Drumbeat: February 4, 2011

Posted by Leanan on February 4, 2011 - 10:25am

Analysis: Oil returns to U.S rails to avoid mammoth Midwest glut

(Reuters) - Trains once revolutionized the U.S. oil trade by getting barrels to market faster than horse and buggy. Some 150 years later, crude is hopping the rails again as today's oil barons look to cash in on the biggest domestic price gap in decades.Shipments of oil in rail tankers, though still small, may have already doubled from a year ago, industry estimates show. They could soon surge further as producers, railways and storage firms build up to a dozen crude-by-rail terminals, allowing oil from an oversupplied U.S. Midwest to flow to destinations where it's priced much higher, including on the Gulf Coast.

The incentive is clear: Light oil sold for around $81 a barrel at wells in the Bakken shale of North Dakota this week. After a 1,600-mile rail journey south, which can cost as little as $7 a barrel, the same oil could fetch $104 in Louisiana.

FACTBOX-Several US oil terminals plan to move crude by rail

(Reuters) - Up to a dozen railroad terminals to load, unload and store oil are sprouting up around the United States as oil shippers turn to railroads to deliver barrels into markets where crude is priced higher.

Gulf Oil Products Strengthen as Refinery Disruptions Persist

Oil products in the Gulf Coast strengthened as Royal Dutch Shell Plc flared at its Deer Park refinery and chemical plant in Texas and Citgo Petroleum Corp.’s Corpus Christi East, Texas, refinery suffered a power outage.Gasoline and diesel in the region rose to their highest levels versus New York Mercantile Exchange futures in more than a week.

Gas prices climbing despite hefty supply

Retail gasoline prices are likely to creep higher as anti-government protests continue in Egypt and concerns remain about the stability of the Middle East.

Venezuela sees $200 oil if Suez canal closes

(Reuters) - Oil prices could more than double to $200 per barrel if the Suez Canal closes because of the crisis in Egypt, though there is no sign of that happening at the moment, Venezuela's oil minister said on Friday.Oil Minister Rafael Ramirez, who is usually hawkish on prices, said OPEC would call an emergency meeting if the canal closed, but he saw no need for such an extraordinary gathering of member states right now despite Egypt's turmoil.

"There is sufficient oil (in the market) and there have been no interruptions, but if they close Suez, that could take the oil price to $200," Ramirez told reporters.

British oil companies and banks in limbo over Egypt protests

British companies are flying out staff and halting operations as the civil disorder escalates in Egypt but they have also found themselves under verbal attack for being too close to the government of president Hosni Mubarak.BP has also been accused of working "hand in glove with dictatorship" while Vodafone is under fire for bowing to presidential pressure to shut the mobile telephone network down.

Hundreds march against government in Jordan

AMMAN, Jordan (AP) — Hundreds of Jordanians inspired by Egypt's uprising on Friday staged a protest against Jordan's prime minister, installed just days earlier in response to anti-government marches.

The chance of a Tunisian scenario in Russia is somewhere less than zero. The conditions simply do not exist.The popular revolt in Tunisia – I assume it was not a phony revolution like the "Orange Revolution” or the “Rose Revolution,” or the now-forgotten “Tulip Revolution” – was the result of the public’s revulsion at years of hopelessness and stagnation.

In Russia, innumerable polls, over many years – see, for example, Levada data – show that Russians appreciate the steady improvement of their own living conditions and give the government a great deal of credit for it.

New Mexico Gas Co. moves to restore service

One of two transmission lines that serve Alamogordo, Ruidoso and Tularosa did stop operating early Thursday morning. At least 16,000 customers experienced 45-minute rotating outages in those areas between 6 a.m. and 8 a.m., as PNM fixed the system, Garber said.The company also reported a five-minute outage in downtown Albuquerque and a 15-minute blackout in Santa Fe on Thursday.

“Overall, we’ve done pretty well and we don’t anticipate any more problems,” Garber said.

Rosneft considering Vankor gas exports to China

Rosneft, Russia's largest oil company, is considering the possibility of exporting gas from its massive Siberian fields to China, a top executive said on Friday.

Regulators approve TransCanada shale gas line

CALGARY, Alberta (Reuters) - TransCanada Corp said on Friday that regulators have approved its plan to build a C$310 million ($313 million) pipeline to carry gas from the Horn River shale gas region of northeastern British Columbia to market.

Canadian oil pipelines to ration space next month

CALGARY — Space on Canadian oil pipelines will remain tight through at least the end of February, as Enbridge Inc and Kinder Morgan Energy Partners both said on Monday their lines can’t ship as much crude next month as customers have requested.

British Airways blames oil price for fuel surcharge increase

British Airways has raised its fuel surcharge for the second time in two months after the Egypt crisis pushed the global oil price to more than $100 (£62) a barrel.BA first introduced the levy in 2004 to cover the fluctuating cost of oil and the cost of the add-on has rocketed since its debut at a modest £2.50 per flight.

Israel, Palestinians float Gaza gas rapprochement

(Reuters) - Israel and the Palestinians are close to talks on developing a gas field off the Gaza Strip and other initiatives for an independent infrastructure there, Israeli Prime Minister Benjamin Netanyahu said on Friday.

BP Spill Claims Czar Told: Loosen Purse Strings

(CBS/AP) ATLANTA - The Justice Department is telling the administrator of the $20 billion fund for Gulf oil spill victims that his job is not to preserve money or return it to BP, and is insisting he loosen the purse strings to help people who are still suffering from last year's disaster.

Department of Energy seeks to cut solar costs by 75 percent

(Reuters) - The U.S. Department of Energy said on Friday it will spend $27 million on a new effort to reduce the costs of solar power by 75 percent by the end of the decade in a bid to make the renewable power source as cheap as fossil fuels.

Persian Gulf Oil Producers Dodge Mideast Unrest With $90 Crude

With oil above $90 a barrel, it’s business as usual for Arabian Gulf exporters regardless of the uprisings that are rocking other Arab nations.From the time former Tunisian president Zine El Abidine Ben Ali fled his country and the mass demonstrations to oust Egyptian leader Hosni Mubarak started on January 25, Saudi Arabia hosted former US President Bill Clinton and former British Prime Minister Tony Blair. Executives from Alcoa, Boeing and UBS Global Asset Management were among those in the Saudi capital for a conference last month.

“It is different for Arab Gulf monarchies because they have financial wealth, no strong opposition and no real threat from within,” Khalid Al Dakhil, a Saudi sociologist and a former political science professor at King Saud University in Riyadh, said in a telephone interview.

Stuart Staniford: Why oil matters more than rubber

I was thinking about Paul Krugman's Cross of Rubber column, and in particular the associated blog post Commodities: This Time is Different. My take on Krugman is that he's an extremely brilliant guy who's been thinking about economics for a good long time. His enormous knowledge and insight are invaluable, and I pay close attention to his writing. However, I also think he's gotten into some pretty deeply scripted habits of thinking based on past events and isn't paying close enough attention to the ways in which the present and the future are likely to be different than the past. In particular, his frame of reference for the events of the last few years has been past deflationary episodes such as the Great Depression in the 1930s and Japan in the 1990s.

John Michael Greer: Overcoming systems stupidity

Readers of mine with sufficiently long memories may be wondering if the evening news somehow accidentally got swapped for archived footage of a performance of that durable Sixties folk number The Merry Minuet, with its lines about rioting in Africa and global mayhem in general. Certainly that was the thought that occurred to me as news from Egypt and Tunisia jostled the category 5 cyclone (we’d say "hurricane" on this side of the planet) that just walloped Australia, and the far more modest but still impressive winter storm that’s sweeping across America as I write this.Looked at in isolation, each of these stories are business as usual. Political turmoil in Third World nations is common enough, and big storms are a fact of life in Australia as well as the United States. Still, it’s exactly that habit of looking at news stories in isolation that fosters the blindness to history as it’s happening that I’ve discussed here repeatedly. Remember that the world is a whole system and put the news into context accordingly, and troubling patterns appear.

Remembering history (Comment to Tim Murray and Tom Butler)

It is worthwhile to recall history as we ponder Tim Murray’s proposition that we direct our “energy into stopping economic growth” rather than saving “the environment piecemeal” through conservation efforts. It’s enlightening to go back to Thomas Jefferson just to gain some perspective on what happened when the market economy was fertilized with the industrial revolution. Thomas Jefferson, writing in preindustrial America, thought one of the attributes of our nation that would enable us to “become happy and prosperous people” was the fact that we possessed “a chosen country, with room enough for our descendants to the hundredth and thousandth generation.” Do the math, because it gives you some perspective on Jefferson’s world. Apparently Jefferson thought we had a big enough unsettled country for agricultural expansion to take place for 20,000 years. Clearly, Jefferson didn’t anticipate what was coming. The pace and reach of economic expansion were beyond anything he could have imagined as he looked westward from Monticello at the turn of the 19th century. Yet little more than a century after Jefferson wrote these words the country had become an industrial giant and most of the land had been given over to private ownership.

While Jevons' Paradox suggests that technological conservation of energy will be eroded by greater usage, there is an even more fundamental problem, namely that: 1) technological progress is less useful than usually thought, because of marginal returns and 2) technological advancement and innovation has slowed alarmingly over the last decades. This is why The Ascent of Man seems so timeless: mankind has not ascended much in the recent past. We are in fact witnessing a severe collapse of creativity and innovation in spite of the newest apps on your phone.

Dr Daniel Yergin speaks about the ‘new energy future’

During his speech, Dr Yergin addressed new developments within the energy industry as well as questions about supply and demand and the shift from West to East in the global economy. “Oil continues to serve as a register or marker of the world economy. A significant shift has occurred in the geography of oil markets. In 2000, the OECD countries - the developed world - used about two thirds of the world’s oil. That’s where the market was. But since 2000, about half of the world’s oil is used by the developed countries and the other half used by emerging markets and the share of emerging markets is going to increase,” Dr Yergin explained.

Wild weather hits Norwegian flows

Strong winds blowing off Norway have affected production at two major gas processing plants and led Statoil to reduce staffing at some of its offshore platforms.

Saudi port reopens, six vessels loading

Saudi Arabia's Ras Tanura port, a major oil operations centre for Saudi Aramco, has resumed operations after a brief shutdown on Thursday due to bad weather, a port source said.

Pemex Closes Third Oil Export Port in Gulf of Mexico

Petroleos Mexicanos, the state-owned oil company, closed its third crude export terminal in the Gulf of Mexico because of strong winds and high waves.

Rosneft says BP Arctic venture will not be PSA

(Reuters) - Russia's largest oil producer Rosneft will set up an operating joint venture with BP to develop offshore Arctic reserves rather than a production sharing agreement, the Russian major said on Friday.

El Paso pulls maximum volumes out of gas storage

(Reuters) - El Paso Natural Gas Co said on Friday it is pulling maximum natural gas volumes out of its Washington Ranch storage field in New Mexico to make up for supply shortfalls.Some supplies are frozen in wells due to unusually cold weather in the U.S. Southwest.

North Texans see fuel, food shortages due to unprecedented ice storm

It doesn't happen often in North Texas, but gas outlets across the area are reporting shortages. Officials say since the ice storm hit two days ago, delivery tankers have had a difficult time trying to travel on the icy roads.Nate Colbert, who manages the One Stop convenience store in Dallas says that while his grocery delivery came in, the gas is now two days over due.

Ivory Coast May Soon Face Fuel Shortages, Industry Group Warns Its Members

Ivory Coast, the world’s biggest cocoa producer, may face an imminent fuel shortage, according to a letter sent by an industry group to its members.Crude oil supply problems at the Societe Ivoirienne de Raffinage “could cause a petrol and gas shortage very soon,” according to the National Federation of Industries and Services in a letter dated yesterday and obtained by Bloomberg.

Higher O&G Prices Could Reduce AROs for Upstream Companies

Fitch Ratings reports that higher year-over-year crude and natural gas prices in 2010 may reduce the size of reported Asset Retirement Obligations (AROs) for upstream U.S. oil & gas producers, by extending existing field lives and thereby delaying the remediation costs and associated present value (PV) of related retirement obligations.

KATHMANDU: Shortage of petroleum products hit consumers across the country, as Nepal Oil Corporation (NOC), citing factors like public holidays, distributed just about a day equivalent volume of fuel in the market over the last five days.

Mexican auditors uncover more corruption at state oil giant

Mexico City – Mexico's SFP audit agency announced disciplinary measures against 12 employees of state-owned Petroleos Mexicanos for improperly awarding 38.9 million pesos ($3.1 million) in contracts to firms that were unqualified to perform the required tasks.The abuses occurred during the process of repairing hurricane damage at Pemex's Escolin petrochemical complex in the Gulf coast state of Veracruz, the SFP said in a statement.

U.S. natgas rig count slips 2 to 911--Baker Hughes

NEW YORK (Reuters) - The number of rigs drilling for natural gas in the United States fell by two this week to 911, oil services firm Baker Hughes said on Friday.That was down 8 percent from the 2010 peak of 992 set in mid-August, the highest since February 2009 when 1,018 rigs were drilling for gas.

Aramco's drilling rig count seen unchanged in 2011

Offshore drilling in Saudi Arabia would see a slight increase this year but the state oil giant Saudi Aramco is expected to keep the rig count largely steady from last year, industry sources said.The world's largest oil exporter, which has 95 rigs now in operation, saw the number of rigs used drop in 2009 from 130 as a result of decreased activity in oil. In 2010, the number of rigs used was 96, an Aramco executive told Reuters last year.

South African Chamber of Mines CEO insists that there is “no coal supply or quality crisis”.

Chamber accepts Minister’s coal-cooperation call, slams Eskom

JOAHNNESBURG (miningweekly.com) – The Chamber of Mines has accepted the call for the South African coal-mining industry to work closely with government, but it has slammed State power utility Eskom for seeking the imposition of heavy-handed coal-control mechanisms.The McCloskey coal conference in Cape Town heard Eskom lobby for State intervention to prevent energy coal needed domestically from being exported.

BG Group says Egypt unrest not affecting production

LONDON (Reuters) - Unrest in Egypt is having a minimal impact on BG Group with analysts shrugging off concerns that it could hurt the British company in future as it homes in on Brazil and Australia for growth."Production continues unaffected as do operations at the liquefied natural gas (LNG) facilities at Idku, they're not experiencing any impact from the unrest," a spokesman for BG told Reuters on Friday.

Sizing Up Egypt’s Impact On Exxon

Egypt’s 700,000 barrels a day compares to Russia and Saudi Arabia’s approximate 10 million barrels a day each, and so Egypt itself has little impact on total supply. [2]The greatest impact Egypt has on the global oil and gas market, however, is its operations of the Suez canal and the Suez-Mediterranean (Sumed) pipeline. Though there are no signs that disruptions might occur to these strategic arteries, the alternative to shipping through the Suez is for ships carrying crude and liquefied natural gas to go around the African continent – an additional 6,000 miles.

Petrol shortage hits Cairo as turmoil disrupts supply

Dubai: Egyptian commuters and taxi drivers are facing fuel shortages in Cairo as the supply chain is crippled by transport problems and labour shortages sparked by the turmoil, analysts say.Petrol pumps were either closed down or rationing fuel supplies, Egyptian residents said. "I went to three petrol pumps yesterday and didn't find any fuel. The fourth one said they were closing and told us we can fill a maximum of 20 litres," Mohammad Yehia, a resident of Nasr City, told Gulf News by telephone.

Companies Reassess Risk as Political Violence in Egypt Continues

Political unrest in Egypt has prompted oil and gas companies, as well as companies from a number of industries, to reassess the adequacy of their insurance coverage and risk management arrangements, according to New York-based insurance broker and risk adviser Marsh.

The formative experiences of Obama's life tell him that change in developing countries is inexorable and that reform can often succeed. Not every popular movement turns out as disastrously as the Iranian revolution of 1979, Obama believes. There are positive models, including the "people power" movement that replaced Ferdinand Marcos in the Philippines in 1986, the fall of the Berlin Wall in 1989 and the overthrow in 1998 of the dictatorial President Suharto in Indonesia, whom Obama remembers from his boyhood.What shapes Obama's thinking isn't ideological so much as personal: When he talks to human-rights activists from overseas, he often recalls what it was like to live in an authoritarian country - where even in seemingly calm times, there was an omnipresent fear and tension. His Indonesian stepfather, Lolo, once admitted that he had seen a man killed "because he was weak."

Hunger, Food Shortages Fuel Uprisings

GENEVA (IPS) - The rise in food prices and growing hunger, one of the causes of the popular uprisings in Tunisia, Egypt and other countries in the Arab world, is due to financial speculation and not a lack of arable land, says Janaina Stronzake, a leader of Brazil's Landless Workers Movement (MST).The shortage of staple food items and hunger are used as weapons, and they end up forcing populations to act in certain ways, said Stronzake, who also represents the international peasant movement La Vía Campesina.

Why Global Food Price Inflation Really Matters

Perhaps central bankers are like potted plants, able to subsist on little more than water and sunlight. That would help explain Federal Reserve Chairman Ben Bernanke's statement Thursday that -- rising commodity prices notwithstanding -- overall inflation remains "quite low." As for folks who eat food, well, global food prices hit an all-time high last month, in both nominal and inflation-adjusted terms, according to the U.N.

U.S. in Contempt Over Gulf Drill Ban, Judge Rules

The Obama Administration acted in contempt by continuing its deepwater-drilling moratorium after the policy was struck down, a New Orleans judge ruled.Interior Department regulators acted with “determined disregard” by lifting and reinstituting a series of policy changes that restricted offshore drilling, following the worst offshore oil spill in U.S. history, U.S. District Judge, Martin Feldman of New Orleans ruled yesterday.

India Oil may build $5 bln refinery in Turkey

ISTANBUL (Reuters) - Indian Oil Corp is interested in building a $5 billion refinery in Turkey and is currently carrying out feasibility work on the project, India's junior trade minister, Jyotiraditya Scindia, said on Friday.IOC and India's Oil and Natural Gas Corp are interested in exploring for oil and natural gas in Turkey, Scindia also told reporters.

U.S. utilities forecast conservative 2011

BANGALORE (Reuters) - Smaller U.S. utilities TECO Energy, PPL Corp and Constellation Energy Group forecast conservative earnings for this year, reckoning higher costs may hit their margins and a normal weather could pull down sales.In a weak economic environment, sales at power companies tend to be over-dependent on weather. A hotter-than-expected summer and a cooler-than-expected winter had helped utilities last year.

China's Booming Economy May Produce the Majority of World Coal Emissions by 2035 -- EIA

China's growth kept churning through the 2009 global financial crisis that left the United States and Europe in economic shambles. That kept China's global carbon emissions on a steadily upward trajectory, according to the U.S. Energy Information Administration.EIA emissions data released last month add weight to a body of evidence suggesting that, in terms of greenhouse gas emissions, slumping Western economies will be no match for growth in China and India.

Bill McKibben: A Revolution in Our Atmosphere, From Burning Too Many Fossil Fuels

The point I'm trying to make is: chemistry and physics work. We don't just live in a suburb, or in a free-market democracy; we live on an earth that has certain rules. Physics and chemistry don't care what John Boehner thinks, they're unmoved by what will make Barack Obama's reelection easier. More carbon means more heat means more trouble -- and the trouble has barely begun. So far we've raised the temperature of the planet about a degree, which has been enough to melt the Arctic. The consensus prediction for the century is that without dramatic action to stem the use of fossil fuel -- far more quickly than is politically or economically convenient -- we'll see temperatures climb five degrees this century. Given that one degree melts the Arctic, just how lucky are we feeling?

EU leaders to grapple with divergent energy proposals

EUOBSERVER / BRUSSELS - A stronger EU mandate for dealing with gas-rich autocracies in the Caspian region, more public funding for renewable energy sources and a north-south energy corridor will be on the agenda of an EU summit on Friday (4 February). But France, Germany and eastern EU members are at odds over what to prioritise.

Energy Firms Aided by U.S. Find Backers

WASHINGTON — In late 2009, the federal government gave $151 million in grants to advance 37 clean energy ideas deemed too radical or too preliminary to attract much private financing — like electricity storage that mimics photosynthesis and batteries that double or triple the energy stored per pound.Since then, six of the projects have made enough progress to attract $108 million in private venture capital financing — about four private dollars for every dollar that the taxpayers spent to get them rolling — the Department of Energy plans to announce Thursday.

How Much Energy Do We Use While Watching the Super Bowl Broadcast? [Infographic]

Ever wonder just how much energy is used by televisions (and those watching them) across the U.S. during the Super Bowl? So did GE, which mashed up statistics from Nielsen, the Energy Information Administration, ABS Alaskan, and the U.S. Census to figure out that the energy used to power home televisions watching the Super Bowl (over 158.5 million TVs) could power all the homes in Green Bay, Pittsburgh, and Dallas for 10 hours. We're not suggesting you turn off the game, but it is something to think about as you bask in the glow of your big screen.

Pondering Landscapes: A Chat with BLDGBLOG Author Geoff Manaugh

Debbie Chachra is a materials scientist at the Olin College of Engineering, outside Boston, and she’s been studying natural plastic—what she calls “bee plastic”—produced by a species of bee native to New England. This plastic has properties—such as a resistance to biodegrading—that make it very interesting for future industrial uses, but, more importantly, it is made without the use of fossil fuels. This means it might someday be a reliable source of non-oil-based plastics—something that will be highly valuable in a world going through peak oil.So the idea that little bees in New England, forming their own natural plastics, might someday replace part of the global fossil fuel industry is hugely interesting to me—and it’s that type of biomimicry that interests me, far more than watching architecture students design gigantic buildings that look like orchids.

Dmitry Orlov: Peak Oil Lessons From The Soviet Union

Dmitry Orlov, engineer and author, warns that the US's reliance on diminishing fuel supplies might be sending it down the same path the Soviet Union took before it collapsed.In this fifth video in the series “Peak Oil and a Changing Climate” from The Nation and On The Earth Productions, Orlov, who was an eyewitness to the collapse of the Soviet Union, asserts that as oil becomes more expensive and scarcer, the US will no longer be able to finance its oil addiction and the economy will hit a wall.

“Sixty percent of all of our transportation fuels are imported—a lot of that is on credit. A large chunk of the trade deficit is actually in transportation fuels. When those stop arriving because of our inability to borrow more money, then the economy is at a standstill,” he says.

Oil rises to $91 on Egypt protests, US jobs report

SINGAPORE – Oil prices rose to near $91 a barrel Friday in Asia as traders eyed violent street clashes in Egypt and a key U.S. jobs report.

Egypt Riots Add Pressure on OPEC With $100 Oil

OPEC is under pressure from consumers to boost supply as most of the world’s benchmark crudes surpass $100 a barrel amid political unrest in North Africa and the Middle East.Oil prices are high enough to “derail” the global economic recovery, Fatih Birol of the International Energy Agency said this week. Saudi Arabian Oil Minister Ali al-Naimi said last week prices nearer $75 would be “appropriate.” Goldman Sachs Group Inc. says the Organization of Petroleum Exporting Countries has already raised output.

Generally, patterns will end well before their most obvious conclusion. In this case, I don’t expect oil prices to funnel into the triangle point at the $120 level in January of 2013. That would be highly unlikely. What’s more likely is that the price of oil will at some point break above or below the two lines of the triangle.Once that happens, all bets are off. Oil could head back to $35 a barrel (unlikely), or they’ll skyrocket back towards old highs of $147 (more likely).

Peak Oil 101: A Closer Look at Oil Production and Demand

Take a good long hard look at that chart. The Saudis say they can ramp up production at any time. Their peak production occurred in 2005. That’s funny. Matt Simmons said peak worldwide production would occur in 2005. When prices skyrocketed in 2008, the Saudis did not reach their previous peak production of 2005. Why? Did they not want to make billions of profits? Only a fool would pass up such riches, unless they just didn’t really have the ability to produce more.Now Saudi production is 14% below 2008 levels.

Administration Study Lends Support to Proposed Canadian Oil Pipeline

WASHINGTON -- A proposed oil pipeline from Canada to the U.S. Gulf Coast could substantially reduce U.S. dependency on oil from the Middle East and other regions, according to a report commissioned by the Obama administration.The study suggests the 1,900-mile pipeline, coupled with a reduction in overall U.S. oil demand, "could essentially eliminate Middle East crude imports longer term." The $7 billion project would carry crude oil extracted from tar sands in Alberta, Canada, to refineries in Texas.

FACTBOX-OPEC, oil majors' capacity expansion plans

(Reuters) - The following outlines capital expenditure plans by oil majors and OPEC.

New Mexico governor declares emergency, orders government offices closed due to natural gas shortage

ALBUQUERQUE, N.M. (AP) - With tens of thousands of people across New Mexico without natural gas service, Gov. Susana Martinez on Thursday declared a state of emergency, ordered government offices be shut down Friday and urged schools to "strongly consider" remaining closed for the day.Demand has soared because of extremely cold weather across the state since Tuesday. New Mexico Gas Company said rolling blackouts in West Texas also impeded the delivery of natural gas to New Mexico.

AEP Texas warns of possible local rolling blackouts

(Reuters) - American Electric Power Co Inc's AEP Texas unit urged customers in the Rio Grande Valley to conserve power because continued cold weather could cause more power plant problems, requiring additional rolling blackouts in the area.

Natural gas crunch leaves thousands shivering in Southwest

SANTA FE, New Mexico (Reuters) – Thousands of New Mexicans and others across the Southwest were left huddling against bitter cold on Thursday after supplies of natural gas were cut off to their communities.Frigid weather throughout the region knocked out natural gas production equal to nearly 5 percent of daily nationwide demand as wells froze and plunging temperatures caused problems for processing plants.

Chilean blackout raises threat of energy rationing

Chile's mining and energy minister isn't ruling out electricity rationing if the country keeps suffering a drought that reduces its hydroelectric capacity.Laurence Golborne spoke after a failure in a substation brought down the electricity grid in nine of Chile's 15 states, blacking out half the nation early Thursday.

Brazil Auctions for Renewable Energy to Include Natural Gas

Brazil is seeking proposals for natural gas power plants, two months after releasing an official energy plan that said the country wouldn’t build new electricity projects powered by fossil fuels.

Calif. utility told to cut gas pipeline pressures

SAN FRANCISCO – California regulators have ordered Pacific Gas & Electric Co. to lower the pressure on some natural gas pipelines in heavily populated areas to 20 percent below their maximum thresholds.

BP selling its Southern Calif. gasoline business

LOS ANGELES – BP PLC says it is selling its Southern California gasoline business as part of a major restructuring after last year's catastrophic oil spill in the Gulf of Mexico.The sale includes the huge Carson refinery south of downtown Los Angeles and its local Arco gasoline operations.

Judge finds Feinberg not independent of BP

WILMINGTON, Delaware (Reuters) – The administrator of BP Plc's $20 billion fund to compensate victims of the Gulf oil spill is not independent and the oil company must refrain from calling him "neutral," a federal judge ruled on Wednesday.

Oil Spill, Redux: Revisiting a Mystery

The question is: What was the origin of the 5,000-barrel-per-day flow rate that the government and BP promulgated in the early weeks of the spill?

Shell: No Beaufort Sea drilling in Arctic for 2011

ANCHORAGE, Alaska – Shell Alaska has dropped plans to drill in the Arctic waters of the Beaufort Sea this year and will concentrate on obtaining permits for the 2012 season, company Vice President Pete Slaiby said Thursday.The recent remand of air permits issued by the Environmental Protection Agency was the final driver behind the decision, Slaiby said at a news conference.

Greens: Alaska oil delay a win for polar bears

WASHINGTON (AFP) – US environmentalists on Thursday hailed a delay in Royal Dutch Shell's Alaska oil drilling plans as a victory for polar bears, but outraged local leaders said the move would cost jobs.

Russian shareholders 'may sell TNK-BP stake'

MOSCOW (AFP) – The Russian shareholders of TNK-BP are considering selling their stake in the Russian-British oil joint venture to the Russian state or BP's partner state-controlled Rosneft, a report said Friday.

State-run Nigerian National Petroleum Corporation (NNPC) used its unique trading position to make profits at the expense of the government between 2006 and 2008, according to an independent audit of Nigeria's oil sale payments.

India’s State Bank to Help End Gridlock Over Iran Oil Payments

India arranged for State Bank of India, the nation’s biggest lender, to help in making payments for crude oil purchases from Iran, ending a five-week gridlock that threatened $9.5 billion of annual bilateral oil trade.

Coal Mines, Ports Reopen in Australia as Yasi Moves Inland and Weakens

Coal and metals mines, railroads and ports are reopening in Queensland after suffering minimal damage yesterday from Tropical Cyclone Yasi, the first Category 5 storm to strike the Australian state since 1918.

Egyptians Mass After Friday Prayer to Force Out Mubarak

Today “may mark the turning point to see whether this uprising is going to continue or whether the regime will sort of be able to wear it down,” Michael Hudson, director of the Middle East Institute at the National University of Singapore, told Bloomberg Television.

Beach Energy Halts Egypt Oil Drilling, Withdraws Two Employees on Unrest

Beach Energy Ltd., an Australian oil and gas producer, said it put drilling at one of its ventures in Egypt on hold after communications were cut because of political unrest, disrupting supplies to the rig.

Tunisia, Egypt and the protracted collapse of the American empire

What is happening in Tunisia and Egypt is only a manifestation of a deeper convergence of fundamental structural crises, which are truly global in scale. The eruption of social and political unrest has followed the impact of deepening economic turbulence across the region, due to the inflationary impact of rocketing fuel and food prices. As of mid-January, even before Ben Ali had fled Tunis, riots were breaking out in Algeria, Morocco, Yemen and Jordan. The key grievances? Rampant unemployment, unaffordable food and consumer goods, endemic poverty, lack of basic services, and political repression.

Sharply rising food prices have often meant trouble for governments, especially when people expect better and the cost of food is a big fraction of average household consumption. In the U.S., where grocery costs are a small fraction of the average budget, it is hard to imagine the effect of sharply rising prices for bread or rice, cooking oil, and other essential foods. It's seldom been enough for out-of-touch regimes to say, "let them eat paistries" (or brioche, as Marie Antoinette put it in the face of the French revolution).

A Food Manifesto for the Future

End government subsidies to processed food. We grow more corn for livestock and cars than for humans, and it’s subsidized by more than $3 billion annually; most of it is processed beyond recognition. The story is similar for other crops, including soy: 98 percent of soybean meal becomes livestock feed, while most soybean oil is used in processed foods. Meanwhile, the marketers of the junk food made from these crops receive tax write-offs for the costs of promoting their wares. Total agricultural subsidies in 2009 were around $16 billion, which would pay for a great many of the ideas that follow.

Far-Off Energy Advances... Today

We often wonder what energy will be like 50 or 100 years from now...Perpetual motion, fusion, hydrogen, and other theoretical solutions often enter the discussion.

But we rarely pay attention to the far-off energy advances being funded and explored today, at this very moment...

Blended fuel gaining in popularity throughout ND

Ethanol fuel blends increased by 133 percent in North Dakota last year, thanks in part to new blender pumps installed in communities around the state, according to the North Dakota Department of Commerce.

Government Backs $1 Billion Plan to Make Gasoline from Wood

The Energy Department has offered a Texas company a loan guarantee for a $1 billion project to build four small factories that would turn wood chips into an oil substitute.The loan guarantee, if finalized, would be about four times larger than any previous guarantee for biofuels. Its aim is to spur industrial-scale production of substitutes for gasoline and diesel from renewable sources beyond food crops like corn and sugar, a goal that many companies are chasing but none has yet achieved.

Ireland must invest more in ocean energy, forum told

IRELAND SHOULD “not be over-reliant on gas” and should be making a much greater commitment to ocean energy resources, Bord Gáis chief executive John Mullins has said.

CHINA overtook America as the world leader in wind power in 2010, according to a new annual report by the Global Wind Energy Council. The chart below shows the five countries that make the greatest use of wind energy.

Consumers claim $33M in erroneous vehicle tax credits

About 20% of federal tax credits claimed for alternative and plug-in electric vehicles during the first seven months of 2010 were erroneous, costing U.S. taxpayers more than $33 million, the Treasury Department's inspector general for tax administration said Thursday.

Instabilities and Critical Opportunities:

Guy Debord's Contributions to Crisis Theory

To apply this in a very general way we might consider how capitalism in the US has mainly escaped criticism, while discourses throughout Europe, perhaps most notably in Greece, demonstrate that capitalism could be identified as the cause of the crisis. Here in the US the question of the culprit is always a personal question, or a question about one policy or another, but is never a systems question that considers capitalism itself.

A guide for business in turbulent times

The book has its flaws. The broad scope and short length – just 240 pages – mean that at times the material becomes a little skimpy. Brown is not a man who always likes to see both sides of an argument, and often neglects the drawbacks of the solutions that he proposes.However, as a provocative primer on some of the key global issues that businesses will face in the coming decades, World on the Edge can be highly recommended.

Using land wisely is crucial for protecting ecosystem services

There have been many arguments about "peak oil" and the depletion of metals, but there is one resource that without doubt is limited in supply: land. Unlike most ordinary products, an increase in the price of land doesn't bring about an incentive to produce any more of it - because there can't be any more. The Dutch reclaimed land from the sea, but rising sea levels now mean we have less land.Geopolitical competition for territory among major powers is well known. But there is another competition for territory taking place today which is potentially far more important for the future: the competition for land use; dividing up the finite amount of land which exists.

These feet are made for walking

Since the 1970s there has been a massive decline in children walking to school, people walking to work and walking generally. This decline is extremely significant as physical inactivity and obesity are rising at an alarming rate. Only 37 per cent of Australian adults do enough exercise for it to benefit their health. Research indicates that 61 per cent of adults are overweight or obese, as are 25 per cent of children aged 5–17. The total cost of obesity to the Australian economy is estimated to be $37.7 billion.

'Radical' clean energy shift could save 4 tln euros: WWF

GENEVA (AFP) – The environmental group WWF argued on Thursday that a radical, near total elimination of oil and shift to clean energy within 40 years would generate four trillion euros ($5.4 trillion) in savings a year.

Camden Conference to Be Dedicated to Matthew Simmons

The board of directors of the Camden Conference has announced that it will dedicate the upcoming conference, "The Challenges of Asia" (February 18 through 20), to honor the memory of Matthew R. Simmons. Simmons was the keynote speaker for the 15th Camden Conference in 2002, "The Politics of Energy and Water." His talk was titled "Nightmares and Dreams about World Energy Crises." He was a long-standing member of the Camden Conference Advisory Council and had always been a generous benefactor in support of the mission of the organization.

Crops Wither and Prices Rise in Chinese Drought

HONG KONG — A severe drought in northern China has badly damaged the winter wheat crop and left the ground very dry for the spring planting, fueling inflation and alarming China’s leaders.President Hu Jintao and Prime Minister Wen Jiabao separately toured drought-stricken regions this week and have called for “all-out efforts” to address the effects of water shortages on agriculture, state media reported on Thursday. Mr. Wen made a similar trip just 10 days ago and called for long-term improvements in water management.

BlueNext Resumes Carbon Trading After 2-Week Halt

BlueNext SA, the Paris-based spot exchange for carbon allowances, resumed trading today after a 15-day suspension because of European emission permit thefts from national registries.

Climate mass migration fears 'unfounded'

New research challenges the view that people would migrate to other nations as a result of climate change.

Future cyclones could be more extreme

CYCLONE YASI is probably early real-world evidence of scientific predictions that global warming will lead to more extreme weather events, according to the government's expert climate change adviser, Professor Ross Garnaut.He says that if it is, given the evidence that global warming is tracking at the highest end of international predictions, then future cyclones could prove that we ''ain't seen nothing yet''.

I'm writing a policy piece on natural gas - focus on fracking vs. conservation. Is there anything at all suspicious about this timing of troubles in New Mexico? I've not had a chance to research but I understand an electric shortage in Texas was contributing to the problem. There have been legitimate instances where cold fronts have squatted on Texas, shutting down wind generated electricity and causing outages.

Strange days we live in, strange days indeed ...

It doesn't sound suspicious to me.

Part of the problem was that the blackouts in Texas meant the natural gas wasn't being pumped through the pipelines. NM didn't get the gas they were expecting. Plus the cold temps froze wellheads, which has happened before. (There was a big blackout in the Denver area a few years ago for that reason.)

The @PCNEnergy people do sometimes lean on the Drumbeat for a portion of the daily content - and it's the keeping of the detailed context of our energy sector, as you display here, that makes this place so valuable.

I've been gone a good long time, but now that I've got 600+ Congressional staff paying attention to what our analysts say I've got time to be back here and working on the next phase of our government takeover :-)

This reminds me of the Russian-Ukraine-Eastern Europe gas pipeline "controversies" of the recent past.

I wonder if this would look suspicious in post-collapse north america.

The Fort Worth Star Telegram has a good article on the blackouts. One of the key problems is that the natural gas curtailment rules are outdated, and there was no differentiation between industrial users and power plants. So, when the line pressures started falling, Atmos Energy cut off natural gas supplies to both industrial plants and power plants, and after some coal fired power plants went off line because of freezing water lines, many backup gas fired plants could not come on line because of low line pressures. Ironically enough, some natural gas supplies were curtailed because of rolling blackouts impacting the Atmos system.

The curtailments on Wednesday were so widespread and sudden that some hospitals lost power.

Cold exposes jumble of flaws in Texas electric policies

Read more: http://www.star-telegram.com/2011/02/03/2822392/cold-exposes-jumble-of-f...

All's well in Texas, y'all, at least it will be when J.R. returns:

I hope that the writers will incorporate Peak Oil into the story line. I've often thought that popular media is the best way to get the message to masses. It'll be fun to see Hagman and Duffy reprise their roles, perhaps J.R. as the 'evil oil baron' again and Bobby as the PO aware promoter of alt energy ;-) I wonder if the PV panels are still on Southfork :-0

Hagman has a massive array of solar panels for his house and has been featured on the green channel. Don't think much of his lifestyle but maybe some of this will filter into the TV show.

Yeah, in Germany...

http://graphics8.nytimes.com/images/2010/07/14/business/14Adco/14Adco-po...

Larry Hagman signed a ad deal with Solar World last year.

Evil Oil man reforms into a Solar Mogal and is now a human..

Ad taking with Sue Ellen

http://www.youtube.com/watch?v=UvzO_8eFx2A&NR=1

This is possibly the best ad : JR calls Cliff Barns is an idiot for drilling

http://www.youtube.com/watch?v=n-WzlEPIg54&feature=related

In der deutschen

http://www.youtube.com/watch?v=RVugWDwPwb4&feature=related

I believe SolarWorld and Sharp are the only PV manufactures to run National TV Ad's

Shine baby Shine

Gotta love it when people build positive feedback loops into the failure modes of complex systems. Good engineers lose sleep worrying about how the system is going to work under normal conditions; great engineers lose sleep worrying about the failure modes they haven't thought of. Certainly the most challenging technical job I ever had to do was establishing the rules for software components in a large highly-distributed control system that would isolate failures rather than propagating them.

Good MBA learned JIT management paradigms, and can without really trying hang all the engineers out to dry. All it takes for stability is some distributed storage and nicely damped control system. High frequency control loops ripple so fast that only computers can react (and make them worse). Nice slow ones let humans workout better approaches not in the standard procedures and keep things working.

It sounds almost like little warehouses, with a counter and guy with a phone ;-)

My spouse works in a shop that supplies components to a broad range of brand-name manufacturers. For 3 days trucks have not been running due to snow. It's hard on her company as shipping equals cashflow, but it's much worse for their customers. A good many large, successful companies are screaming for parts because their lines are shutting down, after only 3 days without advanced-planned deliveries. Many of the subcomponent-parts are sourced initially from China, with a six-week minimum cycle time, so obviously there is a long pipeline. Apparently companies have gotten so good at controlling material inventories with JIT delivery expectations that such a tiny delay can cause major issues for them.

It's to the yelling and finger-pointing point. "We can't ship if your shipper doesn't come by". "We picked from your recommended shippers". "Well, bring us a truck and we'll load your parts". "You find a truck -- I've got other vendors to scream at."

Apparently both sides are happy to punt to Fed-Ex and UPS. They cost more, and cannot make ANY GUARANTEES AT ALL right now, other than they'll pick up the parts. But then both sides agree that they can blame the shipper.

So, I've learned that an important part of JIT is having a scapegoat for when it turns into NQIT (not quite in time).

Capitalism is not about humans. Let's face it, it's about the machine. What is the point of an "economy"?

Having lived through it, I wouldn't call it a "big" blackout. It was a Saturday morning, outside temperature about -6 °F. Rolling blackouts across the metro area, the one affecting me being about 45 minutes long. Every year or two we have a longer period w/o power from failures associated with thunderstorms. For example, a couple of years ago, our house was without power for ~30 hours after a particularly nasty storm, with 60+ MPH wind gusts, went through.

Icing in the pipes near the wellheads was, IIRC, attributed to some improper installation and practices. Those appear to have been mitigated, as there was no reported recurrence of the problem this past week when we were down below -15 °F.

I gather not all the blackouts were "rolling." We had at least one regular poster here who lived in the suburbs of Denver. He was without power for hours that day.

In 2007, New Mexico produced 1449 billion cubic feet of gas and consumed 234.

http://www.swenergy.org/publications/factsheets/NM-Factsheet.pdf

Of course, a lot of that gas is produced in the SE part of the state and probably heads east into Texas. Much of the rest is produced in the NW corner and feeds electric utilities.

Perhaps a future explanation of some shortfall:

Problems in El Paso, which also means problems in Tucson and even San Diego:

http://www.bloomberg.com/news/2011-02-04/cold-snap-causes-gas-shortages-...

http://azstarnet.com/news/local/article_4d933f6e-2fd8-11e0-9561-001cc4c0...

My in-laws live in Sierra Vista,(high desert in southeast AZ) and experienced gas shut-off too. Combined with temperature of 3 F at night (unusually cold fo far south), their water pipe froze too and they were told not to expect gas for another three days. They have electric scale heater too but it is not enough to keep their house toasty as they like it and they might get rolling black out too.

All Albuquerque public schools closed today as well as University of New Mexico, as well as a /very/ large office/industrial complex in town. Conserving NG and taking care of water pipe breaks in buildings. No work for me today, get to use a little PTO and hang with my better half and squids.

[edit] 30F, sunny and very pleasant to me and my family....just got some oak/cedar/pinon for the fireplace.

Folks are doing OK, Gas is flowing to residences in ABQ.

News said that up in Espanola and Taos and some other places in NM the NG is still off.

Government buildings, churches, hotels/motels are available for people to shelter with heat.

Temps will rise over the next few days...maybe this was the low point in the winter temps down here.

But surely this cannot be! The US is awash - awash I tell you! - in shale gas. And shale oil is close on its heels. And besides, the climate is not changing, extreme events are not increasing, they are not, are not, are NOT! [as face turns blue...]

We must get to the bottom of this 'shortage'. Scapegoats must be found. Heads must roll. After all, the American lifestyle is non-negotiable!

clifman - Alright...stop badgering me...I confess. As soon as I saw the weather forecast I shut all my NG wells in to cause a false shortage and drive prices up. Granted I don't benefit since my NG cash flow has gone to zero but my fellow oil patch hands are dancing in the streets. Actually in Houston right now they are more likely slipping on th butts from the icy conditions but they are still very happy. Rumor has it they are about to commission a statue of me to honor my sacrafice for the good of all. The all of us, of course...not you.

Hey, Tip...Alan was here http://www.theoildrum.com/node/7406#comment-764939 yesterday.

Link up top: Dmitry Orlov: Peak Oil Lessons From The Soviet Union

I found this yesterday and have listened to it twice. This is Orlov at his best. The Cornucopians will likely ignore it, the doomers will love it. Those in between will absolutely hate it. By those in between I mean those who know about peak oil and the possibility of financial collapse but believe we can fix everything. That group hates Orlov and will criticize his every word.

Orlov covers peak oil and the coming collapse pretty well, then in the last few minutes he discusses Global Warming.

Pity, he doesn't offer any way to "fix" the global warming problem either. ;-)

Ron P.

Yes Dmitry definitely tells it like is. He even dares to mention the coming massive human dieoff, i.e. our population must decline rapidly from 7 billion to about 1 billion without industrial agriculture. And that's without catastrophic climate change which we are also having. Even Oil Drummers mostly can't bear to consider this. I personally have a hard time imagining what will be left alive on this planet in 50 years. Humans will do anything to stay alive after all.

I personally have a hard time imagining what will be left alive on this planet in 50 years.

According to the WWF we humans will be living on "100% Renewable Energy by 2050."

I did not read the article, but I think they might be right. Those that make it through the bottleneck might be relyinig 100% on solar energy the old, old, OLD fashioned way ;)

From the article:

And from the WWF report A clean energy future starts now!

No Aardvark, they are not right. You are talking about life after the bottleneck, they are not. They believe the world's population, expected to be about 9 billion in 2050, could be supported entirely by renewable energy.

Okay, everyone listen up, that means you too Orlov, here is what we must do... Yeah right!

Ron P.

Thanks Ron, I had a feeling they were whistling past the graveyard while smoking crack.

I do love the "this is how we can do it" plans that come out of the crack dens of the technodupedtopians.

Kind of like Lester Brown's Plan B books? It's not like there are no doomers among the technocopian crowd.

I was actually thinking of Lester in this case - what version is he up to now anyway?

Shouldn't he just change it from "Plan B, version 741" to "Plan C" (or plan Z) by now ? Maybe Lester was a consultant for the WWF on this bit of tripe.

It's an odd feeling, almost funny in a sad sort of way, to run across one of his older books in a used book store. He has been saying the same thing for the last 20 or 30 years now. How many different ways can you tell people who are conspicuously NOT LISTENING that "the solution is obvious"?

I believe his latest is titled "Planet on the edge". Perhaps from there we can speculate that the next title will be "Planet in mid-air, carried only by fast fading momentum", followed by "Planet in free fall, consumed by fear, panic, and rage".

Finally we get to "Planet in smouldering ruins" in which, I have no doubt, Lester will tirelessly remind us that "the solution is obvious".

Cheers,

Jerry

WWF is very good at raising large amounts of money because they present what donors want to hear. It's a good business model for them. They're also big on "paper victories" in which they get a declaration that some problem has been solved, and then announce it solved, and then move on.

There was a niche, and they & their ilk filled it.

My brother used to work for WWF. He didn't have much respect for the American branch because a lot of the kinds of things being discussed here. Some of the international programs are a tad more reality based.

Hello Snarlin and Ron,

re: "http://www.energybulletin.net/stories/2011-02-03/energy-report-100-renewable-energy-2050"

The WWF report. Did anyone actually read it?

From (dare I say "our"?) POV, it can't be right, but I'd like to know where they went wrong.

re: Brown. The problem w. Brown, it seemed to me, is that he doesn't do - or, even outline the necessity for - the "top-level" analysis:

1) Is it possible to maintain an industrial economy with an all-electric basis - (And yes...there is the growth issue) - using no FF inputs?

2) If so, what is required in terms of the transition from largely LF basis, to an all-electric basis? How much material throughput, finance, labor, and...(drumroll)...FF...are required for this "transition"?

3) You know, the other suggestions, such as those concerning the food/ag system, may well be part of a "transition" that might work.

AFAIK, no one, anywhere is doing any kind of "top-level" analysis. Which is too bad, given that we still have *some* oil left.

And, we do have the means to do this. (www.oildepletion.word.press.com)

Hi Aniya;

In case SA and RP haven't weighed in.. I went as far as the Energy Bulletin Brief on this.. can't devote the time to the 256 page WWF document.

I have to say I'm not as worried about 'where they went wrong'.. sure, they make a prediction, and one that seems pretty pat and unlikely for us to fulfill.. but I do say US, not them. I just think they tried to bite off the 'whole thing', and it's inevitable that they'll gag on it. It's sort of their SWEATER SPEECH.. and you can take such things as you will.

The question, for me, is are they pointing in useful directions?

I'm sure that there are folks associated with WWF who would have picked very different emphases then we see summarized here.. (I'm actually browsing the damn thing now.. it's a big pdf, and full of big graphics..) I don't see a chunk on Population, yet.. or one on Reducing Consumption.. but they have a BIG page saying Climate Change is REAL, and it's happening NOW.. now if the wordsmiths here want to tinker and bicker over that choice of words, that wouldn't be unexpected. But these guys are ringing the bell.

I guess I'm asking you to help me reframe your question towards, 'What have they gotten right?' We're in increasingly imperfect times, so finding errors will be painfully easy.. but won't get many people into lifeboats.

Basically, their main push is to say 'Lets build out with Renewables..(and let's be smart about how we do it)' .. which I see little fault in. "2050" .. eeehn, we'll see. I'm more interested in 2011, 2012.

Best,

Bob

HI Bob,

Thanks for writing.

Well, I'd say, my main question is not meant to be fault-finding. I'm attempting to be objective. I want to look at what is possible, technically - and in terms of organization and socially, which is where much positive change can occur (in theory).

So, my tough question is this: How do you know that a "build-out" of re-newables will result in anything other than be one more use of FF on the downslope - a use that is *not* really sustainable?

My point is: renewables may or may not be an actually workable idea, in terms of powering an industrial economy. If it is, what does that economy look like and what else MUST happen for this new economy and arrangement to work?

If we don't ask the question, we will not understand what is actually required to make the most positive "transition."

I'm not saying they made an "error," that is a simple error.

I'm saying they are purporting to ask a question, but they do not really ask the right question.

Yes, let us assume for purposes of argumentation that all electrical generation can be replaced by renewables.

What about the intersection with fossil fuels? How does that - the decline of same - enter into it?

Bob, I am all for the types of things you are fond of, and likewise, for your basic concept of doing what we can.

At the same time, I'd like to see people who have the tools and expertise of "big picture" analysis to take into account the reality of "peak oil" and do analysis.

I don't see this happening. Perhaps I'm ignorant of work in progress.

I think you might be missing a more fundamental internal contradiction functioning on almost every level:

Government can't tell people the truth because they want votes.

Business can't tell people the truth because they want customers.

NGOs can't tell people the truth because they want members.

(Almost) no one has any incentive to tell anyone the truth.

Are we really surprised?

Young children, they can tell truth to geezer power. [ i.mage.+]

Young children, they can step forward to the front of the parade and point at the clothes-less emperors and raise their hands and say, "Stop this nonsense, this mad march towards the edge of the cliff".

"We are entitled to a life too. Not just you, you, you."

"Our children, those who will be your grandchildren, they are entitled to a life too. Not just you, you, you."

It's time to put a halt to the Century of Me.

It's time to put a halt to the Century of Live as If there's no tomorrow.

It's time to admit that Naked Capitalism has no morals.

7 Billion people cannot be unleashed to each do anything they want.

The world is a china shop and you are all raging mad bulls. [ i.mage.+]

______________

[i]= image, [+]= more info

[ i.mage.+]

HI step,

Thanks for your comment. I wanted to reply to just one part.

re: "Naked Capitalism has no morals."

The morals you speak about are WRT the extraction of resources from our (smaller-than-once-imagined) planet, yes?

This has been ever the case with humans, has it not? On the whole, once agrarian societies hit - humans use all available resources, and do not see the consequences. Or, if they see them, they do nothing to forestall them.

So, part of my response is that it seems to me that "capitalism" does not have a corner on the lack of morality.

Having said that, there are many indications of a moral desire, and, in fact, people who want to promote well-being of others and not cause others to suffer. That's on the positive side: many examples. in fact, the NGOs referred to above - many started out exactly geared towards this end.

Humans have learned a lot: science, perspectives on human nature, and ways of getting along. In fact, the entire concept of "sustainability" - the questions we can ask.

So, it may be there are some avenues there for a "better outcome."

Thank you, dohboi,

This is an extremely important point.

It's difficult to tell the truth if one will experience harm from doing so.

One must be prepared to accept the consequences, and/or look for means of safety.

There are ways to deal with this. Or, let me say: Are there ways to deal with this?

How can we have more honesty? Where does it begin?

Some places I have looked for assistance: www.cnvc.org, www.gordontraining.com, in terms of a way to communicate that recognizes, at least, the need for safety.

Articulating the point, for example, as you do, is absolutely critical. Perhaps this is a place to begin.

I've been watching the Nation peak oil videos, they are all good.

Kunstler came off as a bit arrogant.

Dmitry seems depressed. Maybe it's all too much for him, being part of two societies which have collapsed/are collapsing. He's right, though.

In some ways, a feeling of total hopelessness is liberating. However, while there is probably nothing we can or will do to fix any of these problems, there is one thing that can be done by the individual; don't breed and expose your descendants to the coming catastrophe. Their pain is more important than your ego which seems to have the need to proliferate your seed. The need to breed served us well for a time but has not done so for at least a couple of centuries now.

Unfortunately, the biggest breeders are generally amongst those who have no inkling of the coming darkness.

Which brings to mind the situation in Egypt. While I share some of their enthusiasm in ridding themselves of the dictator, things are only going to get worse in the future regardless of who is in charge. They are condemned by their Demographics where the average age is under 25. The media has mentioned this numerous times but has failed to have any deep discussion of its implications.

Psychologically it may not be worse. If you are dirt-poor and everyone around you is dirt-poor you feel normal. But if you are dirt-poor and there is a small elite in control of the government who is living in extravagant luxury you feel very angry.

"The Wahbenzi"; the elite who drive around in Mercedes Benzes.

I learned this amusing term when I was in Tanzania about thirty years ago.

As we are seeing in Egypt, the poor can simmer for a pretty long, long time under these circumstances before sullen acceptance finally gives way to rage.

I listened to the Orlov interview.

It was eerie, actually. Eerie because of how closely Orlov's views mirror my own. I actually recited almost the identical "Orlov comment stream" just yesterday to a friend of mine. He had given me a book for Christmas written by a well known conservative commentator who hit on all of the usual conservative talking points popular in that segment of the media today. My friend wanted to know what I thought about the book. I had to explain to him that in spite of my being more broadly sympathetic to conservative views than liberal views, I felt that the conservatives where essentially smoking from the same crack pipe as the liberals. I ended up reciting a nearly verbatim rendition of the Orlov interview!

(I was especially amused by the observation about Afghanistan being a magnet for dying empires; the place they all seem to go to for administration of the coup de grace.)

The Russians were not the first to suffer defeat on Afghanistan's plains and they will not be the last.

The Young British Soldier by Rudyard Kipling

Ron P.

I especially loved the part where he declared, with a suitably tired look on his face, that peak oil theory is "boring". In the video he doesn't go into detail, but he beautifully deconstructs the idea that the downslope of the Hubbert curve will be so smooth you can negotiate it in bathroom slippers here:

Peak Oil is History

http://cluborlov.blogspot.com/2010/11/peak-oil-is-history.html

Cheers,

Jerry

Yes indeed, the "graceful smooth and continuous curve spanning decades" is what the historians get after curve fitting.

Reality will have bumps. I'm thinking of Yosemite Sam bouncing down a very long staircase.

Peak Oil 101: A Closer Look at Oil Production and Demand

This is key to understand.

The Saudis are always portrayed as those who will save the day. In the 2005-2008 run-up of oil prices, they failed to significantly raise output.

The same stories(fairytales) they told us then, we hear from them today. The market is "well supplied", any increases in prices are due to "speculation" and evil hedge fund managers.

Saudi internal consumption has also gone up considerably. I think Jeff Brown(a.k.a. Westexas) has showed a number of times in the comments section that net exports for Saudi Arabia peaked in 2005 - over 5 years ago.

Everyone remember the standard definition of Peak Oil? "We won't know that we've hit it until we are several years, probably over 5, after the fact".

Well, we are now into the 6th year that Saudi has peaked. They can still boost output but if they failed, and they've failed so far in 5 straight years, then we can conclude the show is over.

Without significant Saudi capacity, Peak Oil is already occuring.

In fact, the food prices(and the social unrest we've seen) has pointed to this already.

The reserve capacity that Saudi Arabia does indeed have is mainly there because of the demand destruction of the 2008 oil shock.

The world's oil fields are depleting at about 3.5-4 mb/d per year.

The outlook for tar sands is dismal. Maybe 2-3 mb/d can be raised in the next ten years in an optimal scenario. Iraq will get to 5.5 mb/d in a realistic scenario, also just a couple of mb/d more than they are now producing. And this is all forecast around 2020, 9 full years ahead of us.

At the same time, as Deutsche Bank and others have shown, you need less and less of an oil price for the economy to take a hit. It takes less and less for food prices to grow. And added to all of this: climate change. The floods in Australia, the extreme cold winters in the Northern hemisphere and the global record temperature levels worldwide shows it is already taking an increased effect, mainly on our food supply.

What was just a short while back a 'Doomer Scenario' is now factual reality.

And remember, we're still only in the beginning of February.

The food situation will get outright catastrophic around April-May, just like in 2008. The only problem is, we don't have the cash to bail out our economies now.

I used to look forward, in a sense, to Peak Oil before. I saw it as our chance to get things right as nature forces us to do so, since we cannot do it on our own.

Now, as things look increasingly as the last dying years of relative peace and stability, I admit I feel frightened. I admit I wish this all was a hoax, that the denialers were right all along. That we're all just a bunch of crazy, overtheorizing doomers with too much time on our hands. In one sense I hope the blind cornucopians are right.

I now, for the first time ever, see the allure of blocking out reality.

Reality is painful and messy. It takes mental strength and fortitude to deal with it, something I only have a limited amount of.

Your sort of at the acceptance stage of the process one goes through when facing any challenge that can be life threatening--you will get through this and move on to the--What can I do about making my position in all this as safe as possible--once you start doing that you'll feel less helpless and eventually accept the reality with much less fear. I am sure that most folks have or are going through the same type of emotions as they become aware of energy scarcity--I give you credit for speaking openly about it. It's a good start!

Leaving aside the opinions on whether this is a doomer scenario or not, we are still at a critical point in building up a suite of evidence useful for policy making.

Instead of SA how about considering the evidence coming out of Russia?

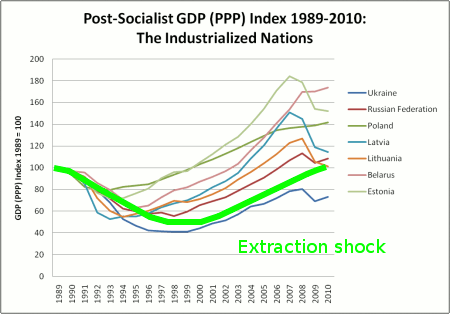

Based on 2002 data, ASPO had made a prediction of how the Russia/Former Soviet Union crude oil profile would proceed. I tried reproducing the production curve (in brown below) based on applying the Oil Shock Model to the discovery data with an extrapolated Dispersive Discovery model (see the green curve)

I really have no idea how the ASPO curve was extrapolated beyond 2002, but dang if they might have nailed it dead on. And put that together with what I have done, which is to take a pure model of oil extraction and reproduce the features of production, including taking a stab at understanding what actually occurred during the USSR/Russia transition period. What this means is that the oil depletion analysis can gain some credibility and we may indeed be able to use these ideas for forward-looking policy.

And if some people think forward-looking=doom, I consider analysis as just something that needs to be done.

EDIT: Look at the extraction perturbation notch that I have in the oil shock model above. What this says is that between 1990 and 2010, Russia experience a decline in productive extraction based likely on instability in their economy.

Now look at the actual productivity numbers coming out of Russia at the same time:

Note that the exact same dip occurred in measured productivity from the economic indicators. It went from 100% levels, notching to below 60% before increasing back up to 100% at the present time. This is substantiation in how these shocks can directly effect extraction and thus production levels.

EDIT #2:

Here is a smaller sized GIF with the extraction shock notch roughly overlaid (in bright green):

I did the fit first and then dug out the corroborating evidence. Turmoil in the economy suppresses the need for oil while the Russion oil companies faced the same economic conditions so production dropped.

No problem. Hit the sauce big time.

Thats been my solution - that and living in LA - if the worse comes I will go fast

lol. My wife and I hit the sauce too, though she does it to drown out my constant PO banter. What's that river in Egypt?

I'm in LA myself...I don't look forward to going fast though!

I'd be interested to see a geographic distribution of the TOD community. Has it ever been posted? I must know hundreds of people, but it seems none of the PO aware ones live near me.

-dr

Used to live close to you in Santa Barbara. Now not so close in Aberystwyth, UK. Diesel @ $8.22 per US gallon.

I used to live in San Diego and moved to Lyon, France last August. I don't know how long before California economy crash but in my field (basic research and higher education), the situation started to stink early in 2008. Here is a recent report from University of California about cuts in higher education http://www.universityofcalifornia.edu/news/article/24764

Since January, most non tenure positions have been cut = people fired. Further budget reduction are expected...

Leiten, IMO a good summary of what is going on and I share your feelings.

Also what I thought about Iraq: 5-6 mb/d. There are a few more glimmers of hope that could buy some time. Petrobas planning to double its production to 4 mb/d in 2020 and massive steam (thermal) EOR that caused Oman's production to rise, both mentioned in Drumbeat two days ago.

I think I'm stuck at the same stage.

I have attempted a few changes, but frankly they're all just tinkering with BAU. For me to implement the kind of changes that I feel are suitable (growing own veg, solar heating, thermal store, and small scale wind) needs to get the rest of my family on board. Sadly this is where I stumble.

Partly it's a case of "Dad's off again", but also it would involve letting my kids know that they probably won't get to University, drive the cars they dream of etc. It takes a stronger man than I to crush a child's dream. All I can hope for is to guide them towards figuring it out themselves and be there for them when they understand. They worked out Atheism for themselves, so there is some hope. :-)

I sympathise with that.

I remember the shock and panic I felt when I first saw carefully constructed explanations of Peak Oil. I didn't want my children to feel their world crumble like that, and I thought the sooner I told them what I thought, the better. So far, I think I was right, but maybe yours are older than mine.

I've spent the winter digging, and am ready to grow some veg (not a solution to a problem - an insufficient response to a predicament). I would never preach at them, but I'm hoping that going out and getting my hands dirty will send the message that I really believe they need to prepare for a different future.

It never occured to me to ask my kids (is that bad?). I suppose at times they thought I was like Roy (Richard Dreyfuss) in Close Encounters of the Third Kind. My son (eldest) said it's OK; there are advantages to people thinking you're crazy. Since I never really went through the "stages", perhaps he's right. Crazy from the get-go ;-)

My wife DID actually compare me to Roy from Close Encounters at one point :)

Hi all you Dads and Moms,

re: Child's dream, children, and life.

"We weren't meant to survive

But to live."

More to the point, I highly recommend taking a listen to this 23-minute story:

www.thisamericanlife.org program #177. "American Limbo."

"Act One: The family that flees together, trees together."

"The Jarvis family, a group of eight, goes on the run from the law - for seven years. They live on a boat, in a treehouse, in a swamp. And how do the kids turn out? Surprisingly well."

One thing that struck the commentator is their collective sense of humor, their adaptability, and their "...utter devotion to each other."

A kind of trust and the meaning of sharing - under any circumstances. The meaning that comes from...I guess I'd call it...putting the person first.

Interesting story..too bad Uncle Sam makes such great purchase of persecuting folks for growing, and even just ingesting, a plant. Keeps the big bucks flowing into the police, prison, and lawyer industries.

But what got my attention as well was: Six children.

Unless four or more of them were adopted, that is four too many according to the simple math of the replacement ratio necessary to support a stable, level population with zero growth.

HI Heisenberg,

Thanks for your response.

The part I thought was worth sharing is about how the kids treated one another, the basic foundation of respect and trust, and thus, they were very adaptable - one might use the word "resilient."

Able to enjoy many different kinds of circumstances. Actually enjoy them.

What they got out of life was doing things together, learning, sharing and having fun. Plenty of laughter and caring to go around. No shortage.

Aniya,

The fact that there are people who can truly enjoy their basic, fundamental interactions with their fellow humans, without the customary material trappings which commonly define 'success' (at least in the U.S.) is indeed inspiring.

People will find such attitudes to be profoundly enabling in the future.

Keep on keeping on!

"The only problem is, we don't have the cash to bail out our economies now. "