New High of Liquid Fuel Production

Posted by Stuart Staniford on January 5, 2011 - 11:34am

This post is based on two articles previously published at Early Warning.

New High of Liquid Fuel Production

Prospects for a New Peak in Crude & Condensate

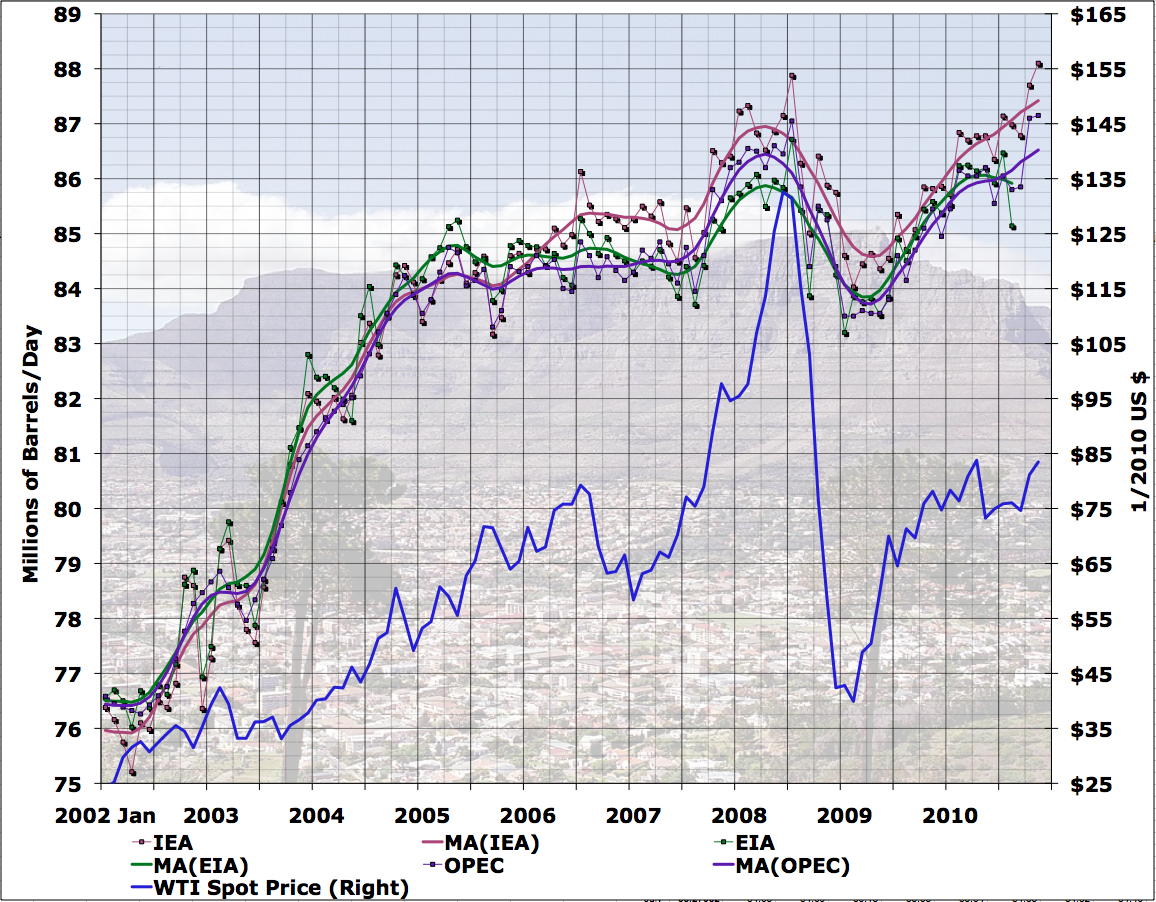

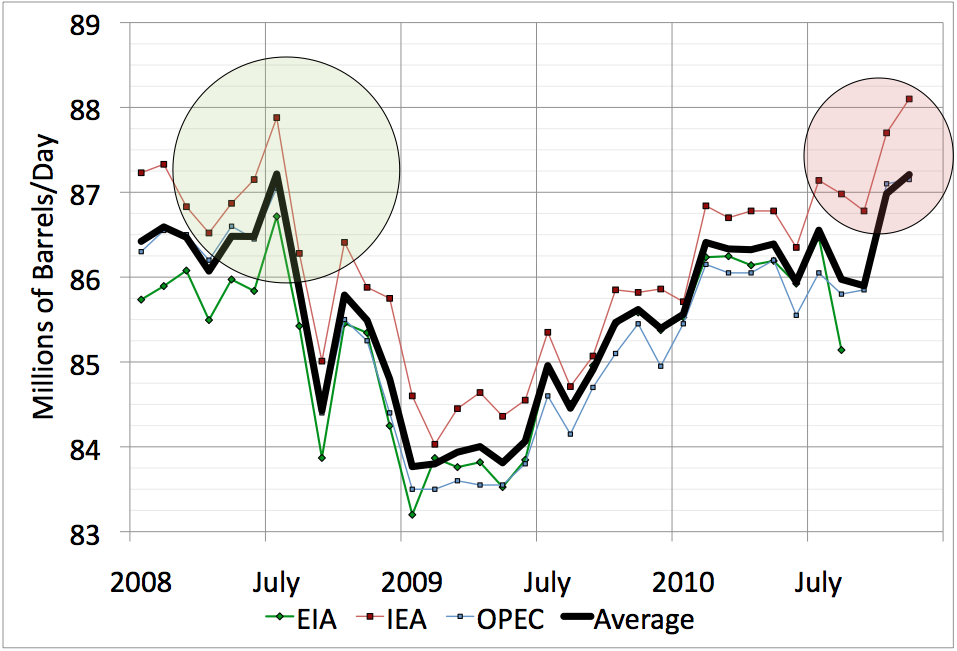

Both the IEA and OPEC came out with new monthly reports recently. And both report that oil production in November 2010 exceeded the previous high month of July 2008 (back when oil was over $140). Probably the difference is within the margin of error, and in any case the third agency (the EIA) won't weigh in for a few months.

Stuart Staniford is a long standing contributor to TheOilDrum but now writes for his own blog Early Warning. This is Stuart's first post on TheOilDrum for some time and it would be very much appreciated if commenters focussed exclusively on on-topic comments.

At the moment, the average index looks like pretty much a statistical tie:

Still, a significant point: not peak monthly oil just yet. As long as there isn't a massive financial crisis in the next few months (which is what happened to the last global high in oil production) I imagine we'll clearly exceed the July 2008 peak production. In particular, the point I first made here still holds: the increases in the last eighteen months have largely come from non-OPEC production rather than OPEC, and the latter undoubtedly still have some spare capacity that can be released (at a price). Thus production can and will go somewhat higher as long as demand continues to increase, which will be true as long as the global economy doesn't hit another big pothole.

However, prices have been creeping up lately:

I wouldn't be surprised to see that trend continue, on and off, until it starts to cause real problems.

Prospects for a New Peak in Crude & Condensate

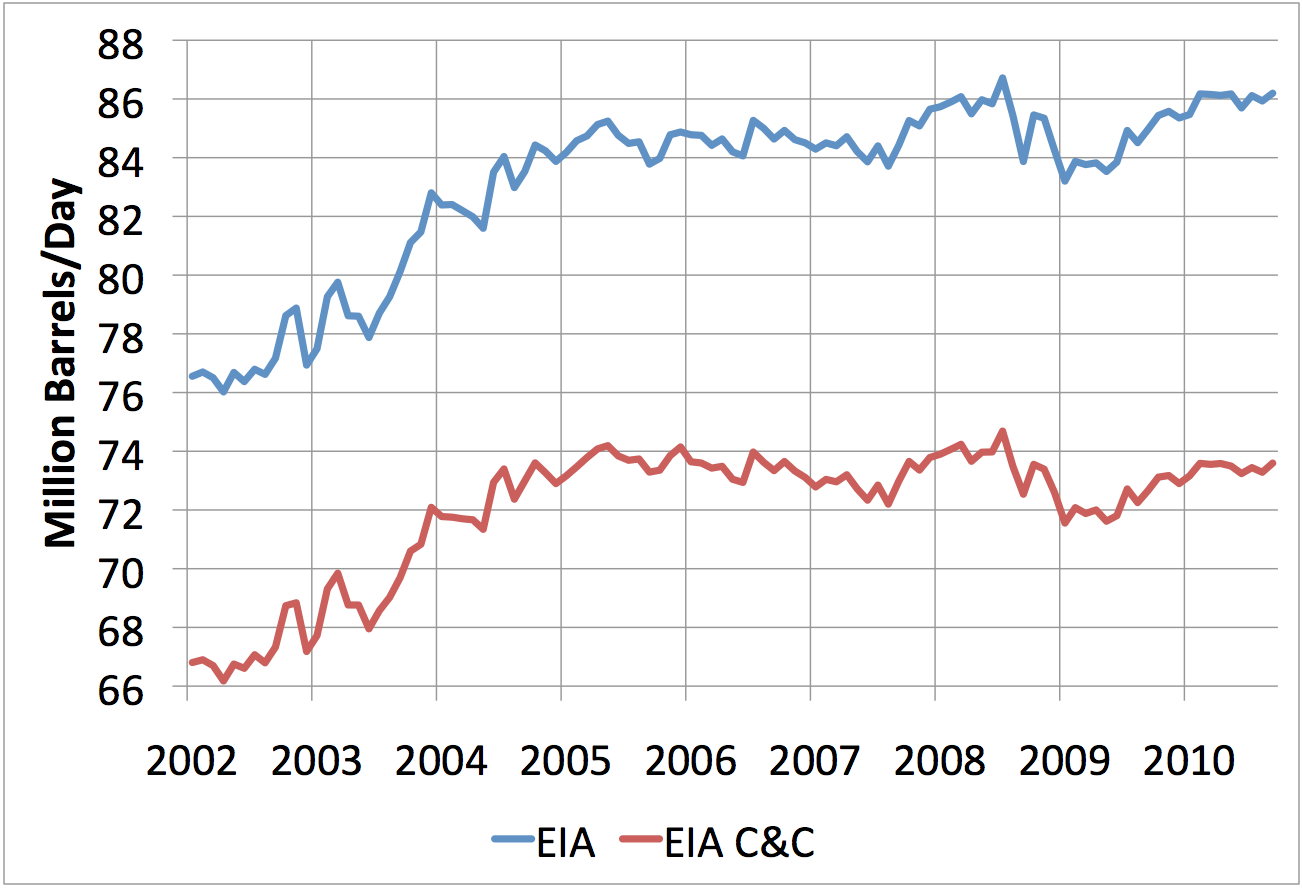

Of course, the full liquid fuel series that the various agencies report on include things that aren't really oil, such as biofuels, and natural gas liquids (things like butane and propane). There are decent arguments on both sides of what exact definition of oil one should use. If we look at one more conservative but reasonable definition - crude plus lease condensate (C&C) - we see the picture below (according to the EIA). I have shown the full liquid fuel series in blue, and only the C&C component in red.

Now, the EIA is only up to September as of today, whereas OPEC and the IEA have just released November numbers. So the big leap up in October/November is not apparent in the graph above. However, if these two EIA series behave like the ones that have been released, they will jump up by over a million barrels/day between September and November. As of September, the EIA all liquids series is 0.5mbd below it's all time peak, so it will very likely exceed it as the next couple of month's numbers come out. However, the EIA C&C number is 1.1mbd below it's all time peak, so it will be a near thing when the November numbers are out.

Still, if demand stays strong and prices up, it seems likely that supply will increase further in the next six months. If so, then it's likely that the July 2008 crude+condensate peak will also be exceeded.

The bottom line is this: those people running around saying that the all-time peak in monthly oil production was definitely in 2005 or 2008 are running a considerable risk of having events make fools of them. Appropriate caveats should be used.

To what degree are we certain these numbers are coming from holes in the ground, not tankers in the bay?

Spike capacity derived from emptying storage is one thing, but sustained capacity is another. Are there numbers for draw down of storage, say of oil stockpiled during the collapse in demand?

IMO, average annual numbers provide a better indication of actual production and tend to filter out monthly fluctuations due to inventory changes, seasonal factors and maintenance issues. And I think that average annual oil prices give us a better indication of fundamental supply & demand factors.

Consider a simple example, a salesman who gets monthly commission checks. Let's say that he makes $50,000 in July, but his annual income for the year is $240,000. Which metric is a better indication of his annual income and of his actual earning capacity, the monthly peak of $50,000 or the average monthly income of $20,000?

Gary:

By and large, the decrease in production associated with the great recession was intentional cutbacks by OPEC, but the recovery of the production since has not come from OPEC, but from non-OPEC countries increasing their production. I wrote about this pattern back in April - the graphs there are a little dated, but the basic pattern hasn't changed much since.

$64,000 question: why?

I can just about see non-OPEC production in certain countries, like Angola, ramping up slightly in response to policies enacted as a result of the $147 spike. But why would OPEC sit back and eat the loss in revenue associated with cutting production and not seek to take advantage of $90 oil?

There aren't many explanations, and they don't point towards a bright, all-you-can-eat future, do they?

Angola is in OPEC :-)

There is some hint in recent Saudi production data that they have been starting to increase production, but it's hard to be sure given how bad the data is:

However, I'm pretty sure they have not been struggling to maintain production because the rig count has been falling, not rising:

The rig count is very telling. Clearly major panic in 2005 - when the bumpy ascending plateau was reached, and KSA discovered they didn't really have much spare capacity left. Drilled a pile of wells on Khurais and Ghawar - and since they have relaxed, and all the while decline has been eating away at their capacity.

How significant would you say that little up tick in rig count is at the tail end of your chart:-) ?

Yeah, I noticed the tick up too, and I'm pretty keen to see the next few months of data :-)

of course, as you know, drilling in ksa doesn't generally have any immediate effect on production, or capacity. saudi aramco will spend years planning and executing megaproject processing capacity expansions. the drilling of wells occurs in the background.

a recent example:

http://www.bloomberg.com/news/2011-01-03/aramco-receives-bids-for-shayba...

if saudi aramco is to maintain their capacity, they may have to become more nimble - as their fields and projects become smaller.

I don't have the chart, but the biggest drilling boom in Texas history was in the late Seventies, into the early Eighties, in response to a 10 fold increase in oil prices.

the biggest drilling boom in Texas history was in the late Seventies, into the early Eighties, in response to a 10 fold increase in oil prices.

Yes, and the drilling effort was remarkably unsuccessful in increasing Texas oil production. You cannot find oil that is not there (although some people seem to believe more in magic than geology).

Or to be more accurate, the smaller fields that we are finding post-peak haven't been able to offset the decline from the older, larger fields like the East Texas Field.

Here is a chart of US rig count

http://www.wtrg.com/prices.htm

Compare it to the Saudi one above. The spike seems to be a very good indicator of a peak in oil production.

Also note its after peak production in other words its a lagging indicator.

Probably quite telling. I see in this graph, that the 20 oldest rigs were mothballed or cut up during the economic downturn. Plus one exploded and sank... so now, new orders are being placed with an expectation of $90-125 bbl oil and new safety scrutiny on the older rigs. This count could go up quite a bit, with a tailing off a little later on as some of the more venerables are retired when their replacements enter service.

Oops, yeah I persist with not thinking of Angola in OPEC, even 5 years later.

Question remain however, the 'why' rather than the 'what' of OPEC production. They cut production in tune with reduced demand, but they didn't raise it as demand returned.

Possible motives include:

My guess is partly 1 and partly 5, with a bit of 4. OPEC is looking to ensure it maximises both its price for a non-renewable resource, and its duration in getting that price. At the same time, what's the point of investing billions in new capacity/infill drilling/etc. if all it does is push down the price for the bulk of their product? Better to allow extraction to tail-off, commensurate with maximising the price like a good cartel.

If that's actually their thinking (and its not much of a jump) then active management of the price, in the process pushing down demand, is the order of the day. The $80+ region of pricing is enough to actively reduce low efficiency uses of oil around the world. Thus, over time, the price can float up, with less oil produced, and still not throw the global economy into reverse.

Active fuel efficiency promotion by OPEC, so they can harvest the maximum returns in a supply constrained world. By forcing out the low efficiency usage they can get higher prices for the bulk of their production. That's a new variation on an old tune.

Play that forward into the near future of actual declining global production.

Production can't keep pace with demand > Price spikes > Recession > Demand falls > Balance restored

It's the downwards sawtooth we all expect, with a cycle time of several years. Problem for OPEC et al is it's start/stop on production and income. So can they smooth that sawtooth? If they can balance the global economy on the ragged edge of recession, demand rises are slowed and price collapses can be avoided by 'slightly' induced recessions via 'slightly' increased prices. Enhanced growth is no longer the win-win, now its zero growth that's OPEC's target.

Call it 'Puppetmaster OPEC'. It's an active control mechanism for oil demand, using price to keep the global economy on the edge of recession. Is it possible? I'm thinking not, not with the perturbations inherent in the system - but you could see the advantages from OPEC's position. They get to recover the absolute maximum for their resource AND pull the strings of the entire world. A megalomaniac's dream.

Why take $90 when they can wait for $140 while their competitors use up their resources.

NAOM

"So can they smooth that sawtooth? If they can balance the global economy on the ragged edge of recession, demand rises are slowed and price collapses can be avoided by 'slightly' induced recessions via 'slightly' increased prices."

This is precisely what I pondered on while showeling snow yesterday. If I was intelligent, and had the phone number to a few guys in top OPEC i knew since 15 years, this is what I would propose the production numbers to follow for a strategy.

I even thought if something like this get posted here, GaryP would get a phone call from KSA and ask to remove his post ;) to close to the truth methinks!

Our 2006 paper using Texas and the Lower 48 as models for Saudi Arabia & the world:

http://www.energybulletin.net/node/16459

The Texas/Saudi crude oil production chart, from the 2006 paper, updated with 2006-2010 Saudi production data (2010 is based on data through 9/10) is shown below. If 2005 does turn out to be the final production peak, there was an element of luck involved in posting this chart in early 2006, but the real story is Saudi net oil exports. I think that it is very unlikely that they will ever again exceed their 2005 annual net export rate of 9.1 mbpd (total petroleum liquids).

From 2002 to 2008, we saw six straight years of year over year increases in annual oil prices, and Saudi Arabia showed a significant increase in net oil exports (total petroleum liquids) from 2002 to 2005, in response to rising oil prices, but they showed significant declines in annual net oil exports from 2005 to 2008, relative to 2005, in response to rising oil prices. Something clearly changed. Note the similarity to the Texas production/price chart down the thread.

It could be that the price movements are more speculative than supply/demand. The first chart shows a huge swing in price whose impact on volume is rather muted by comparison. If producers think supply/demand is reasonably balanced, then they are simply letting speculators with cheap leverage run the price.

Just a thought.

Cooter

A related point is that July 2008 "production" was not actual production that month (or the month before).

EVERY oil producer in the world had an incentive to reduce working inventory as close to the MOL (minimum operating level) as feasible. In the USA, Canada and perhaps North Sea, this drawdown in working inventory would not be counted as production, but in much of the world it would be.

And Saudi Aramco has large volumes in long term storage (one estimate from years ago was 70 million barrels, most in KSA, but some in Amsterdam and the Caribbean). A modest drawdown there would "pop' July 2008 production to an all time record. The fear of economic damage from $147/barrel oil would be an incentive for KSA to throw extra supplies from storage on the market.

Today's more modest price increase slope is less likely to pull down inventories (after the tankers anchored at sea have been emptied, although they are not counted as "production" typically), so I "strongly suspect" that reported production today is almost all real production.

None-the-Less, Net World Oil Exports/Imports are almost 2 million b/day below their peak. And that number matters more than Peak Oil per se.

Just Stopping By,

Alan

With Brent trading on $94 and Tapis on $101, this up tick in demand / production provides important piece of jigsaw. World economic recovery seems to be gathering pace. As Gail noted in her recent post, stage seems to be set for a rerun of 2008. If sovereign debt problems and banking insolvencies don't derail the party (at any moment) then it will be interesting to see what energy price is required to halt growth this time around. Inflation looks set to zoom.

Its also worth noting long time lag between higher oil price and investment feeding through to increased production in OECD.

Thanks Stuart

I must say I never thought when opec cut production in 2008 that this production just vanished it would have required a depletion rate of 10% to do so. Also the new fields shown on wiki megaprojects make it a good bet that the 2008 high will be broken during 2011.

Ofcourse the big question is how much of this becomes net exports?

But one thing i am quite sure of peak oil is not yet passed.

Following is a table showing global net oil exports* versus Chindia's rising net oil imports from 2005 to 2009. If we assume an exporters' production level of about 61 mbpd for 2010 and consumption of 18 mbpd, annual 2010 global net oil exports would be about 43 mbpd.

If we assume Chindia's net imports were about 8 mbpd, then "Available" net oil exports, i.e., the volume of global net oil exports not consumed by China + India, would have fallen from about 41 mbpd in 2005 to about 35 mbpd in 2010. Chindia's combined net oil imports as a percentage of global net oil exports, based on the foregoing assumptions, would have risen from 11% in 2005 to about 19% in 2010.

*Net oil exporters of 100,000 bpd or more in 2005, which is 99%+ of global net oil exports, principally BP (total petroleum liquids) data with minor EIA inputs

Following is the chart showing the 1972 Texas and 1999 North Sea crude oil production peaks lined up with each other, and then charts showing US oil prices (vertical scale) versus Texas and North Sea crude production around their respective peaks.

Even with the benefit of slowing rising unconventional production (which was not a factor in the Texas & North Sea peaks), global crude oil production is showing a similar pattern, having--so far at least--failed to exceed the 2005 annual rate.

The key question is why has global annual conventional + unconventional crude oil production (C+C, EIA) so far failed to exceed the 2005 annual rate for four years and for 2010 to date, despite the fact that annual oil prices have exceeded the 2005 annual rate for five years? This lack of a production increase in response to rising oil prices is especially noteworthy given the large increase in production from 2002 to 2005, in response to rising oil prices.

WT

I have assumed that the world production curve would broadly track the US and north sea production curve, that is, a broad peak lasting 6 or 7 years then beginning a decline.

the megaprojects database seemed to support this

this new data from Stuart, so late in the "peaking" period (that is, I take world production to have broadly plateaued since mid 2004, so we are in the 7th year) is surprising

I agree with your comments about using annual averages of price and production, and long term 10 year trends in price direction.

As noted up the thread, we need to look at annual data, and the key difference between regions like the US Lower 48 in 1970 and the North Sea in 1999 versus the world in 2005 is that globally we now have a slowly rising contribution unconventional production that was not a material factor in the Lower 48 and North Sea declines.

In any case, annual oil prices since 2005 have all exceeded the 2005 annual level of $57, with four of the five years showing year over year increases in oil prices (with 2010 being the second highest annual oil price in history), yet annual global crude oil production has so far at least not exceeded the 2005 annual rate, in contrast to the rapid increase in production from 2002 to 2005, in response to rising oil prices.

I would actually say we entered the plateau in very late 2003 at about 70.5 mbd, since we have been in a range with that as the low and 75 as the high ever since. The whole 'all liquids' thing should be ignored--moving goal posts, double counting, differences in energy content...

But even if their isn't a new 'real' daily or even annual high production number, I am guessing that every extension of the plateau will come out of an even steeper fall off the other side whenever that does come.

And of course the raw numbers also overlook things like ELM and net energy/EROEI...

We all need to realize that anything and everything that can be used (conventional and non-conventional) will be done to maintain the plateau. It's not in the best interest of oil producing nations to allow a descent, and if super-straws or adding in ethanol can help the numbers and output, then it's going to be done.

But like you mention Dohboi, the longer the plateau is maintained, the sharper the shark fin decline once it gets started.

Personally I'm not surprised at this long plateau period, the undulating plateau of seemingly new highs, etc. It's just par for the course. I'm figuring at least 10 years of plateau due in part to the addition of non-conventional. As easily extracted crude descends these other sources will be ramped up until like Gail says, price dictates what the economy can handle.

My take on the width of these production peaks is that the curves are similar, but the global production curve is wider, between 200 and 300 years wide. Therefore, I expect the width of the peak of global production to be wider than the peaks in the U.S. and North Sea production curves. We might be near the peak in global production for 10 to 20 years, i.e. 2004 to 2024, and consume up to 500 billion barrels around the peak. The world's crude oil resources are not as extensively developed as the U.S.'s and North Sea's which ought to help extend the plateau.

Thats actually fairly close to the new party line thats forming. As far as I can tell the argument is that the oil is there however a lot of it is now what we call unconventional. It will be expensive to develop but it exists.

Indeed exactly how wide the production range is is open to question why not a thousand years ? Why pick 500 million barrels ?

Its simply a big number. The problem is not oil its simply a matter of cost since oil is more expensive demand for oil will grow slower and economic growth will simply be slower than it was in the past. Thus its a demand pull event.

The claim is this has obviously already happened in the more mature economies. Whats happening right now is simply that developing economies are still expanding and the oil industry has not yet really started producing oil at the new high prices.

Although its certainly started to respond with the growth in none-OPEC supplies. As demand stabilizes and prices stabilize at a new higher baseline supporting our large but expensive reserve base then oil production in a sense is simply moving to a new mature phase and for that matter so is the oil economy.

The actual peak when it finally occurs could well not be all that much higher than now say perhaps 100mbd or so ?

It might be ten years before we get there.

Oil will continue to play and important role in the worlds economy. Meanwhile steadily and probably slower than most people expect alternatives such as EV's will play and ever increasing role. Help keeping price down but also delaying the exploitation of our vast but somewhat expensive endowment of oil.

I have to guess overtime the assumption is that alternatives will allow growth to rebound even though oil remains expensive but still widely used. Where oil can be replaced it will be replaced but where its useful it will stay.

I'd argue that in such a scenario the eventual decline in oil production won't occur because of lack of oil simply because the new infrastructure that has expanded to around alternatives esp electricity has expanded to the point that its cheaper to continue to expand it than it is to maintain the oil infrastructure. This would be similar to the decline of the coal powered steamer. As oil powered shipping became increasingly common coal bunkers where eliminated and coal fired ships became non-viable not because we ran out of coal but simply because the distribution network was dismantled.

As with coal oil would continue to be used its got plenty of uses outside of transportation but its production rate will be controlled by the changing use pattern not supply.

Cool but whats interesting is how demand can surge by 3mbd despite the relatively high price. And play a role in sending oil over 100 once and it looks like again. How can demand from developing nations remain robust while collapsing in the more mature economies ? For now the long term picture leaves our recent past very murky. Basically it seems simply the result of a unfortunate combination of events. The move to "expensive" oil was painful and it seems unexpected. Indeed the explosive growth of China and India basically caught the oil industry flat footed and just happened to overlap with the transition between conventional crude and enormous but different unconventional production. Sh%$t happens sometimes. However given the recent report and assuming OPEC capacity claims are reasonably true it looks like we made it through the transition period even though it was a bit rocky. It might get a bit tight here and there in the future but it looks like we have years to go esp if non-OPEC oil production continues to rise.

We might strain capacity again but the possibility is fading. Also of course at some point Chinese expansion should start to cool down same with India. The real problem is they are simply growing too fast. For China coal production is simply so large now its difficult to believe that can keep the rate of expansion up. This will help cool their economy.

Also for India overtime the new high oil prices should eventually slow the rate of economic expansion. For the US our economy may be growing again but we still have one hell of a debt issue left to deal with. The EU is not looking to hot. In short over the next few years growth in China and India should moderate indeed they might even suffer a mild recession while growth in the US and Europe should also be very slow. As the short term becomes long term a lot of the issues that have been ignored for now won't be and they will have to be solved and they will be a bit painful.

Maybe not a double dip but tough going for several more years. OPEC will ensure a bottom on oil prices so we can be safe in assuming the spare capacity will be with us for a long time to come.

So still some tough times ahead but basically we made it through our pinch point and transitioned.

Problem is one piece of the puzzle is still missing indeed the cornerstone of the whole story has yet to be laid.

OPEC has yet to surge production to stem price increases. Indeed as prices rise they seem to be moving the goal posts on us. It was primarly non-OPEC that did the heavy lifting so far according to the official numbers.

Until OPEC actually shows it can contain oil prices well, the truth is still in the future.

Obviously I don't buy into the story.

Being the cynical bastard I am however I don't expect the truth far from it indeed I fully expect some "event" above ground that will have and impact on OPEC's ability to deliver oil or demand. It won't be their fault of course. This beautiful vision of the future will still be there of course I just suspect that events will seem to keep happening that somehow mean we will never get there.

500 billion barrels is approximately 73 Mb/d * 365 days/year * 20 years. I presented the number to give an idea of how much crude oil and condensate might be consumed near the global peak and to suggest the falling edge might be rather steep.

Look I don't want to be a dead horse but I will :)

If we can do 73 mbd for 20 years and extract 500 billion barrels of oil well perhaps we can also ramp up to 100mbd over ten years etc. Indeed good chance we can produce more than 500 billion barrels assuming what your saying makes sense today.

A 20-30 year wide peak event simply does not make a lot of sense to me I'm sorry. Its indicative of a substantially higher oil resource base. I'd argue at least 3-4 trillion barrels remaining makes sense even if you assume a symmetric decline in our current fields regardless of the overall shape. Indeed it suggests most of the oil that will be burned has yet to even be discovered.

If it was a matter of price well if we assume say 80-120 as a price range that allows us to tap these reserves why stay at 73 mbd ? If we assume that we can do 73 for 20 years well clearly we would have economic expansion over the same time period and if the oil exists the demand for it would be higher in the future. If you want to take this route then I'd argue that we would do say 75mbd or less at 100 dollar oil say 85mbd at 150 and say 90+ at 200. If its a price issue I'd argue the world will adjust to higher prices and overall growth would ensure production continued to increase.

Perhaps oil production would peak over the 20 year span perhaps not. If such capacity existed it would be effectively unpredictable how much oil would be produced and at what price point. One has to think that with high priced oil and our latest multi-branched lateral wells and fracking technology that production would continue to climb. And of course the new high prices are certainly to garner a few more technical breakthroughs or make some methods that are often too expensive today feasible tomorrow. Look at how fast horizontal drilling expanded once it was perfected.

If the current plateau is real then its simply the result of the almost random overlap of a number of events and it will be resolved peak oil is somewhere well in the future and its difficult to even guess the same of the curve.

If peak oil is happening now then I think the long plateau implied by current production claims makes no sense. Not even for my shark fin fall off model. Oil production would remain high for too long. The argument for the asymmetric production in the first place was because technical enhancements allowed production to remain high past 50% of URR indeed past 60% of URR and close to 70%. Almost by definition the time period one could keep the max production rate against advancing depletion is fairly short. Indeed the actual onset of the plateau itself is very likely to be delayed until you hit 60% of URR. And its unlikely to be maintained after 70% URR. Looking at global oil production then the period of time where we passed through a 10% remaining URR change with production close to its present value is easy enough to see. About the earliest date you could pick would be say 1995 and production was clearly rising through 2004.

Basically about ten years at most to burn through 10% of the remaining URR and thats in my opinion stretching the time case quite a bit. Obviously since 2004 we then burned through a good bit more of our remaining URR. Going with the 10 year extreme estimate well then the plateau ends in 2014. I'm not convinced that the same technical advances which held the plateau will also allow and initial shallow decline period of 1mbd or less for several years say at least 5. This puts the final obvious decline out to 2019 or 2020. And not only is this really pushing the model its negating almost all future discoveries. All the shark fin model buys you is a fairly small number of years of high production at the expense of eventually very steep declines as you approach 80% of your remaining URR perhaps expensive oil does expand the time getting you perhaps close to your 20 year claim.

Perhaps it still fits and is still correct but I find it questionable. Realistically I'd argue your looking at two cycles. The end of cheap oil and the onset of expensive oil. The new demand for expensive oil is driving the expansion and shifting the decline outwards. The entire argument rests primarily on technology and it makes more sense when your considering such a long interval that fundamentals also change over the same time period. For example expansion of heavy oil production and deep water would perhaps add significantly to the resource base. A long shark fin is intrinsically a different model from on I considered. With new hard to develop resources becoming financially viable the existence of the "fin" is questionable. In short your really pushing it. It may well eventually prove correct but I dunno.

Instead if any sort of shark fin model makes sense well its going to have a much shorter duration. My best guess at the shape of the top is 10 years of increasing production past 50% URR 5 years of flat production then 10 years of shallow decline followed by a big drop. Basically a parallelogram. Technology at first allows you to increase production then stem the initial decline and then keep it initially shallow. The assumption is a total URR of about 1.5trillion barrels.

The time scale is pinned via the onset of both horizontal drilling and rising production in the 1990's. This also pins the URR estimate as we would have hit 50% of URR or a symmetric peak in the early 1990's.

Look at the graphs here:

http://www.hubbertpeak.com/curves.htm

And Ivanhoe the real father of the shark fin.

I'd argue that the symmetric peak if it was going to happen was clearly forming in the early 1990's. Technical innovation esp horizontal drilling that would eventually result in a shark fin became widely deployed at this point.

Certainly one can argue the shape of the curve. Anyone assuming and asymmetric curve has serious problems explaining the shape around the peak. The shark fin concept is far more about the eventual steep drop not the exact shape of the top. By definition its detailed shape is driving by technology. I think my argument for a squashed pyramid is very reasonable and eliminates the unnatural sudden fall off and replaces it with a much more sensible linear decline phase.

No matter how you slice and dice it its still well pinned in the early 1990's and by default also pins the URR.

Ivanhoe was a bit off on his shape and production actually continued to increase instead of flatlining as he thought.

His curve is still basically correct in my opinion simply the details around the peak are hard to discern.

Indeed in my calculated oil production I see what seems to be two technical moves upward not just one. The second is probably expansion of offshore drilling in any case the revolution in oil drilling technology that started in the 1980's was bearing fruit. Indeed the onset of symmetric peak was soon well in the past and even if expected quickly forgotten.

Hubbert's predictions esp the lower estimates of 1,350 billion where seemingly wrong.

However as I've said you can pin the curve and indeed it says that Hubberts low estimate was actually very close to correct. If he missed at all it was not by much. I guess 1,400 to 1,500 indeed if I'm wrong its to the high side thus closer to his results. Distortion of production from technology did not happen suddenly Dec 1, 1990 it was already causing some distortion in the late 1980's. I'm far more likely to be high than anything.

Regardless esp if you adopt the concept of a linear decline phase no way does a shark fin fit todays numbers.

Correcting Ivanhoes projection to include and additional growth and linear decline phase still puts you falling of the cliff in production. Using the distillate and argument and upstream technical innovation allowing optimization of distillate production dampens the economic impact but still prices work to pin things even more.

I believe one of two answers work.

1.) Hubbert nailed it with his low case symmetric curve.

2.) The Ivanhoe technical correction i.e shark fin was fundamentally correct.

3.) The peak needs further modification to recognize the ramp plataue and linear decline caused by technology. ( My correction to Ivanhoe)

3.) Price narrows down the situation and we apply one additional upstream factor where complex refining allows significant leeway to produce more distillate.

4.) Rising lease condensate and NGLS primarly from wet NG wells offset the demand for light petroleum products including gasoline allowing complex refining even more leeway to produce distillates.

With this Peak oil is seen as having two big events. The first was a shortage of distillates as oil production fell below the offsetting abilities of advanced refining the second was when production really did go over the cliff.

Amazingly it seems that if the second has occurred then it just happened to happen in the depths of the greatest recession in history. Or not amazing at all depending on your opinion. Regardless current oil prices would have had to resulted from a steep drop in oil production aka the cliff all the way through the recession period.

Thus we eventually repeat the distillate shock of 2008 but pass through it rapidly into real shortages.

Obviously oil production numbers have been fudged big time for a while.

------------------------------------

Or you have to throw all these models out. It is some sort of long plateau and or multi decade peak. Mine is I think the most extreme one but effectively all the peak oil models are effectively wrong if we are looking at 30 years plus of high oil production or at least all the near term ones are wrong and all the long term ones wrong for different reasons.

Still everyone got it wrong one way or another. Yet thats really my point. I think my short term shark fin model is still valid. If so then we are not only going to see a price shock real soon now its doubtful that prices will really fall off after the distillate shock. It won't be an exact repeat of the 2008 distillate shock simply a bigger and different one that starts in the same way.

I don't know but one thing is for sure any sort of long plateau model even if it eventually ends in a steep drop will be interesting to understand if it turn out true. For now at least I'm betting Hubbert nailed it coming and going.

Obviously he could not easily predict the technical innovations but still he nailed it.

Indeed you have a pretty interesting paper see slide 10.

http://www.docstoc.com/docs/22383983/Evaluation-of-Crude-Oil-Production-...

I'm saying the early giants nailed it perfectly using simply symmetric models.

All the later forecasters have simply misinterpreted the effects of technical innovation.

Now its even worse falsified public data is being used to try and support the longest forecasts I guess underpinned by the belief that high prices and technology will find the oil just like it was able to offset the symmetric 90's peak.

In a sense if we can just keep things going then the truth will eventually match what we are more subprime is contained logic if you will.

In the other approach technology also beat these early forecasters and also of course all of the later near term peak oil forecasters they where all wrong however technology not only enhanced production but also greatly expanded reserves.

Its only real weakness was the expense and the fairly slow rate that production could be increased. Its a very different oil production curve and since technology play a huge role its exact shape is also difficult to discern. But no real shortage of oil is on the horizon even if cheap oil is a thing of the past.

Regardless the near term symmetric peak oil proponents still got beat by technology coming and going its simply a matter of how exactly did they get beat. Technology has in my opinion clearly played a very significant role in oil production and its effects have not been correctly included in most peak oil scenarios the only question is the exact nature of its role. If its a shark fin then then using price to do the final curve pinning means we are already over the cliff. If technology has indeed also expanded the producible reserve base substantially then oil production should continue to increase simply at a bit slower rate than in the pass and only cheap oil is in the rear view mirror the peak is not even discernible.

I know less about this than you do, but it seems to me that nationalized oil companies might behave differently than purely profit-seeking oil companies, especially as they learned over time. I am thinking in particular of the Saudis, Iranians, and Norwegians. It seems to me that a quick spike does not profit them as a long plateau; someone that's thinking about a country's economy, and not chasing quarterly results, might favor a long steady stream of money in a stable world economy, to a quick pile of cash (that is worth what, in 20 years?) and the resulting unstable economy.

I'm not sure if this explains Venezuela's behavior or not. One corollary/advantage of dribbling out the oil, is that you would not sink a ton of money into your oil production infrastructure, preferring instead to extra the maximum value from what you already have.

Not likely. Logic that you, the good doctor, displays goes a long ways to understanding.

I'm not a REAL doctor, understand :-). And my degree's in CS -- what ails your computer today?

Well read the new tech talk that now up on Venezuela the investments to develop heavy crude increments are huge.

Assuming that they are holding back is questionable. Better to assume that the remaining oil resources seem to require a significantly different level of investment to extract. From Brazil deepwater to the heavy oil deposits the technical challenge is dramatically higher than it used to be.

This seems to result in two key points.

1.) The reserve base has to be huge to justify the expenses.

2.) Development will be slow.

The production rate from these reserves is effectively independent of their discovery date and ultimate URR except for the fact they need to be large to justify the investment. Intrinsically I argue they don't fit most oil depletion models.

Also one has to imagine if there was any other significant prospects for oil that where similar to what we had in the past they would be developed first. Your certainly scrapping the bottom of the barrel with these projects.

Other places like Iraq which might hold more traditional oil reserves suffer from whats probably long term political instability thats not easily fixed.

Simply given this move to non-traditional sources suggests that traditional produces are at the minimum no longer capable of large incremental increases. Many could well be in decline. Certainly this will put tremendous political strain on producing nations esp given many are also seeing internal consumption climb.

Countries like Mexico that historically minimized their interaction with the big oil companies are faced with the issue of needing technical help to manage their declining reserves. At the same time internal politics will become heated to say the least.

Technical and political factors rule distorting the production curve perhaps significantly from any simple discovery development production cycle. Basically across the board in every single country the nature of oil extraction and the challenges facing the industry change dramatically. Accidents like we had in the US can also happen at any point especially as things simply get more complex.

Perhaps I'm also right are partially right and underneath all of this we are now finding that our previous applications of technology have resulted in steep declines of our remaining traditional reserves even as the barriers to expansion and continued development grow.

Does it matter well yes it does the details of whats happening right now will determine the future of the oil industry.

Across the board I think its obvious that the entire industry is undergoing a fundamental change as the days of cheap oil are clearly over.

The simplistic symmetric models based eventually on URR estimates fail to capture the new situation. Technical and political issues cannot be ignored.

As far as nations willingly holding back production of legacy "cheap oil" fields to maximize profits. Well thats one explanation. Does it even make sense.

If one takes the new reserve estimates that have been published at face value well oil production at its current rates or higher will continue for decades to come. We are not even close to the midpoint much less decline. Why hold back right now ? You have decades of production. Certainly it will be more expensive and expansion will become harder but the production is there. Why cut back now to "force" a higher price expensive oil seems to be a given. Lacking any reasonable models for future oil production acting today in anticipation of some well defined result decades from now seems questionable.

Indeed your implicitly assuming that oil producing nations have excellent models of their current and future production and more than this excellent models of global production and demand over the next several decades. Even though we have already been through one horrendous price crash. Making the assumption that decisions are being made now to accomplish some goal thats decades in the future is interesting.

I don't think the situation is that simple indeed the intrinsic problem is one of significant increase in complexity not simplicity. Claiming that we now have rational actors that are deftly able to navigate this complex situation with almost perfect knowledge is well questionable. We have not even considered the impact of EV's and alternatives such as GTL in a high priced yet reasonably well supplied world. I'm not excited about EV's over the short term but if one is talking about twenty years then EV's, NG etc all become significant. And last but not least you cannot ignore the financial situation. China one day perhaps soon is going to have to slow its growth rate. Western nations have huge debt loads the entire global economy is unbalanced. Any sort of multi-decade planning has to consider the evolution of our financial system. Obviously something has to be done about it over a 20 year span.

And of course you have to also assume that all these nations are very confident in their governments over twenty or more years. Suddenly politicians esp in unstable parts of the world become visionaries ?

At the very least lets see some new models attempting to model this new world with all its complexity. All I see is a very opaque and unknowable future with way to many factors at play. What I'm saying is pretty simple all bets are now off all the models broken this might be because of corrupt data as I claim or not. Its literally impossible to guess what the future holds.

If people actually take the time to try and model I think they will see numerous divergent outcomes are possible depending on the details future oil production is driven almost completely by how economic/political/technical factors interact.

Well, I'm upfront about not knowing enough, but I also can't quite make sense of what I observe, and what I read. And I think there's a possibility that maybe people running countries learn, plus there's no doubt weird diplomatic interactions between countries that there are not between corporations.

Or to put it differently -- economists are famous for pretending that ugly real-world entities fit their beautiful models, but corporations and nations are different beasts.

Countries that treat their reserves as state secrets and don't allow independent audits ?

Countries like the US that still don't even have and energy policy ?

I agree with you that they have learned something indeed I think they have learned a lot.

Just I think we differ substantially on the exact nature of what has been learned.

One need only look beyond oil at other issues we face to see what our government have learned.

http://www.scientificamerican.com/article.cfm?id=future-of-kyoto-protoco...

The sad thing is many people consider the Global Warming debate a success ?

No doubt it taught the world governments a thing or two but like I said perhaps we differ on exactly what the lesson was.

If nothing else is reaching a peak I think peak arrogance, selfishness and disregard for the common man has hit and all time high. Historically the greatest atrocities are often committed when governments shed the fetters of accountability and no longer listen to their people.

http://www.abs-cbnnews.com/nation/11/30/10/wikileaks-cablegate-shows-us-...

Now as far as oil goes simply consider for a moment that we might have been fed a pack of lies. What reasonably independent data exists that can confirm or deny such a situation ? If you do ask the question well the answer is very little some scraps of data. Some interesting moves in the markets. I even looked into CO2 as I've mentioned.

But the reality is we don't have any real checks and balances against duplicity as far as oil is concerned.

Heck as far as I know no country in the world has ever raised any sort of official concern about OPEC's interesting

reserve claims much less more vigorous action.

Well lets look shall we little information is not no information.

http://www.energyintel.com/documentdetail.asp?document_id=167229

And we get a bit of real data it seems in this report.

A 48% recovery rate is excellent and Kuwait has been applying modern technology to its fields for decades.

Such a result is a perfect match for what I'm claiming has happened that advanced technology has kept production levels high till nations are in the last few percent of oil that can be recovered at high flow rates. This paper was in 2006.

Its not 2009 if the above is true well Kuwaiti production should now be declining rapidly or at best be on the verge of decline.

And we have reports like this.

http://www.gregcroft.com/burgan.ivnu

Now whats really really neat is if Kuwait and Saudi production did start crashing indeed probably problems in numerous countries well the economic crisis could readily have hidden a huge change in overall production.

http://noir.bloomberg.com/apps/news?pid=newsarchive&sid=akpmrbF4lZtQ

With current prices approaching 90 a barrel overall oil production could have fallen by as much as 4mbd !

Obviously this casts serious doubt on Chinese imports and internal consumption claims.

Setting aside oil for a moment lets just check some official Chinese numbers.

http://www.washingtonpost.com/wp-dyn/content/article/2006/05/19/AR200605...

Almost a 50% difference ! And this is a statistic that has a reasonable chance at being recreated. No telling what the error is in other stats with China 30% or more is probably a safe bet.

Here is and excellent overview of Chinese statistics.

http://www.theoildrum.com/node/6126

Forget about oil its the least of your problems. If Chinese statistics have serious flaws well fairly quickly you run into and ever bigger problem. You have a huge car problem. Thats not to say that demand for cars in China is probably not growing at a healthy rate but if you even consider a large but for the Chinese reasonable difference of 5% well you have a problem. A better Chinese correction is 50% thats the norm not the exception.

If one simply "corrects" the Chinese stats we get a growth rate of 10-15% actually not at all out of line with corrected GDP numbers. Next of course crushing rates or the rate of removal of older vehicles in China is as far as I know not known. Its however a pretty good bet that all the old Communist era cars where rapidly scrapped.

There seems to be zero chance that we can get good scrapping rates however the Russian auto industry is not doing well.

http://www.livetradingnews.com/russias-car-industry-s-big-q-upgrade-or-d...

If one assumes that FSU countries and China and India have effectively rapidly replaced their fleets with either new more modern local model or imports or locally build foreign designs well its huge. The transition is over a very short period of time but its important to note that in the US fleet replacement following the 1980's oil crisis resulted little change in overall oil demand. Often the change in fuel efficiency is larger between old poorly maintained auto's of the FSU and china and modern cars. Thats not to say they are not seeing fleet expansion simply that the relationship between the fleet modernization thats taking place and fuel demand is likely to not be a simple 1:1 change.

However all of this is simply sidestepping the real issue and elephant in the room. The problem is it casts serious doubts on the claimed production figures made by our international car companies. Any attempt to try and guess corrected auto import figures leaves a huge gaping hole in the production claims by public car companies.

This is of course a startling claim right ? Well lets look around and see what we can find.

http://www.thetruthaboutcars.com/2010/11/gm-breaks-2-million-car-sound-b...

Ouch !

Now we see the game in China joint ventures are the rule not the exception. Well if every member of the joint venture gets to claim 100% of the production voila ! Fantastic numbers. Apply my educated guess I used to live in China so I know how they do their government math and bingo my estimate is right on. Obviously we have to correct the growth in Chinese demand by a similar amount and of course unlike everyone else consider the scrapping rate.

This eventually results in a probable growth rate for Chinese oil demand of around 2-5% per year.

Now whats really interesting is we have plenty of evidence that Chinese oil imports are probably much higher than this.

Even if you again assume questionable stats in this case you have yet another big problem. China is still no matter how you slice and dice it importing too much oil. Indeed the game with car numbers goes a long way to covering up a real and obvious surge in imports.

Well crashing oil production is not just the domain of the worlds exporters if its happening well it happens in every oil producing country. China like the US is not immune to its own national peak. This time around however like the rest of the world technology played a bigger role and the resulting decline is probably far sharper.

China it seems is not immune to the problem of rapidly falling oil production indeed if I'm right they are in a serious bind. The rapid expansion of Chinese oil companies in the international space takes on a whole new meaning if I'm right.

Also of course they would be just as willing to play along with the rest of the world in fudging numbers.

If anything they are in the worst shape of all. Japan of course was already in the frying pan and has been for some time.

If one assumes Russia like everyone else is having production issues well the EU is also stuck.

With China, Russia, the US, and many OPEC and non-OPEC exporters politically motivated to keep a lid on oil production problems what are the chances of any sort of truth emerging. Not only is it not in anyones best interest to go against any attempt to keep portraying things as normal. Its important to the biggest economies in the world. Who is going to stand up on and issue where China and the US are in perfect agreement ? Consider also the financial position China has created ? The best description I can come up is with is that our world leaders are in a ring playing Russian Roulette with each other everyone has a gun pointed at the other and each one has a few bullets in his gun.

Indeed the number one issue facing the world right now is in my opinion a rapid fall in domestic Chinese oil production if thats whats happening. If I'm even close to being right about global oil supplies falling and one includes export land concepts. Its a ticking time bomb and it does not have a solution. The world simply cannot accommodate a China that is seeing rapid declines in domestic oil production. And China can no longer change its course and reign in growth without facing collapse. Indeed a perfect storm is brewing and I simply don't see any solution.

With just a bit of digging its really not all that hard to figure out whats really going on indeed the attempts to hide the real situation become increasingly superficial and ludicrous the more you dig. Its simply not that hard to figure out whats being hidden if we are being told a pack of lies and its fairly obvious why. The only way out is to try and keep things under control and hope they get better or war. Sooner than later this high stakes game will probably come unraveled.

The problem is, you seem to think that what the Saudis should learn, is to allow independent audits. How does this help the Saudis? There are what's-in-it-for-them lines of reasoning that support them having a fair amount of oil, and being in no hurry to pump it. Suppose an independent audit revealed this -- would they like this? Conversely, suppose their reserves are near their end, but they wish to prolong their influence as long as possible in OPEC. Would an independent audit serve this purpose?

Countries with marginal or difficult-to-produce fields, why should they be in a hurry to produce them? I've heard that production can be harmed if you do extraction wrong, why not let someone else be the guinea pig first?

And, in all cases, people who stand to profit now, who are expected to deliver results next quarter, have a fair amount of money to spend on PR. For example, is Venezuela "wasting" their oil, or "conserving" it? Beats me, but I think this is a very interesting question.

LOL :)

The Saudi's don't have to learn anything. Its the nations dependent on oil imports which have the problems.

Its the US, EU, China, Japan etc that should have been at to forefront of a transparent oil infrastructure.

For the US and China this includes a real transparent assessment of domestic production. Heck the long term potential for US production is just as opaque as the Saudi's for different reasons but still our own reporting is at best poor.

A significant about of oil production in the US is from stripper wells.

http://www.epmag.com/Magazine/2009/1/item26683.php

http://www.onepetro.org/mslib/servlet/onepetropreview?id=00020513&soc=SPE

I can go on and on...

http://www.onepetro.org/mslib/servlet/onepetropreview?id=00003828&soc=SPE

Its not like these issues are unknown.

Thus simply starting with one of the most basic issues baseline stripper well production in the US and its potential impact of future US production and working my way out to eventually question KSA production what do I find ?

And almost criminal lack of concern about our energy supply.

Heck you have things moving in the opposite direction with increasing taxes on these marginal producers.

http://findarticles.com/p/articles/mi_qn4182/is_20100728/ai_n54662743/

Who knows how heavy handed central government polices have impacted Chinese oil production over the short and long term.

Whats really happened with oil production under authoritarian regimes like Saudi Arabia ?

The oil spill disaster in the GOM for example highlighted just how poorly the industry was regulated. Effectively for all intents and purposes self regulated. Although it detracts from my argument to some extent the Industry in general has obviously done a good job of regulating itself as far as safety is concerned. Accidents are and exception not a rule.

This says nothing however about the quality of long term management of our natural resources and overall accountability.

In the end all you really have are statements from the leaders of Saudi Arabia and the large oil companies that they are wise stewards of these resources.

The governments of the world maintain a literally blind trust in the oil industry. The critical problem is perhaps not that the trust is justified but thats its literally blind. There is zero public accountability and oversight as far as long term resource management goes from the smallest stripper well in Oklahoma to the giant Ghawar field in Saudi Arabia.

The world seems content to simply look at effectively unaudited R/P ratios and continue on its merry way.

I love this explanation.

http://moneyterms.co.uk/reserve-replacement-ratio/

Surely its possible that this decades long policy of benign neglect and trust might have resulted in a building crisis ?

What would happen if say other critical industries such as Banks where allowed to effectively self regulate themselves ?

Ohh wait ....

History is so full of eventual crisis from lax regulation that its impossible to find a situation where such and approach ended well. Indeed government regulations are almost always created in response to a crisis of one sort or another in one industry or another. Often way too late to solve the original problems and seldom anticipating the need for any sort of stewardship. The industry quickly regains the "trust" of the government often with a steady stream of payoffs and we move on till the next crisis.

Perhaps the oil industry is different I seriously doubt it. And this is not to demean the workers in the industry the vast majority never deal with these sorts of higher level problems. Indeed even inside companies data that allows you to even ascertain such issues is often only available to upper management. Few has access to it generally because its considered sensitive. Sometimes from time to time they do and we get our whistle blowers. The significance of one or more whistle blowers is often disregarded but eventually becomes clear in hindsight.

Again we turn to history and in this case to the history of the oil industry has it really established that its occupies and almost unique position in history and is the one industry that won't eventually abuse its trusted position ?

I'm not just talking about national oil companies but the entire industry.

I'd argue that not only does such assurance not exist if you dig it seems that the industry has developed in such a way that some fairly huge discrepancies could readily exist. This does not mean by any means that they do exist simply that the opacity level if you will is so high that a huge range of real conditions could readily underly the public positions of the oil industry.

Given this and given history well eventually it seems as time progress these concerns do turn out to be right the unregulated industries sooner or later abuse their position of trust as events force them to either be forthright and suffer the consequences or lie and get by for a bit longer.

Again this does not mean that the oil industry has fallen into this trap but it also does not mean they have not.

The trap is there and one day if history is any guide we can make a safe bet that the industry will choose the wrong path. There is a very good chance given oil price action that it already has at least to some extent. It inability to meet demand and prevent high oil prices alone is enough to justify the existence of issues which where not addressed by the industry itself. It failed in its obligations to its customers.

The only real question is just how much has it failed was it simply the result of unanticipated robust demand and failure to regulate speculators in the futures markets as claimed ?

Or is it a much larger issue ?

At the very least I'll argue we really don't have a clue all we have is trust me.

One of two things have happened the oil industry was simply blind sided by a series of events and is working hard to rectify the problem and ensure stable oil prices or they are they are telling ever larger lies.

We have seen similar things happen in the past in the Sugar industry which is about as honorable as the Oil industry.

(Thats not saying much :)

Its chock full of all kinds of price swings and corruption. Indeed sugar is of course intertwined deeply with the slave trade and effective slavery for cane cutters. In comparison the oil industry actually looks pretty good :)

Just consider for a moment what the sugar industry would do if it was faced with falling sugar production say for some reason no matter what they did they would have less sugar cane every year ? If your willing to read about the history of sugar and then conclude you would trust the sugar industry to do the right thing and manage the declining production say perhaps investing in alternatives well then you can trust the oil industry. Personally I'd like to know if you would be interested in millions of acres of sugar cane fields recently available in Alaska because of global warming.

Seriously however I have no doubt that the oil industry has some serious problems. Trust me is not the answer. The only question is just what these problems are and how serious are they. And the way things are now structured you cannot dismiss the potential for a crisis. Most Americans are ignorant of history but not everyone was born yesterday.

The price spike should have caused a massive outcry for and audit of the global oil industry that was heeded by our governments. It did not.

Perhaps because the governments already know the cause ?

Pleasr throttle back. Everything you write detracts from your argument.

Not to mention that it's at least 5 times too long for what it says, so most people reach MEGO and stop bothering. I know I have.

Memmel, maybe there's something like Immodium for logorrhea. Get some and use it.

I did a bit of searching today and found this from 2000.

http://nl.newsbank.com/nl-search/we/Archives?p_product=NewsLibrary&p_mul...

If you look you will find many news reports about falling stagnant or falling domestic production in China from 2000 and even up into 2004.

http://english.people.com.cn/200403/25/eng20040325_138469.shtml

And this

http://www.sciencedirect.com/science?_ob=ArticleURL&_udi=B6V2S-5005SMM-2...

and this..

http://web.cup.edu.cn/peakoil/document/20100805090622040004.pdf

And in 2011 just how is old Daqing doing ?

http://www.chinaknowledge.com/Newswires/News_Detail.aspx?type=1&cat=CMP&...

I think the Mexicans need to learn a thing or two from the Chinese about reporting oil production.

Edited to add missing links.

"The key question is why has global annual conventional + unconventional crude oil production (C+C, EIA) so far failed to exceed the 2005 annual rate for four years and for 2010 to date, despite the fact that annual oil prices have exceeded the 2005 annual rate for five years?"

Could it be that the nature of the Great Recession is a demand-based slump. This is unlike any comparable modern downturn. Until recently there has been no signal to open the spigots.

Yes, especially given the big drop in demand in those countries where white folks don't rule the roost.

Global Crude Oil Production Versus US Oil Prices

2002-2005 & 2005-2008 (EIA, crude + condensate)

2002: 67.16 mbpd & $26

2003: 69.43 mbpd & $31

2004: 72.48 mbpd & $42

2005: 73.72 mbpd & $57

2006: 73.46 mbpd & $66

2007: 73.00 mbpd & $72

2008: 73.71 mbpd & $100

I agree that global demand at annual oil prices in the $66 to $100 range (2006 to 2008) was lower than it would be at oil prices in the $26 to $57 range that we saw from 2002 to 2005. However, the question is, why did global producers increase production by more than six mbpd from 2002 to 2005, in response to rising oil prices, but show flat to lower production from 2005 to 2008, in response to rising oil prices? Sometimes, the simplest explanation is the best, i.e., Peaks Happen.

We are on the "bumpy plateau" of peak oil production. There may yet be a year with a higher total annual production than 2005 but I doubt it will be by much. The monthly number is far noisier and certainly can pop higher briefly.

Several years ago, Stuart himself raised a couple of important questions:

1. How long will the peak last?

2. What will be the decline rate once we begin the downward move?

The first question is relevant in that it partially defines the amount of time that global civilization has to respond to the peak in liquid hydrocarbons. The second is relevant in that it defines how hard and how quickly the changes will hit us once they begin in earnest.

These questions are, in my opinion, far more important than defining some exact date for peak oil. Unfortunately, they get little discussion anymore, particularly the second question.

Agreed. Add in the little net export problem we have and the first few years after the peak could be ferocious:

For comparison, the 73 shortage was ~ 4%.

2008 annual was lower due to the recession. It impacted demand. Production was lower as a result. To point out the obvious. You really should include this in these boilerplate arguments of yours, you know. It's a bit disingenuous otherwise. A simple linear trend from Jan-July '08 suggests that if demand had stayed steady the annual figure would have been ca. 74.5 mb/d, and there goes your theory. The flatness '05-07 and decline in KSA are the bona fide alarm bells.

Rapier is correct that we really shouldn't be in a froth insisting that this or that year was the absolute peak. The industry could still pull off one final hoorah. I notice the US rebounded to ca. 96% of its absolute peak about a year later, too. Doubtless there are other examples.

But why does the exact month or year of PO matter? It is a worthless statistic in the grand scheme of things. We are generally at the top of the mountain. It does not matter a hill of beans whether we are within 1-3 years plus or minus of that point. We are all facing this one way or the other. It is not decades away in 2030 or something it is facings us in the near term.

The biggest producers cannot all go flat in such a way as to mean that they are resting for a while to make a new peak of any future significance.

What probably matters more than the exact date of aggregate PO is PO per oil consuming capita. (the reason for the “oil consuming” is because if one never really used oil PO is irrelevant anyway). Once that metric goes down outside of the noise band it is going to be painful.

Rgds

WeekendPeak

I wonder if one could view the spike up and down in 2008 as the "changing of the guard" between western and eastern influence driving price? The super-spike likely occurred as multiple growing economies converged to drive demand sharply. After the spike, China comes along to fuel the recent price increases, while the west sorts itself out in the economic doldrums.

Given the uncertain relationship between total production, price, and demand, I can't help but think that there must be a better figure of merit that "peak oil" or "peak price". Perhaps some utility function per nation of GDP divided by oil expenditure (imports times price per barrel, plus the cost of extraction alone for internal production)?

Intuitively, it's not just the quantity that matters, but the price, and not just the price-quantity product, but what you actually do with it, that determines the health of a nation. The UK as an export nation had benefits that the UK as an importing nation does not. Ditto for the US.

On the world stage, one would think a summation could readily result in a simple curve for world GDP, given the fungibility of oil overall and netting out of imports and exports. In such a case, cost of extraction overall would be the key -- and that brings us back to EROI and EROEI in a round-about way.

Probably all of this is trivial from an economics cash-flow analysis. I suspect we are simply focusing on a triviality of "peak production" and missing a more complex but also more meaningful competitive value model. It would be easy for our marginal utility per barrel of imported oil to shift as the cost rises and we not even notice the transition point. Knowing where that point might lie would provide a rubric for determining when a shift from maximum-consumption to higher-efficiency become mandatory.

On the next level down, it may well be the Ethanol is good for Iowa but unhelpful for the nation. Or it may be helpful to both, compared to imported oil. Or it might be lost in the weeds compared to low-hanging efficiency fruit. I'm not sure we have any way of knowing today.

In a stable market, the price of oil is the price of marginal production. OPEC (or at least SA) is doing it's best to preserve a stable market with the price high enough to maximise global production by bringing on tar sands and deep water and other high cost oil. This of course does not mean that all oil costs $90 to extract, so the average cost of production globally is much lower. The difference is the profit to the oil producers. This profit is re-invested into the world economy, albeit a lot goes into inefficient prestige projects like artificial island resorts for the super rich. The end result is that global economy becomes deeply unbalanced. Major oil importers are dramatically impoverished, important infrastructure projects like renewable energy systems are underfunded, the rich get richer and the poor starve. Riots and Wars proliferate.

The truth is that the peak of oil production (or net energy from liquid fuels) is going to cause a major a period of geopolitical instability at its best, and all out war at its worst.

All monthly prices in 2008 were above the $57 average annual price that we saw in 2005--until December, 2008. And on the production side, 2005 was heavily impacted by hurricanes. Regarding the obsession with July, 2008, I suspect that there was a lot of inventory liquidation going on, given an average monthly price of $133. In any case, here are the updated global C+C numbers:

Global Crude Oil Production Versus US Oil Annual Spot Crude Prices

(EIA, crude + condensate)

2002: 67.16 mbpd & $26

2003: 69.43 mbpd & $31

2004: 72.48 mbpd & $42

2005: 73.72 mbpd & $57

2006: 73.46 mbpd & $66

2007: 73.00 mbpd & $72

2008: 73.71 mbpd & $100

2009: 72.31 mbpd & $62

2010: 73.44* mbpd & $79

*Through 9/10 and subject to revision

There was a clear price signal from 2002 to 2005, as oil prices rose from $26 to $57. In response, global crude oil production increased by 6.56 mbpd.

Annual oil prices from 2006 to 2010 inclusive have all exceeded the $57 level, and four of the five years have shown year over year increases in annual oil prices. In response, global annual crude oil production has so far not exceeded the 2005 level, and in fact we have seen a cumulative shortfall--on the order of a billion barrels of oil--between what we would have produced at the 2005 rate and what was actually produced.

But of course the real battle is in the global net export market, and a plausible scenario is that the global supply of Available Net Exports, i.e., the volume of global net exports not consumed by Chindia, is in the process of falling from 41 mbpd 2005 to about 27 mbpd in 2015.

Most intersesting are the years from 2002 until 2004. Even production increases of more than 2m b/d were not sufficient to prevent prices from rising dramatically. Everyone may calculate where production figures should be in 2011 if something like BAU for the OECD nations could have materialized.

Second: Availability beats prices. The rising prices did not prevent global GDP from growing, but the shortage does.

-There would not have been an malnutrition problem in germany at the end of WWII if the nazis only printed enough foodstamps. Many, who laugh about this fuzzy logik become true believers when it comes to the terms of oil and $, instead of food and foodstamps.

Yes, but GDP correlates to gross energy, not net energy. Net energy is what the world feels. "The economy" runs on net energy.

73.71 mbpd & $100 (2008) yields much lower net energy than 73.72 mbpd & $57 (2005).

Prices are often "sticky" on the way down as well. We are human after all. Not perfectly rational.

What is the definition of "oil production" and of "liquid fuel production"?

Is CTL (Coal converted To Liquid) included in the definition of the phrase "oil production"?

Obviously it would seem that CTL should be included in the definition of the phrase "liquid fuel production", but what are the metrics for such a thing? How can it be in barrels per day? If BTUs are used, shouldn't there be an asterisk and an EROI number attached?

We just had lengthy discussion behind the scenes here on energy content and accounting of liquids, especially with regard to NGLs that per unit volume contain much less energy than distillates for example and also place of refinery gains where volume expansion is not accompanied by energy expansion. Personally I don't think ethanol should count as primary energy and should be treated more like electricity where one energy source is used to produce another.

It would be good if the IEA began accounting using net energy content of fuels - but dream on.

Very interesting... Is there any chance someone "behind the scenes" could distill out the essentials of this discussion, and run it as a main post?

Here is a comment from a college kid named David Murphy:

If we are to consider NGLs and other unconventional resources of oil as substitutes for oil, than we should also consider conventional oil a substitute for whale oil. After all, whale oil and the oil sands are both chemically similar to crude oil, and crude oil production offset the decline in whale oil production due to depletion of whales just like NGLs and unconventional oil may offset the decline in crude oil production due to the depletion of conventional crude. Thus, by this transitive property of economics, we are really still waiting for a peak in whale oil production!

If anyone would like to frame their argument to consider all combustible hydrocarbons as crude oil, that’s fine with me. However, we all realize an important point concerning the transitions between types of combustible hydrocarbons is their relative costs to find, extract, and produce. The real cost to find, extract, and produce conventional petroleum is lower than whale oil – so obviously that was a good transition, economically speaking, for everyone but the whalers. The real cost to find, extract, and produce non-conventional petroleum (tar sands, e.g.) is higher than conventional petroleum, so obviously this will be a less good transition – for everyone but the Canadians.

Yes, "all liquid fuels" includes CTL, as well as biofuels, and NGLs, GTL, syncrude from tar sands. Thus it's closest to "everything you can pour into an engine, however produced", except for the lightest fractions of NGLs.

IF it's true, then ha, ha. It'll teach us not to have an evangelical hold on our ideas. Even our best science, to paraphrase Einstein, is a meager thing (but it's all we have).

Two words: Downward revisions.

Seven words: Never trusted any of the numbers before, still don't.

Three words: Cantarell, North Sea.

Two more words: Undulating plateau.

Four words: Specific peak don't matter.

Eight nice words: Thanks, Stuart. Nice, condensed report. I likes that.

"Nice, condensed report."

Yes indeed. This is condensate we can appreciate '-)

But I must admit to missing Rembrandt's excellent monthly oilwatches. Are they coming back soon?

Should be one this month.

I hope so. Please, Rembrandt, pretty please....

One word: Afghanistan

Two words: Kazakhstan, Turkmenistan

Three words: Gulf of Mexico

One more word: Iraq

Four words: Iran, the real prize

Five words: The American military industrial complex

One more not so nice word: War

And todays bonus cover-up numbers: 911

A thorough examination of the matter:

And just three more words: truth will out (Shakespeare, The Merchant of Venice)

Maybe the glass is still more than 1/2 full

hey stueys back.. how far north of 74mbd C+C are we looking at ? Are we envisaging a new C+C plateau bouncing around 76mbd?

won't somebody just turn the tap off?