Why are WTI and Brent Oil Prices so Different?

Posted by Gail the Actuary on February 22, 2011 - 6:34am

We have all heard at least a partial explanation as to why West Texas Intermediate (WTI) and Brent prices are so far apart. We have been told that the Midwest is oversupplied because of all of the Canadian imports, and the crude oil cannot get down as far as the Gulf Coast, because while there is pipeline capacity to the Midwest, there isn’t adequate pipeline capacity to the Gulf Coast. I have done a little research and tried to add some more context and details. For example, the opening of two pipelines from Canada (one on April 1, 2010 and one on February 8, 2011) seems to be contributing to the problem, as is rising North Dakota oil production.

There are two pipelines (Seaway – 430,000 barrels a day capacity and Capline – 1.2 million barrels a day capacity) bringing oil up from the Gulf to the Midwest. It is really the conflict between the oil coming up from the Gulf and the oil from the North that is leading to excessive crude oil supply for Midwest refineries and the resulting lower price for WTI crude oil at Cushing. Demand for output from the refineries remains high though, so prices for refined products remains high, even as prices for crude oil are low. This mismatch provides an opportunity for refiners to make high profits.

There are various ways of fixing the problem. Bringing less oil up from the Gulf would seem to be part of the solution. Conoco Phillips, one of the owners of the Seaway pipeline (and an owner of Midwest refineries), says it is not interested in reversing it. But lower prices by themselves would seem to result in less oil being shipped through the pipelines up from the Gulf, and may at least partially fix the problem.

Trucking and rail transportation of oil to the Gulf Coast may also be part of the solution, but arranging this may take some time, because of the large quantities involved. If shipping by train or truck is worked out, I would expect that the price of WTI will move closer to Brent, to reflect the additional shipping cost involved, perhaps $10 or $15 a barrel. The availability of this solution should help to cap the spread between West Texas Intermediate and Brent.

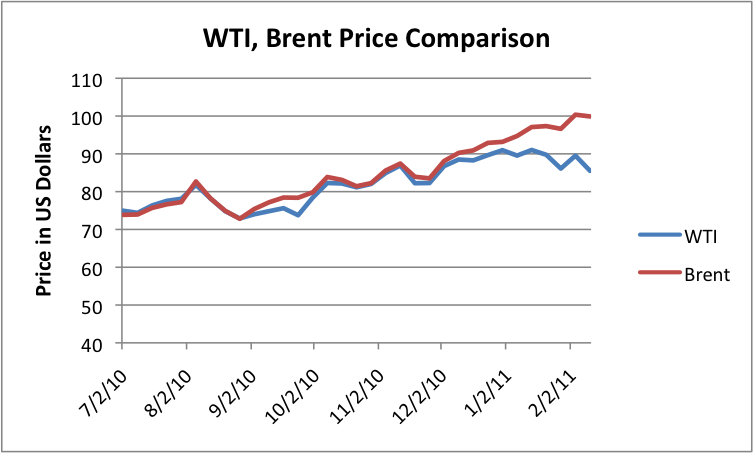

Inspection of Figure 1 indicates that the gap between Brent and WTI prices started in December 2010, and has widened in 2011. Below the fold, I show some more details about what is happening and the prospects for getting the gap fixed.

Rising Production in North Dakota and Canada

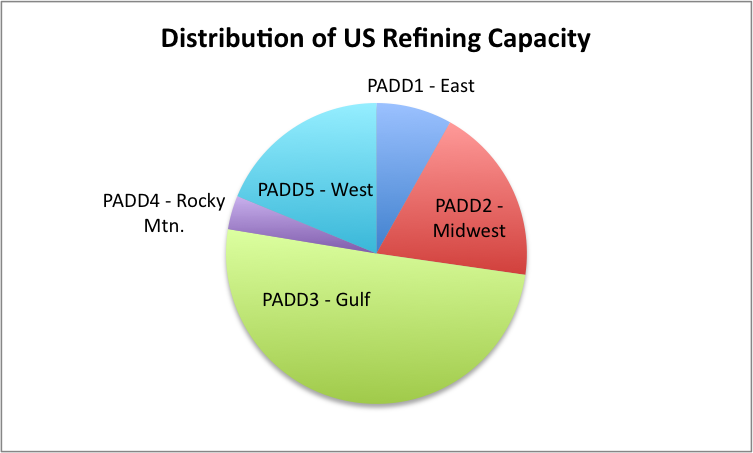

Underlying all of this is rising oil production in “PADD2″ (the EIA’s designation for the Midwest, which includes the Bakken in North Dakota) and also rising imports into PADD2 of crude oil from western Canada.

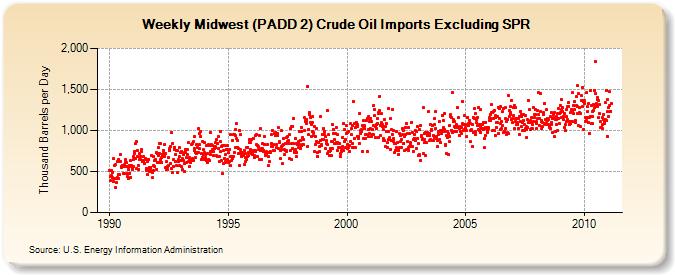

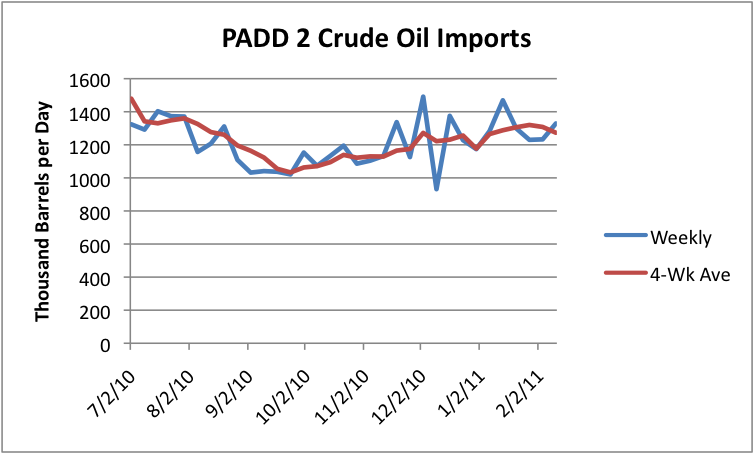

Figure 2 shows the oil imported into PADD2 from Canada. While imports have been rising since 1990, there has been no spectacular recent rise in the amount of oil coming into the US from Canada. A closer look at the last eight months (shown in Figure 3, below) shows that there have been ups and downs, which I will later show correspond to the timing of pipeline closures and operation at reduced pressure because of spills.

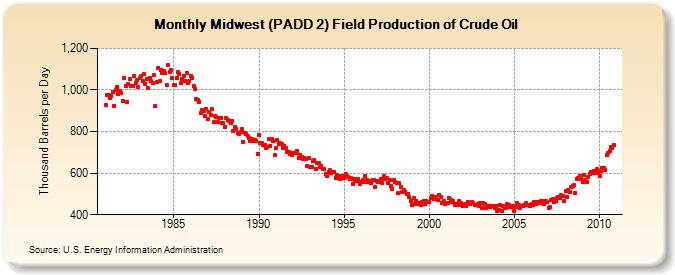

The production that appears to be increasing rapidly is production from the Bakken region in North Dakota.

This graph includes all of PADD2. North Dakota is about half of the total, and the only rapidly growing portion. The graph shows production only through November 2010, but it is no doubt higher in December, January, and February. (For more on the Bakken, see my recent post Is Shale Oil the Answer to Peak Oil.)

Thus, it appears that US PADD2 production has recently increased by a high percentage, but relative to a low base, while imports from Canada are generally rising, although not necessarily by very much recently. Both would tend to put pressure on Midwest refinery capacity, if the area were already up against limits, but probably not otherwise.

Midwest Refinery Capacity

We have all heard that these Midwest refining capacity is inadequate. EIA doesn’t give much history of refinery capacity by region, but apparently, the Midwest at one time had more capacity than it does now.

Currently, the Midwest has about 18% of US refining capacity, amounting to about 3.3 million barrels a day. Imports from Canada from Figure 2 or 3 would appear to be about 1.3 million barrels a day, and PADD 2 production would appear to be about 800,000 barrels a day, making a total of roughly 2.1 million barrels a day. This is not enough oil to supply Midwest refineries, and the reason for pipelines from the Gulf. Consumption of oil products in the Midwest is about 4.9 million barrels a day, considerably more than it refines, so the Midwest also depends on imports of oil products from other parts of the country for its needs.

There are two crude pipelines from the Gulf to the Midwest. The Seaway Pipeline with a capacity of 430,000 barrels a day brings oil up from the Gulf coast to Cushing, while the Capline pipeline, with a capacity of 1,200,000 barrels a day, brings crude from Louisiana to Southern Illinois. It is the conflict of the crude oil coming from the North with the crude oil coming from the South that is causing the oversupply of crude oil to Midwest refineries.

It should be noted that some refineries have been set up to handle very heavy oil from Canada, and others have not. There are also other differences in refineries that make some better for some types of crude oil than for other types. Because of this, even if the total amount of crude oil were to match up precisely with the available Midwest capacity, there might still be refineries with not enough crude and others with too much.

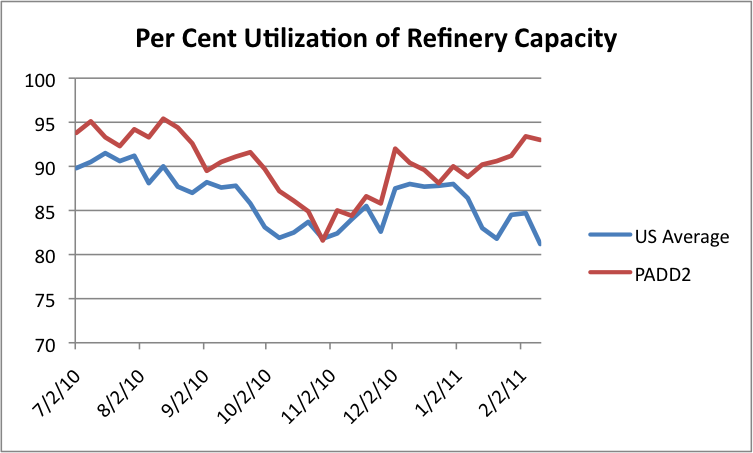

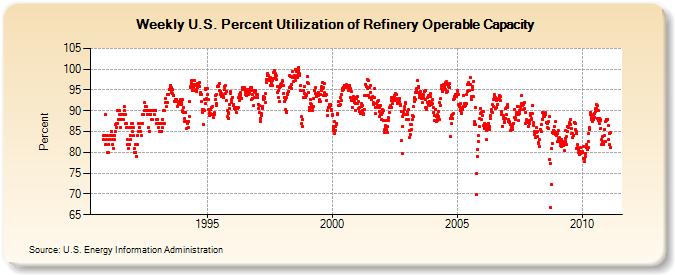

According to EIA data, PADD2 (Midwest) refineries are running at 95% of capacity, while other refineries are running at much lower percentages of capacity. Some of the other “PADDs” are running at 75% of refinery capacity–too low to make a profit. The level of refinery utilization tends to vary by the time of year–this is an unusual time for utilization to be so high. If utilization is high now, a “normal” summer rise in utilization would not really be possible. So effectively “maxing out” at refinery utilization seems to be part of the problem.

Since the buyers of crude oil are generally refineries, if they have all the oil they can take, they are not going to bid very much for more crude oil, except perhaps out in the future, when they aren’t so overbooked, and this seems to be the pattern we are seeing for West Texas Intermediate.

Figure 7 shows that it is not all that unusual for the industry to run at 95% utilization of operable capacity. US overall utilization of US refineries is down considerably since the 1995 to 2005 period. There is clearly plenty of capacity in the US, outside of PADD2, if oil could get transported to the right location.

Pipeline Issues

Part of the problem seems to be pipeline issues–particularly new pipelines that don’t go to the Gulf. There are really two new pipelines. The first is Enbridge’s Alberta Clipper Line. It opened in April 2010 and carries up to 450,000 barrels a day from Hardisty, Alberta to Superior, Wisconsin. From there, it is added to existing US pipelines.

The Enbridge Alberta Clipper is the red line (labeled with a “1″), connecting up with Superior, Wisconsin. This pipeline no doubt accounts for whatever increase in PADD2 imports occurred since early 2010, which from Figure 2 above, doesn’t appear to be much.

One reason that the Alberta Clipper doesn’t seem to actually be doing very much to increase US imports is the fact that it appears to have been built for a bigger increase in Canadian production than actually took place, so is running under capacity.

The other reason for the lack of increase is because of leak-related shut downs and reductions in capacity in US pipelines. First, on July 8, 2010, there was a spill in Michigan on the Line 6B (built to carry 290,000 barrels a day, but carrying 190,000 barrels a day). Then, on September 9, there was a leak discovered outside of Chicago in Line 6A (built to carry 670,000 barrels a day, but carrying 459,000 barrels a day before the leak). Both of these leaks were repaired, but Enbridge was ordered to run the pipelines at lower pressure afterward. One report said the reduction in pressure had the potential to reduce deliveries of Line 6A by 300,000 barrels a day. The long and short of this is that while the April 1 increase in pipeline capacity theoretically had the potential to increase deliveries, the closures and reduced pipeline pressures (which reduced the flow rate) prevented much of an actual increase in deliveries. I would not be surprised if we continue to have problems with leaks. There seem to be real issues with putting heavy crude through very old US pipelines–see my post on this issue.

Since the Alberta Clipper didn’t actually increase deliveries very much, crude has been accumulating in Canada. On January 24 Reuters said, “Capacity on Canadian oil pipelines has been tight since this summer, when two of Enbridge’s lines in the Midwest ruptured, backing up crude supplies in Alberta. Oil producers have since been trying to winnow down Alberta stockpiles, routinely requesting more space than available on the lines leaving the province.”

A second new pipeline, Trans Canada’s Keystone Pipeline with a capacity of 590,000 barrels of crude oil a day, was added in February 8. It is labeled with a numeral “2″ on Figure 8. Since it opened so recently, the effects would not yet appear in Figure 3 amounts. The new section brings oil from Steele City Nebraska to Cushing, and raises capacity on the line by 145,000 barrels per day. The addition of this line appears to have the potential to bring more oil into the Midwest, where refining capacity is already “maxed out”. It seems to me that the opening of this line is a major part of what is scaring refineries, since they already have as much crude oil as they can handle from other sources. They are offering low prices for additional oil, recognizing they cannot really handle more.

Storage Maxed Out?

A graph of recent PADD2 storage (the entire amount, not just Cushing) is shown in Figure 9.

Clearly, crude oil in storage was already on an upward trend before the Alberta Clipper pipeline opened on April 1, 2010. If we compare the recent changes in inventory to what has happened with PADD2 imports (Figure 3), we see that there seems to be a close correlation. Between the opening of the pipeline and the day of the first spill (July 26, 2010), inventory increased from 85.0 million barrels to 97.7 million barrels. This was an increase of 12.7 million barrels in about 116 days, indicating that PADD 2 was accumulating inventory at a rate of about 109,000 barrels a day.

Once the first outage began, inventory was drawn down, reaching about 90.7 million barrels when Line 6B was finally put back on at a reduced rate on September 27, 2010. Figure 3 shows piped oil imports began increasing about November 1, 2010. Between November 1 and February 11, inventories increased from 90.7 million barrels to 99.2 million barrels, an increase of 8.5 million barrels in 102 days, or 83,000 barrels a day of inventory accumulation. So it looks as if PADD2 was not able to handle the additional crude oil added by the Alberta Clipper during the times it increased flow from Canada. It is not surprising that refineries are worried about the Trans Canada’s Keystone pipeline expansion coming on line February 8, adding even more potential crude oil supply.

Are the new low crude oil prices reducing PADD2 gasoline prices?

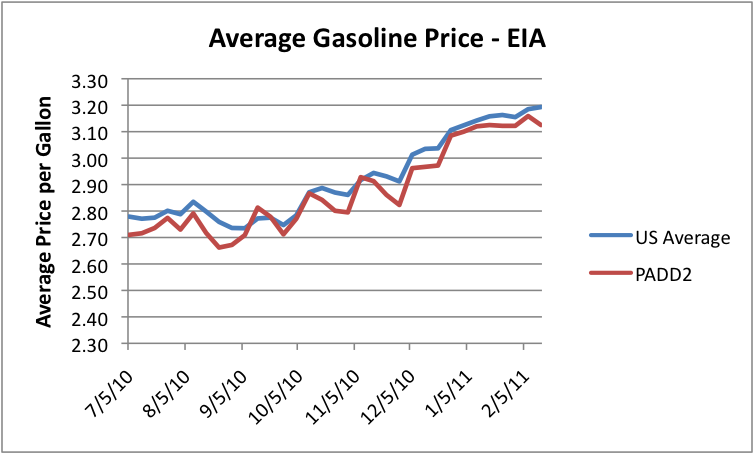

This is a graph comparing PADD2 gasoline prices to US average gasoline prices.

The lower prices that refineries have been paying for crude in PADD2 do not seem to be translating to lower gasoline prices. There would seem to be three reasons for this. First, demand for products, like gasoline, remains high in the Midwest. It is crude oil that is oversupplied, because of pipeline issues and other factors. Second, it is not clear whether refineries actually paid the reduced prices that we have been seeing recently. They may have had long-term contracts or have hedged their costs, so that they did not benefit from the reduced price for WTI. Third, since PADD2 consumes more oil products than it produces, it is importing oil products refined elsewhere, and must pay the “going rate” for them.

How will all of this resolve?

Some have suggested that TransCanada’s Keystone XL pipeline (labeled as “3″ on Figure 8 ) will help solve the problem, when it is completed in 2013. I am not so sure. For one thing, the pipeline hasn’t been approved yet, and it has substantial opposition in the US. Furthermore, unless Canadian production really ramps up, it is not clear that there will be enough crude oil to fill another pipeline. There are already two recent pipelines bringing more oil into PADD2, and they are likely nowhere near full. Canada also has options for sending its crude elsewhere–see pipelines to the West Coast, labeled “4″, “5″, and “6″ on Figure 8.

To handle our current problems, what seems to be needed is a pipeline specifically from Cushing to the Gulf coast. Even this piece of the Keystone XL pipeline has substantial opposition, and won’t be available until 2013, assuming it is approved and moves ahead as planned. If the portion of Keystone XL from Canada is added as well, it will also be bring more crude from Canada, adding to the amount of oil that needs to be transported to the Gulf Coast. The new segment to the Gulf Coast may not add much more capacity than what is being brought south by the new line.

As mentioned in the introduction, there is a 430,000 barrel a day crude oil pipeline that brings crude oil up from the Gulf Coast to Cushing, called the Seaway Pipeline. If it were reversed, it theoretically might solve the problem, assuming that each refinery could still get the type of crude it needs. ConocoPhillips, a partial owner of Seaway, has said it is not interested in reversing the pipeline. Conoco Phillips operates refineries in the Midwest, and stands to make money if there is a large gap between crude oil prices and the selling prices of products (in other words, crack spread). But there may be other reasons for wanting the pipeline to continue flowing in toward Cushing. A 860,000 change in capacity (from +430,000 to -430,000) would a big change to digest, even for a PADD that is oversupplied.

If the selling price of crude oil in the Midwest remains depressed long enough, sellers will find other markets for their crude oil, and the Seaway and Capline pipelines bringing oil up from the Gulf will operate at reduced capacities. That would be one solution to the PADD2 crunch. If the situation is bad enough, long enough, it is possible that the Seaway Pipeline owners will relent and turn the pipeline direction around, so it pumps oil toward the Gulf, instead of up to Cushing.

Another option is railroad or truck shipping of oil from the Midwest down to the Gulf Coast. According to Dennis Gartman, the cost of shipping crude from Cushing to the coast is $10 barrel by truck and $6 barrel by train. If there really is sufficient train and trucking capacity, this would seem to be the approach to use. A person would think the price differential would then be reduced to the additional transit cost, or the additional transit cost, plus a small margin. The price differential between Brent and WTI would then go back to $10 or $15 barrel.

One way or another, the gap between WTI and Brent prices seems unlikely to continue growing, and I would expect the differential to eventually start dropping. It nothing else, as the total supply of oil drops, there will be less oil to fill pipelines from the Gulf to the Midwest, making more opportunity for locally produced oil to use the local refineries.

Why is there no mention to the african and middle-east popular revolutions? I was thinking that must have made Brent prices go up and away from WTI.

From everything I can see, Brent is moving with other world oil prices. Even oil prices in the US on the Gulf Coast are higher than WTI at Cushing, and US gasoline prices are following a pattern closer to Brent.

So I didn't see it as a real issue.

Gail,

Could oil prices at the US Gulf be represented by Louisiana Sweet?

As for example given here:

http://www.upstreamonline.com/marketdata/markets_crude.htm

Brent is at $104.32 now according to upstreamonline.com, and up almost $2 today.

Libya and other Middle-East tensions are contributing to this. We have Libya post up now too.

The Brent oil price is now responding to events in Libya because most of the Libyan oil exports go to Europe. Here are the details:

23/2/2011

Quick primer on Libyan oil

http://www.crudeoilpeak.com/?p=2621

On Aljazeera, Caroline Bain

http://www.eiuresources.com/mediadir/default.asp?Criteria=FullName&Locat...

appeared saying OPEC has a spare capacity of 5-6 mb/d

That may soon be tested. What is happening in North Africa and the Middle East will change all our lives.

2 Iranian warships are passing through the Suez canal now. Destination: Syria

I have a Libya post up on Our Finite World. It may eventually be up on TOD as well.

Here is a government website which shows price FOB, or Free on Board. Definition: pertains to a transaction whereby the seller makes the product available within an agreed on period at a given port at a given price; it is the responsibility of the buyer to arrange for the transportation and insurance.

As you can see, the price has been running somewhere between WTI and Brent depending on location:

http://www.eia.doe.gov/dnav/pet/pet_pri_wco_k_w.htm

An upstream.com article says this:

Output of Forties, the crude which normally sets the dated Brent benchmark, is set to be slightly lower, while daily supply of all four benchmark crudes – Forties, Brent, Oseberg and Ekofisk – will fall 90,000 bpd or 7.4%.

http://www.upstreamonline.com/live/article244864.ece

There are clearly two events driving the current spread. Too much oil at Cushing, and too little in the North Sea.

There's also SemCrude's daily price bulletin which provides prices for:

Oklahoma Sweet+

Central Oklahoma Sweet+

Panhandle Northwest OK

Oklahoma Sour

West Texas Intermediate

Kansas Sweet

Eastern Kansas

Northwest Kansas

Kansas Common

Texas Panhandle

Eastern Colorado

North Dakota Sweet

North Dakota Sour

Kansas Sour

Nebraska Intermediate

Southwest Kansas

http://crudeoilpostings.semgroupcorp.com/

lol...some expert on CNN last night said that because Libyan oil all goes to

Europe, any decline in output wouldn't affect North America.

CNN is absolutely right. Europe won't compete with its american friend on the international oil market to offset the loss, will it?

Perhaps expert should be written "expert" in this case. I don't think TOD would be interested in any posts from him, though.

The US does actually import from Libya.

The CNN expert is right, because the Atlantic has become a barrier for oil tankers due to giant squid lurking on top of the mid-Atlantic ridge.

What about option Nine?

That new option #9 would be to build the Alaska Canada Rail link and haul upgraded oil sands to Valdez and/or Port Mackenzie (Anchorage area).

Options 4, 5 or 6 all require social licence from First Nations and 80% British Columbians.

That is not forthcoming it appears.

Alaskans would take on this 50 year plus burden or risk of supertanker spill I suspect.

This would improve AK State revenues by re 'filling' the TAPS for delivery to Valdez terminal.

What would happen if this was considered?

Hauling bitumen to Alaska sounds like it would use a moderate amount of diesel. The EROI of bitumen not great to begin with, and the fuel used for shipping it across to China will cut the EROI back further. Adding the cost of sending it to Alaska would seem to be a real issue--would likely bring the EROI too low (and cost too high). I would expect that Canada would send the bitumen by rail to somewhere closer (Vancouver, or even Seattle), before they would ship it to Alaska.

I think the current pipeline proposal is for farther north (like Prince Rupert). The NIMBYism in Vancouver has to be seen to be believed - you can barely build a gas station here, never mind an oil export facility.

There is a lot of pressure to not allow any shipments from anywhere in BC, though, due to the risk of a tanker spill. And US interest groups are paying to encourage protests against any proposed pipeline.

Simkin, you are correct about the nimbyism. It is at a tipping point out there along the Left Coast as they call themselves.

The Enviro anti-Enbridge / oil-tar sands campaign funds sources has been well documented and revealed by Vivian Krause of Vancouver.

There is an accountability and transparency issue when it comes to who is funding many of these NGO enviro groups.

But I would not go so far as to say the locals along the pipeline route are being "manipulated".

Helped out might be a better word. They are quite sincere and capable of judging that a supertanker spill is an outcome and risk they just don't want.

Enbridge and the founder shippers have spent north of a Quarter Billion so far to try and get this pipeline approved.

Last small point, the CN Rail Pipeline-on-Rails proposal is to Prince Rupert and the ENB Gateway Pipeline is to Kitimat.

CN Rail as far as I can tell are going to put the oil/bitumen on supertankers. That's a non-starter - hard to sell.

Agreed. I don't think it's worth the risk to send oil to China, for that matter, either. We should keep it in the ground until we need it.

Gail: Ideally it would be a electric rail. Alan Drake and other rail Buffs would likely back that idea up.

The EROI is important and to improve that part of the equation beyond low carbon electro-rail transport, upgrading in Canada is a pre-requisite if oil sands output goes to Asia, according to Ottawa policy. Of course the oil products could go to California also.

Pumping (jamming) crude and particularly dilbit through pipelines is very GHG intensive.

But the capital cost of the rail link to Alaska will be will be expensive, I agree.

Pipeline model financing works for pipelines. Should work for railroads also.

You are correct that Canada (Kinder Morgan, a US outfit) would like to ship to Vancouver but if I have it right, Valdez ia 3 to 4 days closer in time and distance than the congested Vancouver port. And a supertanker port is the same tough hard sell for Vancouver as Simkin points out below...tahn it is for Kitimat and Prince Rupert.

All the risks and not a lot of benefit.

Have you looked at the distance between Alaskan and Canadian rail lines (not counting the little White Pass line). No rail exists past Eielson AFB a bit southeast of Fairbanks. There is huge resistance to building a bridge across the Tanana River to extend that line to Fort Greely--near Delta Junction. That little less than a 100 mile section is years out if lucky at the moment. Interestingly in this feasibility study that section is shown as existing.

No rail exists between Delta Junction and Valdez--about 270 miles over permafrost, tundra and at couple mountain passes, one of which, Thompson Pass, is about 2800 feet, less than ten miles from the port and gets and average of 555 inches of snow year. So I guess you would need to build an oil terminal at Delta Junction to feed directly into TAPS.

Then you are talking 60,000 barrels of oil in a 100 car train--about all they run up and down our mountains. So ten trains a day (that is ten each way so about an hour spacing between trains with sufficient sidings unless the huge span through mountains and muskeg was double tracked) would move a little over a half million barrels a day. Remember that proposed rail extension is meant to handle iron, coal and other resources so other trains would also be sharing the dream track. Option #9 looks farther out than any of the other right now.

Luke: the distance is quite far depending if it goes from Watson Lake south or direct across the top of BC.

Either way its a lot of new track and will cost $10 to $20 Billion. But if you shipping a million bpd, that can pay for a lot of very efficient electric rail very quickly.

I am not up to speed on the latest about the Tanana bridge crossing so as to tie in / meet the AL_CAN rail link with ARRC.

You are right about injecting into the TAPS. They need the new flow to keep the TAPS going. That injection / tank farm buffer will cost also.

Option #9 looks better when all the others can't be done. It will take a bit more time for The Powers That Be to reach that conclusion.

That's the Free Lunch from a narrowing of the WTI-Brent spread if there is a true market for the oil sands.

A $3/barrel WTI uptick will result in a $2+ B a year more for the Western Canada oil patch ...if you use 2M bpd as a W-Can production estimate.

You really think BC and First Nations would rather approve moving crude on rolling stock across their northern tier before they will approve an oil port? I bet we talking 10 years if the rail planning process were to start yesterday before a shovel would move. It would seem other solutions to make the tar sands oil more readily shippable might be forthcoming long before that.

I actually would like to see Canada and Alaska rail hook up, and maybe an Alaskan extension to the Bering Strait...but I'm not holding my breath. The Tanana crossing will likely get worked out sooner or later.

But then Fairbanks got its start a bit over a century ago when E.T. Barnette was beached here with his load of trade stock. The steamer's captain wouldn't risk heading farther up the Tanana with low fall water conditions. Barnette was bringing his supplies to Tanana Crossing (near today's Tok) to start a trading post there, getting in on the ground floor for the railroad coming through from Canada in a year or two. Don't know that his supplies would have held out long enough, Barnette himself would have of course never seen that railroad. He died in 1933. I'm not counting on seeing it myself.

[Do] You really think BC and First Nations would rather approve moving crude on rolling stock across their northern tier before they will approve an oil port? [on the BC West Coast]

That's a good question. I suggest that the answer is Yes.

First, because Coastal FN's and others in the Interior of BC have said No Way for Supertankers.

Second, if one accepts that as a definitive "no" then it would be a good idea to consider an option.

Third, would First Nations and AK NA's along the well known and laid out AK, Yukon and Northern BC/Alberta railway routes accept such an intrusion into their territories?

The answer to that question would be to ask them first and see what they say. That process could take a while I'll agree.

But 10 years? I suspect the answer of Yes or No or Maybe/What's The Deal could come faster than that.

RE: The Bering Straight crossing idea...I agree that is a bit off into the future

I checked out the Tanana RR Bridge crossing ..thx for the link. Seems they have a few options that could allow it to proceed.

I will admit that this grandiose scheme requires some applied vision and a Project Champion.

That's what's missing. That and a bit more time for people to accept that this AL-CAN rail link could be an acceptable win-win-win for everyone.

That new option #9 would be to build the Alaska Canada Rail link and haul upgraded oil sands to Valdez and/or Port Mackenzie (Anchorage area).

A more likely alternative would be to haul the oil on the CN line west from Edmonton, AB to Prince Rupert, BC. That line has been in existence for most of a century, is a really first-class rail line with very low grades, leading to a really first-class deepwater port with lots of room for tankers, and is only about 10% utilized.

That is exactly what I thought when I looked at the proposed lines in the summary I linked. I do remember when a bit of a rain caused flood played havoc with that Rupert line and road in fall of 1978--I was in Sitka and stayed there an extra week waiting for the route to open up. Two trains got washed out with the tracks if I recall. Still, a very rare event.

Would there be much resistance to an oil terminal in Rupert? It just seems a pipeline would be far more efficient, reliable and more environmentally sound than to have that much crude travelling in rolling stock.

Luke H asks;

Would there be much resistance to an oil terminal in Rupert?

IMHO, the answer is Yes. Same wall of determined oppostion as there is for a supertanker terminal in Kitimat.

An oil spill in that 100 km plus long narrow Douglas channel might even be "preferred" to a spill out from Prince Rupert, in the open, during a storm, in November, when you get those 100 foot waves. You could boom off the spill site easier.

As for pipelines being far more efficient, reliable and more environmentally sound...that gets debated in following threads, as Gail points out the recent report about long term impacts of shipping bitumen (dilbit).

Its apples and oranges in any event.

We ( The Royal We ) need a railway to Alaska. Railways do many things, very well for many more people for way longer than a pipeline.

It's a Nation-Building project for both Alaska, Canada and the USA.

RockyMtn Guy:

Yes it is CN's finest section of track, according to CN. They have spent a lot on upgrading as this section (Prince Rupert to Chicago) a critical piece of Canada's Asia-Pacific Gateway Infrastructure project initiated quite few years ago.

They call it their platinum grade track section, althought they did have a coal train mishap last week and 30 odd railcars rolled over on a curve...No official word yet on why that happened on their very best track.

Not helpful for selling Rail as a safe way to haul oil compared to pipelines and keeping the spill out of rivers and creeks.

and Yes, this section could use way more utilization as you point out.

Except, I repeat, supertankers in BC Coastal waters is a non-starter. As with the pipeline to Kitimat.

LNG tankers seem to be OK though...as the Apache LNG terminal has local approvals.

Except, I repeat, supertankers in BC Coastal waters is a non-starter.

No? What do you think those big things moving in and out of Vancouver Harbour are? Those are AfraMax tankers. And the harbour is only limited to AfraMax tankers by water depth - the clearances are pretty tight for them.

They are talking about dredging First and Second Narrows so they can move SuezMax Tankers in and out of Vancouver. Oil tankers already move in and out of Kitimat on a regular basis, and there's no limit on their size.

There is no prohibition against supertankers moving through BC waters. There is a voluntary exclusion zone keeping tankers moving between Alaska and Washington State away from the BC coastline, but there is nothing to stop oil tankers moving in and out from the BC coastline.

I suppose it makes people in BC feel more comfortable to believe that oil companies aren't allowed to do what they are already doing.

The ironic part is that people here (i'm on Vancouver Island) often are completely unaware that significant tanker traffic moves through the Juan de Fuca straits to Vancouver and Seattle every day.

However, that represents a tiny fraction of the BC coast line. In fact, a lot of the protected water tanker traffic is in Washington waters, not BC waters.

The rest of the BC Coast, all 2000km of it from Vancouver all the way to Prince Rupert is completely devoid of oil tanker traffic and there is an extremely strong want to preserve that.

I personally support that sentiment fully. Not least of which because I have spent a lot of time on the water from Georgia Strait to Hecate Strait, the Inside Passage and the Haida Gwai (nee Queen Charlotte Island). These are almost completely unspoilt regions of wilderness. There is no need for tankers to be traversing those waters. This article and other handwringing about oil prices not-withstanding shipping oil to Prince Rupert or Kitimat would only enable yet more consumption of the very thing that is enabling the destruction of our civilization.

Good point. And you can add another chunk of jagged shoreline called the Alaska Panhandle, all the way to Juneau and further

The Alaskans I've spoken with are even more unaware of events un-folding around the Gateway pipeline and the risk equation they will have no say in....

Oblivious is not too strong a word.

This is true. And it is a tight fit heading under/thru the Second Narrows bridge.

There's 12 metres or so clearance to the abutments to spare according to an article on this issue. Dredging won't improve that at all. But they are talking about the current smallish tankers...

And it is true that supertankers and the much smaller SuezMax could ply the waters around Vancouver. And out into the busy Salish Sea (new name for Georgia Straight, Puget Sound and Juan de Fuca).

And there is no 'official' Federal Gov't (Ottawa) moratorium moving thru BC waters.

This is all true and happening right now. And way way more to come.

But if there was an alternative, would that not be a good idea.... to remove this spill risk?

That is The Question

That, I suggest, is what British Columbians (80%) would be comfortable with.

Best Hopes for this to happen ( as some certain rail guys might say )

How to get oil sands crude to the coast

The 'coast' could be Valdez Alaska (if they will agree to take on this burden)

Storage capacity was tight in Ks with the shutdown of the McPherson NCRA Refinery for a turnaround.

http://www.hutchnews.com/Bizmore/sun-biz--NCRA-turnaround--1

I see the story is from October 2010, so the issue of inadequate storage capacity has been around for a while.

The idea of changing direction of the Seaway line has been dismissed because the line is made the wrong way. While changing the direction can be overcome there are other issues.

First WCS (Western Canadian Select) the benchmark Canadian crude is a different crude than the line is designed to pump. New pumps that are capable of pumping the heavier, dirty WCS has a lead time of a year. These are not off shelf items.

Second due to the viscosity of WCS the pipeline capacity will be about 2/3 of the design.

Third, WCS is a asphalt based crude which requires different processing than the paraffin based crude the refinery's are set up to use.

While these are issues that will be overcome by the refinery's they are not things that can be overcome in a few weeks.

The supply chain to the refinery will need to be changed, the blendstock for the runs will have to be adjusted and additional upgrades to the asphalt side of the refinery will have to be done. WCS makes a lot of asphalt. The marketing side of the refinery will need to ramp up and a big issue with asphalt is the biggest end-user. I.E. State and local government.

Might check who is having issues with getting money to upgrade infrastructure.

From what I have been reading, quite a bit of the additional stuff that is being shipped is "DilBit" rather than Western Canadian Select. If this is the case, the problem is even worse than you describe.

Western Canadian Select is made by blending bitumen with Synthetic Crude Oil (SCO). SCO is a light oil, made by "upgrading" bitumen--that is, putting it through an "upgrader" that does some steps of refining. (I am sure you can explain this better than I can, but I expect readers don't know what synthetic crude oil is.) The resulting oil is heavy, and as you say, would present problems for the pipeline. The Western Canadian Select I am familiar with is made with a 50% -50% mixture of bitumen and SCO. This is what Conoco Philips was making, back when I visited their plant in Alberta.

DilBit is made by diluting bitumen with naphtha or condensates. I have read that this mixture is 70% bitumen, and 30% diluent. Dilbit seems to be even worse for shipping than Western Canadian Select, because of the volatility of the diluent. This is a recent report about some the problems it causes when shipped through pipelines. I think there are some apples/oranges comparisons in the report, but its basic point about DilBit being a major problem for shipping is valid. There really is a need for specially designed pipelines to ship it.

Cenovus Energy

So, it's an attempt to create a synthetic benchmark crude oil which can be traded on international markets just like WTI or Brent.

This is a recent report about some the problems it causes when shipped through pipelines.

The Alberta Energy Resources Conservation Board has some pretty nasty things to say about this report:

Reading between the lines, I would say the Alberta government is really calling them a bunch of liars, and having read the report, and being intimately familiar with oilfield safety standards in Alberta, I'd have to agree with the Alberta government. They are a bunch of liars.

Really, I've never been afraid to call a spade an *effing* shovel, or suffered fools kindly. And I don't know why I should start now.

I agree that the results of the study are likely overstated. I wish we could trust groups that are "pro" either side to put out fair reports.

I think though that old pipelines are vulnerable to problems. I know that when I dug through the news reports last year about the Enbridge spill, and found out the DilBit set off alarms very frequently, it was concerning. It seemed like the alarm system had been set up for a different type of oil. The spill occurred at relatively low pressure, in an old pipeline that ran through a swampy area that was subject to a lot of flexing because of freezing and thaws. It was easy to see this was a vulnerable area. The papers also carried a story about a similar leak in 2002 in Minnesota.

See my earlier post.

Well, it is true that the Enbridge line that ruptured was 1) very old and 2) carrying much more oil than it was originally intended to move.

Originally that line was intended to carry Canadian oil from oilfields in Alberta to refineries in Ontario. It was run through the US mainly because it is much easier to trench pipeline excavations in the swamps south of the Great Lakes rather than the solid Canadian Shield granite north of the great lakes.

I suppose it does bring up the question of whether regulatory authorities should put a "Best Before" date on pipelines, after which they should be abandoned and a new pipe laid parallel to them. Other than that, they could require much more intensive inspection of old pipelines, particularly ones that are carrying much more and heavier oil than their original design specs.

There is the ongoing issue that the North American pipeline system is doing things it was never designed to do. But the reference above, Tar Sands Pipelines Safety Risks is highly misleading about the underlying issues. The issues really relate to the need to inspect ageing pipelines more frequently and thoroughly, and replace corroded sections as required, not to the properties of the crude oil they are moving.

The inescapable fact is that North America's reserves of sweet, light oil are largely exhausted, and the crude oil supplies available now are heavier and higher in sulfur than in the past. If you can't live with that, you will have to give up driving.

I am afraid it is worse than giving up driving. It is also giving up food brought to us by truck, and tractors plowing our fields. There aren't any perfect solutions. I think that a lot of the protesters assume that wind turbines will save the day, or we can just import oil from Brazil. If it were that easy, we would have found solutions long ago.

Gail: If I may digress from the topic of WTI-Brent spread and railways...

You said, If it were that easy, we would have found solutions long ago.

What if it was that easy?

What if, for example, wind turbines were able to "Save the Day" in the oil sands (maybe not for the planet)?

Would the experts at EROI at TOD be willing to examine this potential?

Energy from wind can lift bitumen from the ground right now.

This ET Energy technology is in the commercial proving stage with significant funding from the Alberta government.

I believe you have mentioned this company in a previous post quite a while ago. (?)

ET Energy ppt slides indicate that this process (E-Tdsp) can extract bitumen from deposits at approx $10,000 per flowing barrel per day. The energy cost (KWh's) is approx $6/barrel extracted.

This is extremely Low Capex for developing oil sands compared to current methods right now. It is also rapidly scalable, unlike the other methods.....

If these ETdsp projects were to use renewable energy from the grid (not coal power), then we have a low carbon, lower impact, no water withdrawal from rivers, no tailings ponds outcome.

.... and coupled as feedstock to the new CO2 sequestering NWU upgraders, we have a product ( ULS Diesel ) that could be described as the Worlds Greenest FF

Assume we have abundent wind energy available in BC and Alberta.

Could we combine these three new technologies: Wind, E-T Energy and NWU upgraders and discuss / examine the costs and EROI if this was deployed on a large scale?

The other result is that it could double the recoverable reserves of extractable oil sands by accessing the deposits unavailable to current technologies, SAGD and surface mining.

This would move the oil sands into another league when it comes to energy security for North America....

OR

Another way to look at it?.. We could cut the footprint & impact to this area of the planet by half or more.

It needs to be examined for its combined EROI and perhaps the folks at TOD could help out here.

The problem is that Alberta's wind power potential is in the South of the province (the Pincher Creek/Crowsnest Pass area), and the oil sands are in the North of the province. The distance between the two areas is on the order of 1000 kilometres.

The oil sands area has just about every conceivable energy source except wind. It has natural gas, coal, undeveloped hydroelectric sites, and it even has uranium. Just not much wind.

At this point in time, natural gas is the cheapest energy source in the area.

We can use this Southern AB wind resource to eventually help AB utilities get off coal power, if Coal CSS proves too expensive.

Wind in BC needs a place to go and Alberta is close by and a large intertie would do the trick. BC Hydro and AESO, the 2 transmission grid operators have a set of $200M and $500M P/L Intertie projects in planning stages. Together they will cost in the range of $10-15/MWh over the long term.

This load or sink to provide power to electro-thermally lift bitumen out of the ground can be switched off and on without the same consequence as other loads normally connected to the grid. As long as the average amount of energy (KWh's) are deliverd, you get oil out at a rate of approx 130 barrels per day per MW of installed wind capacity depending on capacity factor.

At times when grid capacity is needed, it is available for higher value use. Due to this unique type of electrical load Intermittency of wind is less of a factor and besides, BC Hydro has ample hydro for backup in the reservoirs

In the Peace Region of BC, the capacity factors are very high and the available wind development sites will easily support a million barrels per day extraction rate using this new technology.

If you are referring to the 1800 MW Slave River hydro project (and you may not be) this was recently abandoned due to lack of FN support and social licence. Hydro project nixed

The other technologies, gas being cheap, is not the issue as they are not suitable as they are not renewable. Carbon offsets available to this low carbon, bitumen extraction process will add significantly to the bottom line EROI.

Plus this premium product, Worlds Greenest FF Oil Product will require transparent accountability for certification

Large scale multi-GW Nuclear power will crowd out and compete with flexible, scalable and lower cost renewables. Although I must admit, these emerging small modular nuke plants seem to be moving forward towards commercial viability

Only problem is, this strategy transfers electric power in the wrong direction. The oil sands now have huge excess potential electricity generation which has no market, in that they could easily replace present direct-gas-fired steam generators with gas turbine exhaust heated steam generators (co-generation) if there were any available use for the electricity. They've been trying to get an HVDC line from there into the southwest US for years, but a combination of economics, hate for oil sands, and NIMBY have blocked it.

Yes, that is a "problem" if The Powers That Be allow Business As Usual to continue.....

This large excess power generation from the BAU oil sands operations is tainted by its carbon emissions.

That powerline south to the US will have the same problems as a similar powerline proposed for years, from BC to California.

The much cleaner BC Grid power offering to CA, shaped by BC Hydro reservoirs, may well not be viable either;

California and other southern States want certified Green power that meets their RPS standards;

BC Grid power is "contaminated" by overnight coal power imports from the US and Alberta and:

BC Grid Power exports will be further contaminated by valley-flooding projects such as the 900 MW Site C;

Solar power has become very competitive to the BC offering just in the last few years, with molten salt storage technologies making a local resource a much better deal for California;

No Powerline to build (Billions); No exporting clean energy jobs to BC; (the true showstopper)

That's why this Alberta HVDC P/line carrying this high carbon power to the US will have a tough time...

This idea of "upgrading" the simple cycle gas turbines to CoGen CCGT with thermal Mass Ratio turn down capability is a good idea and I've heard that is what "they" want to do. (Who is They?)

Best idea there is to sell this FF power internal to Alberta and replace domestic coal fired power. Lots of potential there to shut down coal power but that's unlikely unless the big utilities are allowed to write these dinosaurs off...or are forced to add CCS to the newest, cleanest powerplants.

But that is very expensive and may not work in the long run.

But Alberta could do a deal where they sold their super low carbon, renewable energy extracted bitumen, supplied to the just-announced NWU upgrader that will sequestor via EOR all its emissions and will produce a product that would meet Low Carbon Fuel Standards in California.

California would love to take that sort of "greenish" diesel. They could not say "no".

This Worlds Greenest FF Oil would now have lower life cycle emissions compared to any other conventional oil product coming in from anywhere....including also their own local domestic Heavy Oil production (we can't go there)

That would result in the person filling up his fuel tank, whether in California, or in Eastern Canada or anywhere this Premium Branded Certified ULS diesel is sold...... will know he/she as the ultimate consumer (emitter), is driving change in the Oil Sands of Alberta.

He/She, if driving a future GM Volt with the diesel ICE option, is the individual who is actually responsible for as much as 95+% of the CO2 emissions resulting from driving his/her vehicle. Maybe more if this fuel is delivered by the current Old School rail or the future electrified NA rail system....

Yes, I agree, a future that will likely never happen.

Use nuclear power. A nuclear power plant to generate steam is fairly easy to build.

RD Shell tried to locate a Nuke Plant in the Peace Region with Bruce Power doing the "Local Promotion".

Did not work out well. No Go.

Easy to build? Where might that be? Finland?

Easy to finance? Maybe in France. China or Japan. Not in Alberta.

Easy to Permit? Not in Alberta.

Easy to get Liability insurance? Nope, but the taxpayors of Canada will take the risk on. Unknowingly.

It is not the pipelines that need to be different, it is the pumps. These pumps more augur the oil rather than pump it. The old All American Pipe Line from Pentland Station CA to Wink TX overcame the issue of the asphalt based crude by heating it as it left the pump stations and had insulated pipe to keep the oil warm. The line was not on operation long enough to determine if this would result in higher corrosion rates on the pipelines toward the ends that would be cooler. But the Canadian crude is very abrasive. There is a lot of sand still in it and from what I have heard is very hard on the pumps.

I hear the pipeline companies are looking a making "Pipeline Crude" at Cushing by blending crude oil coming in from West Texas via Basin and Centurion to raise the API and viscosity. I do not know this for sure.

But you look at all the pipe coming in to Cushing and the lack of a hole to push it out of makes one wonder. It is a proven fact you can only put 5 gallons of poop in a 5 gallond bucket.

Gail, some comments about dilbit:

Dilbit can be made with condensate as diluent, or it can be made with naptha. I think the volatility or vapor pressure issue may arise with condensate if it's not properly stabilized, but that's just a stabilization problem. And this is also provided the condensate doesn't include components which precipitate asphaltines from the heavy crude.

Dilbit made with naptha is stable, if the naptha is stabilized and it has the right density and viscosity. Oil upgraders make naptha, and this product requires hydrogenation to make sure it's stable.

So any problems shipping dilbit, synbit, or any other crude arise from improper treatment prior to pumping - and this can be solved fairly easy with the right equipment in the upgrader kit.

I think there's an issue which somebody may want to investigate. IF the refiners in the Great Lakes area are making a fat profit because there's too much supply coming in from Canada, are these refiners also the pipeline owners who could reverse the lines and ship south? This may be a simple case of people who own lines wanting to make sure the market is bottled up to keep the refinery margins as high as possible.

And this implies the Canadian producers need to wise up and find a way to release their crude down to the US Gulf Coast.

fdoleza, you are correct about a wise-up solution.

That would be the TC Keystone pipeline.

Wiser still...

Access to Asian markets.

If only they could get a pipeline approved. To the West Coast of BC.

Easy to Build. Impossible to get approved.

Can you verify your idea that these pipelines are

pumping heavy crude(22.3 API)?

http://en.wikipedia.org/wiki/API_gravity

They are pumping syncrude with an API of +24 deg or API 29.

A tiny amount of diluent(NGL) is involved in the process 925 bpd out of 85027 bpd of syncrude in a 100000 bpd bitumen unit.

The whole idea that vast amounts of diluents are used

in Albert Syncrude seems wrong.

http://www.osti.gov/bridge/purl.cover.jsp;jsessionid=178C266B2092F7D2214...

PDVSA is trying to push 9 API extraheavy syncrude thru their Orinoco pipeline by mixing it with large amounts of naphtha API 47 diluent to make a pipelineable ~API 20.

I guess this works barely.

http://www.entrepreneur.com/tradejournals/article/173117494.html

It seems to be DilBit that they are shipping through the pipeline. This is the stuff made from 70% bitumen, 30% naphtha. See my comment immediately above in response to "dbigkhunna". Also, my post relating to the Michigan pipeline spill.

Even if it were Western Canadian Select being shipped, it would not be what the pipelines were designed for.

Also, see this news article from October 2010 saying, "Syncrude output to average 285,000 bpd, down 19 pct from capacity". That synthetic crude oil can be mixed 50-50 with bitumen to make Western Canadian Select, or it can be shipped by itself. But once it is gone, the rest of the bitumen must be diluted with something else.

I stand corrected (probably).

It appears that Cenovus, the Enbridge oil part spin off was pushing this WCS heavy oil garbage(20.5 API) in November 2009 as a brilliant new idea and of course the pipeline ruptured was Enbridges.

http://www.cenovus.com/operations/doing-business-with-us/marketing/weste...

To me it seems that a pattern is emerging in the oil/gas industry ethos.

It resembles the BP Macondo fiasco with management 'making things happen' resulting invariably in disaster.

I am not convinced that what caused the problem in Michigan was Western Canadian Select. I think it was probably "DilBit"--the unstable 70% -30% mix. WCS is 50%-50%, and it sounds like it is quite a bit more stable.

Supposing that the price of WTI is much lower than the price of other oils of corresponding quality (at other places than Cushing). Why then would any one pump oil of that quality in the Seaway (or the Capline) pipeline from the Gulf Coast to Cushing/Mid West. (Which appears to occur - altought that may be a misunderstanding on my part. )

From the Gulf it must be possible to ship that oil to other places where the price is higher. Or perhaps rather avoid shipping such oil (from e.g. the Arabian Gulf or West Africa) to the US Gulf Coast in the first place.

Long term contract, locked in at a different price. Once the contract is up, I expect it would change.

Long term contract, locked in at a different price. Once the contract is up, I expect it would change.

Gail,

I can see a point here. But, not if you at the same time suggest that the differential might be alleviated by trucking or railroading oil from Cushing to the Coast.

Suppose one or other market participant is having a long term contract for oil that one time or other passes the Coast. Further suppose that instead of using/refining the oil they would want to sell it (e.g. as suggested by trucking it to the Coast). Obviously they would not go through the trouble of first having it piped to Cushing and then transported back to the Coast. They would sell it at the Coast when it passes there.

Given the price differential: Any contracted oil (coming from the Coast) that cannot/will not be used/refined must be up for sale and ought to stay at the Coast instead of being transported to storage at Cushing.

Obviously you could argue that the steep contango would stimulate transporting from the Coast for storage at Cushing. On the other hand this contango must be greater than the price differential (between Coast and Cushing) if that argument should hold. In addition comes a cost of storage.

Please excuse me for being a bit repetitious about this, but that comes from the fact that I still after all these discussions do not understand this.

I too cannot but wonder if there is a scent of a rat here.

Looks to me like a wide-open potential for another "Enron" situation here, where by creating false congestion in the transmission system, they can manipulate the market in their favour. One thing you can be VERY sure of, no oil company or group of companies is stupid enough to ship 1 mmbpd from texas to Cushing, then immediately re-ship 1 mmbpd from Cushing to texas, EXPECIALLY by rail or truck.

Far smarter for the Canadian producers than pipelining crude to the Pacific Coast / China would be simply to construct sufficient bitumen-to-lite upgrader plus bitumen-to-final refining capacity in Saskatchewan to take over the PADD2 market.

They have some of that already, only it's located in OK and surrounding states!

Edit: Note the difficulty in justifying a new refinery -- none in the US for decades. There is a lower bar for upgrading existing refineries. I would suspect that on a value ROI (no national interests or such at play) the existing US refinery base will prove to be adequate, and it will be cheaper to ship crude and products around than to build new refineries. I could be wrong, though.

Is there a stockcharts.com symbol for Brent? The symbol for WTI is $WTIC.

The WTI Brent spread peaked at over $19. It has declined rapidly the last few days and is as I type just over $10. I put this down to fear of events in Libya overcoming any trading conditions. The traders have decided it is not the time to play games.

Gail, I smell a rat here. I just don't believe that the price difference between Brent and WTI which has been close to $20 is due to local supply / demand conditions at Cushing. WTI is a global bench mark and Brent and WTI have always converged quickly when spread opens up like this. So either WTI has been devalued by all that syncrude coming in, in other words it's now junk oil or this is market manipulation that you touch upon.

Check out these charts:

ICE Brent front month

http://markets.ft.com/tearsheets/performance.asp?s=1054972&ss=WSODIssue

OILB

http://markets.ft.com/tearsheets/performance.asp?s=OILB:LSE

OILW

http://markets.ft.com/tearsheets/performance.asp?s=oilw&x=0&y=0&vsc_appI...

Oil B is an ETF based on Brent front month and I've noticed it has decoupled from the underlying asset since 2008.

Oil W is an ETF based off WTI two months out. Note how it has not appreciated in value for 18 months.

I made some enquiries and was told this:

"Oilb follows the 1 month future and Oilw the 2 month future so they won't match in terms of performance. In the WTI futures market there has been volatility of contract and price with the futures price at a premium to current with the pull to delivery wasting capital (this is less pronounced in the 1 month) on roll over (which is permanent attrition)"

So, with market in contango capital gets wasted? And on the London market more capital gets wasted on the WTI contract 2 months out. Who is making money here?

anyone?

Euan,

I have also wondered if there is some price manipulation at the root of this. But who stands to win? I do not know except that refineries seem to be winners on cheap input.

On the other hand this situation seem to have dire consequences for some pretty heavy interests, e.g. there is a risk that market participant start to consider WTI contracts as irrelevant. If that happens NYMEX stand the risk of losing lots of (profitable) business.

Anyone who knows what NYMEX thinks or does in response to this situation?

they probably think "I don't have to go up in front of congress and answer a lot of questions about speculators"

I just don't believe that the price difference between Brent and WTI which has been close to $20 is due to local supply / demand conditions at Cushing. WTI is a global bench mark and Brent and WTI have always converged quickly when spread opens up like this. So either WTI has been devalued by all that syncrude coming in, in other words it's now junk oil or this is market manipulation that you touch upon.

WTI is becoming just a local grade of crude oil reflecting local conditions at Cushing, Oklahoma. The trouble with WTI at Cushing is that you can't put it on a supertanker and ship it to China and India - there aren't enough pipelines to the coast. And, in today's world, China and India are where the big demand is coming from. US demand is falling.

That's why WTI is so low, and Louisiana crude is so high. Traders can put Louisiana on a supertanker and ship it anywhere in the world they want to. If there's no demand for it in the US, they can ship it to Europe or India or China.

There is also a cyclic component to this variation where Brent increases cost relative to the previous "baseline." Until very recently, Brent has traded on the spot market for less than WTI. But the cyclic component has been there for quite some time (easier to see using rolling weekly averages).

WTI is the least expensive of the bunch that are tracked on upstreamonline followed by Alaska North Slope. Most others exceed $100/barrel with Louisiana Sweet currently trading on the spot market at $108.47/bbl. Using a 3-2-1 crack spread on WTI gives you a very "profitable" margin. But other, more expensive, oils will eventually fall from favor and the "glut" will eventually right itself because the high differential crack spread will make the transportation costs more palatable.

Thanks for a most informative post Gail

If there really is sufficient train and trucking capacity, this would seem to be the approach to use.

A single 100 car train moves about 60,000 barrels of oil. Even with enough cars and engines rail oil shipment is limited by loading/offloading facility capacity and rail track and switchyard capacity. Maybe someone out there has some numbers on spare overall and specific rail capacity in/between the regions that are now out of balance.

Trucking oil from Cushing to the Gulf Coast!? I have read cost approximations of USD 10-15 per barrel (personnally I have no ideas as to what it might cost). This cannot possibly make any (economic) sense at the same time as oil is piped in the other direction.

A cost of $10-$15 for trucking oil from Cushing to the Gulf Coast just establishes how wide the WTI/Brent spread can be over the long term. If it gets much higher than that, people will start trucking oil from Cushing to the Coast.

Moving oil by rail costs about half as much as moving it by truck - i.e. $5-$7/bbl. Building loading/unloading terminals takes a bit of time, but given the price differentials, loading/unloading terminals are popping up like mushrooms along US rail lines.

As far as capacity is concerned, a unit train of tank cars can move 60,000 barrels. You can move 24 unit trains in both directions over a single-track line. That would be 1.44 million barrels per day. If you double-track it, you can move considerably more than 2.88 million bpd because trains don't have to wait on sidings to pass, and can run end-to-end with automatic train control.

The capacity of railroad systems depends on how many tracks you run in parallel. I've heard of 8-track main lines in Europe, but if you needed more you could always add more tracks.

Those rail lines are hardly empty at the moment, nor are a lot of the us railroad beds good enough to handle maximum traffic, some specifics on particular lines would be helpful.

I've no idea how utilized the rail facilities at the refineries with lots of unused refining capacity are or at least at tank farms properly connected to same said refineries. Its all doable, just in what sort of time frame?

Do you have any idea of how much spare tank car capacity exists in the US and Canada?

Well, there are railroad lines all over the US, and some of them are in pretty good shape, especially the main lines. The main lines have no trouble handling 100-car unit trains of 100-ton tank cars. It's much easier on the tracks than hauling coal, which is what the railroads specialize in.

The overloaded rail lines generally run east-west moving containers and western coal to eastern markets. The oil tank cars would usually run north-south to the Gulf Coast.

There is insufficient loading/unloading capacity at oil fields and refineries at the moment, but from what I hear, tank car loading/unloading terminals are beginning to sprout like mushrooms along US railroad lines everywhere necessary.

I think they can probably build tank cars faster than loading/unloading terminals - i.e. as fast as they need to.

Trucking oil from Cushing to the Coast, if the same (type of) oil is simultaneously piped from the Cost to Cushing that seems very unlikely to happen.

So someone buys it at, say 95, at Cushing. After transporting it to the Coast it has cost, say 105. It sells at a profit of, say 3, i.e. at 108 at the Coast. Then this oil or some of equal quality is piped to Cushing and sold for 95. The only ones profiting from this would be the truckers and pipe owners.

I cannot possibly see how this could happen before piping from the Coast to Cushing has stopped (if we ar talking about the same quality of oil).

Trucking oil from Cushing to the Coast, if the same (type of) oil is simultaneously piped from the Cost to Cushing that seems very unlikely to happen.

I think there's something fishy about it, too. ConocoPhillips says it will not reverse the Seaway line leading from the Coast to Cushing, whereas ExxonMobile DID reverse its Pegasus line to take oil from Cushing to the Coast.

Could it have something to do with the fact that ExxonMobile and other refiners have much more refining capacity on the Gulf Coast than ConocoPhillips, whereas ConocoPhillips has a bunch of mid-continent refineries that already have access to oil from Cushing?

It smells like a blocking action. ConocoPhillips can't use all that pipeline capacity, which is much more than its Gulf Coast refinery can handle, and may be more interested in stopping its competitors (XOM, BP, Shell, Valero, etc) from getting access to cheap oil from Cushing than providing any kind of service to them.

I would be less suspicious if I didn't know any crude oil marketers. It wouldn't be the first time one of them tied up a pipeline so their competitors couldn't get any oil to their refineries. I could give examples, but some of these people know where I live.

COP would be cutting its throat. The mid con refineries are set up for lighter, lower sulphur crude. Changing a refinery over is a 3-5 year project and a lot of CapX. No matter how much you would like to change to use the lower cost crude, you can't. And again, what are you going to do with the asphalt?

The mid con facilities tend to have smaller asphalt units because the base crude are low in asphalt. Changing to the Canadian crude will require substantial upgraded in the asphalt units and storage.

COP would be cutting its throat. The mid con refineries are set up for lighter, lower sulphur crude. Changing a refinery over is a 3-5 year project and a lot of CapX. No matter how much you would like to change to use the lower cost crude, you can't.

Who is cutting whose throat? Not ConocoPhillips. In 2007, ConocoPhillips signed a joint venture with the big Canadian oil producer, Cenovus to take an interest in the oil sands, and to upgrade a couple of its oil refineries to process heavy oil. Wood River is its biggest refinery.

Wood River Refinery

Borger Texas Refinery

You are onto something there RMG

Gaming the system is through control/dominance on the production side and on the refinery side.

The majors.

That's what prompted CN Rail Pipeline on Rails initiative.

The small guys (~40%) in the oil sands patch. The smaller innovative companies who cannot get involved in these massive pipeline ventures.

You need the Big Bucks to play. So the smaller guys would like to deal with another method/shipper that could better meet their needs, so they don't get squeezed and end up begging or price takers for access to these pipelines.

RockyMtn Guy is quite right about rail capacity being scalable, competitive and an alternative to trucks and I'll add - pipelines too..

A double track AK rail link purpose built for hauling oil sands product would have great future ability to build out capacity over time...anchored by long term contracts. Lots of railcars will be needed no doubt. Good jobs there for people.

What about 200 unit trains RockyMtnGuy?

As for load/unload terminals, yes they will cost something, but I bet an automated quick turnaround design could be considered.

Once again, not BAU Old School design. Something innovative.

I bet CN Rail-Altex have this already figured out for their customers.

I bet CN Rail-Altex have this already figured out for their customers.

Well I bet their customers would like to get the oil at Rupert, but it doesn't sound like you think that is happening. I'm all for tanking the 'crude' to Delta Junction though I'm betting the west coast and Hawaiian refiners that get their product from Valdez now would have to change their plants to handle that northern Alberta goo.

I'm sure a new designed rail system could accommodate 200 car units, it's pretty much a a matter of roadbed/rolling stock/engine design. Not sure if switch yard design cares how long a train is but likely they are geared for certain size train units. But you are talking a near dedicated yet to be built line so lots of options would be on the table, but it would be advantageous use rolling stock that could be used on the rest of the rail network. Longer trains have a lot more coupler uptake as well. I've no idea how high tech that has become or how high tech you would want it to become when the cars travel a day or three through -40 a couple months a year.

The other week the guys were discussing the difficulty of emptying waxy Sudan crude from tank cars in Africa--can't imagine that tar sand gunk would be a bit of a problem after travelling a few days in the subarctic from northern Alberta to a Delta Junction, Alaska terminal. Winter is only six or seven months long though ?- )

I know you can pick up power from hotbox type generators to heat the tank cars but that all adds resistance if the train is diesel electric. Lots of wire to run from the yet to be built BC hydro if you run it electric (unless you plan to burn a bunch of the oil for power instead), but it can be done. Russia moves freight in the arctic electric. Wonder what the percentage break down between juice to heat the 'crude' and juice to move the load. If you want fast turn around that stuff better be able to flow as soon as it hits the terminal. Unless its cheaper to heat it at the terminal and have a dozen or so train units parked and heating up at all times.

Not trying to rain on your parade but rather give you some idea of the costs that might be involved. I can't imagine the train idea being near as efficient as a pipeline--where the movement of the crude itself generates heat which is retained by the insulated pipe--we do have a day or two experience with that sort of thing in Alaska too you know.

I just took a look at my favorite old north south line, the Illinois Central--damned if CN hadn't bought it in the late 90's. Smart move. Rupert to New Orleans--I'd by that ticket but I'm afraid its just freight these days.

Any oil sands products shipped by rail to Valdez or Port Mackenzie would be loaded on supertankers and could go to refineries or markets anywhere.

Which is the point of this series of threads in response to Gail's post RE; The WTI- Brent Spread and Why is it so wide etc...

$2,3 or $5 / barrel may seem like very little, but on an annual basis, it can pay for a lot of track ....

I'd like to get into the details about options if the AL-CAN rail link was optimized for long term hauling of oil sands to Pacific tidewater (or until we get off oil, whichever comes first !)

But it should probably be under a new post at a future time.

My sources have informed me that insulated railcars would lose very little heat over a week to 10 days it would take to haul hot bitumen only. 20-30 degrees C at most. That would be from AB all the way to GULF Coast USA.

To the injection point at TAPS, 3 or 4 days transit time the heat loss would be even less. The railcars would have steam or electric power to re-heat if necessary.....if the product is syncrude or ULS Diesel this is not a problem. I would imagine the off-loading of cooled bitumen (not dilbit) would be a problem though. maybe the supertanker has to leave some diluent onboard when unloading the backhaul of diluent at port mac ...at Valdez it would have to be something different.

The issue of safety in case of de-railment accidents is addressed somewhat as the 6 inch foam insulation wrap will act as a tremendous impact absorber, much like a good helmut offers....

yes there are a lot of costs and details to work out. No doubt about that.

Rail is most always way more efficient than jamming crude down pipelines. But efficiency needs to be defined.

Is it in terms of GHG emmissions? Or operational cost? Are GHG emissions a cost burden to a Pipeline CAPEX or just a cost passed on to the shippers rather than the pipeline owner?

In the case of an electric driven rail link, the GHG's are very low if the power comes from the BC grid, assuming we stop buying that cheap coal power overnight from Alberta..... :) :)

would imagine the off-loading of cooled bitumen (not dilbit) would be a problem though.

It would see this would be no more of a problem for tar sand oil delivered by rail to AK than by pipe to the BC coast.

Rail is most always way more efficient than jamming crude down pipelines

???????? you must have meant inefficient.

This article is from 2005 put pipeline shipment from Houston to NY city at $1.05/barrel at the time. Oil shipment in the well rail served GOM great plains regions is said to lay at $6.00/barrel or there abouts in the above post.

Now add a little distance to the rail shipping

from a 2009 Investing Daily article

CN’s economic feasibility study concludes that Canadian oil producers and their customers are paying CAD17.95 per barrel to ship oil from Alberta to US gulf coast refineries

...you are talking way more than a few dollars a barrel. Rail shipment looks to be stopgap until pipes are built.

Yes you are right. What was CN going to do?

They would offload onto a supertanker. I just have not learned what they will do when it gets to Asia somewhere.

Does it retain enough heat so they can unload it quickly? Any ideas how that will work?

RE; Rail efficiency. I explained that part. and so does CN Rail in their analysis of what the actual costs are for shipping 70/30 dilbit by pipeline.

I think they concluded they were cheaper and scalable up and down. and did not necessarily require 15 year contracts.

"Efficiency in general describes the extent to which time or effort is well used for the intended task or purpose. It is often used with the specific gloss of relaying the capability of a specific application of effort to produce a specific outcome effectively with a minimum amount or quantity of waste, expense, or unnecessary effort. "Efficiency" has widely varying meanings in different disciplines."

This holds true for CN's application .... in the sense that the rail or track is already there.

In the case of the AL-CAN rail link. The track has to be built.

To compensate for this, it will require long term shipper committments from Asian buyers.

Something that is the easy part to come by.... if you believe the investments various Asian companies have made in the oil sands of Alberta lately.

more on this later if this idea catches anybody's attention....which so far, other than a few...(which I do not mean to offend) has not attracted too much comment.

It must mean it's not doable. Ever.

So.

Moving oil to the US Gulf Coast makes sense. By Pipeline or Rail. Close to same cost. (if you accept that Keystone will eventually get approved and that the extra Billion just tacked on won't go much higher)

But moving it about 70% of this distance is not doable. That's Crazy.

So I know when to quit when I'm ahead!

Let the WTI-Brent Spread and non-marketplace for oil sands continue !!!

So it's true that there is no Free Lunch. Even though Enbridge says the uptick is there the moment Gateway starts loading supertankers at Kitimat....

What about 200 unit trains RockyMtnGuy?

I would say they would be about twice as long as the sidings on the tracks. You can probably get up to 120 cars on a train, but beyond that you would have to start redesigning the railroad system to make it fit.

100-car trains of 100-ton cars work out pretty well - 60,000 barrels or so of oil. They can pull it with a couple of big diesel locomotives on the front, and a couple of mid-train locomotives on remote control. If they were electric, you could use half as many locomotives - one on the front and one in the middle. Two guys in the head locomotive, one to drive it, and another to smack him in the head if he falls asleep. Beyond that, it starts to become less efficient.

There are a few pieces of the puzzle missing here.

One of them is that Enbridge Pipelines (which happens to operate the biggest pipeline system in the world), bought BP's Cushing to Chicago Pipeline System (CCPS) in 2003. In 2006 they reversed it to take oil from Chicago to Cushing and renamed it the Spearhead Pipeline. In 2009 they boosted its capacity from 125,000 bpd to 190,000 bpd.

If you look at the map, there are two Enbridge pipelines delivering oil from Alberta to Superior, WI, and two delivering oil from Superior, WI to Chicago, IL and Flanagan, IL. And from there the Spearhead system delivers the oil to Cushing, OK.

That's just one of the reasons there is so much oil filling up the storage tanks in Cushing, OK. Another major reason is TransCanada Pipeline's Keystone system. But, there are others as well.

You forgot the other reason.

The oil filling up Cushing is heavy high sulfur crude

which people don't want to refine. Yes, US has the capability to refine it having done for the heavy Mexico Maya 22 deg and Venezuelan Bachaquero 17-24 deg for half a century.

But nobody likes it.

http://www.eia.doe.gov/dnav/pet/pet_pri_wco_k_w.htm

I guess Cenovus also owns the Wood River refinery.

Frankly I thought the US would get our syncrude nicely cleaned up but where's the profit in that?

It rubs me the wrong way that bastards would degrade

nice clean syncrude and abuse good old pipelines to shove out this goop nobody wants.

And Gnewt Gingerich wants to terminate the EPA.

The oil filling up Cushing is heavy high sulfur crude which people don't want to refine.