is certainly of higher quality than coal. But sometimes quality seems unclear, or not possible to delineate on one axis. E.g., how would you compare electricity and oil? Given the use of oil for transportation, and the _current_ unsuitability of electricity for the same purpose, is oil of "higher quality"?

One important detail in the above price chart: the pause in the price rise of NG in the last couple of years. Especially given the peaking of NG in North America. (And I assume that chart depicts prices in the USA.) I believe that that dip in NG price is a result of the shutting down of fertilizer and plastics factories in response to the preceding rise of NG prices - these industries have moved to places with still-abundant NG, such as Trinidad or Qatar. The resulting "glut" of NG supply in the USA (relative to demand) is temporary: as demand from other uses grows and catches up with declining supply, expect the price curves of NG and oil to again correlate. One indication that NG prices are artificially low right now is the fact that in parts of the US it is now cheaper to heat with electricity (using plain resistive radiators) than to use oil or propane for heat. If this situation lasts, it would shift more of the heating load onto electricity, causing more demand for NG, and eventually increasing the price of NG - above a per-BTU parity level, since power stations are much less efficient than good non-electric home heating devices.

Regarding NG price, I think a couple of warm winters may have helped the cost trend also.

Another reason that I expect the price of NG will need to increase is to encourage the production of tight gas/shale gas. These tend to be higher cost, probably due to lower EROI. If we really need the NG for heat and electric, it seems like the cost relativity to oil is likely to increase.

Dear Prof. Hall,

perhaps another 'balloon' could be added to your diagram -an 'Energy Efficiency' balloon. This would reflect the amount of Energy that could be saved by things like replacing tungsten light bulbs, better insulation, etc. I think McKinsey has published some studies on how big the energy savings could be. I assume this 'efficiency bubble' would counteract overall EROI decline.

Regards, Nick.

Nick, you make an excellent point.

If we measure EROEI at the production end, we should also have a statistic for work done per unit of energy at the consuming end.

Compare the amount of fuel consumed for example to 50 move miles per hour on level ground with a 2500 pound vehicle in say 1970 to today.

Or the energy consumption of operating a television set for one in 1970 to today, or the energy consumption to maintain X tempeture in a refrigerator of X square feet. Work done for energy consumed.

I think people would be amazed at the difference over 30 years.

RC

Thats a very important issue, but one separate from the supply side. You are talking about demand changes via conservation and/or efficiency which is different from the fundamental energy qualities/characteristics of a fuel. HOW you use it after you've spent the energy to get it.

True, but it seems impossible to speculate on the effects of decreasing supply without considering the demand side. One has to take both together to comment on potential impacts. Since our systems our highly inefficient, I believe that the demand side could fall significantly while energy supply falls, keeping our standard of living in balance for the immediate future. For example, with the advent of global networks, air travel hasn't been needed by most for over twenty years now. In reality, the Haves will continue to abuse the resources and the Have Nots will continue to increase in suffering so I am just rambling.

Hmmm... since EROEI has been falling since 19XX, it could be proved that it has an effect on our standard of living and then speculation based solely on the supply side would be okay.

I think the Professor Hall's analysis is awesome and love that bubble graph.

Well we have had a tremendous amount of wealth concentration at the high end since the 1970's this concentration effect alone can keep the standard of living of the wealthy increasing even as the standard falls for the rest.

On the lower end we have been blowing a credit bubble since the 1960's and moved to two income families and overall oil has been cheap. So the low end even as its been drained has managed to keep extending itself by adding wage earning power via first women going to work then making higher wages and via credit.

Also in general we have increased the educational level with a lot more college degrees again increasing the average wage. And finally rebuilding from WWII/Communism is just now coming to a end with the world producing evenly in a pattern similar to the 1920's. This is the first time since the 1920's that we have had most of the globes economies working. This growth in china/Russia etc have fed the older economies esp financial/banking.

And of course technology has advanced allowing excellent efficiency gains where it makes economic sense.

So despite the peaking of average energy usage we have had a lot of trends that have allowed the GDP to keep growing outside of efficiency gains which can continue a lot ending in effectiveness. For the US in particular the move to a dual income pretty much peaked in effectiveness over the last ten years. Now the need to have two wage earners who's jobs may prevent both moving close to work results in flat are negative income gains.

In any case we have had a lot of other trends taking place which in my opinion have masked the effect of peak energy for some time. You would have to look at the lifestyles of the working poor to see if they are better off now than say in the 1970's but at least in the US racism played a big role in the earning power of the poor until recently. I'm not saying its gone but its difficult to split out increases in earning power as racism receded from a underlying drop/flat result because of peak energy consumption.

In closing too many factors are at play in the US to get a clear signal and Japan/Europe where devastated by war etc. Actually about the only place you might easily look could be say Egypt but they don't really have technology? I find it hard to think of a place that not suffered other issues which swamped the underlying energy trend.

Maybe Sweden could be used as a baseline Norway is out because of the oil. Sweden and Finland might be one of a handful of technically advanced countries that down have significant other effects.

Interesting for Finland on a energy basis they are flat.

http://earthtrends.wri.org/pdf_library/country_profiles/ene_cou_246.pdf

Here is the percapita GDP I'm certain its not inflation adjusted.

http://earthtrends.wri.org/pdf_library/country_profiles/ene_cou_246.pdf

Its increased from 10,00 in 1980 to 30,000 USD per person.

Adjust for inflation they have been flat to decreasing over time.

This is a fantastic paper with a different view point and Finland fares well.

http://www.scribd.com/doc/100405/Usable-Productivity-Growth-in-the-Unite...

I urge you to read it. So it depends. However in general we have not seen blazing growth once you do a few adjustments. If the paper had say included adding the two wage earner effect over the time period and growth to parity in wages coupled with increased eduction rates neither of which are long term stable I'd say the most of these would be zero.

If you then do a quality of life metric with the assumption that you could live comfortably on a single wage and the second wage earner was optional or a lifestyle choice i.e one could choose to say home and raise kids go to school etc. then its decidedly negative.

The energy return of insulation is very dependent on on the type of insulation. Blown in cellulose made from recycled paper has a very high EROEI. Fiberglass on the other hand may be a net energy loser. Manufacturing fiberglass is very energy intensive. An argument was made that installing more than 3 inches would use more natural gas than the amount saved over the next 20 years. These figures though were based on 1970s technology.

Consider this example. Before any insulation was installed a house used 100 units of fuel. After installing a layer of insulation use dropped to 50 units resulting in a net of 50 units. Then a second layer of equal thickness was added and fuel use was cut in half again. This second layer though only saved 25 units of fuel. Additional layers each save smaller and smaller amounts of fuel until the amount of fuel used manufacturing the insulation exceeds the amount of fuel saved. In a time of shrinking fuel supply the question of best use of what remains becomes more and more significant.

Um...France has 58 reactors (59 if you include the FBR Phenix) not 21. Also the reactors used for enrichment are smaller than the fleet average and only 75% of the uranium enriched is used in France's reactors, the rest being exported.

It's also disingenuous to characterise nuclear's EROEI by only considering energy intensive diffusion enrichment, when it comprises only 40% of enrichment capacity today and will fall to 0% within the decade.

We are also attempting to develop at this time, independently, a more explicit protocol for deriving EROI and associated criteria. We recognize that a lot of the difference amongst different estimates for the same fuels at this time are definitional and especially relate to the boundaries used, an issue that we are attempting to deal with independently. An example of the confusion we face relates to the messages that came in to the earlier posting on TOD of our “balloon graph” where as one responder (mkwin) states that there was a new study indicating that the EROI of the Forsmark nuclear power in Europe was some 93 returned for one invested. But the next responder (Chris) stated that since the enriched fuel had been provided by France, where some 3 of 21 or so nuclear plants were required to enrich the fuel used by the 21 plants then the maximum EROI would be about 7 to 1, something, more in line with our own earlier conclusions. Or is it? So we will see how this goes, filter the responses and try to get a more substantive basis for our various EROI estimates from the results. So if you are interested in this issue read on. - Charles Hall

So far advocates of the EROI approach have demonstrated nothing but their own incompetence. Aside from getting off on the wrong foot by not checking his facts, Charles Hall demonstrates a deeper problem with the EROI approach. Suppose Hall counted French reactors correctly, what would that tell us? It tells us that the French use a very inefficient uranium enrichment technology, but very little about the potential efficiency of the nuclear power. A number of Western European countries rely on a uranium enrichment technology that is 50 time more efficient than the French technology, but the Canadian's build a reactor that is so efficient that they do not need to enrich uranium at all. Which technology do we index for our EROI of nuclear power?

Does it make any sense at all to talk about the EROI of Lemhi Pass Thorium? Thorium Energy, Inc., has stated:

"the Company’s claims are significant mining veins, which contain 600,000 tons of proven thorium oxide reserves. Various estimates indicate additional probable reserves of as much as 1.8 million tons or more of thorium oxide contained within these claims."

"In fact, vein deposits of thorite (ThSiO 4), such as those that occur in the area of the Lemhi Pass, present the highest grade thorium, mineral, and are believed to contain approximately 25 to 63 percent thorium oxide (ThO 2) per ton of raw ore. Thus one ton of thorium ore could potentially yield as much as 500-1,200 lbs. of high grade thorium oxide (ThO 2), as compared with less than one percent of raw Uranium ore that is typically utilizable."

http://www.thoriumenergy.com/index.php?option=com_content&task=view&id=1...

A ton of thorium can produce up to a GW of electricity a year.

A comment on my blog noted:

"Consider the implications of the Lemhi-Pass Thorium finds of 25%-63% Th oxide content."

"At 25% the reactor needs mining of 4 tons/year. This can be easily accomplished by 4 guys with shovels and a pickup in a day. "

"TO PRODUCE 1 GWyear."

"Probably the best EROEI of any technology ever."

What is the significance of EROI here? Why would it matter?

EROI X Scale = Energy surplus.

Is thorium and all the non-energy inputs scalable?

What about the cost to build new plants that require fossil fuel based processes to build?

What are the environmental issues with mining/using thorium?

Can the scaling of nuclear/electricity based transportation happen fast enough to overcome global (geological/political) depletion of high EROI liquid fuels? (e.g. can we build a new high energy gain system while the old high energy gain system is in decay?)

(I don't have the answers to any of these questions but they all would need to be considered)

EROI X Scale = Energy surplus.

Is thorium and all the non-energy inputs scalable?

What about the cost to build new plants that require fossil fuel based processes to build?

What are the environmental issues with mining/using thorium?

Can the scaling of nuclear/electricity based transportation happen fast enough to overcome global (geological/political) depletion of high EROI liquid fuels? (e.g. can we build a new high energy gain system while the old high energy gain system is in decay?)

(I don't have the answers to any of these questions but they all would need to be considered) - Nate Hagens

Nate, You must be joking. There are well documented studies of the energy input in reactors. Dr. Ralph Moir has studies the cost of electrical production from a thorium fuel reactor. Go here (http://www.geocities.com/rmoir2003/2mlt_slt.htm)

and down load "Cost of electricity from Molten Salt Reactors (MSR),"

(The MSBR design he studied is put of date.)

You ask, "What are the environmental issues with mining/using thorium?"

Quick answer, probably far less than with uranium based nuclear power, because the fuel comes out of the ground at much higher levels of concentration, and thorium based reactors can produces electricity at much greater efficiency, than current uranium based nuclear power technology.

"Can the scaling of nuclear/electricity based transportation happen fast enough to overcome global (geological/political) depletion of high EROI liquid fuels?" Quick answer: That depends on political and economic decisions. We can if the decisions are made to make the resources input a priority. A little fear increases decision makers intelligence markedly. Of course a lot of fear makes everyone stupid.

No. I wasn't joking. I don't know much about nuclear, though one of Charlies pieces is an EROI analysis of nuclear which will be up in 2 weeks. I'd prefer to defer the nuclear EROI discussion to there but a quick, stupid question:

If thorium is the cats meow, why aren't smart, self-interested individuals and groups rushing like mad to scale thorium reactors for profit and glory?

If thorium is the cats meow, why aren't smart, self-interested individuals and groups rushing like mad to scale thorium reactors for profit and glory? - Nate Hagens

Does the name Conrad Windham ring any bells?

http://www.touchbriefings.com/pdf/2980/windham.pdf

Jack Lifton has been writing about thorium for investors during the past couple of years.

In a advisory which he dated February 22, 2007, http://www.resourceinvestor.com/pebble.asp?relid=29249

Lifton wrote:

"Look at the U.S. Geological Survey (USGS) documentation on thorium, but, be aware, that it is out of date. The current USGS material shows the U.S. with less than 200,000 tonnes of thorium reserves. In fact a new company, so far private, Thorium Energy, Inc. told me that the unpublished results of a new study commissioned by it from the USGS that show that TE’s Lemhi Pass property in Idaho has 600,000 tonnes of thorium reserves by itself. This if proved out would give the U.S. the largest reserves of thorium in the world, and would in fact be more than 1/3 of the world’s known thorium."

Lifton added:

"Thorium Power, Inc. has told me that they already have the technology to “switch over” from uranium to thorium more than 60% of the reactors in use today in the world."

"They said that a switched over or built from the ground up thorium powered reactor has for the “blanket” a total of three times the life of a uranium powered reactor. This would mean that the savings during the first fuel cycles will pay for the changeover in the case of a “retrofit.” The core can be used to burn fissionable grade plutonium to non weapons grade material while the blanket will be made from thorium and uranium-233, not 238, so that no weapons grade plutonium-239 can be produced in the reactor."

In another advisory dated February 27, 2008,

http://www.resourceinvestor.com/pebble.asp?relid=40784

Lifton discussed a paper by Richard Reed, a consultant with Idaho Engineering & Geology, Inc, and Dr. Virginia Gillerman of The Idaho Geological Survey, that had been presented the day before at the annual meeting of the Society for Mining, Metallurgy, and Exploration. The title of the Reed and Gillerman paper was “Thorium and Rare Earths in the Lemhi Pass Region.”

Lifton reported that USGS thorium specialist "Mr. James Hedrick was in fact the moderator of the special session of the SME where Reed and Gillerman presented their current results. Mr. Hedrick has stated that the credibility of the work by Reed and Gillerman and the extent of the deposits mapped by them will cause the USGS to re-evaluate both their thorium and rare earth mineral commodity surveys, and that later in the year the figures for the reserves and resources of both the US, and the world, for thorium and the rare earths will be revised to take into account the very large amounts of both which are now proved to be present in the Lemhi Pass region."

Lifton demonstrated his intelligence by referring to my blog "Nuclear Green" for a further background to his advisory.

On February 28, 2008, Lifton added more details from the Society for Mining, Metallurgy, and Exploration's annual meeting.

http://www.resourceinvestor.com/pebble.asp?relid=40858

Lofton commented:

"The disconnect between the usual conservatism of professional geology and the hype of commercial promotion, usually downplayed, or ignored, at ‘investment conferences,’ was much in evidence at this meeting. Ironically, it was the businessmen who were sceptical, and the professionals who were excited."

As to why "smart, self-interested individuals and groups rushing like mad to scale thorium reactors for profit and glory? " I for one am. are there any other "smart, self-interested individuals" reading my words?

While I don't have a reference for this, apparently U233 from thorium is always contaminated by U232, which is quite radioactive. This would increase handling expenses. Of course, if the Th is transmuted and "burned" in place, it would cease to be a issue.

Actually U232 is no problem in a reactor where radioactivity is the order of the day. U232 is a problem fore anyone who wants to turn U233 into an atomic weapon.

Well it didn't take McCrab and Barton long to pop out of the woodwork. Where's Dezakin?

I'm glad you fellows are here. I am using a chunk of nuclear sourced electricity at this very moment. Candu stuff at that. Looking at my electricity bill, I note that 'Debt retirement charge/Reglement de la dette' is still biting into my bank account. As it turns out this 'tax' is a gift of the old Ontario Hydro's nuclear build program of the last century.

When do I stop paying?

When do I stop paying? - toilforoil

Probably not for a long time, those new Ontario nuks have got to be paid for. But if it is any comfort, you may be paying a little less taxes for health insurance, since Ontario doctors are convinced that a shift away from coal fired plants will lower healthcare expenses.

Oh, I'm not paying for new nukes. I and millions others are paying for the old nukes. It is, afterall, called debt retirement, at least in English. You nukees keep telling us that your product has a magnificient return on energy invested, and yet after buying in, we pay and pay and pay.

As for the costs of health care, I recommend less stress, more walking, less gadgets, less eating, less phamaceuticals, more laughing, less cows, pigs and chickens, more brocolli...and especially more self-knowledge.

Don't worry toilforoil, there are at least two factors that mitigate your fission-based electric cost. One is the general increase in fuel costs. Since nuclear fuel contributes a small fraction of its electric rate, unlike fossil fuel costs for their electric rates, your rates should trend favorably compared to those unfortunates without fission-based electric. Another is that wizard Bernanke is casting his hyperinflation spell on the dollar, and probably the Loonie too, so we Yanks are effectively retiring that tiresome debt as a bonus. Now you can't say that we never did anything for you! :-)

BTW, there is a rather large charge that does not appear on your power bill, but that you are paying along with everyone else. Air pollution with GHG is reducing health and increasing mortality now, and will continue to do so for centuries, if you accept AGW, which I do.

It's his turn to fondle the fuel rod.....lucky bastard!

He didn't even consider CANDUs that can run on natural uranium without enrichment. They usually don't though, because enriched uranium has higher burn-up.(i.e. the lower EROI enriched uranium makes more financial sense)

Also depending on how you define your system boundaries you'll get different EROI. Consider for instance if you had oil that you want to extract, but can only extract it if you burn over half the oil in place in situ.

If you consider this energy to be part of the system you clearly get an EROI <1, but society as whole can still gain usable energy from extracting this oil as the energy you spent wasn't spendable in any other way. If you don't consider it to be part of the system you get an EROI that could be far in excess of unity, but that doesn't accurately reflect how dirty your extraction method was nor that a lot of the oil in place was burnt.

He didn't even consider CANDUs that can run on natural uranium without enrichment. They usually don't though, because enriched uranium has higher burn-up.(i.e. the lower EROI enriched uranium makes more financial sense) - Soylent

I didn't need to for the direction of my argument which was to point to problems with the EROI concepts. In fact, CANDU reactors can recycle "spent fuel," from American LWR, and generate electricity from it. At the moment enriched uranium is artificially cheap, due to the post cold war effort to burn up cold war atomic bombs.

The part I have emphasised is false. Every CANDU and CANDU clone to date has run on unenriched UO2 and nothing but.

The speaker may be confused by talk of the Advanced CANDU (ACR). It is specified to burn slightly enriched uranium, and thereby be able to run with a smaller heavy water inventory. No ACR has yet been built.

(Last year a CANDU started up in Romania and a clone in India.)

Boron: A Better Energy Carrier than Hydrogen?

Dr. Hall (and Nate)

I totally agree that EROI needs to be positive. But how positive is debatable. The key in my mind is how much consumption needs to be met?

Analyzing fossil fuel use in the developed world in order to find a large supply of high EROI energy to replace it, is the wrong approach.

It is like taking a conventional house in the U.S. (an inefficient energy hog) attempting to put up solar cells and wind turbines to meet demand, and saying that renewable energy is not viable. The key is to redesign the house to use passive solar, replace appliances and reduce the peak energy demand to a level that can be met by renewable and then install the correct mix of renewables for that site. Small change in lifestyle huge reduction in energy consumption that can now be met with a "poor" EROI energy source

Your approach is correct to find all renewable sources that are EROI positive. But this search can't be confused with comparison to current fossil fuels use, IMHO.

A lot of food is not grown in a positive EROI way today, but we do it anyway. We do it because it is economically advantageous for someone to do it that way, not because it is the most energy efficient way to grow food. I am convinced that most fossil fuel use is this way. We have created systems that are inherently energy inefficient because there is/was an economic advantage to use that approach. The alternatives were driven out of our society decades ago with the easy access to energy.

A different manufacturing approach would have been/will be used in the future when energy is scarcer. These different approaches should have large impact on the calculation of EROI because the same energy is likely to be gotten out but much less or a very different kind of energy put in.

I am in no way disputing your authority in this field. I am raising the possibility that we haven't made much gain on EROI since the 1970's because we deliberately turned our backs on this approach because our economic approach rewarded it. The whole system is designed (rigged?) towards a poor EROI in order to consume lots of energy.

The Second Law ensures that EROI will always be negative. Calculations that give a positive EROI simply ignore certain inputs. Which inputs to ignore is an arbitrary decision. This arbitrariness is why EROI is not a very useful metric, contrary to the views of these authors.

This is false.

A) EROI is a ratio so can't be negative (minor quibble), but more importantly

B) we care about energy to do work. If there is a pool of oil in my backyard that can be sucked out with little energetic effort, the loss due to second law still leaves a HUGE positive energy gain that can be later used in various special ways. Your comment is only correct if you measure it on a time scale of hundreds of millions of years which is irrelevant to modern civilizations usage of oil.

C)I agree EROI ignores certain inputs, specifically non-energy inputs like water, soil erosion, GHGs, etc. But it does not ignore energy inputs (except very narrow bounded studies or ones that are incorrect)

What metric would you prefer?

If you've been following my posts you will see that I take the long view.

You simply ignore all the starshine that went into biofuels, fossil fuels, even fissile isotopes. You can speed, steal, even kill... but you can't break the 2nd Law.

"... but you can't break the 2nd Law." But the 2nd law applies only to closed systems. In open systems the 2nd law can easily be bent: the evolution of complex ordered systems such as life being the primary example.

You can ignore factors that do not have a significant impact on your calculation, it's done all the time and works quite well, Newton's laws being a good example. All "laws" are in fact approximations of one sort of another.

So far as we know, the universe is a closed system. It amazes me how cavalierly you EROI fans simply ignore the sun.

pedantic quibble: It is logically unknowable whether or not our universe is a closed system. A perfectly closed system would not allow exchange of information across system 'boundaries'.

In practical terms, the Earth is an open system. Like you say, we get lots of energy from old Sol. Other considerations apply, as far as the viability of humankind goes.

"... how cavalierly you EROI fans simply ignore the sun." Consideration of the sun's energy input (thermodynamic, electrical, and gravitational) to Earthbound computations of EROI has nothing to do with cavalier attitudes but with problem scoping. At the macro (human)level, the sun's energy can get considered a constant and "free" energy source.

What are the costs in term of planetary homeorrhetic mechanisms of extracting massive amounts of reduced carbon from the crust? I'm more concerned with these costs or "usages" of oil than I am about "modern civilization's useage of oil." What are the biogeochemical considerations that go into the EROI calculations? Are they insignificant? Are they the overriding considerations, or should be? Or are they simply ignored? AGW informs us that these considerations aren't insignificant. By what metric do you quantify these considerations? Perhaps they operate over tectonic timescales. Does this make them "irrelevant"? How do you know? Fact is that you, nor anyone else, knows how to evaluate these input/output, cost/benefit considerations. You arbitrarily decide to ignore factors you don't understand or consider irrelevant to your own interests. If you think outside the mindset predicated by human economics you see how meaningless these EROI analyses are, from the perspective of the planet. And it's that perspective some of us care about the most.

Actually, I've written a mathematical framework for net energy analysis to account for specifically these non-energy inputs that society 'values' which is the headline paper in this months AMBIO- (Royal Academy of Sweden).I'll post a link later this week. But its not for me to decide what society values - my coauthor and I just came up with a theoretical framework so that everybody speaks the same language.

Cool. Will be interesting reading when you post the link.

p.s. Though we tried, we were unable to find a place for the term 'homeorrhetic' in our paper.

Biogeochemical feedback mechanisms tend to be homeorrhetic rather than homeostatic. That is, they track a dynamic rather than a static set point. This is due to orbital forcing, the ratio of carbonate vs silicate rock being subducted at any given time, gradual decline of radiogenic heat over time, etc. Sorry for the jargon.

"If you think outside the mindset predicated by human economics you see how meaningless these EROI analyses are, from the perspective of the planet. And it's that perspective some of us care about the most."

I guess this means that you're on George Bush's party line to god. Or do you have some other means of discerning the perspective of the planet? Oh, I see, you think outside the mindset...and you get to the perspective of the planet. Wow. Transcendentally transported.

As I read Professor Hall's first installment, I noted the cautionary tone in which he made his contention that EROI analysis provides guidance of use to policy makers.

Thanks Professor Hall, looks like you have a winner series here! One question on your statement:

few understand the degree to which most technologies today are principally a means of subsidizing whatever it is we do with still-cheap petroleum

Could the word subsidizing be replaced with the word leveraging? (might help in communicating with the financial Boyz?)

Efficiency in the use of petroleum has increased while there has been a decrease in net energy from petroleum. If efficiency remains a constant while net energy were to merely decrease at a constant rate the net effective energy would decrease at an exponential rate. Is this what is implied in your statement above?

I think that you'll find that the financial boyz have had enough of leveraging and that they are now very keen on subsidizing, especially of their lifestyle by taxpayers,

Peter.

Heh! Peter, you cynic you, where is your trust in the avarice of ones fellow sharptrader? Anyway the Boyz in the back room will be lucky, after the financial dust settles, if there is a single taxpayer left to buy them even a dinner a la tube steak.

"There is a strong view held by myself and others (see references at end) that because our main economic concepts were derived during a period of our expanding ability to do everything – i.e. that more or less regardless of policy we were able to pump more oil out of the ground readily to implement whatever we were trying to do, that conventional economic approaches may have much less relevance during times of contracting supplies."

This is a very insightful point. Consider the "main economic concept" emphasizing the value of specialization. In the early days of the industrial era Adam Smith argued the advantages of specialization with his famous example of pin production. It is almost heretical today to contest the 'truthfulness' of Smith's contention. For many, Smith revealed a universal, timeless truth.

Yet, as Georgescu-Roegen wrote, "The craftsman of the Middle Ages, for instance, had to know how to perform all the tasks required by the elementary process of his trade, otherwise, he would have had to remain idle part of the time and share with others the revenue accruing to labor. Under such conditions, specialization was uneconomical." (Georgescu-Roegen, 1971, pp 236-237)

Georgescu-Roegen argues convincingly that specialization in the factory production process is uneconomical under conditions characterised by low intensity of demand. Idle tools and idle workers still impose costs, but generate no goods or services (and little demand).

If the coal had run out in 1800, would Adam Smith be invoked today?

How Low can EROI Go?

Not to 1:1. Look at this graph of natural gas prices. The well head price is much lower than the delivered price. Looking at the 1990 numbers, you can see that most of the cost was in distribution. By 2008 that had reversed and most of the cost was at the well head but only by a little.

So finding the EROI at the well head is just the first step in calculating the EROI for a fuel source. The distribution cost would at least double the energy inputs.

cool chart - looks like winter of 05/06 retailers made a killing.

Hurricane Katrina.

They made good revenue but were they able to collect? Not in Minneapolis.

They have managed to collect most of that by now, but prices are heading back up (as per your last article).

http://www.startribune.com/business/11227141.html

http://www.startribune.com/local/12448316.html

It makes me worried about the long term viability of these distribution companies.

Yup, distribution, installation, infrastructure, etc are all very relevant. Which is why we see such huge discrepancies between the claimed EROI, and energy payback period, for PV panels, based on energy used in the factory to manufacture them, vs. the real-world installed cost of a PV system, including freight, labor, mounting hardware, cables, inverter, etc. The latter often comes up with a payback period of 20 years or more, vs. several months to 4 years at the factory level.

Which brings up a general issue: what can we, and what can't we, learn about EROI from economic costs. Obviously one should not mix costs from disparate times with very different energy prices. E.g., a PV panel may "pay back" well if the price of electricity rises over time, but that's comparing apples (cost of energy to install the system, at current prices) with oranges (value of electricity provided some years later, at higher prices). Also need to be alert to hidden subsidies (e.g. tax credits fo solar power, or for ethanol). Sometimes the subsidies may get too convoluted to figure out. But on the other hand energy-only analyses may miss important components (such as the labor to install the PV panels), or get bogged down in arguments over the "correct" scope.

I've heard that Dr. Hall believes that an energy source with an EROI of less than about 4:1 is not useful for human society. (See the horizontal line in the bubble chart.) I'd love to hear how he came up with that assessment. In particular, it hints that there are societal (economic?) costs that are necessarily left out of the EROI analysis but impact the usefulness of the energy source nevertheless.

It sounds as though Prof. Hall wants to do another numbers and data filled analysis of a simple minded application of EROEI that ignores logic and market prices and what they mean. This is futile in my opinion. As I have posted many times EROEI is full of logic errors and limited by deeming price and renew-ability as irrelevant. EROEI is only valid when comparing like and like as in two oil wells where inputs and outputs vary. It is also valid in comparing like and like over time as to show that EROEI is declining for oil over time.

Numbers have rules for use which are almost second nature to many of us. Logic also has rules which it appears are not so obvious to even college professors. Those who are enthralled with data seem to discount the rules of logic for some reason. To them if the numbers add up, the conclusion is valid. They know that 2 + 2 = 4 so then they jump to the conclusion that 2 apples + 2 oranges = 4 fruit. In doing this, they do not seem to understand that 4 fruit does not tell us anything about whether apples or oranges are superior. Now suppose we subtract 2 apples from 4 fruit. What is the answer? Some would say 2 oranges, but that is obvious only because we were discussing apples and oranges. 4 fruit in and of itself does not tell us much. Perhaps 4 fruit - 2 apples = 2 tangerines or 2 pineapples, we do not know.

This is the problem when comparing unlike and unlike. The numbers may make sense but the logic does not. The whole point of comparison is to find things that are sufficiently similar so as to deduce another similarity. When unlike and unlike are compared as with oil and ethanol, no valid conclusions can be reached because they are not sufficiently alike. The main difference is that ethanol is renewable and oil is not. In the case of electricity from fossil fuels, EROEI is again meaningless because of comparing unlike and unlike. Electricity production is valid because of it's utility compared to the fossil fuel inputs even though EROEI far below one.

Ignoring price is the other major logic error of EROEI. Price matters, especially in calculating EROEI for a locality such as the United States. There are at least 2 kinds of oil in the U.S.: domestically produced and imported. They each have very different EROEI because the imported oil has to be paid for. The price paid is obviously the energy content of the oil since the seller is not getting the economic gain of the oil. The buyer gets the economic gain from the oil. The buyer uses energy to do the refining, distribution and of course consumption. Thus imported oil has a negative EROEI for Americans. Because all but about 5mb/d of American's 20mb/d is imported, EROEI for oil in the U.S. must be negative.

Nonetheless oil is held up by the anti ethanol crowd as the standard which ethanol must meet. There is no logic to this. It is nonsense.

And so it is with all the unlike and unlike alternative fuels to which EROEI is misapplied and in which the relevancy of price is ignored.

There is no logic to this. It is nonsense.

Price is irrelevant. If I have to burn a barrel of oil to pump out a barrel of oil, it doesn't matter if oil is 10 cents a barrel or $1,000,000 a barrel. The whole exercise becomes a waste of time as no useable (net) energy is produced.

Antoinetta III

But, but... don't you see, domestic oil is free and it's only foreign oil that costs a thousand bucks so the eroei on mandated ethanol is really really something or other that's really really good for everybody involved, or something like that. And if you don't agree then you're nonsense. Everybody knows that, or this. OH you know what I mean.

2(x) + 2(x) = 4(x) <~~ I think this is what you're saying.

How do you price an ecosystem? How do you price beauty? This is the problem with EROEI analyses. This goes beyond ergs & BTUs. The destruction wrought on the biosphere - and perhaps upon the lithosphere itself - have to be factored in for any EROEI analysis to be meaningful. How do you quantify this? What if not everyone agrees with your pricing schedule? This whole line of reasoning (or lack thereof) is a waste of time.

Precisely!

EROEI is a totally amoral concept worthy of an economist. (There is nothing in classical economics to 'disprove' slavery, genocide, etc.)

Peak Oil should educate us in what we should do, not to seek to greedily maximize net energy, a single measure.

There is no categorical imperative to screw thy neighbor; the EROEI of burning dirty coal is far higher than scrubbing it therefore we should stop pollution controls.

If oil has an EROEI higher than wind would it justify a war to obtain oil?

Should nuclear be pursued based on EROEI regardless of dangers?

It's inexcusable at this point in human development to rely on an amoral and largely arbitrary yardstick to decide what we MUST do.

"at this point in human development"

What point is this?

There is actually a point in my point besides the point of the pointlessness of your post, but you probably want to brush up on your Niebuhr before tackling it.

In the meantime, both you and Darwinsong need to get a grip. Charles Hall is making an argument favouring the addition of an analytical tool to the policy/decision making process. Moreover, is there any reason to believe that he would not want the policy toolbox to provide the means to account for all aspects of the rise in entropy caused by human action?

Some people want to discredit EROI analysis because it kills their pet projects, like using land to grow corn to make into ethanol. That wouldn't be you, would it?

What YOU need to get a grip on is that for EROEI to be meaningful you (or Dr. Hall) would have to 1.) include ALL the inputs on the EI side and 2.) provide nonarbitrary pricing on intangibles. Since you're not willing to do 1. and CAN'T do 2., the entire exercise of EROEI analysis remains meaningless.

It certainly wouldn't be me. So long as hunger persists in the world, growing food for fuel is immoral. Period.

Nate:

I think EROI is an important concept to get across. Charles is correct that once EROI is sufficiently large it hardly matters, i.e. it is not a very important way to determine which of two projects with EROI of say 20 and 100 is better. But if the EROI are 1.4 and .7, then low EROI should be a red flag that more detailed analysis of why the number is so low should be performed.

On a different point, your point (2) claims that the subprime crisis is a consequence of peak oil. I think most economists would disagree with it. I'm not an economist, but I think the subprime meltdown was inevitable with/without PO. My concern is that some readers whom we need to reach might consider it to be an outrageous claim. I know that when I see an outrageous claim by an author, I usually stop reading, and may even mentally consign the author to the "crank, do not waste time on" list. For that reason I think you should not make that statement -or at least make it further down in the paper, and with sufficient caveats that an undesirable and unintended loss of skeptical readership is avoided.

Thanks. I edited Charlies submission for typos, etc. but did not change any content.e.g. that comment about subprime was his and I'll let him defend it.