Will 2011 be a rerun of 2008? (Longer version)

Posted by Gail the Actuary on January 3, 2011 - 11:20am

An article similar to this ran in ASPO-USA's December 20, 2010 newsletter. I call this one "longer version" to distinguish it from the "two-graph" version that ran in the newsletter.

We all remember the oil price run-up (and run back down) of 2008. Now, with prices similar to where they were in the fall of 2007, the question quite naturally arises as to whether we are headed for another similar scenario.

Of course, we know that the scenario cannot really be the same. World economies are now much weaker than in late 2007. Several countries are having problems with debt, even with oil at its current price. If the oil price rises by $20 or $30 or $40 barrel, we can be pretty sure that those countries will be in much worse financial condition. And while governments have learned to deal with collapsing banks, citizens have a “been there, done that” attitude. They may not be as willing to bail out banks that seem to be contributing to the problems of the day.

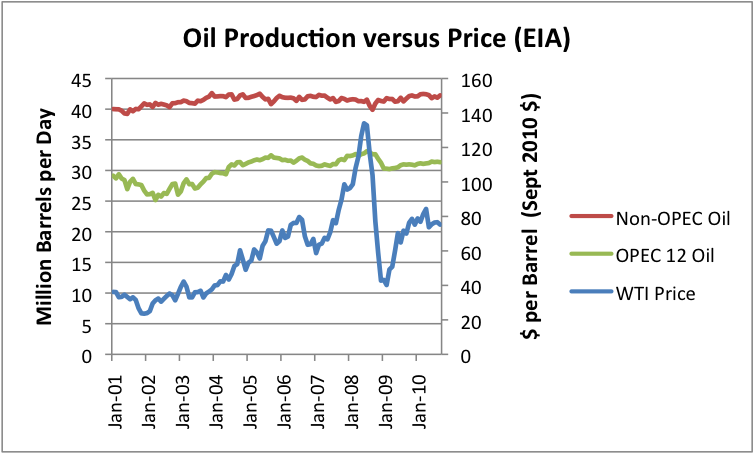

If we look back at what happened three years ago, there was a huge run up in the price of oil, but very little change in oil supply.

Oil price roughly corresponded to today’s price in October 2007. Between then and July 2008 (the peak in both prices and production), OPEC increased its oil supply by 1.3 million barrels. Non-OPEC actually decreased its supply by about 0.3 million barrels a day between October 2007 and July 2008, providing a net increase in oil supply of only about 1 million barrels a day, despite the huge run-up in prices.

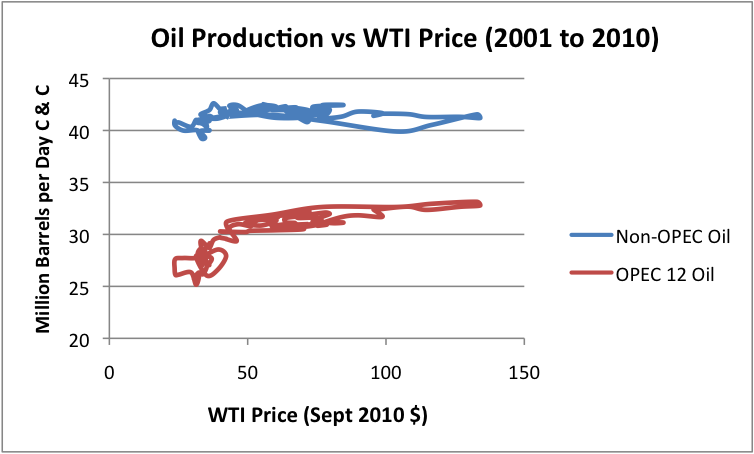

It can be seen from the above graph that the supply of OPEC oil has tended to increase, as oil prices increase. Non-OPEC supply has been much less responsive to price. This is another way of graphing the relationship between oil price and oil production:

In Figure 2, as oil price increases along the horizontal axis, we see that non-OPEC oil production remains virtually flat. As oil price increases for the OPEC 12, we see the kind of supply curve we might expect to see for a supplier that has a small amount of more expensive capacity that it can put on line when prices justify it. The catch is that the amount of supply added as prices rise isn’t really very much–as we just saw, 1.3 million barrels a day, between October 2007 and July 2008.

Eventually, the economy could not handle the high oil prices, and prices dropped. Credit availability began dropping and recession became a greater and greater issue.

Will this time be different? It seems to me that OPEC has done a good job of convincing the world that it has a lot of extra supply, but it is less than clear that it has much more excess capacity than it had in the 2007-2008 period. OPEC shows this image on its website, but this may just be a long-standing approach aimed at convincing the world that it has more oil (and power) than it really does.

Spare capacity, like oil reserves, is not audited. The higher the numbers proclaimed to the world, the more powerful OPEC appears, both in the eyes of its own people, and in the eyes of people around the world. OPEC shows lists of new projects and investment amounts, but it is not clear that the new capacity being added is more than what is needed to offset declines in other fields. The new production amounts listed (shown separately by country--this is the one for Saudi Arabia) come to something like 6% of production – this could simply represent offsets to declines in fields elsewhere. The problem is we really don’t know, because no auditing is ever done. We are just expected to trust Saudi Arabia and OPEC on a matter of importance to the world.

OPEC tells us it is acting as a cartel, but when a person looks closely at the data, only three countries appear to be pumping at less than full capacity: Saudi Arabia, United Arab Emirates, and Kuwait. Production rises and falls with price for these countries. It is not all that difficult to coordinate the activities of three countries, especially when one of them–Saudi Arabia–is doing most of the adjustment to oil supply. So all of OPEC’s marvelous abilities may not be all that marvelous. If Saudi Arabia knows it can sell oil it withholds from the market at a higher price later, it is not a bad move to hold a bit of oil off the market, and claim that the amount being held off the market is much higher.

In the next year, there is a significant chance that oil demand may rise. While oil supplies are at this point adequate, if demand continues to grow, we could very well see another surge in oil prices, and another test as to whether there really is spare capacity. If the supply curves shown in Figure 2 are any indication, we won’t be getting much more oil, perhaps another 1.5 million barrels a day, even if prices spike.

The one possibility that would seem to postpone such a price run-up is if world economies in the very near term start heading into major recession. Such a recession might indicate that even the current oil price is too high for economies to handle, in their weakened state.

I believe the limit on how much oil will be supplied is not the amount of oil in the ground; rather the limit is how high a price economies can afford. This in turn is tied to the true value of the oil to society–whether oil can really be used to produce goods and services to justify its price. The problems we experienced in 2008, and may experience in the not-to-distant future, suggest that we may be reaching this limit.

There is one economy that seems to thrive with high oil prices, namely China. They continue to increase their imports yearly no matter what the price. In Darwinian terms we are going to have survival of the fittest in a war for the oil that is left.

I think what they have done, by running huge trade surpluses year after year, is cornered the world's supply of dollars and translated that into a flow of oil (at least what is left of it). Since they have converted all of those dollars into treasuries, they have effectively created a never ending supply of oil, as our federal reserve prints money, it ends up in China, either through the trade surplus, or direct payments from our treasury. As the flow of money continues to divert oil supplies into China, it will drive the price higher and higher, making it more unaffordable for the rest of the word. If the price of oil goes down, it helps china, if it goes up, it helps them as well, this is a cycle that can only end badly for anyone outside of China.

Any way you look at it, there is about to be a tremedous redistribution of wealth in this world.

Thats because they increase their money/credit supply faster than we do. I.e. the 'affordability' of the oil is not organic.

There is no free lunch, but many gaming the system can and do eat early..

Another thing about China is that they don't use much oil. Instead, they use a lot of coal, and they have been ramping up coal usage greatly. So their total energy usage has been growing greatly. Even their oil use has been growing, because they have been able to import more and more (with increased money/credit and with all of their exports, that depend a lot on coal).

Coal only generates electricity. China still needs oil for transportation, diesel, and manufacturing involving plastics etc. It's just that they don't have a large car based middle class. It is not true to say they use coal in the place of oil.

There are some substitutions that can be made--electric bicycles for cars, for example. China seems to have at least some electric passenger trains, as well.

All new trains and train lines being built these days are electric, without exceptions (to my knowledge)

And indeed China is building quite a few of them (much more than a few actually)

Thats because they increase their money/credit supply faster than we do

Nate, could you expand on that? What are the mechanics of the expansion of money that you have in mind?

As best I can tell, China's economy is expanding because their economy is immature, and it's partly a command economy. OTOH, the US's economy is mature and more decentralized, which means that when people get scared, it's easy for the economy to slow down.

I'm assuming, Nate, that you are saying that China increases their money supply relative to their GDP at a faster rate than the US grows its money/credit supply relative to its GDP. It would seem growing the money/credit supply quickly would devalue the currency some. That of course would make oil more expensive. This is not a problem if increased cost for oil is dwarfed by real increases in the GDP brought about by importing that more costly oil. It all kind of makes my head spin, and it does that enough already naturally (after I used concrete as a headrestraint--but hey no whiplash).

China is not alone in showing increasing oil consumption--at the end of this decade versus the late Nineties--against a long term increase in oil prices:

How do you think China is getting more oil, when the supply for the U.S. and India, seem to be stunted by the high prices?

See my reply above. Also, what little oil they are using ends up disproportionately benefiting the manufacturing and distribution of goods that can be sold to others, rather than discretionary use (visiting relatives, for example). The additional cash from the goods sale makes it easier to buy imports.

Gail,

Do you have data to support this?

China now has 60m cars on the road with 12-18m (depending on the source) new added each year. Even if they drive half the miles that US drivers travel, it is starting to have a significant effect.

Remember that China's middle class population is almost as large as the entire US population. They also now have a national highway system that rivals the US system.

The Chinese don't display the same usage patterns as Americans. They don't buy huge SUV's to commute to work every day, and they don't live on 2-acre lots in vast sprawling suburbs.

They don't drive because e.g. their job is 20 miles in one direction, the shopping center is 20 miles in the other direction, and there is no public transit - which is the motivation behind a lot of US driving.

In China the job will be within bicycling distance, the shopping will be within walking distance, and there will be public transit, including high-speed rail to other cities. When they do drive somewhere, it is because it is difficult to get to by bicycle or high-speed train, and when they go, they usually take as many people in the car as they can, not just themselves. However, because driving is a rare thing for most car owners, it is something they can afford to do when they want to.

As you said, China's middle class is almost as large as the entire US population, but unlike in the US they have a lot of disposable income since their lifestyles are still rather frugal, and their disposable incomes are increasing rapidly.

Have you a source for this stuff?

Have you a source for this stuff?

I find The Economist is a good source for this kind of stuff. Also I've been in China, seen the Chinese in action in other countries, and consulted for international oil companies which (unbeknownst to most people) were controlled by Chinese interests.

The dense cities and short journeys are very clear if you go to China: incredible investment in subways in the big cities, and if you take a bus out on a Chinese inter-city motorway in what would be the rush-hour it's strikingly empty.

Correct Chinese usage patterns are not the same as the US. Yet the US managed to build sprawling suburbs and drive SUV's and grow VMT at a steady rate while oil usage remained basically flat to falling ?

Maybe one day I won't be the only one thats skeptical about changes in actual Chinese oil consumption.

Us consumption patters from 1992-2008 show about a 4mpd increase in demand over 16 years. High prices reduced this back to only about 3mbd from 1992-2010 basically 20 years. The annual change is minute 150kbd or so.

One reason is simple geometry as the radius increases the amount of land increases geometrically while distance traveled does not. Its complex because new office centers in suburbia also introduce new centers or locus points.

If anything Chinese growth patterns are even tighter than the US. I'd argue that they can easily do what they are doing with and even lower average annual increase in oil usage indeed almost noise level.

Obviously Chinese oil imports are increasingly strongly but I'd argue that I see no reason that this is not also because of the same reasons that US imports increase i.e falling domestic production rising demand plays a significantly secondary role.

Given the nature of Chinese growth vs the US with its similarities to say New York or Tokyo not Chicago even giving them a 300kbd annual net increase in demand is significant vs the US. Thats certainly possible.

However if this is actually having a big effect oil prices well then supply would have to be under serious strain. Obviously falling domestic production coupled with rising imports as I suspect can be a lot larger as its geologically driven. If they are losing say 300kbd of production and demand is rising by 300kbd per year well now 600kbd is starting to reach a number that would have a real impact on global prices. A few years of that and net imports become pretty large.

If we assume other large producing nations that are also net importers are facing a similar situation indeed lets assume even exporters are under the same situation rising demand and falling production. You have demand for imports increasing rapidly as exports fall rapidly.

Again looking at the US if it was simply a case of rising prices and relatively steady production well it seems the US is capable of cutting back on demand at certain price points. One would expect the same is true for China or any nation for that matter with a lot of flexibility in demand if oil prices become onerous. I think a pure demand pull model with relatively steady oil production results in a rapid flattening of prices at some balanced level. In fact if this was the case then I would argue that oil prices should reach some fairly reasonable but slightly painful level and then remain flat for a long time as efficiency gains offset growth. Demand elasticity would keep prices in a fairly narrow but high range. Historically high prices would also support alternatives not just conservation.

Its interesting that simply assuming China is actually similar to the US and furthermore its consumption pattern is closer to what we see in New Your city allows you paint and entirely different picture of the situation yet get the same result.

I don't think you are actually describing typical America. There are SOME with the commute patterns that you describe, but given that minimum 1/3 of us are crammed in at 2000/square mile or denser, if you assume every family is 5 (way high) you get 400 families/acre, or 1.6 acres/family -- with no space left over for anything else. Families of 4 or smaller are the rule, that gives only 1.3 acres/family -- and the street/utility bite is proportionally larger.

Those of us who live in dense areas, ought to consider transporting ourselves like other people in other countries (including wealthy ones) who live in dense areas. We'd save a fair amount of gasoline, we'd spend less on medicine, economic activity would probably increase (in our town, it is often parking-limited; using bikes to get around gives an order-of-magnitude increase in potential traffic). Those of us who live in sparse areas, should approve of this, because you'd like cheaper gasoline, wouldn't you?

I'm describing people at the margin (an economic concept). It is not the 1/3 who are living at a density of 2000 families/square mile who will be in trouble, it is the ones with working class incomes who live in 3500 square foot McMansions on two-acre lots 20 miles from the nearest services that will find themselves in trouble when oil supplies start to decline in earnest. They are the ones who will find themselves pushing a shopping cart 20 miles down the freeway to the nearest food bank to keep themselves from starving to death.

However, I have some bad news for you. You need to get the density up over 8 dwelling units per acre if you want to make public transit viable. This works out to 5120 families per square mile, and assuming 4 persons per family, that means 20,480 people per square mile - ten times the population density that you are describing as "crammed". This is why public transit is not viable in much of the US.

However, I don't consider that particularly dense. I've lived in some very nice neighborhoods in Canadian cities with a much higher population density than that (Vancouver is particularly nice despite its high density). Most of the cities in Europe and Asia have higher densities in their residential areas, and they have many perfectly lovely neighborhoods for families to raise children in.

It's just a huge conceptual leap for most Americans to realize that this may be their future. Either that or living in a cardboard box and pushing a shopping cart down the freeway to the food bank.

I struggle with the density requirement for mass transit, as an areal calculation. Most mass transit appears to be linearly driven -- trains and trams on tracks, buses on routes, even cars on highways -- so it would seem that passenger density should be given as a "people per mile of route" rather than "people per square mile".

This is important, obviously, if you envision a lower density area laterally feeding into a higher-density transport route. If your neighborhood is 1/10th the target density, you may have to walk 10 times as far to catch your stop, but you have a nice big yard to walk to.

I guess there are secondary costs for sidewalks and other infrastructure besides transportation, but those would also be trade-offs of lifestyle and location versus convenience.

With a hub-and-spoke system, even a fairly large suburban area could be readily aggregated to fill a single high-capacity line, with real-estate near the hubs commanding a commercial premium for traffic.

Over time, you'd have malls and shops at the aggregation hubs, apts and condos near the stops on the lines, single family residences and perhaps estates a little further out, and then farms and large-acreage businesses. Bikes and/or EVs (park and ride) could easily cover the mile or two from the stops to the homes for the underbuilt areas.

I think this was part of Alan's Transit Oriented Development, and seems viable to me.

The guideline of requiring a minimum of 8 dwelling units per acre to make public transit viable for most people is just a general rule of thumb. If you go with transit corridors, this just means 8 dwelling units per acre within the transit corridor.

However, I did some checking and the arbitrary assumption of 4 persons per dwelling unit is not valid in modern society. It looks like it is closer to 2.5 persons per dwelling unit, which would give a density of 20 people per acre, or 12,800 people per square mile. Also, that is net density, not gross density - it's only the density in areas people actually live in. Unpopulated areas don't really count.

Another rule of thumb is that most people are willing to walk 5 minutes to a bus stop or 10 minutes to a rail rapid transit station. Since people generally walk about 3 miles per hour, that means they will walk 1/4 mile to a bus stop or 1/2 mile to a rail station. This defines the width of your transit corridors - 1/2 mile wide for a bus route, and 1 mile wide for a rail system. However, within that corridor you need adequate density to get the passenger traffic for an efficient system.

It is true that you could build a city as a radial pattern of transit corridors with green space between them. This would have the advantage that, in the rail case, all the people would not only be within a 10 minute walk of a rail line, but also within a 10 minute walk of a green space. I would say that it would make for a rather pleasant neighborhood to live in. Actually, I lived in a neighborhood like that, and it was very pleasant.

The problem with walking "10 times as far to catch your stop" is that you will be walking 50 minutes to the bus stop, or 1 hour 40 minutes to the train station. How many people are willing to do that? Not many.

Most parts of US cities have densities which are too low, so their transit systems operate with mostly empty vehicles and with heavy government subsidies. Many European and Asian cities have higher densities along their transit routes, so their buses and trains run full most of the time.

European and Asian governments also tend to tax gasoline heavily and use the money to subsidize public transit because they do not want to incur the balance of trade deficits that result from importing oil to keep cars on the road. The US government has not caught on to the rational behind this strategy, and thus incurs very large balance-of-trade deficits as a result of the huge oil import demands for all those cars driving everywhere. This is becoming less and less sustainable as world oil demand tightens and prices rise.

A 10 minute walk is only maybe a 2-minute bike ride, or a 1 minute EV ride. I would think the goal would be to fill the trains and trams, and have a "modified" walkable area to get the transit density up in suburbia.

As an example, the town I'm in has 70K people. That's enough for what, maybe 6 sq miles of supportable density (as opposed to the maybe 35 or 40 sq miles it has today)? In transit terms that would be maybe 3 miles of rail or 6 miles of busing.

To overlay that here, you'd end up at best with a train close to town center (it's freight-only today, but in the right place, just like it was 100 years ago!), or buses partway along the two highway-edges. In essence, where people exit the highways today you'd need park-and-ride to get home across the last few miles. A lucky few could walk, more could bike, and some would need a vehicle.

But all of that is traversed by school buses today -- a partial bus infrastructure subsidy that could arguably transfer to city buses. Part also has a city bus today, but very infrequent. Parts have a "senior van" service as well.

All in all, I think the transit design approach would work, but about half the existing neighborhoods in my town are where "green space" ought to be. To preserve those means either adding more people (via apartments) or spending a higher fracture on transit. Maybe the latter as a step toward the former? And EVs/bikes/cycles as a step before that?

To me, this sort of layout doesn't seem unsustainable IF you have work to go to. I'm less worried about how to get to the priorities of life (work, stores, doctors, schools) than I am about keeping them available to get to.

As an example, the town I'm in has 70K people. That's enough for what, maybe 6 sq miles of supportable density (as opposed to the maybe 35 or 40 sq miles it has today)?

In many countries in Europe, it would actually occupy 6 square miles or less. They have innumerable cozy little towns dotting the countryside, rather than having the towns sprawl all over the landscape as in the US. A lot of these towns date back to the middle ages, when there was no such thing as automobile transportation, and in fact most people didn't even have horses, so they had to be able to walk to the marketplace.

I think the rules in these countries are such that you can't indiscriminately subdivide farmland, and so there is a very sharp dividing line between the dense little towns, and the pastoral countryside. The goal is to preserve farmland as farmland, not create huge suburban building lots for people to build McMansions on.

Anyhow, if you put 70K people into 6 square miles in a radial pattern, common for medieval towns, no point would be more than 1.4 miles from the center, or a 30 minute walk at most. That would be 5 minutes or so by bicycle, and everyone would have a bicycle. If you put an inter-city train station at the center, that would quite nicely serve the whole town.

That would be rather typical for Europe, but I think it would be a huge conceptual leap for most Americans.

You have hit the core of the problem right there, though your line (which I italicized) might be taken to imply a crop of McMansions was the goal of a long term plan. Of course we all know those travesties are merely the result of a process that makes short term dollar revenue per square foot of land its goal. It's what might be called an 'organic' process which utilizes every shortcut to quick revenue it can. Of course the process that ended up yielding this most unwieldly of crops grew the oil business, among so many others, big time. So many comfortable lives and retirements have thus been created...it is a tangled web ?-)

Being 1 mile from a commuter rail line is not the same as being 1 mile from a commuter rail station.

Even with much higher population densities and gasoline taxes over 80% of passenger miles are traveled by car.

Your math doesn't match reality, at least not if you throw bicycles into the mix (and it seems rather artificial to exclude them).

Groningen, Netherlands. 6000 per square mile (far less than 20,000). 57% bicycle trip share. Sounds like something-not-cars is working quite well at 1/3 the density you think is required. There's a glitch in your math or your assumptions. (I'm trying to get a map of the city that helps me check that they don't have an artificial concentration in the middle; there is some, but my guesstimate is less than 3:1 crowding).

And at any rate, other Dutch towns are less dense, yet still manage non-trivial (> 1/3) bike trip shares. Bikes have the additional advantage, if you combine them with transit stations, of multiplying the feed-in radius (vs walking) by at least a factor of 3, so 9x the area, or 9x less density required to be viable. Commuter rail stations in Boston burbs tend to be parking-limited, but the roads feeding them are grossly unfriendly to bikes.

Of course, the frustrating thing to me is that we already have cities demographically/geographically similar to Groningen here in the US (I live on the edge of one), yet almost everyone prefers to sit on their butts, get fat, burn gas, and complain about the traffic and parking.

India showed only a small decline in consumption in 2009. Note the difference in 2009 consumption versus 1998 for the various countries (although there were of course huge differences in magnitudes). In any case, I think that developing countries can outbid many developed OECD countries because such a large percentage of OECD oil consumption is related to discretionary spending, and of course subsidies are certainly a factor in many countries. Here is a chart of global net oil export numbers versus Chindia's net oil imports.

And this article looks at a couple of scenarios for 2015:

http://www.energybulletin.net/stories/2010-10-18/peak-oil-versus-peak-ex...

Deutsche Bank pointed out in a report issued last month that:

Judging from what's listed in the megaprojects wiki it looks like we didn't bring enough online last year to overcome declines, either. The front page says 3240 kb/d for 2010; when I tally up all the projects on individual pages I get 4950 kb/d, but don't get excited - 1850 kb/d of that is Rumalia, which might have been boosted up 18.5 kb/d. Maybe.

Assuming a decline of -3755 kb/d - i.e., 4.39% x 85471 kb/d - we would be in the hole -515 kb/d. Or so. Or not. 85471 is just an arbitrary number for global demand I'm using; 4.39 is IEO 2008's 4.35% decline rate that's grown .01%, as the IEA said the natural decline rate would do. Maybe it's really 4.44%? Or?

Certainly it doesn't seem like we needed that spare cap, or, again, OPEC are just letting us know how "happy" they are. Incidentally, if you adjust for inflation $28 in 2001 equates to $34.59 now. That might explain some of the OPEC attitude. Well, not really. Let's hope they use it as an excuse some day, that would be funny.

"Assuming a decline of -3755 kb/d - i.e., 4.39% x 85471 kb/d -"

You can't take a percentage of the total liquids production which contains crude, NGLs, bio fuels and processing gains. NGLs are growing. Any assumed decline rate should be applied to crude only

It's just a ballpark figure, I haven't examined this in any exhaustive manner. Not sure why a decline rate wouldn't apply to NGLs, either. C+C reached a new absolute in 2008, too; dampened output thereafter is due to OPEC quotas which NGLs aren't subject to, and in fact OPEC all liquids spare capacity is smaller than C+C at the moment, paradoxically enough.

I noticed that the megaprojects database hasn't been yupdated since January 2010. Is anyone working to keep it current or is it a dead duck?

I wrote a post about Wiki Oil Megaprojects - overall tallies at my blog. Tony made some updates last year, but mostly of an editing nature I think; the big addition seems to be Rumalia for 2010 adding 1.8 mb/d, which, if you haven't noticed, hasn't happened! This is a topic I'm devoting some time to, albeit right now I'm trying out varying approaches to conducting the research. I've compiled a list of company websites but those aren't actually of much use, although it's nice to have on hand. Searching for 'oil startup 201_" will be my next tack; perhaps trawling through industry rags like RIGZONE to see what pops up.

By my calc all liquids spare capacity measured from OPEC's July 2008 absolute peak is ca. 1.4 mb/d, while C+C is ca. 1.7, as I state above a rather odd circumstance. This is purely shut-in production, I'm disregarding new oil like Khurais Mk 2, which presumably is up and running while An Dar and Shedgum take a nap. Presumably.

I'm reminded of the older camper's saying - how you don't have to be faster than the bear, you just have to be faster than the other campers.

Whether we're increasing oil production, holding stable, or declining, someone still gets plenty and someone still gets outcompeted. The number of countries that are falling short is increasing, as the higher prices hurt the "developing countries" (I wonder how much longer that optimistic tag will last?) and the middling countries, such as ourselves, see their assets drain away simply to maintain the status quo.

...so China is out in front, while the bear is right on our tail. They could have years before they have much to worry about - plenty of us slow campers out here still.

I think your contention that China is buying up US Treasuries is probably incorrect. The last time I looked, they had (with emphasis on the past tense) bought up a fairly large number of US Treasuries. The amount that sticks in my mind is around $550 Billion. That was up until a couple of years ago. In the last couple of years, there seems to be some evidence that they haven't purchased many more US Treasuries and have behaved in a way that would suggest that they are diversifying their holdings among a broad basket of commodities and currencies. The reporting on this is a bit murky because they seem to use a range of third parties to do significant parts of their trading.

There has even been a fair amount of buzz suggesting that they are trying to reduce their holdings of US Treasuries because they think that the US government is trying to devalue the US dollar with respect to the Yuan.

The scary part is that they are probably correct in this contention.

In the last couple of years, there seems to be some evidence that they haven't purchased many more US Treasuries and have behaved in a way that would suggest that they are diversifying their holdings among a broad basket of commodities and currencies

I think the Chinese are trying to get rid of their US Treasuries by exchanging them for resource assets around the world. They're trying to be subtle about it because if people became aware of what was happening, the value of those Treasuries would drop and they would lose money on them.

There has even been a fair amount of buzz suggesting that they are trying to reduce their holdings of US Treasuries because they think that the US government is trying to devalue the US dollar with respect to the Yuan.

I think it's fairly obvious the US government is trying to devalue the US dollar with respect to the Yuan. In fact Obama got a fair amount of flak at the last G-20 meeting for charging that the Chinese government was manipulating its currency to keep its value down, because it was obvious to other countries that the US was doing the same thing with the US dollar.

RockyMountainGuy:

Thanks for the detail.

I think the US government is being disingenuous about its intentions.

The Chinese are being fairly straight up about things.

The Fed inflates the money supply --- everyone else in the world gets inflation.

This was well said, and little understood...

Have you read "Griftopia" by Matt Taibi? I understand he has a chapter about the oil price spike of 2008 being purely a matter of speculation. This matters because his book is #260 at Amazon and a lot of the people who we ultimately can reach with a message about constraints may well be clouded by Taibbi and others dismissiveness about oil depletion- he is a good writer and popular.

My own view is that oil price spike WAS speculation, but not in the sense typically claimed. It (and the other commodity movements) in 2008 were symptoms of the terminus of the private credit bubble, (we've yet to have the terminus of the public/govt credit bubble). Thus it was 'speculation' but not on oil individually per se, and we see how oil supply responded (not much).

Though it seems to be the terminus of the private credit bubble:

it's rare that there ever is a single cause for any event. The context must be correct before some cause can have its impact. We are in awe of the person who runs very fast but pay no attention to the ground that makes the speed possible. Or we marvel at the 100th story of a building and forget the other 99 that make the 100th possible.

So what are all the causes to the 2008 run up in price? I'm not going to attempt to list them all now but speculation is certainly one of them. So was a flood of credit.

However, if we are looking for some sort of sequence of causes, I think Collin Campbell expresses it best when he says that "speculators spotted a rising trend." In other words, a fundamental tightness due to supply and demand started to push up prices and speculators then did what they always do: they tried to make money before the bubble popped. They used whatever means was at their disposal and credit was very easy to obtain at that time.

Reading your comment closely Nate I don't think that you are saying that private credit was the only cause of the price spike but a quick read could leave someone with that impression.

I agree with you, borrowed money tends to drive up the price of everything it touches and when it is withdrawn, watch out.

Nate,

I work in the oil industry (in finance) and there was NO spare capacity in the global marketplace in 08. Demand was clearly exceeding what the industry was capable of supplying by June/July of 08. So while I agree there was money flowing into oil during the run up it was not the catalyst for $147 oil.

In addition, most of what you call the "speculative" market is simply companies like mine hedging our crude production with a bank with a put or a call. This is not funny money, it is two counterparties trading or "speculating" on acutal physical volumes. Most times the banks are just intermediaries taking a fee on each barrel. These trades are very important for helping companies manage cash flow to cushion commoditiy price volitility.

Unless you consider reletively new ETF's like ticker USO speculative trading which is held by a broad array of americans in their retirement accounts and has actually had terrible performance in relation to the price of oil due to contango I am not sure where you see the speculative money flows coming from and what instruments they would they be purchasing? Crude contracts are traded with purpose, to help it's producers (E&P's) and consumers (i.e. SouthWest Airlines) smooth cash flow and a allow for budgetary planning. When talking heads ramble on about speculative trading of oil they are talking about futures contracts that represent physical volumes, if oil supply increased dramatically it is certain that the price of oil would head down but that is not happening.

People did not all of the sudden realize oil was an asset and start speculating on it three years ago causing the price to quadruple, it was supply that failed to keep up. Look at the 80's and 90's, oil traded within in a relative range (cheap by today's standards) and speculating on oil futures contracts was being done all day long.

To blame speculators for the high oil price is simply too easy, if it were that easy the banks would have total control over markets and as we saw in 08 they really have no ability to mitigate or even defend themselves against an oil supply induced market contraction. There is no evil man behind the curtain here, the banks are actually doing us all a favor right now (although they think it's for different reasons) by printing money and softening the blow of no growth in the liquids supply. Without the banks floating us with a buffer of liquidity our time would be up right now and unemployment would easily be north of 20%.

Yup. How long it can last and what happens to trade if/when it ends are some important questions.

Unemployment already *is* north of 20% in some places if you go by U-6 (the broadest measure).

Why didn't $145 dollar oil bring more supplies into the US? China sure did not have a problem getting imports at that price?

Here is China's net imports for the last several years:

http://tonto.eia.doe.gov/country/img/charts_png/CH_petnet_img.png

It's primarily because China is capable of out bidding the U.S. for crude now. They have a much lower debt load and are the new 800 lbs gorilla in the global oil marketplace. Since the U.S. is now a debtor nation we have to borrow vast sums of money from countries like China to purchase our oil. This adds a significant premium to what we have to pay and essentially chokes off our ability to out bid China who is paying with not only cash but cash the U.S. is sending them to pay our debts.

They are in a superior financial position to out bid us for each barrel and as we have seen for each additional barrel that China consumes the U.S. loses. Since there is not enough additional supply for both nations to grow their consumption one has to give it up, since we are the debtor nation it is us. This is why we can watch the Chinese have a rising standard of living while ours goes down. The Chinese however are not invincible to the oil price and it's effects and have already seen significant inflation especially with food prices.

Do you think that the Brent crude price is what China is currently willing to pay for each barrel?

Well, every contract is different. With Venezuela they are paying primarily with investment in Venezuela itself through infrastructure and technology, with some African nations they simply provide bribes. The other advantage China has is political. Much of the oil left in the world is in unsavory places run by corrupt regimes. China has a no strings attached attitude when it comes to procurement of resources. Like in Darfur or Nigeria the U.S. comes in with all these humanitarian demands and conditions that come with doing business. China doesn't care if these regimes are committing genocide, they just want the oil and will pay regimes whatever it takes.

Because they are more ruthless and have no pre-conditions, they are able to outmaneuver us. Combine this with their financial superiority and aggresive resource procurement agenda and they will continue to suck up the worlds resources in a hurry. I mean if there was oil in North Korea the Chinese would be there putting Kim Jong up in a palace if it meant they could access it. The U.S. just can't politically pull these things off.

If you look at the graph of their imports, they are adding one million barrels per day per year. Are they adding refinery capacity at the same rate?

Not sure, I know that in the case of Venezuela they are specifically building refineries to process their heavy crude from the Orinoco belt down there. Currently only the U.S. has refineries that can process Venezuela’s crude, once the Chinese refineries are complete this year or next Venezuela will start shifting exports from the U.S. to China, this will be another blow to our fuel supplies and economy. In my opnion it would be wise to have a military intervention down there to take Hugo out before this happens. Otherwise our economy is going to take yet another huge hit.

Wouldn't China respond by selling U.S. bonds en masse? They could really wreak financial destruction on us, by raising our iterest rates.

It would have to be a covert operation I suppose. At a minimum we could fire up the rhetoric to put pressure on him. His government has run their oil industry into the ground due to mismanagement and corruption, Hugo went out to bid to find a buyer last month for much of his oil assets (like Citgo) to bring them back to full operation and no one showed up to bid for fear after they made a huge investment his government would sieze the assets again without warning. This is a weakness we could expliot if we wanted. Venezuela is one of our top three crude suppliers and we can't afford to lose them.

This is a huge problem for his government and funding their social programs. Yes, China could interveign and disrupt our debt markets but that would have huge negative implications for them as well as they are not yet entirely separated from us financially.

We either give up our oil consumption willingly through diplomatic complacency and thus deeper recession or we get aggresive like China. It's really going to come down to eat or be eaten most likely but at the same time you obviously want to avoid an all out resource conflict.

At what point do you think that they will be able to separate from us financially? That will probably be the end game at that point. We will probably have to pay off our debt at that time like Germany after WWI. What will we pay it off with?

When China becomes the largest consumer of oil, I'll bet the dollar really starts to decline in value.

That's a tough call but my assumption is that over the course of this decade it will take place. It's a slow process but China has to replace U.S. consumption with it's own domestic consumption. This is happening now, they have a growing middle class and we have shrinking one.

As their internal demand increases they will rely less on us for exports and buy less of our debt, treasury rates will spike and the U.S. will look like current day Euruope - austerity being force everywhere you look, high unemployment and social unrest all while the blame will be put on politicians who will be helpless to fix anything.

I think this is happening right now, their exports to the U.S. are gradually declining even as their oil imports are rising. We are less and less able to afford our trade deficit so it continues to decline. Our debt has expanded to the point where any rise in interest rates will further cripple our economy. I wonder if anyone in Washington is paying attention to the situation.

http://cr4re.com/charts/charts.html?Trade#category=Trade&chart=TradeDefi...

Nebraska/Wildcatter

You guys ought to put your previous dialog in one of those "Teddy Bears Explain It All" video like you see on the Web. It would be perfect!

Bravo to both. Until they get round to doing the teddy bear video, I took the liberty to showcase this illuminating dialogue in a post on the baobab2050.org blog, titled Wildcatter and nebraska Discuss The US - China Great Game Over Oil and Debt

USO holds futures as "assets". As of this moment they are long http://www.unitedstatesoilfund.com/uso-holdings.php

3 different feb contracts. So what that means is that somebody else SOLD those contracts to USO - i.e. somebody else is short. The net number of contracts is zero. Nada. Nothing. Zilch.

Why people think that ETFs which have financial assets rather than physical assets as underlying collateral can influence prices is beyond me. Similarly with puts and calls - for every long there is a short. Futures and options are risk transfer tools, nothing else. They don't change the total amount of outstanding risk, they just shift it.

Buy=Sell and Long=Short

WeekendPeak

Great posts Wildcatter, interesting to read an insider's perspective.

Not too sure if the US should be indulging in "Covert Operations", or outright "Military Intervention" (= war), to rid itself of inconvenient dictators though. I kind of recall that hasn't worked out too well for the US lately ....

Agreed there. Every time I hear that sort of nonsense from americans I can't help thinking "It serves you right". Why not identify what you want specifically from Venezuela, then co-operate with whomever they've elected as their legitimate government to make that happen? Oh, I forgot, you've pissed them off so much in the past trying to help your oil companies steal their stuff for nothing that now they don't like you and would rather trust China, which you identify as a bunch of exploitive jerks who can't be trusted.... Hmmm... A reality disconnect there somewhere perhaps?

Is it even possible to avoid an 'all out resource conflict'? Seems to me these are signs of incresing tension leading up to the 'big grab' for whatever is left.

"it would be wise to have a military intervention down there"

I am saddened when I read this. Isn't the USA a city on a hill? A light to the nations?

As during anytime in history when resource shortages start effecting the well being of the population all bets are off. As we have seen with China it pays to protect your own countries interests. I don't want the U.S. to turn into Europe and have a 25%+ unemployment rate and a rioting soon to be starving population. Do you? If our liquid fuel supplies get choked off or we are out bid into poverty we all lose big time, and I don't mean just giving up your SUV I mean you don't have a job or any food on the table.

Just food for thought, I wonder how much of our military equipment comes from China. I was in the Air Force once and ripped the liner out of my Beret. The liner said "union made in the USA" but underneath it said "made in Czechoslovakia." This was in 1985 when they were communist.

Wow, all those good comments, and then you write that.

What history really tells us - and this includes recent US history - is that no one's a winner in war, dude. If possible you want to try to prevent war, not invoke it.

If this kind of thinking becomes prevalent in the US, then major resource wars (or one big one) will become inevitable. God help us all.

It's easy to talk about peace when your stomach is full and your children are fed. But history has shown that when people watch there children go hungry, wars are soon to follow. I'm not saying it is right, but the reality of it must be recognized. We must deal with peoples expectations now and set up a system where all needs are met, to avoid bloodshed in the future.

remember 10 kcal of hydrocarbons = 1 kcal of food

I think that depends upon the food. There's a big difference between eating plants and eating animals, and even between eating birds and eating mammals (birds are more efficient converters). What I read (Pimentel) is that peanuts are about 1:1.

One reason I suspect (no references) that India and China keep on buying oil, is that they get more bang out of each barrel that they import. Look at what we do with imported oil -- single-occupancy fat-mobiles. One of the links on the post-o-graphs, was to a very interesting presentation on the spread of e-bikes and e-mopeds in China. A lot, plain and simple, and those get you all the speed of a car in urban traffic, plenty of range, but they are cheap and are very efficient, even compared to motorcycles.

Plain and simple, if one economy can get 200 person-miles of transportation out of a gallon of gasoline, and the other can get 20, that gallon is "worth more" to the efficient economy. I imagine 4-person carpools in Tatas (or whatever they call that new tiny Indian car).

And as far as war goes, as long as I see so many people stupidly wasting oil, I am no mood to go to war over it. Carpooling in a subcompact to work to save money, is a long long way from sending your kids to bed hungry. There are things worth fighting for. Our "right" to drive the largest possible vehicles for the shortest and stupidest of trips, is not one of those things.

We are an oil tribe. Take a mental note of everything around you that is either made from oil, or transported by it. We have even figured out how to convert hydrocarbons into food. What is going to happen is similar to what would happen to an amazon rain forest tribe, it their river dried up or was diverted.

No, we're a bunch of lazy-asses (and speak for yourself, says the guy who rode his bike to work yesterday, and drove a Honda Civic today). Other people living developed-world lives have figured out how live well on less oil;. we don't even have to figure, merely do what they do. People eventually respond to price signals. We can do something that tribe cannot do, which is read about how other people very much like us solved the problem, and imitate their solutions.

Amen to that, but we need to figure out how to convince our Society, how dangerous the situation is before large scale change begins to happen. How do we do that?

I am not entirely sure. I don't know if "danger" is the right thing to sell. I will say that the popular definitions of "responsibility" and "American values" have gotten completely f***ed around in recent decades.

Off in bicycle-world, there is a larger and larger movement to get "normal people" on bicycles in "normal clothes" for everyday transit (sample books include Pedaling Revolution by Mapes, Bicycle Diaries by Byrne, Bike Snob's new book; sample blogs include amsterdamize, copenhagenzie, a view from the cycle path, and many more). I've signed on to this slightly myself. Long term, I *must* ride, or at least I must get serious amounts of exercise (so says my doctor, so says my blood chemistry, so says my aversion to a sensible diet). And so I ride, at least 2x/week to work (more in the summer), usually in "normal" clothes, a cargo bike with a chain case, so I don't get grease on my clothes, and so I can carry stuff that people normally "need" cars to carry (including, sometimes, my kids). Winter, I put snow tires, with studs, on my bike, because there's ice, especially yesterday. At night, I've got (good) lights. What is generally proposed, is facilities that feel safe for everyone (your mom, your wife, your grandmother), because that is what worked in the Netherlands. Or "wouldn't it be nice for you if your neighbors rode bikes, what do you suppose it would take to make that happen?"

And understand, people promoting bikes are not saying "works great in the Netherlands, therefore, you should ride a bike in rural West Virginia". They are saying (for example), "Groningen has a 57% bike trip share, and the Cambridge(Mass)+neighboring towns are very similar, so why not there, hmmm?" It's completely stupifying, because Cambridge really is traffic+parking limited, and it can easily take longer to drive home than bike home, though car-best-case it does not. So on the one hand, if it's not working here, where would it ever work, on the other hand, this is clearly the place to hammer on it, because if you CAN ride a bike in Cambridge, it's easily better than driving. The one big problem is that as people switch to bikes, it will free up street space, and "important" people on "urgent" trips will take advantage of this to drive quickly, and no doubt carelessly.

So, not sure. I'm sure that this is the place to hammer on it, but I am also well aware that it has not worked yet. I certainly wouldn't expect much progress in rural hilly places.

NOW, once you spend a little time (a year or so) biking to work and thus and such, you may eventually start to think, "unnecessary car use, bad for me, bad for my community, bad for my country". That doesn't appear to be a message with much traction among non-cyclists.

For one thing, how about treating with the legitimately elected government of Venezuela fairly and honestly as equals, rather than the sort of knee-jerk response seen above? If they won't let you own the oilfields or refineries, well, how much do you want the oil?

It's the Tata Nano, and there have been some problems with it quite recently.

I notice " 'It's seen as a poor man's car,' said Masih. 'People don't want to take that image along with them.' "

Conspicuous consumption (Thorstein Veblen) lives. It's a social problem, not a technical problem.

metal,

I totally agree,in the abstract, with the SENTIMENT AND REASONING behind the contention that nobody wins a war.

I am sorry to say the facts do not correlate with such sentiments and reasoning.

We live and die as individuals, and as societies,in constant Darwinian competition.

History records a constant string of winners of wars.War, in reality, if not name, is a constant in human affairs.If it is not conducted with such weapons as rocks, clubs, assault rifles, and aircraft, it is conducted with pen, ink, bribery, and propaganda.

Right now, within our own society, it seems that the banksters and their puppets in govt are raking in all the pots.

At this time, we are sacrificing a few thousand of our own young men and women , plus a lot of treasure, in the business of getting the oil necessary to maintain our position as a superpower.While I feel pain and sorrow for every soldier currently lost,anyone with a hard head(as opposed to a soft head) realizes that we sacrifice many, many times more lives for no reason at all, other than that as a society , we don't REALLY give a damn.

And gasoline is still cheap enough that I can afford to renew the registration and insurance on our old 4x4 pickup truck for the winter months,even though it gets only around ten mpg on the local mountain roads. ;)

I personally know of many people who have died prematurely due to a lack of medical care. :(

As a matter of fact, based on my personal experience, I wonder if a young man in the American armed forces is not safer in uniform than out, given that soldiers seem to come disproportionately from the poorer and more violent portions of our society.At least they eat fairly well, and are not likely to be consuming large quantities of dangerous drugs, or riding high performance motorcycles while intoxicated,or racing their cars on the street, and they have access to good medical care.

Of course the time must inevitably arrive,in historical terms, when we will lose a war in a big way.

Till then, we might as well, enjoy the spoils, as we are still winning-for the moment, at least.

I wonder for how long.

Our remaining days on top may be drawing to a close soon.

Paint me a realist.

I know where you are coming from Farmer Mac, history does indeed read like a contstant string of wars, many or most of which can be attributed to a resource grab of some kind(although usually due to greed rather than shortage).

However the cost of war, even in just a financial sense, as America has so dearly suffered of late, isn't just about the actual military conflict. The true cost, both ecomonically, socially and politically often comes later. It's not just a moral argument I'm making here.

You know, as an aside, it's not only big wars and large standing armies that hold an empire together. The Roman Empire's amazing longetivy is sometimes attributed to it's willingness to take bring "civilization" to "the barbarians", some of whom could become Roman citizens themselves, no doubt some local leaders couldn't wait to get in on the act. Romans also respected and even worshiped local deities. Maybe a few lessons here the US could take from the Romans. I for one would hope the America's 'days on top' are not due for immediate closure...

The 25%+ unemployment rate is just not correct. The EU's overall rate in 8.3% --not even Latvia has an unemployment rate that high. http://en.wikipedia.org/wiki/Economy_of_the_European_Union#Unemployment Actually, if the U.S. government reported the real numbers accurately, we'd be a lot closer to 25% than Europe: http://www.shadowstats.com/alternate_data/unemployment-charts.

While not as overfed as we are, I rather doubt Europe's population is going to be starving anytime soon. As far as the rioting goes, we could learn a thing or two from the Europeans about civil disobedience. Over there, government tends to fear the people, while over here it's the exact opposite.

Add to this, the fact that Europeans get cradle-to-grave healthcare coverage, paid time off, sick and maternity leave, and generally better unemployment benefits. We should *be* so lucky.

And all of this has been subsidized by large amounts of cheap oil coming out of the North Sea. It will be interesting to see if they can maintain this utopia as production continues to decline.

Cheap oil, you think? Well, 85% of our gasoline cost is tax.

And right now the gasoline price is around $10.00 /gallon, and I think you'll find that Norwegians, who unlike us still have a big crude oil surplus, are paying around the same.

You might find that the Utopia is not on this side of the Atlantic......

I said cheap oil, not cheap gasoline. The people who run your refineries have been selling your gasoline and refined products to the U.S. while keeping the diesel fuel and feedstocks. Fully 25% of refinery output has been diverted to the U.S. and this has allowed the profits to remain in Europe and subsidize your standard of living. The high price of gasoline has discouraged it's use on the continent and left it's availability for export.

To be honest we have both lived in a Utopia of sorts which is about change drastically.

And the VAT tax is 12-18%. A better taxing scheme pays for more benefits. Also defense spending is minuscule compared with the US.

This is not as important as you think. The entire North Sea produces less than 4 million barrels (and that is a roughly 2 year old number so it is lower still), the rest is imported, mostly from the Middle East and Russia.

What I worry about is the downwarding global export trends. But you americans import to, so when these levels start getting to low, we are all up the creek with no paddle.

cartoonish and exaggerated description of the state of europe. 25% unemployment is off the mark as in the notion of starvation on the near horizon.

civil unrest is growing and will be a factor in 2011 but this will not result in starvation.

Here is the formula that most corporations in the developed world use to survive and prosper:

profits= products sold - expenses.

Pretty much every company has figured out how to cut their expenses to the bone by using cheap oil in some way, either in during the manufacturing or delivery process. Any company that has not used this formula has not been able to compete and is no longer with us. This is darwinism. The enviroment is getting ready to radically change, oil is becoming more and more expensive, and companies are not really able to increase the price of products sold, so their bottom lines are being squeezed almost universally. The companies that are able to adapt to this changing enviroment will survive. I think the Chineese see this changing reality, our country needs to recognize it as well.

I am not happy with this liberal use of the Darwinism term. Natural selection is a complex process of many interacting variables on the biological world yet it gets co-opted as a political term again and again as if using the term is scientific proof in of its self for the ideas behind that political vision.

not saying your wrong in your analysis you understand..

IMHO your short term doomerocity is over wrought. Especially given the tenure of the post concerns 2011

You're much too kind. But then the new policy is to be nice to the factually and logically challenged. Apparently, this results in a better world.

+100

We already tried a junta there. Didn't work.

I wouldn't put it past us to try again, but Latin America is turning more and more against us, and any interference in V would just accelerate this tendency.

We need to get off of oil. The idea that we all need to drive around in enormous trucks in order to have a tolerable lifestyle is beyond laughable. The Europeans are rioting because their governments are threatening to scale back free university educations and fully funded retirement at 55...

We should be so lucky to be able to riot over such 'austerity measures.'

We have already long ago given up on anything like life in a modern industrial economy as most of the rest of the industrial world has known it--no public transport, no universal medical coverage.....--mostly because Reagun and co. destroyed unions.

Our best hope is for some relatively civilized country like Venezuela or China to take us over and show us how it's done.

Well, let's hope not. But I do agree with you about America's over dependence on oil - the key is to reduce that dependence, and as quickly as possible.

Venezuela is quickly becoming a destitute nation because as it's oil reserves deplete so do it's coffers to fund it's socialized state run economy. Furthermore Hugo cannot even attract outside investment to run his operations anymore because he has scared off all capital after nationalizing and gutting industry there.

Modern day "civilized" safety net nations are the direct result of fossil fuel wealth that is quickly depleting. Europe's seemingly draconian austerity is the result of making promises that are impossible to keep such as "retirement". The concept of retirement and free education will come and go with fossil fuel age. But I digress because this is not a political debate it is a matter of resource depletion, the illusion of temporary wealth it has created and the loss of civility and peace of nations that comes with it.

All I am suggesting is being a bit tougher diplomatically to ensure we don't have an abrupt disruption in our fuel supply. As we had a preview of shortages in the 70's a stretch of months, years or more of shortages would surely change your mind as to the importance that oil supply has to feeding and mobilizing this nation.

I am not arguing that a reduction in our dependence of fossil fuels is absolutely imperative, but it’s not realistic, we are a reactive society. Our government is actively promoting getting back to BAU right now as we speak. The time to act was in the 70’s, now all that’s left is damage control and trying to engineer the softest landing possible. That may include trying to extend fossil fuel supplies as long as possible. This is the only thing our government knows how to do anyway. Do you really expect a peaceful outcome here? With all do respect, it is foolish to think so.

Unfortunately, if we continue on the path we are going, the more likely armed conflict becomes. Connecting the dots paints a very ugly picture.

Here I’m with Nebraska and Wildcatter. The current attempts at BAU don’t paint a pretty picture, and there’s a real chance it’s all going to end bad.

Should fossil fuel shortages hit us sooner rather than later, there’s gonna be some real anger out there and public opinion on what to do about it could get nasty.

Aggressive behaviour by the US is probably inevitable, and the US like any other decent democratic country, will seek to protect it’s citizens in the best way it sees. The problem is that if short-sighted behaviour leads to major military conflict, neither the US or anybody else will be ‘winners’. I don’t see this as some soft “easy to say when your kids are well fed” statement, it’s bloody obvious.

The scary thing is how close all this could be, and how just a few hotheads in the wrong place at the wrong time could make for a very bad outcome to the PO problem

Perhaps the "few hotheads" have influenced power for a long time?

Armageddon it yet? Or more importantly are you?

... errrrrr

http://en.wikipedia.org/wiki/Gun_violence_in_the_United_States

Looks pretty aggressive already.

Let's hope you don't start 'starving and rioting' like your European cousins !

Right, if only the auto companies had a strong union the imports would not have had a chance. And if the teachers could get a union going our schools would be first class.

Oh wow! You mean it is that simple? Get rid of the unions and all will be well? Whocodanode?

But then, why is that AR, AL, MS and LA, all right-to-work states where teacher unions are virtually powerless (and where some school districts do not even have unions) all rank at or near the bottom for student performance on all national assessment tests?

Why is it that MN and ND, states with strong teachers unions, are generally at the top of those same tests? Why is is that VA, a right to work state with weak (though not powerless) teachers unions ranks in the upper third on most of those same tests and in the top 10 if you only look at scores from districts in the Northern VA? Meanwhile, MI, with strong teachers' unions ranks about the same as VA overall, though higher if you drop scores from the three biggest metro areas?

If only there was such a simple correlation between teachers' unions and student performance.

The same for the auto industry. I worked in GM plants in MI in the early 70's while going to college. The Japanese were just beginning to make measurable inroads in auto sales then. My shift manager claimed that there was nothing to worry about because the "Japs" would never build a car that any but the poorest or dumbest Americans would buy. I later heard the same idea from the plant manager. Unfortunately, some of the top union leaders seemed to agree with that sentiment.

After some of the managers found out I was doing a degree in business I was asked to take part in a "round table" discussion among managers and selected workers to come up with ways to improve our production. I mistakenly thought that "product" was a key part of production and suggested that the line be modified to include cut-outs every few assembly stations where we could set aside cars that had visible defects and those defects could be fixed before the car continued down the line.

Trouble was, managers got paid bonuses based on production so my proposal never really had a chance. Production was, essentially, cars out the door, and that included cars that left the line with known defects. Those cars were supposedly tagged by inspectors on the line and the defects were corrected after the finished car came off the line.

We had a good sized lot where such cars sat waiting to be pulled into a garage, partially disassembled, fixed and then reassembled. The defect lot was often used as a punishment for workers who had ticked off managers or union leaders and for new hires waiting to get on the line.

Full time workers could buy a new car every three years directly from the line at cost. We were offered a discount price on cars from the defect lot. I was quickly told to never take one of those cars. Instead, the company pushed them off on the unsuspecting public.

In the late 70's I spent a few days visiting a friend from college days who worked as a junior manager at a Big 3 plant in MI. He told me he had nearly been hooted out of a management meeting for bringing in a workers suggestion from one of the suggestion boxes.

The derision was for two reasons. First, the suggestion was obviously from a newbie since the old hands all knew the suggestion boxes were just decorations. Second, worker suggestions were obviously questionable since, after all, they came from workers and not college-educated engineers and managers and workers would only have a "little picture" view of how an auto plant and the auto manufacturing business should work.

I could go on a lot longer about the patronizing and demeaning attitude of managers towards workers, the reciprocated dislike of managers by the workers and the often dysfunctional workplaces that resulted from those attitudes, but this post is already too long and I think I have at least raised a valid counterpoint to your simplistic claim.

Care to tell me again how the decline of the American auto industry was the sole fault of the unions?

Obviously any viable production line should not have much rework required, so I would question the quality of the process, workers, training, and suppliers in this example, besides the mgmt. Obviously what people want is better value embodied by the car puchase, and the Japanese still excel at this. "Better" is subjective, as Japanese cars from Japan do not necessarily cost less than US cars, nor do Japanese cars built in America. A Honda Fit (made in Japan) and a Chevy Aveo (made in Korea) are about the same size, about the same cost, and look at lot a like. One is best in class and the other is worst in class. What caused GM to contract and quite successfully sell such a crappy car, when Japan was able to do so much better? It's not a labor issue, nor a production mgmt one -- it's a pretty fundamental flaw in understanding what a good car actually IS.

Another major issue is the notion of "workers" and "managers". Who ever came up with that distinction? Division of labor doesn't mean arbitrary classifications of work levels, but simply compartmentalized expertise.

Each of us readily sees the weaknesses in a situation in which they have experience. I have my Medicaid and crazy exec amd insurance company stories and so forth....and we each make our life decisions based on the viewpoints we have.

When things go badly, there are always multiple faults. When things go well, there are always multiple reasons as well. Unions may not have been the death of US automaking, but they were not the cause of its early success nor sufficient to prevent its demise either. Ditto for the US educational system. Somewhere in both is an overall acceptance of low performance by those inside, with a modicum of choice by those outside. Capitalism has its downsides, but freedom to choose (including free enterprise) does work out a lot of inefficiencies.

Unions can sit around and argue with mgmt about which one is at fault, until their organizations simply evaporate.

Who said that? Stop putting false words in my mouth. The actual comment in question is;

Apparently you agree, I do not.

More importantly, the problem with education is that it is not run like a competitive enterprise; it is run more like the Motor Vehicle Department or the post office.

My recommendation for education, like my recommendation for energy, is based on the observation that excellence rarely happens by accident. Excellence is most likely in an environment of well informed competition on a level playing field.

1…Determine what constitutes a good education.

2…Develop testing that accurately measures the level of achievement of the goals in #1.

3…Publish a document with the test results at the end of each year.

When we test students we are really testing the teachers. The document would contain a list of all schools, all teachers and all classes taught by each teacher. The teacher would get a numerical score for each class indicating the gain their students achieved relative to their average lifetime performance.

4…Allow parents to choose their school. There would be no cherry picking. When applications exceed capacity a lottery would determine who gets in.

5…The money goes with the student.

This system would point out which schools have the most effective teachers. The best teachers would command much higher salaries in a competitive marketplace, and that would encourage sharp people to get into education. The ineffective teachers would have to find work elsewhere.

Public schools would compete with private schools on a level playing field.

We could spend hours on each of these points, and it is well worth doing.

The worst thing that could happen under this system is that there would be no change because the public schools are doing such a great job, and in fact, there would be little change where that is the case.

The biggest improvements would be where schools are worst.

You are obviously an ideologue, sure that 'free markets' and competition will solve every conceivable problem.

I do now share this faith, and don't care to try to shake yours.

Best wishes for a happy New Year.

The recent perhaps overly greedy history of unions eg. in Detroit, is not a very true picture of the history of the union movement. I've worked out what proportion of gross sales go to (union and management) employees of large paper companies in Canada, and it comes out between 12% and 15%, probably about exactly the same percentage as goes to loan interest and share dividends. I'd guess its not much different in the auto industry.

So in your ideal world, what SHOULD be the proper proportion of gross sales going to capital versus labour?

JN2:

No people or nation has a clean history. Humans are tribal apes who find joy in massacring each another, without exception.

Still, the U.S. is responsible for the single greatest crime in the history of war. Luckily for the U.S. the Fourth Geneva Convention only came into being in 1949 - not that it means much, as there is no global government. I'm sure the dead of Hiroshima and Nagasaki would agree, had they a voice.

IMHO, after that action the U.S. irrecoverably ceded any moral authority it might have once had.

The authority of the U.S. is based on power. And what power it is.

Still, the U.S. is responsible for the single greatest crime in the history of war.

Not trying to get the U.S. off the hook for nuking Japan here, but if we're going by wartime civilian body count, Hiroshima and Nagasaki are probably not even in the top 5. The Jewish Holocaust, the Armenian Genocide, and the Rwandan Genocide killed an order of magnitude more people each, and that's just off the top of my head.

Nice notion, that Geneva Convention thing (and the largely but mostly supported 1977 restriction on indiscriminate warfare). Happened to come about when the US, as the newly emerged superpower/empire awash in energy and resources, happened to be in control. The US is perhaps the least bloodthirsty empirical regime in history, pushing along such pleasant concepts as eliminating disease and hunger in Africa and Asia.

Now we have way more people, less energy, fewer resources, and the law-abiding nations have tied their own hands.

War used to include rape and pillage, wholesale slaughter, salting of fields, and all that. Even in the Civil War purposefully burning cities of our own countrymen was common.

People like to flagellate the US, but I think it's clear that people are people, and much more bloodthirsty wars have been common throughout history, as they are today. A lot of people are killed without even declaring war these days.

Wonder how many decades it will be before the Geneva Convention will no longer apply to "civilized" nations? It obviously already does not for many conflicts.

Well, the Cambodian farmers trying to work dryland rice crops alongside the Ho Chi Min trail, and burying the kids who still today encounter unexploded ordinance might take a somewhat different view of the begnign enlightment of the US as empire. And the US still refuses to ratify any international treaty to limit the use of air-sown mines or bomblets. Many many other examples, eg. refusal to recognize any international authority over any US citizen regarding anything from genocide to war crimes.

Agreed, the US is probably not the worst imperial power ever, by many measures. But there is no denying that a LOT of innocents have done a lot of suffering to support the incomes of US overseas investors.

Why would anybody agree to anything that limits their power, if they don't have to? I've been in legal situations before and had attorneys advise me exactly so - never give away rights without adequate compensation. International law has obvious value in that it keeps trade working well, but beyond the point that bullets start flying it has little substance. It would make more sense to not even attempt to pass such agreements if there is no viable enforcement action (which the UN is not, IMHO).

Definitely sucks to be the board on which multinational games and conflicts are played. ME and Africa are likely going to learn this again.

So okay, I know that's how the world works. The biggest bully on the block etc. It simply burns / entertains me to then see a lot of self-righteous jerks stand up in the UN and demand that Iran or N. Korea should voluntarily relinquish their weapons programs "for the good of the world". You want that sort of world, quit moaning about it.

I still can see in my mind those images of Iraqi military in 2002 / 03 publicly destroying all their missile arsenal on TV, on the understanding that if they disarmed, then there would be no invasion. I was thinking "you can't be that naive, the US is determined to invade you regardless".

My point is, your international negotiators would get a lot further esp. re. credibility with your allies and with others less friendly, if you quit lying about the reality you choose to live by.

Of course the proper way to live in the world is to renounce offensive / pre-emptive violence and pitch your forces in with those of your allies to create a single world force which can truely monopolize the use of violence for deterrent purposes only. But the bully on the block never agrees to that, does he?