Drumbeat: May 27, 2011

Posted by Leanan on May 27, 2011 - 10:10am

OPEC oil output rises in May - survey

(Reuters) - OPEC crude oil output is expected to rise in May as extra oil from Saudi Arabia, Nigeria and Iraq counters a further decline in Libyan supply, a Reuters survey found on Friday.Any extra supply from the Organisation of the Petroleum Exporting Countries is likely to be welcomed by consumer nations concerned about the impact of oil prices well above $100 a barrel on economic growth and inflation.

High gas prices change holiday travel plans

NEW YORK (CNNMoney) -- The high price of gas is forcing many Americans to change their travel plans for the Memorial Day weekend, according to a survey released Friday.A CNN/Opinion Research poll showed that one in four adult Americans have altered their plans for this weekend because of high gas prices, and more than half say they have changed their overall vacation plans.

U.S. natgas rig count climbs 15 to 881-Baker Hughes

NEW YORK (Reuters) - The number of rigs drilling for natural gas in the United States climbed 15 this week to 881, its first gain in three weeks, data from oil services firm Baker Hughes showed on Friday.

Ukraine faces huge gas transit losses by 2015

MOSCOW/BRUSSELS (Reuters) - Russia's Nord Stream and South Stream pipelines could deprive Ukraine of the equivalent of two-thirds its gas transit volumes when they start up, threatening the country with significant losses in revenues.Russia supplies Europe with one quarter of its gas needs and 80 percent of that gas is delivered via Ukraine. The remaining volumes travel through another western neighbour, Belarus.

Weathering The Storm: Above-Normal Hurricane Season Predicted

Though hurricane predictions vary depending on the source, four forecasts for the 2011 hurricane season, which runs from June 1 through November 30, agree that there will be an above normal number of hurricanes in the Atlantic this year.

Aramco discussing globalization strategy

HOUSTON - Saudi Aramco, the world’s biggest oil company in terms of oil reserves and production, is discussing a strategy to extend its operations into more than 50 countries in the next 10-20 years.“We want to transform Saudi Aramco from a leading oil and gas company into a fully integrated, truly global energy and chemicals enterprise with extensive operations in the kingdom and around the globe,” said Aramco President and Chief Executive Officer Khalid A. Al-Falih in an interview posted on the company’s web site.

Why Keystone Pipeline Will Weaken the US

Big, long pipelines don't create resilient communities let alone healthy energy appetites for that matter. And in the case of Keystone XL the pipeline will actually raise, not depress prices at the pump. Nor will it improve energy security by one gallon. In the end the pipeline will simply become a Tar Sands Road to China. That's right, China.That blunt analysis comes from the internationally celebrated oil and gas consultant Philip Verleger. The U.S. economist has studied the behaviour of oil markets for decades, recognizes hubris when he sees it, and has written 100 articles and books on the weird world of energy economics.

Floodwaters Shut Down 30 Oil Wells in Williston Area

About 30 oil wells were shut off ahead of the rising water on the Missouri River west of Williston and a few of those wells are now under water.

The prudence of a Chinese-funded security strategy for Af-Pak

Already China has saved the day in Central Asia, building large pipelines that have helped to snap a Russian monopoly on oil and natural gas shipments from the self-hobbling Turkmen and Kazakhs, an aim of western strategists since the mid-1990s. Now Pakistan has asked China to build it an Arabian Sea naval base. Should the world be alarmed? No it shouldn’t -- we ought to appreciate more Chinese-funded execution of western-backed strategic aims both there and in neighboring Afghanistan.

Tom Whipple - ENERGY: Peak Oil and the Great Recession

When in the late 1990s it was recognized that world oil production was likely to start declining early in the twenty-first century, petroleum geologists and other industry observers started talking and writing about the economic damage this event would cause. Serious economic consequences were a virtual certainty because, since the beginning of the industrial age, economic growth had required increasing quantities of fossil fuels.During most of the twentieth century economic growth increased the demand for oil, which had come to serve as our primary transportation fuel, the source of energy for many production processes, and the raw material for an ever-increasing range of industrial products. Unless satisfactory substitutes could be found quickly, economic growth was likely to stop. And without alternatives, economic decline—if not a collapse—was likely.

In diplomatic shift, Russia calls for Gadhafi to step down

Tripoli, Libya (CNN) -- Russian President Dmitry Medvedev has joined American and other European leaders in calling for Moammar Gadhafi to step down from power -- a shift that appears to indicate a closing diplomatic window for the longtime Libyan strongman.

Britain says Libya war entering new phase

(Reuters) - Prime Minister David Cameron said on Friday that NATO's war to oust Libyan leader Muammar Gaddafi was entering a new phase and that the deployment of British helicopters would turn up the pressure.

Yemeni jets bomb opposition tribal forces

(CNN) -- In an escalation of Yemen's crisis, air force combat jets bombed tribal forces opposed to embattled President Ali Abdullah Saleh, a senior defense official said.

Yemen Shortages Worsen as Street Violence Leaves Locals Searching for Food

Safiah Hussein al-Raimi stood for hours outside a store in Yemen’s capital, Sana’a, for five straight days to buy a tank of cooking gas to prepare food for her husband and four children. She left empty handed each time.“Life is becoming hell here and we can’t afford it,” al- Raimi, 43, said as she lined up during her fifth attempt. “We have no gas, no power, not enough food.”

Syrian forces fire on protesters; 8 killed

(CNN) -- Syrian security forces fired on anti-government protesters in several southern towns Friday, killing at least eight people, organizers said.Bullets flew in the early morning hours as hundreds took to the streets in Dael to chant for support of the military, separate from the security forces, said the witness, who refused to be named for fear of his safety.

Fuel shortage in Egypt adds to the poor’s woes

CAIRO - How could a widow live on a monthly pension of LE240 ($40) and afford a butane gas cylinder for LE17? The answer to this question shows why consumers have to queue up for hours outside main outlets to buy a cylinder for the official price of LE4, particularly in times of shortage, when the price shoots up five times or even more.These queues usually lack the least degree of order. Skirmishes and fights erupt easily, either because of little respect for the queue or because of short supply.

Currently, the proportion of energy from coal in Pakistan is negligible — only 0.10 percent of our total energy generation. The development of Thar coal can be a major catalyst for the nation to unite and work towards common objectives.

NEPRA raises power tariff as people demand electricity

ISLAMABAD: The average Pakistani is being handed a double deuce by the electricity generation companies. While the load shedding hours increase steadily, the National Electric Power Regulatory Authority has authorised a power tariff hike.

Power cuts darken mood in Pakistan

As Pakistan’s leaders continue to agonise over the US’s breach of their country’s sovereignty following the killing of Osama bin Laden its people are more concerned with something closer to home: power cuts.Nationwide power shortages have brought protesters on to the streets of Pakistan in recent days with many parts of the country suffering “load-shedding” when power utilities, long starved of investment, cut back supply. The result is that as the stifling summer heat rises many households are lucky to receive eight hours of electricity a day.

The air conditioners and fans cut out in near 50C summer heat and violence soon follows.

Motorists run dry as Sharjah follows Dubai with petrol shortage

SHARJAH // For the second time in just a few weeks some motorists found themselves unable to refuel their vehicles because of a petrol shortage .Last month, petrol stations in Dubai ran short of fuel because of a "hold-up in logistics operations after tanker lorries failed to arrive to the loading decks on schedule".

Vietnam: Illegal petrol speculation leads to shortage

HCM CITY — Stiffer penalties should be imposed on filling stations to prevent speculation at petrol retailers around the country, according to industry experts.Vuong Thai Dung, deputy general director of the Viet Nam National Petroleum Corporation (Petrolimex), said Government regulations required that petrol retailers be supervised by their wholesalers to create a more transparent petrol manufacturing chain.

SKARDU: The damage to Alam Bridge, Baltistan’s only connection with the rest of the world, has not been repaired despite the passage of nine days, leading to scarcity of petrol and diesel severely hitting the two districts of Baltistan.

Fracking may change South Africa's energy future

The discovery of natural gas through hydraulic fracturing, or fracking, could be a game changer for the South African economy, believes Philip Lloyd, a professor at the Cape Peninsula University of Technology.

Nigeria signs gas supply deals with energy firms

(Reuters) - Nigeria signed domestic gas supply agreements with some of its biggest foreign energy partners on Friday, deals which Oil Minister Deziani Allison-Madueke said would help meet the needs of its expanding power sector.

Nigerian youth employed to guard oil pipelines

Nigeria's government has employed 12,000 young people to protect oil and gas pipelines in the Niger Delta.

Greenpeace and watchdog attack 'scaremongering' energy firms

A fresh row has erupted over the chancellor's £2bn energy windfall tax after green campaigners accused oil and gas companies of "scaremongering" and making "bogus" claims in their bid to reverse the controversial increase.Greenpeace and Platform, the oil and gas watchdog, said: "Threatening the loss of jobs and investment is the oldest trick in the political lobby book. Given that the UK tax regime is acknowledged as being one of the most favourable in the world for energy companies, claims by this vocal and influential lobby need to be rigorously examined by independent bodies, rather than be taken at face value."

The True Cost of Gasoline: Three questions with Andy Chu of A123 Systems

In September, A123 Systems Inc. opened the largest lithium-ion-battery factory in North America, thanks in part to a $249 million grant from the U.S. Department of Energy. A123 also plans to open a coating plant in Romulus, Mich., with the help of $125 million in state incentives.

Shell may partner with Rosneft in Arctic offshore oil venture

Royal Dutch Shell RDS.B-N could become a partner in Arctic oil exploration of Russia’s biggest producer Rosneft, Prime Minister Vladimir Putin said on Friday.BP is not out of the picture, he added, speaking to journalists at his residence outside of Moscow.

Indonesia Energy Profile: Leading Exporter Of Coal And Natural Gas – Analysis

Indonesia has the largest population in Southeast Asia and the fourth largest population in the world (behind China, India, and the United States). It is also the world’s third-fastest growing economy.Although Indonesia has been a net importer of oil since 2004, it is the sixth largest net exporter of natural gas, and the second largest net exporter of coal. However, as a result of inadequate infrastructure and Indonesia’s complex business environment, Indonesia has struggled to attract investment sufficient to meet its energy development goals.

Asia's shaky water and energy balancing act

SINGAPORE — Much of central China along the Yangtze River is in the grip of its worst energy crisis in years. The electricity cuts for industry and households have been exacerbated by a five-month drought that has dried up rivers, reducing hydroelectric generating capacity and leaving many people and large swaths of farmland short of water.It is a symptom of a key challenge for China in the 21st century. The world's most populous nation and second-biggest economy must make difficult choices between two vital resources, energy and fresh water. Both help drive economic expansion, grow food and raise living standards.

Data Centers: The Energy Problem

Data center energy use is rising at such a high rate that the trend could spur consumer surcharges for data use. Imagine getting hit with a fee for posting on Twitter or Facebook, buying gifts online, or paying bills on the Web.Think about it: We pay package delivery companies a surcharge for the fuel used to transport our packages. Might we one day pay an online retailer a “data center energy surcharge” for the electricity used to power the data center that processes our purchase?

"Perfect storm" creating another Sudan crisis

(AP) TURALEI, Sudan - A top U.S. official warned of a humanitarian crisis Friday over the north's invasion of a disputed territory as southern towns taking in tens of thousands of fleeing villagers were running short of food, fuel and shelter.

A turning-point we miss at our peril

We have the choice of burning all the oil left and hacking down all the remaining rainforests - or saving humanity.

Intl. Energy Agency: Transforming Electrical Generation is Key to Fighting Climate Change

In a book released today, the 28-member country International Energy Agency, states that the threat of climate change demands an “unprecedented transformation” in how electric power is produced.

A different kind of carbon trading tax

Let’s look at the bigger picture. Spare capacity is an indisputable fundamental factor in oil prices, but it is only what gets the whooping-and-cheering Goldman Sachs, Morgan Stanley and their clients to the casino table. Once they are there, they are standing alongside traditional traders, and pouring their extremely high net worth into the same pot. It’s that piling up of the cash on the table that pumps air into the oil price. Should we ignore that pile while the investment banks divert our attention to the nice flowers and pretty birds? No, we shouldn’t.

The number of alternative-fuel vehicles in the state has exploded since 2007, from 14,000 to more than 70,000. However, they still represent a fraction of the vehicles on the road: 1.7 percent. Of the state’s 4.2 million vehicles, including cars, trucks, and buses, 4.1 million are powered by gas.The energy-efficient vehicles cover a wide variety of systems, ranging from hybrids that use electric and gas, compressed natural gas, electric, flexible fuel, and propane. By far the most common are the hybrids, such as the Toyota Prius, with more than 40,000 on the road in the state.

Off-grid city of the future being built near Tokyo

Residents of Kanagawa, one Tokyo’s adjoining prefectures, will doubtless be pleased to hear today that they’re to get a shiny new high-tech neighbor in the form of a futuristic smart town being built in Fujisawa City, 50 kilometers west of the capital.The project, led by Panasonic and including eight other firms, will see Fujisawa Sustainable Smart Town spring up on 19 hectares of land that will become home to some 3,000 people by March 2014.

Why ComEd's Smart Grid and Rate Hike Might Not Be a Bad Thing

The Illinois Commerce Commission approved ComEd's request for a rate hike that will cost consumers a little over three dollars a month, it's estimated. Lisa Madigan has been pounding the utility over the rate hike, leading to concessions from ComEd. But the end game, the implementation of a "smart grid" that would put the onus on consumers to get the three bucks back through decreased usage, might actually be good—for the public generally, if not all consumers individually—in the long run.

Iran says nuclear bomb would be "strategic mistake"

VIENNA (Reuters) - Iran's nuclear envoy said on Friday it would be a "strategic mistake" to build atom bombs, dismissing what a leading Western expert cited as evidence suggesting Tehran was seeking the means to do just that.Ali Asghar Soltanieh, Iran's ambassador to the International Atomic Energy Agency (IAEA), also insisted during a public debate that sanctions and the Stuxnet computer virus had failed to slow the Islamic Republic's disputed nuclear program.

Japan wants Tepco to pay small biz for nuke crisis - Nikkei

(Nikkei) - The Japanese government wants Tokyo Electric Power Co (Tepco) to pay small and midsize businesses half their earnings lost till May as provisional compensation for the Fukushima Daiichi nuclear disaster, the Nikkei business daily reported.

John Michael Greer: A fashion for austerity

The tempest in a media teapot over the apocalyptic predictions of California radio evangelist Harold Camping, it seems to me, provides a useful glimpse into the state of the collective imagination here in America. Camping, for those of my readers who somehow managed to miss the flurry of news stories, announced some months ago that the Rapture – the sudden miraculous teleportation of every devout Christian from earth to Heaven, which plays a central role in one account of the end times that’s popular just now in American Protestant circles – was going to happen at 6 pm last Saturday.

How defining planetary boundaries can transform our approach to growth

Our planet’s ability to provide an accommodating environment for humanity is being challenged by our own activities. The environment—our life-support system—is changing rapidly from the stable Holocene state of the last 12,000 years, during which we developed agriculture, villages, cities, and contemporary civilizations, to an unknown future state of significantly different conditions. One way to address this challenge is to determine “safe boundaries” based on fundamental characteristics of our planet and to operate within them. By “boundary,” we mean a specific point related to a global-scale environmental process beyond which humanity should not go. Identifying our planet’s intrinsic, nonnegotiable limits is not easy, but here we specify nine areas that are most in need of well-defined planetary boundaries, and we explain the steps needed to begin defining and living within them.

Why Time Is Short Now That We're Past Peak Oil

The only thing that could prevent another oil shock from happening before the end of 2012 would be another major economic contraction. The emerging oil data continues to tell a tale of ever-tightening supplies that will soon be exceeded by rising global demand. This time, we will not be able to blame speculators for the steep prices we experience; instead, we will have nothing to blame but geology.

The case for a disorderly energy descent

The energy descent from peak oil production imposes decades of contraction in the global economy. An orderly contraction, particularly in the US, is not likely for a number of reasons. This is a summary of the case for a disorderly descent, garnered from many sources, a couple of which are listed at the end of the essay.One reason has to do with the nature of the oil extraction and processing industry. According to industry experts, once existing oil wells are shut down, the costs of restarting production are high. The same is true for refinery shut-downs. Also, refineries cannot be economically run at less than capacity. Finally, oil exploration is an increasingly costly and lengthy process. These supply chain problems magnify oil price volatility as it interacts with global economic contraction, thereby punctuating economic behavior with ever deeper stall-outs.

The China bubble: An export-led development model

Throughout the 1970s and early 1980s, Japan gradually strengthened the yen so as to support the development of a consumer culture, and consumption rose to more than half of GDP. In 1985, Tokyo let its currency appreciate more rapidly. But the result was simply a spectacular inflation of real estate and stock prices. The bubble’s collapse lasted more than a decade, with stock prices scraping bottom in 2003 (before plummeting even further after the commencement of the current global crisis in 2008). Export-oriented industries could not adapt to a domestically led economy because there was insufficient consumer demand. And so rapid growth turned to stagnation, which has persisted up to the present.Japan still runs on exports, but now government spending is an essential prop for the economy. Twenty years of fiscal stimulus have done little more than stave off even more serious economic contraction, while government debt has grown to nearly 200 percent of GDP.

Consumers are no doubt happy that oil prices are heading south for the time being. And while there’s understandable anger that gasoline prices haven’t come down as quickly, there’s typically a lag effect, so analysts expect pump prices to drop further. But here’s the thing. High oil and fuel prices aren’t necessarily what we should be most worried about. The real threat to the economy—to households and businesses alike—is the sheer unpredictability of energy costs. Over the past five years the price of west Texas crude, the primary American benchmark for oil, has yo-yoed from US$60 a barrel to US$145 in 2008, all the way back down to US$30 during the recession, then up again to US$114, before settling this year around US$100. That last drop, of nearly 13 per cent, occurred over four days, a shift that a decade ago might have occurred over the span of months.Such extreme swings in energy prices are leaving companies and consumers paralyzed. If you’re a business manager, how do you decide whether to invest or hire when you have no idea how much one of your largest expenses will cost even a month from now? For prospective home or car buyers, it’s a similar story. Do you buy a big home in the suburbs and risk high gas prices for your daily commute, or pay more to live in the city and skip the car altogether? “The volatility can actually slow investment behaviour, and when you do that, you begin to slow the pace at which the economy can potentially grow,” says Kenneth Medlock, a fellow in energy studies at the James A. Baker III Institute for Public Policy at Rice University. “It’s putting a chokehold on investment.”

In other words, wild swings in oil prices threaten to cripple the economy. And experts say it could get much worse.

Oil rises to near $101 on weaker US dollar

SINGAPORE – Oil prices crept higher to near $101 a barrel Friday in Asia as a weaker dollar overrode signs of tepid U.S. economic growth.

Japan prices rise for first time in over 2 years

TOKYO — Japan's consumer prices in April rose for the first time in more than two years on a spike in energy and tobacco prices, the government said Friday.Japan's core consumer price index, which excludes fresh food, climbed 0.6 percent last month from a year earlier, marking the first year-on-year increase since December 2008, the Ministry of Internal Affairs and Communications said.

Now, Air India flies into jet fuel crisis

With Air India defaulting on payment of jet fuel bills, state-run oil firms have restricted supplies of fuel to the extent of the national air carrier's ability to make payment in cash, but supplies have not been stopped.At no airport have supplies to Air India been stopped, officials at the three oil marketing companies said.

India May Raise Diesel Rates to Cut $44 Billion Loss

India may increase diesel, kerosene and cooking gas prices to support state-run refiners facing revenue losses of 2 trillion rupees ($44 billion) this fiscal year, an oil ministry official said today. Energy shares surged.

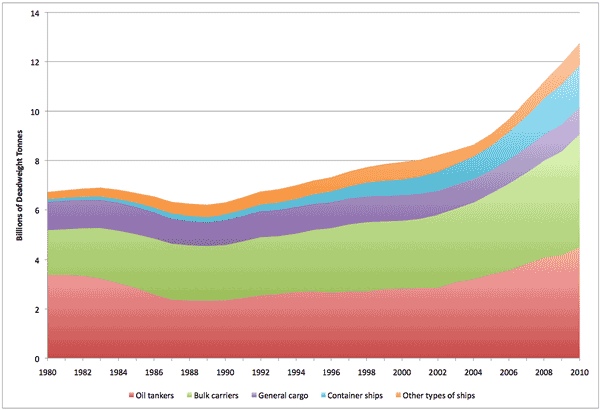

Stuart Staniford: Global Shipping Capacity

Obviously, oil is being conserved somewhere, since production growth has slowed down. However, it's not being conserved by shipping less. Instead, the rapid growth of China and other developing markets is driving a pronounced expansion in shipping capacity, even in the face of the 2005-2008 oil shock and the great recession.

There has also been a strain of thought in the peak oil community that oil trade would decline much more rapidly than global oil production post peak (exemplified in extreme form by Jeff Brown's export land model). Note the red band in the first graph above, which represents the capacity of oil tankers. If this is any guide, the onset of a plateau in oil production has been associated with increases in oil trade, not decreases.

In Memorial Day Forays, an Economic Snapshot

Are you going away this Memorial Day weekend, and how far are you going to drive?A lot of economists would like to know. The answers, when gathered for the entire population, will tell them a lot about where the nation’s economy is going.

Global LNG-Summer demand continues to push Asian LNG prices higher

PERTH/NEW YORK (Reuters) - Asian spot prices for liquefied natural gas (LNG) rose to around $13.50 per million British thermal units (mmBtu) as demand picks up ahead of summer, but trade was limited by a lack of ships to transport the fuel."Asia is still seeing demand for cargoes although prices are holding more steady," ICAP analysts said in a note.

China Lures Crude From U.S. as Colombia’s Ecopetrol Targets Asia Oil Sales

Ecopetrol SA, the Colombian oil producer which expects to more than double output this decade, said it plans to ship a greater share of its crude to Asia as growing demand in China competes for supplies with the U.S.The company may no longer ship the majority of its crude to the U.S. in 10 years because Asia sales will be more profitable, Chief Executive Officer Javier Gutierrez said yesterday in an interview in Bogota. A pipeline the company is weighing that would carry oil to a new port on the Pacific coast to supply Asian refineries may also attract Chinese investment, he said.

Norway shipping magnate refutes oil price charges

A Norwegian shipping magnate on Thursday refuted claims by U.S. commodity regulators that companies he owns manipulated crude oil futures prices on the New York Mercantile Exchange in 2008.

Royal Oyster Group says US sanctions unfair

Royal Oyster Group, one of two Dubai companies facing US sanctions over trade with Iran, says it has been unfairly targeted.The company denied supplying oil products to Iran, saying it had merely shipped "base oils" from Iranian refineries to buyers in Oman, India and the UAE.

Iranian envoy says sanctions have not affected country's disputed nuclear program

VIENNA - Iran's envoy to the International Atomic Energy Agency says sanctions against his country have not had any impact on its disputed nuclear activities.Ali Asghar Soltanieh says the same applies to the effect of the Stuxnet computer worm late last year and that "no matter what, the Iranian people are more determined to continue."

Cnooc: Confident Will Achieve Full Year Output Target This Year

HONG KONG -(Dow Jones)- Cnooc Ltd., China's largest offshore oil and gas producer by capacity, expects to meet its full-year output target despite the shutdown of four oil fields in the Bohai Bay last month due to a malfunction, Chief Executive Yang Hua said Friday.Cnooc said in March it planned to raise crude-oil and natural gas output in 2011, targeting production of 355 million-365 million barrels of oil equivalent, up 8%-11% from 328.8 million barrels in 2010.

Dewa seeks $1.5 billion abroad for private power plant

Dubai's state utility has begun an international campaign to finance its first private power and water plant.Officials from the Dubai Electricity and Water Authority (Dewa) plan to visit Japan and Europe next month to pitch a US$1.5 billion (Dh5.5bn) power and water desalination project to banks, said Waleed Salman, Dewa's vice president of strategy and business development.

Vietnam says Chinese boats harassed oil exploration ship

(Reuters) - Chinese patrol boats challenged a Vietnamese ship exploring for oil in the South China Sea, damaging equipment and warning the ship that it was violating Chinese territory, a Vietnamese official said on Friday.Do Van Hau, deputy chief executive of state oil and gas group Petrovietnam, said he had asked the government to make "the strongest possible" protest to China over the incident, which took place early on Thursday about 120 km (80 miles) off the south-central coast of Vietnam, state media reported.

S. China Sea Oil Rush Risks Clashes as U.S. Bolsters Vietnam

(Bloomberg) -- Vietnam and the Philippines are pushing forward oil and gas exploration projects in areas of the South China Sea claimed by China, sparking a fresh clash in one of the world’s busiest shipping corridors.

BP asks judge to dismiss many spill claims

BP PLC is asking a federal judge to dismiss most of the court claims filed against the oil giant by businesses and individuals who say they suffered economic damage from last year's massive Gulf oil spill.

Big US oil companies face growing concern on fracking

DALLAS/SAN RAMON, Calif. (Reuters) - Large blocks of investors in the two biggest U.S. oil companies on Wednesday demanded more disclosure about the environmental risks of extracting oil and gas through hydraulic fracturing.

Venezuela: US sanctions to hurt US businesses most

Venezuela's foreign minister says U.S. sanctions against the country's state oil company will primarily affect American businesses.Foreign Minister Nicolas Maduro says the U.S. sanctions "affect businesspeople of the United States, not us."

Chavez's new message for opponents: 'Let me work!'

CARACAS, Venezuela (AP) — Hugo Chavez seems to have everything a president could want: power to legislate by executive decree, a bonanza of oil earnings and political allies who dominate nearly all major public institutions.So Venezuela's opposition is vexed by a government campaign accusing opponents of blocking his programs as the country heads toward presidential elections in 2012.

Japan moves to protect children as new nuclear leak revealed

(Reuters) - Japan will pay schools near the quake-ravaged Fukushima nuclear power plant to remove radioactive top soil and set a lower radiation exposure limit for schoolchildren after a growing outcry over health risks.The Education Ministry triggered protests in April when it set a radiation exposure limit for children of 20 millisieverts per year, the same dosage the International Commission on Radiation Protection recommends for nuclear plant workers.

'Tornado Alley' nuclear reactor, 150 miles outside Joplin, Mo., not fully twister-proof

The closest nuclear power plant to tornado-ravaged Joplin, Mo., was singled out weeks before the storm for being vulnerable to twisters.Inspections triggered by Japan's nuclear crisis found that some emergency equipment and storage sites at the Wolf Creek nuclear plant in southeastern Kansas might not survive a tornado.

Hamilton: Higher oil prices fuelling dirtier, not cleaner projects

Has supply peaked? It depends. If you’re talking conventional oil production, some energy economists and analysts have said it happened between 2006 and 2008. Others say 2012 will be the year, and many more say it will be before 2020.It’s safe to say, then, we’re in the “peak oil” zone, conventionally speaking. The evidence of this is that oil prices have found a near-permanent home in triple-digit territory.

So, has there been a mad rush to invest in cleaner, relatively more affordable alternatives to oil? Not really — it’s been more like a casual stroll, even though such alternatives are highly competitive with oil above $100 (U.S.) a barrel.

Critical Metals: Investing at a Crossroad

Byron Capital Markets believes in a long-term secular shift toward energy efficiency, both through new technologies and weight saving. This shift will be driven because of increasing prices for fossil fuels. While I, personally, am not a peak oil theorist, I am also realistic enough to understand that feeding the Brazil, Russia, India and China beast with cheap oil will demand a neglect of the environment that not many oil-producing regions will sustain. We believe that electrification of transport fleets and maximization of our electrical grids are important future areas of development. Electrifying cars will pull on materials such as rare earths (for their weight-saving and efficiency gains), lithium (for batteries), vanadium (for use in better and stronger metal alloys, as well as in next-generation batteries), graphite (lithium battery anodes), scandium (advanced aluminum alloys), and barium (for ultracapacitors). Maximizing the existing electrical grid demands storage and more generating capacity, so critical materials include uranium (in reactors), lithium and vanadium (for storage). Copper is also an increasingly critical commodity.

Making Money On Triple-Digit Oil

Speaking of competing forecasts on oil, we were given a big reason to doubt whether it should cost over $100 per barrel recently when the CEO of Exxon Mobil, Rex Tillerson, made comments earlier this month at a Senate hearing about $60-70 being fair value, if based purely on supply and demand. His explanation for the current excess value was that price was being driven by the speculation of big oil companies and the high-frequency trading firms we just talked about. I wonder if any of the Senators thought to ask, “Is Exxon involved in this speculation?”The more important question is whether or not Tillerson is correct. The market seems to be giving a much different answer than this expert. And most of that answer revolves around two synergistic themes. First is the idea of scarcity for a non-renewable resource. This idea often comes by the moniker “peak oil,” symbolizing that we may have seen, or are about to see in the next few years, the maximum levels of reserves globally.

From confused "peak oil" theorists to confused Congressmen, it's all but impossible to hear a discussion of US energy policy without hearing the left's tired refrain: "The United States currently uses 25% of the world oil production but has only 2% of world reserves." The left uses this misinformation to argue against domestic oil drilling, claiming that with only two percent of the world's reserves, we can't possibly have enough oil in the ground to matter.It's a line which reminds me of Mark Twain's wisdom (which he attributed to Benjamin Disraeli) that "There are three kinds of lies: lies, damned lies and statistics." Twain would be proud of these haters of fossil fuels whose "statistics" fall apart upon examination of a couple of definitions and a few pieces of data.

Garden Tour of Edible Delights

Where once water-hungry lawns grew, 11 families within a six-block radius of Laguna Beach’s Oak Street tilled and turned the earth into a cornucopia of homegrown produce and an edible garden village.From patchwork quilts to elegant designs of wild fennel, trellised beans, trailing blackberries and potted potatoes, the public is invited to take a bicycle or walking tour of Oak Village’s vegetable and fruit gardens between 9 a.m. and noon Saturday, May 28. A $10 donation is requested.

2012 Chevy Cruze Eco: Mileage gain, no pain

The Eco version of the Chevrolet Cruze compact sedan is the fuel-mileage special. It currently holds the highest highway rating (42 mpg) for any gasoline-power car sold in the U.S.

German Steel Industry Warns Of Rising Costs In Move to Renewable Energy

Germany’s steel industry said it fears costs for electricity could at least double to 400 million euros annually as the country seeks to move toward renewable sources of energy.Hans Juergen Kerkhoff, president of the German steel association, said in an e-mailed statement that the country’s renewable energy bill would “deal a new blow to the steel industry.”

Starfish Prefers Energy Efficiency Technologies Over Solar, Wave Power

Starfish Ventures, Australia’s biggest venture capital fund, plans to invest in businesses focused on energy efficiency and avoid solar and wave power until a carbon price makes the technologies more attractive.

BUNNY WILLIAMS, the no-nonsense decorator known for her lush English-style rooms, is laying in light bulbs like canned goods. Incandescent bulbs, that is — 60 and 75 watters — because she likes a double-cluster lamp with a high- and a low-watt bulb, one for reading, one for mood.“Every time I go to Costco, I buy more wattage,” Ms. Williams said the other day. She is as green as anybody, she added, but she can’t abide the sickly hue of a twisty compact fluorescent bulb, though she’s tried warming it up with shade liners in creams and pinks. Nor does she care for the cool blue of an LED.

A Bright Side to the Bulb Changeover

Interior designers who use LED lighting don't have to worry about returning regularly to replace incandescent bulbs that have burned out.

New Mileage Stickers Include Greenhouse Gas Data

WASHINGTON — The federal government unveiled new fuel economy window stickers on Wednesday, for vehicles starting with the 2013 model year, that for the first time include estimated annual fuel costs and the vehicle’s overall environmental impact.The new labels, which replace a five-year-old design that provided only basic information about estimated fuel economy, represent the broadest overhaul in the sticker program’s 35-year history. There will be different labels for conventional vehicles, plug-in hybrids and all-electric vehicles, with cars running solely on battery power estimated to get 99 miles per gallon.

Post Primer: Who’s calling dibs on the North Pole?

Denmark has leaked information about planting the Danish flag in the North Pole ahead of a meeting with the UN Commission on the Limits of the Continental Shelf. (In case you’re not up on your UN commissions, that’s the one that decides which country should have sovereignty over the far north.) So, what’s the rush? The North Pole’s seabed is extremely useful to each country that wishes to claim it, and Russia, Canada, Norway, the United States and Denmark are all eligible to launch programs showing that the much-coveted Arctic sector should belong to their country. Below, what you need to know about who’s calling dibs on the North Pole.

GOP presidential hopefuls shift on global warming

WASHINGTON—For Republican presidential contenders who once supported combatting global warming, the race is heating up.Faced with an activist right wing that questions the science linking pollution to changes in the Earth's climate and also disdains big government, most of the GOP contenders have stepped back from their previous positions on global warming. Some have apologized outright for past support of proposals to reduce heat-trapping pollution. And those who haven't fully recanted are under pressure to do so.

Christie Pulls New Jersey From 10-State Climate Initiative

Gov. Chris Christie said Thursday that New Jersey would become the first state to withdraw from a 10-state trading system, the Regional Greenhouse Gas Initiative, declaring it an ineffective way to reduce carbon dioxide emissions.The decision delighted Republicans who have introduced bills in the New Jersey Legislature to repeal a law authorizing the state’s participation in the program. But it dismayed environmental advocates, who called it a serious blow to the state’s efforts to reduce emissions from power plants and foster a shift from fossil fuels to renewable energy.

EPA asks NJ to reconsider leaving emissions pact

Federal environmental regulators are urging Gov. Chris Christie to reconsider a decision to pull New Jersey from a 10-state greenhouse gas reduction program.

Sea Level at the Jersey Shore Will Rise One Foot by 2050

Jersey beaches bring in big tourism revenue for the state and are a popular summer destination for local residents, but the rapidly changing environment may cause a shift along the sandy shores.Sea level along the Jersey Shore is expected to rise by one foot by 2050, according to Ken Miller, a geology professor at Rutgers University.

Island Nations May Keep Some Sovereignty if Rising Seas Make Them Uninhabitable

NEW YORK -- Global sea level rise has put a handful of nations at risk of extinction -- small island states in the Pacific and Indian oceans. But this week, a collection of international lawyers and politicians have begun work to ensure that doesn't happen.

Many native-born Australians, and those born overseas who migrated to Australia in search of a better life, did not anticipate that our expectations might be prematurely curtailed by population growth, peak oil or climate change. A decade ago, when we celebrated the new millennium, such ideas were hardly on the radar.Not on our radar, perhaps, but not entirely unexpected. A little thought would have told us that exponential growth in our use of natural resources is bound to end when those resources run out, or if damaging by-products compromise our environment.

Here is a link to a fun advertising for electric car http://www.dailymotion.com/video/xixskx_renault-electriques-un-film-publ...

It's in French but the video is funy even without the sound. Their message is that we already use electricty for so many things, why not for car... Of course it is just an ad.

LOL when I saw the miniature jerrycan. Just yesterday I inventoried my old ones after seeing a rusty old one go for $50 on e-bay.

http://truthiscontagious.com/2011/05/27/super-typhoon-songda-projected-t...

Super Typhoon Songda, which according to Weather Underground will form shortly as a Category 5 storm with 156+ mph winds, will take a northeasterly direction and 2 days later will pass right above Fukushima. The good news: by the time it passes over Fukushima, Songda will be merely a Tropical storm. The bad news: by the time it passes over Fukushima, Songda will be a Tropical storm. As the latest dispersion projection from ZAMG shows, over the next two days the I-131 plume will be covering all of the mainland.

RE: Stuart Staniford: Global Shipping Capacity

Nice graphs on shipping capacity in that blog post. The

conclusionsupposition that increases in shipping capacity represent increases in oil trade is off-the-mark, IMO. Off the top of my head, What is missing from this complex picture is:1) Charters of oil tankers at current prices are not enough to cover the shipper's cost because of overcapacity. A good indicator of overcapacity is the baltic dirty index. A low charter price should mean that much of this capacity is sitting idle. I know they are converting some tankers to carry LNG instead of oil because of this issue.

2) Lately, I have seen reports of slow steaming to save bunker fuel. This increases the trip length by at least 300% (I am guessing). You could actually have more ships chartered and less oil being shipped which is to a certain extent true with the current price of oil.

3) Ships are ordered to be built at least four or five years before they are delivered. Overcapacity today is a result of decisions made before the peak in global oil exports. Capacity in no way reflects the level of current exports.

4) Single hulled oil tankers were being phased out by 2010. That resulted in a lot of new build double hulls, and

tanker over capacity.

You are guessing wrong with 300% increase trip times. 30% increased trip times would halve fuel consumption for many carriers. I think consumption goes up with the square of speed, near to the designed sailing speeds. However, I am no engineer...

If you go to extreme, 300% is valid. However, it looks like 30% is probably average.

Slow Steaming Brings Fuels, Lubes into Spotlight

Another link

A different opinion. Link

GE sees solar cheaper than fossil fuels in 5 years

http://climateprogress.org/2011/05/26/ge-solar-cheaper-than-fossil-fuels...

How many times have time periods been projected for solar to overtake FF in price? I remember similar type statements being made many decades ago. But just like I said then, I'll say it again, if it can be done, do it.

"...if it can be done, do it."

A little patience, my friend:

Doin' it!

Re: Republican candidates who have reversed their positions on global warming. I think it is reasonable to conclude that this was based on perceptions of voters rather than an honest assessment of the science or consideration of new evidence refuting the inevitably of climate change.

Given the probable consequences of global warming, both in the future and currently, this seems like one of the most immoral stances I can imagine. But there is always doubt. I guess that is how they assuage their consciences, if any. Now, of course, if a man will strap his dog to the top of his station wagon and head cross country, I suppose he is capable of just about anything.

From stem cell research to evolutionary biology to global warming, the Republican party has fully embraced anti-science and agnotology. At some point, one hopes, delusion must run aground on the rocks of reality.

But stupidity is a pretty hard nut to crack.

Some are interpreting the recent NY congressional election (dems won a seat in a Republican district) as signs the R's have have gone too far. I'm more in the wait and see if it (the change) lasts camp.

The analysis that's been published leans heavily to the theory that the Republicans' problem was that they switched from their position of two years ago — we'll protect Medicare at all costs — to a position of doing away with Medicare as it currently exists. The district is reported to have a sizable population of older voters who were outraged by the proposed changes.

If the Republicans have been getting any heat from their constituents about their stands on energy and science (as opposed to Medicare), it hasn't been getting much play in the media.

Neither republicans nor democrats can accurately diagnose our problems, so I'm not going to pay much attention to them anymore.

We have a very large and growing cumulative debt that can't be payed back, a fiat currency backed only by power and oil that is looking increasingly suspicious and is slowly being rejected by the rest of the world, declining marginal returns on complexity at the federal level - especially when it comes to our expensive wars, transfer payments, and healthcare, an infrastructure that must be radically altered to adjust to the peak oil age (mostly reducing sprawl and building rail), and no sustainable immigration/population policy.

We are filling this country with more and more people (even as the people age), trying to keep every last one of them alive forever, and hoping for some magical growth that will pay back the debt and cover up massive fraud, especially in the mortgage markets, which, if revealed, would surely bring down all of our major banks.

Our entire economy is heavily dependent on what is now a declining energy resource - and this is a consequence of both the built infrastructure as well as the size of this country. It takes oil to ship things around! And even if we were to somehow build rail to do the job, it would take alot longer to move things and people, and would not result in the type of growth that could pay back our debts.

We seem to lack a coherent foreign policy. Some sort of strange mishmash of controlling Arab populations, paying off their leaders, and hoping that the oil flows to us and that there are no more "terrorist" attacks, ever again. And if there are, that would mean we would double down! And, always lurking in the shadows, is our relationship with Israel, which would almost definitely mean more war if they were ever threatened.

All the while, we have one party that thinks things will improve if we just teach creation myths in schools, make abortion illegal, and return us to the dark ages. We have another party that thinks things will improve if only more money can be extracted from the productive middle class, and payed out to the favored group of the day, who so desperately need all the help they can get now that everybody in society has been rendered sick or dependent.

Now, of course we still have the most dynamic economy in the world, and North America is the place you want to be in the event of a genuine global collapse.

But the point is that a society, even one as rich as America, can only take so many hits. It's basically over now, and it's not worth paying attention to the political kabuki theatre.

Love Matt Taibbi...none the less it's probably a good idea to pass stuff like this through the TOD filter.

While, most of the article is about 2008 it does imply current trends.

I suppose some of the things to filter are the claim that the Saudis were in fact having trouble selling their crude in world markets (maybe so at $140/bbl) and had to discount it and the claim that they told Bush to reign in the Wall Street speculators.

Wikileaks: Speculators Helped Cause Oil Bubble

Pete

For starters, why didn't Saudi Arabia simply lower their prices if they couldn't find buyers. The fact that SA implied that speculators were causing high prices means nothing.

Pete 'mistakingly' cut and pasted the wrong part of the Taibbi piece.

This portion shows what Wikileaks said about Saudi concerns.

Strange that Saudi, or anyone else would blame US speculators for the world price of oil since the price of oil in the US is the cheapest oil in the world. The "Speculator Driven" WTI closed out last week at a price of $99.49 a barrel. Yet even in the US oil was really selling at almost $5 above that figure. And the world oil price was $9 above the speculator driven price.

This Week In Petroleum, Crude Oil Crude Oil Estimated Contract Prices

May/20/11 Total OPEC 108.38 Total Non-OPEC 108.63 Total World 108.48 United States 104.23Those U.S. speculators are doing their very best to keep prices down but world supply and demand keeps raising its ugly head and pushing prices up.

Ron P.

The Saudis have a vested interested in keeping non-conventional oil off the market. There is a lot more non-conventional oil than conventional oil in the world, and much of it is probably economic at current oil prices. For instance, the price of WTI at the moment is about $100/bbl, whereas Canada has considerably more oil than Saudi Arabia that they can produce for about half that price.

The main thing that frightens the Saudis is that if investors knew that Saudi Arabia did not have the oil it claims it has, and knew that oil prices would continue to remain high, the investors would put their money into non-conventional resources and flood the market with non-conventional oil. This is already occurring in North America - Canadian non-conventional oil is backing Saudi oil out of the American market and depressing the price of WTI because the production costs on Canadian oil sands are far below the price of Saudi oil.

Saudi Arabia is very much at risk from this trend, so you can count on them to lie about 1) the oil reserves they actually have and, 2) who is really responsible for current high oil prices. My reading of the situation is that 1) they do not have as much oil as they claim they have, and 2) it is their inability to meet demand that is causing high prices.

And then there is the Orinoco Belt heavy oil/tar....

As James Galbraith puts it the oil market traditionally didn't have a floor, so one was constructed by the swing producer(s). But now, on the cusp of declining oil production and in the midst of economic dynamism in a huge swath of the world, the oil market doesn't have a ceiling, other than an aggregated undetermined ability and willingness to pay.

The stage is set for 'players' to seek the unknown. What is the price the market will bear? The script is written in multiple commercial laws. The players succeed or gain on their ability to add value to huge financial resources already in their possession.

From a rabbit's perspective human kind made a big mistake by failing to master the bounce.

This WL is interesting:

Saudi Oilfields are 'Sick'

April 20, 2009. No field-specific info, but:

Thanks Joules, this is very interesting. An admission that Ghawar is in bad shape. We all knew this but it is good to get it straight from the Saudis themselves. And with horizontal wells they are sucking the oil straight from the crest. I suppose that is because that is the only place that they can get much oil. Lower down it's mostly water.

I really don't understand why horizontal wells increase the reservoir's exposure to water damage. There is less water at the crest so they pump less water. How can this increase exposure to water damage. Once the water hits the crest it's all over, or nearly so anyway. But would it be any different with vertical wells?

Ron P.

Saudi Oilfields are 'Sick'

It's nice to have a S E C R E T document from an American consulate confirming what an old oil hand would already suspect if one was not naive and did not really believe what the Saudis were telling people.

The Saudis are doing all kinds of things from a production enhancement standpoint that one would only expect them to do if their oil fields were in a lot of trouble. However, Saudi Arabian reserve and production data are state secrets, so you have to count on the CIA to get good intelligence on them, since you obviously can't count on the Saudis to be honest and aboveboard about it.

The CIA needs to hack into the Saudi well files, extract the data, and turn it over to a few experienced oil men to analyze, who of course will do it for standard consulting fees. Not me, because I'm retired and out of the consulting game. Just a gentle hint if they are not already on the case.

An eye-opener reading the comments on the "Myth of Peak Oil" editorial. Several abiotic oil believers chime in and then this guy trying to add some reason gets attacked by the others:

I like the nom de plume, the name on the grave where all the money is stashed away.

The editorial itself points to how the cornucopians argue. They may not attack the main issue but they nitpick the details and the math. In this case it is the claim that the USA has only 2% of the world's reserves. This is one response that Mr. Stanton got: "You all you've got to say is that peak oil is real? You went around your elbow to scratch your ear as the article was about the misuse of statistics to state that the U.S. has but 2% of the world's reserves. The only mention to peak oil was in passing. Did I miss something?".

That is a basic approach perfected by the climate science skeptics, latch on to a detail and hammer on it, thus serving to discredit the entire argument.

If you dig THAT grave, WEB, you'll never see a penny of that money.

It's in the grave NEXT to Arch Stanton; the one marked, "Unknown" ;-)

You see, in this world there's two kinds of people, my friend: Those with proven, recoverable oil reserves and those who must purchase them. You purchase.

helios +1

Holy great movie references, Batman! Another (+1)!

Either that guy was a nincompoop, or he is saavy: Arch Stanton's grave was an empty promise, just like abiotic oil, KIC-1, etc.

Amen. There were a number of interesting features of this partisan bit:

I can only imagine how he would react if climate scientists used the term "undetermined potential climate forcing", but no matter, he accepts the highly modeled UTRR figure uncritically. Here's another one, offered as the soothing voice of reason:

LOL. Anyone remember the Blues Brothers movie where Jake (Elwood?) asks the club owner "what type of music do you play here?" Answer: "We play both types: Country and Western...."

Best hopes for a balanced energy policy, before it's too late.

The worst part of the "Myth" item is that he accepts part of the definition of UTRR, but omits (conveniently) the rest.

http://www.nicholas.duke.edu/thegreengrok/oilglossary

So... it turns out that UTRR is not even pie in the sky... it is hypothetical pie in the sky.

Craig

There are ways to estimate how much is undiscovered based on what has been found so far. That is the basis of the dispersive discovery model. These kinds of models are all hypothetical because they are based on a hypothesis for the way the statistics will play out. It's all a matter of who has the better hypothesis.

Undiscovered technically recoverable oil resource (UTRR) is oil we don't know exists and which we couldn't afford to produce even if we knew where it was. This is basically oil that would be produced if wishes were horses and pigs could fly. It's not something that any rational oil man would be interested in drilling for, unless of course the government subsidized 125% of the drilling cost.

I'm just speaking as someone who worked for a company that had 125% of its drilling costs subsidized by the Canadian government - which unfortunately came to an unpleasant end when the government noticed we weren't finding any oil even with the subsidies.

Getting in an interior designer to a change a light bulb...snort!

I'm also not sure on this light problem. I can't tell the normal bulbs from the new ones except the new ones take an extra second or so to get to full brightness.

I was surprised to find that my electricity consumption decreased to an average of <500kwh/mo from >850kwh/mo after I changed all the lights to compact fluorescent a couple of years ago.

We use gas/wood for heat, water heater, cookstove so the effect of the lightbulb change is magnified, but it was a lot more than I had expected.

The newest ones seem very reliable; they are certainly inexpensive, and the color has improved (or I have just got used to it.)

I don't know about life-cycle energy costs or the problems of disposal -- all I can really see is my savings.

I can't tell the difference either Richard. I use the bright whites, which are 2700°K temperature, and I think it's a great color. My sister likes the bright whites, but that's much too cold for my tastes. It makes me dislike being at her house. Everyone's bleached teeth are glowing.

I replaced every indoor bulb in my building (4 units) with compact fluorescents more than ten years ago and was astonished at how much my electric bill dropped. It seems like I recovered my cost in just a few months. I should go back in my records and quantify what it was exactly.

In my apartment, I have a total of 16 bulbs, mostly 13w, but some 25's. If I have every light on at once, I'd be using a mere 280w. If they were equivalent incandescents, it would be 1120w. Of course, this never happens. Often I have one 13w bulb going in a lamp. My office which has 6 can lights is the worst for load at 78w total, but that's much too bright, so I split the circuit in half and switch three at a time independently.

In the beginning, I had one ceiling fixture that was cursed and would burn out bulbs. It was a triple bulb fixture and I'd lose a bulb here and a bulb there and over about a years time the last one would go and I'd throw in three new ones. I renovated the room, replaced the old post and tube wiring, and installed recessed can lights. That cured the bulb problem. I don't think I've had a single bulb failure in the past three years. I've no idea what it was about the previous fixture and wire that was deadly to the CFL's.

Oops. I meant to say I like the 'soft' whites.

"This light problem" is not necessarily an open-and-shut case. Just because you can't tell two light sources apart, that doesn't mean the next person can't. To guarantee that, the two spectra must match up closely, which, for an incandescent versus a CFL, they most decidedly do not. An incandescent shows a smooth spectrum; a typical CFL shows a very spiky spectrum with strong lines; and many "white" LEDs, even the "warm" ones, show a double-hump spectrum very deficient in some shades of green.

When red traffic lights were first converted to LED, 660nm LEDs (deep red) were often used, because in the early days those were the brightest based on power output and standard chromaticity charts. However, perception of deep red varies enormously from person to person (that is, a standard chromaticity chart is nonsense with respect to deep red, as there is no universal standard), so standards bodies stepped in and such a deep red is no longer used (or at least shouldn't be used) in new assemblies. There are similar variations in the eye's green and blue sensors (cone cells), but in the past they were of little consequence. [Note: all this is apart from outright color-blindness.]

Until fairly recently, there were just two options for normal indoor lighting: incandescents and tubular fluorescents. Tubular fluorescents have always been too ghastly and flickery to see much use in homes, save for the occasional desk or shop light. So one saw them mainly in places where bean counters could force them upon captive audiences, such as offices.

But now that we've got environmental bean counters heavy-handedly forcing undesirable (to some people) light sources (and toilets and God knows what-all else) upon people in their homes, it should be no surprise when some regard that as intrusive, nor when it affects their voting. Indeed, our environmental bean counters seem to have a problem with tactics, too often maximizing the ratio of conniptions to actual environmental gains, and thereby painting themselves as arrogant twerps.

The other visual perception that varies greatly is flicker. For example, some people can set their CRT monitor (if they still have one) for 60Hz or even 50Hz and find nothing amiss, while others will go bananas from the intense (to them) flicker. Incandescent bulbs have an intrinsic smoothing mechanism. LEDs and CFLs do not - and to save a few cents, a few of them may still have only half-wave rectifiers, which will aggravate the problem.

Probably the new light sources will improve gradually. The spectral issues may prove easier to fix with LEDs, where the underlying light source has a somewhat smooth spectrum, than with gas-discharge lamps, which start off with intense spectral lines; but LEDs are still very expensive. For the time being, one size doesn't fit all.

At my wife's insistence, I replaced a CFL with an LED flood lamp (can type fixture) just to see the effect. She loves it! I am ambivalent however.

One thing I can tell you though is that it will take at least the life of the bulb to realize sufficient power savings to cover the cost of the bulb. In the mid term, it is the long life of the LED (or the claimed long life - time will tell) that may cover increased cost ($40 for one bulb!).

The reason my wife gave for wanting to do this is that CFLs have mercury in them, and disposal is problematic. I agree with that, but since I already have the CFL I would have waited until it died to replace it.

Craig

I replaced all the incandescent light bulbs with CFL back in 2006 when I installed the solar panels. I haven't had one burn out yet. The cats have destroyed 2 by knocking over the lamps. One we put in a grocery bag in the attic. The other broke so we openned the windows, shut the door so nothing could go into the room for a day, and then cleaned up. Beats the heck out of me what the morbidity is but that should be compared to breathing traffic fumes all day and all the other fun stuff in modern life.

Has anyone calculated the volume of CFL bulbs one generates in a lifetime? I think you can just toss them all in a grocery sack in the attic and not worry about it.

I wouldn't worry too much about the mercury in a compact fluorescent: the total amount is about 5 milligrams in a bulb, and it's metallic mercury. According to the EPA the safe level is 0.1mg per cubic meter of air (breathing the vapor is the danger). So to exceed this limit you'd have to:

Vaporizing mercury is not very easy: it boils at 357C (674F) and the vapor pressure at normal temperatures is about 0.00001 atmospheres. Fifty cubic meters of air is about the volume of the rather small room I'm sitting in at present. So I suppose if I put a broken fluorescent in an uncovered pan over a propane burner in a small room with doors and windows closed and heated it to a dull red heat I might be exposed to possibly dangerous levels of mercury vapor.

However, I suspect the additional mercury exposure from mercury emitted by combustion of coal to generate the additional electricity needed for an incandescent bulb is more dangerous.

All flourescent lights have mercury in them -- it is not something new with CFLs. A 4' tube will have about twice the mercury as a CFL, while a 2' tube is about the same. I'd guess that the circleline, desk lamp, grow light, and U shaped tubes are all about the same.

It isn't just the direct power - also consider the indirect power consumed by using incandescents. By this I mean the additional load on the AC system to remove all of the additional heat.

One of our neighbors put in a new AC unit a month ago, and my wife and I were wondering why the thing was always running - even when the outdoor temperature was quite cool and comfortable. We were over one night, and they hadn't put in any CFLs at all, and when you turned on the lights, you could feel the room warm up. In our house with all of the CFLs, that problem doesn't exist (it isn't just the CFLs, of course - other things like computers and whatnot can also throw off heat).

And there is one more indirect cost - their AC unit wore out before ours, but their system runs a lot more than ours does. I can't prove that this contributed to the earlier failure of their system, of course, but I can't help but wonder whether the systems would tend to last longer if you don't use them as much. Replacing an AC system isn't cheap at all, and if we can get 15 years out of the thing while the neighbors only get 12, that's another cost that is very measurable.

Well, if you're gonna count beans, might as well make 'em the environmental kind!

Something that fascinates me about "The Light Bulb Conversation".

Why do so many people say "I don't like fluorescents / LEDs because the colour is not like my incandescent bulb". I have this feeling that when Mr Edison (or whoever your favourite inventor of the light bulb is) he (or she) did not design for the colour output. I suspect what WAS taken into account was the electrical voltage/amperage/frequency; filament breakdown temperature, lifespan, glass type, fill gas and ease & cost of production.

If you are old enough to have seen a photograph taken with indoor incandescent light using daylight emulsion you might remember the ghastly yellow colour. That was an almost true rendition of the colour difference between sunlight and incandescent light; and it was nasty and jaundiced; but fortunately humans can filter false colour out of a scene.

Now that we CAN design for colour output, when I buy a light I want about the colour temperature of sunlight. Yes, the light from a welding arc is a little too blue for me, but otherwise make it as blue as possible. I just don't understand this pining for a yellow light spectrum determined by a 1890's factory owner. Most of my ancestors grew up viewing scenery using the spectrum of sunlight, and if it's good enough for my great grandpappy it's good enough for me.

And has anyone ever met a person who just smashes their CFL's & throws them in the domestic trash? This whole 'it has mercury in it' argument is right up there with quoting the bible to justify mobile phone use; or the 'I can't afford a $40 lightbulb because I'm too stupid to calculate the future electrical cost'.

Sheesh.

That's something I've wondered about too! Your comment brings back all my experiences with photography and having to use "Blue" flashbulbs with "Daylight" film indoors to get correct color rendition. How did current incandescent light bulbs end up with the color temperature they have? Not because they were anything like the "Daylight" we evolved under which is about 5500K-6500K (3000K at sunset/sunrise to 12,000K-18,000K for skylight),or like the gaslight they replaced at 2000K-2200K.

http://micro.magnet.fsu.edu/primer/photomicrography/colortemperature.html

The hotter the filament is run, the higher the color temperature and brightness of the emitted light. However, the hotter the filament, the shorter the life. Where a typical 100 watt lamp has a color temperature of about 2900K and a life of about 700-1000 hours, a 500 watt 3400K incandescent photoflood lamp has a lifetime of only about 10 hours. They are the same design, but the photoflood is run at a higher temperature. There's a tradeoff between lifetime and brightness/color temperature that has to be made for any given bulb/filament design.

I'd be willing to bet that this is a "acquired" preference, much like for certain foods, and that we only prefer it because it's what we're already used to.

Huh? Everyone I know does it. Heck, I do it. What else are you supposed to do with them when they break?

As for the color...I find the color of CFLs (and regular flourescents) very harsh. Not very flattering. Sunlight is rather unflattering as well - too harsh. There's a reason photographers like the "sweet light" - the hour after dawn and before sunset.

I still use CFLs because I'm concerned about energy efficiency and climate change, but if I weren't, I wouldn't have the things.

I let Lowe's recycle my CFLs and other fluorescents when they fail. I think Home Depot also offers that service.

The incandescant light bulb replaced the gas mantle with a color temperature around 2300 degrees F.

But you are right about florescent tubes. I've never found them objectionable unless they are flickering. They are in the kitchen, den and living room, which is where the lights are on the most.

Great grandpappy doesn't go back far enough. Go back; go way, way back. Up until just a few years ago, for over a hundred thousand years the color of all artificial light was the color of ...fire.

I think a hundred thousand years is enough time for preferences regarding artificial light color temperature to go beyond mere individual tastes. The color of fire, for a hundred thousand years, has meant warmth, safety, companionship, and food.

I like my artificial light yellow. A deep, golden yellow. To you it's ghastly. To me it's that horrible greenish and blueish light that's ghastly- it makes everyone the color of a corpse, it's the color of sickness and death.

Candlelight runs around 2000K. The warmer incandescents run around 2700K. To me, even a 100 watt incandescent is too white. I use lower wattages to get the warmer, yellower light.

The instant I find out about a CFL with a color temp of 2700K or lower I will convert my entire house. But as far as I can tell, the manufacturers of CFLs and LEDs aren't even trying to develop a product in this color range. Perhaps it isn't physically possible for CFLs and LEDs to achieve? And so millions of people are laying in stores of the light they like.

Does anyone know what the lowest color temp CFL available is?

Grab your wallet, VT.... The Philips Tornado True Colour is 2700K and its a 900 series lamp which means the minimum (guaranteed) CRI or Colour Rendering Index is 89, with most lamps being in the low 90s.

See: http://download.p4c.philips.com/l4bt/3/341622/tornado_true_color_341622_...

By comparison, a standard CFL has a CRI of 82 (higher numbers are better).

Cheers,

Paul

I wanted to...

First I was very excited, now I'm very frustrated.

I looked around online. Walmart doesn't have it. Lowe's doesn't have it. Home Depot doesn't have it. Amazon doesn't even have it!

Aaargh!

While I was looking, I also found a review that warned that many of these bulbs have weird size and weird shape bases that don't fit standard lighting fixtures. Hmmm.

Also, the light that gets the most use is a beautiful antique table lamp that uses the kind of lampshade that clips right onto the lightbulb itself. That's the one I'd want to try it with; the most rigorous test is the light that gets the heaviest use. Would the Tornado accept the clip-on lampshade?

Sorry, VT, for some reason I though you resided in the UK. Unfortunately, it's not available in the United States at this time .

Clip on shades can be a bit of a challenge with mini-twist CFLs, however, the ones that have a conventional A shape should work just fine (e.g., http://www.lighting.philips.com/us_en/products/energy_saver/softwhite.ph...). This one has a colour temperature of 2700K but the CRI is 82.

Cheers,

Paul

Ot you could try this one the Plumen, colour temp 2700K, which I think looks much better than the spirals;

However, when you "grab your wallet" you might grab it shut, as these "designer" bulbs are $30 ea. Make sure you put them where everyone sees and talks about them so you at least get some style points for your money.

A quick change in topic Paul - is there a standard for 12V outlets and sockets? I'm considering running a separate 12V circuit for lights and fans and such, and wondered if there was an existing standard or should I make up my own with automotive hardware.

Thanks!

I'm afraid I don't know the answer, Twilight; sorry. Perhaps Fred, Bob or Ghung can help us out, as all three are well acquainted with low-voltage systems.

Cheers,

Paul

I don't think there is a "standard" as such. Many 12V lights are made to fit into standard fixtures, like the Edison screw base, MR16 halogens, etc

I will say, from my experience fixing up the trailers that I would not use standard automotive hardware, but RV or (better still) marine stuff instead.

Also, DC is much harder on switches and contacts than AC, especially if you have high amp loads at 12V. You should be fine if it is LED lights you are working with.

OK, thanks. RV & boat stuff is probably where I will look. I'm OK with the current draw & switch issues, as I'm an EE and I design power supplies among other things.

One of my concerns is that we use fans in the summer to cool the house, and I would like to set up a 12Vdc fan (I accept that it will be smaller than I use now). Simple solar 12V charging systems are very common now and I see no reason not to set up some basic circuits - other than the usual problem of running wires in a 180 year old stone and log structure of course.

The closest thing to a 'standard' is the cigarette lighter adapter. Some folks I know use the high amp AC plugs and recepticles (where one blade is perpendicular to the other), though they can be expensive and aren't made for low voltage DC. Make sure to size your wires big enough and do the math for amperage (Amps= watts/voltage) and efficiency goes up with wire size. With long runs, it may be more efficient to use a small inverter and AC appliances. Voltage drops can be a problem with 12VDC. Be sure to fuse everything!

Yeah, I thought about those but they are absurdly big, plus the spring contact tip is not particularly effective as there is no wiping action, which leaves it vulnerable to corrosion. After all, it was designed to heat a cigarette lighter. Using a variant of standard AC outlets would work great, but there's always the possibility of people getting confused.

Try looking on Farnel, Digikey or Mouser web sites you may find some on there. Many DC connectors are not made to be connected live though so make sure the circuit is off when (un)plugging. For switching larger loads consider a relay, the contacts tend to be better made than the ones in switches and it can be easy to use a 2 or 4 way relay to split the load over several contacts.

NAOM

As I have said before, 12VDC is hobbled by the lack of standards.

For lights This works with MR-11, MR-16, G4, and generic Bi-Pin. At 25 cents each they are a bargan.

As for connectors Anderson SB-50 (6319 or 6319G1) is the best. Or you can use the powerpole connectors which are about $.75 each.

Edit, Change link to cheaper socket source.

"I think a hundred thousand years is enough time for preferences regarding artificial light color temperature to go beyond mere individual tastes. The color of fire, for a hundred thousand years, has meant warmth, safety, companionship, and food."

OK, now that's an idea that I can accept for an innate preference for a color temperature. I just couldn't see how it applied to an incandescent lamp. Your idea could make sense to me.

I agree with you entirely, but we use CFLs anyway and have become fairly used to them. We buy the 60W and 40W equivalent soft white versions. If you put them behind a paper shade it helps some. It's funny but I don't notice them that much inside anymore, but if I look at the house from outside I can really notice it.

Yeah, the 'fire' argument makes a lot more sense than 'I like the colour of hot tungsten...'

Bryan

So I'll note my own odd-color low-power lighting solution: strings of clear LED's that emit green light; a 10-meter string of 100 LED's is about $6, and I get green since the human eye is more sensitive to it. This isn't for reading, but for enough light to navigate an otherwise dark room safely. Amazingly bright, and pulls less than a half watt per string according to my kill-a-watt. A lot less than that on "twinkle" mode, but one can only stand so much twinkling in life. I have no idea how long they'll last, but they don't get warm.

I know plenty of people who can not afford to pay for CFL's as they are just to costly compared to "normal" blubs. If you were to ask them to even think about a blub that costs more than 5 bucks each, they'd do without it rather than pay the price.