Drumbeat: May 13, 2011

Posted by Leanan on May 13, 2011 - 10:27am

Gulf states seek high-tech oil boost

RIYADH, Saudi Arabia (UPI) -- Persian Gulf oil producers are turning to advanced technology as fields become depleted and extracting the crude becomes more difficult while global demand grows.Energy industry analysts see a major surge in demand for oil that, even if there are no serious disruptions in supply in the Middle East because of the current political upheavals sweeping the region, will challenge the current supply base to the limit.

Subsidies give Saudis an appetite for oil

In the desert outside Riyadh, young Saudis spend entire nights drag racing. There are few other options for entertainment in the kingdom and such car races are an economical way of letting off steam.Thanks to government subsidies, petrol costs only 12 cents a litre in Saudi Arabia, making it cheaper than bottled water.

The same subsidy system also holds down the prices of drinking water and electricity consumption in a country where almost all buildings are air-conditioned.

At least 1 dead as Syria regime changes tactics against protesters

BEIRUT — Syrian security forces opened fire on thousands of protesters Friday, killing at least one person with a gunshot to the head as soldiers tried to blunt demonstrations by occupying mosques and blocking public squares, activists said.The death in the central city of Homs marks the latest bloodshed in what has become a weekly rhythm during the two-month uprising, with protesters taking to the streets every Friday, only to be met with bullets, tear gas and batons.

China suspends export of diesel fuel amid shortage

China's economic planning agency says it is suspending exports of diesel fuel to help counter shortages likely to worsen during the peak summer months, as the country endures widespread power shortages.

Heinberg: Will Natural Gas Fuel America in the 21st Century? - Foreword to new report

A detailed new energy report argues that the natural gas industry has propagated dangerously false claims about natural gas production supply, cost and environmental impact. The report, "Will Natural Gas Fuel America in the 21st Century" is authored by leading geoscientist and Post Carbon Institute Fellow J. David Hughes.

EPA Pressures Pa. to Tighten Wastewater Disposal Standards

The U.S. Environmental Protection Agency on Thursday stepped up pressure on Pennsylvania regulators to tighten wastewater disposal standards for natural gas drillers, a federal assertion of authority that rubbed the Marcellus Shale industry the wrong way.The EPA directed the six biggest Marcellus Shale natural gas operators to disclose how and where they recycle or dispose of drilling wastewater in the region. Those companies have promised to abide by a call from Pennsylvania's top environmental regulator to stop sending their wastewater to 15 treatment plants by Thursday.

Pensacola Beach recovering 1 year after spill

PENSACOLA BEACH, Fla. — Pensacola Beach's famously white sands — coated in thick crude last year after the nation's worst offshore oil spill — are back to their original color, and tourist arrivals outnumber what they were before BP's blown-out well spewed 172 million gallons of oil into the Gulf of Mexico.Hotels and restaurants that sat largely abandoned at the height of the spill are reporting a 50 percent increase this spring compared to the same time last year before the disaster.

Missed Opportunity: Transit and Jobs in Metropolitan America

Nearly 70 percent of large metropolitan residents live in neighborhoods with access to transit service of some kind. Transit coverage is highest in Western metro areas such as Honolulu and Los Angeles, and lowest in Southern metro areas such as Chattanooga and Greenville. Regardless of region, residents of cities and lower-income neighborhoods have better access to transit than residents of suburbs and middle/higher-income neighborhoods.In neighborhoods covered by transit, morning rush hour service occurs about once every 10 minutes for the typical metropolitan commuter. In less than one quarter of large metro areas (23), however, is this typical service frequency, or “headway,” under 10 minutes. These include very large metro areas such as New York, Los Angeles, Houston, and Washington. Transit services city residents on average almost twice as frequently as suburban residents.

Since the energy crisis of the ‘70s, motorists have been seeking ways of cutting down on transportation costs. Early on, creative motorists parked alongside roads, on private property or in commercial parking lots, which created safety concerns. These circumstances are what prompted the establishment of organized carpool lots in 1974.

John Michael Greer: Hair Shirts, Hypocrisy, and Wilkins Micawber

I field emails and comments a couple of times a week from people who are seriously troubled about the future. They see themselves as trapped in a system that’s already started to go to bits around them, and lacking the money and other resources that would be needed to make the preparations they’d have to make to weather the approaching crash. A good many of them are living in apartments with nowhere to garden and few options for energy retrofits, and they quite reasonably worry about what’s going to happen when access to energy becomes intermittent, food prices spike, and what now counts as a comfortable urban lifestyle begins the long downhill skid into the shantytown existence facing something like half of the American people within a few decades. They want to know what options I can suggest for them.The core strategy for people in this position? Use much less, so that expenditures drop well below income, freeing up money to be used to get out of the current, unsustainable situation.

Surviving the Apocalypse in the Suburbs

What if you had three weeks to prepare for a life-changing disaster? A severe ice storm, earthquake, flood, or something similar? Wendy Brown says that preparing for disaster leaves us better equipped for the changes that are happening right now. Carl Etnier interviews Brown about her book, Surviving the Apocalypse in the Suburbs: The thrivalist's guide to life without oil.

We expats wonder, what in the world are we doing here? We fantasize that we’re promoting the transition from a medieval theocratic dictatorship into something that can work in a modern world. But that would amount to a revolution, and Saudis are way too sharp to upend things. Why derail a gravy train, especially when, as Saudis will explain, it was Allah who put this oil beneath these sands?

As oil prices drop, Fed should get credit

Since the financial Panic of 2008, the Federal Reserve’s easy-money policy has been widely blamed for a global run-up in commodity prices — especially oil. Now that oil prices appear to have peaked and are coming back down, it’s time to give the Fed some credit.After flooding the financial system with cash for more than two years in an effort to stabilize financial markets and economy, the Fed is getting ready to turn off the taps. The anticipation is one reason oil prices are coming back down, according to oil market watchers like Peter Beutel, president of Cameron Hanover.

“The major factor in this market — through riots in the Middle East, floods along the Mississippi, the lack of new offshore drilling or a national energy plan, slow employment gains and a housing market in the dumps, through gains in gasoline stocks or declines in consumption — is the U.S. dollar,” he said. “And that is determined by actions taken by the Fed.”

Mississippi-River Flooding Threatens Louisiana Oil, Natural-Gas Production

The rising floodwaters of the Mississippi River, threatening towns and farms between Memphis and the Gulf of Mexico, may affect 10 percent of Louisiana’s onshore crude oil production.A total of 2,264 oil wells are responsible for about 19,000 barrels of crude a day, said Matt Ross, communications director for the Louisiana Oil and Gas Association. He said 150 companies are preparing for flooding in a four-parish area in the southern part of the state.

Russia may boost oil export duty if gasoline shortages last

Russia, the world's largest oil producer, may raise export duties on raw materials for gasoline production, if local fuel shortages persist, Energy Minister Sergei Shmatko said on Friday."It may be related to vacuum gas oil and straight run gasoline - the raw material used to produce high-grade petrol. It is exported a lot, and its export is profitable. We do not rule out raising export duties on this kind of raw material," Shmatko said.

Petronas to Build $20 Billion Malaysia Oil, Chemical Hub Next to Singapore

Petroliam Nasional Bhd., Malaysia’s state oil and gas company, will build a $20 billion refining complex bordering Singapore to benefit from increased global demand for petrochemicals and plastics.

Power outage hits biggest Venezuelan refineries

CARACAS, Venezuela - A power outage has interrupted operations at Venezuela's largest oil refinery complex.The state oil company Petroleos de Venezuela SA says some units of the Cardon and Amuay refineries in western Venezuela were temporarily halted by the outage.

Enbridge: Replacing 75 miles of Ind., Mich. pipe

MARSHALL, Mich. - Enbridge Inc. plans to spend $286 million to replace 75 miles of pipeline in Indiana and Michigan after a 2010 break that spilled at least 800,000 gallons of oil into the Kalamazoo River system, the Houston-based company announced Thursday.

Total makes Poland shale gas move

Supermajors Total and ExxonMobil have hatched an agreement to divide up a couple of shale gas plays in Poland but are keeping mum on key details.

Fossil fuels: what's not to love!

A controllable source of energy that has only two major downsides — finite supply and being the source of the CO2 that's driving climate change — what's not to love all right!

Thar She Blows: Whale Age Teaches Us about Oil

Ugo Bardi, an Italian chemist, says the history of the whaling industry really teaches us two things about peak oil or the end of cheap petroleum. As sperm whales got dearer, candle buyers experienced strong price oscillations and greater instability in the marketplace. Depletion happened without a reliable or cheaper technology on the shelf.At the end of his rumination on Moby Dick, Wagner asks a rude question. It's one that Melville posed in a later novel: do we want to become "the graceless Anglo-Saxons, who, in the name of Trade, deflower the World's last sylvan glade?"

How Lombard Odier is tackling the commodity slump

Does this mean we are at peak oil? Not at all: it simply means that resources are harder to find and develop than they were, often in more technically challenging areas (such as the Brazilian deepwater) or in countries that are harder to do business with. There is still plenty of oil out there, it is just more of a challenge to find and develop it, and that may effectively curb the ability of global oil production to grow. Hence those companies that can source new reservoirs of oil and gas stand to benefit greatly from this.This provides a strong support for oil prices up to $90-$100 a barrel as this represents the marginal cost of replacing the most expensive barrels of global oil production. As a result we feel comfortable investing in those businesses that discount lower prices than this in their valuation.

Two hard-asset letters still confident

Despite his overall imminent-shortages-in-everything thesis, King writes: “We’re at a point where it’s safe to say that there may indeed be a few more Saudi Arabia-equivalents of oil out there, offshore.”He adds: “It’s good news, although the fact of ‘more oil’ just changes the shape and timing of the eventual Peak Oil curve. The world still needs to evolve its energy systems towards efficiency, conservation and acceptable pricing, while understanding the significance of the tiny — truly tiny — amount of global energy supply that can or will soon come from alternative sources.”

Many industries reap tax breaks. Is picking on Big Oil unfair?

The oil industry, under fire from congressional Democrats for reaping big tax breaks even while amassing huge profits, responds with a simple argument: Don't pick on us.

Why This Man and His Team Are the Greenest in Rochester

For John Batdorf, this weekend's Green Living Festival all started with peak oil.It was six years ago, and Batdorf was in his mid-40s, living in Grand Blanc and semiretired from his position as CEO of his own software and computer systems company.

He remembers reading an article in Rolling Stone magazine about the inevitability of a time when there isn't enough oil to go around.

Despite peak oil, it still remains the cheapest option to generate energy per kilowatt than any other source when all costs are factored in. One reason for this is that the technology has been around for more than a century and has been continually refined with a system of distribution perfected over this period of time, unlike any other source of energy.But the fact remains that oil is a non renewable source and will eventually run out. The answer to the question “when?” is hotly debated but there is no denying that it is a finite source that is highly polluting and will continue to take a heavy toll on the world’s environment as it runs out.

HAVE YOU EVER NOTICED how many excuses we all find to not act in defense of the planet? Sure, we all have errands to run and e-mails to answer and we all need down time and the problems are so big and [INSERT YOUR BEST EXCUSE HERE]. But lately I’ve been encountering a particularly frustrating excuse that a lot of people seem to be giving for not acting: they say it’s too late, that various tipping points have been reached in terms of runaway global warming, and that especially because of the lag time between carbon emissions and increased temperature, we’re already doomed, so what’s the point of fighting back?

Much of this book is based on the research of psychologist Philip Tetlock, who examined thousands of predictions from hundreds of experts (political scientists, economists, journalists) in order to determine their accuracy. Through his study, Gardner tells us, Tetlock discovered “the simple and disturbing truth is that the experts’ predictions were no more accurate than random guesses.” However, he did find what he believes to be a factor determining which experts were able to make more accurate predictions than others. Those experts that he termed “hedgehogs,” people who seem solely concerned with looking at things in terms of one big idea, were far more likely to make inaccurate predictions. On the other hand, “foxes” are more analytical and not as confident as hedgehogs, yet are more often able to make accurate predictions.The author uses this framework of hedgehogs vs. foxes as he examines a myriad of examples of predictions from the recent past. As Gardner states, it is the hedgehogs that tend to dominate the media when it comes to discussing the future. Tune into any political talk show and you will very likely find some expert or another brashly predicting some cataclysmic change on the horizon based on a theory about one big idea (i.e. climate change, terrorism, overpopulation, peak oil, the list goes on and on). This is not necessarily a new phenomenon. Since the dawn of modern science, people have tried to use scientific methods to ascertain what the future holds. Yet history has proved time and again that people, not to mention the environments surrounding us, are full of surprises.

One-third of global food production goes to waste: FAO

The FAO found that about 1.3bn tonnes of food is wasted somewhere along the supply chain each year, with wealthier consumers in North America and Europe wasting nearly twice as much as those in poorer countries. Consumers in richer countries throw away about 222m tonnes of food each year, most of it fruit and vegetables, and nearly as much as the entire net food production of sub-Saharan Africa, at 230m tonnes.However, industrialized and developing countries tend to waste about the same amount of food on an absolute basis, the report found – 670m tonnes a year and 630m tonnes a year respectively. While most food wastage in richer nations occurs on a consumer level, in developing countries about 40 percent of wastage happens at the post-harvest or processing level due to poor infrastructure and lack of investment in food production systems – a problem the report terms ‘food loss’.

Why Sustainability Reporting Is Revolutionary

Five years ago, we worked with a number of key stakeholders to scenario plan for the volatile and resource constrained world we saw emerging. We identified key indicators of stress that would force change upon economies and businesses: Peak oil and rising gas prices. The number of weather disruptions that then led to droughts or floods impacting commodity prices. Growing inequity between rich and poor. Breakdowns in global governance mechanisms. Greater transparency and access to information as an accelerator of change.Today all those indicators are flashing amber. And because of that, we collectively must create a new pace and scale of change. One that is measured against a ticking clock that counts in days, not decades.

Challenges of a Colorado Local Food Initiative

Building up Boulder County’s local food system – increasing the capacity for food to be grown, processed, distributed and sold within the county – is a goal of Boulder-based nonprofit organization Transition Colorado. The organization’s outlook is informed by the global Transition movement, a grassroots effort tied to the Transition Network in the United Kingdom and focused on strengthening communities dealing with what Michael Brownlee, cofounder of Transition Colorado, refers to as a “convergence of global crises.”

NFU wants South Frontenac livestock bylaw revisited

"Local 316 has been active over the past decade in building the local food system in Frontenac and Lennox & Addington Counties, in the City of Kingston and beyond," she said. "Given the likely circumstances of the future peak oil, climate change, uncertain global and political conditions and food shortages we believe that every community needs to protect the food security of its citizens by increasing the community's ability to grow and process its own food."Permitting the residents of South Frontenac Township to keep limited numbers of livestock, particularly small livestock, on properties under three acres in size, will increase the community's food production capacity, by building its knowledge, skill and experience."

Coal Curriculum Called Unfit for 4th Graders

Three advocacy groups have started a letter-writing campaign asking Scholastic Inc. to stop distributing the fourth-grade curriculum materials that the American Coal Foundation paid the company to develop.The three groups — Rethinking Schools, the Campaign for a Commercial-Free Childhood and Friends of the Earth — say that Scholastic’s “United States of Energy” package gives children a one-sided view of coal, failing to mention its negative effects on the environment and human health.

In a Green Town, Activists See Red Over Lockheed Martin

BURLINGTON, Vt. — Car sharing is beloved in this laid-back college town, as are solar panels, rain gardens and most anything designed to fight global warming from the ground up. A bicycle service will pick up your kitchen scraps for composting, and farmers will deliver your vegetables in a biodiesel-fueled truck.Pride in these homegrown efforts runs deep, and so some Burlingtonians were livid when Mayor Bob Kiss announced a partnership late last year with Lockheed Martin, the military contractor, to work on clean-energy projects.

In a Changing Antarctica, Some Penguins Thrive as Others Suffer

In the past three decades, the Adélie population on the peninsula, northeast of the Ross Sea, has fallen by almost 90 percent. The peninsula’s only emperor colony is now extinct. The mean winter air temperature of the Western Antarctic Peninsula, one of the most rapidly warming areas on the planet, has risen 10.8 degrees Fahrenheit in the past half-century, delivering more snowfall that buries the rocks the Adélie penguins return to each spring to nest — and favoring penguins that can survive without ice and breed later, like gentoos, whose numbers have surged by 14,000 percent.

Global resource consumption to triple by 2050: UN

UNITED NATIONS — Global consumption of natural resources could almost triple to 140 billion tons a year by 2050 unless nations take drastic steps, the United Nations warned Thursday.A UN environment panel said the world cannot sustain the tearaway rate of use of minerals, ores and fossil and plant fuels. It called on governments to "decouple" economic growth from natural resource consumption.

With the world population expected to hit 9.3 billion by 2050 and developing nations becoming more prosperous, the report warned "the prospect of much higher resource consumption levels is far beyond what is likely sustainable."

Ten Billion of us in 2100 - U.N. World Population Prospects

A very lightly covered recent story was the release of the United Nations "World Population Prospects: The 2010 Revision" report in early May. This fascinating study gives us some insight into how our world will look in the future and how population distribution will change over the next 90 years.

Oil Rises a Second Day, Climbs Above $100, as European Growth Accelerates

Crude oil rose for a second day in New York after stronger-than-forecast economic growth figures for the euro zone fanned speculation that fuel demand in Europe will increase.Futures climbed as much as 1.7 percent to more than $100 a barrel. Gross domestic product growth in the 17-nation euro region accelerated to 0.8 percent from 0.3 percent, the European Union’s statistics office said, beating the 0.6 percent median forecast in a Bloomberg survey. The Bank of Korea unexpectedly kept interest rates unchanged after two increases this year.

Wholesale prices rise due to pricier gas, food

WASHINGTON — Companies paid more for raw materials and factory goods in April, mostly because energy prices jumped for the seventh straight month.

There is plenty of life left in this Oil Age yet

According to him, you must remember the number 3,000,000,000,000 barrels when you think about oil. "One trillion we have already consumed, one trillion we know about, and we hope there's a further one trillion to find," he says. He's clearly not a fan of the "peak oil" theory.

Erdogan to Free Tankers With $12 Billion Canal

Turkish Prime Minister Recep Tayyip Erdogan’s plan to divert tankers from the Bosporus to a new canal may unclog one of the worst chokepoints for energy carriers such as A.P. Moller-Maersk A/S of Denmark and Greece’s Tsakos Energy Navigation Ltd.

Norway curbs oil reliance in revised 2011 budget

(Reuters) - Norway's government proposed a 2011 revised budget that reduces the structural deficit before oil revenues are considered to 112.9 billion Norwegian crowns ($20.43 billion) from 128.1 billion crowns seen in October.The government said it was aiming to avoid a situation in which Norwegian interest rates rise faster than those in the euro zone so that the crown currency does not strengthen further.

Norway’s state coffers are set for a Nkr311 billion ($56.6 billion) boost from oil revenues this year but a further expected production drop is casting a shadow over the cash bonanza.

Texas could lead way in gas drilling disclosure

HOUSTON – Texas is poised to become the first state to require gas drillers to publicly disclose the chemicals they use to release natural gas from tight rock formations, a measure that could set the stage for other states and Congress to move ahead with their own initiatives to regulate hydraulic fracturing.But environmentalists caution the bill, while a step in the right direction, remains too protective of industry.

Clement will summon oil execs for gas price grilling

Industry Minister Tony Clement says he will call oil refinery executives, gasoline retailers and distributors to Ottawa and demand answers as to the rationale behind fluctuating gas prices.

Big Oil execs hit back on tax proposal

NEW YORK (CNNMoney) -- Dragged before Congress as gas prices explode at the pump, oil executives mounted a vigorous defense of their business practices on Thursday -- pushing back against plans to eliminate tax breaks for the "big five" oil and gas companies.All five executives acknowledged rising prices at the pump, but much of their testimony focused on the impact of a plan floated by Senate Democrats that would eliminate a raft of tax breaks.

US House votes for offshore oil drilling expansion

WASHINGTON (AFP) – The Republican-held US House of Representatives on Thursday voted to defy the White House and expand offshore oil drilling amid deep voter anger at soaring gasoline prices.Lawmakers backed the bill by a 243-179 margin, but it was unlikely to clear the Senate, where majority Democrats have called such efforts giveaways to oil companies a year after the massive spill in the Gulf of Mexico.

Colorado Republicans push Obama on domestic oil production

WASHINGTON — Inspired by an onslaught of constituent frets about soaring gasoline prices, three Republican congressmen from Colorado are pushing the Obama administration to boost domestic oil production as a way to give consumers relief at the pump.

Nigerian Troops Attack Militant Camps in Oil-Producing Niger Delta Region

Nigerian troops launched attacks on suspected militant camps in the country’s southern oil-producing Niger River delta after a military patrol was fired upon in the area, an army spokesman said.

Pakistan Taliban Threatens U.S. as Blasts Kill 80

Twin bombings at a paramilitary police academy in northwest Pakistan killed 80 people in what the Pakistan Taliban said was in part revenge for the killing of Osama bin Laden and a precursor to attacks against the U.S.

Hundreds of Iraqi protesters demand better services, jobs, reforms by June 7 deadline

BAGHDAD — More than 500 Iraqi protesters have gathered in downtown Baghdad, demanding better government services and more jobs.The demonstration Friday at Baghdad’s central Tahrir Square was one of the largest in Iraq in recent weeks.

Yemen's Saleh defies crowds demanding his exit

(Reuters) - Huge crowds in Sanaa and other Yemeni cities demanded on Friday that President Ali Abdullah Saleh leave after months of popular tumult that has brought the Arab world's poorest country close to economic meltdown.But in a defiant speech to thousands of flag-waving supporters, Saleh declared: "We will confront a challenge with a challenge."

Pressure mounts on Gadhafi within Libya's capital

TRIPOLI, Libya (AP) — Pressure is mounting on Moammar Gadhafi from within his stronghold in the Libyan capital, with increasing NATO airstrikes and worsening shortages of fuel and goods. An activist said Friday that there has also been a wave of anti-government protests in several Tripoli neighborhoods this week — dissent that in the past has been met with zero tolerance and brutal force.

Qatar cancels plans to build power plants in Syria

In view of the continuing unrest in Syria, Qatar Electricity & Water Co (QEWC) has cancelled plans to build two power plants in the country.

Rosneft Still Weighing Arctic, Swap Deal Before May 16 Deadline on BP Deal

OAO Rosneft, Russia’s largest oil producer, is still weighing a proposal to replace BP Plc with the U.K. company’s local venture in an Arctic exploration deal as a May 16 deadline on a related share swap looms.

Ukraine, Russia start talks on gas pricing - Azarov

(Reuters) - Ukraine has begun formal negotiations with Russia to secure a new price formula for imports of Russian gas replacing that agreed in January 2009, Ukrainian Prime Minister Mykola Azarov said on Friday."Negotiations have just begun ... but I do not doubt that we will arrive at a formula which is acceptable to us," Azarov said in an interview with Reuters.

Japan to Help Tepco Pay Nuclear Claims; Banks May Have to Write Off Debt

Japan’s government will provide financial aid for Tokyo Electric Power Co. to protect the utility from bankruptcy as it pays compensation to those affected by the worst nuclear disaster in 25 years.

Japan Credit Rating cuts Tepco's debt ratings by 2 notches

(Reuters) - Japan Credit Rating Agency has slashed debt ratings of troubled Tokyo Electric Power by two notches although they remained three notches above the triple-B (BBB) grade that could help trigger liquidation by bond holders.

Lloyd’s of London Predicts $1.95 Billion in Claims From Japan Earthquake

Lloyd’s of London, the world’s oldest insurance market, said losses from this year’s natural disasters in Japan, New Zealand and Australia will cost about $3.8 billion, making it the costliest first quarter on record.The Japanese earthquake and tsunami in March will cost Lloyd’s about $1.95 billion in claims, less than a tenth of the total estimated $30 billion total loss for the industry, the market said today in a statement. Claims from the New Zealand earthquake may total $1.2 billion, and flooding in Australia may cost $650 million, Lloyd’s said today.

Disaster Plan Problems Found at U.S. Nuclear Plants

ROCKVILLE, Md. — Despite repeated assurances that American nuclear plants are better equipped to deal with natural disasters than their counterparts in Japan, regulators said Thursday that recent inspections had found serious problems with some emergency equipment that would have made it unusable in an accident.

Uranium May Rise to $75 a Pound in 2012 After Fukushima, Uranium One Says

Uranium prices may trade from $70 to $75 a pound next year after problems at Japan’s Fukushima Dai- Ichi nuclear power plant are resolved, Fletcher Newton, a vice president at Uranium One Inc. (UUU), said in Beijing.

Panel on Nuclear Waste Disposal to Propose Above-Ground Storage

WASHINGTON — A commission created to help resolve the impasse over the disposal of the nation’s nuclear waste will propose establishing one or more sites where used reactor fuel could be stored in steel and concrete structures on the earth’s surface for decades, members of the commission said this week.

Gas prices push commuters to the train

NEW YORK (CNNMoney) -- Rising gas prices are helping drive big growth in ridership at several public transit systems across the country.In Miami, passenger counts on the regional rail service connecting the city to the northern suburbs were up more than 12% in April from a year earlier, according to the American Public Transit Association.

In New Mexico, the "Rail Runner," a commuter train that runs from south of Albuquerque to Santa Fe, attracted 14% more riders last month.

And in the Raleigh-Durham-Chapel Hill area of North Carolina, ridership on the express bus service connecting the three cities is up 18%.

The spike is being attributed to people going back to work after the recession, and a steady rise in gas prices that's taxing the budgets of many motorists.

13 ways to save on gas this summer

Don’t tell the kids it’s going to be another staycation summer just yet. While the price of gas in the United States is still more than a dollar higher than the same time last year, analysts say gas prices may have hit their peak and are expected to drop, offering drivers some relief. In the meantime, there are plenty of ways to keep your fuel bill in check, from choosing the right destination to downloading the right app. Below, 13 tips for cutting the cost of that summer road trip.

Thieves drain $2,000 worth of gas from Pasadena, Calif. station

The suspects used some type of card or mechanism to trigger the pumps to release the gas. Officials say the suspects hauled it away using flatbed trucks, reports CBS station KCBS.According to police the four men made off with 528 gallons to be exact, totaling about $2,246, reports the station.

The truth about airline fuel surcharges

The truth is that the only figure that matters is the total price—base fare plus fuel surcharge—and looking at either separately is rank idiocy.

Answer to cheap power is blowing in offshore wind

During the last ice age, glaciers a mile high pushed several dozen cubic miles of rock, sand and debris into the ocean off North America’s mid-Atlantic coast, creating a broad shelf that extends up to 40 miles offshore. This long, flat stretch of seabed and the shallow, windy waters that cover it make the ideal spot for dozens of offshore wind farms — and if all goes well, the network that would link those turbines together and back to the coast will soon be in place.

Smog-eating aluminum panels launch for buildings

Buildings that eat smog? Alcoa, a maker of aluminum products, introduced an architectural panel Thursday that it says not only cleans itself but also the air around it.

Resilience planning for wild weather and climate change

Queensland, the state of floods and cyclones that devastated property, has become Australia’s laboratory for sustainable building, for creating resilient homes, offices and structures in the face of climatic volatility.In a radical scheme, Grantham residents who had confronted a deadly mountain of water in the floods, have been invited to apply for land swaps to higher ground after the small southeast town was declared the first designated reconstruction area under the new Queensland Reconstruction Authority’s powers. The local council is working with reconstruction authority to create the land swaps.

Oil slick threatens Arctic bay

MURMANSK, Russia (UPI) -- Russian scientists said it is "hard to assess" the effect an oil spill into the Barents Sea is having on marine life.The spill occurred Saturday as water from melting ice carried underground oil into Kandalaksha Bay near Murmansk, RIA Novosti, reported. By Thursday morning, a slick that was one-fifth of an inch thick in places had spread across almost 52 acres, just under one-10th of a square mile.

Coastal nations urged to preserve Arctic waters

Two hundred miles above Canada’s most northern shore lies a body of international water that has been covered in ice for more than 800,000 years – a sea the size of the Mediterranean kept beyond reach of commercial fishing interests by a vast frozen dome of white.But the ice shield is melting and no agreements are in place to prevent boats from China, Japan and other fishing nations from entering the High Arctic to reap an undersea bounty that could become accessible in just a few years.

Battle for Arctic oil intensifies as US sends Clinton to polar summit

The US government has signalled a new determination to assert its role in Arctic oil and gas exploration by sending secretary of state Hillary Clinton and other ministers to a summit of the region's powers for the first time.Clinton and the US secretary of the interior, Ken Salazar, were both at the biennial meeting in the Greenland capital of Nuuk amid fears by environmentalists of a "carve up" of Arctic resources that could savage a pristine environment.

Iceland Views Arctic Oil Rush With ‘Apprehension,’ Minister Says

Iceland, the island that suffered Europe’s biggest banking meltdown during the financial crisis, is viewing the rush to develop oil in the Arctic region with “apprehension,” Foreign Minister Ossur Skarphedinsson said.“There’s quite a lot of excitement about it in Iceland, but also apprehension because we literally are in the affluent of the Arctic Ocean so a spillage could have some serious consequences for countries like ours, as well as the Faeroes and Greenland,” Skarphedinsson said in an interview in Nuuk. “That is why it is important that the Arctic Council takes the initiative that only the safest practices will be used.”

Harper’s Arctic ice show: political stagecraft masks cold reality

The point of the exercise was to remind Canadians that the Conservative government is determined to defend this country’s sovereignty in the Far North.“The first responsibility of government is to take care of our security,” Mr. Harper told several hundred Canadian Forces troops, mostly aboriginal Arctic Rangers and others who are part of the thousand-odd Canadians involved in this summer’s annual Operation Nanook military exercises. “Nothing comes before that.”

As Clinton works against global warming in Greenland, some there don’t mind it

NUUK, Greenland — Few places on Earth have seen starker changes in weather than this icebound island straddling the Arctic Circle. With that in mind, America’s top diplomat arrived here this week intent on calling attention to the perils of climate change.The problem was that Greenlanders aren’t exactly complaining.

How peak oil solves the climate change problem

Peak oilists warn that fossil fuel depletion will cause an economic collapse.Climatologists say carbon emissions will cause an environmental crisis.

To a certain extent, only one of these doomsday scenarios can happen.

Gingrich Feels the Heat for Appearing in Global Warming Ad With Pelosi

Every presidential candidate is going to come into the 2012 race with baggage. But Newt Gingrich has what, for primary voters, could be a doozy in his closet -- three years ago, he cut an ad with Nancy Pelosi for Al Gore's climate change group.

Sierra Club wants landmark climate law altered

California's quest to create the world's first clean energy economy was again under fire this week when the Sierra Club urged Gov. Jerry Brown to drastically alter key elements of the much criticized climate protection law.The state's largest environmental group urged the governor in a May 9 letter to re-evaluate and revise proposed "cap-and-trade" business incentives, particularly the rules that would allow companies to offset their pollution by purchasing credits from clean businesses outside the state and country.

Scientist: Leave coal in the ground

The "father of climate change" has a stark message for those proposing to mine fossil fuels in New Zealand: "Leave the coal in the ground."James Hansen, the first scientist to bring global warming to the world's attention in testimony to the United States Congress, is in the country for a series of public talks.

Research Panel Says Climate Change Doubts Slow Urgent Action

Public misconceptions of climate change have thwarted urgently needed U.S. efforts to reduce emissions blamed for global warming, according to a report from the National Research Council of the National Academies.The media sometimes present aspects of climate change that are well-established as if they were “matters of serious debate,” according to the report released today in Washington. Groups opposed to policies limiting carbon-dioxide emissions are influencing some reporting, according to the study, which was requested by Congress in 2008 when Democrats were in the majority. It was prepared by a committee of scientists, engineers and economists.

2,300-year climate record suggests severe tropical droughts as northern temperatures rise

A 2,300-year climate record University of Pittsburgh researchers recovered from an Andes Mountains lake reveals that as temperatures in the Northern Hemisphere rise, the planet's densely populated tropical regions will most likely experience severe water shortages as the crucial summer monsoons become drier. The Pitt team found that equatorial regions of South America already are receiving less rainfall than at any point in the past millennium.

The article that quotes Navratil saying there are 3 trillion barrel rather than say 2 trillion barrels goes on to say he does not support peak oil. This is completely false. He supports peak oil he just places the peak a little further out say 2040 rather than 2010.

Good points. Most conventional oil depletion analysis is handicapped because of an over-reliance on Hubbert Linearization. The problem then is that peak oil "theory" is equated with a cheap heuristic and it will be judged to succeed or fail based on how the data lines up. It is really much more than that depending on how fast we can discover what is left and how much we have underestimated reserve growth.

I apply a model with a URR of 2.8 trillion and it still gives a peak around 2008. I don't know what kind of math they use to get a peak of 2040 for 3 trillion. At a constant production of 33 GB per year, 30 years is a trillion barrels, so that model could be a long plateau followed by a steep decline. The alternative is a fatter-tail slow decline, which is what I advocate. The HL model is pretty much toast and something better is needed.

The article is There is plenty of life left in this Oil Age yet just in case anyone was wondering.

The idea that there is one trillion barrels of oil left to be discovered is pure fantasy. Such a claim marks a person as one who is not really following the debate very close. Discoveries are falling off and the idea that they will one day spurt up again like they did in the sixties is just a little silly.

But Web, few of us peak oil followers are concerned with Hubbert Linearization. I haven't seen anyone post a Hubbert Linearization chart in months. And I don't see us being handicapped at all. Flow rates are what peak oil is all about. And flow rates, according to the EIA, made a new high in 2010. But a chart of JODI figures shows crude oil peaking in 2006. I am working on that data and will post a chart after the new JODI numbers come out next week. I realize that their numbers are not complete but I have allowed for that with other data and estimates.

Anyway I just wanted to point out that it is not about Hubbert at all but about flow rates. And of course oil available to all importing nations peaked in 2005. Net oil exports were down by 3 million barrels per day in 2009 verses 2005 and I expect that did not improve very much, if any, in 2010. Anyway you look at it, peak oil is in the rear view mirror.

Ron P.

I always wonder what kind of world that most of the depletion analysts live in. I happen to work in the world of statistics where you have to consider uncertainty, the role of entropy and variability, and do some logical modeling. So the fact that you have noticed that little mention of HL is made anymore is quite telling. (It still shows up in the TOD best-of archive and it is in the popular pieces, Deffeyes for example) The same problem exists with bottom-up data collection in that no room for extrapolation is possible. It is actually worse in that case because no allowance for future discovery is ever made.

The world of fantasy is where one takes a cheap heuristic and extrapolates that to some future trend, or does bottom-up without allowing for the unknown. That is why they have consistently underestimated how much we may have available.

I really don't think it is about a "debate" as much as being able to deal with the data correctly. The days of just being able to eyeball things and make assertions or put faith in heuristics are long over. The future is about statistically analyzing what we have left and dealing with renewables or other non-oil non-renewables in the same way.

The Oil Shock Model is the only analytical approach that I am aware of that actually uses flows to estimate production rates. If you don't believe me look at the equations I use.

Ron, So my larger question is how to apply that JODI number suggesting the peak occurs at 2006. What will the URR be for that data? I have a peak at 2008 for a URR of 2.8 trillion. How can one peak at 2006 give 2 trillion and a peak 2 years later give 2.8 trillion? It is really about estimating the fatness of the tail in the out years. HL fails at this and bottom-up estimates fail at this because you need a good discovery model. This is interesting stuff but I wish that a little more thought would go into a model by some other curious folks.

Web, you're joking right. Peak oil is about flow rates not URR. We will know what the URR really was when the last drop has been pumped out of the ground and not before. I hope to post my data and a chart with an explanation Friday, one week from today, or the day after. I will explain why I favor JODI over the EIA data. I have discovered a serious flaw in the EIA data and it concerns the massive revisions made last month in their data.

Up through December 2009 the EIA OPEC data had followed, very closely, the OPEC OMR data as well as the JODI data for OPEC. then in January 2010 the EIA OPEC data suddenly stopped this track and shot up dramatically as compared to the OPEC OMR and JODI data. But I am getting ahead of myself here. I will cover all this in detail at a later date. In the meantime I am still massaging the data.

I have no idea what the UUR is or will be. But I do have a very good idea when oil peaked, at least up to now. And I posted below, net oil exports peaked, quite clearly, in 2005, the same year that consumption in the US peaked. Peak oil is in the rear view mirror.

Ron P.

I'm excited to read about what you've uncovered/determined. You are referring to the 4 or 5 month period in which the production data for Saudi Arabia was revised up by 600K to 800K for each month? That revision has been bothering me since it came out.

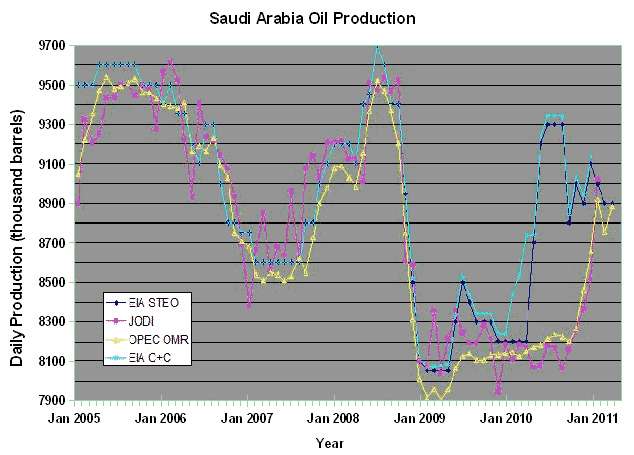

Yes, that is most of it. Here is a comparison of EIA data, both Short Term Energy Outlook, EIA C+C, JODI OPEC and OPEC's Oil Market Report. The data runs from January 2005 thru April 2011 for the Short Term Energy Outlook and OPEC's OMR, thru February 2011 for Jodi and thru January 2011 for EIA C+C.

As you can see the data for all four follows closely until January 2011 when EIA C+C suddenly starts to climb. Then in April The STEO takes off, I guess in an attempt to catch C+C. ;-) Then in June, July August and September Saudi, according to the EIA, produced almost as much as they produced in 2008. JODI and the OMR says that this didn't happen. Platts and others agree pretty much with the OMR and JODI.

I really don't believe this dramatic increase really happened because the EIA C+C did not report it when it supposedly happened, they only revised it in their January report, the last one posted.

Saudi Arabia Oil Production January 2005 thru April 2011

Note: The STEO OPEC data is Crude only while the EIA C+C is Crude + Condensate. The STEO data for all non-OPEC is all liquids. This leads to quite a bit of confusion.

Ron P.

Ron, As some helpful advice you might want to consider the XY scatter plot in Excel so that you can label the X axis with something more meaningful than months. The description of when the upticks is confusing because you said it takes off in Jan 2011 whereas it should be in January 2010?

I replotted it below :

Yes I should have said it takes off in January 2010. I often make stupid mistakes like that when I am in a hurry. Thanks for the correction.

I must figure out this XY scatter plot. I have never used it before.

Ron P.

The key to it is that you use a column for the dates and then apply a "edit, fill, series" menu command to populate the column. Then you chart with that first column as the X series, which it will do automatically if you select a block of data with the XY Scatter type. I am using OpenOffice right now but Excel does it the same way.

I did clearly state that I considered flow rates as well as the URR. The Oil Shock Model is based on stochastic flow rates modeled at different points in the oil production process. I laid this model out in the online book The Oil ConunDrum. I am not joking about this because it is based on tried and true analysis that other disciplines have used for years but from what I can gather that the oil geologists haven't figured out yet.

Surely, you are joking? I don't know how you can say this and also believe in the concept of a finite resource. There are two components to this kind of model (others call it a compartment model BTW) the estimated size of the compartments and the flow between the compartments. Without an estimate of the size of the container the flow reaches a steady-state. You are just looking at perturbations in the data from the steady-state flow and without a model of the size you really can't get a handle at the long-term truth.

No doubt that what you are doing will help in figuring out some of the recent OPEC data but that is not what we are talking about, which is the long term analysis. So you really have no idea of how much oil is in the tail of the decline?

Of course you can say that it will depend on price, but that will point back to a quantitative analysis as there are estimates of URR for the different grades of crude oil and one can apply the concept of EROEI to see how effective extracting that difficult oil will be.

Web, I am not in the model building business. And to Oct who wrote below:

I am not a seer of the future either. As far as peak oil is concerned I am basically a historian. Peak crude oil happened in 2006 and peak oil available to all importers happened in 2005. Also US oil consumption has decreased by almost 8 percent since 2005. Now that is a lot and that is, in my opinion, very important. The reason for that decline was peak oil and in particular peak oil exports which took place in 2005.

No, we are really debating peak oil, whether it is in the past or in the future. My argument is that it is in the past and I believe the data, other than the EIA data, supports that. And even the EIA data agrees that net oil exports have declined by 3 million barrels per day since 2005.

How much oil is in the tail of the decline is important but not the most important thing. I don't think you are the seer that you believe you are. The economy is really something that is almost impossible to predict. Will there be massive inflation, or perhaps deflation? Will there be massive unemployment that will kill the demand for oil, knocking the price down? I really have no idea. All we really have is the past. All we have is the past flow rates and we can see that they are up and down but at least according to JODI the overall direction since 2006 is down.

And no, I will not say it depends on price, I will say that the price will depend on the availability of oil as well as the state of the economy. And the state of the economy depends on the availability of oil as well as the price of oil. Confusing I know but they are all tied together and the tipping point is, or rather was, peak oil.

Hmmm, I am trying to get people interested in applying some different approaches. Sam Foucher picked up on some of it a while back but that is about it. Lots of other people look at it with an open mind which is also good.

So the main thing is that I put it out here so people can take a look at it and improve on it if they so choose. Or criticize where I have something wrong.

I get a lot of "Well you haven't done Iraq or Brazil, so there!"

It helps a lot more if you say something constructive.

You are doing a fantastic job at whatever it is that you are doing. How is that? What I meant to say was I don't think your mathematics can really predict the future of oil production. Don't take it personally but I really don't believe anyone can do it, it is not just you.

Now there are a lot of things that can be said about the future, like things that will eventually take place, at least that is my opinion, for what it's worth. Like we know that the earth is in deep overshoot and sooner or later there will be a massive reduction in population. That is a lead pipe cinch. What we cannot say is when it will happen or how long it will take or how the whole thing will play out. No mathematical algorithm can be created that will predict these things.

So playing with stochastics may be lots of fun but I really don't think they are a very good predictor of the future. That was my point.

Ron P.

I'd like to make another constructive comment. I read and enjoy WHT's statisitical and mathematical model comments, but I think he has a comparative advantage in prose. His prose is excellent.

It is fair to say that nothing is certain yet probability theory is the way the world operates in terms of everything from insurance policies to gambling payouts. It is the best alternative out of the few alternatives we have for predicting outcomes. This is the no-brainer part of my decision to approach it this way. YMMV.

Web,

I'm kind of tired of hearing about Hubbert's inadequacies. He was out there making pretty darn good estimates when there was much less data to work with. More importantly, he saw the big picture before anyone else and wasn't afraid to make his case. If we can see farther today it's because we have his shoulders to stand on.

I think the reason little is mentioned about HL anymore is because so many recognize that we are just past or at least at the peak now, so there's little point to debating one model vs. another. Web, I enjoy and respect your work, but at this point our need for predictions and explanations of peak oil are less urgent than our need to figure out how the hell our kids are going to eat.

But if extraction rates change as in oil shocks, then Hubbert's math cannot account for it.

Hubbert knew that and he hand waved about it (you can watch it on Youtube if you want).

That is Web's point and it is valid, since he can model oil production with a simple model and a series of shocks in the extraction rates.

So presently the best predictive tool is Web's model.

Very well put , thx!

Jevons, Liebig, Maltus have also been "proven" wrong by far to many shortsighted professors looking "the other way".

The values of the lectures of these folks (Jevons, Liebig, Maltus, and more) will be better understood when the remedy Crude Oil falls into short(er) supply.

Wherever their spirits are ... they have probably already been seated at first row well stocked up with coke n' popcorn .... ready for the premiere of "PO_first proper act".

/snark

Exactly.

I respect the work too and if it's your thing so be it - but at some point it just amounts to so much mental masturbation.

Regardless of the ultimate shape of the "fat tail" the world we now live in is depending on their being nothing resembling a tail whatsoever... A tail refers to decline and the problem we face is not that it's X% decline being factored in to forecasts when it should actually be Y%... it's that the forecasts are all banking on X or Y% increase in production.

In other words we can't get the "serious" analysts to even recognize Hubbert consistently nevermind arguing over the details of the shape of the curve.

I've paraphrased the quote (source unknown - wish I could find it again) before on TOD - I think by a climate scientist weighing in on the "debate" over climate change - "the human species will go down in history as having studied the minute detail of its own extinction" which I took to mean that we study and study and gather data and evidence ad nauseum but what the hell does it matter when we fail to act (or even acknowledge) on what the big picture evidence is smashing us over the head with.

Kingfish, Web doesn't need me to defend him, but I think it's worth pointing out that Web (as I understand it) is concerned about the robustness of the argument necessary to influence public policy. That is, he understands that the data and standards of evidence and proof needed to change the course we are on at the level of government initiative is very high given that the established paradigm denies that there is any validity at all to the whole concept of Peak Oil.

OTOH, you and I are already convinced. I (and I'm guessing you, too), do not require Web's standards of proof in order to take the actions I believe will help mitigate the harshness of the challenges I think I will face going forward. I already possess what I believe is a robust enough data set (and at a high enough confidence level) with which to set a future course for my own little boat. But many others aren't there yet.

My own personal opinion is that it is a waste of one's time and energy to try to influence the course of public policy. But I suppose it's an interesting and enjoyable intellectual challenge to at least assemble the pieces necessary for the attempt. At any rate, I'd never try to tell anyone what they should do with their own time.

Well put. I pay close attention to the way the discussion is playing out in the media and it is predictably taking the same course as the climate science "debate", where the skeptics are now pinning the conventional PO analysis with all sorts of nit-picky arguments that they made against the GWCC studies. Certain media outlets that have never mentioned Peak Oil before are now suddenly launching into attacks (or even bringing up abiotic oil) against some analysis, say in terms of how how much the Arctic National Wildlife Refuge actually holds. How do you respond to something like that apart from actually doing a deeper analysis? Its not enough to say that Hubbert predicted something would happen, instead you come back with an up-to-date analysis and then you say that the government is holding back historical data that can help with a better analysis. You essentially want to make your case better and better so that the decision makers get convinced and the skeptics become marginalized. That is the theory anyways. People can say it is tilting at windmills, but remember as Jabberwock said, it is not wasting your time, it is using up my time which I am free to waste as I want. This forum allows me to sharpen my arguments as well, so thanks.

I actually sent a letter off to my US senator who sits on the energy committee. I haven't heard anything back yet but it doesn't mean I will not keep trying.

The above discussion reminds me of some papers by Adam Brandt. This one "Testing Hubbert":

http://www.iaee.org/en/students/best_papers/Adam_Brandt.pdf

and this one, which Brandt co-authored for the UK Energy Research council:

http://www.ukerc.ac.uk/support/tiki-download_file.php?fileId=283

The big question is whether production is best modelled by a symmetric curve (with decline rate after peak similar to growth rate up to peak) or by an asymmetric curve (with very different growth and decline rates).

In the first paper, Brandt argues that asymmetric models work better when describing regions which have already peaked. Though his analysis suggests that no single model describes all regions. For instance US Lower 48 is described quite well by a symmetric Hubbert (strictly Gaussian) model, yet is also described well by a symmetric "linear" model: straight line up to peak, then straight line down again. There are significant regions which aren't described well by any "single peak" model, notably Saudi Arabia.

There is support for this in the second paper too: see Figure 2.19 (page 34) and Table 3.7 (page 68). The estimates there are that many post-peak countries and giant oil fields reached their peaks well before they became 50% depleted; the average peak seems to be closer to 1/3 of URR. That fits in with a "fast rise, slow fall" model.

Notice that if this applies to the world as a whole, then we could easily be at (or just past peak) now, having produced slightly more than 1 trillion barrels of a URR of 3 trillion barrels. Whereas in a symmetric model, if we are at peak now, then the URR would be about 2 trillion barrels. So both positions on global URR are justifiable.

Incidentally, there is a further argument to be made here that the differences in URR estimates really shouldn't affect estimates of peak date much. If you assume a low global URR, then you should also have a low URR estimate for the countries and fields that are already past peak; so this leads to a high estimate of the depletion fraction at peak e.g. close to 50%. Whereas if (like Brandt) you assume a URR of about 3 trillion, say based on USGS 2000, then you should also assume a high URR (+ fat tail) for the countries and fields that are already past peak, which brings down the estimate of their depletion level when they were at peak e.g. to around 35%. These effects will compensate each other, and peak should still be about now whatever URR you assume.

What you can't plausibly do is argue for a high URR, and a symmetric model. It's even less plausible to argue for a high URR and an asymmetric model but skewed in the other direction (with faster decline rates than growth rates). That's the only way you can get a peak around 2030 or later.

By the way, the above only applies to conventional crude (or C+C). "All liquids" is a bit different.

That is pretty much the premise.

That finding results from doing the modeling.

That contradiction makes the case against Hubber Linearization, as this would push the peak to the out years.

I recall reading recently a remark once made by the late Daniel Patrick Moynihan to the effect that “everyone is entitled to his own opinions, but not to his own facts.” (Quoted from memory.) I think of that remark now whenever I encounter peak oil and global warming deniers—not that it’s any help in arguing against such denials, since the disputes invariably revolve less around facts than around opposing, but not always explicit, worldviews (e.g., limits to growth vs. none). Reminds one, too, of Thomas Kuhn’s suggestion that new paradigms don’t gain ascendancy so much because they convert those who cling to old paradigms as because those who champion the old ones eventually die off. In a way, Moynihan’s remark, just as Kuhn’s work, points to the difficulty of having rational or fruitful arguments when profoundly different perspectives are in conflict. If a fact is a datum in a system of data (forget where I first heard this idea), there is not surprisingly a lot of arguing at cross purposes with respect to global climate and resource depletion. In the end, of course, nature will do what nature will do, regardless of what we humans think.

Yes, Max Planck expressed the same idea when he said: Science advances one funeral at a time.

Ron P.

Yet, there is a big difference between the facts and the truth. We are at the mercy of whoever provides us with data to quantitatively interpret the facts. So the facts equals the data we can access at the present time with a large dollop of uncertainty thrown in. The truth is what lays underneath the data after reducing the uncertainty and what is in store for the future.

So the context is what is closer to the truth: a 2 trillion URR that is guessed at by some of the questionable heuristics we have used in the past, or is it closer to 3 trillion that this guy Navratil proposes? Who knows, he may have his own model that he is keeping to himself or his organization. I don't really go for that approach and prefer to keep the analysis out in the open.

The difference between 2 trillion and 3 trillion will make a difference, as will the lower-grades of crude that will still be available.

The truth doesn't pay attention to the binary distinctions of 2 trillion equating to peak oil and 3 trillion indicating not peak oil. But this doesn't mean that you give up on seeking the truth, because it will in fact help with decision-making policy.

The climate scientists know the importance of distinguishing between the data and the truth. The facts and data is what we observe right now and what exists in the historical record. The truth is only found out by applying a scientific method and extrapolating to the future.

Well, let's test that astounding assertion with, say, meteorology - and by that I mean the subject that applies "scientific method" in the form of computer models to "extrapolate into the future" and forecast tomorrow's weather (as opposed to the rather different subject of TV talking-heads spectating out loud at screens displaying possibly cherry-picked model results.)

The test seems to go rather badly, since there are plenty of disparate forecasts for tomorrow's weather, depending on the vagaries of which scientific model and which run one might examine. There simply is no "is 'the truth' "; there is only an assortment of quasi-"truths" that cannot be sorted out until after the fact. And the long persistence of a plurality of "scientific" models producing disparate results for the same data set is a bit disturbing with respect to assigning a useful meaning to the adjective "scientific" as used in "scientific model."

Now I could be wrong, but I would absolutely expect resource depletion models to suffer from analogous problems - and in spades since inherently uncharacterizable and unpredictable (with even remotely adequate precision) economic and social factors also come into play, unlike with tomorrow's weather which is essentially pure physics. So a bit of humility might be in order.

To make a statement against someone's science using weather models as your talking point is rather cynical. The same can be said for politicians that predict how the markets will respond to their policies.

Of course, thermodynamics, electrodynamics, chemistry, physics -- all those predictive tools turn out to actually be reasonably correct.

So why would oil extraction be subject to the laws of the unpredictable weather?

It is not so hard to understand. There is oil only on the upper skin of the earth and we poked holes all over the planet. There are plenty of economic forces pushing for extensive drilling. We even know where oil is that we are not allowed to drill yet.

So how do you reckon the model is wrong? (That everyone lied about past discoveries?)

How do you know that random dispersive processes do not follow natural log relationships?

The discoveries peak alone tells you the truth of the matter. Forget the exact minute and second of the peak. No one can deny history.

So Web's model is basically saying that extraction rates and depletion kinetics will occur according to natural rate laws. What do you disagree with there.

Basic issue is that we are trying to predict the rate of extraction, into the future. Agreed?

That rate is determined partly by geology & technology - mainly the upper bound. However it's much more defined by the societal systems and feedbacks that drive which resources get extracted, in what order, to what level of completeness, and with what caps put on practical rate extraction.

Even worse, the rules of the game on the way up ARE NOT the rules of the game on the way down. The reality that there will be less available tomorrow ripples changes throughout the system and behaviours. Therefore taking what's happened in the past cannot give you information on what will happen in the future.

WHT's model is a resolutely stochastically/mathematically based model, and implicitly takes how things behaved before as the model of how things will happen in future. Furthermore, in previous discussions, WHT has said he doesn't hold with complexity or detailed system feedback effects as the determinates for a workable future production model (I think I remembering him say he didn't hold with complexity at all).

So that's why I think the model is wrong - it ignores the system and the complexity derived from system effects. It might give an estimate of the upper bound, but even here, you can conceive of a scenario where exploration rates is a decision taken out of the hands of businesses (eg it might increase).

I kind of liken it to Black-Scholes in economics - nice maths that works OK within the confines of the assumptions made, but where those assumptions mean it stops working when interconnected system effects dominate.

Sure, no one has tried to do this before, and I think I have a good framework for the analysis.

I gave a decent account of my evaluation of complexity in a TOD article I wrote a while ago. The gist of it is that as things get more complex, they actually get simpler to evaluate. This is not actually a very extraordinary statement as it explains all of statistical mechanics and entropy. This simplification also explains things like random matrix theory and network behavior which have been in the news recently. These tend to converge to simpler expressions independent of the complexity of the configuration. I am just applying these ideas to disciplines that haven't been exposed to the ideas or that the people in charge didn't think they would need.

Stuff like chaos theory and attractors is actually craptastic because those ideas actually don't consider the complexity in the proper context, which involves the state of disorder in the system. Once that goes through the wash you are left with behavior that simply revolves around the mean energy values and a maximum entropy spread in variability.

Yet the point is that no one has actually made the effort to get to the point I have gotten to. That should be the baseline. You need to get to at least this point, and consider the disorder in the system, before you go on to the next stages, which is what you are advocating. If these second-order effects are swamped by the first-order effects of entropy, then you are really back at the baseline. I would like to see an example of something that I could try to deconstruct.

I think I am on to something very obvious with most of my work and that is the problem. It is so blindingly obvious and run-of-the-mill in fact that most physicists and scientists don't want to admit to it or discuss it further. You see, disorder smears the effects that they desire to see. The physicist and economist Didier Sornette, who is an associate of Taleb of Black Swan fame and has worked with Laherrere, wrote a book on critical phenomena in the natural sciences. Its a good book because he does a lot of useful analysis, but in one section he goes through all the possible mechanisms that could give a "power-law" distribution which is a hallmark of certain interesting physical processes (and potentially Nobel Prize worthy). Yet he completely neglects the fact that one obvious case of power-law comes from dividing two random distributions each with a mean. Something as basic as Rate is deltaX/deltaT can give a power-law distribution. But this is not considered interesting because it is not earth-shattering new physics so Sornette conveniently ignores it. Well, I don't ignore it because that is the state of the world; all these agents performing independent seemingly random processes yet it all becomes easily characterized. -- just take a look at the distribution of stripper wells upthread, that is a one parameter fit and I don't need to understand system complexity. That result comes through the wash of disorder and entropy all on its own.

Like I said, you have to get to this point before you take it somewhere else. You are applying the leapfrog argument or demanding impossible perfection, whereas I suggest that we look at what we have and go from there. I am seriously looking at the possibility that the model is wrong but you have to really lay out the special context before it means anything to me, more than just an assertion on your part. You want EROEI, I can add that easily. You want a networked ELM model, I could take a shot at that.

You still haven't shown an understanding or appreciation of probability as this same knock comes up in many of your comments. When you are talking about quasi-"truths", I immediately see that as a probability distribution. So the weather forecasts are multiple continuously updated Bayesian estimates that get better and converge over time. Most people don't see it that way, and it doesn't have anything to do with humility, but depends on education level. Not much I can do about that situation.

WHT prediction of FSU

http://mobjectivist.blogspot.com/2005/11/fsu-oil-shock-model.html

according to him, it should be in decline by 10% by now. As I said before if you get countries like Russia wrong you will get world production wrong and you did.

If he starts doing weather forecasts we will all be wearing coats in July.

Thanks for providing the example. That chart from 2005 showed a projected trajectory given only knowledge of the previously reported FSU yearly discoveries. In other words, there was no discovery model attached to the data. It was raw discovery data, with no modeled extrapolation for future discoveries.

So what you are seeing in my blog is the analysis done in real time over the years. I started essentially in 2005 with the Oil Shock Model and a gradual refinement until I could put it together within the larger volume (The Oil ConunDrum). So when I made that chart I still hadn't come up with the Dispersive Discovery Model that I only completed in 2007.

Earlier this year, I spent some time revisiting FSU and comparing it to the alternate ASPO prediction for FSU. This time I actually placed in an extrapolated Discovery Model for the out years. So in a way this was a calibration of the model. This is what it looks like when laid up against the ASPO. The key idea here is to look at the oil shock perturbation notch during the FSU breakup and see how it models the production profile. That's pretty neat.

So it shows lots of things going on, and of course the out year projection is based primarily on the model of past discoveries and that the proportional extraction rate maintains at the historical levels. Its a good start and am proud of my work with the data I have available.

Now Web, the one thing I thing we all do not know is what the future rate of extraction may be. How will the oil extraction rate constant shift in the future? That is a source of uncertainty in your model.

Of course, what people may not appreciate. The way it will go based on a historic perspective is a decrease in oil extraction rate. World oil extraction rate has not increased since the 70s. Thus peak oil would only hit a little further out.

So... why all the fuss?

Just want to acknowledge to all involved that this is one of the better strings I have seen on TOD for the last year or so. I was here >5 years ago to learn but don't post much anymore. Nothing to contribute and nothing really new in the data or discussion, just noise around previous predictions. I check in once in a while to catch up on insider details.

I congratulate all the posters in the string for staying civil, talking about the complexity of the problem and difficulty in making accurate predictions over any 24 month period. This is how differences in interpreting highly complex issues should be discussed. Nearly everyone seemed to be learning about something or somebody along the way. Highly useful example to newcomers IMHO.

Yes, certainly that shows up in the cusp of the oil production profile for FSU near the peak at 2010. My estimate returned the extraction rate to what it was previous to the Soviet breakup. We knew the extraction rate had to rebound after the transition but we don't know if would return at a higher or lower level than before.

Was the capitalist Russia more greedy than the Soviet Union, or did they have more efficient technology? That's essentially a judgment call so I left it as is. Yet the point is that one can fiddle with the stochastic mean extraction rate and see how the outcome will change.

I think Westexas and Foucher have a similar analysis for Russia with a spread of outcomes.

Sounds like you are a cherry picker. But you failed to cherry pick the correct predictions. Maybe your horse-blinders are on too tight to show both sides of the coin ;-)

Aspo published paper with some interesting predictions particularly Saudi Arabia

http://www.aspousa.org/index.php/newsletters/peak-oil-review/file-librar...

The Aram thesis clearly shows that people should not be too sure of themselves when they say peak oil happened in 2006

http://www.tsl.uu.se/uhdsg/Publications/Aram_Thesis.pdf

The first paper is hand-wavy qualitative and I have read some of Bentley's other papers which say basically the same thing.

The second paper does modeling but makes no mention of convolution and doesn't consider proportional extraction rate, which is the key to adding elements variability to the calculation. His way is not the way I model the real world.

The point is that Russia does have some difficult-to-reach frontier areas that could contain future oil discoveries. That explains why the global context is important. The amount of oil left to be discovered in Russia is smaller in proportion to the world than it is to the total in Russia. This is simply an application of the law of large numbers. The peak may extend for Russia but not necessarily for the world.

Need to clarify your point.

The point is the Sam Foucher did this piece on Russia a couple of years ago.

http://www.theoildrum.com/node/3626

He calculated production level from new fields, however most of them have in fact done better than he predicted.

There are also new areas which are believed to contain quite large amounts of oil, so could delay peak by another few years.

http://premier.gov.ru/eng/events/news/14105/

We have increased our output of oil and gas. Growth in gas production has reached almost 12%. As for oil, for the first time ever, we have produced 505 million tonnes per year. Today, Russia is the world’s leading oil producer. And we must continue to maintain this production level in the years to come.

I’d like to draw your attention to the fact that we have increased oil output primarily by extracting from major deposits in Eastern Siberia, such as Vankorskoye, Talakanskoye, and Verkhnechonskoye. We have also begun production at the Korchagin deposit on the Caspian Sea.

OK, so now we have established you are from Russia. Russia is one area from many when we consider global oil projections. My estimate of URR of 2.8 trillion barrels accounts for future discoveries in remote areas, such as from Siberia for example.

The point I have been making for months on end now is, if an error is made with a significant country such as Russia then the error will effect global predictions.

Non OPEC did not decline because Russia did not decline.

There are just a handful of countries whose rate of increase will determine future global production, none are more important than Iraq.